Legislative Analyst's Office, October 1998

California Spending Plan 1998-99

|

Chapter 3

Major Features of

The 1998-99 Budget Plan

|

The budget includes over $35 billion in

Proposition 98 spending in 1998-99 for K-14 education. This

represents an increase of $2.4 billion, or 7.3 percent,

from the revised 1997-98 funding level. Figure 1 (see page

26) summarizes for 1997-98 and 1998-99 the effect of the budget

package on K-12 schools, community colleges, and other specific

agencies.

| Figure 1 |

| Proposition 98 Budget Summary |

1997-98 and 1998-99

(Dollars in Billions) |

| |

1997-98 |

|

| |

Budget Act |

Revised |

1998-99

Budget Act |

| |

|

|

|

| K-12 Proposition 98 |

|

|

|

| General Fund |

$19.9 |

$20.4 |

$22.1 |

| Local property taxes |

9.0 |

8.8 |

9.2 |

| Totals, K-12 |

$28.9 |

$29.2 |

$31.3 |

| Average Daily Attendance

(ADA) |

5,359,444 |

5,357,024 |

5,453,060 |

| Amount per ADA |

$5,386 |

$5,454 |

$5,735 |

| California Community

Colleges |

|

|

| General Fund |

$1.9 |

$1.9 |

$2.2 |

| Local property taxes |

1.4 |

1.4 |

1.4 |

| Totals, Community

Colleges |

$3.3 |

$3.3 |

$3.6 |

| |

|

|

|

| Other agencies |

$0.1 |

$0.1 |

$0.1 |

| Loan repayment |

$0.2 |

$0.2 |

$0.3 |

| Grand Totals, Proposition

98 |

$32.5 |

$32.8 |

$35.2 |

| General Fund |

$21.8 |

$22.3 |

$24.6 |

| Local property taxes |

10.4 |

10.2 |

10.6 |

| |

|

|

|

The Proposition 98 appropriation

reflects the fact that the Legislature appropriated more General

Fund monies than required to meet the constitutional minimum.

Specifically, the Legislature appropriated $177 million more

than the 1997-98 minimum funding level and $587 million more

than what would have been required to satisfy the guarantee in

1998-99. (These amounts include $50 million in each year in

accordance with Proposition 227, the initiative requiring

English-only instruction.)

The K-12 portion of the Proposition 98

budget package includes:

Figure 2 (see page 27) displays K-12

per-pupil funding amounts from 1991-92 through 1998-99. After

adjusting for the effects of inflation and changes in attendance

accounting, per-pupil funding has increased $520, or

10 percent, over the period.

1998-99 Baseline Increases.

Compared to the 1997-98 Budget Act, K-12

Proposition 98 funding increased by $2.4 billion. The

budget allocates $1.6 billion to provide inflation and

growth adjustments. Specifically, the budget includes about

$540 million to accommodate a projected 1.8 percent

increase in the student population, $833 million for a

3.95 percent K-12 revenue limit cost-of-living adjustment

(COLA), and about $200 million for a 2.18 percent K-12

categorical programs COLA.

The budget directs the remaining increased

funding for other purposes, including new programs and existing

K-12 categorical programs (see Figure 3). The major

discretionary increases in the budget are as follows:

1997-98 and Prior Years

"Settle-Up" Funding. Proposition 98

minimum funding levels are determined by one of four specific

formulas, each using a set of specified factors. Because the

factors change during the year, the minimum funding guarantee

under Proposition 98 also changes. Any additional amount

needed to satisfy the guarantee from a past fiscal year is

referred to as Proposition 98 settle-up funding.

The budget contains approximately

$640 million in settle-up funding for K-12 programs.

Figure 4 displays the major allocations of these monies. The

budget appropriates most of these funds for one-time activities.

Specifically, the budget allocates $180 million in block

grants to local school sites for one-time expenditures. Each

school will receive about $30 per student, with no school

receiving less than $10,000. As Figure 4 illustrates, the

budget also includes one-time augmentations for the digital high

school project ($86 million)and various other purposes.

Governor's Vetoes.

The Governor vetoed $88 million of settle-up funds and

$408 million in 1998-99 Proposition 98 funds for K-12

in the budget and trailer bills. The Governor also vetoed

$57 million of 1998-99 Proposition 98 funds for the

community colleges. Of the 1998-99 vetoed funds, the Governor

deleted funding for increases to beginning teacher salaries

($50 million) and reduced funding for school desegregation

($37.1 million).

Also, as part of the 1998-99 vetoed funds,

the Governor vetoed $250 million for programs related to

school reform, but set aside these funds for subsequent

legislation that would increase school accountability and improve

student achievement. These "set-asides" included

$94 million for K-12 categorical program growth and COLA

funding, $75 million for remedial summer school,

$50 million for low-performing schools, and $30 million

for college preparation.

