Analysis of the 2001-02 Budget BillLegislative Analyst's Office

|

This year, the Legislature and Governor face the dual challenge of both (1) crafting a budget that addresses the programmatic needs of California citizens and (2) developing strategies for dealing with the state's ongoing electricity crisis. These tasks are especially challenging given that the state's economic and fiscal environment is increasingly uncertain. As discussed in the "Legislative Considerations" section below, decisions made with regard to addressing the state's electricity issues—including the amount of General Fund resources that should be used for this purpose—could have a significant impact on the amount of resources available for other budget priorities and proposals this year. They also could necessitate significant revisions to the Governor's budget proposal between now and its final enactment.

In this part we discuss the Governor's 2001-02 budget proposal and provide our own perspective on the budget outlook. We then discuss key decisions that the Legislature will face as it juggles addressing both the electricity crisis and its other priorities.

The 2001-02 Governor's Budget proposes total state spending of $102 billion (excluding expenditures of federal funds and selected bond funds). This represents an increase of $7.5 billion, or 7.9 percent, over the current year. Slightly over 80 percent of this total spending is from the General Fund, while the remainder is from special funds. As discussed below, the main focus of the Governor's budgetary initiatives involves education and energy.

As shown in Figure 1, the budget projects that General Fund revenues will total $79.4 billion in 2001-02, an increase over the current year of $2.5 billion (3.3 percent). By comparison, budget-year General Fund expenditures are estimated at $82.9 billion, an increase of $3.1 billion (3.9 percent) over 2000-01. After accounting for set-asides for litigation and encumbrances, the Governor's estimated 2001-02 year-end General Fund budgetary reserve is $1.9 billion, or about 2.4 percent of expenditures.

| Figure 1 | ||||

| Governor's Budget General Fund Condition | ||||

| 1999-00 Through 2001-02 (Dollars in Millions) | ||||

| 2001-02 | ||||

| 1999-00 | 2000-01 | Amount | Percent Change | |

| Prior-year fund balance |

$3,930 |

$9,367 | $6,557 | |

| Revenues and transfers |

71,931 |

76,899 | 79,434 | 3.3% |

| Total resources available |

$75,861 |

$86,266 | $85,991 | |

| Expenditures |

$66,494 |

$79,708 | $82,853 | 3.9% |

| Ending fund balance |

$9,367 |

$6,557 | $3,139 | |

| Encumbrances |

$701 |

$701 | $701 | |

| Set-aside for legal contingencies |

— |

7 | 500 | |

| Reserve | $8,666 | $5,849 | $1,937 | |

| Detail may not total due to rounding. | ||||

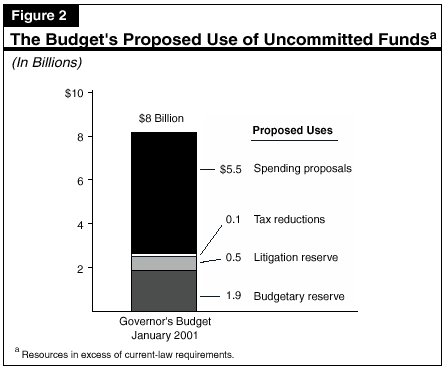

The budget allocates approximately $8 billion in resources not committed for current-law requirements in 2001-02. Figure 2 shows that about $5.5 billion of this total is for new spending initiatives, $0.1 billion is for tax relief, $1.9 billion is for the reserve, and $0.5 billion is set aside for litigation. Of these uncommitted resources, about 70 percent ($5.7 billion) of the total is for one-time uses (including funding reserves), while the remaining 30 percent ($2.3 billion) is for ongoing uses.

