With approval of Proposition 37 at the 1984 general election, voters amended the State Constitution to authorize the creation of the California Lottery. Proposition 37 also established the California State Lottery Commission, which has broad powers to oversee the lottery’s operations and fund distributions. While lottery operations are subject to oversight hearings by policy committees, lottery funds are not appropriated in the annual budget act.

The law requires that at least 34 percent of all lottery revenues, unclaimed prizes, and interest be distributed as supplemental funding to public educational institutions. Approximately 50 percent of revenues is distributed as prizes, and no more than 16 percent of revenues goes toward operating expenses, including compensation of participating retailers. With revenues of $3.3 billion in 2006–07, the lottery distributed $1.2 billion to public schools, community colleges, and universities. Lottery funds total less than 2 percent of all K–12 revenues.

Sales declined 7.4 percent between 2005–06 and 2006–07. Lagging consumer interest in several games, including the multistate MEGA Millions game, SuperLOTTO Plus, and instant ticket games, were responsible for the decline. Such declines have occurred periodically during the lottery’s first two decades, including sharp drops during the late 1980s and early 1990s. Since 1997–98, however, lottery distributions to education have grown an average of 4.2 percent per year. At its June 2007 meeting, the Lottery Commission approved a 2007–08 budget that assumes lottery sales of $3.4 billion, an increase of about 1 percent over the prior year. The 2008–09 Governor’s Budget assumes that the Lottery meets this sales forecast in 2007–08, and, consistent with prior budgeting practices, assumes no growth in sales in 2008–09. Under the forecast, lottery distributions to education—$1.2 billion in 2006–07—would remain flat through 2008–09.

The Governor has proposed leasing the California Lottery to a private concessionaire to improve its sales and generate funds for public purposes. This would require major changes to statutory restrictions on the lottery and, likely, approval by voters. A lottery transaction would generate a large up–front payment for the state under the Governor’s proposal, as well as under other scenarios that do not involve leasing lottery management to private entities.

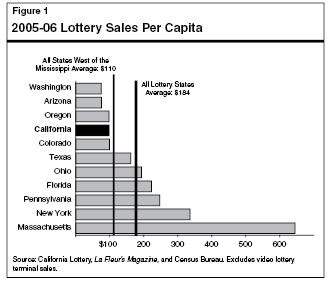

Lottery Sales Per Capita Are Low Compared to National Averages. The underlying issue framing recent policy discussions about the lottery has been its low sales per capita relative to other states. Figure 1 shows that in 2005–06, lottery sales per capita in California were about one–half of the national average. The administration seeks changes in lottery operations that it believes would lead to lottery sales increasing to a level closer to the national average. This would entail roughly a doubling of annual sales by the California Lottery and would increase per capita sales here far above the level currently reported for all states west of the Mississippi River. There is a long history of western states’ lotteries generating less money than lotteries in some eastern states.

Governor’s Proposals. In the 2007 May Revision, the Governor requested that the Legislature authorize the lease of operating rights for the lottery to a private concessionaire for a multidecade period—perhaps for 40 years. In October, the Governor proposed a lottery lease to instead help finance his health care proposal. The proposal is a general framework—similar to those proposed, but not yet adopted, in several other states—rather than a detailed implementation plan. Generally, the proposal assumes that the private sector would be more skilled than Lottery Commission staff in increasing visibility and sales for lottery games. In exchange for the lease to the private entity, the state would receive a one–time payment under the Governor’s plan and/or annual payments from the private entity. While the Governor subsequently withdrew the lottery from his health care proposal, administration officials have indicated their continuing interest in pursuing a lottery lease.

Freeing Up Restrictions on the Lottery Would Be Required. While not spelled out in detail in the Governor’s framework, it is generally acknowledged that the administration’s plan would require significant loosening of some statutory restrictions concerning lottery operations. For example, the percentage of lottery sales paid out in prizes would need to be loosened. Several other states with higher per capita sales pay out a higher percentage of lottery revenues in prizes, and some states that have experimented with increasing prize payout percentages have found that this increases overall lottery profits. (In fact, the California Lottery has used administrative savings to boost Scratcher game payouts, with some success in increasing sales.) Many other technical changes to statutes may also need to be considered to maximize the value to the state from a lottery lease. Because the Lottery Act was implemented as a voter initiative, substantial statutory changes such as these would likely require voter approval.

