In this brief we analyze the Governor’s May Revision proposal to borrow $6 billion from the Pooled Money Investment Account (PMIA) to make a one-time payment to reduce state pension liabilities at CalPERS. The Governor proposes that the state General Fund and special funds repay this loan with interest over a period of about eight years.

May 16, 2017

The 2017-18 Budget

Governor's CalPERS Borrowing Proposal

Executive Summary

In this brief we analyze the Governor’s May Revision proposal to borrow $6 billion from state government funds in the Pooled Money Investment Account. These funds would be Used to make a one-time payment to reduce state pension liabilities at CalPERS. The Governor proposes that the state General Fund and special funds repay this loan with interest over a period of about eight years.

Administration Proposes Large Commitment of Resources Without Sufficient Planning. We think the plan would probably save the state money over the long run, although uncertainties remain about the likelihood and magnitude of this benefit. However, the administration is asking the Legislature to approve a large commitment of public resources with insufficient consideration. The administration has provided few of the legal or quantitative analyses that the Legislature should expect when receiving a request of this magnitude and complexity. In particular, additional pension cost analyses should have been prepared by professional actuaries. In addition, the administration should have already conducted a review to determine how many of the state’s special funds will have difficulty making loan repayments under the proposal. (Instead, the administration plans to conduct this analysis after the Legislature has approved the loan.) Finally, the administration should have conducted a more thorough legal analysis of such a novel proposal.

Recommend Legislature Act on Plan Later in Session. The administration has introduced this proposal as part of the May Revision—with only weeks before the constitutional deadline for the Legislature to approve the budget. We doubt that all of the issues we raise can be reviewed by the June 15 budget deadline. However, there is no reason that the Legislature must make a decision before June 15. We recommend the Legislature wait to act on this plan until after the administration has submitted more analysis. At that point, the Legislature could decide whether or not to approve the proposal.

Introduction

The state has large unfunded liabilities associated with retirement benefits earned by state employees. A recent decision by the California Public Employees' Retirement System (CalPERS) board will require the state to contribute more money each year to pay down pension liabilities. As part of his May Revision to the 2017-18 budget, the Governor proposes that the state borrow $6 billion from its short-term savings account to make a one-time payment to CalPERS to reduce these unfunded liabilities and save the state money over the long term by lowering annual pension costs. This brief describes and evaluates the Governor’s proposal. In addition, we provide comments and recommendations for the Legislature to consider as it decides whether to approve the Governor’s proposal.

Background

In this section, we provide background on the administration’s proposal. This background includes information related to the state’s short-term savings and investments, the use of those accounts to help the state manage cash flows, budgetary borrowing to address budget shortfalls, the state’s retirement liabilities, and the constitutional minimum amounts the state must spend on annual debt payments under Proposition 2 (2014).

State’s Short-Term Savings and Investments

State’s Short-Term Savings Accounts. The Pooled Money Investment Account (PMIA) is the state’s short-term savings account. The PMIA holds funds on behalf of the state, as well as cities, counties, and other local entities in the separate Local Agency Investment Fund (LAIF). As of the quarter that ended in March 2017, the balance of the PMIA was roughly $70 billion. The state’s portion accounted for two-thirds of this total while the local portion represented the remaining one-third. LAIF balances are never used by the state. However, investment returns from the PMIA are accrued to the entire pool, so changes in those returns affect the LAIF. Much of the state funds invested in the PMIA are held in the Surplus Money Investment Fund (SMIF), the portion of the PMIA that holds most balances of the state’s special funds.

PMIA Reserve Balances Are High. The roughly $70 billion in the PMIA includes money from the state’s main operating account and hundreds of other funds (including special funds). Working capital needs for hundreds of separate state funds—needed to manage seasonal cash flows of each fund and pay state bills on time—always total in the tens of billions of dollars. Reserve balances in both the General Fund and other funds tend to grow during periods of economic expansion when revenues are higher. The current economic expansion has lasted nearly eight years, one of the longest periods of uninterrupted economic growth on record. For these reasons the PMIA now has significant balances—billions more than needed to cover all state working capital needs in the near term.

PMIA Is Managed by the State Treasurer and Governed by Board. The Investment Division of the State Treasurer’s Office manages the PMIA and invests its money in safe instruments. The PMIA is governed by the Pooled Money Investment Board (PMIB), which includes the Treasurer, the Controller, and the Director of Finance. The PMIB has a fiduciary duty to safeguard the interests of its investors—the state and local governments with funds invested in the LAIF.

