May 15, 2007

Overview of the 2007-08 May Revision

The administration released its May Revision yesterday, identifying over $2 billion in new budget solutions to address a comparable level of increased budgetary problem. In this document, we provide our initial assessment of the problem definition and the viability of the administration’s proposed solutions.

Summary

Major Changes in the May Revision

Changes in Revenues and Expenditures Since January. The administration’s estimates for major tax revenues are down $243 million combined over the current and budget years since January. Stronger-than-expected 2006-07 revenue growth is more than offset by weakness in 2007-08. General Fund costs are higher for Proposition 98 and prisons. The administration has also provided a more realistic estimate of gambling revenues and delayed the sale of pension obligation bonds.

New Budget Solutions. These factors led to the administration putting forward over $2 billion in new budget solutions. The administration proposes to sell EdFund, capture tobacco securitization revenues now rather than over time, expand a redirection of public transit funds for General Fund purposes, and eliminate a scheduled increase for Supplemental Security Income/State Supplementary Program (SSI/SSP) recipients.

Reserve. Under the administration’s estimates, the state would end the budget year with a reserve of $2.2 billion.

LAO Comments

Revenue Estimate Reasonable. The administration’s revenue forecast for the state’s major revenues is reasonable. While our estimates for individual taxes differ from the administration’s, offsetting forecasts result in similar totals.

Reserve Likely Overstated by $1.7 Billion. The May Revision makes a number of optimistic assumptions about its proposals—such as the legality of its public transit proposal, its estimates of gambling and property tax revenues, and assumed savings from midyear reductions. In total, we estimate that the Governor’s reserve is likely overstated by $1.7 billion, and the May Revision would leave only a $529 million reserve. This reduced reserve would be subject to additional risks and cost pressures.

Out-Year Problem Has Worsened. We estimate that, under the Governor’s proposals, state expenditures would exceed revenues by more than $3 billion in 2007-08. This shortfall would grow to more than $5 billion in 2008-09 due to a number of one-time solutions contained within the May Revision.

Focusing on Eliminating Deficit-Financing Bond Debt Should Not Be an Immediate Priority. The administration continues to dedicate $1.6 billion in supplemental appropriations to pay off the state’s deficit-financing bonds early. This would help the state’s budget beginning in 2009-10. Due to the precariously balanced 2007-08 budget, we believe these funds could be better used in addressing near-term budget problems.

LAO Bottom Line

The administration has attempted to address a $2 billion decline in the state’s fiscal outlook. Due to several overly optimistic assumptions, however, the May Revision overstates its reserve by about $1.7 billion—leaving an estimated reserve of $529 million. Even this reserve level would be subject to considerable risks and pressures. As a result, the Legislature will face a significant challenge to develop a 2007-08 budget that realistically reflects revenues and spending while maintaining a prudent reserve. As it sets its own priorities, it should identify solutions that realistically balance the state’s finances on an ongoing basis while also avoiding new ongoing commitments (absent identified funding to pay for them).

Major Features of the May Revision

In order to address a shortfall between the state’s revenues and expenditures, the Governor’s January budget proposed a number of budget-balancing actions, including a major redirection in transportation funds and significant reductions in social services. Since January, the administration’s view of the budget outlook has worsened by more than $2 billion. Consequently, it has proposed new solutions to offset these higher costs and lower revenues. These changes are summarized in Figure 1.

|

Figure 1

How

May Revision Addresses $2.3 Billion in Lower Revenues and Higher Costs |

|

(In Millions) |

|

Governor's

January 10 Reserve |

$2,085 |

|

|

|

|

Items Worsening

General Fund Condition |

-$2,293 |

|

Updated

Proposition 98 |

|

|

Higher 2006-07 minimum

guarantee |

-$372 |

|

Higher 2007-08 minimum

guarantee |

-104 |

|

Lower property taxes and

other changes |

-333 |

|

Pension Obligation Bonds Deferred to

2008-09 |

-$525 |

|

Lower Revenues |

|

|

Updated major tax revenues

forecast |

-$243 |

|

Lower tribal gambling

revenue forecast |

-192 |

|

Lower tideland oil revenues |

-86 |

|

Higher Program Costs |

|

|

Higher correctional officer

arbitration costs |

-$200 |

|

Higher firefighting costs |

-115 |

|

Implementation of AB 900

prison system changes |

-97 |

|

All other (net) |

-26 |

|

New Solutions

Improving General Fund Condition |

$2,407 |

|

Sale

of EdFund—the state’s student loan guaranty agency |

$980 |

|

Accelerate tobacco

securitization fund transfers |

600 |

|

Higher tobacco securitization

revenues |

357 |

|

Expansion of Home-to-School

Transportation proposal |

200 |

|

Suspend SSI/SSP cost-of-living

adjustment |

185 |

|

Additional midyear reductions

to departmental budgets |

46 |

|

Eliminate Williamson Act subventions |

39 |

|

May Revision

Reserve |

$2,199 |

General Fund Condition

Figure 2 shows the administration’s estimate of the General Fund’s condition taking into consideration its May Revision proposals. It shows that the current fiscal year began with a prior-year balance of $10.5 billion. Consequently, even though current-year spending is expected to exceed revenues by $6.1 billion, the administration projects that the state will start 2007-08 with a balance of $4.4 billion. In the budget year, expenditures would exceed revenues by $1.5 billion. The administration estimates the state would end the budget year with a reserve of $2.2 billion. This is slightly more than the $2.1 billion reserve assumed in the January budget proposal.

