January 12, 2005

The Governor's proposal contains significant program savings—particularly in K-12 education, social services, and transportation—and borrowing to address the state's 2005-06 budget shortfall. While the 2005-06 proposal has several positive attributes, it falls well short of fully addressing the state's ongoing projected fiscal imbalances. Moreover, its budget reform proposals would put more future state spending on "cruise control" and hamper the ability of future policy makers to establish budget priorities.

The state faces major challenges related to both a large shortfall in the 2005-06 budget and an ongoing structural imbalance between revenues and expenditures that will persist in subsequent years absent ongoing corrective actions.

The Governor's 2005-06 budget proposal addresses the 2005-06 budget shortfall primarily through program savings in K-12 education, social services, transportation, and employee compensation. The plan also relies on about $1.7 billion of the remaining Proposition 57 deficit-bond proceeds, and contains various other funding shifts and borrowing. It assumes some additional revenues from expanded tax auditing, but does not propose new tax increases.

The Governor has also called the Legislature into special session to consider several structural budget reforms relating to the budget process, pensions, transportation funding, and Proposition 98 (K-14 education) funding.

The 2005-06 budget plan has several positive attributes. It realistically portrays the size of the problem facing the state and contains reasonable estimates for its solutions. It also contains a significant amount of ongoing savings.

However, while the budget's proposals would address the 2005-06 shortfall, it falls well short of fully addressing the state's ongoing structural imbalances. Moreover, its budget reform proposals would dramatically reduce the ability of future policy makers to establish budget priorities when addressing future budget shortfalls.

Over the past year, both the nation and California have experienced solid economic growth, led by continued gains in consumer spending, large increases in business investments, and expanding exports. The budget assumes that growth will continue at a moderate pace, with jobs and personal income benefiting from an accelerated pace of hiring by businesses. At the national level, U.S. real gross domestic product is projected to grow 3.3 percent in 2005 and 3 percent in 2006, reflecting balanced gains in consumer and business spending. In California, wage and salary jobs are projected to increase by 1.8 percent in both 2005 and 2006, up from the 1 percent increase in 2004. Personal income is forecast to accelerate modestly from 5.6 percent in 2004 to 5.8 percent in 2005 and 6 percent in 2006.

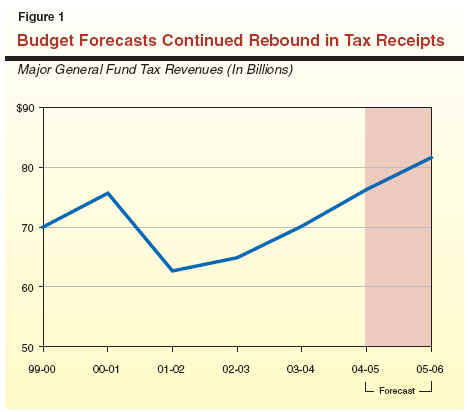

The administration projects that total General Fund revenues and transfers will increase from $74.8 billion in 2003-04 to $78.2 billion in 2004-05 (a 4.6 percent increase), and further to $83.8 billion in 2005-06 (a 7.1 percent increase). The revenue and transfer totals for each year are affected by numerous factors, such as special fund loans, one-time asset sales, and pension bond proceeds. Figure 1 shows revenues from the state's major General Fund taxes, which have been relatively less affected by special factors and thus provide a more accurate picture of how current economic changes are affecting the state's revenue base. It shows that tax revenues are projected to grow by 8.7 percent in the current year and by 7 percent in 2005-06, or by significantly more than growth in statewide personal income during the two years. The relatively strong growth rates reflect sharp gains in corporation taxes and more moderate, but still healthy, growth in the sales and personal income taxes.

