2009-10 Budget Analysis Series: Resources

In our Analysis of the 1992–93 Budget Bill (see page IV–19), we addressed the subject of the state’s overall strategy for funding resources and environmental protection programs. In that analysis, we described several ways that these program areas could be funded. In general, we recommended that (1) when state programs provide benefits to identifiable parties, or (2) when they address the negative environmental impacts of activities undertaken by specific parties, it is appropriate for those parties to pay for the costs of the related programs.

Since the time of our 1992–93 Analysis, the funding mix used to support natural resources and environmental protection programs has evolved, with greater reliance on a large number of special funds and bond funds with narrowly tailored uses. In the following analysis, we review the current funding structure for resources and environmental protection programs in light of these changes. We also make general recommendations for ways to restructure the current funding system to allow more effective spending of state funds and to provide greater spending flexibility to meet legislative funding priorities.

Funding Natural Resources and Environmental Protection. In the areas of natural resources and environmental protection, there are different means the state can use to fund its programs. When deciding what the appropriate fund source for a program should be, it is important to consider both the purpose of the program and the groups or individuals that are connected to the program. (For example, the parties connected to a program may be beneficiaries of a state service or those regulated by the state.) In general terms, there are two basic ways to fund these programs.

The first way to fund programs is through the use of general revenue sources. There are many program areas that benefit the state as a whole, such as programs to protect wildlife habitat or watersheds which provide water supplies to much of the state. In cases where the benefits of a state program accrue to most or all of the state’s residents, we believe that it is appropriate to use general revenue sources to fund those programs. The most obvious example of a general revenue source is the state’s General Fund—to which almost all state residents make some contribution. Also included in general revenue sources are general obligation bond funds that are repaid using the state’s General Fund.

The second way to fund programs is based on fees or other charges levied on specific parties. In some cases there are direct, identifiable beneficiaries of state programs. Because these individuals or groups derive a direct benefit from a state service or access to a public resource, we contend that it is good policy for those parties to pay for the benefits they receive. This is commonly referred to as the beneficiary pays principle. For example, hunters and fisherman pay licensing fees to the state. In this case, the beneficiaries of a state program pay for the state’s cost to protect existing populations of fish and wildlife as well as programs to provide additional hunting and fishing opportunities.

On the other hand, there are cases where individuals or groups directly impact a public resource in a negative way. To the extent those polluters are identifiable, the state may impose regulatory fees on them to pay for both the costs to prevent or control pollution and to clean up pollution. This is commonly referred to as the polluter pays principle. For example, the state collects fees on oil imported into the state to support the regulation of oil imports and to support a trust fund for cleaning up oil spills when the actual polluter cannot be identified or is unable to pay the costs. In this case, industry supports the cost of regulation and the potential cleanup of oil spills.

Of course, a mixture of general revenues and fees can be used to fund a state program and this reflects current practice. For example, the state park system is supported, in part, by the General Fund because the system protects natural and historic resources that belong to the residents of the state as a whole. The state park system also derives considerable funding support from user fees charged to visitors because those visitors derive a direct benefit from access to parks.

Funding Sources Are Subject to Different Legal Constraints. In addition to the policy reasons for using certain types of funding sources for programs, there are differing legal constraints between fund sources that affect the Legislature’s ability to raise and spend revenues from those fund sources. There are different legal parameters for the General Fund, fee–based special funds, and general obligation bond funds.

General Fund monies are collected broadly from taxpayers and are available by legislative appropriation for broad purposes. Relative to other fund sources, the Legislature has a great deal of flexibility regarding what programs can be funded from the General Fund. A General Fund tax increase can only be enacted with a two–thirds vote of the Legislature and revenues from such tax increases generally can be appropriated only with a two–thirds vote of the Legislature.

In addition to the major sources of General Fund tax revenues, the state collects a wide variety of other revenues which are deposited in special funds. As mentioned above, the state often assesses fees under the beneficiary pays or polluter pays principles. A fee may be enacted by the Legislature on a majority vote, provided there is sufficient “nexus” between the universe of fee payers and the programmatic activity for which the fee revenues are used. Typically, these revenues are deposited into a special fund and may be appropriated by the Legislature on a majority vote.

