In this section, we provide technical detail on the Proposition 98 budget. Specifically, we discuss estimates for the Proposition 98 minimum guarantee under both the Governor's and LAO's forecasts. We also provide information on suspending Proposition 98, forecasts of local property tax revenues, and an update on various other Proposition 98 funding issues (including “settle–up” obligations, unfunded mandate claims, and maintenance factor).

Administration Estimates State Owes $37 Million in Settle–Up for 2006–07. Due to changes to revenue estimates, the administration estimates the Proposition 98 minimum guarantee requirement for 2006–07 has increased slightly—by $68 million—from the $55 billion assumed when the 2007–08 budget was enacted. About one–half of this increased spending requirement has already been met through higher–than–expected revenue limit payments for 2006–07. Therefore, the administration estimates the state still owes $37 million to meet the minimum guarantee for the prior year. (The budget proposal does not include these funds, meaning the state would have to settle up with a one–time payment of $37 million to schools at some point in the future.) While the total Proposition 98 funding level has changed only slightly for 2006–07, the General Fund share has increased significantly—by over $600 million—due to a decline in local property tax revenue. Later in this section, we discuss the effect of changes in property taxes on Proposition 98.

Settle–Up Obligation Now Estimated to Be About $160 Million. Based on updated 2006–07 data that became available after the Governor's budget was put together, the minimum guarantee is about $190 million higher than assumed in the 2007–08 Budget Act. As a result, the future settle–up obligation for 2006–07 is now estimated at about $160 million (or roughly $125 million higher than the administration’s estimate).

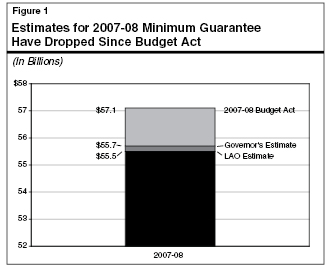

Estimates for state tax revenues in the current year have declined significantly from when the 2007–08 budget was enacted. Correspondingly, the estimate of the Proposition 98 minimum guarantee has also dropped. Figure 1 compares the Governor's and our estimates for the revised 2007–08 Proposition 98 requirement, based on our different forecasts of General Fund revenues.

Governor Estimates Minimum Guarantee Has Dropped by $1.5 Billion. The Governor estimates General Fund revenues have declined by around $4 billion compared to what was assumed when the 2007–08 budget was enacted. As a result, the administration’s estimate of the minimum guarantee is about $55.7 billion. This is almost $1.5 billion lower than the Proposition 98 budget act funding level.

LAO Estimates Minimum Guarantee Has Dropped an Additional $125 Million. As discussed in our companion publication, The 2008‑09 Budget: Perspectives and Issues (P&I), our estimate of 2007–08 General Fund tax revenues is roughly $300 million lower than the Governor's forecast. Consequently, our estimate for the minimum guarantee is also slightly lower. As shown in the figure, the minimum guarantee is now estimated to be $55.5 billion, or roughly $1.6 billion below the budget act spending level.

Action Needed to Reduce Spending to Minimum Guarantee. Estimates for the minimum guarantee will continue to fluctuate until General Fund revenues are finalized in the fall of 2008. While the K–14 funding requirement may drop in response to decline in General Fund revenues, Proposition 98 spending does not adjust on the natural. The Legislature would need to take action in the current year to reduce Proposition 98 spending to the minimum guarantee.

Minimum Guarantee for 2007–08 Now Based on “Test 3.” Under both the Governor's and our forecasts, the decline in revenue estimates has shifted the calculation used to determine the 2007–08 minimum guarantee from “Test 2”—which was assumed when the budget was enacted—to Test 3. In a Test 2 year, the minimum guarantee is based on growth in per capita personal income. When year–to–year growth in General Fund revenues is relatively sluggish, the state is allowed to provide less than would be required under Test 2. In such years, the minimum guarantee is based on growth in per capita General Fund revenue (Test 3).

In most years, the Proposition 98 minimum guarantee is based on the amount provided in the previous year. Thus, without knowing what the Legislature will ultimately decide to spend on Proposition 98 in 2007–08, it is difficult to predict the funding requirement for 2008‑09. Nonetheless, this section describes the Governor's 2008‑09 Proposition 98 proposal and explains how it would change under the updated LAO revenue forecast.

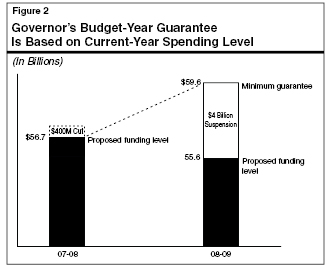

The Governor Proposes to Provide $55.6 Billion for K–14 Education in 2008‑09.

