2014

Other Budget Issues

| Last Updated: | 3/19/2014 |

| Budget Issue: | LAO answers some recent questions concerning CalSTRS unfunded liabilities |

| Program: | CalSTRS |

| Finding or Recommendation: | This note provides responses to some recent questions concerning unfunded liabilities of the California State Teachers' Retirement System. |

Further Detail

Below are some recent questions concerning the California State Teachers' Retirement System (CalSTRS) and our replies.

Is CalSTRS' Unfunded Liability $71 Billion or $80 Billion?

Background. Unfunded liabilities are actuarial estimates of the value of pension benefits already earned by pension members for which no assets are on hand. Like many public pension systems, CalSTRS estimates that it has assets on hand to cover the majority of its members' accrued benefit liabilities, but billions more are needed to fully fund all of these liabilities. In its 2014-15 Governor's Budget Summary (released on January 9), the administration listed CalSTRS' unfunded liability as being $80.4 billion. In our office's November 2013 Fiscal Outlook publication (see page 9) we cited CalSTRS' unfunded liability as being $71 billion. CalSTRS recently cited the $71 billion figure in a press release.

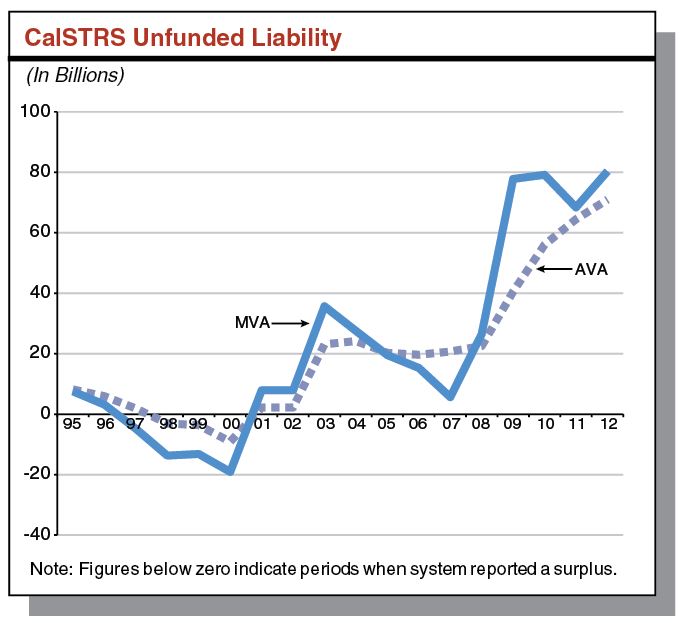

The AVA and MVA Methods of Calculating Unfunded Liabilities. There are several ways to calculate a pension system's unfunded liabilities. The $71 billion figure is the primary number that CalSTRS has used to describe its unfunded liabilities. The $71 billion figure is cited, for example, on page 4 of the system's most recent defined benefit program valuation (which covers program finances through June 30, 2012). This $71 billion figure is calculated using the system's actuarial value of assets (AVA). The administration's $80.4 billion number also was listed in that valuation on the final line of a long list of numbers on page 10. The valuation describes the $80.4 billion number as an "alternate" unfunded liability calculation based on the market value of assets (MVA). (California's model public pension system disclosure guidelines suggest that systems disclose unfunded liability calculations using both the MVA and AVA methods, as CalSTRS does.)

Why Does the LAO Cite the $71 Billion Figure? For a system like CalSTRS—a system with significant unfunded liabilities that are not yet being addressed—we prefer the AVA figure, which currently produces CalSTRS' unfunded liability calculation of $71 billion. CalSTRS' AVA figure is based on a valuation of assets that spreads (or "smooths") each year's asset gains or losses over the following three years. The AVA calculation responds slowly to sudden spikes or large losses, making it much less volatile and a steadier indicator of how a system should be funded over time. (As CalSTRS CEO Jack Ehnes described it in a recent online post, the AVA calculation "lessen[s] the impact of short term fluctuations in the value of assets.")

The figure below illustrates how the AVA method of calculating unfunded liabilities has reacted more slowly than the MVA method to (1) the dot.com bubble of the late 1990s, (2) the economic slowdown of the early 2000s, (3) the housing bubble of the mid-2000s, and (4) the financial crisis of 2008 and 2009. As the stock market and other investments zoom upward, MVA unfunded liability calculations zoom downward, while AVA calculations remain steadier. (One might expect the MVA unfunded liability calculation, for example, to fall somewhat in CalSTRS' upcoming June 2013 valuation update, given the system's strong investment performance in 2012-13.) Conversely, when the stock market and other investments crash, MVA unfunded liability calculations zoom upward, while AVA calculations respond more gradually.

