January 14, 2008

(See Elizabeth Hill's Webcast)

2008-09: Overview of the Governor’s Budget

The Governor’s budget proposes more than $17 billion in budget solutions to bring the state’s 2008–09 budget into balance. In this document, we provide our initial assessment of the administration’s proposals and advise the Legislature on how to approach the special session to address the state’s fiscal emergency.

Summary

Budget Gap Addressed Through Borrowing and Spending Reductions

To close an estimated $14.5 billion budget shortfall, the administration proposes more than $17 billion in corrective actions, including:

- Issuing more deficit–financing bonds ($3.3 billion).

- Suspending a supplementary payment in 2008–09, which would have helped pay off outstanding deficit–financing bonds ($1.5 billion).

- Accruing tax revenues received in 2009–10 to 2008–09 ($2 billion).

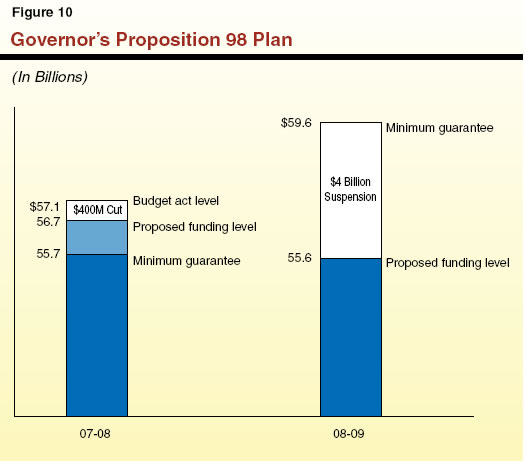

- Reducing K–14 education spending in the current year ($400 million) and suspending the Proposition 98 minimum guarantee in 2008–09 ($4 billion).

Reducing spending in most other state programs ($4 billion).

LAO Comments

Generally Reasonable Numbers From the Governor. The administration’s revenue forecast is generally reasonable, though it has some downside risk from recent cash trends and continued negative economic reports. The budget’s spending proposals also generally are built upon solid assumptions about caseload and program requirements.

All State Programs Are Not Equally Important. While the administration’s approach of across–the–board reductions has the appeal of fairness, it reflects little effort to prioritize and determine which state programs provide essential services or are most critical for California’s future. The risk with the administration’s approach is that—by attempting to preserve most funding for most programs—many programs end up operating in a less than optimal manner and provide lower quality services to the public.

Revenue Solutions Should Be Expanded. In the context of the amount of corrective actions that are proposed, the administration’s ongoing revenue–raising proposals are minimal. The Legislature should identify additional revenue solutions, including tax expenditures (such as tax credits or deductions) that can be modified or eliminated, and/or costs that can appropriately be supported by user and regulatory fees.

Balancing Cash Demands With Programmatic Impacts. The administration’s efforts to improve the state’s cash balance make sense in light of the state’s sluggish economy and continued uncertainty about revenue receipts on a month–to–month basis. Yet, the Legislature will have to balance a number of the proposals against the programmatic impacts from delaying payments to school districts and local governments.

Budget Reform Proposals Are Flawed. The proposed budget reforms represent a serious diminution of the Legislature’s appropriation authority. In addition, the proposals would limit future policy makers’ options to craft budgets.

Missed Opportunity on Proposition 98. In the current year, the administration loses a critical opportunity to achieve additional budgetary flexibility by not reducing education spending to the Proposition 98 minimum guarantee. We identify a way to do this without affecting current school operations.

LAO Bottom Line

The Governor has put forward an aggressive agenda for the special session and the 2008–09 budget. The Legislature should focus first on those areas where time is of the essence—where early decisions will allow state programs to achieve desired savings in the current year. The special session should also be used to lay the groundwork for achieving budget–year savings—for instance, by developing any program restructurings and taking any necessary actions on the current–year Proposition 98 minimum guarantee. In contrast to the Governor’s approach of across–the–board reductions, in our view the Legislature should (1) eliminate or further reduce low–priority programs in order to minimize the impact on higher priority programs and (2) examine additional revenue options as part of a more balanced approach. Making tough choices now will allow the state to move closer to bringing its long–term spending and revenues into alignment.

Budget Overview

A declining economic outlook, sagging revenues, and rising costs have created bleak prospects for the state’s current– and budget years. The Governor identified a gap of $14.5 billion between revenues and expenditures and proposes more than $17 billion in current and budget–year solutions to bring the state’s budget back into balance. These budget–balancing actions include the issuance of additional deficit–financing bonds, higher revenue accruals, and budget reductions across most state programs. A number of these proposals would require legislative action in the current fiscal year, which led the Governor to declare a fiscal emergency under the State Constitution and call the Legislature into special session. The Governor also has a number of proposals to improve the state’s cash position.

Total Revenues and Spending

The Governor’s budget proposes General Fund state spending in 2008–09 of $101 billion. After accounting for the administration’s proposals to change the 2007–08 budget, General Fund expenditures are projected to decline from $103.4 billion in 2007–08 (a drop of 2.3 percent). On the other hand, General Fund revenues are projected to grow from $100.8 billion to $102.9 billion (an increase of 2.1 percent).

General Fund Condition

Figure 1 shows the General Fund’s condition from 2006–07 through 2008–09 under the Governor’s budget’s assumptions and proposals. The current fiscal year is estimated to have begun the year with a reserve of $3.5 billion. With proposed expenditures of $2.6 billion more than revenues, the Governor’s budget projects ending 2007–08 with a reserve of less than $1 billion. For the budget year, various budget–balancing proposals would allow the state to grow the reserve to $2.8 billion.