In the final days of the session, the

Legislature passed several bills to restore these funds and to

address the school reform concerns raised in the Governor's

set-aside veto messages. Of these bills, the Governor vetoed SB

1561 (Leslie), which would have provided $50 million for

low-performing schools, because the bill did not meet the

Governor's expectations regarding accountability. He signed

several other bills that, together, restored $218 million

for 1998-99, including $94 million for categorical programs

growth and COLA, $75 million for remedial summer school,

$30 million for remedial instruction for grades 7 to 9, and

$18 million for college preparatory programs. (See the

appendix at the end of this report for a list of significant

spending bills passed at the end of the session.)

The Governor also vetoed $8 million in

non-Proposition 98 funding for Department of Education state

operations (executive management), approximately one-quarter of

the department's operating budget. In his veto message, the

Governor set the $8 million aside, pending enactment of

legislation to transfer specified legal counsel positions from

the Department of Education to the Attorney General. Since the

Legislature did not subsequently pass such legislation,

resolution of this issue may require action by the Legislature

early in the next session.

The budget includes significant funding

increases for the University of California (UC), California State

University (CSU), California Community Colleges (CCC), and the

Student Aid Commission. It provides sufficient funds to

accommodate enrollment growth, as well as funds for growth in

prior years that were not explicitly funded in prior budgets. The

budget also provides $55 million from the General Fund to

compensate the three public systems for the revenue loss

associated with a 5 percent undergraduate fee reduction

mandated by Chapter 853, Statutes of 1997 (AB 1318,

Ducheny). Figure 5 shows the change in funding for each

major segment of higher education for 1998-99 from selected fund

sources.

The budget provides $340 million, or

16 percent, more in General Fund support for the UC in

1998-99 than in 1997-98. The major augmentations include:

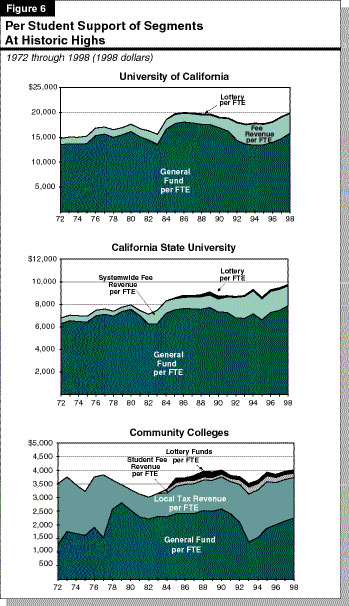

Figure 6 (see page 32) shows the

per-student funding history for UC over the past 26 years

adjusted for the effects of inflation.

The budget provides $267 million, or

14 percent, more in General Fund support for CSU in 1998-99 than

in 1997-98. Major augmentations include:

Figure 6 also shows the per-student funding

history for CSU over the past 26 years adjusted for the effects

of inflation.

The budget package contains major funding

increases for community colleges. This resulted, in part, because

the budget exceeds the

Proposition 98 minimum funding guarantee for K-14 education by

$587 million. General Fund spending for community colleges totals

approximately $2.2 billion in the budget year. This

represents a $234 million, or 12 percent, increase

above the 1997-98 level. Despite expected enrollment growth,

student fee revenues are expected to decline by $10 million,

mainly due to the $1 per credit unit reduction mandated for

1998-99 by Chapter 853.

1998-99 Expenditures.

Figure 7 illustrates the major program increases funded in

1998-99. The budget includes $100 million for a new

"partnership for excellence." It also includes $90.4

million to fund enrollment growth of 3 percent, and $71.4 million

for COLAs of 2.3 percent.

The partnership for excellence funds will

be distributed to districts on a per-student basis to improve the

performance of colleges in teaching students. The CCC Board of

Governors will develop outcome measures and goals upon which

future performance will be assessed. Beginning with the 2001-02

fiscal year, the board will consider whether partnership for

excellence funds should be allocated based on district

performance.

Settle-Up Expenditures. The budget includes

$75 million in "settle-up" funding for 1997-98 and

prior years for several one-time activities. Trailer bill

language authorizes up to $20 million of this amount to be

used to backfill property tax deficiencies for the 1997-98 fiscal

year, if needed. Half of whatever remains would be allocated to

districts on a per-student basis for instructional equipment,

library materials, and technology infrastructure. The other half

would be allocated by the Chancellor's Office on a

project-priority basis for facility maintenance, architectural

barrier removal, and abatement of hazardous substances.

Governor Vetoed Legislation to

Add $46 Million. The Governor vetoed

$57 million from the amount approved by the Legislature for

the community colleges in the 1998-99 Budget Act. The

vetoes included $11 million for noncredit instruction and

$8.9 million for equalization of state funding among college

districts. Assembly Bill 2398 (Ducheny) would have provided

$11 million for the noncredit courses and $35 million

to "fully" equalize state funding among college

districts. The Governor vetoed AB 2398.

