In this report, we analyze the Governor’s Proposition 98 budget package for schools and community colleges. In the first section, we provide background on public schools in California. (We provide background information on community colleges in our forthcoming Higher Education Budget Analysis.) In the second section, we provide background on Proposition 98 and the calculation of the minimum funding guarantee for schools and community colleges. We next describe and assess the Governor’s estimates of the minimum guarantee and his corresponding Proposition 98 spending package. In the remaining sections of the report, we describe and assess the Governor’s specific Proposition 98 proposals.

K–12 Education in Context

This section provides a profile of the state’s K–12 public education system. We present information on California’s students, school districts, funding, teachers, various program aspects, and student performance. (While 9 percent of California’s school–age children attend private schools, most of the available summary data—and therefore most of what we discuss in this section—are limited to the students who attend the state’s public schools.) When such data are available, we provide perspective on how California’s K–12 system compares to those of other states. Throughout this section, we cite the most recent data available from government sources. In some cases—particularly for national comparison data, which typically takes years to compile—this information may be several years old.

California Has More K–12 Students Than Any Other State. In 2013–14, California’s public schools enrolled 6.2 million students, representing 13 percent of all public school students in the nation. About two–thirds of these students were in grades kindergarten through eight, with one–third attending high school. These enrollment levels include nearly 1 million (11 percent) more students compared to 20 years ago. Statewide enrollment grew rapidly between 1993–94 and 2003–04, averaging 2 percent growth each year. Over the past decade, however, student enrollment has been relatively steady, with enrollment in 2013–14 about 1 percent below the 2004–05 level.

Almost Six in Ten California Students Are From Low–Income Families. In 2011–12, 59 percent of California’s public school students were eligible to receive a free or reduced price school meal. States frequently use this measure as an indicator of student poverty. Qualifying students come from families earning no more than 185 percent of the federal poverty level—$44,000 annually for a family of four. California’s rate of free or reduced price meal eligibility is slightly above the nationwide rate.

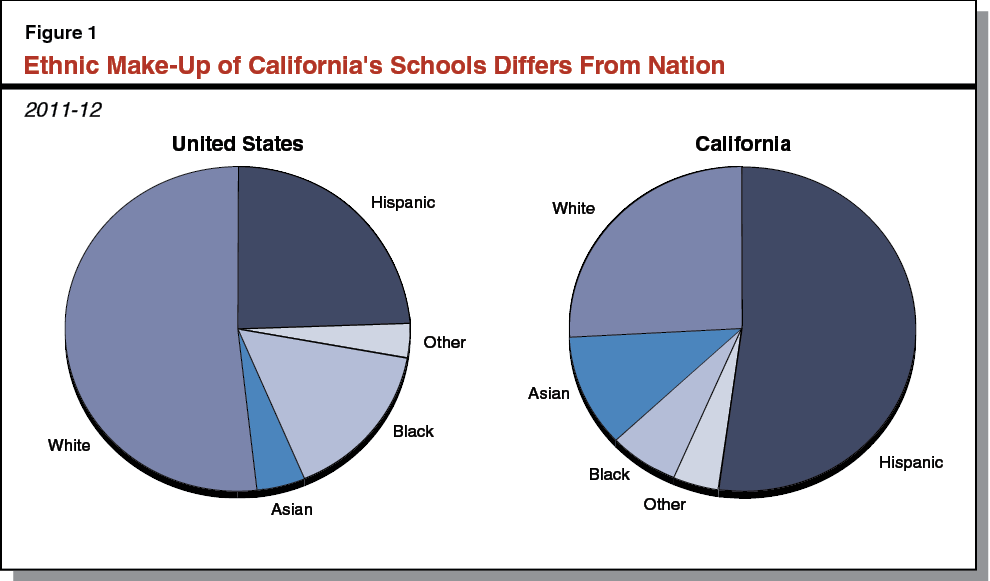

Half of California Students Are Hispanic. As shown in Figure 1, the ethnic make–up of California’s students is notably distinct from the nationwide picture. While slightly more than half (52 percent) of American students are white and about one–quarter are of Hispanic origin, in California those percentages are flipped. Asian students make up a slightly larger percentage of students in California (11 percent compared to 5 percent nationwide), while California schools serve proportionally fewer black students (7 percent compared to 16 percent nationwide).

Nearly One–Quarter of California Students Are English Learners (ELs). In 2013–14, 23 percent (1.4 million) of California students were classified as ELs—a higher proportion than in any other state. One out of every three EL students in the nation attends school in California. Even more California students, however—almost 2.7 million students overall—speak a primary language other than English at home. Whereas about half of these students are classified as ELs, the remainder are considered Fluent English Proficient. California students come from families speaking over 60 different languages, although the vast majority (79 percent) speak Spanish, with Vietnamese as the next most common language (3 percent).

One in Ten California Students Identified With a Disability Affecting Their Education. In 2013–14, about 635,000, or roughly 10 percent of K–12 students in the state, were diagnosed with a disability that affects their educational attainment. Pursuant to federal law, schools must provide these students with special education services. California identifies a smaller proportion of students for special education compared to most other states. (The national identification rate is about 11 percent of K–12 public school enrollment.) Specific learning disabilities—including dyslexia—are the most common diagnoses requiring special education services (affecting about 4 percent of the state’s K–12 students), followed by speech and language impairments. While the overall prevalence of students with autism and chronic health problems still is relatively rare (each affecting about 1 percent of all California public school students), the number of students diagnosed with these disabilities has increased notably over the last decade.

Size of California School Districts Varies Dramatically. As shown in Figure 2, California’s nearly 1,000 school districts vary greatly in size. Almost three–quarters of all California school districts serve fewer than 5,000 students. Combined, these 678 districts serve just 16 percent of all students in the state. Moreover, about one–quarter of the state’s districts contain only a single school. At the other extreme, 12 very large districts with over 40,000 students educate about one–fifth of all students in the state, with one district—Los Angeles Unified—representing about 10 percent of all students. Seven of the state’s counties contain only a single school district, while Los Angeles County contains 80 discrete districts.

Figure 2

California School Districts Vary Greatly in Size

2013–14

|

District Sizea

|

Number of Districts

|

Percent of All Districts

|

Total

Studentsa

|

Percent of All Studentsa

|

|

6 to 300

|

237

|

25%

|

29,758

|

1%

|

|

301 to 2,500

|

310

|

33

|

344,027

|

6

|

|

2,501 to 5,000

|

131

|

14

|

471,410

|

9

|

|

5,001 to 10,000

|

120

|

13

|

890,314

|

16

|

|

10,001 to 40,000

|

134

|

14

|

2,598,223

|

47

|

|

40,000+

|

12

|

1

|

1,167,871

|

21

|

|

Totals

|

944

|

100%

|

5,501,603

|

100%

|

Charter Schools Represent Fast–Growing Sector of California’s K–12 School System. An increasing share of California students attend charter schools instead of traditional district–operated schools. Publicly funded charter schools are similar to traditional schools in many ways—they must employ state–certified teachers, and they must teach and assess students based on the same state academic standards. Because they are not subject to certain laws and regulations, however, they have more flexibility over the design of their education program. While overall statewide K–12 enrollment has been relatively flat, the number of students attending charter schools has more than tripled over the past decade, growing at an average rate of 12 percent each year. In 2013–14, charter schools served nearly 500,000 students at more than 1,100 schools, representing about 8 percent of the statewide student population.

About One in Ten California High School Students Attend an Alternative School at Some Point. While the majority of California students attend traditional school district or charter schools, some students require a different educational environment. Students attending alternative schools typically have been chronically truant, are significantly behind in high school credits, or have been expelled or incarcerated. Alternative schools (including community day schools, county community schools, continuation high schools, and juvenile court schools) are operated by both school districts and county offices of education (COEs). (The district–run alternative schools generally serve the students with less severe challenges, such as students with minor behavioral or academic issues.) Alternative schools typically are used as short–term placements, with students often attending for less than a year.

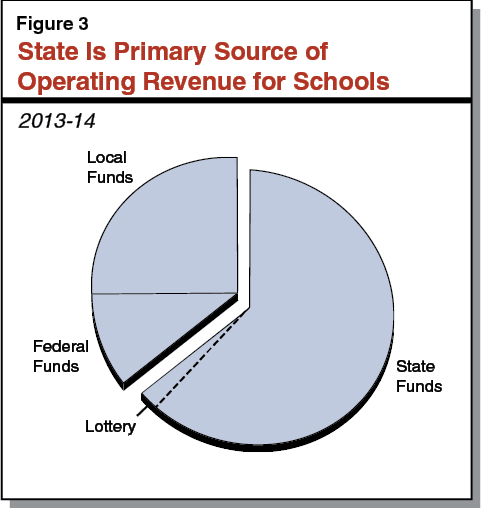

State Is Primary Source of Operating Revenue for Schools. In 2013–14, school districts received $73 billion in total funding from all sources. As shown in Figure 3, the largest share of school funding comes from the state, with smaller shares coming from local sources (primarily from local property tax revenue) and the federal government. These proportions differ from many other states, where local property tax revenues cover a much larger share of school funding. (Unlike many other states, California’s State Constitution limits local property tax rates.) Additionally, in contrast to many other states, most school districts’ overall funding levels are not affected by how much local property tax revenue they receive. This is because California generally uses local property tax revenue as an offset for state General Fund spending. (That is, if a district receives more local property tax revenue in a given year, the state reduces the district’s General Fund support by a like amount.)

