2009-10 Budget Analysis Series: Higher Education

Pension Plan Will Need Money Soon… But Employee Contributions Should Resume First

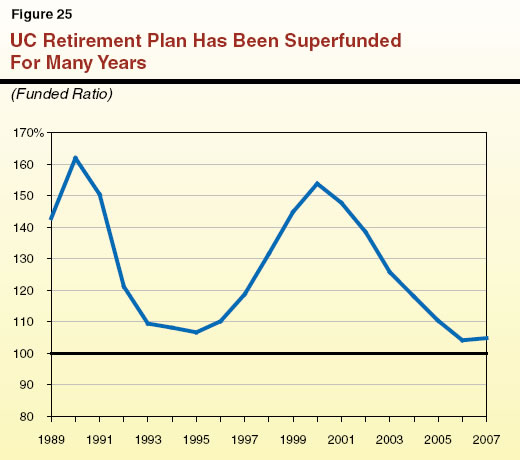

UC Has Long Had a Fully–Funded Pension Plan. Like most public employers, UC provides its career workers with a comprehensive package of retirement benefits, including health benefits and a pension. Unlike nearly all other major pension programs, however, the UC Retirement Plan (UCRP) has not required any new infusion of funding for nearly two decades. During this “funding holiday,” neither the state, UC, or employees have contributed to the plan. The funding holiday began in 1990. It has lasted so long because (1) overfunding by the state, UC, and employees prior to 1990 led to a substantial surplus in the pension fund at that time and (2) UCRP investments have benefited from a remarkable period of sustained investment gains since 1990. Figure 25 shows the recent history of UCRP’s funded ratio—that is, the actuarial value of its assets compared to the value of pension benefits accrued to date by UC employees and retirees. Since about 1987, UCRP’s assets have exceeded its liabilities. In pension policy, this sometimes is referred to as a “superfunded” pension plan. Few, if any, other major pension funds can boast such a long track record of being superfunded.

Time for the Nearly Two–Decade Funding Holiday to Come to an End. For plans like UCRP, it is nearly impossible for a funding holiday to be sustained forever since this would require year after year of abnormally strong investment returns. Each year, existing and new employees accrue future pension benefits under existing pension formulas, but because of the continuing funding holiday, no new funds have been set aside and invested to cover these costs. This reduces the plan’s funded status over the long term. In addition, broad declines in stock and other investments during 2008 probably will result in further declines in the funded status. Without the resumption of employer and employee contributions, these declines will become apparent in future annual valuations of UCRP. We expect, as do UC’s actuaries, that UCRP’s fall 2009 valuation will show that its funded status has dropped below 100 percent for the first time in over 20 years. Keeping the pension plan’s funded status near the 100 percent level—the state’s policy for its major pension funds—will require an end to the funding holiday soon.

Governor Proposes $20 Million Contribution—Much Less Than UC Requested. The Governor proposes that the state increase General Fund appropriations to UC by $20 million in 2009–10 to help the university resume contributions to UCRP. The $20 million figure appears to have been chosen arbitrarily. Keeping UCRP fully funded will eventually require total contributions (from all state, UC, and employee sources) of over $1.3 billion per year. (This $1.3 billion per year figure will grow over time with inflation and payroll, among other actuarial factors. Additional increases will be needed for any unfunded liability that emerges due to a delay in resuming contributions or other reasons.)

The Regents do not propose that the state contribute anywhere close to the full $1.3 billion amount. First, the spending plan reflected in the Regents’ 2009–10 budget request does not ramp up contributions to UCRP to the full $1.3 billion contribution amount immediately. Instead, the plan assumed total contributions to UCRP of only about $875 million in 2009–10. Under the Regents’ actuarial policies, a ramp–up to the full contribution amount likely would occur over the next several years. Second, the Regents have proposed that, in any given year, the state pay only a share of UC’s total employer contribution—roughly equal to the portion of university personnel costs that UC officials estimate is covered from state General Fund appropriations. In its 2009–10 budget request, for example, the Regents assumed that the “state General Fund and student fee share” of UCRP retirement contributions would be $228 million in 2009–10—a number that would grow by tens of millions or hundreds of millions of dollars per year over the next few years as the university ramps up to the full contribution level. The UC employer contributions—and, therefore, the state’s share of those contributions under the Regents’ proposed funding approach—would depend on what portion of the total UCRP contributions are deducted from employees’ paychecks. The greater the employees’ contributions, the less the total UC employer contribution would be. The UC budget request assumed that employees would resume contributing 2 percent of their pay to UCRP beginning on July 1, 2009. This resumption of employee contributions would require—for rank–and–file staff—agreements with UC’s unions. The unions have strongly resisted resumptions of contributions in recent years.

