In This Report

LAO CONTACTS

Motor Vehicle Account,

California Highway Patrol,

Department of Motor Vehicles

Highway and Road Repair Needs,

Caltrans

February 23, 2016

The 2016-17 Budget

Transportation Proposals

Executive Summary

Overview. The Governor’s budget provides a total of $17 billion from various fund sources for all departments and programs under the California State Transportation Agency in 2016–17. This is an increase of $664 million, or 4 percent, over the estimated current–year expenditures. The budget includes $10.5 billion for the California Department of Transportation, $2.4 billion for the California Highway Patrol (CHP), $1.8 billion for the California High–Speed Rail Authority, $1.1 billion for the Department of Motor Vehicles (DMV), and $459 million for transit assistance. In this report, we assess the Governor’s budget proposals in the transportation area. Below, we summarize our major findings and recommendations.

Highway and Road Maintenance and Repair Needs. In order to assist the Legislature in its deliberations regarding increased funding for state highway and road repairs, we assess the costs to maintain and rehabilitate core aspects of the state highway system—pavement, bridges, and culverts—as well as local roads. We find that the state has ongoing highway repair needs of about $3.6 billion annually as well as an existing backlog of needed repairs totaling roughly $12 billion. This need is significantly higher than can be addressed through the existing funding of about $1.6 billion for these purposes.

In this report, we recommend a roadmap to assist the Legislature in ensuring that the highest priority needs are addressed first and that any additional funding provided is aligned with those needs. Specifically, we recommend the Legislature (1) make the Highway Maintenance Program the highest priority for additional funding to address the $1.1 billion in ongoing unmet needs as well as a $3 billion existing maintenance backlog, (2) make the State Highway Operation and Protection Program the next priority for additional funds, (3) determine the level of funding for local roads based on legislative priorities weighed against state highway needs, (4) align permanent funding sources with ongoing needs and temporary funding sources with one–time needs (such as addressing backlogs), and (5) adopt accountability measures to ensure that any additional funds are spent effectively.

Motor Vehicle Account (MVA) Fund Condition. The MVA, which receives most of its revenues from vehicle registration and driver license fees, primarily supports CHP and DMV. Due to expenditures outpacing revenues, the MVA has faced an operational shortfall in recent years and will continue to experience a shortfall in 2016–17, absent corrective actions. In order to address this shortfall and to support proposed new expenditures, the Governor proposes to raise the vehicle registration fee by $10 and index the fee to inflation. Under the Governor’s plan, we find that the MVA will be barely balanced over the next few years and likely face an operational shortfall in the tens of millions by 2019–20. The Legislature will need to take steps to address the ongoing shortfall in the MVA and prevent insolvency. While the Governor’s approach is one way of addressing the problems in the near term, there are alternatives to the Governor’s approach. The Legislature could adopt a mix of strategies that involve limiting spending from the MVA, increasing MVA revenues, or eliminating an existing transfer from the MVA to the General Fund. The Legislature will also want to consider the Governor’s proposals to increase MVA expenditures in the context of a larger strategy for resolving the operational shortfall in the MVA.

DMV Self–Service Terminals. The Governor’s budget proposes $8 million from the MVA on an ongoing basis to fund existing and increased costs related to expanding the use of self–service terminals—kiosks that allow DMV customers to process their vehicle registration renewal without the assistance of DMV staff and immediately receive a registration card and sticker. While the expansion of self–service terminals has merit, the Governor’s specific proposal raises concerns. We find that the administration’s plan to expand the use of self–service terminals lacks sufficient detail and that providing additional funding as proposed by the Governor is not justified. Accordingly, we recommend that the Legislature reject the Governor’s proposal and require DMV to develop a comprehensive plan for the use of self–service terminals.

Overview of the Governor’s Budget

The California State Transportation Agency (CalSTA) has jurisdiction over the state’s transportation departments and programs. These departments and programs include California Department of Transportation (Caltrans), High–Speed Rail Authority (HSRA), California Highway Patrol (CHP), Department of Motor Vehicles (DMV), State Transit Assistance (STA), California Transportation Commission (CTC), and the Board of Pilot Commissioners.

The Governor’s budget proposes a total of $17 billion in expenditures from various fund sources—the General Fund, state special funds, bond funds, federal funds, and reimbursements—for all departments and programs under CalSTA in 2016–17. This is an increase of $664 million, or 4 percent, over estimated expenditures for the current year. The increase primarily reflects the shifting of some HSRA workload and expenditures initially assumed to occur in 2015–16 to 2016–17. In addition, the budget reflects increased spending for highway and road projects in 2016–17 resulting from the first–year implementation of a transportation infrastructure funding package proposed by the Governor.

Spending by Major Transportation Programs

Figure 1 shows spending for the state’s major transportation programs and departments from selected sources.

Figure 1

Transportation Budget Summary—Selected Funding Sources

(Dollars in Millions)

|

Actual 2014–15 |

Estimated 2015–16 |

Proposed 2016–17 |

Change From 2015–16 |

||

|

Amount |

Percent |

||||

|

Department of Transportation |

|||||

|

General Fund |

$83.4 |

$84.0 |

— |

–$84.0 |

100.0% |

|

Special funds |

3,189.5 |

3,564.8 |

$4,255.5 |

690.6 |

19.4 |

|

Bond funds |

531.1 |

430.2 |

259.9 |

–170.4 |

–39.6 |

|

Federal funds |

4,226.3 |

5,712.7 |

4,737.5 |

–975.3 |

–17.1 |

|

Local funds |

1,014.9 |

1,121.1 |

1,238.1 |

117.0 |

10.4 |

|

Totals |

$9,045.2 |

$10,913.0 |

$10,490.9 |

–$422.1 |

–3.9% |

|

California Highway Patrol |

|||||

|

Motor Vehicle Account |

$2,009.3 |

$2,198.4 |

$2,241.2 |

$42.8 |

1.9% |

|

Other special funds |

177.2 |

185.1 |

136.7 |

–48.3 |

–26.1 |

|

Federal funds |

17.0 |

20.2 |

20.2 |

— |

— |

|

Totals |

$2,203.5 |

$2,403.7 |

$2,398.2 |

–$5.5 |

–0.2% |

|

High–Speed Rail Authority |

|||||

|

Bond funds |

$1,115.3 |

$269.3 |

$1,153.6 |

$884.2 |

328.3% |

|

Federal funds |

840.5 |

28.0 |

32.0 |

4.0 |

14.3 |

|

Greenhouse Gas Reduction Fund |

250.0 |

600.0 |

600.0 |

— |

— |

|

Reimbursements |

0.9 |

— |

— |

— |

— |

|

Totals |

$2,206.7 |

$897.3 |

$1,785.6 |

$888.2 |

99.0% |

|

Department of Motor Vehicles |

|||||

|

General Fund |

— |

— |

$3.9 |

$3.9 |

— |

|

Motor Vehicle Account |

$1,044.2 |

$1,090.9 |

1,060.1 |

–30.9 |

–2.8% |

|

Other special funds |

43.6 |

47.3 |

45.4 |

–1.9 |

–4.0 |

|

Federal funds |

1.4 |

2.9 |

2.9 |

— |

— |

|

Totals |

$1,089.2 |

$1,141.1 |

$1,112.2 |

–$28.9 |

–2.5% |

|

State Transit Assistance |

|||||

|

Public Transportaiton Account |

$383.9 |

$299.4 |

$315.2 |

$15.8 |

5.3% |

|

Bond funds |

668.9 |

154.0 |

44.1 |

–109.9 |

–71.3 |

|

Greenhouse Gas Reduction Fund |

24.2 |

119.8 |

99.8 |

–20.0 |

–16.7 |

|

Totals |

$1,077.0 |

$573.2 |

$459.1 |

–$114.1 |

–19.9% |

Caltrans. The Governor’s budget proposes total expenditures of $10.5 billion in 2016–17 for Caltrans—$422 million, or 4 percent, less than estimated current–year expenditures. As shown in Figure 1, Caltrans expenditures from federal funds and bond funds are assumed to decrease by $975 million and $170 million, respectively. This reflects an assumption that a greater amount of federal funds will be spent in the current year (rather than in the prior year as was previously assumed). The reduction also reflects the completion of certain Proposition 1B (2006) bond projects in the current year.

HSRA. The Governor’s budget proposes total expenditures of about $1.8 billion in 2016–17 for HSRA. This amount is $888 million (or two times) more than the estimated level of expenditures in the current year. The increase in expenditures assumes that Proposition 1A (2008) bonds are sold to support local projects known as “blended system projects” that upgrade infrastructure so that high–speed trains could share the tracks of certain local systems.

CHP and DMV. The budget proposes $2.4 billion for CHP in 2016–17, which is about the same as the current–year estimated level. Over 90 percent of all CHP expenditures are supported from the Motor Vehicle Account (MVA), which generates its revenues primarily from vehicle registration and driver license fees. For DMV, the Governor’s budget proposes total expenditures of about $1.1 billion—$29 million, or about 3 percent, less than estimated current–year expenditures. About 95 percent of all DMV expenditures would come from the MVA.

Transit Assistance. The Governor’s budget estimates total expenditures of $459 million in 2016–17 for the STA program, which is $114 million, or 20 percent, less that estimated current–year expenditures. This reduced spending reflects the completion in the current year of transit capital projects supported with Proposition 1B bond funds.

Back to the TopHighway and Road Maintenance and Repair Needs

On the day the Governor signed the 2015–16 Budget Act, he called a special legislative session on transportation. Specifically, he called on the Legislature to adopt legislation to provide a permanent and sustainable increase in funding for transportation in part to (1) maintain and repair the state’s transportation infrastructure and (2) complement local efforts to repair and improve transportation infrastructure. As part of this special session, the Governor proposed last fall a transportation funding package to provide an estimated $3.6 billion annual increase in funding for transportation programs. Of this amount, $2.4 billion is for state highway repairs and local road improvements. These proposals are generally reflected in the Governor’s proposed budget for 2016–17.

As part of its deliberations regarding increased funding for state highway and road repairs, the Legislature will want to first understand the magnitude of the repair work that is needed and then determine the most appropriate way to fund these costs. Below, we (1) provide background information on the current condition of the state’s highways and roads and the programs available to repair them, (2) assess the costs to maintain and rehabilitate the core aspects of the state’s highway system—pavement, bridges, and culverts—as well as local roads, (3) recommend a roadmap for addressing the needs we identify, and (4) compare the Governor’s proposal to our recommended approach.

