The Beverage Container Recycling Program (BCRP) encourages the recycling of certain beverage containers in California. The fund supporting the program has faced an ongoing structural deficit for several years and cannot continue to sustain current revenue and expenditure levels. Therefore, programmatic changes will need to be made within the next few years in order to avoid statutorily required automatic funding cuts. Acting sooner provides a greater number of options to address the deficit and allows for more flexibility when implementing any changes. In this report, we (1) provide an overview of the BCRP, (2) assess the structural deficit and the various supplemental programs supported by the fund, and (3) review options and make recommendations to address the deficit and improve BCRP effectiveness. In addition, a glossary is included as an appendix to this report that provides a list of key terms and their definitions.

In preparing this report, we reviewed budget documents and reports from both the Department of Resources Recycling and Recovery (CalRecycle) and outside sources; met with a number of program participants; spoke with representatives from other states; and toured a variety of recycling, processing, and manufacturing facilities.

CalRecycle regulates solid waste facilities (including landfills) and manages the recycling of various materials, such as beverage containers, electronic waste, tires, and used oil. The Division of Recycling within CalRecycle administers the BCRP, which is commonly referred to as the “bottle bill.” In this section, we provide an overview of the BCRP, including how the program works and a description of various supplemental programs that are part of the BCRP.

Program Goals. The BCRP was established almost 30 years ago with the enactment of Chapter 1290, Statutes of 1986 (AB 2020, Margolin). The purpose of the program is to be a self–funded program that encourages consumers to recycle certain beverage containers. The program accomplishes this goal by first requiring consumers to pay a deposit for each eligible container purchased. Then the program guarantees consumers repayment of that deposit—the California Redemption Value, or “CRV”—for each eligible container returned to a certified recycler. Statute includes two main goals for the program: (1) reducing litter and (2) achieving a recycling rate of 80 percent for eligible containers.

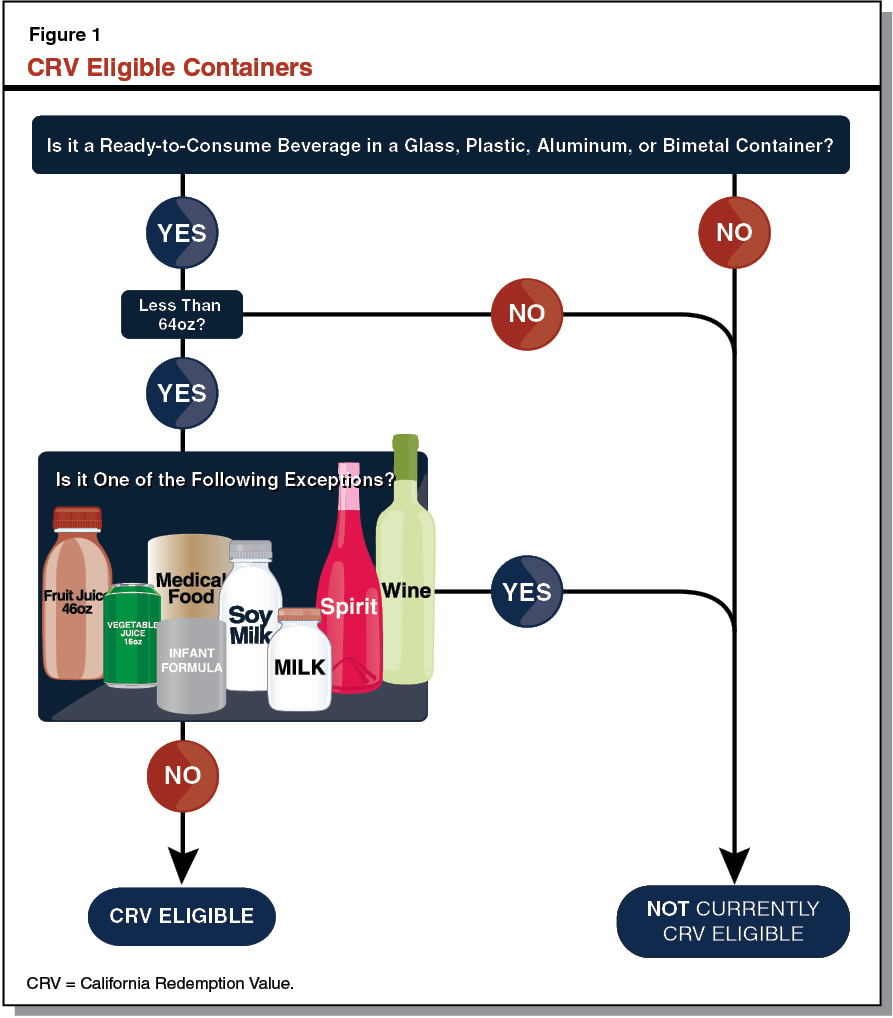

Eligible Containers. As shown in Figure 1, only certain beverage containers are part of the CRV program. Whether a particular container is part of the program depends on the material, size, and content of the container. Most containers made from glass, plastic, aluminum, and bimetal (consisting of one or more metals, including steel usually) are eligible, though there are exceptions. For example, containers for wine, spirits, milk, and soy drinks are not eligible for CRV, regardless of the container type. Container types that are not included in the CRV program are most cartons, such as milk cartons, and pouches made from multiple materials. Any container that holds 64 ounces or more is also not eligible.

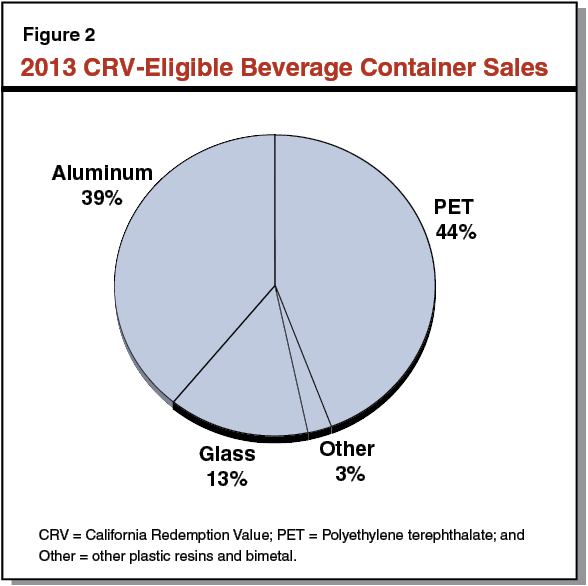

As shown in Figure 2, about 97 percent of CRV–eligible containers sold in California are made from aluminum, glass, or polyethylene terephthalate (PET) plastic (a specific type of plastic resin that most plastic water and soda bottles are made from). Of this amount, PET and aluminum each represent roughly 40 percent of eligible container sales. Other types of plastic and bimetal make up the other 3 percent of total sales.