|

Figure 2

Governor’s Budget General Fund Condition |

|

(In Millions) |

|

|

2006‑07 |

2007‑08 |

|

Prior-year fund balance |

$10,540 |

$4,433 |

|

Revenues and transfersa |

96,157 |

102,276 |

|

Total resources available |

$106,697 |

$106,709 |

|

Expenditures |

102,264 |

103,765 |

|

Ending fund balance |

$4,433 |

$2,944 |

|

Encumbrances |

745 |

745 |

|

Reserve |

$3,688 |

$2,199 |

|

Budget Stabilization Account |

$472 |

$1,495 |

|

Reserve for Economic

Uncertainties |

3,216 |

704 |

|

|

|

a

2006‑07 amount includes $472 million and 2007‑08

amount includes $1.023 billion in General Fund

revenues transferred to the Budget Stabilization

Account, which the administration excludes from its

revenue totals. These different treatments do not

affect the bottom-line reserve shown. |

Changes in Revenues

The administration’s new revenue forecast projects stronger current-year tax revenues than in January, but this increase would be more than offset by downward adjustments in the budget year. Specifically, the current-year estimate shows increased revenues from major sources of $563 million—driven by improved personal income tax and corporation tax revenues. The struggling housing market and other economic factors have led the administration to reduce its budget-year estimate by $806 million. Personal income, sales, and insurance tax revenues are all assumed to be lower, partially offset by stronger corporation tax revenues.

Changes in Expenditures

Compared to the Governor’s January budget, proposed expenditures for the budget year are up $624 million. The major increases in budget-year expenditures since January are due to:

-

Added General Fund spending to: (1) meet the higher 2007-08 Proposition 98 minimum guarantee ($104 million), and (2) reflect the altered treatment of a proposal to redirect public transit funds to benefit the General Fund ($627 million).

-

Recognition that the pension obligation bonds will not be sold in 2007-08. The bonds were proposed to reduce General Fund retirement payments by $273 million (as well as increase revenues by $252 million). The administration now assumes the sale will occur in 2008-09.

These increased costs are partially offset by a proposed suspension of a January 2008 SSI/SSP cost-of-living adjustment (COLA) (reducing spending by $185 million).

Economic and Revenue Forecast of the May Revision

Economic Forecast

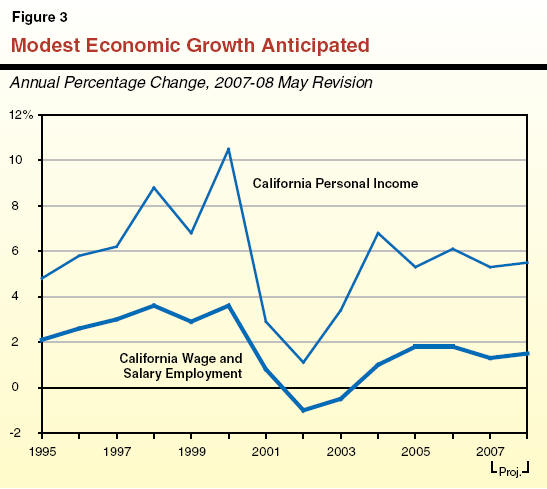

The economic forecast underlying the May Revision’s fiscal estimates assumes that both the nation and California will experience continued, though modest, economic growth over the next couple of years. As shown in Figure 3, the state’s economy is expected to experience slower growth than in 2006, with personal income growth averaging in the mid-5-percent range and growth in jobs well under 2 percent. Growth will be slowest in 2007, in part due to the drag on the economy associated with the housing market’s problems, before strengthening in 2008 and beyond. The May Revision’s forecast for continued modest economic growth reflects the consensus views of most economists at this time.

Revenue Forecast

The May Revision projects that General Fund revenues and transfers will total $96.2 billion in 2006-07 and $102.3 billion in 2007-08, for a budget-year growth of $6.1 billion (6.4 percent). This represents a two-year increase of $1.1 billion over the amount of revenues forecast in January 2007 in the 2007-08 Governor’s Budget, reflecting the administration’s EdFund and tobacco securitization proposals—partially offset by the decline in the state’s major tax revenues. Figure 4 summarizes the changes, which are discussed in more detail below.

|

Figure 4

May

Revision Revenue Changes Compared to January Forecast |

|

(In Millions) |

|

|

2006‑07 |

2007‑08 |

Two-Year Total |

|

Selected Major Taxes: |

|

|

|

|

Personal income tax |

$201 |

-$362 |

-$161 |

|

Sales and use taxes |

12 |

-506 |

-494 |

|

Corporation tax |

406 |

237 |

643 |

|

Insurance tax |

-54 |

-173 |

-227 |

|

Other |

-2 |

-2 |

-4 |

|

Subtotals, Major Taxes |

($563) |

(-$806) |

(-$243) |

|

Other

Revenues: |

|

|

|

|

EdFund |

— |

$1,000 |

$1,000 |

|

Tobacco securitization |

$600 |

357 |

957 |

|

Pension obligation bonds |

— |

-252 |

-252 |

|

Tribal gambling |

— |

-192 |

-192 |

|

All other |

4 |

-131 |

-127 |

|

Subtotals, Other Revenues |

($604) |

($782) |

($1,385) |

|

Totals |

$1,167 |

-$24 |

$1,142 |

-

Corporation taxes were revised up by over $640 million for the two years combined. This reflects the recent healthy performance of corporate profits and greater-than-projected revenue receipts from them collected since January. Through April, for example, corporate tax receipts were $564 million above expectations.

-

Sales and use taxes have been revised down by almost $500 million, all of which occurs in the budget year. Of this amount, over one-half is due to a weaker economy, while over $200 million reflects a higher spillover into the Public Transportation Account (PTA) primarily caused by increased retail gasoline prices.

-

Personal income taxes are down a net of about $160 million. Revenues are up in the current year and down in the budget year.

-

Insurance taxes are down by over $225 million, primarily reflecting a recent Board of Equalization ruling regarding how the timing of insurance premium receipts are treated.

-

Other revenues and transfers are up by about $1.4 billion, including $0.6 billion in the current year and $0.8 billion in the budget year. This includes gains of $1 billion from the sale of EdFund and nearly $960 million in tobacco securitization revenues, and reductions of about $250 million associated with pension obligation bonds and close to $200 million in tribal gambling receipts. We discuss the tobacco securitization revenues in more detail in the nearby box.