Figure 1

Governor’s Budget General Fund Condition |

(Dollars in Millions) |

|

|

|

Proposed for 2008‑09 |

|

Actual 2006‑07 |

Proposed 2007‑08 |

Amount |

Percent

Change |

Prior-year fund balance |

$9,898 |

$4,372 |

$1,757 |

|

Revenues and transfersa |

95,887 |

100,758 |

102,904 |

2.1% |

Total resources available |

$105,785 |

$105,130 |

$104,661 |

|

Expenditures |

$101,413 |

$103,373 |

$100,998 |

-2.3% |

Ending fund balance |

$4,372 |

$1,757 |

$3,663 |

|

Encumbrances |

$885 |

$885 |

$885 |

|

Reserve |

$3,487 |

$872 |

$2,778 |

|

Budget Stabilization Account (BSA) |

472 |

— |

— |

|

Reserve for Economic Uncertainties |

3,015 |

872 |

2,778 |

|

|

a Display of revenues related to the BSA is different than the administration. The 2006‑07 amount includes $472 million and 2007‑08 amount

includes $1.023 billion in General Fund revenues received in those years and transferred to the BSA. The administration instead shows the

entire $1.494 billion as 2007‑08 revenues, when the funds were transferred back to the General Fund. |

How the Budget Covers the Shortfall

Comparison of the Problem Definition to Our November Forecast. In November, we estimated that, under current–law revenues and expenditures, the state would need $9.8 billion in solutions to bring the 2008–09 budget into balance. In contrast, the Governor’s budget has identified a problem of $14.5 billion. On the revenue side of the budget, the administration’s revenue forecast is significantly below our estimates from two months ago. This reflects the continuing deterioration of the state’s cash collections and economic outlook. Specifically, as shown in Figure 2 (see next page), the administration’s revenue forecast through the current year is more than $1 billion below our November forecast, and the 2008–09 amount is $2.8 billion below our forecast. (These numbers also reflect that the administration expects $500 million from the sale of EdFund in 2007–08 while we expected the sale to occur in 2008–09.)

Figure 2

How the Governor’s Budget Closes the 2008-09 Shortfall |

(In Millions) |

|

Reserve as of

June 30, 2008 |

LAO November Forecast |

-$9,790 |

Lower Administration Revenue Forecast |

|

2006-07 and 2007-08 |

-$1,166 |

2008-09 |

-2,781 |

Higher Administration Spending Forecast |

-$742 |

Administration’s Definition of Shortfall |

-$14,479 |

Budget Solutions |

|

Reduce Proposition 98 spending |

|

2007-08 reduction |

$400 |

Suspend 2008-09 minimum guarantee |

4,825a |

Issue additional deficit-financing bonds |

3,313 |

Accrue 2009-10 revenues to 2008-09 |

2,001 |

Suspend transfer to Budget Stabilization Account |

1,509 |

Reduce Medi-Cal spending |

1,126 |

UC/CSU reductions (unallocated) |

569 |

CalWORKs reforms |

463 |

Early release of prisoners and summary parole |

372 |

Suspend SSI/SSP COLAs |

323 |

Other solutions |

2,356 |

Governor’s Budget Estimate of 2008‑09 Reserve |

$2,778 |

|

Note: Positive numbers help the reserve and negative numbers hurt the reserve. |

a The administration proposes a $4 billion suspension. Due to the way it built its baseline budget, it shows savings of a somewhat higher amount. |

Regarding expenditures, the administration’s estimate of overall baseline spending is slightly higher—$742 million combined over all years—than our forecast. Some of the key differences are the administration (1) showing lower property taxes over multiple years (driving higher General Fund Proposition 98 spending) and (2) including its higher education compacts as part of its baseline costs. Both forecasts accounted for rising costs from a lost teachers’ retirement lawsuit, the Southern California wildfires, and the administration’s proposal to provide correctional officers with a 5 percent raise (as part of imposing its last contract offer on the union). We will be updating our revenue and expenditure forecasts in February as part of our The 2008–09 Budget: Perspectives and Issues (P&I) publication.

Budget Solutions. To address this $14.5 billion problem, the Governor’s budget includes more than $17 billion in solutions. Figure 2 summarizes the major components of the Governor’s solutions (using the administration’s estimates of the solutions). Described in more detail later in this report, the major components are:

- More Deficit–Financing Bonds and Slower Repayment. Using its existing authority, the administration plans to issue $3.3 billion in additional deficit–financing bonds in the current year. The administration also plans to suspend the 2008–09 transfer to the Budget Stabilization Account (BSA), which suspends a $1.5 billion supplemental debt–service payment on deficit–financing bonds.

- Revenue Accrual. The budget adds $2 billion in 2008–09 personal income and corporation tax revenues by accruing dollars that are currently reflected as 2009–10 revenues.

- Spending Reductions. The budget proposes spending reductions across most areas of state government, including a $4 billion suspension of Proposition 98 in the budget year.

Components of the Governor’s Budget Plan

Economic and Revenue Projections

Economic Forecast—Sluggish Growth Through 2008

The economy throughout 2007 exhibited somewhat mixed performance, but appears to have ended the year on a very soft note. Recent job gains for both the nation and state, for example, appear to have been quite weak, while turmoil in housing markets and high energy prices continued to drag down overall growth. The budget’s economic forecast for the remainder of 2007–08 and 2008–09 is for subdued economic performance. Both the national and California economies are expected to experience slower growth in 2008 than in 2007—especially in the earlier parts of 2008—followed by somewhat better but still modest growth in 2009. Continuing problems in the housing sector and high energy prices will be the main forces holding down growth.

Key Forecast Data. The administration’s revised economic forecasts for both the nation and state are softer than the May Revision economic forecast upon which the 2007–08 Budget Act relied.

- For the nation, the Governor’s budget forecasts that real gross domestic product growth will slow from 2.1 percent in 2007, to 1.9 percent in 2008, before strengthening to 2.9 percent in 2009. Regarding national employment, it predicts job growth will drop from a weak 1.3 percent in 2007, to only 0.8 percent in 2008, and then increase to 1.2 percent in 2009.

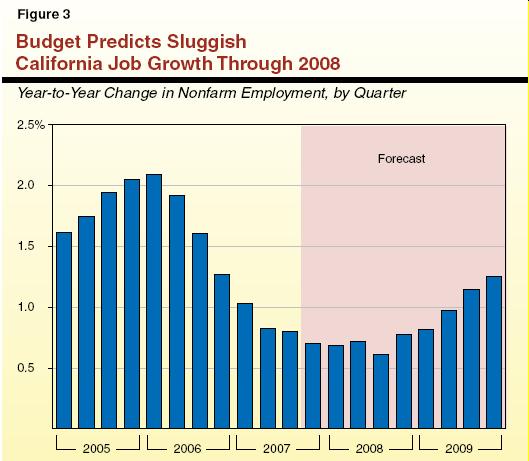

- For California, personal income growth—the broadest single measure available of the state’s overall economic activity—is predicted to slow from 5.6 percent in 2007, to 4.8 percent in 2008, and then firm up a bit to 5.2 percent in 2009. Job growth is expected to drop from only 0.8 percent for 2007, to 0.7 percent for 2008, and then drift up to 1 percent for 2009. New housing permits in the state are expected to be very soft—only 95,000 in 2008, compared to an average of more than 160,000 annually for the past ten years. Figure 3 shows the predicted quarterly pattern of California job growth.