Other Unfunded Liability Estimates. Some question CalSTRS' unfunded liability estimates on other grounds: mainly, that the system's long-term average annual investment return estimates are too optimistic. In a related matter, new accounting guidelines will require reporting a new figure, "net pension liability," that will be much higher than current unfunded liability calculations. These types of estimates can result in CalSTRS' unfunded liabilities being displayed as much higher—over $100 billion in some cases. In general, these are separate matters from the MVA/AVA discussion above. In recent years, in its actuarial valuations, CalSTRS has lowered its long-term annual investment return assumption from 8.0 percent to 7.5 percent. (Since 2010, those changes have increased both MVA and AVA unfunded liabilities above what they would have been otherwise.) We note that CalSTRS has achieved its 7.5 percent average annual investment return target over the last 20 years. That being said, lower investment return assumptions reduce the risk that compensation costs for today's employees will be passed to future generations.

How Much More Is Needed Each Year to Pay Off CalSTRS' Liabilities?

Background. In February 2013, CalSTRS submitted a report to the Legislature with various options for addressing its unfunded liabilities over the next several decades. Based on that report, in a March 2013 presentation to the Legislature, we said:

Strong 2012-13 Investment Returns. The figures cited above were based on CalSTRS' valuation as of June 30, 2012, the most recent available. In 2012-13, however, CalSTRS reportedly achieved strong investment results—well in excess of its actuarially assumed 7.5 percent annual investment return. In general, as the system's June 30, 2013 actuarial valuation is finalized (it is to be submitted to the CalSTRS' board in April), some calculations of the system's unfunded liability or extra amounts needed to fully fund the system may decline somewhat due to the strong 2012-13 investment return.

Recently Updated Figures from CalSTRS. In an agenda item for its February 2014 board meeting, the CalSTRS board has been provided with updated data concerning the additional funding needed to address the system's unfunded liabilities. This agenda item reflects the impact of the system's 13.8 percent estimated investment return in 2012-13. The agenda item considers the additional cost needed—beginning in 2015 (one year later than indicated in our March 2013 handout)—to achieve an estimated 100 percent funded level (with no unfunded liabilities) within 30 years of the start of increased contributions. The system estimates that this additional cost would total 14.2 percent of teacher payroll, an amount that it estimates would total $4.2 billion in the first year, 2015-16. In general, the longer that the additional contributions are delayed, the higher the annual contribution rate would have to be to fully fund the system within about 30 years.

The agenda item also considers the effect of a gradual increase in contributions to CalSTRS. If contributions increased by 3 percent of teacher payroll each year beginning in 2015, contributions ultimately would have to increase by nearly 16 percent of teacher payroll above currently required levels by 2020. (Based on estimates in the February 2014 agenda item, 16 percent of teacher payroll in 2020 would apparently equal around $5.5 billion per year at that time.) The scenarios described above assume that the system meets its 7.5 percent average annual return target over the period. Weaker investment performance would require higher contributions.

To Fully Fund Within About 30 Years, Gradual Ramp-Up to Over $5 Billion in New Annual Contributions Likely Needed. Assuming a gradual ramp up of contributions from state, district, and/or employee sources over the next few years, it appears to us that increased funding totaling somewhere over $5 billion per year could be required to fully address CalSTRS’ unfunded liabilities within about 30 years. Specifically, this is the amount that would be needed once additional contributions are fully phased in, assuming that additional contributions start in 2015 at a ramp-up rate of an additional 3 percent of teacher payroll per year. This assumes that the system is able, over the long term, to achieve its 7.5 percent average annual investment return target. Depending on the details of the funding plan, investment returns, and other actuarial factors, the over $5 billion estimate could end up being somewhat too high or too low.

More Costly the Longer We Wait. Last month, we discussed the state's options to address the potential $5 billion of additional annual costs related to CalSTRS in our Overview of the Governor's Budget (see pages 13 and 22). In general, the most important action the state can take to minimize the long-term cost of addressing CalSTRS' liabilities is to act quickly to increase funding to the system from some combination of state, district, and teacher sources. As we noted in the Overview publication, the state could set aside some money during the 2014-15 budget process—given the state's recent revenue influx—in anticipation of the adoption of a long-term CalSTRS funding plan. In any event, addressing CalSTRS' funding problem will be a very expensive proposition for the state, school districts, and/or teachers, and the responsibility to adopt a solution will in the end rest squarely with the Legislature and the Governor.

LAO analysis prepared by: Ryan Miller and Jason Sisney.