October 2007

California Spending Plan 2007–08

The Budget Act and Related Legislation

Contents

Key Features of the 2007–08 Budget

Budget Overview

Evolution of the Budget

Corrections Capital Outlay

Budget–Related Legislation

Expenditure Highlights

Proposition 98

K–12 Education

Higher Education

Health

Social Services

Judiciary and Criminal Justice

Transportation

Resources and Environmental Protection

2006 Bond Package

Employee Compensation and Retirement

Other Major Provisions

Key Features of the 2007–08 Budget

The 2007–08 budget focuses on closing the gap between its General Fund revenues and expenditures for the fiscal year. The enacted budget, with the Governor’s vetoes, assumed that the state would spend no more than it received in 2007–08 and end the year with a $4.1 billion reserve. Since the budget’s enactment, however, the state has made a one–time payment to the state’s teacher retirement system of $500 million in response to a court decision. In addition, as discussed in more detail below, a number of additional risks will potentially further reduce the reserve.

Budget Overview

Total State Spending

The state spending plan for 2007–08 includes total budget expenditures of $131.5 billion. This includes $102.3 billion from the General Fund and $29.2 billion from special funds. As Figure 1 shows, this is an increase of 4.3 percent from 2006–07, primarily due to increases in special fund spending. The state also expects to spend $14 billion in bond funds for infrastructure during the fiscal year. This is an increase of almost $5 billion (51 percent) from the previous year—which reflects the beginning rollout of spending from $42.7 billion in general obligation bonds approved by voters in November 2006.

Figure 1

2007-08 Budget Package

Total State Expenditures |

(Dollars in Millions) |

Fund Type |

Actual

2005-06 |

Estimated 2006-07 |

Enacted

2007-08 |

Change From 2006-07 |

Amount |

Percent |

General Fund |

$91,592 |

$101,656 |

$102,258 |

$602 |

0.6% |

Special funds |

22,716 |

24,403 |

29,213 |

4,810 |

19.7 |

Budget Totals |

$114,308 |

$126,059 |

$131,471 |

$5,412 |

4.3% |

Selected bond funds |

5,304 |

9,293 |

14,072 |

4,779 |

51.4 |

Totals |

$119,612 |

$135,352 |

$145,543 |

$10,191 |

7.5% |

The General Fund Condition

Figure 2 summarizes the estimated General Fund condition for 2006–07 and 2007–08 under the budget plan. (As described in more detail below, the General Fund condition will be affected by several developments that have occurred since the signing of the budget. The largest such action is the payment of $500 million to the state’s teacher retirement system.)

2006–07. The figure shows that 2006–07 began the year with a fund balance of $10.5 billion. This large balance is related to (1) the sale of over $11 billion in deficit–financing bonds and other forms of budgetary borrowing in previous years and (2) the carryover of unanticipated revenues received in 2005–06 and earlier. The state spent an estimated $6 billion more during the year than was received in revenues. Based on the 2007 May Revision revenue estimates, the year ended with a fund balance of $4.8 billion. However, revenues collected for the months of May and June were about $600 million less than the May Revision estimate. Revenue totals for 2006–07 will be finalized later in the fall.

2007–08. The budget plan projects revenues of $102.3 billion in 2007–08, an increase of 6.5 percent from 2006–07. The plan authorizes expenditures of an equal amount, an increase of 0.6 percent. At the time of enactment, this left the General Fund with a year–end reserve of $4.1 billion. The enacted budget reserve, however, was subsequently reduced by $500 million due to the teacher retirement payment. The reserve is made up of two components:

- $2.6 billion in the state’s traditional reserve—known as the Special Fund for Economic Uncertainties.

- $1.5 billion in the Budget Stabilization Account, which was established when voters approved Proposition 58 in March of 2004. The budget act provides authority for the administration to transfer these funds to the General Fund during the fiscal year if needed.

Figure 2

2007-08 Budget

General Fund Condition |

(In Millions) |

|

2006‑07 |

2007‑08 |

Prior-year fund balance |

$10,454 |

$4,811 |

Revenues and transfersa |

96,013 |

102,262 |

Total resources available |

$106,467 |

$107,073 |

Expenditures |

$101,656 |

$102,258 |

Ending fund balance |

$4,811 |

$4,815 |

Encumbrances |

745 |

745 |

Reserveb |

$4,066 |

$4,070 |

Budget Stabilization Account (BSA) |

$472 |

$1,494 |

Reserve for economic uncertainties |

$3,594 |

$2,575 |

|

a 2006-07 amount includes $472 million and 2007-08 amount includes $1.023 billion in General Fund revenues transferred to BSA, which the administration excludes from its revenue totals. These different treatments do not affect the bottom-line reserve shown. |

b Under the budget's revenue assumptions, the state would need to appropriate from the reserve roughly $400 million more each in 2006-07 and 2007-08 for Proposition 98 spending. |

Programmatic Features of the 2007–08 Budget

Spending by Program Area. Figure 3 shows General Fund spending by major program area for 2005–06 through 2007–08. Specific program area features include:

- K–12 education spending remains the single largest area of the budget, accounting for 38 percent of the General Fund total. Education funding is expected to grow by $921 million (2.4 percent). The bulk of new spending is for a 4.53 percent cost–of–living adjustment (COLA).

- The fastest growing area of the budget is criminal justice, which is budgeted to increase $770 million (6.3 percent). This reflects costs to comply with various health care court cases and implement Proposition 83 (Jessica’s Law).

- The second fastest growing area is higher education, expected to grow by $631 million (5.6 percent). Under the budget plan, the University of California, California State University, and California Community Colleges segments all receive base augmentations to address salaries and other cost increases, as well as augmentations to fully fund anticipated enrollment growth.

- Transportation funding declines by 50 percent—reflecting a one–time $1.4 billion loan repayment made in 2006–07 associated with Proposition 42 transfers that had been deferred from earlier years. (Not reflected in the figure is special fund support for transportation, which increased by 19 percent over the same period.)

Figure 3

2007-08 Budget Package

General Fund Spending by Major Program Area |

(Dollars in Millions) |

|

Actual 2005-06 |

Estimated 2006-07 |

Enacted 2007-08 |

Change From 2006-07 |

Amount |

Percent |

K-12 Education |

$36,425 |

$38,523 |

$39,445 |

$921 |

2.4% |

Higher Education |

10,232 |

11,310 |

11,941 |

631 |

5.6 |

Health |

17,124 |

19,542 |

20,276 |

734 |

3.8 |

Social Services |

9,218 |

9,876 |

9,443 |

-434 |

-4.4 |

Criminal Justice |

10,243 |

12,154 |

12,924 |

770 |

6.3 |

Transportation |

1,699 |

2,986 |

1,481 |

-1,505 |

-50.4 |

All other |

6,651 |

7,264 |

6,749 |

-515 |

-7.1 |

Totals |

$91,592 |

$101,656 |

$102,258 |

$602 |

0.6% |

Budget Solutions. In order to address the state’s operating shortfall, the budget includes the following major solutions:

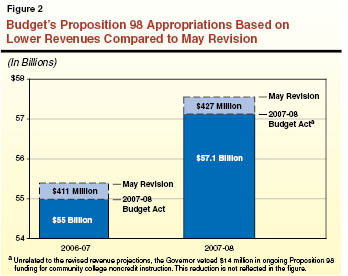

- Proposition 98. The Governor’s May Revision revenue forecast (assumed by the Legislature in enacting the budget) results in a higher Proposition 98 guarantee for 2006–07 than included in the 2006–07 Budget Act. Due to uncertainty regarding this revenue projection (particularly as it relates to final 2006–07 revenues), the budget does not provide $411 million in 2006–07 Proposition 98 “settle–up” funds. Carrying this lower base into 2007–08, the budget also assumes the 2007–08 minimum guarantee will be lower by $427 million, generating additional General Fund savings. If the May Revision revenue forecast proves accurate, therefore, the state would owe more than $800 million in additional funds to education under the Proposition 98 minimum guarantee. These funds would come from the budget’s reserve.

- Transportation. The budget uses almost $1.3 billion in Public Transportation Account funds to reduce General Fund expenditures. The budget plan also assumes $596 million in General Fund benefit for 2008–09.

