Legislative Analyst's OfficeAnalysis of the 2001-02 Budget Bill |

Trial Court Funding (0450)

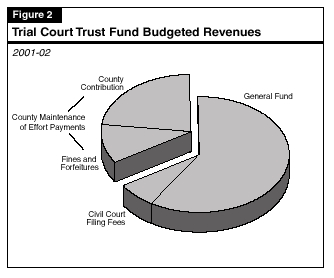

The Trial Court Funding item provides state funds for support of the state's trial courts. The budget proposes total expenditures in 2001-02 of $2.2 billion for support of the Trial Court Funding Program. This is $110 million, or 5.3 percent, greater than estimated current-year expenditures. Figure 1 shows proposed expenditures for the trial courts in the past, current, and budget years. The Trial Court Trust Fund is the main funding source for trial court activities. Figure 2 shows the sources of revenue for the fund.

| Figure 1 | |||

| Trial Court Funding Program | |||

| (In Millions) | |||

| Actual 1999-00 |

Estimated 2000-01 |

Proposed 2001-02 | |

| Trial court operations |

$1,609.5 |

$1,775.2 | $1,861.5 |

| Court interpreters |

50.3 |

54.4 | 58.1 |

| Superior court judges salaries |

160.2 |

212.9 | 232.6 |

| Assigned judges |

16.7 |

17.7 | 17.8 |

| Totals | $1,836.7 | $2,060.2 | $2,170.0 |

The budget proposes a number of augmentations for support of the trial courts in 2001-02. The major proposals include the following:

Chapter 850, Statutes of 1997 (AB 233, Escutia and Pringle)—the Lockyer-Isenberg Trial Court Funding Act of 1997—shifted primary fiscal responsibility for support of the trial courts from the counties to the state. This measure resulted in a major new financial responsibility for the state's General Fund and provided general purpose fiscal relief to counties by capping their future financial obligations for court operations.

As the state has proceeded to implement this new funding structure, it has encountered a number of issues that will require clarification in additional legislation or changes in budgeting practices. Below we discuss three issues that we believe the Legislature and Governor should consider this year. These issues are court facilities, court-related fees, and court employee salaries.

Background. Chapter 850 established the Task Force on Court Facilities to identify the capital outlay needs of trial and appellate court facilities. The legislation also directed the task force to provide options and recommendations for funding court facility maintenance, improvements, and expansion. Finally, Chapter 850 directed the task force to recommend an appropriate assignment of state and local funding responsibilities for these facilities as well as a transition plan for any changes.

The task force submitted an interim report on October 1, 1999. A second interim report is expected in the spring of 2001, and a final report was originally due July 1, 2001. However, the task force now estimates that its final report will not be issued until October 2001. In formulating its recommendations, the task force relied on a survey of existing county facilities and a model for court facility standards which incorporated existing and anticipated funding levels.

Task Force Recommendations. The task force has voted to recommend that the state assume full responsibility for funding and maintaining court facilities and has designed a transition plan to achieve this. The task force chose not to adopt a single plan to transfer and manage all facilities. Instead it recommends that the Judicial Council and the counties negotiate the transfer of facility responsibilities on a building-by-building basis. Under this plan, the state would have the option of either taking title to a building or leasing court space from the county.

Counties, on the other hand, would continue to have responsibility for financing at least a portion of the cost of facility operations and maintenance through a maintenance-of-effort (MOE) agreement with the state. This would obligate counties to make payments to the state based on historical funding levels of operations and maintenance.

Figure 3 summarizes some of the transfer principles recommended by the task force.

| Figure 3 |

| Key Features of County-to State Transfer Of Responsibility for Court Facilities Recommended by Task Force |

Because existing law already requires the state to assume responsibility for court operations, having the state assume responsibility for court facilities is consistent with that action. In addition, failure to do so may result in continued neglect and deterioration of some facilities. We, therefore, recommend the enactment of legislation that transfers responsibility for court facilities to the state. We also recommend that the legislation do the following: (1) provide authority for the state to assume responsibility in a timely manner, (2) include court facilities in the state's existing capital outlay planning process, (3) establish a streamlined facility transfer process, (4) establish a funding mechanism that recognizes those counties which have made a good-faith effort to maintain their court facilities, and (5) count court facility funding as fiscal relief in the context of the state-county fiscal relationship.