Total Spending by Program Area

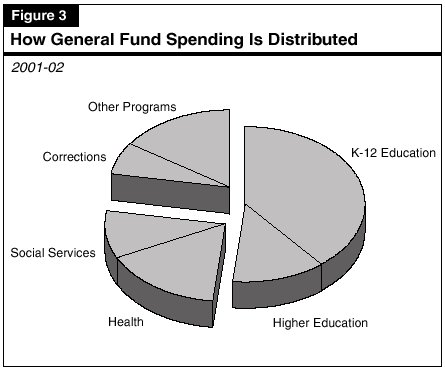

Figure 3 shows the proposed distribution of General Fund spending in 2001-02 by major program area. Nearly 52 percent of the total involves education, including about 39 percent for K-12 and 13 percent for higher education. About 26 percent is for programs relating to health and social services, including Medi-Cal, the Supplemental Security Income/State Supplementary Program (SSI/SSP), and the California Work Opportunity and Responsibility to Kids (CalWORKs) program. Another 7 percent is for corrections, and the remaining 15 percent covers general government, local tax relief, and other programs.

Figure 4 details the budget's proposed General Fund spending levels by major program areas for 1999-00 through 2001-02. It shows that:

| Figure 4 | ||||

| General Fund Spending by Major Program Area | ||||

| (Dollars in Millions) | ||||

|

|

Proposed 2001-02 | |||

| Actual 1999-00 |

Estimated 2000-01 |

Amount | Percent Change | |

| Education Programs | ||||

| K-12—Proposition 98 |

$25,270 |

$27,270 | $29,471 | 8.1% |

| Community Colleges—Proposition 98 |

2,390 |

2,654 | 2,877 | 8.4 |

| UC/CSU |

4,891 |

5,826 | 6,397 | 9.8 |

| Other |

3,058 |

3,956 | 4,137 | 4.6 |

| Health and Social Services Programs a | ||||

| Medi-Cal |

$8,065 |

$9,458 | $9,325 | -1.4% |

| CalWORKs |

1,991 |

1,935 | 2,128 | 10.0 |

| SSI/SSP |

2,501 |

2,626 | 2,870 | 9.3 |

| Other |

5,193 |

6,849 | 7,866 | 14.8 |

|

Youth and Adult Corrections |

$4,748 |

$5,181 | $5,389 | 4.0% |

| All Others b |

$8,780 |

$14,659 | $13,144 | -10.3% |

| Totals | $66,494 | $79,708 | $82,853 | 3.9% |

| a The 2001-02 decline in Medi-Cal and increase in the "Other" category is due to a technical shift of $600 million to the Department of Developmental Services and the replacement of $170 million of General Fund spending with tobacco settlement funds. | ||||

| b The 2001-02 decline is primarily due to the magnitude of one-time spending in 2000-01. | ||||

The Governor's proposed budget continues major themes of the past two years. It includes significant increases in ongoing funding for K-12 and higher education, a large amount of one-time commitments, and set-asides for a budgetary reserve and litigation contingencies. In other areas, it generally covers caseload and cost-of-living increases, but includes relatively few new ongoing initiatives. Figure 5 summarizes these key features.

| Figure 5 |

| Key Features of the 2001-02 Governor's Budgetary Proposal |

| |

| |

| |

| |

| |

| |

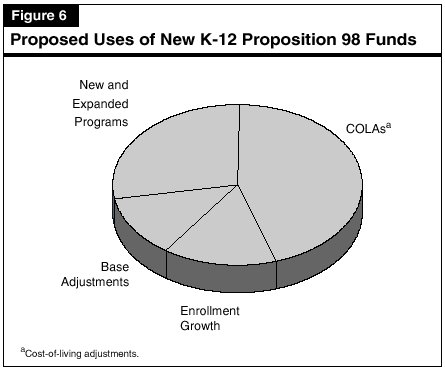

Proposition 98 allocations (which include local property tax revenues) to K-12 schools total $41.3 billion in 2001-02. This represents an increase of over $3.2 billion, or 8.3 percent, above the current-year estimate. Per-pupil spending under Proposition 98 increases by $479, or 7.1 percent, to $7,174 per pupil. The budget proposes Proposition 98 spending that exceeds the estimated minimum funding guarantee by $1.9 billion. Figure 6 displays the major proposed uses of the additional $3.2 billion of Proposition 98 funds.

The largest share of the new monies—$1.4 billion (45 percent)—would provide a 3.91 percent COLA for district and county office apportionments (revenue limits) and categorical programs. General purpose and categorical program funding for the projected 1.08 percent growth in the student population accounts for $463 million, or 15 percent, of new Proposition 98 funds. Providing full-year funding for programs that began in the current year and other net adjustments account for almost $400 million, or 13 percent of new funding.