- Revenue Assumptions. The budget package assumes $1 billion in one–time revenues from the sale of EdFund, the state’s nonprofit student loan guaranty agency. The budget also assumes $293 million in new General Fund revenues from amended tribal gambling compacts. The budget package accelerates the transfer of $600 million in tobacco securitization funds to the General Fund. These tobacco funds were originally scheduled to be transferred in 2008–09 and 2009–10. Moreover, the budget benefits from an additional $357 million in higher–than–expected revenues from the securitization.

- Social Services Savings. The budget achieves ongoing savings of about $247 million from suspending a California Work Opportunity and Responsibility to Kids (CalWORKs) COLA for one year and permanently delaying the state Supplemental Security Income/State Supplementary Program (SSI/SSP) COLA for five months.

- Governor’s Vetoes. The Governor vetoed $703 million in General Fund expenditures from the budget passed by the Legislature. The largest veto was a $332 million reduction to the state’s Medi–Cal Program based on the administration’s assertion that earlier estimates were too high. The second largest veto was a $72 million reduction in the amount provided for higher state employee compensation costs. The administration expects departments to pay for these higher employee compensation costs from existing funds.

Budget–Related Developments Since Enactment

Since the budget’s enactment in August, there have been a number of other budget–related developments.

Teachers’ Retirement Payment. In 2003–04, as a budget balancing solution, the state reduced by $500 million a statutory annual appropriation to the purchasing power protection program of the California State Teachers’ Retirement System (CalSTRS) on a one–time basis. In September 2007, the Third District Court of Appeal ruled that the reduction unconstitutionally violated the contractual rights of system members. Consequently, the administration repaid the $500 million using the underlying statutory appropriation. The amount of interest owed on the payment is still being determined and will require a future appropriation to be paid. The interest owed could total in the range of $200 million.

Public Transportation Fund Lawsuit. On September 6, 2007, the state was sued by public transit advocates arguing that the budget’s redirection of more than $1 billion in transportation funds to benefit the General Fund is illegal. The case has not yet been heard.

Fifth Indian Compact Approved. The budget package assumes receipt of $293 million in new General Fund revenues from amended compacts negotiated between the Governor and five Southern California Indian tribes. At the time of the budget’s enactment, only four of these compacts had been approved by the Legislature. On September 7, the Legislature approved SB 941 (Padilla) which ratifies the Fifth compact between the state and the San Manuel Band of Mission Indians.

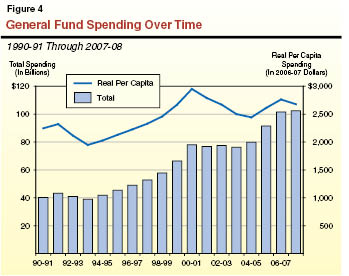

General Fund Spending Over Time

Figure 4 shows General Fund expenditures from 1990–91 through 2007–08 both in current dollars and as adjusted for population and inflation (that is, in real per capita terms). The figure illustrates that after growing rapidly in the late 1990s, real per capita spending fell significantly throughout the first part of the 2000s. From 2004–05 through 2006–07, real per capita spending rebounded somewhat. For 2007–08, the rate of inflation is expected to be greater than the authorized expenditure increase of 0.6 percent—resulting in a drop in real per capita spending.

Out–Year Impacts of the 2007–08 Budget

As described above, many of the budget solutions are of a one–time nature. Based on the 2007–08 budget plan’s policies, therefore, the state would once again face operating shortfalls of more than $5 billion in both 2008–09 and 2009–10. In addition, the CalSTRS payment has already reduced the reserve by $500 million. Other optimistic assumptions and legal risks threaten to reduce the reserve even further. A lower reserve will reduce the carryover funds available to help solve these future budget problems. We will be updating our fiscal projections for 2007–08 and future years in November 2007, when we release our annual publication California’s Fiscal Outlook.

Evolution of the Budget

In this section, we highlight the major developments in the evolution of the 2007–08 budget, beginning with the Governor’s original January budget proposal and ending in August 2007, when the budget was signed into law.

Governor’s January Proposal

The 2006–07 budget benefited from surging revenues to significantly increase education spending and prepay budgetary debt. In contrast, the outlook for the 2007–08 budget was more troubling. Although 2007–08 revenues were forecast to outpace revenue growth in 2006–07, 2007–08 expenditures were expected to exceed available revenues. As a result, the January budget proposed more than $3 billion in budgetary solutions. Even after these solutions, the plan assumed that budget–year expenditures would exceed revenues by almost $1 billion and relied on part of the carryover reserve to make up the difference. It projected a reserve of $2.1 billion at the end of the budget year.

Major Proposals. Figure 5 (next page) summarizes the administration’s major proposals from January. The administration’s major proposal for increased spending was a $595 million supplemental payment towards the retirement of the state’s deficit–financing bonds earlier than scheduled. The administration’s largest budget solutions were:

- A redirection of $1.1 billion from transportation purposes to benefit the General Fund.

- The assumption of more than $500 million in new revenues from amended tribal gambling compacts.

- $496 million in savings from changes to the CalWORKs program, including placing new time limits and sanctions on children whose parents cannot or will not comply with participation requirements.

May Revision

Worse Budget Outlook. Between January and May, the administration’s view of the budget outlook worsened by more than $2 billion. While its revised revenue forecast projected a similar amount of tax revenues in 2006–07 and 2007–08 combined, more of the revenues were now expected in 2006–07. Consequently, the state’s minimum funding requirement under Proposition 98 went up by almost $500 million over the two years combined. In addition, lower property tax receipts in 2005–06 increased state General Fund obligations for K–12 education by about $300 million. In other program areas, higher correctional officer costs from an arbitration decision and higher firefighter costs pushed expenditures upwards. In addition, the administration shifted the expected sale of the pension obligation bonds from 2007–08 to 2008–09—eliminating a $525 million budget–year solution. (A court ruling against the state in July 2007 later forced the administration to drop this proposal altogether.)

Figure 5

Key Elements of Governor’s January Proposal

2007-08 Budget |

|

Deficit-Financing Bonds |

• In addition to the $1.5 billion payment from the sales tax through the “triple flip,” provided a $1 billion payment from the Budget Stabilization Account. |

• Provided an additional $595 million supplemental appropriation for the

accelerated payoff of the bonds. |

Proposition 98 Education |

• Implemented 2006‑07 program expansions, but did not propose new expansions for 2007‑08. Provided Proposition 98 support for CalWORKs-related child care, resulting in General Fund savings. |

• Rebenched the minimum guarantee related to a home-to-school transportation proposal, thus lowering it in future years. |

Transportation |

• Used $1.1 billion from the Public Transportation Account to replace General Fund spending in three areas: Proposition 98 funding for home-to-school transportation; transportation services provided by regional centers; and debt service on general obligation bonds issued for transportation projects. |

Social Services |

• Suspended the July 1, 2007 COLA for CalWORKs grants, and placed new time limits and sanctions on children whose parents cannot or will not comply with CalWORKs participation requirements. |

Revenues |

• Assumed $506 million in new General Fund revenues from amended gambling compacts with five tribes. |

• Assumed sale of pension obligation bonds in 2007‑08 with a General Fund benefit of $525 million. |

New Solutions. In response to the worsening budget outlook, the administration proposed more than $2 billion in new solutions, which are summarized in Figure 6. The largest proposed solution was the sale of EdFund, at an estimated price of $1 billion. The May Revision took advantage of $357 million in higher–than–expected revenues from the state’s securitization of its tobacco settlement funds. In addition, the administration accelerated the General Fund transfers of $600 million of these funds that were originally scheduled to be transferred in future years. The largest proposed reduction in program services was a suspension of the statutory January 2008 SSI/SSP COLA, reducing state costs by $185 million. With these solutions, the May Revision projected a reserve of $2.2 billion.

Figure 6

May Revision—Key Differences From January

2007-08 Budget |

|

Proposition 98 Education |

• Modified home-to-school transportation proposal to eliminate the rebenching of the minimum guarantee. |

• Provided more than $400 million in 2006‑07 settle-up funds to reflect a higher estimated minimum guarantee due to revised revenue estimate. |

Higher Education |

• Proposed selling EdFund to a private buyer for an estimated $1 billion. |

Transportation |

• Proposed to use $200 million in additional transportation funds for General Fund benefit through a modified home-to-school transportation proposal. |

Social Services |

• Suspended the statutory January 2008 SSI/SSP COLA. |

Revenues |

• Reduced estimate of tribal gambling revenues by $192 million. |

• Counted $957 million in additional and accelerated revenues from tobacco

securitization. |

• Shifted sale of pension obligation bonds to 2008‑09 due to legal delays. |

Lease of Lottery. The administration also proposed a long–term lease of the State Lottery to a private vendor. Although suggesting that the one–time benefit of such a lease could total in the billions of dollars, the May Revision made no budgetary assumptions regarding the revenue benefit.