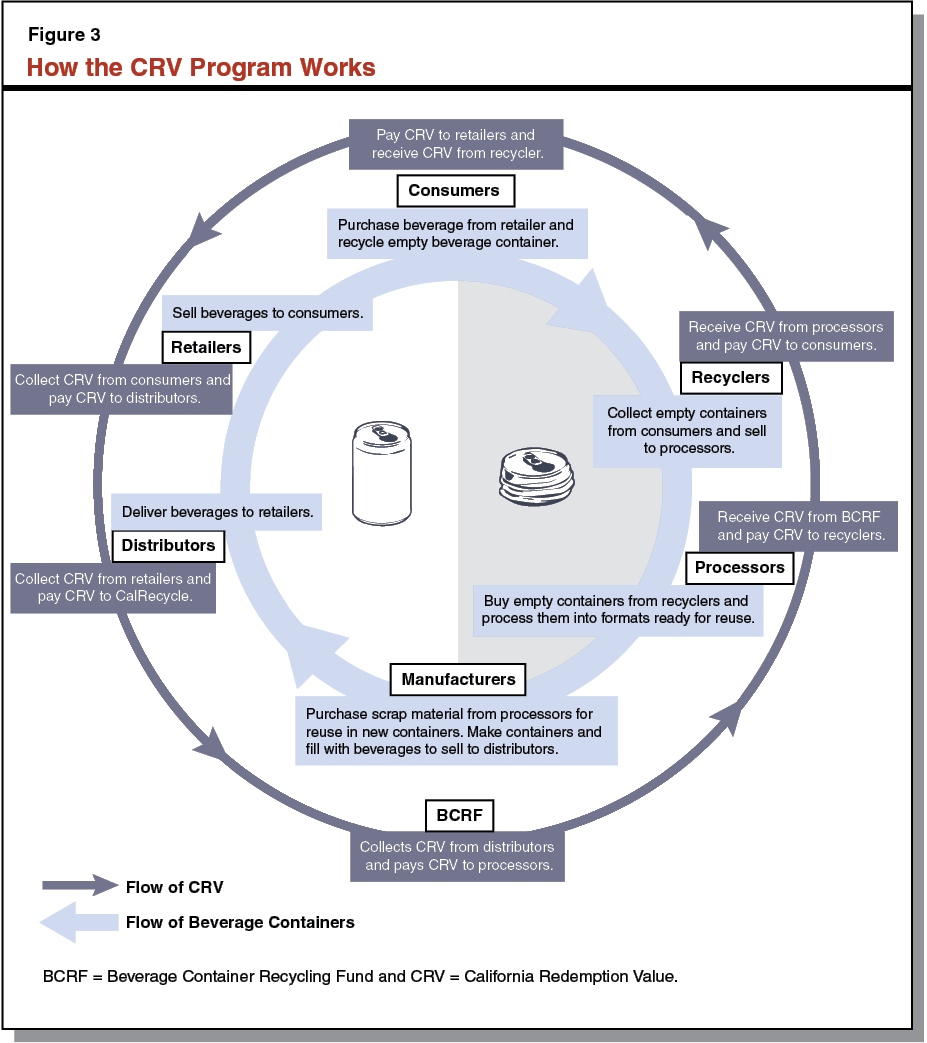

Flow of CRV Containers and Payments. As shown in Figure 3—and discussed in more detail below—the CRV program involves the flow of beverage containers and payments between several sets of parties, including consumers, retailers, recyclers, and manufacturers. At each stage, beverage containers and CRV are exchanged between participants. The Beverage Container Recycling Fund (BCRF) is the state’s fund used to collect and distribute payments for the CRV program. Below, we describe how the CRV program operates and the roles of the different parties involved.

- Flow of Beverage Containers. The flow of containers is shown in the inner, clockwise circle of Figure 3. The recycling of CRV containers begins after consumers have purchased and consumed a beverage. At that point, they may choose to recycle the container. To do so, they must give the empty container to a recycler—a recycling center, curbside collector, or other collection program—which collects the containers and then sells them to a processor. Processors then sort, clean, and process the containers into formats ready for reuse—such as glass cullet or plastic flake—which they are able to sell to manufacturers for use in new beverage containers or other types of products. Beverage manufacturers combine the recycled material with virgin material to create new containers and fill them with beverages. The new beverages are sold to distributors, who deliver the beverages to retailers. Retailers then sell the beverages to consumers.

- Flow of CRV. The flow of CRV is shown in the outer, counterclockwise circle of Figure 3. Generally, when beverage containers are exchanged, there is a corresponding CRV exchange. When consumers purchase beverages, they pay CRV to retailers. Retailers pass the CRV to beverage distributors. Beverage distributors pay CRV on all new beverage containers they sell in California to the BCRF. The BCRF is then used to pay CRV to processors for the containers they process. Processors pass the CRV on to the recyclers who collected the empty containers. Recyclers, in turn, pay CRV to consumers who redeem their beverage containers at a recycling center. In this way, consumers are able to recoup their CRV from the recycler, and from the consumer’s perspective, the CRV can be viewed as a “deposit.” Similarly, other entities pay and recoup CRV in such a way that their CRV collections and costs net out to zero.

Several Ways to Redeem Containers. Consumers and other participants (such as restaurants, schools, and nonprofit organizations) can redeem containers in one of several ways.

- One way is a “convenience zone” recycling center. These centers are located within a certain radius of supermarkets. Some that meet specific requirements—which are discussed below—receive payments called “handling fees” to encourage locating in these areas. These recycling centers typically serve individuals and collect a lower volume of containers than other types of recycling centers.

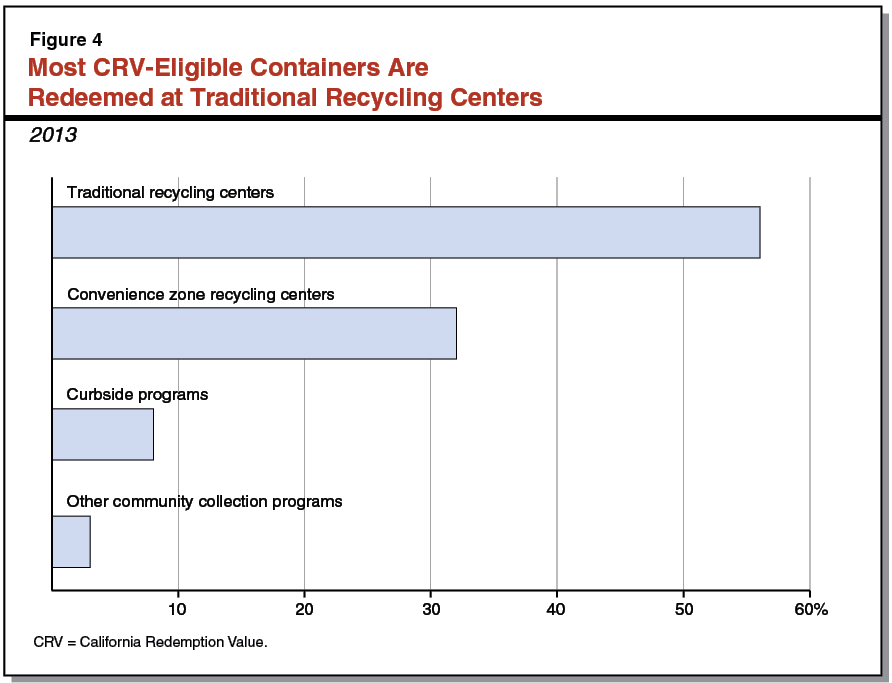

- A second way is a “traditional” recycling center, which refers to a recycler located outside the radius of supermarkets. These recyclers usually accept large quantities of materials, frequently by truckload from municipal or commercial waste collection services. Traditional recyclers collect slightly more than half of all CRV containers.

- Consumers can also place containers in their residential curbside recycling collection or take them to other community drop–off programs, such as those operated as fundraisers or by local nonprofit groups. However, under these options, consumers are not able to redeem their deposit, which is kept by the collecting organization.

As shown in Figure 4, most CRV containers are redeemed at traditional recycling centers, while relatively few are redeemed through curbside collection or other community collection programs (such as drop–off and community service programs).

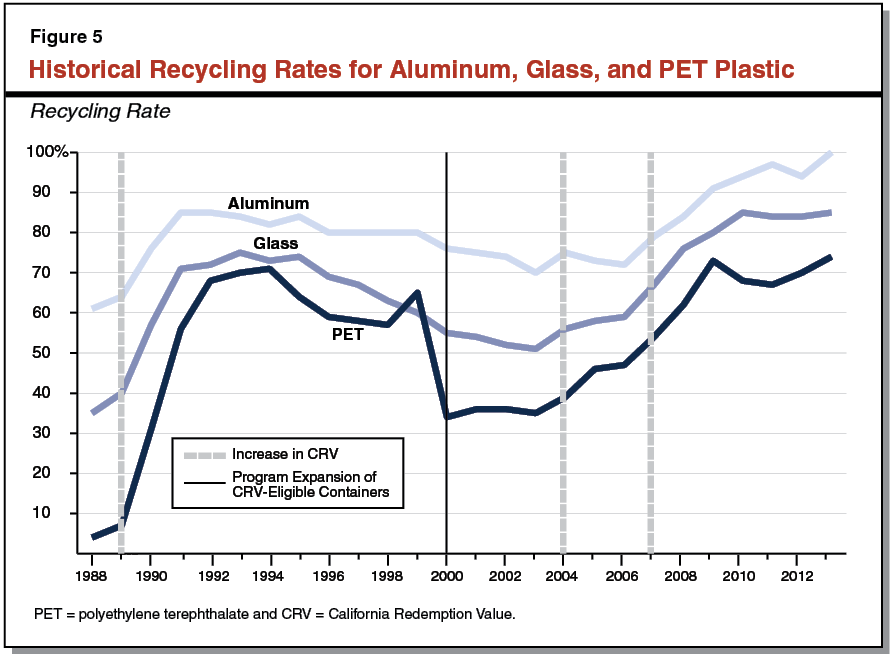

Recycling of CRV–Eligible Containers Has Increased. Since the program was first implemented, the recycling rate of eligible containers has increased from 52 percent to 82 percent, exceeding the statutory recycling goal of 80 percent. Moreover, the total number of containers that are recycled has tripled due to the higher recycling rate and several expansions in the types of eligible containers over the years. Figure 5 shows the increase in recycling rates for the three primary CRV materials—PET plastic, glass, and aluminum—since implementation of the BCRP. We note that these rates have fluctuated during that time in response to the CRV amount, program expansion, and other factors. While recycling has increased, it is less clear how this has impacted the other main goal of the BCRP, litter reduction. Given the increase in redeemed containers, it is likely that beverage container litter has been reduced, but there have not been studies performed to evaluate this question in recent years.

