February 2005

Our analysis indicates that the Governor's California Rx plan for drug discounts for the uninsured provides a reasonable starting point for the development of such a program. However, we propose, among other changes, that in the event that drug makers fail to make good on their promises for significant price concessions, an automatic trigger would phase-out the proposed voluntary approach to obtaining rebates from drug manufacturers, and be replaced by an alternative strategy likely to result in greater discounts on more drugs for consumers.

Steadily increasing consumer prices for prescription drugs and estimates that more than 6 million Californians lack health insurance have prompted the Legislature to explore a number of options for providing assistance to those with high prescription drug bills.

In response, the Legislature enacted Chapter 946, Statutes of 1999 (SB 393, Speier), to require retail pharmacies to sell prescription drugs to persons enrolled in the Medicare Program at a discount—just above Medi-Cal Program prices. Further legislation (Chapter 696, Statutes of 2001 [SB 696, Speier]) was enacted to provide deeper discounts to these individuals through rebates from drug companies. The latter measure (known as the Golden Bear Pharmacy Assistance Program) has never been implemented, partly because of administrative problems related to passing those rebates along to consumers. In addition to these state programs, some private parties, including a number of drug manufacturers, have offered their own privately subsidized programs to provide discounted drugs, or in some cases even free medications, for some consumers.

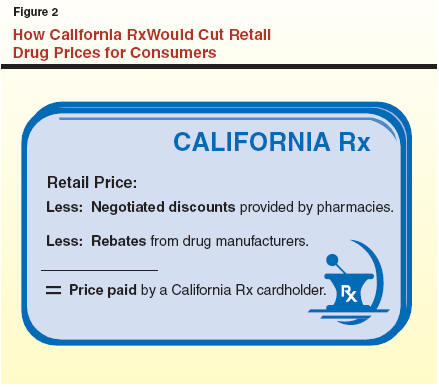

Governor's Proposal. The Governor's 2005–06 budget plan for the Department of Health Services (DHS) proposes to establish a California Rx program aimed at reducing the costs certain California consumers would have to pay for drugs purchased at pharmacies. The California Rx plan was initially offered in a modified form as amendments to several legislative measures last year, but was not adopted. Since that time, the Governor has revised his legislative proposal in some significant respects (now contained in SB 19 [Ortiz]), and incorporated a request for 18.5 staff positions and about $3.9 million from the General Fund into the 2005–06 spending plan for DHS. Key features of the proposal are summarized in Figures 1, 2, and 3, and discussed below.

|

Figure 1 Major Components of California Rx |

|

|

|

ü Who Is Covered? Uninsured California residents in families with income up to 300 percent of the federal poverty level would be eligible to enroll. |

|

ü Voluntary Pharmacist Participation. Pharmacists who voluntarily chose to participate would assist individuals in applying for discount cards and must sell prescription drugs at agreed-upon discounts. |

|

ü Voluntary Drug Company Participation. Drug manufacturers could participate in the program if they voluntarily agreed to enable further discounts on prices through payment of rebates to the state. |

|

ü Federal Designation. The state would obtain federal designation as a State Pharmacy Assistance Program, which opens the door to deeper price-cutting by drug makers. |

|

ü Program Integration. The state’s California Rx card would be integrated with private consumer discount programs operated by the drug companies themselves. One discount card would access all participating programs. |

|

ü Related Efforts. In a related effort, drug makers have pledged to spend $10 million over two years to publicize and fund toll-free telephone lines and Internet web sites to create a “single point of entry” for discounted drugs for Californians or, in some cases, free medications through existing privately funded assistance programs. |

Eligibility. The Governor proposes to allow low- and moderate-income California residents to enroll in the program by paying a $15 annual fee in order to obtain a prescription drug purchase discount card. In general, those eligible would be individuals and families with incomes up to 300 percent of the federal poverty level (FPL)—up to roughly $28,000 a year in income for an individual or $56,500 for a family of four. The new discount program would be available on a voluntary basis mainly for persons who do not have other forms of health insurance coverage through either private health insurance or enrollment in the state's Medicaid Program (known as Medi-Cal in California) or in the Healthy Families insurance programs for children. Medicare enrollees could participate in the program in some circumstances.