It is important for the state to decide whether to assume responsibility for court facilities. Currently court facilities have a backlog of deferred maintenance issues which are increasing. This growing backlog is a result of two factors. The first is the historical nature of the relationship between counties and courts. Those counties that have not had a close working relationship with their courts traditionally have been disinclined to invest resources in their facilities. The second factor is a more recent behavioral change on the part of counties in anticipation of a state takeover of facilities. In these cases, counties may have reduced their efforts to maintain and improve their facilities because they have no incentive to do so.

Since Chapter 850 already established the state's responsibility for trial court operations, we concur with the task force conclusion that state assumption of responsibility for facilities is consistent with that action. We differ with the task force, however, on specific findings. It is important that legislation be enacted to clearly identify the state's authority with regard to ownership and management of these facilities.

State Needs to Acknowledge Huge Fiscal Liability. It is important for the Legislature to be aware that with this state responsibility comes a huge amount of future capital outlay needs. The task force estimates that there are approximately 440 trial court facilities occupying 10 million square feet of space. Of these facilities, approximately two-thirds are mixed-use, meaning the court shares building space with other county personnel and operations. Of the space in mixed-use buildings, about 52 percent is occupied by court operations.

Based on its county survey, the task force's preliminary estimates of annual support and lease costs for court facilities are $119 million. This amount would be partially offset by the county share for facility operations and maintenance costs established through a negotiated MOE agreement (currently estimated at $80 million to 90 million annually). Beyond this, the task force has identified future capital funding needs in the multibillion dollar range over the next 20 years. While we recognize that a future need exists, we are concerned about task force expectations regarding the state's ability and willingness to address that future need. We also are concerned about the feasibility and desirability of some of the elements in the task force's transition plan. Below we identify these concerns and suggest alternative approaches.

Court Facilities Need to Be Included in the State's Capital Outlay Planning Process. The task force report does not lay out how court facility priorities would be considered in the context of other state capital outlay priorities. However, the report appears to assume that the state would develop a separate system for evaluating and funding court facility needs. To the extent the state assumes responsibility for court facilities, we recommend that any process developed by the Judicial Council for funding court capital outlay be conducted within the context of the process set forth in Chapter 606, Statutes of 1999 (AB 1473, Hertzberg). This legislation emphasizes the Legislature's intent that the state establish and annually update a five-year plan for identifying and establishing priorities for all state infrastructure needs.

The incorporation of court facilities into the statewide capital outlay planning process means that court facility needs will be reviewed as part of a statewide review process and in conjunction with statewide capital outlay needs. It does not imply a commitment to or guarantee for any particular level of funding for court facilities. As part of this process, the Judicial Council would be required to submit a five-year plan for court facility needs to the administration and Legislature like any other state agency.

Facility Transfer Process Needs to Be Streamlined. As indicated earlier, the task force estimates there are 440 trial court facility buildings. Requiring the state to negotiate the transfer of each building presents a difficult administrative task that could drag on for years. Nor does it offer any motivation or incentives to counties to move to a quick resolution. We recommend that any legislation relating to the assumption of state responsibility identify a specific date or time frame for facility transfer to avoid continuing problems of deferred maintenance.

Because of the diversity which exists among facilities, we recommend that the state be authorized to negotiate with counties on the terms of transfer for mixed-use and historical buildings. In the case of mixed-use buildings, we suggest that those facilities where the majority of space is occupied by the court be transferred to the state, but that the state be authorized to negotiate with counties on the continued provision of space to other county occupants. The state also should be allowed to require long-term leases from counties in mixed-use buildings so as to avoid having to seek tenants for that space in the future.

As regards historical buildings, we recommend a process that would respect their significance to the community but not exempt them from statewide policies on court facilities. Specifically, the state should negotiate with counties to allow them to have access to or retain the ability to use historical facilities for specified purposes.

