January 12, 2006

The 2006-07 Governor’s Budget now projects that the state will be able to fund much more than a current-law budget and still maintain fiscal balance in 2006-07. The plan, however, moves the state in the wrong direction in terms of reaching its longer-term goal of getting its fiscal house in order. Given the state’s current structural budget shortfall, we believe that the 2006-07 budget should focus more on paying down existing debt before making expansive new commitments.

In our November forecast, we indicated that a much-improved revenue picture would enable California to fund current-law budget requirements in 2006-07, but that the state still faced a longer-term structural gap between revenues and expenditures.

As a result of further improvements in the revenue outlook, the 2006-07 Governor’s Budget now projects that the state will be able to fund much more than a current-law budget and still maintain fiscal balance in the budget year. Specifically, the proposal includes over $4 billion in higher spending, including over $2 billion for new or expanded programs and $920 million for the prepayment of a loan due to transportation in 2007-08. The budget package also contains a major long-term infrastructure proposal covering transportation, flood protection and water supply, education, and corrections.

The budget’s more positive revenue assumptions compared to our November report appear reasonable in light of recent positive cash revenue trends, and we believe that some of the actions proposed-namely the prepayment of budgetary debt-make sense in light of the improved outlook. However, we also believe that the overall plan moves the state in the wrong direction in terms of reaching its longer-term goal of getting its fiscal house in order. Instead of using the current unexpected revenue increases-which are primarily from more volatile revenue sources such as business profits and capital gains-to reduce outstanding obligations, the budget ratchets up ongoing spending by about $2 billion. Given the state’s current structural budget shortfall, as well as the substantial outstanding obligations that eventually have to be repaid related to past borrowings from schools, local governments, and transportation, we believe that the 2006-07 budget should focus more on paying down existing debt before making expansive new commitments.

In November, we estimated that the state would have enough resources to fund current-law spending requirements in the budget year and still maintain a modest $1.2 billion reserve. As indicated in Figure 1, the Governor’s budget contains higher costs totaling $4.6 billion and new savings and added resources of about $4 billion relative to our November baseline estimates.

|

Figure 1 Changes to 2006-07 Reserve Estimate |

||

|

(Dollars in Billions) |

||

|

2006-07 Reserve, LAO November Estimate |

|

$1.2 |

|

Differences in the 2006‑07 Governor's Budget: |

|

|

|

Higher Costs: |

|

|

|

Proposition 98 |

$2.2 |

|

|

Higher education |

0.2 |

|

|

Prepayment of portion of Proposition 42 loan |

0.9 |

|

|

Additional deficit-financing bond payments |

0.5 |

|

|

Pension bonds not issued |

0.5 |

|

|

Other (net) |

0.3 |

|

|

Total Higher Costs/Reduced Resources |

$4.6 |

|

|

New Resources/Savings: |

|

|

|

Higher revenue estimate |

$2.6 |

|

|

Revenue-related proposals |

0.3 |

|

|

Social services |

0.9 |

|

|

Statewide/other (net) |

0.2 |

|

|

Total, New Resources/Savings |

$4.0 |

|

|

2006-07 Reserve, Governor’s Budget Forecast |

|

$0.6 |

Higher Costs. On the cost side, the budget proposes $2.5 billion in added spending for K-12 and higher education, $920 million for the prepayment of a portion of a transportation loan due in 2007-08, $460 million in additional deficit-financing bond repayments, and $525 million in additional spending and lost revenues due to the loss of pension obligation bond proceeds.

New Savings/Resources. These include $2.6 billion in higher revenues for 2004-05 through 2006-07 combined, $252 million from revenue-related proposals, and about $900 million in social services-related savings. The $900 million in social services-related savings relative to our November baseline is primarily due to nonpolicy factors. For example, the budget assumes that the state will avoid about $460 million in California Work Opportunity and Responsibility to Kids (CalWORKs) grant costs by prevailing in its appeal of a recent Superior Court ruling in the Guillen lawsuit.

Taking into account the $4.6 billion in higher costs and the $4 billion in new resources and savings, the budget estimates a 2006-07 year-end reserve of $613 million (or about one-half of the November estimate).

The economic picture has become slightly more positive over the past six months. The U.S. and California economies grew at a solid pace through 2005, despite record energy prices and rising interest rates. The administration assumes that this growth will continue through 2006 and 2007, although at a more subdued pace. At the national level, real (inflation-adjusted) gross domestic product growth is projected to slow from 3.6 percent in 2005 to 3.2 percent in 2006 and further to 3 percent in 2007. California’s outlook is similar to that for the nation, with statewide current-dollar personal income growth predicted to slow from 6 percent in 2005, to 5.8 percent in 2006, and 5.5 percent in 2007.

Although statewide economic activity has been only modestly stronger than assumed in the 2005-06 Budget Act, revenues have soared in recent months-with receipts during the first six months of this fiscal year exceeding the 2005-06 Budget Act forecast by well over $2 billion.