Figure 6 (page 32) shows the per-student

funding history for the Community Colleges for the past 26 years

adjusted for the effects of inflation.

The budget appropriates $352 million

from the General Fund for the Student Aid Commission in 1998-99.

This is $57 million, or 19 percent, above expenditures

in 1997-98. The growth in the commission's budget provides for

5,056 additional new Cal-Grant awards and an increase in the

maximum annual grant amount from $8,184 to $9,036.

In this section, we describe the major

features of the health and social services funding in the state

spending plan. General Fund support for health and social

services programs in 1998-99 totals $15.3 billion, an

increase of 4.6 percent over the prior year. This growth in

expenditures is the net result of welfare grant increases,

workload-related activities, and new or expanded programs such as

the Foster Care Initiative, which were partially offset by

various savings. The largest amount of savings resulted from

caseload reductions and federal carryover funds in the California

Work Opportunity and Responsibility to Kids (CalWORKs) program.

Figure 8 shows the changes in expenditures in the major

welfare grant programs and the Medi-Cal Program.

Figure 9 (see page 36) describes the

major General Fund changes (from prior law) enacted in the 1998-99

Budget Act and related legislation. The major health trailer

bill was AB 2780 (Gallegos, Ducheny, Villaraigosa) which, among

other things, reduced the state administrative fee for the

Disproportionate Share Hospital program and established a newborn

hearing screening program. The major social services trailer bill

was AB 2779 (Aroner, Ducheny, Villarai-gosa) which, among other

changes, reversed a prior 4.9 percent CalWORKs grant

reduction and reinstated the COLA for Cal-WORKs grants.

In response to federal welfare reform

legislation, the Legislature created the CalWORKs program in

1997. This program, which replaced the Aid to Families with

Dependent Children (AFDC) program, provides cash grants and

welfare-to-work services to families with children whose incomes

are not adequate to meet their basic needs. The budget plan

provides $1.8 billion from the General Fund for the CalWORKs

program in 1998-99. Even though the budget contains increased

funding for welfare-to-work services and county fiscal

incentives, General Fund spending is projected to decline by

12 percent in 1998-99 because of caseload reductions and the

availability of unexpended federal Temporary Assistance for Needy

Families (TANF) funds from prior years.

Grant Payments. The

Legislature rejected the Governor's proposal to make permanent a

previously enacted 4.9 percent grant reduction and to

eliminate the statutory COLA. These actions result in costs of

$230 million compared to the Governor's budget but no cost

in relation to prior law.

As a result of the grant and COLA

restorations, effective November 1, 1998, the maximum

grant for a family of three in high-cost counties will increase

by $46 to a total of $611 per month, and the corresponding grant

in low-cost counties will increase by $44 to a total of $582 (see

Figure 10, page 37). Budget trailer bill legislation,

however, provides that future COLAs will be suspended in any year

where revenues are insufficient to "trigger" an

additional vehicle license fee reduction, beginning in 2000-01

(see the "Tax Provisions" section of this report).

Employment Services.

The budget appropriates about $1 billion for CalWORKs

employment services (General Fund and federal block grant funds).

The Legislature reduced the Governor's request by (1)

$166 million for basic employment services because the funds

are in excess of the estimated amount needed to fully fund the

program, and (2) $85 million by deferring the state match

for the new federal Welfare-to-Work block grant. The budget

appropriation includes the full amount requested by the Governor

($373 million) for county "fiscal incentives,"

which are payments based on the state's grant savings in the

program.

Mental Health Services for

CalWORKs Recipients. The budget, as passed by the

Legislature, included $22 million from the General Fund for

mental health services for CalWORKs recipients. This expenditure

would have drawn down $23 million in additional federal

Medicaid funds. The Governor, however, vetoed these funds because

the General Fund appropriation was above the minimum amount

needed to meet the federal "maintenance of effort"

requirement.

Caseload Reduction.

Since reaching its peak in 1994-95, the CalWORKs/AFDC caseload

has declined by about 20 percent (see Figure 11, page

38). For 1998-99, the caseload is projected to decline by

9.6 percent, resulting in grant savings of about

$350 million compared to 1997-98.

The Supplemental Security Income/State

Supplementary Program (SSI/SSP) is a state and federally funded

program that provides grants to low-income aged, blind, and

disabled persons. The budget appropriates $2.2 billion from

the General Fund for the program in 1998-99, which is an increase

of 8.2 percent over 1997-98. This spending increase is

largely attributable to higher grants effective

January 1999.

