Projected to End With a Small Reserve. The 2013–14 budget assumed that 2012–13 would end with a $254 million reserve. Our General Fund revenue forecast for 2012–13 now projects $1.65 billion in higher revenues for 2012–13, compared to the budget act’s assumptions. Revenues for 2012–13 ended stronger than was assumed, principally due to personal income tax (PIT) collections. Our higher revenue forecast results in $1.75 billion in additional General Fund expenditures under the Proposition 98 minimum guarantee. That is, for every $1.00 of extra revenue, state spending for schools and community colleges on average is projected to grow by $1.07. This is due to the manner in which the budget plan makes so called “maintenance factor payments” to schools and community colleges. Assuming only minor changes in the entering fund balance, we estimate that 2012–13 ended with a $234 million reserve. While this small reserve equals only 0.2 percent of 2012–13 spending, it nevertheless would be the first positive year–end reserve since 2007–08.

The 2013–14 budget assumed the state would end the fiscal year with a reserve of $1.1 billion. We now estimate that the reserve will more than double—to $2.4 billion—primarily as the net result of the following factors:

- $4.7 Billion in Higher Revenues. Largely due to a higher forecast of capital gains and stronger–than–expected stock price growth, our forecast of PIT revenues for 2013–14 is about $5.2 billion higher than was assumed in the 2013–14 budget. That increase in revenues is partially offset by lower projections of sales and use tax (SUT) and corporation tax (CT) revenues of about $200 million for each of these two tax sources.

- $3.1 Billion in Higher General Fund Proposition 98 Spending. Most of the increased spending in our forecast for 2013–14 is for schools and community colleges. Specifically, we estimate that the Proposition 98 General Fund spending will be $3.1 billion higher than the amount provided in the budget due to our forecast of higher state revenues.

- $0.3 Billion in Other Spending. We estimate that other General Fund spending will be nearly $300 million higher than assumed in the 2013–14 budget. For example, in September 2013 the Legislature passed Chapter 310, Statutes of 2013 (SB 105, Steinberg), which appropriated additional funding to address a federal court order requiring the state to reduce the prison population. We estimate that the California Department of Corrections and Rehabilitation will have net additional spending of nearly $250 million in 2013–14.

These changes have the effect of increasing the 2013–14 operating surplus from the $817 million assumed in the budget to $2.2 billion.

Basis for Our Projections

Purpose of Our Forecast. This forecast does not attempt to predict the budgetary decisions that will be made by the state’s elected leaders. Rather, it is our office’s best estimate of the state’s fiscal condition if current law and current policies remain unchanged through 2019–20. In the near term, therefore, the purpose of this forecast is to provide the Legislature with our best estimate of the resources that will be available in next year’s budget deliberations. Beyond 2014–15, the forecast aims to provide lawmakers with a general sense of the future health of the General Fund budget.

Uses Standard Economic Forecasting Practices. Economic conditions affect not only tax revenues that the state collects, but also state spending levels. For example, the state’s Proposition 98 minimum guarantee for schools and community colleges is determined based on changes in state revenues and economic factors. Further, state spending for health and human services tends to change along with factors such as unemployment, age, and income. Consistent with other mainstream economic forecasts, our forecast assumes that the economy will grow throughout the forecast period. We do not presume that we can predict the timing of recessions.

Forecast Generally Based on Current Laws. Our estimates generally are based on current laws, including those in the State Constitution (such as the Proposition 98 minimum guarantee for schools and community colleges), state statutes, and federal law. In general, this means that we assume taxes and programs operate throughout the forecast period consistent with current law. For example, if state law authorizes a certain tax or program through only part of our forecast period, we generally assume that the law is allowed to play out and that the tax or program expires. For instance, our forecast assumes that the temporary taxes approved by voters in Proposition 30 will expire during the forecast period because it would take a future action either by the Legislature or by voters to extend those taxes.

Forecast Also Considers Certain Recent State Practices. In some cases, we have relied on what has been recent state practice in forecasting revenues and spending. For example, although the state’s hospital quality assurance fee—which offsets General Fund Medi–Cal costs—expires in 2016, the Legislature has extended the fee three times since its initial adoption. In this case, we assume that the current state practice is to continue reauthorizing that fee. Similarly, transfers to the Budget Stabilization Account, the state’s rainy–day fund created by Proposition 58 (2004), have been suspended each year since 2008–09. We assume those suspensions continue throughout the forecast period. Later in this chapter, we discuss how the state might build a comparable reserve under an alternate scenario.

COLAs and Inflation Adjustments Generally Omitted. Consistent with the state laws adopted in 2009 that eliminated automatic cost–of–living adjustments (COLAs) and price increases for most state programs, our forecast generally omits such inflation–related cost increases. This means, for example, that budgets for the universities have not been adjusted for general price increases throughout the forecast period. We include inflation–related cost increases when they are required under federal or state law, as is common in health programs.

Many State Liabilities Remain Unpaid Under Current Law. In the case of state liabilities with repayment dates in state law, we generally assume those liabilities to be repaid according to schedule. For example, our forecast assumes that the deficit–financing bonds authorized by Proposition 57 (2004) continue to be repaid under their established financing mechanism. Other liabilities, however, are not required to be repaid by the state General Fund on any specific timeline under today’s laws and policies. These include some of the items on the Governor’s “wall of debt” (a collection of various budgetary liabilities), along with unfunded liabilities of the California State Teachers’ Retirement System. If the state were to make additional payments toward repaying these liabilities, the operating surpluses projected in our forecast would be reduced by like amounts.

We project that the General Fund operating surplus in 2014–15 will be $3.2 billion, an increase of about $1 billion from our forecast of the 2013–14 operating surplus. Generally, the larger operating surplus is the result of our forecast of revenues growing faster than our forecast of expenditures. In 2014–15, we project that General Fund revenues and transfers will grow 5.7 percent and that spending will grow 4.8 percent. Specifically, our forecast reflects the following:

- $5.8 Billion in Higher Revenues. While revenue growth is expected to be somewhat depressed in 2013–14—due mainly to higher income taxpayers accelerating 2013 income into 2012—we expect revenues to bounce back in 2014–15, principally related to PIT growth. Specifically, we forecast PIT growth in 2014–15 to be 8.1 percent for a year–over–year increase of $5.4 billion. Further, we forecast 2014–15 growth in the CT and SUT to be 6.9 percent and 3.3 percent, respectively.

- $3.3 Billion in Higher General Fund Proposition 98 Spending. Our forecast of healthy revenue growth in 2014–15 produces additional growth in Proposition 98 spending. We estimate that General Fund spending needed to satisfy the Proposition 98 guarantee will increase $3.3 billion over our revised projection of 2013–14 spending levels.

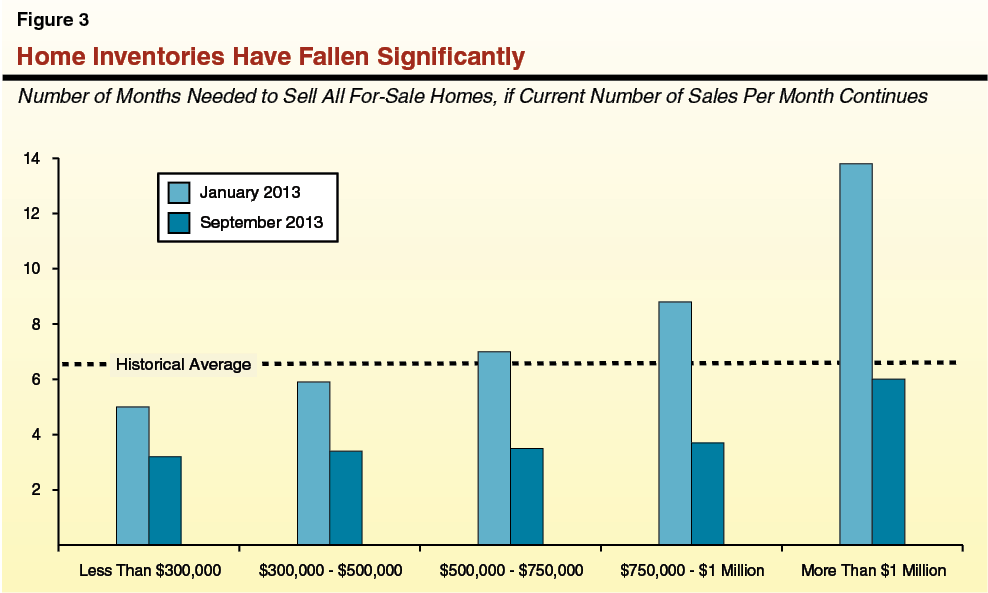

- $1.5 Billion in Higher Spending in Other Parts of the Budget. Outside of Proposition 98, we forecast that spending will increase by $1.5 billion in 2014–15. Most notably, this includes increases of $630 million in debt service on infrastructure bonds and about $600 million in health and human services (excluding California Work Opportunity and Responsibility to Kids [CalWORKs]). The higher spending is offset by increased savings of $650 million related to a decision in the 2013–14 budget to redirect certain realignment funds to help pay for what otherwise would be state costs for CalWORKs.