Final Budget

Following the May Revision, the Senate and Assembly took actions on the administration’s revised proposals, and the budget was sent to the Conference Committee to reconcile the differences between the houses. The adopted Conference Committee version of the budget had a reserve of $2 billion. It made a number of key changes to the May Revision including:

- Rejection of the $595 million supplemental payment on the deficit–financing bonds.

- Rejection of the Governor’s proposed CalWORKs time limits and sanctions.

- A reduced General Fund benefit from the redirection of transportation funds.

- Reduced 2006–07 Proposition 98 expenditures by not providing settle–up funds.

After the close of the Conference Committee, the Governor and the Legislature continued budget negotiations. On July 20, the Assembly passed the Conference budget bill along with a supplemental bill that made amendments to the plan. After another month, on August 21, the Senate passed these bills along with additional amendments to the package. After making $703 million in General Fund vetoes promised during negotiations, the Governor signed this budget package on August 24. Figure 7 summarizes the key differences between the enacted budget compared to the May Revision. In comparison to the Conference version of the budget, key negotiated changes were:

- A reserve of $4.1 billion, compared to $2 billion.

- Reducing 2007–08 General Fund Proposition 98 expenditures by assuming a lower minimum guarantee in 2006–07 carried forward to 2007–08.

- Increasing the use of transportation funds to benefit the General Fund to the May Revision’s level.

- Delaying the SSI/SSP COLA by five months.

Figure 7

Final Budget—Key Differences From May Revision

2007-08 Budget |

|

Reserve |

• Increases reserve by almost $2 billion, to $4.1 billion. |

Deficit-Financing Bonds |

• Rejects proposal to make $595 million supplemental payment for outstanding deficit-financing bonds. |

Proposition 98 Education |

• Does not provide 2006‑07 settle-up payment and builds off this lower base for its assumption of the 2007‑08 minimum guarantee. |

Transportation |

• Uses $1.3 billion in transportation funds for General Fund benefit, but modifies the administration’s home-to-school transportation proposal. |

Social Services |

• Delays a SSI/SSP COLA for five months, rather than suspend it for a year. |

• Rejects the administration’s proposals for CalWORKs time limits and

sanctions. |

Revenues |

• Deleted pension obligation bonds from spending plan due to appeals court

decision against the state. |

The Legislature took no action related to the leasing of the Lottery. Additional key features of the enacted budget package are described in the “Expenditure Highlights” section.

Corrections Capital Outlay

As the Legislature was considering the 2007–08 budget, it was also reviewing a proposal by the Governor to authorize $9 billion in lease–revenue bonds for prison construction. The plan would have dedicated $5 billion for the expansion of state prison capacity and $4 billion for local jail beds for adult offenders. After several months of negotiations, the Legislature passed a somewhat different prison construction package, which the Governor signed into law in May as Chapter 7, Statutes of 2007 (AB 900, Solorio). Chapter 7 appropriates $300 million from the General Fund to improve and expand infrastructure capacity (such as water, electrical, or sewage capacity) at existing prison facilities, as well as $50 million from the General Fund to improve rehabilitation and treatment programs for prison inmates and parolees. Chapter 7 also authorizes $7.4 billion in lease–revenue bonds. The lease–revenue bonds authorized by Chapter 7 are intended to add approximately:

- 12,000 beds and programming space at existing prison facilities in order to replace “temporary beds” currently in use.

- 16,000 reentry facility beds for inmates who are within one year of being released to parole.

- Medical, dental, and mental health treatment space and housing for approximately 8,000 inmates.

- 13,000 beds at local jail facilities.

The costs of the lease–revenue bonds appropriated by Chapter 7 will largely be incurred in subsequent budget years as these bonds are sold and paid off.

The Legislature also approved SB 99 (Senate Budget and Fiscal Review Committee) which, if signed into law, would in effect earmark $146 million of these funds for a centralized health facility at the state prison at San Quentin ordered by the court–appointed Receiver currently overseeing the department’s inmate medical system.

Budget–Related Legislation

In addition to the 2007–08 Budget Act, the budget package includes a number of related measures enacted to implement and carry out the budget’s provisions. Several such measures were passed at the end of the legislative session. Figure 8 lists these bills.

Figure 8

2007‑08 Budget and Budget-Related Legislation |

Bill Number |

Chapter |

Author |

Subject |

Budget Package |

|

|

SB 77 |

171 |

Ducheny |

Budget bill (conference report) |

SB 78 |

172 |

Ducheny |

Budget bill revisions |

SB 79 |

173 |

Committee on Budget and Fiscal Review |

Transportation |

SB 80 |

174 |

Committee on Budget and Fiscal Review |

Education |

SB 81 |

175 |

Committee on Budget and Fiscal Review |

Corrections |

SB 82 |

176 |

Committee on Budget and Fiscal Review |

Justice |

SB 84 |

177 |

Committee on Budget and Fiscal Review |

Human services |

SB 85 |

178 |

Committee on Budget and Fiscal Review |

Resources |

SB 86 |

179 |

Committee on Budget and Fiscal Review |

General government |

SB 87 |

180 |

Committee on Budget and Fiscal Review |

Taxation |

SB 88 |

181 |

Committee on Budget and Fiscal Review |

Proposition 1B |

SB 89 |

182 |

Committee on Budget and Fiscal Review |

EdFund |

SB 90 |

183 |

Committee on Budget and Fiscal Review |

Information technology |

SB 91 |

184 |

Committee on Budget and Fiscal Review |

EdFund |

SB 97 |

185 |

Dutton |

California Environmental Quality Act |

AB 199 |

186 |

Budget Committee |

General government revisions |

AB 201 |

187 |

Budget Committee |

Proposition 1B revisions |

AB 203 |

188 |

Budget Committee |

Health |

Post-Budget Legislation |

|

AB 191 |

Pending |

Budget Committee |

Corrections cleanup |

AB 192 |

Pending |

Budget Committee |

General government cleanup |

AB 193 |

Pending |

Budget Committee |

Transportation spillover |

AB 194 |

Pending |

Budget Committee |

Governor’s vetoes modified |

AB 195 |

Pending |

Budget Committee |

Health clinic services |

AB 196 |

Pending |

Budget Committee |

Proposition 1B—local streets |

Expenditure Highlights

Proposition 98

Proposition 98 funding constitutes about three–fourths of total funding for K–14 education (K–12 schools and community colleges). In this section, we review Proposition 98 funding in the 2007–08 Budget Act. We also review various related issues, including the effect of General Fund revenue changes on total Proposition 98 funding levels, the additional funding provided to K–12 schools and community colleges as a result of a recent settlement, and the K–14 education credit card. In a following section, we discuss the total K–12 budget in more detail, and in the “Higher Education” section, we discuss the total community college budget in more detail.

The 2007–08 budget package includes $57.1 billion in total ongoing Proposition 98 funding for K–14 education. This represents an increase of $2.1 billion, or 3.9 percent, from the revised 2006–07 spending level. General Fund support covers about one–third of this increase ($697 million) and local property tax revenue covers the remainder ($1.4 billion). Figure 1 (next page) displays Proposition 98 funding, by source, for K–12 schools, community colleges, and other affected agencies. (In addition to the totals displayed in Figure 1, $300 million is being allocated to K–12 schools and community colleges as a result of a recent settlement agreement. (Please see box on page 16 for additional detail.)

Budget Relies Heavily on One–Time and Special Fund Monies. As shown in Figure 1, the budget contains $2.1 billion in new ongoing Proposition 98 funding for 2007–08. This year–to–year growth is insufficient to cover all 2007–08 K–14 baseline costs. For example, providing cost–of–living adjustments (COLAs) to existing K–12 and community college programs at the statutory rate (4.53 percent) costs roughly $2.4 billion. To fund baseline costs without appropriating more than the Proposition 98 minimum guarantee, the Legislature used other funding sources to supplement the ongoing Proposition 98 budget. In particular, the budget package uses a considerable amount of one–time and special fund monies ($567 million) to support baseline costs. The state, therefore, will enter 2008–09 with a large “hole” in the ongoing Proposition 98 budget. (The shortfall involves only K–12 programs and is discussed in more detail in the K–12 education section. The budget fully funds all community college baseline costs.)

