LAO Contact

March 21, 2018

The 2018-19 Budget

Analysis of the Governor's 340B Medi-Cal Proposal

Summary

This budget report analyzes the Governor’s 2018‑19 budget proposal to eliminate the use of the 340B Drug Pricing Program in Medi‑Cal. The federal 340B Program (1992) entitles eligible healthcare providers (mainly hospitals and clinics that serve large numbers of low‑income patients) to discounts on outpatient prescription drugs. These discounts result in savings that benefit participating healthcare providers and their healthcare partners. Federal Medicaid law establishes a separate federal Medicaid prescription drug discount program that results in prescription drug savings for Medi‑Cal (savings are shared between the state and federal government). Currently, either of the two federal prescription drug discount programs could apply when drugs are dispensed to Medi‑Cal enrollees. However, federal law requires that only one of the drug discount programs be used for a given drug dispensed to a Medi‑Cal enrollee.

The Governor’s proposal requires the use of the federal Medicaid discount program and prohibits the use of the 340B Program for a given drug dispensed to a Medi‑Cal enrollee. In support of his proposal, the Governor cites challenges in administering the federal Medicaid discount program in conjunction with the 340B Program (preventing prohibited duplicate discounts after the fact) and asserts that the proposal would result in state General Fund savings. The administration does not currently have, but is working on, an estimate of the savings that would ultimately be generated under its proposal. (These savings would not likely be generated before 2019‑20.)

We find that the Governor’s proposal merits serious consideration from the Legislature since, among other benefits, it would likely result in state savings that the Legislature could, in turn, use to fund its priorities. We note, however, that these savings would be in place of savings currently enjoyed by eligible healthcare providers. Before making a decision on the Governor’s proposal, we recommend that the Legislature ask the administration to provide the following key information on the Governor’s proposal: (1) the amount of Medi‑Cal savings that would be generated and (2) the impact on healthcare providers currently participating in the 340B Program. We provide a preliminary analysis of alternative policy approaches to addressing the challenges associated with the use of the 340B Program in Medi‑Cal, highlighting some of the trade‑offs associated with each alternative approach. We recommend that the Legislature ask for additional information from the administration on the trade‑offs of each alternative approach during upcoming budget hearings.

Background

340B Program Is a Federal Prescription Drug Discount Program

The federal 340B Drug Pricing Program (which we refer to as the 340B Program), established in 1992, requires drug manufacturers to provide discounts on the outpatient prescription drugs they sell to certain eligible healthcare providers, referred to as “covered entities.”

Eligible Healthcare Providers. There are various criteria that healthcare providers may meet in order to be designated as covered entities that are eligible for the 340B Program. Major healthcare provider types that are generally eligible to participate in the program include certain hospitals that serve large numbers of low‑income patients (including both the uninsured and Medicaid enrollees); certain rural hospitals; community health clinics, such as Federally Qualified Health Centers (FQHCs), which are not‑for‑profit outpatient health facilities that provide general healthcare services; and others.

340B Discounted Prescription Drugs Available to Covered Entities’ Patients Regardless of Payer. Under federal law, covered entities may dispense or arrange for the dispensing of 340B prescription drugs to their own patients, regardless of who ultimately pays for the prescription drugs. As such, the 340B discounts apply regardless of whether the covered entity is ultimately reimbursed for the dispensed prescription drugs by Medicaid, Medicare, commercial health insurance, or the patient.

340B Program Provides Significant Discounts for Covered Entities. The 340B Program generally requires covered entities to receive prescription drug discounts that reduce the prices paid by a covered entity to at least the lower of (1) the best price offered to most public and private entities or (2) the average manufacturer sales prices minus a percentage of between 13 percent and 23.1 percent (depending on the type of the prescription drug).

Nationwide, the 340B Program Is Estimated to Have Saved Covered Entities Around $6 Billion in 2015. In 2015 (the most recent year for which the information is available), covered entities are estimated to have saved around $6 billion on prescription drugs through the 340B Program. Net of the 340B discounts, covered entities are estimated to have spent over $12 billion on 340B prescription drugs in 2015.

Covered Entities Retain a Portion of 340B Savings. 340B savings result from the lower relative cost of 340B prescription drugs compared to non‑340B drugs. Ultimately, savings resulting from the 340B Program are likely shared by multiple participants in the healthcare system rather than entirely retained by covered entities themselves. Covered entities retain 340B savings by charging external payers of 340B prescription drugs—such as health insurers—prices that are higher than the 340B prices at which they acquired the drugs. The 340B Program does not place restrictions on how covered entities may use any retained savings. To the extent covered entities charge external payers lower prices for prescription drugs than they would have if the drugs had been purchased without the 340B discounts, then these external payers benefit from the 340B discounts as well.