The Revenue Forecast—Down Substantially

The budget estimates revenues of $95.9 billion in 2006–07 (2.6 percent growth), $100.8 billion in 2007–08 (5.1 percent growth), and $102.9 billion in 2008–09 (2.1 percent growth). For the three years combined, these revenues are down by $3.8 billion from the 2007–08 Budget Act estimate. The current–and budget–year amounts reflect the combination of recent cash trends, the revised economic outlook, and $5.5 billion in revenue–related proposals.

Cash Has Been Weak. Reflecting weaker economic performance than was previously forecast, tax–related cash receipts during the first six months of 2007–08 fell far short of what was assumed in the 2007–08 Budget Act. For example, through December, combined receipts from the largest three taxes were down $1.7 billion from the budget act, which itself had assumed only modest growth. Although income tax withholding has been running somewhat ahead of expectations, other income tax payments, corporate tax payments, and sales and use tax revenues have all come up short.

Underlying Multiyear Revenues Down $9.3 Billion. Incorporating this cash shortfall along with its revised, more subdued economic forecast, the administration’s new revenue projections for the prior, current, and budget years combined are down—absent policy changes—by $9.3 billion. This includes $6.4 billion for personal income taxes, reflecting such factors as slower projected personal income growth and lower capital gains and stock–option income. It also includes $2.9 billion for sales and use taxes, which in part reflects the depressed housing sector.

$5.5 Billion in Revenue–Related Proposals. To partially make up for these economics–driven revenue declines, the administration is proposing $5.5 billion in revenue–related proposals. These would leave its estimated revenues for the prior, current, and budget years combined down $3.8 billion from the enacted budget. The administration’s proposals include:

- Accruing $2 billion in 2008–09 from the portion of personal income tax ($1.2 billion) and corporation tax ($0.8 billion) estimated payments associated with June activity and paid in September 2009. These revenues currently are counted as 2009–10 revenues.

- Increased revenues of about $150 million in 2008–09 and growing amounts thereafter from augmenting the Franchise Tax Board’s (FTB’s) and the Board of Equalization’s (BOE’s) tax enforcement and compliance activities.

- Reinstatement of the 12–month rule for applying the use tax to out–of–state purchases of vehicles, vessels, and aircraft, to generate $5 million in 2007–08 and $21 million in 2008–09.

The administration also proposes to issue $3.3 billion in additional deficit–financing bonds, which is discussed below.

Deficit–Financing Bonds

The administration proposes two solutions regarding the state’s deficit–financing bonds. Combined, these proposals would provide the state with $4.8 billion in budgetary solutions on a one–time basis—with higher costs of a like amount (plus interest) in the future. Both of these actions are within the administration’s control and would not require legislative action. The administration estimates that these two actions will delay paying off the bonds by more than two years, until the summer of 2012.

Issuing $3.3 Billion. Propositions 57 and 58, passed by the voters in 2004, authorized the state to sell up to $15 billion in deficit–financing bonds. In essence, the voters allowed the state to borrow money to pay off a portion of the state’ budget debts (as of the end of 2003–04). After the passage of the measures, the state raised $11.3 billion from these bonds. The administration now proposes to raise an additional $3.3 billion in 2007–08 from issuing more bonds.

Suspending BSA Transfer. The basic mechanism for the repayment of the bonds is the “triple flip” which diverts one–quarter of a cent of local sales tax revenues to debt payments. (The local revenues are replaced on a dollar–for–dollar basis through the property tax, which in turn increases General Fund spending on education.) The triple flip is expected to make a $1.5 billion payment towards bond debt in 2008–09. In addition, Proposition 58 provided that a supplementary payment for debt service would be made annually equal to one–half of the funds deposited into the BSA (the other half is used as a budget reserve). The BSA is scheduled to receive $3 billion in 2008–09. Under the Constitution, however, the Governor is authorized to suspend the annual transfer. The administration plans to suspend the 2008–09 transfer—reducing 2008–09 expenditures by $1.5 billion by not making the supplementary bond payment.

Special Session— Current–Year Savings

Under Proposition 58, if the budget’s revenues and/or spending substantially change in a negative way, the Governor may declare a fiscal emergency and call the Legislature into special session to address the emergency. On January 10, the Governor called a special session for the current budget problem. Under Proposition 58, if the Legislature does not send the Governor at least one bill to address the fiscal emergency by the 45th day after the declaration, it cannot act on other legislation. The Governor has made a number of substantial proposals for the Legislature’s consideration. We describe the key proposals with current–year savings below and summarize them in Figure 4. The administration is also seeking early legislative action on a number of budget–year proposals which we describe later in this report.

Figure 4

Special Session Proposals With Current-Year Savings |

(In Millions) |

|

Amount of Savings |

|

2007‑08 |

2008‑09 |

Proposition 98 spending reduction |

$400 |

— |

Medi-Cal delayed provider payments |

165 |

— |

CalWORKs reforms |

74 |

$389 |

Medi-Cal provider rate reduction |

33 |

602 |

SSI/SSP June 2008 COLA suspension |

23 |

271 |

Early release of prisoners and summary parole |

18 |

354 |

Various other proposals |

104 |

800a |

Totals |

$817 |

$2,416 |

|

a LAO estimate. |

Proposition 98

For the current year, the Governor proposes to reduce total Proposition 98 funding for K–12 schools and California Community Colleges (CCC) by roughly $400 million. As shown in Figure 5 (see next page), Proposition 98 funding would decline from the 2007–08 Budget Act level of $57.1 billion to $56.7 billion.

Governor Proposes to Reduce Current–Year Proposition 98 Spending, but Not Down to Minimum Guarantee. As described above, the administration’s estimate of state tax revenues in the current year is significantly lower than what was assumed when the budget was enacted. As a result, the administration’s estimate of the Proposition 98 minimum guarantee also has dropped. The estimated minimum guarantee is now almost $1.5 billion lower than the Proposition 98 budget act funding level. The Governor’s budget proposes to reduce current–year Proposition 98 spending by $400 million—leaving spending more than $1 billion above the required funding level. The proposed reduction is made to K–12 and CCC apportionments ($360 million and $40 million, respectively). The administration, however, has stated that it hopes to identify one–time funds that could partly backfill those reductions, thereby lessening the impact on apportionments.

Decline in Local Property Tax Revenue Raises General Fund Obligation. Figure 5 also shows the proposed change in Proposition 98 funding by source. Even with the Governor’s proposal to reduce current–year spending by $400 million, General Fund spending for Proposition 98 still increases by almost $230 million. This is because of a reduction in local property tax revenue—a decline of $645 million compared to what was assumed when the budget was enacted. The bulk of this decline is due to an overestimate of property taxes in 2006–07, with the discrepancy carrying forward into the current year. Because school property taxes generally offset the General Fund share of Proposition 98 funding, the downward adjustment results in an automatic increase in General Fund spending.