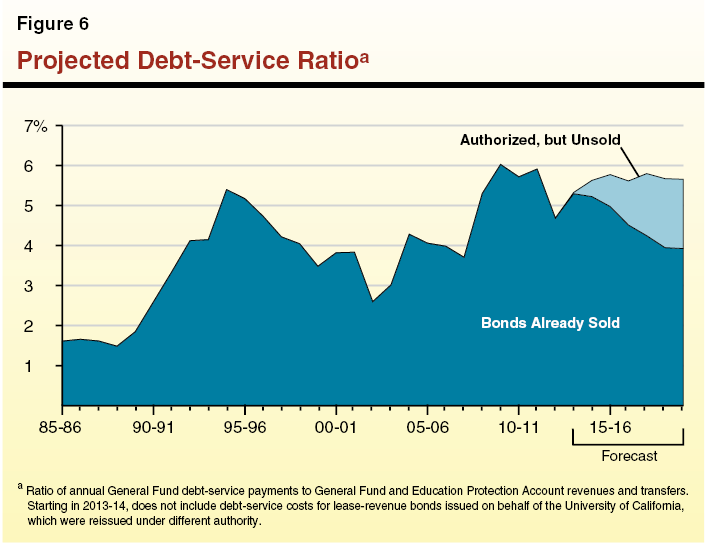

As shown in Figure 2, we project that operating surpluses will grow at a rate of between about $1 billion and $3 billion each year between 2014–15 and 2017–18, at which point we estimate that they will reach $9.6 billion under current laws and policies. As the temporary taxes authorized by Proposition 30 phase out over several fiscal years near the end of our forecast period, we project that operating surpluses will remain stable as revenues and expenditures grow at similar rates. All this is premised upon our assumption of continuing economic growth through 2020.

In the Near and Medium Term, Strong Revenue Growth. Proposition 30 increased PIT rates on high–income taxpayers from 2012 through 2018, and SUT rates from 2013 through 2016. Under our forecast, Proposition 30 greatly influences revenue growth, particularly in the case of the PIT. Because taxable income has been growing faster for high–income taxpayers, by increasing the marginal PIT rates on those individuals, Proposition 30 has the effect of boosting PIT growth higher than it would be otherwise. In 2014–15 and 2015–16, we forecast total General Fund revenues and transfers to grow 5.7 percent in each year. We project revenue growth to slow thereafter to 4.6 percent in 2016–17 and 4.3 percent in 2017–18, due largely to the phase out of the ¼–cent sales tax increase authorized by Proposition 30.

As Proposition 30 PIT Increases Phase Out—Much Slower Revenue Growth Forecasted. Under Proposition 30, the increase in PIT rates for high–income taxpayers generates a much greater proportion of revenue than the sales tax increase. As a result, the phase out of the higher rates in 2018–19 and 2019–20 has a much more significant impact on revenue growth. Over these two fiscal years, we project that General Fund revenues grow at an average annual rate of only 1.9 percent. As shown in Figure 2, this has the effect of stabilizing the projected trend of annual operating surpluses, as revenues and expenditures grow at similar rates in those two years. In fact, the phase out of Proposition 30 would have had the effect of reducing those operating surpluses in 2018–19 and 2019–20, were it not for projected property tax growth and the end of the “triple flip,” as described below.

General Fund Benefits From Property Taxes, End of Triple Flip in Our Forecast. The Proposition 98 minimum guarantee is funded by two revenue streams—state General Fund support and local property tax revenue distributed to schools. In most years, this local property tax revenue offsets the amount that the state must spend on schools and community colleges, resulting in dollar–for–dollar savings for the General Fund. We project that in the later years of our forecast increases in the Proposition 98 minimum guarantee will largely be paid from school property tax growth. Specifically, while we project that General Fund Proposition 98 spending will increase by 7.8 percent in 2014–15 and 4.4 percent in 2015–16, we forecast it to slow thereafter to an average annual rate of just 0.9 percent for the remainder of the forecast period. The property tax–related factors include:

- Healthy Local Property Tax Growth. As described in Chapter 3, over the next several years, we project underlying local property taxes to grow, on average, about 7 percent each year. This is consistent with average historical growth, but above levels seen in recent years.

- Increased Property Taxes Due to Redevelopment Dissolution. We project that school property taxes related to the dissolution of redevelopment agencies (RDA) will increase from $763 million in 2013–14 to $1.9 billion in 2019–20. These state savings will be offset somewhat by decreases in the revenues from RDA assets over the period.

- End of Triple Flip. Finally, we project that the triple flip—a complex financing mechanism created to repay the state’s deficit–financing bonds of the 2000s—will turn off in 2016–17, resulting in an annual General Fund benefit of about $1.6 billion beginning in 2016–17.

Forecast Reflects Continued Improvement in State’s Finances. In our November 2012 Fiscal Outlook report, we projected that with continued growth in the economy and restraint in new program commitments, the state budget could experience multibillion–dollar operating surpluses within a few years. Since that time, our forecast of General Fund revenues and transfers has increased by a few billion dollars for 2013–14 and 2014–15, and by between $2 billion and $3 billion for each of 2015–16 through 2017–18. In the June budget package for 2013–14, the Legislature and the Governor limited new commitments to a small handful of areas. These factors produce a budgetary situation for 2014–15 that is even more promising than we projected last year.

Surpluses Dependent on Several Key Assumptions. Despite the large reserve that we are projecting for the 2014–15 budget process, the state’s continued fiscal recovery is dependent on a number of assumptions that may not come to pass. Specifically, our forecast assumes:

- Continued Economic Growth. Our forecast assumes steady, moderate economic growth, typical of that seen during a mature economic expansion. This growth drives the increase in revenues and contributes to lower General Fund spending in some areas of the budget (such as CalWORKs grant payments). This assumed economic growth also informs our forecast of local property tax growth, which as mentioned earlier offsets General Fund spending required to meet the Proposition 98 minimum guarantee. Economic growth, therefore, is probably the most important assumption in our forecast.

- Many Budgetary and Retirement Liabilities Remain Unpaid. As described earlier, our forecast assumes that some of the state’s budgetary and retirement liabilities are repaid. For example, we assume that the state increases payments to the California Public Employees’ Retirement System (CalPERS) as required by the CalPERS board, which will reduce the state’s unfunded liabilities for state employee pension benefits over time. Other liabilities, however, are not required to be repaid from the state General Fund on specific timelines under today’s laws and policies. These include some of the items on the Governor’s wall of debt, along with massive retirement liabilities related to the California State Teachers’ Retirement System. If additional payments are made in the future to repay these various liabilities, the operating surpluses in our forecast would be reduced by a like amount. (Besides support from the General Fund, other sources of funding—from school districts and teachers, for example—and other policy decisions may be needed to address some of these liabilities over time.)

Recession Possible During Forecast Period. Like other economic forecasters, we are unable to predict the timing of either a major slowdown in the economy or an actual recession. The severity of the most recent recession may result in a longer–than–average economic expansion. However, it is possible that a recession will occur before 2020. In fact, the current U.S. economic expansion is already over four years old. Since World War II, the average expansion has been just under five years.

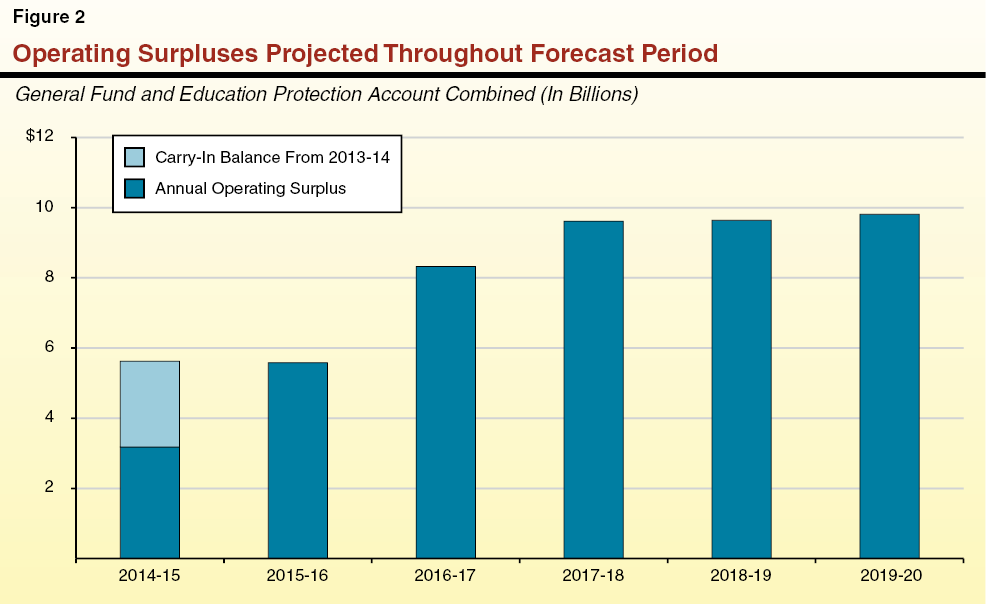

Sketch of Hypothetical Recession. To demonstrate the budgetary effects of a possible recession, we have produced one hypothetical recession scenario, as displayed in Figure 3. We developed this scenario to simulate how a moderate recession could affect state finances, but this is merely an illustration of one possible scenario—the severity of an actual recession sometime during the future could be stronger or weaker than that portrayed in Figure 3. In the scenario displayed in Figure 3, revenues fall 10 percent below what our forecast would otherwise be for 2015–16, and then 15 percent below forecasted levels for 2016–17. The revenue losses would be offset somewhat by lower Proposition 98 minimum requirements, and we assume that the state would reduce spending to the lower allowed spending levels. Specifically, the Proposition 98 minimum guarantee would decline 8 percent below what our forecast would otherwise be in 2015–16, and then 12 percent below for 2016–17.

