Ballot Pages

A.G. File No. 2018-004

August 21, 2018

Pursuant to Elections Code Section 9005, we have reviewed the proposed constitutional and statutory initiative (A.G. File No. 18-0004, Amendment #1) that would create a new statewide tax on sugar-sweetened drinks.

Background

Taxes on Sugar-Sweetened Drinks

Four California Cities Tax Sugar-Sweetened Drinks. Albany, Berkeley, Oakland, and San Francisco levy excise taxes on nonalcoholic sugar-sweetened drinks. These taxes require businesses to pay one cent for every fluid ounce of sugar-sweetened drinks that they distribute to retailers within city limits. The taxed drinks include soda, energy drinks, sports drinks, sweetened teas, and fruit drinks containing less than 100 percent juice. For the four cities combined, these taxes currently raise an estimated $25 million per year.

State Bans New Local Taxes on Sugar-Sweetened Drinks. A law passed by the Legislature and signed by the Governor on June 28, 2018 prohibits other local governments from enacting new excise taxes on sugar-sweetened drinks. The law also prohibits local excise taxes on many other types of food and drinks. This ban on local food and drink taxes ends on January 1, 2031.

State Health Programs

Health Care Programs. The state administers several programs that provide health care coverage to Californians. Through these health care programs, the state pays for the treatment and prevention of medical and dental conditions, including diseases linked to sugar-sweetened drinks, such as heart disease, obesity, diabetes, and dental disease. Medi-Cal, which provides health care coverage to more than 13 million low-income Californians, is the state’s largest health care program, with a total budget of $104 billion ($37 billion state and local) in 2018-19. Other state programs that fund health care include the California Public Employees’ Retirement System (CalPERS), which pays for health insurance coverage for state and local government employees and their dependents, and the California Health Benefit Exchange (Covered California), where low-income individuals can obtain subsidized health insurance coverage. (In 2017, CalPERS provided coverage for 1.4 million people, with premiums totaling $8.9 billion, a large share of which was paid by state and local governments. Roughly 1.2 million Californians are expected to obtain insurance through Covered California in 2018-19, with $6 billion in projected federal subsidies.)

Disease Prevention and Other Public Health Programs. The state administers a variety of programs that address diseases linked to sugar-sweetened drinks. These programs are intended to reduce consumption of unhealthy foods and drinks, increase access to healthy foods and clean drinking water, prevent and reverse diseases, and fund research. These programs are run by numerous state departments, including the Department of Public Health, the Department of Education, the University of California, the Department of Social Services, the Department of Food and Agriculture, and the Water Resources Control Board. Most of their funding comes from federal funds and state special funds.

State Spending Limit

Proposition 4 of 1979 added to the State Constitution annual limits on state and individual local government spending. These limits apply to the appropriation of all tax revenues, unless specifically exempted in the constitution.

Proposal

Statewide Tax on Sugar-Sweetened Drinks

This measure creates a new two-cent-per-ounce statewide excise tax on sugar-sweetened drinks starting July 1, 2021. It sets aside up to 5 percent of the revenue for the California Department of Tax and Fee Administration to administer the tax and up to $400,000 per year for the California State Auditor to conduct financial audits of the agencies that receive revenue from the tax.

After paying for tax administration and audits, the remaining funds would be spent as follows:

- 82 Percent for Health Care. This money would be spent on existing programs that fund prevention and treatment for medical and dental diseases linked to sugar-sweetened drinks. Within these existing programs, the money would be used “to improve quality and access to health care programs.”

- 12 Percent for Disease Prevention. This money would support programs that seek to reduce consumption of sugar-sweetened drinks and to prevent diseases linked to sugar-sweetened drinks.

- 3 Percent for Access to Healthy Foods and Water. This money would pay for improving access to fruit, vegetables, and clean drinking water.

- 3 Percent for Research. This money would fund research on diseases linked to sugar-sweetened drinks.

The measure states that these funds shall supplement and not supplant existing funds.