Medicaid Prescription Drug Discounts (Separate From the 340B Program)

Medi‑Cal is the state’s Medicaid program, which provides healthcare coverage to low‑income state residents. The Department of Health Care Services (DHCS) administers Medi‑Cal.

Medi‑Cal Pays Enrollees’ Prescription Drug Costs. Prescription drugs are a covered benefit under Medi‑Cal. Accordingly, Medi‑Cal pays for the drugs prescribed and dispensed to Medi‑Cal enrollees.

Prescription Drug Reimbursement in Fee‑for‑Service (FFS) and Managed Care. Medi‑Cal pays for enrollees’ prescription drug costs through both of its major delivery systems, FFS and managed care. In FFS, the state reimburses pharmacies directly for each drug dispensed to Medi‑Cal enrollees. In managed care, the state pays managed care plans (MCPs) a predetermined per‑member per‑month payment that is expected—on average—to cover each MCP member’s healthcare costs, including her or his average expected prescription drug costs. About 80 percent of Medi‑Cal enrollees are enrolled in managed care. We would note that certain prescription drugs, such as antipsychotics, are paid for through the FFS system even if the Medi‑Cal enrollee is enrolled in Medi‑Cal managed care.

Medi‑Cal Receives Discounts on Prescription Drugs. Federal law requires drug manufacturers to provide discounts on prescription drugs ultimately paid for by Medicaid. Despite being a separate prescription drug discount program from the 340B Program, Medicaid’s prescription drug discounts are calculated through the same statutory formulas as the 340B prescription drug discounts and, as such, are likely similar in magnitude. Unlike the 340B prescription drug discounts, which occur on the front end, Medicaid’s prescription drug discounts come in the form of retroactive rebates from manufacturers for prescription drugs that have already been paid for and dispensed by pharmacies to Medi‑Cal enrollees.

Medicaid Prescription Drug Rebates Recently Expanded to Managed Care. Prior to the Patient Protection and Affordable Care Act (ACA), the state only collected prescription drug rebates within the FFS delivery system (as well as for a subset of county‑operated MCPs). The ACA expanded the state’s authority to collect Medicaid prescription drug rebates within Medi‑Cal managed care.

Total General Fund Benefit Resulting From Federal Medicaid Prescription Drug Rebates Is Over $1.3 Billion. DHCS estimates that it will collect over $4.1 billion in federal Medicaid prescription drug rebates in total in 2017‑18, over $1.3 billion of which represents savings to the General Fund. Around half of these rebates are collected for drugs paid for through FFS (and a subset of county‑operated MCPs), with the remaining half collected for prescription drugs paid for through managed care.

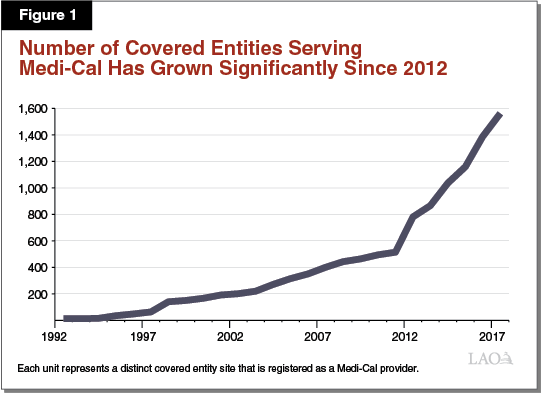

Interaction Between 340B Program and Medicaid

The 340B Program and the Medicaid prescription drug rebate program are separate prescription drug discount programs. They interact, however, when covered entities dispense 340B prescription drugs to Medi‑Cal enrollees. Under current federal and state law, covered entities may choose whether to dispense 340B prescription drugs to their patients who have Medi‑Cal coverage. It is our understanding that, in practice, the dispensing of 340B prescription drugs to Medi‑Cal enrollees is widespread. We estimate that there are at least 1,500 covered entity sites in California that serve as Medi‑Cal providers and dispense 340B prescription drugs to Medi‑Cal patients. As shown in Figure 1, since the implementation of the ACA, the number of covered entity sites participating in Medi‑Cal has increased dramatically. The interaction between the 340B Program and Medicaid creates administrative complexities, which we summarize below.