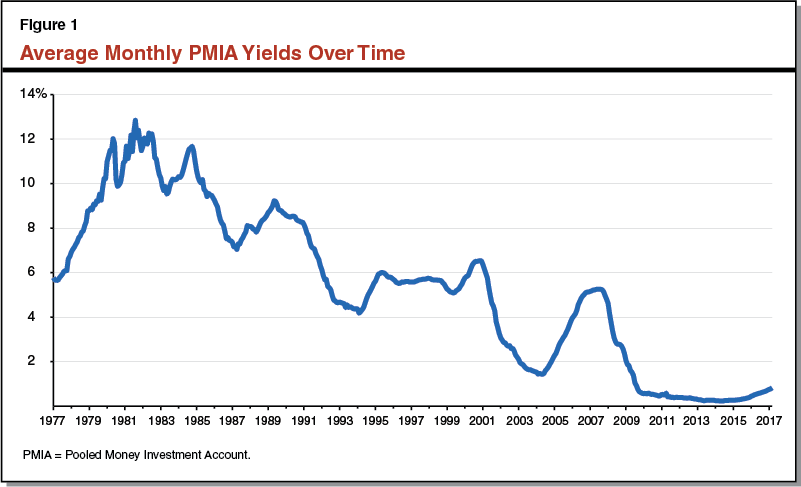

PMIA Yield Has Varied Over Time. The Treasurer typically invests funds in the PMIA in safe instruments with short-term maturity schedules. The average effective yield of those investments is currently 0.88 percent. However, as shown in Figure 1, these average yields have varied over time. In the early 1980s, they were generally above 10 percent and fell to around 9 percent in the early 1990s. For much of the late 1990s and 2000s, the yield averaged around 6 percent, although it fell after the dot-com bust and ensuing recession in the early 2000s. After the rate fell in 2008, it has remained near zero as inflation and U.S. Treasury yields have also remained low.

Cash Management

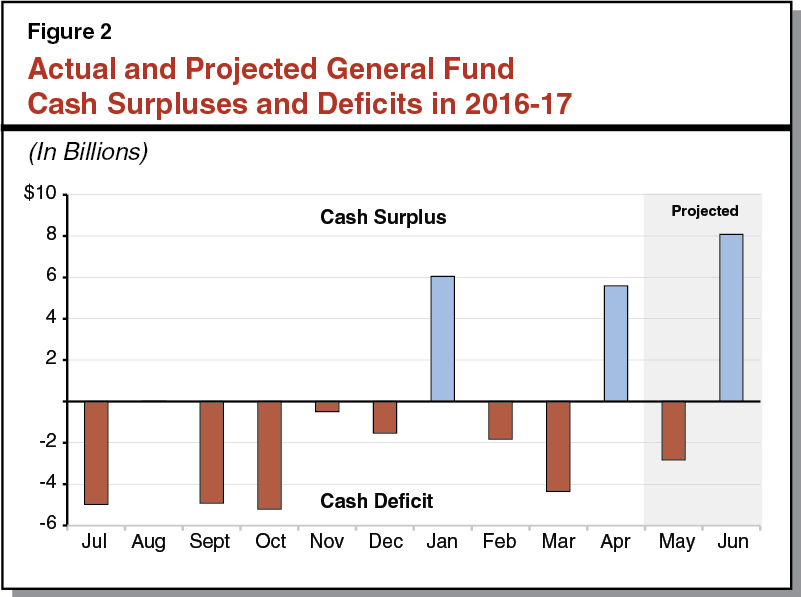

Cash Deficits Often Occur During the First Half of the Fiscal Year. Cash flows in the General Fund can swing widely throughout the year. In particular, the state usually faces seasonal cash deficits during the early months of the state fiscal year when the state typically has more spending than receipts. This is because state tax collections are concentrated in the second half of the fiscal year, especially in April (the annual income tax payment deadline), January, and June. Figure 2 displays the state’s month-by-month cash surpluses and deficits in 2016-17.

Internal Borrowing From PMIA Used to Manage State’s Cash Flow. In addition to serving as the state’s short-term investment account, the PMIA is an important tool to help the state manage seasonal cash deficits, as noted above. During times of cash imbalances, the General Fund borrows billions of dollars from other state funds held in the PMIA. The General Fund pays the PMIA back with interest each year. The administration estimates the costs of internal borrowing for cash management purposes will be roughly $20 million in 2017-18.

State Can Use External Borrowing to Manage Cash Deficits. Internal sources are not always sufficient to allow the General Fund to address its monthly cash flow deficits. In these cases, the state uses a short-term external cash borrowing instrument, known as a Revenue Anticipation Note (RAN), to address cash flow. Although the state has not issued a RAN since 2014-15, RAN issuance occurred every year between the mid-1980s and 2014-15 (except 2000-01), in both good and bad budgetary situations. RANs are typically issued early in a fiscal year and are repaid prior to the end of the fiscal year of issuance. RANs are repaid at a market rate of interest to municipal bond investors.

Budgetary Borrowing to Address Budget Shortfalls

Borrowing to Help Balance Annual State Budget. When the state faced significant budget shortfalls during the 2000s, the Legislature authorized the General Fund to borrow large amounts from dozens of specific special funds. Unlike cash management borrowing, which is repaid within the fiscal year, these “budgetary loans” from special funds have sometimes remained outstanding for several years. California courts have opined that the Legislature has broad discretion to authorize such loans to help balance the General Fund budget as long as the loans do not interfere with the core “object for which the special fund was created.” At their peak in 2013, special fund budgetary loans outstanding totaled $4.6 billion. The state, however, now has repaid most of those loans—largely by using debt payment funds from Proposition 2. According to the administration’s current estimates, about $1.4 billion of these loans now are outstanding. (In addition, the state has roughly $2 billion in other outstanding transportation-related loans that the administration tracks separately.)

