May 19, 2008

Overview of the 2008-09 May Revision

Summary

Changes in the May Revision

Changes in Revenues and Expenditures Since January. The state’s sluggish economy has reduced the revenue outlook for 2008–09 by about $6 billion. Combined with rising costs in some areas, the state faces a remaining budget shortfall of $15 billion, after accounting for the $7 billion in solutions adopted as part of the special session.

New Budget Solutions. The administration proposes more than $8 billion in new solutions to close the widening budget gap. By far the largest solution is the securitization of future lottery revenues—expected to provide $15 billion over the next few years ($5.1 billion in 2008–09). The administration also proposes a spending cap and automatic across–the–board reductions in the future. Other proposed solutions include loans from special funds, the redirection of transportation monies to benefit the General Fund, and further reductions to health and social services programs.

LAO Assessment of the May Revision

Most Forecasts Reasonable. While we have some differences from the administration’s forecast of revenues and expenditures, the overall budget–year estimates are reasonable. In total, we project that—if the Legislature adopted all of the administration‘s proposals and they were successfully implemented—the state’s year–end reserve in 2008–09 would be about $500 million less than estimated by the administration. However, multibillion dollar shortfalls would reemerge in 2010–11.

Lottery Bond Size and Assumptions Flawed. The administration makes overly optimistic estimates about the potential growth in lottery sales and profits. Consequently, its securitization proposal would create the strong likelihood that distributions to public education from the lottery would fall well short of their current levels—perhaps by $5 billion over the next 12 years combined.

Budget Reforms Seriously Flawed. The administration’s overly complicated proposed budget reforms suffer from a variety of problems, including:

- Budget Shortfall Locked In. Under our revenue estimates, the administration‘s revenue cap leads to counterproductive results—the required deposit of General Fund monies into a new reserve at the same time that the state faces multibillion dollar shortfalls. The cap also could prevent the state from accessing some of the lottery proceeds intended to help solve the budget problem. As a result, the administration’s reforms could lock the state’s operating shortfall in place and lead to automatic multibillion dollar across–the–board reductions.

- Loss of Legislative Authority. The proposed across–the–board reductions fail to prioritize which state programs are most essential while undermining the Legislature’s constitutional authority over appropriations.

LAO Alternative Offers Better Approach

Updated Solutions. We have updated our LAO alternative budget to reflect the state’s worsening fiscal situation. We continue to offer a balanced approach between reduced spending and increased revenues, while protecting core state services. Our alternative provides about $900 million more in ongoing programmatic K–14 education support compared to the Governor’s plan.

More Responsible Lottery Plan. Our plan includes a more responsible lottery securitization—resulting in a General Fund benefit of $5.6 billion over two years—with a dramatically reduced risk to education’s lottery funding. The one–time proceeds help our plan to balance in 2008–09 and 2009–10. The plan remains balanced through our forecast period.

Simpler Budget Reform. We offer some much simpler approaches to increasing the size of the state’s reserve in good fiscal times. In addition, the Legislature should consider systematically reviewing budgetary formulas and “unlock” the state budget by changing formulas that no longer meet current state priorities.

LAO Bottom Line

The sluggish economy has severely worsened the state’s ongoing mismatch between revenues and spending. All available solutions involve consequences and trade–offs. A reliance on overly optimistic lottery growth assumptions and a massive bond structure will put school funding from this source at risk. In addition, it could result in unsustainable ongoing spending commitments using a limited–time revenue source. Similarly, pinning the state’s long–term prospects on future multibillion dollar across–the–board reductions is no answer. We continue to offer an alternative approach to assist the Legislature with its budget deliberations.

This report provides an overview of the Governor’s May Revision and an update to our alternative budget approach. It begins with a summary of the administration’s budget plan. We then provide the Legislature with an assessment of the May Revision—with proposed alternative approaches that the Legislature can consider.

Major Features of the May Revision

Overview of Major Changes

Declining Revenues. A declining economic outlook, sagging revenues, and rising costs have created bleak prospects for the state’s 2008–09 budget. In January, the Governor identified a gap of $14.5 billion between revenues and expenditures (over the current and budget years combined) and proposed more than $17 billion in solutions. Since that time, there have been a number of key developments, including:

- A further deterioration of the economic and revenue outlook for 2008–09 ($6 billion).

- Rising state expenditures in a number of state programs ($1.7 billion).

The net effect of these developments is that, compared to the Governor’s January proposal, the administration view of the state’s budget outlook—absent any action—has worsened to a total of $22 billion. We describe the calculation of this budget problem in more detail in the box below.

What Is the Size of the Budget Problem?

There are several ways to identify the size of the state’s budget problem. The simplest way, however, is to ask the question: If the Legislature and Governor did nothing, how large would the state’s deficit be at the end of the budget year? This is the approach that the administration took in January in identifying a $14.5 billion problem. In February, due principally to a declining revenue outlook, our office increased that amount to $16 billion. Since that time, the administration projects that revenues have decreased and spending has increased by a total of $7.7 billion. The budget problem, therefore, is $22.2 billion under the administration’s view. (The May Revision documents use an amount of $24.2 billion. This amount, however, includes its desire to build a $2 billion reserve.)

The Legislature and the Governor began to address the budget shortfall by adopting more than $7 billion in solutions in the special session earlier this year. (The administration’s problem and solution statements exclude the loss of a lawsuit related to the use of $409 million from the Public Transportation Account, which was corrected by the Legislature in the special session.) An equally important question, therefore, is: How much more of a problem remains to be solved after accounting for special session actions? As shown in the figure, that amount is $15.2 billion under the administration’s projections. Our calculation of the underlying budget problem is similar to the administration’s.

The State’s Remaining Budget

Shortfall Is $15 Billion |

(In Billions) |

|

Governor’s Estimate |

Problem as of January |

-$14.5 |

+ |

May Forecast |

|

Lower revenues |

-$6.0 |

Higher spending |

-1.7 |

= |

Revised Problem |

-$22.2 |

- |

Special Session Solutions |

$7.0 |

= |

Remaining Problem |

-$15.2 |

+ |

Proposed Solutions |

$17.2 |

= |

May Revision Reserve |

$2.0 |

|

Special Session. Responding to the worsening budget situation, the Legislature and the Governor in February agreed to the adoption of more than $7 billion in solutions, as summarized in Figure 1.

Figure 1

Special Session Actions |

2007‑08 and 2008‑09 Savings

(In Millions) |

|

|

Sale of additional deficit-financing bonds |

$3,313 |

Suspension of Budget Stabilization Account transfer |

1,509 |

Reduction of Medi-Cal provider rates |

508 |

Reduction in current-year Proposition 98 spending |

507 |

Public Transportation Account reimbursement to the General Funda |

409 |

Regional center cost containment measures |

229 |

Higher tideland oil revenue estimate |

218 |

Delay of Medi-Cal checkwrite |

165 |

Delay of SSI/SSP cost-of-living adjustment (COLA) |

91 |

Delay of new judges |

76 |

Shift payment schedule for mandate claims |

75 |

Delay of CalWORKs COLA |

42 |

Elimination of CalWORKs performance incentives |

40 |

Recognition of CDCR program delays |

40 |

Shift of parks maintenance to bond funds |

30 |

Other |

201 |

Total |

$7,452 |

|

a The administration excludes this issue from both its problem and solution definition. |

Erosion of Savings. In January, the administration assumed that many of its proposals would be approved by March 1, 2008. In those cases in which the Legislature has not to date approved the proposals, the savings that are still achievable have been reduced. The administration, therefore, has adjusted its proposals to assume a July 1 approval date—reducing estimated savings by $535 million.

Reversal of Previous Proposals. The administration has also chosen to pull back on earlier reduction proposals in several areas by:

- Providing increased Proposition 98 funding for K–14 schools ($1.1 billion).

- Dropping its early release of state prisoners proposal ($256 million).

- Providing increased funds to the University of California and the California State University ($196 million).

- Dropping its proposal to close 48 state parks ($13 million).