Background

Highway and Road Funding

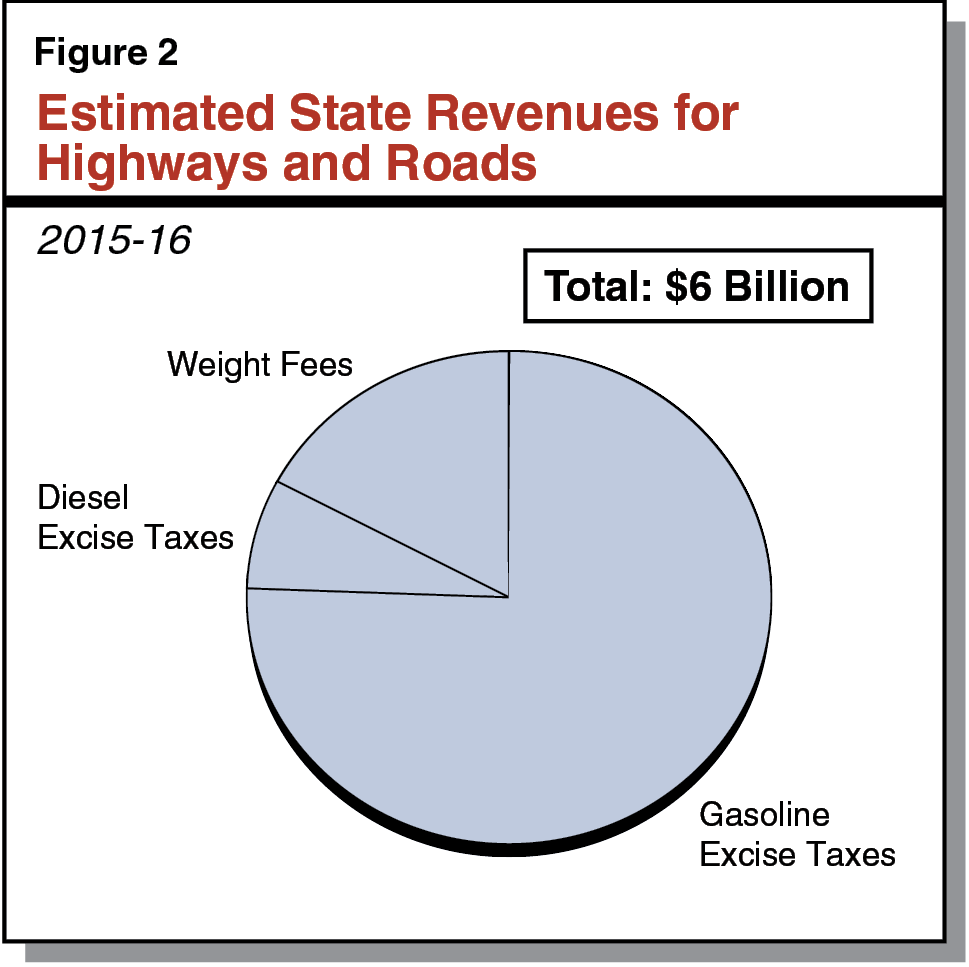

Funding for highway and road infrastructure in California comes from numerous state, local, and federal sources. Most state funding for transportation comes from excise taxes on gasoline and diesel fuel that are dedicated to funding highways and roads. In 2015–16, the state’s gasoline excise tax rate is 30 cents per gallon and the diesel excise tax rate is 13 cents per gallon. In addition, the state also charges weight fees for vehicles that carry heavy loads on the state’s roadways, such as commercial trucks. As shown in Figure 2, state revenues from the above sources are estimated to be $6 billion for 2015–16, with about three–fourths coming from state excise taxes on gasoline. These revenues support various state highway programs (including maintenance and repair programs), as well as cities and counties for their local street and road systems.

State Highway System Maintenance and Repair

Caltrans Responsible for Maintaining and Rehabilitating Highway System. The state’s highway system includes about 50,000 lane–miles of pavement, 13,100 bridges, and 205,000 culverts. (Culverts are pipes or other openings that allow naturally occurring water to flow beneath the roadway, such as when a highway crosses a small stream.) The highway system also includes other facilities, such as roadside rest areas, landscaped and non–landscaped roadside, and maintenance buildings.

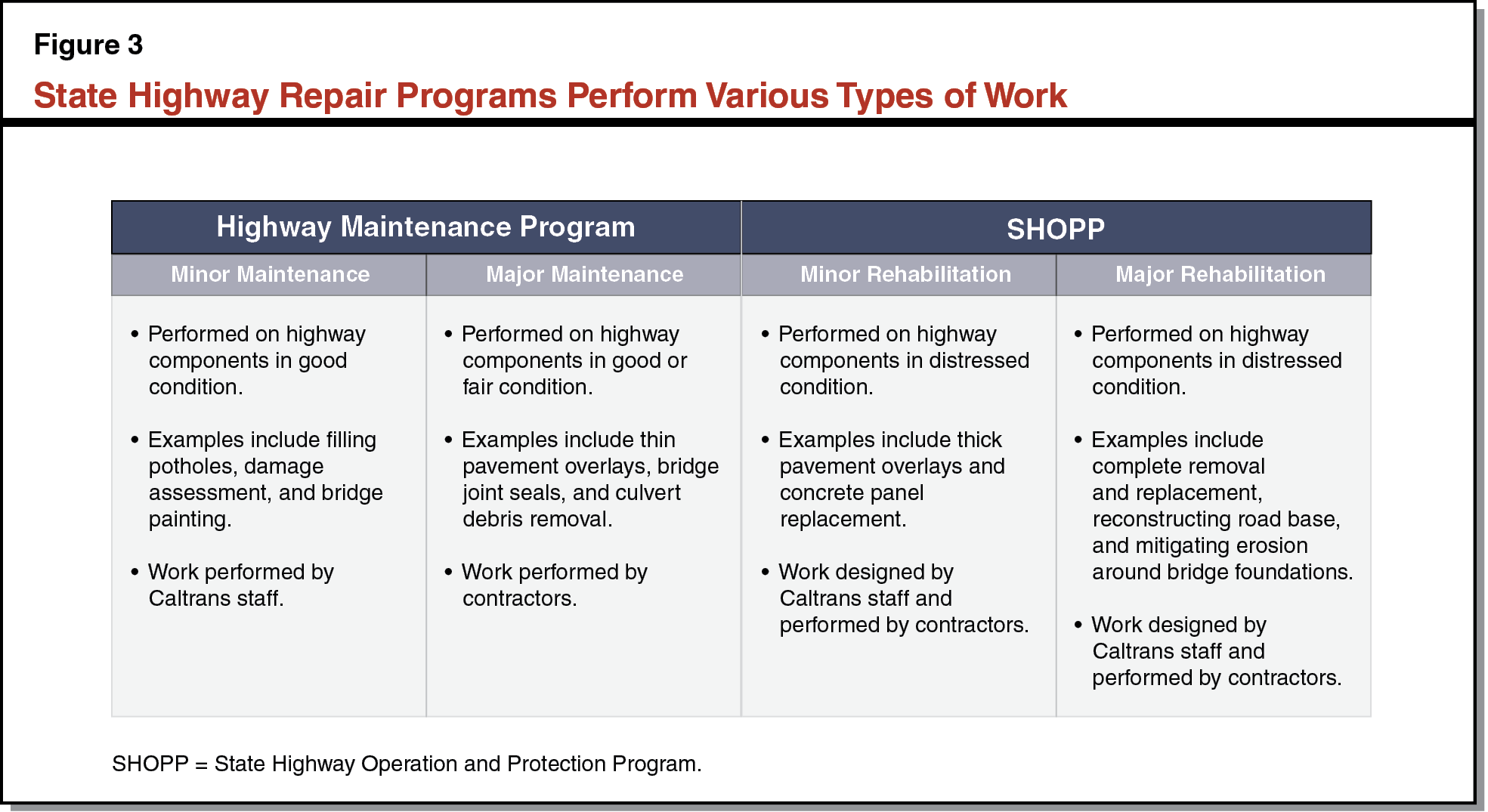

Highway infrastructure is designed and built to have certain lifespans and requires maintenance and rehabilitation work at regular intervals over the course of a lifespan. Caltrans is responsible for maintaining and rehabilitating the state’s highway system and does so through two programs—the Highway Maintenance Program and the State Highway Operation and Protection Program (SHOPP). Together, these two programs perform the spectrum of necessary repair work on the core aspects of the highway system—pavement, bridges, and culverts. Figure 3 summarizes this spectrum of maintenance and rehabilitation work. As shown in the figure and discussed below, the Highway Maintenance Program focuses on highway components that are in good or fair condition, while SHOPP focuses on highway components that are in distressed condition.

Highway Maintenance Program. The Highway Maintenance Program is responsible for:

- Minor Routine Maintenance. Most minor routine maintenance activities consist of operational activities such as roadside landscaping, graffiti removal, and trash pick–up. A small portion of this routine maintenance include minor repairs to pavement, bridges, and culverts. Such repairs include filling potholes and bridge painting. Minor routine maintenance work is performed directly by Caltrans staff.

- Major Maintenance Projects. Major maintenance projects are more significant repairs to help preserve highway pavement, bridges, and culverts. These projects are performed by construction contractors and overseen by Caltrans staff. A typical project would be the application of a thin overlay to a stretch of a state highway.

In 2015–16, Caltrans plans to spend a total of $1.4 billion in state funds for the Highway Maintenance Program—$1 billion for minor routine maintenance and $434 million for major maintenance projects. The $434 million for major maintenance projects includes $234 million for pavement, $177 million for bridges, and $23 million for culverts.

SHOPP. The SHOPP is a program of capital projects to rehabilitate or reconstruct highways when they reach the end of their useful life. Unlike the Highway Maintenance Program, SHOPP projects can involve tearing up and replacing an entire roadway or building a new bridge to replace an old one. SHOPP projects often require significant work by Caltrans staff to design and manage each project. The construction of SHOPP projects is done by a construction contractor. In 2015–16, Caltrans estimates that it will spend $2.3 billion on SHOPP projects, including about $1.5 billion in federal funds and about $800 million in state funds. Of the total amount, Caltrans plans to spend about $1.2 billion: on pavement ($800 million), bridges ($350 million), and culverts ($50 million). The remainder of SHOPP funding is available for other purposes such as responding to emergencies and safety improvements.

Current Condition of the State Highway System. Caltrans periodically assesses the highway system to determine the condition of pavement, bridges, and culverts. While the highway system is aging and is experiencing a lack of proper maintenance, the majority of the system is in good condition. Specifically, Caltrans finds:

- Majority of Pavement in Good Condition. The Caltrans 2015 State of the Pavement Report indicates that 53 percent of pavement (about 25,500 lane–miles) is in good condition, 31 percent (about 15,500 lane–miles) is in fair condition, and 16 percent (about 8,000 lane–miles) is distressed. Caltrans determined these conditions using a sophisticated and robust pavement management system that was developed and completed during the last several years.

- Bridges in Very Good Condition on Average, but Small Percent in Distressed Condition. Caltrans reports the overall condition of state highway bridges using a measure of the average condition of highway bridges—known as the “Bridge Health Index.” To develop the index, Caltrans ranks the condition of each bridge from 0 (poor condition) to 100 (excellent condition), weights the scores to reflect the size of each bridge, and then calculates an average statewide index score. In 2015, the statewide index score was 97.1—meaning on average the state’s bridges are in very good condition. However, Caltrans reports that about 500 highway bridges statewide are distressed, which is about 4 percent of total bridges. According to Caltrans, these bridges require major rehabilitation or replacement, but are not an immediate safety issue.