Figure 5

Governor Proposes Midyear Proposition 98 Reduction |

(Dollars in Millions) |

|

2007‑08 |

|

Change |

|

Budget Act |

Revised |

|

Amount |

Percent |

K-12 education |

$50,797 |

$50,423 |

|

-$374 |

-0.7% |

California Community Colleges |

6,209 |

6,167 |

|

-41 |

-0.7 |

Other agencies |

119 |

119 |

|

-1 |

-0.6 |

Totals |

$57,125 |

$56,709 |

|

-$416a |

-0.7% |

General Fund |

$41,479 |

$41,707 |

|

$229 |

0.6% |

Local property tax revenue |

15,646 |

15,001 |

|

-645 |

-4.1 |

|

a Of this amount, $400 million reflects the Governor's proposed reduction to K-12 revenue limits ($360 million) and California Community Colleges apportionments ($40 million). The remaining $16 million is due to technical adjustments that would have occurred automatically. |

Detail may not add due to rounding. |

Social Services

CalWORKs Reform Package. The Governor proposes California Work Opportunity and Responsibility to Kids (CalWORKs) changes which (1) result in net savings of $74 million in 2007–08 and $389 million in 2008–09, and (2) increase the state’s work participation rate. Key elements include:

- Graduated Full–Family Sanction. Currently, when an adult does not comply with program requirements, the family is sanctioned by eliminating the adult portion of the grant (about 19 percent). The Governor proposes to increase this sanction to 50 percent of the remaining child–only grant after six months in sanction status, and completely eliminate the family’s grant after another six months elapses, unless the adult comes into compliance.

- Time Limits for Aided Children. Currently, after five years of aid, a family’s grant is reduced by the adult portion and the children receive a “child–only” grant in the safety net program. Effective June 1, 2008, the Governor proposes to eliminate the children’s safety net grant unless their parent(s) meet federal work participation requirements. This five–year time limit also applies to most other child–only cases.

- Work Incentive Nutritional Supplement. Effective July 2009, the budget proposes to provide $40 per month in additional food coupons to families who are receiving Food Stamps and meeting federal work participation requirements, but are not currently receiving CalWORKs.

Cost–Of–Living Adjustments (COLAs) for Cash Grants. The Governor proposes to delete the June 2008 state COLA for Supplemental Security Income/State Supplementary Program (SSI/SSP) recipients. This results in savings of $23 million in 2007–08 and $271 million in 2008–09. (The administration also proposes deleting the June 2009 SSI/SSP COLA, which would reduce 2008–09 costs by another $29 million.) The budget reflects the pass–through of the federal COLAs in January 2008 and January 2009. The budget provides the July 2008 CalWORKs COLA ($131 million).

Medi–Cal

Provider Payment Reductions. The budget proposes current–year General Fund savings of $33 million, growing to $602 million in the budget year from reducing provider rates for Medi–Cal. The savings would be achieved through a 10 percent provider payment reduction to most fee–for–service providers (generally physicians). Medi–Cal managed care plans would also be reduced.

Delay Payments to Providers. The state generally makes weekly payments to Medi–Cal fee–for–service providers to reimburse them for the claims they have submitted. The budget plan proposes to permanently delay payments to Medi–Cal providers at the end of the year for a one–time General Fund savings of $165 million. The providers would receive this payment instead in the budget year.

Corrections and Rehabilitation

Early Release of Prisoners and Summary Parole. The budget plan identifies initial savings of almost $18 million in 2007–08 that would exceed $758 million by 2009–10 from (1) the release up to 20 months early from prison of offenders who do not have violent or serious or certain sex crimes on their record and (2) no longer actively supervising such offenders on parole. The administration estimates that, at full implementation of these proposals, about 35,000 fewer prison beds would be needed and 28,000 fewer offenders would be under state parole supervision.

Other Reductions

The Governor’s proposals also include a number of other smaller reductions to various programs which would reduce 2007–08 expenditures by more than $100 million. These reductions would affect various programs primarily in the health and social services areas. Once these reductions are annualized for 2008–09, the reductions would generate an estimated $800 million.

Additional Budget–Year Proposals

For 2008–09, the Governor’s budget assumes full–year savings from the reductions proposed to be adopted in the special session. In addition, the budget proposes further reductions to most areas of the state budget.

Key programmatic features of the proposed 2008–09 budget—including program reductions, spending augmentations, and revenue changes—are summarized in Figure 6.

Figure 6

Key Programmatic Features of the Governor's 2008‑09 Budget |

|

Special Session Reductions |

• Continues program reductions proposed for the special session, including CalWORKs reforms, the suspension of SSI/SSP COLAs, cuts to Medi-Cal provider rates, and the early release of prisoners and summary parole. |

Proposition 98 |

• Suspends the minimum guarantee by $4 billion. |

Higher Education |

• Reduces General Fund support for UC and CSU by $197 million from the current-year level. Most of these reductions would be unallocated and more than offset by student fee increases. |

• Provides no funding for new participation in the competitive Cal Grant programs. |

Transportation |

• Transfers $1.485 billion in gasoline sales tax revenues from the General Fund to the Transportation Investment Fund, as required by Proposition 42. |

• Provides $455 million in “spillover” gasoline sales tax revenue in the Mass Transportation Fund to (1) pay $354 million in debt service on transportation bonds and (2) repay $83 million in prior Proposition 42 transportation loans owed by the General Fund. |

Health |

• Eliminates specified Medi-Cal optional benefits for adults over the age of 21 who are not in a nursing facility. |

• Ends continuous Medi-Cal eligibility for children and restores quarterly status reports for children and parents. |

Social Services |

• Reduces county allocations for child welfare services and foster care grants by approximately 10 percent. |

• Reduces IHSS hours for domestic services (meal preparation, cleaning, errands) by 18 percent. |

Criminal Justice |

• Shifts $2.2 billion of bond financing approved in 2007 for construction of prison beds and reentry facilities to the Receiver for health beds. Also provides funding to build a new Death Row complex at San Quentin. |

• Provides some new funding to Receiver to improve inmate medical care, but no unallocated reserve. |

General Government |

• Raises $105 million from a new surcharge on fire insurance policies statewide to supplant General Fund reductions and expand wildland firefighting under Cal-Fire, Office of Emergency Services, and Military Department. |

• Proposes financing the costs of the $1.6 billion Financial Information System for California (FI$Cal), a computer project to modernize the state’s budgeting and accounting systems. |

