July 2005

On July 11, 2005, the Governor signed the 2005-06 Budget Act. In this report we highlight the major features of the budget package.

Budget Overview

On July 7, 2005, the Legislature passed the 2005-06 Budget Bill along with implementing measures (see Appendix 1 for a list of these "trailer bills"). The Governor signed the budget on July 11, after using his line item veto authority to reduce appropriations by $190 million ($115 million General Fund).

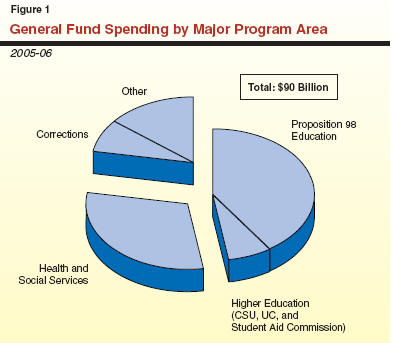

The budget package authorizes total spending of $113 billion, of which $90 billion is from the General Fund and $23 billion is from special funds. Figure 1 shows the distribution of General Fund spending.

The 2005-06 budget reflects an improving state fiscal picture brought about by better-than-expected growth in General Fund revenues. The new spending plan funds the Proposition 42 transfer to transportation, and includes significant increases in both K-12 and higher education. The new budget does not use any of the remaining $3.7 billion in deficit-financing bonds authorized by Proposition 57 in March 2004, and it prepays a $1.2 billion loan due to local governments in 2006-07.

At the same time, the spending plan includes roughly $6 billion in savings and related budget solutions in order to maintain budgetary balance. About one-half of the solutions is from holding 2004-05 Proposition 98 funding at the level anticipated in the 2004-05 budget package. Another $450 million is from reductions in social services programs, mostly from the suspension of cost-of-living adjustments for California Work Opportunity and Responsibility to Kids and Supplemental Security Income/State Supplementary Program grants. The budget also includes $525 million in one-time revenues from the refinancing of a previous tobacco-settlement backed bond. It counts on a $428 million loan from Merrill Lynch to fund the Paterno lawsuit settlement (relating to flood-related damage that occurred in 1986). Finally, it retains $380 million in transportation-related sales tax proceeds (Public Transportation Account "spillover" funds) in the General Fund.

Figure 2 shows that 2004-05 began with a large prior-year balance of $7.3 billion, and that revenues are estimated to total $79.9 billion in 2004-05 and $84.5 billion in 2005-06. The prior-year balance and the revenue totals for 2004-05 and 2005-06 are being affected by amnesty-related payments. These impacts, which are described in our Overview of the 2005-06 May Revision, raised the prior-year balance by nearly $4 billion, but are estimated to reduce collections by over $1 billion in both 2004-05 and 2005-06.

|

Figure 2 The 2005-06 Budget |

||

|

(In Millions) |

||

|

|

2004-05 |

2005-06 |

|

Prior-year fund balance |

$7,279 |

$7,498 |

|

Revenues and transfers |

79,935 |

84,471 |

|

Deficit Financing Bond |

2,012 |

— |

|

Total resources available |

$89,226 |

$91,969 |

|

Expenditures |

81,728 |

90,026 |

|

Ending fund balance |

$7,498 |

$1,943 |

|

Encumbrances |

641 |

641 |

|

Reserve |

$6,857 |

$1,302 |

The figure also shows that expenditures are projected to grow from $81.7 billion in 2004-05 to $90 billion in 2005-06, an increase of over 10 percent. The large increase partly reflects (1) the Proposition 42 transfers, which were deferred in 2004-05 but fully funded in 2005-06; and (2) the prepayment of the local government loan in 2005-06.

Because expenditures are expected to exceed revenues in both 2004-05 and 2005-06, the General Fund's reserve shrinks to just over $1.3 billion by the conclusion of the budget year.

2006-07 Effects. The savings included in the 2005-06 budget will address part of the state's ongoing structural budget shortfalls. However, even if all of the savings in the plan are fully achieved, we believe that current-law expenditures will exceed projected revenues by around $6.1 billion in 2006-07. (This does not include an $880 million transfer to the Budget Stabilization Account required by Proposition 58.) Taking into account the $1.3 billion reserve available at the end of 2005-06, the remaining year-end shortfall in 2006-07 would be roughly $4.8 billion, absent corrective actions. We will be updating our 2006-07 fiscal projections in November, when we release our California Fiscal Outlook.

Prepared by the Fiscal Forecasting and Budget Overview Section—(916) 319-8306

As Figure 1 shows, the budget package includes $50 billion in Proposition 98 spending in 2005-06 for K-14 education (K-12 schools and community colleges). This represents an increase of $3 billion or 6.4 percent from the revised 2004-05 spending level. Figure 1 summarizes the budget package for K-12 schools, community colleges and other agencies for both the current and past fiscal years. In 2005-06, funding for K-12 education grows 6.1 percent and community college funding grows 9.3 percent. The budget-package also provides $316 million in one-time Proposition 98 funds associated with prior years for K-12 and $16 million for community colleges. In addition, no appropriations are included in the budget package to provide additional funds to schools in 2004-05.