The top portion of Figure 2 summarizes the items which have worsened the General Fund condition.

Figure 2

May Revision Proposes More Than $8 Billion in

New Solutions |

(In Millions) |

Governor’s January 10 Reserve |

$2,778 |

|

|

Items Worsening General Fund Condition |

-$9,224 |

Lower Revenues |

|

Updated major revenues forecast |

-$5,201 |

EdFund sale delayed |

-500 |

Other revenues |

-296 |

Erosion of Savings From January Proposals |

-$535 |

Changes to Proposition 98 |

|

Lower property taxes |

-$740 |

Increased funding |

-1,130 |

Other Restorations and Increased Costs |

|

Higher Receiver spending |

-$453 |

Elimination of unidentifiable savings estimate |

-270 |

Drop correctional early release proposal |

-256 |

Restoration of university spending |

-196 |

Medi-Cal managed care rates |

-170 |

County reimbursement for presidential primary costs |

-89 |

Higher firefighting costs |

-80 |

Various Workload and Other Adjustments (Net Savings) |

693 |

New Solutions Improving General Fund Condition |

$8,455 |

Sell lottery bonds |

$5,122 |

Expand use of transportation funds to benefit General Fund |

828 |

Special fund loans |

564 |

Reduce funding for correctional officers pay offer |

421 |

CalWORKs grant reductions and policy changes |

370 |

Accelerate limited liability company fee payment |

360 |

Reduce IHSS state participation to minimum wage |

187 |

Eliminate Cash Assistance Program for Immigrants |

111 |

Do not pass through federal SSI cost-of-living adjustment |

109 |

Reduce health services for newly qualified immigrants |

87 |

Defer mandates repayment |

75 |

Other (net) |

221 |

May Revision Reserve |

$2,009 |

|

Note: Positive numbers help the state’s bottom line and negative numbers hurt the state’s bottom line. |

New Solutions. Accounting for the declining revenues, special session actions, and changes to its earlier proposed solutions, the administration has proposed new solutions in the May Revision totaling more than $8 billion. These changes are summarized in Figure 2 and include:

- The securitization of future proceeds from the state lottery—yielding $15 billion in proceeds available for a proposed new reserve fund (described below). The May Revision proposes using $5.1 billion of this amount in 2008–09.

- A redirection of public transportation funds to benefit the General Fund ($828 million).

- Loans from state special funds, to be paid back in 2010–11 and later years ($564 million).

- Various reductions to health and social services programs (about $1.1 billion).

General Fund Condition

Figure 3 shows the administration’s estimate of the General Fund’s condition taking into consideration its May Revision proposals. Accounting for the special session solutions, 2007–08 spending exceeds revenues by $2.8 billion—leaving less than a $1 billion reserve at the end of the year. For 2008–09, the administration proposes $103 billion in revenues and $101.8 billion in spending. Consequently, the reserve would grow to $2 billion at the end of the budget year.

Figure 3

Governor’s May Revision General Fund Condition |

(Dollars in Millions) |

|

|

2008‑09 |

|

2007‑08 |

Amount |

Percent Change |

Prior-year fund balance |

$4,568 |

$1,743 |

|

Revenues and transfersa |

100,718 |

102,987 |

2.3% |

Total resources available |

$105,286 |

$104,730 |

|

Expenditures |

$103,543 |

$101,836 |

-1.6% |

Ending fund balance |

$1,743 |

$2,894 |

|

Encumbrances |

$885 |

$885 |

|

Reserve |

$858 |

$2,009 |

|

Budget Stabilization Account (BSA) |

— |

— |

|

Special Fund for Economic Uncertainties |

$858 |

$2,009 |

|

|

a Display of revenues related to the BSA is different than the administration’s. The 2006-07 revenue amount (reflected in the prior-year fund balance) includes $472 million and the 2007-08 revenue amount includes $1.023 billion in General Fund revenues received in those years and transferred to the BSA. The administration instead shows the entire $1.494 billion as 2007‑08 revenues, when the funds were transferred back to the General Fund. |

Administration’s Economic And Revenue Outlook

Economic Forecast

The economic forecast underlying the May Revision’s fiscal estimates assumes that California will feel the effects of the economic slowdown somewhat more than the rest of the nation, with little growth in the current year before picking up to moderate growth within a couple of years. The state’s economy is expected to slow in 2008, with personal income growth of 4.5 percent and a slight loss in jobs. The housing sector’s woes would continue into 2009, providing a significant drag on economic growth in the state. Beginning in mid–2009, the pace of growth is expected to accelerate.

Revenue Forecast

The May Revision projects General Fund revenues and transfers of $100.7 billion in 2007–08 and $103 billion in 2008–09, for a budget–year growth of $2.2 billion (2.3 percent). The revenue totals for each of the two years is virtually unchanged since the January Governor’s budget (see Figure 4). This masks large offsetting changes, particularly in 2008–09, where significant decreases in tax revenues ($5.7 billion) are offset by the administration’s lottery securitization proposal and proposed fund transfers.

Figure 4

May Revision Revenue Changes

Compared to January Forecast |

(In Millions) |

|

2007‑08 |

2008‑09 |

Two-Year Total |

Tax Revenues: |

|

|

|

Personal income tax |

$1,407 |

-$2,725 |

-$1,318 |

Sales and use taxes |

-589 |

-1,854 |

-2,443 |

Corporation tax |

-540 |

-898 |

-1,438 |

Insurance tax |

96 |

-247 |

-151 |

Other |

-3 |

-5 |

-8 |

Subtotals, Taxes |

($371) |

(-$5,729) |

(-$5,358) |

Other Revenues: |

|

|

|

EdFund |

-$500 |

— |

-$500 |

Lottery securitization |

— |

$5,122 |

5,122 |

Tribal gambling |

-7 |

16 |

9 |

All other |

95 |

674 |

769 |

Subtotals, Other Revenues |

(-$412) |

($5,812) |

($5,400) |

Totals |

-$40 |

$83 |

$43 |

|

Detail may not total due to rounding. |

As reflected in Figure 4:

- Sales and use taxes are reduced by $2.4 billion for the current and budget years combined. This is primarily due to the weak economy, reflecting the negative effect of the soft housing markets on taxable sales. Also, significantly higher gas prices in 2008 result in an increased amount of gasoline and diesel sales tax revenues that are diverted from the General Fund.

- Corporation taxes decline by $1.4 billion for the two years combined. This reduction mainly reflects the weakness in cash receipts and corporate profits.

- Personal income taxes fall $1.3 billion over the two years. Collections are up in 2007–08 by $1.4 billion due to higher payments made in April 2008. This increase is offset by a $2.7 billion reduction in payments in the budget year, caused in part by a significant estimated reduction in capital gains in 2008–09.

- Other revenues and transfers are up by a net of $5.4 billion. This mainly reflects the $5.1 billion the administration expects to receive from the securitization of the lottery. Increased special fund borrowing and transfers offset the loss of $500 million in revenues from the delayed sale of EdFund.

Programmatic Features of the May Revision

Figure 5 provides a summary of the major programmatic features of the May Revision affecting the state’s General Fund. Below, we describe the administration’s key proposals related to budget reform, the lottery, and Proposition 98.