Not all CRV–eligible containers are recycled, and therefore the CRV deposit paid when a consumer purchased these containers is never redeemed. This means that distributors pay more CRV into the BCRF than is claimed by consumers. In 2013–14, for example, the BCRF received roughly $1.2 billion in deposits, but only about $1 billion—or over 80 percent—was spent on redemption payments. State law requires that much of the unredeemed CRV be spent on specified recycling–related programs. These supplemental programs are not directly involved in the exchange of CRV, but they are intended to help achieve the programmatic goals of increased recycling and reduced litter.

In total, there are currently ten supplemental programs funded from the BCRF (including program administration). Such programs include subsidizing glass and plastic recycling, encouraging supermarket recycling collection sites, and providing grants for market development and other recycling–related activities. CalRecycle estimates that a total of $279 million will be spent on supplemental programs in 2015–16. Figure 6 lists all of the supplemental program expenditures from the BCRF and their estimated 2015–16 funding levels, as well as the estimated amount of CRV payments. Most of the funding amounts for the supplemental programs are set in statute and are continuously appropriated. We describe each supplemental program in more detail below.

Figure 6

BCRF Expenditures

(In Millions)

|

Expenditures

|

2015–16 Projection

|

|

California Redemption Payments

|

$1,036.5

|

|

Supplemental Program Expenditures

|

|

|

Processing fee offsets

|

$75.4

|

|

Handling fees

|

55.3

|

|

CalRecycle administration

|

50.0

|

|

Administrative fees

|

44.7

|

|

Curbside supplemental payments

|

15.0

|

|

Payments to local governments

|

10.5

|

|

Plastic Market Development Payments

|

10.0

|

|

Quality Incentive Payments

|

10.0

|

|

Local Conservation Corps grants

|

6.4

|

|

Beverage Container Recycling Competitive Grants

|

1.5

|

|

Subtotal

|

($278.8)

|

|

Total Expenditures

|

$1,315.3

|

Processing Fee Offsets Reduce Manufacturers’ Fees. For many material types, the cost of recycling containers is greater than the value of the recycled material, which is referred to as the “scrap value.” This means that, absent some additional financial support, accepting these containers from consumers and recycling them would be unprofitable for recyclers and processors, and they would be unlikely to do so. In addition, recycling these containers has benefits that are not reflected in their scrap value, such as reduced litter, environmental benefits like reduced greenhouse gas emissions, and preservation of the resources used to make virgin materials. For these reasons, the state subsidizes recycling by making “processing payments” from the BCRF to recyclers and processors. (As discussed below, only the portion of processing payments covered by unredeemed CRV is considered a supplemental program.) Processing payments are intended to cover the difference between a container’s scrap value and the cost of recycling it (including a reasonable rate of return). Both the costs of recycling and the scrap value of beverage containers can fluctuate significantly based on changing market prices. As a result, processing payments vary over time.

The department determines processing payment amounts by estimating recycling costs through surveys of recyclers every two years and calculating scrap values based on monthly reports from processors. The processing payments are typically set once per year, but the department does have the authority to make some adjustments in the interim if scrap values change significantly. Processing payments are projected to be almost $90 million in 2015–16. These payments are funded from two sources.

- Processing Fees. The cost to the BCRF of making processing payments is partially covered by the beverage manufacturers who produce these containers when they pay “processing fees” into the BCRF. The reason for having manufacturers pay processing fees is because they are the ones that produce and benefit from disposable containers, and therefore are assessed for some of the costs of their disposal or recycling. The processing fees are calculated based, in part, on the number of containers each manufacturer sells. While processing fees used to cover the full cost of making processing payments to recyclers and producers, over time the financial burden on manufacturers has been reduced, as discussed below. Processing fees are estimated to be about $14 million in 2015–16. (These are not considered a supplemental program since they are not paid by unredeemed CRV.)

- Processing Fee Offsets. The difference between the processing fees paid by manufacturers and the processing payments paid to recyclers and processors is made up by the BCRF. This supplemental payment is referred to as the “processing fee offset.” Since 2003, processing fees and offsets have been determined on a sliding scale based on recycling rates. As recycling rates for specific materials increase, beverage manufacturers that produce containers from those materials pay proportionally less in processing fees. This sliding scale or tiered system is intended to provide manufacturers more of an incentive to produce containers that are likely to be recycled by linking their processing fee costs to recycling rates. Some manufacturers have also argued that the sliding scale provides an incentive structure for manufactures to encourage recycling of their products. Figure 7 shows the sliding scale for manufacturers that determines how much of the processing payment they must cover through processing fees and how much is paid by the BCRF through processing fee offsets. Processing fee offsets are projected to be $75 million in 2015–16.

Figure 7

Higher Recycling Rates Result in Manufacturer Paying Less Under Tiered System

|

Recycling Rate (%)

|

Processing Fee Paid by Manufacturer

|

Processing Fee Offset Paid by BCRF

|

Processing Payment to Recyclers and Processors

|

|

Less than 30%

|

65%

|

35%

|

100%

|

|

30 to 39

|

20

|

80

|

100

|

|

40 to 44

|

18

|

82

|

100

|

|

45 to 49

|

15

|

85

|

100

|

|

50 to 54

|

14

|

86

|

100

|

|

55 to 59

|

13

|

87

|

100

|

|

60 to 64

|

12

|

88

|

100

|

|

65 to 74

|

11

|

89

|

100

|

|

75 or above

|

10

|

90

|

100

|

Handling Fees. State law generally requires that all supermarkets in the state with more than $2 million in gross annual sales have a nearby recycling center. Supermarkets that do not have a recycling center within a specific radius are required to take back containers themselves or pay a fine, unless CalRecycle grants them a special status exempting them from this requirement. “Handling fees” are designed to encourage recyclers to locate near supermarkets with the intention of making recycling more convenient for consumers. These payments are made from the BCRF to a recycler that is (1) co–located with a supermarket that has more than $2 million in gross annual sales and (2) the only recycler serving that convenience zone. There are some exceptions to this location requirement. For example, a recycling center in a “rural region” as designated by CalRecycle can locate anywhere inside a convenience zone and still receive handling fees if it meets other eligibility requirements. The handling fees are also designed to cover the additional costs to a recycler of locating at supermarket sites. Recyclers in these locations can experience higher costs due to more expensive rent, higher transportation costs, less economies of scale due to lower volume of redeemed containers, or other factors.

Handling fees are calculated based on the difference between the average per container cost for recyclers located at supermarkets and other recyclers. This per container cost difference is then applied to the number of containers redeemed by each eligible recycler. As shown in Figure 8, the average costs to recyclers varies by volume processed. Based on data from 2012, handling fees are currently set at about one cent per recycled container.

Figure 8

Handling Fees Cover Higher Per Container Collection Costs

|

Recycler

|

Average Number of Containers Redeemed Per Recycler (Millions)

|

Weighted–Average Cost Per Container (Cents)

|

|

Receiving handling fees

|

4.4

|

2.4

|

|

Not receiving handling fees

|

9.8

|

1.4

|

|

Difference (Handling Fee Per Container)

|

|

1.0

|

CalRecycle Program Administration. Program administration costs to CalRecycle are covered by unredeemed CRV so that the program is self–sustaining and does not rely on any outside funding. California’s program has greater state involvement and government program administration than similar programs in other states. The program administration of most container deposit programs in other states is carried out by the private sector—especially retailers, distributors, and manufacturers. CalRecycle administrative activities include running certification programs for operators, program enforcement, conducting surveys to determine processing payments and handling fees, and education and outreach, among other activities.

Administrative Fees. Statute provides administrative fees to beverage distributors, recyclers, and processors to defray their costs of program participation. Specifically, beverage distributors retain 1.5 percent of collected CRV to cover administrative costs, and CalRecycle pays processors 2.5 percent of their reimbursed CRV (processors then distribute 0.75 percent to recyclers). In 2015–16, the administrative fees retained by distributors are expected to be $19 million, and administrative fees paid to processors are estimated to be $26 million, for a total of $45 million.