|

Figure 1 Proposition 98 Budget Summary |

||||

|

(Dollars in Billions) |

||||

|

|

2004‑05 |

|

Percent Change |

|

|

|

Enacted |

Revised |

2005‑06 |

|

|

K-12 |

$42.1 |

$42.1 |

$44.6a |

6.1% |

|

California Community Colleges |

4.8 |

4.8 |

5.2 |

9.3 |

|

Other agencies |

0.1 |

0.1 |

0.1 |

— |

|

Totals, Proposition 98 |

$47.0 |

$47.0 |

$50.0 |

6.4% |

|

K-12 |

|

|

|

|

|

Average Daily Attendance (ADA) |

6,006,898 |

5,990,309 |

6,031,404 |

0.7% |

|

Amount per ADA (in dollars) |

$7,006 |

$7,023 |

$7,402 |

5.4 |

|

a Total for 2005‑06 includes $27 million in program spending vetoed by the Governor but set aside for future legislation. |

||||

The K-12 portion of the Proposition 98 budget package includes:

Figure 2 shows the major changes in the 2005-06 budget from the prior year. In general, the budget fully funds base programs adjusted for growth and cost-of-living adjustments (COLA). In addition the budget provides an additional $401 million in general purpose funds to restore reductions and foregone COLA from prior years.

|

Figure 2 Major K-12 Proposition 98 Changesa |

|

|

(In Millions) |

|

|

2004‑05 Budget Act |

$42,087.3 |

|

Reduction in K-12 attendance |

-$33.5 |

|

Property tax adjustment |

21.3 |

|

Deferred maintenance |

-4.7 |

|

2004‑05 Revised K-12 Spending Level |

$42,070.4 |

|

Revenue Limit: |

|

|

Cost-of-living adjustment (COLA) |

$1,301.9 |

|

Growth |

189.7 |

|

Public Employees’ Retirement System and Unemployment Insurance |

-116.1 |

|

Deficit factor reduction |

400.6 |

|

Subtotal |

($1,776.2) |

|

Categorical Programs: |

|

|

COLA |

$420.0 |

|

Growth |

138.5 |

|

Restore programs funded with one-time funds |

151.5 |

|

Special education augmentations |

66.1 |

|

Veto set-asides |

27.0 |

|

High school exit exam—student assistance |

20.0 |

|

Other |

-25.7 |

|

Subtotal |

($797.4) |

|

Total Changes |

$2,573.6 |

|

2005‑06 Budget Act |

$44,644.0 |

|

|

|

|

a These amounts reflect the budget and accompanying legislation as enacted. Some of these amounts will change if technical clean-up legislation is enacted in the remainder of the session. |

|

Major funding changes include:

Other major budget actions include:

The budget provides an additional $316 million in one-time K-12 education funds needed to meet Proposition 98 obligations from prior years. Figure 3 shows the uses of these one-time funds.

|

Figure 3 K-12 Spending From One-Time Funds |

|

|

(In Millions) |

|

|

|

|

|

School facilities emergency repairs (Williams settlement) |

$183.5 |

|

Payment of prior K-12 mandate claims |

60.6 |

|

Low-Performing School Enrichment Block Granta |

22.3 |

|

Fruits and Vegetables Initiative |

18.2 |

|

Charter School Facilities Grants |

9.0 |

|

Other |

22.3 |

|

Total |

$315.9 |

|

|

|

|

a Language

in budget act identifies "up to" $49.5 million for this

program, but only provides |

|

The major one-time spending includes:

The Governor vetoed approximately $27 million in ongoing K-12 funding—including $20 million for instructional materials for English learners, $4.8 million from special education one-time grants, and $2 million for the Healthy Start program. The Governor set aside the funding for future legislation. The Governor also vetoed $74 million in federal carryover funds from various programs, and set the funds aside in accordance with a May Revision proposal to redirect carryover funds to low performing schools and districts. The Legislature rejected this May Revision proposal.

Prepared by the K-12 Education Section—

(916) 319-8333

The enacted budget provides a total of $9.7 billion in General Fund support for higher education in 2005-06 (see Figure 1). This reflects an increase of $879 million, or 9.9 percent, above the amount provided in 2004-05. In addition, student fee increases approved for the University of California (UC) and the California State University (CSU) will provide another $190 million in new, unrestricted funding for the university systems.

|

Figure 1 Higher

Education Budget Summary |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Change |

|

|

|

2004-05 |

2005-06 |

Amount |

Percent |

|

University of California |

$2,715.1 |

$2,843.2 |

$128.1 |

4.7% |

|

California State University |

2,481.1 |

2,615.1 |

134.0 |

5.4 |

|

California Community Colleges |

3,050.5 |

3,512.9 |

462.4 |

15.2 |

|

Student Aid Commission |

598.6 |

752.4 |

153.9 |

25.7 |

|

California Postsecondary |

2.1 |

2.1 |

— |

— |

|

Hastings College of the Law |

8.1 |

8.4 |

0.2 |

3.0 |

|

Totals, Higher Education |

$8,855.5 |

$9,734.1 |

$878.6 |

9.9% |

The budget provides $2.8 billion in General Fund support for UC in 2005-06. This is $128 million, or 4.7 percent, more than was provided in the prior year. In addition, UC will receive $114 million in new revenue from student fee increases already approved by the UC Board of Regents (including adjustments of 8 percent for undergraduates and 10 percent for graduate students). The budget allows UC to determine how this additional fee revenue will be spent.

Major General Fund augmentations include:

In adopting the 2005-06 budget, the Legislature rejected the Governor's proposal to reduce state support for UC's outreach programs. Instead, the budget maintains funding for these programs at their 2004-05 levels.

The budget provides $2.6 billion in General Fund support for CSU in 2005-06. This is an increase of $134 million, or 5.4 percent, from the revised prior-year amount. In addition, CSU will receive $76 million in new revenue from student fee increases already approved by the CSU Board of Trustees (adjustments of 8 percent for undergraduates and 10 percent for graduate students). The budget allows CSU to determine how this additional fee revenue will be spent.