LAO Assessment of May Revision Economic and Revenue Forecasts

We find that the May Revision’s economic and revenue forecasts are generally reasonable in light of the uncertainties that characterize both the economy and revenue picture. Our own revised economic forecast, while a bit stronger than the administration's in some areas, is similar in its general thrust—continued modest economic expansion with weakness in 2007 and strengthening thereafter. Likewise, our revenue forecast, while different for many of the state’s individual revenue sources, has a similar bottom line. Thus, from this perspective, the administration's projections are reasonable.

The economic and revenue outlooks face two main uncertainties. First is the economic uncertainties associated with the outlook for the housing market in light of recent sales declines, foreclosures, and price reductions. Second is the future path of crude oil and retail gasoline prices. Adverse developments in these areas could significantly impact both overall economic performance and state revenues. Likewise, key elements of the revenue base, such as capital gains and stock options, are highly volatile and, therefore, difficult to accurately predict. As shown in Figure 5, the administration is projecting that capital gains and stock options will experience modest growth in the near future. Relatively small differences in actual growth rates, however, could generate revenue swings of hundreds of millions of dollars.

Increased Revenues From Tobacco Bonds

Tobacco Securitization.

Under the terms of a 1998 agreement which California and most other states signed with four leading tobacco companies, the state receives annual tobacco settlement revenue (TSR) payments in perpetuity, including an estimated $10-plus billion over the first 25 years. In 2003, to help balance the state’s budget, the state converted a portion of this future TSR stream into an upfront payment of $4.5 billion. In return, those investors who provided the $4.5 billion will be repaid over time, with interest, from the TSRs when they are actually received. A second round of tobacco securitization was done in 2005.

Refinancing Yields More Revenues Than Expected.

The Governor’s January budget proposal assumed that the previously issued tobacco bonds would be refinanced to take advantage of lower interest rates and other favorable market conditions. The budget assumed that the refinancing would raise an additional $900 million, which for budgetary purposes would be transferred to the General Fund on the following schedule: $300 million in 2007-08, $450 million in 2008-09, and $150 million in 2009-10 (connected to the timing of increased costs for payments to schools under the Quality Education Investment Act). Ultimately, the refinancing raised an additional $357 million beyond what was assumed in January, for a total of $1.257 billion.

May Revision Proposes to Accelerate General Fund Benefit.

The May Revision proposes to transfer these bond proceeds to the General Fund entirely in 2006-07 ($600 million) and 2007-08 ($657 million). Thus, the May Revision includes $957 million in current- and budget-year revenues beyond what was assumed in January. By accelerating the transfers to the General Fund, this proposal worsens the state’s operating deficit in 2008-09 and 2009-10 relative to January’s schedule.

|

Programmatic features of the May Revision

Figure 6 provides information on the major programmatic features of the May Revision affecting the General Fund. Below, we discuss the administration’s proposals related to Proposition 98, EdFund, and transportation.

|

Figure 6

Key

General Fund Features of May Revision |

|

|

|

K-14 Education |

|

·

Increases General Fund share of

Proposition 98 by $113 million for 2007‑08 due

primarily to an increase in the minimum guarantee.

|

|

·

Uses additional ongoing funds to

support higher cost-of-living adjustment (COLA) and

a variety of new programs. Underfunds 2007‑08 K-12

attendance-related costs by $366 million due to

technical error. |

|

·

Provides $542 million in additional

one-time funds for various K-14 purposes, including

emergency facility repairs, equipment, deferred

maintenance, and several new one-time initiatives. |

|

Higher Education |

|

·

Proposes selling EdFund to a private

buyer for an estimated $1 billion. |

|

Health and Social Services |

|

·

Suspends the statutory January 2008

Supplemental Security Income/State Supplementary

Program (SSI/SSP) COLA, resulting in General Fund

savings of $185 million in 2007‑08 (half year) and

$370 million in 2008‑09 (full year). |

|

·

Retains proposals to suspend the July

2007 CalWORKs COLA, impose new time limits and

sanctions on children whose parents cannot or will

not comply with participation requirements, and

shift certain CalWORKs child care costs to

Proposition 98 funds. |

|

·

Provides $107 million for Medi-Cal

managed care plans to reflect implementation of a

new rate-setting methodology. |

|

Criminal Justice |

|

·

Increases reserve for new initiatives

of the court-appointed Receiver from $150 million to

$175 million, but does not take into account the

Receiver’s own May Revision proposal for an

additional $150 million for the corrections health

budget. |

|

·

Does not include the new staffing and

other resources needed to manage the major new

prison-building program approved in recent state

legislation (AB 900). The administration has created

a team of experts to plan this work effort and

intends to make a subsequent request for this

purpose. |

|

Transportation |

|

·

Proposes to use $200 million in

additional projected Public Transportation Account

“spillover” funds (related to sales taxes on

gasoline) to reimburse the General Fund for

Home-to-School Transportation expenditures in the

current year. This is in addition to the modified

January proposal of reimbursing the General Fund for

$630 million in Home-to-School expenditures in the

budget year. |

|

General Government |

|

·

Proposes a long-term lease of the

State Lottery to a private vendor (but makes no

budgetary assumptions regarding the lease). |

|

·

Eliminates $39 million in subventions

to local governments with agricultural and

open-space lands under Williamson Act contracts. |

Proposition 98—K-14 Education

Figure 7 compares the Governor’s revised budget for 2006-07 with the revised budget for 2007-08. As shown in the figure, Proposition 98 funding increases by $2.2 billion, or 3.9 percent, year over year. Two-thirds of this increase is covered with higher property tax revenues whereas one-third is covered with additional General Fund support. Using revised attendance estimates, the overall Proposition 98 increase translates into a 4.4 percent increase in K-12 per pupil spending and less than a 1 percent increase in community college spending per student.

