The California Department of Forestry and Fire Protection (CalFire), under the policy direction of the Board of Forestry, provides fire protection services directly or through contracts for timberlands, rangelands, and watershed lands owned privately or by state or local agencies. These areas of department responsibility are referred to as “state responsibility areas” (SRA). In addition, the department regulates timber harvesting on forestland owned privately or by the state and provides a variety of resource management services for owners of forestlands, rangelands, and watershed lands.

The budget requests about $1.4 billion for the department in 2008–09, including support and capital outlay expenditures. Of this amount, 94 percent is for fire protection, 5 percent is for resource management, and 1 percent is for State Fire Marshal activities and administration.

The total proposal represents a decrease of $163 million below estimated current–year expenditures. This reflects a combination of decreased emergency fire protection costs of $149 million (largely reflecting one–time expenditures to fight the 2007 Southern California wildfires), General Fund budget–balancing program reductions of $8 million, and increases of $33 million for the Governor’s Wildland Firefighting Initiative and $276 million in capital outlay expenditures.

The General Fund provides the largest portion of the department’s funding for state operations and capital outlay—$601 million (about 44 percent). The remaining funds will come from lease–revenue bonds ($369 million), reimbursements ($261 million), a newly created Insurance Fund ($78 million), federal funds ($23 million), and various other state funds, including bond funds.

In addition to the department’s base fire protection budget, the budget proposal includes $69 million from the General Fund for emergency fire suppression (known as the E–Fund). As in the current year, the budget bill contains language that authorizes the Director of Finance to augment this amount as necessary to address emergency fire suppression costs. (The costs of wildland firefighting can vary substantially from year to year, making it difficult to accurately budget for emergency fire suppression. However, we note that the budgeted General Fund amount for emergency fire protection is roughly $36 million less than the five–year average for such costs.)

The Governor proposes to create a surcharge on commercial and residential property insurance policies statewide to raise additional revenues which would both offset reductions in the department’s General Fund budget and pay for program expansions. We recommend an alternative fire protection fee structure that would more closely relate fees paid to the benefits received by the beneficiaries of the state’s fire protection. Specifically, we recommend that the Legislature impose a fee on property owners in state responsibility areas, that the fee raise revenues equivalent to 50 percent of the department’s General Fund base fire protection budget, and that the fee be focused mainly on residential property.

Governor’s Fire Insurance Surcharge Proposal. In order to partially offset the state’s cost of providing fire protection services, the administration proposes to levy a surcharge on commercial and residential “multi–peril” property insurance policies. The proposed surcharge would be 1.25 percent of the cost of policies and would be assessed on all policyholders statewide. The administration projects that this proposed surcharge will generate approximately $100 million in revenues in the budget year and $125 million per year thereafter (reflecting full–year collection). The surcharge would be collected by the Department of Insurance.

The Governor’s proposed insurance surcharge would be used both to partially offset existing costs for fire protection in the department as well as in the Office of Emergency Services (OES) and to expand fire protection services in CalFire, OES, and the Military Department as shown in Figure 1. In the budget year, the administration proposes to offset $45 million in existing costs in the department and to expand programs in the department by $33 million. In OES, the budget proposes to offset General Fund reductions of $1.9 million and to expand programs by $10.2 million. In the Military Department, the budget proposes to expand programs by $9.2 million.

|

|

|

Figure 1

Uses of the Governor’s Proposed Insurance

Surchargea |

|

2008-09

(In Thousands) |

|

Department |

General Fund

Offset |

Program

Expansion |

Total |

|

Forestry and Fire Protection |

$44,700 |

$33,100 |

$77,800 |

|

Office of Emergency Services |

1,900 |

10,200 |

12,100 |

|

Military Department |

— |

9,200 |

9,200 |

|

Department of Insurance |

— |

— |

— |

|

Totals |

$46,600 |

$52,500 |

$99,100 |

|

|

|

a About $5.8

million of projected surcharge revenues in the budget year would

go into a fund reserve. |

|

|

While the administration’s proposal would generate General Fund savings, we do not recommend the Legislature approve it. Specifically, we believe that a fire protection fee should be paid by those who directly benefit from this service. Also, we believe there is the potential to create additional General Fund savings by raising a higher level of revenues.