Duplicate Discounts Sometimes Occur, but Are Prohibited Under Federal Law. A duplicate discount can occur when a state Medicaid program collects a Medicaid rebate from a drug manufacturer on a prescription drug dispensed by a covered entity to a Medicaid enrollee. A major goal of federal law and regulation related to the 340B Program is to prevent duplicate discounts from occurring when 340B prescription drugs are dispensed to Medicaid enrollees. In this case, the covered entity has already received an up‑front 340B discount on the dispensed prescription drug. A duplicate discount would occur should the state collect a Medicaid rebate on that same prescription drug. While not allowed under federal law, such duplicate discounts can occur in situations when a Medicaid program is not aware that a 340B prescription drug—as opposed to a non‑340B prescription drug—was dispensed to an enrollee. Without information indicating that a dispensed prescription drug was a 340B drug, the Medicaid program would seek to collect a rebate on that drug and therefore risk receiving a duplicate discount. To prevent the provision of duplicate discounts, drug manufacturers are challenging certain Medicaid prescription drug rebates sought by DHCS on the grounds that the requested rebates relate to 340B drugs to which a 340B discount has already been applied. According to the administration, this is having the effect of adding complexity to, and slowing down, the prescription drug rebate collection process in Medi‑Cal.

Who Benefits From Prescription Drug Discounts Varies Between the 340B Program and the Medi‑Cal Drug Rebate Program. As previously discussed, covered entities retain at least a portion of the savings generated by the 340B Program by charging payers of 340B prescription drugs—including Medi‑Cal MCPs—prices that are higher than the 340B prices at which they acquired the drugs. Savings generated by Medicaid prescription drug rebates, on the other hand, are fully retained by the state and federal government.

In the sections that follow, we describe in greater detail how the 340B Program and Medicaid interact within Medi‑Cal’s major delivery systems and pharmacy arrangements.

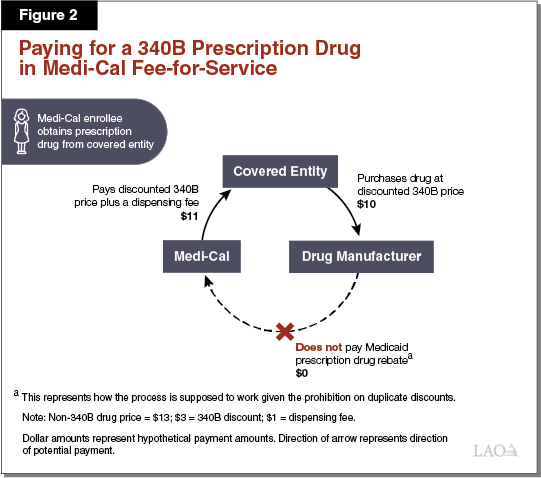

Fee‑for‑Service

Paying for a 340B Prescription Drug in Medi‑Cal FFS. As elaborated in the text below, Figure 2 illustrates how the 340B Program is designed to work within Medi‑Cal FFS. The dollar amounts listed represent hypothetical payment amounts. In the simplest Medi‑Cal FFS arrangement, a covered entity, such as a public hospital, would purchase a prescription drug at its 340B price ($10) directly from a drug manufacturer. A Medi‑Cal enrollee would then visit the public hospital, be prescribed a drug, and obtain the prescription drug from the public hospital’s in‑house pharmacy. Following the submission of a FFS claim for payment by the public hospital to the state, Medi‑Cal would then reimburse the covered entity for the prescription drug obtained ($10 plus a $1 dispensing fee). The claim submitted would include an identifier that indicates that the dispensed prescription drug was obtained through the 340B Program.

Duplicate Discounts Largely Avoided in Medi‑Cal FFS. Because Medi‑Cal FFS prescription drug claims—at least when dispensed at covered entities’ in‑house pharmacies—include a 340B identifier, information that a 340B drug was dispensed is generally effectively communicated to DHCS. DHCS would then exclude the drug from its Medicaid rebate claims list that is sent to the drug’s manufacturer, and therefore not collect a rebate. It is our understanding that DHCS largely avoids mistakenly attempting to collect duplicate discounts in FFS—at least when dispensed at covered entities’ in‑house pharmacies—since 340B drugs are readily identified through the FFS claims process.