Major General Fund augmentations include:

In adopting the budget, the Legislature reverted to the state General Fund

$15.5 million in prior-year enrollment funding that the

university did not use for additional students in

2004-05. The Legislature also rejected the Governor's proposal to reduce state

support for CSU's outreach programs. Instead, the budget maintains funding for outreach

programs at their 2004-05 levels.

Unlike UC and CSU, the California Community Colleges (CCC) receive substantial funding from local property taxes which, when combined with its General Fund support, comprises CCC's funding under Proposition 98. The 2005-06 budget provides CCC with $5.2 billion in Proposition 98 support. This is $442 million, or 9.3 percent, more than was provided in 2004-05. The CCC's share of total Proposition 98 support is 10.46 percent, which exceeds the 2004-05 level of 10.2 percent.

The General Fund portion of CCC's funding totals $3.5 billion in 2005-06, which reflects an increase of $462 million, or 15.2 percent, from the revised 2004-05 level. (The large General Fund increase is due in part to a one-time property tax adjustment in 2005-06.)

Major features of CCC's budget include:

The Governor vetoed a reappropriation of $37.4 million of Proposition 98 Reversion Account funds, but "set aside" this funding for anticipated legislation that would fund career technical education. This funding is reflected in the community college General Fund total in Figure 1.

The budget provides $752 million in General Fund support for the Student Aid Commission. This is $154 million, or 26 percent, more than 2004-05 expenditures. About two-thirds of this increase ($96 million) is to backfill a reduction in general purpose funding from the Student Loan Operating Fund. The budget raises Cal Grant awards for UC and CSU students by 8 percent to cover 2005-06 fee increases and maintains all other award amounts at their current-year levels. In addition, UC and CSU operate their own financial aid programs for their students. Funding for these programs, which comes from student fee revenue, would increase by a combined $64 million, or 13 percent, in 2005-06.

Prepared by the Higher Education Section—

(916) 319-8331

The 2005-06 budget plan provides about $17.9 billion from the General Fund for health programs, which is an increase of about $1.8 billion, or 11.5 percent, compared to the revised prior-year level of spending. Several key aspects of the budget package are discussed below and summarized in Figure 1.

|

Figure 1 Major Changes—State Health Programs |

|

|

(In Millions) |

|

|

2005‑06 General Fund Effect |

|

|

Medi-Cal |

|

|

Adjust for net increase in base program costs |

$484 |

|

Increase rates for nursing homes |

404 |

|

Continue higher rates for Los Angeles County clinics |

30 |

|

Medicare Part D Drug Benefit |

|

|

Reflect "clawback" payments owed to federal government |

$511 |

|

Continue coverage of selected drugs not covered by Medicare |

47 |

|

Adjust for savings on Medi-Cal drug costs |

-760 |

|

Reduce payments to managed care plans |

-58 |

|

Public Health |

|

|

Provide local assistance to combat West Nile Virus outbreak |

$12 |

|

Augment AIDS prevention and education efforts |

6 |

|

Use Proposition 99 funds to offset costs of hospital rate increases |

-26 |

|

Prenatal Care Services |

|

|

Shift Medi-Cal and AIM prenatal services to federal fundsa |

-$192 |

|

Healthy Families Program |

|

|

Increase application assistance and enrollment activities |

$6 |

|

Emergency Medical Services Authority |

|

|

Provide grants to improve the operation of trauma care centers |

$10 |

|

Department of Developmental Services |

|

|

Adopt unallocated reductions, rate freeze, other temporary savings |

-$84 |

|

Department of Mental Health |

|

|

Fund two state mandates for special education children |

$120 |

|

Activate beds at new state hospital in Coalinga |

66 |

|

Shift General Fund support for prison inmates to DMH |

61 |

|

Include lease-revenue bond payments for Coalinga hospital |

27 |

|

|

|

|

a Reflects combined savings for 2004‑05 and 2005‑06. |

|

The 2005-06 enacted budget provides about $13 billion from the General Fund ($34.9 billion all funds) for Medi-Cal local assistance expenditures. This amounts to about a $1.3 billion or 11 percent increase in General Fund support for Medi-Cal local assistance. The increase in expenditures reflects (1) ongoing growth in caseload; (2) increases in costs and utilization of medical services in the base program; (3) rate increases for nursing homes and certain other providers; and (4) a number of significant policy changes in Medi-Cal, including those described below.

Medi-Cal Redesign—Expansion of Managed Care. The budget plan expands Medi-Cal managed care to additional counties, but generally rejects an administration proposal to mandate the enrollment of aged and disabled beneficiaries in managed care. The exception would be aged and disabled beneficiaries who enroll in county organized health systems, consistent with the current practice. Funding to begin implementing these changes is provided in 2005-06. However, savings from these changes would not be realized for several years.

A proposal for long-term care integration of health and social services programs in three counties, which was a part of the original managed care expansion package, is to be considered outside of the budget process in policy legislation.

Medi-Cal Redesign—Other Proposals. The budget plan adopts an $1,800 annual limit on dental services provided to adults. In so doing, the Legislature modified an administration proposal for a dental cap in a way that will result in lower savings but also affect fewer Medi-Cal beneficiaries. However, the budget plan does not include some other components of a plan to redesign the Medi-Cal Program, including a proposal to require certain Medi-Cal beneficiaries to pay monthly premiums to participate in the program.

Restructuring Hospital Finances. No changes in the structure of state support for public and private hospitals were incorporated in the budget, but it assumes that a new federal hospital waiver will be implemented in the budget year. A recent agreement between the administration and federal authorities over such changes will be considered in separate policy legislation. In a related matter, the budget plan continues payments to certain Los Angeles County health clinics at an enhanced reimbursement rate that would otherwise have been discontinued.