Hypothetical Moderate Recession Would Produce Operating Deficits. In 2013–14 and 2014–15, Figure 3 starts with the same $2.4 billion “carry–in balance” from 2013–14 and the same $3.2 billion operating surplus for 2014–15 as under our standard forecast. Aside from the factors mentioned above, we assume the same set of current laws and policies as under our standard forecast. As such, we assume that no additional ongoing commitments are made in either 2013–14 or 2014–15 and that the entire $5.6 billion is effectively held in reserve. Under this scenario, the state would face a roughly $900 million operating deficit in 2015–16, which would then grow to about $2.4 billion in 2016–17.

A $5.6 Billion Reserve Could Absorb Deficits Under Hypothetical Scenario. As we mentioned earlier, this is merely a sketch of one hypothetical recession. The severity of an actual recession during our forecast period could be stronger or weaker. Nevertheless, absent additional ongoing commitments, the $5.6 billion reserve that we project for the state budget by the end of 2014–15 could more than absorb the combined $3.3 billion in operating deficits over the two–year period of this hypothetical recession. On the other hand, if the entire $5.6 billion were committed to ongoing spending prior to 2015–16, under this scenario the operating deficits would grow by a similar amount (to perhaps $6.5 billion in 2015–16 and $8 billion in 2016–17), requiring the Legislature and the Governor to address large budget shortfalls. This illustration demonstrates the importance of building a sizable reserve in preparation for the next economic downturn. Caution, therefore, is appropriate in weighing new spending both within Proposition 98—as total funding for schools and community colleges would decline under this scenario—and on the non–Proposition 98 side of the budget. Absent a prudent reserve, the Legislature could well face during the next economic downturn some of the same difficult decisions that it was required to make during the past decade.

The state’s budgetary condition is stronger than at any time in the past decade. The state’s structural deficit—in which ongoing spending commitments were greater than projected revenues—is no more. Furthermore, assuming continued economic growth, the Legislature and the Governor will have choices for how to allocate multibillion dollar surpluses. Our forecast indicates that there is room in the budget for new ongoing spending commitments. (In fact, Proposition 98 will require major additional spending for schools.) But as discussed earlier, committing too much too soon could create budget shortfalls in the event of an economic downturn. Further, the state has commitments that were made in the past—principally retirement liabilities and, to a lesser extent, budgetary liabilities—that have yet to be funded. And the state in recent years has not provided many of our existing programs with inflation adjustments. As inflation increases—as may occur in the next few years—it will be harder to ignore its limiting effects on purchasing power for state programs. Figure 4 displays one rough approach for using potential surpluses that prepares for the next economic downturn while paying for past commitments, maintaining existing programs, and making new commitments.

Figure 4

An Approach to Using Possible Surpluses

General Fund and Education Protection Account Combined (In Billions)

|

|

2013–14

|

2014–15

|

2015–16

|

2016–17

|

2017–18a

|

2018–19a

|

2019–20a

|

|

LAO Operating Surpluses

|

$2.4b

|

$3.2

|

$5.6

|

$8.3

|

$9.6

|

$9.6

|

$9.8

|

|

Prepare for Next Downturn

|

|

|

|

|

|

|

|

|

Build $8 billion reserve by 2016–17

|

2.4

|

1.9

|

1.9

|

1.9

|

—

|

—

|

—

|

|

Pay off remainder of “wall of debt”c

|

—

|

—

|

1.2

|

2.3

|

3.1

|

—

|

—

|

|

Pay for Past Commitments

|

|

|

|

|

|

|

|

|

Pay down unfunded retirement liabilities (CalSTRS, retiree health, and UC pensions)

|

—

|

0.5

|

1.0

|

1.5

|

2.0

|

2.5

|

3.0

|

|

Maintain Existing Programs

|

|

|

|

|

|

|

|

|

Inflation increases for various state programsd

|

—

|

0.4

|

0.6

|

1.2

|

1.8

|

2.5

|

3.2

|

|

Create New Commitments

|

|

|

|

|

|

|

|

|

Program expansions, tax reductions, and infrastructure

|

—

|

0.5

|

1.0

|

1.5

|

2.0

|

2.5

|

3.0

|

Preparing for the Next Economic Downturn. In our view, this is the most important category in Figure 4 during the early years of our forecast. Building a strong reserve and repaying some of our budgetary liabilities would enhance the state’s fiscal condition in preparation for the next economic downturn. In Figure 4, we suggest the state aim for an $8 billion reserve in the state’s Special Fund for Economic Uncertainties by 2016–17. (We chose a target of $8 billion based on the size of the reserve envisioned by Proposition 58 [2004].) We suggest that the Legislature begin building this reserve by maintaining the entire $2.4 billion carry–in reserve from 2013–14 that we forecast. Given that we are nearly halfway through 2013–14, the strategy for other categories in Figure 4 would begin with the 2014–15 fiscal year. As discussed in Chapter 3, if the Legislature used all of the additional funds that would be provided to Proposition 98 in our forecast for 2012–13 and 2013–14, along with half of the growth in 2014–15, the state could retire at least three–quarters of the Proposition 98 obligations in the Governor’s wall of debt. In 2015–16, we show how the state could begin to pay down the non–Proposition 98 items in the wall of debt not already assumed to be repaid under our forecast, including settle–up payments to schools and community colleges. This approach satisfies the dual goals of (1) building a strong reserve and (2) eliminating the budgetary liabilities before the temporary taxes authorized by Proposition 30 expire at the end of 2018.

Paying for Past Commitments. While our recent fiscal forecasts have indicated a sharp turnaround in the state’s budgetary condition, we have continued to highlight various retirement obligations that remain unaddressed. Most notably, these include the $71 billion unfunded liability for pension benefits already earned by the state’s teachers and administrators. The University of California’s (UC’s) pension plan also must continue addressing a significant funding issue, and state and California State University (CSU) retiree health benefits are not being funded as employees earn those benefits. The approach outlined in Figure 4 would commit an additional $500 million each year to address these liabilities, which would result in $3 billion of total new annual funding for these liabilities by 2019–20. Even if the state provides this added annual funding, additional payments from other units of government and public employees—or other policy changes—would be required to address these unfunded retirement obligations over the next three decades or so.

Maintaining Existing Programs. State laws adopted in 2009 ended automatic inflation adjustments for many state programs. (Some programs are either exempt from this requirement or must provide adjustments by federal rules.) If a program’s budget is held constant over a given period, public services are in a sense reduced by inflation for that period. This is because as the price of goods and services increase over time, a fixed dollar amount is able to purchase less goods and services. Over the past few years, this has been a minor problem because inflation rates have been very low. Over the next few years, however, inflation may return closer to historical norms. When this occurs, there will be more spending pressures on state–funded programs. Figure 4 shows the cost of providing inflation adjustments to programs that do not already receive such adjustments in our forecast. These programs include UC, CSU, State Supplementary Payment (SSP) grants, and the judicial branch. (Amounts listed in Figure 4 for 2014–15 and 2015–16 are net of costs in recently negotiated pay increases for state employees.)

Creating New Commitments. The Legislature has implemented billions of dollars in cuts over the past decade. Clearly, there is pent up demand for restoring some of those cuts, as well as creating new commitments. It is appropriate for the Legislature to begin debating how to prioritize the use of possible surpluses for new commitments beginning in 2014–15. We estimate that the 2014–15 Proposition 98 minimum guarantee will increase $6.4 billion compared with the 2013–14 spending level. Outside of Proposition 98, gradual spending increases would avoid overcommitting state resources, thereby reducing the possibility of future budget imbalances in the event of an economic downturn. As a rough example, the approach in Figure 4 provides $500 million in new commitments each year above totals already assumed in our forecast for program restorations/expansions, tax reductions, and infrastructure spending (including any future bond authorizations, such as a water bond). By 2019–20, this would result in $3 billion for such new commitments.