- Majority of Culverts in Good Condition. Caltrans staff conduct ongoing assessments of highway culverts. The most recent data from these assessments indicates that 60 percent of culverts (about 123,000) are in good condition, 26 percent (about 53,000) are in fair condition, and 14 percent (about 29,000) are distressed.

Local Road Maintenance and Repair

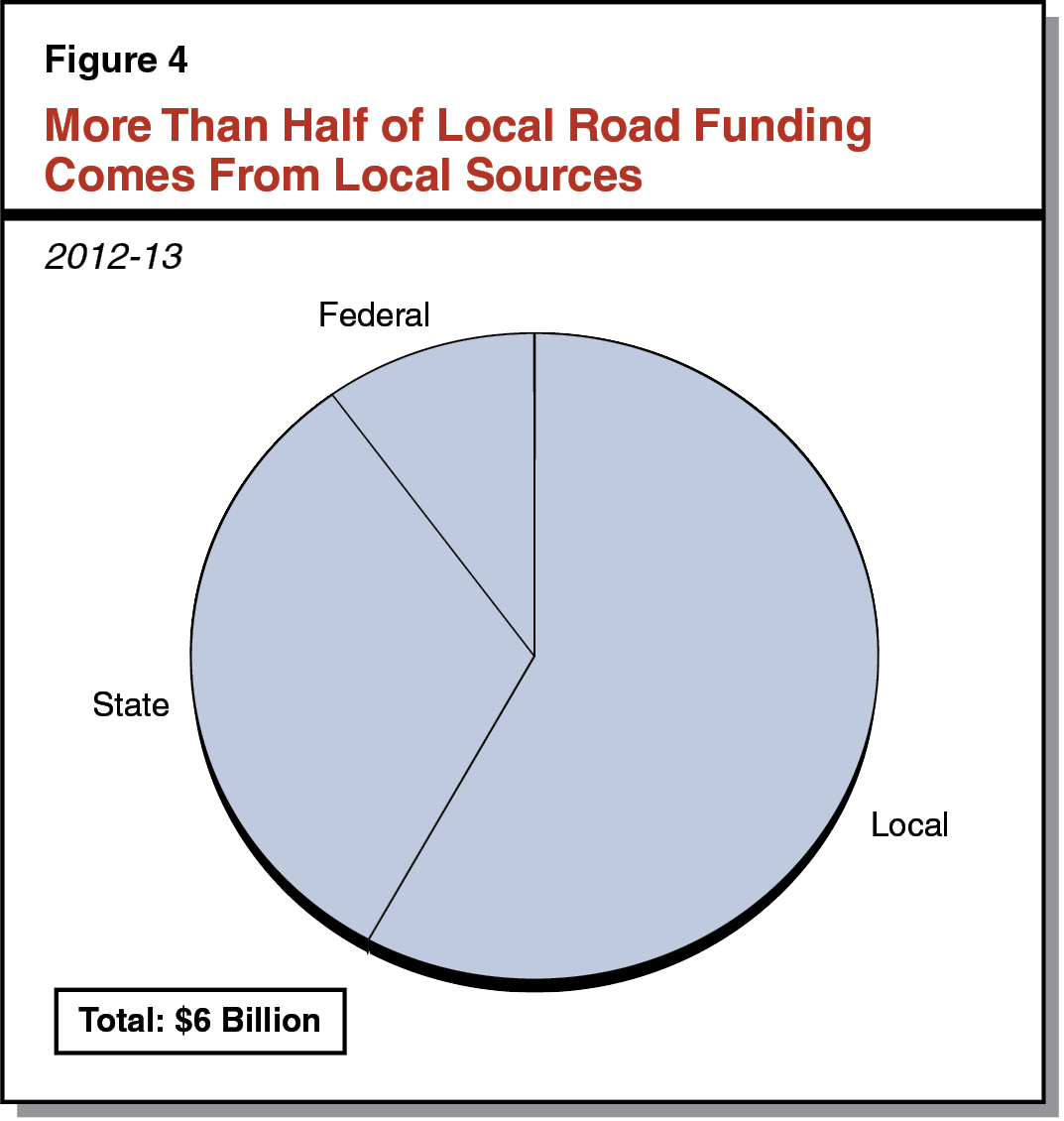

More Than Half of Local Road Funding Comes From Local Sources. The 58 counties and 482 cities in California own and maintain over 300,000 paved lane–miles of local streets and roads. They also own nearly 12,000 bridges and numerous other aspects of their local road systems, such as storm drains and traffic signals. Funding for local streets and roads comes from federal, local, and state sources. As shown in Figure 4, a total of $6 billion was available in 2012–13 to cities and counties for local roads (based on the most recent data reported to the State Controller’s Office). This amount includes $3.5 billion in local sources, $1.9 billion in state funds, and $600 million in federal funds.

Local agencies spent a majority of the above $6 billion on road repairs. Specifically, $2.1 billion was expended on road maintenance and $1.9 billion for road reconstruction, with the remainder of funds for other purposes such as engineering work, new road construction, and administrative costs.

Current Condition of Local Roads. Unlike for the state highway system, the state does not periodically assess and measure the condition of local streets and roads. Understanding the condition of local streets and roads is challenging due to the large number of local agencies involved in road maintenance and repair, the large size of local systems, and variations in local practices for assessing road conditions and data collection. In order to provide some information regarding the condition of local roads, the California State Association of Counties and the League of California Cities sponsored an effort that surveyed cities and counties and compiled the information provided in a report called The California Statewide Local Streets and Roads Needs Assessment. The report was first published in 2008 and subsequently updated in 2010, 2012, and 2014.

As part of the report, each city and county self–reports certain information on the condition of their local road systems. For example, each jurisdiction reports the average pavement condition ranging from failed to excellent. Based on the information collected, it was reported in 2014 that more than half of local pavement was in good condition, with almost one–fourth in at–risk condition, and the remaining one–fourth in poor or failed condition. The 2014 report also noted 2,800 local bridges require rehabilitation or replacement.

LAO Assessment of Highway and Road Repair Needs

A key consideration in determining an appropriate level of funding for transportation is the cost and type of maintenance and rehabilitation work that is needed on the state’s highways and local roads. In order to assist the Legislature, we analyzed the data available on highway and road conditions, the frequency with which certain types of repairs are needed, and the average cost of repairs. Based on this information, we estimated the level of funding needed to meet maintenance and repair needs for the core aspects of the highway system—pavement, bridges, and culverts—as well as for local roads.

Highway Maintenance Program Needs

Significant Ongoing Maintenance Needs. As discussed above, the Highway Maintenance Program performs both minor routine maintenance and major maintenance projects. We focused our analysis on the needs related to major maintenance projects, because these projects are a primary way Caltrans preserves and maintains pavement, bridges, and culverts. In May 2015, Caltrans provided the Legislature with its 2015 Five–Year Maintenance Plan, which includes information on the maintenance needs for pavement, bridges, and culverts. (State law requires Caltrans to provide a maintenance plan every other year.) Based on the information in this plan, we estimated the ongoing level of funding for major maintenance projects on pavement, bridges, and culverts that would be needed to meet certain maintenance schedules provided to us by Caltrans. For example, Caltrans estimates that pavement requires on average a maintenance treatment every seven years and culverts require on average major maintenance every 15 years, in order to maintain a state of good repair and defer more costly rehabilitation. Although we relied largely on data from Caltrans, our estimates are generally higher than those reported by the department. A primary reason for this difference is that we took into account the maintenance costs to address all highway culverts while Caltrans’ estimates only accounted for half of the state’s highway culverts.

Figure 5 summarizes our estimates of the ongoing needs for major maintenance projects. As shown in the figure, the Highway Maintenance Program would require about $1.6 billion annually in order to fully fund ongoing major maintenance on pavement, bridges, and culverts.

Figure 5

Ongoing Program Needs for Major Maintenance Projects

(In Millions)

|

Pavement |

$750 |

|

Bridges |

200 |

|

Culverts |

600 |

|

Total |

$1,550 |

Maintenance Backlog of $3 Billion. In addition to the ongoing needs, there is a backlog of deferred major maintenance projects that needs to be addressed. Based on data from Caltrans, we estimate that about 6,000 lane–miles of pavement, 900 bridges, and 41,000 culverts currently require a major maintenance project. As shown in Figure 6, we estimate that it would cost about $3 billion on a one–time basis to eliminate this backlog, with the majority of the costs associated with culvert maintenance.

Figure 6

Backlog of Major Maintenance Projects

(In Millions)

|

Pavement |

$700 |

|

Bridges |

250 |

|

Culverts |

2,000 |

|

Total |

$2,950 |

Current Funding Level Falls Short of Meeting Needs. The level of funding needed for major maintenance projects in the Highway Maintenance Program is significantly greater than the current annual funding level for this program of $434 million. Figure 7 compares current funding levels for major highway maintenance projects to the ongoing needs. As shown in the figure, the total annual amount of funding needed to meet ongoing needs is about $1.6 billion, or about $1.1 billion more than the current funding level. Most of the annual shortfall in funding relates to the maintenance of pavement and culverts.

Figure 7

Current Funding Level Falls Short of Meeting Ongoing Major Maintenance Needs

(In Millions)

|

Current Funding Level |

Ongoing Annual Need |

Annual Shortfall |

|

|

Pavement |

$234 |

$750 |

–$516 |

|

Bridges |

177 |

200 |

–23 |

|

Culverts |

23 |

600 |

–577 |

|

Totals |

$434 |

$1,550 |

–$1,116 |

In addition, because the current level of Highway Maintenance Program funding is insufficient to meet ongoing needs, the $3 billion backlog of deferred maintenance would remain unaddressed and likely grow in the future. Due to the magnitude of deferred maintenance, the entire backlog of work could not be addressed in a single year. While the actual amount of time necessary to address this backlog would depend on the availability of funds, as well as how quickly Caltrans is able to award contracts, we think that addressing the backlog over a three–year period is one reasonable approach. Such an approach would spread the cost of the backlog over time, while addressing much of the backlog of needs before pavement, bridges, and culverts deteriorate to the point of requiring more costly rehabilitation work through additional SHOPP projects. Addressing the backlog over a three–year period would temporarily increase the above annual level of funding needed to meet total maintenance needs by $1 billion in the short run. Specifically, total annual funding needed would be about $2.6 billion for three years (about $2 billion more than the current funding level) and then decline to an annual level of about $1.6 billion thereafter.

SHOPP Needs

Due to uncertainties around future highway repair needs, complexities with understanding the type of repairs actually used for given highway conditions, as well as inconsistencies in some of the data provided to us by Caltrans, the needs for SHOPP are less clear than for the Highway Maintenance Program. Although we were able to develop an estimate for the SHOPP by using the best data available, we note that these estimates are subject to some uncertainty.