Facility Code Compliance Issues Need Attention. The task force survey of court facilities identified and catalogued a wide range of compliance problems associated with the American with Disabilities Act, seismic safety, and other fire and life safety code issues. Some of these problems relate to retroactive code requirements which include changes required to address urgent and immediate problems with existing facilities' condition. In general, counties should be responsible for those retroactive code changes that went into effect when a facility was under county ownership. The state, however, would be responsible for any nonretroactive code compliance requirements, that is, changes required for any future facility designs or modifications. These future compliance requirements would need to be addressed as part of the state's capital outlay planning process.

Need to Recognize Some Counties' Efforts to Maintain Facilities and Make Them Code Compliant. The task force report recommended that counties provide an MOE facility contribution to the state, based on a five-year average of maintenance and operations costs. The task force, however, recommended elimination of a county's responsibility for deferred maintenance. This would have the effect of rewarding those counties that have neglected their facilities while penalizing counties that chose to maintain their facilities. In addition, the task force did not directly address the issue of responsibility for code compliance but merely recommended that the state have the option of deciding whether or not to accept facilities "deemed unsuitable for court use." If the state deemed a facility unsuitable, presumably the county would continue to operate the facility but would have no responsibility or incentive for improving it.

Because of these problems, we recommend that any legislation dealing with state responsibility for facilities require that these costs be included in each county's respective MOE contribution to the state. Counties that have maintained and improved their facilities would have a lower MOE, all other things being equal, than counties that have chosen to defer their maintenance. To the extent a county has not renovated its facilities for code compliance because of demonstrated fiscal constraints, the Legislature may wish to consider the feasibility of "forgiving" some or all of that cost through a buyout of the county's MOE. This approach would be similar to that provided for in current law regarding MOE agreements for court operations in small counties.

Count Court Facility Funding as Fiscal Relief in the Context of the State-County Fiscal Relationship. The task force report does not address the fact that the transfer of court facilities from counties to the state will provide significant fiscal relief to counties through a reduced responsibility for maintenance and expansions. Accordingly, we further recommend that any legislation specify that the state's contribution toward existing and future capital outlay needs, less the county share identified in the MOE agreement, be considered fiscal relief in the context of the state-county fiscal relationship.

Trial courts collect a number of fees that were not specifically designated for either the courts or the counties by the Trial Court Funding Act of 1997. It is necessary to obtain more detailed information on how these fees should be divided. Accordingly, we recommend that the Legislature request the Bureau of State Audits to perform an audit to determine the total amount of revenues generated by these fees, which entities—the courts or counties—are receiving the revenues, and how that revenue is currently being used.

Background. Chapter 850 and other recent trial court funding legislation changed the amounts and distribution of court-related fees. This legislation also transferred a variety of court-related fees collected by trial courts and local governments to the state's trust fund as an important part of the state's new financing mechanism for trial courts.

About 50 fees collected by the trial courts, however, were not designated for either the state or local governments. Some of the "undesignated" court fees include fees for postponement, change of venue, filing for Writ of Execution, and the civil assessment fee. The amount of each fee varies from $1 to as much as $1,000.

Working Group Failed to Reach a Conclusion. An informal 12-member working group, composed of court executives and county administrators, made an effort to determine how much revenue these undesignated fees generate and whether the state or counties should receive the funds.

The group identified and catalogued, by statute, all court-related fees not addressed in Chapter 850 and placed them in one of four categories. Three of the categories include fees in which the disposition (to either the state or counties) is clearly identified in statute. The fourth category consists of fees where the use or disposition is not specified. About 47 percent of the fees not addressed by Chapter 850 fall into this category.

The working group dissolved without concluding how to distribute the fee revenues in the fourth category. The Judicial Council has continued to meet with county representatives in an attempt to reach an agreement on the distribution of the fees, but a lack of information has prevented the resolution of this issue. Currently, we have revenue estimates for only one fee and no information about how that revenue is used.

Initial Estimates Suggest Significant Revenues. Currently, no detail is available on where all the fees are being deposited, the total amount of fee revenue, and how it is used. The Administrative Office of the Courts (AOC) collected information from the courts on one undesignated fee, the civil assessment, which is believed to generate the largest amount of revenue. Courts impose this fee for late payment of court ordered fines. In 2000, reported revenue for this fee amounted to $36.4 million through the third quarter of the year with 37 counties reporting. This is an unverified estimate, but probably represents the minimum amount of revenue from civil assessments. The AOC estimates the total for the year for this one fee at approximately $49 million.