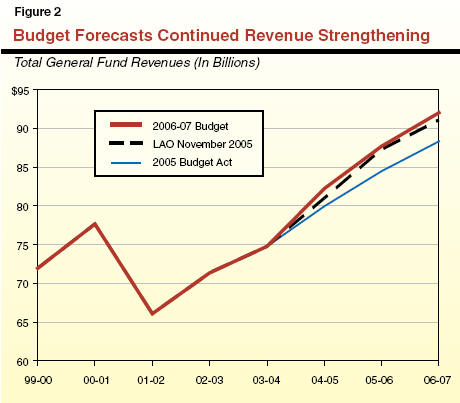

Based partly on these recent cash gains, the new budget proposal assumes much higher revenue totals for 2004-05 through 2006-07 relative to the 2005-06 Budget Act estimate (see Figure 2). It specifically assumes that revenues were $82.2 billion in 2004-05-a full $2.3 billion more than the estimate in the 2005-06 Budget Act. This unusually large prior-year revision is partly related to strong collections in recent months that are attributable to 2004-05 activity (which under California’s accounting system, is accrued back to the earlier fiscal year). It also reflects an increase by the Franchise Tax Board (FTB) of its audit collections in 2005-06 (which are also accrued back to the previous year).

The budget assumes that the higher revenue trend will continue through the current year and budget year. It specifically estimates that revenues will reach $87.7 billion in 2005-06 (up $3.2 billion from the 2005-06 Budget Act) and $92 billion in 2006-07 (up $3.7 billion from the preliminary out-year estimates made at the time the 2005-06 Budget Act was adopted).

Policy Changes/Other Factors. The budget includes $252 million in new tax revenues, mostly from proposals which would extend for one year (1) the suspension of the teachers’ personal income tax credit, and (2) the recent change in the application of the use tax to vessels and aircraft. These revenue increases are offset by an equal $252 million reduction resulting from the delay in the sale of pension obligation bonds.

Amnesty-Related Assumptions. The 2005-06 Budget Act assumed that last year’s tax amnesty program generated $3.8 billion in combined personal income tax and corporation tax receipts. Under the state’s accounting system, these receipts were accrued back to 2003-04 and prior years, and reflected as an increase in the state’s 2004-05 carry-in balance. The budget also assumed that, since most of the amnesty-related revenues were associated with so-called “protective claims” payments on audit issues that had already been identified, all but $380 million would be offset by lower net audit collections in 2004-05 through 2006-06. The updated forecast continues to assume that all but $380 million will eventually be “given back.” However, the new estimate assumes that it will take longer for these offsets to occur. Instead of all the offsets occurring by the end of 2006-07, the new forecast assumes that $920 million will occur in 2007-08 and later years.

LAO Assessment. The administration’s revenue forecast is up from our November projections by $1.25 billion in the prior year, $412 million in the current year, and $929 million in 2006-07-for a three-year total of $2.6 billion. The large prior-year difference is related to the administration’s use of revised prior-year accrual adjustments reported by the FTB for the corporation tax. While the three-year difference is unusually large for forecasts made less than two-months apart, we believe that the higher current estimates are justified in light of the recent very-strong cash growth trends and the reassessment made by the FTB regarding audit collections. In fact, revenue collections in December and early January-normally a key revenue period since it includes receipts from the final quarterly estimated payments from individuals and corporations-appear to be quite strong. If this strength is sustained through the end of January, it could suggest that the revenue trend is above even the administration’s most current forecast. We will be evaluating recent cash receipts along with other new economic and revenue data for purposes of developing our own updated projections, which will be included in the Perspectives and Issues released next month.

The budget proposes total state spending in 2006-07 of $123 billion (excluding expenditures of federal funds and bond funds). General Fund spending is projected to increase from $90.3 billion to $97.9 billion (an increase of 8.4 percent), while special funds spending falls slightly from $25.4 billion to $25 billion. The decline in special funds spending is due to one-time transfers and other factors. Tax receipts supporting the special funds are projected to grow moderately during the budget year.

Figure 3 shows the General Fund’s condition from 2004-05 through 2006-07 under the budget’s assumptions and proposals. It shows that:

|

Figure 3 Governor’s Budget |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Proposed for 2006-07 |

|

|

|

Actual |

Estimated |

Amount |

Percent |

|

Prior-year fund balance |

$7,228 |

$9,634 |

$7,031 |

|

|

Revenues and transfers |

82,209 |

87,691 |

92,005 |

4.9% |

|

Total resources available |

($89,438) |

($97,325) |

($99,036) |

|

|

Expenditures |

$79,804 |

$90,294 |

$97,902 |

8.4% |

|

Ending fund balance |

$9,634 |

$7,031 |

$1,134 |

|

|

Encumbrances |

$521 |

$521 |

$521 |

|

|

Reserve |

$9,112 |

$6,510 |

$613 |

|

|

Budget Stabilization Account |

— |

— |

$460 |

|

|

Reserve for Economic Uncertainties |

$9,112 |

$6,510 |

153 |

|

The 2004-05 fiscal year concluded with a reserve of $9.1 billion. The reserve amount is up sharply from the $7.5 billion estimate included in the 2005-06 Budget Act, and is $1 billion more than the amount assumed in our November forecast. This improvement from both of the previous estimates is due mainly to large upward revisions to year-end revenue accruals to the corporation tax and personal income tax. More generally, the large 2004-05 reserve is a reflection of strong amnesty payments received last year, and includes the proceeds of the deficit-financing bonds issued in 2003-04.