Curbside Supplemental Payments. Statute allows for an annual payment of $15 million to residential curbside recycling collection programs and neighborhood drop–off programs to encourage curbside recycling. The curbside supplemental payment is distributed to individual programs based on each program’s share of beverage containers collected over the past year. Based on the number of containers redeemed in 2013–14, the curbside payments are equivalent to approximately $0.01 per container. In addition, curbside collection operators receive revenue from the CRV for containers that they collect, processing payments, and administrative fees, as well as contract payments from local governments that utilize their services.

Payments to Local Governments. Statute provides $10.5 million to cities and counties for beverage container recycling and litter cleanup activities. Payments are distributed proportionally based on each jurisdiction’s population, with payments averaging $20,000 per jurisdiction in 2013–14. There is limited information regarding how these funds are used statewide. Based on our conversations with local government officials, it appears that at least in some places the payments are used for small–scale, ongoing activities such as purchasing recycling bins, advertising, public education, and litter cleanup.

Plastic Market Development (PMD) Payments. Statute authorizes PMD payments to plastic processors and plastic product manufacturers for empty plastic beverage containers that are processed and recycled into new material in California. This program is intended to develop California’s recycled plastic processing and manufacturing capacity, and avoid exporting plastic containers collected by recycling programs. Theoretically, increasing processing and manufacturing opportunities could increase the demand for recycled plastic, which could increase the scrap value and ultimately lower the processing payments to plastic recyclers and processors.

Quality Incentive Payments (QIP). Statute provides QIP in order to improve the quality and marketability of collected glass containers. Increasing the quality of recycled containers is frequently done by cleaning the containers (freeing them from other materials and contaminants) and sorting them by color. Currently, all of the $10 million available for QIP is paid to processors who sort glass by color.

Local Conservation Corp (LCC) Grants. Statute provides grants to LCCs—regional, nonprofit organizations that provide job skills training and educational opportunities to young adults—for beverage container litter reduction and recycling programs. For example, LCCs have used BCRP grants to (1) provide recycling services at businesses, special events, and schools; (2) collect CRV containers and other mixed recycling; and (3) reduce trash through litter abatement projects. (The 2014–15 Budget Act shifted some funding for the LCCs from the BCRF to three other special fund sources, thereby reducing LCC reliance on the BCRF on an ongoing basis.)

Beverage Container Recycling Competitive Grants. Statute provides grants to governments, nonprofit entities, and private businesses for beverage container recycling and litter reduction programs. In 2013–14, for example, grants were used to establish recycling programs in schools, purchase recycling receptacles for outdoor public areas, and increase beverage container recycling in underprivileged communities.

In reviewing the BCRP, particularly the program’s revenues and expenditures, we identified several issues that merit legislative consideration. Specifically, we find: (1) the BCRF faces an ongoing structural deficit estimated at almost $60 million annually, (2) processing offsets are a major cost to the BCRF and do not clearly support program goals, (3) the effectiveness of some supplemental programs is unclear, and (4) it is unclear whether administrative fees reflect participants’ actual administrative costs. We describe each of these findings in more detail below.

As discussed below, the BCRF faces several challenges that have resulted in an ongoing structural deficit. We find that this deficit is largely a product of higher recycling rates and spending on supplemental programs, which has spent down historical fund balances.

Increasing Recycling Rates and Supplemental Programs Create Shortfall in BCRF. By far, the largest expenditure from the BCRF is the CRV paid out when containers are returned. Total CRV expenditure amounts fluctuate based on the recycling rate but have made up more than 80 percent of all BCRF spending in recent years. In prior years, however, recycling rates were much lower. Consequently, the program paid less out in CRV and had surplus funds. As described above, the Legislature has chosen to use surplus funds to support various supplemental programs, such as recycling activities and reducing manufacturers’ processing fees. Some of these surplus funds were also loaned to the General Fund in prior years. A higher recycling rate in recent years has meant that more of the BCRF revenue has been paid out for CRV, leaving less money for the other supplemental activities. Moreover, some supplemental programs—such as handling fees and processing payments—are paid on a per container basis, and therefore these expenditures increase as the number of containers redeemed increases. The combined effects due to higher recycling rates—less money available after CRV payments and higher supplemental program expenditures—make it much more difficult for the BCRF to operate with a structural balance as the recycling rate rises. Figure 9 shows how funds available for supplemental programs varies by recycling rate, as well as the impact on the BCRF’s annual balance.

Figure 9

High Recycling Rate Results in Less Money for Supplemental Programs

2015–16 (Dollars in Millions)

|

|

Recycling Rate Scenarios

|

|

|

75 Percent

|

85 Percent

|

95 Percent

|

|

Total CRV paid by consumers

|

$1,254

|

$1,254

|

$1,254

|

|

CRV payments for redeemed containers

|

940

|

1,066

|

1,191

|

|

Funds Available for Supplemental Programs

|

$313

|

$188

|

$63

|

|

Supplemental program expendituresa

|

($263)

|

($284)

|

($305)

|

|

Net (Structural Deficit)

|

$51

|

(–$96)

|

(–$243)

|

The number of supplemental programs—and the funding provided for them—have increased over the years. Many supplemental programs were adopted or increased when there was a large fund surplus. As a result of the combination of a higher recycling rate and the cost of supplemental programs, the BCRF has operated under an annual structural deficit averaging about $90 million since 2008–09. According to CalRecycle’s estimates, the fund is currently forecast to have an operating deficit of $60 million in 2015–16 and run an annual average operating deficit of $56 million from 2014–15 to 2017–18, absent any changes made to reduce expenditures or increase revenues. Figure 10 shows the projected revenue, expenditures, and structural deficit for all program funds in 2015–16.

Figure 10

BCRP Structural Deficit Projected in 2015–16

(In Millions)

|

Revenues

|

|

|

Total CRV paid by consumers

|

$1,254

|

|

Processing fees paid by manufacturers

|

14

|

|

Subtotal

|

($1,268)

|

|

Expenditures

|

|

|

Total CRV paid out on redeemed containersa

|

$1,036

|

|

Other program expendituresb

|

291

|

|

Subtotal

|

($1,328)

|

|

Net Structural Deficit

|

–$60

|

|

Projected Ending Fund Balance

|

$274

|

While the BCRF has had operating deficits in the past, it was able to absorb the deficits by having a large fund balance that built up when the recycling rate was low. This balance is being depleted and prior year loans from the BCRF have mostly been repaid. The fund balance at the end of the 2015–16 budget year is projected to be about $274 million—$220 million in the BCRF and $54 million in various subaccounts. This includes repayments of all outstanding loans that were made to the General Fund. Without other changes, the fund balance will be further reduced each year. CalRecycle projects the fund balance will decline to 5 percent of revenues—the statutorily required minimum—sometime after 2017–18. Eventually, the balance will fall below this threshold, thereby triggering statutorily required reductions as discussed below.

Proportional Reductions. Under current law, if there are insufficient funds available in the BCRF to make all of the required CRV and supplemental payments while maintaining a 5 percent reserve, the department is required to reduce supplemental program payments (except program administration) in equal proportions in order to keep the fund in balance (commonly referred to as “proportional reductions”). Proportional reductions are problematic because they do not allow for discretion in spending based on priorities or other factors. For example, the department would not have the opportunity to prioritize programs that are deemed to be the most effective at increasing recycling. Additionally, proportional reductions are very disruptive to program participants because they can experience a significant cut in funding without much warning to plan accordingly. Proportional reductions have occurred one time in the past, from November 2009 to March 2010. During that time, CalRecycle had to implement proportional reductions of nearly 100 percent to maintain the BCRF’s solvency. Major impacts included (1) no handling fees paid to eligible recyclers, (2) increased processing fees charged to beverage manufacturers totaling around $50 million, and (3) elimination of most grant and market development program funding.

Available Funding Sensitive to Several Factors. The amount of money available for supplemental programs is small relative to the amount of CRV paid in and redeemed. Consequently, small changes in beverage sales (CRV paid in) or the recycling rate (redeemed CRV paid out) can have a significant effect on the amount of funding remaining to support supplemental programs. For example, a 5 percent increase in the quantity of beverages sold would result in a net increase of about $10 million in CRV revenue, and an increase in the recycling rate of 1 percentage point would increase CRV expenditures by $12 million.

In addition, expenditures for some supplemental programs are based on certain market rates that fluctuate. For example, rising or falling material scrap values dictate the amount of the processing payments paid. Similarly, the amount of handling fees paid from the BCRF depends on the recyclers’ costs of doing business at a supermarket site, including costs for rent and wages. When these programs require larger expenditures, there is less money available for other supplemental programs.