State Per–Pupil Funding in 2014–15 Slightly Below Pre–Recession Level. The 2014–15 Budget Act provided schools with $8,931 per student. This is roughly $300 below the 2007–08 pre–recession level adjusted for inflation. (Under the Governor’s budget, the 2015–16 per–pupil funding level is about $200 above the inflation–adjusted 2007–08 level.)

Most Funding Is Allocated Through the Local Control Funding Formula (LCFF). In 2013–14, the state allocated 87 percent of K–12 education funding (state General Fund and local property tax revenue) through LCFF. School districts and charter schools may use LCFF funds for any educational purpose, though they must use a portion of these funds for increasing or improving services for EL and low–income students. (We discuss LCFF in more detail later in this report.) In addition to LCFF funds, the state provides funding for various categorical programs, the largest being special education. (Categorical programs restrict funding for specified purposes.)

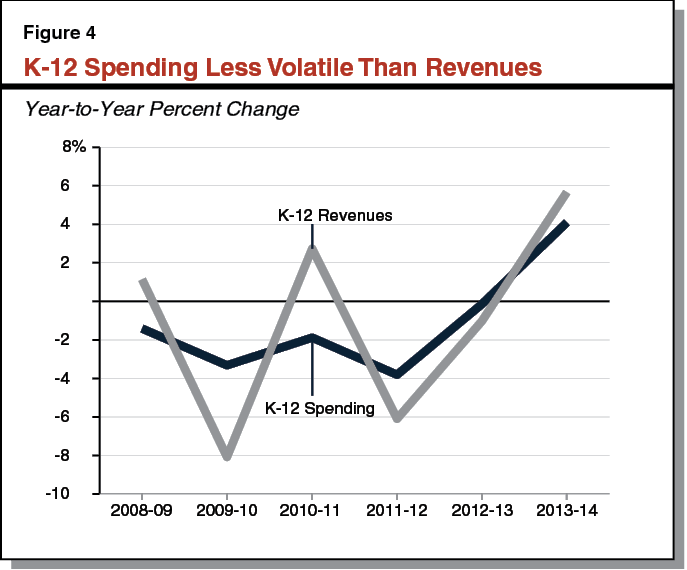

Over Past Seven Years, Revenues More Volatile Than Spending. As shown in Figure 4, changes in school district revenues have been more volatile than their expenditures. In 2009–10, when school district revenues decreased by 8 percent, their spending decreased by only 3 percent. In 2013–14, district revenues increased almost 6 percent, but their spending increased by only 4 percent. These data suggest school districts adjust spending somewhat gradually in response to decreases and increases in revenues. Rather than make drastic cuts in 2009–10, districts were more likely to make modest reductions and use their reserves to fund their programs. Districts continued to make more modest reductions until revenues increased considerably in 2013–14.

California Per–Pupil Spending Ranks Below Two–Thirds of States. Based on data from 2011–12, California ranked 36th in per–pupil spending among the 50 states and District of Columbia. In 2007–08, prior to the most recent recession, California ranked 23rd in per–pupil spending. The decrease in ranking is primarily due to the reductions the state made during the recession. (Because of the state’s progressive income tax rate structure, California’s revenues are highly sensitive to changes in the economy and financial markets. California’s budget was therefore more severely affected by the recession compared to most other states.) Given California has made significant increases in K–12 funding over the past three years, its ranking likely will increase as newer data become available.

If Adjusted for Cost of Employment, California Drops in the Rankings. Some organizations produce rankings of state per–pupil spending with adjustments for regional costs. In these rankings, California typically ranks much lower. In one recent ranking, for example, California ranked 45th in per–pupil spending. The adjustments in these rankings are primarily intended to control for the variation in wages across the country, with average wages higher in California.

California Teachers Have Roughly the Same Levels of Education and Experience as Teachers in Other States. As shown in Figure 5, the education and experience levels of California’s teacher workforce are somewhat reflective of national trends. In both California and across the nation, about 60 percent of teachers have been teaching for at least ten years, and a relatively small proportion (9 percent) are new teachers with fewer than three years of experience. About 4 in 10 teachers possess a bachelor’s degree, and more than half possess either a master’s degree or advanced graduate work.

Figure 5

California Has Smaller but Better Paid Teacher Workforce Than Nation

2011–12a

|

|

California

|

United States

|

|

Overall

|

|

|

|

Total Number

|

268,689

|

3,103,263

|

|

Student/Teacher Ratio

|

23.4

|

16.0

|

|

Experience

|

|

|

|

Less than 3 years

|

9%

|

9%

|

|

3 to 9 years

|

29

|

33

|

|

10 to 20 years

|

42

|

36

|

|

More than 20 years

|

19

|

21

|

|

Education

|

|

|

|

Less than Bachelor’s

|

5%

|

4%

|

|

Bachelor’s Degree

|

43

|

40

|

|

Master’s Degree

|

39

|

48

|

|

Education Specialist or Doctorate

|

13

|

9

|

|

Salary

|

|

|

|

Average Teacher Salaryb

|

$62,010

|

$46,340

|

|

Median Salary, All Bachelor’s Degree Holdersc

|

53,033

|

49,157

|

|

Salary by Years of Experienceb

|

|

|

|

2 or fewer years

|

$47,310

|

$38,330

|

|

6 to 10 years years

|

58,570

|

44,040

|

|

More than 20 years

|

73,980

|

56,620

|

California’s Teacher Salaries Higher Than Most Other States. Figure 5 also shows that California’s teachers earn more than their peers across the nation at all levels of experience. In 2011–12, California’s average salary for a teacher holding a bachelor’s degree ranked highest in the nation. As shown, the difference in average salary between California and the rest of the nation is greater for teachers (almost $16,000) than for all bachelor’s degree holders (almost $4,000). This suggests that the higher teacher salaries are based on additional factors besides a higher cost of living in California.

California Has Relatively Fewer Teachers, Relatively Larger Class Sizes. While California’s teachers are better paid than the rest of the nation, the state employs comparatively fewer of them. As shown in Figure 5, on average California teachers are responsible for 23.4 students, compared to the national average ratio of 16 students for each teacher. Moreover, in 2011–12 California ranked tenth in the nation for largest average elementary class sizes (21.5 students, compared to the national average of 20) and had the largest average secondary class sizes in the country (30 students, compared to the national average of 23.4).

Like Most States, California’s Instruction Now Based on Common Core State Standards. In 2010, California adopted the Common Core State Standards (with the addition of a few California–specific standards) as the new foundation for what students should know and be able to do in English–language arts and mathematics from kindergarten through twelfth grade. California has had academic content standards for over 15 years, but the new standards are designed to be better at preparing students for college and career. California schools are in the process of implementing the new standards by modifying curriculum, conducting professional development for staff, and purchasing new instructional materials. Forty three other states also have adopted and are implementing the Common Core State Standards. (In addition to the new standards for English–language arts and mathematics, California recently adopted the nationally developed Next Generation Science Standards. The state also maintains state–specific content standards in other academic areas, including history–social science, world languages, career technical education, and visual and performing arts.)

Students With Disabilities Frequently Receive Special Education Services in Separate Settings. Pursuant to federal law, California schools develop individualized education plans for students with identified disabilities affecting their education. In addition to extra academic supports in a classroom setting, these plans sometimes include other special education services such as language, occupational, and behavioral therapies. Compared to many other states, California more frequently educates students with disabilities in separate classrooms or settings. In 2011, only about half of the state’s students with disabilities spent the vast majority of their instructional time in regular classrooms, compared to the national average of about 60 percent.

Schools Provide Additional Academic Services Based on Student Needs. Besides special education, California schools also provide different types of academic services for students with specific needs. For example, EL students typically receive instruction to help them learn English. In 2011–12, 70 percent of the state’s EL students received English Language Development services and/or Specially Designed Academic Instruction in English. An additional 23 percent received support to learn English along with instruction or support in their primary language. California schools also provide a number of supplemental academic services to students who are struggling academically, including tutoring and academic counseling as well as after school and summer school programs.

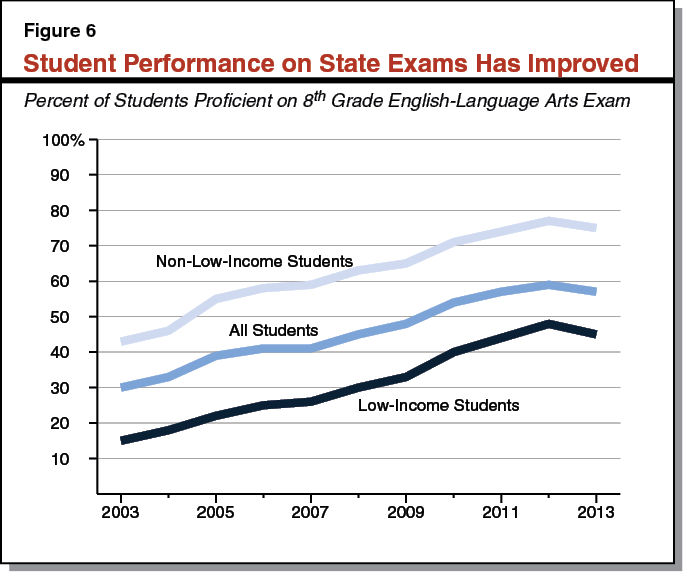

Student Performance on State Exams Has Improved. Student performance on the California Standards Tests (CSTs) has improved significantly over the past 10 years. As Figure 6 shows, the percentage of students scoring advanced or proficient on the eighth grade English–language arts exam has almost doubled—from 30 percent to 57 percent—in the past 10 years. Performance has improved at similar rates for both low–income and non–low–income students. Student performance also has improved at similar rates on mathematics exams and in English–language arts at other grade levels. The CSTs were based on the academic content standards adopted by California in 1997. Beginning in spring 2015, assessments in mathematics and English–language arts will be based on the Common Core State Standards. These assessments were developed by the Smarter Balanced Assessment Consortium, which includes 21 states. (As part of the transition to the new exams, California suspended the CSTs in spring 2014. Thus, no performance data is available for 2014.)

