January 12, 2007

Allocating Local Sales Taxes: Issues and Options

Recent agreements between cities and private businesses involving diversions of millions of dollars of local sales taxes have highlighted concerns raised over the years about the present “situs-based” system for allocating local sales taxes. This report looks at these concerns and discusses options for dealing with them.

Executive Summary

Local governments receive about $7 billion in revenues related to the Bradley-Burns sales tax each year. This point-of-sale allocation system (sometimes referred to as a “situs-based” system) raises several important issues and concerns. For example:

- The present situs-based allocation method gives local governments strong fiscal incentives to orient their land-use policies to favor retail over other types of development and has led to counterproductive competition between communities for sales tax-generating businesses.

- One manifestation of unproductive competition is the use of sales tax rebates and other financial incentives by local agencies to sales tax-generating businesses locating within their borders. These have been used to encourage the relocation of sales offices and the creation of “buying companies” for the purposes of diverting sales taxes.

- The use of financial incentives does not result in net benefits to a broader economic region within the state. It simply shifts existing sales taxes from one jurisdiction to another-at the cost of government resources that could be used for other purposes.

The counterproductive aspects of the current system could be addressed through major reforms involving either the local sales tax allocation methodology or changes in local government’s system of taxes. Both of these options would involve significant public policy trade-offs and would require changes to the state’s Constitution.

Short of adopting major reforms, the state could adopt targeted changes focused on limiting the use of financial incentives for diverting sales taxes. One very important action in this area would be to restrict the use of buying companies for this purpose.

Over the years, significant policy concerns have been raised regarding the state’s current method of allocating local sales taxes to the point of sale (a so-called “situs-based” system). Recently, these concerns have focused on one of the negative consequences of the situs-based system-the counterproductive competition that it creates between local communities for sales tax-generating businesses. A key example is the use by local agencies of sales tax rebates and financial incentives to divert sales taxes from other communities. In this report, we review the various issues raised by the current allocation methods, and then focus on the use of financial incentives by local communities. We conclude by highlighting options available to the Legislature to address concerns raised by the current local sales tax allocation system.

|

Allocation of Bradley-Burns Sales Taxes

California state and local governments impose various sales and use tax rates that sum to a combined rate of from 7.25 percent to 8.75 percent, depending on the local jurisdiction involved. The main components are a statewide rate (currently 6.25 percent), the Bradley-Burns uniform local rate, and various other optional local levies for transportation and other purposes.

Under the Bradley-Burns Uniform Sales and Use Tax Law, local governments levy a 1.25 percent rate on taxable sales, of which 1 percent is used for general purposes and 0.25 percent is used for transportation purposes.

Provisions associated with the deficit-financing bonds approved by voters in 2004 (Proposition 57) temporarily reduced the rate by one-quarter cent, and replaced it with a one-quarter cent state special fund sales tax for repayment of the bonds. The reduction on local sales taxes are replaced, dollar for dollar, by property taxes shifted from school districts (which are, in turn, replaced by General Fund appropriations-the combination of these actions is referred to as the “triple flip”). Thus, local governments still receive the equivalent of a 1.25 percent rate on taxable sales-or about $7 billion in 2006-07.

The allocation issues discussed in this report apply principally to the Bradley Burns portion of the sales tax, as it is the only portion where sales taxes are predominately allocated to specific cities or counties based on the site of the seller (sometimes called a situs-based system). The other portions are used for statewide purposes, are allocated at the countywide or regional level, and/or are allocated based on other criteria.