For the purposes of this analysis, we consider the mechanism to raise revenues for fire protection separately from proposals for how to spend those additional revenues. We discuss the Governor’s specific proposals to expand the department’s fire protection activities later in this section and we discuss the proposals to expand programs in OES and the Military Department in the “General Government” chapter of this Analysis. We also discuss issues with the insurance surcharge proposal in our

“Department of Insurance” section of the “General Government” chapter.

State’s Responsibility for Wildland Firefighting. The state is responsible for wildland firefighting in SRA. These SRA are primarily privately–owned timberlands, rangelands, and watersheds. Lands owned by the federal government or incorporated within existing city limits are excluded from SRA. Also, if the density of houses is greater than three units per acre, the Board of Forestry generally removes these lands from SRA and local governments become responsible for fire protection. Existing law requires the department to provide wildland fire protection on SRA. The law allows the department to provide other emergency services—such as structure fire protection or medical emergency response—in SRA when resources are available and it is within the department’s budget. For a more detailed discussion of the state’s responsibility for fire protection and the department’s fire protection activities, please see our

Analysis of the 2007–08 Budget Bill, page B–76.

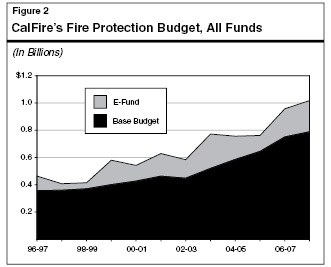

Continually Increasing Costs of State Fire Protection. The department’s fire protection budget is divided into baseline fire protection and emergency expenditures. The baseline budget includes normal day–to–day costs, such as salaries and benefits for employees, the costs of operating facilities, and other regular firefighting costs. The budget also includes funding for the E–Fund which is used to pay for costs of fire protection beyond budgeted expenditures, such as overtime or special equipment rentals. The E–Fund expenditures are typically associated with large wildland fires that vary considerably in number and severity year to year.

As shown in Figure 2, the department’s budget for fire protection has increased significantly over the last decade. Actual fire protection expenditures (including E–Fund) in 1997–98 were $408 million. In the current year, the department estimates total fire protection expenditures (including E–Fund expenditures beyond the budget appropriation) will be over $1 billion—a 150 percent increase. (Excluding E–Fund expenditures—the most volatile portion of the department’s fire protection budget—costs have nonetheless still increased by 120 percent over this period.) As discussed below, there are many reasons why the state’s expenditures for fire protection have grown so substantially over the last decade.

The state’s cost of fire protection has increased so dramatically in recent years both due to increasing cost of services, such as labor costs for firefighters, and increasing fire protection workload. There are several factors that have either increased or complicated the department’s fire protection workload, thereby increasing the department’s expenditures:

- Changes in Wildland Fuel Conditions. Fire suppression activities over the last century have left much of the state’s wildlands filled with fallen trees, standing dead trees, and heavy undergrowth. As these fuels have built up, the risk of catastrophic fires has grown. In addition, several years of drought followed by insect infestations in Southern California and the Sierras have killed many trees, increasing the risk of large, dangerous fires in these regions of the state.

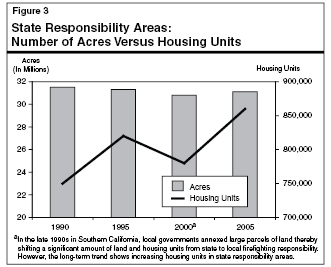

- Increasing Development in the Wildland Urban Interface. Over the last several decades, the state has experienced significant housing development at the boundary between wildlands and urban areas, known as the wildland urban interface. In particular, significant development has occurred in the Sierra Nevada foothills and the interior ranges of Southern California. As can be seen in Figure 3, while the total acreage in SRA has remained stable over the last 15 years, the number of housing units in SRA has increased by 15 percent over this period—despite changes in SRA designations which have moved fire protection responsibility for significant numbers of houses from SRA to local responsibility areas. As development increases in previously undeveloped—and often fire prone—areas, fire protection costs increase for several reasons. First, the presence of more people increases the incidence of wildland fires, as fires from human–caused activities spread to wildland areas. Second, protecting people and homes often requires greater fire suppression effort than would typically be used on forests or rangelands. Finally, the presence of people and structures can sometimes limit the techniques used for fire prevention or suppression. For example, the use of prescribed burning to reduce available fuel loads or the use of aircraft to suppress fires may be limited by the presence of homes in a formerly wildland area. The inability to use these kinds of fire suppression tactics increases the need for more labor–intensive firefighting methods to protect people and homes.