California Ranks Near Bottom on National Tests. Figure 7 shows California’s ranking on the National Assessment of Educational Progress, a federal assessment conducted nationwide. As the figure shows, California performs near the bottom in tests of reading and mathematics for fourth and eighth grades. Although the performance of non–low–income students tends to rank somewhat higher than that of low–income students, both groups perform lower than their peers in other states. California’s performance compared to other states has not changed significantly in the past 10 years. In addition to having lower performance compared to other states, California also has among the largest “achievement gaps”—the difference between the scores of low–income and non–low–income students. In fourth grade reading, for example, California’s achievement gap is ranked 45th in the country. (That is, 44 states have achievement gaps that are smaller than California.)

Figure 7

California Ranks Near Bottom on National Testsa

California’s Ranking Among 50 States and District of Columbia

|

|

All

Students

|

Low–Income Students

|

Non–Low–Income Students

|

Achievement

Gapb

|

|

4th Grade

|

|

|

|

|

|

Reading

|

46

|

48

|

38

|

45

|

|

Mathematics

|

46

|

49

|

42

|

43

|

|

8th Grade

|

|

|

|

|

|

Reading

|

41

|

42

|

29

|

45

|

|

Mathematics

|

44

|

47

|

38

|

43

|

Eight in Ten Students Graduate High School Within Four Years. Of the cohort of students that entered ninth grade in the 2009–10 school year, 80.4 percent graduated within four years, 11.4 percent dropped out of school, and 7.4 percent returned to school for a fifth year. Less than 1 percent of students completed their high school education after four years having received either a High School Equivalency Certificate (if they passed the General Educational Development Test) or a special education certificate of completion.

Increasing Share of Graduates Meet University Eligibility Requirements. In 2013, 39 percent of California students graduated high school having completed the coursework required to be eligible for admission to the University of California and California State University. This proportion has been gradually increasing over the last 20 years. In 1993, only 33 percent of California high school graduates met eligibility requirements for the state’s public universities.

California Students’ College Attendance Rates About the Same as National Average. Federal data from 2010 show that 62 percent of California high school graduates attend college (including community colleges and other institutions that offer an associate’s degree). This compares to 63 percent nationwide. College–going rates have declined somewhat since 2008, both nationally (1 percent) and, to an even greater degree, in California (nearly 4 percent).

Proposition 98 Sets Minimum Funding Level for Schools and Community Colleges. State budgeting for schools and community colleges is governed largely by Proposition 98, passed by voters in 1988. The measure, modified by Proposition 111 in 1990, establishes a minimum funding requirement for schools and community colleges, commonly referred to as the minimum guarantee. Both state General Fund and local property tax revenue apply toward meeting the minimum guarantee.

Various Inputs Determine Applicable “Test.” As described in Figure 8, the minimum guarantee is determined by one of three tests set forth in the State Constitution. These tests are based on several inputs, including changes in K–12 attendance, local property tax revenue, per capita personal income, and per capita General Fund revenue. The applicable test that sets the minimum guarantee is triggered automatically depending on these inputs. For 21 of the past 27 years, Test 2 or Test 3 has been the applicable test. In these years, the minimum guarantee builds upon the level of funding provided the prior year. Since the inputs are not finalized until several years after the close of the fiscal year, the applicable test can fluctuate and the minimum guarantee can change significantly from the level initially assumed in the budget.

Figure 8

Minimum Guarantee Determined by One of Three Tests

|

|

|

Test 1—Share of General Fund. Provides roughly 40 percent of state General Fund revenue to K–14 education. The guarantee has been determined using this test 4 of the last 27 years.

|

|

Test 2—Growth in Per Capita Personal Income. Adjusts prior–year Proposition 98 funding for changes in K–12 attendance and per capita personal income. The guarantee has been determined using this test 13 of the last 27 years.

|

|

Test 3—Growth in General Fund Revenues. Adjusts prior–year Proposition 98 funding for changes in K–12 attendance and per capita General Fund revenue. Generally, this test is operative when General Fund revenue grows more slowly than per capita personal income. The guarantee has been determined using this test 8 of the last 27 years.

|

State Can Provide More or Less Than Minimum Guarantee. Although the applicable Proposition 98 test is determined by the various inputs, the state need not always provide funding at the level required by the minimum guarantee. During the economic boom that prevailed in the late 1990’s, for example, the state for several years provided more funding than was required by the minimum guarantee. Alternatively, in 2004–05 and 2010–11, the state applied a provision of Proposition 98 allowing for the suspension of the minimum guarantee upon a two–thirds vote of each house of the Legislature. When the state suspends the minimum guarantee, it can provide a lower level of funding but creates an out–year obligation to restore K–14 funding in later years (described below).

State Creates “Maintenance Factor” Obligation in Certain Years. Proposition 111 allows the state to provide less funding than the Test 2 level if Test 3 is operative or the minimum guarantee is suspended. In these years, the state creates a maintenance factor obligation, which is equal to the difference between the higher Test 2 level and the amount of funding actually provided. Moving forward, the maintenance factor obligation is adjusted annually for changes in K–12 attendance and per capita personal income. The state has carried an outstanding maintenance factor in 20 of the past 25 years, including an estimated $2.6 billion at the end of 2014–15.

Maintenance Factor Payments Based on Growth in General Fund Revenue. When an outstanding maintenance factor obligation exists, the Constitution requires the state to make additional payments until the obligation has been paid off. These additional payments are made when state revenue is growing more quickly than per capita personal income, with the exact amount determined by formula. When state revenue grows very quickly, larger payments are made and the obligation is paid off in a shorter time. The additional funding provided by the maintenance factor payments increases the minimum guarantee on an ongoing basis. Until all maintenance factor is paid off, however, the state generates savings each year compared with the higher level of funding otherwise required.

Recent Application of Maintenance Factor Payments Has Made Minimum Guarantee Extremely Sensitive in Certain Years to Changes in General Fund Revenue. Though the principle underlying maintenance factor is straightforward—the state must increase Proposition 98 funding more quickly in good years to make up for reductions in leaner years—there has been contention over how the state is to make maintenance factor payments in Test 1 years with strong revenue growth. In 2012–13, the state chose to make maintenance factor payments “on top” of the Test 1 level. That is, the minimum guarantee was calculated as the sum of the Test 1 level and the maintenance factor payment required by formula. Such an approach causes the minimum guarantee to be very sensitive to changes in General Fund revenue, with the guarantee changing virtually dollar for dollar with General Fund revenue. As a rule of thumb, the Test 1 amount increases by 40 cents for every additional dollar in General Fund revenue, while the maintenance factor payment increases by roughly 50 cents. As a result, nearly every new dollar of revenue must go towards meeting the higher minimum guarantee.

Application Has Ratcheted Up Minimum Guarantee Billions of Dollars. The state’s approach directly affected the minimum guarantee in 2011–12, 2012–13, and 2014–15. Under an alternative maintenance factor approach that we describe in our report, The 2012–13 Budget: Proposition 98 Maintenance Factor: An Analysis of the Governor’s Treatment, the minimum guarantee remains sensitive to changes in General Fund revenue but not as sensitive as the state’s recent application. As a result of its approach the past few years, we estimate the 2014–15 minimum guarantee is over $2 billion higher than it would have been under the alternative approach.

“Spike Protection” Limits Ongoing Effect of Large Revenue Increases. Another provision of Proposition 98 prevents the minimum guarantee from growing too quickly during years when growth in state General Fund revenue is particularly strong. In Test 1 years when the minimum guarantee increases at a much faster rate than per capita personal income, spike protection excludes a portion of Proposition 98 funding from the calculation of the minimum guarantee in the subsequent year. Specifically, once the Test 1 level exceeds the Test 2 level by more than 1.5 percent of state General Fund revenue, some of the excess funding is excluded from the calculation of the minimum guarantee the following year.

Legislature Determines How to Allocate Proposition 98 Funding. Upon determining the amount of total Proposition 98 funding to provide, the Legislature decides how to spend the associated funds. Historically, the Legislature has provided about 89 percent of funding to schools and 11 percent to community colleges. Within these two allocations, funds are further divided into one of two basic purposes—general (or unrestricted) purposes and categorical (or restricted) purposes. The state allocates general purpose funding to schools through LCFF and to community colleges through apportionments.

As part of its budget package, the administration has updated its estimates of the minimum guarantee for 2013–14, 2014–15, and 2015–16. The first part of this section describes the key factors driving these changes and the associated General Fund costs. The second section analyzes how further changes in state revenue could affect the minimum guarantee.

Minimum Guarantee Up $371 Million. As shown in Figure 9, the administration’s revised estimate of the 2013–14 minimum guarantee is $58.7 billion, a $371 million increase from the June 2014 estimate. The largest contributing factor is a $361 million increase in General Fund revenue, which increases the minimum guarantee by about $200 million. The administration also has revised its estimate of K–12 attendance upward 0.17 percent, increasing the minimum guarantee by an additional $100 million. The remaining increase is explained by various minor changes in other inputs affecting Proposition 98, including revised estimates of state population and small changes to the minimum guarantee in earlier years. Though Test 3 remains the applicable test, the increase in the minimum guarantee reduces the amount of new maintenance factor created. Whereas the state had estimated in June 2014 that $458 million in maintenance factor would be created, the Governor now estimates only $241 million is created.