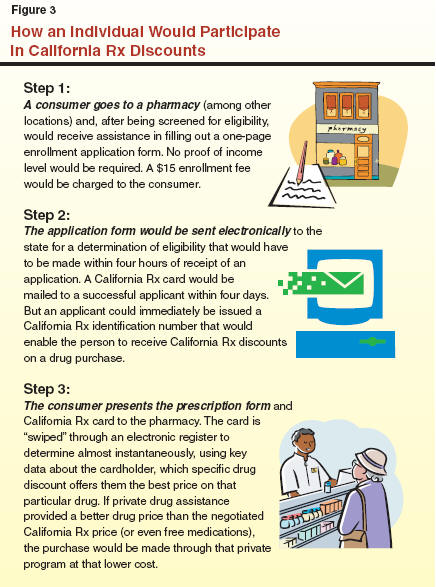

An applicant would not be required to provide any form of written proof of family income level. The administration estimates that up to 5 million Californians would be eligible to enroll in California Rx.

Pharmacy Discounts. The drug discount card would be generally similar in nature to the discount cards now available from various public and private programs including, most recently, the Medicare Program. Pharmacists who voluntarily chose to participate in the program would assist qualifying individuals in applying to the state for the discount cards, and must also agree to sell prescription drugs to persons possessing such cards at an agreed-upon discount negotiated in advance on a statewide basis with the state.

Voluntary Rebate Mechanism. The prescription drug prices paid by California Rx cardholders are to be further discounted through rebates the state would negotiate and obtain on a voluntary basis with drug manufacturers. In effect, the state would collect an agreed-upon amount of rebate money from a drug manufacturer each time a California Rx participant purchased one of the manufacturer's covered drug products using the discount card. The measure sets as a goal that the state obtain discounts for consumers equal to the lowest available commercial price—on average, about 40 percent below the price available in retail pharmacies.

The pharmacies would act as a sort of middleman in such transactions. In addition to the discount that a pharmacy would be required to provide a consumer on the price of a drug purchase, the pharmacy would further discount the price of a drug sold to a California Rx participant by a dollar amount equal to the applicable drug manufacturer's rebate. The pharmacy would subsequently be reimbursed by the state in an amount equal to that rebate. The state, in turn, would be reimbursed for these payouts to pharmacies through regular payments of the rebates from the drug manufacturers.

State Pharmacy Assistance Program Designation. Due to its voluntary nature, the California Rx program would not necessarily provide discounts for all available prescription drugs. Also, a drug maker could agree to allow some drugs, but not others, to be included in the California Rx program. The administration proposes to encourage drug manufacturers to cooperate in providing deeper discounts, and on a greater product line of drugs, by obtaining federal designation for California Rx as a State Pharmacy Assistance Program (SPAP).

Federal law generally requires drug manufacturers to offer their lowest prices to certain federally supported health programs. If a state were to negotiate a significant discount on a drug with its manufacturer, federal law effectively requires that the company cut its price even further for all of its sales of the same product to federal health programs. These federal constraints thus ordinarily make drug manufacturers resistant to negotiating deep discounts on drugs with other private or public entities, such as for the California Rx program. Designation as an SPAP addresses this concern, because drug sales to an SPAP are exempted from these so-called federal "best price" rules. If a drug company discounted the price at which it sold its product for the California Rx program, it would be under no obligation to further discount its prices for federally supported health programs. A state program such as California Rx can qualify for this federal designation so long as no federal funds are used for its support and the program has set income limits on eligibility. The exact income limits that must be set are not specified in federal rules.

Integration With Other Drug Discounts. Another aspect of the Governor's proposal involves integration of the California Rx discounts with other consumer discount programs, including a number offered by the drug companies themselves. The administration proposes to create a "seamless" system by which one discount card would automatically provide consumers access to the best discount available to them for a particular drug purchase. The administration believes that available computer technology would allow a pharmacy to determine, almost instantaneously, which private or public discount program would offer the best price for a drug to a consumer presenting a California Rx card at the time of purchase.

