The primary goal of California’s criminal justice system is to provide public safety by deterring and preventing crime, punishing individuals who commit crime, and reintegrating criminals back into the community. The state’s major criminal justice programs include the court system, the CDCR, and the Department of Justice. The Governor’s budget proposes total expenditures of $14.1 billion for judicial and criminal justice programs. Below, we describe recent trends in state spending on criminal justice and provide an overview of the major changes in the Governor’s proposed budget for criminal justice programs in 2014–15.

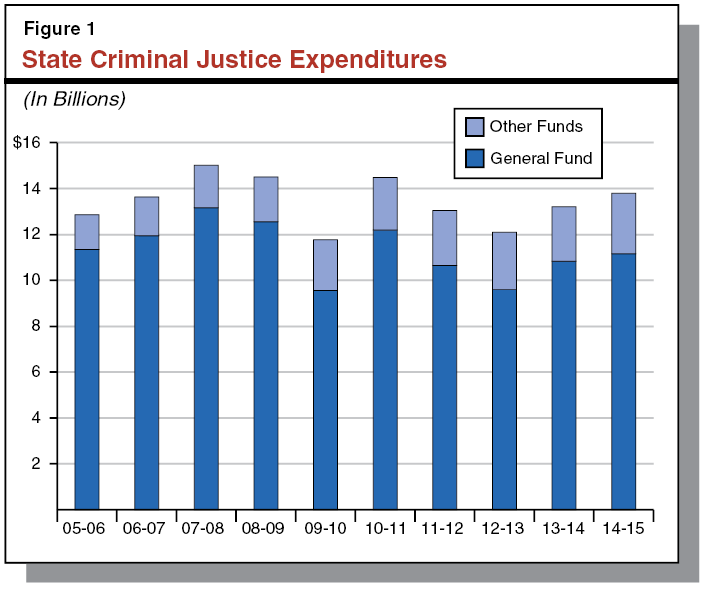

Over the past decade, total state spending on criminal justice programs has varied. In particular, criminal justice spending declined in recent years but increased in 2013–14 and is proposed to further increase in 2014–15 under the Governor’s budget. As shown in Figure 1, state spending on criminal justice peaked in 2007–08 at about $15 billion. In comparison, state spending on criminal justice was about $12 million in 2012–13, reflecting a continued decline since 2010–11. As we discuss below, much of this decline was related to reduced expenditures on the state’s judicial branch and correctional system.

Decline in Corrections Spending. The primary reason for the decline in spending on corrections over this time period is the impact of various policy changes enacted to reduce the state’s prison population. The state took these actions to help reduce state spending and comply with a federal court order to reduce prison overcrowding, as well as to achieve improved criminal justice outcomes. Some of the actions taken include (1) providing counties a fiscal incentive to reduce the number of felony probationers that fail on probation and are sent to state prison, (2) increasing the number of credits inmates can earn to accelerate their release date from prison, (3) making certain parolees who violate a term of their parole ineligible for return to prison, and (4) increasing the dollar threshold for certain property crimes to be considered a felony, thus making fewer offenders eligible for prison. The most significant of these changes, however, happened with the passage of the 2011 realignment which, among other changes, shifted various criminal justice responsibilities from the state to counties. In particular, the 2011 realignment made felons generally ineligible for state prison unless they had a current or prior conviction for a serious, violent, or sex–related offense. By the end of 2012–13, realignment had reduced the prison population by tens of thousands of inmates.

Decline in Judicial Branch Spending. The state’s recent fiscal crisis also resulted in significant General Fund reductions to the judicial branch, particularly the trial courts. The judicial branch has received a series of one–time and ongoing General Fund reductions since 2008–09. By 2012–13, the branch had received ongoing General Fund reductions totaling $778 million. Of this amount, $724 million in reductions were allocated to the trial courts. However, various one–time and ongoing solutions were used to offset most of the reductions to the trial courts. As we discuss later in this report, despite these offsets, the trial courts had to take various actions to absorb some reductions, which impacted court services differently across courts.

Figure 2 summarizes expenditures from all fund sources for criminal justice programs in 2012–13 and as revised and proposed by the Governor for 2013–14 and 2014–15. As shown in the figure, total spending on criminal justice programs is proposed to increase from an estimated $13.6 billion in the current year to $14.1 billion in the budget year. This is an increase of 4 percent. General Fund spending is proposed to increase 3.2 percent over current–year expenditure levels.

Figure 2

Judicial and Criminal Justice Budget Summary

(Dollars in Millions)

|

|

Actual

2012–13

|

Estimated

2013–14

|

Proposed

2014–15

|

Change From 2013–14

|

|

Actual

|

Percent

|

|

CDCR

|

$8,742

|

$9,441

|

$9,833

|

$391

|

4.1%

|

|

General Funda

|

8,551

|

9,281

|

9,513

|

232

|

2.5

|

|

Special and other funds

|

191

|

160

|

320

|

160

|

99.7

|

|

Judicial Branch

|

$2,825

|

$3,117

|

$3,274

|

$157

|

5.0%

|

|

General Fund

|

748

|

1,220

|

1,325

|

105

|

8.6

|

|

Special and other funds

|

2,077

|

1,897

|

1,949

|

52

|

2.7

|

|

Department of Justice

|

$660

|

$769

|

$771

|

$2

|

0.2%

|

|

General Fund

|

154

|

178

|

194

|

17

|

9.3

|

|

Special and other funds

|

507

|

591

|

577

|

–15

|

–2.5

|

|

BSCC

|

$95

|

$129

|

$134

|

$5

|

3.8%

|

|

General Fund

|

40

|

44

|

45

|

1

|

1.2

|

|

Special and other funds

|

55

|

85

|

89

|

4

|

5.2

|

|

Other Departmentsb

|

$138

|

$125

|

$114

|

–$12

|

–9.3%

|

|

General Fund

|

82

|

64

|

58

|

–6

|

–9.8

|

|

Special and other funds

|

56

|

61

|

56

|

–5

|

–8.9

|

|

Totals, All Departments

|

$12,460

|

$13,582

|

$14,125

|

$543

|

4.0%

|

|

General Fund

|

9,574

|

10,787

|

11,135

|

348

|

3.2

|

|

Special and other funds

|

2,886

|

2,795

|

2,990

|

196

|

7.0

|

Major Budget Proposals. Most of the proposed increase in spending is for CDCR and the judicial branch. For example, increased funding of $261 million is provided to CDCR to help meet the population cap ordered by the federal courts. The Governor’s budget also provides increased funding to CDCR for additional costs related to worker’s compensation, and employee salary and training. In addition, the proposed budget includes a $105 million General Fund augmentation for the judicial branch—$100 million to support trial court operations and $5 million to support state level court and Judicial Council operations.

Realignment Funding. As mentioned above, the 2011 realignment shifted several criminal justice programs from state to county responsibility. Along with the shift of these programs, state law shifted a share of the state sales tax, as well as Vehicle License Fee revenue, to local governments. The passage of Proposition 30 by voters in November 2012, among other changes, permanently guaranteed these revenues to local governments. The Governor’s budget includes an estimate of revenues projected to go to local governments over the next few years. These estimates are generally in line with prior estimates. As shown in Figure 3, total funding for the criminal justice programs realigned is expected to increase from $2.1 billion in 2012–13 to $2.3 billion in 2014–15.

Figure 3

Estimated Revenues to Counties for 2011 Realignment of Criminal Justice Programs

(In Millions)

|

|

2012–13

|

2013–14

|

2014–15

|

|

Community corrections

|

$930

|

$1,063

|

$1,094

|

|

Trial court security

|

508

|

517

|

538

|

|

Law enforcement grants

|

490

|

490

|

497

|

|

Juvenile justice grants

|

110

|

119

|

140

|

|

District attorneys and public defenders

|

20

|

21

|

27

|

|

Totals

|

$2,058

|

$2,210

|

$2,296

|

In addition to the funds provided to counties directly through the 2011 realignment legislation, the state has also authorized lease–revenue bonds to fund the construction and modernization of county jails following the realignment. Specifically, Chapter 42, Statutes of 2012 (SB 1022, Committee on Budget and Fiscal Review), authorized $500 million to help counties construct and modify jails to accommodate longer–term inmates who have been shifted to county responsibility. The Governor’s budget for 2014–15 proposes that an additional $500 million in lease–revenue bonds be authorized to support the construction of county facilities.