Figure 9

Increase in 2013–14 and 2014–15 Minimum Guarantees

(In Millions)

|

|

2013–14

|

|

2014–15

|

|

June 2014 Estimate

|

January 2015 Estimate

|

Change

|

June 2014 Estimate

|

January 2015

Estimate

|

Change

|

|

Minimum Guarantee

|

|

|

|

|

|

|

|

|

General Fund

|

$42,731

|

$42,824

|

$94

|

|

$44,462

|

$46,648

|

$2,186

|

|

Local property tax

|

15,572

|

15,849

|

277

|

|

16,397

|

16,505

|

108

|

|

Totals

|

$58,302

|

$58,673

|

$371

|

|

$60,859

|

$63,153

|

$2,294

|

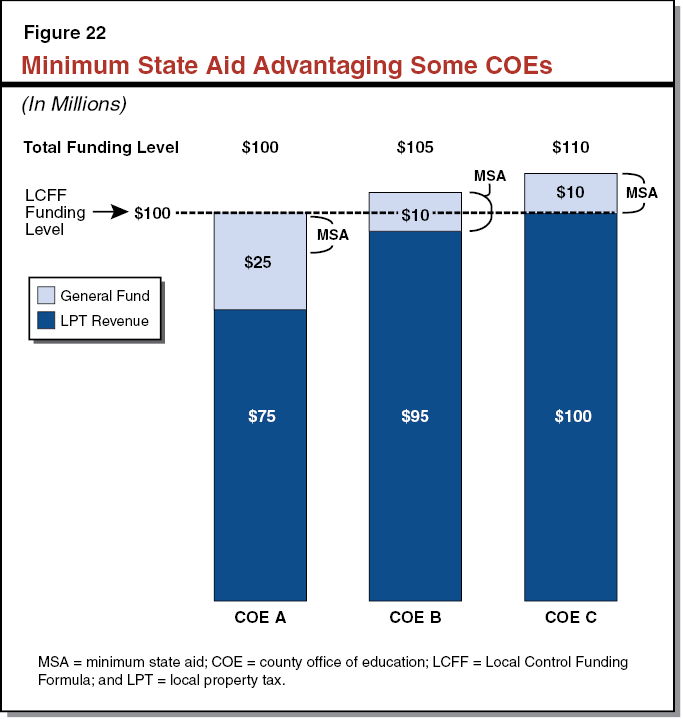

Higher Local Property Tax Estimates Mitigate Increase in General Fund Costs. Though the minimum guarantee is up $371 million in 2013–14, Proposition 98 General Fund costs increase only $94 million, with local property tax revenue increasing $277 million. (Because Test 3 is the applicable test in 2013–14, increases in local property tax revenue offset General Fund costs.) Figure 10 shows how the various components of local property tax revenue have changed in 2013–14 and 2014–15. Of the increase in local property tax revenue in 2013–14, $155 million is related to the dissolution of redevelopment agencies (RDAs). (The legislation that dissolved RDAs provided for a gradual shift of local revenue back to schools and local governments that will increase over time as RDA–related debt is repaid. It also provided for the sale of assets owned by the former RDAs, with proceeds distributed to schools and local governments. Of the $155 million increase, $111 million relates to the ongoing shift and $44 million relates to the sale of assets.) In addition, the Governor revises his estimate of “excess tax revenue” downward by $115 million, which in turn increases the amount of local revenue that offsets Proposition 98 General Fund costs. (Excess tax revenue reflects local revenue that some school districts, COEs, and community colleges receive beyond their general purpose funding levels set by the state. This excess revenue is excluded from the calculation of Proposition 98.) These two increases in local revenue are offset by a minor adjustment to base property tax revenue.

Figure 10

Increases in 2013–14 and 2014–15 Proposition 98 Property Tax Revenue Estimates

Based on Governor’s Budget (In Millions)

|

|

2013–14

|

|

2014–15

|

|

June

2014

Estimate

|

January

2015

Estimate

|

Change

|

June

2014

Estimate

|

January

2015

Estimate

|

Change

|

|

Local Property Tax Components

|

|

|

|

|

|

|

|

|

Base property tax revenue

|

$15,437

|

$15,443

|

$6

|

|

$16,401

|

$16,443

|

$42

|

|

Ongoing RDA revenue shift

|

800

|

911

|

111

|

|

743

|

824

|

81

|

|

Sale of RDA assets

|

274

|

318

|

44

|

|

42

|

67

|

25

|

|

Excess tax revenuea

|

–939

|

–824

|

115

|

|

–789

|

–829

|

–40

|

|

Totals

|

$15,572

|

$15,849

|

$277

|

|

$16,397

|

$16,505

|

$108

|

Minimum Guarantee Up $2.3 Billion. As shown in Figure 9, the administration’s revised estimate of the 2014–15 minimum guarantee is $63.2 billion, a $2.3 billion increase from the June 2014 estimate. About $2.2 billion of this increase is attributable to General Fund revenue being $2.5 billion higher than previously assumed. Test 1 remains the applicable test in 2014–15. As described earlier, General Fund revenue increases yield a near dollar–for–dollar effect on the minimum guarantee in 2014–15 because of the state’s approach to paying maintenance factor in Test 1 years. The remainder of the increase is a result of local property tax revenue being higher than June 2014 estimates. Given 2014–15 is a Test 1 year, increases in most components of property tax revenue result in an increase in the minimum guarantee and greater total funding for schools and community colleges. (The exception is the sale of RDA assets, as the state’s practice has been to rebench the minimum guarantee to account for changes in these proceeds.) The Governor also updates his estimate of the amount of maintenance factor paid, from $2.6 billion in June 2014 to $3.8 billion. Under the Governor’s budget, the state would end 2014–15 with $2.6 billion in outstanding maintenance factor.

General Fund Covers Bulk of Increase in Minimum Guarantee. Of the $2.3 billion increase in the minimum guarantee, $2.2 billion is covered by state General Fund and $108 million by local property tax revenue. As shown in Figure 10, the largest local property tax adjustment is $81 million for higher–than–expected ongoing revenue shifted from former RDAs. Also, the sale of former RDA assets and the corresponding shift of one–time proceeds to schools and community colleges are $25 million higher than expected last June. Small adjustments to base local property tax revenue and excess tax estimates account for the remainder of the revision.

Minimum Guarantee Up $4.9 Billion Over 2014–15 Budget Act Level. As Figure 11 shows, the administration estimates the minimum guarantee will be $65.7 billion in 2015–16. This is $2.6 billion (4 percent) above the revised 2014–15 guarantee and $4.9 billion (8 percent) above the 2014–15 Budget Act level. Because Test 2 is the applicable test in 2015–16, the guarantee is affected primarily by the higher minimum guarantee in 2014–15 and growth in per capita personal income (2.9 percent). (Though changes in K–12 attendance also affect the calculation, the Governor projects attendance to be virtually flat from 2014–15 to 2015–16.) Since the Governor projects state revenue will grow more quickly than per capita personal income, the budget also includes a $725 million maintenance factor payment in 2015–16. This payment would leave the state with $1.9 billion in outstanding maintenance factor at the end of 2015–16.

Figure 11

Proposition 98 Funding

Dollars in Millions)

|

|

2013–14

Revised

|

2014–15

Revised

|

2015–16 Proposed

|

Change From 2014–15

|

|

Amount

|

Percent

|

|

Preschool

|

$507

|

$664

|

$657

|

–$8

|

–1%

|

|

K–12 Education

|

|

|

|

|

|

|

General Fund

|

$38,005

|

$41,322

|

$41,280

|

–$43

|

—

|

|

Local property tax revenue

|

13,671

|

14,184

|

16,068

|

1,885

|

13

|

|

Subtotals

|

($51,675)

|

($55,506)

|

($57,348)

|

($1,842)

|

(3%)

|

|

California Community Colleges

|

|

|

|

|

|

|

General Fund

|

$4,235

|

$4,581

|

$5,002

|

$421

|

9%

|

|

Local property tax revenue

|

2,178

|

2,321

|

2,628

|

307

|

13

|

|

Subtotals

|

($6,413)

|

($6,902)

|

($7,630)

|

($728)

|

(11%)

|

|

Other Agencies

|

$78

|

$80

|

$80

|

—

|

—

|

|

Totals

|

$58,673

|

$63,153

|

$65,716

|

$2,563

|

4%

|

|

General Fund

|

$42,824

|

$46,648

|

$47,019

|

$371

|

1%

|

|

Local property tax revenue

|

15,849

|

16,505

|

18,697

|

2,192

|

13

|

Increases in Minimum Guarantee Largely Covered by Higher Local Property Tax Revenue. Though the minimum guarantee grows by $2.6 billion from revised 2014–15 estimates to 2015–16, state General Fund spending grows by only $371 million (1 percent), as local property tax revenue increases by $2.2 billion (13 percent) over the revised 2014–15 estimates. As shown in Figure 12, this large increase in local revenue mainly results from the following three factors.

