LAO Contacts

- In-Home Supportive Services

- SSI/SSP

- CalWORKs

- Overall Human Services Issues

Budget and Policy Post

February 28, 2017The 2017-18 Budget

Analysis of the Human Services Budget

In-Home Supportive Services

Background

Overview of the In-Home Supportive Services (IHSS) Program. The IHSS program provides personal care and domestic services to low-income individuals to help them remain safely in their own homes and communities. In order to qualify for IHSS, a recipient must be aged, blind, or disabled and in most cases have income below the level necessary to qualify for Supplemental Security Income/State Supplementary Payment cash assistance. The recipients are eligible to receive up to 283 hours per month of assistance with tasks such as bathing, dressing, housework, and meal preparation. In most cases, the recipient is responsible for hiring and supervising a paid IHSS provider—oftentimes a family member or relative. Social workers employed by county welfare departments conduct an in-home IHSS assessment of an individual’s needs in order to determine the amount and type of service hours to be provided. The average number of service hours that will be provided to IHSS recipients is projected to be 105 hours per month in 2017-18.

IHSS Receives Funding From a Combination of Federal, State, and Local Sources. The IHSS program is predominately delivered as a benefit of the state-federal Medicaid health services program (known as Medi-Cal in California) for low-income populations. The IHSS program is subject to federal Medicaid rules, including the federal medical assistance percentage reimbursement rate for California of 50 percent of costs for most Medi-Cal recipients. Additionally, about 40 percent of IHSS recipients, based on their assessed level of need, qualify for an enhanced federal reimbursement rate of 56 percent, referred to as Community First Choice Option. As a result, the effective federal reimbursement rate for IHSS is about 54 percent.

The remaining costs of the IHSS program are paid for by the state and counties. Historically, the state paid for 65 percent of nonfederal program costs and counties paid for the remaining 35 percent. Beginning in 2012-13, the Coordinated Care Initiative (CCI) replaced the prior county contribution rate with a county IHSS maintenance-of-effort (MOE). The county MOE generally sets counties’ contributions to IHSS at their 2011-12 expenditure levels and increases the contributions annually by 3.5 percent plus any additional costs associated with locally negotiated IHSS wage increases. Since the implementation of the MOE, the state General Fund has assumed all nonfederal IHSS costs above counties’ MOE expenditure levels. (We note that, as part of the 2017-18 budget, the Governor has eliminated the IHSS county MOE pursuant to a “poison pill” provision in CCI-related legislation [as discussed later]—returning counties to their historic cost-sharing ratio.)

Budget Overview and LAO Assessment

The Governor’s budget proposes a total of $10.6 billion (all funds) for IHSS in 2017-18, which is about $660 million (7 percent) above estimated expenditures in 2016-17.The budget includes about $3.1 billion from the General Fund for support of the IHSS program in 2017-18. This is a net decrease of $375 million (11 percent) below estimated General Fund costs in 2016-17. It is important to note that the year-over-year net reduction in IHSS General Fund expenditures masks a number of cost increases, savings, and cost shifts. Below, we discuss some of the main components of the Governor’s budget for IHSS and note any issues with them.

Increase in IHSS Basic Services Costs

Caseload growth, rise in hours per case, and wage increases for IHSS providers are key cost drivers of increasing IHSS service costs. Figure 1 provides a historical overview of changes in these factors. Below, we describe recent caseload, hours per case, and IHSS wage trends and how these primary cost drivers affect the Governor’s 2017-18 proposal for IHSS.

- Increasing Caseload. Within the past three years, IHSS caseload has grown at an average rate of about 5 percent annually. The Governor’s proposal assumes similar growth in 2017-18, with average monthly caseload for IHSS estimated to be a little over 515,000. We have reviewed the caseload projections in light of actual caseload data available to date and do not recommend any adjustments at this time.