The judicial branch is responsible for the interpretation of law, the protection of an individual’s rights, the orderly settlement of all legal disputes, and the adjudication of accusations of legal violations. The branch consists of statewide courts (the Supreme Court and Courts of Appeal), trial courts in each of the state’s 58 counties, and statewide entities of the branch (the Judicial Council, Judicial Branch Facility Program, and the Habeas Corpus Resource Center). The branch receives revenues from several funding sources including the state General Fund, civil filing fees, criminal penalties and fines, county maintenance–of–effort payments, and federal grants.

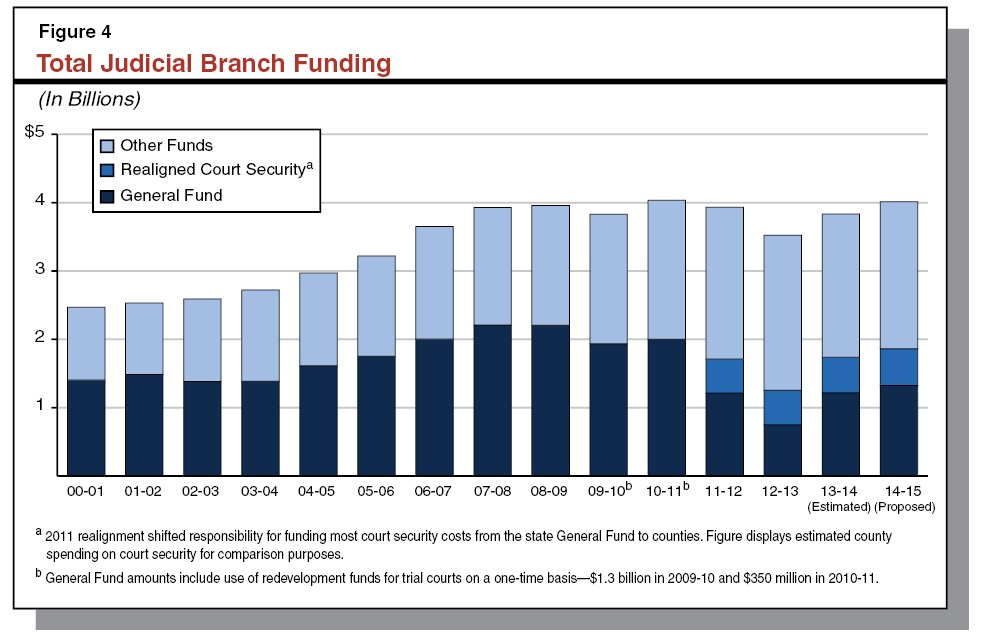

Figure 4 shows total funding for the judicial branch from 2000–01 through 2014–15. As shown in the figure, funding for the branch peaked in 2010–11 at roughly $4 billion and then subsequently declined through 2012–13. This decline is primarily due to significant reductions in the level of General Fund support provided to the branch during this time period. We note, however, that total funding for the judicial branch increased in 2013–14 and is proposed to increase in 2014–15 under the Governor’s budget. Specifically, the 2013–14 Budget Act included a $63 million General Fund augmentation for the judicial branch and the Governor’s budget for 2014–15 proposes an additional $105 million General Fund augmentation. Under the Governor’s budget, the General Fund share of the total judicial branch budget will be 33 percent in 2014–15.

As shown in Figure 5, the Governor’s budget proposes $3.3 billion from all state funds to support the judicial branch in 2014–15, an increase of $157 million, or 5 percent, above the revised amount for 2013–14. (These totals do not include expenditures from local revenues or trial court reserves.) Of the total budget proposed for the judicial branch in 2014–15, roughly $1.3 billion is from the General Fund. This is a net increase of about $105 million, or 8.6 percent, from the 2013–14 level.

Figure 5

Judicial Branch Budget Summary—All State Funds

(Dollars in Millions)

|

|

2012–13

Actual

|

2013–14

Estimated

|

2014–15

Proposed

|

Change From 2013–14

|

|

Amount

|

Percent

|

|

State Trial Courts

|

$2,237

|

$2,443

|

$2,531

|

$88

|

3.6%

|

|

Supreme Court

|

43

|

44

|

45

|

1

|

1.5

|

|

Courts of Appeal

|

202

|

208

|

211

|

3

|

1.6

|

|

Judicial Council

|

135

|

142

|

141

|

–1

|

–0.4

|

|

Judicial Branch Facility Program

|

195

|

267

|

332

|

65

|

24.3

|

|

Habeas Corpus Resource Center

|

13

|

14

|

14

|

—

|

1.4

|

|

Totals

|

$2,825

|

$3,117

|

$3,274

|

$157

|

5.0%

|

Prior–Year Budget Reductions and Offsets. The judicial branch received a series of one–time and ongoing General Fund reductions from 2008–09 through 2012–13. By 2012–13, the branch had received ongoing General Fund reductions totaling $778 million. Of this amount, $724 million in ongoing General Fund reductions were allocated to the trial courts. However, the 2013–14 budget provided a $60 million General Fund augmentation to the trial courts to help offset these reductions. Specifically, the augmentation reduced the total ongoing General Fund reductions to the trial courts to $664 million in 2013–14.

Additionally, since 2008–09, the Legislature and Judicial Council (the policymaking and governing body of the judicial branch) used various one–time and ongoing solutions to offset most of the reductions to the trial courts. Such solutions included using revenues from increased fines and fees, transfers from judicial branch special funds, and trial court reserves. (Reserves are the accumulation of unspent funds from prior years that are carried over and kept by each trial court.)

Despite most of the reductions being offset, the trial courts still had to absorb $215 million in General Fund reductions in 2013–14. (We would note that some courts may have used one–time resources to absorb their share of this reduction in 2013–14. Such courts will have to absorb these reductions again in 2014–15. In contrast, other courts may have absorbed more than their share of the reduction in 2013–14 in order to plan ahead for additional ongoing reductions the following year.) Trial courts have taken various actions to accommodate these reductions. These actions include leaving staff vacancies unfilled, renegotiating contracts with employees and vendors, delaying purchases, closing courtrooms or courthouses, reducing clerk office hours, and reducing self–help and family law services. While the impacts of these actions vary across courts and depend on the specific operational choices made by each court, some of these actions have resulted in reduced access to court services, longer wait times for court services and hearings, and courts being unable to complete workload in a timely manner.

In order to help minimize the extent to which these operational actions affected court users, a number of courts also made various changes to their operations. These changes include installing dropboxes for individuals to submit court paperwork when clerks’ offices are closed and purchasing kiosks where individuals can pay for traffic tickets. In addition, some courts have made multiyear investments to operate more efficiently. For example, some courts have shifted to electronic filing of documents in certain case types and developed online systems where individuals can automatically schedule hearings for select case types.

New Funding Allocation Methodology. In April 2013, the Judicial Council approved a new method for allocating funds appropriated for trial court operations in the annual state budget to individual trial courts. This new methodology, also known as the Workload Allocation Funding Methodology (WAFM), is intended to distribute funding among the trial courts based on workload. (Previously, such funding was allocated on a “pro rata” basis, generally based on the historic share of statewide allocations received by each trial court.) Specifically, the new formula starts with a Resource Assessment Study (RAS), which estimates the number of personnel needed for each court primarily based on the number of filings for various case types and the amount of time it takes staff to process each filing. Each court’s estimated staffing need is then converted to a cost estimate for personnel and combined with various other cost factors not captured in the RAS model (such as workload costs and other factors considered unique to a specific trial court) to determine the total estimated workload–driven costs for each trial court. The total cost for each court is then used to determine that court’s percentage of total trial court operations costs. These percentages are then applied to the funding appropriated to the trial courts in the state budget to determine how much funding each individual trial court will receive that year.

Beginning in 2013–14, the judicial branch implemented a five–year plan to phase in the implementation of its new allocation methodology. Under the plan, a greater percentage of funds appropriated for trial court operations will be allocated using WAFM each year with a lesser amount being allocated under the old methodology. Upon full implementation, 50 percent of trial court operations funding will be allocated using WAFM, and 50 percent will be allocated using the old pro rata percentages. However, the branch intends to allocate any augmentations provided to trial court operations (such as the $60 million General Fund augmentation provided in the 2013–14 budget) based on the WAFM model, unless the funding is provided for a specified purpose (such as for court interpreters for example). To the extent such additional funding is provided, the branch will shift an equivalent amount of funding from the amount allocated based on the old methodology to the amount allocated based on WAFM (referred to as the “dollar–for–dollar match”), thereby reducing the amount allocated using the old method and increasing the amount allocated by WAFM. Therefore, under the branch’s plan, additional funding will result in a greater share of trial court funding allocated using WAFM. The judicial branch reports that it would take a cumulative $700 million augmentation for all trial court operations funding to be allocated under WAFM.