Related Efforts. As part of the California Rx program, the administration has indicated that the Pharmaceutical Researchers and Manufacturers Association (PhRMA), a private group representing major drug makers, has pledged to contribute $10 million over two years for related efforts to reduce the drug prices paid by Californians. The funds would be used to publicize and fund toll-free telephone lines and Internet web sites for a "single point of entry" by which eligible citizens would obtain discounted drugs or, in some cases, free medications through already-established privately funded assistance programs. These efforts are scheduled to begin this spring.

As it considers its response to the Governor's California Rx budget request and the associated proposed legislation, we recommend that the Legislature carefully weigh the pros and cons of the Governor's proposal and also compare his approach to alternative strategies for reducing drug costs being considered in other states. These issues are discussed below.

Our analysis indicates that the Governor's plan offers some potential advantages and benefits to the state if it were implemented effectively.

Low Risk of Litigation. For reasons discussed in more detail later in this analysis, a number of pharmacy assistance proposals developed in other states have encountered legal challenges that have, thus far, prevented their full implementation. The Governor's approach relies upon voluntary participation by drug manufacturers, an approach that health policy and legal analysts have suggested minimizes the risk of major legal challenges that could slow or even thwart start-up of the discount program. The PhRMA, a leading plaintiff in such legal challenges in other states, has endorsed the Governor's proposal and indicated that it would not mount a legal challenge to it in court.

Academic researchers interpret a recent U.S. Supreme Court ruling involving a program in the State of Maine ("Maine Rx Plus") to mean that alternative approaches for providing pharmacy assistance are available to the states. One commonly discussed approach is to require drug companies to provide participants in such programs the same or similar rebates that are mandated for Medicaid beneficiaries. Nonetheless, it is likely that some of these alternative approaches would provoke legal challenges that, even if ultimately rejected by the courts, would probably delay the implementation of a pharmacy assistance program. The Governor's approach would probably not encounter such legal delays, at least on that basis. The state would also avoid the potential unknown costs of engaging in such litigation.

Broader Access to Drug Discounts. Most existing drug discount programs target the elderly and disabled for assistance. That is now largely true for the private discount programs being sponsored by drug manufacturers, and it is also the case for the state's existing pharmacy assistance program. That program, enacted in 1999 as Chapter 946, requires pharmacies to sell prescription drugs to persons enrolled in Medicare—the elderly and disabled—at just above Medi-Cal prices. California Rx would result in greater access to drug discounts to persons who are largely excluded from these existing discount programs—including children and families in low- and moderate-income households. While this group, as a whole, is in better health overall and thus does not ordinarily bear heavy prescription drug costs, some individual families and children may have chronic medical conditions, such as asthma, that could require ongoing and regular prescriptions for sometimes-expensive medications.

Potential Fiscal Benefits for the State. The implementation of a pharmacy assistance program, such as California Rx, could provide some fiscal benefits to the state by keeping some uninsured individuals from becoming eligible or enrolled in full-scope state-supported medical benefit programs, such as Medi-Cal. Absent the discounts that might be available under such a pharmacy assistance program, for example, some poorer uninsured individuals might forego the purchase of their prescribed drugs, eventually become disabled as a result of their untreated medical condition, and thus become eligible for a full package of Medi-Cal benefits. Other individuals might "spend down" their financial assets on expensive drug purchases absent such discounts and in that way become eligible for Medi-Cal. The exact fiscal benefit to the state from a pharmacy assistance program is unknown, but could be significant if California Rx enrolled a large number of consumers.

In discussions with the Legislature, the administration has emphasized its belief that its proposal would clear the way for implementation of its pharmacy assistance program in a timely manner. This ease and speed of implementation involves a significant tradeoff, in that some of the alternative approaches discussed below would give the state a stronger bargaining position in negotiations with drug manufacturers that would probably result in greater discounts for the public for a more extensive list of prescription drugs. In particular, the administration's proposal to negotiate rebates on a voluntary basis with drug manufacturers would probably result in lower rebates, and agreements for rebates on fewer types of drugs, than if the state took the same approach as the State of Maine.

The Maine Rx Plus Approach. Maine, along with some other states, intends to leverage its Medicaid Program to strongly encourage drug manufacturers to provide substantial rebates on drug prices for participants in its Maine Rx Plus pharmacy assistance program. In particular, any drug maker which does not agree to provide deep rebates on prescription drug prices for Maine Rx Plus cardholders (who are not enrolled in Medicaid) will lose its preferred status for providing drugs for Maine's Medicaid Program.

