For the past several years, the administration has been engaged in the planning efforts of the Financial Information System for California (FI$Cal) project that will replace the state's multiple aging and disparate financial systems with a single, fully integrated, modern system for the entire state. Project staff recently completed a procurement for the vendor who will build FI$Cal and is ready to begin system design and development. They have submitted several documents to the Legislature, including a special project report (SPR) updating the project, a statutorily required report including information on the procurement, and a budget request for the first year of system development. The Legislature has a significant decision before it as it considers the budget year request and whether the state can afford to go forward with the project at this point. To assist the Legislature in considering the future of the FI$Cal system, we provide extensive background on the project, including details about the procurement; review and analyze the project's status and its current plans based on the selected vendor's proposal; and offer our bottom line on the FI$Cal project, providing recommendations on financing strategies, change management, and staffing plans.

Original Concept. In 2005, the Department of Finance (DOF) submitted to the Office of Technology Review, Oversight and Security (OTROS) a feasibility study report (FSR), the initial business justification for an information technology (IT) project, which proposed implementing a commercial off–the–shelf financial system for DOF. The Budget Information System (BIS), as this system would be called, was envisioned to better meet DOF's budget development and administrative needs. The new system would replace DOF's numerous stand–alone and aging financial systems that support the budget process, reduce redundant and manually intensive workload, and act as a repository for state department data to assist DOF and department staff in budget development, among other functions.

The DOF estimated that BIS would take about three years to build, beginning in 2008, and cost about $140 million. The OTROS approved the BIS FSR in the summer of 2005. The Legislature approved the BIS budget request for $2.2 million in the 2005–06 Budget Act to begin planning activities.

Expanding Project Scope. In the fall of 2006, project staff submitted to OTROS an SPR, an updated project document that is triggered by cost increases of 10 percent or more to a project. The SPR cited significant changes in scope and in the governance of the project. Rather than build a new system for DOF, project staff stated that a majority of state departments were reliant on aging, inadequate, and sometimes unsupported technology and there was a need to modernize and replace the state's entire financial management infrastructure. The SPR proposed increasing the scope of the project to include developing a single integrated financial information system for the state. The project was renamed FI$Cal and would be managed by a partnership of control agencies:

- DOF

- The State Controller's Office (SCO)

- The State Treasurer's Office (STO)

- The Department of General Services (DGS)

The new system was estimated to take about five years to develop, beginning with development in late 2008, and cost about $1.3 billion. The OTROS approved the changes to the project's scope in December 2006.

Legislature Approves Plans and Increases Legislative Oversight. The Legislature, recognizing the state's need for an integrated financial management system, approved the plan to expand the project scope and appropriated $6.7 million in the 2007–08 Budget Act for the FI$Cal project to continue with planning activities. However, given the potentially significant financial investment for the state, the Legislature adopted budget act language adding additional oversight of the project by the Bureau of State Audits. Additionally, project staff was required to submit, by April 2008, an approved SPR to the Legislature with information on potential project alternatives, including but not limited to (1) the original BIS scope, (2) implementation plans, (3) governance structure, and (4) funding strategies, among other issues.

Updated Proposal. In December 2007, OTROS approved the project's SPR 2, which included information that largely responded to the Legislature's requirements in the 2007–08 Budget Act. The SPR 2 offered advantages and disadvantages of various FI$Cal alternatives but proposed maintaining the project's expanded scope to modernize the state's financial processes and implement FI$Cal to all departments. Total costs were revised to $1.6 billion. Project staff proposed a funding plan which included borrowing $1.2 billion through bond financing. (Due to constitutional restrictions, the type of bond would be one whose repayment was subject to annual appropriation by the Legislature. The bond would be repaid with a combination of General Fund and special fund monies.) The remaining $400 million would be pay–as–you–go financing, also paid through a mix of General Fund and special fund monies. Under the project's proposed plan, the development schedule was extended by an additional two years, with project implementation beginning in 2010, to reflect increased planning efforts and other project activities.

In our Analysis of the 2008–09 Budget Bill, we expressed some concerns regarding the updated proposal including the high risk nature of such a large IT project and the significant reliance on bond financing. We recommended modifications to reduce risk and increase legislative review and oversight that included dividing development into two phases. The initial phase would implement FI$Cal to a limited number of departments. Upon rollout to these departments, project staff would submit a status report to the Joint Legislative Budget Committee (JLBC), including but not limited to lessons learned during the initial phase. Only upon legislative approval of the report would the project be able to continue to phase two and the implementation of FI$Cal to the remainder of the state. The Legislature acknowledged the state's need for a modern financial system but agreed that there were significant risks inherent to a project the size and complexity of FI$Cal. Therefore, in the 2008–09 Budget Act, the Legislature approved the continuation of the FI$Cal project, adopting our recommendation for development in two phases with a pause in between to review the submitted project report. The Legislature authorized $40 million for planning and procurement activities.

Project Review Prompts More Changes. In response to legislative concerns, FI$Cal project staff contracted with experts in January 2009 to conduct a project review that included an examination of the project's intended objectives and business requirements (as stated in SPR 2 and as codified in legislation and a recommendation of the best procurement strategy for securing a vendor to build the proposed system). Based upon the project review, FI$Cal staff:

- Revised the implementation strategy, moving away from a planned "big bang" approach whereby all functions (accounting, budgeting, cash management, and procurement) would be implemented in departments all at once.

- Proposed initially implementing a reduced set of functions to a small number of departments, with more functions being added in successive waves to the remainder of departments. (This decision was meant to reduce the initial cost for implementation as well as to mitigate the risk associated with a big bang approach.)