Figure 12

Proposition 98 Property Tax Revenue Estimates

Based on Governor’s Budget (Dollars in Millions)

|

|

2013–14

Revised

|

2014–15

Revised

|

2015–16

Estimated

|

Change From 2014–15

|

|

Amount

|

Percent

|

|

Local Property Tax Components

|

|

|

|

|

|

|

Base property tax revenue

|

$15,443

|

$16,443

|

$17,257

|

$813

|

5.0%

|

|

End of “triple flip”

|

—

|

—

|

1,228

|

1,228

|

—

|

|

Ongoing RDA revenue shift

|

911

|

824

|

977

|

153

|

18.6

|

|

Sale of RDA assets

|

318

|

67

|

72

|

5

|

7.5

|

|

Excess tax revenuea

|

–824

|

–829

|

–837

|

–8

|

–1.0

|

|

Totals

|

$15,849

|

$16,505

|

$18,697

|

$2,192

|

13.3%

|

- Phase–Out of “Triple Flip” ($1.2 Billion). The largest factor driving the increase is the end of the triple flip. Under this complex financing mechanism, the state (1) redirected local sales tax revenue to pay off the state’s Economic Recovery Bonds (approved by voters in 2004 to help close the state budget deficit), (2) backfilled cities and counties with property tax revenue shifted from schools and community colleges, and (3) backfilled schools and community colleges with state General Fund revenue. The Governor’s budget assumes the state retires the Economic Recovery Bonds after the first three months of the fiscal year, resulting in $1.2 billion flowing back to K–14 education in 2015–16. (The state will receive the full benefit of the phase–out—about $1.6 billion—in 2016–17.)

- Growth in Underlying Property Tax Revenue ($813 Million). The Governor’s budget assumes that base local property tax revenue (which consists primarily of the 1 percent tax levied on the value of residential and commercial property) grows by 5.0 percent in 2015–16. This increase reflects a lower growth rate than 2014–15 but remains about the same as the historic growth level.

- Increase in RDA–Related Revenue ($158 Million). The Governor’s budget assumes that total revenue related to the dissolution of RDAs increases by $158 million, including $153 million related to the ongoing RDA revenue shift and $5 million related to the sale of RDA assets. Total K–14 revenue attributable to the dissolution of RDAs is projected to reach about $1 billion in 2015–16.

If Revenue in 2014–15 Increases, Most Will Go to Proposition 98. As described earlier, the minimum guarantee in 2014–15 is highly sensitive to changes in state General Fund revenue, with a near dollar–for–dollar effect on Proposition 98 funding. Recent economic and state tax data suggest that, barring a sustained stock market drop before June, 2014–15 General Fund revenue could exceed the administration’s estimates by $1 billion to $2 billion. Given that such a large share of additional General Fund revenue in 2014–15 would be required to go to Proposition 98, the Legislature could begin considering how it might allocate such a large, year–end funding increase to schools and community colleges. (This strong relationship between revenue and the minimum guarantee holds in 2014–15 until the state pays down all remaining maintenance factor. We estimate revenues would need to increase $4.4 billion above the Governor’s estimates for the state to retire all outstanding maintenance factor. Above that threshold, the minimum guarantee would increase only 40 cents for every $1 increase in state General Fund revenue.)

If 2014–15 Minimum Guarantee Increases, 2015–16 Minimum Guarantee Also Increases. Because Test 2 or Test 3 is likely to be operative in 2015–16, the 2015–16 minimum guarantee very likely will build off the prior–year Proposition 98 funding level. That is, any increase in the 2014–15 minimum guarantee likely will increase the 2015–16 guarantee. The state’s obligation to fund Proposition 98 at this higher level would remain even if the increase in 2014–15 were the result of a temporary stock market surge or other one–time revenue. For example, if the state were to experience a $2 billion revenue spike in 2014–15, with none of the revenue increase sustained in 2015–16, the minimum guarantee would increase by about $1.9 billion in 2014–15 and $1.3 billion in 2015–16. Over the two–year period, the state would need to provide an additional $3.2 billion in funding with only $2 billion in additional revenue, thereby straining the rest of the state budget. Even if the additional revenue were sustained in 2015–16, the state still would be required to dedicate virtually all new funding to Proposition 98. For example, if revenue were to increase by $2 billion in 2014–15 and $2 billion in 2015–16, the minimum guarantee would increase by about $1.9 billion in 2014–15 and $2 billion in 2015–16. Over the two–year period, the state would need to provide $3.9 billion of the $4 billion to Proposition 98. (In addition, to the extent these revenue increases were associated with capital gains, they could increase the state reserve and debt funding requirements established by Proposition 2.) These examples illustrate that additional revenue in 2014–15 would have a very favorable effect on schools and community colleges but not on other parts of the budget.

If 2014–15 Minimum Guarantee Rises More Than $2.3 Billion, Spike Protection Reduces Effect on 2015–16 Minimum Guarantee. The year–to–year dynamics between 2014–15 and 2015–16 change once a certain 2014–15 guarantee threshold is met. Specifically, if the 2014–15 minimum guarantee rises by more than $2.3 billion above the Governor’s budget level, the spike protection provisions of Proposition 98 become operative. As a result, a large portion of the funding exceeding the $2.3 billion threshold is not included in the calculation of the 2015–16 minimum guarantee. That is, though the spike protection provision does not cap the amount by which Proposition 98 may increase in 2014–15, it reduces the amount of that increase that would be used to determine the minimum guarantee in 2015–16. This provision effectively limits the adverse effect on the rest of the budget resulting from a revenue spike in 2014–15 and the corresponding ongoing growth in the minimum guarantee.

Statutory Supplement Contributes to Higher Minimum Guarantee in 2015–16 Under Certain Conditions. Though the Governor anticipates Test 2 will be the applicable test in 2015–16, additional one–time revenue in 2014–15 could reduce the year–year growth rate in 2015–16 and make Test 3 operative. Under Test 3, statute requires the state to make a supplemental appropriation to ensure the minimum guarantee grows at least as quickly as the rest of the state budget. (The exact amount is controlled by formula but never exceeds the amount needed to bring the minimum guarantee back to the Test 2 funding level.) For example, if revenue were to spike by $4 billion in 2014–15, with none of the revenue sustained in 2015–16, the state would be required to provide a $1.1 billion supplement in 2015–16. The relatively large size of the supplement is related to an interaction with the end of the triple flip. Specifically, the end of the triple flip frees–up $1.2 billion in General Fund revenue, causing growth in non–Proposition 98 General Fund spending to appear relatively larger than growth in the minimum guarantee. As a result, the size of the supplement is more than twice what it would have been had the triple flip ended in a different year.

Deposits in State School Reserve Remain Unlikely in Near Term. Proposition 2, approved by voters in the November 2014 election, established a new state–level school funding reserve. The state must make deposits into this reserve when certain conditions are met. Among these conditions, Test 1 must be the applicable Proposition 98 test and the state must have paid off all maintenance factor created before 2014–15. The interaction between these two requirements makes deposits unlikely in the near term. For example, if the state does experience a one–time revenue spike in 2014–15, it might pay off its maintenance factor obligation more quickly. Making a large payment, however, would increase the ongoing Proposition 98 funding level and make Test 1 less likely to be operative in the future. Alternatively, if state revenue does not increase above the Governor’s estimates, the state could be at least a few years away from paying off all pre–existing maintenance factor. Since state deposits into the new school account are unlikely in the near term, limits on local district reserves linked to these deposits also likely would not take effect in the near term. (In anticipation of the limits applying in future years, some districts, however, may begin changing their behavior in the near term.)

The Governor’s budget includes a number of new spending proposals. The first part of this section summarizes these proposals and the second part provides our assessment of the Governor’s overall spending package.

Governor’s Budget Package Includes $7.8 Billion in New Proposition 98 Funding. The Governor’s budget includes a total of $7.8 billion in additional funding related to increases in the Proposition 98 minimum guarantee. From an accounting perspective, $371 million is attributable to 2013–14, $2.3 billion is attributable to 2014–15, $4.9 billion is attributable to 2015–16, and $256 million is attributable to earlier years. (The $256 million allocation consists of a settle–up payment related to meeting the Proposition 98 minimum guarantee for 2006–07 and 2009–10.) Schools and community colleges, however, will receive all of this funding in 2015–16. Below, we describe the major spending proposals associated with each fiscal year.

Higher 2013–14 Spending. Corresponding to the increase in the minimum guarantee, the Governor’s package contains $371 million in higher Proposition 98 spending in 2013–14. This amount consists of $301 million for mandate backlog payments ($221 million for schools and $80 million for community colleges) and $70 million to cover net higher costs from various LCFF and CCC apportionment adjustments.

Higher 2014–15 Spending. As shown at the top of Figure 13, the Governor’s package contains $2.3 billion in higher Proposition 98 spending in 2014–15, also corresponding to the estimated increase in the 2014–15 minimum guarantee. As required by trailer legislation enacted last year, the Governor designates $992 million to eliminate all remaining deferrals. The Governor also proposes $975 million to pay down more of the mandate backlog and $48 million in one–time funding to continue the Career Technical Education Pathways Initiative for one additional year. The Governor also makes various technical adjustments, most of which relate to updating estimates of LCFF and CCC apportionment costs.