Most Sales Allocated Based on

Location of the Seller…

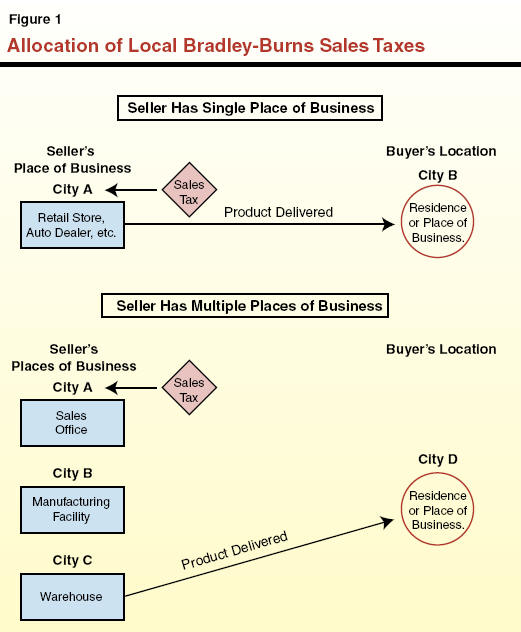

State law generally requires that Bradley-Burns sales taxes be allocated to the place of business of the retailer (see Figure 1). For the majority of sales, this is simply the place where the transaction occurs-such as the retail store, auto dealer, or restaurant (see top panel of Figure 1). However, in cases where the seller has more than one place of business and the sales and delivery of a product occur at separate locations, BOE regulations require that the sales be allocated to the seller’s location where the principal sales negotiations are carried on. This is usually the sales office of the company (see the bottom panel of Figure 1).

…One Key Exception-Jet Fuel

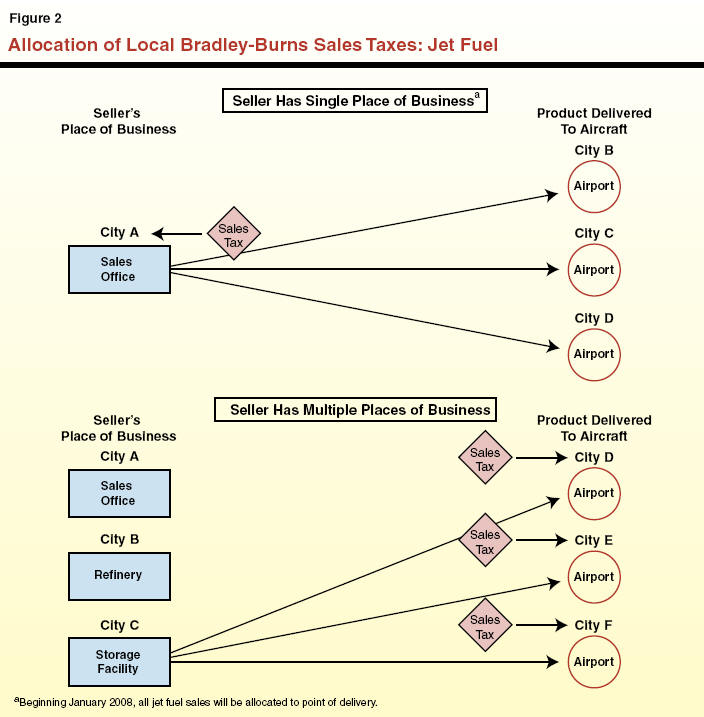

State law provides special allocation rules for jet fuel (see Figure 2). Under these rules, if the seller has just one place of business in California, then the sales taxes on jet fuel are allocated in the same manner as other commodities-to the jurisdiction of the seller. However, if the seller has more than one place of business in this state, then the sales are allocated to the point of delivery to the aircraft. The point-of-delivery rules for jet fuel are the result of Chapter 1027, Statutes of 1998

(AB 66, Baca), which, among other things, settled a dispute regarding the allocation of jet fuel delivered to San Francisco International Airport.

In 2005, the Legislature passed Chapter 391, Statutes of 2005 (AB 451, Yee). Under this measure, all jet fuel sales made on or after January 1, 2008, will be allocated to the point of delivery-regardless of whether the seller has one or more places of business in California. As discussed in more detail below, Chapter 391 was enacted in response to an agreement between United Airlines and the City of Oakland that resulted in the diversion of sales taxes on certain jet fuel sales.

Concerns Raised by

the Present Allocation System

Over the years, significant policy concerns have been raised regarding the use of point of sale to allocate local sales taxes. These concerns, summarized in Figure 3, relate principally to the incentives local governments face to use their land use and economic development powers to promote retail development in their community.

|

Figure 3

Concerns

Raised Regarding Present System of Allocating Local Sales

Taxes |

|

|

|

ü

Local governments place an undue emphasis on

retail development in local land use planning. |

|

ü

Local governments place an undue emphasis on

retail activities in local economic development, sometimes

engaging in unproductive competition with other communities

for sales tax dollars. |

Undue Emphasis on Retail Development In Local Land Use Planning

Under our governance system, cities and counties have considerable authority over new land developments. These local governments establish general plans for their communities, determine the intensity and purpose by which areas may be developed, and approve permits for individual projects. While cities and counties review many factors when making these decisions, the impact of land development on the fiscal health of the local government is among the higher considerations.