In response to a decline in the 2007–08 minimum guarantee, the Governor

proposes to reduce current–year spending by $400 million. Figure 2 shows how the Governor's proposed funding level of $56.7 billion in 2007–08 results in a minimum guarantee of slightly more than $59.6 billion in 2008‑09. The figure also shows that the Governor's proposed funding level for 2008‑09—$55.6 billion—is around $4 billion less than his calculation of the guarantee. Funding at this lower level would require the Legislature to suspend the Proposition 98 requirement. Please see the

nearby text box for more detail on how a Proposition 98 suspension works.

Although the State Constitution establishes a guaranteed level of funding for K–14 education each year, it also permits the Legislature to waive that requirement for a single year at a time. By a two–thirds vote in legislation separate from the budget bill, the Legislature can “suspend” the Proposition 98 minimum guarantee and provide less education funding than would otherwise be required by the constitutional formulas. Suspension is a tool that allows the Legislature to balance K–14 priorities with its other General Fund priorities without being constrained by formula–driven requirements.

Suspension has taken place only once since Proposition 98 was enacted—in 2004–05. Chapter 213, Statutes of 2004 (SB 1101, Senate Budget and Fiscal Review), authorized the suspension. Certain language in Chapter 213 led to a disagreement over the size of the suspension. The disagreement ultimately led to a statutory commitment to provide additional funding to K–14 education. Specifically, a dispute arose over whether Chapter 213 intended to lock in place the amount of the suspension or a specific spending level.

To avoid future disagreement, the Legislature could vote to suspend the minimum guarantee without regard to the dollar amount of the suspension, spending at whatever level it deems appropriate. Suspending Proposition 98 gives the Legislature full discretion over what the K–14 funding level will be for that year.

While suspending the minimum guarantee allows the Legislature to fund K–14 education at whatever level it chooses, in subsequent years the state is required to accelerate growth in Proposition 98 funding. When General Fund revenues strengthen, the Constitution requires a relatively large share of new funding to go to Proposition 98—until overall K–14 funding is back to where it otherwise would have been absent the suspension. In this way, a Proposition 98 suspension can provide several years of savings for the state, but it only represents a limited–term funding reduction for schools and community colleges. The mechanism for accelerating growth in the K–14 funding base is known as maintenance factor and is described in more detail later in this section.

Governor's Accrual Proposal Helps Trigger Test 2 Year. As part of his budget package, the Governor proposes to attribute $2 billion in tax revenue that would be collected in 2009–10 back to 2008‑09. (The details of this proposal and our concerns with this approach are discussed in our

P&I [Part V].) Accruing these dollars back to 2008‑09 significantly increases the year–to–year General Fund per capita growth rate compared to what it otherwise would be—5.9 percent compared 3.8 percent. This one–time boost in General Fund revenues means the Proposition 98 minimum guarantee is calculated based on Test 2.

LAO Revenue Forecast Would Lower Amount of Governor's Suspension by $400 Million. Notwithstanding the issue of the accrual proposal, our forecast of underlying 2008‑09 General Fund tax revenues is almost $1.2 billion lower than that of the administration. However, we have a slightly higher estimate of per capita personal income, the Test 2 growth factor (4.4 percent instead of 4.2 percent). The net result of these two differences is a somewhat lower estimate for the 2008‑09 minimum guarantee. Specifically, we estimate a minimum guarantee of $59.3 billion in 2008‑09 under the Governor's plan—around $400 million less than the Governor's estimate. Under his plan, a $400 million drop in the minimum guarantee would simply reduce the gap between the minimum guarantee and his proposed spending level. That is, the amount of the suspension would be reduced to $3.6 billion. The amount of funding going to schools in 2008‑09, however, would remain unchanged.

Revenue–Related Actions Will Affect Proposition 98 Requirements. If the Legislature chooses to make changes to the revenue–related policies included in the Governor's proposal, it will have an effect on the Proposition 98 minimum guarantee. In general, for each dollar of tax revenue the

state raises, the minimum guarantee will increase by about 50 cents—until it reaches $59.7 billion (the “long–term Test 2 level”). Conversely, if the Legislature rejects the Governor's accrual proposal (or if General Fund tax revenues decline), the minimum guarantee would drop by about one–half of each dollar lost.