Figure 13

Proposition 98 Spending Changes

(In Millions)

|

2014–15 Budget Act Spending Level

|

$60,859

|

|

Technical Adjustments

|

$279

|

|

K–12 Education

|

|

|

Pay down deferrals (one time)

|

$897

|

|

Pay down mandate backlog (one time)

|

829

|

|

Subtotal

|

($1,726)

|

|

California Community Colleges

|

|

|

Pay down mandate backlog (one time)

|

$146

|

|

Pay down deferrals (one–time)

|

94

|

|

Provide funding for CTE Pathways Initiative (one time)

|

48

|

|

Subtotal

|

($288)

|

|

Total Changes

|

$2,294

|

|

2014–15 Revised Spending Level

|

$63,153

|

|

Technical Adjustments

|

|

|

Remove prior–year, one–time payments

|

–$3,503

|

|

Adjust energy efficiency funds

|

15

|

|

Annualize funding for 4,000 new preschool slots

|

15

|

|

Make other adjustments

|

166

|

|

Subtotal

|

(–$3,307)

|

|

K–12 Education

|

|

|

Fund LCFF increase for school districts

|

$4,048

|

|

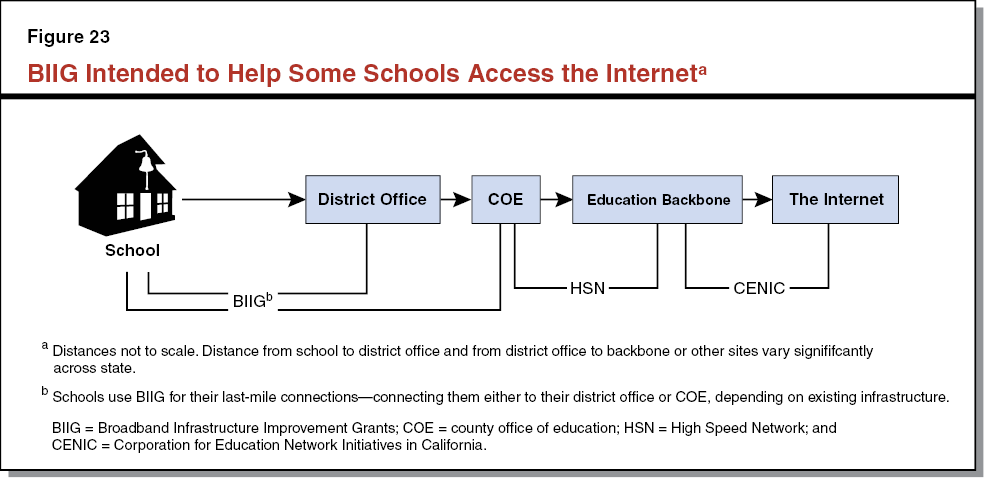

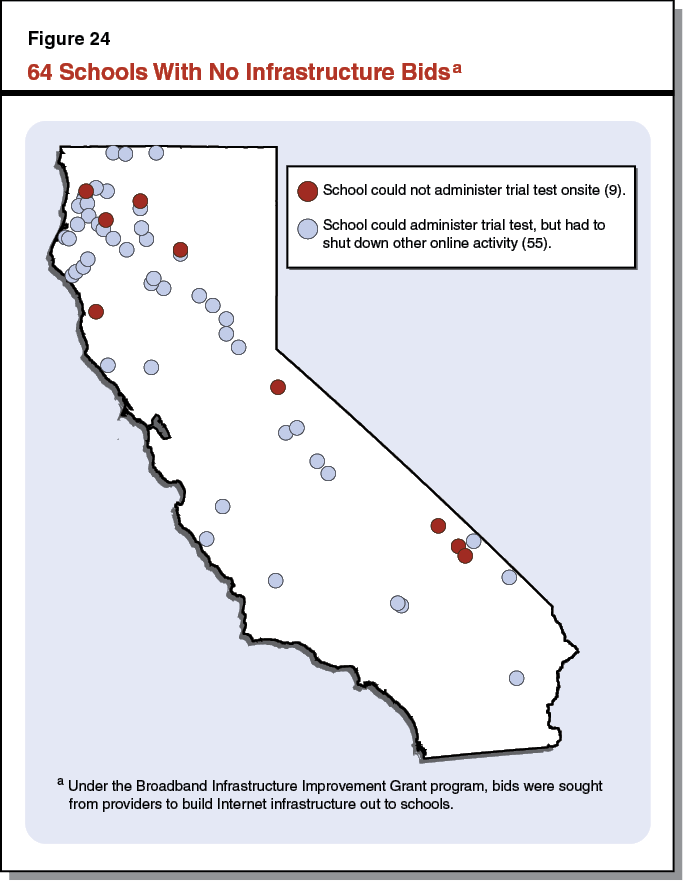

Fund Internet infrastructure grants (one time)

|

100

|

|

Provide K–12 COLA for select programs

|

71

|

|

Increase funding for the Charter School Facility Grant Program

|

50

|

|

Subtotal

|

($4,270)

|

|

Workforce Education and Training

|

|

|

Fund adult education consortia

|

$500

|

|

Fund career technical education grants (one time)

|

250

|

|

Fund certain noncredit courses at credit rate

|

49

|

|

Fund new apprenticeships in high–demand occupations

|

15

|

|

Increase funding for established apprenticeships

|

14

|

|

Subtotal

|

($828)

|

|

California Community Colleges

|

|

|

Augment student support programs

|

$200

|

|

Augment CCC funding (to be specified in May Revision)a

|

170

|

|

Pay down mandate backlog (one time)

|

125

|

|

Provide apportionment increase (above growth and COLA)

|

125

|

|

Fund 2 percent enrollment growth

|

107

|

|

Provide 1.58 percent COLA for apportionments

|

92

|

|

Remove enrollment stability funding

|

–47

|

|

Subtotal

|

($772)

|

|

Total Changes

|

$2,563

|

|

2015–16 Proposed Spending Level

|

$65,716

|

Higher 2015–16 Spending. As shown in Figure 13, the Governor’s budget for 2015–16 increases Proposition 98 spending by $4.9 billion from the 2014–15 Budget Act level. Though the Governor proposes a number of augmentations, he dedicates the bulk of new spending to: (1) LCFF implementation, (2) a package of workforce education and training initiatives, and (3) community college apportionments. In 2015–16, the Governor also dedicates $125 million to almost entirely eliminate the CCC mandates backlog. (Altogether, across all three fiscal years, the Governor’s package includes a total of $1.5 billion to reduce the state’s outstanding mandate backlog.)

Plan Also Pays Off Emergency Repair Program Obligation. The Governor’s budget includes $273 million for the last payment toward the Emergency Repair Program. Statute requires the state to provide a total of $800 million to school districts for emergency facility repairs, and the state has provided $527 million to date. (Of the $273 million, $163 million comes from a settle–up payment and $110 million comes from unspent prior–year Proposition 98 funds. The Governor uses the remainder of the $256 million settle–up payment for mandates, which is reflected in the amounts referenced above.)

Overall, Per–Pupil Funding Increases Significantly. Overall, the Governor’s plan increases Proposition 98 K–12 funding from the revised 2014–15 level of $9,263 to $9,571 in 2015–16—an increase of $308 (3.3 percent). Comparable funding for the community colleges also increases, from the revised 2014–15 level of $6,066 per full–time equivalent (FTE) student in to $6,574 per FTE student in 2015–16—an increase of $508 (8.4 percent).

Governor’s Spending Priorities Generally Consistent With Legislature’s Priorities. The Governor’s major proposals are consistent with many of the Legislature’s spending priorities over the past few years. Most notably, both the Governor and Legislature have given top priority to new ongoing school funding for implementing the LCFF. The Governor and the Legislature also have worked together over the past few years to enact certain changes to adult education and have tasked agency staff to recommend additional improvements moving forward. Furthermore, as discussed below, both the Governor and the Legislature have placed a high priority on paying down outstanding obligations.

Proposed Budget Makes Notable Progress Toward Retiring Education Obligations. The Governor’s budget package would allow the state to make substantial progress toward retiring its existing obligations to schools and community colleges. By paying down all remaining deferrals, the state would return to the statutory payment schedule for the first time since 2000–01. For schools and community colleges, this would improve cash flow and reduce reliance on short–term borrowing. The Governor’s plan also would make notable progress toward retiring the mandate backlog. We believe the Governor’s emphasis on paying off existing obligations is a sensible approach, particularly while state revenue remains strong.

Devoting Some 2015–16 Funding for One–Time Purposes Provides Cushion if Revenue Declines in Future Years. Though we anticipate the state’s moderate economic growth will continue in the near term, the minimum guarantee could decrease in 2016–17 or future years if stock market prices were to drop or growth in the economy and personal income were to decline. Even a modest slowdown could reduce the 2016–17 minimum guarantee below the Governor’s proposed 2015–16 spending level. Were the Legislature to commit all 2015–16 funds for ongoing purposes, a decline in 2016–17 likely would require reductions to ongoing programs, potentially reversing progress the state has made in recent years toward fully implementing LCFF. The Governor’s budget partially mitigates the risks associated with this scenario by dedicating $475 million of the increase in 2015–16 to one–time purposes. If the minimum guarantee were to decrease by no more than this amount in 2016–17, the Legislature could avoid the need to reduce ongoing programs. To provide a larger cushion in the event of a 2016–17 decline, the Legislature may want to consider dedicating a larger amount of 2015–16 spending for one–time activities.

Estimate of General Fund Community College Apportionment Costs Too High. We identified a technical issue in the Governor’s budget relating to community college apportionments (which are funded through a combination of state General Fund and local property tax revenue). Specifically, the state share of community college apportionment costs is over–budgeted by $170 million. The administration is aware of the issue and intends to have a proposal in May that would spend the available funds on other community college activities. The Legislature, however, could allocate the funds for any Proposition 98 purpose.

The largest proposal in the Governor’s budget is a $4 billion augmentation for implementation of LCFF. Below, we discuss the enactment of the LCFF and the main components of the formula. We then describe and assess the Governor’s proposal.