Under the state’s local finance system (including the situs-based allocation of the sales tax), cities and counties typically report that they receive the highest net revenues from retail developments-and that housing and manufacturing developments frequently yield more costs to the local government than tax revenues. These fiscal evaluations of development have resulted in many cities and counties orienting their land use policies to promote retail over other land uses.

While an individual city or county may receive greater tax revenues by promoting retail development in their community, this undue focus on retail is undesirable from a state standpoint. For example, the cost of new manufacturing or housing development may be increased if a community zones disproportionate amounts of ready-to-develop land for future retail development-and leaves less desirable land for other development purposes. Similarly, developers of manufacturing or housing may face higher costs if local agencies require them to pay impact fees, build infrastructure improvements, or modify their plans to alter their development’s fiscal effect on local government.

Undue Emphasis on Retail Activities in Local Economic Development

Retail establishments typically have choices where to locate their businesses and can be successful at multiple locations in different cities (or the unincorporated area of counties) within a region. Given the significant tax revenue benefits associated with retail activity occurring in a community, local governments frequently encourage major retail businesses to locate, remain, or expand operations within their borders. This encouragement can take different forms, but frequently includes local governments using their economic development powers to condemn property to assemble parcels of land suitable for retail, finance related infrastructure (such as road improvements or parking for the retail establishment), exempt the retail enterprise from locally imposed taxes or fees, and/or rebate to the business a portion of the tax associated with retail activities occurring at the location.

Communities Frequently Engage in Unproductive Competition. Over the years, when large retail establishments have considered relocation or expansion into a region, local governments have often competed against one another by offering the business ever more generous packages of incentives to operate within their borders. From a state standpoint, this competition among jurisdictions for sales tax revenues generally is unproductive. There is a finite market for retail spending within an economic region. Thus, the main result of the various incentives offered to the business is simply a relocation of the retail activity from one community to another-with no net gain in economic output or efficiency to the region or state as a whole. In addition, the cost of the economic incentives drain local government resources that otherwise would be available for public purposes.

In recent years, there has been considerable interest in one form of economic incentive local governments have offered to retail establishments: rebating sales taxes. While the remainder of this report will focus on examples involving the use of these rebates, it is important to note that this business incentive is simply one manifestation of the significant fiscal interest local governments have to encourage retail activities within their borders.

Sales Tax Rebates and

Other Financial Incentives

Sales tax rebates and financial incentives are provided by local governments directly to businesses, without the involvement of the state. In the case of sales tax sharing agreements between cities and local businesses, for example, the local taxes are allocated by the Board of Equalization (BOE) to the local jurisdictions, which then rebate the agreed-to portion of the sales tax to the business. Given the lack of state-level involvement, there is no comprehensive information regarding the frequency and magnitude of sales tax rebates and other forms of financial incentives. It is clear, however, from discussions with local officials, as well as the number of legal cases involving disputes between local communities, that financial incentives by local governments are not uncommon.

Legal Basis for Financial Incentives

There is no law or regulation that specifically authorizes local governments to provide financial incentives. Our understanding is that local governments generally rely on authority granted to them in the California Constitution concerning how they conduct their municipal affairs. A key constitutional provision in this area is Article XI , Section 5, which states that charter cities (which encompass a majority of the state’s population) may “make and enforce all ordinances and regulations in respect to municipal affairs.” Local agreements involving sales tax rebates typically reference one or more municipal purposes, such as additional revenues, more jobs, or the general well-being of the community.

Main Ways That Financial Incentives Are Used

Financial incentives are typically provided by local governments in return for the location or expansion of a business into a community-or to encourage an existing business to remain in the community. Some of the higher profile examples involve sales tax sharing agreements between cities and large sales tax generators, such as auto dealers, big box stores, or malls. However, as noted above, financial incentives can take many forms, and they are provided to a wide variety of tax-generating businesses. Even in cases where the incentive does not involve a sales tax sharing agreement, the magnitude of the incentive is often tied, directly or indirectly, to the sales tax generation potential of the business.