This means that a doctor would be required to have prior authorization to prescribe that manufacturer's drug for a Maine Medicaid enrollee, making it less likely in some cases to be prescribed if other similar drugs are available which do not require such prior authorization. Drug makers which agree to provide significant rebates will not face prior authorization requirements for their products. This phase of Maine's program is expected to commence this spring. The state reports that it has already secured rebates with 20 drug companies for 200 drugs with prices up to 60 percent below the retail pharmacy price.

Iowa Had Little Success at Voluntary Rebate Approach. It does not appear likely that California Rx will be able to obtain rebates comparable to Maine through a voluntary approach. Iowa state officials took a comparable voluntary approach in the state's "Iowa Priority" program but, according to academic researchers, deemed their effort a failure after only 3 of 20 companies that were approached agreed to participate.

The administration has indicated that it has received preliminary commitments from major drug industry leaders to cooperate with the new California program, and projects that the pharmacy and manufacturer rebates together will reduce the cost of drugs on average by 40 percent compared to retail pharmacy prices. However, that would still be significantly below the 60 percent to 65 percent savings off pharmacy retail prices that the state generally receives under the Medi-Cal Program. The full extent of rebate savings that could be achieved under a voluntary California Rx approach and the full list of drugs for which rebates would be received, would not be known, in any event, until after rebate contracts were negotiated and signed over the next year with drug companies.

A Fundamental Strategic Choice. The administration's California Rx proposal presents the Legislature with a fundamental choice between what we view as two valid strategic approaches.

The first choice is to proceed relatively quickly and easily with the Governor's approach of attempting to gain rebates on a voluntary basis from drug manufacturers. This approach would probably generate some significant discounts on some prescription drugs for low- and middle-income consumers, although the exact level of savings will be hard to know until rebate agreements are finalized. The experience of Iowa's program that we noted earlier is evidence that major price concessions on a wide range of drugs is by no means assured for Californians.

In the alternative, the Legislature could follow the lead of Maine and other states and implement a pharmacy assistance program that does not rely upon voluntary rebates but instead requires rebates from companies as a condition of allowing their drug products to keep their preferred status in the Medi-Cal Program (meaning that they would not be subject to prior authorization requirements).

This alternative approach would probably result in a greater level of savings for consumers than the Governor's proposal, with greater rebates being received on a more extensive list of prescription drugs. Last year's U.S. Supreme Court ruling in the Maine case has opened the door to such an approach, and Maine itself appears to be on the brink of implementing such a strategy.

However, we also believe the Medi-Cal leveraging strategy is not one that would be implemented quickly. Creating a direct linkage between California Rx and Medi-Cal would probably require a lengthy and complicated process for obtaining the necessary federal approvals. Moreover, the experience of other states is that such a statutory approach would almost certainly face a protracted legal challenge from the pharmaceutical industry that would probably delay the implementation of a discount program in California.

Our recommended approach for addressing this key strategic choice is discussed below and summarized in Figure 4.

|

Figure 4 The LAO Alternative: A “Trigger” for California Rx |

|

|

|

Voluntary Rebates. The Department of Health Services (DHS) would negotiate voluntary rebates with drug manufacturers sufficient to meet the specific goals established in the California Rx legislation for providing significant discounts on a full complement of drug products. |

|

Annual Certification. The Director of DHS would certify in writing each year whether drug manufacturers were complying with these statutory goals, including specifically whether the average discounts being received resulted in the anticipated level of discounts. A written report on drug makers’ compliance with California Rx goals would be provided to the Legislature and the public each year. |

|

Program Continuation. If the DHS Director certified that the statutory goals of California Rx were being met (including provisions requiring continuation of private outreach efforts and the single point of entry for discount programs) the voluntary rebate approach would continue for at least another year. |

|

Trigger New Programs. If the DHS Director did not certify compliance with the goals of the program by drug makers, he or she would automatically be required by statute to phase out the voluntary rebate program and to seek federal approval for and implement a strategy to leverage the Medicaid Program to obtain deep discounts for persons enrolled in California Rx. A drug might no longer have preferred status in Medi-Cal if its manufacturer did not have a written agreement with the state to provide a rebate for California Rx. |

Try Governor's Approach First, But With a Trigger. In our view, both of the strategic approaches we have discussed have some merit. Accordingly, we recommend that the Legislature try the administration's approach for voluntary rebates first—but direct DHS in advance to move forward with the second approach if the Governor's program should fail to achieve its goals.