- Recommended changing from a traditional procurement approach to a multi–stage approach. According to the review, the multi–stage procurement strategy would assist the project in eliciting more qualified vendors and more responsive proposals for building the FI$Cal system. (The multi–stage procurement approach is described more below.)

The changes spurred by the project review were included in a new SPR 3, which was approved in November 2009 by the Office of the Chief Information Officer (OCIO), the entity that replaced OTROS. (The OCIO was subsequently renamed the California Technology Agency [CTA].) The SPR 3 described project activities and estimated the total costs from the beginning of the project through vendor selection—about $110 million through December 2011. Staff explained that the total cost and schedule for the project would be predicated on the vendor and its software application selected at the end of the procurement process. At that point, the project would submit SPR 4, which would include the project plan for development and implementation, in addition to an estimate of the total project cost and time schedule.

Legislature Requires Review Period Prior to System Development. The Legislature approved the changes detailed in SPR 3 in the 2010–11 Budget Act, which included $43 million in funding for the FI$Cal project to commence the multi–stage procurement process. Additionally, pursuant to Chapter 727, Statutes of 2010 (AB 1621, Blumenfield), the Legislature replaced the pause and the status report that was planned between phases one and two. Instead, the Legislature required that project staff submit a written report upon completion of the multi–stage procurement for legislative review. We discuss this in further detail later in the report.

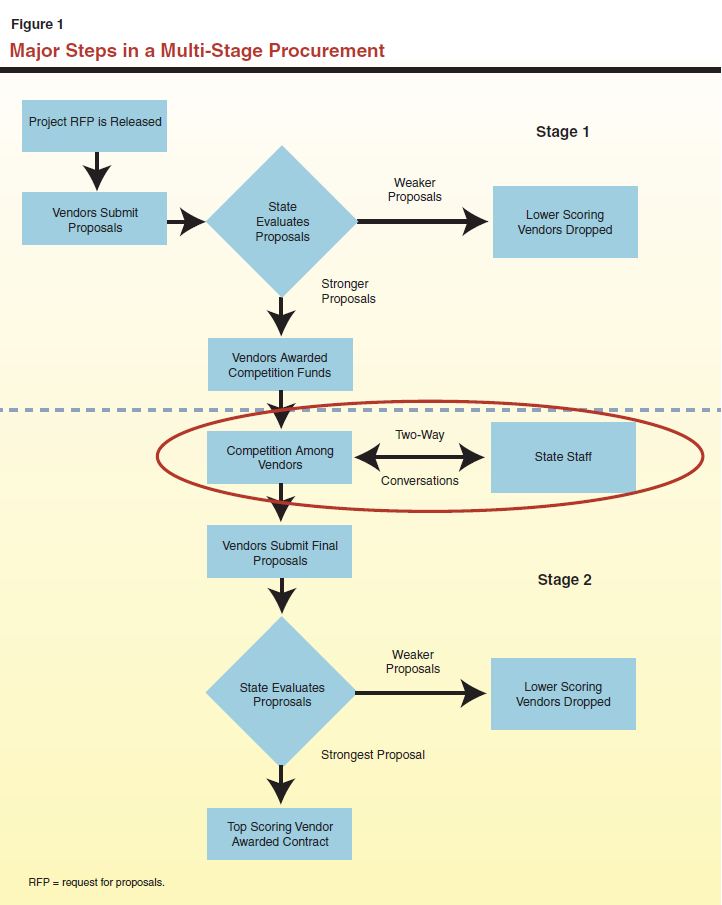

Opting for a Two–Stage Procurement Approach. Upon legislative approval of project changes, project staff commenced with a two–stage procurement. Traditionally, the state has used a firm fixed price (FFP) procurement approach for securing IT services for large automation projects. In an FFP approach, the state releases a request for proposal (RFP) which includes the business requirements and goals for a proposed system. Interested vendors submit to the state a written proposal in response to the RFP that includes a technical solution and information on the associated cost and time to implement that solution. The state then scores each solution based on criteria spelled out in the RFP. The vendor with the highest score ultimately is awarded the contract.

In contrast to the FFP approach, a two–stage procurement is a single procurement that is divided into two stages. During the first stage, as with the FFP approach, the state releases an RFP to solicit interested vendors meeting a minimum level of qualifications. In practical terms, stage one serves as a screening stage. The strongest vendors are awarded funds at the end of stage one to participate in a stage–two competition. This stage–two competition, sometimes referred to as a "bake–off," requires vendor staff to participate in activities with state staff to learn the state's business goals and IT infrastructure needs. At the end of this stage, vendors submit a final proposal for the development of the entire system, which is evaluated and scored on criteria spelled out in the original RFP. The vendor with the highest scoring proposal is awarded the contract to develop the FI$Cal system. Figure 1 depicts the major steps in a multi–stage procurement. (See nearby box for details on the advantages and disadvantages of using a multi–stage procurement approach.)

Advantages and Disadvantages of the Multi–Stage Procurement Approach. There are several advantages of conducting a multi–stage procurement for information technology (IT) projects. State and vendor staff spend a significant portion of time in two–way communications with one another during the stage–two competition. This enables vendor staff the opportunity to determine the state's business and IT infrastructure needs, to flesh out potentially ambiguous or unclear requirements included in the request for proposal, and to prepare a more responsive and accurate technical proposal and cost estimate than would otherwise be the case when following the more traditional firm fixed price (FFP) approach (which does not allow for such communication to take place prior). The more accurate the technical and cost proposals, the less potential there is for unexpected costs and delays during actual system development. During this time, state project staff also has the opportunity to learn vital information about the vendors and to assess their quality and ability to meet state needs. Generally, under an FFP procurement, this assessment could not take place until after the state had already signed the contract with the vendor. At that point, any changes to the contract are considered change requests or amendments to the contract and could result in potentially significant cost increases for the state.