340B Savings Essentially Passed on to the State in FFS. State law requires Medi‑Cal to reimburse covered entities for prescription drugs dispensed to Medi‑Cal enrollees through the FFS delivery system at covered entities’ actual acquisition costs plus a professional dispensing fee. Since actual acquisition costs for 340B drugs should at least roughly equal the 340B prices paid, covered entities should not be retaining savings under the 340B Program for prescription drugs dispensed to Medi‑Cal enrollees through FFS. Instead, covered entities’ 340B savings are passed onto the state (and shared with the federal government) in the form of lower reimbursement rates for the 340B prescription drugs dispensed to Medi‑Cal enrollees within the FFS system.

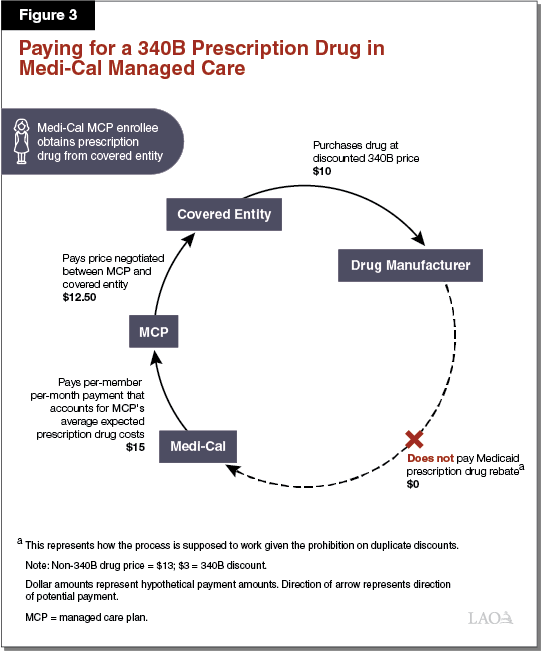

Managed Care

Paying for a 340B Prescription Drug in Medi‑Cal Managed Care. Paying for 340B prescription drugs in Medi‑Cal managed care differs from FFS in a number of respects. As elaborated in the text below, Figure 3 illustrates one way in which the 340B Program is supposed to work within Medi‑Cal managed care. The dollar amounts listed represent hypothetical payment amounts. Under a simplified model of the use of 340B prescription drugs in Medi‑Cal managed care, a public hospital that is a covered entity would, as under the FFS example above, purchase a prescription drug at its 340B price ($10) directly from a drug manufacturer. The public hospital would then dispense the 340B drug to a patient with Medi‑Cal coverage from an in‑house pharmacy. Then, instead of submitting a claim for reimbursement to the state through FFS, the covered entity would bill the Medi‑Cal MCP in which the patient is enrolled. The Medi‑Cal MCP would then pay the covered entity ($12.50) using funds it receives from the state in the form of ongoing per‑member per‑month payments ($15). Provided the 340B drug is properly identified as a 340B drug and this information is conveyed to DHCS in a timely manner, Medi‑Cal would not retroactively seek a Medicaid rebate on the drug from its manufacturer.

Covered Entities May Retain at Least a Portion of 340B Savings in Managed Care. Unlike in Medi‑Cal FFS, covered entities may receive reimbursement from Medi‑Cal MCPs for 340B prescription drugs that is higher than their actual (discounted) cost of acquiring the prescription drugs. This is because state and federal rules allow covered entities to bill Medi‑Cal MCPs for the 340B prescription drugs dispensed to their members at whatever reimbursement rates are agreed to between the particular covered entity and MCP. Medi‑Cal MCPs, in turn, are funded by the state through per‑member per‑month payments that account for the prescription drug costs of the MCPs’ members. Since (1) MCPs’ costs in paying for 340B prescription drugs can be higher than covered entities’ costs in purchasing them and (2) state payments to MCPs generally reflect MCPs’ costs, the state may ultimately reimburse covered entities for 340B prescription drugs at higher than their 340B costs. It is our understanding that this is commonly the case in practice. This allows covered entities to retain savings through the use of the 340B Program in Medi‑Cal managed care and increases Medi‑Cal costs beyond what they would otherwise be. It is our understanding that, under managed care, information identifying that a 340B drug was dispensed is not always communicated to DHCS, potentially resulting in duplicate discounts.

