All Articles

The second "wave" of December 2014 state revenue collection information—preliminary General Fund sales and use tax (sales tax) collections—is now available. (The first wave of information concerning personal and corporate income taxes was originally posted here several days ago.)

Key Points: December Sales Tax Collections

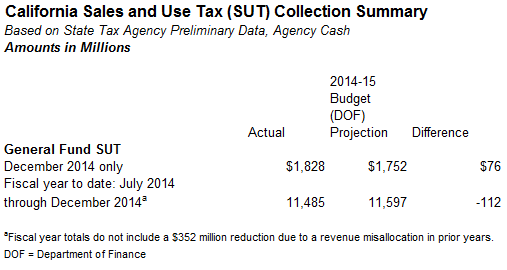

- For December, Collections 4% Above June 2014 Budget Projections. December sales tax collections were $76 million (4.3 percent) above the administration's monthly projections, which were finalized at the time the 2014-15 Budget Act was passed in June.

- For Fiscal Year to Date, Collections Near Budget Forecast. Halfway through the 2014-15 fiscal year, state sales tax collections for the fiscal year to date are running close to last June's budget forecast. For the period from July 2014 through December 2014, General Fund sales tax collections for 2014-15 are $11.5 billion, roughly 1 percent below the administration's projections over that entire period. (This amount excludes a one-time $350 million accounting adjustment that occurred a few months ago to correct for a misallocation of taxes to local governments in prior years. That adjustment is expected to be booked to prior fiscal years in the state budgetary accounting system, thereby not directly affecting 2014-15 revenue totals.)

- "Big Three" State Revenues for Fiscal Year to Date Well Above Projections. As we noted earlier this week, combined personal and corporate income taxes were $3.6 billion above the administration's June 2014 budget act projections for the 2014-15 fiscal year through December. Sales taxes are $112 million below the June 2014 budget forecast for the same period. Combined, therefore, these "Big Three" taxes (the state General Fund's three largest revenue sources) are now about $3.5 billion above last June's budget projections at the halfway point of the 2014-15 fiscal year. As we discussed in our earlier post on income taxes, the strong December results increase the chances that 2014-15 revenues will be billions of dollars above our November 2014 projections, with virtually all of those extra revenues expected to go to schools and community colleges.

- New Administration Revenue Projections Expected on Friday. The Governor will introduce his proposed 2015-16 state budget plan on Friday. At that time, as usual, it is expected that updated administration revenue estimates will include new monthly projections, including ones that "true up" prior months' revenue totals to amounts actually received. Accordingly, revenue data after the Governor's budget introduction will not be directly comparable to figures discussed in this note.

Revenue Tracking: By the Numbers

Methodology

- Agency Cash Is Preferred Method to Track State Budgetary Revenue Totals. In general, the data we provide concerning monthly revenue collections is based on preliminary agency cash reports—the most timely data received from the state's tax agencies concerning their collections. Agency cash reports are used to track revenue collections compared to state budget projections. Due to timing differences, agency cash reports are not directly comparable to "Controller's cash" reports.

- Accruals Generally Not Reflected In These Reports. A fiscal year's state budget revenues also are affected by revenue accruals, which generally can not be reflected in monthly agency cash reports.

- Education Protection Account. Unless otherwise indicated, General Fund revenue collections include those for the Education Protection Account established by Proposition 30 (2012).

- Preliminary Amounts Can Change. Preliminary agency cash reports can and do change based on subsequent data reconciliations and updates.