The multi–stage procurement strategy does carry with it some potential disadvantages. For example, conducting a multi–stage procurement can protract the procurement schedule, increasing the length of time to develop a new system. Additionally, the state would have more upfront vendor costs as this approach allows it to contract and pay multiple vendors to participate in the bake–off competition. (Generally, the state does not subsidize vendor activities during a procurement. However, because of the potentially large investment that vendors would be making to participate in stage–two activities, the Department of General Services believes subsidizing vendors' costs encourages greater vendor participation. More vendor participation can lead to increased competition, resulting in potentially lower overall costs for the state.) Another downside is that state staff would be responsible for managing multiple vendor contracts simultaneously.

On balance, we believe the advantages of this procurement approach outweigh its disadvantages. For more detailed analysis, please see our November 11, 2009 report, Try Before You Buy: Expanding Multi–Stage Procurements for Large IT Systems.

Stage One. The FI$Cal project conducted a two–stage procurement much like that described above. In April 2010, the state released an RFP to solicit proposals from vendors who met specific criteria, including:

- Successfully developing a large IT system (where the vendor contract was over $50 million and where the system would support a minimum of 10,000 users).

- Successfully demonstrating corporate financial viability and credit worthiness.

- Guaranteeing experienced staff for key project positions.

Three vendors submitted stage–one proposals. All three vendors met the minimum criteria and in June 2010 the state awarded contracts, $1.4 million each, to all three to participate in the second stage.

Stage Two. During the first several months of the stage–two procurement, state and vendor staff were co–located and communicated on a daily basis. Project staff participated in 78 presentations and 72 confidential vendor discussions and responded to over 2,000 vendor questions. The main objectives of these interactions was for FI$Cal project staff to: (1) impart relevant information to vendors about the state's current systems and business processes and expectations for the proposed system so that vendors could develop responsive proposals and (2) assess vendor quality, ability, and understanding of the state's needs. As a result of this two–way communication, the state issued 15 addenda that refined, revised, and clarified many of the requirements included in the RFP. In June 2011, all three vendors submitted proposals for building the FI$Cal system to DGS staff, who were responsible for running the procurement.

Intent to Award. Over several months, DGS procurement and FI$Cal project staff reviewed the three vendor proposals, conducted individual negotiations with vendor staff addressing issues found in each proposal, and finally evaluated and scored updated proposals from each vendor. On March 1, 2012, the state announced its intent to award the contract to Accenture LLP (hereafter referred to as Accenture), the highest scoring bidder.

Based upon the Accenture proposal, the project staff has updated plans and included important information in three different documents:

- The SPR 4, which was approved by CTA on March 2, 2012, includes details on all project changes, cost estimates to build and implement the new system by fiscal years, and implementation plans.

- The report to the JLBC, submitted on March 2, 2012, includes the costs and benefits of alternative approaches to implementing the complete FI$Cal system (with all functions to all departments) as well as information on how the proposed solution meets demands for a flexible financial management system. As required by statute, the state may not sign the contract with the selected vendor until the JLBC has had 90 days to review this report. (That 90–day period ends on May 31, 2012.)

- The Governor's 2012–13 budget requests for the FI$Cal project, which includes $90 million in the budget year to begin the first year of system development.

Following is a review of the major components included in these documents.

Major Components of SPR 4

Scope Left Unchanged. The scope of the proposed plan remains unchanged from recent project documents. The FI$Cal system will be the state's single, integrated, financial information system, providing accounting, budgeting, cash management, and procurement functions throughout the state.

New Project Costs and Timeline. Based on Accenture's proposal, project staff estimate the total cost to build and deploy the FI$Cal system will be about $620 million ($330 million General Fund). This is an additional $530 million beyond what will already have been spent through 2011–12—from the budget year until full system implementation in 2017–18. This amount, though sizable, is a significant reduction from the $1.6 billion figure included in SPR 2. The proposed schedule is to implement FI$Cal over five years (rather than the SPR 2 estimate of seven years) to the entire state, beginning with implementation activities in 2013. See Figure 2 for project costs (including planning and other pre–development expenditures incurred to date) by fiscal year through 2017–18.

Figure 2

Costs for FI$Cal

(In Millions)

|

Fiscal Year

|

General Fund

|

Total Funds

|

|

2005–06

|

$0.5

|

$0.9

|

|

2006–07

|

2.2

|

5.0

|

|

2007–08

|

6.2

|

6.2

|

|

2008–09

|

2.1

|

5.6

|

|

2009–10

|

2.1

|

12.3

|

|

2010–11

|

1.8

|

25.8

|

|

2011–12

|

2.7

|

38.8

|

|

2012–13

|

53.5

|

89.0

|

|

2013–14

|

50.8

|

84.6

|

|

2014–15

|

61.2

|

101.9

|

|

2015–16

|

78.1

|

130.0

|

|

2016–17

|

50.6

|

84.2

|

|

2017–18

|

19.5

|

32.5

|

|

Totals

|

$331.5

|

$616.8

|

Factors Behind Project Cost Reductions. A majority of the reduction in project costs from the $1.6 billion figure in SPR 2 to the current $620 million figure is largely attributable to four proposed changes to the project since SPR 2 and the receipt of the Accenture proposal:

- Project staff costs have been reduced by $80 million. The estimated number of project staff has decreased from 499 to 304 positions due to the shorter implementation timeline (by two years), as stated above.