It is important to note that just because revenues are deposited in a special fund, it does not legally make them fee revenues. For example, the Governor’s budget includes a proposal to assess a surcharge on property insurance premiums to pay for state emergency response costs. Revenues from this surcharge would be deposited into a special fund. However, based on our discussions with staff at Legislative Counsel, we believe these revenues would be considered tax revenues. This characterization has several implications for these funds—including the vote requirements for enactment of the surcharge and appropriation of the funds, the creation of an additional state funding requirement for education under Proposition 98, and the potential use of these revenues for other purposes unrelated to emergency response.

Under the State Constitution, the voters may authorize the sale of state general obligation bonds with a majority vote. Unless otherwise specified in the measure, general obligation bonds are repaid using the state’s General Fund. While there are general requirements in the Government Code for the use of such bond funds (including a general requirement that they be used for capital purposes), the bond measure itself largely determines how the funds are to be spent. In some cases, bond measures provide very detailed allocations of funding to different programs. In other cases, bond measures allow the Legislature wide latitude in appropriating the funds.

Most state funds are subject to legislative appropriation, meaning that before they can be spent, they must be appropriated by the Legislature in the annual budget act or other legislation. In some cases, either a piece of legislation or a bond measure provides the appropriation authority to the administration to spend funds without any further action by the Legislature. We generally recommend that funds be subject to annual legislative appropriation so that the Legislature can exercise oversight over the expenditures of funds.

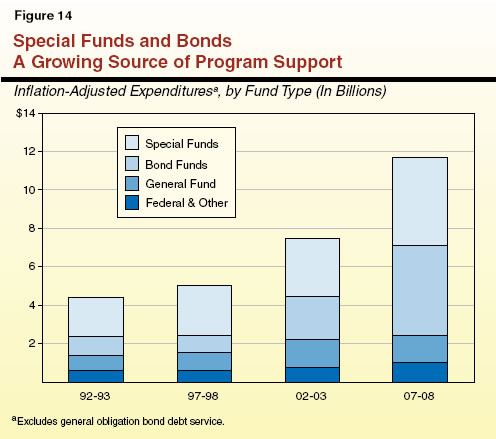

Shift in Funding Sources to Bonds and Narrowly Constrained Special Funds. In recent years, special funds have generally provided the largest source of funding for resources and environmental protection programs, followed by general obligation bond funds, the General Fund, and then other fund sources, as shown in Figure 14. While special funds have historically played a major role in funding resources programs, over the last 15 years the relative importance of the General Fund has declined, while bond funds have become a much larger share of total spending.

Trends in Structure of Bond Measures and Special Funds. Since 1996, the voters have approved about $22 billion in general obligation bonds for resources and environmental protection programs. These bond measures have included both legislative measures and voter initiatives. As the state’s reliance on bond funds has increased, the make–up of those general obligation bonds has become a key driver of resources–related spending.

Typically, bond measures specifically allocate funding among many program areas, while leaving some or all of the authority to appropriate the bond funds to the Legislature. For example, Proposition 84, a voter initiative enacted in 2006, allocates $5.4 billion among about 70 different uses. While most of Proposition 84 is subject to legislative appropriation, the Legislature is not allowed to reallocate funds among the various uses specified in the bond measure. On the other hand, some recent legislative bond measures—such as Propositions 1B and 1E—allocate funds to a handful of general program areas and authorize the Legislature to appropriate those funds within the general requirements of the bond measure.

Another trend over the last two decades is a greater reliance on special funds that are only available for very narrowly defined uses. A good example is the Fish and Game Preservation Fund. This fund has almost two–dozen individual accounts dedicated to very specific uses as well as a large “nondedicated” account for broader purposes. While all the funds in the Fish and Game Preservation Fund are generally used for the protection of the state’s natural resources, each individual subaccount has strict statutory constraints on its use. In practice, this system of very specific accounts creates administrative costs for the state and limits the Legislature’s ability to direct funding from low–priority activities to high–priority activities without making statutory changes.

On the other hand, there are special funds which can be used for a relatively broad range of purposes within a programmatic area. For example, the Toxic Substances Control Account—which is supported by regulatory fees, cost recoveries, and penalties relating to hazardous substances—is generally available for expenditures relating to the prevention, regulation, and cleanup of hazardous substances.