The administration's economic and revenue assumptions are similar—but slightly more optimistic—than our November fiscal forecast. After adjusting for policy-related changes, the budget's revenue forecast for 2003-04 through 2005-06 is up by a combined total of $260 million—a modest difference given the size and volatility of the revenue base. We will be updating our projections in February to account for updated information on revenue trends and on economic performance at the end of 2004 and the start of 2005.

The budget proposes total state spending in 2005-06 of $109 billion (excluding expenditures of federal funds and bond funds). This represents an increase of 4.4 percent from the current year. General Fund spending is projected to increase from $82.3 billion to $85.7 billion, while special funds spending rises from $22.1 billion to $23.3 billion. Figure 2 shows the General Fund's condition from 2003-04 through 2005-06 under the budget's assumptions and proposals. It shows:

|

Figure 2 Governor’s Budget |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Proposed

for 2005-06 |

|

|

|

2003‑04 |

2004‑05 |

Amount |

Percent |

|

Prior-year fund balance |

$5,060 |

$3,489 |

$1,425 |

|

|

Revenues and transfers |

74,762 |

78,219 |

83,772 |

7.1% |

|

Deficit bond proceeds |

— |

2,012 |

1,683 |

|

|

Total

resources available |

($79,822) |

($83,720) |

($86,879) |

|

|

Expenditures |

$76,333 |

$82,295 |

$85,738 |

4.2% |

|

Ending fund balance |

$3,489 |

$1,425 |

$1,141 |

|

|

Encumbrances |

$641 |

$641 |

$641 |

|

|

Reserve |

$2,847 |

$783 |

$500 |

|

Figure 3 shows General Fund spending by major program area. It shows large variation in growth among major program areas, reflecting proposed program changes and a variety of other factors. The Governor's major spending proposals in individual program areas are discussed in detail later in this report.

|

Figure 3 General Fund Spending by

Major Program Area |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Proposed

for 2005-06 |

|

|

|

Actual |

Estimated |

Amount |

Percent |

|

Education |

|

|

|

|

|

K-12 Proposition 98 |

$28,154 |

$30,992 |

$33,117 |

6.9% |

|

CCC Proposition 98 |

2,272 |

3,036 |

3,321 |

9.4 |

|

UC/CSU |

5,527 |

5,212 |

5,413 |

3.9 |

|

Other |

2,159 |

4,559 |

4,076 |

-10.6 |

|

Health and Social Services |

|

|

|

|

|

Medi-Cal |

$9,879 |

$11,965 |

$12,948 |

8.2% |

|

CalWORKs |

2,064 |

2,146 |

1,940 |

-9.6 |

|

SSI/SSP |

3,123 |

3,444 |

3,523 |

2.3 |

|

Other |

7,696 |

7,988 |

8,297 |

3.9 |

|

Youth and Adult Corrections |

$5,389 |

$6,933 |

$7,014 |

1.2% |

|

All Other |

$10,069 |

$6,021 |

$6,089 |

1.1% |

|

Totals |

$76,333 |

$82,295 |

$85,738 |

4.2% |

The revenue and expenditure estimates shown in Figures 2 and 3 reflect $9.1 billion in

savings that the Governor has proposed to

(1) eliminate a projected budget deficit of $8.6 billion and (2) maintain a reserve

of $500 million. About $1.1 billion of the

savings are proposed for the current year, and

$8 billion are proposed for 2005-06.

Difference From LAO November 2004 Estimate. The administration's projected budget shortfall is somewhat larger than the $6.7 billion gap that we had estimated in November. The difference reflects numerous factors, including the administration's lower property tax estimates (which results in added General Fund obligations for Proposition 98), as well as its inclusion of costs associated with the settlement of a lawsuit related to local flooding. For purposes of this report, we are using the administration's definition of the budget problem and solutions. (We will be updating our own estimates next month in the Perspectives and Issues.)