Special Fund Balances. These special fund loan repayments and the current economic expansion have both contributed to increasing special fund balances. In 2011-12, aggregate reserves in California’s special funds totaled $8 billion. In January, the administration estimated that aggregate special fund reserves would reach $16 billion in 2016-17 (excluding the Budget Stabilization Account). Even with proposed spending increases in this year’s budget, special fund reserves—sometimes cautiously estimated in the past—are estimated to remain above $12 billion. (Balances held in the PMIA at any given time include special fund and other state fund reserves and funds’ working capital, including expenses committed but not yet distributed.) In January, we suggested—as we have in prior years—that the state’s elected leaders should review some special funds with significant balances to determine if one-time or ongoing fee reductions—or changes in the funds’ spending—are needed.

Retirement Liabilities

Large Unfunded Liabilities. There are three major categories of state liabilities—retirement, infrastructure, and budgetary liabilities. According to the administration’s estimates, nearly one-half of the nearly $282 billion of outstanding liabilities across these three categories are attributable to pension and retiree health benefits earned to date by active and former state employees. Specifically, CalPERS pension liabilities are estimated to be about $60 billion and the state’s unfunded liabilities associated with state employee retiree health benefits are estimated to exceed $76 billion.

Recent Assumption Change Contributed to Increasing Contributions. CalPERS pensions are funded from three sources: investment gains, employer contributions, and employee contributions. CalPERS reports that about two-thirds of benefit payments are paid from past investment gains. CalPERS expects investment returns over the next decade to be lower than past returns. At its December 2016 meeting, the CalPERS board voted to lower the investment return assumption from 7.5 percent to 7.0 percent over the next three years. By assuming less money comes into the system through investment gains, the state will be required to contribute more money to pay for higher normal costs and a larger unfunded liability. CalPERS estimates that the state’s contributions will increase from $5.9 billion in 2017-18 to over $9 billion by 2023-24.

State Beginning to Prefund Retiree Health Benefits. Until recently, like most governments in the United States, California did not fund health and dental benefits for its retirees during their working careers in state government. This has resulted in large unfunded liabilities for those benefits. The state has begun implementing its plan to address retiree health benefit liabilities through (1) employer (state) and employee contributions to prefund these benefits and (2) a reduction in the benefits earned by future employees. Through the collective bargaining process, the state has implemented its plan for most state employees.

Proposition 2 Debt Payment Requirements

Establishes Minimum Annual Debt Payments Toward Certain Eligible Debts. Passed by voters in 2014, Proposition 2 amended the State Constitution to require the state to make certain extra annual debt payments and budget reserve deposits each year. The goals of the measure were to bolster state reserves and accelerate payments on certain state debts. These payments are required through 2029‑30. Thereafter, the required annual debt payments become optional, but amounts not spent on debt must be deposited into the rainy day reserve. Unlike reserve requirements, which the Governor and Legislature may reduce during a budget emergency, the state may not reduce the required annual amounts of debt payments under Proposition 2 for any reason through 2029-30.

Certain Payments Toward State-Level Pension Plans Are Eligible. There are three types of outstanding debts eligible for payments under Proposition 2. They are: (1) certain budgetary liabilities (including the amounts the state’s General Fund owes special funds, as described above), (2) certain payments of statewide pension system liabilities, and (3) prefunding for state retiree health benefits. Proposition 2 requires payments for pension and retiree health liabilities to be “in excess” of “current base amounts.”

Total Required Amounts Will Vary Each Year. A formula determines the required minimum amount of extra Proposition 2 debt payments each year. First, the state must set aside 1.5 percent of General Fund revenues and transfers. Second, the state must set aside a portion of capital gains tax revenues that exceed a specified threshold (we refer to this as “excess capital gains taxes”). The state must split these totals between debt payments and reserve deposits. While the 1.5 percent amount is relatively steady, excess capital gains taxes can vary significantly with fluctuations in capital gains revenues, which are very volatile. The administration currently projects required Proposition 2 debt repayments will vary from $1.7 billion in 2017-18 to $1.2 billion in 2020-21.

Planned Proposition 2 Payments for State Retiree Health Plan. At least until 2020-21, the administration proposes to count all of the state’s current and future costs of prefunding retiree health benefits toward Proposition 2. This year, those General Fund costs are about $90 million, but under the administration’s current projections they will rise to $300 million in 2020-21.

Governor’s Proposal

This discussion considers information received about the plan as of Monday, May 15, 2017. Draft statutory language was received after that date.

Initial Loan

Administration Proposes Borrowing $6 Billion. In the May Revision, the Governor proposes borrowing $6 billion from the state's portion of the PMIA to make a supplemental payment to CalPERS. This $6 billion contribution would be in addition to the actuarially required contributions to CalPERS—referred to as an “additional discretionary payment” to CalPERS. The administration chose this figure based on a variety of qualitative factors. In particular, the administration says this amount would: (1) reduce the state’s long-term pension costs resulting from the lower discount rate, (2) make the state’s 2017-18 CalPERS contributions roughly double what it otherwise would be, and (3) be low enough that it would not cause a strain on the PMIA.