In most cases, counties retain the majority of the civil assessment revenue. Some courts and counties have agreed to share this revenue or use the funds for court facilities. Less than five courts retain all the revenue.

Need for Clarification of Designated Agency. Fees whose designation are specified in statute clearly present no problem in determining who should receive those revenues. It also is easy to resolve questions regarding designation of fees which are clearly tied to a specific function, such as photocopying court records, though it may be desirable to amend existing law to make that designation official. The problem lies with those fees for which designation to the court or counties is not readily apparent because statute is silent, and there is no clear connection between the fee and a particular function.

This situation needs clarification for two reasons. First, it is important to treat revenues uniformly throughout the state and guarantee that the courts and the counties receive an appropriate share. Second, the Legislature needs to be able to estimate the level of revenue available from civil assessments and other fees as it considers the issue of who should be responsible for court facilities and reviews the increasing costs of trial court operations, both discussed in this section.

Analyst's Recommendation. Because the revenue generated by undesignated court fees is significant, it is important for the Legislature to identify a method for determining the distribution of these fee revenues among counties and the courts. Therefore, we recommend that the Legislature request the Bureau of State Audits to perform an audit to determine the total amount of revenues generated by these undesignated fees, which entity—the courts or counties—currently receive these revenues, and how these revenues are being used.

We recommend that the Judicial Council develop and submit a proposal to the Legislature, prior to budget hearings, for funding the costs of negotiated salary increases for trial court staff and court security personnel.

Background. Salaries for trial court employees are determined at the local level, largely as a result of negotiations between court representatives and labor organizations. Because the state has assumed financial responsibility for trial courts, the funds it provides to courts are used to support these negotiated salary increases (NSIs). The time delays that often exist between when NSIs are negotiated and when they become effective means their full fiscal impact may not be realized for several years.

The state has funded trial court NSIs negotiated in previous years and the current year through budget appropriations or deficiency requests. The current-year's budget act included a one-time provision to adjust the trial court budget by the amount of the average state employee salary and benefit increase and directed the Judicial Council to provide a permanent funding policy to the Governor and Legislature by December 31, 2000. At the time this analysis was prepared, the Judicial Council and the administration had not decided on a permanent policy for funding NSIs. Furthermore, the Governor's budget does not contain funds for trial courts to use for NSIs, now estimated at $38 million.

Implications of Not Providing Full Funding. Trial courts are obligated to pay for NSIs whether they have received funds to do so or not. To the extent the state budget fails to appropriate funds for NSIs, trial courts will have to redirect other resources to pay for these unfunded costs.

This may not be a problem for some courts that can generate savings from reduced workload or more efficient operations. We are concerned, however, about the extent to which some courts may choose to redirect resources that the state provides to them for specific programs and services. For example, the Governor's budget provides tens of millions of dollars for new programs related to court security, family and children, and infrastructure improvement needs. If the trial courts do not receive funds for NSIs, it is likely they will redirect funds provided for these other new programs to cover the costs of their NSIs. To the extent that NSIs are not funded in the budget, the Legislature has no guarantee that funds it approves for other specific trial court activities ultimately will be used by individual court systems for those purposes.

The NSI Funding Policy Needed. To ensure fiscal accountability, the state needs to develop a realistic method for budgeting funds for the trial court NSIs. Such a mechanism should recognize that the courts are obligated to fully pay for their salary commitments. The mechanism should also give courts incentives to negotiate salary agreements that are cost-effective from the state's perspective, given that the state is now responsible for funding NSIs.

There are two alternatives the Legislature may wish to consider in budgeting funds for court NSIs. The Judicial Council indicates that budgeting funds at a level similar to that negotiated for state employees would provide an amount sufficient to cover the budget-year costs of the NSIs. Thus, the Legislature annually could set aside the same amounts for trial court NSIs as it does for state employees in budget bill Item 9800, for distribution by the Department of Finance. This alternative, however, may have the effect of giving courts an incentive to bring negotiated increases up to the amounts negotiated for state employees.