Main Solutions. As shown in Figure 4, the great majority of savings are related to ten major proposals and the use of $1.7 billion of the remaining deficit-financing bonds (leaving roughly $2 billion for subsequent years). Significant savings are proposed for the following areas:

|

Figure 4 Savings From Major Budget

Proposals |

|

|

2004-05 and 2005-06 |

|

|

|

Amount |

|

Education |

|

|

Hold

current-year Proposition 98 at 2004‑05 Budget Act

level |

$2,284 |

|

Eliminate

state base program contribution to the State Teachers’ |

469 |

|

Transportation |

|

|

Suspend

Proposition 42 transfer |

1,310 |

|

Hold

Public Transportation Account spillover in General Fund |

216 |

|

Health and Social Services |

|

|

CalWORKs

and SSI/SSP grant savings |

714 |

|

Reduce

state participation in IHSS wages |

195 |

|

Federal

funds replace General Fund for certain prenatal care |

191 |

|

Judgment bond to fund Paterno lawsuit settlement |

464 |

|

State employee pension and other compensation changes |

408 |

|

Local mandate suspensions |

250 |

|

Deficit-financing bonds |

1,677 |

|

All other |

915 |

|

Total |

$9,093 |

Other Savings. The remaining $915 million in savings is related to a variety of proposals throughout the budget. These include: a package of Medi-Cal reforms such as a modification of dental benefits for adults; tiered reimbursements for child care providers under the CalWORKs program; expanded audit activities related to the "tax gap" and abusive tax shelters; the elimination of the senior citizens' property tax assistance program and a reduction in the seniors' renter assistance program; and an across-the-board reduction to state operations.

Ongoing Savings in Budget Plan. It appears that of the $8 billion in savings proposed for 2005-06, about $4.5 billion are ongoing in nature. We estimate that these savings would expand to around $5 billion in 2006-07, mainly because the fiscal impact of the SSI/SSP grant savings would double in that year when full-year effects occur.

Figure 5 summarizes the budget's proposed Proposition 98 allocation for K-12 schools and community colleges. It shows a total of $50 billion in 2005-06, an increase of $2,886 million, or 6.1 percent, over the administration's current-year estimate. Chapter 213, Statutes of 2004 (SB 1101, Budget and Fiscal Review Committee), suspended the Proposition 98 minimum guarantee for 2004-05, proposing a targeted suspension level of $2 billion less than would have otherwise been required absent suspension. Given the General Fund revenue growth assumed in the budget, the state would have to provide an additional $1.1 billion in the current year to meet the Chapter 213 suspension target. By not providing this additional funding, the state generates savings of $1.1 billion in 2004-05. In addition, the lower funding level for 2004-05 results in a $1.2 billion lower guarantee for 2005-06. Thus, the state saves $2.3 billion over the two years.

|

Figure 5 Proposed Proposition 98

Funding |

||||

|

(Dollars in Millions) |

||||

|

|

2004‑05

Revised |

2005‑06

Proposed |

Change |

|

|

|

Amount |

Percent |

||

|

K-12 |

$42,183 |

$44,710 |

$2,527 |

6.0% |

|

California Community Colleges |

4,804 |

5,163 |

359 |

7.5 |

|

Totalsa |

$47,083 |

$49,968 |

$2,886 |

6.1% |

|

General Fund |

($34,124) |

($36,532) |

($2,410) |

(7.1%) |

|

Local property tax |

(12,959) |

(13,435) |

(476) |

(3.7) |

|

Per Pupil Spending |

|

|

|

|

|

K-12 average daily attendance |

6,015,984 |

6,063,491 |

47,507 |

0.8% |

|

K-12 funding per pupil |

$7,012 |

$7,374 |

$362 |

5.2 |

|

|

||||

|

a

Total Proposition 98 amounts include almost $100 million

in funding that goes to other state agencies for educational purposes. |

||||

Growth in Proposition 98 spending in 2005-06 is mainly supported by an additional $2.4 billion (7.1 percent increase) in General Fund revenues, with an additional $476 million (3.7 percent increase) in local property tax revenues. While the Governor's budget assumes 8.9 percent growth in local property tax revenues, a technical adjustment related to the state's vehicle license fee obligation reduces the year-to-year increase in 2005-06.