As discussed earlier, processing fee offsets funded by the BCRF are based on calculations of net processing costs, which are the difference between the costs of recycling a container and its value as recycled scrap material. The department determines the net processing costs through biennial surveys of recyclers. As described below, the current processing fee offset structure does not clearly support the program’s goals.

Glass Is Relatively Expensive to Recycle. Different materials go through different processes to be cleaned, sorted, and recycled, which result in different recycling costs for each material. Additionally, the recycled materials are used for different products, which means that some materials have higher post–recycled scrap value than others. These differences mean that some materials are generally profitable to recycle, while others would cause recyclers and processors to lose money if they did not receive processing payments from the BCRF. As shown in Figure 11, recycling aluminum containers is profitable because the scrap value is greater than the cost to recycle. Thus, no processing payment is made for aluminum. However, PET plastic and glass both cost more to recycle than they are worth as scrap material. In particular, recycling glass results in a large loss, with the cost to recycle glass roughly 30 times greater than its scrap value.

Figure 11

Scrap Value and Cost by Material (2012)

Value and Cost of Different Materials (Cents Per Container)

|

Material

|

Scrap Value

|

Cost to Recycle

|

Profit (Loss)

|

|

Aluminum

|

2.40

|

1.03

|

1.37

|

|

PET plastic

|

1.08

|

1.35

|

(0.27)

|

|

Glass

|

0.08

|

2.43

|

(2.36)

|

The total amount of processing fees, payments, and fee offsets reflect these cost differences, as well as the total number of containers recycled. Consequently, glass processors and recyclers are projected to receive a total of $63.2 million in processing payments in 2015–16—$5.9 million in processing fees paid by glass manufacturers and $55.3 million in processing fee offsets. At the same time, plastic processors and recyclers are projected to receive a total of $24.2 million in processing payments—$7.1 million in processing fees paid by plastic manufacturers and $20.2 million in processing fee offsets. (In the long term, processing fees plus fee offsets should equal processing payments. However, in the short term, they may not sum due to the timing of payments and transfers.)

Single–Stream Curbside Collection Contributes to Low Value of Scrap. Collection methods can have a significant impact on processing costs and scrap value. Redemption centers sort containers by material. This results in loads of containers that do not need to be separated, have low levels of contamination (they do not have other materials and impurities mixed in), and reduces breakage. Other methods allow consumers to combine all recyclables together. When all materials are combined during collection, this is referred to as “single stream.” The single–stream method is often utilized for curbside collection because it allows for the use of single–compartment trucks, collection can be automated, and collection routes can be serviced more efficiently.

According to the department, recyclers, and manufacturers, single–stream curbside collection frequently results in poor scrap quality, meaning that materials collected this way are more expensive to recycle and a greater portion of materials that are collected cannot be recycled due to contamination. Therefore, some materials returned via single stream will end up in a landfill rather than being recycled. Glass is especially affected by single–stream curbside collection because it is easily broken into small pieces that are difficult to sort and clean when mixed with other materials. Additionally, there is proportionally more glass in the curbside program than other material types. CalRecycle estimates that 21 percent of CRV–eligible glass is redeemed through curbside programs compared to just 6 percent of all CRV–eligible material.

These differences can have a significant impact on the value of the collected material. For example, glass scrap from a single–stream curbside collector may be worth almost nothing or even have negative value. In some cases, processors are paid to take away glass that come in through single–stream collection. Glass from redemption centers, on the other hand, can sell for as much as $40 to $60 per ton, according to some recyclers and processors we have spoken with.

Based on our review, it is unclear how the processing fee offset advances the goals of BCRP, particularly given the current structural deficit of the BCRF. As discussed below, we also find that the current process used by the department to determine processing payments may not always accurately reflect actual recycling costs. Given that the processing fee offset is the largest BCRF supplemental payment—making up roughly a third of total spending on supplemental programs (excluding CalRecycle administrative costs)—it is important to review its effectiveness in meeting program goals.

Unclear How Processing Fee Offset Advances Program Goals. The processing fee offset reduces the program’s impact on beverage container manufacturers—especially glass manufacturers—by reducing the amount of processing fees that they must pay into the program. The current tiered structure was intended to incentivize manufacturers to produce containers that are likely to be recycled by rewarding the use of materials with high recycling rates and providing an incentive structure for manufacturers to encourage recycling of their products. However, it is unclear how the tiered structure currently encourages recycling. The three materials that make up 97 percent of CRV–eligible sales in California all enjoy similarly high recycling rates. Therefore, the incentive is weak for manufacturers to switch to a material with a higher recycling rate in order to be in a more favorable processing fee offset tier. For example, a manufacturer who switched from PET plastic to glass, which has a slightly higher recycling rate, would have their processing fee rate by just 1 percentage point.

Additionally, it is unclear how much influence beverage manufacturers have over recycling rates since the number of containers returned is ultimately up to consumers.

The current processing fee offset structure does not require manufacturers to consider the lifecycle costs of the materials that they use in their products. By significantly reducing the amount of processing fees, the program effectively subsidizes materials that are relatively more expensive to recycle. This reduces the incentive for manufacturers to choose materials that are less expensive to recycle.

Department’s Calculations Have Limitations. The amount of processing payments, processing fees, and processing fee offsets all depend on the cost of recycling and the scrap value of materials. As required by state law, CalRecycle determines these variables through surveys of recyclers every two years and reports from processors each month. The surveys establish the statewide average cost of recycling a beverage container, and the scrap value is derived from monthly reports. The department uses this information to set a processing payment per pound that all recyclers in the state receive, and a processing fee per container that all manufacturers pay statewide. Between surveys, the department can only adjust recycler cost estimates for inflation. Each cost survey costs about $3 million to conduct, and administering the payments has other associated costs such as accounting and auditing.

CalRecycle’s method of determining processing cost amounts has several limitations. The rates paid are uniform throughout the state despite the fact that costs and scrap values vary locally. While statewide rates are easier for CalRecycle to administer, they also might be inaccurate for specific regions or individual recyclers whose costs are above or below average. Additionally, market rates such as recycler costs and the scrap value of materials change regularly. For example, the scrap value of PET varies depending on demand—both domestically and internationally—and the relative price of virgin PET material, which can be influenced by oil prices and other factors. However, processing fees and payments are calculated only once per year. (The department does have the ability to make some adjustments during the year, but only in the case where scrap values fluctuate significantly from the prior year.) Therefore, processing payment and fee rates are not always able to change with market rates, and they potentially do not accurately reflect actual recycling costs in those periods between rate adjustments. Incorrect payment amounts could result in overpaying recyclers (paying more than actual costs), which increases the expense of the program and overcharges manufacturers. It could also result in underpaying recyclers (paying less than actual costs), which would cause them to lose money and possibly shut down operations. Finally, the surveys divert money from recycling activities to program administration.

While supplemental programs might have merit, we find that many of the programs have not been evaluated for effectiveness. As we discuss below, some programs (such as handling fees) could probably achieve better results with some changes.

In order to receive handling fee payments, a for–profit recycler must be located in a supermarket parking lot or in a designated rural region. (Nonprofit recyclers—which make up a very small portion of recyclers—have more flexibility on where they can locate.) We find that this payment structure does not maximize convenience for many consumers, and may raise convenience–zone recycler costs, resulting in higher handling fee payments from the BCRF.

About Half of Convenience Zones Are Served by a Recycler. Currently, only about half of the state’s 3,800 “convenience zones”—locations within a half mile radius of a grocery store with at least $2 million in gross sales—have a recycler. The percent of convenience zones served has stayed roughly the same over the last decade, despite changes in the structure and amount of handling fees paid. (We note that CalRecycle exempts many zones without recyclers because there exists other recycling opportunities in the area, or the unserved status is temporary.) Unserved zones represent areas with limited or inadequate recycling opportunities for consumers, meaning that it is not convenient for people to redeem their beverage containers for CRV. The share of served zones also varies regionally, and some regions have significantly fewer served zones. For example, only about one–fifth of convenience zones in San Francisco are served.

Current Handling Fee Structure Prioritizes Redemption Volume Over Consumer Convenience. Based on conversations with department staff, they believe that a significant portion of containers redeemed at convenience zone recyclers are not returned by the original consumer of the beverage. Instead, CalRecycle estimates that individuals who collect containers from litter, trash, or scavenging through curbside and other recycling receptacles redeem a significant amount—and possibly a majority—of containers. This would mean that the original consumers are generally not redeeming their containers to reclaim the CRV deposit that they paid. However, it is not possible to verify this because there are no studies available that examine who redeems containers.