Borrowing Would Occur From State’s Share of PMIA, Not Individual Special Funds. Mechanically, the proposal represents a borrowing technique that is a shift from past practice for loans scheduled in the annual budget. Rather than borrow from individual special funds as the state has done in past, this loan would come from PMIA as a whole. (Repayments, however, would be apportioned by fund, which we discuss in more detail below.) As a result, we understand that this proposal would not reduce individual special funds’ balances on official fund condition statements when the transaction is executed in 2017-18.

Contribute Money to CalPERS Over Course of 2017-18. The administration proposes depositing the borrowed money with CalPERS on a periodic basis throughout the 2017-18 fiscal year to accommodate cash flow needs. The precise plan—such as the size and amount of each of those installments—was still being worked out as we prepared this analysis.

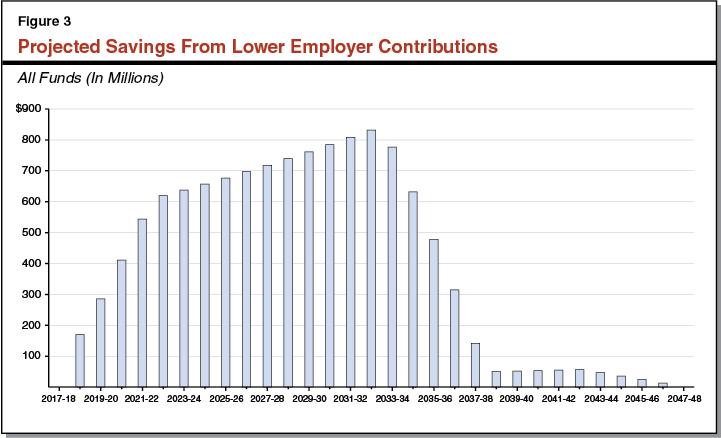

Higher Payment Today Reduces Future Costs. Any additional discretionary payment reduces a pension plan’s unfunded liabilities and the future contributions that must be made to the system. In general, paying more earlier reduces long-term pension costs because these contributions have more time to compound investment returns, reducing the need for future contributions. CalPERS estimates that the $6 billion additional discretionary payment would substantially mitigate state employer contributions as a result of the recent change in the investment return assumption. Specifically, CalPERS estimates that the state’s employer pension contributions would be 6.7 percent lower (reducing the state’s annual contribution by about $638 million) by 2023-24 because of the additional discretionary payment. These benefits would be distributed among the General Fund and special funds that make pension payments. The administration estimates that this would reduce total employer contribution costs by roughly $12 billion over 30 years. (In addition, there would be about $1 billion of interest costs, for a net state budgetary benefit of about $11 billion.) The pension savings grow over time, as shown in Figure 3.

Loan Repayments

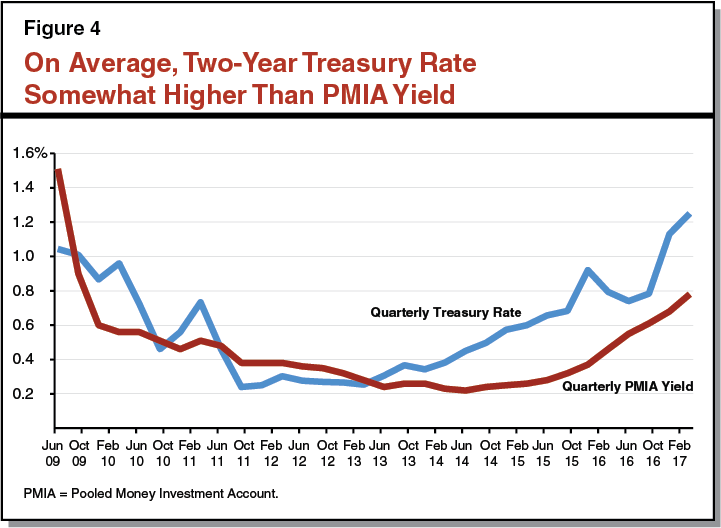

Interest Rate Charged to Loan Would Vary With Two-Year Treasury Rate. The administration proposes to repay the loan with interest each year. This rate would float (vary) with a two-year Treasury rate—specifically, an index based on the average yield of a range of Treasury securities, adjusted to the equivalent of a two-year maturity. In recent years, this two-year Treasury rate has averaged somewhat above the PMIA quarterly yield (0.6 percent compared to 0.45 percent). Figure 4 compares these rates over time.