Figure 1

Ongoing Proposition 98 Budget Summary |

(In Millions) |

|

2006-07

Revised |

2007-08

Budget Act |

Change |

Amount |

Percent |

K-12 Education |

|

|

|

|

General Fund |

$36,637 |

$37,203 |

$565 |

1.5% |

Local property tax revenue |

12,346 |

13,594 |

1,248 |

10.1 |

Subtotals |

$48,983 |

$50,797 |

$1,813 |

3.7% |

California Community Colleges |

|

|

|

|

General Fund |

$4,030 |

$4,157 |

$127 |

3.2% |

Local property tax revenue |

1,857 |

2,052 |

195 |

10.5 |

Subtotals |

$5,886 |

$6,209 |

$322 |

5.5% |

Other Agencies |

$114 |

$119 |

$5 |

4.3% |

Totals, Proposition 98 |

$54,984 |

$57,125 |

$2,141 |

3.9% |

General Fund |

$40,781 |

$41,479 |

$697 |

1.7% |

Local property tax revenue |

14,203 |

15,646 |

1,443 |

10.2 |

Revenue Fluctuations Affect 2006–07 Proposition 98 Decision Making. Estimates of state revenues fluctuated notably throughout 2006–07, which, in turn, affected estimates of the 2006–07 Proposition 98 minimum guarantee. Most significantly, the Governor’s May Revision revenue forecast resulted in a higher estimated Proposition 98 obligation for 2006–07 compared to earlier estimates. Specifically, the May Revision forecast assumed the state would have to provide $411 million in additional Proposition 98 “settle up” to meet the minimum guarantee for 2006–07 (see Figure 2). Although the Legislature assumed the May Revision revenue forecast in enacting the overall 2007–08 budget, it chose to use more recent revenue estimates for the purposes of Proposition 98. At the time most Proposition 98 decisions were being made, both state General Fund revenues and the Proposition 98 minimum guarantee for 2006–07 appeared down relative to the May Revision. Based on the updated revenue projections, the state no longer appeared to owe Proposition 98 settle–up for 2006–07. As a result, the budget act does not contain the $411 million settle–up payment proposed in the May Revision.

Depending on Final 2006–07 Revenues, K–14 Funding Could Increase. If finalized revenue figures for 2006–07 result in a higher minimum guarantee than the level provided in the budget, the state will automatically owe a settle–up payment for 2006–07. The state will need to provide this funding through subsequent budget action. In contrast, if finalized revenue figures come in lower than projections, the state cannot reduce Proposition 98 spending for 2006–07 because the fiscal year has already ended. Instead, the state will have spent more than required by the Proposition 98 minimum guarantee.

Decisions for 2006–07 Affect Estimated Proposition 98 Minimum Guarantee for 2007–08. Because the Proposition 98 requirement for 2007–08 builds off the 2006–07 spending level, not providing the settle–up payment in that year also lowers the minimum guarantee for 2007–08. Specifically, as shown in Figure 2, this action reduced the 2007–08 minimum guarantee by $427 million compared to the May Revision. As suggested above, if final 2006–07 revenues come in higher than anticipated, then the estimated Proposition 98 obligation for 2007–08 also would be correspondingly higher.

K–14 Credit Card Update

From 2001–02 through 2003–04, the state achieved substantial budget solution by delaying certain Proposition 98 spending. Specifically, the state decided to defer significant education costs ($1.3 billion) to the subsequent fiscal year. (Rather than a budget reduction, these deferrals resulted in districts receiving some state funds a few weeks later than normal.) In addition, the state delayed reimbursement of outstanding mandate cost claims. (At that time, the state had outstanding claims dating back to 1995–96.) In 2003–04, as a further budget solution, the state also made reductions to K–12 revenue limits. We have referred to these various delays as the education “credit card.”

Still Carrying Almost $1.9 Billion on Education Credit Card. Figure 3 displays the balance of the credit card in 2005–06 and 2006–07 and our estimate of the amount owed in 2007–08. The figure shows that the education credit card balance was reduced by almost $1 billion in 2006–07, with the substantial repayment of K–12 mandate claims and full restoration of K–12 revenue limits.

Figure 3

Update on the K-14 Education Credit Card Balance |

(In Millions) |

|

2005-06 |

2006-07 |

2007-08 |

Deferrals |

|

|

|

K-12 |

$1,103 |

$1,103 |

$1,103 |

Community Colleges |

200 |

200 |

200 |

Mandates |

|

|

|

K-12a |

$900 |

$275 |

$435 |

Community Colleges |

100 |

90 |

115 |

K-12 revenue limits |

$300 |

— |

— |

Totals |

$2,603 |

$1,668 |

$1,853 |

|

a Excludes claims that are unlikely to be paid as the result of court decisions or recent determinations by the Commission on State Mandates. |

In contrast, the 2007–08 budget package increases the credit card balance—making no progress toward paying down outstanding deferral and mandate obligations, providing no funding for new K–12 mandate costs, and providing little funding ($4 million) for community college mandate costs. (We expect K–14 claims for mandated local programs to reach about $185 million in 2007–08, which adds to the $365 million still owed from prior years.) As a result, the credit card will grow to almost $1.9 billion in 2007–08.

Additional Funds Provided Through First Settlement Payment

The Quality Education Investment Act (QEIA), established by Chapter 751, Statutes of 2006 (SB 1133, Torlakson), formalized a settlement agreement between the Governor and the California Teachers Association. Consistent with the lawsuit, QEIA appropriated a total of roughly $2.7 billion over a seven–year period beginning in 2007–08. (As a result of this legislation, QEIA payments are not part of the annual budget process.) As required in QEIA, the state is allocating $300 million to K–12 schools ($268 million) and community colleges ($32 million) in 2007–08. These funds are to be used primarily for class size reduction in grades 4 through 12 and for expanding career technical education in community colleges. Whereas roughly 500 low–performing K–12 schools already have been selected to receive K–12 QEIA funding, the funding allocation process for the community college QEIA share is still being determined. |

K–12 Education

Figure 4 displays all significant funding sources for K–12 education in 2006–07 and 2007–08. The figure shows that funding from all sources totals $68.9 billion in 2007–08, an increase of $2.4 billion, or 3.6 percent, from 2006–07. Ongoing K–12 Proposition 98 spending in 2007–08 totals $50.8 billion, an increase of $1.8 billion, or 3.7 percent, from 2006–07. Spending from all other fund sources totals $18.1 billion, an increase of $568 million, or 3.2 percent, from 2006–07. (Not shown in Figure 4 is a substantial amount of Proposition 98 funding that was unspent in prior years and is reappropriated for various K–12 purposes.)

Figure 4

K-12 Education Budget Summary |

(Dollars in Millions) |

|

Revised

2006-07 |

Proposed

2007-08 |

Changes From 2006-07 |

|

Amount |

Percent |

K-12 Proposition 98 |

|

|

|

|

State General Fund |

$36,637 |

$37,203 |

$565 |

1.5% |

Local property tax revenue |

12,346 |

13,594 |

1,248 |

10.1 |

Subtotals |

($48,983) |

($50,797) |

($1,813) |

(3.7%) |

Other Funds |

|

|

|

|

General Fund |

|

|

|

|

Teacher retirement |

$876 |

$1,496a |

$620 |

70.9% |

Bond payments |

1,764 |

2,179 |

415 |

23.5 |

Other programs |

548 |

401 |

(147) |

-26.8 |

State lottery funds |

904 |

904 |

— |

— |

Federal funds |

7,111 |

6,692 |

(419) |

-5.9 |

Other |

6,347 |

6,446 |

98 |

1.5 |

Subtotals |

($17,550) |

($18,118) |

($568) |

(3.2%) |

Totals |

$66,533 |

$68,915 |

$2,381 |

3.6% |

|

Totals may not add due to rounding. |

a This total includes the estimated K-12 share of a one-time $500 million California State Teachers’

Retirement System payment resulting from a recent court order. |

One–Time Adjustments Contribute to Large Increase in Teachers’ Retirement Costs. As shown in Figure 4, the state’s annual K–12 contribution to the California State Teachers’ Retirement System (CalSTRS) increases significantly in 2007–08—by $620 million, or 71 percent. The magnitude of this increase is due to two one–time adjustments—a settle–up for prior–year accounting errors that resulted in a reduction to payments in 2006–07 and a court settlement that increased the state’s contribution in 2007–08. (See the “Retirement” section for further discussion of this court settlement.) Each of these factors has the effect of increasing the year–to–year change. Absent these one–time adjustments, CalSTRS contributions increase at a rate of roughly 4.2 percent, reflecting typical growth in teacher payroll.