In 2005-06, expenditures are expected to exceed revenues by $2.6 billion, leaving $6.5 billion in the reserve.

In 2006-07, expenditures increase to nearly $98 billion, while revenues are projected to reach $92 billion. The resulting large operating shortfall results in a further decline in the reserve, to $613 million by the close of the budget year.

The main programmatic and related features of the budget are shown in Figure 4. As indicated above, the budget includes roughly $2 billion in program augmentations and about $1.3 billion in new loan repayments beyond what is required by current law.

|

Figure 4 Key Programmatic

Features of the |

|

|

|

|

|

Proposition 98 |

Spends $1.7 billion more than required by the minimum guarantee in 2006‑07. This fully funds growth and cost-of-living adjustments (COLAs), and provides an additional $1.2 billion in program spending, including equalization of school district funding, restorations of COLAs foregone in prior years, mandates, and teacher retention initiatives. |

|

|

In addition, provides $428 million in new spending for K-12 after school programs as required by Proposition 49. |

|

CSU/UC |

Provides funds for Governor’s higher education compact. |

|

|

Provides General Fund monies to “buy out” student fee increases in 2006‑07. |

|

Transportation |

Makes full $1.4 billion Proposition 42 transfer for 2006‑07, plus pays $920 million toward loan repayment due to transportation in 2007‑08. |

|

Health and |

Further delays “pass through” of federal COLA for SSI/SSP recipients from April 2007 to July 2008. |

|

|

Assumes state will prevail on appeal of Guillen court case, avoiding $460 million in additional costs. |

|

|

Reduces funding for county administration, child care, and welfare-to-work services. |

|

|

Health budget includes series of actions to enroll more children in health coverage, and augmentations for disaster preparedness efforts. |

|

Criminal Justice |

Expands inmate and parolee programs and the correctional officer academy. |

|

|

Proposes phase-in of 150 new judgeships over three years. |

|

Statewide |

Assumes $920 million transfer to Budget Stabilization Account, with one-half of the total going for early prepayment of outstanding deficit-financing bonds (per current law). |

|

|

Assumes $258 million in unspecified savings. |

The main increase involves Proposition 98 education, where the Governor is proposing to provide $2.2 billion more than the minimum guarantee over the current and budget year combined. These added funds are proposed for such purposes as school district equalization, payment of past mandates, and cost-of-living adjustments (COLAs) foregone in past years. In addition, the budget provides $428 million in new spending for K-12 after school programs as required by Proposition 49. In the higher education area, the budget includes funding for the “buy out” of student fee increases for both the California Sate University (CSU) and the University of California (UC).

In other areas, the budget proposes to fully fund the Proposition 42 transfer to transportation, as well as to prepay $920 million of an outstanding Proposition 42 loan due in 2007-08. It also contains modest expansions in the criminal justice area for additional judgeships and expanded inmate and parolee programs.

A small portion of these increased costs are offset by savings from proposals involving the areas of social services and state administration.

Figure 5 shows General Fund spending by major program area. It shows large increases in education, the big increase related to the Proposition 42 loan repayment, and varying growth rates in other programs. As has been the case in recent years, the spending totals in many areas are affected by one-time funding, shifts in funding between departments, and other factors.

|

Figure 5 General Fund Spending by Major Program Area |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Proposed for 2006-07 |

|

|

|

Actual |

Estimated |

Amount |

Percent |

|

Education |

|

|

|

|

|

K-12 Proposition 98 |

$30,863 |

$32,792 |

$36,403 |

11.0% |

|

CCC Proposition 98 |

3,036 |

3,412 |

3,949 |

15.7 |

|

UC/CSU |

5,175 |

5,446 |

5,834 |

7.1 |

|

Other |

4,380 |

4,567 |

4,918 |

7.7 |

|

Health and Social Services |

|

|

|

|

|

Medi-Cal |

$11,593 |

$13,197 |

$13,739 |

4.1% |

|

CalWORKs |

2,054 |

1,958 |

1,951 |

-0.4 |

|

SSI/SSP |

3,411 |

3,506 |

3,564 |

1.7 |

|

IHSS |

1,198 |

1,259 |

1,310 |

4.1 |

|

Other |

6,596 |

7,341 |

7,909 |

7.7 |

|

Youth and Adult Corrections |

$6,968 |

$7,658 |

$8,081 |

5.5% |

|

Transportation |

$347 |

$1,686 |

$2,683 |

59.1% |

|

All Other |

$4,183 |

$7,473 |

$7,561 |

1.2% |

|

Totals |

$79,804 |

$90,294 |

$97,902 |

8.4% |

Based on our initial review, the budget appears to face potential unbudgeted costs approaching $1 billion. The largest potential expense is in CalWORKs, where the state would face added grant costs totaling about $460 million should it not be successful in its appeal of the Guillen case. The state also will likely face $140 million in additional local mandate liabilities for 2004-05 and 2005-06 combined. In addition, the budget does not include added costs for any new employee bargaining agreements, even though 18 contracts will have expired by July 2, 2006.

In this section, we discuss the impact of the Governor’s budget plan on individual program areas as well as his Strategic Growth Plan (see nearby box).