Medi-Cal spending is reduced under the budget plan to reflect the shift of prescription drug coverage for certain aged and disabled beneficiaries to the new federal Medicare Part D drug benefit that takes effect in January 2006. Specifically, payments to Medi-Cal managed care plans are reduced to reflect the change of some plan beneficiaries receiving their drug coverage from Medicare instead of Medi-Cal.

The budget plan also recognizes increased state costs resulting from the change, including so-called "clawback" payments that will be owed to the federal government under the new federal law. The budget also recognizes additional costs to the state that would result from continuation of Medi-Cal coverage of certain drugs that are not available under the new Medicare Part D federal benefit. Also, the budget plan calls for preparing state contingency plans for emergency drug coverage in the Medi-Cal Program and other actions to assist Medi-Cal beneficiaries who may encounter problems in their transition to Medicare Part D drug coverage.

The budget plan for Medicare Part D also reflects additional related adjustments in Medi-Cal and in the budgets of the Departments of Aging, Mental Health, and Developmental Services.

The budget plan provides the Department of Health Services with about $416 million from the General Fund ($2.1 billion all funds) for public health local assistance during 2005-06. This reflects an overall increase of about $79 million (all funds) or 4 percent in annual spending for the program over the revised prior-year level of spending. General Fund spending for public health local assistance would increase by about $28 million.

Changes for New and Existing Programs. The Legislature rejected an administration proposal for a new program to obtain discounts on drugs for low- and moderate-income Californians. The spending plan includes (1) a scaled-down proposal for new programs to prevent obesity, (2) assistance to local agencies to address outbreaks of the West Nile Virus, and (3) an augmentation for an existing state program for AIDS prevention and education. However, the Governor vetoed a legislative augmentation to expand enrollment in an existing prostate cancer treatment program.

Proposition 99 Funding Shifts. The budget plan achieves General Fund savings by shifting Proposition 99 funds to cover the cost of certain Medi-Cal hospital rate increases. The budget also provides Proposition 99 funding to augment state programs for tobacco education, indigent care, rural health demonstration projects, assistance to physicians with their student loans, asthma prevention, and breast cancer screening.

The budget plan achieves about $304 million in state savings in 2004-05 and 2005-06 (combined) by taking advantage of available federal funds for support of prenatal care services provided under the Medi-Cal and Access for Infants and Mothers (AIM) programs. These funds, available under the federal State Children's Health Insurance Program, take the place of state support. The state would achieve about $192 million in General Fund savings in Medi-Cal and about $112 million in savings of Proposition 99 funds in AIM.

The budget plan provides about $346 million from the General Fund ($959 million all funds) for local assistance under the Healthy Families Program during 2005-06. This reflects an overall increase of about $149 million (all funds) or 18 percent in annual spending for the program. General Fund spending for Healthy Families local assistance would increase by about $53 million. This increase in costs is primarily the result of underlying increases in caseload and provider rates. Also, the budget plan provides funding for application assistance and other activities to increase the enrollment of children in the program.

Trauma Care Centers. The budget plan augments the Emergency Medical Services Authority by $10 million from the General Fund for grants to improve the operation of trauma care centers. In signing the budget, the Governor indicated that he supports the provision of these additional funds on a one-time basis.

The budget provides almost $2.3 billion from the General Fund ($3.7 billion all funds) for services to individuals with developmental disabilities in developmental centers and regional centers. This amounts to an increase of about $152 million and 7.1 percent in General Fund support over the revised prior-year level of spending.

Community Programs. The 2005-06 budget includes a total of $1.9 billion from the General Fund ($2.9 billion all funds) for community services for the developmentally disabled, an increase in General Fund resources of about $157 million over the prior fiscal year due mainly to increases in caseload, costs, and utilization of regional center services. Part of the budget increase is due to the provision of funds for regional centers to comply with federal waiver requirements and an expansion of the self-directed community services program, which gives regional center clients more control over the services and supports that are purchased for them.

The budget continues several mostly temporary actions to hold down program costs, such as an unallocated reduction to purchase of services, rate freezes, and the suspension of startup funds for some new programs. However, the Legislature did not approve proposals to save $10 million from the General Fund on various cost-containment strategies for regional center programs.

Developmental Centers. The budget provides $379 million from the General Fund for operations of the developmental centers ($709 million all funds), about a 1.9 percent decrease below the revised prior-year level of spending. The budget continues to support plans to close the Agnews Developmental Center by July 2007 and place many of its clients in community programs.

The budget provides about $1.3 billion from the General Fund ($3 billion all funds) for mental health services provided in state hospitals and in various community programs. This is about a $312 million or 32 percent increase in General Fund support compared to the revised prior-year level of spending for mental health programs.

Community Programs. The 2005-06 budget includes about $429 million from the General Fund (almost $2 billion all funds) for local assistance for the mentally ill, about a 41 percent increase in General Fund support compared to the revised prior-year level of spending.

The spending plan does not include proposals to suspend or repeal two state mandates on counties to provide mental health care for children who require special education services, and instead augments the budget by $120 million from the General Fund to keep the existing program in place for at least another year. In signing the budget, the Governor indicated that he supports this funding on a one-time basis and directed DMH to draft a plan to convert the program from a mandate to a categorical program next year.

The budget plan also authorizes staffing and funding for DMH and five other state agencies to expand mental health programs in keeping with Proposition 63, approved last year by the voters.

State Hospitals. The budget provides about $801 million from the General Fund for state hospital operations (about $887 million all funds). The $170 million or 27 percent increase in General Fund resources was due to several factors, including caseload increases, funding shifts, the activation of a new state hospital in Coalinga, and the addition of lease-revenue bond payments for this facility.