Based on our review of the various special funds that have been used to support programs in the natural resources and environmental protection areas of the state budget, we find an increasing amount of funding is narrowly constrained. In 1992–93, we estimate that 69 percent of special fund expenditures came from funds that can be characterized as narrowly focused. By 2007–08, narrowly constrained funds made up 83 percent of such expenditures.

Consequences of Current Funding Structure. The funding structure that has evolved over the last two decades has implications for the state’s ability to allocate funding to priority programs.

- Funding May Not Change as Priorities Do. Because much of the funding for resources and environmental protection come from special funds and narrowly constrained bond funds, the Legislature’s ability to react to evolving funding needs is constrained. If new funding needs arise, it is difficult to reprogram existing funds from lower–priority areas of the budget to higher–priority areas. This is particularly true of bond funds. The bond measures approved by the voters in recent years have been very large and consequently have been spent over many years. As new challenges arise, the Legislature does not have the authority to reprioritize expenditures from existing bond funds. Instead, the Legislature must choose between shifting General Fund monies from other areas of the budget, creating new revenue sources, or not funding new priorities.

- Spending Is Often Driven by Available Revenues, Not Needs. For many programs supported by smaller and/or more narrowly constrained special funds, annual budgeting is largely based on the fee revenues that are available, rather than on an evaluation of the funding required to meet statutory requirements. In addition, because there are so many small programs with individual funding sources, it is difficult for the Legislature to provide effective oversight of these many programs within the time constraints of the budget process. Thus, many programs continue year after year with relatively little consideration as to whether they continue to meet state priorities for funding.

- Use of Bond Funds Creates Debt Service Costs. Because bond funds are borrowed money, the state is obligated to pay them back with interest, generally over 30 years. In general, for every million dollars borrowed, the state pays back $1.2 million (after accounting for inflation). As the state has come to rely on bonds more and more in recent years, debt service has become a major General Fund cost in the resources area. In the budget year, debt service is projected to cost more than $720 million in the resources and environmental protection areas. This is second only to fire protection as a use of General Fund support in this part of the budget. Consequently, General Fund support for other priority programs is limited by the necessity to repay general obligation bond costs.

Recommend the State Move Towards Simpler and More Flexible Funding. The following are some general approaches we recommend the Legislature rely upon in the coming years to improve budgeting in the resources and environmental protection area. We believe these principles can be applied in the future to evaluate proposals for funding resource programs, potential statutory changes, and proposed bond measures.

- Where Appropriate, Consolidate Funds. There are opportunities for the Legislature to consolidate existing special funds while adhering to the general purposes for which those funds were created. This would allow the Legislature greater flexibility in setting funding priorities within programs, while still supporting the general goals of the program. For example, the many separate accounts in the Fish and Game Preservation Fund could be consolidated into a single account which would still be used to support fish and game activities, but with greater flexibility and lower administrative costs.

- Tie Fee Revenues to the Budget Act. In general, we recommend the Legislature make statutory changes that would tie fee levels to budget act appropriations for a program. During the budget process, state agencies and DOF would inform the Legislature of the fee levels needed to support proposed appropriations, and subsequently set fee levels such that they would generate revenues sufficient to support the approved appropriations. Thus, if new program needs arose, they could be addressed in the budget process without having to make statutory changes each time. Similarly, if program expenditures were lower than fee revenues and fund balances built up, fee levels would be reduced correspondingly.

- Rely Less on Bond Funding, Particularly Constrained Bond Funds. As the Legislature considers future bond measures, we recommend that only those programmatic activities that will yield long–term benefits should be supported with borrowed money. There may be areas of the budget—for example, programs to increase the efficiency of water use—that can be funded on a “pay–as–you–go” basis with new or existing funds, thereby reducing the need for borrowed money. Also, we recommend that future bond measures allocate funds to a few general areas—such as water quality or wildlife habitat restoration—rather than narrowly prescribing how funds must be allocated. This would allow future Legislatures the flexibility to appropriate funds to meet evolving state priorities. Finally, we recommend that all the funds provided in future bond measures be subject to annual appropriation to allow legislative oversight of these expenditures.

Return to Resources Table of Contents,

2009-10 Budget Analysis Series

Return to Full Table of Contents,

2009-10 Budget Analysis Series