State Enacts New School Funding Formula in 2013–14. Legislation enacted as part of the 2013–14 budget package made major changes to the way the state allocates funding to school districts and charter schools. Previously, the state distributed school funding through revenue limits (general purpose grants) and more than 40 state categorical programs. The funding provided through categorical programs constrained districts’ spending choices—providing restricted state dollars that districts could use for only certain activities. The state replaced the historical revenue limit and categorical funding system with a student–oriented, formula–based funding system known as LCFF.

Formula Based on Student and District Characteristics. As displayed in Figure 14, LCFF provides districts and charter schools with base funding tied to four grade spans; supplemental funding for English learner, low–income, and foster youth (EL/LI) students; and concentration funding for districts with relatively high proportions of EL/LI students. Generally, the base rates increase for higher grades in recognition of the greater costs of education at higher levels—for example, providing career technical education in high school. (The K–3 rate is higher to support class size reduction in those grades.) Under the LCFF system, differences in districts’ and charter schools’ funding levels are based on their student characteristics.

Figure 14

Per–Student Funding Under LCFF

|

Grade Spans

|

Base Ratesa

|

Supplemental Fundingb

|

Concentration Fundingc

|

|

K–3

|

$7,741

|

$1,548

|

$3,870

|

|

4–6

|

7,116

|

1,423

|

3,558

|

|

7–8

|

7,328

|

1,466

|

3,664

|

|

9–12

|

8,711

|

1,742

|

4,356

|

An Illustration of Two Districts’ LCFF Calculations. Figure 15 shows the LCFF calculation for two equally sized elementary school districts. Both districts generate the same amount of base funding given they serve the same number of students in the K–3 and 4–6 grade spans. Though they have the same attendance by grade span, District A has a notably higher share of EL/LI students compared to District B. As a result, District A generates more supplemental funding than the other district. Unlike District B, District A also generates concentration funding given its share of EL/LI students exceeds the 55 percent threshold. Given the difference in student demographics, District A receives a total of $426,000 more than the other district.

Figure 15

Illustration of LCFF Calculation for Two Elementary Districtsa

|

|

District A

|

District B

|

|

Attendance

|

|

|

|

K–3

|

100 students

|

100 students

|

|

4–6

|

120 students

|

120 students

|

|

EL/LI percentageb

|

91%

|

50%

|

|

Grade span funding

|

$1,628,000

|

$1,628,000

|

|

Supplemental funding

|

$296,000

|

$163,000

|

|

Concentration funding

|

$293,000

|

—

|

|

Totals

|

$2,217,000

|

$1,791,000

|

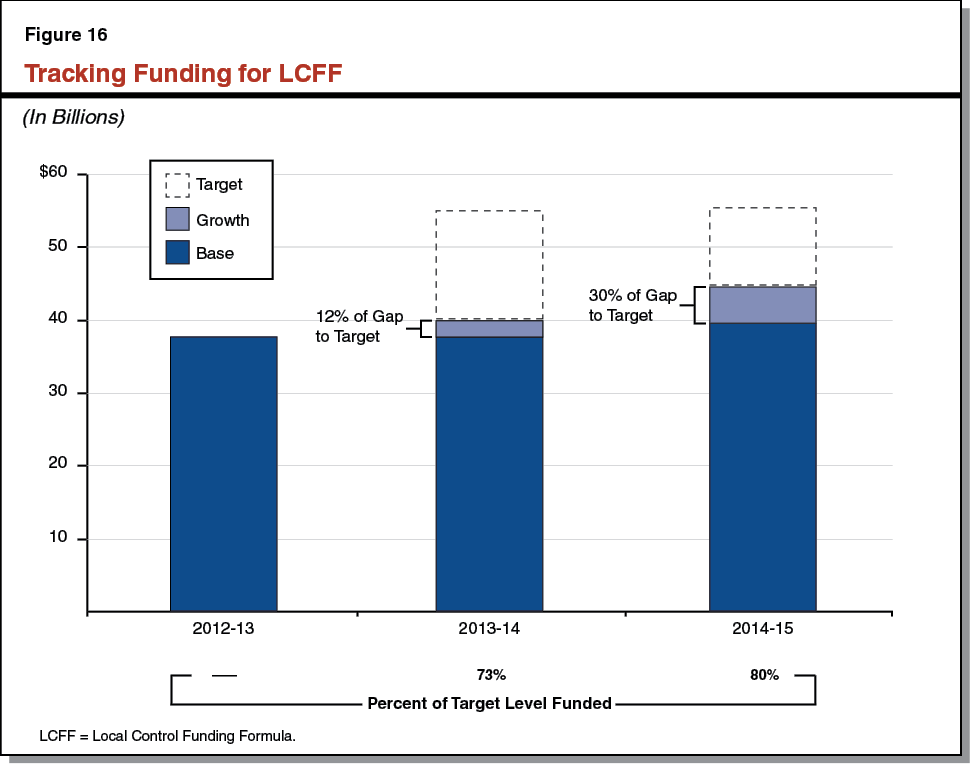

Implementation Expected to Take a Number of Years. The new system is much more costly than the prior system. At the time of enactment, fully implementing LCFF was estimated to cost $18 billion more than the 2012–13 K–12 spending level. Based on projections of growth in Proposition 98 funding, the administration estimated that the state would reach full implementation in 2020–21. Each year the total cost of the new system changes due to (1) increasing the base rates by COLA and (2) changes in attendance and student demographics. As displayed in Figure 16, over the past two years, the state has provided $6.8 billion towards implementing the formula. For 2014–15, statewide funding for LCFF is estimated to be 80 percent of the full implementation cost.

Districts Have Discretion Over Use of Funds. LCFF funding is largely considered general purpose, which districts can use at their discretion. For supplemental and concentration funding, however, statute requires districts to demonstrate that they “increase or improve” services for EL/LI students in proportion to the increase in funding generated by the students. As required by statute, the State Board of Education developed a formula to link the proportional increase in funding with increase in services, but districts have no explicit requirement to spend a certain amount on EL/LI services. (Given legislative interest the past few years, the nearby box describes the information available on EL/LI students under the new system.)

Since the enactment of the Local Control Funding Formula (LCFF), legislators have expressed interest in learning more about how English Learners and low–income (EL/LI) students are faring under the new system. Below, we discuss what is known to date about EL/LI funding, spending, services, and performance.

Considerable Funding Provided for EL/LI Students. One frequently asked question is how much funding the state is providing for EL/LI students under the new funding system. If LCFF had been fully implemented in 2014–15, the state would have provided districts with $35 billion (out of a total of $58 billion in LCFF funding) on behalf of EL/LI students. In 2014–15, the state is providing total funding sufficient to cover only 80 percent of full implementation costs. If one assumes all components of the formula are being phased in at the same rate (that is, base, supplemental, and concentration funding all are 80 percent funded on a statewide basis), then districts received $28 billion (out of a total $46 billion in LCFF funding) for EL/LI students—$21 billion base funding, $4 billion supplemental funding, and $3 billion concentration funding.

Unknown How Much Districts Are Spending in Total on EL/LI Students. Another frequently asked question relates to the total amount districts are spending to educate EL/LI students. Currently, the state cannot answer this question, largely because statute does not require districts to measure or report their EL/LI–specific expenditures. The state does not require this specific type of reporting because it would be difficult, complex, and problematic for districts to undertake. For example, would the state want to require districts to pro–rate each of their teachers’ time to measure contact with EL/LI students versus other students? The state does collect districts’ expenditure data through a system called the “Standardized Account Code Structure,” but the system currently is not designed to capture the type of data needed to isolate total EL/LI expenditures.

Districts’ Supplemental Expenditures Also Unknown. Even if total EL/LI expenditures are not available, some legislators have wondered if the state has data on supplemental expenditures for EL/LI students. Although districts receive separate base, supplemental, and concentration funding, the state does not define base versus supplemental expenditures. Making this distinction is difficult. For example, are smaller class sizes a supplemental service? Are counseling services for all students a supplemental expenditure? Under the new system, the state also does not require districts to use their supplemental and concentration funding exclusively for EL/LI students or require districts to report what expenditures those pots of funding support. For all of these reasons, the Standardized Account Code Structure neither differentiates between the subcomponents of the LCFF (base, supplement, and concentration) nor collects data on supplemental expenditures. Districts’ Local Control and Accountability Plans (LCAPs) contain some supplemental expenditure data, but this information is based on districts’ local definitions of supplemental expenditures and the state does not aggregate the information. (Prior to LCFF, districts received restricted Economic Impact Aid funds—funds that could be used only for EL and low–performing students and had to be used in prescribed ways. Given the associated rules were much more restrictive, districts were able to track their Economic Impact Aid spending through the Standardized Account Code Structure, which contained codes specific to funding source and expenditure activity.)

Information on EL/LI Services Available but Not Compiled and Reported Statewide. Another common question relates to what services EL/LI students are receiving under the new system compared to the former system. Under the new system, statute requires districts to describe the services they will provide EL/LI students in their LCAPs. Based on our review of 50 district LCAPs, districts largely are pursuing similar types of services as those provided under Economic Impact Aid, although perhaps at greater levels. Professional development for teachers and purchasing supplemental materials continue to be among the most common overarching strategies for serving EL/LI students. Though data on services are available through LCAPs, the state is not compiling the data contained in the local plans into a central data repository. As a result, it does not have ready access to statewide data on all districts’ EL/LI services.