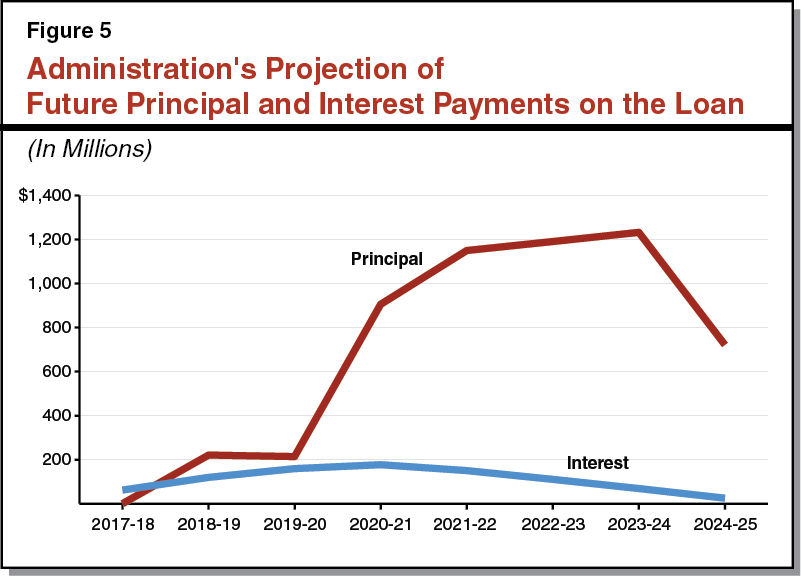

Pay Loan Back Over Next Eight Years or So. The administration has not determined a precise plan for the state General Fund and other funds to repay the $6 billion loan from the PMIA. The administration provided our office a “working plan” that would pay the loan off in eight years. While the administration indicates that this payment period is flexible, it intends to take no longer than ten years to pay off the loan. Under the working plan, the General Fund would cover repayments on behalf of both itself and associated special funds in 2017-18 with a $427 million repayment (consisting of a $365 million principal payment plus a $62 million interest payment) counted toward Proposition 2 debt payment requirements. Other funds would begin making payments in 2018-19 and would later proportionally compensate the General Fund for the 2017-18 payment. Figure 5 shows the administration’s projections of future principal and interest payments until 2024-25.

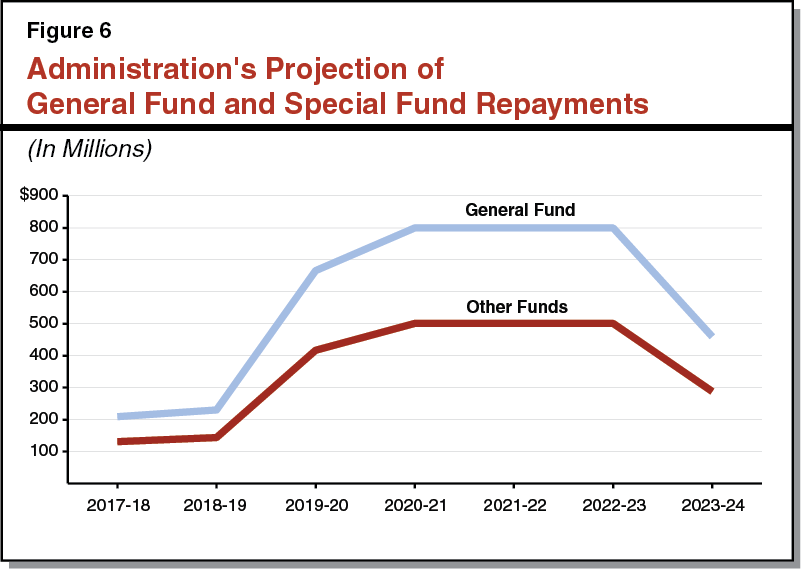

Administration Estimates the State Repayments Would Total Roughly $7 Billion. Under the administration’s current projection of interest costs, total loan repayments—principal and interest payments—would be roughly $7 billion. The administration’s proposal would, as we understand it, distribute these costs across the General Fund and other funds based on the proportional split of pension contributions by fund source. Consequently, the General Fund and other funds would be charged for around 60 percent and 40 percent of these costs, respectively. Under the administration’s current projections, over the life of the loan, the General Fund would repay $4.4 billion and special funds will collectively repay $2.5 billion. Figure 6 shows the administration’s anticipated repayments by fund type using its projected interest rates.

Proposition 2 Would Cover General Fund Portion of Loan Repayments. For the General Fund’s share of future loan repayments, the administration proposes establishing General Fund repayments based on the varying Proposition 2 debt payment requirements. The administration argues the repayments are consistent with the spirit of the law. In particular, the additional payment would be (1) for the purpose of reducing unfunded liabilities for state-pension benefits and (2) “in excess of current base amounts” required to be paid to CalPERS each year.

Special Funds Would Repay Loan Using Available Resources. Under the administration’s projections, the benefits of the loan in terms of lower employer contribution rates would eventually offset the full annual costs of the loan repayment. However, under the same projections, the full benefits of those lower rates would not materialize until 2022-23. In the interim years, we suspect that some special funds and other state funds may face a net cost from this loan. Some of these funds may not have sufficient resources to cover those costs. In these cases, interim General Fund support may be necessary—essentially to loan some special funds and other funds money to cover their initial annual cots under this plan. Affected special funds would then owe this money (with interest) to the General Fund. The administration has not assessed how many funds would face this issue, nor the amount of General Fund resources needed to support them. Representatives of the administration have told us they would work out these details during the summer after the final budget is adopted.