Figure 5

Key General Fund Programmatic Features of May Revision |

|

K-14 Education |

Proposition 98. Provides $1.1 billion more for K-14 education in 2008-09 than the January proposal. Funds the Proposition 98 minimum guarantee. |

Community Colleges. Increases budgeted enrollment growth to 1.67 percent ($35 million). Provides

$75 million in one-time funds to backfill a current-year shortfall in property tax revenues. |

Higher Education |

Universities. Augments General Fund support for UC and CSU ($196 million). As a result, both segments would receive the same level of General Fund support in 2008-09 as they are receiving in the current year. |

EdFund. Proposes that the EdFund sale scheduled for 2007-08 be delayed until 2009-10 (at an assumed price of $500 million). |

Health and Social Services |

CalWORKs. Reduces grants by 5 percent ($108 million), conditions eligibility on face-to-face interview every six months ($60 million), and deletes the October 2008 cost-of-living adjustment (COLA) ($121 million). Replaces certain General Fund support for CalGrants, juvenile probation, and Foster Care with TANF block grant funds. |

SSI/SSP. Does not pass through the federal January 2009 COLA ($109 million in 2008-09 and $218 million in 2009-10). Eliminates the state-only cash assistance program for legal immigrants ($111 million). |

IHSS. Reduces state participation in provider wages to the minimum wage ($187 million). Replaces proposal to reduce domestic service hours for all recipients with new proposals that (1) limit eligibility for domestic services to the most severely disabled and (2) increase share-of-cost payments for higher functioning recipients. |

Managed Care. Provides $170 million to fund rate increases for Medi-Cal managed health care plans. |

Reduced Medi-Cal Eligibility. Lowers the allowable income level for persons applying for Medi-Cal eligibility

under Section 1931(b), thereby reducing caseload and generating budget-year savings of $31 million and growing to about $340 million in 2011-12. |

Medi-Cal Changes for Immigrants. Saves $42 million by implementing a monthly eligibility requirement for emergency services for undocumented immigrants. Saves $87 million by limiting benefits for newly qualified immigrants and certain other immigrants to the same level of benefits currently provided to noncitizens. |

Criminal Justice |

Early Release. Increases spending by $256 million due to the withdrawal of a proposal for the early release of some inmates from prison up to 20 months early. |

Transportation |

Revenues to Help General Fund. Relative to the January budget, proposes to use an additional $828 million in gasoline and diesel sales tax revenues to help the General Fund in 2008-09. Specifically, provides: (1) $593 million to reimburse the General Fund for Home-to-School Transportation, and (2) $235 million to pay past- and current-years transportation bond debt service. |

Resources |

State Parks. Drops park closure proposal by restoring General Fund dollars ($12 million) and increasing park fees ($1.5 million). |

General Government |

Correctional Officer Pay Raise. Withdraws most funding to implement last, best, and final offer to correctional officers and proposes to fund costs from reserve ($421 million). |

Insurance Surcharge for Wildland Firefighting. Restructures proposed surcharge on property insurance policies statewide to make it risk-based. Would (1) supplant General Fund reductions ($51 million) and (2) expand wildland firefighting under CalFire and the Office of Emergency Services. |

Budget Reform

In January, the Governor proposed a constitutional measure to make a number of changes to the budget process. The May Revision modifies those changes and proposes interactions with its lottery proposal. While we have not had the opportunity to see the administration’s proposed language, our understanding of the main components is described below.

Ten–Year Revenue Growth Rate. The administration proposes to limit the amount of revenues that the General Fund could receive in any year. Specifically, the amount would be limited by the average growth rate of General Fund revenues over the prior ten years.

Deposits Into New Reserve. In any year in which General Fund revenues were expected to grow by more than the revenue cap set by the ten–year average (based on a Department of Finance [DOF] forecast), the “excess” revenues would be deposited into a new reserve called the Revenue Stabilization Fund (RSF). Of any excess revenue deposits, 40 percent would be deposited into an education subaccount. The RSF would be in addition to the state’s two existing reserves, the Special Fund for Economic Uncertainties and the Budget Stabilization Account (BSA).

Transfers Out of the RSF. Unlike the state’s current reserves, the Legislature could not generally access the funds in the RSF, including in cases of fiscal emergencies. Instead, funds could only be transferred from the RSF to the General Fund (by a two–thirds legislative vote) in years in which General Fund revenues were forecasted to grow less than the cap set by the ten–year average growth rate—up to the amount of the cap. Funds in the education subaccount could be withdrawn in less restricted circumstances (by a majority vote) to cover Proposition 98 expenses (such as maintenance factor or settle–up costs, or to supplement funding in slow growth years).

Building Up Reserve Balance. The aim of the Governor’s proposal is to build up a substantial amount of funds in the RSF—up to 15 percent of annual General Fund revenues (about $15 billion currently). After the 15 percent reserve was met, the measure would require the Legislature to spend any additional funds on a variety of one–time purposes.

Automatic Midyear Budget Reductions. The measure would also establish a system by which the administration could trigger across–the–board reductions if the state’s budget situation declined. If the state’s current–year budget was projected to have a negative reserve, then the administration would trigger reductions. The amount of the reductions—up to 5 percent reductions on an annualized basis—would depend upon the severity of the budget shortfall. The Legislature would be required to pass contingency laws for entitlement programs—where spending is driven by requirements in existing law—to specify how these reductions would be implemented, if triggered. Reductions to Proposition 98 base revenue limits and cost–of–living adjustments (COLAs) would be exempt from any reductions. Virtually all other programs, with certain exceptions such as debt service, would be subject to reductions.

No Suspension of Proposition 98. The measure also would eliminate the provision in the Constitution that allows the Legislature to suspend Proposition 98 in any year. This provision would go into effect once the state’s existing maintenance factor is repaid (currently estimated to be in 2010–11).

State Lottery Securitization And Sales Tax Trigger

As a crucial part of his budget balancing plan, the Governor proposes to raise $15 billion over the next three years from securitizing the lottery. While the administration has not completed legislative language to implement the proposal, we understand that the plan would involve going to voters in November 2008 and asking them to approve (1) changes to the existing Lottery Act intended to allow the lottery to increase its sales volume and (2) provisions to facilitate securitization (or sale) of a portion of future lottery profits to bond investors in exchange for a series of upfront payments. The administration estimates that the bond transactions would generate enough funds to allow deposits to the reserve of up to $15 billion over the next three fiscal years, including $5.1 billion in 2008–09. This 2008–09 deposit to the reserve would be transferred immediately to the General Fund.

Lottery Background

Voters approved Proposition 37 (the Lottery Act) in 1984. The act requires the Lottery Commission to distribute about 50 percent of lottery revenues as prizes each year and about 34 percent of revenues as supplemental funding to public educational entities, including school districts, community college districts, and the two public university systems. Over time, lottery revenues have been volatile, and they have never grown to be a significant percentage of state public education revenues. Currently, lottery distributions are about $1.2 billion per year and provide only about 1.5 percent of total K–12 school funding. Under current law, the state’s General Fund receives no funds from the lottery.

Proposed Changes to the Lottery

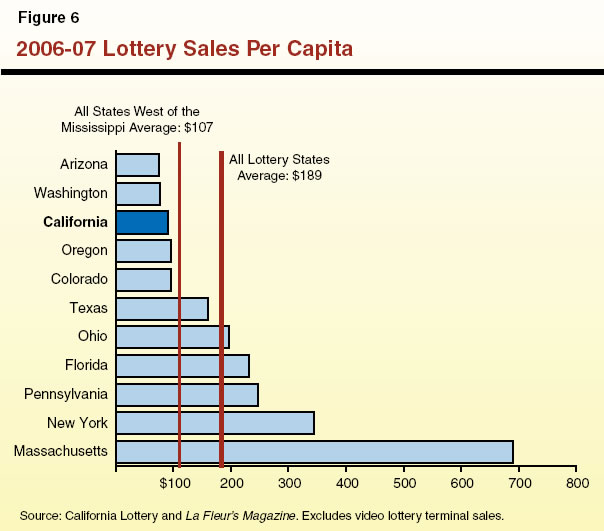

Per Capita Sales Lag the National Average. Over the past year, the Governor has repeatedly raised the issue of the California Lottery’s sales performance, relative to the other 41 U.S. states with lotteries. Figure 6 shows that in 2006–07 per capita lottery sales in California ($91) were about 50 percent of the national average ($189). (Western states have always had lower lottery sales, and California’s per capita sales lag the average of these states by a much smaller margin.) The Governor, as well as several industry experts, have attributed at least a part of this sales lag to the lack of flexibility granted the Lottery Commission in its initiative statute to adapt to changes in the state’s economy, demographics, and gambling marketplace.