Budget Fully Funds Growth, COLAs, and Some Program Expansion. The Governor's budget proposes $2.5 billion (6 percent increase) in new K-12 expenditures in 2005-06:

Other Major Budget and Policy Initiatives. The Governor proposes several major budget and policy initiatives that accompany the budget.

The Governor's budget proposes a General Fund increase of $299 million, or 9.8 percent, for CCC. When combined with local property taxes, this results in a $359 million, or 7.5 percent, increase in Proposition 98 funding.

These funding increases will support a COLA of 3.93 percent and enrollment growth of 3 percent (or 32,289 full-time equivalent students). The budget assumes that student fees will remain at $26 per unit, which remains the lowest community college fee level in the country.

The CCC budget also includes $20 million in one-time funding from the Proposition 98 Reversion Account to create new vocational curricula that link K-12 and community college classroom work.

The Governor's budget proposal would increase General Fund support for UC by $97.5 million, or 3.6 percent, from the 2004-05 level. The CSU's General Fund support would increase by $111 million, or 4.4 percent. These increases primarily are intended to fund enrollment growth of 2.5 percent at each segment, as well as base increases of 3 percent (which is the same as our estimate of inflation for 2005-06).

In addition to these General Fund increases, the governing boards of both UC and CSU have already approved fee increases of 8 percent for undergraduate students and 10 percent for graduate students for 2005-06. The Governor's budget anticipates that as a result, student fee revenue will increase by $150 million at UC and by $101 million at CSU. These revenues would not be used as a budget solution to offset General Fund costs, but would instead be available to the segments for whatever purposes they chose. When General Fund support and fee revenue are combined, UC's budget would increase by 5.5 percent and CSU's budget would increase by 5.9 percent.

The proposed General Fund support and fee increases are consistent with the Governor's "compacts" he developed with UC and CSU last spring. The compacts, which are not binding on the Legislature, specify targets for the Governor's budget requests through 2010-11.

General Fund support for CSAC would increase by a total of $156 million, or 26.5 percent. Roughly one-third of this amount would fund increased costs of providing financial aid to needy students. The remaining two-thirds of the General Fund augmentation would be used to backfill a reduction in funding from the Student Loan Operating Fund (SLOF). About $147 million in surplus funding in the SLOF was used on a one-time basis in the current year to achieve General Fund savings. For 2005-06, the Governor proposes a smaller, one-time shift of $35 million from the SLOF.

The Governor's budget would increase the size of Cal Grant awards to fully cover the increased fees at UC and CSU for eligible needy students. However, it would decrease the size of new Cal Grant awards for students attending private colleges and universities by about 10 percent, for $7.5 million in General Fund savings.

Medi-Cal Reform Proposal. The administration is proposing a series of changes to the structure of the Medi-Cal Program. These include: (1) expansion of managed care for families and kids as well as the aged and disabled, (2) new premiums (generally ranging from $4 to $10 per month per person) for certain beneficiaries with higher incomes, (3) imposition of a cap on adult dental services of $1,000 per year, (4) restructuring of hospital revenue streams, (5) expedited processing of children's applications for health coverage through the so-called "single point of entry" contractor at the state level instead of sending Medi-Cal applications on to counties, and (6) stronger state monitoring of county administration of program eligibility.

Medicare Drug Benefit. The budget plan reflects both General Fund increases and decreases from the implementation of the new Medicare drug benefit authorized last year by Congress. This includes about $746 million in state savings from the shift of drug coverage for some Medi-Cal beneficiaries to Medicare, but also about $647 million in so-called "clawback" payments to the federal government for the support of Medicare. Increases in Medicare premiums would add $156 million in General Fund costs.