Prepared by the Health Section—

(916) 319-8350

General Fund support for social services programs in 2005-06 totals $9.3 billion, an increase of 3.3 percent over the prior year. Most of the increase is due to the deferral of the annual federal child support automation penalty from 2004-05 to 2005-06, caseload increases in the Supplemental Security Income/State Supplementary Program (SSI/SSP) and the In-Home Supportive Services (IHSS) program, partially offset by decreases in California Work Opportunity and Responsibility to Kids (CalWORKs) and Foster Care.

The final budget rejects the Governor's proposals with respect to reducing state support of IHSS provider wages and the use of Temporary Assistance for Needy Families (TANF) federal funds to support juvenile probation costs in the Corrections Standards Authority. The 2005-06 Budget Act and related legislation make various changes to current law, and the fiscal impacts of these changes are summarized in Figure 1 (see next page). (Despite the reductions shown in Figure 1, certain social services programs, such as SSI/SSP, continue to grow due to caseload increases.)

|

Figure 1

Major

Changes—Social Services Programs |

|

|

(In Millions) |

|

|

Programs |

Change From Prior Law/ Practice |

|

SSI/SSP |

|

|

Suspends January 2006 state COLA |

-$130.9 |

|

Delays January 2006 federal COLA until April 2006 |

-48.0 |

|

CalWORKsa |

|

|

Suspends July 2005 COLA |

-$135.5 |

|

Savings resulting from SDE child care used to satisfy MOE |

-85.7 |

|

Establishes pay-for-performance county

incentive |

-22.2 |

|

Veto of county block grant funds |

-25.0 |

|

Reappropriates prior year county block grant funds |

50.0 |

|

Foster Care and Child Welfare Services |

|

|

Replaces General Fund with federal TANF

funds for |

-$55.1 |

|

Replaces General Fund with federal TANF funds for child welfare services |

-8.0 |

|

Child welfare program improvement plans |

11.0 |

|

Licensing and State Operations |

|

|

Continue fingerprint fee for one year |

-$1.5 |

|

State operations unallocated reduction |

-8.0 |

|

Department of Aging |

|

|

Increase for health insurance counseling

services |

$3.8b |

|

Total |

-$455.1 |

|

|

|

|

a Combined General Fund and federal TANF block grant funds. |

|

|

b Combined federal and special funds. |

|

State Cost-of-Living Adjustment (COLA) Suspension. Budget related legislation suspends the state COLA for January 2006 (the 2005-06 fiscal year) and January 2007 (the 2006-07 fiscal year). Suspension of the January 2006 COLA results in six-month savings of $131 million in 2005-06, rising to $262 million in 2006-07. Suspension of the 2007 state COLA will result in additional savings in 2006-07 of about $137 million, with the exact amount depending upon actual future changes in state and federal price indexes.

Federal COLA Delay. The budget delays the "pass through" of the federal COLA to recipients from January to April in both 2006 and 2007. These delays result in estimated one-time savings of $48 million and $42 million, respectively. The maximum combined monthly SSI/SSP grant for an individual will remain at $812 through March 2006, increasing to an estimated $827 in April 2006, and $840 in April 2007.

Suspension of CalWORKs COLA. Budget related legislation suspends the CalWORKs grant COLA for two years. Suspending the 2005-06 COLA, results in a CalWORKs grant savings of $135.5 million. For 2006-07, the combined savings increases to an estimated $274 million. For a family of three in a high-cost county, the maximum grant will remain at $723 per month through June 2007.

Veto of County Block Grant Funds. Budget-related legislation allows county welfare departments to retain up to $50 million in unspent county block grant funds from 2004-05 to support CalWORKs administration and welfare-to-work services. As a result of the availability of these carryover funds, the Governor vetoed $25 million in CalWORKs county block grant funds.

County Incentive Program. Legislation establishes an incentive system with performance measures designed to encourage counties to increase participation by CalWORKs recipients in welfare-to-work activities. The budget reflects $22 million in grant savings associated with higher participation as a result of this incentive system and sets aside $30 million in funding in the TANF reserve to reward counties for improved performance.

Other Actions. By counting spending by the State Department of Education on child care for families who are eligible for CalWORKs (rather than receiving CalWORKs), the budget increases countable child care maintenance-of-effort (MOE) funding by approximately $86 million. This permits an identical savings in the General Fund appropriation for CalWORKs in the Department of Social Services (DSS) while maintaining compliance with the federal MOE requirement.

Federal Waiver for Able-Bodied Adult Recipients. Budget related legislation requires DSS to apply for federal waivers of Food Stamp work requirements in counties that have able-bodied adult recipients without children living in areas of high unemployment. These waivers allow eligible adults to receive Food Stamps for more than three months in a three-year period. State law would allow counties to opt out of the federal waiver.

Veto in Food Stamps Administration. The Legislature provided $24 million ($10 million General Fund and $14 million federal funding) in increased funding for Food Stamps administration because of a concern that the savings associated with quarterly, rather than monthly, eligibility determination were overstated. The Governor vetoed this legislative augmentation and required DSS to work with counties to determine more precisely the cost of Food Stamps administration under quarterly reporting in time for the January 2006 budget.

TANF Transfers Into the Title XX Social Services Block Grant. For the first time, budget legislation authorizes TANF block grant funds to be transferred into Title XX to offset costs in foster care grants ($55.1 million) and certain CWS costs ($8 million).