Other Major Provisions

Lets Local Governments Tax Nonalcoholic Drinks. The measure amends the State Constitution to allow local governments to tax nonalcoholic drinks. This constitutional provision would override the aforementioned ban on local food and drink taxes.

Exempts New State Revenues From State Spending Limit. The measure amends the State Constitution to exempt the measure's revenues and spending from the state's constitutional spending limit. (This constitutional exemption is similar to ones already in place for prior, voter-approved excise taxes.)

Fiscal Effects

New State Revenue

Sources of Revenue Uncertainty. The amount of revenue from the new statewide tax would depend on a variety of factors, including:

- Consumption Prior to Tax. The current level of sugar-sweetened drink consumption in California is uncertain due to data limitations. The level of consumption in 2021—when the tax would go into effect—is even more uncertain.

- Response to Tax. The tax likely would raise retail prices of sugar-sweetened drinks by 15 percent to 25 percent on average. As a result, consumers would buy fewer sugar-sweetened drinks. Some of the programs funded by the tax could further reduce consumption of these drinks. The magnitude of the resulting drop in consumption likely would be in the range of 15 percent to 35 percent.

New Revenue of Roughly $2 Billion to $3 Billion in 2022-23. In light of the uncertainties noted above, revenues could fall within a wide range. We estimate that the new tax would raise roughly $2 billion to $3 billion in revenue annually, beginning in 2022-23.

Revenue Likely Somewhat Lower in 2021-22. The statewide tax would go into effect on July 1, 2021. In anticipation of the new tax, consumers and retailers likely would stockpile sugary drinks—buying more drinks shortly before July 1, and fewer drinks shortly after. This stockpiling effect likely would make revenue in the first year of the tax—2021-22—somewhat lower than revenue in 2022-23.