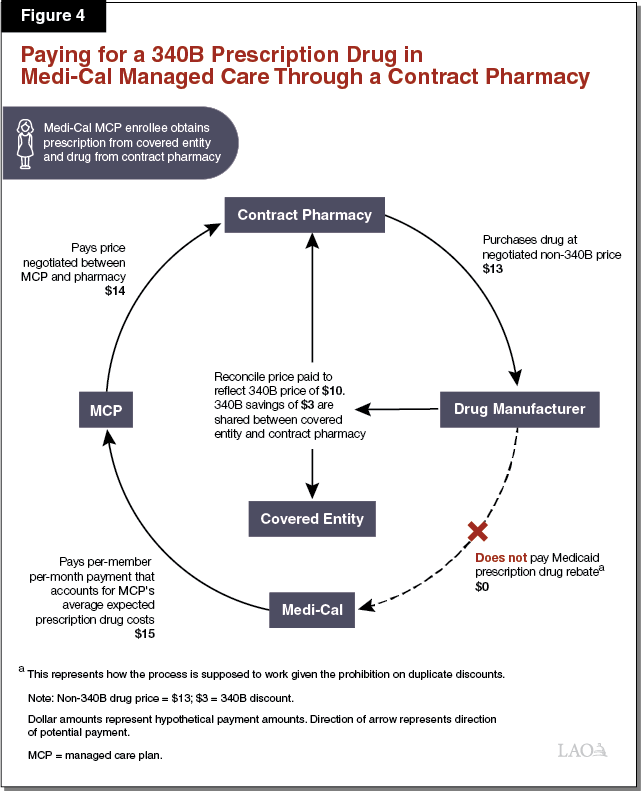

Contract Pharmacies

The use of “contract pharmacies” in the 340B Program introduces additional complexity into how the 340B Program operates in relation to the Medicaid prescription drug rebate program. Contract pharmacies—a term that is here used solely in the context of the 340B Program—are pharmacies that are owned and operated separately from a covered entity but who have a contract with a covered entity to dispense 340B prescription drugs on the covered entity’s behalf. CVS and Rite Aid, for example, might serve as contract pharmacies for certain covered entities. Contract pharmacy arrangements occur in both Medi‑Cal FFS and managed care. (Our discussion of contract pharmacies below focuses on managed care because it is generally under managed care that covered entities and contract pharmacies can share in a portion of the 340B savings.) The use of contract pharmacies has increased significantly following federal guidance, released in 2010, that authorized their expanded use.

Paying for a 340B Prescription Drug Dispensed by a Contract Pharmacy in Medi‑Cal Managed Care. As elaborated in the text below, Figure 4 illustrates how a 340B contract pharmacy arrangement might work in Medi‑Cal managed care. The listed dollar amounts represent hypothetical payment amounts. While covered entities’ arrangements with contract pharmacies vary, an example of how the use of a contract pharmacy in Medi‑Cal managed care can work is as follows. The contract pharmacy purchases a prescription drug from a manufacturer at a negotiated sales price ($13), which generally would be higher than the 340B price at which that drug would have been sold to a covered entity. A Medi‑Cal managed care enrollee visits a public hospital that is a covered entity for a medical appointment and obtains a prescription. The enrollee then visits the contract pharmacy, which dispenses the prescribed drug. Without identifying at the time of the transaction that the Medi‑Cal enrollee was a patient of a contracted covered entity (the public hospital), the contract pharmacy would bill the enrollee’s MCP at the customary non‑340B prescription drug reimbursement rate ($14) agreed to between the pharmacy and the MCP. Later, the contract pharmacy and public hospital would review the pharmacy’s records to determine whether any prescription drugs were dispensed to patients of the public hospital. After it is determined that the Medi‑Cal enrollee who obtained the prescription was a patient of the public hospital, the public hospital and the contract pharmacy would go through a reconciliation process with the manufacturer that effectively lowers the purchase price of the dispensed drug to its 340B price ($10). According to DHCS, information indicating that the dispensed drug was reclassified as a 340B prescription drug is often not provided to DHCS in a timely manner to allow for the exclusion of the drug from the Medicaid drug rebate claims list sent to the drug’s manufacturer, raising the possibility of a duplicate discount.

Covered Entities, Contract Pharmacies, and Potentially Others Share in the 340B Savings Under Contract Pharmacy Arrangements. Under the scenario outlined above, the contract pharmacy and the covered entity would share in the savings resulting from the lower cost of the 340B prescription drug. The savings are generated by the difference between how much the MCP pays the contract pharmacy/covered entity for the drug and how much it ultimately costs the contract pharmacy/covered entity to obtain the 340B drug from the manufacturer. The savings are shared between the contract pharmacy and the covered entity in order to encourage mutual participation in the contract pharmacy 340B arrangement. It is also possible that the MCP might share in some of the 340B savings. Insofar as the MCP shares in 340B savings, at least a portion of the MCP’s share may be passed on to the state in the form of slightly lower Medi‑Cal managed care per‑member per‑month payments.