Strategic Growth PlanTogether with the proposed 2006-07 budget, the Governor is proposing a Strategic Growth Plan, a ten-year funding plan to improve state infrastructure. Areas of capital improvement include: transportation; education-both K-12 and higher education; flood control and water supply; public safety and courts; and other public service infrastructure. Key Elements of PlanPlan Calls for $222.6 Billion Infrastructure Funding Over Ten Years. The figure below summarizes the funding proposed by the plan. As shown in the figure, about one-half of the funding ($107 billion) would be for transportation/air quality improvements. Over one-fourth of the funding would be for K-12 and higher education facility improvements. Flood control and water supply projects would account for 16 percent of total proposed funding, and the remaining 9 percent would be for public safety, mainly for local jail construction, and court improvements.

Funding to Come From a Mix of Existing and New Sources, Including Bonds. The Governor proposes to fund the plan with a mix of existing and new fund sources including general obligation (GO) bonds. Specifically, about 43 percent ($96 billion) of the funding would be provided from existing resources such as state and federal gas tax revenues. About 31 percent ($68 billion) of the funding would be provided from GO bonds, and other new resources would account for the remaining 27 percent of funding ($59 billion). These include primarily private investments in transportation facilities and future transportation bonds that would be backed by state gas tax and weight fee revenues and future federal transportation funds. Plan Includes a Total of $68 Billion in GO Bonds. The plan calls for $25.2 billion of the proposed bonds to be authorized in 2006, with the remaining bonds to be authorized over four successive election cycles, from 2008 through 2014. Of the amount to be authorized in 2006, about one-half ($12.4 billion) is proposed for education, and almost one-quarter ($6 billion) would be for transportation. The remaining amounts would pay for flood control and other water management projects, public safety and court improvements. The proposed GO bond level for the coming decade is slightly below the amount of GO bonds approved by the voters over the last decade. Plan Proposes Constitutional Cap on Debt Service. In addition, the Governor proposes to place a cap on the amount the state would spend for infrastructure debt service each year relative to the state’s General Fund revenue. Specifically, the Governor proposes a constitutional amendment to set that limit at 6 percent. Plan Has Positive AspectsPlan Takes a Long-Term Perspective. The plan proposes funding for infrastructure in several key state program areas. By considering the funding requirements for these areas over ten years, the Governor’s plan highlights the substantial amount of capital improvements the state should consider making over the long term in order to accommodate the state’s demand for services ranging from schools, to highways, to the courts. Plan Considers Multiple Funding Sources. The plan identifies a combination of sources for funding state capital improvements including user fees and private investment, instead of exclusively relying on bonds. Plan Identifies Elements Previously Understated. The plan also identifies certain elements of capital improvements that have been understated or overlooked in the past. For instance, the plan addresses flood control-related infrastructure funding requirements at a level several times higher than previously identified. Similarly, the plan highlights the role of goods movement in transportation, an area the state has not focused much attention on previously. Many Details Yet to Be DefinedState Infrastructure Plan Still Under Development. The plan provides overall funding levels for large program areas. For many of these program areas, however, it is not clear at this time what specific projects and types of capital improvements are to be funded. In addition, the plan does not provide an overall assessment of statewide needs. Current law requires that the Governor submit annually in January a state infrastructure plan. For various reasons, no plan was prepared for either 2004 or 2005. According to the Department of Finance, the required 2006 plan will not be available until around March 2006. Without the plan, the Legislature cannot gauge whether the administration’s project priorities correspond with its own. Plan Relies on Some Questionable AssumptionsIn addition to the proposed GO bonds, the Strategic Growth Plan assumes significant amounts of existing and new funding sources. While undoubtedly the state will be receiving substantial portions of the assumed funding, some of the amounts are based on questionable assumptions.

Issues for Legislative ConsiderationThe Strategic Growth Plan raises a number of issues that warrant legislative consideration. Is a Debt-Service Ratio Cap Needed to Ensure Affordability? As we have indicated in the past, there is no accepted “rule” for how much debt is “too much” or how many bonds the state can “afford.” Rather, this depends on policy choices about how much of the state’s revenues to devote to the funding of infrastructure versus other state spending priorities, and also what level of taxes and user charges is appropriate for the funding of infrastructure. In addition, it depends on the state’s ability to sell its bonds at reasonable interest rates in the financial marketplace. Under certain circumstances, a debt-service cap could interfere with the state achieving an optimal mix of infrastructure versus other types of spending, or could encourage the use of nonoptimal bond maturity structures simply in order to circumvent the cap. In such cases, a cap would not be in the public interest. Policy Proposals Inherent in Plan. The Strategic Growth Plan contains numerous other policy proposals, the pros and cons of which the Legislature will need to examine:

Issues Regarding State and Local Responsibilities. The Legislature will need to decide whether an infrastructure program is a state, local, or shared responsibility. For instance:

Other Areas of Infrastructure Improvements. The Strategic Growth Plan addresses some of the key areas of the state’s infrastructure. The plan, however, does not address other parts of the state’s infrastructure, such as deferred maintenance in the state park system, seismic improvements of state hospitals and University of California hospitals, as well as facility improvements that may be needed for various state buildings over the next decade. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

