November 4, 2014

Proposition 45

Approval of Healthcare Insurance Rate Changes. Initiative Statute.

Yes/No Statement

A YES vote on this measure means: Rates for individual and small group health insurance would need to be approved by the Insurance Commissioner before taking effect.

A NO vote on this measure means: State regulators would continue to have the authority to review, but not approve, rates for individual and small group health insurance.

Summary of Legislative Analyst’s Estimate of Net State and Local Government Fiscal Impact

Ballot Label

Fiscal Impact: Increased state administrative costs to regulate health insurance, likely not exceeding the low millions of dollars annually in most years, funded from fees paid by health insurance companies.

Background

This measure requires the Insurance Commissioner (the Commissioner) to approve rates for certain types of health insurance. The rate approval process would be similar to a process that is currently used for other types of insurance, such as automobile and homeowner’s insurance. Below, we provide background information on health insurance in California and automobile and homeowner’s insurance rate regulation.

Health Insurance in California

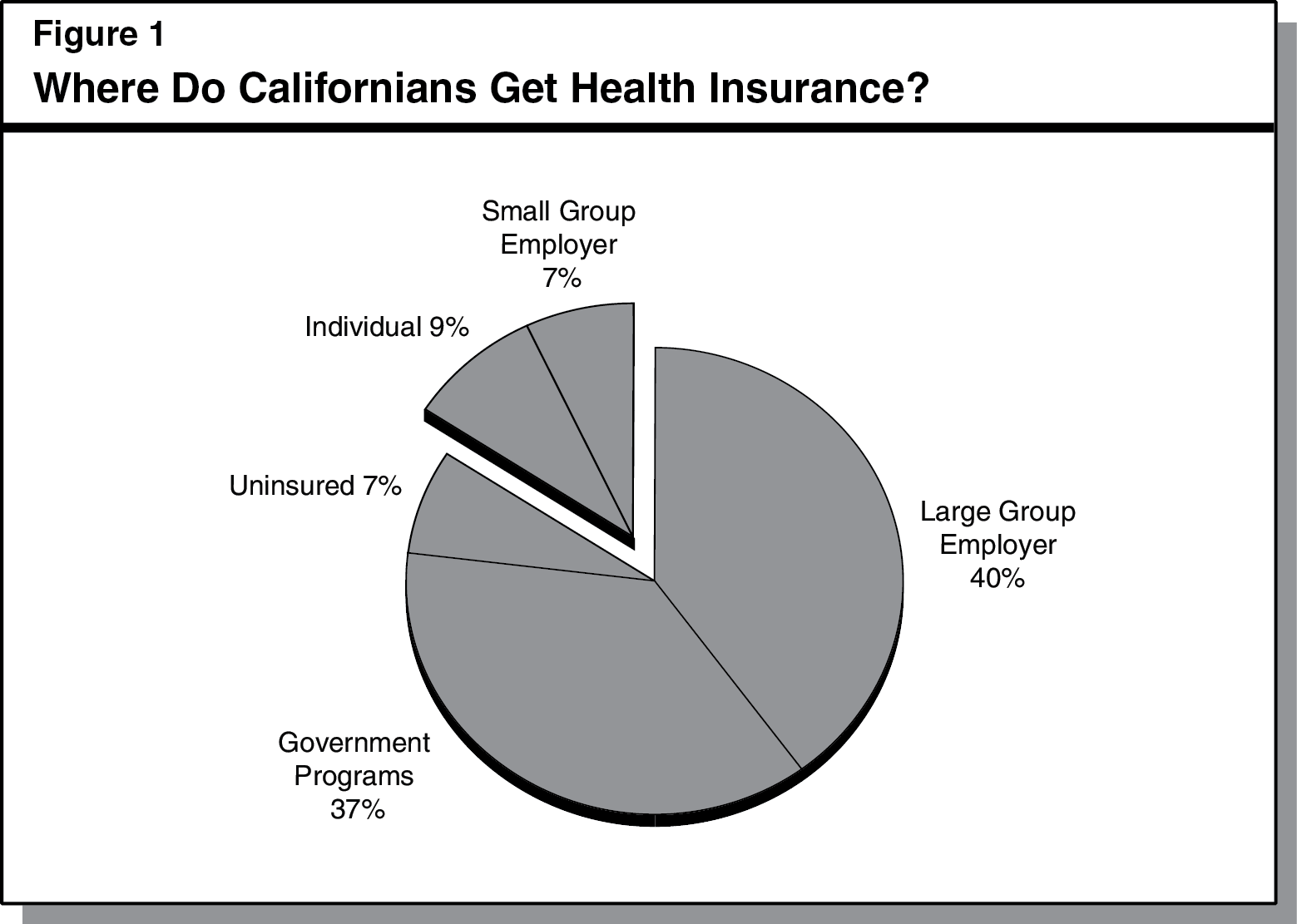

Sources of Health Insurance. As shown in Figure 1, Californians obtain health insurance in many different ways. Some individuals and families obtain it from government programs, such as Medicare or Medicaid (known as Medi-Cal in California). Other individuals and families obtain job-based health insurance from their employers. Job-based coverage provided by companies with more than 50 employees is known as large group coverage. Coverage provided by companies with 50 or fewer employees is known as small group coverage. Still other individuals and families purchase health insurance directly from a health insurance company (also known as individual health insurance). This measure mainly applies to individual and small group health insurance—which covers roughly 6 million Californians, or 16 percent of the population.

Two State Departments Oversee Health Insurance in California. Most health insurance products sold in California must be approved by state regulators to ensure they meet state requirements. For example, health insurance companies must provide basic benefits to enrollees—such as physician visits, hospitalizations, and prescription drugs—and have an adequate number of physicians available to provide care in a timely manner. These requirements are generally enforced by either the Department of Managed Health Care (DMHC) or the California Department of Insurance (CDI). The DMHC is run by a Governor-appointed director and it regulates some types of health insurance. The CDI is run by the elected Commissioner, and it regulates other types of health insurance. Most insured Californians have health insurance that is regulated by DMHC. The regulation of California’s individual or small group health insurance is somewhat more evenly split between DMHC and CDI. The costs of each department’s activities are generally funded through fees on the regulated insurance companies. Some other types of health insurance, such as the federal Medicare program, are generally not subject to state requirements and therefore not regulated by either department.