- Program/department staff costs have been reduced by $260 million. Previously, 243 dedicated full–time department/program staff were assumed to be a project cost throughout the duration of a seven–year implementation. The objective was to engage staff in activities at the department level to better ensure successful transition to the new system. A major proposed change is utilizing department staff on a part–time basis and only when FI$Cal is being implemented to staffs' respective departments. As a result of this change, the project does not plan to reimburse departments for the use of program staff during implementation and this cost category has been eliminated. We discuss potential implications of this reduction later in the report.

- Primary vendor costs have been reduced by $170 million. Upon selection of Accenture to build the FI$Cal system, project staff now have a more accurate estimate of the cost of these services.

- Continuing data center services costs have been reduced by $280 million. Based on the proposed plan, costs have been updated to reflect the necessary data center services needed to support the FI$Cal system.

The above savings cannot be attributed to changes in the project scope. Rather, they can be attributed to two main factors. First, cost estimates for goods, services, and staffing have been more accurately reflected. Second, the project's decision to move to a more phased implementation approach results in lower overall project costs through reduced risk to the vendor and lower state staffing costs for system implementation.

Pay–As–You–Go Is the Proposed Financing Plan. Project staff considered three main financing alternatives—pay–as–you–go, vendor financing, and bond financing—to pay for costs of the project from here on out. The following are potential advantages and disadvantages of each alternative as spelled out by project staff:

- The pay–as–you–go approach would depend on annual appropriations from the General Fund and special funds to cover project costs. While this would be costly in the short run in terms of affordability, it is the least expensive in the long run, as it avoids interest and fees associated with debt financing.

- The vendor financing approach would involve the state obtaining financing from the selected vendor and paying it back with interest over a specified amount of time. The financing would be structured as a privately placed obligation with the state's repayment subject to annual appropriation of the Legislature. While this approach would help reduce some of the upfront General Fund costs of system development, it would increase the overall cost of the project by adding interest payments. The advantage of vendor financing is that it allows for flexibility to lower payments in early years and to spread payments over several years going beyond project implementation so as to provide General Fund relief in the near term. Additionally, project staff states that only a portion of the vendor contract costs, likely not more than $200 million, may be eligible for vendor financing. (The actual eligible costs would have to be negotiated with the vendor.) The remaining costs, $400 million or more, would still have to be paid for through other financing means.

- The bond financing approach would require the state to issue bonds in the capital markets to pay for a portion of project costs. The state's repayment of the bonds, as with vendor financing, would be subject to annual appropriation of the Legislature. Also, similar to vendor financing, bond financing has the advantage of reducing up–front General Fund costs, but it would increase the overall cost of the project by adding interest payments. And here as well, only a portion of project costs would be eligible for bond financing. Project staff estimates this would not be more than $300 million. (Activities such as planning, project management, and change management would likely not be eligible for bond financing.) The remaining costs, $300 million or more, would have to be paid for through other financing means.

As stated above, the terms for both vendor and bond financing must include language making the availability of state funds for the repayment of the debt obligation subject to annual appropriation of the Legislature. The STO has advised the project staff that were the state to use one of these financing mechanisms but then halt the project and fail to appropriate funds to repay the vendor financing or bonds, such action could be viewed as a default by rating agencies and investors. Such an action could result in a downgrade to all the state's General Fund supported debt and could impair the state's ability to access the capital markets in the future.

Figure 3 provides estimates of implementation costs under each financing approach as prepared by project staff. Given the lower overall cost of pay–as–you–go financing and concerns about the feasibility of vendor and bond financing, project staff propose to move forward with the pay–as–you–go approach for funding the remainder of the FI$Cal project.

Figure 3

FI$Cal Financing Approaches and Project Costsa

(Dollars in Millions)

|

Financing Approach

|

Estimated Interest Rate

|

Project Costs Eligible for Financing

|

Total Project Implementation Costs, With Interest

|

Estimated Interest

|

|

Pay–as–you–go

|

NA

|

NA

|

$522

|

NA

|

|

Vendor financing

|

5.00%

|

up to $200b

|

596d

|

$73

|

|

Bond financing

|

4.25

|

up to $300c

|

591d

|

69

|

Benchmarking Effort Shows Potential Savings From FI$Cal Implementation. Project staff contracted with an outside expert to provide the state with both quantitative and qualitative measures of the potential long–term benefits of FI$Cal. After gathering interview and survey data across 43 state departments, including information on how the state currently conducts its financial business, the contractor concluded that upon full implementation of FI$Cal, the state could see annual savings and/or cost avoidance of $415 million. These quantitative benefits include:

- Annual process cost savings of $173 million. The currently high levels of effort and manual labor required to conduct the state's financial transactions would be greatly reduced under the FI$Cal system, allowing for more streamlined business processes.

- Annual technology cost savings of $28 million. The new system would allow state agencies to retire their legacy systems, thus reducing maintenance and operation and data center costs.

- Annual procurement effectiveness improvement benefits of $213 million. New and more effective procurement processes and access to procurement–related data currently unavailable, such as statewide expenditure on particular goods and services or the number of contracts executed with particular vendors, would result in more strategic purchasing of products and higher volume discounts for the state.

