Compared to the current year, General Fund spending for health and social services programs is proposed to decrease by 0.9 percent to about $29.3 billion. Most of this net decrease is attributable to a variety of caseload increases which are more than offset by proposed budget–balancing reductions in Medi–Cal reimbursement rates, grants for children receiving California Work Opportunity and Responsibility to Kids, foster care and related payments, In–Home Supportive Services domestic service hours, and county administration of various programs.

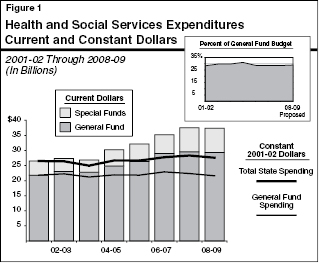

Budget Year. The budget proposes General Fund expenditures of $29.3 billion for health and social services programs in 2008–09, which is 29 percent of total proposed General Fund expenditures. Figure 1 shows health and social services spending from 2001–02 through 2008–09. The proposed General Fund budget for 2008–09 is $300 million (0.9 percent) below proposed spending for 2007–08. The overview reflects the Governor’s January 10 budget plan and does not reflect technical adjustments, provided at a later date, that we describe in our analysis of the Medi–Cal Program. The reduction reflects budget–balancing reductions (BBRs) proposed for these programs by the Governor. Special funds spending for health and social services is proposed to increase by about $170 million (2.1 percent) to about $8.1 billion. Most of this special funds growth is due to an increase in realignment payments to local government.

Historical Trends. Figure 1 shows that General Fund expenditures (current dollars) for health and social services programs are projected to increase by $7.5 billion (or 34 percent) from 2001–02 through 2008–09. This represents an average annual increase of 4.3 percent. Similarly, combined General Fund and special funds expenditures are projected to increase by about $10.9 billion (41 percent) from 2001–02 through 2008–09, an average annual growth rate of 5 percent.

Adjusting for Inflation. Figure 1 also displays the spending for these programs adjusted for inflation (constant dollars). On this basis, General Fund expenditures are estimated to decrease by 1 percent from 2001–02 through 2008–09. Compared to the current year, General Fund spending for 2008–09 is proposed to decline by 3.3 percent in constant dollars. Combined General Fund and special funds expenditures are estimated to increase by 4.2 percent during this same period, an average annual increase of less than 1 percent.

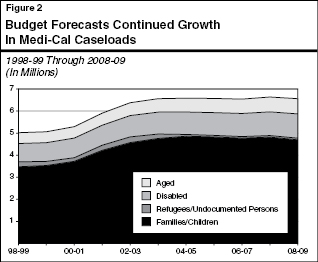

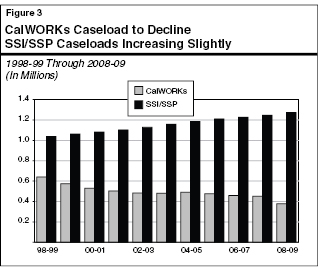

Caseload trends are one important factor influencing health and social services expenditures. Figures 2 and 3 illustrate the budget’s projected caseload trends for the largest health and social services programs. Figure 2 shows Medi–Cal caseload trends over the last decade, divided into four groups: (1) families and children, (2) refugees and undocumented persons, (3) disabled beneficiaries, and (4) aged persons (who are primarily recipients of Supplemental Security Income/State Supplementary Program [SSI/SSP]). Figure 3 shows the caseloads for California Work Opportunity and Responsibility to Kids (CalWORKs) and SSI/SSP.

Medi–Cal Caseload. The Governor’s budget plan assumes that the current–year caseload for Medi–Cal will increase by 51,600 individuals, or almost 2 percent, over the number assumed in the 2007–08 Budget Act. As

shown in Figure 2, the Governor’s budget plan assumes a modest decrease of 73,900 individuals, or a 1.1 percent reduction, in caseload for the budget year in the Medi–Cal Program. The caseload projections for 2008–09 take into account reductions of almost 172,000 individuals attributable to the Governor’s proposed reinstatement of quarterly reporting requirements for children and parents. The Medi–Cal budget proposal also reflects caseload growth in several eligibility categories for the aged and disabled.