|

Figure 7

Proposition 98 Funding: Year-to-Year Changes |

|

(Dollars in Millions) |

|

|

2006‑07 Revised |

2007‑08 Revised |

Change |

|

|

Amount |

Percent |

|

K-12 |

$49,284 |

$51,224 |

$1,940 |

3.9% |

|

Community colleges |

5,996 |

6,223 |

226 |

3.8 |

|

Other |

114 |

119 |

5 |

4.3 |

|

Totals |

$55,395 |

$57,566 |

$2,171 |

3.9% |

|

General Fund |

$41,192 |

$41,930 |

$737 |

1.8% |

|

Local property tax |

14,203 |

15,636 |

1,433 |

10.1 |

|

K-12

attendance |

5,960,176 |

5,931,525 |

-28,651 |

-0.5% |

|

K-12 per pupil spending |

$8,269 |

$8,636 |

$367 |

4.4% |

|

CCC

full-time equivalent students (FTES) |

1,139,921 |

1,174,118 |

34,197 |

3.0% |

|

CCC per FTES spending |

$5,260 |

$5,300 |

$40 |

0.8% |

Major Proposition 98 Adjustments. The Governor’s May Revision makes Proposition 98 adjustments to 2005-06, 2006-07, and 2007-08. For 2005-06, it increases the General Fund share of Proposition 98 by $316 million, due primarily to a downward adjustment in local property tax revenues. (See box below for information on this issue.) For 2006-07 and 2007-08, the May Revision increases the Proposition 98 minimum guarantee by $372 million and $104 million, respectively, due to healthier-than-expected General Fund revenues. These adjustments to the current year and budget year are shown in Figure 8.

|

Figure 8

Proposition 98 Funding: Comparing January Budget and May Revision |

|

(In Millions) |

|

|

2006‑07 |

2007‑08 |

|

Total Proposition 98a |

|

|

|

January budget |

$55,022 |

$57,462b |

|

May Revision |

55,395 |

57,566 |

|

Changes |

$372 |

$104 |

|

K-12 |

|

|

|

January budget |

$49,011 |

$51,073b |

|

May Revision |

49,284 |

51,224 |

|

Changes |

$273 |

$151 |

|

Community

Colleges |

|

|

|

January budget |

$5,897 |

$6,274 |

|

May Revision |

5,996 |

6,223 |

|

Changes |

$99 |

-$52 |

|

|

|

a

Includes Proposition 98 funding spent by other

agencies including Department of Corrections and Rehabilitation and state special schools. |

|

b To

make comparisons more straightforward, does not

includes Governor's proposal to fund Home-to-School

Transportation program ($627 million) from the

Public Transportation Account. |

Uncertainty Regarding Historical Property Tax Receipts

Approximately one-third of local property taxes are currently allocated to local schools (including community colleges). Virtually all these property tax receipts offset dollar-for-dollar the state’s General Fund financing obligations under Proposition 98.

The LAO property tax growth forecast for 2007-08 is lower than that of the Department of Finance (DOF). This is due to different assumptions about the effect of the real estate slowdown and the amount of property tax receipts that will flow to local schools. For this reason, the LAO General Fund forecast for Proposition 98 is $190 million higher than that of the DOF.

Beyond this budget-year forecasting difference, there is also a serious risk related to baseline property tax revenues. During the 2005-06 fiscal year, the growth in property tax receipts received by K-12 school districts was significantly lower than the growth in overall property tax receipts around the state. This shortfall led to a gap of approximately $280 million between actual receipts and the budgeted amount. (The May Revision recognizes these higher costs.) There are a number of possible reasons for this difference and the state has experienced some differences between these growth rates in prior years. However, the shortfall in growth rates during 2005-06 was unprecedented by historical standards, and we do not yet understand the reasons it happened.

The allocation of property tax revenues has been particularly complicated in recent years (due to such factors as the vehicle license fee swap, two-year property tax shift in 2004-05 and 2005-06, the “triple flip,” and the growth of redevelopment). This potentially explains some of the problem. Year-to-year timing differences between the collection of revenues by counties and the receipt of revenues by schools could also explain the 2005-06 shortfall. It is possible, for instance, that additional receipts may flow to the schools during the 2006-07 fiscal year, which may counterbalance the low growth in 2005-06. In making its Proposition 98 baseline forecasts, DOF has assumed that this rebound will occur, and also that it will be large enough in magnitude to compensate for the effects of the lower receipts in 2005-06.

There is, however, a significant chance that the shortfall will not be fully compensated by higher growth in 2006-07. As a result, the state could face up to $310 million in additional 2006-07 Proposition 98 General Fund spending and $350 million in additional 2007-08 spending.

|

Major Changes in Ongoing Proposition 98 Spending

As shown in Figure 9, the May Revision totals include several changes to the Governor’s budget. Of greatest magnitude, the administration proposes to restore Proposition 98 funding for the Home-to-School Transportation program ($627 million) and fully fund the Proposition 98 minimum guarantee. The Governor’s budget initially had proposed to reduce Proposition 98 funding for the program and lower the guarantee. The May Revision provides $247 million to increase the K-14 COLA from the January estimate of 4.04 percent to the final rate of 4.53 percent. It also reduces support for community college apportionments by $80 million to adjust for unrealized enrollment. It makes no change to the administration’s January proposal to increase Proposition 98 funding for child care by $269 million, and it continues to provide virtually no funding for the ongoing cost of mandates (estimated to be about $185 million in 2007-08).