Legislature Has Restricted Use of

Incentives for Certain Relocations

In most cases, incentives do not involve the redirection of existing sales taxes from one community to another. (Rather, they are aimed at attracting new or expanded business.) However, there are a number of high profile instances where this has been the case. In recent years, the state has restricted the use of financial incentives in some areas where competition between communities has been most intense. In 1999, the Legislature passed Chapter 462, Statutes of 1999 (AB 178, Torlakson), which required a community that uses financial incentives to lure a big-box retailer or auto dealer from a neighboring community to offer the other community a contract apportioning the sales taxes generated by the business between the two jurisdictions. The provisions of Chapter 462 were replaced by tougher restrictions in 2003, with the enactment of Chapter 781, Statutes of 2003 (SB 114, Torlakson). This measure prohibits a community from providing any form of financial assistance to a vehicle dealer or big-box retailer relocating from a neighboring community.

But Other Types of

Tax Diversions Continue

While Chapter 781 prohibits the use of financial incentives to lure auto dealers and big-box retailers from other communities, incentives can continue to be used to encourage other business relocations. They also continue to be used to encourage other actions by businesses that result in the redirection of sales taxes. Two such actions-each of which have involved the redirection of millions of dollars of local sales taxes-are (1) the consolidation of sales offices into a community and (2) the redirection of sales taxes through the creation of a buying company.

Relocation or Consolidation of

Sales Offices

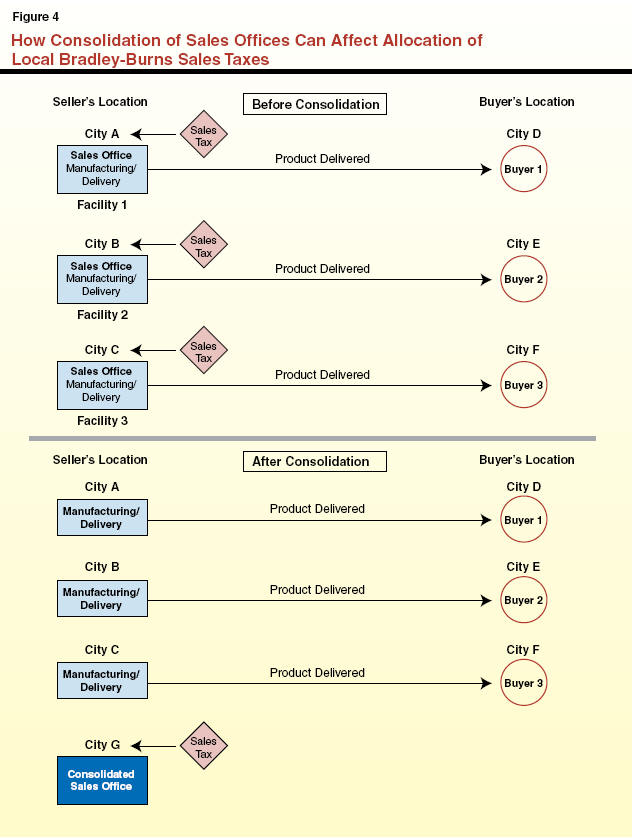

This involves an incentive payment to a business that locates a sales office in a community. As noted earlier, in cases where companies have multiple operations in California, sales taxes are allocated to the place where the principal sales negotiation takes place. For some businesses, such as cement manufacturers, Internet or mail order franchises, or suppliers of large computer systems, the sales offices may be located with other operations of the business or may be located in a separate location. If a company that has multiple places of business decides to consolidate all of its sales into just one office, the local jurisdiction which has that consolidated office can benefit from all the statewide sales of the business (see Figure 4).

Example-Agreement Between City of Corona and Robertson’s Ready Mix. One well-publicized example of sales office consolidation occurred in 2000, when a Southern California cement manufacturer (Robertson’s Ready Mix) entered into an agreement with the City of Corona. Prior to this agreement, the company had numerous sales offices located with its concrete batch plants in 20 different jurisdictions. Under the agreement, the company consolidated all of its sales offices into one central location within Corona’s city limits. In return, the city rebated approximately one-half of its additional sales tax revenues to the company for one year.