The Governor’s budget for 2014–15 proposes an ongoing General Fund augmentation of $100 million to support trial court operations. (The budget also provides a $5 million augmentation to support state level courts and Judicial Council operations.) The budget requires that the additional funding be allocated based on WAFM. However, the trial courts would have flexibility in spending these funds.

Augmentation Reduces Ongoing Reductions. As discussed previously, the total ongoing General Fund reductions to the trial courts totaled $664 million 2013–14. The Governor’s augmentation would reduce these ongoing reductions to $564 million for 2014–15. As shown in Figure 6, the budget assumes that $249 million in resources will be available to help offset a portion of this reduction. This leaves $315 million in reductions that will have to be absorbed by trial courts in 2014–15, a net increase of $100 million over the amount already assumed to be absorbed by the trial courts in 2013–14. This net increase in reductions results from the lack of trial court reserves available to offset ongoing reductions.

Figure 6

Trial Courts Budget Reductions Through 2014–15

(In Millions)

|

|

2008–09

|

2009–10

|

2010–11

|

2011–12

|

2012–13

|

2013–14 (Estimated)

|

2014–15 (Budgeted)

|

|

General Fund Reduction

|

|

|

|

|

|

|

|

|

One–time reduction

|

–$92

|

–$100

|

–$30

|

—

|

–$418

|

—

|

—

|

|

Ongoing reductions (cumulative)

|

—

|

–261

|

–286

|

–$606

|

–724

|

–$664

|

–$564

|

|

Total Reductions

|

–$92

|

–$361

|

–$316

|

–$606

|

–$1142

|

–$664

|

–$564

|

|

Solutions to Address Reduction

|

|

|

|

|

|

|

|

|

Construction fund transfers

|

—

|

$25

|

$98

|

$213

|

$299

|

$55

|

$55

|

|

Other special fund transfers

|

—

|

110

|

62

|

89

|

102

|

52

|

52

|

|

Trial court reserves

|

—

|

—

|

—

|

—

|

385

|

200

|

—

|

|

Increased fines and fees

|

—

|

18

|

66

|

71

|

121

|

121

|

121

|

|

Statewide programmatic changes

|

—

|

18

|

14

|

19

|

21

|

21

|

21

|

|

Total Solutions

|

—

|

$171

|

$240

|

$392

|

$928

|

$449

|

$249

|

|

Reductions Allocated to the Trial Courtsa

|

–$92

|

–$190

|

–$76

|

–$214

|

–$214

|

–$215

|

–$315

|

Increased Employee Benefit Costs. The trial courts indicate that they will face increased cost pressures in 2014–15 related to growing retirement and benefit costs. Currently, individual trial courts (primarily presiding judges and/or court executive officers) conduct separate and independent negotiations with local labor organizations representing most trial court employees. This differs from the collective bargaining process for most state employees, where the California Department of Human Resources oversees statewide labor negotiations on behalf of the Governor. In addition, unlike memoranda of understanding (MOU) negotiated with state employees, agreements negotiated with trial court employees are not subject to ratification by the Legislature and cost increases are not automatically included in the budget. Moreover, some trial court employees continue to participate in county retirement and health benefit programs. As a result, both the state and individual trial courts lack control over the level of these benefits set by the counties and provided to these trial court employees, and more importantly, the costs that must be paid to provide those benefits.

In recent years, concerns have been raised regarding whether trial courts have been effectively containing costs in their negotiations with trial court employees. For example, the Governor’s Budget Summary raises the concern that trial court employees in a number of courts are not (1) making retirement contributions or (2) making contributions in a manner similar to executive branch employees, who are generally required to contribute 8 percent to 10 percent of their salary towards these costs. In view of such concerns, the administration has not proposed additional funding specifically for increased trial court retirement and benefit costs since 2010–11. According to the judicial branch, these unfunded cost increases will reach an estimated $64.1 million by the end of 2013–14. Without additional resources to support these costs, trial courts will use more of their operational funds to meet these obligations, which could result in reduced levels of service to the public.

Few Statutory Changes to Increase Efficiency Adopted to Date. In 2012–13, the Legislature requested that the judicial branch submit a report on potential operational efficiencies, including those requiring statutory amendments. The Legislature’s intent was to identify efficiencies that, if adopted, would help the trial courts address their ongoing budget reductions. In May 2012, the judicial branch submitted to the Legislature a list of 17 measures that would result in greater operational efficiencies or additional court revenues. (Our publication,

The 2013–14 Budget: Governor’s Criminal Justice Proposals, describes in detail many of these measures.) However, only four administrative efficiencies and user fee increases have subsequently been implemented to date. In order to effectively absorb ongoing budget reductions, additional changes to make the courts operate more efficiently will likely need to be adopted.

Less Resources Available to Offset Reductions. Over the last five years, the state has transferred funds from various judicial branch special funds (such as those related to court construction) to help offset budget reductions to the trial courts. However, the availability of resources from these funds to offset reductions in the budget year will be limited. For example, most of the transfers to the trial courts have come from three special funds: the State Court Facilities Construction Fund (SCFCF), the Immediate and Critical Needs Account (ICNA), and the State Trial Court Improvement and Modernization Fund (IMF). However, the repeated transfer of dollars from these three funds has greatly reduced their fund balances. As a result, additional transfers would likely delay planned projects or reduce certain services typically supported by the fund (such as judicial education programs and self–help centers). Additionally, as we discuss in the next section, the fund balances for the SCFCF and ICNA have been identified as potential sources for temporary cash flow loans, which places further constraints on the availability of these funds to offset reductions.

Similarly, trial courts used their reserves to minimize the impact of ongoing funding reductions upon court users. However, the repeated use of reserve funds over the past five years and the full implementation of the new trial court reserves policy mean minimal reserve funds will be available to help offset budget reductions in 2014–15. (We discuss the reserves policy in more detail later in this report.)

Limited Ability to Increase Revenues to Offset Reductions. The Legislature has approved increases in criminal and civil fines and fees in recent years to fund court facility construction projects and to offset reductions to trial court funding. As can be seen in Figure 7, revenues from the recent fee increases are projected to decline in 2013–14 but will generally meet the original revenue estimates of the courts. Moreover, revenues for most of the individual fee increases are lower than what was projected. This could be an indication that, at least for some fines and fees, additional increases may not result in as much revenue as previously achieved. This could also be a signal of reduced access to justice as fewer people are accessing the civil court process because of the increased costs.

Figure 7

Total Revenues From Recent Fee Increases

(Revenues in Millions)

|

Fee or Penalty

|

Fee

Increase

|

Initial Revenue Projections

|

2012–13

Revenues (Actual)

|

Current Revenue Projections for 2013–14a

|

|

Increased in 2010–11

|

|

|

|

|

|

Summary Judgment Fee

|

$300

|

$6.2

|

$5.3

|

$4.7

|

|

Telephonic Hearing Fee

|

20

|

6.0

|

7.1

|

3.9

|

|

First Paper Filing Fee

|

20 or 40

|

40.1

|

31.8

|

30.6

|

|

Pro Hac Vice Fee

|

250

|

0.8

|

0.5

|

0.5

|

|

Parking Citation Penalty

|

3

|

10.5

|

25.5

|

21.3

|

|

Total New Revenues

|

|

$63.6

|

$70.3

|

$61.0

|

|

Increased in 2012–13

|

|

|

|

|

|

Jury Deposit Fee

|

$150

|

$11.7

|

$17.9

|

$11.5

|

|

Motion Fee

|

20

|

8.3

|

7.6

|

7.4

|

|

First Paper Filing Fee

|

40

|

21.1

|

20.4

|

20.5

|

|

Will Deposit Fee

|

50

|

2.2

|

1.0

|

1.0

|

|

Complex Case Fee

|

450

|

7.1

|

11.3

|

13.3

|

|

Total New Revenues

|

|

$50.4

|

$58.2

|

$53.8

|

|

a Estimated using partial–year revenues received through November 30, 2013.

|

Access to Court Services May Not Substantially Increase. While the Governor’s budget provides an additional $100 million in ongoing General Fund support for trial court operations, these funds may not result in a substantial restoration of access to court services. First, the Governor’s budget does not include a list of priorities or requirements for the use of these additional funds, such as requiring that they be used to increase public access to court services. We note that the 2013–14 budget requires that the trial courts use the $60 million augmentation provided to specifically increase access to court services, as well as report on both the expected and actual use of the funds. Second, as discussed above, trial courts (1) face increased cost pressures in 2014–15 and (2) will need to take actions to absorb around $100 million in additional ongoing prior–year reductions as one–time solutions previously used to offset these reductions will no longer be available in 2014–15. Thus, trial courts will need to take actions to absorb these cost increases and reductions on an ongoing basis, which could include further operational reductions. In view of the above, it is possible that the increased funding proposed in the Governor’s budget will only minimize further reductions in court services.