Budget Reflects Decrease in Federal Funds for K–12 Education. The budget includes $6.7 billion in federal funds for K–12 education in 2007–08, a decrease of $419 million from the prior year. Over one–half of this reduction results from the budget action to increase Proposition 98 support for child care by $269 million and redirect a like amount of federal funds to non–K–12 programs. Other large decreases include $50 million resulting from a decline in Stage 2 child care caseload and a $50 million reduction to the federal Title I program.

Budget Includes Increased Payments for School Facility Bonds. Figure 4 also shows an increase of $415 million in debt service due to recent investments the state has made in school facilities through Proposition 47 (2002) and Proposition 55 (2004). These measures authorized the state to sell a total of $21.4 billion in bonds for school facilities. Proposition 1D, approved by voters in November 2006, authorized an additional $7.3 billion for school facilities. These bonds, however, have not yet been sold and so are not reflected in Figure 4. (See the “2006 Bond Package” section for further discussion of Proposition 1D.)

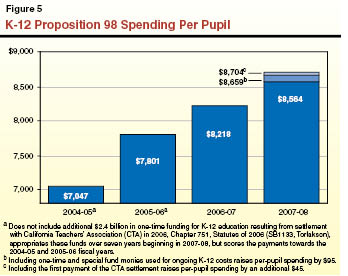

Per–Pupil Spending Continues to Increase. As shown in Figure 5, recent budgets resulted in substantial increases in per–pupil Proposition 98 spending. Specifically, per–pupil Proposition 98 spending increased by $1,171, or 16.6 percent, between 2004–05 and 2006–07 (or 8.3 percent in inflation–adjusted dollars). Based on the 2007–08 Budget Act, ongoing Proposition 98 per–pupil spending is $8,564—an increase of $346, or 4.2 percent, over the prior year. Including the one–time and special funds used to support ongoing costs (a total of $567 million), per–pupil spending grows to $8,659—an increase of $441, or 5.4 percent, above 2006–07. If the first Quality Education Investment Act payment also is included, per–pupil funding further grows to $8,704—an increase of $486, or 5.9 percent, above 2006–07.

Ongoing Funding

Figure 6 displays major changes in ongoing K–12 funding from the revised 2006–07 budget. As shown, the budget provides $1.8 billion in new ongoing Proposition 98 funding.

Major funding changes include:

- Growth and COLA ($2.1 Billion). The budget includes $2.1 billion to provide a 4.53 percent COLA for revenue limits and most categorical programs (including both statutory and discretionary COLAs). The budget also reflects a net of $11 million in savings due to estimates that statewide attendance will decline by 0.48 percent in 2007–08 compared to revised estimates for the preceding year.

- Child Care Shift ($269 Million). The budget increases the Proposition 98 share of Stage 2 California Work Opportunity and Responsibility to Kids (CalWORKs) child care funding by $269 million. This is simply a shift in funding source and does not affect total monies available for child care. Previously, this portion of the state’s child care program was supported with federal funds. Shifting this share to Proposition 98 allows those federal dollars to be used for other related costs previously covered by the state, thereby resulting in a like amount of state General Fund savings.

- School Meals ($24.9 Million). The budget increases the school meals reimbursement rate by 4.7 cents—for a total 2007–08 reimbursement rate of 21 cents per meal. The rate increase is linked to new statutory requirements that school districts improve the quality of the meals they serve.

- High Priority Schools Grant Program (HPSGP) (–$100 Million). The budget recognizes savings due to schools from the first cohort beginning to exit the program and no new cohorts being funded. Full funding is provided for all remaining program participants.

Figure 6

Ongoing K-12

Proposition 98 Funding |

(In Millions) |

|

|

Major Changes |

|

Cost-of-living adjustments |

$2,122.8 |

Child care funding shift |

269.0 |

School meals |

24.9 |

State median income adjustment |

6.8 |

Early Mental Health Initiative |

5.0 |

Preschool wrap-around care |

5.0 |

Other/baseline adjustments |

57.5 |

Growth |

-11.0 |

High Priority Schools Grant Program |

-100.0 |

Ongoing shortfall |

-566.6 |

Total Changes |

$1,813.4 |

One–Time Funding

In addition to ongoing Proposition 98 funding, the budget provides $700 million in one–time and special funds for K–12 education. This funding comes from four sources:

- Proposition 98 Reversion Account ($249 Million). Reappropriates funds that were appropriated for K–14 education in prior years but not used.

- Emergency Repair Program ($250 Million). Transfers unused funds back to Proposition 98 Reversion Account, then reappropriates for new purposes. Funds were previously set aside for emergency facility needs at low performing schools as part of the Williams v. California settlement. Budget control language stipulates that funds be returned to the program if it experiences higher–than–anticipated costs in 2007–08.

- Prior–Year HPSGP Funds ($102 Million). Reappropriates unused funding from prior years to support program in 2007–08.

- Public Transportation Account ($99 Million). Funds portion of school transportation program. The account is funded by gasoline and diesel sales tax revenue that must be used for mass transportation and planning purposes.

One–Time Funds Used to Backfill Ongoing Shortfall. As mentioned earlier, ongoing Proposition 98 funding falls $567 million short of what is required to support the budget’s ongoing K–12 expenditures. Specifically, the budget created ongoing shortfalls in the Home–to–School Transportation, HPSGP, and Deferred Maintenance programs—meaning the budget provided less ongoing Proposition 98 funding than needed to fully cover associated ongoing costs. As shown in the top one–half of Figure 7, the budget uses one–time and special fund monies to backfill the shortfalls. With these additional monies, the three programs are fully funded—meaning base costs as well as cost increases associated with growth and COLA are covered. However, the significant use of one–time funds means the state will enter 2008–09 with a large hole in the ongoing K–12 budget.

Figure 7

K-12 Spending From One-Time and Special Funds |

(In Millions) |

|

Amount |

One-Time/Special Fund Monies Used for Ongoing Purposes: |

|

Home-to-School Transportation backfill |

$349.1a |

Deferred maintenance backfill |

115.5 |

High Priority Schools Grant Program backfill |

102.0 |

Total—Ongoing Purposes |

$566.6 |

One-Time Monies Used for One-Time Purposes |

|

Emergency Repair Program |

$100.0 |

Charter school facilities grants |

18.0b |

Teacher Credentialing Block Grant |

8.8 |

Community Day School deficiency |

4.1 |

High-Speed Network technology refresh |

1.9 |

Reviews of state-administered districts |

0.4 |

Total—One-Time Purposes |

$133.2 |

Grand Total—One-Time/Special Fund Spending |

$699.8 |

|

a Of this total, $250 million is from the Emergency Repair Program (shifted back through the

Proposition 98 Reversion Account) and $99.1 million is from the Public Transportation Account. |

b Appropriated in Chapter 215, Statutes of 2007 (SB 20, Torlakson). |

Other One–Time Spending. The bottom one–half of Figure 7 shows how the remaining one–time funds are used. The budget plan includes $100 million for emergency facility repairs, $18 million for charter school facilities, and roughly $15 million to support four other existing programs.

K–12 Vetoes

As shown in Figure 8, the Governor vetoed $12 million in K–12 expenditures—most of which involved federal funds. The largest veto was $7.1 million for District Assistance and Intervention Teams (DAITs) that would work with districts that face sanctions under the federal accountability system. The Governor’s veto message expressed a desire to withhold funding until an evaluation of the effectiveness of a DAIT pilot project had been completed.

Several Legislative Packages Undone. While most of the vetoes involved relatively small amounts of funding (often less than $500,000), taken together they represented notable reductions to or the entire elimination of, larger legislative packages. For example, the Governor vetoed almost $1 million for various legislative efforts aimed at better serving English learners. Similarly, the Governor vetoed almost $3 million for various legislative efforts to improve services for students attending alternative schools. Other vetoes also eliminated initiatives involving low–performing schools and special education.