Governor’s Proposal

Governor’s Budget Proposes to Eliminate the Use of 340B in Medi‑Cal. As a part of the Governor’s 2018‑19 budget, the administration has proposed changes in statute that would, conditional on federal approval, prohibit the dispensing of 340B prescription drugs to Medi‑Cal enrollees. Covered entities would remain free to utilize the 340B Program for their non‑Medi‑Cal patients. In other words, of the two federal prescription drug discount programs that currently can apply when drugs are dispensed to Medi‑Cal enrollees—only one of which can be used—the Governor’s proposal requires the use of the Medicaid rebate program and prohibits the use of the 340B Program.

Federal approval of the Governor’s proposal is required since Medi‑Cal is overseen by both the state and federal governments. In the event that the federal government declines to approve the full elimination of the use of the 340B Program in Medi‑Cal, the proposed changes in statute would authorize DHCS to alternatively seek federal approval to (1) prohibit or limit the use of contract pharmacies in Medi‑Cal and/or (2) prohibit or limit certain types of covered entities from dispensing certain or all 340B prescription drugs to Medi‑Cal enrollees. (The proposal does not specify which types of covered entities could be prohibited or limited from using the 340B Program in Medi‑Cal or which prescription drugs could be targeted for exclusion.) Changes to the allowable use of the 340B Program under the Governor’s proposal would take place following federal approval but no sooner than January 1, 2019. Below, we summarize three of the administration’s primary rationales for its proposal.

- Reduce the Administrative Complexity of Utilizing the 340B Program in Medi‑Cal. According to DHCS, utilizing the 340B Program in Medi‑Cal is administratively complex given the federal requirement that the department have policies and procedures in place to avoid the collection of duplicate discounts. Identification of 340B prescription drugs is necessary so that these drugs can be excluded from the Medicaid drug rebates sought by DHCS. It is our understanding that the administrative complexity relates to identifying 340B prescription drugs in a comprehensive and timely manner, especially in managed care and under contract pharmacy arrangements.

- Prevent Duplicate Discounts. According to the administration, preventing duplicate discounts is critical for the purpose of Medi‑Cal program integrity (including compliance with federal law). The administration has noted that in recent years there has been increased scrutiny at the federal government of the problem of duplicate discounts, specifically, and the use of the 340B Program in Medicaid, broadly. Prohibiting the dispensing of 340B prescription drugs in Medi‑Cal would prevent duplicate discounts from occurring since the only discounts collected on drugs dispensed to Medi‑Cal beneficiaries would be by the state in the form of Medicaid drug rebates.

- Generate State Savings. Eliminating the use of the 340B Program has the potential to generate state savings since the state would be able to collect Medicaid drug rebates on prescription drugs that otherwise would have been dispensed under the 340B Program and therefore not eligible for a Medicaid drug rebate. These savings would largely be generated under Medi‑Cal managed care since in FFS covered entities’ 340B savings should largely already be passed on to the state in the form of lower reimbursement costs. The administration has not released an estimate of savings under its proposal but has indicated that it is currently working on one. Ultimately, state savings resulting from the Governor’s proposal would likely not be available until after 2018‑19.

LAO Assessment

Recognize the Administrative Challenges Caused by the 340B Program. We recognize that the complexity of utilizing the 340B Program in Medi‑Cal has grown in recent years, largely due to the ACA’s expansion of Medicaid prescription drug rebates to managed care, as well as due to the increasing use of contract pharmacy arrangements. These relatively recent developments have made the task of appropriately avoiding duplicate discounts more challenging for DHCS.

Proposal Would Likely Bring the Benefit of State Medi‑Cal Savings . . . We agree with the administration’s assessment that the elimination of the use of the 340B Program in Medi‑Cal would likely ultimately result in overall state savings. These savings would largely come in the form of higher Medi‑Cal managed care prescription drug rebates. However, these savings would be partially offset by higher Medi‑Cal costs elsewhere, such as potentially higher prescription drug costs in managed care since no 340B savings would be passed along to MCPs. The state would ultimately have to compensate MCPs for their higher prescription drug costs. We would note that total Medicaid drug rebate amounts are shared between the federal and state governments, with the state currently receiving about one‑third of the total rebate revenue.