Healthy Families Program (HFP) Caseload. The Governor’s budget plan assumes that the current–year enrollment for HFP will fall short by about 20,500 children compared to the number assumed in the 2007–08 Budget Act. However, the spending plan further assumes that the program caseload will increase by about 66,000 children, or about 7 percent, during the budget year. The budget proposal estimates that a total of about 954,000 children will be enrolled in HFP as of June 2009.

The CalWORKs and SSI/SSP Caseloads. Figure 3 shows the caseload trend for CalWORKs and SSI/SSP. The SSI/SSP cases are reported as individual persons, while CalWORKs cases are primarily families. For 2008–09, the budget assumes that CalWORKs will serve about 960,000 individuals.

As Figure 3 shows, the CalWORKs caseload declined steadily from 1998–99, essentially leveling out in 2003–04. This period of substantial CalWORKs caseload decline was due to various factors, including the improving economy, lower birth rates for young women, a decline in legal immigration to California, and, since 1999–00, the impact of CalWORKs program interventions (including additional employment services). In 2004–05 the caseload experienced its first year–over–year increase (about 2 percent) in almost a decade. After this one–time increase, the caseload resumed its decline, at just over 3 percent in 2005–06 and 2006–07. For 2007–08 the decline is forecasted to moderate to 1.8 percent. In 2008–09, the caseload is projected to drop by about 16 percent mostly due to policy proposals which (1) increase sanctions on families where the parents do not meet program participation requirements and (2) impose new time limits on children.

The SSI/SSP caseload can be divided into two major components—the aged and the disabled. The aged caseload generally increases in proportion to increases in the eligible population—age 65 or older (increasing at about 1.5 percent per year). This component accounts for about 30 percent of the total caseload. The larger component—the disabled caseload—typically increases by about 2.5 percent per year. Since 1998, the overall caseload has been growing moderately, between 2 percent and 2.5 percent each year. For 2007–08 and 2008–09, the budget forecasts caseload growth of 1.7 percent and 2.1 percent, respectively.

Figure 4 shows expenditures for the major health and social services programs in 2006–07, and as proposed for 2007–08 and 2008–09. Both the current– and budget–year amounts reflect the Governor’s BBRs. As shown in the figure, three major benefit payment programs—Medi–Cal, CalWORKs, and SSI/SSP—account for a large share, about two–thirds, of total spending in the health and social services area.

As Figure 4 shows, General Fund spending is proposed to decrease for both Medi–Cal (–3.4 percent) and HFP (–1.5 percent) in the budget year. In contrast, the budget plan proposes increased funding for community mental health services (7.8 percent), mental hospitals (6.9 percent), and regional centers (5.4 percent). Despite the increases in these three programs, the significant cuts proposed in the Medi–Cal Program result in an overall reduction in spending for services provided by the state’s health care programs.