Specifically, we recommend that the California Rx legislation be amended to automatically require the director of DHS to phase out the voluntary approach, and to commence the implementation of a Medi-Cal leveraging strategy for California Rx, in the event that drug makers fail to make good on their promises to the administration to offer significant price concessions on an extensive list of prescription drug products.

In such a circumstance, the eligibility standard for the program would also automatically be expanded to 400 percent of FPL in place of the present 300 percent of FPL standard. We believe this additional trigger would provide a further incentive for drug makers to agree to substantial rebates because of the additional number of Californians who would be eligible to participate in the program.

Under our approach, the legislation would require the Director of DHS to certify each year the level of drug manufacturer compliance with the California Rx program. In a publicly released report that would be made available to the Legislature for its review, the Director of DHS would have to certify whether: (1) the drug discount goals identified in the legislation were being met for a full complement of medically necessary drugs, (2) that private entities were still cooperating with state efforts to create a single seamless California Rx program with access to private pharmacy assistance programs, and (3) that private support was continuing for outreach activities to make consumers aware of California Rx as well as the single point of entry to provide improved access to private discount programs.

The legislation would specify that, if the Director of DHS did not certify in writing each year that all three of these conditions were being met, the director would automatically be required to seek federal approval for, and to implement, a Medicaid leveraging strategy for the California Rx program. Specifically, the measure would generally require that signed, written agreements exist between the state and drug companies for agreed-upon rebates as a condition of letting their drug products have preferred status in the Medi-Cal Program (meaning they could be prescribed for Medi-Cal beneficiaries without prior authorization).

We believe that such a trigger provision would increase the odds that the administration's approach to pharmacy assistance would succeed. As drug makers considered whether to provide drug discounts on a voluntary basis for a full range of drugs, the consequences of any failure to follow through on their promises to the administration would be clear: If a voluntary approach does not work, the state will automatically move forward with a strategy to ensure such rebates are provided by use of the state's considerable Medi-Cal drug purchasing power. Our proposed trigger language would also hold the drug industry accountable for ensuring that it fulfilled its promises to make its own pharmacy assistance programs more accessible to eligible Californians.

Beyond not resulting in the lowest prices, the Governor's approach to establishing a pharmacy assistance program has other weaknesses and raises some policy issues that may be of concern to the Legislature. These concerns are summarized in Figure 5 and discussed below.

|

Figure 5 Additional LAO Issues and Concerns With California Rx |

|

|

|

Some basic accountability measures are lacking. |

|

Proposed timing for start-up of the program is problematic. |

|

Continuation of outreach is not assured after two years. |

|

Integration of multiple private and public drug discount programs into one “seamless” system will be difficult to accomplish. |

|

Proposed legislation exempts California Rx from competitive bidding requirements that apply to most other state agencies and programs. |

|

Proposed consumer fee level is high compared to other states. |

|

Budget request lacks key details and does not account for the “float”—the funding gap between when rebate money is paid to the state and when the state must pay pharmacies for rebates paid to consumers. |

Accountability Measures Lacking. The administration proposal does not put in place any specific mechanism for estimating and evaluating the effectiveness of the California Rx program in regard to reducing drug prices, or for informing the Legislature on a regular basis of the progress being made by the program in that effort.

Other provisions for ensuring accountability in the new program also seem to be missing from the California Rx legislation. Although the measure specifies that drug manufacturers who agree to voluntarily participate in the program are obliged to pay rebates at least quarterly to the state, for example, no sanctions are provided in the measure for drug companies which fail to remit their rebates to the state completely and in a timely fashion. Although the administration has indicated the California Rx program would include audits to ensure rebates are being appropriately paid to the state by drug companies, the budget request does not include any auditors to check their books.