Lower Estimates of Local Property Tax Revenue Increase General Fund Obligation by Almost $1.4 Billion. Proposition 98 funding for school districts and community colleges is composed of both General Fund and local property tax revenue. In general, property tax revenue offsets the General Fund obligation for Proposition 98, so decreases in local revenue support result in a dollar–for–dollar increase in General Fund support. As shown in Figure 3, the amount of local property tax revenue available to support Proposition 98 has declined dramatically from what was assumed when the 2007–08 budget was enacted—by a cumulative total of almost $1.4 billion across 2005–06, 2006–07, and 2007–08. This downward adjustment results in an automatic increase in General Fund spending by a like amount.

|

|

|

Figure 3

Local Property Tax Revenue Going to Schools

Lower Than Expected |

|

(In Millions) |

|

|

2005‑06 |

2006‑07 |

2007‑08 |

|

2007‑08 Budget Act |

$13,608 |

$14,203 |

15,646 |

|

Governor’s budget |

13,478 |

13,604 |

15,001 |

|

Differencesa |

-$130 |

-$599 |

-$645 |

|

Three-Year Total |

|

|

-$1,374 |

|

|

|

a As a result of

these reductions, the General Fund share of Proposition 98

spending increases

automatically by a like amount. |

|

|

Shortfall Largely Due to Overestimates. Of the $1.4 billion decline in local property tax revenues, $130 million is related to 2005–06. The administration states this decrease is due to a technical error that occurred when the 2007–08 Budget Act was put together. The remainder of the shortfall results from an overestimate of K–14 property taxes for the prior and current years. In 2005–06, initial property tax receipts reported by school districts came in several hundred million dollars lower than the administration had originally projected. Believing mistakes might be occurring in county allocations or school district reporting, the state built the 2006–07 and 2007–08 budgets assuming the discrepancy was a one–time glitch and the “missing” property tax revenue from 2005–06 would be restored to base levels in subsequent years. A subsequent audit by the State Controller’s Office found no major errors in county allocation of property taxes or K–14 revenue reporting. Thus, the administration had to revise its estimates for the prior and current years, leading to a downward adjustment of around $600 million in each year.

Updated Data Suggest Slightly Higher Property Taxes for 2006–07 and 2007–08. Based on updated 2006–07 property tax data obtained by the LAO after the Governor's budget was prepared, it appears school property tax revenues might be higher in both the prior and current years. As shown in Figure 4, property tax revenues for 2006–07 are $185 million higher than estimated in the Governor's budget. We assume this 2006–07 base will carry forward, and thus have a higher estimate for the current year (up $119 million). These additional revenues result in a like amount of General Fund savings. They also partly offset the large shortfall described above.

|

|

|

Figure 4

Property Tax Revenues Likely Higher

Than Forecasted for Prior and Current Year |

|

(In Millions) |

|

|

2006‑07 |

2007‑08 |

2008‑09 |

|

Governor’s budget |

$13,604 |

$15,001 |

$16,046 |

|

LAO forecast |

13,789 |

15,120 |

16,047 |

|

Differences |

$185 |

$119 |

$1 |

|

|

School Property Tax Forecast Same for 2008‑09. Compared to the administration, we forecast slower growth in local property tax revenue going to schools (6.1 percent compared to 7 percent). Although we anticipate a higher property tax revenue base in 2007–08, as a result of the interaction of these two factors (base and growth rate), our estimate for the amount of revenue schools will receive in 2008‑09 is almost exactly the same as that of the administration ($16 billion).

In addition to the annual minimum guarantee, the state faces a number of other Proposition 98–related funding issues. Many of these are obligations left over from the state’s last budget downturn in the early part of the decade. In some cases, addressing these commitments will require additional General Fund resources, whereas some can be funded from within the annual Proposition 98 appropriation. Figure 5 provides a brief summary of these funding issues under the Governor's budget proposal. Below, we discuss them in greater detail.

A settle–up obligation is generated when K–12 attendance or General Fund revenues increase after the budget is enacted—resulting in a Proposition 98 minimum guarantee that is higher than the funding level included in the budget act. In 2006, the California Department of Education and the Director of Finance determined the state owed schools roughly $1.4 billion to meet the minimum guarantee for four prior years—1995–96, 1996–97, 2002–03, and 2003–04.

In 2006–07, the state paid $300 million towards this obligation, leaving the amount owed at $1.1 billion. Chapter 216, Statutes of 2004 (SB 1108, Committee on Budget and Fiscal Review) calls for annual payments of $150 million beginning in 2008‑09 for the purposes of repaying these settle–up obligations. As Figure 5 displays, the proposed budget includes the budget–year payment. As directed by Chapter 216, first call on these funds is to pay schools and community colleges for the costs of prior–year mandates.