Figure 8

Governor’s Vetoes—K-12 Education |

(In Thousands) |

|

Amount |

Fund Type |

Staffing |

Low-Performing Schools |

|

|

|

District Intervention and Assistance Teams |

$7,100 |

Federal ongoing |

— |

Staff to implement corrective actions |

350 |

Federal ongoing |

4 positions |

Alternative Schools |

|

|

|

Technical assistance for English learners |

$1,600 |

Federal one-time |

4 positions |

Technical assistance for special education students |

1,050 |

Federal one-time |

— |

Incarcerated youth coordinator |

133 |

General Fund ongoing |

1 position |

English Learners (EL) |

|

|

|

Evaluation of EL best practices pilot project |

$500a |

Federal one-time |

— |

Pilot project for EL instructional materials |

300 |

Federal one-time |

— |

EL professional development program |

120 |

General Fund ongoing |

1 position |

Outreach to non-English speaking parents |

50 |

Federal one-time |

— |

Special Education |

|

|

|

Learning disabilities best practices study |

$400 |

Federal one-time |

— |

Evaluation of dispute resolution services |

150 |

Federal one-time |

— |

Other |

|

|

|

Support for highly qualified teachers |

$198 |

Federal ongoing |

6 positions |

Study of poverty indicators |

125 |

Federal one-time |

— |

Total |

$12,076 |

|

|

|

|

a Reduced from $1 million. |

|

Higher Education

The budget provides a total of $11.3 billion in General Fund support for higher education in 2007–08 (see Figure 9). This reflects an increase of $475 million, or 4.4 percent, above the amount provided in 2006–07. As shown in the figure, the budget provides the University of California (UC) with $3.3 billion in General Fund support, which is $191 million, or 6.2 percent, more than the 2006–07 level. For the California State University (CSU), the budget appropriates $3 billion in General Fund support, which is an increase of $176 million, or 6.2 percent.

The budget provides the California Community Colleges (CCC) with $4.2 billion in General Fund support for 2007–08, which is $39 million more than 2006–07. (All but about $30 million of this amount counts toward Proposition 98.) However, CCC also receives more than $2 billion in local property tax revenue that is interchangeable with General Fund support for program purposes. When General Fund and local property tax support are combined, CCC’s Proposition 98 funding increases by $322 million, or 5.5 percent, from the prior year.

The budget also provides $873 million in General Fund support to the California Student Aid Commission (CSAC). This funding, which supports the state’s Cal Grant and other financial aid programs, is $70 million, or 8.7 percent, above the 2006–07 level.

Figure 9

Higher Education General Fund Support |

(Dollars in Millions) |

|

2006-07 |

2007-08 |

Amount |

Percent |

University of California |

$3,083.4 |

$3,273.9 |

$190.6 |

6.2% |

California State University |

2,810.4 |

2,985.9 |

175.5 |

6.2 |

California Community Collegesa |

4,148.7 |

4,187.3 |

38.6 |

0.9 |

Student Aid Commission |

802.9 |

873.0 |

70.0 |

8.7 |

Hastings College of the Law |

10.7 |

10.6 |

—b |

— |

California Postsecondary Education Commission |

2.2 |

2.2 |

— |

— |

Totals |

$10,858.2 |

$11,332.9 |

$474.7 |

4.4% |

|

a Excludes more than $2 billion in local property tax revenue under Proposition 98. |

b Less than $50,000. |

UC and CSU

General Fund Base Increases. Both university systems received General Fund base augmentations of 4 percent, amounting to $117 million for UC and $109 million for CSU. Although generally intended to address salaries and other cost increases, the segments’ use of these augmentations is unrestricted.

Student Fees. Student fees are set by the governing boards of the respective university systems. For 2007–08, the UC Regents and the CSU Trustees have approved fee increases of 7 percent and 10 percent, respectively. The enacted state budget assumes these fee increases will provide additional revenue of $105 million for UC and $98 million for CSU. Because fee revenue is unrestricted, it effectively provides additional base increases to the segments’ budgets. When the fee increases and General Fund base increases are combined, UC’s base funding increases by 4.5 percent and CSU’s base funding increases by 5.6 percent.

Enrollment Growth. Both university systems received funding for about 2.5 percent enrollment growth, which is expected to accommodate all likely enrollment demand. Enrollment funding augmentations include $52.9 million for an additional 5,000 full–time equivalent (FTE) students at UC and $64.4 million for an additional 8,355 FTE students at CSU. Funding for these students is determined using a methodology adopted by the Legislature in 2006–07 for determining the marginal cost of serving each additional student. For the second year in a row, the Legislature rejected a different methodology proposed by the Governor.

Student Academic Preparation (Outreach). The Legislature rejected the Governor’s proposal to reduce General Fund support for student academic preparation programs by $19.3 million at UC and $7 million at CSU. With these proposed cuts restored, the budget funds these programs at $31.3 million for UC and $52 million for CSU. The Governor vetoed language that would have required UC to report on its use of this funding and the effectiveness of the programs. However, the Governor’s veto message indicates that he is nevertheless instructing UC to comply with the reporting requirement to the extent resources permit. The Governor did not veto a similar reporting requirement for CSU.

UC Research Programs. The Legislature rejected the Governor’s proposals to quadruple state funding for UC’s Institutes for Science and Innovation from $4.8 million to $20 million. It also rejected the Governor’s proposed $5 million augmentation to support a high–speed computer development project for which UC was also seeking federal grant funding. However, the Legislature did approve $70 million in lease–revenue bond funding for a new alternative energy research facility at UC Berkeley. (This project is described in the Capital Outlay section, below.) The Legislature also rejected the Governor’s proposal to eliminate $6 million in General Fund support for UC’s Labor Institutes.

Nursing Programs. The budget package includes augmentations for expanding enrollment of registered nursing students. These new enrollment slots are provided on top of both segments’ regular growth allocations, and the funding rate for these students is higher than the regular marginal cost amount. For UC, the 2007–08 Budget Act provides an augmentation of $757,000 to fund 57 FTE students in the entry–level master’s program. (This program is available to students that already hold a bachelor’s, or higher, degree in a non–nursing field.) The budget also provides $3.6 million to fund an additional 340 nursing enrollment slots in CSU’s bachelor’s degree program.

Governor’s Vetoes. The Governor vetoed two legislative augmentations to UC’s budget, including $1.5 million for agricultural research and $1.5 million for oceanographic research. He also vetoed $500,000 that had been included in his January proposal to help fund a UC–Mexico research facility in Mexico City.

California Community Colleges

The budget provides CCC with $4.2 billion in General Fund support for 2007–08, which is $39 million more than the revised 2006–07 level. Virtually all of CCC’s General Fund support counts toward the state’s Proposition 98 expenditures, as does CCC’s local property tax revenue. Total Proposition 98 support for CCC in 2007–08 is $6.2 billion, which is 10.9 percent of total Proposition 98 appropriations.

Base Budget Increase. The budget includes $263 million to fund a 4.5 percent base increase for CCC. This increase follows the same statutory formula used to calculate the K–12 COLA. The base budget increase applies to CCC’s general apportionments and selected categorical programs.

Enrollment Growth. The budget reflects two key adjustments for CCC enrollment. First, base enrollment funding was reduced by $80 million to account for recent enrollment declines that have left many slots unfilled. (Even after this reduction, the CCC system retains funding for an estimated 12,000 enrollment slots that were unfilled in 2006–07.) Second, CCC received an augmentation of $108 million to fund new enrollment growth of 2 percent, or about 22,000 FTE students. When remaining unused enrollment capacity from 2006–07 is combined with funded growth for 2007–08, CCC could accommodate a total of 34,000 additional FTE students in 2007–08.

Student Fees. The budget package makes no change to student fee levels, which remain at $20 per unit. These fees are expected to generate $285 million in revenue for the CCC system. Another $224 million in potential fee revenue will be waived as a result of the CCC’s fee waiver program for needy students.

Basic Skills Programs. The budget includes a permanent redirection of $33.1 million in base funding for basic skills enhancements. This funding had previously been available as categorical funding to districts that enrolled students in basic skills courses beyond their established enrollment caps. (Basic skills courses include precollegiate classes such as elementary mathematics and English.) However, as no district currently exceeds its enrollment cap, this funding could not be used for its intended purpose.