LAO Comments

Based on the information we have been provided to date, we think the Governor’s pension borrowing proposal is promising from an overall state budgetary perspective. That said—as we discuss in this section—there are a number of uncertainties about the Governor’s proposal and questions that we suggest the Legislature consider as it assesses this proposal. Unaddressed, these issues could reduce the overall benefit of the proposal to the state or result in more risk for state and local governments.

Fiscal Benefit to State Likely, but Uncertainties Remain

Administration Anticipates Net Benefits of $11 Billion. The administration anticipates this proposal would have a net benefit to the state, over the long run, of $11 billion. This benefit assumes long-term savings of $12 billion from lower employer contribution rates and long-term costs of $1 billion from interest on the loan. These benefits would be distributed among the General Fund and special funds.

Budget Savings Likely, but Hard to Predict. Over the long term, it is likely that the General Fund and special funds would experience net savings as a result of the one-time deposit to CalPERS. While the administration projects this benefit would be $11 billion, the precise amount of the benefit is unknown. The extent to which these savings are realized for the General Fund and all of the special funds would depend on a number of key factors:

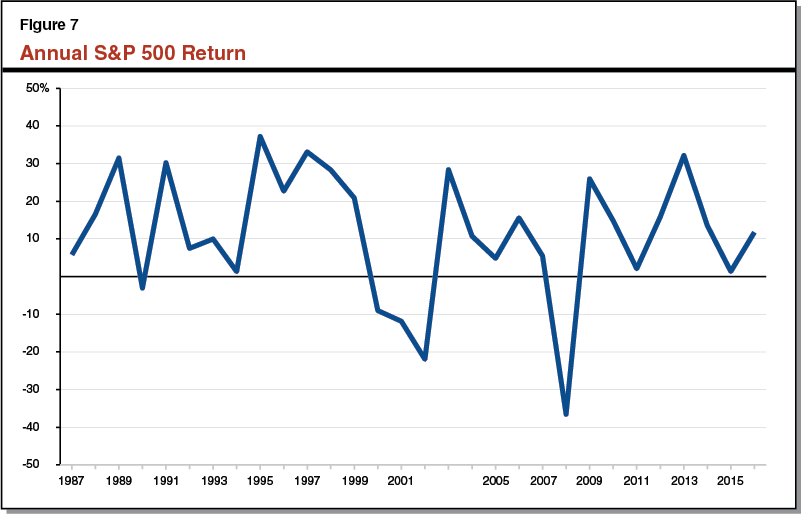

- Investment Returns. The extent to which the $6 billion additional discretionary payment to CalPERS in 2017-18 reduced state contributions—and therefore generated state savings—would depend largely on investment returns. The administration assumes CalPERS investments will earn an average return of 7 percent each year. However, this return depends largely on the U.S. stock market, which fluctuates significantly. To illustrate fluctuations in the market, Figure 7 shows the annual returns of the S&P 500 over the past 30 years. The state could be investing the $6 billion at a high point in investment markets—both our office and the administration’s economic projections assume that stock prices stagnate over the next few years—which would mean the actual savings to the state would be different from (and potentially less than) the administration suggests. If actual returns on the $6 billion deposit are higher or lower than 7 percent, the realized savings from the proposal could increase or decrease.

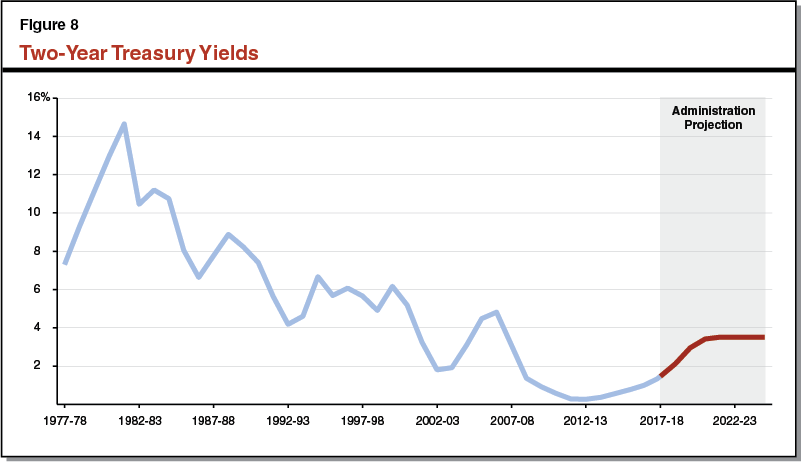

- Interest Rates. Under the administration’s proposal, the cost of the loan over its lifetime will depend, in large part, on changes in a specific index of two-year Treasury yields (which will determine the interest rate, and therefore interest costs of the loan). Figure 8 shows historic yields of this index and the administration’s assumptions about rates over the course of the loan. Under these assumptions, the interest cost of the loan would be $874 million over its lifetime. If interest rates remained lower, or climbed higher, these costs would vary accordingly.