|

Figure 9

Proposition 98 Ongoing Proposals |

|

(In Millions) |

|

|

|

|

January Budget |

|

|

Cost-of-living adjustment

(COLA) (4.04 percent) |

$2,137.5 |

|

Attendance changes |

38.7 |

|

Home-to-School

Transportation |

-626.8 |

|

Child care funding shift |

269.0 |

|

Other |

-0.4 |

|

Total |

$1,818.0 |

|

May Revision |

|

|

Home-to-School

Transportation |

$626.8 |

|

Higher COLA (4.53 percent) |

246.8 |

|

Attendance changes |

-374.9 |

|

High Priority Schools Grant

program |

-100.0 |

|

Additional teachers for

career technical education |

50.0 |

|

Additional teachers for a

through g courses |

50.0 |

|

Preschool expansion |

50.0 |

|

Special education |

35.5 |

|

Additional career technical

education counselors |

25.0 |

|

School meals/child nutrition |

24.9 |

|

Other |

96.4 |

|

Total |

$730.6 |

Expands Programs and Creates New Programs. Whereas the Governor’s budget funded no ongoing program expansions or new ongoing programs, the May Revision proposes numerous ongoing initiatives. Building off of current-year initiatives, it includes $50 million for expanding preschool, $25 million to fund a higher reimbursement rate for the school meals program, and $25 million for hiring additional counselors focused on career technical education. It also includes slightly more than $100 million for about a dozen other special ongoing initiatives. The May Revision also redirects $100 million from the High Priority School Grant Program (HP Program) to two new initiatives—hiring new career technical education teachers ($50 million) and new teachers of college preparatory classes ($50 million). The administration states that this redirection has been agreed to by the plaintiffs in the Williams settlement.

Technical Error Creates $366 Million Problem. The May Revision also makes attendance-related adjustments to K-12 education and community colleges. For K-12 education, it adjusts average daily attendance (ADA) upward by slightly more than 19,000 in the current year and almost 14,000 in the budget year. Despite these ADA increases, the May Revision scores $293 million in attendance-related savings relative to the Governor’s budget. We determined that this reduction was due to a technical error whereby the $350 million provided in the current year for revenue limit equalization was not carried forward, thereby understating the costs to the base budget for 2007-08. After adjusting for the 2007-08 COLA, this $366 million error can be addressed by: (1) making reductions to Proposition 98 spending of a comparable amount to stay at the minimum guarantee, (2) using special fund or one-time Proposition 98 monies to increase K-14 funding while still staying at the minimum guarantee, or (3) identifying other General Fund monies and appropriating above the guarantee. For community colleges, the May Revision reduces apportionments by $80 million to account for unrealized enrollment.

LAO Approach. In constructing the Proposition 98 ongoing package, we recommend the Legislature cover baseline costs (such as mandates and other already authorized programs) prior to funding new programs. We also recommend covering the $366 million attendance-related cost within the Proposition 98 minimum guarantee. To cover this cost, we recommend rejecting all of the Governor’s new ongoing proposals. Rejecting all of these proposals, however, still leaves more than $200 million in unfunded attendance-related costs. We recommend using one-time Proposition 98 funds to cover this remaining shortfall. In addition, rather than redirecting HP funds to new initiatives, we recommend augmenting Economic Impact Aid. Such an approach would allow districts serving low-income students and English learners to determine what types of additional teachers and services likely would be most effective.

Major Changes in One-Time Proposition 98 Spending

As shown in Figure 10, the May Revision contains $542 million in additional one-time funds. Coupled with the one-time funds provided in the Governor’s budget, over $800 million is available for one-time K-14 expenses. This amount is split about evenly between current-year “settle-up” funds and Proposition 98 Reversion Account funds.

|

Figure 10

Proposition 98 One-Time Proposalsa |

|

(In Millions) |

|

|

|

|

January Budget |

|

|

Emergency Repair Program |

$100.0 |

|

Teacher recruitment and

retention |

50.0 |

|

Charter School Facilities |

43.9 |

|

Child Care Stage 2 |

25.7 |

|

Other |

41.9 |

|

Subtotal |

($261.6) |

|

May Revision |

|

|

School safety plans |

$100.0 |

|

Emergency Repair Program |

96.0 |

|

CalPADS pre-implementation

plans |

65.0 |

|

K-12 career technical

equipment |

50.0 |

|

CCC career technical

equipment |

50.0 |

|

CCC nursing programs |

50.0 |

|

Supplemental instruction

deficiencies |

48.1 |

|

CCC deferred maintenance |

48.0 |

|

Other |

34.4 |

|

Subtotal |

($541.5) |

|

Total |

$803.0 |

|

|

|

a

Includes "settle-up" funds for 2006-07 as well as

Proposition 98 Reversion Account monies. |

Proposed Uses of One-Time Funds. Of these funds, almost $200 million is provided for the Emergency Repair Program, $100 million is provided for a special initiative relating to school safety plans, and $100 million is provided for K-12 and community college career technical equipment. Other sizable proposals include $65 million for assisting districts in providing the state with student-level data, $50 million for community college nursing programs, $50 million for teacher recruitment and retention, slightly less than $50 million to cover deficiencies in mandatory supplemental instruction programs, and slightly less than $50 million for community college deferred maintenance. The remaining funds support more than a dozen other one-time initiatives.

LAO Approach. Although we typically would recommend the Legislature not use one-time funds to support ongoing expenses, the $366 million attendance-related technical error likely entails significant reworking of the Governor’s proposed ongoing Proposition 98 budget. To the extent ongoing funds cannot be identified to fully fund ongoing baseline costs, available one-time funds would represent a potential short-term solution. After covering shortfalls with the ongoing budget, we recommend using any remaining one-time funds to cover program deficiencies.

Key May Revision Solution: Governor Proposes Sale of EdFund

Under federal guaranteed loan programs, students take out loans from private lenders (such as banks), while the federal government guarantees repayment of the loans if the student defaults. Federal law requires that each state designate a guaranty agency with responsibility for processing the guarantee and performing related administrative functions. Since 1979, the California Student Aid Commission (CSAC) has been the state’s designated agency, although the state could choose from many other private and public guarantee agencies operating in the United States.

Until the mid-1990s, CSAC sometimes performed its loan guarantee function in house and sometimes contracted with third parties. In 1997, the state created a nonprofit public benefit corporation, EdFund, to perform these functions as CSAC’s auxiliary. EdFund earns revenues from the federal government for performing these duties, and some of this revenue has been used to offset costs CSAC incurs for administering state grant programs. In recent years, concerns have been raised about the organizational relationships between CSAC and EdFund. In addition, recent efforts by the U.S. Department of Education and the Congress to modify the federal loan programs have added uncertainty as to EdFund’s costs and revenues.