Impact of Funding Increase Will Vary by Court. We would also note that the impact of the proposed funding increase will vary across courts. This is because there are differences in:

- Cost Pressures Faced by Courts. Individual trial courts face different cost pressures. For example, some trial courts may have better controlled retirement and health costs through negotiations with employees, and therefore may be free to use more of the proposed augmentation for other purposes, such as increasing services to the public.

- Operational Actions Taken to Address Reductions. Trial courts also differ in the operational choices they made over the past few years to address their ongoing reductions. For example, some courts may have addressed most or all of their share of ongoing reductions through actions that resulted in ongoing savings. Thus, these particular courts may be able to use their share of the augmentation to restore services to the public. Other courts may have used limited–term solutions. To the extent that such limited–term solutions are no longer available, these courts will need to use more of the augmentation as a backfill to help minimize further service reductions.

- WAFM Funding. The implementation of WAFM impacts individual trial courts differently. The old prorata allocation methodology preserved existing funding inequities among the trial courts, as it was based on the historic share of funding received by courts rather than workload faced by the court. The WAFM corrects these inequities by redistributing funds among the courts based on workload. Thus, courts that historically have had more funding relative to their workload will benefit very little from the augmentation proposed by the Governor. In contrast, courts with less funding relative to their workload will benefit comparatively more from the augmentation.

Define Legislative Funding Priorities for Proposed Augmentation. Given the cost increases in employee benefits and the limited availability of resources to help trial courts absorb an increasing amount of ongoing reductions in 2014–15, as well as legislative concerns regarding the likely negative impacts of such challenges on court users, we find that the Governor’s proposed $100 million augmentation merits consideration. However, if the Legislature determines that (1) further minimizing the amount of additional impacts on court users is a statewide priority and (2) efficiencies or other options do not allow the courts to provide the level of service it desires, the Legislature could chose to provide additional General Fund support on either a one–time or an ongoing basis.

Regardless of the amount of additional funding provided to the trial courts in 2014–15, we recommend that the Legislature establish priorities for how the increased funding should be spent—for example, increasing access to court services. We also recommend that the Legislature require the courts to report on the expected use of such funds prior to allocation and on the actual use of the funds near the end of the fiscal year. Such information would allow the Legislature to conduct oversight to ensure that the additional funds provided are used to meet legislative priorities.

Consider Implementing More Efficiencies. We recommend that the Legislature consider further actions to help the trial courts operate more efficiently. For example, the Legislature could reevaluate the proposed statutory changes that were not enacted last year. These changes would allow the courts to do more with existing dollars, thereby minimizing the impact of their budget reductions. Additionally, in conversations with courts and other judicial branch stakeholders, a number of other such statutory changes exist that would increase efficiency. For example, courts have informed us that under current law, they may only discard death penalty files and exhibits upon the execution of the defendant. Since most individuals on death row are not executed but die due to natural causes, courts cannot destroy their case records and bear the costs of storing these files and exhibits indefinitely. The Legislature could modify current law to allow death penalty files and exhibits to be discarded on the death of the defendant, regardless of how the defendant died, which would reduce storage costs. Such changes could help provide the judicial branch with additional ongoing savings or revenues that could help further offset ongoing reductions. If the Legislature is interested in implementing a broader range of efficiencies beyond those already proposed, it could consider convening a task force to identify and recommend efficiencies, as we discuss in greater detail in the nearby box.

The Legislature could consider convening an independent task force—consisting of a broad range of judicial branch stakeholders—to comprehensively evaluate court processes and identify operational efficiencies that would reduce costs to the courts, improve delivery of court services, and increase access to court services. Although similar task forces have been convened in the past, these groups have only provided the Legislature with recommendations for which there is unanimous consensus. Consequently, the recommendations of these task forces have been limited in scope.

To maximize the menu of efficiencies available for legislative consideration, the Legislature could direct the task force to identify all efficiencies proposed by stakeholders, along with an assessment of each efficiency’s impact (fiscal or otherwise). Dissenting members would then be allowed to provide their concerns and rationale for opposition. This would then enable the Legislature to consider a broad range of efficiencies as well as the fiscal and policy implications of each option.

Establish Comprehensive Trial Court Assessment Program. Currently, there is insufficient information to assess whether trial courts are using the funding provided in the annual budget effectively. This makes it difficult for the Legislature to ensure that (1) certain levels of access to courts services are provided, (2) trial courts use existing and increased funding in an effective manner, and (3) funding is allocated and used consistent with legislative priorities. For example, it is unclear exactly how each trial court has absorbed past reductions and how such actions have impacted court outcomes. Thus, we recommend that the Legislature take steps towards establishing a comprehensive performance assessment program for the trial courts. (We initially made such a recommendation in our 2011 report, Completing the Goals of Trial Court Realignment.) While the judicial branch collects some statewide information related to certain measures of trial court performance (such as the time it takes a court to process its caseload), it currently lacks a comprehensive set of measurements for which data is collected consistently on a statewide basis.

In developing a comprehensive performance assessment program, we first recommend that the Legislature specify in statute the specific performance measurements it believes are most important and require the Judicial Council to collect data on each measurement from individual trial courts on an annual basis. In determining the specific performance measurements, we believe that it will first be important for the Legislature to solicit input from the Judicial Council. Thus, we recommend the Judicial Council report to the Legislature by a specified date on its recommendations regarding appropriate measurements. In preparing this report, the Judicial Council should examine the measurements currently used by federal courts and other state courts.

After the Legislature adopts specific performance measurements for the trial courts in statute, and once data on these measurements have been reported by the Judicial Council for at least two years, we recommend that the Legislature establish a system for holding individual courts accountable for their performance relative to those standards. Such an accountability system would involve the establishment of (1) a specific benchmark that the courts would be expected to meet for each measurement and (2) steps that would be taken should the court fail to meet the benchmark over time (such as by requiring a court that fails to meet a benchmark to adopt the practices of those courts that were successful in meeting the same performance benchmark).

Use of Trial Court Reserves. Chapter 850, Statutes of 1997 (AB 233, Escutia and Pringle), allowed the Judicial Council to authorize trial courts to establish reserves to hold any unspent funds from prior years. Chapter 850 did not place restrictions on the amount of reserves each court could maintain or how they could be used. These reserves consist of funding designated by the court as either restricted or unrestricted. Restricted reserves include (1) funds set aside to fulfill contractual obligations or statutory requirements and (2) funds usable only for specific purposes. Examples of restricted reserves includes funds set aside to cover short–term facility lease costs, service contracts, license agreements, and children’s waiting room costs. Unrestricted funds are generally used to avoid cash shortfalls caused by normal revenue or expenditure fluctuations, to make one–time investments in technology or equipment, and to cover unanticipated costs.

New Reserves Policy Enacted in 2012–13. As part of the 2012–13 budget package, the Legislature approved legislation to change the above reserve policy that allows trial courts to retain unlimited reserves. Specifically, beginning in 2014–15, each trial court will only be allowed to retain reserves of up to 1 percent of its prior–year operating budget. Additionally, legislation was approved to establish a statewide trial court reserve, managed by the Judicial Council, beginning in 2012–13. This statewide reserve consists of a withholding of 2 percent of the total funds appropriated for trial court operations in a given year—approximately $37.2 million in 2014–15. Trial courts can petition the Judicial Council for an allocation from this statewide reserve to address unforeseen emergencies, unanticipated expenses for existing programs, or unavoidable funding shortfalls. Any unexpended funds in the statewide reserve would be distributed to the trial courts on a prorated basis at the end of each fiscal year.