Figure 6 summarizes the budget’s proposed Proposition 98 allocations for K-12 schools and community colleges. It shows a total of $54.2 billion in 2006-07, an increase of $4.3 billion, or 8.7 percent, over the revised current-year estimate. Most of the increase in proposed Proposition 98 spending is supported by General Fund revenues ($4.1 billion). For 2004-05 and 2005-06, $1.3 billion in local property tax revenues were transferred annually from local governments to schools. In 2006-07 those transfers end, requiring the General Fund to backfill the loss. Strong local property tax growth (underlying local property tax revenues are projected to grow at 10.7 percent) allows property tax support for Proposition 98 to increase by $187 million despite the end of the local government transfer.

|

Figure 6 Proposed Proposition 98 Funding |

||||

|

(Dollars in Millions) |

||||

|

|

Revised |

Proposed |

Change From |

|

|

|

Amount |

Percent |

||

|

K-12 |

$44,637 |

$48,366 |

$3,729 |

8.4% |

|

California Community Colleges |

5,242 |

5,848 |

606 |

11.6 |

|

Totalsa |

$49,879 |

$54,214 |

$4,335 |

8.7% |

|

General Fund |

($36,311) |

($40,455) |

($4,144) |

(11.4%) |

|

Local property tax revenue |

(13,675) |

(13,862) |

(187) |

(1.4) |

|

Per Student Spending |

|

|

|

|

|

K-12 average daily attendance |

6,010,454 |

6,023,040 |

12,586 |

0.2% |

|

K-12 funding per pupil |

$7,427 |

$8,030 |

$604 |

8.1 |

|

CCC full-time equivalent students (FTES) |

1,168,417 |

1,203,469 |

35,052 |

3.0 |

|

CCC funding per FTES |

$4,486 |

$4,859 |

$373 |

8.3 |

|

|

||||

|

a Total Proposition 98 amounts include around $105 million in funding that goes to other state agencies for education purposes.

|

||||

In the current year, funding increases $25 per pupil to $7,427 because the Governor proposes roughly the same spending level as in the 2005-06 Budget Act but estimates 21,000 fewer students. Per pupil spending in 2006-07 is $8,030, an increase of $604 per pupil, or 8.1 percent, from the revised current-year level. For community colleges, funding grows to $4,859 per full-time equivalent student, an increase of $373, or 8.3 percent.

The Governor Proposes Additional Resources for K-14 Education. The Governor proposes to appropriate above the Proposition 98 minimum guarantee (generally referred to as an “overappropriation”) in both the current and budget years. Figure 7 shows that the cumulative overappropriations for 2005-06 and 2006-07 result in an additional $2.2 billion in General Fund expenditures compared to the minimum guarantee. The state is currently spending $264 million above the minimum guarantee in 2005-06. The additional spending increases the base for 2006-07 by a similar amount. On top of that, the Governor’s 2006-07 spending level overappropriates an additional $1.7 billion, resulting in a cumulative overappropriation for 2006-07 of $1.9 billion.

|

Figure 7 Proposed

Appropriations |

||

|

(In Billions) |

||

|

|

2005‑06 |

2006‑07 |

|

Proposed Proposition 98 funding level |

$50.0 |

$54.3 |

|

Minimum guarantee |

49.7 |

52.4a |

|

Difference |

$0.3 |

$1.9 |

|

Two-Year Total |

|

$2.2 |

|

|

||

|

a Assuming the state

appropriated at the minimum guarantee in 2005‑06. Includes

$426 million in spending above the minimum guarantee in 2006‑07 that

is required by Proposition 49 (after school |

||

Department of Finance (DOF) and California Department of Education (CDE) Agree on Prior-Year Obligations. The 2004-05 education budget trailer bill required DOF and CDE to agree on the Proposition 98 calculation for prior years. This “certification” determined that the state owes schools a cumulative $1.3 billion (referred to as prior-year settle-up) to meet the minimum guarantee for all fiscal years prior to 2004-05. The Governor proposes to provide $133 million to begin meeting these obligations. These funds are proposed to fund state reimbursable mandates for the community colleges and school districts.

Budget Fully Funds Growth, COLAs, and Several Program Expansions. The Governor’s budget proposes $3.7 billion (8.4 percent increase) in new K-12 expenditures in 2006-07.

COLAs and Growth-$2.3 Billion. The proposal fully funds both statutory and discretionary growth and COLAs. Specifically, the budget provides $2.3 billion for a 5.18 percent COLA-$1.7 billion for revenue limits (general purpose funds) and $594 million for categorical programs-and $143 million for a 0.21 percent attendance growth. Other base adjustments include a decrease of $136 million for unemployment insurance and Public Employees’ Retirement System costs, and $33.3 million for other adjustments.

Proposition 49 (After School Programs)-$426 Million. Proposition 49 requires that the state appropriate an additional $428 million for after school programs if state spending reaches a specified threshold, or “trigger.” The spending level in the Governor’s budget triggers the Proposition 49 spending. In addition to the $426 million in Proposition 98 funding, the budget proposes around $2 million to CDE for administration and evaluation.