This agreement resulted in the shifting of roughly $2 million in sales taxes to Corona (which was then divided equally with the concrete company) and away from its neighboring cities. Among the many concerns raised by this agreement was that communities where the batch plants resided lost sales taxes and thus were no longer being compensated for the environmental, infrastructure, and public service burdens being placed on them by the concrete manufacturing and delivery operations. Several legislative measures were introduced which would have allocated the sales taxes back to the batch plants from which the concrete deliveries were made. The measures did not pass, however, due partly to concerns about the creation of special local sales tax allocation rules for just one industry.

Creation of a Buying Company

Although financial incentives are normally used to attract businesses that sell taxable commodities, there are also notable examples of where they are provided to companies that are large purchasers of taxable commodities. Specifically, they have been provided by local agencies to businesses that create subsidiary buying companies for the purpose of redirecting sales taxes into the community.

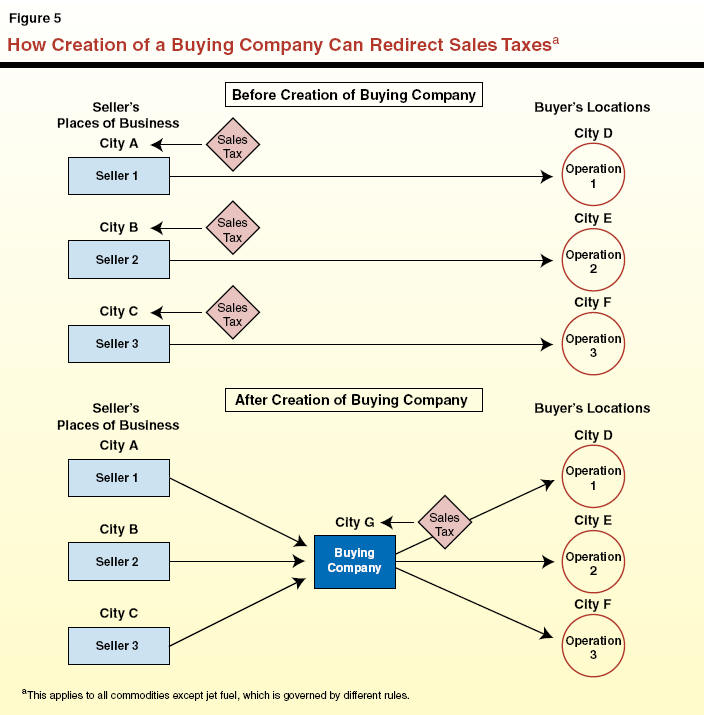

How Location of a Buying Company Can Redirect Sales Taxes. Under current state BOE regulations, a business can set up a subsidiary “buying company” to purchase taxable commodities on its behalf. This subsidiary is granted a seller’s license by BOE. The way in which a buying company can then be used to redirect sales taxes is illustrated in Figure 5.

- The top panel shows that, before the creation of a subsidiary buying company, the sales taxes on items purchased by a business are collected by the companies selling the products and allocated to the cities where they reside. (In the case of jet fuel, the taxes are allocated to where the fuel is delivered, if the seller has more than one place of business in California.)

- The bottom panel shows that, after its creation, the buying company acquires the commodities from the original sellers and then resells them to its parent. The original transactions are not subject to the sales tax, since the products are being purchased by the buying company for resale. However, the final sale between the buying company and its parent company is taxable and the sales taxes are allocated to the jurisdiction in which the buying company resides (see bottom panel of Figure 5).

Through the creation of a buying company, a business that is purchasing taxable commodities can reallocate the sales tax from the location of the original sellers (or, in the case of jet fuel, the location where the fuel is delivered) to the location of the buying company.

Key Example-Oakland Agreement With United Airlines. Although we are aware of several cases where buying companies have been used to divert significant amounts of local sales taxes, the most publicized example is related to the 2003 agreement reached between the City of Oakland and United Airlines involving the diversion of sales taxes on jet fuel. Prior to this agreement, jet fuel purchased by United Airlines was allocated to the various points of delivery throughout the state-roughly one-half to San Francisco International Airport (and divided between San Mateo and San Francisco Counties), about 40 percent to Los Angeles International Airport, and the remainder to other areas throughout the state. The point-of-delivery allocation was consistent with Chapter 1027, which requires that the sales taxes be allocated to the point of delivery in the case where the seller has more than one place of business in California. In this case, the seller was a major oil company with multiple operations in this state.