Voters Would Be Asked to Free Lottery From Restrictions. Unlike the Governor’s prior proposals to lease operations of the lottery to a private entity, the Lottery Commission would continue to operate the enterprise under the May Revision proposal. However, voters would be asked to give the commission the authority to increase the percentage of revenues paid out as prizes above 50 percent. The commission would be granted this authority in order to entice customers to purchase more lottery tickets, thereby increasing sales. Because prizes would consume a larger percentage of lottery revenues, the percentage for administrative expenses and/or profits (currently distributed to public education) would have to be proportionately reduced. Nevertheless, experience in some other jurisdictions suggests that such changes would increase the actual dollar amount of lottery profits by some amount. In addition, the administration proposal may contain changes to allow the lottery to operate a broader variety of games and market them more aggressively. The administration assumes that lottery sales could be roughly doubled—bringing per capita sales to about the national average—in the next five to ten years.

Proposed Lottery Securitization

Upfront Proceeds for Use in Balancing the Budget. Voters also would be asked to approve provisions that would facilitate securitization of a portion of future lottery profits. Like the state’s prior securitization of tobacco settlement revenues, this one would involve bond investors providing the state with large upfront payments to use for public purposes in exchange for the rights to an ongoing revenue stream. Payments to educational entities would be subordinate to these bond obligations (meaning that the bondholders have the first call on lottery profits). Under the Governor’s plan, these payments to public education would never in any event exceed $1.2 billion—roughly the amount of funding provided now. Excess lottery funds—above those needed to pay debt service to bondholders and meet the $1.2 billion annual payment obligation—would be distributed to the RSF, according to administration officials. During the early years of the new structure, one or more “reserve accounts”—totaling up to several billion dollars—may need to be funded in order to provide greater assurances that the $1.2 billion would be available for education on an annual basis as lottery sales ramp up to a higher level. In order to fund such reserves, the costs of issuing the bonds and the $15 billion transfer to the RSF, the combined amount of bonds to be issued might exceed $20 billion. The bonds would be repaid over roughly a 30–year period.

Administration Forecasts That Education Would Get $1.2 Billion Every Year. While the administration acknowledges that there is no way to know for sure how much the proposed changes would increase lottery profits, its forecast model assumes that such profits would grow from $1.2 billion in 2007–08 to over $2.4 billion at some point between 2013 and 2017. This means that total lottery sales would increase from $3.4 billion to over $7 billion during this five– to ten–year period. In so doing, per capita sales would approach the national average, according to the administration’s assumptions. This assumed increase in lottery sales allows the administration to forecast that debt service will be paid in full each year and public education will receive a distribution of $1.2 billion annually. If, on the other hand, lottery sales and profits did not grow as much as forecast by the administration, bondholders would continue to receive payments, but public education would experience a drop in lottery payments.

“Fail–Safe” Mechanism to Fund New Reserve

Voter Rejection or Lawsuits Could Stall Securitization Plan. If the Legislature agrees to place the administration’s lottery securitization plan on the ballot, either voter rejection or lawsuits (such as those that could be filed by the state’s other gambling interests) could stall implementation of the plan and issuance of the lottery securitization bonds. The Governor, therefore, proposes that the Legislature approve a measure to allow the Director of Finance to trigger a temporary one–cent sales tax increase if he determines that the General Fund needs additional revenues from the RSF to bring the state up to the ten–year average of revenue growth. The triggered increase would remain in place until the RSF has reached 15 percent of General Fund revenues or June 30, 2011, whichever occurs first. A one–cent sales tax increase would provide $6 billion on an annual basis. Following elimination of the temporary tax increase, the administration proposes that residents receive tax rebates at some point in the future that in the aggregate would equal the amount of revenues collected.

Proposition 98— K–14 Education

Provides Roughly $1.1 Billion More Relative to January, Meets Minimum Guarantee. As shown in Figure 7, the Governor’s May proposal provides $1.1 billion more for K–14 education in 2008–09 compared to his January proposal. Under the May proposal, ongoing Proposition 98 spending is $56.8 billion. At this spending level, the administration meets the Proposition 98 minimum guarantee, or K–14 funding requirement, for 2008–09. By comparison, the administration’s January proposal had suspended Proposition 98, providing $4 billion less than otherwise required. Compared to January, the estimated Proposition 98 minimum guarantee has dropped by about $3 billion due to the substantial drop in estimated General Fund revenues.

Figure 7

Proposition 98 Spending:

Comparing January Budget and May Revision |

2008‑09

(In Millions) |

|

January Budget |

May Revision |

Change |

K-12 |

$49,311 |

$50,408 |

$1,097 |

California Community Colleges |

6,223 |

6,251 |

28 |

Othera |

106 |

111 |

5 |

Total Proposition 98 |

$55,640 |

$56,769 |

$1,130 |

|

a Includes Department of Developmental Services, California Department of Corrections and Rehabilitation, and state special schools. |

Year–to–Year Funding Increases Less Than $200 Million. Even with the administration providing $1.1 billion more for K–14 education relative to the January budget, total year–to–year funding would increase by less than $200 million. As shown in Figure 8, funding for K–12 education would increase by about $70 million whereas funding for the California Community Colleges (CCC) would increase by about $130 million year to year.

Figure 8

May Revision Proposition 98 Spending:

Year-to-Year Changes |

(Dollars in Millions) |

|

2007‑08

Revised |

2008‑09

Revised |

Change |

|

Amount |

Percent |

K-12 |

$50,336 |

$50,408 |

$72 |

0.1% |

California Community Colleges (CCC) |

6,119 |

6,251 |

132 |

2.2 |

Other |

121 |

111 |

-10 |

-8.1 |

Totals |

$56,576 |

$56,769 |

$194 |

0.3% |

K-12 attendance |

5,946,802 |

5,915,672 |

-31,130 |

-0.5% |

K-12 per pupil spending |

$8,464 |

$8,521 |

$57 |

0.7% |

CCC full-time equivalent students (FTES) |

1,188,529 |

1,192,930 |

4,401 |

0.4% |

CCC per FTES spending |

$5,148 |

$5,240 |

$91 |

1.8% |

Maintains Across–the–Board Approach to Building K–14 Budget. Figure 9 shows all the major Proposition 98 changes in the Governor’s January and May proposals. Reversing a part of his January proposal, the Governor’s May Revision restores base funding for K–12 revenue limits ($841 million) and special education ($238 million). To offset some of the proposed new spending, the Governor’s May Revision proposal significantly reduces funding for K–12 deferred maintenance—cutting $223 million from the program, leaving about $40 million for districts that qualify for hardship funding. With the exception of CCC’s foster care program, a portion of CCC enrollment growth, and a portion of the state special schools funding, it maintains all other budget–balancing reductions for K–14 programs proposed in January. The administration also maintains its January proposal not to provide a COLA to any K–14 education program. Providing a COLA to all programs that normally receive one would cost about $3.1 billion.

Figure 9

Proposition 98 Budget Changes |

(In Millions) |

2007‑08 Revised |

$56,576 |

January Budget |

|

Restore funding for ongoing programs |

$567 |

Restore 2007‑08 special session reductions |

507 |

Community college enrollment growth |

182 |

K-12 decline in average daily attendance (ADA) |

-121 |

Budget-balancing reductions |

-2,087 |

Other |

-10 |

Subtotal January |

(-$962) |

May Revision |

|

Restore revenue limit base reduction |

$841 |

Restore special education base reduction |

238 |

Revenue limit ADA growth (higher 2007‑08 base) |

142 |

Revenue limit UI/CalPERSa |

119 |

Child care |

42 |

Community college growth |

35 |

Deferred maintenance |

-223 |

COEb revenue limit adjustment |

-38 |

Subtotal May |

($1,156) |

Total Year-to-Year Change |

$194 |

2008‑09 Proposal |

$56,769 |

|

a Unemployment Insurance/California Public Employees' Retirement System. |

b County Office of Education. |

Includes Package of Fiscal Flexibility Proposals. To help school districts respond to a tight budget, the administration’s May Revision proposal includes a package of fiscal flexibility options. Many of the options included in the package have been used in previous years to help school districts when facing similar tight budget situations. The Governor’s package contains flexibility provisions relating to school districts’ unrestricted operating reserves, maintenance reserves, and restricted categorical program reserves as well as provisions that would allow school districts to move funds among various categorical programs. The flexibility provisions would allow districts to reduce their unrestricted reserve as well as use restricted reserve funds to provide apportionment increases of at least 2 percent. They also would allow school districts to reduce their routine maintenance reserve and suspend local set asides for deferred maintenance. The May Revision also provides community college districts with some flexibility to transfer funds among certain categorical programs.