Review, but Not Approval, of Health Insurance Rates. As of 2011, health insurance companies must file information on proposed rates for all individual and small group health insurance with either DMHC or CDI before those rates can go into effect. (Insurance companies are not required to file large group rate information.) Both DMHC and CDI review the rate information and say whether the rate increases are reasonable or not. When evaluating the reasonableness of health insurance rates, DMHC and CDI may consider a variety of factors, such as: (1) which medical benefits are covered, (2) what portion of the costs enrollees pay through copayments and deductibles, and (3) whether a company’s administrative costs are reasonable. The departments are also required to make certain information from these reviews available to the public on their websites. However, DMHC and CDI currently have no authority to reject or approve the rates before they take effect.

Federal Health Care Reform Creates Health Benefit Exchanges. The federal Patient Protection and Affordable Care Act enacted in 2010, also referred to as federal health care reform, created marketplaces called health benefit exchanges. Insurance companies may sell health insurance products to individuals and small businesses on these exchanges. Certain low- to moderate-income individuals and families may receive federal subsidies to make their health insurance more affordable. These federal subsidies are not available for insurance purchased outside the exchange. California’s exchange—operational since October 2013—is known as Covered California, and it is governed by a five-member board (the Board) composed of individuals appointed by the Governor and the Legislature. Covered California is currently funded by federal funds and fees assessed on participating health insurance companies.

Covered California Board Negotiates With Health Insurers. Under state law, the Board has the authority to approve which health insurance products are sold through Covered California, subject to state and federal requirements. Thus, the Board negotiates certain plan characteristics—such as rates—with health insurance companies seeking to sell products through Covered California.

Individual Market Health Insurance Sold During “Open Enrollment.” Generally, persons may enroll in individual market health insurance only during certain months, or open enrollment periods. Open enrollment generally begins in the fall and lasts a few months.