• Reduces ongoing contribution to CalSTRS in exchange for guaranteeing existing inflation protection benefit, and spreads court-ordered interest payment over three years. |

• Contains funds for the administration’s proposed 5 percent pay raise for correctional officers in 2007‑08, but no new funds for salary increases for state workers whose labor contracts expire at the end of 2007‑08. |

• Shifts about $75 million in mandate reimbursements to local governments in 2009‑10. |

Infrastructure |

• Proposes $48 billion in new general obligation bonds to be put before the state’s voters in 2008 and 2010, for education, water, high-speed rail, and court facilities. |

Revenues |

• Raises $21 million by reinstating recent use tax law changes related to vehicles, vessels, and aircraft. |

• Augments tax agencies by $44 million from the General Fund to increase revenues by $151 million. |

• Accelerates the accrual of $2 billion in tax revenues from 2009‑10 to 2008‑09. |

• Assumes $430 million in General Fund revenues from tribal gambling compacts. |

Budget Reductions

As described in more detail below, the administration’s implementation of budget reductions can be categorized into four main types. The net result of the proposed $9 billion in reductions is summarized by program area in Figure 7.

Figure 7

General Fund Spending by Major Program |

(Dollars in Millions) |

|

|

|

Proposed 2008‑09 |

|

Actual 2006‑07 |

Estimated 2007‑08 |

Amount |

Percent Change |

Education |

|

|

|

|

K-12 Proposition 98 |

$37,264 |

$37,473 |

$35,461 |

-5.4% |

Community Colleges

Proposition 98 |

4,030 |

4,116 |

4,027 |

-2.2 |

UC/CSU |

5,883 |

6,231 |

6,035 |

-3.1 |

Other |

4,120 |

6,027 |

5,587 |

-7.3 |

Health and Social Services |

|

|

|

|

Medi-Cal |

$13,406 |

$14,064 |

$13,585 |

-3.4% |

CalWORKs |

2,018 |

1,481 |

1,547 |

4.5 |

SSI/SSP |

3,534 |

3,641 |

3,748 |

2.9 |

In-Home Supportive Services |

1,474 |

1,630 |

1,633 |

0.2 |

Other |

8,580 |

8,762 |

8,786 |

0.3 |

Youth and Adult Corrections |

$9,118 |

$10,096 |

$10,268 |

1.7% |

Transportation |

$2,980 |

$1,439 |

$1,485 |

3.3% |

All Other |

$9,007 |

$8,414 |

$8,837 |

5.0% |

Totals |

$101,413 |

$103,373 |

$100,998 |

-2.3% |

Exempt Programs. The administration chose to exempt a number of expenditure programs from its reductions. These programs include debt service, retiree health costs, the Proposition 42 transfer for transportation, most retirement contributions, tax collection agencies, state mental health hospitals, emergency fire

suppression, and capital outlay spending. In total, these exemptions account for well over $10 billion in annual state spending.

Specific Policy Proposals (About $3 Billion). In order to generate savings in a number of areas, the administration proposes significant policy and/or funding changes to the way in which programs operate. These proposals have a policy rationale and specific mechanisms to achieve the savings. Some examples include the suspension of COLAs, the CalWORKs reform proposals, and the early release of prisoners.

Across–the–Board–Reductions (About $5 Billion). In a number of other departments, the proposed reductions tend to be evenly distributed across all of a department’s programs. The largest example of this type of across–the–board reduction is Proposition 98, where revenue limits and categorical programs are generally cut by about 10 percent. In some cases, the administration identifies how these reductions will be achieved. In other cases, the approaches to generate the savings are less clear.

Unallocated Reductions (About $1 Billion). For constitutional officers (such as the Attorney General and State Controller), branches of government (the Legislature and the courts), and the university systems (University of California [UC] and California State University [CSU]), the administration chose not to allocate the reductions (typically 10 percent). Instead, these entities would be left to determine the nature of the reductions on their own. As such, the programmatic effect of the reductions is not estimated by the administration.

Proposition 98

Figure 8 displays the Governor’s budget–year proposal for Proposition 98. For 2008–09, the Governor’s budget provides $55.6 billion in total K–14 Proposition 98 funding. This reflects a drop of almost $1.1 billion compared to the Governor’s revised current–year proposal. This equates to a reduction of roughly 2 percent. The entire year–to–year reduction is reflected by K–12 education. In contrast, community colleges would receive a slight increase ($55 million, or 0.9 percent). The community college augmentation is due largely to higher apportionment funding relating to the Governor’s proposals to restore the current–year apportionment cut and accommodate additional enrollment growth (which more than offset the proposed reductions to categorical programs).

Figure 8

Proposition 98 Budget Proposal for 2008‑09

$1.1 Billion Less Than 2007‑08 |

(Dollars in Millions) |

|

2007-08

Revised |

2008-09

Proposed |

Change |

|

Amount |

Percent |

K-12 Education |

$50,423 |

$49,310 |

-$1,112 |

-2.2% |

California Community Colleges |

6,167 |

6,223 |

55 |

0.9 |

Other agencies |

119 |

106 |

-12 |

-10.2 |

Totals |

$56,709 |

$55,640 |

-$1,069 |

-1.9% |

General Fund |

$41,707 |

$39,593 |

-$2,114 |

-5.1% |

Local property tax revenue |

15,001 |

16,046 |

1,045 |

7.0 |

Proposed General Fund Cut Partly Offset by Projected Increase in Local Property Tax Revenue. Also shown in the figure, General Fund support of Proposition 98 would decline by $2.1 billion, or 5.1 percent, from the Governor’s revised current–year proposal. This drop is partly offset by a projected $1 billion, or 7 percent, year–to–year increase in local property tax revenue.

Governor Proposes to Suspend Proposition 98 Minimum Guarantee in 2008–09. The administration proposes to suspend Proposition 98 in 2008–09 and provide about $4 billion, or 6.7 percent, less than its estimate of the minimum guarantee. Suspending Proposition 98 requires the Legislature pass a separate piece of legislation by a two–thirds vote. Suspension has taken place only once since Proposition 98 was enacted—in 2004–05. While suspending the minimum guarantee would allow the Legislature to fund K–14 education at whatever level it chooses in 2008–09, Proposition 98 contains a requirement that the base K–14 funding level be restored in future years.