Significant Ongoing SHOPP Needs. Eventually, all highways will deteriorate to the point where rehabilitation is needed through a SHOPP project. Based on recent data and reports provided to us by Caltrans, we estimated the ongoing level of funding needed for SHOPP projects on pavement, bridges, and culverts. Figure 8 shows our estimates of these ongoing SHOPP needs. As shown in the figure, we estimate that the SHOPP would require roughly $2 billion annually in order to fully fund ongoing rehabilitation for pavement, bridges, and culverts.

Figure 8

Ongoing Program Needs for SHOPP

(In Millions)

|

Pavement |

$900 |

|

Bridges |

350 |

|

Culverts |

750 |

|

Totals |

$2,000 |

|

SHOPP = State Highway Operation and Protection Program. |

|

We note that the SHOPP data Caltrans provided to us does not reflect the use of maintenance best practices, and therefore does not account for savings likely to be achieved through a fully funded Highway Maintenance Program. Accordingly, if the state were to fully fund maintenance projects, the ongoing SHOPP needs in the long run would be lower than we estimate at this time.

SHOPP Backlog of Roughly $9 Billion. In addition to the ongoing needs, there is a backlog of deferred SHOPP projects that has accumulated over the years. This is partly due to insufficient funding levels in prior years, as well as highways needing rehabilitation sooner due to a lack of proper maintenance. As shown in Figure 9, roughly $9 billion is needed on a one–time basis to eliminate a SHOPP backlog of about 3,000 lane–miles of pavement, 500 bridges, and 8,000 culverts.

Figure 9

Backlog of SHOPP Projects

(In Millions)

|

Pavement |

$1,700 |

|

Bridges |

5,800 |

|

Culverts |

1,500 |

|

Total |

$9,000 |

|

SHOPP = State Highway Operation and Protection Program. |

|

Current Funding Level Falls Short of Meeting Needs. The level of funding we identify as being needed for rehabilitation projects in the SHOPP is significantly greater than the current annual funding level for this program of $1.2 billion. Figure 10 compares the current funding levels for SHOPP to our estimate of the ongoing needs. As shown in the figure, the total annual amount of funding needed to meet ongoing SHOPP needs is roughly $2 billion annually, or about $800 million more than the current funding level. Most of the annual shortfall in funding relates to the rehabilitation of culverts.

Figure 10

Current Funding Level Falls Short of Meeting Ongoing SHOPP Needs

(In Millions)

|

Current Funding Level |

Ongoing Annual Need |

Annual Shortfall |

|

|

Pavement |

$800 |

$900 |

–$100 |

|

Bridges |

350 |

350 |

— |

|

Culverts |

50 |

750 |

–700 |

|

Totals |

$1,200 |

$2,000 |

–$800 |

|

SHOPP = State Highway Operation and Protection Program. |

|||

In addition, because the current level of SHOPP funding is insufficient to meet ongoing needs, the $9 billion backlog would remain unaddressed and likely grow in the future. Due to the magnitude of the SHOPP backlog, the entire backlog of work could not be addressed in a single year or even in a couple of years. While the actual amount of time necessary to address this backlog would depend on the availability of funds, as well as how quickly Caltrans is able to design projects, we think that addressing the backlog over a ten–year period is one reasonable approach. We also note that rehabilitation projects take a much longer time to complete than maintenance work. Addressing the backlog over a ten–year period would temporarily increase the above annual funding needed to meet total SHOPP needs by $900 million for a decade. Specifically, total annual funding needed would be $2.9 billion for ten years (about $1.7 billion more than the current funding level) and then decline to an annual level of roughly $2 billion thereafter when the backlog is eliminated. (Please see the nearby box for a discussion of how our SHOPP estimates compare to those of Caltrans.)

Comparison of LAO and Caltrans SHOPP Needs Estimates

As part of its 2015 Ten–Year State Highway Operation and Protection Program (SHOPP) plan, the California Department of Transportation (Caltrans) estimates how much funding it thinks is needed for SHOPP. Specifically, Caltrans estimated that it needed a total of $4.4 billion annually for ten years to meet highway rehabilitation needs for pavement, bridges, and culverts. This amount includes funding for ongoing needs as well as additional funding to help address existing backlogs. In comparison, we estimate that the ongoing funding needs for pavement, bridge, and culvert projects in SHOPP is $2 billion. In addition, we identified an existing backlog of about $9 billion of needed SHOPP projects. If the state were to address this backlog over a ten–year period, we estimate total annual funding needed would be $2.9 billion for ten years.

The primary reason why our estimate is lower than that of Caltrans is because we found that certain assumptions made by the department appeared to overstate SHOPP needs for pavement and bridges and were not supported by the data provided to us by the department. For example, we based our estimates on the projections of the future level of distressed pavement as identified in the department’s 2015 State of the Pavement Report, which uses data on the actual condition of the pavement and a sophisticated and robust pavement management system. Caltrans’ estimates are much higher than supported by these projections, and it has not been able to substantiate its estimates at this time. We also note that Caltrans assumes a substantial ongoing increase is needed for bridges, but this appears to be inconsistent with the department’s data on actual bridge conditions. Specifically, Caltrans’ Bridge Health Index currently rates bridges statewide as being in very good condition on average. The index level has even shown improvement over the last few years at the current $350 million funding level.

Summary of Highway Maintenance and SHOPP Needs

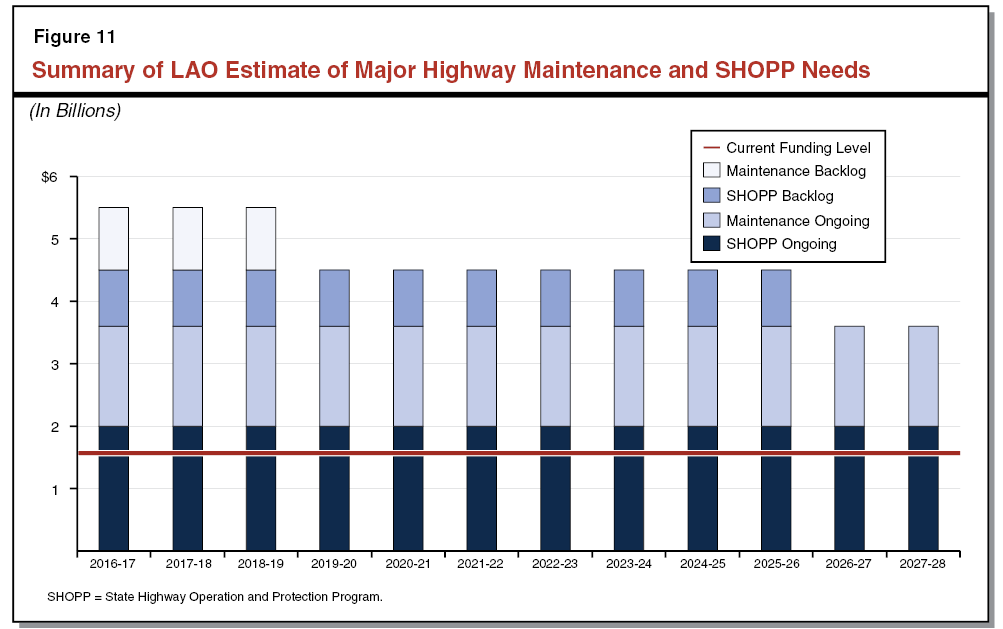

Based on our above analysis of the needs for the Highway Maintenance Program and the SHOPP, we estimate that the total ongoing annual level of funding needed for highway repairs is about $3.6 billion. In addition, we find there is a one–time cost to address an existing backlog of needed highway repairs totaling roughly $12 billion. As discussed previously, addressing the maintenance backlog over a three–year period and the SHOPP backlog over a ten–year period is one reasonable approach. Figure 11 summarizes the annual funding required to meet ongoing needs and to address the existing backlog of projects during these time periods. As the figure shows, we estimate that the total amount needed for state highway repair programs in 2016–17 is roughly $5.5 billion and would decline to $3.6 billion annually beginning in 2026–27.

Local Road Maintenance and Repair Needs

As mentioned previously, understanding the condition of local roads is challenging. Due to the limitations around the available data, we were not able to develop a comprehensive analysis of local road maintenance and rehabilitation needs. In the absence of such data, we evaluated the previously described 2014 California Statewide Local Streets and Roads Needs Assessment to determine if that report provides a reasonable assessment of local needs. While the information in the 2014 report appears to be the most complete assessment available of the condition and needs of local street and road systems in California, the accuracy and consistency of the self–reported data is unknown. For example, it is likely that some jurisdictions have better data on the condition of their roads or had more resources available to complete the survey than other jurisdictions. In addition, while the approach to estimating some of the needs (such as for bridges) appears reasonable, we find that certain assumptions in the report appear to overstate the level of funding needed, as discussed below.

Ongoing Funding Need for Local Roads Potentially Overstated. First, the 2014 report estimates that, in total, local agencies require an additional $73 billion to fund pavement maintenance and repairs over the next ten years. However, our review finds that this estimate assumes a goal of bringing all local street and road pavement into good or excellent condition, which does not reflect the fact that some portions of pavement will always be in fair or distressed condition as roads deteriorate and eventually come to the end of their useful life. As such, the 2014 report does not appear to provide an assessment of the ongoing needs to repair local roads, but rather the one–time cost of bringing all local road pavement into good or excellent condition. By reflecting costs that would actually be spread over time as a one–time need, the study appears to overstate the level of funding that would actually be needed on an ongoing basis.

Report Appears to Not Account for All Existing Funds. Second, the report compares the estimated needs with existing funding levels. However, the amount of existing funding included in this calculation appears to be significantly lower than the amount cities and counties reported to the State Controller’s Office as being spent on road maintenance and repairs. For example, in 2012–13, cities and counties reported that they spent $4 billion on road repairs, which is significantly higher than the $2.5 billion assumed in the 2012 local road assessment report. To the extent that the 2014 report similarly underestimates the level of funding currently available to meet local road repair needs, it would overstate the estimated funding shortfall for local road repairs.

LAO Recommended Roadmap for Addressing Repair Needs

As part of the ongoing special session on transportation, both the Governor and the Legislature have made it a priority to identify increased funding to help address highways and road repair needs. Based on our assessment of these needs, we provide below a roadmap to assist the Legislature in its deliberations. The overall intent of our recommended roadmap is to help ensure that the highest priority needs are addressed first and that any additional funding provided is aligned with those needs and is allocated in an efficient and effective manner.

Prioritize and Fully Fund Highway Maintenance Program

To the extent that that Legislature identifies additional transportation funding, we recommend making the Highway Maintenance Program the highest priority for such funding. This is because maintenance projects are significantly more cost–effective than allowing highways to deteriorate such that a SHOPP rehabilitation project is needed. For example, Caltrans estimates that for every dollar spent on a major maintenance project for pavement, bridges, and culverts, between $4 to $12 of costs can be deferred by postponing the need for rehabilitation. In addition, major maintenance projects can improve safety and the ride–quality (such as pavement smoothness) of highways.