A second alternative is for the Legislature to annually appropriate a lump sum "NSI reserve" in the Trial Court Funding budget and adopt budget bill language to specify the following: (1) funds are to be distributed only after NSIs are finalized and (2) any amounts not specifically needed for NSIs would revert to the General Fund.

In either case, the Legislature should encourage the trial courts and the Judicial Council to time their negotiations so that NSIs can appropriately be funded through the state budget process to allow maximum opportunity for legislative review and ensure that courts ultimately spend their funds in the manner intended.

Analyst's Recommendation. If funds are not provided for NSI costs, trial courts likely will redirect resources away from other budgeted activities to pay for court employee salary increases. The Legislature, therefore, needs to consider a permanent approach to budgeting funds for trial court NSIs. For this reason, we recommend that the Judicial Council develop and submit a proposal to the Legislature, prior to budget hearings, for funding NSIs on a permanent basis.

The budget requests $35.8 million to fund the increased costs of court operations. In order to develop a strategy for dealing with these escalating costs, we recommend the Legislature adopt supplemental report language directing the Judicial Council to report on the following: (1) ways to provide the courts with the authority and flexibility they need to purchase court services in a cost-effective manner, (2) an incentive plan for use by the Administrative Offices of the Court in the review of court budget proposals to encourage local courts to reduce costs and achieve efficiencies in their operations, (3) the feasibility of the Judicial Council and courts having a role in negotiating the cost of court services provided by counties but funded by the state, and (4) any statutory changes needed to implement its recommendations.

Background. As indicated earlier, Chapter 850 shifted primary fiscal responsibility for support of the trial courts from counties to the state. Chapter 850 also included provisions to: (1) permit counties to continue to provide services to each court at a rate that does not exceed the costs of providing similar services to county departments or special districts, (2) establish California Rules of Court, Rule 810, which defines court operations for the purpose of identifying state-funded costs, and (3) specify that the state is solely responsible for funding court operations as of July 1, 1997.

Courts Seek Funds for Increased Cost of County-Provided Services. In the budget year, courts are facing increased operating costs in three areas from county-provided services.

Budget Request. The budget proposes a total of $35.8 million for two local trial court funding requests. The first is $32.8 million for the increased costs of county-provided services. The second is $3 million for the costs to courts to provide functions previously provided by counties. We discuss these two proposals in the following pages.

The budget requests $32.8 million for the increased court costs of county-provided services. The two previous budgets provided a total of nearly $28 million for increases in existing and newly identified charges for county-provided services. These amounts represent increases in the cost of doing business at a "current services" level, rather than an expansion of existing programs and services. They also represent costs over which the courts have little to no control. In some cases the courts are prohibited from purchasing services from anyone other than the county. In other cases the county is the only entity available to provide these services. We discuss some of these budget increase proposals below.

Local Courts Seek Funds for In-House Administrative Operations. The budget also requests $3 million and 55 staff for court in-house administrative operations. The new positions are for accounting and budgeting, training programs, house counsel to advise courts, and mail and janitorial services. This funding also will be used to establish (1) accounting and fiscal services ($515,000), (2) janitorial and handy-person services ($114,000), (3) in-house counsel ($51,000), (4) mail and courier services ($57,000), (5) personnel services ($396,000), and (6) purchasing services ($101,000).

The need for additional state funding for court in-house administrative positions and services is a result of two factors. First, the courts are taking over work previously performed by the counties. Second, the courts require additional funds to handle workload the counties previously had deferred. Court dependence on counties to provide administrative services is decreasing for a variety of reasons. In many cases counties are unable to provide the services required and in some cases the county has chosen not to provide the services in the future.

Below, we discuss some approaches the Legislature may wish to consider in order to address the escalating costs of court operations and services.

Emerging Market for Providers of Court Operations and Services. Trial courts are experiencing a new environment in which many services once provided by the county must be purchased elsewhere, handled in-house, or provided by the AOC within the Judicial Council. As new markets develop from which courts may purchase court services, it will be necessary for the state to identify ways to increase the ability of and incentive for courts to purchase services in the most cost-effective way.