In Future Years, State Could Use Performance Data to Identify Successful Strategies for Serving EL/LI Students. Once the state has a number of years of student performance data, it will be better positioned to assess the impact of the new system on EL/LI students. The state has long considered how best to serve EL/LI students. The LCFF itself was a recognition the state wanted to do more to help EL/LI students improve their academic performance. Given the overarching goal of LCFF to help students improve, the state likely will want to examine EL/LI performance data carefully. Down the road, were the state to find that some districts’ EL/LI students are performing much better than other districts’ EL/LI students (even under a system that provides all districts the same amount for these students), it could examine differences in services to determine if some instructional approaches and practices are more effective.

Provides $4 Billion for District and Charter School LCFF Increases. Consistent with the prior two years, the Governor’s largest proposed programmatic augmentation in 2015–16 is for LCFF. The Governor’s budget provides $4 billion (9 percent) increase from 2014–15—bringing total LCFF funding to $51 billion. The Governor estimates the additional funding would close 32 percent of the remaining gap to target funding levels. We estimate the proposed 2015–16 LCFF funding level would be approximately 85 percent of the statewide full implementation cost.

Allows Regional Occupational Centers and Programs (ROCPs) and Adult Education Maintenance–of–Effort (MOE) Provisions to Expire. Under LCFF statute, districts were required to spend no less in 2013–14 and 2014–15 than they did in 2012–13 on ROCPs and adult education. Consistent with statute, the Governor’s proposal allows these MOEs to expire. Almost all ROCP funding flowed to districts and COEs. As a result, districts and COEs will have discretion over how to spend funds previously reserved for ROCPs. Three ROCP joint powers agencies received a total of $444,000 directly from the state and additional funding from participating districts in their regions. With the expiration of the MOE, these ROCPs will no longer receive direct state funding and the participating districts may choose to change the level of funding they pass through to the ROCPs in 2015–16. (As we discuss later in this report, the Governor’s budget includes several other workforce development proposals that provide additional funding for career technical education.)

Shifts Home–to–School Transportation Funding From Joint Powers Agencies to Member Districts. In 2012–13, eight joint powers agencies received a total of $13.7 million directly from the state to provide transportation services to about 70 districts. Implementing statute continued funding these joint powers agencies for 2013–14 and 2014–15. Consistent with statute, the Governor’s proposal allows this funding to expire at the end of 2014–15. Starting in 2015–16, the Governor proposes apportioning the funding that had gone to the joint powers agencies among their member districts. Each joint powers agency would determine the amount of funding to apportion to each of its member districts. These amounts would be added on top of the member districts’ LCFF funding allocations and would need to continue being spent on transportation services (as is the case with all other districts’ former Home–to–School Transportation allocations). Given the proposal shifts the $13.7 million from the former joint power agencies to their member districts, it has no effect on total transportation costs.

Makes Adjustments for Growth in Attendance. The Governor’s budget adjusts LCFF funding to account for slight upward revisions in attendance estimates for 2013–14 and 2014–15, as well as for projected attendance in 2015–16. For 2013–14, the administration estimates attendance growth will be 0.32 percent higher than assumed at the time of the 2014–15 Budget Act. (The California Department of Education released final 2013–14 LCFF apportionment data in late June 2014, after the 2014–15 budget plan was adopted.) These updated estimates of attendance increase 2013–14 LCFF costs by $116 million. For 2014–15, the administration estimates attendance growth will be 0.55 percent higher than assumed at the time of the 2014–15 Budget Act. These updated estimates of attendance increase LCFF costs by $222 million. For 2015–16, the Governor anticipates district attendance will decline and charter attendance will increase, causing a net decline in attendance of 0.01 percent from the revised 2014–15 level. Because statute allows districts with declining enrollment to receive their prior–year funding level (under a one–year hold harmless provision), the savings from districts’ declining enrollment is only $6.8 million. The increase in charter attendance results in $59.5 million higher costs. The net cost due to changes in attendance is $52.7 million.

Package of LCFF–Related Proposals Reasonable. We do not have concerns with the LCFF–related proposals discussed in this section. The Governor’s proposal to dedicate the bulk of any additional ongoing school funding to LCFF is consistent with the past two years of implementation and supports reaching the target funding levels as quickly as possible. We also think the Governor’s ADA adjustments are reasonable, as they are based on the best available data. The Governor’s proposal to allow the ROCP and adult education MOEs to expire is consistent with the statutory intent of initially easing transition to the new funding system while subsequently giving districts greater discretion over the use of their LCFF funding. The Governor’s proposal to shift school transportation funding from joint powers agencies to their member districts would treat all districts receiving transportation funding similarly regardless of how they previously had provided their transportation services.

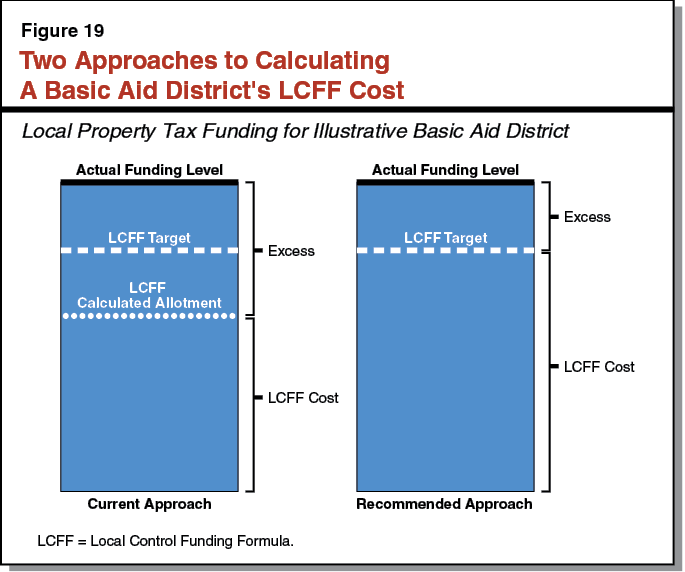

In this section, we describe how the state calculates school districts’ LCFF allotments during the LCFF transition period and explain how that affects the amount of local property tax revenue that counts as Proposition 98 spending. We then describe how the Governor’s budget accounts for these issues. As the Governor’s approach not only systematically understates the additional local property tax revenue under LCFF, but also creates the potential for exceeding the minimum guarantee on an ongoing basis, we provide the Legislature an alternative approach for accounting for local property tax revenue. The alternative is less sensitive to changes in property tax estimates and avoids the potential of Proposition 98 spending increasing above budgeted levels.

During Transition, Most Districts Receive State Funding to Close Their “Gaps.” Most school districts’ current LCFF funding levels are below their ultimate LCFF statutory funding targets. Over the next several years, the state plans to ramp up these districts’ funding levels until the targets are reached. (As described earlier in this report, LCFF is much more costly than the previous funding system. Currently, most districts receive 75 percent to 90 percent of their funding targets.) During this transition period, these districts receive additional state funding based on their “gaps”—the difference between their prior–year LCFF allotment and their target funding levels. Each year, the state closes the same percentage of each district’s gap based on a General Fund appropriation for LCFF. This appropriation counts towards the total LCFF cost. The LCFF, in turn, is the largest component of Proposition 98 spending each year. To date, the state has decided to make a General Fund appropriation for LCFF that is sufficient to meet (but not exceed) the estimated Proposition 98 minimum guarantee for that year.

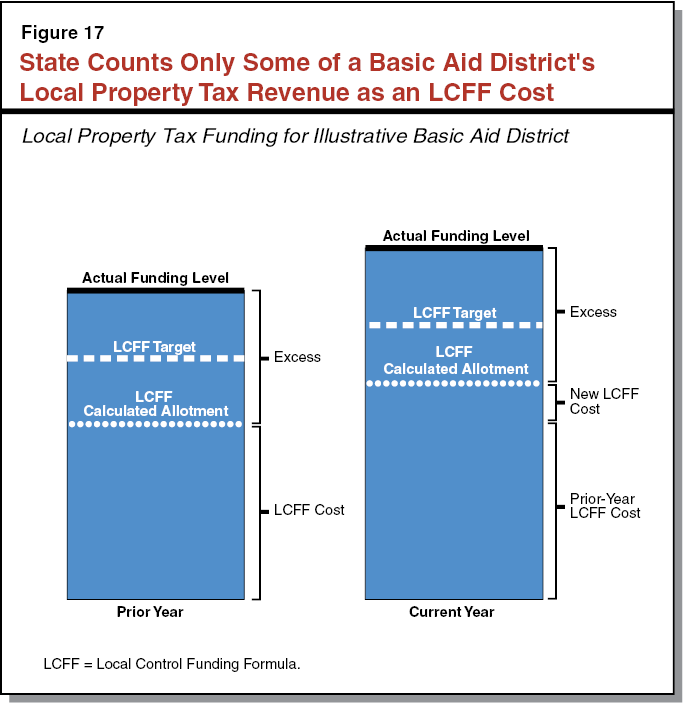

Some Districts Do Not Receive State Gap Funding Because of High Local Property Tax Revenue. Though the vast majority of districts receive state gap funding because they do not have sufficient local property tax revenue to reach their annual LCFF allotments, about 1 in every 10 districts have sufficient local property tax revenue to meet or exceed their LCFF allotments. These districts are known as basic aid districts. State policy allows these districts to keep this “excess” local property tax revenue and spend it for any educational purpose. Of the 108 basic aid districts in the state, all have property tax revenues in excess of their current LCFF allotments and 79 of them now have property tax revenues in excess of the their ultimate LCFF funding targets.