LAO Alternative Fee Recommendation. We recommend the Legislature create a new fee on SRA lands and use a portion of the revenues to offset the proposed General Fund reduction for the department’s fire protection program—thus avoiding the need to close facilities in the budget year.

Because the state provides a service—fire protection—that directly benefits a particular group—landowners in SRA—it is appropriate that those beneficiaries pay for a portion of the state’s cost for fire protection. Because the department provides fire protection for natural resources of statewide significance—such as watersheds that provide drinking water for much of the state—it is also appropriate that the state as a whole pay for a portion of the cost of fire protection. Therefore we believe that it is equitable that the state’s cost of providing fire protection in SRA be split between the direct beneficiaries and the state’s taxpayers as a whole.

Specifically, we recommend the Legislature enact a fee assessed on property owners in SRA that would pay for 50 percent of the state’s General Fund baseline cost for fire protection. We recommend that E–Fund costs be excluded from this baseline, as E–fund costs are often caused by large fire events that are of statewide significance. Based on the 2007–08 enacted budget, fee revenues from our proposed fee would be about $265 million. The Legislature may wish to adopt an SRA fee along these lines, but one that reflects a different level of cost sharing between the state and the beneficiaries. Whatever the cost sharing level is, we recommend that the Legislature design the fee such that it recovers a specified percentage of the state’s General Fund baseline fire protection budget. This will ensure that the fee payers continue to pay an equitable share of the state’s General Fund cost for fire protection over time.

The structure of the fee—who should pay the fee and at what level—is an important policy decision for the Legislature. Given that increasing development in the wildland urban interface is a key driver of the state’s increasing cost for fire protection, we recommend that residential homeowners in SRA pay most of the fee. For example, if the fee were assessed entirely on residential structures, the annual fee per residence would be about $310. On the other hand, for example, if the residential fee were supplemented with a $1 per–acre fee on all SRA lands whether developed or not, the annual fee per residence would be reduced to about $270 per year. Because the economic productivity of undeveloped lands can vary considerably, the Legislature may wish to create fee caps or exemptions for certain undeveloped lands that do not generate sufficient revenue to support a fee.

Implementation Issues in Imposing a Fee on SRA Lands. Under current statute, there is no existing fee on SRA landowners. Imposing such a fee will require legislation. In order to achieve revenues in the budget year, it will be necessary for the Legislature to consider and pass fee legislation soon—either in the special session, or shortly thereafter with an urgency clause.

Under our proposal, the SRA fee would be assessed on landowners (homeowners, non–developed landowners, or both). The fee would be included in property tax bills and would be collected by county assessors or controllers. Based on our research, we believe the assessors will need information on parcels in SRA by July or August 2008, to include the fee in the tax bills that go out in September and October, in order to generate fee revenues when property taxes are paid in December 2008 and April 2009.

The cost to the counties of administering the fee will be the responsibility of the state, and will likely be from 5 percent to 10 percent of fee revenues in the first year, with lower costs thereafter. The ability to determine which parcels are in SRA and to quickly update property assessments to reflect a new fee will vary considerably among counties. The department may be able to provide some assistance to the counties in this regard.

If some counties lack the capacity to update property assessments to implement the fee as designed in the budget year, the Legislature could set a 2008–09 revenue target for each county based on the estimated number of houses and acres in the county’s SRA. The county assessors could use available information to allocate that revenue target among SRA landowners in the county, until their information systems are updated to assess the fee as designed.

A key policy issue in assessing a fire protection fee is using risk as a factor when setting fee levels. In the long term, we recommend the Legislature use risk as a criterion when setting fee levels. For example, the Legislature could set higher fees on houses or lands that are located in high fire hazard areas, as determined by the department. While it would not be feasible to use fire hazard information to set fee rates in the budget year, the Legislature could include fire hazard as a criterion in the fee structure to be implemented in future years.

The Governor’s budget proposes General Fund budget–balancing reductions of $8 million in areas for which an alternative funding source is not proposed. We recommend the Legislature reject certain reductions totaling $2.1 million. (Increase Item 3540–001–0001 by $2.1 million.)