As discussed earlier, we estimate that an additional $1.1 billion is needed annually in order to fully meet the ongoing needs for major maintenance projects. In addition, about $3 billion in one–time costs is also needed to address the existing backlog of maintenance projects. This one–time cost could be spread out over multiple years, such as $1 billion each year over three years. Eliminating this backlog would extend the lifespan of the state’s highways and delay the need for more costly rehabilitation projects in SHOPP.

Prioritize SHOPP Needs Next

After meeting the needs of the Highway Maintenance Program, we recommend that the Legislature make additional funding for SHOPP projects its next priority. As indicated above, we estimated an annual ongoing shortfall of around $800 million and a one–time $9 billion need to address the current backlog of projects. We recommend allocating increased SHOPP funds to the specific needs we identified above. To the extent there is not sufficient funding to address all SHOPP needs, the Legislature would need to prioritize which needs to address. For example, the Legislature may want to prioritize (1) ongoing culvert needs, since these have the greatest unmet need, or (2) addressing the backlog of distressed bridges, which could present a safety issue in the future.

Determine Level of Local Road Funding Based on Legislative Priorities

The Legislature will want to consider the state’s role and responsibility in funding local road needs. As discussed previously, local roads are funded through various sources with locals providing the majority of total funding. While the state has historically shared transportation revenues with local agencies, the Legislature will want to weigh the level of funding to give to local agencies against the state’s highway needs. Given the current distribution formulas for local road funding allocations, the Legislature will also want to consider whether new funding is intended for any local road need, or if dollars should be directed specifically to maintenance and repair needs. For example, if the Legislature wants to ensure funding meets the highest priority local road repair needs, it will need to determine a process for allocating funding that takes these needs into account.

Align Funding Sources With Funding Priorities

After determining which highway and road repair needs it wants to fund and the level of funding it wants to provide, the next step would be for the Legislature to ensure that the funding sources identified are aligned to the specific needs being funded. Specifically, permanent ongoing revenues (such as permanent taxes) are best used to meet ongoing needs. On the other hand, backlogs of work do not require ongoing funding and can instead be addressed with one–time or temporary funding sources (such as bonds, temporary taxes, or redirections from existing revenues). As discussed previously, both the Highway Maintenance Program and SHOPP have significant ongoing and one–time funding needs.

Adopt Accountability Measures to Ensure Effective Use of Funds

In order to ensure that any additional funds for transportation are spent effectively and in a way that meets legislative priorities, we recommend adopting well–defined and robust accountability measures. Specifically, we recommend that the Legislature adopt performance metrics for both the Highway Maintenance Program and SHOPP that provide a comprehensive assessment of the condition of the highway system. For example, the Legislature could establish goals that a certain amount of pavement be kept in good condition. Regarding highway bridges, we recommend that the Legislature require Caltrans to provide more detailed information on the number of distressed bridges and the estimated cost and timing for returning them to a state of good repair. In order to track progress toward meeting these goals, we recommend the Legislature require Caltrans to report on the status of these metrics on a regular basis, such as requiring this information in Caltrans’ biennial SHOPP and Highway Maintenance plans. To the extent that funding is made available for local roads, we recommend that the Legislature adopt performance and reporting requirements related to the use of these funds as well. For example, the Legislature may want to establish goals for the condition of local road pavement and bridges and require local agencies to identify the estimated costs associated with road repairs.

In addition, the Legislature will want to consider more robust accountability measures in the allocation of funds, in particular for SHOPP. As we found in our May 2014 report The 2014–15 Budget: Capital Outlay Support Program Review, SHOPP currently has limited project–level external oversight. Specifically, as discussed in that report, we recommend that the Legislature require CTC—an independent commission with a role in allocating certain state transportation funds—to perform project–level oversight of SHOPP.

Governor’s Proposal Falls Short of Addressing Highway Needs

In order to illustrate how our above recommended roadmap could be utilized, we assess below the Governor’s transportation funding proposal based on our roadmap’s key principles.

Governor’s Proposal. As indicated earlier, the Governor’s transportation funding package proposes to provide an estimated $3.6 billion annual increase for state and local transportation infrastructure, primarily from a new $65 vehicle registration tax and increases in gasoline and diesel excise taxes. Revenue from the funding package would phase in during 2016–17 and 2017–18 and provide a permanent ongoing increase thereafter. Of the total increased revenue, $2.4 billion would be for highway and road repairs—$1.4 billion for state highways and $1 billion for local roads. As shown in Figure 12, the $1.4 billion proposed increase for state highways would result in total funding for pavement, bridge, and culvert repairs of about $3 billion when combined with the $1.6 billion currently available for these purposes. As indicated in the figure, nearly all of the $1.4 billion increase for state highways would fund rehabilitation projects in SHOPP, with $20 million available for major maintenance projects.

Figure 12

Governor’s Proposal for Increased Funding for Highway Repairs

(In Millions)

|

Current Funding |

Proposed Increase |

Total |

|

|

SHOPP |

|||

|

Pavement |

$800 |

$900 |

$1,700 |

|

Bridges |

350 |

300 |

650 |

|

Culverts |

50 |

200 |

250 |

|

SHOPP Subtotals |

($1,200) |

($1,400) |

($2,600) |

|

Major Maintenance |

$434 |

$20 |

$454 |

|

Totals |

$1,634 |

$1,420 |

$3,054 |

|

SHOPP = State Highway Operation and Protection Program. |

|||

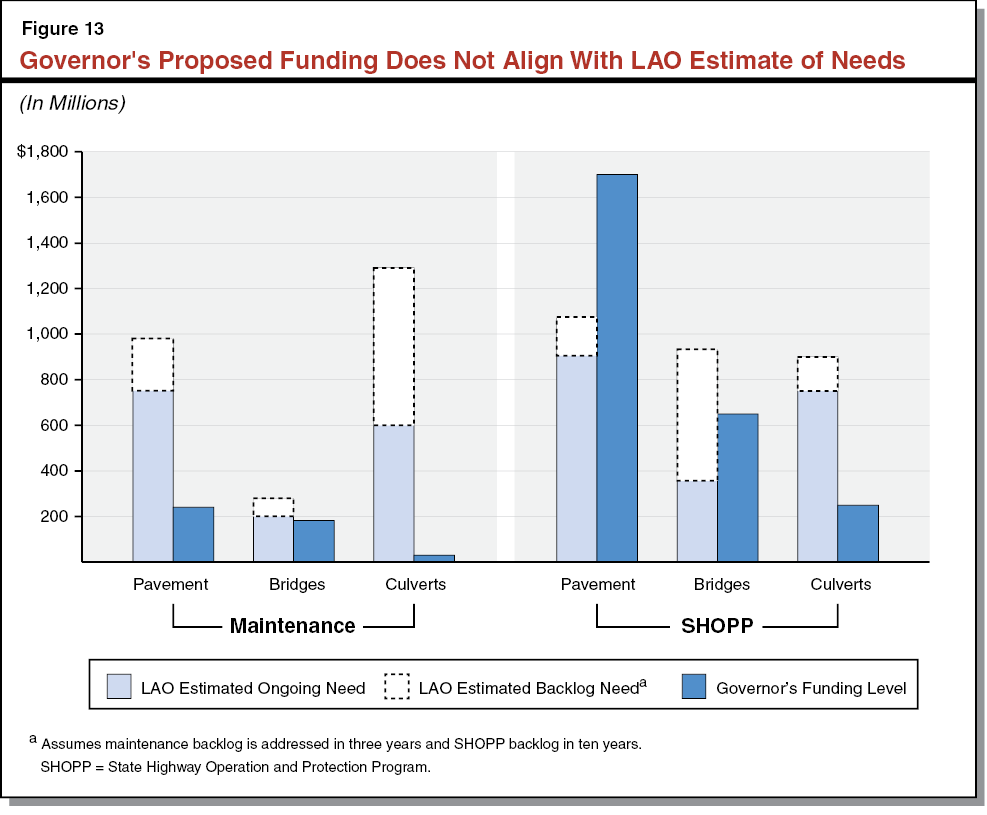

Proposed Allocation of Funding Would Not Meet Highway Needs Effectively. Although the Governor’s proposed $3 billion in total funding for highway repairs is in the rough magnitude of funding needed to address the ongoing $3.6 billion need we identified above related to highway maintenance and rehabilitation, the proposed funding would fall short of addressing the existing backlog of projects and would not be allocated effectively. Figure 13 compares our estimated needs for the Highway Maintenance Program and SHOPP with the level of funding proposed by the Governor. As the figure shows, the total funding levels provided under the Governor’s plan for pavement, bridge, and culvert maintenance and SHOPP projects do not align well with the needs we identified. Specifically, we find that the Governor’s proposal:

- Provides Little Funding to Meet Major Highway Maintenance Needs. The Governor’s proposal provides only a $20 million increase for major maintenance projects in the Highway Maintenance Program, for a total of $454 million. Thus, of the $1.6 billion ongoing maintenance need, $1.1 billion would remain unfunded. Because the proposed level of Highway Maintenance Program funding is insufficient to meet ongoing needs, the $3 billion backlog of deferred maintenance would remain unaddressed and likely grow in the future. In addition, if maintenance is deferred for too long, pavement, bridges, and culverts will deteriorate to the point of requiring more costly rehabilitation work through additional SHOPP projects.

- Generally Funds Short–Term SHOPP Need, but Mix of Projects Not Aligned With Needs. Under the Governor’s plan, a total of $2.6 billion would be available annually for pavement, bridge, and culvert SHOPP projects—more than twice the current level of $1.2 billion. Unlike the Highway Maintenance Program, the Governor’s proposal would make significant progress toward addressing the $2.9 billion that we identified to fully fund SHOPP ongoing needs and eliminate the existing backlog over a ten–year period. However, we find that the mix of pavement, bridge, and culvert projects that the Governor proposes to fund does not align with the actual needs of SHOPP. For example, as shown in Figure 13, while the Governor’s proposal would allocate much more funding than needed for pavement projects, it would not provide sufficient funding for both culvert and bridge projects.

- Provides More SHOPP Funding Than Needed in Long Run. Under the Governor’s proposal, once the existing backlog of SHOPP projects is eliminated, SHOPP would receive about $600 million more each year than needed to meet ongoing needs. This is because under the Governor’s plan, the new revenues allocated to SHOPP would come from permanent tax increases that would continue even when the need for funding is less in the future.

Governor’s Accountability Measures Are Limited. The Governor’s proposal also includes various accountability measures related to the additional funding provided for highway repairs. First, the Governor establishes certain performance goals for highway pavement, bridges, and culverts and requires Caltrans to report to CTC on its progress in meeting these goals. For example, one of the Governor’s goals is to have no more than 10 percent of highway pavement in distressed condition. However, the proposal lacks a specific goal for how much highway pavement would be kept in good condition versus in fair condition. Similarly, for bridges, the Governor proposes a performance goal of achieving a Bridge Health Index score of 95. However, as discussed above, this index is currently at a score of 97.1—meaning Caltrans is already meeting this goal under existing funding levels.