|

|

|

Figure 4

Major Health and Social Services Programs

Budget Summarya |

|

(Dollars in Millions) |

|

|

Actual

2006‑07 |

Estimatedb

2007‑08 |

Proposed

2008‑09 |

|

Change From 2007‑08 |

|

|

Amount |

Percent |

|

Medi-Cal |

|

|

|

|

|

|

|

General Fund |

$13,628.3 |

$14,063.9 |

$13,591.8 |

|

-$472.1 |

-3.4% |

|

All funds |

35,402.1 |

36,997.1 |

36,034.7 |

|

-962.4 |

-2.6 |

|

CalWORKs |

|

|

|

|

|

|

|

General Fund |

$2,017.8 |

$1,481.0 |

$1,547.2 |

|

$66.2 |

4.5% |

|

All funds |

N/A |

5,176.5 |

4,798.2 |

|

-378.4 |

-7.3 |

|

Foster Care/Child Welfare

Services |

|

|

|

|

|

|

General Fund |

N/A |

$1,235.7 |

$1,140.5 |

|

-$95.2 |

-7.7% |

|

All funds |

N/A |

4,365.8 |

4,179.3 |

|

-186.5 |

-4.3 |

|

SSI/SSP |

|

|

|

|

|

|

|

General Fund |

$3,427.3 |

$3,640.8 |

$3,747.9 |

|

$107.1 |

2.9% |

|

All funds |

N/A |

9,153.7 |

9,510.2 |

|

356.4 |

3.9 |

|

In-Home Supportive Services |

|

|

|

|

|

|

|

General Fund |

$1,474.0 |

$1,629.8 |

$1,632.6 |

|

$2.8 |

0.2% |

|

All funds |

N/A |

4,863.2 |

4,846.9 |

|

-16.3 |

-0.3 |

|

Regional Centers/Community Services |

|

|

|

|

|

|

General Fund |

$2,106.8 |

$2,222.4 |

$2,342.2 |

|

$119.8 |

5.4% |

|

All funds |

3,288.2 |

3,656.8 |

3,798.3 |

|

141.5 |

3.9 |

|

Community Mental Health

Services |

|

|

|

|

|

|

General Fund |

$755.1 |

$756.3 |

$815.0 |

|

$58.7 |

7.8% |

|

All funds |

2,188.4 |

3,492.6 |

3,562.4 |

|

69.8 |

2.0 |

|

Mental Hospitals/Long-Term Care

Services |

|

|

|

|

|

|

General Fund |

$959.2 |

$1,128.3 |

$1,206.2 |

|

$77.9 |

6.9% |

|

All funds |

1,034.1 |

1,234.4 |

1,312.9 |

|

78.5 |

6.4 |

|

Healthy Families Program |

|

|

|

|

|

|

|

General Fund |

$347.7 |

$393.6 |

$387.8 |

|

-$5.7 |

-1.5% |

|

All funds |

969.6 |

1,090.1 |

1,072.4 |

|

-17.7 |

-1.6 |

|

Child Support Services |

|

|

|

|

|

|

|

General Fund |

$525.6 |

$351.5 |

$300.8 |

|

-$50.7 |

-14.4% |

|

All funds |

1,116.5 |

1,036.6 |

858.9 |

|

-177.7 |

-17.1 |

|

|

|

a Excludes

administrative headquarters support. |

|

b Includes

Governor's budget-balancing reduction proposals. |

|

N/A=not available. |

|

|

In regard to major social services programs, General Fund support will increase for CalWORKs (4 percent) and SSI/SSP (2.9 percent) even after the Governor’s BBRs (discussed later). Conversely, the budget proposes to reduce General Fund support for Child Welfare Services/Foster Care (–7.7 percent) and Child Support Services (–14 percent), primarily as a result of BBRs. Overall, the budget proposes to hold General Fund spending on social services programs constant at about $9.5 billion.

Figures 5 and 6 illustrate the major budget changes proposed for health and social services programs in 2008–09. (We include the federal Temporary Assistance for Needy Families [TANF] funds for CalWORKs because, as a block grant, they are essentially interchangeable with state funds within the program.) Most of the major changes can be grouped into five categories: (1) funding caseload changes, (2) suspending certain cost–of–living adjustments (COLAs), (3) rate reductions, (4) across–the–board reductions, and (5) other policy changes.