Governor Proposes 10.9 Percent General Fund Reduction From Workload Budget. The Governor’s proposal for K–14 education is built off a “workload” budget, generally assuming both growth and COLA adjustments (although specific growth factors vary by program and some programs do not receive COLAs). The administration then reduces the General Fund share of the workload budget for apportionments (K–12 and CCC) and each categorical program by 10.9 percent. For programs that receive increases in local property tax support (including apportionments and special education), the General Fund reduction is partly offset. To achieve part of the reduction, the budget provides no COLAs to K–12 and CCC programs in 2008–09. The remaining cuts generally would be achieved by reducing existing funding rates or program participation.

Deficit Factor and New COLA Index. Consistent with past practice, the administration proposes to restore the reduction to K–12 revenue limits when funding becomes available in future years. This would be done through a “deficit factor.” Once funding had been restored and the deficit factor eliminated, revenue limit funding would be up to the level it otherwise would have been absent the proposed reductions. The administration does not propose a deficit factor for community colleges. The administration also proposes to change the statutory COLA index used for most K–12 programs (and, traditionally, about one–half of community college programs) from the state–local deflator to the California Consumer Price Index for Wage Earners and Clerical Workers (CA CPI–W). The administration believes the CA CPI–W would better reflect education–related expenses, as employee compensation accounts for the vast majority of schools’ operating expenses. The proposal would have no immediate effect in 2008–09 (given no COLA is proposed).

Cash Management

Due to the continued decline in the state’s revenue outlook, the administration has expressed concerns with the state’s ability to meet its cash demands, in addition to its budgetary demands. Budget solutions—such as the issuance of an additional $3.3 billion in deficit–financing bonds or suspending COLAs—help with the state’s cash management by adding revenues or reducing spending. To create an additional cushion for the state’s cash obligations, the administration has proposed special session legislation to implement a series of delays in the timing of normal state payments. In particular, these are designed to increase the amount of cash–on–hand in July and August 2008, in case of a late budget and/or before the state can issue revenue anticipation notes. Since these proposals shift funds from one month to another within a fiscal year, these cash management proposals—totaling $4.7 billion and summarized in Figure 9—do not affect the state’s budget reserve for any given year.

Figure 9

Key Proposals to Improve State’s Cash Balance |

(In Millions) |

Proposal |

Benefit |

Proposition 98 |

|

• Delay deferred apportionments for K-12 schools and community colleges by two months. |

$1,300 |

Social Services |

|

• Delay program disbursements by two months. |

$814 |

CalSTRS |

|

• Pay July inflation protection program costs in two installments—November and April. |

$584 |

Transportation |

|

• Delay gas tax disbursements to local governments by one to five months. |

$500 |

Medi-Cal |

|

• Delay checks for certain providers of medical services from August until September. |

$454 |

• Delay managed care and dental payments by one month. |

232 |

• Delay first quarter payment for county administration by one to two months. |

164 |

Developmental Services |

|

• Delay regional center advances. |

$400 |

Mental Health |

|

• Delay managed care advance by two months. |

$200 |

Early and Periodic Screening, Diagnosis, and Treatment |

|

• Delay quarterly advance to counties by two months. |

$92 |

Total |

$4,740 |

Budget Reforms

The Governor proposes that a constitutional amendment be put before the state’s voters related to the state’s budgeting process. The Governor has identified two problems with the state’s current system:

- The state does not save enough during good economic times and is, therefore, ill–prepared for swift deteriorations in revenues.

- Spending formulas make it too difficult to slow spending during bad economic times.

The constitutional amendment—the actual language of which is not yet available—would attempt to address these two areas, as described below.

New Reserve. The Governor proposes creating a third state reserve (in addition to the Special Fund for Economic Uncertainties and BSA) to be called the Revenue Stabilization Fund (RSF). The RSF would receive revenues from the General Fund of any amount over the average long–term trend of revenue growth rate. In any year in which revenue growth was below the average, transfers could be made back to the General Fund. Unlike the current BSA, the Legislature could not make transfers back to the General Fund due to a fiscal emergency.

Unilateral Executive Power to Cut Spending. In addition, the proposal would give the Governor new powers to make program reductions when he predicts the state will be in a budget deficit. Depending on the severity of the deficit, reductions would be either 2 percent or 5 percent on an annualized basis. The Governor also seeks legislation that would allow him to make reductions to the services of statutory entitlement programs.

LAO’s Initial Assessment of the Governor’s Proposals

In this section, we provide our initial reaction to various aspects of the Governor’s budget proposals.

Economic and Revenue Forecasts Appear Reasonable, but Some Downside Risk

Negative Recent Economic News. The administration’s forecast for subdued economic growth is consistent with the current consensus view of economists. However, exactly how soft the economy will be is less clear. Since the administration’s economic forecast was prepared in November, there have been some particularly negative economic reports in such areas as job growth suggesting that the economy might be weaker than previously thought. The profits outlook also has dimmed a bit. This raises the possibility that economic performance in 2008 might prove to be even weaker than the budget is forecasting. There will be some particularly important economic data coming out prior to when we release our February 2008–09 P&I, such as estimates of how the nation’s economy performed in the fourth quarter of 2007 and how California job growth did in December. While the administration’s current economic forecast is not unreasonable, these data may help clarify whether the administration’s economic forecast should be adjusted further downward.

Some Downward Revenue Risks. Our initial reaction is that the administration’s revenue projections appear to be generally consistent with its underlying economic forecast. We do have some preliminary concerns, however, about the strength of the revenue numbers. For instance, there was a nearly $600 million December shortfall in corporate tax receipts. The administration’s cash projections appear to rely on this amount being largely recouped in March 2008 when final payments are due. Based on past trends, this is an aggressive assumption. Another concern is whether the recently reported softness in certain economic data like job growth will eventually necessitate lowering the economic and revenue forecasts.

More Information Soon. Cash receipts during the next few weeks will provide the state with a clearer picture of revenue trends. January is a huge revenue month—second largest of the year—with $11.6 billion in receipts projected, including $8.3 billion from the personal income tax. During this period, the state will be receiving payments related to the fourth quarter estimated taxes from individuals, which are due on January 15. Historically, the strength in these payments has often been an early indicator of the strength or weakness in final payments that are remitted in April. We will be reviewing the upcoming collections and other new economic and revenue information for purposes of making a more complete assessment of the administration’s revenue outlook, as well as our own forecast. Our updated projections will be included in the 2008–09 P&I released next month.