Overcommitting Now Could Bring Back Budget Shortfalls. The state’s elected leaders have made very difficult choices in recent years that were necessary to eliminate the state’s structural budget deficit. These choices included reductions in ongoing spending commitments, as well as the temporary taxes authorized by the voters in Proposition 30. The state’s actions, combined with modest economic growth over the past few years, have put the state budget on the verge of a possible multibillion dollar surplus. Continuing to improve the state’s fiscal health will require a balanced strategy of building reserves, retiring budgetary liabilities, and paying for past commitments. Such a strategy would also allow our current programs to keep up with inflation and provide an opportunity to make new program commitments. If, however, too many ongoing spending commitments are made too soon, and a prudent reserve is not built up in the next few years, the state budget could be unprepared for the next economic downturn. In that case the state’s elected leaders could be faced with many of the same difficult choices that they were forced to make over the past decade.

Figure 1 summarizes our current forecast assumptions for the U.S. and California economies between now and 2020. Our forecast assumes continuation of the current economic recovery, but at a somewhat faster pace than recent years. The recovery is projected to be driven by the following key factors:

- The recovery of housing markets (discussed later in this section).

- Little or no additional fiscal contraction by the federal government over the next few years and a gradual tightening of monetary policy by the Federal Reserve (also discussed in this section).

- Improving job markets, accompanied by a decline in national and state unemployment rates.

Figure 1

LAO Economic Forecast Summary

|

United States

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

|

Percent change in:

|

|

|

|

|

|

|

|

|

|

Real gross domestic product

|

1.5%

|

2.5%

|

3.2%

|

3.2%

|

3.1%

|

2.9%

|

2.8%

|

2.5%

|

|

Personal income

|

2.8

|

4.7

|

4.9

|

5.2

|

5.4

|

5.1

|

4.8

|

4.5

|

|

Wage and salary employment

|

1.6

|

1.7

|

1.8

|

1.8

|

1.6

|

1.2

|

0.9

|

0.7

|

|

Consumer price index

|

1.5

|

1.6

|

1.7

|

1.9

|

1.9

|

1.9

|

1.9

|

2.0

|

|

Unemployment rate

|

7.5%

|

7.1%

|

6.5%

|

6.0%

|

5.7%

|

5.4%

|

5.1%

|

5.0%

|

|

Housing starts (thousands)

|

914

|

1,152

|

1,481

|

1,611

|

1,605

|

1,613

|

1,634

|

1,615

|

|

Percent change from prior year

|

16.7%

|

26.1%

|

28.5%

|

8.8%

|

–0.4%

|

0.5%

|

1.3%

|

–1.2%

|

|

S&P 500 average monthly levela

|

1,637

|

1,780

|

1,850

|

1,930

|

1,992

|

2,055

|

2,128

|

2,203

|

|

Average target federal funds rate

|

0.1%

|

0.2%

|

0.4%

|

2.2%

|

3.8%

|

4.0%

|

4.0%

|

4.0%

|

|

California

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

|

Percent change in:

|

|

|

|

|

|

|

|

|

|

Personal income

|

2.1%

|

5.4%

|

5.5%

|

5.5%

|

5.6%

|

5.4%

|

5.4%

|

5.2%

|

|

Wage and salary employment

|

1.7

|

2.2

|

2.0

|

1.8

|

1.5

|

1.2

|

1.4

|

1.3

|

|

Consumer price index

|

1.5

|

1.6

|

1.7

|

1.9

|

1.9

|

1.9

|

1.9

|

2.0

|

|

Unemployment rate

|

8.9%

|

7.8%

|

7.1%

|

6.5%

|

6.0%

|

5.7%

|

5.3%

|

4.9%

|

|

Housing permits (thousands)

|

88

|

120

|

136

|

149

|

155

|

158

|

160

|

161

|

|

Percent change from prior year

|

50.4%

|

36.1%

|

13.9%

|

9.6%

|

3.7%

|

1.8%

|

1.3%

|

0.9%

|

|

Single–unit permits (thousands)

|

40

|

61

|

68

|

76

|

78

|

79

|

78

|

78

|

|

Multi–unit permits (thousands)

|

48

|

59

|

68

|

74

|

77

|

79

|

82

|

84

|

|

Population growth rate

|

0.8%

|

0.9%

|

0.9%

|

0.8%

|

0.7%

|

0.7%

|

0.7%

|

0.7%

|

Comparisons With Recent Economic Forecasts. Figure 2 compares some key forecast assumptions for the U.S. and California in 2013 and 2014 with those of some other recent forecasts by our office, the state’s Department of Finance, and the UCLA Anderson Forecast, a research effort of the UCLA Anderson School of Management. All of these forecasts assumed the same three factors—described above—helped fuel this recovery. In general, however, we now forecast somewhat weaker economic growth for the nation and California in 2013 and 2014, as compared to our last forecast in May. Federal fiscal and tax policies—and, to a minor extent, the uncertainty resulting from last month’s shutdown and debt ceiling debate—seem to be slowing economic growth somewhat in 2013. (Significant methodological changes affecting the calculation of personal income and various other national and state economic data—especially changes to state personal income calculations implemented by federal data agencies in late September 2013—make it difficult to compare our current personal income forecast to prior forecasts.)

Figure 2

Comparing LAO November Forecast With Other Recent Forecasts

|

|

2013

|

|

2014

|

|

LAO May 2013

|

DOF May 2013

|

UCLA Sept. 2013

|

LAO Nov. 2013

|

LAO May 2013

|

DOF May 2013

|

UCLA Sept. 2013

|

LAO Nov. 2013

|

|

United States

|

|

|

|

|

|

|

|

|

|

|

Percent change in:

|

|

|

|

|

|

|

|

|

|

|

Real gross domestic product

|

2.0%

|

2.0%

|

1.5%

|

1.5%

|

|

2.8%

|

2.8%

|

2.8%

|

2.5%

|

|

Personal income

|

2.8

|

2.8

|

2.6

|

2.8

|

|

5.1

|

5.1

|

5.1

|

4.7

|

|

Wage and salary employment

|

1.5

|

1.5

|

1.6

|

1.6

|

|

1.6

|

1.6

|

1.6

|

1.7

|

|

Consumer price index

|

1.4

|

1.8

|

1.5

|

1.5

|

|

1.6

|

1.9

|

1.7

|

1.6

|

|

California

|

|

|

|

|

|

|

|

|

|

|

Percent change in:

|

|

|

|

|

|

|

|

|

|

|

Personal incomea

|

3.3%

|

2.2%

|

3.8%

|

2.1%

|

|

5.9%

|

5.7%

|

5.7%

|

5.4%

|

|

Wage and salary employment

|

2.0

|

2.1

|

1.7

|

1.7

|

|

2.5

|

2.4

|

1.9

|

2.2

|

|

Unemployment rate

|

9.3%

|

9.4%

|

8.9%

|

8.9%

|

|

8.3%

|

8.6%

|

7.9%

|

7.8 %

|

|

Housing permits (thousands)

|

91

|

82

|

79

|

88

|

|

123

|

121

|

104

|

120

|

While several key economic variables are weaker than assumed in our most recent forecast, stock prices were considerably stronger through early November 2013 than our office assumed earlier this year. This has important implications for the state’s personal income taxes, which we discuss later in this report.

The Possibility of a Future Recession. A recession occurs when there is a significant decline in economic activity that spreads across the economy and lasts at least a few months. Our economic forecast currently does not assume that a recession occurs between now and 2020, but of course, one is possible. Consistent with other mainstream economic forecasters, we generally assume in our forecast the continuation of the current economic expansion cycle in line with projected long–term trends. In other words, like most economic forecasters, we do not presume that we can predict the timing of future recessions or significant economic downturns.

The current, slow national economic expansion began in June 2009. Since the Civil War, the longest U.S. economic expansion lasted ten years (from March 1991 to March 2001). Since World War II, the average U.S. economic expansion has lasted just under five years. The severity of the most recent recession—the longest and deepest since World War II—may give rise to a longer than average economic expansion that lasts well into the late 2010s or early 2020s. In other words, with growth currently so slow and so many unemployed, it may be a while before the economy “overheats” again and then contracts. On the other hand, recessions could be triggered by various causes that are difficult to predict (such as a terrorist attack or international conflict), and therefore, a recession could occur at any time. In Chapter 1, for example, we discussed how one future, hypothetical recession scenario might affect state finances.

The federal government is the nation’s largest employer and purchaser of health care services. It levies considerably more taxes than either state or local governments. Federal regulations also affect most parts of the economy. The U.S. government’s fiscal, policy, and monetary decisions, therefore, affect virtually every element of our economic forecast. This section discusses the effects of the October 2013 federal government shutdown and debt ceiling debates, how currently restrained federal fiscal policy affects our forecast, and our forecast assumptions concerning monetary policy.