|

|

|

Figure 5

Health Services Programs

Proposed Major Changes for 2008‑09

General Fund |

|

|

|

|

|

|

Medi-Cal

(Local Assistance) |

Requested: |

$13.6 Billion |

|

|

|

|

Decrease: |

$472.1 Million |

(-3.4%) |

|

|

|

|

|

|

|

+ $295 million for

increases in costs and utilization of prescription drugs and

inpatient hospital services |

|

|

|

+ $93 million for

increased payments to Medi-Cal managed care plans |

|

|

|

+ $59 million from

increased costs for premiums paid by Medi-Cal on behalf of

beneficiaries who are also enrolled in the federal Medicare Program |

|

|

|

|

|

|

|

– $602 million

from reducing provider rates for physicians and other medical and

service providers |

|

|

|

– $134 million by

eliminating certain optional benefits for adults who are not in a

nursing facility such as dental and chiropractic services |

|

|

|

– $92 million from

reductions in caseload due to the elimination of continuous

eligibility for children and restoration of quarterly status reports

for children and parents |

|

|

|

– $87 million from

reducing rates paid to long-term care facilities and certain

hospitals |

|

|

|

|

|

|

|

Department

of Developmental Services (Local Assistance) |

Requested: |

$2.3 Billion |

|

|

|

|

Increase: |

$119.8 Million |

(+5.4%) |

|

|

|

|

|

|

|

+ $62 million

primarily for increases in regional center caseloads |

|

|

|

|

|

|

|

– $215 million

continuation of regional center cost containment measures |

|

|

|

|

|

|

|

|

Figure 6

Social Services Programs

Proposed Major Changes for 2008‑09

General Fund |

|

|

|

|

|

|

CalWORKs |

Requested: |

$1.5 Billion |

|

|

|

|

Increase: |

$66 Million |

(+4.5%) |

|

|

|

|

|

|

|

+ $258 million

to backfill reduced Temporary Assistance for Needy Families (TANF)

balances |

|

|

|

+ $131 million

for the 4.25 percent cost-of-living adjustment

|

|

|

|

+ $87 million

for restoring the TANF reserve |

|

|

|

+ $83 million

for child care and services for families who comply with work

requirements in response to the graduated full-family sanction |

|

|

|

|

|

|

|

– $57 million

for caseload decrease |

|

|

|

– $486 million

from grant savings associated with new time limits and the

graduated full-family sanction |

|

|

|

|

|

|

|

SSI/SSP |

Requested: |

$3.7 Billion |

|

|

|

|

Increase: |

$107 Million |

(+2.9%) |

|

|

|

|

|

|

|

+ $103 million

for caseload increase |

|

|

|

|

|

|

|

In-Home

Supportive Services |

Requested: |

$1.6 Billion |

|

|

|

|

Increase: |

$3 Million |

(+0.2%) |

|

|

|

|

|

|

|

+ $79 million

for caseload increase |

|

|

|

+ $52 million

for new computer system |

|

|

|

|

|

|

|

– $10 million

from reducing county administration by 10 percent |

|

|

|

– $109 million

from reducing domestic service hours by 18 percent |

|

|

|

|

|

Caseload Changes. The budget reflects caseload changes in the major health and social services programs. For example, the budget reduces resources for the Medi–Cal caseload in 2008–09 because of the expected caseload decline resulting from elimination of continuous eligibility for children and restoration of quarterly status reports for children and parents. General Fund support for regional centers (RCs) that serve the developmentally disabled would continue to grow due mainly to caseload growth. Funding would be adjusted upward in the budget year for HFP to reflect anticipated caseload growth.

Suspended COLAs. Pursuant to current law, the budget provides $131 million to fund the July 2008 CalWORKs COLA. The budget proposes to delete both the June 2008 and June 2009 SSI/SSP COLAs, resulting in total savings of $23 million in 2007–08 and $300 million in 2008–09. The budget does not provide the discretionary Foster Care COLA, nor does it provide the inflationary adjustment for payments to counties for administration of the Medi–Cal Program resulting in General Fund savings of $22.4 million in 2008–09.

Rate Reductions. The Governor proposes rate reductions in Medi–Cal, HFP, Foster Care, Developmental Services, Rehabilitation, Alcohol and Drug Programs, and to other health care services. These rate reductions are generally in the range of 10 percent and taken together result in General Fund savings of about $800 million.