Handling fees are paid on a per container basis. Therefore, this payment structure incentivizes locating in sites more likely to achieve high–volume recycling. While maximizing the number of containers redeemed is important, many other program payments are based on container volume. Handling fees, on the other hand, are intended to maximize consumer convenience rather than the number of containers collected. Since container collectors bring in a much higher volume of containers per person, volume–based payments encourage locations that are convenient for them. However, this payment structure might not encourage sites to be located where it is most convenient for consumers who only redeem the containers that they have consumed, which is likely to be a much lower volume.

Other Limitations. As discussed above, in order to receive handling fees, a recycling center generally must be located within the supermarket parking lot. This specific requirement limits competition for recycler sites, and there might be cheaper or more suitable locations nearby. In addition, current law defines convenience as proximity to a supermarket. However, convenience might vary by different factors, such as the proximity of the supermarket to consumers and local transportation options. A supermarket might not always be the most convenient location for many consumers—for example, for consumers who do not purchase their beverages at supermarkets. Therefore, payments based on a single definition of convenience might not result in incentivizing recyclers to locate at sites that are the most convenient.

The cost–effectiveness of several supplemental programs is unclear because their effects on recycling rates, litter, or other outcomes have not been measured. For example, payments to local governments do not include any reporting requirements. So, it is difficult to determine how exactly the money is spent and how effective it is at increasing recycling and reducing litter. This information is critical to determine the best use of limited program dollars. Payments to local governments, competitive grants, grants to the LCCs, QIPs, and PMD payments might have merit, but their cost–effectiveness relative to other programs is difficult to determine without quantifying their impact on litter or recycling.

Distributors, processors, and recyclers received $43 million in administrative fees in 2013–14, which was intended to cover some of their costs of program participation, such as costs associated with reporting requirements. The administrative fees are determined by a percentage of CRV collected or paid out. These percentages have not been adjusted for several years. Fee rates for distributors were last adjusted in 2006, and they were last adjusted for processors and recyclers in 2000. In the past, CalRecycle has asserted that stakeholder administrative costs have declined due to automation of required reporting. However, the department has not performed a workload analysis to evaluate participants’ costs. Administrative fees should be tied to actual costs of program participation in order to accurately offset these costs without overpaying participants.

Given the ongoing structural deficit of the BCRF, the Legislature will have to take steps to bring the fund’s revenues and expenditures back into balance in order to avoid proportional reductions. Below, we discuss the range of options for increasing revenues and reducing expenditures, as well as the trade–offs associated with each.

Increase CRV. The simplest way to increase revenue for the program is to raise the amount of the CRV. When the program was created, the CRV was 1 cent. The CRV has been raised several times since the start of the program, most recently in 2007 when it was increased to 5 cents per container (10 cents for larger containers). As a higher CRV increases revenue to the program, it also increases the incentive for people to redeem containers. To the extent this resulted in increased recycling rates, BCRF expenditures for CRV redemptions would increase commensurately. Therefore, while raising the CRV would be consistent with the policy goals of the program, its net effect on the deficit might be relatively small.

For example, if the CRV were to be increased by 1 cent, it would result in roughly an 18 percent increase in revenues ($225 million). If the current recycling rate remained unchanged, CRV paid out would increase by $186 million, resulting in a net gain to the fund of about $39 million. However, if the increased CRV resulted in consumers redeeming more containers, the net effect on the fund would be lower. If the recycling rate increased enough, the net effect could even be negative due to the increase in CRV paid out being greater than the increase in CRV paid in. More redeemed containers could also lead to some increased program costs, such as higher processing payments and handling fees, which would further reduce the net gain of a CRV increase.

Given these impacts, some container deposit programs (such as the program in Hawaii) charge consumers more at the time of purchase than they are refunded when they redeem the container. The difference is used to fund program administration. This structure ensures higher revenues than expenditures. However, the payment is no longer purely a deposit. Instead, it simply shifts program costs to beverage consumers, including those who recycle their containers.

Expand Containers in Program. Another option for increasing program revenue is to expand the types of beverages and containers included in the program, such as wine, milk, cartons, or foil pouches. While such changes would increase revenue to the program when CRV is paid in on new containers, they would also increase expenditures when these containers are redeemed. As with increasing the CRV, expanding the types of containers in the program might support the policy goals of the program by increasing recycling. However, it probably would not have a large net effect on the deficit in the long run if the recycling rate of the new containers increases over time. For example, after the program was significantly expanded in 2000 to include additional containers (such as water bottles), recycling rates for CRV–eligible containers declined (since the new containers initially had much lower recycling rates), but after eight years the rates returned to the previous level and have since surpassed it.

There are also several options to reduce program expenditures. For example, as we discuss below, the Legislature could adopt elements from the Governor’s 2014–15 budget proposal, which we found to be a reasonable way to eliminate the deficit. (For more information on that proposal, see our report The 2014–15 Budget: Resources and Environmental Protection.) However, there are other options the Legislature could choose. The Legislature can reduce expenditures by eliminating programs, reducing program funding, or reorganizing supplemental programs.

- Supplemental Program Elimination. The Governor’s 2014–15 proposal, for example, included eliminating processing fee offsets, eliminating curbside supplemental payments, eliminating administrative fees for processors and recyclers, and eliminating local government payments. The Legislature could also eliminate other supplemental programs that it did not deem of high priority or found to be less effective than others.

- Reduce Supplemental Program Funding. Alternatively, the Legislature could reduce the funding level for some or all supplemental programs rather than eliminate them entirely. This might make sense, for example, if the Legislature found a particular program to be useful but not as high a priority for funding as its current level.

- Reorganizing Some Programs to Achieve Savings. Finally, some programs could be reorganized to achieve savings. For example, the administration previously proposed restructuring handling fees from a per–container payment to a flat amount for qualifying recyclers, which would have resulted in savings to the fund.

While reducing or eliminating funding for these programs would reduce expenditures from the BCRF, it could also result in reduced recycling or increased litter to the extent that these programs were supporting BCRP goals.

Reducing Fraud Can Affect Fund Condition, Depending on Cost–Effectiveness. One of CalRecycle’s administrative responsibilities is to identify and correct fraudulent activities, such as redemption of non–CRV eligible materials. Increased enforcement could reduce fraudulent payments from the BCRF. However, enforcement can be staff–intensive and expensive. Costs should be weighed against expected benefits including financial returns, deterrence, and other factors to determine the appropriate level of enforcement. We note that pursuing every suspected instance of fraud is rarely a cost–effective use of a program’s resources, and enforcement activities that cost more than they are able to recover will contribute to—rather than reduce—the deficit. Some enforcement activities—such as investigating potential underreporting of beverage container sales—could have the effect of increasing BCRF revenues (rather than reducing expenditures).

CalRecycle has recently taken several actions to increase enforcement and reduce fraud. For example, the department has reduced the amount of containers that can be redeemed at one time making it more difficult for people to redeem large quantities of fraudulent containers at once. In addition, CalRecycle has partnered with the California Department of Food and Agriculture to identify out–of–state containers coming across the border that could illegally be redeemed for CRV. CalRecycle has also increased inspections of recyclers and dealers. The State Auditor recently reviewed CalRecycle’s enforcement efforts, and found that it is uncertain how quickly stronger antifraud enforcement and revenue collections would produce results and how effective they would be at easing the beverage program’s financial imbalance.

Based on our review of the above options and our assessment of the supplemental programs, we make several recommendations below that would address the BCRF deficit and improve overall program effectiveness. First, we recommend shifting processing costs to manufacturers. This would reduce BCRF expenditures significantly, probably eliminating the structural deficit. It would also better align the costs of recycling disposable containers with production decision–making by requiring producers to cover the recycling costs of their products. Second, we make several recommendations designed to improve the cost–effectiveness of the BCRP, including (1) changing handling fee payments in order to improve convenience for consumers, (2) evaluating supplemental programs to determine how cost–effective they are at achieving recycling and litter reduction goals, and (3) adjusting the administrative fee to reflect the actual costs of program participation. In combination, we believe these recommendations would allow the BCRP to be financially sustainable at current rates of recycling and potentially higher future rates. Figure 12 provides a summary of our recommendations, which are discussed in greater detail below.