Second, under the Governor’s plan, CTC would have the authority to withhold future funding from Caltrans if it determines that program funds were not appropriately spent. However, CTC could only withhold all SHOPP funding from Caltrans rather than only withholding funding related to specific projects that CTC determines to have problems. Given the extreme nature of withholding all program funding and the negative consequences on all SHOPP projects, CTC would likely be hesitant to use this authority, resulting in limited accountability. Instead, requiring CTC to perform project–level oversight, as we recommend, would allow CTC to allocate or withhold funding for specific projects and provide a more meaningful level of accountability.

Back to the TopMVA Fund Condition

The MVA was created to support the state’s activities to administer and enforce laws regulating the operation and registration of vehicles used on public streets and highways, as well as to mitigate the environmental effects of vehicle emissions. During the last couple of years, concerns about the solvency of the MVA have arisen as spending from the account has grown faster than revenues. Below, we (1) provide background information on MVA revenues and expenditures, (2) describe the Governor’s proposals related to the MVA, (3) assess the condition of the MVA, and (4) identify issues for legislative consideration.

Background

Revenues. The MVA receives most of its revenues from vehicle registration fees. In 2015–16, $3.2 billion in revenues are estimated to be deposited into the MVA, with vehicle registration fees accounting for about $2.3 billion (72 percent). Vehicle registration fees currently total $70 for each registered vehicle, which consists of two components:

- Base Registration Fee ($46). The state charges a base registration fee of $46, with $43 going to the MVA and $3 going to support certain environmental mitigation programs. The base registration fee was last increased in 2011 by $12 (from $34 to $46).

- CHP Fee ($24). The state also charges an additional fee of $24 that directly benefits CHP. In 2014, this fee was increased by $1 (from $23 to $24) and was indexed to the Consumer Price Index (CPI), allowing the fee to automatically increase with inflation.

The MVA also receives a significant amount of revenue from driver license fees. Revenue from these fees fluctuates based on the number of licenses renewed each year. In recent years, such revenue has averaged about $300 million annually, accounting for roughly 10 percent of total MVA revenues. The current driver license fee is $33 and was last increased by $1 in 2014. The driver license fee is also indexed to the CPI. The remaining MVA revenues primarily come from late fees associated with vehicle registration and driver license renewals, identification card fees, and miscellaneous fees for special permits and certificates (such as fees related to the regulation of automobile dealers and driver training schools).

The use of most MVA revenues are limited by the California Constitution to the administration and enforcement of laws regulating the use of vehicles on public highways and roads, as well as certain other transportation uses. However, about $80 million of the miscellaneous MVA revenue sources are not limited by constitutional provisions. Because they are available for broader purposes, these miscellaneous revenues are not retained in the MVA, but are instead transferred to the General Fund.

Expenditures. The MVA primarily provides funding to three state departments—CHP, DMV, and the Air Resources Board—to support the activities authorized in the California Constitution. In recent years, expenditures from the MVA have increased. Some of these increases affect the MVA only in the short run (such as increased limited–term funding to DMV for the implementation of Chapter 524 of 2013 [AB 60, Alejo]). Others create longer–term cost pressures on the MVA that can extend several years. These ongoing cost drivers include:

- CHP Officers’ Salary Increases. The state and the union representing CHP officers negotiated a memorandum of understanding (MOU) in 2013 that provides salary increases for CHP officers annually from 2013–14 through 2018–19. The MOU specifies that the increases are determined by calculating the weighted average of the salaries of the state’s five largest local police agencies. As a result, CHP officers received average salary increases of 5 percent a year in both 2013–14 and 2014–15, increasing ongoing MVA costs by $10 million.

- CHP Air Fleet Replacement. As part of an ongoing air fleet replacement plan for CHP’s fleet of 26 aircraft, the Legislature approved $17 million in 2013–14, $16 million in 2014–15, and $14 million in 2015–16. Under the approved plan, the funding level for air fleet replacement will remain at $14 million in 2016–17, and decline to $8 million in 2017–18 and remain at that level on an ongoing basis.

- CHP Area Office Replacement. In 2013–14, the Legislature approved a total of $6.4 million to initiate the administration’s multiyear plan to replace existing CHP area offices. The funding supported the acquisition of land for one new office and the advanced planning to replace five additional offices. For the five new offices, the Legislature subsequently approved $32.4 million in 2014–15 to fund the acquisition of land and $137 million in 2015–16 to fund the design and construction of these facilities and begin the advanced planning for up to five additional facilities.

- DMV Field Office Replacement. In 2015–16, the Legislature approved $4.7 million to initiate the administration’s multiyear plan to replace existing DMV field offices. The funding supported pre–construction activities to replace three DMV field offices.

Operational Shortfalls. Due to expenditures outpacing revenues, the MVA faced an operational shortfall in 2015–16 of about $300 million, which was addressed through the one–time repayment of $480 million in loans that were previously made from the MVA to the General Fund. Absent corrective actions, the account would again experience an operational shortfall in 2016–17.

Governor’s Proposals

The administration estimates an MVA operational shortfall of about $310 million in 2016–17 (assuming no new revenue or expenditures), with this amount increasing in future years. If left unaddressed, the ongoing shortfalls would result in the MVA becoming insolvent in 2017–18. In order to help address this ongoing shortfall and maintain the solvency of the MVA, the Governor proposes to increase revenues into the MVA by increasing the base vehicle registration fee. As we discuss below, under the Governor’s plan, the proposed fee increase would also support new MVA expenditure proposals by the Governor that total $52 million.

$10 Registration Fee Increase. In order to help address the expected operational shortfall in the MVA, the Governor proposes to increase the base vehicle registration fee by $10 (from $46 to $56) effective January 1, 2017. Additionally, the Governor proposes to index the base registration fee to the CPI beginning in 2017–18, similar to the CHP fee and driver license fee. The Governor’s budget assumes that the increased fee will generate about $80 million in 2016–17, and about $360 million upon full implementation in 2017–18. (As discussed earlier in this report, the budget also includes a $65 vehicle registration tax that would fund transportation infrastructure programs.)

New MVA Expenditures. While the above fee increase would help address the operational shortfalls of the MVA with increased revenues, the Governor’s budget also includes proposals totaling $52 million that would further increase MVA expenditures in 2016–17 and beyond. The major new expenditures include:

- Additional CHP Area Office Replacement. The budget includes $25 million for site acquisition and preliminary plans for new CHP offices in Hayward, El Centro, and Ventura. The administration currently plans to request an additional $106 million as part of the 2017–18 budget to fund the construction of these three offices. In addition, the budget includes $800,000 for advanced planning to identify three additional area offices that would be proposed for replacement in future years as part of the administration’s ongoing plan to replace outdated CHP area offices.

- Additional DMV Field Office Replacement. The Governor’s budget includes $5.6 million for the design phase of the three DMV office replacement projects initiated in the current year ($4.3 million), as well as to initiate the replacement of another office ($1.3 million). The administration plans to request an additional $52 million as part of the 2017–18 and 2018–19 budgets to fund the construction of these four offices.

- Additional DMV Self–Service Terminals. The budget proposes $8 million on an ongoing basis to expand the use of self–service terminals that handle common DMV transactions, such as vehicle registration renewal. Under the proposal, DMV would contract with a vendor to place between 30 and 50 self–service terminals in businesses around the state, such as grocery stores. (We discuss this proposal in more detail later in this report.)

MVA Barely Balanced Under Governor’s Proposal

The Governor has proposed steps to address the operational shortfalls in the MVA. However, our estimates of the Governor’s plan indicate that the MVA would be barely balanced over the next few years and likely face an operational shortfall in the tens of millions of dollars by 2019–20. Our forecast includes revenue estimates based on historical trends and the proposed fee increase, and expenditure estimates based on proposals already approved by the Legislature and those proposed in the Governor’s budget, as well as reflected in the administration’s 2016 Five–Year Infrastructure Plan. Our forecast also includes out–year expenditures related to the annual pay increases for CHP officers referenced above.

We also note that various additional cost pressures could further impact the solvency of the MVA the next several years. For example, CHP and DMV currently operate certain information technology legacy systems that will likely require replacement in the coming years and are not accounted for in our forecast.

Issues for Legislative Consideration

The Legislature will need to take steps to address the ongoing shortfall in the MVA and prevent insolvency. While the Governor’s approach is one way of addressing the shortfalls in the near term, there are alternatives. The Legislature will also want to consider taking actions to ensure that the MVA is sufficiently balanced in both the near and long term. The Legislature could address such shortfalls by adopting a mix of the following strategies:

- Reduce or Limit MVA Expenditures. One approach to addressing the shortfalls in the MVA is to reduce expenditures or slow the pace of spending growth. Even a modest reduction to the pace of spending growth could significantly help the MVA’s condition in the future. For example, the Legislature could defer the start of new capital projects to replace CHP and DMV facilities, or approve fewer new projects in future years than are included in the 2016 Five–Year Infrastructure Plan. We note that such actions would leave various safety and operational challenges at certain offices unaddressed for an additional time period. Furthermore, the Legislature could identify alternative sources to fund certain existing or proposed MVA expenditures.

- Increase MVA Revenues. As proposed by the Governor, the Legislature could increase the vehicle registration fee. In determining an appropriate fee increase, it will want to consider the potential fiscal impacts on vehicle owners. The Legislature could also choose to increase non–registration MVA fees, such as driver license fees.

- Eliminate General Fund Transfer. As mentioned earlier, the MVA receives about $80 million in miscellaneous revenues that are not limited in their use by the California Constitution. Under existing law, these revenues are transferred to the General Fund, making them unavailable to support MVA expenditures. The Legislature could change state law in order to keep these revenues in the MVA.

Caltrans

Caltrans is responsible for planning, coordinating, and implementing the development and operation of the state’s transportation system. These responsibilities are carried out in four programs. Three programs—Highway Transportation, Mass Transportation, and Aeronautics—concentrate on specific transportation modes. Transportation Planning seeks to improve the planning of all modes.

The Governor’s budget proposes total expenditures of about $10.5 billion for Caltrans in 2016–17. This is $422 million, or about 4 percent, lower than the estimated current–year expenditures. Most of the proposed spending supports the department’s highway program, which primarily includes $3.6 billion for capital outlay, $2.2 billion for local assistance, $1.9 billion for highway maintenance and operations, and $1.7 billion to provide the support necessary to deliver capital highway projects. The total level of spending proposed for Caltrans in 2016–17 supports about 19,000 positions at the department and several thousand transportation improvement projects statewide.

Proposition 1B

LAO Bottom Line. We recommend that the Legislature approve the Governor’s proposal for Proposition 1B administrative staff for only two years (2016–17 and 2017–18)—rather than over a five–year period as proposed—given the uncertainty regarding future workload.