Includes About $500 Million in One–Time Proposition 98 Spending. In addition to ongoing Proposition 98 spending, the Governor‘s May Revision proposal includes slightly more than $500 million in one–time spending in 2008–09. (The January proposal contained no specific one–time spending proposals.) Of the newly identified resources, the bulk comes from the After School and Safety Education program, which expanded significantly in 2006–07 and is estimated to have a large unexpended balance. Of the newly identified one–time monies, the Governor’s May proposal uses $324 million for California Work Opportunities and Responsibility to Kids (CalWORKs) child care, $100 million for the Emergency Repair Program, $75 million for CCC to backfill its estimated loss in local property tax revenue in the current year, $8 million for improvements in the reporting of student data, and $3 million for Personnel Management Assistance Teams.

Do the May Revision’s Numbers Add Up?

We have examined the implications of the May Revision using our own revenue forecast and our own estimates of the impact of the Governor’s proposals on revenues and expenditures. In other words, if the Legislature adopted all of the Governor’s proposals, what would the budget look like under our independent estimates?

Economic and Revenue Assessment. Our current– and budget–year economic and revenue forecasts are similar to those of the administration. For both forecasts, economic growth is expected to stay minimal until mid–2009 and begin to strengthen thereafter, with our forecast providing a somewhat faster revenue bounce back. At this point in time, however, there is more uncertainty than normal about the severity and duration of this economic slowdown.

Our revised economic forecast is slightly more pessimistic than that of the administration. As a result, our estimate of revenues totals about $300 million less than the administration’s over the current and budget years combined—a minor difference given the state’s General Fund revenue base of roughly $100 billion. Whereas in past years small differences in a fiscal year’s total revenues often masked large offsetting projections in the major taxes, our forecasts this time are similar to the administration’s for all the major revenue sources.

Spending Projections. The administration’s spending projections are generally reasonable. In total, we project that spending under the Governor’s policies would be about $250 million higher in 2007–08 and 2008–09 combined than the administration’s projections. One key factor is our treatment of the administration’s correctional officers pay proposal—a 5 percent pay raise for correctional officers, retroactive to July 1, 2007. We have counted the entire $521 million cost over two years as expenditures under the Governor’s plan. Although the May Revision removes most of this funding from its expenditure totals, the administration continues to support the pay raise. While the Legislature has not acted upon the proposal, we believe that including the costs in the Governor’s spending totals more accurately reflects the true costs of the administration’s policies. We also project more than $300 million in higher health and social services program costs (principally in CalWORKs and Medi–Cal) due largely to higher caseloads. Our caseload forecasts take account of more recent trends than the administration used in developing the May Revision.

Partially offsetting these higher costs is our assumption of an additional $600 million (roughly $300 million each in the current and budget years) in local property taxes—lowering the state’s Proposition 98 General Fund obligations. For the budget year, the administration and our office estimate similar levels of growth (significantly reduced due to the struggling housing market). We, however, have a higher base of revenues in 2007–08 from which this growth occurs. Our discussions with local officials and review of recent data lead us to conclude that the administration has lowered its current–year estimate too much. Most of the recent downward adjustments to property tax assessments will affect revenues in 2008–09 and future years.

Governor’s Reserve Would Be $1.5 Billion… As a result of these revenue and spending projections, if the Legislature were to adopt all of the Governor’s budget proposals and policies and they worked as intended, we project that the state’s year–end 2008–09 reserve would be about $500 million lower than the administration assumes.

…But Budget Out of Balance if Sales Tax Is Triggered. The administration describes its sales tax trigger as a fail–safe mechanism in case the lottery proposal is defeated or delayed. Our understanding is that the earliest that the Director of Finance could trigger the sales tax would be January 1, 2009. Thus, in 2008–09, the sales tax increase could only produce a half–year’s worth of revenues—roughly $3 billion. If triggered, the Governor’s proposed budget would be in a deficit as a result of the difference between the assumed lottery securitization ($5 billion) and the half–year sales tax revenues ($3 billion). (There also would be higher Proposition 98 obligations in 2008–09 if the sales tax, rather than the lottery, was used as a revenue source.)

An Alternative Approach to Closing the Budget Gap

In February, we criticized the Governor’s budget for its failure to prioritize state spending and consider revenue solutions. As a result, we offered an LAO Alternative Budget that, in our view, presented the Legislature with a more meaningful starting point for its budget deliberations (please see The 2008–09 Budget: Perspectives and Issues [P&I], pages 89 to 176). The main components of the alternative were:

- A Balanced Budget Through 2012–13. Unlike the Governor, our plan took a long–term view to keep the state’s revenues and spending in balance throughout our forecast period.

- Targeted Program Reductions. Rather than making across–the–board reductions, our approach was to maintain core services at their current level. We eliminated or modified ineffective programs. We also considered the availability of alternative fund sources to maintain service levels.

- Rethinking Which State Programs Are Operated or Funded by the State. Our approach shifted program responsibilities to the local level when it made programmatic sense.

- A Better Proposition 98 Approach. Our plan focused on maintaining the same level of ongoing program support as in 2007–08.

- Add Revenues in a Reasonable Manner. We selected tax credits or exemptions for reductions or elimination (totaling $2.7 billion) because they are not achieving their stated purposes or are of lower priority. We proposed no broad–based tax rate increases.

- No Additional Borrowing or Debt. We did not add any new borrowing or debt to the state’s credit card.

May Revision Makes Marginal Progress in Some Areas. In some respects, the May Revision makes progress in putting forth a budget plan. In contrast to its January across–the–board reductions, the administration’s priorities are reflected in those areas which received May Revision augmentations—K–14 education, higher education, and corrections. By contrast, certain programs—health, social services, and transportation—received additional reductions. In addition, unlike in January, the administration now acknowledges that the budget gap cannot be closed with spending reductions alone and proposes a new source of revenues (lottery securitization or sales tax revenues). Yet, the underlying budget from January generally remains—across–the–board reductions that often lack a clear rationale. In addition, as discussed below, the major new solutions proposed raise serious concerns.

Dismal Budget Outlook Requires Additional LAO Solutions. Since we still fundamentally disagree with the across–the–board reduction approach laid out by the administration, we continue to offer an alternative budget to the Legislature—but one that includes additional solutions to address the worsening problem. The major differences between the administration and our updated plan are summarized in Figure 10. The sharp decline in the revenue outlook required us to make even more difficult choices than our earlier proposal. Still, we maintained our basic approach of protecting core services and not proposing broad–based tax rate increases. Our alternative provides a balanced budget in 2008–09, ending the year with a $1 billion reserve.