Restoration of Foregone COLAs-$206 Million. To balance the 2003-04 budget the state reduced or “deficited” revenue limits by not providing a COLA. Over the last two years, the state has been restoring those funds. The proposed $206 million in funding would restore most of the remainder, leaving approximately $100 million outstanding.

Revenue Limit Equalization-$200 Million. The budget provides $200 million to reduce historical inequities in general purpose spending. According to the administration, these funds would be allocated using the current statutory equalization methodology.

State Mandates-$133 Million Ongoing and $152 Million One Time. The budget provides $133 million to reimburse schools for a significant portion of the ongoing costs of mandates. In addition, the budget provides $152 million in one-time funding-$133 million from prior-year settle-up funds (as mentioned above) and $19 million from the Proposition 98 reversion account.

Other Proposals-$438 Million. In addition, the Governor proposes additional funding for teacher recruitment, retention, and training in low performing schools ($165 million); school art grants ($100 million); physical education ($85 million); and $88 million for other proposals.

Prior- and Current-Year Declining Enrollment Adjustments. The administration updated its estimate of the statutory declining enrollment formula. The budget proposal provides an additional $117 million in 2004-05 and $128 million in 2005-06 to fully fund these costs.

The Governor’s budget proposes $606 million in new Proposition 98 expenditures for community colleges in 2006-07. This reflects an 11.6 percent increase over the revised current-year estimate. Major new expenditures include:

COLAs and Growth-$434 Million. The proposal provides funding for COLAs at the same rate (5.18 percent) as K-12’s statutory rate. It also funds an assumed 3 percent growth in enrollment. This is significantly above the statutory minimum guideline of adult population growth, which is estimated to be 1.74 percent.

Equalization-$130 Million. The Governor proposes an additional $130 million for equalization, which is estimated to achieve the statutory target for equalization.

Workforce Development-$30 Million. The Governor proposes an additional $30 million to expand upon his current-year initiative on economic development and career technical education. This funding builds upon an existing base of $20 million, for a total of $50 million in 2006-07.

The Governor’s budget proposal would increase General Fund support for UC by $210 million, or 7.4 percent, from the 2005-06 level. The CSU’s General Fund support would increase by $178 million, or 6.9 percent.

About two-thirds of the new funding is intended to fund enrollment growth of 2.5 percent at each segment and General Fund base increases of 3 percent. The remainder ($75 million for UC and $54.4 million for CSU) is proposed to buy out approved fee increases at the two segments that were to go into effect for 2006-07. In other words, the Governor proposes that UC and CSU cancel their planned fee increases of 8 percent for undergraduate students and 10 percent for graduate students, and accept additional General Fund support in lieu of the fee revenue they would have collected. The segments would be free to use the buyout funds however they wished. As a result of this fee buyout, the segments’ General Fund base increases effectively rise to 5.8 percent at UC and 5.2 percent at CSU.

The Governor’s budget would eliminate all state support for outreach programs, which in 2005-06 amounted to $17.3 million at UC and $7 million at CSU.

General Fund support for CSAC would increase by a total of $109 million, or 15 percent. A little less than one-half of this amount ($51 million) would fund increased Cal Grant costs. Of this amount, $12 million would be used to restore an earlier reduction in Cal Grant awards for needy students attending private institutions, and the remainder would be used for new Cal Grant awards. In addition, a little less than one-half ($51 million) of the proposed General Fund augmentation would be used to backfill a reduction in funding from the Student Loan Operating Fund (SLOF). For 2006-07, the Governor is proposing no transfer of monies from the SLOF to the Cal Grant program. The remainder of the augmentation ($7 million) would be used to cover increased costs of the Assumption Program of Loans for Education.

The proposed spending plan includes more than $47 million in General Fund augmentations for the Department of Health Services (DHS) and the Emergency Medical Services Authority for various actions intended to prevent the state from suffering a flu pandemic or other public health outbreaks and to respond more effectively in the event such a disaster occurs. The health-related items are part of a larger disaster preparedness package proposed by the administration that also includes additional new state resources for the Department of Food and Agriculture and the Offices of Emergency Services and Homeland Security.

The administration is proposing a series of actions in the Medi-Cal and Healthy Families Program to enroll more children in health coverage and to increase the number in such programs who renew their enrollment each year. The proposals, with identified costs of $38 million from the General Fund, do not change eligibility, but focus on increasing the number of children in coverage who are already eligible for benefits under current law.

The budget plan implements legislation enacted last year (Chapter 560 [SB 1100, Perata]), in response to a state-federal agreement on the restructuring of Medi-Cal financing for California hospitals. The budget plan includes various significant shifts in special funds and General Fund support among private and public hospitals relating to Chapter 560. The administration estimates the increase in the available level of federal funding for hospitals over 2005-06 and 2006-07 to be about $1 billion. Among the various shifts in funding, the budget proposes to use about $90 million in federal funds from the newly created “safety net care pool” to reduce the General Fund cost for four state programs to help the uninsured: (1) California Children’s Services, (2) the Genetically Handicapped Persons Program, (3) the non-Medi-Cal part of the Breast and Cervical Cancer Treatment Program, and (4) long-term care services for Medically Indigent Adults.