Assumed Slowdown in Growth in Late 2013. Two key events—the partial shutdown of federal government operations in October 2013 and uncertainty about whether federal leaders would increase the government’s maximum authorized debt levels (the “debt ceiling”)—are believed to have slowed U.S. economic growth during the current quarter (October through December 2013). Our office’s economic forecast—largely developed in the first half of October during the shutdown—assumes that 2013 annual real gross domestic product (GDP) growth is between 0.1 and 0.2 percentage points lower than it otherwise might be due to the various negative effects of the shutdown and debt ceiling debate. (Other actions of the federal government earlier this year—discussed later in this section—resulted in an additional drag on 2013 growth.)

The main effects of the shutdown and debt ceiling on economic growth may have been the loss of some economic activity and hiring by federal contractors during the current quarter, as well as increased consumer and business uncertainty. Because the shutdown has affected federal economic data gathering (and is resulting in one–time changes to certain economic statistics for the month of October), it will take some time before the effects of the federal debates can be known with a higher degree of confidence.

Shutdown and Debt Ceiling Deadlines Not Assumed to Affect Economy in 2014. Enactment of a continuing appropriations act on October 17 ensured that the federal government avoided defaulting on debt or its other spending commitments until at least a few weeks after the next formal debt ceiling deadline: February 7, 2014. As occurred this year, the U.S. Treasury will be able to use “extraordinary measures” in other federal accounts to avoid default until a few weeks after the February 7 deadline—likely until some point in March, a period during which the Treasury typically sends out large amounts of individual income tax refunds. The act also funds the federal government until January 15 at current spending levels—reduced earlier this year under the U.S. government’s sequestration process for automatic spending reductions. Accordingly, after January 15, another partial government shutdown is possible.

While these federal deadlines create the possibility of additional economic disruptions in early 2014, our forecast assumes little or no economic slowdown next year related specifically to those deadlines. Financial markets and many other participants in the economy seem desensitized to the recurring budget debates in Washington, and with the last shutdown, federal leaders acted on a bipartisan basis to repay federal workers who were prohibited from working during the period. (If such repayments occurred after any future shutdowns, the economic impact would be minimized.) Our forecast assumption—for little or no economic effect next year due to these federal debates—will more likely prove to be correct if federal leaders either come to agreement quickly on 2014 budget matters or pass yet another continuing appropriations bill and debt ceiling expansion in advance of the current deadlines. If our assumption proves incorrect and the 2014 deadlines result in additional drags on economic growth, various economic metrics—GDP, personal income, employment, stock prices, and other assumptions—could be negatively affected, and California’s fiscal situation could be weakened to an unknown extent.

Forecast Could Be Affected by Major Tax, Budget, and Other Policy Choices. Our forecast also could be affected to the extent that federal leaders come to agreement soon on some of the major policy issues they have been discussing, including changes to the nation’s tax code, alterations to future health and Social Security benefits, modifications to the 2010 health care law known as the Patient Protection and Affordable Care Act (ACA), and changes to immigration policies. These types of changes could affect various aspects of the economy in significant ways—either positively or negatively.

Spending on health care makes up 18 percent of U.S. GDP. Implementation of the ACA will affect many decisions by businesses and employers, state and local governments, insurance companies, and health care providers. Both our state spending and economic forecasts contain various assumptions about health care costs in future years. It is likely that the significant changes resulting from the new law will result in economic changes that differ from those assumed in mainstream forecasting models, such as those in our forecast. This will affect both the U.S. and California economic forecasts in the future—either positively or negatively.

The U.S. government runs annual budget deficits in most years. It issues sovereign debt—U.S. Treasuries—to the investing public and to certain government accounts (such as the Social Security trust fund) to fund those deficits. The annual budget deficits and total federal debt each are expressed as a percentage of GDP in any given year. Currently, the annual budget deficit of the federal government totals about 4 percent of GDP, and total federal debt held by the public totals 73 percent of GDP.

Shrinking Recently, Deficits Expected to Grow in the Future. In recent months, as a result of various federal tax and spending actions, the end of spending for recession stimulus programs, and the recovery of the economy, the federal government’s annual budget deficits have shrunk considerably—from 10 percent of GDP in 2009 to roughly 4 percent of GDP now. Health care inflation also has been slowing, contributing to lower annual deficits. The Congressional Budget Office (CBO) estimates that deficits would decline further under current federal policies to 2 percent of GDP by 2015. Deficits are forecast to gradually rise again thereafter due to projected increases in interest rates (which increases interest costs on the national debt), spending pressures resulting from the nation’s rapidly aging population, and continued inflation in health care costs. According to the CBO, these gradual increases in deficits could take total federal debt held by the public to near–record levels—around 100 percent of GDP—by the late 2030s. As its sovereign debt levels rise, the U.S. economy and federal budgets could become more vulnerable to economic shocks. For example, the federal government could be less able to run deficits, as it did in recent years, to aid state and local government finances during recessions.

Federal Fiscal Policy Has Slowed the Recent Economic Recovery. In the past few years, federal fiscal and policy decisions have slowed the rate of U.S. economic growth. In September, Moody’s Analytics, an economic advisory firm, estimated that the drag on the economy from (1) recent sequestration and other federal spending cuts, (2) increases in payroll taxes, (3) increases in taxes on high–income earners, and (4) other fiscal actions that went into effect this year is reducing 2013 real GDP growth by about 1.5 percentage points. This federal fiscal policy drag is greater than in any other year since the defense drawdown that followed World War II, according to that firm. Other estimates vary. If, however, one assumes that the Moody’s analysis is correct, this would mean that, if federal fiscal policy were economically neutral (producing no fiscal drag), our forecast might be for real GDP growth in 2013 of about 3 percent—roughly double the level of economic expansion we are currently projecting.

Forecast Assumes No Additional Major Federal Fiscal Restraints. With the federal sequestration policy scheduled to ramp up in the coming months, it appears that the economic drag from federal fiscal restraint is approacing its peak, assuming no further substantial increases in taxes or decreases in spending in the near term. Our forecast assumes that federal policymakers act in the coming months to relax the currently scheduled sequestration cuts a bit—for example, by reducing scheduled defense cuts. For federal fiscal year 2014, the forecast assumes a federal budget slightly higher than the $967 billion for annually appropriated domestic and defense programs that was approved by the House of Representatives. Federal spending is forecast to grow in future years at less than the rate of nominal GDP growth. Our economic forecast also assumes the gradual elimination of extended unemployment insurance benefits over several years, rather than having them disappear entirely in 2014.

Budget Adjustments Will Affect Future Economic Growth. There is general consensus that the federal government will have to implement fiscal and/or tax policy changes to reduce its debt levels in future decades. There are, however, substantial disagreements over when and how such changes should be implemented and on the size of such adjustments. As CBO has noted, federal leaders face trade–offs in deciding how quickly to implement policies to moderate the future growth of federal debt. For example, to reduce projected federal debt in the late 2030s to about 70 percent of GDP, the combination of increased revenues and decreased spending would have to equal about 1.9 percent of GDP per year if implemented beginning in 2025, rather than 0.9 percent of GDP per year if implemented beginning in 2014. (Those simulations omit the effects that deficits and debt would have on economic growth and interest rates. Incorporating such effects would make the impact of delaying policy changes even larger, CBO says.) To the extent that these policy changes affect the overall economy, economic growth for California and the nation may slow in the future, relative to past trends.

Accommodative Monetary Policy Still in Place. In September 2013, the Federal Reserve surprised many financial market participants by opting to keep in place its current monetary policy for the time being. That policy involves both short–term interest rates (specifically, the federal funds rate) of near zero and regular purchases by the Federal Reserve of both mortgage–backed and longer–term U.S. Treasury bonds. These purchases—known as “quantitative easing”—are intended to maintain downward pressure on long–term interest rates, support mortgage markets, and generally boost the slow economic recovery. At the same time, inflation remains very low, such that the Federal Reserve’s Open Market Committee has noted that “inflation persistently below its 2 percent objective could pose risks to economic performance.”

Forecast Assumes Gradual Tightening of Monetary Policy. As the economy expands, gradual tightening of federal monetary policy is likely. Our forecast assumes that “tapering”—the gradual elimination of the Federal Reserve’s bond purchase programs—starts in late 2013 or early 2014. Further, the Federal Reserve is expected to keep its near–zero federal funds rate target until late 2015, when the U.S. unemployment rate is assumed to decline to about 6.5 percent. In the later years of our forecast, the federal funds rate is assumed to rise again to around 4 percent in 2017. (The federal funds rate was last above 4 percent in January 2008.)