Other Budget Changes. The budget plan saves about $191 million in the Medi-Cal Program by shifting part of the state cost of coverage of prenatal care services for some beneficiaries to federal funding. The budget plan would restore state funding for outreach activities to assist persons in applying for benefits and initiate other steps to promote the enrollment of children in the state's Medi-Cal and Healthy Families programs and county-supported initiatives for health coverage.

Proposition 99 Shifts. The budget reflects a number of significant shifts in the use of Proposition 99 tobacco tax revenues. More Proposition 99 dollars would be used to support state mental hospitals, certain community clinics, breast and cervical cancer screening, and Medi-Cal nonemergency medical services. Meanwhile, support for the Access for Infants and Mothers Program would be shifted away from Proposition 99 toward support from the General Fund and federal funds.

Other Budget Changes. The budget plan also provides new state funding for a series of health policy initiatives. About $6 million from the General Fund would be provided for efforts to reduce the incidence of obesity. Almost $4 million is budgeted for the "California Rx" program by which an estimated 5 million low- and moderate-income Californians could receive discounts on prescription drugs at pharmacies. Also, $15 million would be expended for a fee-supported program to expand screening of newborns for various genetic diseases.

Grants. The budget contains three major proposals for the CalWORKs program which reduce grants for recipients. First, the budget reduces the maximum monthly grant by 6.5 percent (from $723 to $676 for a typical family of three), resulting in savings of $212 million. Second, the budget proposes to delete the requirement to provide the statutory COLA, resulting in cost avoidance of $164 million. Third, by reducing the amount of income which is disregarded for the purpose of determining a family's grant, the budget reduces the grant payments for working families, resulting in a savings of $78 million. Under this proposal, a family of three earning $1,000 per month would see their monthly grant reduced by $93, in addition to the $47 grant reduction noted above.

Fund Shifts. The budget achieves additional savings by offsetting General Fund costs in Foster Care ($55 million), Developmental Services ($60 million), and juvenile probation ($201 million), with Temporary Assistance for Needy Families (TANF) funds transferred to the Title XX Social Services Block Grant.

The budget proposes to suspend the January 2006 COLA for the SSI/SSP resulting in cost avoidance of $174 million in 2005-06. In addition, the budget does not "pass through" the federal January 2006 COLA, resulting in state savings of $85 million in the budget year. Together, these proposals result in combined annual savings of $518 million in 2006-07.

The budget proposes to limit state participation in provider wages to the minimum wage, rather than the $10.10 per hour level currently authorized. This results in savings of $195 million.

The budget proposes a series of child care reforms, similar to last year's proposal. The proposal would save $95 million in the State Department of Education programs and $63 million in child care for CalWORKs recipients. Key features of the proposal include: (1) phasing in a one-year time limit for Stage 3 child care, (2) tying reimbursement rates to child care quality (which results in significant reductions in reimbursements for license-exempt care), (3) waiting list reforms, and (4) basing income eligibility on the percentage of federal poverty rather than state median income. Most of the savings come from the proposed reduction in reimbursement rates to unlicensed providers.

The Governor's budget for the California Department of Corrections (CDC) includes several augmentations, the largest being $280 million to fund a projected increase in the inmate population. As regards the Youth Authority, the budget indicates that the May Revision will include proposals to reform the juvenile justice system, including funding to implement the Farrell v. Allen court settlement which deals with conditions of confinement at the Youth Authority.

In order to achieve savings, the budget proposes to (1) shift funding for county juvenile probation programs from the General Fund to federal TANF funds ($201 million), (2) reduce funding for local juvenile crime prevention programs ($75 million), (3) eliminate grant funding for sheriffs in small and rural counties ($18.5 million), and (4) reduce CDC's spending by $95 million.