Automobile and Homeowner’s Insurance Rate Regulation

Automobile and Homeowner’s Insurance Rates Subject to Rate Approval Process. In 1988, California voters approved Proposition 103, which requires that rates for certain types of insurance—including automobile and homeowner’s insurance—not be excessive, inadequate, or unfairly discriminatory. (Health insurance is not currently subject to Proposition 103 requirements.) Proposition 103 requires the Commissioner to review and approve proposed rates before such rates take effect. The Commissioner may hold a public hearing on any proposed rate. In addition, a consumer or a consumer representative can challenge a proposed rate and request a public hearing. The Commissioner is required to grant a request for a public hearing when proposed rate changes exceed certain percentages. The Commissioner has the final authority to approve or reject proposed rates. The Commissioner’s rate decision can be appealed to the courts by consumers, consumer representatives, or insurance companies.

Proposal

Individual and Small Group Health Insurance Rates Must Be Approved by the Commissioner. The measure makes current and future individual and small group health insurance rates—including rates for health insurance that is regulated by CDI or DMHC—subject to the rate approval process established under Proposition 103. The measure also states that rates proposed after November 6, 2012 must be approved by the Commissioner, and payments based on rates in effect on November 6, 2012 are subject to refund. There is some legal uncertainty about whether the Commissioner could require health insurance companies to issue refunds for health insurance no longer in effect.

The measure also broadly defines “rates” in a way that includes other factors beyond premiums, such as benefits, copayments, and deductibles. While there is some uncertainty regarding how this provision would be interpreted, it likely would not give the Commissioner any new authority to approve characteristics of health insurance products beyond premiums, such as the types of benefits covered.

Existing DMHC Regulatory Authority Would Remain in Place. Under the measure, DMHC would continue to regulate certain types of health insurance and have the authority to review certain health insurance rates. However, the Commissioner would have the sole authority to approve the rates.

Insurance Filing Fees Collected to Pay for State Administrative Costs. Any additional administrative costs to CDI resulting from the measure would be financed by increased fees paid by health insurance companies.

Prohibition on Consideration of Credit History and Prior Insurance Coverage. The measure also prohibits the use of an individual’s credit history or the absence of prior insurance coverage for determining rates or eligibility for health, automobile, or homeowner’s insurance. Current law already generally prohibits the use of such factors when determining rates or eligibility for health insurance. Current law allows some use of credit history or prior insurance coverage when determining rates or eligibility for automobile and homeowner’s insurance. However, in practice, insurance companies generally have not used such factors.

Fiscal Effects

The most significant fiscal effects of this measure on state and local governments, described in detail below, are on state administrative costs. The net additional state administrative costs from this measure would likely not exceed the low millions of dollars annually, but could be higher in some years. These costs would be funded from additional fee revenues collected from health insurance companies.

Increased State Administrative Costs for CDI. This measure would result in additional costs for CDI, including costs to review and approve health insurance rates and conduct public hearings on proposed rates. These ongoing costs would likely not exceed the low millions of dollars annually. The amount of additional costs would depend on several factors, including how often CDI or consumer representatives challenge proposed rates. The costs could be somewhat higher in the initial years after the measure takes effect. For example, there would be additional one-time costs if CDI reassessed rates that are currently in effect.

Unclear Effects on DMHC’s Administrative Costs. The measure does not directly impose new duties on DMHC, but it could affect DMHC’s administrative costs. The direction and extent of this potential effect is unclear. For example, over time, the degree to which DMHC would continue to review health insurance rates in light of the rate approval authority given to CDI under the measure is unclear. If DMHC reduced or eliminated its rate review activities, this would result in administrative savings of up to several hundred thousand dollars annually. On the other hand, some of DMHC’s administrative costs could increase under the measure if actions taken by the Commissioner resulted in additional regulatory workload for DMHC.

Potential Administrative Costs for Covered California. The measure does not impose new duties on Covered California, but it could result in additional administrative costs. The new rate approval process conducted by CDI would likely result in a longer approval process for some individual and small group health insurance products. To the extent there is a long delay in approval for a product, it could result in that product not being offered during an open enrollment period. This could, in turn, have fiscal effects on Covered California. For example, there could be additional costs to provide consumer assistance to individuals who switch to a different health insurance company. It is unclear whether long delays in rate approvals would occur under the measure or, if they do occur, how often they would occur.

Return to Propositions

Return to Legislative Analyst's Office Home Page