Generally Solid Budget Numbers From the Governor

Last year, we criticized the administration’s budget proposals for relying on a series of overly optimistic assumptions and ignoring some high–cost risks. Such an approach portrayed the budget’s bottom line in a better light than was prudent. In contrast, this year’s budget proposals tend to be built upon more reasonable assumptions and projections of revenues, costs, and risks. Based on our initial review, the budget generally contains solid estimates of the levels of savings identified from its reductions. In addition, the administration’s plan recognizes that some proposals need to be implemented early in order to generate a full year’s worth of savings for 2008–09. As was the case at the time of our November 2007 forecast of the state’s budget outlook, the state faces a number of legal and other risks. For instance, there is a current legal challenge to the 2007–08 budget’s policy of redirecting transportation funds for the General Fund’s benefit which accounts for almost $2 billion in budget solutions over the current and budget years.

Some Exceptions. In contrast to its generally solid estimates, some items in the Governor’s budget continue to be built on rosy assumptions. For instance, the administration’s estimate of Indian gambling revenues could be around $200 million too high over 2007–08 and 2008–09 combined (even if the state’s voters approve Propositions 94, 95, 96, and 97 on the February 2008 ballot). In addition, the administration’s proposals to reduce payments to the California State Teachers’ Retirement System (CalSTRS) suffer from the same problem as last year’s rejected proposal—they may violate active and retired teachers’ contractual rights and, therefore, be legally unworkable.

Questions About the Revenue Accrual. The administration proposes to accrue $2 billion in tax revenues into 2008–09 that are currently scored in 2009–10. The administration contends that this change is in–line with generally accepted accounting principles (GAAP). In our initial review, we have not yet been able to determine whether this proposal is a reasonable change in accounting practices or merely a convenient way to generate a one–time revenue bump. Our questions include:

- Is there a specific June liability for which it is appropriate to accrue revenues received in September?

-

Are there other revenue accruals that should be changed by following the same logic (even if it means revenue reductions)? Similarly, are there ways the administration proposes to treat expenditures (such as current and proposed treatments of Medi–Cal expenses) which would need to be changed under GAAP that would hurt the state’s bottom line?

All State Programs Are Not Equally Important

Limited Effort to Set Priorities. The administration’s approach to have virtually all programs share in the pain of balancing the budget has some surface appeal of “fairness.” Yet, it fails to differentiate between the importance of various state programs. All state programs are not equally valuable. The administration’s budget reductions reflect little effort to prioritize and determine which state programs provide essential services or are most critical to California’s future. In many cases, there appears to be no rationale or justification for the reductions (other than saving money). The risk with the administration’s approach is that—by attempting to preserve most funding for most programs—many programs end up operating in a less than optimal manner thus providing lower quality services to the public. In contrast, we would suggest that the Legislature collectively attempt to determine which programs are most important. The Legislature then should strive to minimize the budget’s impact on these higher–priority programs. In doing so, some lower–priority programs may have to be reduced by more than the Governor’s budget levels. Duplicative programs should be eliminated, and inefficient programs should be restructured or terminated.

Revenue Solutions Should Be Expanded

As noted earlier, the administration’s budget plan affects most areas of the spending side of the budget. On the revenue side, the administration makes some modest adjustments to increase revenues (beyond the one–time accrual of $2 billion in future revenues to the budget year and the issuing of additional deficit–financing bonds). For example, the administration proposes to reinstate the 12 month use tax requirement on vehicles, vessels, and aircraft, as well as to augment staff at the BOE and FTB to improve tax collections. The administration also looks to create an insurance surcharge to partially defray General Fund wildfire costs and anticipates student fees will be raised to defray proposed reductions to UC and CSU. In the context of the amount of corrective actions that are proposed, however, these ongoing revenue–related changes are minimal. As such, the Legislature should identify additional revenue solutions, including tax expenditures (such as tax credits or deductions) that can be modified or eliminated, and/or costs that can appropriately be supported by user and regulatory fees. Even without considering a broad–based tax rate increase, these alternatives offer the potential to limit the program reductions in the Legislature’s highest priority programs.

Budget Makes Progress in Closing Ongoing Shortfall

In November, our forecast showed the state continuing to face a gap between its revenues and expenditures each year through 2012–13. Specifically, we estimated the 2009–10 fiscal year faced an $8 billion shortfall, with the amounts dropping to the range of $3 billion in the following years. Virtually all of the administration’s $9 billion in spending reduction proposals are intended to be ongoing. Some factors, however, will partially offset this progress. For instance, the revenue outlook has deteriorated and the issuance of additional deficit–financing bonds and their slower pay off will push extra debt–service costs into the future. We will be updating our revenue and expenditure forecasts next month to evaluate the effect that the Governor’s proposals would have on the state’s long–term budget outlook.

Reform Proposals Are Flawed

The administration offers its budgetary reform proposals with a two–fold rationale that (1) budgetary formulas make state spending difficult to control and (2) the tendency is to not save enough when state revenues increase. While we support the administration’s intent to build up budgetary reserves in good times to help balance the state budget in bad times, we believe the proposals are flawed both in their identification of a problem statement and in their execution of a solution.

Program Spending Can Be Controlled. The Governor’s own budget proves that virtually all aspects of the state budget are controllable—if policy makers are willing to make tough choices.

Formulas Can Be Changed. If the Governor considers state formulas a problem area, the simplest solution would be to change the formulas. The administration takes this approach with proposed changes to the circumstances in which Proposition 49’s afterschool funding can be reduced and which COLA formula is used for K–14 education. It fails, however, to propose any changes to the overall minimum guarantee formula for Proposition 98 or other formulas. Instead, the administration’s approach is to take the state’s already complicated budget system and make it even more complex—with additional formulas to determine (1) when money is deposited in the new reserve and (2) when the Governor can impose spending reductions. Formulas, by their nature, cannot predict all future circumstances. As a result, they tend to limit, rather than increase, future policy makers’ options to craft budgets.

Legislature Should Maintain Its Appropriation Authority. The proposed changes also represent a serious diminution of the Legislature’s authority. Under the State Constitution, only the Legislature can appropriate funds and make midyear reductions to those appropriations. Under the administration’s proposal, the Governor would have the authority to determine when across–the–board reductions and suspensions of state law would occur.

Other Options Available. Proposition 58, passed by the voters in 2004, implemented new budgetary requirements. Given the state’s economic cycle, its provision to build up a budgetary reserve has not yet had an opportunity to fully function. If the Legislature wishes to make additional budgetary changes, it could explore alternatives to the Governor’s proposal that preserve legislative authority, such as strengthening Proposition 58’s provisions or making specific changes to existing formulas.