The proposed budget for the judicial branch includes several major augmentations, including $97.4 million for growth in trial court funding based on the annual change in the state appropriations limit (SAL), $92.5 million for increased trial court salary and benefit costs, and $60.5 million to restore prior one-time reductions. The budget also provides $72.7 million to repay a 2003-04 loan from the State Court Facilities Construction Fund. Finally, the administration indicates that it will propose an annual SAL adjustment for the Supreme Court and Courts of Appeal beginning in 2007-08 similar to the current requirement for the trial courts. No reductions are proposed for the judicial branch.

The Governor's budget proposes to achieve $1.526 billion in savings to the General Fund by:

Under Proposition 42, approved by voters in 2002, revenue from the sales tax on gasoline that previously went to the General Fund is to be transferred into the Transportation Investment Fund for transportation purposes. However, Proposition 42 allows the transfer to be suspended in years in which the transfer would have a significant negative fiscal impact on the General Fund. Since 2003-04, Proposition 42 has been either partially or fully suspended each year, with the suspended amounts to be repaid with interest in later years.

The Governor proposes to amend Proposition 42 to prohibit any suspension after 2006-07. This would allow the transfer to be suspended again in 2006-07, if circumstances warrant.

The Governor proposes to repay Proposition 42 loans over 15 years. Currently, there

are two outstanding Proposition 42 loans to

the General Fund that are due to be repaid.

Specifically, $1.2 billion (plus interest) is due by

June 30, 2008 and $856 million (plus interest)

is due by June 30, 2009. These loans resulted from the suspension of the

Proposition 42 transfers in 2004-05 and 2003-04, respectively.

The Governor's budget shows a delay—from the current year to 2005-06—in the availability of $1.214 billion in bond funds for transportation, backed by tribal gaming revenue. The bond funds are to repay a transportation loan made to the General Fund. Due to a pending lawsuit, the budget now anticipates the bonds would not be issued until 2005-06.

The budget also proposes a trailer bill to make repayment of the $1.214 billion "explicitly contingent upon receipt of the tribal gaming revenue." This implies that if tribal gaming revenue falls short and only a smaller amount of bonds can be issued, the amount of repayment in 2005-06 would be limited to the smaller amount, thereby eliminating the General Fund's obligation to make up the difference in 2005-06. Under current law, the General Fund is required to make up the difference by June 30, 2006. Instead, the difference would be repaid over 15 years.

The budget proposes about $5 billion for resources and environmental protection programs, a reduction of $1.9 billion from estimated 2004-05 expenditures. Most of this reduction reflects a decrease in available bond funds. The budget also reflects an increase in General Fund spending of about 17 percent, largely reflecting increased debt service payments and program augmentations in the Departments of Water Resources, Forestry and Fire Protection, and Parks and Recreation.

Proposal to Finance a Litigation Settlement With Bonds. The budget proposes to finance a pending $464 million settlement of flood-related litigation against the state by issuing a judgment bond in the budget year. The debt service on the bond would be funded from the General Fund, subject to annual legislative appropriations, beginning in 2006-07. It is important to note that this settlement has yet to be finalized and that the terms and structure of such a bond have yet to be determined. While judgment bonds have been issued to finance judgment obligations imposed by courts on local governments, we are not aware of such a bond having been issued by the state.

The administration is proposing major changes in the employee compensation and retirement area, as described below.

Collective Bargaining and Retirement. The administration is proposing to reduce General Fund costs by $408 million by gaining concessions from state employee unions through the collective bargaining process. The largest proposal would save an estimated $296 million by reducing the state's annual retirement payments to the Public Employees' Retirement System (PERS). Under the proposal, state employees would either (1) contribute half of the annual PERS costs (currently state employees pay a fixed share) or (2) opt out of future participation in PERS in exchange for a pay raise. For new employees, the administration proposes to switch to a defined contribution system. Under a defined contribution system, the state's contribution is fixed and employees could invest their own retirement funds but would not have the guarantee of a certain level of benefits upon retirement.