Basic measures to protect against fraudulent applications for enrollment in California Rx also seem to be absent from the proposal. While the legislation specifies that the California Rx enrollment form must include a statement indicating that making a false statement is punishable under penalty of perjury, for example, the measure does not actually contain language making it a crime to make a false claim of eligibility for the program. Moreover, the California Rx legislation would mandate a turnaround time for the state of no more than four hours to make an eligibility determination once it received an application. While prompt processing of applications is a worthy program goal, we are concerned that no exemption from this rule is provided, even if fraud is suspected and the application warrants further investigation before an eligibility determination can be made. This requirement could also add to state administrative costs for operating the program in the future.

We are concerned that if fraud in program enrollment is not effectively prevented, the California Rx program may ultimately be at risk of losing its federal SPAP designation and the better discounts on drugs that this designation makes possible.

Start-Up Timing Problematic. The administration proposes that the new pharmacy assistance program commence January 1, 2006. That date coincides with the startup date for the new Medicare "Part D" drug coverage across the nation. We are concerned that a launch of both programs on the very same day could result in avoidable confusion for consumers and pharmacies. For example, consumers could end up being confused as to which new program had actually enrolled them. In some cases, the result of this confusion could be the loss of an opportunity to enroll in coverage that could save them thousands of dollars in costs annually.

Continuation of Outreach Not Assured. The California Rx proposal relies on private funding for outreach activities. However, that funding is only available for two years. After that point, no mechanism is in place to ensure that efforts continue to make eligible California consumers aware of the program. While the legislative proposal authorizes continued outreach activities, it does not directly provide any state funds for such ongoing efforts. The evidence from other states is that, even with outreach efforts to encourage enrollment, relatively few consumers (as low of 5 percent of those eligible) participate in such programs. We are concerned that, absent ongoing efforts to increase public awareness of the California Rx program, participation rates will be low. We also would note that if the Legislature wished to ensure a greater number of participants, it has the option of expanding program eligibility beyond families with incomes up to 300 percent of FPL. Other states are including families with incomes up to 400 percent of FPL in their drug discount programs.

Integration of Multiple Programs May Not Be Seamless. The proposal for a seamless system that quickly and easily gives consumers access automatically to the best program with the swipe of a card may not prove to be so seamless if private pharmacy assistance plans refuse to modify their rules of participation to conform to the California Rx approach. A number of these private plans limit participation to a lower standard of income, require more documented proof of the family's income levels, and separate application forms, all of which potentially conflict with the California Rx approach.

Exemptions Provided From Competitive Bidding Rules. A provision of the administration's bill allows the California Rx contracts to be exempted from various state competitive bidding requirements. However, the budget request provides no explanation or justification for setting aside these rules.

Fee Level Appears High. The administration's proposed legislation mandates that California consumers pay a $15 application fee, with $15 renewal fees each year thereafter, to participate in California Rx. Pharmacies would keep all fee revenue they collected, which presumably would go to offset their administrative costs for assisting enrollees in enrollment in the discount card program.

A recent national study of drug discount programs suggests that the fee proposed for California Rx is higher than the fee charged by other states with comparable programs. A number of states charge no fee at all to participants. No rationale for the proposed fee level has been provided in the administration's plan. We have been advised that it was the result of negotiations between the administration and pharmacy representatives, and does not reflect any administration estimate of the costs to pharmacies of administering the California Rx enrollment system.

If the administration's initial estimates of enrollment of about 1 million proved to be correct (although we believe they may be high), a $15 fee would generate about $15 million annually in revenue for the pharmacies who agreed to join the California Rx program. We would note that these pharmacies would also benefit financially from the program to the extent that their participation in California Rx brought them new customers bearing the discount drug cards, or at least preventing them from losing customers to other pharmacies participating in the state's new program.

Our analysis of the $3.9 million spending request for California Rx identified several significant fiscal issues, which are described below.

"Float" is Unfunded. As we noted earlier, the California Rx legislation requires that drug manufacturers pay rebates to the state on at least a quarterly basis. However, another separate provision of the bill requires that the state reimburse pharmacies for rebates within two weeks of a consumer's purchase of a drug. In other words, the state will in many cases be obligated to pay out rebates to pharmacies before it actually collects the rebate funds from a drug manufacturer. Moreover, any disputes that will likely arise over the actual amounts owed for rebates could further slow payments of rebate funds from drug makers to the state.