The budget proposes a number of General Fund budget–balancing reductions for which no alternative funding source is proposed. These proposed reductions—totaling about $8 million—include $3 million in resource management activities, $4.8 million in administration, and $315,000 in the Office of the State Fire Marshal.

We recommend that the Legislature offset the component of the proposed General Fund budget–balancing reduction totaling $870,000 that relates to timber harvest plan (THP) review and enforcement with new fees levied on timber operators. We discuss this recommendation in the

“Funding Timber Harvest Plan Review and Enforcement”

write–up in the “Crosscutting Issues” section of this chapter.

We recommend approval of the remaining General Fund budget–balancing reductions, with the following exceptions, totaling $2.1 million:

- We recommend the Legislature reject the administration’s proposal to reduce funding for vegetation management ($1.1 million). These funds are used by the department to plan for and carry out the removal of vegetation in fire–prone areas. Reducing fire prevention activities, such as this, may increase the state’s long–term fire protection costs.

- We recommend the Legislature reject the administration’s proposal to reduce funding for hazardous material cleanup ($165,000). These funds are used to clean up contamination caused by leaking fuel storage tanks and other toxic materials. Under state law, the department does not have discretion whether or not to undertake these cleanups. We note that the administration’s budget proposal does not include a proposal to exempt CalFire from the state’s water quality laws requiring the cleanup of this type of

- contamination. Thus, if the department fails to adequately clean up contaminated sites, it could be subject to fines and/or penalties.

- We recommend the Legislature reject certain proposed cuts in the department’s administrative budget. Specifically, we recommend the Legislature reject the reduction for accounting and audits ($600,000) and contracts and purchasing ($240,000). One of the key activities in these areas is fiscal oversight of the E–Fund. Over the last five years, average E–Fund expenditures from the General Fund have been about $120 million per year. We find that these proposed reductions will impede the department’s ability to adequately oversee this large and unappropriated source of funds, thereby increasing the likelihood that inappropriate, non–emergency costs are charged to the E–Fund, increasing the General Fund cost of fire protection.

While our proposal to reject this subset of the proposed budget–balancing reductions will increase the department’s General Fund budget above the Governor’s proposal by $2.1 million, we note that this increase is more than offset by our proposals to reduce the department’s General Fund budget through new fees for fire protection (discussed above) and for THP review and enforcement.

The Governor’s proposed Wildland Firefighting Initiative includes augmentations of $33.1 million funded from the proposed insurance surcharge to increase firefighter staffing levels throughout the state, upgrade the department’s communication system, and replace the department’s helicopter fleet. We recommend the Legislature reject proposals to increase staffing levels statewide and replace the department’s helicopter fleet because the administration has not shown that these proposals provide a cost–effective way to provide additional fire protection. We recommend approval of the communication system upgrade, to be funded from the General Fund. (Eliminate Item 3540–001–0217 for $33.1 million. Reduce Item 3540–001–0001 by $9.1 million. Increase Item 3540–006–0001 by $13.3 million)

Administration’s Proposals. As we discussed above, the administration is proposing to enact a new surcharge on property insurance in the state. A portion of the proposed new revenues ($44.7 million) would be used to offset the department’s General Fund budget for fire protection. The administration also proposes to augment the department’s base fire protection budget by $33.1 million in the budget year (and an additional $26 million in 2009–10) with the proposed new revenues. (In addition to the proposed augmentations to the department’s budget, there are proposals in OES and the Military Department for firefighting–related augmentations. See our “General Government” chapter of this Analysis for a discussion of those proposals.)

Specifically, the Governor’s budget includes the following augmentations to the department’s budget:

- “4–0 Staffing.” The department’s current practice is to staff fire engines with three firefighters. In the past several years, the administration—by executive order—has increased staffing on fire engines in targeted areas in the summer months to four firefighters per engine. In the current year, 4–0 staffing was done by executive order throughout Southern California (costing about $13.3 million, which was charged to the E–Fund). The budget proposes to expand 4–0 staffing statewide during fire season and the months immediately before and after. The budget–year augmentation for this proposal is $28.9 million. (The total cost of this part of the proposal is $42.2 million. The proposed $28.9 million augmentation reflects the net increase in the department’s expenditure authority. The proposal would also shift $13.3 million in costs from the E–Fund to the department’s base General Fund budget.)