Figure 10

Major Differences Between Governor’s Budget and LAO Alternative |

Governor’s Budget |

LAO Alternative |

Lottery and Borrowing |

|

$15 billion in proceeds from lottery securitization. |

$5.6 billion in proceeds from lottery securitization, with dramatically less risk to schools’ share of existing lottery profits. |

Borrows $564 million from state special funds

to be repaid in the next few years and defers mandate reimbursements to local governments. |

Rejects special fund loans and funds mandate payments. |

Budget Reform |

|

Cap on revenues received in any year, with automatic across-the-board reductions in bad budget years. |

Builds on existing Budget Stabilization Account to increase reserve deposits in good times. |

Reduces budget flexibility by imposing new budget restrictions and eliminating the authority to suspend Proposition 98. |

Rethinks existing budgetary formulas to ensure they reflect current state priorities. |

Revenues |

|

$21 million from change to use tax on out-of-state vessels and vehicles. |

$3.3 billion from 11 changes to tax credits, deductions, and exemptions. |

$1.9 billion paper shift to accrue 2009‑10

revenues to earlier years. |

Rejects accrual proposal. |

Proposition 98 |

|

Ongoing programmatic funding of $56.8 billion. |

Provides $900 million more in programmatic ongoing funding ($57.7 billion). |

Health and Social Services |

|

Many reductions to service levels. |

Generally maintains service levels at their July 1, 2007 level—rejecting many of the administration’s proposals. |

Criminal Justice |

|

Summary parole proposal to eliminate active

supervision of parolees. |

Changes crimes from wobblers to misdemeanors and

implements earned discharge policy for parolees. |

10 percent reduction to local public safety

subventions. |

Eliminates or reduces subvention programs outside of the state’s core responsibility. |

No major change in state-local responsibilities. |

Realignment of parole responsibilities to counties, with

sufficient funding to pay for shifted costs. |

Resources |

|

Generally reduces General Fund program

funding by 10 percent. |

Increased use of fees and bond funds to maintain program services. |

General Government |

|

Provides 5 percent pay raise for correctional

officers (though not explicitly funded). |

No pay raise for correctional officers, as current compensation levels are sufficient to meet labor needs at this time. |

Our toughest decision was whether to include a modified lottery securitization proposal. As described in more detail below, we have included a securitization that would provide the General Fund with $5.6 billion in revenues over two years. It represents a type of borrowing and, therefore, runs counter to our February approach. Yet, in the end, we felt more comfortable with that approach rather than a broad–based tax rate increase or deeper program reductions. There were three main reasons we ultimately included the lottery securitization:

- At a much lower amount, the lottery securitization places a significantly lower risk on education’s lottery funding.

- The borrowing was of a future, new revenue stream—enhanced lottery profits—resulting from voter–approved program changes. As such, debt–service payments would not be coming from existing General Fund revenues which are committed to current programs.

- With the infusion of one–time funds in 2008–09 and 2009–10, we were able to maintain a balanced budget through 2012–13 (though precariously so in some years). By the end of our forecast period, the state would have more than a $1 billion operating balance.

Governor’s Budget Reform: Locks In Shortfall, Threatens Legislative Authority, and Complicates Budget

Flaws in the Governor’s Budget Reform Approach

Governor’s Revenue Cap Would Lock in Shortfall. Formulas, by their nature, cannot predict all future circumstances. As a result, they tend to limit, rather than increase, future policy makers’ options to craft budgets. For instance, the administration’s multiyear plan depends on $6.9 billion in lottery proceeds to balance its budget in 2009–10—the amount it projects the state will be below the ten–year revenue growth rate in that year. Under our own revenue forecast, however, the state’s economy will bounce back somewhat faster than the administration assumes—leading to higher tax revenues in 2009–10. Consequently, although the lottery securitization would raise $6.9 billion, our forecast indicates that the administration’s revenue cap would prevent more than $3 billion of this amount from being available to help the General Fund. In 2010–11, the effects of the revenue cap would be even more counterproductive. Under our forecast, due to revenue growth above the ten–year average, the state would be required to deposit revenues totaling $1.4 billion into the RSF that would otherwise go to the General Fund—despite the state facing a multibillion shortfall between revenues and expenditures in that year. Due to the Governor’s proposed formula, the state could be raising lottery proceeds to help balance the budget but would be prohibited from accessing them. The administration’s budget reforms would lock the state’s budget shortfall in place and could lead to automatic across–the–board reductions.

Midyear Reductions Would Damage Legislative Authority. As we discussed in February’s P&I (please see pages 147 through 157), the administration’s proposal to implement automatic across–the–board reductions in tough budget times is misguided for several reasons.

- Limited Effort to Set Priorities. As is the case with the administration’s budget–balancing reductions this year, the across–the–board approach fails to determine which state programs provide essential services or are most critical to California’s future. The Legislature could determine how reductions were achieved in a particular program through the passage of a contingency law. The Legislature, however, could not prioritize and determine whether some programs should be protected from any reductions or whether others should experience greater reductions.

- Loss of Legislative Authority. The proposed changes also represent a serious diminution of the Legislature’s authority. Under the State Constitution, only the Legislature can appropriate funds and make midyear reductions to those appropriations. Under the administration’s proposal, however, the Governor would have the authority to determine when across–the–board reductions would occur. Moreover, if the Legislature did not pass the contingency laws envisioned by the measure, the Governor would have the authority to waive state laws affecting the state’s core programs.

- Existing Process for Midyear Reductions Is Working. The administration has not made it clear why the existing process to make midyear reductions is not sufficient. Proposition 58 (passed by the voters in March 2004) formalized a process by authorizing the Governor to declare a fiscal emergency and call the Legislature into special session. This new process has the added component of a 45–day schedule to help ensure timely action. This process was used earlier this year and resulted in more than $7 billion in budgetary solutions and brought the 2007–08 budget back into balance. While the across–the–board mechanism envisioned by the administration could implement some reductions a few weeks earlier, it does so by denying the Legislature the opportunity to review the impacts of any proposals prior to their adoption.

LAO Alternative for Budget Reforms

Reserve Changes Can Be Much Simpler. We find the Governor’s goal of increasing reserve amounts in good fiscal times to be a critical component of true budget reform. His approach, however, suffers from serious flaws and should be rejected. Instead, we recommend that the Legislature build upon the reserve requirements established in Proposition 58. The BSA established by that measure has not had an opportunity to operate as envisioned given the state’s recent budget problems. As we laid out in the P&I, we think there are three ways to enhance its operation for the future.

- Increase Total Amount of Reserve. Currently, the BSA has a maximum balance of $8 billion. Building up to this level will take a number of years. Even so, with the state’s volatile revenue structure—where multibillion dollar swings in annual revenue forecasts are common—the Legislature should consider increasing the BSA’s maximum balance. Targeting 10 percent of annual General Fund spending as a long–term goal for building up the reserve (currently $10 billion but growing over time) would give the state a greater cushion from economic downturns.

- Make It Harder to Access Funds. Currently, the Constitution specifies that BSA funds may be accessed through any statute. The 2007–08 budget provided the authority for DOF to access the BSA balance. In the future, if the BSA funds were more difficult to access, the state might make more conservative budgetary decisions to guard against financially over committing the state. For instance, requiring the passage of a separate bill (outside of the budget bill) to access the BSA could make it more difficult to count on using BSA reserve funds in a budget plan.

- Establish Mechanism to Increase Transfers in Really Good Years. We appreciate the administration’s effort to transfer excess revenues to a reserve. The problem is determining what revenues are excess in any year and locking that definition into the Constitution. By driving off of the average growth rate, the administration’s proposal would transfer funds to the RSF in roughly one–half of the years. As an alternative, the Legislature could develop a higher threshold for determining when revenues are considered excess. The Legislature could particularly focus on those years when there is an “April surprise”—personal income tax receipts which surge well beyond the amounts predicted in the budget. When unanticipated revenues are received in April (which is nearly the end of the fiscal year), we think it would be reasonable to consider them as excess and automatically transfer them to the BSA.

Unlocking the Budget. If the Legislature chooses to use the November ballot as part of its 2008–09 budget solution, it should think broadly about budget changes. Over the past 20 years, there have been numerous propositions which have either dedicated tax revenues to specific purposes or locked in General Fund spending. The Legislature could systemically review formulas—both those passed by the voters and those enacted by the Legislature—to determine if they are still needed and continue to reflect today’s priorities. If it chose to “unlock” the state budget by repealing these types of formulas, it would gain greater flexibility in crafting the budget to meet current state priorities. In contrast, the administration’s proposal to eliminate the ability to suspend Proposition 98 would take away one of the Legislature’s tools to respond to a budget crisis.