Figure 12

Summary of Recommendations to Address the Structural Deficit and Improve the Program

|

Require Manufacturers to Pay Lifecycle Costs of Containers

|

- Shift processing costs back to manufacturers by either (1) eliminating processing fee offsets and increasing processing fees accordingly, or (2) implementing a market–based system.

|

- Consider options to reduce recycling costs borne by manufacturers, specifically (1) changing the purpose of curbside supplemental payments, and (2) expanding containers in the program.

|

|

Improve Cost–Effectiveness in the Long Term

|

- Improve convenience with changes to handling fees.

|

- Measure effectiveness of supplemental programs.

|

- Adjust administrative fees to reflect actual costs.

|

In this section, we propose shifting processing costs back to manufacturers. We discuss two options for accomplishing this: (1) phasing out the processing fee offset over several years or (2) implementing a market–based system. We also identify two options to possibly reduce overall processing costs, which would reduce the amount of costs that would be shifted to manufacturers.

There is a strong policy rationale for manufacturers who produce disposable beverage containers to cover the full costs of the containers they produce, including the costs to recycle the container after it has been used. In fact, when the BCRP was first implemented, manufacturers did pay for the costs associated with recycling their containers. At the time, the processing fees paid by manufacturers covered the full cost of the processing payments made to recyclers and processors. However, the current tiered processing fee system implemented in 2003 shifts most of the costs of recycling (for glass and plastic containers) to the BCRF. In more recent years, the BCRF has been able to pay for this from the large fund balance created by unredeemed deposits.

Strengthens Incentives for Manufacturers. While utilizing the BCRF to fund processing fee offsets might have been reasonable when there was a large surplus, we find that it is no longer the best use of limited BCRF monies. As discussed above, it is unclear to us how processing fee offsets continue to further the program’s goals by either increasing recycling or reducing litter. Moreover, the offsets misalign incentives by covering most of the costs of expensive and difficult–to–recycle materials, especially glass. This encourages a higher level of production and use of these containers than there otherwise would be without the offsets, resulting in a higher cost of recycling beverage containers that is largely borne by the BCRF.

Shifts Costs to Producers of Containers. Requiring that manufacturers pay for recycling costs is also consistent with the principal of “extended producer responsibility” or EPR. This refers to a waste management strategy that makes the manufacturer of a product responsible for the products’ entire life–cycle costs including its end–of–life costs associated with recycling or disposal. These costs have traditionally been borne by local governments (and ultimately tax payers) through municipal waste disposal programs. This traditional structure results in an “externality” or a situation where the costs of recycling or disposal are not paid by the buyer or seller of the product, but rather by a third party (such as tax payers). EPR shifts the costs of managing a product at its end of life from waste disposal programs to the manufacturer of the product. By requiring manufacturers to cover end–of–life costs, these costs are incorporated or “internalized” into the total cost of the product when it is sold. Therefore, the price that consumers pay reflects the entire cost of the product—its production and disposal. This means that the people making and using the product cover all of its costs, rather than local governments and tax payers covering a share of disposal costs. Moreover, manufacturers have a financial incentive to design products that are inexpensive to recycle. In California, EPR is already used for carpet, mattresses, and paint.

Addresses BCRF Structural Deficit. Finally, shifting processing costs to manufacturers would probably eliminate the current BCRF structural deficit. As discussed above, processing fee offsets make up about $75 million—more than the projected $60 million structural deficit. If no changes were made to reduce the offsets, other changes to increase revenues or reduce expenditures would have to be made. For example, all of the other supplemental programs would have to be cut by about a third. Moreover, while processing fee offsets represent a large cost to the program, the cost relative to the price of beverages is small—about a fifth of a cent for each PET container and 1.7 cents for each glass container in the program. Therefore, we would expect that the effects of this change on manufacturers and consumers of these containers would be manageable.

The Legislature could eliminate processing fee offsets and increase processing fees accordingly, as previously proposed by the Governor. Under this approach, the processing fees paid by manufacturers would equal the full costs of processing payments. A benefit of this approach is that it would largely rely on the existing structure, which would make it straightforward to implement with clear implications for manufacturers and recyclers. This approach could be phased in over a few years in order to ease the transition of costs to manufacturers.

Market–Based System Could Be More Efficient Approach

Implementing an approach more similar to EPR could have greater benefits than phasing out offsets under the current system, such as gaining market efficiencies and greater flexibility, as discussed below.

Implementing a Market–Based Approach. A market–based system would replace processing fees, fee offsets, and payments with an EPR–type system that makes the manufacturer responsible for the recycling of its CRV materials. This system would work similarly to other EPR programs and have the following key components.

- Manufacturers Purchase Containers From Recycling Market. First, a manufacturer would be required to purchase a certain amount of containers from the California recycling market based on the total amount (by weight) of CRV containers that the manufacturer sold in California. We note that traditional EPR programs require manufacturers to take back their products specifically. However, this approach can be very administratively burdensome for beverage containers due to the very large number of different beverages. For example, in states where beverage manufacturers take back their own containers, collectors must sort the redeemed containers into dozens of groups based on not only material type, but also manufacturer. In order reduce administrative costs, we recommend the state require manufacturers to buy back the same type of material based on the amount they sold in the state. The weight of a manufacturer’s containers sold would be adjusted by the proportion of containers returned for recycling since not all material is redeemed. While manufacturers would not be responsible for their containers, they would still have an incentive to use easier–to–recycle materials and reduce the amount of material used for each container.

- Manufacturers Responsible for Used Containers Being Processed. Second, manufacturers would be responsible for ensuring that used containers are processed into new materials. They could do this themselves, or they could pay a third party to process the containers for reuse. This would shift both financial responsibility and administrative responsibility to producers. A similar system is already in place in Michigan, and that state’s Department of Environmental Quality estimates that about half of redeemed containers are handled by manufacturers and about half are handled by a third party on behalf of manufacturers. Most other container deposit programs in other states place more administrative and financial responsibility on the private sector—especially beverage manufacturers, distributors, and retailers. (Please see the box below for more detailed information regarding the practices of other states.)

- CalRecycle Responsible for Oversight and Enforcement. Third, CalRecycle would oversee and enforce the above requirements. CalRecycle already audits beverage manufacturers and distributors to ensure proper payment of CRV and processing fees. Under this approach, similar audits would still need to occur, but would require manufacturers and distributors to report on the weight of the containers, in addition to their existing reporting requirements. The department would no longer handle processing fees or payments.

Nine other states and many other countries have bottle bill programs. Other jurisdictions, however, operate programs in different ways than California. Notably, several other state programs involve greater use of in–store redemption, administration of the program by beverage manufacturers instead of the government, and higher reuse requirements for specified recyclable materials.

Private Sector Plays a Greater Role in Other Programs. Most other container deposit programs place responsibility, including most financial transactions and administration, for container collection and recycling on the private sector. In these systems, retailers are required to accept returned empty bottles and cans from consumers, and distributors and manufacturers are directly responsible for the collection from retailers, processing, and recycling of their containers. California does not require retailers to accept empty containers, and manufacturers and distributors are only partially financially responsible for container recycling through their payment of processing fees. Additionally, in California, manufacturers and distributors do not play any administrative role in container collection or recycling, and therefore they have little control over the amount of their payments. Instead, CalRecycle collects and distributes payments and oversees collection and recycling activities.

Bottle bill programs in Oregon, Connecticut, Vermont, Massachusetts, Iowa, and Michigan each employ three or fewer state staff, usually as a point of contact for stakeholder information or to oversee the state’s receipt of unredeemed deposits. In contrast, California’s division of recycling within CalRecycle has 137 positions. While state costs are much lower under other systems, however, the cost to the private sector tend to be greater.

Level of State Involvement Has Trade–offs. While California’s program requires greater state involvement and administration than in other states, it also performs additional activities such as data collection and enforcement, administers grant programs, and invests in the development of new recycling technology and collection methods. States with significantly fewer state staff report limited knowledge of beverage container recycling rates and rely on private data to determine program compliance and success. California also has a relatively high beverage container recycling rate when compared with these other states, but some programs that rely on the private sector do have higher rates. Michigan, for example, has a recycling rate near 96 percent.

Benefits of a Market–Based Approach. A market–based approach has several benefits compared to the option of eliminating processing fee offsets. First, it is closer to an EPR model, which requires manufacturers to cover the costs of their products and encourages production of containers that are inexpensive to recycle. Unlike simply eliminating the processing fee offset, requiring manufacturers to be responsible for the amount of material they produce by weight would encourage them to reduce the amount of material used in containers, which saves energy and has other environmental benefits.

Second, giving manufacturers responsibility for the returned containers also provides participants with more choices and greater flexibility in their decision–making. For example, manufacturers would be able to shop around for the best price when purchasing returned containers, which would force recyclers and processors to compete with one another and collect the containers as inexpensively as possible. Manufacturers would retain the option to collect the containers themselves if they believed it would be more cost–effect for them. Accordingly, the market–based system provides many opportunities for stakeholders to make individualized business decisions that maximize their benefits, resulting in a process that is more advantageous to them and more efficient overall.