As discussed earlier in this section, recently updated 2006–07 data suggest the minimum guarantee calculation is higher than the amount of funding provided in that year, meaning the state currently owes an estimated $160 million in settle–up payments for 2006–07.

In addition to settle–up, the state made a statutory commitment relating to the Proposition 98 suspension in 2004–05. Chapter 751, Statutes of 2006 (SB 1133, Torlakson), appropriates $2.8 billion for K–14 education to be paid out over a seven–year period. This funding comes from the General Fund and is in addition to ongoing Proposition 98 funding provided each year. The state provided an initial payment of $300 million in 2007–08.

|

|

|

Figure 5

Proposition 98

Funding Issues |

|

(In Millions) |

|

|

|

Governor’s 2008‑09

Proposal |

|

|

Description |

Amount Added (+)

Or Paid (-) |

Total

Left |

|

Settle-Up |

Constitutional

Obligation. Results when Proposition 98 minimum

guarantee increases after budget has been enacted. State

still owes $1.1 billion for 2002‑03 and 2003‑04. Under

current law, scheduled to be paid in $150 million

installments from the state General Fund over next eight

years (to be used first for mandate reimbursements). |

-$150 |

$951 |

|

Chapter 751 |

Statutory Commitment.

Relates to disagreement over Proposition 98 suspension in

2004‑05. Under current law, $2.5 billion scheduled to be

paid in $450 million installments from the state General

Fund over next six years. Funds are on top of ongoing

Proposition 98 funding. |

-450 |

2,097 |

|

Mandates |

Constitutional Obligation.

Reimburses K-14 education for mandated activities. Payments

have been delayed for several years. Prior-year claims can

be paid with one-time Proposition 98 funds (such as

settle-up funds). Annual ongoing costs for already approved

mandates can be funded with ongoing Proposition 98 monies. |

55a |

567 |

|

Deferrals |

Current Practice.

Pays schools and colleges in July for activities they

undertake in June of previous fiscal year. Funding shift

helped state get one-time savings. Shifting payments back to

June can be accomplished with one-time Proposition 98 funds. |

— |

1,303 |

|

Revenue Limit Deficit

Factor |

Proposed Statutory

Commitment. Governor proposes to reduce revenue limits

and create new statutory deficit factor. Would require

specific percentage growth to be added to revenue limit

funding base in the future. Would be funded with ongoing

Proposition 98 monies. |

2,146b |

2,146b |

|

Maintenance Factor |

Constitutional

Obligation. When Proposition 98 funding is less than the

“long-term Test 2” level, a maintenance factor is generated.

In subsequent years, formula accelerates growth in

Proposition 98 funding until the long-term Test 2 level is

reached. |

4,053 |

4,077 |

|

|

|

a Governor’s

proposal would pay $154 million towards mandate claims

($150 million in settle-up and $4 million ongoing). However,

annual costs of mandates are estimated to be $209 million,

so proposal increases unpaid obligations by $55 million. |

|

b Reflects

Governor’s proposal to change the factor used to calculate

K-12 cost-of-living adjustments (COLAS). The Governor’s

calculation of the deficit factor under the existing

statutory COLA rate is $2.6 billion. |

|

|

For 2008‑09, the Governor's budget includes $450 million from the General Fund to meet the terms of Chapter 751. Of this amount, $402 million would support the “Quality Education Investment Act,” which pays for reduced class sizes and other instructional improvements in low–performing schools across the state. The other $48 million would go to the community college system for a career technical education improvement program ($38 million) and a block grant for equipment and supplies ($10 million).

Since 2001–02, the state has delayed reimbursing schools and community colleges for mandate claims. In essence, the state has required that schools undertake certain activities but has not paid them for the costs they have incurred. We estimate the annual costs of funding existing mandated activities would be around $209 million ($180 million for K–12 education and $29 million for community colleges). While the state made a large payment for outstanding mandate claims in 2006–07—eliminating debts from several prior years—in recent years it has provided virtually no funding for ongoing mandate costs. As a result, the balance of outstanding mandate claims continues to grow, as shown in Figure 6.