CWS Program Improvement Funding. The budget provides $42 million (all funds) for CWS program improvement activities in 2005-06. Compared to 2004-05, overall funding for these activities increased by $3.2 million while General Fund support increased by $11 million (net of the Governor's $3.5 million veto). As part of the funding for these activities, the budget reduces support for a select group of pilot counties and increases support for a competitive grant available statewide to assist counties as they implement action plans for program improvement required by Chapter 678, Statutes of 2001 (AB 636, Steinberg).

CCL. Budget related legislation extends for another year, the suspension of the fingerprint fee exemption for certain licensed providers working in small facilities. This results in General Fund savings of $1.5 million.

DSS State Operations. The Legislature augmented the CCL division by $1.4 million General Fund; in order to mitigate the effect of an $8 million unallocated reduction proposed by the administration in DSS. The Governor vetoed this additional funding.

The budget increases funding for the Health Insurance Counseling and Advocacy Program (HICAP) by $3.8 million. This increase was funded by a combination of federal and special funds (including a $667,000 increase in the fees charged to managed care plans).

The Legislature rejected the proposed elimination of funding for the Naturalization Services Program operated by the Department of Community Services and Development by providing $2.5 million. The Governor vetoed $1 million, leaving program funding at the same level as 2004-05.

Prepared by the Social Services Section—

(916) 319-8353

The 2005-06 Budget Act contains $11.4 billion for judicial and criminal justice programs, including $9.7 billion from the General Fund. The total amount is an increase of $541 million, or 5 percent, from 2004-05 expenditures. The General Fund total represents an increase of $502 million, or 5.5 percent, relative to 2004-05 expenditures.

Figure 1 shows the changes in expenditures in some of the major judicial and criminal justice budgets. We highlight the major changes below.

|

Figure 1

Judicial and

Criminal Justice Budget Summary |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Change |

|

|

Program/Department |

2004‑05 |

2005‑06 |

Amount |

Percent |

|

Judicial Branch |

$1,611 |

$1,746 |

$135 |

8.4% |

|

Department of

Corrections and |

6,794a |

7,264 |

470 |

6.9 |

|

Department of Justice |

330 |

333 |

3 |

0.9 |

|

Citizens' Option for Public Safety |

100 |

100 |

— |

— |

|

Juvenile Justice Grants |

100 |

26 |

-74 |

-74.0 |

|

Other Corrections Programs |

226 |

194 |

-32 |

-14.2 |

|

Totals |

$9,161 |

$9,663 |

$502 |

5.5% |

|

|

||||

|

a

For purposes of comparison, this figure

consists of General Fund spending for

the various |

||||

The budget includes $3 billion for support of the judicial branch. This amount includes $1.7 billion from the General Fund; $475 million transferred from the counties to the state and $825 million in fine, penalty, and court fee revenues. The General Fund amount is $135 million, or 8.4 percent, greater than the revised 2004-05 amount.

Court Operations. Funding for trial court operations is the single largest component of the judicial branch budget, accounting for approximately 75 percent of total judicial branch spending. The 2005-06 budget increases funding to reflect the annual change in the state appropriations limit ($130 million), funds salary and benefit costs as well as court security costs ($93 million); and restores past one-time reductions ($61 million). It also repays a 2003-04 loan from the State Court Facilities Construction Fund to the General Fund ($73 million).

Court Fees. The budget offsets General Fund spending for the courts by approximately $62 million by continuing fee increases made in prior years as well as by adopting new fee increases. Specifically, it (1) extends until December 31, 2005, the $20 surcharge on criminal penalties for court security; (2) reauthorizes the transfer of "undesignated fee" revenue from the counties to the state through 2008-09; (3) increases the civil assessment for failure to appear in court from a maximum of $250 to a maximum of $300; (4) establishes statewide uniformity in court civil fees; and (5) increases certain civil fees.

The budget contains $7.3 billion from the General Fund for support of the newly created California Department of Corrections and Rehabilitation (CDCR), an increase of $470 million, or 6.9 percent, above the revised 2004-05 level. Effective July 1, 2005, the various corrections departments were consolidated into a single department pursuant to Chapter 10, Statutes of 2005 (SB 737, Romero), and the Governor's Reorganization Plan No. 1.

Adult Corrections. Major new spending includes funding to fully activate a new prison in Delano ($91 million), fill vacant positions ($35 million), expand the Basic Correctional Officer Academy ($29 million), and improve inmate medical and dental services ($40 million). The budget also provides $7.5 million to implement new inmate and parole programs and restores $51 million of the $95 million reduction to programs included in the Governor's January budget.

Youth Corrections. The budget provides funding ($9 million General Fund and $15 million Proposition 98) to implement remedial plans relating to the Farrell v. Allen lawsuit. This consists of funds to increase teacher to student ratios in institution schools ($17 million), meet certain requirements of the Americans with Disabilities Act ($3 million), implement a sex offender treatment program ($2.5 million), and improve suicide watch services ($1 million). The CDCR also received funding ($1.2 million) to hire staff and consultants to develop a juvenile justice reform proposal.

Citizens' Option for Public Safety Program (COPS). The budget includes $100 million to continue the COPS program, the same level as provided in 2004-05. The program provides discretionary funding on a per capita basis for local police departments and sheriffs for front line law enforcement (with a minimum guarantee of $100,000), sheriffs for jail services, and district attorneys for prosecution.

Rural and Small County Law Enforcement Programs. The budget restores $18.5 million for the Rural and Small County Law Enforcement grant program, which provides discretionary funds ($500,000 for each of the 37 participating counties) to supplement local law enforcement resources.