We have some reservations on the stated extent of these savings, noting that the project would not commit to specific budget reductions being made in departments to reflect the alleged savings. However, we do believe there is the potential for at least some savings related to there being more efficient financial transactions, fewer systems to maintain and operate, and enhanced purchasing power and more effective procurement processes.

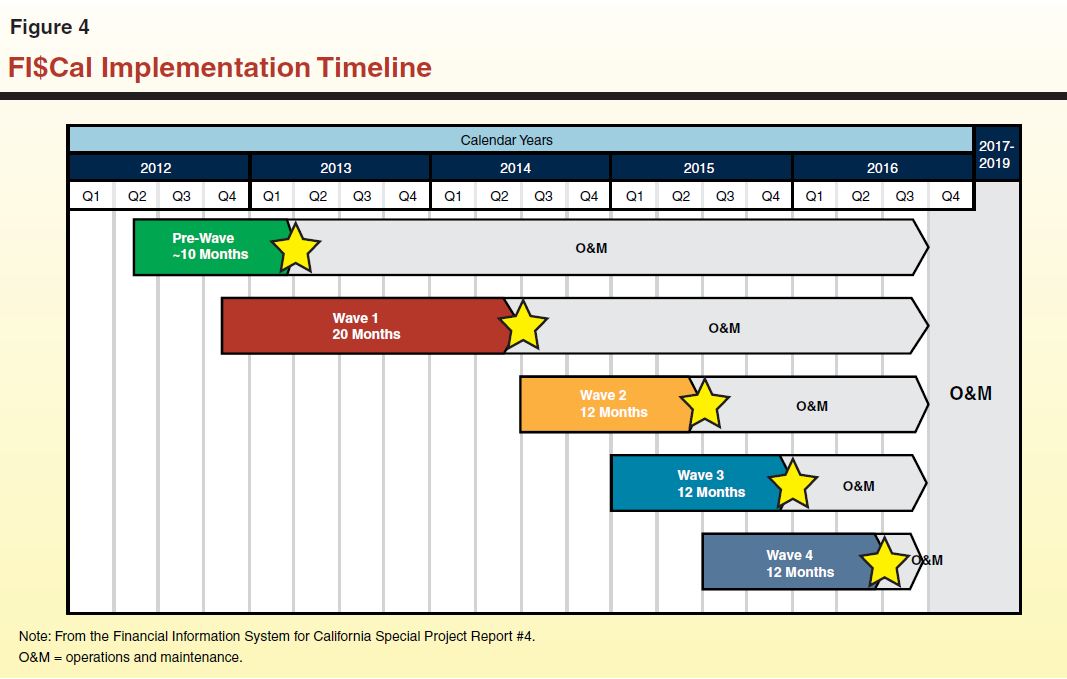

Phased Implementation Approach. The implementation plan is to deploy some system functionality to groups of state departments at a time, over a series of five waves. The first wave is a planning wave, followed by four consecutive and overlapping implementation waves. Figure 4 (taken from SPR 4) summarizes the planned implementation schedule, which we briefly discuss below:

- Pre–Wave (proposed to begin in May 2012)—During this ten–month period, project staff will create "foundational" documents, such as an integrated project schedule and communication management plans, to set the framework for the design, development, and implementation of the system. Additional work efforts will also be accomplished to prepare state departments for the FI$Cal system.

- Wave 1 (proposed to begin in November 2012)—During this 20–month period, most accounting, budgeting, cash management, and procurement functions will be implemented in the four FI$Cal partner agencies (DOF, SCO, STO, and DGS) and a limited number of state departments, including State Board of Equalization (BOE) and the Department of Justice (DOJ). This wave will account for 10 percent of all FI$Cal users.

- Wave 2 (proposed to begin in July 2014)—During this 12–month period, the remainder of accounting, budgeting, cash management, and procurement functions will be implemented in Wave 1 departments and full functionality to a new group of state departments, including Department of Health Care Services, the Franchise Tax Board, and the Department of Fish and Game. This wave will account for an additional 40 percent of all FI$Cal users.

- Wave 3 (proposed to begin in January 2015)—During this 12–month period, full FI$Cal functionality will be implemented in an additional 30 percent of all FI$Cal users, including the Employment Development Department, the CTA, and the Department of Forestry and Fire Protection.

- Wave 4 (proposed to begin in July 2015)—During this 12–month period, FI$Cal will be implemented in the remainder of state departments, including the Department of Child Support Services, California Department of Education (CDE), and the Department of Public Health.

Organizational Change Management. Project staff has identified major change management efforts that should take place in order to engage department staff as they transition to using a new system. These include developing a communication plan for all department staff, planning a comprehensive training strategy for system users, developing a business process reengineering approach, and designing a service center for future maintenance and support to departments. While important change management activities are listed, SPR 4 does not include an overall change management strategy nor does it include a timeline or major milestones for change management efforts.

Major Components of the Report to the Legislature

As described above, Chapter 727 required the FI$Cal project staff to submit a report to the Legislature upon completion of the procurement for a 90–day review prior to signing a contract with the selected vendor. (Figure 5 lists the five required elements of this report.)