- Automatic Vehicle Locators (AVL). The department’s current dispatch and communications system relies on fire engine or aircraft crews to report their location to the dispatch center. If the department loses contact with a crew, it has to rely on information from the crew’s last report to determine where the vehicle or aircraft is located. The administration proposes to upgrade all vehicles and aircraft with a system that will allow the department to automatically determine a vehicle or aircraft’s location at all times. This ongoing budget augmentation is projected to cost $4.2 million in the budget year.

- Helicopter Replacements. The department’s helicopter fleet is composed of UH–1H (Super Huey) helicopters procured from the Department of Defense in the early 1990s. This class of helicopter was first produced in the 1960s. While the department keeps up with all FAA–required and manufacturer–recommended maintenance, over time the cost of replacing increasingly rare spare parts will grow. In addition, the department’s helicopters are not equipped for night flight. The administration proposes to begin acquiring new helicopters in 2009–10. (The budget proposal submitted to the Legislature includes this component, and if the Legislature approves the budget proposal as a whole, the administration interprets this as authorizing the helicopter replacement

portion to be included in the department’s future base budget.) The cost of this proposal is $26 million per year plus additional (unknown) costs for facility upgrades.

Recommend Rejecting Most of the Administration’s Proposal. We recommend that the Legislature reject most of the administration’s Wildland Firefighting Initiative in the department’s budget.

First, we recommend the Legislature reject the proposal to permanently institute 4–0 staffing statewide. While there are likely to be benefits from increasing the number of firefighters on each engine from three to four, the department has not demonstrated that this level of increased staffing is generally cost–effective. Specifically, the administration has been unable to demonstrate that the cost of the proposed significant increase in positions will be offset by an equivalent or greater reduction in emergency fire protection costs. Additionally, the department has not been able to justify why the increased staffing level is needed throughout the state and in all years, rather than targeted to areas of high fire risk or fire seasons of unusual danger. It is also important to note that the department has not estimated the impact from the proposed staffing expansion on its facility costs and capital outlay requirements. The department plans to house the additional firefighters in existing facilities, but most of the department’s facilities are at or near full capacity. The costs to create additional capacity in the department’s facilities to house the proposed positions are unknown—but could result in substantial increases in the department’s capital outlay budget in future years. Finally, we note that the Governor still has the authority to implement 4–0 staffing in targeted areas and times through executive order, as has been exercised over the last several years. (Our recommendation requires both reducing the proposed expenditure from the insurance fund and a technical adjustment to both the department’s base General Fund budget and the E–Fund.)

Second, we recommend the Legislature approve the administration’s proposal to install AVL systems in its vehicles and aircraft. Since we recommend the rejection of the Governor’s proposed insurance surcharge, we recommend this proposal be funded from the General Fund. (We note that our proposed SRA fee would generate revenues sufficient to entirely offset the cost of this augmentation.) We find that this proposal will improve the department’s ability to dispatch resources. More importantly, such a system will provide an additional level of safety for firefighting personnel in the field. The proposed system will allow the department to immediately determine a vehicle or aircraft’s location if contact with the crew is lost, thereby allowing the department to dispatch assistance quickly in an emergency. While the state’s budget situation makes it impractical for the Legislature to approve many program augmentations, we believe the safety benefits for firefighters in the field make this proposal a priority, despite the increased cost.

Finally, we recommend the Legislature reject the administration’s proposal to begin replacing the department’s helicopter fleet. While it is true that maintenance costs for the existing fleet will increase over the coming years, the department has not shown that increasing maintenance costs make replacement cost–effective at this time. Additionally, the department has provided very little detail on the proposed replacement program. Specifically, the department has not provided detailed information on the required capabilities of the new helicopters, the type of helicopters to be purchased, or specific cost information. Because the department does not intend to begin replacement in the budget year, the Legislature does not have to approve this proposal at this time. We also note that the department indicates that there would be costs to upgrade its helicopter facilities, but that the scope of those costs will not be known until more detail about the new helicopter models is available. Rejecting the proposal in the budget year does not prohibit the department from exploring the cost–effectiveness of replacing its helicopters in future years.

Return to Resources Table of Contents, 2008-09 Budget AnalysisReturn to Full Table of Contents, 2008-09 Budget Analysis