In 2003, Oakland entered into an agreement with United Airlines where:

-

United created a “single source purchasing and resale business” (United Aviation Fuel Corporation) within the city limits of Oakland, which purchases all jet fuel for United operations within California. This buying company then resells the fuel to United Airlines at airports throughout California. (The fuel itself is not diverted to Oakland-it continues to be pumped directly from the supplier into holding tanks at the various airports. The buying company merely takes temporary title to the fuel before reselling it to its parent company-United Airlines.)

-

Because this buying company has only one place of business in California, under the terms of Chapter 1027, all jet fuel sales are allocated to point of sale, rather than point of delivery. Thus, all of the jet fuel sales to points in California are sourced to this buying company within the City of Oakland.

-

In return, the city agreed to rebate 65 percent of all Bradley-Burns sales taxes paid on jet fuel purchased through United Aviation Fuel Corporation.

The net impact of this agreement is an annual savings of about $6 million for United Airlines, a net increase (after rebates) of about $3 million in sales taxes to the City of Oakland, and corresponding losses totaling $9 million to other local jurisdictions in California, of which about $4.5 million is borne by San Mateo and San Francisco Counties.

In response to concerns about this diversion, the state enacted Chapter 391, Statutes of 2005 (AB 451, Yee), which requires that all jet fuel sales occurring on or after January 1, 2008, will once again be allocated to the point of delivery, regardless of whether the seller has one or more places of business in the state. While implementation of this measure will address concerns about the diversion of jet fuel sales taxes, buying companies could continue to be used to divert sales taxes on all other types of purchases.

BOE Regulation of Buying Companies

Is Ineffective

One key factor that enabled Oakland to redirect sales taxes on jet fuel is the absence of meaningful regulation of buying companies. These entities are not defined in state statute. Rather, they are established solely through BOE Regulation 1699(h), which defines a buying company as a legal entity that:

-

Is separate from its controlling business.

-

Is created to perform administrative functions, including acquiring goods and services, on behalf of its parent company.

This definition appears to be aimed at preventing the use of buying companies for the purpose of diverting sales taxes. The problem is that the criteria subsequently specified in the regulation that a company must satisfy to be considered a separate entity (and thus eligible to obtain a seller’s license) are minimal. A buying company merely needs to keep invoices-an activity that any company would perform in the normal course of business-or add markup to cover its costs. Even companies failing to meet these minimal requirements can still be granted sellers permits at the discretion of the board.

The BOE staff informs us that it cannot point to a single instance where a seller’s permit has been denied to a buying company because it failed to meet the qualifications of Regulation 1699(h). Moreover, a company seeking a seller’s permit is not even required to provide information about the nature of its sales or customer base (for example, the percent of its sales that are to affiliated companies). As a result, BOE has no way of even telling from the application whether an entity seeking a seller’s permit is a buying company or a traditional retailer.

BOE Voted in 2005 to Retain Regulation 1699(h) in Present Form. In response to the Oakland jet fuel deal with United Airlines, the City and County of San Francisco filed a petition with BOE asking it to amend or repeal regulation 1699(h). The petition claimed that the regulation is ineffective and inconsistent with state law.

In 2005, BOE considered a variety of potential changes to Regulation 1699(h). These included a relatively modest change recommended by its staff that would have required either:

(1) more significant business separation between the buying company and its affiliates or (2) that the board consider a wider range of facts and circumstances in determining whether the buying company should receive a seller’s permit. Some of the factors the board could consider in making this determination is whether there is an economic incentive agreement with a local agency, a stated intent to redirect sales taxes, or the absence of sales to unrelated entities.

The board rejected these modest staff-recommended changes, as well as other potential changes, voting instead to leave the current regulation unchanged. Thus, there remains virtually no practical limitations on the extent to which buying companies can be set up by companies for the purpose of redirecting sales taxes-nor is there even any way for the state to obtain information about their existence or nature.