County Probation Grants. The budget provides $201 million General Fund to continue probation grants that were previously supported by federal Temporary Assistance to Needy Families funds. This grant program, administered by the Corrections Standards Authority (formerly the Board of Corrections), supports a variety of juvenile probation services including anger management, family mentoring, and mental health assessment and counseling to youth detained in juvenile halls, camps, and ranches.

Juvenile Justice Grants. The budget includes $26 million, a reduction of $74 million compared to the prior year. This one-time reduction is a technical adjustment, rather than a programmatic reduction, intended to align the state appropriation to the actual timing of the use of the funds at the local level. These funds go to county level juvenile justice-coordinating councils to support locally identified needs related to juvenile crime.

Prepared by the Criminal Justice Section—

(916) 319-8340

The 2005 budget plan provides total expenditures of $8.7 billion from state special funds and federal funds for the Department of Transportation (Caltrans). This is a 5.5 percent increase in comparison to the 2004-05 expenditure level. The budget provides approximately $3.5 billion for transportation capital outlay, $1.6 billion for capital outlay support, $1.7 billion for local assistance, and about $1 billion for highway operations and maintenance. The budget also provides about $113 million for the support of Caltrans' mass transportation and rail program and about $615 million for transportation planning and departmental administration.

No Suspension of Proposition 42. Consistent with the requirements of proposition 42, the 2005 budget provides for the transfer of gasoline sales tax revenue from the General Fund to the Transportation Improvement Fund for transportation purposes. The previous two budgets, by contrast, fully or partially suspended this transfer in order to address General Fund shortfalls. The total amount of the 2005-06 transfer is estimated at $1.313 billion. This amount is to be allocated as follows:

The previous suspensions of Proposition 42, totaling $2.1 billion plus interest, are to be repaid in 2007-08 and 2008-09, as shown in Figure 1.

|

Figure 1 Transportation Loans and Repaymentsa |

||||||

|

(In Millions) |

||||||

|

|

To General Fundb |

|

To TCRFc |

|||

|

Year |

From |

From |

From |

|

From |

From |

|

2000-01 |

— |

— |

— |

|

$2 |

— |

|

2001-02 |

$173 |

$238 |

— |

|

41 |

$180 |

|

2002-03 |

-173 |

1,145 |

— |

|

520 |

95 |

|

2003-04 |

— |

— |

$868 |

|

-100 |

— |

|

2004-05 |

— |

-183 |

1,243 |

|

-20 |

— |

|

2005-06 |

— |

-1,000d |

— |

|

-443 |

-123 |

|

2006-07 |

— |

— |

— |

|

— |

— |

|

2007-08 |

— |

— |

-1,243 |

|

— |

-153 |

|

2008-09 |

— |

— |

-868 |

|

— |

— |

|

|

||||||

|

SHA = State Highway

Account; TCRF = Traffic Congestion

Relief Fund; TIF = Transportation |

||||||

|

a Amounts do not include interest. |

||||||

|

b Positive numbers are amounts payable to the General Fund, negative numbers are payable from the General Fund. |

||||||

|

c Positive numbers are amounts payable to TCRF, negative numbers are payable from TCRF. |

||||||

|

d To be repaid from revenues resulting from renegotiation of tribal gaming compacts in 2005-06 or whenever revenues become available. Repayment of the remaining $200 million plus interest owed to TCRF will come from future tribal gaming revenue or the General Fund. |

||||||

Tribal Gaming Bond to Repay $1 Billion in Transportation Loans. Under current law, the General Fund is due to repay previous loans totaling $1.2 billion to the Traffic Congestion Relief Fund (TCRF) in 2005-06. Current law also states that this amount is to be repaid by a bond securitized by revenue resulting from renegotiation of tribal gaming compacts. The 2005 budget deletes the requirement that this money be repaid by the end of 2005-06. It also reduces the estimated amount of money to be received from the tribal gaming bond to $1 billion, as shown in Figure 1. The remaining $200 million, plus interest, would be repaid from revenues resulting from future tribal gaming compacts if more compacts are negotiated, or from the General Fund by an unspecified date.

If tribal gaming bonds do generate $1 billion for TCRF in 2005-06, this amount will be allocated as follows:

No "Spillover" Transfer to Mass Transportation. The 2005 budget retains in the General Fund $380 million in spillover revenue resulting from high gasoline prices. This amount would otherwise be transferred to PTA for mass transportation purposes. A budget trailer bill also changes statute so that, if there is spillover in 2006-07, the first $200 million of that spillover will also be retained in the General Fund.

Caltrans Capital Outlay Support. The 2005 budget provides $1.6 billion for design and engineering of capital outlay projects. This amount includes support costs associated with 11,200 personnel-years of state staff, 710 personnel-year-equivalents of cash overtime, and 1,568 personnel-year-equivalents of contracted services.

The 2005 budget provides about $1.4 billion to fund the CHP, an increase of about $42 million (3 percent) compared to the 2004-05 level. The increase is primarily to fund salary and benefit costs of the current memorandum of understanding with patrol officers. About $1.3 billion of the total funding amount will come from the Motor Vehicle Account.

With regard to DMV, the budget provides $775 million in departmental support, about $20 million (2.6 percent) more than the 2004-05 level. The increase would fund primarily the costs of convenience fees assessed by credit card companies for credit card transactions conducted by DMV customers, such as vehicle registration and driver license renewals. Also, the increased costs are for a new financial responsibility reporting and vehicle registration suspension system being developed pursuant to Chapters 920 and 948, Statutes of 2004 (SB 1500, Speier and AB 2709, Levine, respectively).