As part of a larger package of changes to licensing and certification of various health and social services programs, the Governor is proposing to add about 134 new positions to the DHS licensing and certification division, the state agency that licenses nursing homes and other long-term care facilities. The administration is also proposing to collect some fees every other year instead of each year, and would deposit the fee revenues into a new special fund instead of the General Fund.

The budget plan reflects the implementation of Proposition 63, an expansion of mental health community services funded with a state tax surcharge on high-income taxpayers. More than $650 million in Proposition 63 special funds are allocated for local assistance in 2006-07.

The Department of Mental Health (DMH) budget reflects a technical shift of about $340 million in General Fund resources from the DHS Medi-Cal budget to DMH for the ongoing costs of certain mental health services for children enrolled in Medi-Cal.

The budget plan states the Governor’s continued intent to develop a plan to eliminate the AB 3632 (W. Brown) state mandate for mental health services for children enrolled in special education. It sets aside $150 million in the K-12 education and Commission on State Mandates budgets for this purpose.

The administration is requesting to add 453 positions to the state hospital system at a cost of almost $38 million to the General Fund to respond to federal civil-rights investigations that have found deficiencies in the state hospital system.

The spending plan proposes to extend on a one-time basis in 2006-07 the $120 million in General Fund support currently being provided for implementation of Proposition 36, a measure approved by voters in November 2000 to divert certain drug offenders from jail and prison to community drug treatment programs. The administration indicates its support of the continued funding is conditional upon the legislative enactment of changes to Proposition 36, including greater authority for judges to impose short jail sentences on offenders who fail to show up for treatment and to impose drug-testing requirements as a condition of probation.

The budget follows current law which suspends the state January 2007 COLA. With respect to the separate federal COLA, the budget proposes to further delay the “pass though” from April 2007 to July 2008. This results in savings of $48 million in 2006-07 and $185 million in 2007-08.

The budget proposes to extend for five years the period for which a sponsor’s income is “deemed” (counted) to a sponsored immigrant for purposes of determining financial eligibility for the Cash Assistance Program for Immigrants. This results in a cost avoidance of $12.5 million in 2006-07.

The budget follows current law which suspends the July 2006 state COLA. The budget proposes net reductions of $93 million to CalWORKs county block grant funds for administration, child care, and welfare-to-work services. The budget achieves additional savings in child welfare services by replacing $32 million in 2005-06 and $26 million in 2006-07 from the General Fund with federal Temporary Assistance for Needy Families (TANF) block grant funds.

The budget provides $19 million from the General Fund for the children’s services initiative. Of this amount, about $11 million is for new initiatives including the adoption of hard-to-place foster children, kinship support services, and transitional housing for foster youth. The remaining $8 million funds recently enacted legislation (Chapter 640, Statutes of 2005 [AB 1412, Leno]), that helps foster children establish adult/mentor relationships.

The budget proposes $6 million from the General Fund to fund a licensing reform initiative which includes more random inspection visits of facilities, training for licensing analysts, and other changes designed to improve operational efficiency.

The Governor’s budget for the newly reorganized California Department of Corrections and Rehabilitation (CDCR) includes several augmentations, the largest being $161 million for employee compensation, $132 million to fund a projected increase in the inmate population, and $115 million to meet the conditions of various court settlement agreements. Other notable increases are proposed to expand the correctional officer academy ($55 million) and inmate and parolee programs ($23 million). The budget requests approximately 2,300 new positions for CDCR in 2006-07. The budget assumes that the state will receive increased federal reimbursements for state correctional services provided to undocumented felons.

The budget proposes $100 million for the Citizen’s Option for Public Safety program and $100 million for Juvenile Justice Crime Prevention Act grants. It also proposes to continue $201 million General Fund for county juvenile probation grants formerly funded by federal TANF funds.

The budget proposes $123 million for growth in judicial branch funding based on the annual change in the state appropriations limit, which includes support for the Supreme Court and Courts of Appeal, as well as for the trial courts. The budget also proposes to phase-in 150 new judgeships over the next three years, beginning in April 2007 ($6 million). Other notable increases are proposed for trial court security ($19 million) and to upgrade court information technology systems ($15 million). Finally, the budget proposes $30 million General Fund to repay a loan of the same amount from the State Court Facilities Construction Fund.

Proposition 42, approved by voters in 2002, requires that revenue from the sales tax on gasoline that previously went to the General Fund be transferred into the Transportation Investment Fund for transportation purposes. For 2006-07, the budget proposes to transfer $1.4 billion in gasoline sales tax revenue to transportation, as required by Proposition 42. Of the amount, $678 million would be for the Traffic Congestion Relief Program, $582 million for the State Transportation Improvement Program, and $146 million would go to the Public Transportation Account (PTA). Consistent with current law, none of the Proposition 42 funds in 2006-07 would be allocated to local governments for streets and road purposes.

Proposition 42 allows the transfer to be suspended in years in which the transfer would have a significant negative fiscal impact on the General Fund. Since its adoption, Proposition 42 has been suspended twice, in 2003-04 (partial suspension) and 2004-05 (full suspension). Current law requires that the suspended amounts be repaid with interest in later years.