By most measures, the recent collapse of California’s housing market was more widespread and severe than downturns in other parts of the country. From the peak of the market in 2006 and 2007 to the low point during the housing crisis, a key measure of home values suggests that they fell about 50 percent. The median home sales price—a common measure that is influenced by which homeowners choose to sell—plummeted from a peak of $600,000 to $245,000. Over roughly the same period, California shed nearly 1.4 million jobs, a contraction of 9 percent. For many, the interaction of these two declines represented an unprecedented shock to household net worth and monthly finances. Households have slowly repaired their balance sheets since then while home prices, especially since early 2012, have made up substantial lost ground. In this section, we discuss housing’s role in the California economy, recent trends, and our forecast of housing activity.

The housing market affects the economy in three major ways: household net worth, migration trends, and construction activity. First, rising home prices improve homeowners’ financial standing, often leading them to increase spending. On average, each dollar increase in home values leads to a three–cent increase in spending. By contrast, each dollar decline in home value leads to a 10–cent reduction in other spending. Through this channel, home prices affect consumption of goods and services, which has ripple effects throughout the economy. Home prices also affect migration trends—that is, where people decide to live and work. For example, a localized increase in house prices beyond what occurs in the rest of the country makes residing in California comparatively more expensive, resulting in a negative effect on population growth. The final way housing prices affect the economy is more indirect. Rising prices encourage new construction. An increase in construction jobs typically spurs job growth in other sectors that are dependent on local demand such as retail and restaurants.

Although construction activity and employment are crucial to the state’s near–term prospects, construction itself cannot sustain a local economy over the long–term. This is because economic growth, including demand for new housing, relies on increased overall income in an area. This, in turn, can be spurred by such sectors as manufacturing and technology, which sell products in national and international markets, thereby capturing outside income.

California’s housing sector improved broadly during 2012 and the first half of 2013. One year ago, we noted that a sustainable housing recovery appeared imminent. After losing ground throughout 2011, California single–family home prices have climbed 25 percent. Though initially led by the state’s coastal areas, home price appreciation is now widespread, with year–to–date increases that exceed 8 percent in each of the state’s 28 metropolitan regions. These gains indicate healthy housing demand, but also help to mend household balance sheets as price appreciation boosts homeowner equity. Equity improvements reduce the number of “underwater” homeowners, whose outstanding mortgage balances exceed the value of their homes and should, albeit slowly, increase the inventory of homes up for sale (a critical transition if the housing market is to normalize). Though strong price increases come as comforting news for many homeowners, we view the pace of the recent gains as having more to do with short–term supply constraints than with underlying growth in the state’s economy.

Why Have Home Prices Grown So Quickly? In the short–term, job growth and wage gains boost demand for single–family housing, putting upward pressure on prices. Higher prices tend to compel more owners to put their homes on the market. The supply of additional homes absorbs existing demand, causing price increases to slow or stop altogether. In step with an improving economy, the demand for housing increased in early 2012, yet the supply of homes did not respond accordingly. Instead, short–term factors limited the number of available homes, driving prices up 25 percent since January 2012. These factors include:

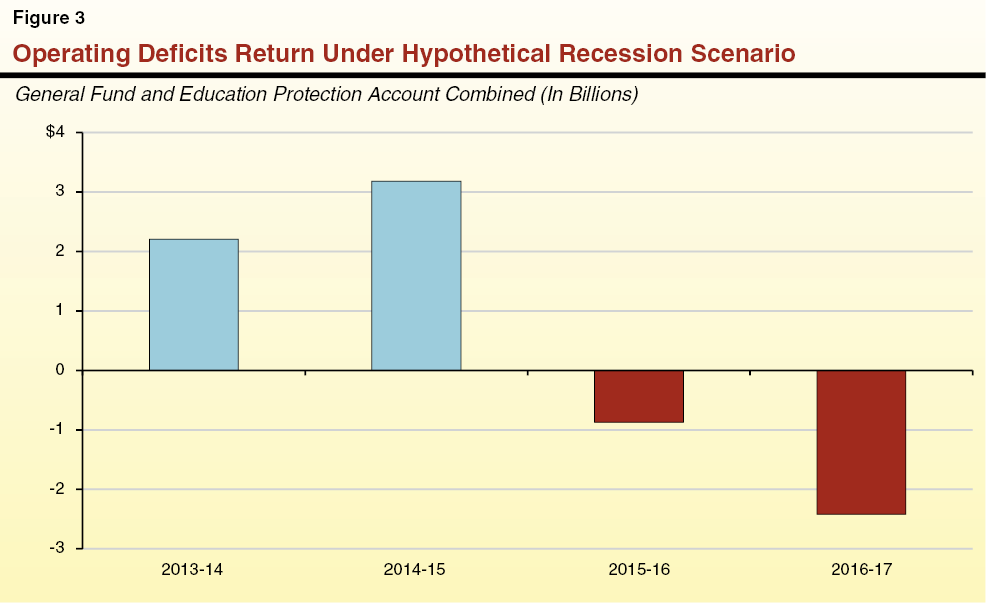

- Cash Investors. Nationwide, 6 million owner–occupied single–family homes converted to rental units over the course of the housing crisis. In most of these cases, investors purchased distressed homes in cash and converted them to rentals, sometimes purchasing hundreds of homes at one time. In Los Angeles, cash purchases as a portion of all home sales increased from 5 percent in 2005 to 34 percent in May 2013, the largest increase in the country. Other areas of California have similarly high all–cash sales rates. Investor demand pushed prices upward—a helpful boost for many distressed areas of the state—but also contributed to reductions in the inventory of owner–occupied homes for sale, which, as shown in Figure 3, has contracted significantly since January 2012.

- Strategic Sellers. The supply of homes for sale depends primarily on the eagerness of current homeowners to sell. Short supplies indicate a general unwillingness or an inability to sell. Unwilling owners may wait to list their homes so as to benefit from expected upward price trends, especially as price gains are accelerating. A national survey of homeowners from earlier this year found that only 25 percent of owners felt it was a good time to sell (whereas two–thirds agreed it was a good time to buy), a sign that potential sellers are waiting. On the other end, more than 15 percent of California homeowners remain underwater on their homes. This means some would–be sellers are unable to do so, keeping a sizable share of the state’s housing stock off the market.

- Cautious Homebuilders. Responding to rising home prices, construction activity has begun to improve. Authorized single–family permits, the first step in constructing a new home, increased from less than 15,000 in the first seven months of 2012 to more than 21,000 in the first seven months of 2013. Though large in percentage terms, this gain represents a historically small response relative to the price increases seen over the same period. (For comparison, the first seven months of 2002 saw 72,000 single–family permits.) In our view, it appears that single–family homebuilders, and, perhaps, their lenders, have remained cautious, wary that increased supply in the short term could dampen prices, threatening the profitability of newly constructed homes. Restricted credit, as well as land–use and development constraints in some areas, also may be holding back some new construction. Until homebuilding quickens, home demand will not be tempered much by new home construction.

Latest Data Suggest Home Prices Are Decelerating to More Normal Trends. Recent price gains appear to be decelerating. Rising mortgage rates and expanding inventories have likely contributed to this deceleration. Interest rates on a 30–year fixed rate mortgage have climbed 1 percentage point since May, equating to a 15 percent increase in the monthly payment on a $200,000 loan. In turn, increased mortgage costs have cooled housing demand. In August and September, home inventories expanded for the first time in a year. These data inform our home price forecast for 2014, which is described below.