- Cash Flow and External Borrowing Costs. While the state has not used a RAN for cash flow purposes in a few years, the state almost certainly will need to use this tool again in the future. By reducing the balance in the PMIA as a whole, the proposal reduces the state’s available cash cushion for internal borrowing. Therefore, implementing the proposal would likely mean the state would need to issue a RAN sooner or in greater amounts than it would have otherwise. This would result in higher state General Fund costs for RAN interest—potentially up to a couple hundred million dollars in some years.

- Internal Borrowing Costs. To the extent that the General Fund must cover special fund repayment costs, special funds will need to pay back the General Fund with interest. In the next couple of years, additional costs to the General Fund loans could be significant, perhaps as high as a few hundred million dollars over the period. Moreover, these shorter-term loans, coupled with the overall PMIA loan, could strain some special funds’ finances. This could require that those special funds either increase fees or reduce services provided to fee payers in some years in order to balance their budgets.

- Length of the Loan. The length of the loan would, in part, be determined by the Proposition 2 debt payment requirements, which are not very predictable. In particular, the administration proposes to vary General Fund repayments dependent on other, future Proposition 2 requirements. Under the administration’s current projections, General Fund repayments from Proposition 2 would reach $800 million in 2021-22. In some years, however, required debt payments may not cover both the proposed CalPERS loan repayments as well as needed funds to continue the administration’s plan to prefund retiree health benefits. (As discussed earlier, this is also a multi-year Proposition 2 obligation.) For example, retiree health benefit prefunding costs are expected to reach $300 million in 2020-21, and likely will increase thereafter. In years when capital gains revenues are low, Proposition 2 debt payment amounts will only include the base amount (which could be less than $1 billion, depending on other revenue performance). Under these circumstances, the administration suggests it may be desirable to repay the loan more slowly—and extend the life of the loan. Changing the length of the loan would affect its costs.

Detailed Analysis About Benefits and Risks Desirable. We believe there is a high probability that the administration’s proposal would result in net savings to the state over the long run. No one definitively can predict the net benefits; however, professional actuaries often use a type of statistical analysis referred to as “stochastic modelling” that uses random variations in assumptions—like market returns—to determine a range of possible outcomes. One type of stochastic modeling is referred to as “Monte Carlo simulations.” These simulations test the effect of many random investment return scenarios in the future to determine a range of probable changes to contributions to a pension system over time. This type of analysis increasingly is a standard for evaluating state and local pension proposals. Such analysis would provide the Legislature a much better sense of the risks associated with the administration’s proposal.

Questions for Legislative Consideration

In addition to the fiscal issues we have identified above, there are a number of important policy and legal questions for the Legislature to consider before approving the Governor’s proposal.

Is This Proposal Legal? There are a variety of limits on the state’s ability to borrow. First, the State Constitution limits the ability of the state to borrow funds without voter approval. Debt to be paid from the state's general taxing authority—such as general obligation bonds to be paid from the General Fund—generally requires voter approval. Over the years, courts have ruled that certain types of borrowing (including short-term debt to cover cash shortfalls and some bonds paid from specific revenue sources, such as specific revenues in a state special funds) can occur without voter approval. Second, the courts have prevented certain types of state borrowing. In 2003, for example, the Legislature—without voter approval—authorized issuance of a type of pension obligation bond, to be sold to municipal bond investors to fund and refund certain state pension obligations. The state sought a court ruling validating the legality of the proposed pension obligation bond. The courts ruled against the state, concluding the proposed pension obligation bonds violated the constitutional debt limit. Finally, Proposition 58, passed by voters in 2004, prohibits most borrowing to fund a "year-end state budget deficit, as may be defined by statute."

Because the Governor’s proposal is novel, none of the constitutional debt limitations discuss the legality of state borrowing from the PMIA for this purpose explicitly. Legal analysis would be needed to reach firm conclusions on the debt limitations' applicability or lack of applicability to this proposed borrowing.

Is This Type of Borrowing a Precedent the Legislature Wants to Establish? This proposal represents a large and novel innovation in California’s state budgeting. The state has never borrowed from the PMIA like this before. Assuming this plan is constitutional, there may be no limits in state law on how such a borrowing could be used in the future. For example, the state could arguably borrow from the PMIA to cover the costs of a large infrastructure project or fund programs—very different goals from the objectives of this proposal to lower future pension costs. We would strongly advise the Legislature against such practices in the future. However, a question now is this: Is the Legislature comfortable with a type of borrowing that could potentially be used in such a problematic way in the future?

Is Proposal Consistent With PMIB’s Fiduciary Duty? The PMIB has a fiduciary duty to its investors, including the state government and local governments with funds in the LAIF. Section 16480.2 of the Government Code also directs the PMIB to invest funds “in such a way as to realize the maximum return consistent with safe and prudent treasury management.” While we think the structure of the $6 billion loan—with a floating interest rate roughly consistent with the PMIA’s typical earnings—could perhaps pass these fiduciary tests, the state’s obligations to local governments suggest the need for a thorough, open process to review these issues. For example, that process could consider if the interest rate under this proposal is enough to compensate LAIF investors. A ten-year loan may need to be based on a higher interest rate than a two-year Treasury yield.