Background

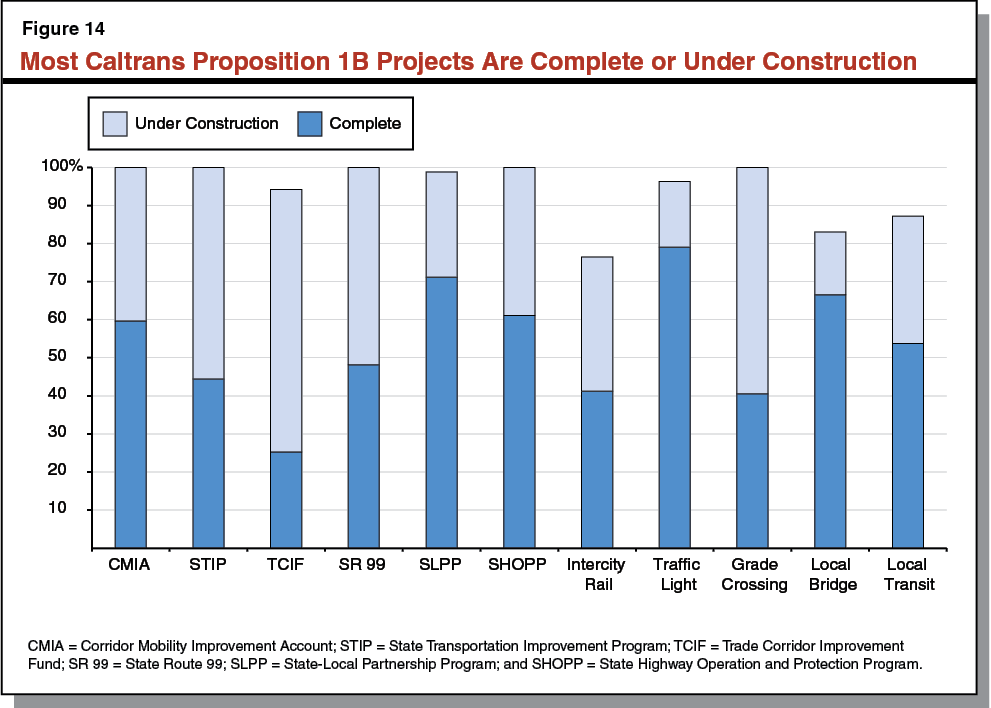

2006 Transportation Bond. In 2006, voters approved Proposition 1B (Highway Safety, Traffic Reduction, Air Quality, and Port Security Bond Act of 2006), which authorized the state to sell about $20 billion in general obligation bonds for various transportation projects. As specified in the proposition, such projects include those intended to improve state highways and local roads, modernize and expand transit systems, improve rail and freight facilities, and mitigate transportation–related air pollution. Caltrans is responsible for administering a majority of the Proposition 1B programs with about 2,300 total projects. As shown in Figure 14, most of the Proposition 1B projects that are administered by Caltrans are either complete or are currently under construction. Specifically, 1,333 projects have completed construction, 763 are under construction, and 230 have not yet started construction.

Administrative Resources to Implement Bond. Since the passage of Proposition 1B, Caltrans has received staff resources for the increased workload associated with the bond programs, including administrative staff. These positions perform administrative work (such as accounting, auditing, and budgeting) that are necessary throughout the various phases of a project—including planning, design, construction, and closeout. For instance, Caltrans accountants process payments to local agencies and make final payment adjustments to close out capital projects. The Legislature has generally approved administrative staff requests for only two years at a time because (1) the bond programs are not permanent and (2) the level of staff needed has fluctuated over time as workload initially ramped up, then reached a peak, and is now declining. For example, the 2014–15 budget provided funding over a two–year period for 42 staff positions at Caltrans to administer Proposition 1B. These positions are set to expire at the end of 2015–16.

Governor’s Proposal

The Governor’s budget proposes $6 million (Proposition 1B funds) and 39 positions in 2016–17 for Caltrans to continue administrative workload associated with Proposition 1B bond programs, a reduction of three positions from the current–year level. Unlike prior years, the Governor’s proposal would generally authorize the requested positions over a five–year period. Figure 15 shows the proposed number of positions and the associated funding requested by year. As shown in the figure, under the Governor’s proposal, Proposition 1B staffing levels would gradually decline to 26 positions in 2020–21.

Figure 15

Governor’s Proposed Proposition 1B Administrative Staffing Plan

(Dollars in Millions)

|

2016–17 |

2017–18 |

2018–19 |

2019–20 |

2020–21 |

|

|

Positions |

39 |

36 |

31 |

29 |

26 |

|

Expenditures |

$6.1 |

$5.8 |

$5.7 |

$5.5 |

$5.2 |

Proposal Raises Concerns Due to Uncertain Future Workload

The level of resources included in the Governor’s budget for Proposition 1B administrative staff in 2016–17 and 2017–18 appear reasonable. The proposal also recognizes that Caltrans’ need for administrative staffing will decline as workload is completed for the Proposition 1B programs. However, we find that the Governor’s approach of requesting administrative staff and funding over a five–year period is subject to considerable uncertainty—particularly after 2017–18. This is primarily because several factors can change the timing and amount of administrative work that Caltrans must perform in the future. For example, savings on projects that finish under budget can be redirected to fund additional projects, resulting in additional administrative work for Caltrans.

Additionally, workload required to close out a project is not fully known until construction is complete and Caltrans has audited the project. Given that roughly 1,000 of Caltrans’ Proposition 1B projects are not yet complete, the level of actual project closeout work could differ significantly from the assumptions made by the administration. To the extent that the Governor’s request overestimates the level of resources necessary for the five–year period, Caltrans would have more administrative staff than actually needed. On the other hand, if the Governor’s request provides less resources than actually needed, projects could experience delays.

LAO Recommendation

Approve Positions Over Two–Year Period. In view of the above concerns, we recommend that the Legislature approve the Governor’s proposal for only two years (2016–17 and 2017–18), rather than over a five–year period as requested. This approach would better ensure that appropriate resources are being provided to Caltrans to meet the needs required under Proposition 1B and allow the Legislature to revisit the department’s Proposition 1B administrative staffing needs in a couple of years to ensure that the appropriate level of resources is provided. Our recommendation would also be consistent with the Legislature’s past practice for funding this workload on a two–year basis.

Back to the TopCalifornia Highway Patrol

The primary mission of the CHP is to ensure safety and enforce traffic laws on state highways and county roads in unincorporated areas. The department also promotes traffic safety by inspecting commercial vehicles, as well as inspecting and certifying school buses, ambulances, and other specialized vehicles. The CHP carries out a variety of other mandated tasks related to law enforcement, including investigating vehicular theft and providing backup to local law enforcement in criminal matters. The operations of the CHP are divided across eight geographic divisions throughout the state.

The Governor’s budget proposes total expenditures of $2.4 billion for CHP in 2016–17, which is about the same level as provided in the current year. The level of spending proposed for CHP for 2016–17 supports about 10,700 positions, of which about 7,500 are uniformed officers.

Area Office Replacement

LAO Bottom Line. We recommend that the Legislature consider the Governor’s proposed CHP area office replacement projects in the context of a larger strategy for resolving the operational shortfall in the MVA. For example, the Legislature may want to defer the replacement of some CHP field offices in order to reduce expenditures from the MVA.

Background

The CHP operates 103 area offices across the state, which usually include a main office building for CHP staff, CHP vehicle parking and service areas, and a dispatch center. Beginning in 2013–14, the administration initiated a plan to replace a few CHP field offices each year for the next several years. The Legislature has approved funding in accordance with this plan each year since 2013–14. Specifically, the 2013–14 budget included $1.5 million for advanced planning and site selection to replace up to five unspecified CHP area offices. Based on the results of this advanced planning, the 2014–15 budget provided (1) $32.4 million to fund the acquisition and preliminary plans for five new CHP areas offices in Crescent City, Quincy, San Diego, Santa Barbara, and Truckee, and (2) $1.7 million for advanced planning and site selection to replace up to five additional unspecified CHP area offices. The 2015–16 budget provided $136 million to fund the design and construction of the area offices in Crescent City, Quincy, San Diego, Santa Barbara, and Truckee, as well as $1 million for advanced planning and site selection to replace five additional unspecified area offices.

Governor’s Proposal

Acquisition and Preliminary Plans for Three New Facilities. The Governor’s budget provides about $25 million from the MVA to fund site acquisition and preliminary plans for new CHP offices in Hayward, Ventura, and El Centro. These three facilities were identified through the site selection process and advanced planning funding provided in 2014–15. Specifically the budget includes:

- $15 million to fund the acquisition and preliminary plans for the Hayward area office replacement project. The proposed facility would be 43,518 square feet, or roughly four times the size of the existing 11,033 square foot office that was built in 1971. The administration plans to request funding to construct the facility as part of the 2017–18 budget at an estimated cost of $38.1 million—for a total project cost of $53.1 million.

- $5.6 million to fund the acquisition and preliminary plans for the Ventura area office replacement project. The proposed facility would be 40,534 square feet, or over three times the size of the existing 12,469 square foot office that was built in 1976. The administration plans to request funding to construct the facility as part of the 2017–18 budget at an estimated cost of $37.1 million—for a total project cost of $42.7 million.

- $4.3 million to fund acquisition and preliminary plans for the El Centro area office replacement project. The proposed facility would be 33,550 square feet, or about seven times the size of the existing 4,575 square foot facility that was built in 1966. The administration plans to request funding to construct the facility as part of the 2017–18 budget, which is estimated to cost $30.4 million—for a total project cost of $34.7 million.

Advanced Planning and Site Selection. The budget also includes $800,000 from the MVA for advanced planning and site selection to identify three additional offices to replace as part of the administration’s ongoing office replacement plan.

Proposal Would Impact MVA Fund Condition

We recognize that many of CHP’s existing area offices have deficiencies that merit their replacement in the near future. However, as we discussed earlier in this report, the MVA is facing an operational shortfall. Although the Governor proposes to increase MVA revenues by raising the vehicle registration fee, we estimate that under the Governor’s proposal (including the costs to replace area offices in Hayward, El Centro, and Ventura) the MVA would be barely balanced over the next few years and likely face an operation shortfall in the tens of millions of dollars by 2019–20.

LAO Recommendation

In view of the above, we recommend that the Legislature consider the proposed CHP area office replacement projects in the context of a larger strategy for resolving the operational shortfall in the MVA. As we suggested earlier in this report, the Legislature may want to reduce MVA expenditures in order to help address shortfalls in the fund. As such, the Legislature may want to consider deferring one or more of the three proposed projects. The Legislature may also want to consider reducing the proposed funding for advanced planning and site selection as a way to limit the number of additional replacement projects (and the associated costs to complete the projects) that are allowed to proceed.

Back to the TopDepartment of Motor Vehicles

The DMV is responsible for registering vehicles, issuing driver licenses, and for promoting safety on California’s streets and highways. Currently, there are 24 million licensed drivers and about 30 million registered vehicles in the state. Additionally, DMV licenses and regulates vehicle–related businesses such as automobile dealers and driver training schools, and collects certain fees and tax revenues for state and local agencies.