Missed Opportunity on Proposition 98

Figure 10 displays the Governor’s overall Proposition 98 proposal for both the current and budget year. In the current year, we think the administration loses a critical opportunity to achieve additional budgetary flexibility. In contrast to the administration’s plan to reduce spending by $400 million, we recommend the Legislature make various adjustments to reduce ongoing Proposition 98 spending all the way down to the minimum guarantee. Importantly, as we explain below, our recommended adjustments would not result in actual midyear cuts for schools or community colleges. Instead, schools and colleges would be left virtually untouched by our proposed changes—able to continue with their current–year activities as now planned. From the state’s perspective, however, such action would create more options in the budget year and offer a more realistic opportunity to avoid suspending Proposition 98 in 2008–09.

Governor’s Plan Has Several Shortcomings. Although the administration hopes to find some one–time savings in the current year, its primary approach is to make a $400 million midyear cut to K–14 apportionments. Such action translates into an actual midyear cut to K–12 schools and community colleges. Because the administration would create a deficit factor for K–12 revenue limits, such an approach also creates additional out–year cost pressure. In addition, by not making adjustments to reduce ongoing Proposition 98 spending to the minimum guarantee, the administration increases the base Proposition 98 funding requirement for 2008–09. This, in turn, increases the pressure to suspend Proposition 98 in order to balance the overall budget.

LAO Plan Has Minor Impact on Current–Year Operations. In contrast to the administration’s plan, we recommend the Legislature reduce the ongoing Proposition 98 spending level in 2007–08 to the minimum guarantee. As noted earlier, the administration’s updated estimate of the 2007–08 guarantee is almost $1.5 billion below the budget act spending level. To achieve this level of reduction, we recommend the Legislature identify as much funding as possible that likely will not be spent by the end of the current fiscal year. That is, the Legislature could (1) identify unspent prior–year monies and swap them with ongoing monies as well as (2) unappropriate unspent current–year monies. The effect of both actions would be to reduce the ongoing Proposition 98 spending level. We think the Legislature might be able to achieve as much as one–half of our recommended reduction through these means. Compared to cutting K–14 apportionments and creating a new out–year obligation, such action holds schools and community colleges harmless and does not create any new out–year obligations.

LAO Plan Reduces Existing Out–Year Obligations. To achieve the remainder of the current–year reduction, we recommend the Legislature take action relating to prior–year Proposition 98 settle–up obligations. Specifically, we recommend the Legislature designate the difference between the Proposition 98 spending level for 2007–08 and the minimum guarantee as settle–up funding. In essence, this would maintain the same level of 2007–08 school funding but reduce the amount of spending that counts toward the minimum guarantee. This is constitutionally allowable and could be specified in a trailer bill. Although such action would not yield General Fund savings in 2007–08 (because the state would continue to spend this amount on schools), the state would benefit from retiring obligations early. The action also allows the state to get down to the minimum guarantee. This, in turn, reduces the 2008–09 guarantee, which would increase the likelihood the state could balance the budget while still meeting the minimum guarantee for 2008–09.

Balancing Cash Demands With Impact on Schools and Local Governments

The administration’s efforts to monitor the state’s cash balance and take corrective actions make sense in light of the state’s sluggish economy and continued uncertainty about revenue receipts on a month–to–month basis. The state should take reasonable steps to ensure that it does not face a cash shortfall. According to the administration’s estimates, the proposed changes will allow the state to have a cash cushion of $6 billion in both July and August. While these amounts are considerably above those that have traditionally been used as a minimum prudent monthly cash reserve, they also assume the adoption of all of the Governor’s budgetary proposals in both the current and budget years. As such, the Legislature will need to monitor how its budgetary actions affect the state’s cash position. In addition, any adopted changes to help the state’s cash management will need to be balanced against the impact on school districts and local governments. The state delaying payments to these entities would reduce their own cash balances and could cause them to increase their borrowing. We have not yet had the opportunity to fully evaluate the programmatic impacts of the Governor’s proposals, which will probably vary considerably across governments by their size and fiscal health.

How Should the Legislature Approach the Governor’s Proposals?

Special Session Provides Early Opportunity to Create 2008–09 Budget Framework

The Legislature is in uncharted waters as it enters the first special session ever under Proposition 58’s fiscal emergency provision. The Governor has put forward an aggressive agenda for the special session, and the 45–day deadline to act (before affecting other legislative business) creates a short window to review the proposals. This deadline, however, can be viewed as just the first mile marker on the road to a 2008–09 budget. The Legislature does not have to decide whether to approve or reject all of the Governor’s special session proposals by this deadline. Rather, it can take some actions to address the state’s fiscal emergency by this deadline. As such, it makes sense to focus first on those areas where time is most of the essence—where early decisions will allow the most time to achieve any desired current–year savings. The special session should also be used to lay the groundwork for achieving budget–year savings—for instance, by considering any program restructurings and lowering the Proposition 98 spending as close to the minimum guarantee as much as possible.

Lay Out the Legislature’s Priorities

As always, the Legislature should make changes to the budget to reflect its own priorities—on both the spending and revenue sides of the ledger. This is particularly relevant this year because the Governor‘s budget attempts to balance the budget primarily by spending reductions and by treating programs the same. Regarding spending, the Legislature should eliminate or further reduce low–priority programs in order to minimize the impact on higher priority programs. In order to help determine which programs should receive the highest priority for limited General Fund dollars, the Legislature may wish to consider:

- Is there demonstrated evidence of a program’s cost–effectiveness?

- Can local governments or the private sector provide the services more efficiently?

- Does a program have an alternative funding source if General Fund support is reduced?

- Can recent program expansions be rolled back?

- Are there ways to slow the rate of growth for fast–growing programs?

Will a reduction result in the loss of federal or other funds?

The answers to these questions, however, should not govern in all cases. A recent program expansion is not necessarily a low priority, nor is the loss of federal funds reason alone to preserve an ineffective program. But asking these questions during legislative deliberations can help inform which areas are higher or lower priority.

Keep an Eye on the Long–Term Budget

The Governor’s budget uses a mix of both one–time and ongoing solutions to close the 2008–09 budget gap. Even if the Legislature does not approve the specific proposals suggested by the administration, this approach of mixing one–time and ongoing solutions makes sense given the nature of the state’s current financial situation. Making tough choices now will allow the state to move closer to bringing its long–term spending and revenues into alignment.

|

Acknowledgments

This report was prepared by

Michael Cohen with help from many others in the office. The Legislative Analyst's Office (LAO) is a nonpartisan

office which provides fiscal and policy information and advice to the Legislature. |

LAO Publications

To request publications call (916) 445-4656. This report and others, as well as

an E-mail subscription service , are

available on the LAO's Internet site at www.lao.ca.gov. The LAO is located at 925

L Street, Suite 1000, Sacramento, CA 95814.

|

Return to LAO Home Page