Options For Addressing Problems With Current Allocation System

There are two basic approaches that the Legislature could take to address the problems associated with the current method of allocating Bradley-Burns sales taxes (see Figure 6). It could undertake a major reform to the local sales tax, or it could adopt a more targeted approach, focusing on factors in the present system that are used to redirect sales taxes.

|

Figure 6

Ways to

Address Problems Related to

Present Local Sales Tax Allocation System |

|

Major Reforms to Local Sales Taxes

(Requires Changes to State Constitution) |

|

·

Revise local sales tax allocation system. |

|

·

Revise local tax base. |

|

·

Combination of above two. |

|

Targeted Solutions |

|

·

Expand current restrictions on financial

incentives for sales tax diversions. |

|

·

Regulate buying companies more effectively. |

Major Reform

Over the years, many groups studying California local finance have recommended that the state make significant changes to the local sales tax to mitigate its undue influence on local government land use planning and economic development activities. The recommendations have included:

-

Changing the Local Government Sales Tax Allocation System. The situs-based allocation methodology for the local sales tax could, for example, be replaced (in whole or in part) with a population-based allocation system. Under this approach, sales tax revenues in a region would be allocated to each community based on the size of its population. This change could apply to all local sales tax revenues, or to the growth in sales tax revenues after a future date.

-

Changing the Local Government Tax Base. Local government sales tax revenues could be swapped (in whole or in part) with another tax. For example, the state could transform the local sales tax into a state resource and provide local governments with (1) an increased share of the local property tax or (2) a per person allocation from the statewide personal income tax.

-

Combination Approach. Various hybrid approaches also are possible. For example, the state could allocate some or all of the local sales tax to the county in which the transaction occurred. Cities, in turn, could receive an increased share of the property tax (redirected from the current county share).

While each of these approaches would reduce local government incentives to use their land use and economic development powers to promote retail developments, none would be easy. Rather, each of the options would require difficult tradeoffs across multiple worthy policy objectives, including state-local fiscal stability and revenue diversification.

Reforms Would Require Changes to State Constitution. Proposition 1A, approved by the voters in March 2004, restricts the ability of the state to reduce local sales tax rates or alter the method of allocation. It also restricts the state’s ability to shift local property taxes between schools and non-school local governments. Given these restrictions, any significant changes to the allocation methods for Bradley-Burns sales taxes or shifts in local sales and property taxes would require changes to the Constitution.

Targeted Changes

As an alternative to making fundamental changes to the local system of taxes, the Legislature could retain the existing system and make focused changes aimed at limiting some of most counterproductive aspects of the current allocation system. Two targeted options are to:

-

Expand Restrictions on Financial Incentives. The Legislature could broaden restrictions it has already placed on the use of financial incentives by local jurisdictions for purposes of luring big-box retailers and auto dealers from other jurisdictions. These restrictions could be expanded, for example, to cover financial incentives (1) used to lure sales offices of multi-jurisdictional companies into a community and (2) granted in return for a business creating a buying company for the purpose of diverting sales taxes from another community.

-

Restrict Use of Buying Companies to Divert Taxes. Given the central role that buying companies have played in the diversion of sales taxes, we believe that more effective regulation of these entities is crucial. One option would be to establish a legal presumption that any company created primarily to acquire goods on behalf of its affiliated businesses is not a separate legal entity for purposes of qualifying for a seller’s permit. A second option would be for BOE to change regulation 1699(h) in a way that limits the ability of buying companies to be used primarily for the redirection of local sales taxes-at a minimum, adopting changes along the lines of those recommended by its staff in 2005 (and discussed earlier). Absent such regulatory changes, the Legislature may wish to amend statute to accomplish the same objective.

The lack of a seller’s permit would not preclude a buying company from performing legitimate business-related functions on behalf of its affiliated businesses, such as centralized purchasing and administration. The only difference is that the company would be considered the consumer-not the seller-of the goods they purchase. As such, the sales taxes associated with their purchases would be collected by the entities from which they acquired the tangible personal property. (In the case of jet fuel, sales taxes would be allocated to the point of delivery.)

|

Acknowledgments This report was prepared by

Brad Williams with contributions from

Marianne O'Malley. The Legislative Analyst's Office (LAO) is a nonpartisan office which provides

fiscal and policy information and advice to the Legislature.

|

LAO Publications To request publications call (916) 445-4656.

This report and others, as well as an E-mail

subscription service

, are available on the LAO's Internet site at www.lao.ca.gov. The LAO is

located at 925 L Street, Suite 1000, Sacramento, CA 95814.

|

Return to LAO Home Page