As part of the May Revision, the Governor proposes to sell EdFund to a private buyer for an estimated $1 billion. The CSAC would no longer have responsibility for overseeing the federal loan program, and instead would concentrate on the state grant programs that it currently administers. Without annual revenues from EdFund to support CSAC’s operations, the Governor proposes $20 million in ongoing General Fund support for CSAC. The Governor does not propose any reductions to CSAC staffing, although several positions are currently dedicated to overseeing EdFund.

Issues for Legislative Consideration. Given its existing structure as a public benefit corporation, EdFund already operates more like a private business entity than a traditional state agency. We believe the administration’s proposal merits consideration, with a key issue being the amount that could be raised through the corporation’s sale. With its large loan portfolio and history of profitable operations, it is reasonable to assume that the state could in fact raise a substantial sum from EdFund’s sale. At the same time, the proposal raises several issues for legislative consideration:

-

What Would Be the Impact on Students and Colleges? If EdFund were sold, campuses could either use the services of the privatized entity or various other guarantee agencies that operate in the state. Campuses also can choose to use federal direct student loan programs that avoid the need for private lenders and guarantee agencies. It is unclear how these various options could affect costs and services to students.

-

What Would Be the Impact on CSAC Staffing? The CSAC has several employees with responsibility for overseeing EdFund activities, as well as about 50 employees assigned to work at EdFund itself. (EdFund has about 565 of its own direct hires who are not state employees.) The disposition of these CSAC employees would depend in part on whether CSAC would remain the state’s designated guarantee agency.

In addition to the proposed sale of EdFund, the May Revision includes another proposal similar in nature—the leasing of the state lottery. (See box below for more details.)

Leasing the Lottery to a Private Operator

The administration is requesting authorization to lease operating rights for the California Lottery to a private concessionaire for a multidecade period—perhaps for 40 years. In exchange, the state would receive a one-time payment—perhaps totaling in the tens of billions of dollars—and/or annual payments from the private entity. The May Revision scores no revenues from the proposal in 2007-08, but suggests the proposal could produce benefits for the state in future fiscal years. The proposal is a general framework rather than a detailed implementation plan.

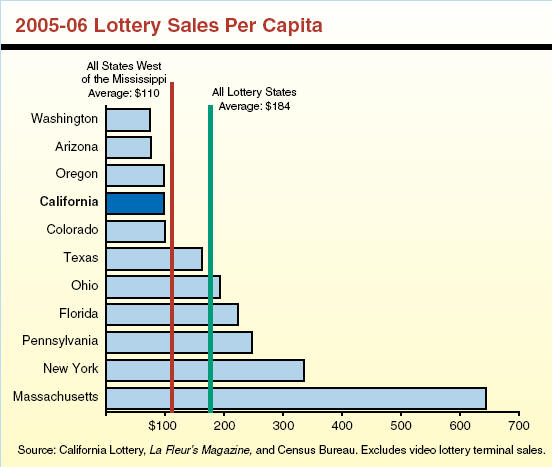

Lottery Revenues and Trends. Voters approved the lottery in 1984. Under the law, at least 34 percent of revenues go to public education, and about 50 percent is used for prizes. With revenues of $3.6 billion in 2005-06, the lottery distributed $1.3 billion to schools, community colleges, and universities. This was a record amount for the lottery, but sales are projected to decline by about 10 percent in 2006-07 due to lagging consumer interest in several lottery games. Such declines have occurred periodically during the lottery’s first two decades, including sharp drops during the late 1980s and early 1990s. During the last decade, including estimated 2006-07 results, lottery distributions have grown an average of 4.1 percent per year. Lottery moneys total less than 2 percent of all K-12 revenues.

Private-Sector Interest. The figure shows that per capita lottery sales in California lag the national average by about 50 percent. States west of the Mississippi typically have lower per capita sales, and California lags the average of this group by about 10 percent. Private-sector entities have been interested in operating lotteries due to the possibility of increased sales. Private entities operate lotteries in Europe and Australia, and several states recently have considered proposals similar to this one.

Issues for Legislative Consideration. The administration’s proposal is worth examining further. We have identified several issues for the Legislature to consider.

-

Use of One-Time Proceeds. The administration proposes using upfront proceeds from the lease to retire debt, including deficit-financing bonds. The Legislature could also use one-time proceeds to for example: (1) retire nondeficit bond debt, (2) retire special fund loans (including transportation), (3) build infrastructure, or (4) reduce unfunded pension or retiree health liabilities.

-

What Is the Lottery Worth? We believe a private entity may be able to improve lottery performance, but no one knows for sure what private firms would pay for the right to operate the lottery. If the Legislature agrees to the administration’s plan, the Legislature may wish to establish parameters for a transaction to be completed, including a minimum upfront payment and/or minimum levels of annual payments from the concessionaire.

-

Flexibility. The state likely would receive the largest bids from the private sector if many limitations on lottery activities—including percentage formulas for payouts, state employment rules (including civil service protections), and procurement requirements—were relaxed.

-

Effect on Other State Revenue Sources. The Legislature should consider the effects a privately run lottery would have (both positive and negative) on other state revenues, including revenues from tribal casinos, sales taxes, and income taxes.

|

Transportation

Relative to the Governor’s January budget, the May Revision projects higher gasoline and diesel sales tax revenues in 2007-08. The May Revision proposes to use most of these increased revenues to offset General Fund expenditures in the current and budget years.

Current Law. The PTA has traditionally been funded by sales tax on diesel fuel and a portion of the sales tax on gasoline. Some PTA revenues come from “spillover”—the amount that gasoline sales tax revenues at the 4.75 percent rate exceed the amount generated from sales tax on all other goods at the 0.25 percent rate. Under current law, one-half of PTA revenues are to be transferred to the State Transit Assistance (STA) program for support of local transit systems, with the remainder used for various other transit and transportation planning purposes.