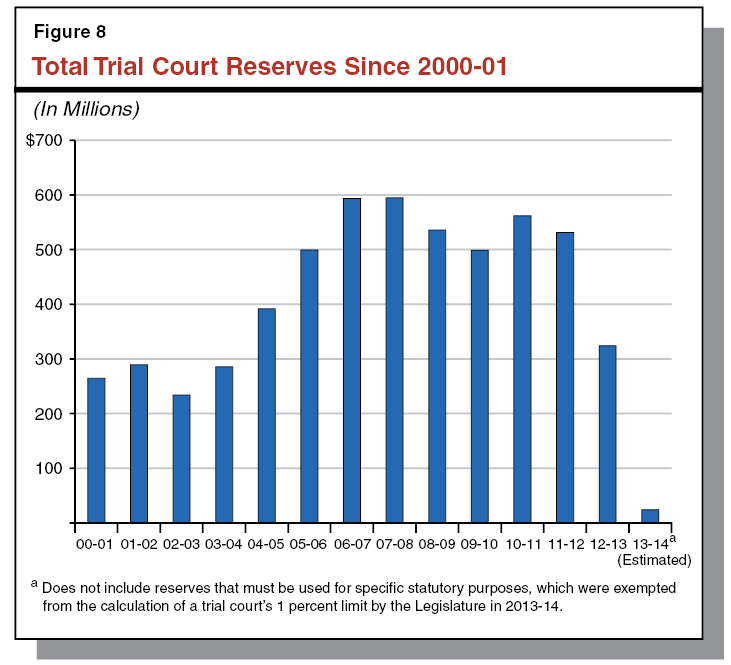

New Reserves Policy Amended in 2013–14. As part of the 2013–14 budget package, the Legislature approved legislation modifying the reserves policy to address some concerns that had been raised about the policy. For example, amendments were approved to authorize intra–branch loans to trial courts from three judicial branch special funds—SCFCF, ICNA, and the Judicial Branch Workers’ Compensation Fund—totaling up to $150 million for cash management purposes. The judicial branch is required to report each year on the amount of such loans made and courts are required to repay each loan within two years. Moreover, in order to increase the amount of reserves available for discretionary use, changes were also made to exempt reserves that must be used for specific statutory purposes (such as funds set aside to establish and maintain a children’s waiting room) from the calculation of a trial court’s 1 percent limit—which totaled about $38 million at the end of 2012–13 and represented about 33 percent of restricted reserve funds. In addition to exempting any such reserves from the calculation of the 1 percent limit, the judicial branch estimates that trial courts will be able to retain up to $24.1 million at the start of 2014–15. As shown in Figure 8, this is a substantial decrease from the $324 million in reserves held at the end of 2012–13.

The Governor’s budget maintains the reserves policy initially enacted as part of the 2012–13 budget package and amended in 2013–14. The administration states that the new reserves policy is more consistent with a state–funded judicial system as it enables the Judicial Council to set statewide priorities for the use of such funds and ensure that their use benefits the entire trial court system.

Cash Flow Concerns Persist Despite Special Fund Loans. Courts currently use their reserves to avoid cash shortfalls when their monthly operating expenses exceed their monthly allocation from the state. This ensures that courts pay all of their bills on time and that certain court programs can continue to operate even when there are delays in federal or other reimbursements. Accordingly, reducing the reserve courts are allowed to retain can create cash flow difficulties for courts. Moreover, the potential for cash shortfalls is exacerbated by the requirement that the judicial branch maintain a statewide reserve of 2 percent, as this means that each court’s total allocation is 2 percent smaller than it would otherwise be. The recent amendments to the reserves policy to permit temporary loans of up to $150 million from the SCFCF, ICNA, and the Judicial Branch Workers’ Compensation Fund should address most of the cash–flow issues in the short run. However, cash–flow loans from these three funds could force the judicial branch to delay payments or planned projects. To prevent this, the Legislature could expand the number of special funds that courts could borrow from for cash–flow purposes. For example, the Legislature could allow loans to be made from the IMF and the Court Facilities Trust Fund as well.

We note, however, that even with expanded authority to borrow from additional judicial branch special funds, it is likely that funds will be unavailable for loans in the long run without delaying projects or reducing support for programs currently funded by these special funds. For example, both the SCFCF and ICNA are currently used to make debt–service payments for completed courthouse construction projects. Over time, more projects will be completed requiring greater expenditures from both of these funds, which would further reduce the availability of such funds for cash shortfall loans. Thus, if priority was placed on ensuring $150 million in loans were available in these funds for cash–flow purposes, the judicial branch would potentially need to delay certain projects.

Courts May Need to Suspend Some Existing Contracts. While the amended reserves policy exempts funds set aside for specific statutory purposes, it does not take into account reserve funding that courts set aside to fulfill contractual obligations. This can create some challenges for the courts. First, some courts have ongoing contractual obligations. For example, some courts may utilize a third–party vendor to process their employee payroll, such as the county personnel agency or a private company. These third–party vendors often require the courts to maintain a certain amount of funding in reserve prior to issuing payroll—an amount generally greater than the 1 percent cap that they are allowed to keep in reserve under the new reserves policy. Without sufficient funds in reserve to meet such obligations, courts may have difficulty making employee payroll or may no longer be able to use their third–party vendor. Second, some courts have entered into one–time or multiyear contracts or agreements to fund various projects, such as replacing aging case management systems. In such circumstances, courts often set aside the entire cost of the project but only make incremental payments once vendors meet performance benchmarks. For example, one trial court has entered into a $2.4 million contract to replace its case management system with $1.1 million due in 2013–14 and $1.3 million due in 2014–15. However, the court will only be able to retain an estimated $305,000 in reserves to comply with the 1 percent cap—an amount significantly less than the $1.3 million due in 2014–15.

Since the above funds are not exempted from the calculation of the 1 percent limit, some courts may be forced to break existing contracts, particularly if an alternative funding source is not identified by the judicial branch. To the extent that courts are able to fulfill these expenditures within the 1 percent cap, they will likely have fewer unrestricted funds available for other purposes. This could potentially result in these courts requiring more loans to cover cash shortfalls, as well as the delayed implementation of additional projects or elimination of programs or services that would otherwise be supported through discretionary funds.

Limits Ability for Courts to Plan for Future Projects. Historically, trial courts built up their reserves to fund projects or programs to help them operate more efficiently, support additional workload, or provide the public with greater access to court services (such as document management, collections, electronic filing, and electronic access technologies). To the extent that the funds currently supporting such projects or programs exceed the 1 percent reserves cap, they could be halted or scaled back. Additionally, because the statewide reserve can only be used to address unforeseen emergencies, unanticipated expenses for existing programs, or unavoidable funding shortfalls, these funds are not available to support projects historically funded from reserves. Thus, the new reserves policy limits the ability of courts to save and plan over time for such investments.

Limits Incentive and Ability of Individual Trial Courts to Implement Efficiencies. Under the amended reserves policy, individual trial courts have less incentive to operate efficiently. The historical ability for courts to set aside unlimited funds encouraged them to operate more efficiently because any savings created could then be used by the court to fund future programs or projects that benefited it directly. Under the new reserves policy, however, reserve funds beyond the 1 percent cap created by efficiencies implemented by individual trial courts cannot be retained by the court. Accordingly, trial courts have less incentive to implement such efficiencies as they will be unable to benefit directly from the savings created. In addition, the reserves policy limits the ability of trial courts to create such efficiencies.

While the Governor’s budget proposes no new changes to the reserves policy in 2014–15, we recommend the Legislature amend existing policy to address some or all of the unintended challenges related to cash flow, meeting existing contracts, planning for future projects, and incentives for implementing operational efficiencies. We find that there are different ways that the Legislature could address each of these challenges.

- Cash–Flow Concerns. In order to address potential cash–flow concerns, the Legislature could make statutory changes to increase the availability of cash, such as by (1) expanding the number of judicial branch special funds eligible for making loans, (2) authorizing the State Controller’s Office to change the frequency of the distribution of funds to the judicial branch, and/or (3) permitting the state to make loans from its borrowable funds to the judicial branch. The Legislature could also exclude funds needed for cash–flow purposes from the calculation of the 1 percent reserve cap.

- Contract Concerns. In order to address concerns regarding the ability of trial courts to meet multiyear contracts, the Legislature could also exempt funds from the 1 percent cap that are (1) set aside as required by some trial court payroll vendors and (2) held to fulfill existing contracts.

- Future Projects. In order to enable courts to fund future projects and programs to improve court operations, the Legislature and judicial branch could establish new processes for prioritizing and funding those projects determined to be of greatest value to the state. For example, the Legislature could require the judicial branch to follow the same processes that currently exist for other state entities for the approval and funding of information technolody projects.

Alternatively, the Legislature could decide to increase the trial court reserves cap from the current 1 percent limit. The new limit could vary depending on the extent that the Legislature takes other actions (such as those described above) to address the challenges currently resulting from the 1 percent cap. For example, according to the judicial branch, trial courts would need to keep approximately 12 percent of their prior–year operating budget in order to avoid cash–flow issues, assuming no other changes are adopted to alleviate concerns regarding cash flow. We note that increasing the cap could also help provide an incentive and ability to invest in future projects that could create operational efficiencies.

