Fiscal Outlook Uses New Model. This post briefly describes our new model for estimating taxable sales—the tax base for the sales and use tax (SUT), a major source of revenue for state and local governments. We used this model to produce SUT revenue estimates for our recently released Fiscal Outlook publication. The model generates estimates of taxable sales based on five economic variables. (These estimates exclude some categories of taxable sales, such as transportation fuels and certain purchases made over the Internet.)

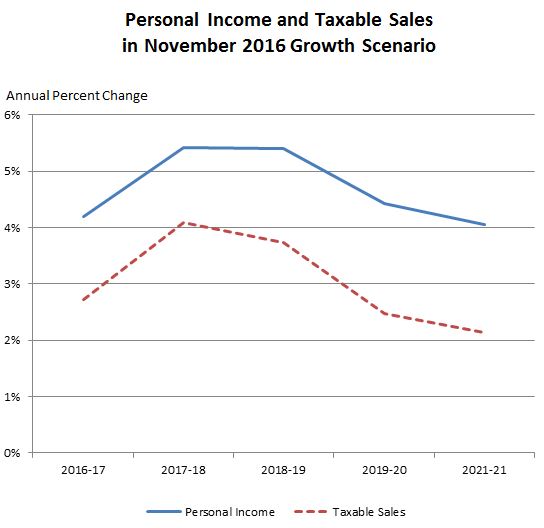

California Economic Variables. Three of the variables in the model are measured at the state level: personal income, employment, and the median price of single-family homes. The model uses future values of these variables from our office’s economic scenarios for California. The figure below shows annual growth in personal income—the most important variable in the model—in the economic growth scenario from the Fiscal Outlook, along with estimated growth in taxable sales in that scenario. As shown in the figure, the model tends to generate taxable sales growth rates that move up and down along with growth in personal income. At the same time, taxable sales grow more slowly than personal income throughout the scenario, consistent with the trend over the last few decades.

U.S. Economic Variables. The model includes two national-level variables: household net worth and household cash flow. These variables reflect the fact that consumers’ purchasing power depends not only on their current income, but also on wealth, credit, and other factors. Although these variables do not measure California’s economic conditions directly, some statistical methods indicate that they are nevertheless quite useful for estimating state-level taxable sales. The model uses future values of these variables from scenarios created by Moody’s Analytics, our office’s national economic data provider.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.