Teachers' Retirement. Currently, the state's General Fund annually contributes roughly 2 percent of teacher payroll to STR's base program. The budget proposes to shift this payment for school districts and/or teachers. This would result in 2005-06 General Fund savings of $469 million.

Pension Bond. The 2004-05 budget package authorizes the issuance of a pension obligation bond. At the time of the budget's enactment, the bond was estimated to provide a General Fund benefit of $929 million in the current year. Using existing statutory authority, the administration now plans to issue the bond in 2005-06 at a somewhat lower amount ($765 million).

The budget assumes almost $250 million in General Fund savings from two statewide approaches:

In our Fiscal Outlook published in November, we indicated that the state faces an ongoing structural budget shortfall, peaking at $10 billion in 2006-07, absent corrective actions. As noted above, the budget proposal for 2005-06 contains about $4.5 billion in ongoing savings, which would expand to roughly $5 billion in the subsequent year. This implies that, if all of the budget proposals were adopted and the savings estimated by the administration were fully achieved, the projected ongoing imbalance between revenues and expenditures would be reduced by roughly one-half. Thus, while adoption of the budget plan would reduce the structural shortfall, the state would continue to face major budget imbalances in 2006-07 and beyond, absent additional corrective actions.

In order to address the persistent out-year imbalances, the Governor has called a special session for the Legislature to consider several major budget reform proposals. They involve:

Proposition 98 Changes. The Governor proposes to modify Proposition 98 in two key ways. First, the proposal would eliminate the ability to suspend Proposition 98's minimum funding requirement with a two-thirds vote of the Legislature. Second, the proposal would eliminate the "Test 3" factor (which reduces the growth rate of Proposition 98 funding during low revenue years).

Across-the-Board Budget Reductions. The Governor proposes changes in the State Constitution which would require across-the-board spending reductions to close a budget gap either (1) shortly after the beginning of a fiscal year when the state has not enacted a budget and faces a fiscal imbalance, or (2) during specified times in a fiscal year when the administration determines an enacted budget has fallen out of balance and the Governor and Legislature fail to agree on a mid-year plan to address the shortfall within a specified time period.

Consolidation of Certain Outstanding Obligations. The Governor proposes that the state repay over a 15-year period the following outstanding obligations: (1) currently outstanding $3.6 billion in "maintenance factor" and $1.3 billion in potential "settle-up" payments to schools, (2) unfunded mandates to local governments and schools (the latter from Proposition 98 funds), (3) Proposition 42 loans from transportation, and (4) other loans from special funds. While under existing law, maintenance factor payments restore ongoing funding for Proposition 98, under the administration's proposal these payments will be one-time adjustments, and will not raise the ongoing Proposition 98 minimum guarantee.

Proposition 42 Payments. Under Proposition 42, sales tax revenues on gasoline are transferred annually from the General Fund to special funds supporting transportation. Proposition 42 includes a provision allowing the suspension of this transfer during difficult budgetary periods. Under the budget's proposal, the Proposition 42 transfer could no longer be suspended after 2006-07.

Special Funds Loans. In recent years, the Governor and Legislature have borrowed balances in special funds to cover General Fund shortfalls. The Governor is proposing that this form of budgetary borrowing be prohibited in the future.

Pension Changes. State and local government employees generally participate in defined benefit retirement plans, where retirement benefits are determined by years of service, age at retirement, and the employees' wage levels. The Governor proposes a constitutional amendment that prohibits state and local governments from offering defined benefit plans to new employees. Such employees would be enrolled in defined contribution plans, similar to 401(k) programs, with public employers making fixed annual payments.

In our November report, we identified several important building blocks to address

the 2005-06 budget problem. These include:

(1) deferring the use of the remaining deficit bonds until 2006-07 and later years; (2)

holding current-year Proposition 98 spending at

the 2004-05 Budget Act levels; (3) avoiding

additional budgetary borrowing; and

(4) adopting ongoing solutions from throughout the

budget, looking at alternatives involving both expenditures and revenues.