- Average Hours Per Case. The Governor’s budget assumes that IHSS average hours per case in 2016-17 and 2017-18 will be roughly the same as average monthly IHSS paid hours in 2015-16. In 2015-16, average hours per case increased by 10 percent—a higher growth rate than prior years—which was partially attributable to the 7 percent restoration of IHSS service hours (discussed more fully below). We have reviewed the average hours per case calculation for 2015-16, which serves as the basis for the current-year and budget-year projections, in light of actual hours per case data available to date and do not raise any concerns at this time. However, as shown in Figure 1, average hours per case have been steadily increasing in recent years. To the extent that 2016-17 and 2017-18 experience growth in the average hours per case similar to prior years (average growth of 2 percent annually), General Fund costs for IHSS in 2017-18 would be about $100 million higher than estimated in the Governor’s budget.

- State and Local Wage Increases. In addition to increasing caseload and hours per case, provider wage increases at the county and state level have contributed to increasing IHSS service costs. The Governor’s budget includes $41 million General Fund ($135 million total funds) for the combined impact of recent state minimum wage increase from $10.00 to $10.50 per hour on January 1, 2017 and the scheduled increase from $10.50 to $11.00 per hour on January 1, 2018. The budget also reflects wage increases negotiated at the county level for IHSS providers. IHSS wages are scheduled to continue to increase incrementally every year as a result of scheduled increases in the state minimum wage through January 1, 2022 (reaching $15 per hour). We note that in future years, as the state minimum wage increases, it will affect more counties and therefore have a greater effect on IHSS service costs.

Figure 1

Recent Growth in Key In-Home Supportive Services (IHSS) Cost Drivers

|

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

2016-17a |

2017-18a |

|

|

IHSS Caseload |

|||||||

|

Monthly average |

432,650 |

443,264 |

425,526b |

443,734b |

467,099b |

491,141b |

516,935b |

|

Percent change |

— |

2% |

-4% |

4% |

5% |

5% |

5% |

|

Hours Per Case |

|||||||

|

Monthly average |

85 |

86 |

92 |

95 |

105 |

105 |

105 |

|

Percent change |

— |

1% |

6% |

4% |

10% |

— |

— |

|

IHSS Hourly Wage |

|||||||

|

Hourly average |

$9.75 |

$10.01 |

$10.16 |

$10.30 |

$11.03 |

$11.19 |

$11.45 |

|

Percent change |

— |

3% |

1% |

1% |

7% |

1% |

2% |

|

a2016-17 and 2017-18 reflect estimates from the 2017-18 Governor’s Budget proposal. bThese caseload numbers do not include modest increases to IHSS caseload attributed to the Affordable Care Act and the Coordinated Care Initiative. |

|||||||

Proposed Continued Restoration of Service Hours From 7 Percent Reduction

The Governor’s budget includes $190 million General Fund ($623 million in total funds) to continue to restore IHSS service hours that were eliminated as a result of a previously enacted 7 percent reduction in service hours, with statute providing that the restoration is conditional on the recently passed managed care organization (MCO) tax being in place. The MCO tax is expected to be effective through 2018-19.

Update on the Implementation of Federal Labor Regulations

That Affect Home Care Workers

In February 2016, the state implemented the new federal labor regulations for IHSS providers following a one-year delay due to federal court action. The federal regulations require the state to (1) pay overtime compensation—at one-and-a-half times the regular rate of pay—to IHSS providers for all hours worked that exceed 40 in a week, and (2) compensate IHSS providers for time spent waiting during medical appointments and traveling between the homes of IHSS recipients.

In preparation for the new IHSS overtime rule, the Legislature adopted statutory workweek caps generally limiting the number of hours an IHSS provider can work to 66 hours per week. When multiplied by roughly four weeks per month, this weekly limit is about equal to the maximum number of service hours that may be allotted to IHSS recipients per month (283 hours per month). Additionally, in 2016, the Department of Social Services (DSS) administratively established two types of exemptions in response to federal guidance asking states implementing workweek caps for IHSS to consider provider exemptions in situations where the caps could lead to increased risk of institutionalization for the consumer. We note that current law does not provide specific authority for these exemptions. (We discuss this issue in a later section.)