Governor’s Budget Proposals Prior to May Revision. The January budget proposed to use $1.1 billion in the PTA funds to offset General Fund expenditures, including the use of:

-

$627 million in PTA money to fund the Home-to-School Transportation program in 2007-08, instead of using Proposition 98 funds. The January budget proposed the funding shift on a permanent basis and to “rebench” the Proposition 98 funding requirement downward by a like amount. In April, the administration modified its Home-to-School Transportation proposal. Instead of rebenching the Proposition 98 funding requirement, the administration proposed that PTA reimburse the General Fund for the cost of the Home-to-School Transportation program on an ongoing basis.

In addition, the Governor’s January budget proposed to permanently eliminate funding STA from spillover revenues.

Governor’s Proposals in the May Revision. The May Revision projects $238 million in additional revenues into the PTA in 2007-08 than were anticipated in the January budget. Most of the increase would come from additional spillover revenues resulting from higher gasoline prices than projected in the January budget. Specifically, the May Revision projects a total of $827 million in spillover, compared to $617 million in the January budget. The May Revision includes the following proposals:

-

Additional Reimbursement to the General Fund for Home-to-School Transportation. The May Revision proposes to use $200 million in PTA revenues to reimburse the General Fund for Home-to-School Transportation expenditures in the current year. The May Revision also increases by $3 million (to $630 million) the amount of PTA funds that would reimburse the General Fund for Home-to-School Transportation expenditures in 2007-08. The increase reflects higher transportation costs for the state special schools. After 2007-08, the May Revision also proposes that $200 million in PTA money be used to reimburse various unspecified General Fund expenditures annually, on an ongoing basis.

With these proposals, the May Revision would leave PTA with a balance of about $100 million at the end of 2007-08, a slight improvement over what was proposed in the January budget ($69 million). However, if PTA revenues fall short of the administration’s projections or expenditures on transit capital projects are higher than anticipated, this projected balance would be reduced. Moreover, the projected balance does not include funding for continued development of a high-speed rail system.

Home-to-School Transportation Proposal Unworkable. In February, we concluded based on conversations with Legislative Counsel Bureau that the administration’s proposed rebenching of Proposition 98 as part of its original Home-to-School Transportation proposal was likely unconstitutional. In its modified form, we conclude that the proposal is still unworkable. In essence, the administration seeks to count the transportation funds simultaneously towards two separate (and mutually exclusive) legal spending requirements—under both the Proposition 98 guarantee and PTA.

Key Considerations for the Legislature

As it reviews the proposals contained within the May Revision, the Legislature will face a number of key issues that we outline below.

Reserve Likely Overstated by $1.7 Billion

In February, we identified a number of assumptions in the Governor’s January budget that were overly optimistic. Since then, the administration has modified several of these assumptions, including (1) no longer assuming the sale of the pension bonds in 2007-08 and (2) reducing its tribal gambling revenue estimate by almost $200 million.

Despite these positive changes, the May Revision continues to rely on a number of optimistic assumptions from its January proposal and adds a number of new ones. As a result, we estimate that the May Revision overstates the state’s General Fund reserve at the end of 2007-08 by almost $1.7 billion. Figure 11 summarizes these factors which are described in more detail below.

|

Figure 11

LAO:

Reserve Likely Overstated by $1.7 Billion |

|

(In Millions) |

|

May Revision

Reserve |

$2,199 |

|

|

|

|

LAO Major

Adjustments |

-$1,670 |

|

Home-to-School Transportation shift proposal

unworkable |

-$830 |

|

Potential correctional officer

contract costs |

-330 |

|

Property taxes growth rate too

high |

-190 |

|

Tribal gambling revenues

overly optimistic |

-184 |

|

Midyear reductions unlikely to

achieve savings |

-136 |

|

LAO Adjusted

Reserve |

$529 |

Home-to-School Transportation Proposal. As discussed above, we do not believe the administration’s transportation proposal is workable. It would not provide the assumed $830 million in savings.

Correctional Officer Salary Increase. Funds paid to correctional officers, their supervisors, and managers total about 40 percent of General Fund personnel costs. The correctional officers’ labor agreement expired in July 2006, and the budget contains no funds for a potential new agreement. The administration’s most recent contract offer, however, would raise General Fund costs by about $330 million in the budget year. While negotiations have been slow and the administration recently requested mediation, it would be prudent for the Legislature in building its budget to account for roughly this amount in potential costs. In February, we raised the possibility that correctional officers could receive a compensation increase on July 1, 2007, even without a new agreement. This is due to the possibility that the prior agreement would continue to govern pay raises. The prior agreement tied compensation to California Highway Patrol officers, who are scheduled for a pay increase in the budget year.

Property Taxes Estimate. As noted earlier, our property tax estimate for the budget year is $190 million lower than the administration’s estimate. These lower revenues increase General Fund Proposition 98 expenditures on a dollar-for-dollar basis.

Tribal Revenue Estimate. As noted above, the administration has significantly reduced its original estimate of revenues from the approval of amended tribal gambling compacts currently pending in the Legislature. The new estimate, however, continues to rely on rosy assumptions regarding the timing of legislative approval, the number of slot machines that would be added by tribes in the short term, and the profitability of those machines. Given the Senate’s action to approve the compacts on a majority vote, our revenue assumption for the Governor’s proposal now assumes implementation on January 1, 2008—rather than the immediate implementation that would occur with a two-thirds approval. To the extent that the five compacts were not effective for 2007-08, the impact on the reserve would be even greater.

Midyear Reductions. The administration assumes that the state will achieve $146 million in savings from reductions to departmental appropriations during the upcoming fiscal year. Recent experience with these types of assumptions has shown that most savings are either double-counted or lead to future departmental budgetary shortfalls. As a result, we project that only a minimal amount of savings ($10 million) could be achieved by the administration’s proposal.