In relation to the above criteria, the budget proposal has several positive attributes. While using some deficit bonds in 2005-06, it preserves nearly $2 billion for use in subsequent years. It does not increase current-year Proposition 98 funding, and many of its solutions would provide ongoing savings. Finally, it relies on reasonable estimates of caseloads, costs, and revenues, and accurately portrays the use of deficit-financing bonds.

At the same time, the budget falls well short of fully dealing with the ongoing structural shortfall, leaving more solutions needed from future budgets. The budget relies nearly entirely on expenditure reductions, targeted on relatively few major areas—namely K-12 education, transportation, and social services. In contrast, health, criminal justice, and resources programs are largely unaffected, and higher education receives a funding augmentation. Revenue increases are a minor part of the proposed solution.

Also, some of the savings scored in the budget are subject to considerable risk. In particular, the budget continues to assume sale of a $765 million pension obligation bond, which is currently subject to court challenge. The $408 million in employee compensation savings are dependent on collective bargaining negotiations. The budget includes savings from unallocated reductions to state operations in most program areas, with the largest amount coming from CDC, and procurement reforms are anticipated to generate more savings in the budget year. Savings related to collective bargaining negotiations, unallocated reductions, and procurement reforms, however, have often fallen short of expected levels in the past.

One of the main concerns posed by this budget relates to its structural reform proposals. We strongly support the objectives of eliminating the state's long-term structural problem, paying off its debts, and maintaining balanced budgets in the future. However, we believe that major proposals affecting future budgets—particularly the Proposition 98 and across-the-board reduction provisions—raise serious concerns.

First, they would dramatically reduce the ability of future policy makers to establish budget priorities, particularly during periods of revenue softness. For example, the proposed changes in Proposition 98 related to suspension and Test 3 would leave policy makers with limited discretion over the allocation of budget resources between Proposition 98 and other state programs. During revenue downturns, the proposal would potentially shift all of the burden of balancing the budget on spending reductions in non-Proposition 98 programs (such as higher education, health, social services, and criminal justice)—or on taxpayers in the form of higher fees and taxes. For example, if the state had not been able to suspend the minimum guarantee when the budget was enacted for 2004-05, school funding would have been required to increase by roughly $4 billion (instead of the $2 billion actually received), which would have necessitated either steeper reductions in other areas, more revenues, or additional borrowing.

Second, the proposed changes represent a serious diminution in the Legislature's authority to appropriate funds and craft budgets. Under the State's Constitution, only the Legislature can appropriate funds—and make mid-year reductions to those appropriations. Under the administration's proposal, the Governor would have the authority to determine when the budget is not balanced, with the default being automatic across-the-board reductions to most state programs, without regard to program priorities.

For these reasons, we believe the Legislature should carefully assess the administration's proposals, starting with a clear understanding of the specific deficiencies in the budgetary process. For instance, the administration suggests that a key problem is that state spending is on autopilot. If the Legislature believes that this is the case, the solution would not be placing more spending on cruise control—as the administration is proposing for Proposition 98 and other areas of the budget. The solution would be to eliminate these types of provisions that limit the Legislature's and Governor's authority to make annual budgetary decisions.

Similarly, the perceived deficiency may be that the recently enacted balanced-budget and mid-year correction provisions in Proposition 58 are not adequate to maintain fiscal balance. If so, there may be alternative proposals which strengthen the existing process while not diminishing the Legislature's central authority in budgetary appropriations.

| Acknowledgments

This report was prepared by Brad Williams with assistance from many others in the office. The Legislative Analyst's Office (LAO) is a nonpartisan office which provides fiscal and policy information and advice to the Legislature. |

LAO Publications

To request publications call (916) 445-4656. This report and others, as well as an E-mail subscription service, are available on the LAO's Internet site at www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000, Sacramento, CA 95814. |