Effects on State Spending

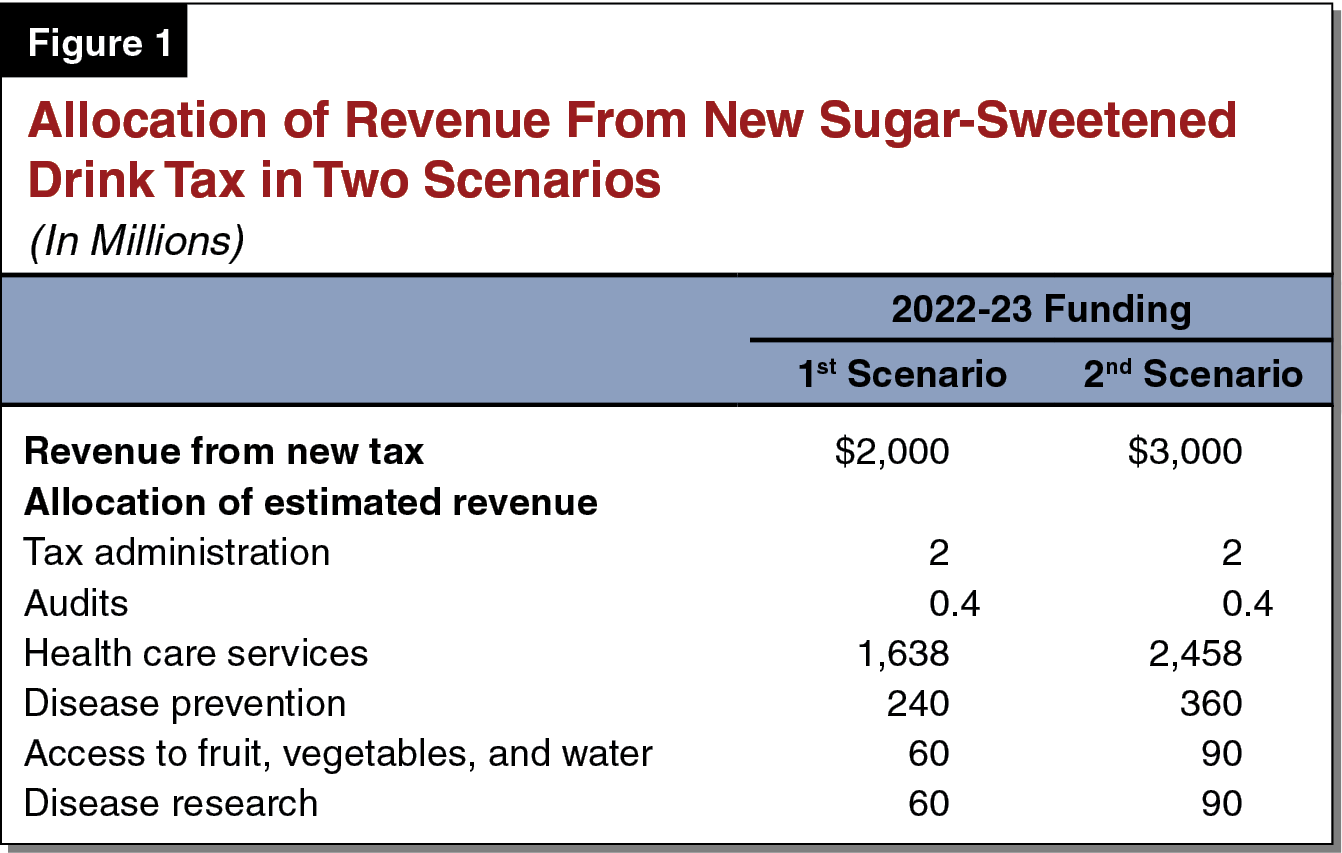

Funds Could Go to Various Departments and Programs. Figure 1 (see next page) shows how 2022-23 revenue from the new tax would be spent in two plausible revenue scenarios: $2 billion and $3 billion. Although the measure sets aside fixed portions of the new revenue for specified purposes, it does so in general terms. As a result, the state could allocate the funding across departments and programs in a variety of ways, depending on decisions made by the Legislature and by the Governor in the annual state budget process.

New Revenue Would Go Primarily to Health Care. In the first scenario shown in the figure, $1.6 billion of the $2 billion in new tax revenue would go to health care in 2022-23. In the other scenario, health care programs would receive $2.5 billion of the $3 billion total. These health care programs could include, for example, the Medi-Cal program.

New Spending for Other Designated Purposes. The measure would increase state and local spending on disease prevention; disease research; and access to fruit, vegetables, and water, likely by hundreds of millions of dollars per year.

Spending on Tax Administration Likely Much Lower Than 5 Percent. Although the measure allows up to 5 percent of the revenue to be used for tax administration, we estimate that the amount of ongoing spending would be much lower—in the short term, roughly $2 million per year.

Changes in Local Revenues

Potential Revenue Increases. The measure would allow local governments to enact taxes on nonalcoholic drinks. To the extent that local governments enact such taxes, local tax revenues would increase. The amount of new revenue would depend on the number of local governments that enact these taxes and on the policy choices they make (such as the tax rate).

Revenue Reductions in Four Cities. As noted above, the new statewide tax would reduce consumption of sugar-sweetened drinks. This drop in consumption would reduce local tax revenue in the four cities that currently levy similar taxes. For the four cities combined, the reduction in annual revenue likely would total several million dollars.

Other Effects

The measure could affect many other aspects of state and local finances, particularly:

- Effects on Health Care Spending. As noted above, the measure would reduce consumption of sugar-sweetened drinks. It also would affect other health-related behaviors, such as consumption of other foods and drinks. The new tax payments and new state and local spending also could affect Californians’ health. The effects on people who face the greatest health risks could be different from the effects on people who face the lowest health risks. The resulting net effect on state and local health care spending is highly uncertain.

- Effects on Tax Revenue. The measure would change the choices made by consumers, which could have a variety of economic effects. These effects, along with the health effects described above, would affect income tax and sales tax revenues. The net effect on these revenues is also highly uncertain.

Summary of Fiscal Effects

This measure would have the following major fiscal effects:

- Increased state revenues starting in 2021-22. Annual revenues would be roughly $2 billion to $3 billion by 2022-23. The measure designates these revenues for health care; disease prevention; disease research; and access to fruit, vegetables, and water.