Third, this system would transition the processing costs of the program from the government to the private sector. We find that the private sector is better equipped to handle this component. As discussed above, processing fees and payments are intended to reflect net processing costs, but market prices change on a frequent basis. The department currently uses surveys to reflect these amounts, and we find that this method has limitations that could result in inaccurate rates at certain times or in certain regions. A private market is better able to accommodate quickly changing prices that vary by location, resulting in transactions that more accurately reflect real time value by locality. This eliminates any over or underpayments associated with relying on surveys, ensuring that a fair price is paid and improving the efficiency of BCRP scrap markets.

Fourth, the market–based system is more reflective of programs in other states that have less government involvement. While these programs perform fewer enforcement and other recycling–related activities and can be more costly to the private sector, they do have much smaller costs associated with administration. For example, Michigan has no staff specifically dedicated to administering its bottle bill program (though there are some staff in the Department of Treasury who administer the fund). Since deposit programs in other states have already demonstrated that the private sector is capable of addressing processing costs, those costs could be shifted from the state to the private market in order to reduce administrative complexity. For example, under the market–based system, the department would no longer need to pay for expensive surveys to determine recycling costs.

Phase–In Needed. If the Legislature shifts processing costs to manufacturers by choosing to implement a market–based system—or simply eliminate the processing fee offsets—the shift will take time for the state to implement and for affected stakeholders to adapt. Therefore, we recommend that the Legislature phase in such changes. Offsets from the BCRF can be phased out over a number of years. If the Legislature chooses to implement a market–based system, the transition could be rolled out in phases by material or container type. During a phase in, CalRecycle would need to monitor the effects on recyclers, especially if the market–based approach is adopted because they would no longer be guaranteed a defined processing payment. If, for example, the department determined that the availability of recyclers declined substantially in some geographic areas, the Legislature could consider providing limited payments to address this problem. These costs would be covered with savings from elimination of the processing fee offset.

As discussed above, one factor that influences processing costs is the collection method. In particular, single–stream curbside collection frequently results in poor scrap quality, thereby making materials collected this way significantly more expensive to recycle, especially for glass. For this reason, approaches that encourage the separation of materials prior to collection could increase the quantity of higher quality scrap material. This would reduce costs to manufacturers under either approach that requires them to pay the lifecycle costs for their materials. For example, under the option of eliminating processing fee offsets, more high quality material would increase recyclers’ revenue from scrap sales, thereby reducing processing payments. Alternatively, under a market–based approach, increased supply of high quality scrap material would reduce the price manufacturers would have to pay when purchasing beverage containers.

We identify two options the Legislature could consider to potentially reduce the costs of recycling by shifting more material out of single–stream recycling and increasing the scrap value. Specifically, the Legislature could (1) change the purpose of the curbside recycling supplemental payments and (2) expand eligible containers in the program.

Change Purpose of Curbside Supplemental Payments. Curbside collection is now common enough that curbside supplemental payments provided simply for operating a curbside program might no longer be a cost–effective use of program funds. Moreover, the quality of materials collected through such a program continues to be a problem. Currently, curbside collection programs receive several payments—CRV, processing payments, curbside supplemental payments, and administrative fees—from the BCRF. However, none of these payments are related to the quality of the materials they collect.

One option is to make the curbside supplemental payment dependent on the quality of collected materials. This would incentivize collection methods that result in higher quality scrap and therefore lower the overall cost of recycling. For example, payments could be made only to curbside operators that keep some materials separated during collection, such as “dual–stream” systems in which residents separate paper and cardboard from other recyclables, or “hybrid” systems where glass is kept separate. The cities of Davis and Berkeley, for example, operate dual–stream systems. Some studies have found that these collection methods yield higher quality materials that have much greater scrap value. Alternatively, CalRecycle could simply set a very high quality threshold that is similar to what dual–stream and hybrid systems are able to collect and pay the supplemental payment only to those collectors able to meet the threshold. We note that existing QIP are also available to improve the quality and marketability of glass containers collected by curbside programs, but their effectiveness is unclear. As curbside supplemental payments and QIP are reevaluated (as recommended below), it might be possible to combine these supplemental programs.

This aspect of processing costs is out of the control of manufacturers, unlike the number or type of container produced. Therefore, while it largely makes sense for manufacturers to cover the processing costs of the containers they produce, putting in place financial incentives that improve the quality of scrap from better collection methods would improve either system. The amount of funding provided for this purpose could be set at the same level as the current curbside recycling program—$15 million. To the extent that it can be demonstrated in the future that this approach is cost–effective, the Legislature could consider expanding the program. However, to the extent that collection programs cannot meet quality standards, this would reduce expenditures from the fund for curbside supplemental payments.

Expanding Containers in Program. Adding new beverage containers to the program could also reduce the average cost to process each container, as well as increase its scrap value. Including containers in the program provides an incentive for consumers to redeem them at collection centers in order to get their CRV deposit back, rather than place the containers in their curbside collection. Containers returned at collection centers have lower processing costs and a higher scrap value than containers collected through curbside because they are kept separated from other materials, limiting contamination. Therefore, to the extent that consumers redeem a larger share of containers at collection centers, it would provide manufacturers with higher quality material with reduced average processing costs. (Adding containers to the program also increases revenue, though by only a relatively small amount once the recycling rate of the new containers increases to a higher level.)

Wine and spirits are a significant portion of beverage containers not currently in the program (we estimate roughly one–fifth of glass beverage containers sold in California), and could contribute to the low value of glass scrap since there is currently no incentive for consumers to return them at recycling centers rather than place them in curbside bins. Importantly, expanding the program to cover these beverage types is not likely to require any additional recycling infrastructure since there already is an established market for recycled glass materials.

Even if the Legislature implements changes to shift lifecycle costs to manufacturers, this may not entirely eliminate the BCRF structural deficit permanently, depending on various factors, including recycling rates and costs. Moreover, if California’s recycling rate increases in the future, that would put further pressure on the BCRF. Therefore, the Legislature may be faced with decisions regarding what level of funding to provide to supplemental programs. Evaluating and improving the effectiveness of these programs can help to prioritize funding toward the programs most likely to improve recycling and reduce litter. Improving program efficiency could also result in cost reductions in the short term.

Consumer convenience—making recycling easy for purchasers of CRV materials—is an important goal of the BCRP because it means that consumers are able to reclaim their deposit if they choose. For this reason, the Legislature created convenience zones, and the program provides handling fees as additional incentive for recyclers to locate in these zones. Despite these payments, nearly half of convenience zones are not served. There are several options to reform handling fee payments in order to improve consumer convenience for the same amount of funding. Below, we recommend (1) elimination of the supermarket location requirement and (2) a pilot program for a new handling fee structure.

Modify Location Requirement for Recyclers. Currently, recyclers must be physically located within or adjacent to a supermarket parking lot in order to receive handling fees. This requirement is meant to make it more convenient for consumers to redeem their CRV deposits, but it comes with significant trade–offs that affect costs and convenience. Alternatively, allowing convenience zone recyclers to be located anywhere within a convenience zone—rather than only on a supermarket site—would expand competition for locations and provide greater flexibility for the recyclers to find a low–cost location. While this option could slightly reduce convenience in some instances—for example, if a customer has to travel from the redemption center to a supermarket to collect payment owed—it could result in more recyclers operating in California, which would improve overall convenience. In addition, greater location flexibility could lower the rent payments of recyclers, which lowers the handling fee payment from the BCRF (since this payment is calculated based on the average costs of being located in a convenience zone). The lower fee payments would benefit the BCRF structural balance. We further recommend adding a requirement that supermarket and other beverage dealers post where the nearest recycler is located if the recycler is not located on site.

Pilot New Handling Fee Structure. Currently, handling fees are paid on a per–container basis so that recyclers located near supermarkets are paid based on the volume of material they collect. We recommend that the Legislature direct CalRecycle to pilot a new structure that would address two goals: (1) maximize the number of recycling locations, and (2) maximize the number of customers served. To address the first goal, the pilot would eliminate the use of a supermarket as the definition of a convenient location. Instead, a flat payment would be provided to recyclers that (1) locate in any area with no other recyclers within a certain radius and (2) collect a minimum amount of containers. The flat payment incentivizes the greatest number of locations since payments are for each unique location. (The Governor has previously proposed a flat handling fee payment.)