. . . While Eliminating a Portion of Covered Entities’ 340B Savings. State savings generated by eliminating the use of the 340B Program in Medi‑Cal would be in place of the 340B savings currently enjoyed by covered entities for prescription drugs dispensed to Medi‑Cal enrollees. Covered entities would still be able to benefit from 340B savings for the 340B prescription drugs they dispense to non‑Medi‑Cal enrollees. While it is highly uncertain, it is our understanding that total state and federal Medi‑Cal savings resulting from the proposal might be very roughly comparable in magnitude with the 340B savings currently enjoyed by covered entities for drugs dispensed to Medi‑Cal enrollees. However, the state would likely only receive about one‑third of these savings since the remaining portion would have to be shared with the federal government.

Potential Impacts on Covered Entities and Their Partners. Under the Governor’s proposal, covered entities and their partners—such as contract pharmacies—would no longer be able to benefit from savings under the 340B Program for prescription drugs paid for through Medi‑Cal. According to certain covered entities’ association groups, the elimination of the use of the 340B Program in Medi‑Cal could result in some covered entities ceasing to participate in the 340B Program altogether if the program ceases to be financially worthwhile. For example, some covered entities that serve high proportions of Medi‑Cal enrollees might no longer find it worthwhile to continue to operate under the 340B Program given the reduced patient population for which 340B discounts would be available. In such cases, for example, the administrative burden of complying with the 340B Program might outweigh the financial benefit to the covered entity. We would note that certain covered entities, such as FQHCs, are reimbursed by Medi‑Cal at the cost of providing care to Medi‑Cal enrollees. Therefore, FQHCs’ loss of savings through eliminating the use of the 340B Program in Medi‑Cal could, in certain situations, be made up for through other, higher Medi‑Cal reimbursements that compensate FQHCs at their higher non‑340B prescription drug costs.

Governor’s Proposal Merits Serious Consideration. We find that the Governor’s proposed elimination of the use of the 340B Program in Medi‑Cal deserves serious consideration by the Legislature since it would (1) likely ultimately result in state savings, (2) eliminate the administrative challenges associated with overseeing the use of the 340B Program in Medi‑Cal, and (3) prevent duplicate discounts from occurring in Medi‑Cal and therefore ensure compliance with federal rules. The potential savings generated by the Governor’s proposal would increase the amount of General Fund resources available for appropriation by the Legislature. Since the associated savings would benefit the state General Fund rather than covered entities, the availability of these greater resources would give the Legislature additional flexibility to pursue its priorities and maximize legislative oversight over how savings resulting from prescription drug discounts are targeted. While the state General Fund savings are likely less than the reduction in 340B savings for covered entities since Medicaid drug rebates have to be shared with the federal government, spending the additional savings on Medi‑Cal or another state program in which the federal government shares in the cost would increase the total benefit to the state beyond what it would otherwise be. Finally, the Legislature could choose to allocate the additional savings to covered entities to, for example, attempt to hold them harmless for the change while at the same time providing input into how this allocated funding is spent by covered entities. (As previously highlighted, there are no restrictions under the 340B Program on how covered entities may use savings resulting from 340B prescription drug discounts.)

Before Reaching a Decision on the Governor’s Proposal, the Legislature Should Ask for Additional Key Information From DHCS. Certain key pieces of information that could inform the Legislature’s decision on the Governor’s 340B proposal have not yet been made available to the Legislature. We recommend that the Legislature request that DHCS gather the following key pieces of information for submittal to the Legislature before making a decision on the Governor’s 340B proposal:

- Medi‑Cal Savings Estimate. The administration has not released an estimate of the amount of state savings its 340B proposal would generate for the Medi‑Cal program if enacted. This information is critical for understanding the state fiscal impact of eliminating the use of the 340B Program in Medi‑Cal.

- Fiscal Impact of Proposal on Covered Entities. The impact of the Governor’s proposal on covered entities’ 340B savings and the overall benefit they receive from the program is currently unknown. Because the information needed to develop an estimate of this fiscal impact is likely not readily available to the administration, we recommend that the Legislature request for DHCS to collect this information from covered entities operating in the state.