The CDCR is responsible for the incarceration of adult felons, including the provision of training, education, and health care services. As of January 15, 2014, CDCR housed about 134,000 adult inmates in the state’s prison system. Most of these inmates are housed in the state’s 34 prisons and 42 conservation camps. Approximately 11,700 inmates are housed in either in–state or out–of–state contracted prisons. The department also supervises and treats about 47,000 adult parolees and is responsible for the apprehension of those parolees who commit new offenses or parole violations. In addition, about 700 juvenile offenders are housed in facilities operated by CDCR’s Division of Juvenile Justice (DJJ), which includes three facilities and one conservation camp.

The Governor’s budget proposes total expenditures of $9.8 billion ($9.5 billion General Fund) for CDCR operations in 2014–15. Figure 9 shows the total operating expenditures estimated in the Governor’s budget for the current year and proposed for the budget year. As the figure indicates, the proposed spending level is an increase of $391 million, or about 4 percent, from the 2013–14 spending level. The department’s budget includes increased spending related to (1) a projected increase in the prison population, (2) the expansion of the correctional officer training academy, (3) increased workers’ compensation expenses, (4) the expansion of rehabilitation programs, and (5) increased use of in–state contract beds for inmates. This additional spending is partially offset by a projected decrease in the adult parole population resulting from the 2011 realignment of adult offenders to counties.

Figure 9

Total Expenditures for CDCR

(Dollars in Millions)

|

|

2012–13 Actual

|

2013–14 Estimated

|

2014–15 Proposed

|

Change From 2013–14

|

|

Amount

|

Percent

|

|

Prisons

|

$7,481

|

$8,214

|

$8,496

|

$282

|

3.3%

|

|

Adult parole

|

621

|

569

|

566

|

–3

|

–0.6

|

|

Administration

|

409

|

430

|

546

|

116

|

21.3

|

|

Juvenile institutions

|

175

|

187

|

179

|

–8

|

–4.7

|

|

Board of Parole Hearings

|

57

|

41

|

46

|

5

|

10.1

|

|

Totals

|

$8,742

|

$9,441

|

$9,833

|

$391

|

4.2%

|

The average daily prison population is projected to be about 138,000 inmates in 2014–15, an increase of roughly 2,800 inmates (2 percent) from the estimated current–year level. This increase is largely due to an increase in admissions to state prison. In particular, the department reports an increase in the number of offenders convicted as “second strikers.” (Under the state’s Three Strikes law, an offender with one previous serious or violent felony conviction who is convicted for any new felony can be sentenced to twice the term otherwise required under law for the new conviction and must serve the sentence in state prison. These particular offenders are commonly referred to as second strikers.) In 2012–13, 5,500 second strikers were admitted to state prison, which is an increase of 33 percent from the prior year. The CDCR’s projections also show that the prison population is expected to continue increasing over the next few years. By June 30, 2019, the department estimates that the prison population will be 143,000.

The average daily parole population is projected to be about 37,000 parolees in the budget year, a decline of about 9,000 parolees (20 percent) from the estimated current–year level. This decline is largely a result of the 2011 realignment, which shifted from the state to the counties the responsibility for supervising certain offenders following their release from prison. The CDCR’s projections also show that the parole population is expected to continue to decline—although at a slower pace—over the next few years. By June 30, 2019, the department estimates that the parole population will be 33,000.

As part of the Governor’s January budget proposal each year, the administration requests modifications to CDCR’s budget based on projected changes in the prison and parole populations in the current and budget years. The administration then adjusts these requests each spring as part of the May Revision based on updated projections of these populations. The adjustments are made both on the overall population of offenders and various subpopulations (such as mentally ill inmates and sex offenders on parole). As can be seen in Figure 10, the administration proposes a net increase of $2.9 million in the current year and a net reduction of $23.4 million in the budget year.

Figure 10

Governor’s Population–Related Proposals

(Dollars in Millions)

|

|

2013–14

|

2014–15

|

|

Prison Population Assumptions

|

|

|

|

2013–14 Budget Act

|

128,885

|

128,885

|

|

Governor’s 2014–15 budget

|

135,006

|

137,788

|

|

Prison Population Adjustments

|

6,121

|

8,903

|

|

Parole Population Assumptions

|

|

|

|

2013–14 Budget Act

|

42,498

|

42,498

|

|

Governor’s 2014–15 budget

|

45,944

|

36,660

|

|

Parole Population Adjustments

|

3,446

|

–5,838

|

|

Budget Adjustments

|

|

|

|

Inmate–related adjustments

|

$5.0

|

$2.2

|

|

Contract bed adjustments

|

–7.7

|

—

|

|

Jail contract reimbursements

|

—

|

13.2

|

|

Health care facility activations

|

–0.2

|

–4.9

|

|

Parolee–related adjustments

|

5.9

|

–28.7

|

|

Other adjustments

|

–0.1

|

–5.1

|

|

Proposed Budget Adjustments

|

$2.9

|

–$23.4

|

The current–year net increase in costs is primarily due to costs from the higher–than–expected 2013–14 parole population, as well as additional unanticipated costs for the recently activated California Health Care Facility (CHCF) in Stockton. These costs are partially offset by savings related to in–state contract beds due to delays in moving inmates into such beds, as well as reduced costs associated with the deactivation of temporary mental health crisis beds at the California Men’s Colony in San Luis Obispo. (The increased cost for the administration’s proposed expansion of in–state contracts in the current year is accounted for elsewhere in the Governor’s budget for CDCR.)

The budget–year net reduction in costs is largely related to the lower–than–expected 2014–15 parole population and reduced costs associated with deactivating temporary mental health crisis beds at the California Institution for Men in Chino and California State Prison, Sacramento. These reductions are partially offset by increased costs to reimburse counties for various services provided to CDCR (such as housing CDCR inmates when they must appear in court), as well as costs from an increase in certain populations of inmates needing mental health care.

In general, the administration’s projections of the prison and parole population are reasonable based on recent trends, and the associated budget adjustments are generally reasonable. We find, however, that potential savings could be realized by adjusting for the delayed activation of CHCF, as well as from reducing reliance on registry for mental health position vacancies.

Delayed Activation of CHCF. The department activated CHCF in July 2013 and began transferring inmates to the prison in phases throughout the fall of 2013. The department’s original activation schedule called for CHCF to have all of its 1,722 beds filled by December 31, 2013. However, the activation of certain housing units were delayed. For example, CDCR delayed the activation of seven 30–bed housing units for mentally ill inmates operated by the Department of State Hospitals (DSH). The CDCR activated two of these units several months behind schedule, and the other five units were inactive at the time of this analysis. It is unclear when the units will be activated. According to CDCR, the delays have resulted from DSH’s inability to hire sufficient mental health professionals to staff the housing units. Moreover, we note that the state recently suspended the transfer of inmates to CHCF due to activation problems (such as inadequate medical supplies). The delayed activation of the housing units should reduce workload for CDCR in 2013–14 and 2014–15. This is because the department does not need to allocate budgeted correctional officer time to provide security for empty housing units. In addition, there are fewer inmates to escort throughout the prison (such as to medical appointments). However, the administration’s request for additional resources for the operation of CHCF does not reflect any savings to CDCR from such workload reductions.

Use of Registry for Mental Health Services. Mental health staffing levels are determined using a ratio staffing model, which is based on patient population, clinical staff recommendations, direction from the Coleman court special master, and other factors. Adjustments are made twice annually based on changes in the patient population. We note, however, that mental health staff positions have consistently been very difficult to fill. Currently, the department has a vacancy rate of 23 percent, excluding registry, blanket, and long–term sick leave. According to CDCR, none of the additional 75 mental health positions authorized by the Legislature for 2013–14 (including psychiatrists, psychologists, and administrative support staff) have been filled. In 2013–14, CDCR estimates that it will realize $36 million in salary savings from those vacancies and is projected to spend $25 million on registry staff (temporary staff paid an hourly wage) to cover the vacant positions.

The CDCR utilizes registry staff because of the difficulties in filling mental health positions and the need to maintain a certain basic level of services. As such, some level of registry is expected and unavoidable. However, registry may be more expensive than hiring civil service staff. Highly trained classifications such as psychiatrists and psychologists are particularly more expensive to hire as registry staff.