The Governor’s May Revision proposed that this funding be redirected to a “student success” initiative that targeted basic skills students. The Legislature rejected the proposal and instead funded an alternative “basic skills initiative” that allocated money differently. The Governor vetoed the funding, but it was subsequently restored through a trailer bill that addressed some of the concerns expressed in the Governor’s veto message.

In addition to this ongoing funding for the basic skills initiative, another $33.1 million in one–time carryover funding from the prior year is available to the CCC system in 2007–08 for similar purposes. The Governor’s May Revision had proposed that these funds be reverted to the Proposition 98 Reversion Account, but the Legislature rejected that proposal.

Noncredit Instruction. Chapter 631, Statutes of 2006 (SB 361, Scott), created a mechanism for increasing the funding rate for noncredit courses that advance career development or college preparation. The 2006–07 Budget Act included $30 million to increase the funding rate for such courses to $3,092 per FTE student, while all other noncredit courses received $2,626 per FTE student. For 2007–08, the Legislature added $13.8 million to further increase the funding rate for these “enhanced” noncredit courses. However, this funding was vetoed by the Governor.

Nursing Education. The community colleges received a base augmentation of $5.2 million to provide a variety of programs (such as tutoring and academic counseling) to reduce attrition among nursing students. In addition, the budget provides $12.1 million in one–time funds—$8.1 million for nursing and other health–related equipment and $4 million to create new nursing programs at four additional campuses.

Governor’s Vetoes. In addition to the vetoes discussed above, the Governor vetoed the following legislative reappropriations from the Proposition 98 Reversion Account:

- $4 million for the Part–Time Faculty Health Insurance Program.

- $1.5 million for a construction training program.

California Student Aid Commission

The budget includes $873 million in General Fund support for CSAC. Almost all of this funding is to support anticipated costs of the Cal Grant programs, the Assumption Program for Loans in Education (APLE), and other student financial aid programs.

Loan Forgiveness Programs. For the third year in a row, the Legislature rejected the Governor’s proposal to restrict 600 APLE awards for the exclusive use of students enrolled in math and science teacher programs at UC and CSU. In addition, the budget package did not include proposed legislation that would have extended the National Guard APLE program’s sunset date of July 1, 2007. As a result, no new awards can be made for this program.

The Legislature adopted provisional language authorizing CSAC to make 100 regular State Nursing Assumption Program of Loans for Education (SNAPLE) awards plus 100 additional SNAPLE awards for nursing students who agree to work in specified state facilities. The Legislature also authorized 100 warrants for the Public Interest Attorney Loan Repayment Program. While it was created several years ago, no warrants have ever been authorized for this program. The Governor vetoed the language authorizing these warrants, as well as the $100,000 the Legislature had appropriated for administrative costs.

Sale of EdFund. The budget package assumes the sale of EdFund, which is a nonprofit public benefit corporation that acts on behalf of CSAC to administer federal loan guarantee programs. The budget assumes that the state will receive $1 billion for this sale, representing a major component of the Governor’s proposed budget solutions. With the sale of EdFund, it is expected that CSAC would relinquish its status as California’s federally designated guarantor for the Federal Family Education Loan Program.

In anticipation of EdFund’s sale, the budget ceases the recent practice of supporting CSAC’s administrative costs with funding generated by EdFund’s activities. To replace this lost revenue, the May Revision proposed a General Fund augmentation of $20.3 million. The Legislature augmented this amount by an additional $3.6 million to maintain the prior–year’s level of funding for the California Student Opportunity and Access Program (Cal–SOAP). The Governor vetoed $2.2 million of this augmentation.

Capital Outlay

As discussed in the “2006 Bond Funding” section of this report, the enacted budget provides the three segments with $1.3 billion in proceeds from the Kindergarten–University Public Education Facilities Bond Act of 2006. This funding supports a variety of capital outlay projects at the three segments. The Legislature made several changes to the Governor’s proposal for spending these funds, including:

- A $68 million reduction to proposed “telemedicine” projects, due to inadequate justification for several projects.

- An appropriation of $10 million for a new Life Sciences Research and Nursing Education facility at a private university (Charles R. Drew University). Provisional language requires formal agreements between UC and the university before the funds can be released.

In addition to funding from the 2006 bond act, the budget includes $105 million for higher education capital outlay from earlier bond acts. Finally, the budget appropriates $70 million in lease–revenue bond proceeds for the construction of an energy research facility at UC Berkeley. That facility will also be supported by a grant from BP (formerly British Petroleum). In budget hearings, the Legislature expressed concern about how the institute would be organized and what BP’s role would be. Because UC and BP had not yet executed an agreement that would address these questions, the Legislature added provisional language preventing the release of funds until after the agreement is signed and provided to the Legislature for review.

Health

The 2007–08 budget plan provides about $20.3 billion from the General Fund for health programs. This is an increase of about $734 million, or 3.8 percent, compared to the revised prior–year spending level, as shown in Figure 10. Several key aspects of the budget package are discussed below and summarized in Figure 11.

Figure 10

Health Services Programs

General Fund Spending |

(Dollars in Millions) |

|

|

|

Change |

|

2006‑07 |

2007‑08 |

Amount |

Percent |

Medi-Cal—local assistance |

$13,621 |

$14,270 |

$650 |

4.8% |

Department of Developmental Services |

2,550 |

2,645 |

95 |

4.0 |

Department of Mental Health |

1,875 |

1,931 |

56 |

3.0 |

Healthy Families Program—local assistance |

362 |

399 |

37 |

10.0 |

Department of Public Health |

— |

391 |

391 |

— |

Department of Health Care Services—local assistance

excluding Medi-Cala |

521 |

163 |

-358 |

-69.0 |

Department of Health Care Services—state operationsb |

269 |

141 |

-128 |

-48.0 |

Department of Alcohol and Drug Programs |

296 |

294 |

-2 |

-1.0 |

Emergency Medical Services Authority |

29 |

13 |

-17 |

-57.0 |

All other health services |

19 |

29 |

10 |

56.0 |

Totals |

$19,542 |

$20,276 |

$734 |

3.8% |

|

a 2006‑07 figure includes expenditures for public health local assistance which transferred to the new Department of Public Health effective

July 2007. |

b 2006‑07 figure includes expenditures for public health state operations which transferred to the new Department of Public Health effective

July 2007. |

Note: May not total due to rounding. |

Figure 11

Major Changes—State Health Programs

2007‑08 General Fund Effect |

(In Millions) |

|

|

Medi-Cal |

|

Governor's veto to reduce program spending |

-$332 |

Increase rates for managed care plans to reflect new rate-setting methodology |

54 |

Governor's veto to reduce funding for managed care plans |

-53 |

Reduce reimbursement rates for drug ingredients |

-39 |

Increase funding for county administration to comply with new

federal eligibility law |

25 |

Exempt certain minors from new federal eligibility law |

20 |

Governor’s veto to delay SB 437 enrollment changes |

-13 |

Governor’s veto to eliminate outreach grants to enroll children |

-10 |

Public Health |

|

Expand efforts to investigate occurrences of foodborne illnesses |

$1 |

Department of Developmental Services |

|

Use Public Transportation Account funds for regional center transportation services |

-$129 |

Department of Mental Health |

|

Governor's veto of funding for Integrated Services for Homeless Mentally Ill Program |

-$55 |

Address prior-year deficiency in Early and Periodic Screening,

Diagnosis and Treatment program |

87 |

Implement Proposition 83 (Jessica's Law) and SB 1128 (Alquist) |

32 |

Department of Alcohol and Drug Programs |

|

Reduce spending on Proposition 36 drug programs |

-$25 |

Medi–Cal

The 2007–08 budget provides about $14.3 billion from the General Fund ($37 billion all funds) for Medi–Cal local assistance expenditures. This amounts to about a $650 million, or 5 percent, increase in General Fund support for Medi–Cal local assistance. This increase would have been greater except for combined Governor’s vetoes of $416 million General Fund from the budget. In his veto messages, the Governor indicated that $332 million of this reduction is based on historical data showing that on average, over the last three fiscal years, Medi–Cal expenditures have fallen short of estimated levels. However, if expenditures exceed the revised level, the state would most likely be obligated to continue to provide Medi–Cal services and to pay the associated costs.