LAO Bottom Line

Fiscal Benefit to the State Seems Likely… The administration is asking the Legislature to approve a large commitment of public resources that will have long-term effects on the state’s finances. From a fiscal perspective, we think this proposal is a promising way to further reduce the state’s sizeable unfunded liability. We also commend the administration for prioritizing the reduction of future pension costs and putting forward a proposal for addressing it.

. . . But Administration Has Not Carefully Considered Its Implications. However, the administration is asking the Legislature to approve a large commitment of public resources without careful analysis. The administration claims the proposal will save the state $11 billion without seriously analyzing the probability this level of savings will actually emerge over time using standard actuarial estimating techniques. The Department of Finance has conducted no review or analysis to determine how many of the state’s special funds will have difficulty making loan repayments under the proposal. Instead, the administration plans to conduct this analysis after the Legislature has approved the loan. Apparently, the administration has not sought a fiduciary counsel opinion to determine if this large, novel transaction meets the PMIB fiduciary duties. Neither has there been, as best we can tell, a period for review and comment on the proposal by local governments with funds in the LAIF. Finally, the administration has not published legal opinions on the constitutionality of this proposal.

LAO Recommendations

The administration has introduced this proposal as part of the May Revision—with only weeks before the constitutional deadline for the Legislature to approve the budget. All of the issues we have raised regarding this proposal cannot be reviewed by the June 15 budget deadline. In our view, however, there is no reason why this proposal needs to be approved by that time. Rather, we recommend below an approach that would allow the Legislature to carefully analyze and consider the implications of this proposal before approving or rejecting it.

Recommend Legislature Direct Administration to Complete Planning Analysis. Before the Legislature acts on the Governor’s proposal, we recommend requiring the administration to perform more due diligence and report the results publicly. Specific items we think are needed in this analysis are:

- Legal Opinions. We recommend the administration be required to consult with fiduciary counsel—whether at the Attorney General’s Office or elsewhere—to determine if the proposal has problematic fiduciary implications for either the PMIB or CalPERS board. In addition, we recommend the administration be required to seek an Attorney General opinion and/or a public validation proceeding in the courts regarding the constitutionality of borrowing from the PMIA for these purposes.

- Risks and Uncertainties. We recommend that the administration be required to report to the Legislature a comprehensive analysis conducted by professional actuaries—using stochastic modeling and other actuarial simulations—quantifying the uncertainties around the proposal listed above. This analysis could include a determination of the probability that the proposal will produce a net benefit for the state—considering both CalPERS and the PMIA’s respective investment returns in the future. This analysis could also consider alternatives for prepayments in terms of their net benefit. For example, would a prepayment for state retiree health unfunded liabilities have a greater net benefit in the long run? Would smaller annual Proposition 2 supplemental payments to CalPERS over time—rather than a large, lump-sum loan—have a greater chance of success?

- Special Funds’ Ability to Pay. We recommend that the administration be required to identify state funds that likely cannot make the repayments in the first few years of implementation, the amount of those shortfalls, and a proposed solution that would allow each fund to pay over the long term. The administration could be required to provide (1) its best estimates of how much money special funds will need to borrow from the General Fund to make their payments, by year, and how their repayments to the General Fund will be structured, and/or (2) specific plans to change each affected special fund’s revenues or spending to cover these shortfalls.

Recommend Legislature Consult With California Actuarial Advisory Panel (CAAP). The CAAP consists of eight actuaries and was established in statute in 2008 to provide public agencies with impartial and independent information on pensions, retiree health benefits, and best practices. We recommend that the Legislature formally ask the CAAP to provide an opinion on (1) the administration’s plans and estimates and (2) whether the state should make such a payment towards either pension or retiree health liabilities. (The CAAP could coordinate its works with that of the other professional actuaries described above.)

Recommend Legislature Act on Plan Later in Session After Receiving More Information. Final legislative action on the administration’s proposal can wait until after June 15. In particular, we recommend the Legislature wait to act on this plan until after the administration has submitted the analyses listed above, which perhaps could be developed by the end of the 2017 legislative session. If the analyses showed a high likelihood of net benefit to the state and there were no major legal concerns, the Legislature could pass implementing legislation to adopt the proposal.

Recommend Flexible Proposition 2 Debt Payments in Budget Plan. To pass a budget in June, the Legislature must include a schedule of required debt payments under Proposition 2. Instead of approving the proposal now without sufficient analysis, the Legislature could “pencil in” a flexible plan for Proposition 2. Under these provisions, the administration’s proposed $427 million repayment would be released if the Legislature adopted implementing legislation later in the session. If no such legislative plan passed, the budget package would include an alternative purpose for the $427 million loan repayment. For example, the Legislature could direct the administration to make an additional, supplemental payment to CalPERS of this amount—but without any borrowing from the PMIA.