A Slimmed Down and More Responsible Lottery Plan

Governor’s Plan: Significant Debt and Significant Risk

$15 Billion Could Be Raised… Currently, the lottery generates $1.2 billion per year in profits, which are distributed entirely to education. Over the last ten years, these profits have grown an average of about 4 percent per year. Debt service on lottery bonds can be structured to require payments of principal in later years, thus “ramping up” the debt payments gradually over three decades. Accordingly, while debt service will eventually exceed $1.2 billion per year under the Governor’s proposal (perhaps growing to about $2 billion per year), investors probably would give the state this upfront money in exchange for (1) strong legal protections within the debt structure to ensure that they will be repaid and (2) a higher interest rate, compared to other state debt instruments.

…But by Threatening Education’s Lottery Funding. There are significant risks to education’s lottery funding in the administration’s plan. The administration’s assumed doubling of lottery sales and profits within five to ten years is a very optimistic assumption, given (1) the relatively weak performance of the lottery during its first 24 years, (2) the consistently lower per capita sales of western states, (3) other states’ experiences with similar policy changes, and (4) the wide variety of other entertainment options available for Californians, including the rapidly growing tribal casino sector. We assess the risk that education would receive less than the planned $1.2 billion deposit in some future years as very high under the Governor’s proposal. When we instead estimated lottery profits assuming per capita sales rise to only about 80 percent of the national average through 2020, our projections indicated that these profits would be around $2 billion in 2019–20, compared to over $2.8 billion in the more conservative of two financial models presented by the administration. In addition, we have concerns about the administration’s estimates about the percentage of lottery sales that could be realized as profits due to optimistic assumptions about prizes and lottery operating expenses (including marketing and retailer incentives). Accordingly, based on these factors and review of other states’ experiences with similar policies, we believe that our lower estimates of future sales and profit growth are much more reasonable than the Governor’s. Based on our assumptions of the Governor’s plan, education would receive $9.4 billion of lottery funding over the first 12 years of the plan—instead of the $14.4 billion assumed by the administration.

LAO’s Overall Assessment. The Governor has raised the issue of improving sales performance of the California Lottery. His plan involves many policy choices beyond those related to the budget. We acknowledge that using some one–time proceeds from a lottery securitization may be a reasonable way to help balance the budget, given the severity of the current fiscal problem. Our major concern with the Governor’s plan, however, is that it makes overly optimistic and potentially unobtainable assumptions about the ability of the lottery to increase its profits. Therefore, there is a very strong likelihood that distributions to public education would fall well short of the $1.2 billion per year targeted by the administration, and this could result in new spending pressures for the General Fund.

LAO Alternative: A More Responsible Lottery Plan

Less Use of One–Time Monies to Balance the Budget. In contrast to the Governor’s proposal to deposit up to $15 billion to the reserve over the next three years, our alternative would use $2.8 billion in 2008–09 and an additional $2.8 billion in 2009–10 to help balance the budget. (Accounting for reserves, the total bonds issued might exceed $8 billion.) Figure 11 compares the Governor’s plan and our alternative lottery securitization proposal.

Figure 11

Comparing the Governor’s Lottery Plan and the LAO Alternative |

Issue |

Governor’s Plan |

LAO Alternative |

Improving the Lottery’s Ability to Increase Sales |

|

Proposed measure on

November 2008 ballot |

Give Lottery Commission more flexibility to set prize payout percentages, design games, market their products, and manage operations. |

Same as Governor’s plan, plus

requirements for transparency and legislative oversight of lottery sales and management. |

Addressing the State Budget Problem |

|

Funds deposited to reserve for use by General Fund |

|

|

—2008‑09 |

$5.1 billion |

$2.8 billion |

—2009‑10 |

$6.9 billion |

$2.8 billion |

—2010‑11 |

$3 billion |

— |

Use of any excess lottery

revenues |

Directs excess revenues to the new reserve. |

Legislature could direct excess

revenues to any priority it chooses. |

Likelihood that excess lottery funds will eventually be available for other uses |

Low—due to the size of the bond

issuance. |

Moderate to strong due to the smaller bond issuance. |

Effects on Education Lottery Funding |

|

Status of education payments in securitized bond structure |

Subordinate to debt service payments. |

Subordinate to debt service

payments. |

Amount available to education

after debt service |

Up to $1.2 billion per year. |

Up to $1.2 billion per year. In addition, the Legislature could direct excess lottery funds to education

or another public purpose. |

LAO estimate of payments to

education through 2020a |

|

|

—Assuming that per capita lottery sales approach the national

average |

$14.4 billion |

$14.4 billion, and more if Legislature designates excess funds for

education. |

—Assuming that per capita sales are only about 80 percent of

national average |

$9.4 billion |

$14.4 billion, and more if Legislature designates excess funds for

education. |

Risks to Investors |

|

|

Likelihood of investors receiving payments in full and on time |

Strong |

Virtually certain, with minimal credit risk. |

Backup Plan if Lottery Securitization Does Not Proceed |

Backup plan |

Temporary 1 percent sales tax in effect until end of 2010‑11 or until certain reserve targets are met. Subsequent rebates to residents. |

Temporary 1 percent sales tax in

calendar-year 2009 only. No

rebates provision. |

|

a Based on administration’s debt service model, adjusted for size of required borrowings. Assumes borrowing of funds for costs of issuance,

required reserves, and additional reserves to increase the likelihood of making planned payments to education as lottery sales ramp up. Like

the administration’s forecast model, assumes linear growth pattern for lottery revenues with little volatility. |

Much Less Risk for Education’s Current Distributions From the Lottery. The LAO alternative—by having much lower debt service payments—dramatically reduces the risk that education would experience substantial reductions in its $1.2 billion annual payments from the lottery. Under the Governor’s plan, education receives this annual distribution only if per capita lottery sales grew from under 50 percent of the national average to a level approaching 100 percent over the next five to ten years. Under the LAO alternative, we estimate that education would receive this payment each year even if per capita lottery sales grow to only about 80 percent of the national average.

Other Proposed Changes. In addition, we propose that voters authorize the Legislature to appropriate excess lottery funds—above those needed to pay debt service to bondholders and meet the $1.2 billion annual payment obligation—to any public purpose. The Legislature, therefore, would have the option of appropriating additional funds to education if excess lottery moneys emerged (after accounting for needed cash flow reserves to address potential volatility in the revenue stream). Given the significantly expanded flexibility granted the Lottery Commission under both our proposal and the Governor’s, we also propose that voters require the lottery’s administrative funds—including marketing monies, retailer commissions, and payments to problem gambling treatment and prevention efforts—to be appropriated by the Legislature. Currently, the commission controls its own administrative budget outside of regular budgetary controls.

Backup Plan if Lottery Securitization Is Delayed or Rejected. Crafting a budget plan that relies on an affirmative vote by voters in November is inherently risky. The administration’s approach of having a backup plan, therefore, makes sense. While the specifics of such an approach would be technically difficult to craft (including how to address Proposition 98 minimum funding guarantee interactions), we think a sales tax increase is a reasonable choice for a contingency plan. We would limit such a tax increase to calendar year 2009.

LAO Alternative for Proposition 98

As with every sector of the state budget, the drop in estimated General Fund revenues for 2008–09 makes building the education budget more challenging. The most substantial change to our alternative budget presented in February entails reducing ongoing Proposition 98 support by about $600 million but then offsetting the entire drop using Public Transportation Account monies to cover the Home–to–School Transportation program. This allows us to retain essentially the same level of ongoing programmatic support for K–14 education as in February while providing the ancillary benefit of eliminating the legal risk entailed in the administration’s treatment of the PTA monies. We also retain our approach of making more targeted reductions as compared to the Governor’s approach of across–the–board reductions. Below, we discuss our revised K–14 budget plan in more detail and compare it to the Governor’s revised plan. As listed in Figure 12, we believe our alternative has several benefits relative to the Governor’s plan.