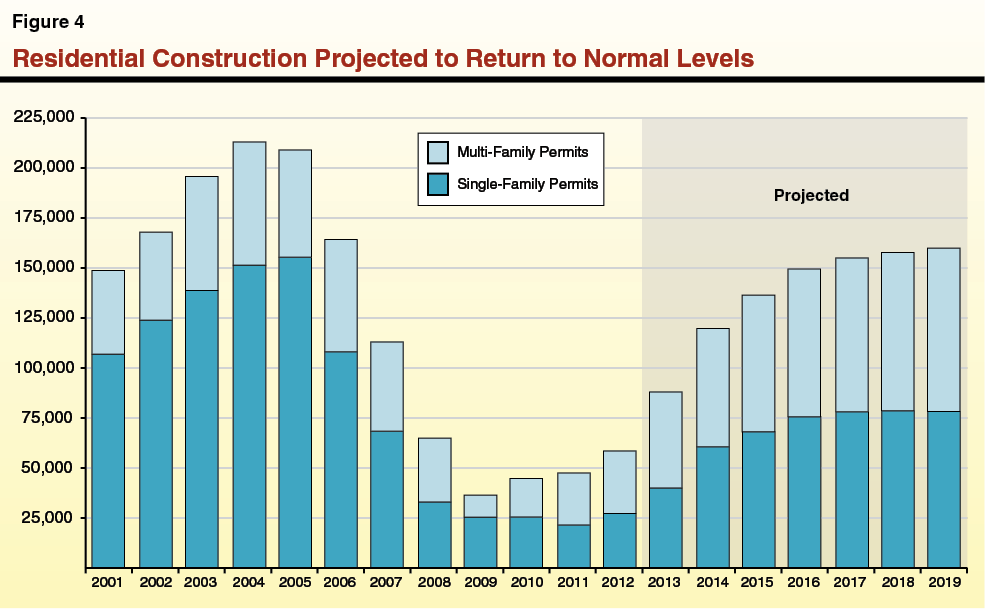

We view the pace of recent price gains as unsustainable, and accordingly expect housing inventories to expand as more homeowners feel it is a good time to sell, as cash investor purchases decline, and new housing construction begins to ratchet up, each of which should absorb existing demand and therefore slow price increases. In particular, we expect home price growth to decelerate significantly, to 7 percent in 2014. We project that construction activity, responding to recent price and rent increases, will post strong gains in 2014 (as shown in Figure 4). In 2014, we forecast residential housing permits to increase by 31,000 units to 120,000 permits total. Permits are projected to increase to 136,000 units in 2015 before stabilizing around 160,000 units annually by the end of our forecast period. Compared to past years, multi–family unit permits are projected to make up a larger portion of newly constructed housing stock. Our residential permits forecast has been lowered notably since our prior forecast, released in May 2013, due primarily to our lower expectation for new single–family home construction. We caution, given the sizable shifts taking place in today’s housing market, that actual price gains and construction activity in the coming years could vary widely—either above or below—our office’s forecast over the next few years.

Figure 5 summarizes our November 2013 multiyear General Fund revenue forecast.

Figure 5

LAO November 2013 Revenue Forecast

General Fund and Education Protection Account Combined (In Billions)

|

|

2012–13

|

2013–14

|

2014–15

|

2015–16

|

2016–17

|

2017–18

|

2018–19

|

2019–20

|

|

Personal income tax

|

$65.0

|

$66.0

|

$71.4

|

$75.9

|

$79.6

|

$83.2

|

$82.9

|

$84.1

|

|

Sales and use tax

|

20.5

|

22.8

|

23.6

|

24.9

|

25.4

|

25.8

|

27.0

|

28.2

|

|

Corporation tax

|

7.7

|

8.3

|

8.9

|

9.5

|

10.1

|

10.6

|

11.2

|

11.8

|

|

Subtotals, “Big Three” taxes

|

($93.2)

|

($97.1)

|

($103.8)

|

($110.3)

|

($115.1)

|

($119.6)

|

($121.1)

|

($124.1)

|

|

Insurance tax

|

$2.2

|

$2.2

|

$2.3

|

$2.4

|

$2.5

|

$2.6

|

$2.7

|

$2.8

|

|

Other revenues

|

2.7

|

2.3

|

1.9

|

1.9

|

1.8

|

1.8

|

1.8

|

1.8

|

|

Net transfers and loans

|

1.7

|

0.3

|

–0.4

|

–0.8

|

–0.4

|

0.2

|

0.3

|

0.3

|

|

Totals, Revenues and Transfers

|

$99.8

|

$101.8

|

$107.6

|

$113.8

|

$119.0

|

$124.2

|

$125.8

|

$128.9

|

In June 2013, the Legislature approved the 2013–14 Budget Act. The State Constitution requires the Legislature to determine the revenue estimates underlying each annual budget, so that the budget meets the requirements for a balanced budget in Proposition 58 (2004). In developing the 2013–14 budget, the Legislature considered both our office’s May 2013 revenue forecast, as well as the May 2013 revenue forecast of the administration. Compared to the administration’s forecast, our office’s May 2013 forecast projected $3.2 billion more in General Fund revenues and transfers across the three fiscal years (2011–12, 2012–13, and 2013–14), due principally to our higher assumptions for capital gains–related personal income taxes in 2013 and 2014. The Legislature and the Governor agreed to base the 2013–14 budget plan on the administration’s May 2013 revenue forecast. Figure 6 compares our November 2013 revenue forecasts by fiscal year with those assumed in the 2013–14 budget.

Figure 6

Comparing LAO November 2013 Revenue Forecast With 2013–14 Budget Act Forecast

(General Fund and Education Protection Account Combined, in Millions)

|

|

2012–13

|

|

2013–14

|

|

2013–14 Budget Act Forecast

|

LAO Nov. 2013 Forecast

|

Difference

|

|

2013–14 Budget Act Forecast

|

LAO Nov. 2013 Forecast

|

Difference

|

|

Personal income tax

|

$63,901

|

$65,030

|

$1,129

|

|

$60,827

|

$66,002

|

$5,175

|

|

Sales and use tax

|

20,240

|

20,482

|

242

|

|

22,983

|

22,809

|

–174

|

|

Corporation tax

|

7,509

|

7,669

|

160

|

|

8,508

|

8,278

|

–230

|

|

Subtotals, “Big Three” taxes

|

($91,650)

|

($93,181)

|

($1,531)

|

|

($92,318)

|

($97,089)

|

($4,771)

|

|

Insurance tax

|

$2,156

|

$2,249

|

$93

|

|

$2,200

|

$2,163

|

–$37

|

|

Other revenues

|

2,641

|

2,664

|

23

|

|

2,249

|

2,254

|

6

|

|

Net transfers and loans

|

1,748

|

1,748

|

—

|

|

331

|

342

|

10

|

|

Totals, Revenues and Transfers

|

$98,195

|

$99,841

|

$1,646

|

|

$97,098

|

$101,847

|

$4,749

|

Higher Revenues Now Projected, Compared to 2013–14 Budget Assumptions. Our office’s projections for General Fund revenues in 2011–12, 2012–13, and 2013–14 combined have increased since May by over $3 billion. As shown in Figure 6, we now project that General Fund revenues and transfers for 2011–12, 2012–13, and 2013–14 combined will be $6.4 billion higher than the amounts assumed in the 2013–14 state budget plan. For 2012–13, state collections exceeded forecasts. For 2013–14, most of the increase in our forecast since May results from higher assumptions concerning capital gains and some other categories of taxable income attributable largely to higher–income personal income tax (PIT) filers. Our increased capital gains assumptions result primarily from stronger stock market and real estate market performance since May.

PIT Collections Running Stronger Than 2013–14 Budget Act Forecast. In 2012–13, revenue collections were stronger than projected by either our office or the administration in May 2013. Through the end of October, 2013–14 PIT estimated payments—tied in large part to capital gains and business income—have exceeded the administration’s monthly projections by 34 percent. Several key PIT payment dates remain during the fiscal year, but to date, the available information suggests that PIT revenues are running considerably stronger than was assumed in the budget act.

Uncertainty remains, however, given that 2012 income tax collections were elevated for a variety of reasons, as discussed below, and preliminary tax agency data on what was reported on 2012 PIT returns will not begin to be made available until a few weeks from now. (Final tax agency data related to 2012 returns will not be available until several months from now.) Moreover, the performance of the stock market has been much stronger than our office assumed in May, and stock performance in the coming few weeks will affect 2013 capital gains to some extent. Uncertainty also results from the state’s complicated revenue accrual methodologies, which move some PIT and other revenues from one fiscal year to a prior one for budgetary accounting purposes.

Legislative Action Needed to Oversee Complex Accrual Process

Prior–Year Revenue Estimates Now Change for at Least Two Years Thereafter. As the 2014–15 budget process begins, we think it is important to emphasize that, under the new “net final payment” accrual process authorized in recent annual budgets for Proposition 30 revenues, personal income tax revenues essentially are still changing for 2011–12. As we understand the accrual process, 2011–12 revenue estimates should keep changing until at least May 2014, given that estimates of 2012 capital gains—a key driver of Proposition 30 revenues for that year—will change until at least that point in time, as tax agencies review and “sample” for statistical purposes more and more 2012 tax returns. Total 2012–13 revenues will change until May 2015, and so on. Even as legislators make budget decisions and weigh various uncertainties about 2013–14 and 2014–15 revenue and spending, they may know less than ever before about the previous two fiscal years’ budget results and the state budget reserves remaining therefrom. We acknowledge that our revenue estimates may be too high or too low by hundreds of millions of dollars per year—or, in some scenarios, over $1 billion per year—due simply to the challenges we face in making projections concerning this complex part of the budget process.

Revenue Calculations Will Affect Future Budgeting. If the administration follows its past practice, it will not display in its 2014 budget publications up–to–date estimates of 2011–12 revenues based on these accrual changes. Based on past practice, 2011–12 revenues would have been “closed” in 2013. Any changes to prior–year revenues—often minor under past accrual policies—would be listed, along with many expenditure reconciliations, as changes to the incoming General Fund balance. If the administration sticks to this past practice, the Legislature will lack complete, transparent access to information that would be important to budgeting—especially information that will help them decide whether Proposition 98 obligations have been appropriately estimated.

