Decline in U.S. Corporate Profits Led by Financials. Corporate profits data was released by the Bureau of Economic Analysis (BEA) today. Profits declined by less than 1 percent in 2014 to $2,090 billion, compared to $2,107 billion in 2013. According to the BEA, profits of financial corporations declined while the profits of domestic non-financial corporations rose.

Corporation Tax Revenue Forecast Unlikely to Be Revised Significantly. California businesses must pay tax on their California-source net income. The corporation tax (CT) generates about 10 percent of General Fund revenue. As part of the annual budget process, the Department of Finance and the LAO forecast corporation tax revenue for several years into the future. These forecasts are based in part on actual and predicted U.S. corporate profits. This annual decline in corporate profits will not greatly affect the most recent revenue outlook because there is not a statistically significant difference between the actual annual change in U.S. corporate profits and the change predicted by the most recent independent economic forecast underlying our models.

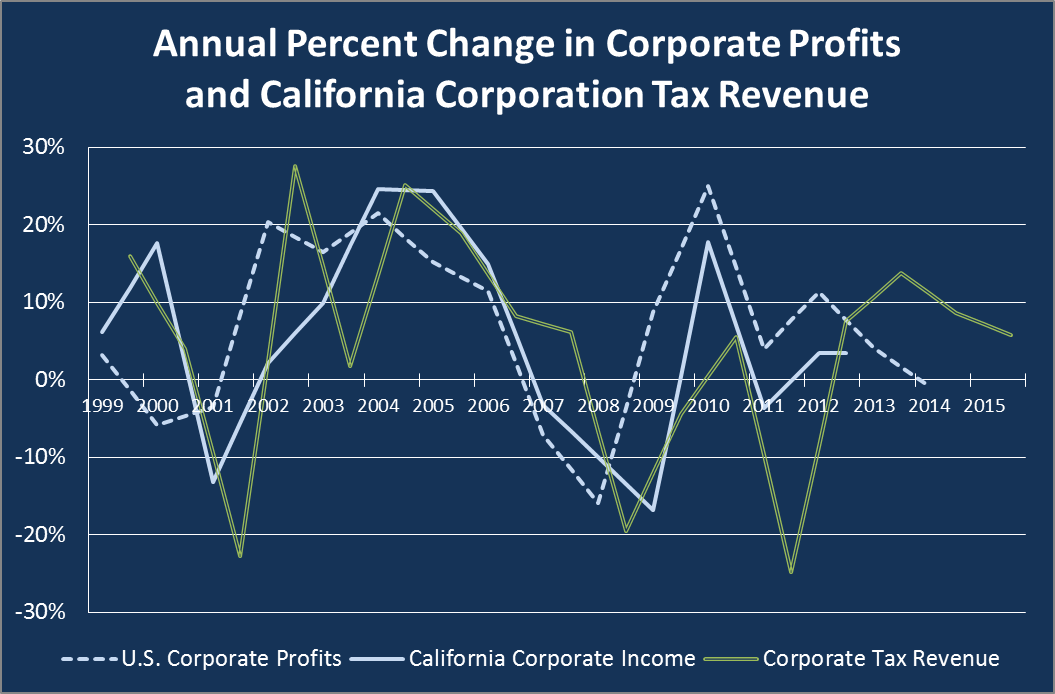

California-Source Corporate Income Correlated With National Profits. Despite important differences in calculating profits for the purpose of state income taxation and national economic accounting, the above chart illustrates how much the annual changes in the two measures of corporate profits are correlated. State fiscal year CT revenue, on the other hand, is much less closely correlated with U.S. corporate profits. Changes in CT revenue lag and, are generally more volatile, than the underlying profits because of various tax policy provisions and timing issues.