|

|

|

Figure 6

K-14 Unfunded Mandate Claim Balance Grows |

|

Governor’s Budget

(In Millions) |

|

|

2006‑07 |

2007‑08 |

2008‑09 |

|

K-12 Education |

|

|

|

|

Outstanding from prior years |

$1,018 |

$226 |

$398 |

|

Ongoing cost |

165 |

172 |

180 |

|

Payment |

-957 |

— |

-125 |

|

Subtotals, K-12 outstanding claims |

($226) |

($398) |

($453) |

|

California

Community Colleges (CCC) |

|

|

|

|

Outstanding from prior years |

100 |

89 |

114 |

|

Ongoing cost |

29 |

29 |

29 |

|

Payment |

-40 |

-4 |

-29 |

|

Subtotals, CCC outstanding claims |

($89) |

($114) |

($114) |

|

Totals, Outstanding Claims |

$315 |

$512 |

$567 |

|

Totals, Mandate Claim Payments |

$997 |

$4 |

$154 |

|

|

In accordance with Chapter 216, the Governor's budget includes $150 million in one–time funds to reimburse districts for prior–year mandate costs ($125 million for K–12 and $25 million for community colleges). (As described earlier, these one–time General Fund payments are scored as meeting Proposition 98 settle–up obligations.) However, the budget proposal contains only $4 million in ongoing funding for community college mandates and virtually none for K–12 schools. As a result, we estimate that under the Governor's proposal the total outstanding mandate obligation will grow to $567 million at the end of 2008‑09.

In 2001–02, when the Proposition 98 minimum guarantee dropped in the middle of the year, the Legislature needed to find a way to reduce spending without causing great disruption to schools. In response, it deferred significant education costs to the subsequent fiscal year. Rather than schools taking an actual midyear cut, these deferrals resulted in school districts and community colleges receiving some state funds a few weeks later than normal. Because payments were made in July instead of June, the state was able to score the expenditures in 2002–03 instead of 2001–02. To achieve further budget savings in 2002–03, the state deferred additional payments to 2003–04. In subsequent years the Legislature has opted to continue the majority of these deferrals ($1.3 billion in total—$1.1 billion for K–12 education and $200 million for community colleges). Retiring the deferrals—that is, shifting the payments back a month so schools receive the funds in the same fiscal year they incur the related costs—would require a one–time Proposition 98 payment. The Governor's budget proposes to not only continue these deferrals, but to shift the payments from July to September in order to help the state’s cash flow.

To achieve budget solution in 2003–04, the state made reductions to K–12 revenue limits. Rather than making these reductions permanent, the Legislature opted to create an obligation to add the foregone amount—referred to as the “deficit factor”—to the revenue limit base in future years. (This was accomplished in 2005–06.) As part of his budget balancing reductions, the Governor proposes to create a new revenue limit deficit factor in 2008‑09 totaling $2.1 billion. (The Governor is also proposing to change the factor used to calculate K–12 cost–of–living adjustments [COLAs]. Using the Governor's estimate for the existing statutory COLA rate, the deficit factor would be $2.6 billion.)

Alternatively, the Legislature could decide to accept some or all of this reduction but not establish a deficit factor. That is, it could lower base revenue limits without establishing a statutory commitment to restore the reduction in the future. This would give the Legislature the option of spending future Proposition 98 monies to enhance revenue limits or for other K–14 priorities. Under the Governor's proposal, the state would spend future Proposition 98 monies to build up the revenue limit funding base by this amount.

Over the long run, the Proposition 98 minimum guarantee is determined by the Test 2 factor—growth in K–12 attendance and growth in per capita personal income. As discussed earlier, the Constitution allows the Legislature to appropriate funding for K–14 education below this long–term Test 2 level under two circumstances:

- Suspension. The Legislature suspends the spending requirements of Proposition 98.

- Test 3. The Constitution automatically reduces the minimum guarantee when per capita General Fund revenues grow more slowly than per capita personal income.

The difference between the minimum guarantee in any particular year and the long–term Test 2 level of spending is known as maintenance factor. Whenever maintenance factor is created, the Constitution requires the state to provide accelerated growth in Proposition 98 funding in future years—until it has reached the long–term Test 2 level. The Constitution requires the state to provide maintenance factor funding only in Test 1 or Test 2 years, when General Fund revenues grow faster than personal income. These required augmentations often boost K–14 revenues substantially when the state is emerging from an economic slowdown.

Governor's Proposal Would Result in a Maintenance Factor of $4.1 Billion. As discussed earlier, the Governor proposes to suspend Proposition 98 in 2008‑09. The $4 billion gap between the Governor's minimum guarantee (roughly $59.6 billion) and his proposed spending level ($55.6 billion) creates a like amount of maintenance factor. Coupled with a small amount of existing maintenance factor, the Governor's proposal would leave K–14 spending about $4.1 billion below the long–term Test 2 level. Over the coming years, the constitutional formulas will accelerate growth in K–14 funding such that this amount is built into the Proposition 98 minimum guarantee until the long–term Test 2 level is reached.

Return to Education Table of Contents, 2008-09 Budget AnalysisReturn to Full Table of Contents, 2008-09 Budget Analysis