Reduce Barriers to Purchasing Cost-Effective Services. In some service areas, such as court security provided by the sheriff, existing state law restricts the court's ability to purchase services from other providers. In other cases, agreements made in the past between courts and counties require the courts to pay for services that may be more expensive than if purchased elsewhere. To the extent possible these kind of arrangements should be avoided in the future. It also may be appropriate for the state to identify a role for the Judicial Council and the courts in negotiation processes that determine state costs of county-provided services which the state is obligated to pay.

Reward Efficiencies Through Trial Court Funding Allocations. The Judicial Council is responsible for distributing funds appropriated for courts. In determining the amount of funds to be allocated to individual courts, the Judicial Council does not have a formal procedure for recognizing operational efficiencies or developing incentives for cost containment measures by courts. A number of cases exist in which trial courts have found ways to save funds, but they have had no incentive to report these savings to the AOC. By developing a funding allocation system which rewards courts for efficiency, courts are encouraged to look for and report savings.

The Judicial Council indicates that under the state's former block grant approach to trial court funding, encouraging efficiency through the allocation formula made sense. The council points out that currently trial courts submit their budget proposals to the AOC, which in turn compiles and submits them to the administration and Legislature. Currently individual trial court allocations are based upon approved requests rather than a formula. The Judicial Council seems to believe this new process precludes the AOC from rewarding efficiency.

We disagree and instead argue that the AOC could incorporate incentives for efficiency early in its review of court requests. Each individual court request that comes to the AOC must have adequate justification in order for the AOC to approve and forward that request. At this stage, the AOC could take into account ways in which individual courts have reduced costs and/or used more efficient procedures.

Analyst's Recommendation. We recommend the Legislature direct the Judicial Council to examine ways to control the escalating costs of state-funded trial court services. To achieve this, we recommend the Legislature adopt the following supplemental report language:

The Judicial Council shall report to the Joint Legislative Budget Committee and the chairs of the Legislature's fiscal committees by December 1, 2001 on the following: (1) ways to provide the courts with the authority and flexibility they need to purchase court services in a cost-effective manner, (2) an incentive plan for use by the Administrative Offices of the Court in the review of court budget proposals to encourage local courts to reduce costs and achieve efficiencies in their operations, (3) the feasibility of the Judicial Council and courts having a role in negotiating the cost of court services provided by counties but funded by the state, and (4) any statutory changes needed to implement its recommendations.

We withhold recommendation on the proposal for $3.5 million for the trial courts to implement the new trial court personnel system in accordance with the Trial Court Employment Protection and Governance Act because the request is premature. The Judicial Council anticipates that a consultant report, due May 2001, will provide detailed information about actual trial court needs. We recommend the Judicial Council present the consultant report and detailed justification for its proposal prior to budget hearings.

Background. The Trial Court Employment Protection and Governance Act of 2000, (Chapter 1010, Statutes of 2000 [SB 2140, Burton]) established a new trial court personnel system. This statute redesignated county employees in the trial courts as "court employees." The courts are required to develop new personnel procedures for these court employees including a uniform classification system, an employment protection system, personnel rules, and eligibility for defined-benefit retirement systems. As the employer, the trial courts will assume responsibility from the county for nearly all aspects of trial court employment.

Budget Request. The budget proposes (1) $2 million and 18.5 positions for the AOC in Item 0250 (Judicial) and (2) $3.5 million and an undetermined number of trial court positions in Item 0450 (Trial Court) to implement the Trial Court Employment Protection and Governance Act.

Funding for Trial Courts Premature. The Judicial Council indicates that some courts have already transitioned from their county's administrative and human resources services to their own. Those courts, however, that have not made this transition were required to assume fiscal and administrative responsibility for ensuring the provision of human resources in January 2001 regardless of which entity actually provides them. To facilitate the immediate transition of these services, the budget proposes $3.5 million to the trial courts for this purpose. At the time this analysis was prepared, the AOC indicated it was unable to provide specific justification for the additional staff related to trial court funding activities. The AOC indicates, however, that it should be able to provide this information in the coming months, once it receives a report from a consultant. The report is expected in April or May of 2001.

Analyst's Recommendation. Receipt of this report will assist the AOC in determining its specific need for funds and staff for trial courts as related to Chapter 1010. We, therefore, withhold recommendation on the $3.5 million request pending receipt of a more detailed proposal from the Judicial Council.