August 12, 2010

Hon. Lois Wolk

Senator, Fifth District

Room 4032, State Capitol

Sacramento, California 95814

Dear Senator Wolk:

At the August 11 informational hearing of the Senate Revenue and Taxation Committee, you asked us to provide further information on our preliminary analysis of the Conference Committee tax swap proposal. In this letter, we will (1) discuss some of the key assumptions for our analysis of the tax swap, (2) provide our estimates of the effects the tax swap, and (3) suggest some alternatives to elements of the tax swap.

As you know, the Conference plan estimates that the tax swap would generate $1.8 billion in net General Fund revenue increases in 2010–11 due to a reduction in the state sales tax rate and an increase in the vehicle license fee (VLF) and personal income tax (PIT) rates. Because both the VLF and PIT are deductible on federal income tax returns for those taxpayers who itemize, the proposal attempts to craft a combination of tax changes that would (1) increase state revenues and (2) still result in each income group in the state paying no net increase in taxes when considering state and federal tax liabilities together.

Estimating Assumptions Are Key to Analysis

Since the release of the Conference tax swap proposal, there has been discussion about the estimates of the total size of increased federal deductions that would occur and the distributional effects of the plan on California taxpayers. These questions are inherently difficult to answer. The results of any analysis depend on a number of key assumptions. In many cases, reasonable minds can differ on the most appropriate assumptions to make. We have reviewed the methodology used by both legislative staff and the Department of Finance (DOF). As discussed more fully below, we have built our own preliminary models that rely on somewhat different assumptions and methodologies as compared to both approaches.

Federal Tax Policy. Under current federal law, federal income tax rates are scheduled to increase in 2011 to their pre-2001 levels. Yet, the President has proposed that the lower tax rates be extended for taxpayers earning below $250,000. Consequently, it is unclear what federal tax rates will be in place for the coming years. (The assumed federal rates affect the value of state income tax deductions—the higher the federal rates, the higher the value of the state income tax deductions.) There are a number of reasonable assumptions that could be made in this area that can significantly affect both the total amount of additional federal tax deductions and their distribution by income group. While we understand that legislative staff and DOF estimates assume the continuation of all the current lower rates, we have assumed the adoption of the President’s proposal to allow higher rates to return for upper incomes.

Effect of Alternative Minimum Tax (AMT). The federal AMT currently affects roughly 75 percent of California taxpayers earning more than $200,000, with a much smaller effect on other taxpayers. It appears that legislative staff and DOF estimates do not account for AMT taxpayers, who would receive no benefit from increasing federal itemized deductions. While difficult to model precisely, our estimate attempts to capture this effect. Given our assumption that the President’s proposal to let the upper-income rate cuts expire will be approved, we assume that only about 30 percent of California taxpayers earning over $200,000 will be subject to AMT. (This is because higher regular tax rates generally reduce the numbers of AMT taxpayers.) We also have assumed that Congress annually extends what is known as the “AMT fix” to prevent additional taxpayers from being subject to the AMT.

Tax Filers Choosing to Itemize. Currently, 62 percent of California taxpayers do not itemize on their federal returns. For those who continue not to itemize, there would be no federal tax benefit from the higher state income and VLF taxes. By increasing state tax rates, however, a greater number of Californians would benefit from itemizing. The issue, therefore, is what percentage of current nonitemizers would begin to itemize. The legislative staff estimates seem to assume that all taxpayers with income over $60,000 would begin to itemize. In contrast, the DOF estimates assume that no taxpayers would change their itemization behavior. We believe the true result would be somewhere in between, and our estimates include an assumption of a modest increase in taxpayers who itemize.

Distributional Effects of Sales Tax and VLF Payments. It is much more difficult to allocate tax impacts by income group for the sales tax and VLF than for the PIT. This is particularly the case with regard to the state’s highest income earners (over $1 million). As with the other estimates, we have taken our best shot at allocating these tax burdens, but they are subject to considerable uncertainty.

Treatment of Taxes Paid by Businesses. A portion of the sales tax and VLF are initially paid by businesses. For purposes of showing the income distribution effects, a key assumption is how these business payments are ultimately borne by individuals. A portion of the effect of tax rate changes would affect individuals outside California. The remaining effects would ultimately be felt by individuals through changes in prices, wages, and other forms of income. It does not appear that the legislative staff estimates adjust for this. Like the DOF, we have attempted to estimate the effect of these tax changes in our distributional analysis. Specifically, building upon some work completed last year by the tax commission, we have allocated most tax paid initially by businesses to the various income groups.

LAO Preliminary Estimates of Effect of Tax Swap

We constructed a preliminary model based on the assumptions described above in an effort to assess the potential impact of the Conference tax proposal. We focused our analysis on 2011–12. For 2010–11, there are two key factors that make the analysis less representative of the ongoing effect. First, as a result of the February 2009 budget agreement, 2010–11 tax rates are higher than their ongoing levels. We felt it was most appropriate to compare the changes to these levels, which will be in effect under current law beginning in 2011–12. Second, as has been observed by DOF, the tax rates presented in the Conference plan assumed that tax rates could be changed as of July 1, 2010. Delayed implementation would necessitate alternative tax rates for this year.