We recommend that the Legislature require the administration to display publicly for budgetary decision–making purposes the adjusted prior–year revenue amounts included in its adjustments to the incoming General Fund balance. Such prior–year revenue changes should be incorporated in all historical documents related to state revenues—otherwise, the reliability of that historical data could decline significantly. Finally, we recommend that the Legislature require the administration—at least once a year on its website—to describe in plain English each of the calculations used to move revenue from one fiscal year to a prior year via the accrual process.

2012–13 PIT Collections Were Elevated . . . PIT collections grew substantially in 2012–13 due to voters’ approval of Proposition 30, large one–time withholding payments related to the initial public offering (IPO) of stock by Facebook, Inc., and one–time accelerations of various types of income in 2012 by high–income taxpayers—especially accelerated realizations of capital gains. (Such accelerations of income allowed some taxpayers to avoid higher federal tax rates that went into effect for some in 2013.) For tax year 2012, by our office’s estimation, capital gains seem to have produced slightly over $10 billion of revenue for the state—around 15 percent of the current annual PIT base. We now estimate that 2012–13 PIT revenues will end higher than the levels projected in both the LAO and administration May 2013 forecasts. Specifically, our current estimate of 2012–13 PIT revenues—$65 billion—is $1.1 billion above the 2013–14 Budget Act assumption, which was based on the administration’s May 2013 forecast.

. . . Which Means PIT Growth to Be Much Slower in 2013–14 . . . In our May 2013 Forecast, we projected that PIT collections would fall by 0.2 percent in 2013–14—an unusual assumption since PIT revenues typically fall only in recession years. Because so much income was accelerated from 2013 to 2012 to avoid higher federal taxes, we assumed that net capital gains realizations by California residents would fall by 30 percent in 2013, affecting both estimated payments in late 2013 and January 2014. Since May, however, the performance of the stock market has exceeded our prior assumptions. While we continue to assume a large drop in net capital gains realized by California taxpayers in 2013, our capital gains assumption for that year is now a few percentage points higher than it was in May. Moreover, our 2014 capital gains assumption—which also affects 2013–14 PIT collections—has risen by over 10 percent, given the recent growth in stock prices. Our new forecast also assumes stronger growth for PIT withholding—revenue collections that result mainly from Californians’ wage income. This assumption seems more consistent with recently strong year–over–year PIT withholding growth (after adjusting for the one–time withholding payments resulting from the Facebook IPO in October 2012). After accounting for accruals, we now forecast that 2013–14 PIT revenues will rise by 1.5 percent to $66 billion. This is $5.2 billion above the amount assumed in the budget approved in June.

. . . And PIT Should Bounce Back in 2014–15. The acceleration of large amounts of revenue from 2013 to 2012 artificially depresses growth in PIT revenues in 2013–14. Accordingly, both our office’s forecast and the administration’s forecast have projected that the growth rate for PIT revenues will bounce upward in 2014–15. In this forecast, we project that PIT revenues grow by 8 percent to $71 billion in 2014–15.

2015–16 and Beyond. Our forecast assumes roughly 5 percent average annual growth in PIT revenues between 2015–16 and 2017–18. This rate of annual growth is consistent with what we would expect in a mature economic expansion—such as that assumed in our multiyear economic forecast through 2020—accompanied by some growth in stock and house prices. We then project much slower growth in 2018–19 and 2019–20 due primarily to the expiration of Proposition 30’s higher PIT rates for high–income taxpayers at the end of 2018. This means that the PIT revenue loss from Proposition 30’s expiration will not occur all at once, but instead will be spread over those two fiscal years. We now project that PIT revenues will fall by 0.4 percent in 2018–19 to under $83 billion before rising by 1.4 percent in 2019–20 to $84 billion.

PIT Revenues Make Up Bigger Percentage of General Fund Than Ever Before. Prior to the first fiscal year affected by Proposition 30, the PIT’s share of total General Fund revenues and transfers had exceeded 60 percent only once—at the end of the “dot–com” bubble in 2000–01. We are now projecting that PIT revenues will comprise two–thirds of total General Fund revenues in 2014–15—the highest such percentage recorded to date in California history. Proposition 30—with its temporary marginal tax rate increases for high–income households—has increased PIT revenues recently. The percentage of the budget paid for from PIT revenues also has risen recently due to other tax policy changes. Specifically, the shift of a portion of the state’s sales and use tax (SUT) from the General Fund to local realignment accounts and a few other changes have reduced the percentage of the General Fund paid from other revenue sources, thereby increasing the share of the General Fund paid by the PIT. Finally, the amount of taxable income received by the top 20 percent of taxpayers has, in real terms, grown much faster than the amounts for middle–income and lower–income taxpayers in recent decades. As these higher–income taxpayers pay the highest marginal tax rates, the increasing concentration of income in that group tends to generate significant growth in PIT revenues over time.

Our forecast projects that PIT will maintain that two–thirds share of annual General Fund revenues. (As our forecast assumes a fairly modest level of capital gains—compared to the size of the economy—in future years, this amount could be higher in particularly strong capital gains years, and it could be weaker when capital gains are very low.) We note, however, that the proportion of the General Fund supported by PIT revenues likely would be growing even if Proposition 30 were not in effect due to more income concentration among the highest–income taxpayers and the other factors described earlier.

Higher Stock Market Driving Higher PIT Projections in the Near Term. The change from year to year in the state’s net capital gains has proven over time to be closely correlated with changes in stock and house prices, as well as stock trading volume. Recently, both stock and house prices have been growing rapidly. Our office’s May 2013 forecast assumed that the S&P 500 index remained close to its May 14, 2013 level of 1650 through the rest of 2013. As of October 25, when we finalized our economic assumptions for this forecast, it closed at 1760 (7 percent above our prior assumptions). This is the key reason for the higher capital gains in our forecast in the near term and a major reason for our higher forecast of 2013–14 PIT revenues.

Stock Market Valuations Near Historical Norms. In general, key stock market valuation metrics—such as the price–to–earnings (PE) ratio for the S&P 500—are in line with historical norms. Some such metrics are somewhat above norms, and some are below. We note, however, that PE ratios are considerably below the levels experienced during the dot–com bubble, when Californians’ net capital gains realizations peaked as a percentage of personal income in the state at 10.6 percent. Our forecast assumes that net capital gains total 5.9 percent of personal income in 2012, 4.3 percent in 2013 (lower due to the income accelerations described earlier), and 6 percent in 2014. This incorporates an assumption that stock prices remain stable—at or near their October 25 level—through March 2014. Thereafter, we assume that stock prices grow slower than the overall growth of the U.S. economy, which results in net capital gains falling to 4.4 percent of personal income by the end of our forecast period in 2020. This forecasting assumption is intended, in the context of the economic expansion we assume through 2020, to keep stock prices near historical norms throughout the period.

Volatile Stock Prices Certainly Cannot Be Predicted With Precision. Because PIT is the state’s largest revenue source, and a significant, volatile portion of that tax is generated from capital gains on the sales of stocks and other assets, every forecast of California’s public finances must reflect an assumption—either explicit or implicit—about the direction of the stock market. Our forecasting methodology attempts to use the most realistic assumptions possible about stock performance in the near term and, to the extent that these assets seem overpriced relative to historical norms, to bring them closer to those norms over time. Currently, there is not clear evidence that stocks are overpriced significantly compared to those norms. Accordingly, we assume stable stock prices in the near term and modest growth thereafter.

Nevertheless, over any given forecast period—even the next few quarters—stock prices can be expected to differ from any set of assumptions. They may be lower in some periods, and they may be higher in others. This volatility—as well as fundamental changes in stock prices that occur during bull and bear markets—may cause actual capital gains to differ significantly from any forecast. In the near term, for example, annual PIT revenues can be $2 billion higher or lower than forecast based on differing capital gains results alone. (Other forecasting differences could produce additional changes in revenues.) State leaders should consider all of this information when making budgetary commitments and determining the level of financial reserves for the state to have at any given time.

Estimated General Fund SUT revenue totaled $20.5 billion in 2012–13, about $240 million higher than the amount assumed in the 2013–14 budget. In 2013–14, we expect SUT receipts to increase by 11 percent to $22.8 billion (about $170 million below the 2013–14 budget assumption). The projected growth in 2013–14 reflects (1) the full–year effect of Proposition 30’s temporary one–quarter cent SUT increase and (2) projected growth in underlying taxable sales of 6.9 percent. In 2014–15, we forecast SUT revenue to increase by 3.3 percent to $23.6 billion. This lower revenue growth is largely due to the new tax credit for manufacturing equipment established by Chapter 69, Statutes of 2013 (AB 93, Committee on Budget), which begins in 2014–15. (Underlying revenue growth—that is, without the impacts of the credit—is 5.4 percent, in line with projected growth in taxable sales.) Projected SUT revenues then increase by 5.6 percent in 2015–16 before growing more slowly over the following two years as the one–quarter cent Proposition 30 SUT increase expires at the end of 2016. Revenue growth stabilizes towards the end of our forecast, closely tracking projected growth in taxable sales.