One way to reduce the need to use expensive registry staff is to encourage individuals providing registry services to transition to civil service positions. However, there is little reason for registry employees to do so, because CDCR currently has no cap on the number of hours a mental health registry employee can work. As a result, individuals can earn more as registry staff. We note that CDCR has put in place such caps on registry nurses in medical classifications because of similar concerns about unnecessary costs.

We withhold recommendation on the administration’s adult population funding request until the May Revision. We will continue to monitor CDCR’s populations, and make recommendations based on the administration’s revised population projections and budget adjustments included in the May Revision. However, we recommend that the Legislature direct the department to make adjustments as part of the May Revision to reflect the savings from the delayed activation of housing units at CHCF.

We also recommend that the Legislature direct the department to report during budget subcommittee hearings this spring on (1) the feasibility of instituting a cap for individual registry employees in cases where such employees are more costly than civil servants and (2) what would be an appropriate cap. The cap would need to be low enough to provide an incentive for these employees to transition to civil service, but not too low that it inhibited the department’s ability to provide mental health services. Such information would assist the Legislature in determining whether and what type of cap should be adopted. To the extent a cap encourages registry employees to transition to civil service, it could reduce the overall cost of mental health services in CDCR. We further recommend the Legislature require the department to report on how all of the savings realized from mental health staff vacancies has been used by the department, in order to determine whether the activities that were funded are consistent with legislative priorities and whether CDCR’s budget should be adjusted accordingly.

Each year the state spends billions of dollars annually both in base staffing costs and overtime costs to ensure each of its prisons is adequately staffed and is able to handle its various workload demands. Below, we describe and identify inefficiencies with how CDCR currently addresses these staffing needs. In addition, we review the Governor’s budget proposals related to CDCR’s staffing and overtime and recommend steps the department could take to address its correctional staffing needs in a more cost–effective manner.

Staffing the 34 adult prisons operated by CDCR represents a unique challenge. This is because many duty assignments (referred to as “posts”) must be filled 24 hours per day, 365 days per year. In particular, many assignments filled by correctional officers, sergeants, and lieutenants are posted positions. If a staff member is unavailable to fill a post, the prison generally cannot leave the post unfilled. Staff in these posts typically work one of three eight hour shifts (referred to as “watches”) each day, five days per week and have two regular days off (RDOs). Thus, a single post is typically filled by three different employees over the course of a day. Staff members assigned to the prison’s “watch office” are employed to ensure that all the posts are filled and are responsible for finding an employee capable of filling posts that are left empty when another employee is unavailable.

Steps Taken to Fill Posts Left Empty When Staff Are Unavailable. There are different reasons why an employee is unavailable to fill an assigned post, with employee leave use being the most common. Each correctional employee used, on average, 365 hours of leave in 2011–12. The most common type of leave used by correctional employees is sick leave. Other types of leave include vacation leave, annual leave (a type of leave employees may choose to earn in lieu of vacation and sick leave), and leave taken by staff to complete professional training and development or to fulfill military duty. In addition, posts can be empty if a position is vacant, such as when CDCR fails to hire enough staff. When a post becomes empty due to vacancies or staff absences, the watch office at the prison takes a series of sequential steps to identify certain employees to fill the absent post as follows.

- Relief Officers. When posts become empty because staff are unavailable, the watch office attempts to first fill the empty posts with relief officers. Relief officers are full–time correctional employees who are assigned to a specific prison. These officers arrive at the prison for a predetermined shift, but may not know which post they will be assigned to on a given day until they arrive at the prison. If there are not enough empty posts on a given watch, relief officers can be assigned other duties, such as searching the prison for contraband. Relief officers receive the same pay and benefits as other correctional officers assigned to regular posts.

- Officers Redirected From Other Posts. If relief officers are not available to fill empty posts, the watch office may then determine whether any correctional employees can be redirected from other posts that do not need continual staffing during the watch in question. Examples of posts that do not require continual staffing include posts in prison investigation units.

- PICOs. If the empty posts are correctional officer assignments (and not for correctional sergeants or lieutenants), the watch office will then attempt to use PICOs to fill the empty posts. Like relief officers, PICOs generally are assigned to a specific prison. However, unlike relief officers, PICOs only work if they are called in by the watch office to fill an empty post—similar to how a substitute teacher fills in for a sick school teacher. The pay and benefits of PICOs are contingent on the number of hours they work.

Overtime. If the posts are still empty after the above steps are taken, a watch office will then offer correctional employees the opportunity to earn overtime on a voluntary basis, with more senior officers being offered the opportunity first. If no employees volunteer to work overtime, a watch office will then use involuntary overtime to fill empty posts. Under these circumstances, overtime is assigned in reverse seniority order, with the most junior correctional employee on the previous watch being required to stay and fill the empty post on the next watch.

In addition to the need to fill posts, workload that falls outside each watch can also drive the need for correctional employee staffing and overtime. The most significant workload that results in the need for staffing and overtime is the workload associated with medical guarding and transportation. Such workload occurs when inmates require certain types of medical care that cannot be provided on–site and correctional staff must transport them to their appointments and guard them while they are there. This often results in overtime because the total time to transport and guard inmates can extend beyond the end of an officer’s shift. Other workload also contributes to the need for correctional staffing and overtime. Examples include the need to conduct investigations, transport inmates to and from their court dates, and various emergencies such as prison riots.

CDCR Budget for Relief Officers and PICOs. In order to estimate the number of relief officers that should be budgeted for in a given year, CDCR has historically used a formula that incorporates both the amount of leave time (such as vacation, sick leave, and training days) accrued by correctional officers as well as how much of that leave time they use. Currently, CDCR estimates that for every ten correctional officer positions, three relief officers must be budgeted for to account for the leave time that will likely be used by regular correctional officers. This ratio of relief officers to correctional officers is known as the “relief factor.” The department also uses a similar process for budgeting relief officers to fill posts left empty by correctional sergeants and lieutenants. The CDCR is budgeted in the current year for a total of about 4,500 correctional relief positions, which consists of 3,800 correctional officers, 530 correctional sergeants, and about 190 correctional lieutenants. In total, this represents about $500 million in costs.

In addition, CDCR has recently employed several hundred PICOs, accounting for 3.5 percent of the department’s total number of correctional officers. Because the department is currently facing high correctional officer vacancy rates, it plans to suspend placing newly hired correctional officers into the PICO program for two years. During this time the department plans to only offer new hires permanent full–time positions while it assesses whether its historical policy of assigning 3.5 percent of its total correctional officers as PICOs should be permanently adjusted. The CDCR does not have a budget specifically for PICOs. Instead, resources for these positions are derived from funding budgeted for overtime and positions that are vacant, as the use of PICOs reduces the need for these funds.

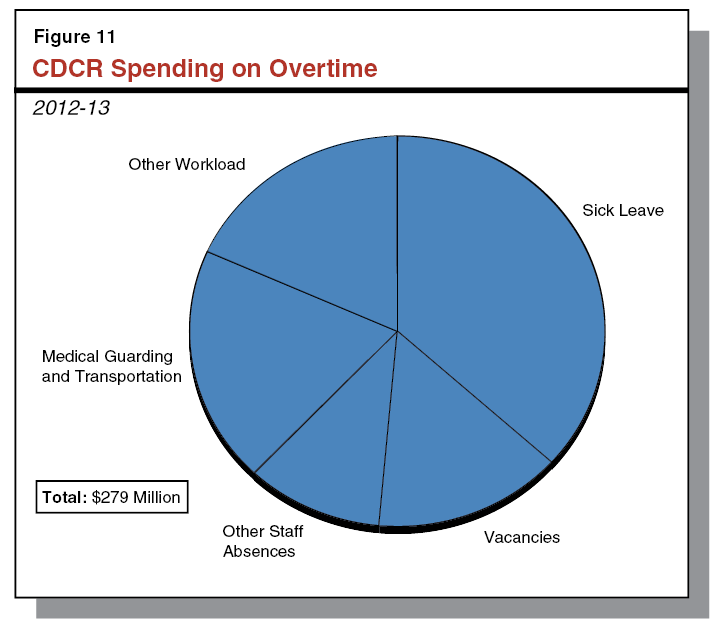

CDCR Spending on Overtime. In 2012–13, CDCR spent $279 million on correctional officer, sergeant, and lieutenant overtime costs. As shown in Figure 11, most of this spending is related to overtime to fill posts left empty due to staff being unavailable. Specifically, almost two–thirds of CDCR’s expenditures on overtime in 2012–13 were related to sick leave, vacant positions, or other staff absences. The remainder was spent on other workload–related overtime (such as medical guarding and transportation).