The budget allocates the remaining funds (almost $900 million) for (1) a variety of new and expanded categorical spending programs over which school districts would have minimal discretion in most instances (over $750 million), and (2) a proposed settlement of school district claims for mandated special education costs ($125 million). (In addition, the budget provides $270 million of one-time funds—attributed to 1999-00—for this proposed settlement.) The largest of these programs in the budget year is a $335 million augmentation to provide intensive training to teachers in recently adopted academic content standards for mathematics and English language arts. The largest new program in terms of annual costs beyond the budget year is the Governor's proposal to add 30-instructional days to the academic year at middle schools. The budget provides $100 million for this purpose in 2001-02. The administration intends that the program reach virtually all middle schools in the state by 2003-04, at an estimated cost to the state potentially exceeding $1 billion annually.

Community Colleges. The budget proposes an 8.3 percent increase in California Community Colleges Proposition 98 funding (the General Fund portion of this share increases by 8.4 percent). This increase includes money for a 3.9 percent COLA and 3 percent enrollment growth. The budget also proposes new funds to assist districts in making part-time faculty salaries more comparable to full-time salaries, and for helping students obtain CalGrants.

The University of California (UC) and the California State University (CSU). The budget proposal includes increases in General Fund spending of 11 percent for UC and 7.8 percent for CSU in the budget year. The new funds support a 5 percent general increase in each budget, in addition to 3 percent enrollment growth for CSU and 3.5 percent enrollment growth for UC. The UC budget includes $308 million in General Fund spending for capital outlay projects. Funding is also included for summer sessions, research, and student outreach and retention.

The budget also includes a $1 billion set-aside for energy-related initiatives, relating to the current electricity crisis facing the state. The funds would be available for programs directed at energy conservation and to increase energy supplies. The administration indicates that specific proposals will be developed in consultation with the Legislature. As discussed in the accompanying shaded box, energy purchases by the state authorized by (1) the Governor's emergency proclamation; (2) Chapter 4x, Statutes of 2001 (AB 1x, Keeley); and (3) Chapter 3x, Statutes of 2001 (SB 7x, Burton) will be reimbursed from revenue bond proceeds. Thus, they will not affect the General Fund resources available for the energy set-asides.

| State Electricity Purchases

Background. On February 1, the Governor signed Chapter 4x, Statutes of 2001 (AB 1x, Keeley), which authorizes the state Department of Water Resources (DWR) to enter into contracts to purchase electricity for resale to utility customers in California. With this measure, the state government is now a key purchaser of electricity for customers of California's private investor-owned utilities. Assembly Bill 1x also authorizes the state to issue revenue bonds to help finance the power purchases, and authorizes the California Public Utilities Commission (CPUC) to set rates which are adequate to cover DWR's power purchasing costs and debt repayments. Although the amount of debt authorized is based on a formula which will be calculated by the CPUC, the administration has indicated that it will likely be in the range of $10 billion. The measure also appropriates $500 million from the General Fund to cover the initial costs of purchasing electricity, and authorizes the state to incur additional deficiencies for this purpose. As of mid-February, the state had used up the $500 million AB 1x appropriation, and had submitted a $500 million deficiency to finance additional power purchases. When combined with $600 million previously authorized by (1) Chapter 3x, Statutes of 2001 (SB 7x, Burton) and (2) the Governor's January 17 emergency proclamation, the state has thus far committed $1.6 billion for electricity purchases. Large Electricity Purchases Are Scheduled. Between now (mid-February) and when the first bond sales occur (currently estimated to be in early May), the General Fund will incur large additional electricity purchase costs—potentially exceeding $2 billion. These large outlays will occur for two reasons. First, there is a 75-day electricity billing cycle, meaning that the General Fund will not receive the first reimbursements for DWR's purchases until mid-April. Second, even after the reimbursements begin, the customers' regulated rate for wholesale purchases (about 7¢/kwh) is well below current-wholesale costs (over 25¢/kwh). The state is currently negotiating fixed-price contracts in an attempt to bring DWR's future procurement costs down. Given current market conditions, however, these costs will likely remain well above current-regulated customer rates during 2001. Current General Fund Appropriations to Be Fully Reimbursed. Under the terms of AB 1x, all General Fund outlays for electricity purchases including interest costs made since the Governor's January 17 emergency proclamation order will be reimbursed from the bond proceeds—including both the $1.6 billion in commitments made through mid-February and the additional deficiencies that are incurred between mid-February and May. Thus, while current electricity purchases will have a temporary adverse effect on the General Fund's cash position, they will not affect the General Fund's budget condition. Under existing law, all electricity purchases currently authorized will be borne by California's utility customers through their future rate payments. Future Fiscal Pressures Could Emerge. While in the near term the bond proceeds will be used to cushion ratepayers from the full magnitude of high electricity costs, these funds are not inexhaustible. At some point, customer rates will need to be raised to cover DWR's purchasing requirements or another funding source will need to be found. |