Analysis of Alternative Policy Approaches. The Governor’s proposal to prohibit the dispensing of 340B prescription drugs to Medi‑Cal enrollees comes with advantages to the state—such as generating state savings and likely simplifying the administration of the Medi‑Cal prescription drug benefit—as well as trade‑offs—such as reducing the fiscal benefit covered entities’ receive through the 340B Program. Alternative policy approaches that would be designed to ensure compliance with the federal rules on duplicate discounts and protect Medi‑Cal program integrity exist, but these would feature different trade‑offs when compared to the Governor’s approach. Below, we offer a preliminary analysis of several alternative policy approaches to address the challenges associated with the use of the 340B Program in Medi‑Cal. We recommend that the Legislature request additional information from the administration on the trade‑offs associated with alternative policy approaches. Such alternative policy approaches include, but are not limited to:

- Prohibit or Limit the Dispensing of 340B Drugs to Medi‑Cal Enrollees at Contract Pharmacies. As proposed under the Governor’s proposal in case the federal government rejects the full elimination of the use of the 340B Program in Medi‑Cal, an alternative policy approach would be to prohibit or limit the dispensing of 340B prescription drugs to Medi‑Cal enrollees at contract pharmacies. (These pharmacies would continue to be allowed to dispense prescription drugs to Medi‑Cal enrollees, just not under the 340B Program.) A potential benefit of this approach is that it would target an area of the 340B Program in Medi‑Cal that is challenging to oversee from a state perspective. It would likely generate some state savings, though the savings would be less than under the Governor’s proposed full elimination of the use of the 340B Program in Medi‑Cal. Covered entities would still be able to retain some savings through the 340B prescription drugs dispensed to Medi‑Cal enrollees—though the amount of savings would likely be less than under current state policy. Contract pharmacies, on the other hand, would no longer be able to benefit from savings under the 340B Program. All in all, this approach could help to ameliorate the problem of duplicate discounts.

- Prohibit or Limit Certain Covered Entities From Dispensing Certain or All 340B Prescription Drugs to Medi‑Cal Enrollees. As proposed under the Governor’s proposal in case the federal government rejects the full elimination of the use of the 340B Program in Medi‑Cal, an alternative policy approach would be to prohibit or limit certain types of covered entities from dispensing certain or all 340B prescription drugs to Medi‑Cal enrollees. The Governor’s proposal does not specify which types of covered entities could be prohibited or limited from using the 340B Program in Medi‑Cal (or which prescription drugs could be targeted for exclusion). Potential policies the administration could pursue under this approach include, for example, prohibiting the use of 340B prescription drugs in Medi‑Cal managed care. Alternatively, the administration could prohibit most covered entities from dispensing 340B prescription drugs to Medi‑Cal enrollees but exempt certain covered entities that are needed to ensure access to care from this prohibition. A potential benefit of this approach is that DHCS could specifically target those covered entities or prescription drugs for which the interaction between the 340B Program and the Medicaid rebate program proves most administratively complex and challenging. However, short of the full elimination of the use of the 340B Program in Medi‑Cal, some degree of administrative complexity as related to the Medi‑Cal prescription drug benefit would remain. In addition, the Governor’s alternative approach would delegate to the administration significant authority to craft state policy concerning the use of the 340B Program in Medi‑Cal, and thereby potentially serve to limit the Legislature’s role in determining the state’s policy approach. While this approach would likely result in some state savings, the amount of savings would likely be less than under the Governor’s proposed full elimination of the use of the 340B Program in Medi‑Cal. All in all, this approach could, depending on how it was ultimately implemented by DHCS, help to address the problem of duplicate discounts.

- Pay for 340B Prescription Drugs at Cost in Managed Care. Requiring MCPs to pay covered entities for 340B prescription drugs at covered entities’ actual acquisition costs plus a professional dispensing fee, as currently required in Medi‑Cal FFS, would be yet another alternative policy approach. A potential benefit of this approach is that it would allow the state (rather than covered entities and their partners) to benefit from the savings generated by the 340B Program within the Medi‑Cal managed care delivery system and harmonize the reimbursement levels that the state pays for 340B drugs across FFS and managed care. State savings generated under this approach could potentially be comparable to those generated under the Governor’s proposed full elimination of the use of the 340B Program in Medi‑Cal. However, given the need under this approach to still make efforts to prevent duplicate discounts, this approach would likely be relatively more administratively burdensome than the Governor’s proposal and could require additional state resources.

The Implications of the Status Quo. Finally, we note that the Legislature could elect to maintain existing state policy related to the use of the 340B Program in Medi‑Cal. This approach would not generate state savings as under the Governor’s proposal or certain alternative approaches we discuss above and instead allow covered entities to continue to retain savings through the use of the 340B Program in Medi‑Cal. Taking no action could place strain on DHCS given the challenges under existing state policy of preventing duplicate discounts, ensuring program integrity in Medi‑Cal, and obtaining the maximum amount of potential state savings available through the federal Medicaid drug rebate program.