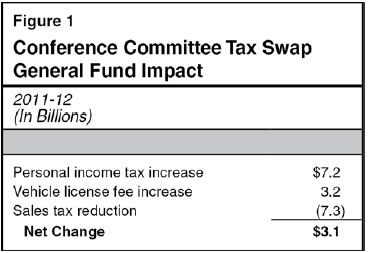

Net General Fund Revenues. As shown in Figure 1, our estimates indicate that in 2011–12 the PIT and VLF tax rate increases would raise more than $10 billion in state General Fund tax revenues. This gain would be offset by a drop in sales tax revenues of over $7 billion. Accordingly, the General Fund would be a net $3.1 billion better off in 2011–12 than under current law.

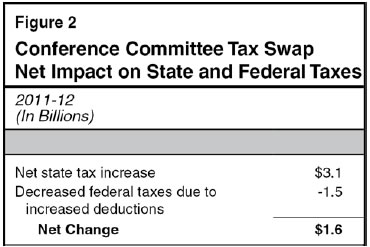

Increased Federal Deductions. While taxpayers would pay $3.1 billion more to the state General Fund in 2011–12, their tax liabilities owed to the federal government would decline for those taxpayers who itemize and are not subject to the AMT. Based on our set of assumptions, we estimate that the increase in federal deductions would reduce federal liabilities by about $1.5 billion. (This is a much lower amount than assumed in the Conference plan and even somewhat smaller than DOF’s.) Consequently, as summarized in Figure 2, taxpayers’ combined state and federal taxes would be higher by about $1.6 billion.

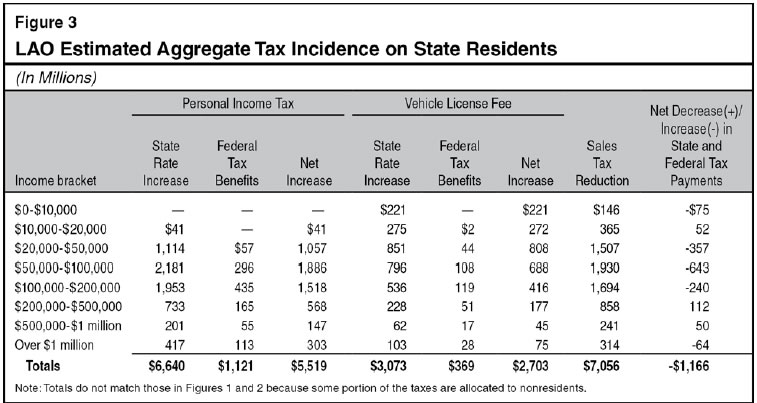

Distributional Effect. Determining the effect of the tax swap by income group is, by far, the most difficult part of the analysis of the Conference proposal. Our analysis of the effect of the swap on each income group of state residents is summarized in Figure 3. (The totals in Figure 3 differ from those in Figures 1 and 2 because some portion of the taxes in the earlier figures are allocated to nonresidents.) Figure 3 shows that several income groups would pay more in net state and federal taxes, including each income group listed between $20,000 and $200,000. Given that the estimates in Figure 3 show an increased aggregate net tax obligation of $1.2 billion for California residents, this is not surprising. As described earlier, the estimated distributional effects of the plan by income group can vary markedly based on different assumptions about federal tax rates and the incidence of the sales tax and VLF.

Volatility

We also looked at the potential impact of the tax swap proposal on the volatility of the state’s tax system. The sales tax is a bit more volatile than personal income as a whole, since it falls heavily on consumer purchases of durable goods. In contrast, the VLF is one of the most stable major revenue sources. The PIT as a whole is the most volatile revenue source, but this is due mostly to the extreme year-to-year variation in income at the top end of the income scale. We estimate that roughly 85 percent of the increase in PIT revenue under the proposal comes from raising rates below the top rate. Income below the top rate shows relatively little annual variation. On balance, the tax swap might slightly reduce the year-to-year volatility of the state’s revenue system.

Other Alternatives

State tax revenues would be increased under the Conference tax rate plan. To the extent that our estimates accurately portray the likely effects of the Conference tax rate changes, however, these changes would fail to meet the other stated policy goal—reducing or holding neutral combined state and federal tax liabilities for all income groups. Yet, the concept of redistributing the state’s tax burden to increase the benefit of federally deductible taxes has merit. Our analysis was focused on using the specific tax rates suggested by the Conference plan. With different tax rates or other modifications, however, we believe there may be the potential to find a more advantageous solution. In essence, the amount of increased federal deductions assumed ($1.5 billion in our analysis) could be available to provide a combination of budget solution and mitigation to taxpayers to offset their higher state taxes.

If you have any further questions on our analysis, please do not hesitate to contact Jason Sisney at 319–8361 or Justin Garosi at 319–8359.

Sincerely,

Mac Taylor

Legislative Analyst

cc: Hon. Darrell Steinberg, President pro Tempore of the Senate

Members of the Senate Revenue and Taxation Committee

Return to LAO Home Page