Issuing Lottery Revenue Bonds—With No Lottery Lease—Is Also An Option. While no other state has yet leased or sold its lottery to a private entity, Florida, Oregon, and West Virginia have issued state revenue bonds—often for capital projects, such as school and university buildings—backed by future lottery sales. In these states, the lottery remains under public ownership and management. Subject to the bonds being legally authorized, however, bond proceeds theoretically could be used for many other purposes, including financing health care or other policy initiatives, retiring state debt, decreasing unfunded retirement liabilities, cash flow relief, or budget relief.

The administration has estimated that a lottery transaction could generate up to $37 billion in up–front proceeds for the state. This estimate is unrealistic. The most such a transaction could generate would probably be one–half that amount or less. Such a transaction would mean that some or all lottery profits would no longer be allocated to educational institutions. The resulting decline in education funding could result in new budgetary pressures for the General Fund.

More Realistic Scenarios Envision a Much Smaller Up–Front Payment. The administration has suggested that leasing the lottery could generate up to $37 billion in upfront proceeds to the state. A lottery lease of the type proposed by the Governor would be unprecedented in the U.S. It is unknown what investors would pay for the right to operate a state lottery over 40 years. This amount could vary substantially depending on the “strings attached” to the deal by the Legislature and voters. Investors seeking to start a company to operate the California Lottery would need capital—as well as assurances that they could earn a positive return for their investment of the capital. Our research indicates that investors may finance a significant part of a required up–front payment to the state through issuing debt. Debt investors would require assurances that the company’s share of lottery profits would be more than sufficient to cover its debt service costs. In order for debt investors to provide a substantial share of a $37 billion or similar up–front payment, they would have to count on dramatic increases in California Lottery sales—essentially, a doubling of per capita sales to levels far above the western states’ average and levels near the national average. Given the recent tumult in the bond markets related to the subprime mortgage crisis—which has resulted in tightening of credit standards—this means that a $37 billion up–front payment is very unlikely to be available to the state, either through a lottery lease or a lottery revenue bond transaction. We believe that a more likely amount available in an up–front payment would be between $10 billion and $20 billion.

Holding Education Harmless Might Require Most or All of Up–Front Payment. Regardless of the up–front amount that could be raised from a lease of the Lottery, the Legislature would have to consider whether those proceeds would first be used to replace the loss of the annual stream of funding allocated to educational entities (currently about $1.2 billion). For example, some will argue that education should be held harmless relative to their current allocations. One way to accomplish this would be to use the up–front payment to establish a large endowment that would generate investment returns and distribute to educational institutions roughly what they would have received from the Lottery under current law for the duration of the lease. The problem is that establishing such an endowment would require using most or all of the up–front payment for this purpose, and this would leave little available for other state purposes—perhaps defeating the purpose of undertaking the transaction in the first place. If, however, the Legislature and voters pursue a large up–front payment from a Lottery transaction, but opt not to establish such an endowment (instead using the up–front proceeds for budget relief or some other purpose), then the Legislature would face the following difficult choices in the future: (1) identifying new revenues or cutting other General Fund expenditures in order to hold education harmless or (2) deciding not to hold education harmless and thereby reduce the funding that schools, community colleges, and public universities would have received under current law.

Leasing the Lottery Would Take Some Time. If the Legislature and voters chose to pursue the Governor’s proposal to lease the lottery, completing such a transaction could take several years. Voter approval may be required, and developing, refining, and finalizing requests for complicated proposals from the private sector could take months or years. Finally, legal challenges, such as from the state’s other gambling interests, to such a sale are possible. Accordingly, if the Legislature wishes to pursue a lottery transaction, it should adopt a realistic timetable for receipt of any up–front proceeds.

The administration appropriately has raised the issue of whether the California Lottery is an underperforming state asset. We recommend that the Legislature continue to explore methods to improve the performance of the Lottery.

Time to Reexamine How the Lottery Works. The basic structure of the California Lottery has been in place for over two decades. We agree with the administration that it is time to examine how this structure and the lottery’s overall sales performance could be improved. We doubt that per capita sales will increase to the national average in the foreseeable future, but there is evidence that California’s lottery may be underperforming relative to other states.

Legislature Should Continue to Examine Possible Changes. The Legislature should continue to explore possible methods to improve the performance of the Lottery. In committee hearings, regular updates from Lottery management on developments resulting from its recently updated business plan may be helpful. The Legislature also may wish to explore statutory changes—generally, changes to give Lottery management more flexibility to manage funds and increase prizes—that could increase the amount of funds generated by the Lottery for public purposes.

Return to General Government Table of Contents, 2008-09 Budget AnalysisReturn to Full Table of Contents, 2008-09 Budget Analysis