These provisions could have a very significant fiscal impact on the state. It is highly likely that the state would have to put aside a large sum of money up front—ranging from $15 million to as much as $60 million, according to administration estimates—to cover the so-called float, the funding gap between the time the rebate money comes to the state and when the state has to pay pharmacies. The administration indicates that it believes the most likely scenario would require $30 million in float funding.

The Governor's budget request did not identify this fiscal impact or request any state funds for the float. When questioned about this issue, administration officials indicated that their intent was to seek sufficient advances of private funds from drug makers to address the cash-flow problem. Failing that, they indicated, their intention is to seek a one-time General Fund appropriation at the time of the May Revision for this purpose. If that turns out to be the case, the first-year cost of the Governor's proposals could be more than eight times the original request included in the Governor's January budget plan.

Some Key Fiscal Details Missing. The budget proposal presented to the Legislature fails to completely justify about $2 million included in the request for "special items of expense." For example, about $1 million is set aside in the budget proposal for computer processing of prescription drug claims and payments of rebates. The budget request assumes that there will be about 5.6 million such claims in 200506. Administration officials indicate that this initial estimate of claims was based on the assumption that perhaps about 1 million persons—roughly 20 percent of the eligible population—would purchase prescription drugs about five to six times per year. Further documentation provided by the administration indicates that enrollment would probably range between 180,000 and 823,000 persons by the end of the budget year. Moreover, the number of drug claims in 2005–06 would range between 400,000 and 1.7 million. Based on these estimates, our analysis indicates that this component of the program is overbudgeted. We also note that the administration's budget request provides little information about how an additional $1 million requested for special items of expense would be used for the development of information systems for California Rx.

Finally, the budget plan proposes to appropriate funding and provide authority for 11 new staff positions who would be assigned to the collection of rebates. The budget plan assumes that all of these staff positions would be hired as of July 2005—six months before there would be any rebates for these staff members to collect. We see no reason why these staff would be needed until after the program starts and consumers begin to purchase drugs using their California Rx rebate cards.

Our analysis of the Governor's budget request and related draft legislation indicates that the California Rx plan provides a reasonable starting point for the development of such a program. In addition to our proposal for a trigger mechanism to ensure the program obtains significant rebates from drug makers, we believe a number of other improvements to the measure should be considered by the Legislature. These recommendations are summarized in Figure 6 and discussed below.

|

Figure 6 How California Rx Could Be Improved |

|

|

|

ü Delay the start-up of California Rx by six months to avoid confusion with the startup of the new Medicare drug benefits program in January 2006. |

|

ü Amend the legislation to require immediate and enforceable penalties if drug makers fail to pay rebates in full and in a timely manner. |

|

ü Strengthen antifraud protections by, for example, eliminating the proposed statutory requirement that all applications be processed within four hours. |

|

ü Protect the state General Fund from the float by requiring private funding sources for these costs. |

|

ü Reduce the budget request to strike funding for which inadequate fiscal detail or justification has been provided and to conform to a recommended six-month delay in the program. |

As we have discussed, the administration proposal to establish a pharmacy assistance program has a number of advantages. It could broaden access to drug discounts to millions of low- and moderate-income Californians who are uninsured and thus have little choice but to pay the highest prices available for their medications. The program could be implemented relatively quickly and with a relatively low risk of litigation.

However, we believe some major changes in the proposal are warranted to improve the odds that the measure will actually result in significant discounts on an extensive list of drugs that are medically necessary. With these and other changes, we believe it is possible to implement an effective pharmacy assistance program in California that would protect the interests of both the taxpayers and consumers.

| Acknowledgments

This report was prepared by Dan Carson. The Legislative Analyst's Office (LAO) is a nonpartisan office which provides fiscal and policy information and advice to the Legislature. |

LAO Publications

To request publications call (916) 445-4656. This report and others, as well as an E-mail subscription service, are available on the LAO's Internet site at www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000, Sacramento, CA 95814. |