As shown in Figure 7, the budget is proposing about $3.3 billion in new one-time programmatic spending in 2001-02 (this one-time amount excludes the $2.4 billion noted earlier that is allocated to reserves). This includes the $1 billion set-aside for various energy initiatives and $772 million in direct appropriations for capital outlay. The budget also includes significant one-time funds for local fiscal relief, new housing initiatives, and various environmental and resources-related purposes.

| Figure 7 | |

| Key One-Time Commitments Proposed in the 2001-02 Budget | |

| (In Millions) | |

| Purpose | Amount |

| Energy initiatives set-aside |

$1,000 |

| Capital outlay |

772 |

| Local government fiscal relief |

250 |

| New housing initiatives |

220 |

| Diesel replacement |

100 |

| Clean beaches |

100 |

| Law enforcement technology grants |

75 |

| Flood control subventions |

74 |

| River parkway initiative |

70 |

| Prison electromechanical doors |

58 |

| Zero-emission vehicle subsidies |

50 |

| Touch screen voting pilot project |

40 |

| Other |

505 |

| Total | $3,314 |

The budget's economic forecast assumes that after a very strong year in 2000, the California economy will slow in line with the national economy during 2001. Accordingly, strong current-year revenue performance will be followed by more-modest gains in 2001-02. Specifically, the budget forecasts that:

This section provides our own perspective on the General Fund outlook for 2000-01 and 2001-02, based on the LAO's economic and revenue forecasts which are described in "Part II" and "Part III" of this volume. We have also developed a forecast for 2002-03 to provide the Legislature with an indication of the longer-term implications of the Governor's mix of one-time and ongoing budgetary proposals. For purposes of these estimates, we assume that the General Fund's costs associated with the energy crisis are limited to those identified in the budget, which mainly consist of the $1 billion set-aside. The purpose of our projections is to provide the Legislature with our independent estimate of the fiscal implications of the Governor's budgetary plan.

Our General Fund outlook for 2000-01 through 2002-03 is shown in Figure 8, while our key outlook-related findings are summarized in Figure 9.

| Figure 8 | |||

| The LAO's General Fund Condition Assuming Governor's Policy Proposals | |||

| 2000-01 Through 2002-03 (In Millions) | |||

| 2000-01 | 2001-02 | 2002-03 | |

| Prior-year fund balance |

$9,367 |

$7,373 | $3,179 |

| Revenues and transfers |

77,609 |

78,960 | 85,612 |

| Total resources available |

$86,976 |

$86,333 | $88,791 |

| Expendituresa |

$79,603 |

$83,153 | $85,968 |

| Ending fund balance |

$7,373 |

$3,179 | $2,823 |

| Encumbrances |

$701 |

$701 | $701 |

| Set-aside for litigation |

7 |

500 | — |

| Reserve | $6,664 | $1,978 | $2,122 |

| a Assumes the LAO's estimates of caseload and costs. | |||

| Figure 9 |

| Key LAO Budget Outlook Findings |

|

|

|

|

|

|

|

In contrast to the past two years, our current General Fund fiscal outlook is generally similar to the administration's. As shown in Figure 8, we forecast that 2001-02 will end with a reserve of $2 billion, or slightly more than the $1.9 billion included in the budget. (If the Governor's set-aside for litigation is included in the reserve, the corresponding figures are $2.5 billion versus $2.4 billion, respectively.) The small difference in our reserve estimates reflects our slightly higher estimate of two-year revenues, partly offset by the two-year additional costs we have identified on the expenditure side of the budget.