More Realistic Budget Planning. It is conceivable that some portion of the amounts discussed above could be realized. Our assessment, however, is that the Legislature should approach its budget planning without counting on the amounts scored by the administration. Instead of working from the May Revision’s stated $2.2 billion reserve, the Legislature should—as its own starting point for budget deliberations—consider the budget as containing a $529 million reserve.

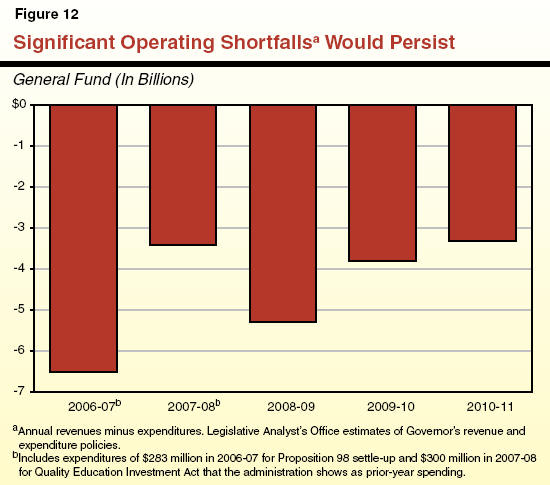

Picture of Future Years More Gloomy

Based on our initial assessment of the May Revision, we have updated our long-term forecast of the state’s ongoing budget shortfall under the Governor’s proposed policies. Taking into account our assessment of the out-year revenue and expenditure implications of the May Revision, we estimate that the 2008-09 operating shortfall would be about $5 billion. The growth in the operating shortfall from the budget year to 2008-09 reflects the administration’s approach of closing the 2007-08 budget gap with a number of one-time solutions, such as the EdFund sale and the acceleration of tobacco securitization revenue transfers. In later years, the shortfall would drop to about $3 billion, as shown in Figure 12. This reduction primarily reflects the payoff of the state’s deficit-financing bond debt in 2009-10. Thus, while closing the 2007-08 budget shortfall will be the most immediate task, the Legislature should also keep an eye on the effect of any budgetary actions this year on upcoming budgets.

Additional Risks Warrant More Caution

Every annual state budget has some legal uncertainties, potentially higher costs, and revenue estimates subject to downward adjustments. Yet, even after accounting for the overly optimistic assumptions discussed above, there are other risks and pressures contained within the administration’s proposed 2007-08 budget plan which—if occur—would put it out of balance.

Legal Issues. Since January, the state prevailed at the appeals court level for a case involving California Work Opportunity and Responsibility to Kids (CalWORKs) grants. However, the case has been appealed to the California Supreme Court. In addition, the state faces a number of other court cases with sizable fiscal liabilities. For instance, the state is currently on the losing end of cases involving the constitutionality of a fee on limited liability corporations, the manner in which the state handles unclaimed property, and the state’s reduction of a required payment to a fund for retired school teachers. In total, these legal risks could exceed $2 billion (primarily of a one-time nature). In addition, the state is currently dealing with a variety of federal lawsuits related to the correctional health care system. While the budget plan includes many costs associated with these lawsuits, the full magnitude of the associated costs remains unknown.

Revenue Assumptions. As discussed in the education section of this report, the lower-than-expected 2005-06 property tax receipts by school districts is not yet fully understood. If this reduction continues in the current and budget years, the state would be exposed to $660 million in additional costs. This amount is in addition to our lower property tax forecast based on the real estate outlook. In addition, as noted earlier, the level of revenues that would be received by the proposed sale of EdFund is subject to uncertainty.

Retiree Health Unfunded Liabilities. Like the vast majority of governments across the country, the state has not funded the estimated costs of future retiree health benefits as they accrue. Instead, the state uses a “pay-as-you-go” funding system where costs are paid as benefits are used by retirees. As a result, the state has a large unfunded liability for the benefits that are earned now but will be paid for later. On May 7, 2007, the State Controller released the state’s first actuarial valuation which identified this unfunded liability as totaling $47.9 billion. In order to fully fund retirees’ future benefits and eliminate this liability over the next three decades, the state would have to begin setting aside an additional $1.2 billion annually. These amounts will grow each year that the state continues its pay-as-you-go approach. Our estimates do not account for these higher costs that will need to be paid at a future date.

Focus on Payoff of Deficit-Financing Bonds Should Not Be Immediate Priority

The administration’s budget proposals have placed an emphasis on paying off the state’s deficit-financing bonds. In addition to the base payment of $1.5 billion, the May Revision continues to propose $1.6 billion in supplemental payments in 2007-08 through two components.

The goal of these prepayments is to pay off the bonds earlier than scheduled and reduce debt costs. The payments would help the state’s budget once the entire amount of outstanding bonds are paid off, beginning in 2009-10. These prepayments are a worthy aim when the state’s budget situation allows. With the nearer-term outlook worsening, however, we question the wisdom of these payments at this time. Given the overstated reserve and additional financial risks, assisting the state to close its budget gaps in 2007-08 and 2008-09 is a more urgent demand.

Conclusion

Despite the state’s improved revenue picture in the current year, the Legislature will face a significant challenge to develop a 2007-08 budget that realistically reflects revenues and spending while maintaining a prudent reserve. The administration has attempted to address a $2 billion decline in the state’s fiscal outlook. Due to several overly optimistic assumptions, however, the May Revision overstates its reserve by about $1.7 billion—leaving an estimated reserve of $529 million. Even this reserve level would be subject to considerable risks and pressures.

|

Acknowledgments The Legislative Analyst's Office (LAO) is a nonpartisan office which provides

fiscal and policy information and advice to the Legislature.

Contact:

Michael Cohen.

|

LAO Publications To request publications call (916) 445-4656.

This report and others, as well as an E-mail

subscription service

, are available on the LAO's Internet site at www.lao.ca.gov. The LAO is

located at 925 L Street, Suite 1000, Sacramento, CA 95814.

|

Return to LAO Home Page