The Governor’s 2014–15 budget proposes $207.2 million in General Fund support for overtime costs. This represents a slight increase from the $201.3 million included in the 2013–14 budget for overtime costs. In addition, the budget proposes to change the methodology CDCR uses to calculate the relief factor. Under the proposal, the relief factor would be calculated based solely on statewide actual leave usage rather than a combination of actual leave usage and accrual rates. In addition, the proposed methodology would incorporate types of leave (such as furlough days) that are not accounted for in the current relief factor. These changes result in the need for an additional $9 million in General Fund support and 84 positions in 2014–15. Under the Governor’s proposal, the relief factor would be adjusted annually based on updated data on actual usage of staff leave in the prior year. In addition, we note that CDCR indicates that while the proposed relief factor change is based on statewide data, it is currently in the process of calculating specific relief factors for individual prisons that could be used to make annual adjustments at each prison in the future.

Our analysis of the way CDCR staffs its prisons and manages overtime indicates that CDCR’s overtime budget is unnecessarily large. While budgeting for overtime related to workload and some absences is necessary, the department does not need to set aside funding specifically for overtime required to cover vacancies and most of the types of leave that result in posts being empty. This is because funding for these types of overtime can be redirected from savings resulting from vacant positions. For example, when overtime is needed to fill a post that is empty due to a vacancy, the department can redirect funding tied to the vacant position to pay for the overtime, as that funding is not being used to pay correctional employees. Similarly, because the department budgets for enough relief officers to cover nearly all of the leave taken by correctional employees, overtime is only necessary to cover for such leave if there are vacant relief officer positions.

We also note that the amount of funding derived from vacant positions is sufficient to fully cover overtime costs. This is because the amount budgeted for each correctional position on a per hour basis, including benefits and other non–salary costs, exceeds the cost of the overtime necessary to cover the number of hours typically worked by correctional employees, as is illustrated in Figure 12. While staff are generally paid one and a half times their usual pay for overtime hours, the increased costs for the higher hourly wage is more than offset by other factors. For example, when the state hires additional correctional staff it must pay for their retirement and benefits whereas there are no such costs incurred for each additional hour of overtime worked.

Figure 12

Amount Budgeted Per Vacant Position Exceeds Average Cost of Overtime

|

|

Officer

|

Sergeant

|

Lieutenant

|

|

Salary

|

$70,128

|

$85,429

|

$96,108

|

|

Benefits and other costs

|

41,691

|

48,902

|

52,900

|

|

Total Amount Budgeted Per Position

|

$111,819

|

$134,331

|

$149,008

|

|

Average number of hours worked

|

1,712

|

1,688

|

1,728

|

|

Hourly Amount Budgeted Per Vacancy

|

$65.31

|

$79.58

|

$86.23

|

|

Average Overtime Hourly Cost

|

$47.92

|

$59.18

|

$68.61

|

However, when CDCR incurs costs for overtime related to workload (such as medical guarding and transportation) and leave not covered by relief officers (such as leave earned when correctional employees work through furlough days), there is no source of funding available to be redirected to cover such costs. Thus, CDCR only needs to set aside overtime funds in its budget exclusively for these purposes.

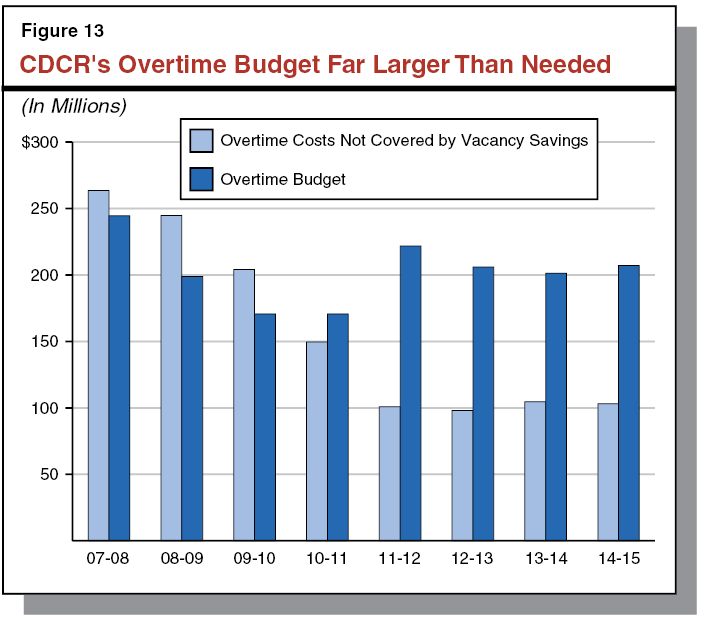

However, as shown in Figure 13, CDCR’s overtime budget in recent years is far larger than what has been required to fund overtime related to workload and absences not covered by relief officers. We note that Figure 13 does not depict CDCR’s actual spending on overtime, but rather compares the amount budgeted for overtime to our estimate of the department’s actual need for overtime funding. While CDCR’s actual spending on overtime has exceeded its budget in recent years, as we explain above, savings from vacancies is available to cover most of these costs. As such, the department’s actual spending on overtime does not reflect its need for overtime funding.

In 2011–12 and 2012–13, CDCR’s overtime budget was more than $100 million above, or about double, the amount required to fund overtime related to workload and absences not covered by relief officers. The discrepancy between CDCR’s overtime budget and its actual need for overtime funding increased significantly in 2011–12, when the department received additional funding because it had typically spent more on overtime than it had previously been budgeted for. At the same time, the implementation of the 2011 realignment reduced the inmate population and the number of correctional employees, which in turn significantly reduced the department’s need for overtime funding. Although CDCR’s overtime budget was reduced slightly in 2012–13, the budget was still more than $100 million beyond its actual need. Similarly, we estimate that the administration’s proposed overtime budget for 2014–15 is over budgeted by more than $100 million.

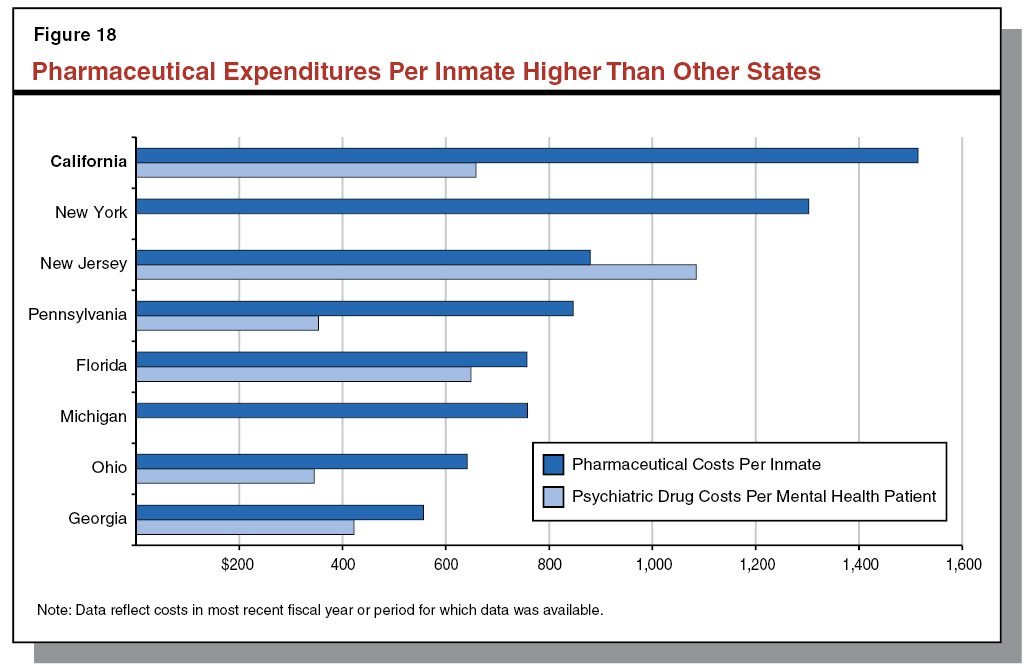

In view of the above, it appears that the funding tied to vacant positions has been used by CDCR for other purposes rather than to support the costs of overtime resulting from the vacancies. Our analysis finds that such funding has typically been used to address unfunded costs that the department has experienced in recent years. For example, in 2012–13, the department incurred $290 million in workers’ compensation costs, despite having only $210 million in its budget for such costs. In order to cover the $80 million shortfall, CDCR redirected unused funds from various places within its budget including funds tied to vacant positions.