As illustrated in Figure 2, the 2017-18 budget includes $463 million in nonfederal—state and county—funds for compliance and administration of the federal labor regulations, an increase of $28 million (6 percent) over estimates for 2016-17. Below, we provide an update on the implementation of overtime pay, provider exemptions, and compensable work after a full year of the new federal labor regulations being in effect and discuss differences in the 2017-18 Governor’s Budget relative to prior budget assumptions.

Figure 2

Updated IHSS Nonfederal Costs to Comply With Federal Labor Regulationsa

(In Millions)

|

2016-17 |

2017-18 |

|||

|

Appropriation |

Revised |

|||

|

Overtime premium pay |

$230 |

$255 |

$271 |

|

|

Travel time and medical accompaniment |

180 |

172 |

183 |

|

|

Provider exemptions |

22 |

5 |

6 |

|

|

Administration |

2 |

3 |

3 |

|

|

Totals |

$434 |

$435 |

$463 |

|

|

aFor 2016-17, the nonfederal costs are 100 percent General Fund. For 2017-18, the nonfederal funds are assumed to be 35 percent county and 65 percent General Fund. |

||||

Continued Limitations on Overtime. The estimates of IHSS provider overtime costs reflect statutory caps, generally limiting the number of hours an IHSS provider can work to 66 hours per week. The majority of IHSS providers work less than 40 hours a week, with about 20 percent of IHSS providers working more than 40 hours per week and receiving overtime pay. As discussed more fully below, IHSS recipients and providers may work additional overtime hours and exceed the 66-hour workweek cap by obtaining an exemption. In addition, IHSS recipients may request additional overtime hours when they require more support in a given workweek—for example, if they fall ill. Upon county approval, IHSS recipients are expected to adjust their provider’s remaining workweek hours so that total monthly hours worked does not exceed the provider’s authorized monthly hour cap. The Governor’s budget estimates that 23 percent of providers will typically work more than 40 hours per week in 2017-18. Of those providers, it is estimated that they will, on average, work 61 overtime hours per month, or a total of about 55 hours per week, in both 2016-17 and 2017-18, an increase of 5 hours from 2016-17 budget estimates.

Continued Compensation for Travel Time and Medical Accompaniment. The Governor’s budget also includes the continuation of compensable hours for medical accompaniment (estimated to average three hours per month) and travel time, under certain conditions. Specifically, compensable travel time applies only to IHSS providers who work for multiple recipients and includes hours spent traveling between the homes of recipients. Based on actual data, the budget estimates that half of providers with multiple recipients will spend and claim an average of 17 travel hours per month, an increase of about 7 hours from the administration’s initial estimate in 2016-17.

Lower-Than-Expected Issued Exemptions to Overtime Limits for Certain Providers. In 2016, DSS issued guidance to counties establishing two exemptions to the 66-hour workweek cap for certain providers with multiple recipients. For both exemptions, the weekly maximum allowable hours are extended from 66 hours per workweek to 90 hours per workweek (not to exceed 360 hours per month).

The first exemption applies to IHSS providers who are related to, live with, and work for two or more IHSS recipients on or before January 31, 2016. Eligible recipients were notified of the exemption and mailed application forms by DSS. The second exemption applies to IHSS providers who work for two or more IHSS recipients whose extraordinary circumstances place them in imminent risk of out-of-home institutionalized care. Qualifying extraordinary circumstances include (1) complex medical or behavioral needs that requires a live-in provider, (2) residence in a rural and remote area where available providers are limited and as a result the recipient is unable to hire another provider, or (3) an inability to hire a provider who speaks his/her same language in order to direct his/her own care. For the most part, recipients or providers contact their IHSS county social worker to determine whether they meet the eligibility criteria for an extraordinary circumstances exemption. Before an IHSS county social worker submits a formal request for an extraordinary circumstances exemption to the state, it must be determined that the recipient, with county assistance, has explored and exhausted all other options to meet their additional service needs, such as hiring another provider.