Major Cost Factors. The net increase in expenditures primarily reflects: (1) increases in managed care provider rates, (2) lower drug costs, (3) increases in county administration costs due to changes in federal law, and (4) ongoing growth in base costs and caseloads. Specifically, the Medi–Cal Program is assumed to grow by about 50,000 cases, or 0.8 percent, in 2007–08 to a total of 6.6 million average monthly users.

Changes in Medi–Cal Managed Care Provider Rates. The budget plan includes $54 million General Fund for rate adjustments to Medi–Cal managed care plans as determined by a new rate setting methodology which will be applied to rates established beginning August 1, 2007. The Governor vetoed $53 million General Fund, the same amount that was approved by the Legislature to “hold harmless” certain managed care plans that would have otherwise received a rate reduction under the new rate setting methodology.

Drug Cost Savings. The budget plan includes savings of almost $39 million General Fund due to reductions in the amount Medi–Cal will reimburse pharmacies for certain drug ingredients. It is anticipated that the reduction in drug ingredient payments will bring them more in line with the actual cost of drug ingredients to pharmacies. The change in reimbursements to pharmacies is consistent with recent changes in federal law and regulations. In order to help ensure that pharmacies continue to participate in Medi–Cal after their reimbursements for certain drug ingredients are reduced, the Legislature adopted statutory language to allow for an adjustment in the dispensing fee paid to pharmacies.

County Administration. The budget plan includes increased funding for county administration costs due mainly to program growth and adjustments to account for increased costs. The budget plan also includes about $25 million General Fund for one–time and ongoing costs for implementation of the federal Deficit Reduction Act (DRA) citizenship verification requirements.

Minor Consent. The budget plan includes $20 million General Fund to backfill a loss of federal funds. California will not require minors who independently seek certain health care services to show proof of citizenship and personal identification. Because such documentation is now required by the federal DRA, the state will not receive its usual federal share of funding for services provided to these beneficiaries.

Additional Governor’s Vetoes. In addition to the vetoes described above, the Governor vetoed Medi–Cal funding in two other significant areas.

- Senate Bill 437 Implementation—Chapter 328, Statutes of 2006 (SB 437, Escutia), enacted various changes to enrollment procedures for Medi–Cal and the Healthy Families Program (HFP), including the establishment of a two–year pilot program for self–certification of income for Medi–Cal applicants. The Governor vetoed $13 million General Fund budgeted for Chapter 328, indicating in his veto message that his intent is to delay implementation by one year.

- Children’s Outreach Initiative—The 2006–07 budget provided the initial funds for efforts to expand children’s enrollment in Medi–Cal and HFP, including grants for counties to conduct outreach programs. The Governor vetoed $10 million General Fund included by the Legislature for 2007–08 to continue these grants.

Establishment of the Department of Public Health

Effective July 1, 2007, Chapter 241, Statutes of 2006 (SB 162, Ortiz), created the new Department of Public Health (DPH) and the Department of Health Care Services (DHCS) from the existing Department of Health Services (DHS). The creation of a separate DPH is intended to elevate the visibility and importance of public health issues. It is also intended to result in increased accountability and improvements in the effectiveness of DPH programs and DHCS programs by allowing each department to administer a narrower range of activities and focus on their respective core missions.

The DPH will administer a broad range of public and environmental health programs to prevent illness in, and promote the health of, the public at large. In contrast, DHCS will deliver health care services to eligible individuals, through the state’s Medicaid program (known as Medi–Cal in California) and through other programs, such as the Genetically Handicapped Persons Program and the California Children’s Services Program. As intended by Chapter 241, the creation of the two new departments did not result in increased expenditures for state operations in 2007–08.

In order to create DPH, the administration reclassified over 50 positions (such as sanitary engineer, health physicist, and others) to administrative positions to staff the new department. The reclassification was done to adhere to the intent of Chapter 241 to remain position neutral. In order to help mitigate the potential adverse programmatic effects of redirecting program staff to administrative functions, the Legislature restored 11 program positions at DPH that were funded by special funds or federal funds. The Governor vetoed the restoration of these positions indicating his intent to ensure that the creation of the new DPH remains budget neutral as intended by Chapter 241.

Additionally, the Legislature took action to increase the fiscal accountability and transparency of DPH. Chapter 188, Statues of 2007 (AB 203, Committee on Budget)—the Health Trailer Bill—requires the Department of Finance (DOF) to revise the Governor’s budget document display for DPH to include more detailed information about past year, current year, and budget year expenditures for each branch in the department. It also requires DPH to provide detailed expenditure information for certain major programs.

Public Health Programs

The 2007–08 budget provides about $390 million from the General Fund ($3.1 billion all funds) for support of public health programs. The Legislature adopted statutory language requiring more accountability in budgeting for the new DPH in order to ensure that it will be able to better exercise fiscal oversight in the future. Specifically, the amounts budgeted for each branch within DPH have to be identified by the administration in budget documents starting in 2008–09.

Foodborne Illness. The budget plan provides almost $1 million for DPH to expand its existing efforts to investigate foodborne illnesses and to provide additional emergency outbreak investigation capacity. These additional resources should increase DPH’s capability to investigate foodborne illnesses, obtain and review food processors’ records, review growing and harvesting practices on farms, and embargo contaminated products.

Healthy Families Program

The 2007–08 budget provides about $399 million from the General Fund ($1.1 billion all funds) for local assistance under the HFP. This reflects an increase of about $94 million all funds ($36.5 million General Fund), or almost 10 percent, in annual spending for the program. This growth is primarily due to increases in caseload and provider rates.

Department of Developmental Services

The budget provides $2.6 billion from the General Fund ($4.4 billion all funds) for services to individuals with developmental disabilities in developmental centers (DCs) and regional centers (RCs). This amounts to an increase of about $95 million, or 3.7 percent, in General Fund support over the revised prior–year level of spending.

Community Programs. The 2007–08 budget includes a total of $2.2 billion from the General Fund ($3.6 billion all funds) for community services for the developmentally disabled, an increase in General Fund resources of about $108 million over the revised prior–year level of spending. The growth in community programs is due mainly to increases in caseload, costs, and utilization of RC services. The budget continues several, mostly temporary, actions to hold down community program costs.

The budget plan includes an allocation of $129 million from the Public Transportation Account (PTA) in lieu of General Fund support to provide certain transportation services to RC clients. If this allocation from the PTA had not been included in the budget, General Fund expenditures for community services for 2007–08 would have grown by about $237 million above the prior–year spending level.

Agnews Developmental Center Closure. The budget continues to support plans to close Agnews DC and place many of its clients in community programs by June 2008.

Department of Mental Health

The budget provides about $1.9 billion from the General Fund ($4.8 billion all funds) for mental health services provided in state hospitals and in various community programs. This is an increase of about $56 million from the General Fund compared to the revised prior–year level of spending.

Community Programs. The 2007–08 budget includes about $777 million from the General Fund ($3.5 billion all funds) for local assistance for the mentally ill, a decrease of about $73 million in General Fund support compared to the revised prior–year level of spending.

Integrated Services for Homeless Mentally Ill Program. The Governor vetoed almost $55 million General Fund for Integrated Services for Homeless Mentally Ill, effectively eliminating all funding for the program. In his veto message the Governor indicated that counties could choose to restructure the program to meet the needs of the counties’ homeless population using other county funding sources, such as federal funds, realignment funds, or Proposition 63 funds.

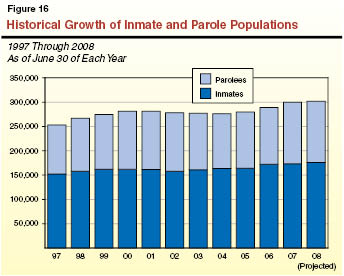

Early and Periodic Screening Diagnosis and Treatment (EPSDT). The budget provides about $454 million General Fund for support of EPSDT, an increase over the prior–year adjusted spending level of almost $48 million or 12 percent. This increase is due mainly to increases in caseload and utilization of services. The increase also reflects modifications to the estimating methodology to eliminate adjustments that generally caused estimates to understate costs in prior years. The modifications to the estimating methodology were recommended by the DOF’s of State Audits and Evaluations which reviewed the Department of Mental Health’s (DMH’s) estimating methodology in light of significant prior–year deficiencies.