Across–the–Board Reductions. The budget proposes to apply across–the–board reductions to many programs after they were first adjusted on a workload basis. Typically, the reduction is in the range of 10 percent of the adjusted base. Impacted programs include child welfare services allocation to counties ($83.7 million), food stamps administration ($14.4 million), IHSS administration ($10.2 million), public health ($31.7 million), the mental health managed care program ($23.8 million), developmental services programs ($22.5 million), and alcohol and drug programs ($6.2 million).

Increasing CalWORKs Sanctions. Currently, when an able–bodied adult does not comply with CalWORKs participation requirements, the family’s grant is reduced by the adult portion, resulting in a “child–only” grant. The Governor proposes to increase this sanction to 50 percent of the remaining child–only grant after six months in sanction status, and completely eliminate the family’s grant after another six months elapses, unless the adult comes into compliance. In response to this increased sanction, the budget estimates that many families will enter employment, resulting in child care and employment services costs of $83 million. In cases where families do not comply, the budget estimates grant and administrative savings of $62 million, so the net cost of this proposal is about $21 million in 2008–09.

Time Limits for Aided Children. Currently, after five years of assistance, a family’s grant is reduced by the adult portion, and the children continue to receive a child–only grant in the safety net program. The budget proposes to eliminate the safety net grant for children whose parents fail to comply with the federal work participation requirements (20 hours per week for families with a child under age 6 or 30 hours per week for families where all children are at least age 6). The budget also proposes to limit assistance to five years for most other child–only cases (such as those with parents who are undocumented or ineligible due to a previous felony drug conviction). These time–limit policies are estimated to result in savings of about $500 million in 2008–09.

Reducing Domestic Service Hours for IHSS Recipients. Currently social workers assess each IHSS client to determine the number of hours of service that the recipient will need to remain safely in their own home. Services include personal care services (such as bathing, toileting, ambulation, and medication management), as well as domestic services (meal preparation, cleaning, and errands). The budget proposes to reduce domestic services hours by 18 percent, resulting in savings of $109 million in 2008–09.

Medi–Cal Benefit Reductions. The budget proposes to eliminate certain Medi–Cal optional benefits provided to adults not residing in nursing facilities including dental, incontinence creams and washes, acupuncture, and chiropractic services for savings of $134 million General Fund in 2008–09. Most of the savings ($115 million) results from the elimination of dental services.

Continue RC Cost Containment Measures. The budget plan proposes to make permanent in 2008–09 cost containment measures that have been in place since 2003–04, for savings of almost $215 million General Fund. The cost containment measures include rate freezes to certain providers and a freeze on funding for the startup of new programs.

Changes to Early and Periodic Screening Diagnosis and Treatment (EPSDT). The budget plan proposes to achieve savings of about $46 million General Fund in the budget year through changes to the EPSDT program. A prior authorization requirement would be imposed on requests for day treatment services exceeding six months in duration. Savings would also be achieved through rate reductions to providers.

HFP Benefit Limits and Co–Payments. The budget proposes to establish a $1,000 annual benefit limit for dental coverage for HFP participants and increase co–payments for nonpreventative services and premiums for children in families with incomes over 150 percent of the federal poverty level. These changes are estimated to result in $20.8 million in annual General Fund savings. According to the Managed Risk Medical Insurance Board, these changes must be negotiated with the health plans by March 1, 2008 in order to be effective for the budget year.

Proposition 36 Funding Reduction. The budget proposes a net reduction of $12 million General Fund for Proposition 36 drug rehabilitation programs. This would be achieved by reducing funding by $10 million for the Substance Abuse and Treatment Trust Fund, established by Proposition 36. Funding for the Substance Abuse Offender Treatment Program—established to improve the outcomes of Proposition 36 Programs—would decrease by $2 million.

Return to Health and Social Services Table of Contents, 2008-09 Budget AnalysisReturn to Full Table of Contents, 2008-09 Budget Analysis