At the time the 2016-17 budget was enacted, it was estimated that approximately 1,200 IHSS providers would receive a family exemption and 5,000 providers would receive an extraordinary circumstances exemption (out of an estimated 462,000 IHSS providers). As of January 2017, about 1,400 providers were issued family exemptions and about 50 providers were issued extraordinary circumstances exemptions. As a result, the Governor’s January proposal includes significantly lower estimates for issued extraordinary circumstances exemptions (135 in 2016-17 and 385 in 2017-18).

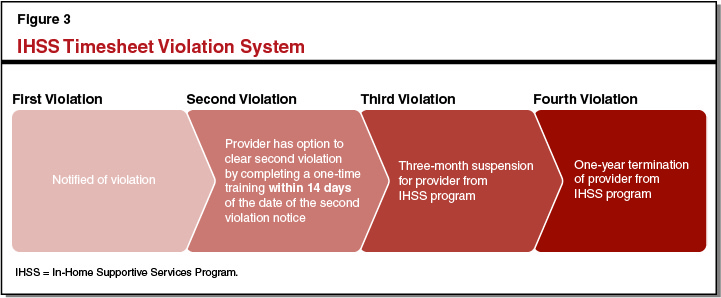

Increasing Number of Timesheet Violations. Starting July 1, 2016, DSS began issuing timesheet violations to providers for exceeding their authorized monthly work caps or permitted travel time (up to 28 hours per month). As shown in Figure 3, violations are administered based on a four-level violation system, with consequences becoming more severe as a provider continues to work above their monthly work cap or allotted travel time. The total number of providers with timesheet violations has increased from 2,912 in July 2016 (the first month in which providers could receive a timesheet violation) to 4,699 in December 2016. Despite these increases, providers with second and third violations remain a significantly small portion of the overall IHSS provider population. IHSS providers have the option to clear second violations through a one-time training about workweek and travel time limits.

The Legislature May Consider Statutorily Establishing Exemptions. The state legislation implementing the federal labor regulations does not provide specific authority for DSS to exempt certain providers from the workweek caps this legislation established, and the administration is not proposing trailer bill language to codify these exemptions in statute. To increase its oversight of the exemption policy, the Legislature may wish to consider adopting trailer bill language to ensure that there is statutory authority for provider exemptions to the workweek caps that is in line with legislative intent.

Termination of Coordinated Care Initiative

Counties’ Share of IHSS Costs Reverts to Prior Cost-Sharing Ratio Resulting in Significant General Fund Savings. Since the IHSS county MOE was instituted, the General Fund has borne a disproportionate amount of growing IHSS program costs, growing at an average rate of 20 percent annually, from $1.7 billion in 2012-13 to an estimated $3.5 billion in 2016-17. County IHSS program costs, by contrast, have increased at an average rate of around 4 percent annually over the same period.

State law contains a poison pill provision that automatically discontinues the pilot program if the Director of Finance determines that the CCI does not generate annual net General Fund savings and is therefore not cost-effective. The Governor’s budget reflects a determination that the CCI is not cost-effective, which the administration primarily attributes to growing General Fund costs under the IHSS county MOE. As a result, the IHSS county MOE will end on July 1, 2017 and be replaced with the prior IHSS program cost-sharing ratio of counties paying 35 percent of nonfederal program costs and the state paying the remaining 65 percent. (We note that the Governor’s budget proposes to seek statutory authority to continue certain components of CCI, not including the statewide IHSS county MOE.)

Comprehensive Analysis of Fiscal and Programmatic Implications Captured in a Separate LAO Report. In the Governor’s proposal, it is estimated that IHSS county costs will increase by $623 million in 2017-18 as a result of the termination of the IHSS county MOE and restoration of the historical IHSS cost-sharing ratio. An in-depth analysis of the potential fiscal and programmatic impacts of terminating the IHSS county MOE can be found in The 2017-18 Budget: The Coordinated Care Initiative: A Critical Juncture.