Recommend Rejecting Governor’s Proposed $20 Million Appropriation. We recommend rejecting the Governor’s proposed $20 million appropriation for UCRP at this time due in part to the state’s budget situation. Nevertheless, we believe that UCRP funding must resume soon in order to keep the plan relatively well–funded. In future years, therefore, the Legislature will need to consider the state’s role in providing additional General Fund money to UC to cover part of its employer contributions to UCRP. Failure to provide additional funds will mean that UC will have to identify other resources to cover the full costs of its employer contributions to UCRP—including, perhaps, reductions in services or increases in student fees.

Recommend Declaring State Policy That UC Workers Should Resume Contributions. Through its direct control of benefit levels and most employer and employee contributions to the two largest statewide public pension programs (the California Public Employees’ Retirement System [CalPERS] and the California State Teachers’ Retirement System), the Legislature already has established the state’s policy that both public employees and employers should contribute to public pension programs. In our view, when considering whether to appropriate funds to UC to cover its pension contributions, the Legislature also will need to consider whether UC workers have agreed to adhere to this long–standing state policy. The Legislature has the option of approving a formal statement of this policy concerning UCRP even before appropriating funds to UC for its pension contributions. We propose that the Legislature call on UC workers to cover approximately one–third of the total contributions needed to fund their pension benefits. Under our approach, UC workers would pay roughly the share of their total pension costs that the average state worker contributes toward the ongoing, or “normal cost,” of his or her CalPERS benefits. We would, however, suggest that the Legislature deviate from its existing state policy in one key way—require UC employees to cover a portion of the costs of any future benefit enhancements or unfunded liabilities that might emerge in UCRP. In the past, we have noted that employees’ fixed pension costs shield them from the financial tradeoffs of pension decisions. By maintaining a proportional share of all future costs, this can be avoided. Employees of UC would benefit under our approach if UCRP becomes superfunded again, which could allow total contributions—and, therefore, employees’ share of those contributions—to be decreased.

To implement this proposal, we recommend that the Legislature include in UC’s item in the 2009–10 Budget Act the following budget bill language:

It is the intent of the Legislature that employees enrolled in the University of California Retirement Plan (UCRP) contribute approximately one–third of the total contributions determined to be necessary for the plan on an annual basis, with the University of California (UC) contributing approximately two–thirds of these total contributions. It is the intent of the Legislature that, upon initiation of such contributions by UCRP members, consideration should be given as to whether and what amount, if any, of additional state funds should be appropriated to UC to assist it in making its share of the total contributions.

Recommend Report at Budget Hearings on Steps to Improve Communication With Employees Concerning UCRP. Discussions between UC and its unions concerning the resumption of contributions to the pension funds have been contentious, and in our conversations with various employee groups, we observe that there is much mistrust and misunderstanding concerning the Regents’ management of the fund. Under its constitutional authority, the Regents serve as the governing board of UCRP. The Legislature, however, has urged more cooperative governance of UCRP. Specifically, Resolution Chapter 126, Statutes of 2007 (SCR 52, Yee), asked the Regents to provide for “shared governance” of UCRP, including trustees representing both faculty and staff participants, similar to the way that CalPERS and other public pension systems are governed. Regardless of whether governance changes are implemented, in the future, as employees resume contributions to UCRP, it will be more important for employee groups to have an understanding with and comfort in the management of UCRP investments and other activities. Therefore, we recommend that UC officials be asked at budget hearings on the steps they have taken to improve communications and trust between the Regents and employee groups concerning the management of UCRP.

Return to Higher Education Table of Contents,

2009-10 Budget Analysis Series

Return to Full Table of Contents,

2009-10 Budget Analysis Series