Figure 5

Elements of Report on FI$Cal Required by Chapter 727a

- Examine the costs and benefits of alternative approaches to the implementation of the FI$Cal system, including, but not limited to, a scaled–back version of the proposed system.

|

- Summarize vendors' assessments of the state's financial systems automation needs.

|

- Provide details about the participating vendors' proposals for the FI$Cal system.

|

- Provide an explanation of project staff's rationale for selecting the winning vendor.

|

- Explain how the proposed solution will meet the demands for a flexible financial management system with the capability to implement various budgeting approaches.

|

Alternative Approaches to Implementing the FI$Cal System. Before commencing with the procurement, project staff had planned on building a system that would include accounting, budgeting, cash management, and procurement functions. This system would be implemented to most state departments in a series of waves. The statutory reporting requirement required that the project consider the benefits and costs of alternatives to that approach, including a scaled–back version of the proposed system. Project staff identified three implementation alternatives—functional phasing, department phasing, and a managed services model—that we describe below. Staff states that no information was available from industry experts or other similar system implementations to extrapolate specific costs or savings that could be associated with these alternatives. Only by restructuring the RFP to include these alternatives (essentially beginning the procurement again) do they believe they could arrive at reasonable cost estimates. Instead, the report considers only the conceptual advantages and disadvantages of each approach, as follows:

- A functional phasing approach would implement one or more of FI$Cal's business functions in succession across state departments. For example, accounting could first be implemented in all departments followed by budgeting or procurement. Advantages of this approach are that major functions could be implemented independently and that there would be discreet points along the development process where a delay (due to lack of resources or other reasons) could reasonably occur without interrupting the development of a particular function. Disadvantages of this approach are that departments would have to experience multiple rounds of change as each function was implemented and the overall timeframe for full FI$Cal system development would be significantly longer, increasing the overall cost of the project and delaying any benefits of having a single integrated financial information system.

- A department phasing approach would implement FI$Cal by groups of departments. Staff states that an advantage of this approach is that it allows for a more targeted implementation to specific groups of departments (for example, departments with failing financial systems could make up the first implementation group) and that the iterative nature of implementation would allow for increased efficiency and lessons learned over time. Disadvantages for a department phasing approach are similar to those listed under the functional phasing approach.

- A managed services model is one where the state would pay different vendors to provide both infrastructure services (networks, servers, storage, et cetera) and software functions (accounting, budgeting, and procurement). Under this model, the state would not own and maintain a single system but would pay vendors to provide the necessary services. While this model has been used with some success in the private sector, reducing costs and creating efficiencies, California is much bigger and more complex than any private sector company currently utilizing a managed services model. It is not clear that such a model could work for California. And if a managed services model were built for California, it would likely be very costly for the state to maintain because of its size.

The State of the State's Financial Systems. During the procurement, vendors were able to confirm information related to California's current financial systems and the proposed FI$Cal solution, as described below:

- California has a convoluted, outdated, and inefficient array of financial systems. Many of these systems were developed in the 1970s and 1980s. This outdated technology cannot easily support modern transaction and business needs.

- The proposed technology solution, as detailed in the project's RFP requirements, along with business process reengineering (a term referring to the effort of making necessary changes to current rules and ways of doing business to enable people to best utilize new IT systems), should address the state's business and technology needs and be flexible enough to allow for future changes and enhancements as necessitated.

Information from the benchmarking effort was also included in the report to comment on the added quantitative and qualitative benefits a single integrated system, such as FI$Cal, would yield to the state when current systems are phased out/replaced.

Competing Vendors' Proposals and Choosing the Winning Bid. The vendors' proposals were fairly similar to one another in terms of implementation schedule and approach. Each of the proposals planned for a five–year phased implementation approach based on functionality and across groups of departments. However, vendor (contract) costs to develop the system varied across proposals, ranging between $210 million to $270 million. (The majority of the remaining project costs consist of staff, hardware and software, data center services, and contracted services.)

In selecting the winning bid, state staff were required to use the criteria as set forth in the RFP. The project states that the criteria were collaboratively developed with input from IT experts and state staff from other large IT projects and incorporated industry best practices. A diverse group of evaluators, including members of the partner agencies, FI$Cal project staff, and DGS procurement staff, reviewed all the relevant material for a period of months. Evaluation criteria included: corporate financial requirements, staff qualification requirements, software and solution requirements, and system costs. Included in the report are the specific scoring details with the maximum number of points a vendor could receive for particular requirements.

Upon completion of evaluating and scoring the proposals, Accenture was determined to be the most responsive bidder with the highest scoring proposal.

Flexible Financial Management System. The report includes information confirming the proposed system's ability to implement various budgeting methodologies, including line–item, zero–based, and performance–based budgeting. However, project staff point out that the system will be most flexible at accommodating a particular budgeting method early in the design phase. During this time, the application software can be "configured" (or organized) in such a way to allow certain functions to be available.

There are currently several different budgeting methodologies utilized across the state. The majority of state departments utilize an incremental budgeting approach, although there are some capital outlay and bond–funded projects that use a zero–based budgeting approach. These specific budgeting methods will be incorporated in the FI$Cal system. However any changes and/or additions to these methods for other state departments would have to be designed within the new system. The sooner the administration and the Legislature can decide on the state's budgeting methodologies that they want FI$Cal to be able to implement, the easier they can be incorporated and likely for less cost than if the system has to be reconfigured in the future.

The Governor's 2012–13 Budget Requests

Combined, the 2012–13 Governor's Budget released in January and a March Finance Letter include a total of $89 million ($53.5 million General Fund) to continue funding the FI$Cal project in the budget year. The requests include funding for 83 previously authorized positions and 86 new positions to provide resources for the first full year of system development with the vendor. Additionally, funding is requested for vendor services, consulting contracts, operating expenses, and data center services.