Prepared by the Transportation Section—

(916) 319-8320

Vehicle License Fee (VLF) Backfill Loan Repayment. During 2003-04, local governments did not receive a portion of the VLF backfill from the General Fund to compensate them for rate reductions in the VLF. This local government shortfall of about $1.2 billion was considered a loan from local governments to the General Fund, with repayment by the state due in 2006-07. Under the budget agreement, the state will repay the entire amount of the loan to local governments in 2005-06—one year earlier than required.

Non Education Mandates. The

budget includes $239.4 million (General Fund) and

$1.7 million (special funds) to reimburse local agencies for their costs to carry out

non-Proposition 98 state mandates in 2004-05 and

(partial year costs) in 2005-06. About half of these

funds ($120 million) reimburse counties for two requirements to provide services for

special education pupils (the so called "AB 3632"

and the Seriously Emotionally Disturbed Students SEDS mandates). These funds are

included under the budget item for the Department

of Mental Health. The remaining funds

($119.4 million General Fund and $1.6 million special funds) reimburse local agencies for

36 other mandates, including those relating to absentee ballots, animal adoption, and

sexually violent predators. These funds are

included under the budget item for the Commission

on State Mandates (CSM). The budget suspends local agency obligations to carry out 31

unfunded mandates for the budget year. Funding for the Peace Officer's Procedural Bill of

Rights (POBOR) mandate is deferred to an

unspecified future date, and the CSM is directed to

reconsider its determination that POBOR constitutes

a state-reimbursable mandate. The budget package also repeals or greatly modifies four

mandates, including the Open Meeting Act mandate, and lengthens from 5 years to 15 years

the period over which the state must pay

previously deferred mandate reimbursements.

Property Tax Administration Grant Program. The budget suspends the Property Tax Administration Grant Program for a two-year period. Under this program, counties receive grants totaling $60 million annually for staff, technology, and other resources to support the administration of the property tax system.

The 2005 budget provides about $3.9 billion for resources programs and $1.4 billion for environmental protection programs for 2005-06.

Of the $3.9 billion for resources programs, about $1.4 billion is from the General Fund and $1.6 billion is from special funds. The remaining $900 million are bond funds and federal funds. This total amount is a decrease of about $1.3 billion from estimated 2004-05 expenditures. This decrease largely results from the large one-time expenditures in 2004-05 from park and water bond funds.

Of the $1.4 billion for environmental

protection programs, $983 million is from special

funds and $172 million is from bond funds.

The remaining $248 million are General Fund

and federal funds. This total amount is a net decrease of $155 million from estimated

2004-05 expenditures, mainly due to large one-time bond-funded expenditures in 2004-05 in

the State Water Resources Control Board. It

should be noted that the 2005 budget for

environmental protection agencies reflects a substantial

increase in special funds—about 23 percent—above

2004-05. Most of this growth reflects an increase in fee-funded air quality incentive

programs.

Significant features include:

Governor's Vetoes. The Governor vetoed (partially or fully) a number of budget changes made by the Legislature. Significant vetoes include:

Employee Compensation Savings. The budget assumes $40 million in General Fund savings from reductions in employee compensation costs. These savings would be achieved through the collective bargaining process with employee unions. The Governor's budget assumed $408 million in savings in this area.

Unallocated Reductions. The budget assumes $100 million in General Fund savings from authority given to the administration to reduce departmental appropriations during the fiscal year. These savings are in addition to unallocated reductions included within individual departmental appropriations of roughly the same magnitude.

Data Centers. The budget creates an item (1955) for the new Department of Technology Services (DTS). The DTS is the result of the Governor's Reorganization Plan No. 2, which merged the Stephen P. Teale Data Center, the Health and Human Services Agency Data Center (HHSDC), and a portion of the Department of General Services' (DGS) Telecommunications Division. Funding for DTS will be provided annually in the budget act. Under the plan, the management of several large information technology projects is transferred from HHSDC to the Health and Human Services Agency.

Tourism Commission. The budget provides $7.3 million in General Fund support to the Tourism Commission. The commission has operated without General Fund support since 2003-04.

Gambling Commission. The budget rejects an administration proposal to expand Gambling Control Commission funding and establish a state gaming testing laboratory.

State Printing. Budget-related legislation extends by one year the ability of state departments to contract with outside vendors for printing needs, rather than the Office of State Publishing within DGS. The Governor vetoed a legislative augmentation of $6.2 million to add 114 positions to the office.

Prepared by the following sections:

Local Government—(916) 319-8315

Resources and Environmental Protection—(916) 319-8323

General Government—(916) 319-8310

|

2005-06 Budget and Budget-Related Legislation |

||

|

Bill Number |

Author |

Subject |

|

SB 77 |

Budget Committee |

Budget (conference report) |

|

SB 80 |

Budget Committee |

Budget revisions |

|

AB 131 |

Budget Committee |

Health |

|

AB 138 |

Budget Committee |

Mandates |

|

AB 139 |

Budget Committee |

General government |

|

AB 145 |

Budget Committee |

Uniform civil filing fees |

|

SB 62 |

Budget Committee |

Transportation |

|

SB 63 |

Budget Committee |

Education |

|

SB 64 |

Budget Committee |

Boards and commissions |

|

SB 68 |

Budget Committee |

Social services |

|

SB 71 |

Budget Committee |

Resources |

|

SB 76 |

Budget Committee |

Hydrogen highway/PIER |

The Legislative Analyst's Office (LAO) is a nonpartisan office

which provides fiscal and policy information and advice to the

Legislature. To request publications call (916) 445-4656. This report and others, as well as an E-mail

subscription service, are available on the LAO's Internet site at

www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000,

Sacramento, CA 95814.

Acknowledgments

LAO Publications

Return to LAO Home Page