The Governor proposes to amend Proposition 42 to prohibit any suspension after 2006-07. This would ensure future transfer of gasoline sales tax revenues to transportation without uncertainty.

The full suspension of the Proposition 42 transfer in 2004-05 totaled about $1.3 billion and must be repaid with interest by 2007-08. The Governor’s budget proposes to repay a portion-$920 million (principal and interest)-of that loan in 2006-07, with the balance (estimated at $430 million) to be repaid in 2007-08. The prepayment would enable a substantial amount of transportation capital projects to be funded sooner than expected.

State law requires certain spillover gasoline sales tax revenue to be deposited in the PTA for mainly rail and transit purposes. Spillover revenues have been retained in the General Fund in the current and past couple of years due to the state’s fiscal condition. For 2006-07, state law specifies that the first $200 million of any spillover revenue will be retained in the General Fund, and the next $125 million be applied to the San Francisco-Oakland Bay Bridge seismic retrofit. Any remaining spillover revenue (in excess of $325 million) would then be deposited in the PTA. The budget projects that spillover gasoline sales tax revenue in 2006-07 will not exceed $325 million. Accordingly, the budget proposes no spillover revenue to the PTA in the budget year.

Chapter 91, Statutes of 2004 (AB 687, Nuńez), provided $1.2 billion in bond funds to repay certain transportation loans made to the General Fund. The bonds will be backed by tribal gaming revenues. Due to pending lawsuits, the bonds were not issued in 2004-05. Instead, issuance was expected in 2005-06. The current-year budget also reduced the amount to be repaid by tribal gaming bonds to $1 billion.

The Governor’s budget continues to assume $1 billion in tribal gaming bond funds to be available for transportation in 2005-06. However, there is currently one pending lawsuit with the potential of delaying the issuance of the bonds and another case is being appealed. Thus, DOF now indicates that this funding will most likely not be available until 2006-07.

The budget proposes no major changes in the area of state employment and retirement. The budget provides funding to pay for the costs associated with existing collective bargaining agreements. Only 3 of the state’s 21 employee bargaining units currently have agreements which extend past July 2, 2006 (one of these contracts is pending approval before the Legislature). There are no funds set aside to pay for any potential costs related to new agreements with the other 18 units.

The budget assumes $258 million in General Fund savings from two approaches:

One-Time Savings. The budget proposes to capture $200 million in one-time savings through Control Section 4.05. In recent years, these savings have been concentrated in a few departments and tended not to reduce services. Rather, the identified savings have related to items that occur “on the natural”- revised caseload estimates or other unexpected events which reduce the cost of programs.

Salaries and Wages Reductions. In addition, the budget proposes to reduce each department’s personnel budget by 1 percent, resulting in savings of $58 million. The administration expects to achieve these savings primarily by holding positions vacant for longer periods of time.

In our November Fiscal Outlook report, we indicated that the state had sufficient carry-over funds to maintain budgetary balance in 2006-07, but that once these funds were exhausted, the state would have to cope with an ongoing operating shortfall between annual revenues and annual expenditures of about $4 billion in 2007-08. Even assuming that the higher revenue trend underlying the Governor’s plan continues into the future, we believe that the added ongoing spending included in the new plan would result in larger out-year fiscal imbalances than we previously identified. We specifically estimate that implementation of the plan would leave the state with an annual operating shortfall of over $5 billion in 2007-08 (over $6 billion if we assume the administration’s policy of including the full Budget Stabilization Account transfer in this calculation).

Based on our initial assessment of the Governor’s budget proposal, the Legislature will face several key issues and considerations as it proceeds to review the proposal and craft its own budget plan in the weeks and months to come. Specifically:

The overall plan fails to take advantage of the opportunity to reduce the underlying structural budget shortfall and, in fact, makes the shortfall worse. Because of this, we believe that it will be important for the Legislature to carefully weigh the benefits of the budget’s proposed program expansions against the potential for continued out-year budget problems, and continue to seek opportunities for addressing the structural imbalance.

In assessing the Governor’s proposed program expansions, it will be important for the Legislature to determine if these specific changes reflect its own budgetary priorities, and whether they represent an effective and efficient use of taxpayer resources.

Although the proposed budget does use some of the recent revenue improvement to reduce budgetary debt accumulated in past years, a considerable amount of debt still remains, such as in the area of unfunded mandates. This debt eventually has to be repaid and, thus, will pose a burden for future budgets if not addressed now.

Although the budget appears to be based on reasonable assumptions about the economy and revenues, the outlook is not without risks. For example, were interest rates to start rising, the stock market falter, the housing market significantly contract, or consumer spending deflate, both economic growth and revenue performance could sharply drop. In addition, as noted earlier, the state faces potential unbudgeted costs approaching $1 billion. Given such uncertainties, the Legislature may wish to use extra caution in undertaking new and ongoing program commitments at this time.

This report was prepared by

Brad Williams,

with assistance from many others in the office. The Legislative Analyst's Office (LAO) is a nonpartisan office

which provides fiscal and policy information and advice to the

Legislature. To request publications call (916) 445-4656. This report and others, as well as an E-mail

subscription service, are available on the LAO's Internet site at

www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000,

Sacramento, CA 95814.

Acknowledgments

LAO Publications

Return to LAO Home Page