The LAO Bottom Line

In our view, project staff have spent a fair amount of time attempting to better define costs and thoughtfully plan for the project. Upon examining the project's proposed plans for FI$Cal, we believe that the benefits of proceeding with FI$Cal development outweigh the costs of the project. We therefore recommend the Legislature approve the continuation of the project. However, we appreciate that, given the state's budget situation, the Legislature has to make difficult decisions regarding programmatic reductions and realize the Legislature has many competing priorities for limited General Fund resources. Therefore, should the Legislature wish to proceed with project development, we offer alternative funding options that reduce the state's reliance on General Fund monies to pay for the project in the short term. Additionally, we point out ways the project's change management and staffing plans to implement FI$Cal statewide could be improved to reduce risk and maximize project benefits.

Benefits of Proceeding Outweigh Costs of Project

General Benefits of an Integrated Financial Management System. We believe that the proposed system has significant benefits for the state, including: automating highly manual processes, minimizing manual reconciliations among control agencies and various separate financial systems, making information more readily available to the public and the state's business partners, generally improving tracking of statewide expenditures, and standardizing the state's financial practices. This system would provide greater transparency and accountability of the state's financial management and improve the budgeting process and the effectiveness of related decisions by providing more comprehensive and up–to–date financial information to the administration and the Legislature to assist in their decision making.

Furthermore, additional cost savings to the state would result from the implementation of FI$Cal, as detailed in the project's benchmarking effort discussed above. While the extent of these savings is unclear, we think that there will be some savings associated with the streamlining of business practices and more strategic procurement.

Costs of Not Proceeding Could Be Significant. In addition to the general benefits accruing to the state from having an integrated financial information system, the actual costs of proceeding with FI$Cal development may not be as high as the potential costs for halting. This is highlighted by the fact that many state departments are or will be in need of replacing their financial systems in the near future and have held off doing so with the expectation that the FI$Cal system would be built and implemented statewide in the near future. Replacing each of the state's systems on an individual, as–needed basis over the next five to ten years could easily exceed the current total FI$Cal project cost, and the state would not obtain the majority of benefits of a fully functioning FI$Cal system. The DOJ, BOE, Department of Motor Vehicles, CDE, and the California Highway Patrol all have identified financial systems in need of replacement in the near future. If these departments were to develop their own systems, the cost for each system would likely be in the tens of millions of dollars or more. (These cost estimates are based on recent IT projects that have developed financial information systems recently. The California Department of Corrections and Rehabilitation and the California Department of Transportation each developed their own systems at a cost of $175 million and $42 million, respectively.)

Over the next several years, more and more departments will need to replace aging and unsupported systems. Many of these separate systems would perform similar functions, but most of them would not be connected and could not easily share information to allow for aggregating statewide data in a meaningful way to assist decision makers, or allow for transparency of the state's financial management. The state would end up paying for each system's development, which in aggregate could easily exceed the total FI$Cal project cost.

Modified Funding Plan Could Reduce General Fund Costs in the Short Term

As discussed above, the proposed plan would entail General Fund costs between $50 million and $80 million over the next several years. Should the Legislature opt to proceed with the FI$Cal project, the proposed pay–as–you–go funding approach, which puts significant pressure on the General Fund in the near term, could be modified. Below, we offer alternative funding approaches for the Legislature to consider that rely less on the General Fund over the next several years. These funding approaches could be combined with one another and with some degree of pay–as–you–go financing from the General Fund and special funds.

- The GS $Mart Loan Program is a public financing program administered and operated by DGS' Procurement Division. The DGS division prequalifies lenders to participate in financing IT and non–IT goods and services for state departments and assists departments in processing loans from these vendors at highly competitive interest rates. While the GS $Mart program has generally been used to finance single purchases under $10 million, it has secured financing for IT–related costs greater than this amount on several occasions. It is also possible for a project to receive multiple loans from multiple vendors through the GS $Mart program, which would increase the amount able to be financed. This program would not likely be able to finance the full cost of FI$Cal development, but FI$Cal project staff may want to take advantage of it to cover some of the costs that would otherwise be funded through the General Fund or special funds.

- Vendor financing may still be a viable financing option for the project to consider. We believe the STO's concern about the language included in the terms of financing (that vendor repayments would be subject to annual appropriation) could be addressed via statute. For example, the Legislature could explicitly state in statute its intent to appropriate funds for its debt obligation to the vendor even if the project is halted. This could reduce the risk that the state would default on its debt obligation, thereby reducing the possibility of a downgrade of the state's credit rating. As stated above, the actual project amount that could be financed via this option are not currently known, but likely would not be more than $200 million.

- Another option the project could consider is a tweak of the pay–as–you–go approach so as to shift the payment of General Fund monies to later years. The project could advance the contributions from the special funds over the next few years with the General Fund in effect making greater contributions in later years. (This could be set up as loans to the General Fund from the special funds. We would expect the General Fund would need to pay back the special funds along with any interest that might be owed those funds over the life of the loan.)

The Legislature could direct that a mix of the above financing approaches along with some degree of pay–as–you–go financing be used to reduce the project's reliance on the General Fund in 2012–13 and the subsequent few years. For example, if project staff utilized GS $Mart to finance $30 million, vendor financing to finance $100 million to $125 million, and advanced contributions from special funds for an additional $125 million, the General Fund contribution over each of the next three years could be reduced from an average of about $55 million (under the project's current financing plan) to an average closer to $20 million to $25 million. While the General Fund would contribute to the repayment of GS $Mart loans and vendor financing and have to repay the special funds, these repayments will be spread out over several years, hopefully to include years where the General Fund contribution is more affordable than currently.