The Governor’s budget includes $1.1 billion for DMV in 2016–17, which is about 3 percent less than the estimated level of spending in the current year. This is due to certain one–time spending in 2015–16. The level of spending proposed for 2016–17 supports about 8,300 positions at DMV.

Self–Service Terminals

LAO Bottom Line. We recommend that the Legislature reject the Governor’s proposal to provide $8 million from the MVA for self–service terminals because we find that the additional funding is not justified. We also recommend that the Legislature require DMV to develop a comprehensive plan for the use of self–service terminals.

Background

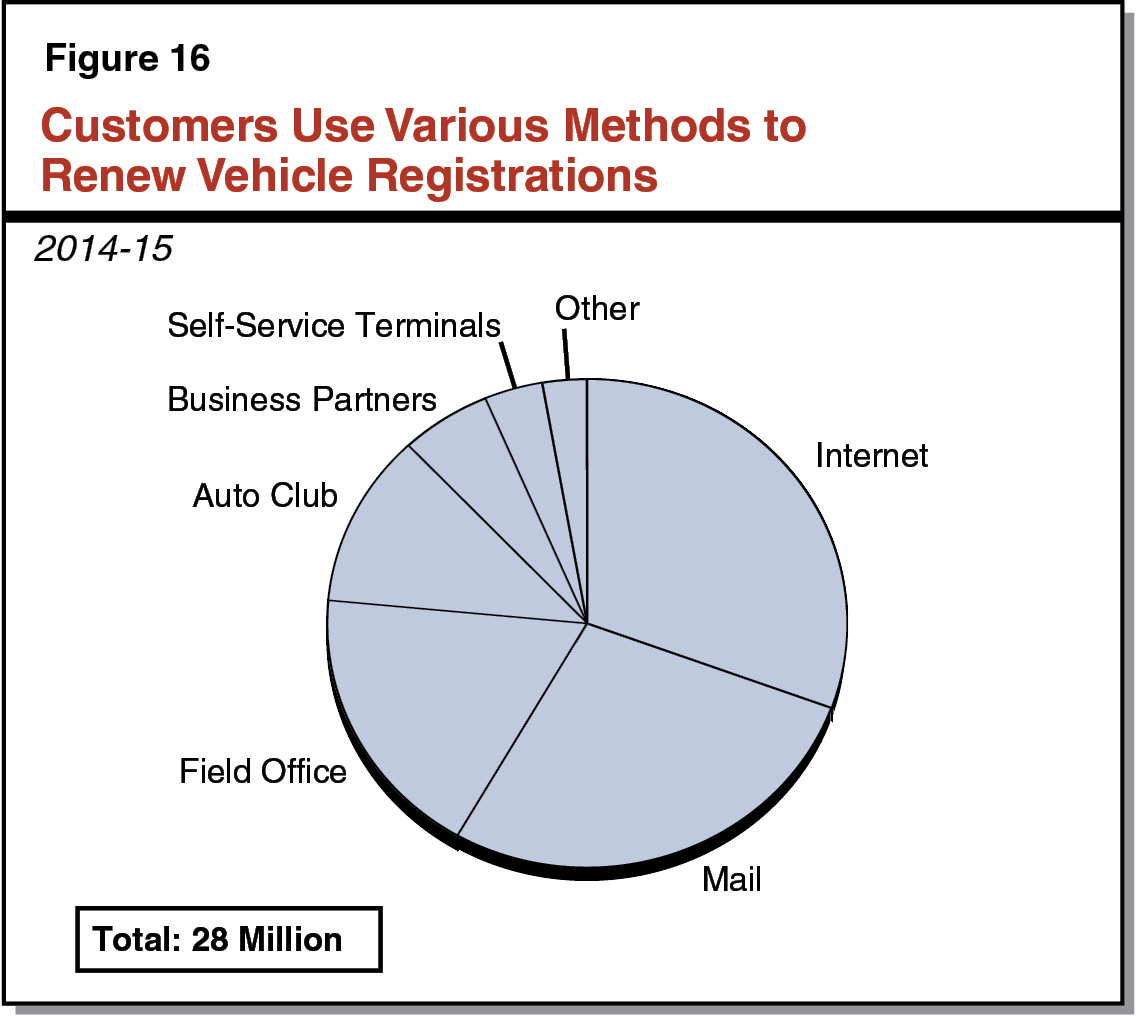

Various Options Available for Renewing Vehicle Registrations. DMV handles about 30 million vehicle registration renewal transactions each year. Customers can renew their registration through one of the several options currently available to them. These include the more traditional options (such as mailing in renewals or coming into field offices or auto clubs), as well as more nontraditional options that have increased over the years (such as completing renewals over the internet and through self–service terminals and business partners). (Under existing state law, DMV is authorized to contract with qualified business partners, such as automobile dealers, for the electronic processing of certain vehicle–related transactions.) Regardless of which option a customer chooses, the base registration renewal fee charged by the DMV is the same under each option. We note, however, that customers who use a business partner are often required to pay a customer service transaction fee directly to the business partner.

Figure 16 shows the proportion of registration renewal transactions that were completed in 2014–15 under each service option. As the figure shows, more than three–fourths of all registration transactions were handled through the internet, mail, and field office visits. Self–service terminals, which we discuss below, made up about 4 percent of total transactions.

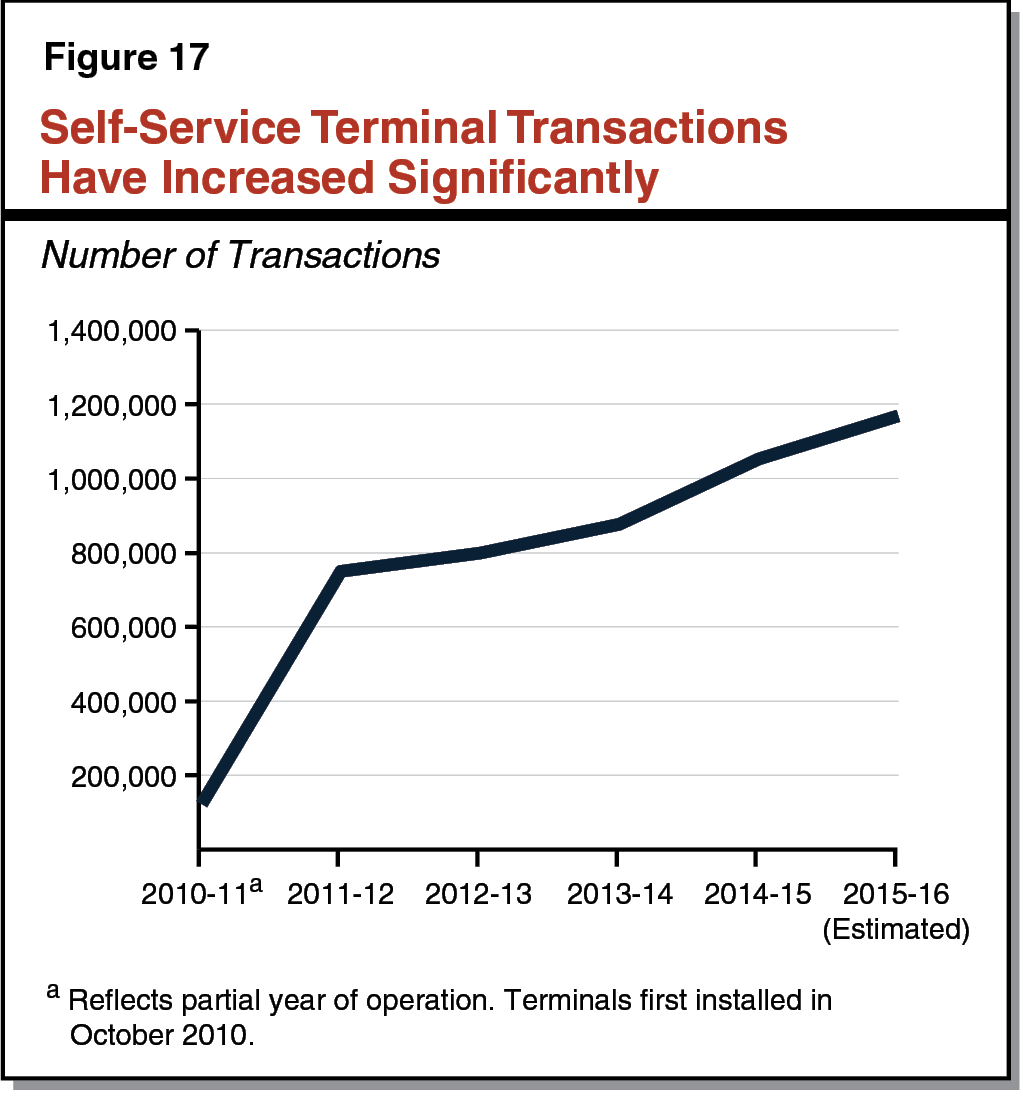

Use of Self–Service Terminals Has Increased Significantly. In October 2010, DMV administratively redirected resources within its base budget to fund the installation of 25 self–service terminals. Subsequently, the department redirected additional resources to double the number of self–service terminals to 50. These terminals allow customers to process their vehicle registration renewal transactions at a kiosk. The DMV’s 50 existing self–service terminals are located inside DMV field offices, accept multiple payment methods including cash, and provide a registration card and sticker to the customer upon completion of the renewal.

Figure 17 shows the number of transactions processed through self–service terminals since they were first implemented in 2010–11. While the total number of transactions processed through self–service terminals is small compared to other service options, use of the terminals has increased significantly during the six years that they have been in operation—from 124,000 transactions in 2010–11 to an estimated 1.2 million transactions in 2015–16.

Self–Service Terminals Convenient Alternative to Being Serviced by Field Office Staff. The existing 50 terminals provide a convenient alternative for customers who go into a field office to renew their vehicle’s registration. In many instances, customers who visit a field office with a self–service terminal are often informed of the option of using a terminal rather than waiting to be serviced by DMV staff. According to DMV, self–service terminals are particularly used by customers who are paying with cash or have waited until the deadline to renew their registration. This is because customers cannot pay with cash through most other options available (such as through the internet or by mail), and many customers who wait until the deadline to renew their registration want to receive a new registration card and sticker immediately to document that they have a valid registration.

Self–Service Terminals Are Cost–Effective. As indicated above, the base registration renewal fee charged to customers is the same regardless of the method the customer chooses to process the renewal. However, DMV’s actual costs to process vehicle registration transactions differs significantly by processing method. Figure 18 shows DMV’s average reported cost to process vehicle registration transactions through the three major service options and through self–service terminals. As indicated in the figure, field office staff transactions are the most costly, with the average field office transaction for a registration renewal costing $23.63. In comparison, transactions processed at self–service terminals are less costly, with an average cost of about $9.37 per transaction. Internet and mail transactions are the least costly.

Figure 18