Figure 12

From Education’s Perspective,

LAO Plan Has Several Benefits |

|

Ongoing programmatic support in 2008‑09 about $900 million higher than under Governor’s plan. |

Ongoing programmatic support in 2009‑10 about $300 million higher due to higher prior-year funding level. |

LAO alternative makes targeted reductions based on the merits of programs rather than reducing virtually all K-14 programs regardless of their merit. |

LAO alternative supports existing programs rather than making deeper cuts to ramp up new programs. |

LAO Alternative Provides Substantially More for Ongoing Program in 2008–09 Compared to Governor’s Plan. As shown in Figure 13, including PTA monies, our revised plan provides $57.7 billion for K–14 education in 2008–09, the same level as we recommended in February. This is about $900 million more in ongoing programmatic support compared to the Governor’s plan. As with the Governor’s May Revision plan, our alternative funds the Proposition 98 minimum guarantee, thereby eliminating the need for suspension. Our estimate of the guarantee is about $300 million higher than under the Governor’s May Revision due to differences in our revenue projections and revenue recommendations. (Importantly, our estimate of the 2008–09 minimum guarantee is higher even though we recommend going down to the guarantee in 2007–08, discussed in more detail below.)

Figure 13

Comparing May Revision and LAO Alternative for 2008‑09 K-14 Education Funding |

(In Millions) |

|

May Revision |

LAO

Alternative |

Difference |

Ongoing Programs |

|

|

|

Proposition 98 |

$56,796 |

$57,110 |

$314 |

Public Transportation Account |

— |

593 |

593 |

Totals |

$56,796 |

$57,703 |

$907 |

LAO Alternative Also Provides More for Ongoing Program in 2009–10. As a result of having a higher ongoing Proposition 98 spending level in 2008–09, our alternative likely would provide more funding for K–14 education in subsequent years. This is because the minimum guarantee for 2009–10 is calculated based on the amount of ongoing Proposition 98 spending the state provides in 2008–09. Thus, spending $300 million more in 2008–09 results in a roughly $300 million increase in the 2009–10 funding requirement. In short, our alternative would provide more ongoing program support not only in the budget year but for several years thereafter. It would not, however, have permanent ramifications for the state, as funding under both the Governor’s and our plan would reach the same level in a few years.

LAO Alternative Continues to Take More Strategic Approach to Building Budget. In our February alternative, we recommended several targeted reductions in order to cover the cost of funding K–14 growth adjustments and K–14 mandates. We used the same approach in building our revised budget. Although our alternative continues to provide $57.7 billion in ongoing programmatic support, workload cost increases require further reductions. Specifically, net growth–related costs for K–12 revenue limits and child care have increased roughly $230 million. Whereas the Governor’s May Revision essentially addresses these cost increases by cutting the same amount from the K–12 deferred maintenance program, we recommend reductions in other areas that we believe would have less adverse impact. Specifically, we recommend eliminating the High Priority Schools Grant Program (which a recent evaluation found to be ineffective) and making a one–time partial reduction to the instructional materials block grant (of roughly $100 million)—achieving roughly the same total level of savings. In tandem with the reduction for instructional materials, we recommend allowing school districts to delay the purchase of new textbooks for one year. Given the instructional materials block grant would retain about $300 million in funding, schools still would be able to replace lost or worn textbooks.

LAO Alternative Requires Additional Current–Year Action. As mentioned above, our alternative requires going down to the Proposition 98 minimum guarantee in 2007–08. Without such action, the minimum guarantee for 2008–09 would be higher under our alternative (given our revenue recommendations) and would require suspension under our alternative. We estimate the Proposition 98 funding requirement for 2007–08 is $864 million less than the current spending level. We recommend three actions to adjust Proposition 98 spending down to the minimum guarantee. Specifically, we recommend using $409 million in PTA monies to support Home–to–School Transportation. This simply requires the state to score the funds differently, without any effect on school districts in either the current or budget year. It also is consistent with our recommended treatment of PTA monies in the budget year, thereby eliminating any potential legal risks. To further adjust spending downward, we recommend recognizing $305 million in unspent funds, almost entirely from the After School Safety and Education program. Finally, we recommend designating $150 million of existing spending as a “settle–up” payment. Such action allows the state to prepay its 2008–09 obligation, thereby freeing up a like amount of General Fund savings. All three recommended actions are consistent with our February approach in that none affects the amount of funding schools are receiving for current operations.

Across Two Years, Plans Provide About the Same Amount of Total Support. Although we think comparing support for ongoing program is most appropriate, Figure 14 compares all funding for ongoing and one–time activities included under the Governor’s plan and our alternative. As shown in the figure, the two plans provide about the same level of total support for K–14 education in 2007–08 and 2008–09. Relative to the Governor’s plan, we provide substantially more ongoing support and substantially less one–time support in the budget year. As noted above, this has important out–year implications. (It also should be noted that the reduction of the $450 million related to the Quality Education Investment Act is a one–time deferral rather than an elimination of the payment.)

Figure 14

LAO K-14 Alternative Provides Greater

Ongoing Funds Compared to May Revision |

(In Millions) |

|

2007‑08 |

|

2008‑09 |

|

Governor |

LAO |

|

Governor |

LAO |

Ongoing Programs |

|

|

|

|

|

|

Proposition 98 |

$56,576 |

$55,712 |

|

$56,796 |

$57,110 |

Public Transportation Account |

— |

409 |

|

— |

593 |

Subtotals |

($56,576) |

($56,121) |

|

($56,796) |

($57,703) |

One-Time Activities |

|

|

|

|

|

Quality Education Investment Acta |

$300 |

$300 |

|

$450 |

—b |

Settle-up payment |

— |

150 |

|

150 |

— |

One-time Proposition 98 |

— |

305 |

|

503 |

$210c |

Other |

— |

— |

|

6 |

36d |

Subtotals |

($300) |

($755) |

|

($1,109) |

($246) |

Totals |

$56,876 |

$56,876 |

|

$57,905 |

$57,949 |

|

a Seven-year program. |

b Reflects one-time deferral rather than elimination of payment. |

c Provides $100 million for Emergency Repair Program, $63 million for child care, and $47 million for community colleges (to backfill part of the current-year local property tax shortfall). |

d Provides $30 million from the Public School Facility Review Revolving Fund and $6 million in excess student fee revenue to backfill the remainder of community colleges' current-year local property tax shortfall. |

Details of Updated LAO Alternative

In February, we proposed more than $17 billion in solutions to close the state’s projected shortfall at that time. In some cases, those solutions are no longer viable. In others, the estimated savings have changed. These changes totaling a few hundred million dollars to our February proposals are provided on our Web site www.lao.ca.gov. In the appendix of this publication, we list the new solutions that we offer to close the additional budget gap. In addition to our lottery proposal, we have included additional solutions totaling several billion dollars, including:

- Redirecting transportation funds to the General Fund in a similar manner as the May Revision (over $700 million).

- A two–year suspension of net operating loss deductions ($664 million more than our February proposal to limit deductions to 50 percent of net income).

Conclusion

The Legislature faces a monumental challenge in developing a balanced 2008–09 budget. As it does so, it must also pay particular attention to closing the state’s ongoing structural mismatch between revenues and spending for future years. All available solutions involve consequences and tradeoffs. We believe that our alternative to the May Revision offers a more balanced and realistic approach.

|

Appendix

LAO Alternative Budget: Additional Savings Proposals |

(In Millions, Scored From Governor’s Workload Budget)a

|

|

|

|

Issue

|

2007–08

|

2008–09

|

|

K–14

|

|

|

Redevelopment—Capture prior–year underreported redevelopment pass–through payments.

|

—

|

$70.0

|

A State Controller’s Office audit found that (1) some redevelopment agencies have not made required pass–through payments to K–14 districts and (2) some K–14 districts have not reported these sums as property taxes. We recommend (1) redevelopment agencies be required to pay overdue sums and

(2) K–14 districts modify their reporting to offset the state’s last five years of increased costs.

|

|

|

Redevelopment—Modify redevelopment pass–through process to ensure funds are provided and reported on an ongoing basis.

|

—