Project Risks Significantly Reduced Through Procurement Process

For the last two years, project staff have planned for and participated in an intensive procurement process. This procurement has (1) reduced a significant amount of uncertainty and risk that usually exists for both the state and vendors and (2) answered many of the questions that are generally present for both the state and vendors when initially developing a large IT project. (For example: How much will the system cost to build? Does the vendor understand the business and program needs of the state? Does the vendor understand the requirements well enough to build the proposed system? Are the requirements well defined? Does the state know what it wants the system to perform?) Uncertainty and risk tend to drive costs up for the state as (1) vendors build premiums into their cost proposals to address perceived risk and uncertainty and (2) there is greater likelihood that expensive change requests will ensue to address the state's omitted or unclear requirements and expectations.

Through the numerous presentations and discussions that took place between project and vendor staff during the procurement, project staff had the opportunity to clarify, refine, and add requirements for the future system; delineate activities that are the responsibility of the state or the vendor; and clearly state its expectations of the vendor and of the proposed system. Having this vital information available so early in the project (before a contract is signed and before system development begins) allowed vendors to develop responsive and competitive proposals, greatly reduced the overall cost for the project, and mitigated some of the risks around building what could be the state's largest and most complex IT system.

Change Management Plan Needs Fleshing Out

The proposed FI$Cal plan lacks important detail around change management. Neither SPR 4 nor the report to the Legislature provides much detail on the project's activities that are intended to help state staff transition from the current systems and current ways of doing business to the new way of doing business under FI$Cal. The project's official Change Management Plan document, which should serve as the foundation for all the project's change management efforts, has not been updated since June 2011 (despite a stated objective within the plan that it be updated quarterly by the Change Management Office). Updating the plan once the development vendor has been selected would be particularly important.

Over the initial planning years of the project, FI$Cal staff took steps to (1) communicate to other state staff (through public forums and other meetings) about the proposed FI$Cal system, (2) engage other state staff in the planning process through the establishment of a Customer Impact Committee (made up of representatives from various departments), and (3) learn from other large IT projects' experiences with change management failures and successes. While these were good initial attempts to prepare the state for a new financial management system, now that a vendor has been selected and development is to begin shortly on the FI$Cal system, it is imperative that the project have a detailed organizational change management strategy. Such a strategy should include a communication plan, a schedule with major milestones and detailed activities for departments by wave, and training plans for individual departments and their staff.

Project Should Update Change Management Plan. We recommend the Legislature direct project staff to develop an up–to–date, fully fleshed out change management plan as soon as possible, presuming that one does not exist unofficially. This plan should be made available to the Legislature and other stakeholders so they can be assured that change management best practices are being employed and that those responsible for using the new system will be adequately trained.

Elimination of Initially Planned Departmental Staff to Implement FI$Cal Undercuts Project Success

As described earlier, FI$Cal staff estimated that an originally planned 243 dedicated full–time department/program staff to assist with the implementation of FI$Cal at the department level (and paid for as a project cost) would no longer be needed given the new phased implementation approach. Instead, the project would rely on departments to provide their own staff on a part–time and as–needed basis to assist in transition and implementation activities at each department. Departments will be responsible for absorbing these costs. While this change of plan avoids—at least on paper—an estimated $260 million cost to the project, we see the potential for problems arising.

Potential Erosion of Department Buy–In. The expectation that departments would provide sufficient staff to assist in transitioning to the FI$Cal system without any reimbursement ignores individual departments' varying capacities to do so. While some departments may be able to absorb the costs of providing this assistance, others will end up "paying" for them through redirecting funds from other priority projects, deferring spending or hiring, or requesting additional appropriations for more staff. Yet, other departments might simply choose to dedicate insufficient staff to assist with a smooth transition to FI$Cal. Departments whose staff already feel a high level of anxiety about using a new system and learning new processes could become increasingly dissatisfied and distrustful of the entire effort. As a result, staff buy–in could be eroded, leading to greater difficulty accepting and transitioning to the new system. Ultimately, this could jeopardize the overall success of the project in providing its intended benefits.

Project Staff Should Report at Hearings on Plan to Ensure Departmental Buy–In, Including Costs to Implement Plan. Given the importance of department staff buy–in to the success of implementation and proper utilization of the new system, we recommend the Legislature direct project staff to report at hearings on plans that ensure that departments will have adequate staff to successfully transition to FI$Cal. Plans could include alternatives to the current proposal to at least partially compensate departments for the proper level of resources needed to implement FI$Cal statewide.

The FI$Cal project involves the development of one of the most ambitious and complex IT systems in the history of the state. It will be utilized in some way by every state department, the Legislature, and the public, allowing transparency into the state's financial data and management that is impossible today given the state's infrastructure. The Legislature has been appropriately concerned about the risk and the cost of this effort.

As this report has highlighted, the project staff has come a long way in mitigating risk and better defining costs for the proposed FI$Cal system. We believe the extensive amount of time and effort the project staff have spent in planning for this system has strengthened the proposal, and we recommend the Legislature approve the project going forward in light of our analysis of the project's costs and benefits. The total cost, however, remains sizeable and represents a significant General Fund cost. Should the Legislature wish to continue with project development, we present alternative funding approaches that reduce the General Fund contribution over the next several years in order to make continuing with the project a more financially viable option at this time. Additionally, we believe the project could be further strengthened if project staff (1) develop a more comprehensive and detailed change management plan and (2) take efforts to ensure that departments have adequate staffing to assist with a smooth transition to FI$Cal.