Economy to Slow in 2001. Although California's economy escaped the national economic slowdown that occurred in the second half of 2000, we believe that economic growth in the state will taper off in 2001. In particular, the state's high-tech sector, which has been a key engine driving our economic growth, will be negatively affected by slowing U.S. business and personal spending on computers, electronics, and software. Another factor contributing to slower state growth is high costs for gasoline, natural gas, electricity, and rents—all of which are limiting the amount of disposable income available for other purchases. Our forecast assumes that electricity prices will rise significantly this year but that major supply disruptions are kept to a minimum.

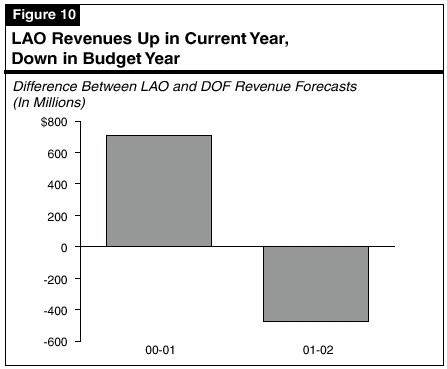

Revenue Picture Mixed. The state's revenue picture is being affected by strong opposing forces. The current revenue trend is moderately above the budget forecast. However, the projected economic slowdown, coupled with the major decline in stock share prices for California's high-tech firms, is likely to have a pronounced adverse effect on budget-year revenue receipts. Taking into account these opposing factors, our revenue forecast is up from the budget projection by $710 million in the current year but down from the budget forecast by about $475 million in the budget year—for a net two-year gain of $235 million (see Figure 10).

Expenditures to Exceed Budget Estimate. We project that General Fund expenditures will exceed the budget by about $195 million in the current and budget years combined. The net increase is due to our inclusion of funds for employee compensation and Medi-Cal rate increases that were not recognized in the Governor's January proposal, partly offset by lower estimates of Department of Corrections inmate population and debt-service costs.

Assuming that the economic slowdown is confined to 2001, we believe that the Governor's budgetary proposal would remain in balance through 2002-03. As discussed in "Part III," our projections are that the economic rebound in 2002 will boost revenues by over 8 percent in 2002-03. Expenditures will grow by about 3.4 percent during that year. The year would end with a reserve of slightly more than $2 billion.

Our budget outlook represents our best assessment of what the net impact will be of the conflicting forces influencing the state's economy and revenues at this time—namely, the current strength in revenue-related data, contrasted with the potential future weakness related to a softening national economy, lower stock market valuations, higher energy prices, and uncertainties about electricity supplies this summer. Depending on how these factors evolve, the revenue outlook could either improve or worsen between now and the May Revision. At this point, however, we believe that the downside risks are particularly significant.

The Legislature will be developing a budget amidst one of the most unusual and challenging set of circumstances in recent history. With the passage of AB 1x, the Governor and Legislature have taken a first step toward stabilizing the state's electricity markets. However, the Legislature now faces a number of major decisions relating to the state's longer-term role in the electricity markets.

One of the basic questions it faces involves the extent to which General Fund resources will be committed for such purposes as utility ratepayer relief, incentives for conservation, and increasing energy supplies. Given the enormous size of California's economy and energy markets, and depending on the types of activities considered, General Fund fiscal exposure could easily surpass the one-time amount set aside in the budget for energy initiatives.

Thus, in addition to the fundamental choices it faces regarding the direction of future energy policy, the Legislature will need to

decide—early on—the extent to which it intends to use General Fund resources to achieve its goals in the energy area. If significant

General Fund resources are to be committed to the energy crisis, it will be extremely important that this be taken into account as the

2001-02 budget is crafted. In this regard, we recommend that the Legislature withhold consideration of $2.3 billion of the

Governor's one-time proposals in the areas outside of energy until May, when the nature and costs of energy-related legislation are

better known and the revenue outlook becomes clearer.

Return to Perspectives and Issues Table of Contents,

2001-02 Budget Analysis