Grant Payments. The

budget provides for the statutory COLA (2.84 percent), as

proposed in the Governor's budget, and an additional grant

increase of 1 percent at a General Fund cost of

$42 million above both prior law and the amount proposed by

the Governor. Effective January 1, 1999, the maximum

grant for aged or disabled individuals will increase by $26 to a

total of $676 per month, and the corresponding grant for couples

will increase by $45 to a total of $1,201 per month (see

Figure 10).

State-Only Program for Certain

Noncitizens. Federal welfare reform and related

legislation made elderly legal noncitizens, who are not disabled,

ineligible for SSI/SSP. In addition, noncitizens who cannot be

naturalized because they are not considered permanent residents

became ineligible for SSI/SSP benefits on

October 1, 1998. (Pending federal legislation may

restore eligibility for these noncitizens.) State budget

legislation provides, for a two-year period, state-only benefits

to these noncitizens (with certain exceptions) at a General Fund

cost of $19 million in 1998-99.

Special Circumstances Program.

The Legislature rejected the Governor's proposal to permanently

eliminate the Special Circumstances Program. This program, which

had been suspended since 1992, provides emergency payments to

SSI/SSP recipients for certain nonrecurring needs, such as

replacing a broken refrigerator or repairing a leaky roof. The

budget includes $8.3 million General Fund for this program,

offset by $6 million in combined savings in SSI/SSP and

Medi-Cal long-term care.

The Food Stamps program provides food stamps

to low-income persons. The cost of the food stamps coupons (over

$2 billion) is borne entirely by the federal government,

with the exception of the state-only program for noncitizens that

is discussed below.

Expanded State-Only Program for

Legal Noncitizens. Budget legislation expands, for

a two-year period, the existing state-only Food Stamps program

for children and elderly noncitizens to include

(1) noncitizens ages 18 through 64 and (2) certain

noncitizens who arrived in the United States after

August 1996. Eligibility for the program will be dependent

on meeting a specified work requirement. The 1998-99 Budget

Act appropriates $71 million for this expansion (which

was partially offset by savings from new federal funds to cover

the pre-existing state-only program for children and the

elderly).

The Foster Care program provides grants to

pay for the care of children placed in foster family homes or

group homes. The Child Welfare Services (CWS) program provides

services to abused and neglected children and children in foster

care and their families. The budget appropriates

$433 million from the General Fund for the Foster Care

program in 1998-99, a 9 percent increase over estimated

General Fund spending in 1997-98. The budget appropriates

$541 million for the CWS program in 1998-99, a

20 percent increase over estimated General Fund spending in

1997-98.

The budget includes an increase of

$103.7 million from the General Fund (including

$7.6 million for a group home COLA required under prior law)

for various increases and reforms in the Foster Care and CWS

programs. Figure 12 (page 40) summarizes the fiscal impact

of the "Foster Care Initiative," and the major features

are described in Figure 13 (page 41).

Federal law requires the states to provide

child support enforcement services to families receiving TANF.

Non-TANF families may request the same services, or seek to

obtain child support through a private attorney. Child support

payments that are collected on behalf of TANF recipients are used

to offset the public costs of TANF grants, except the first $50

of monthly payments which are distributed to the custodial

parent.

In California, the child support enforcement

program is administered by county district attorneys under the

supervision of the Department of Social Services (DSS).

Child Support Automation.

The budget includes $80 million from the General Fund and

federal funds to launch a new approach to automating the child

support enforcement program. The new approach follows the

cancellation in November 1997 of the state's contract with a

vendor to develop the Statewide Automated Child Support System.

Under the new approach, the Health and

Welfare Agency Data Center intends to deploy a Statewide Case

Registry (SCR) and Statewide Distribution Unit (SDU) which will

enable the transmission of data and child support monies across

county lines in compliance with recently enacted welfare reform

laws. The administration's original plan called for counties to

use one of seven automated case management systems to connect to

the SCR and SDU. Assembly Bill 2779 amended the plan to allow up

to four case management systems. Since the administration's plan

has not yet been approved by the federal government and the

federal government will not reimburse for costs already incurred

before approval is granted, it is unclear how much of the

project--which will likely cost several hundred millions of

dollars--will be funded with federal monies and how much will be

funded from the state General Fund.

The Adult Protective Services (APS) program

provides assistance to the elderly and functionally disabled

adults who are victims of abuse, neglect, or exploitation.

Program Expansion.

The Governor proposed expanding the APS program by

$20 million. The Legislature augmented the Governor's

proposal by $32.7 million, but the Governor vetoed this

augmentation.

The In-Home Supportive Services (IHSS)

program provides various services to eligible aged, blind, and

disabled persons who are unable to remain safely in their own

homes without such assistance. The program is administered by the

DSS. The budget appropriates $444 million from the General

Fund for the IHSS program in 1998-99. This represents an increase

of 15 percent over estimated General Fund spending in

1997-98, primarily due to increases in caseload and the minimum

wage (most IHSS service providers earn the minimum wage).

Expansion of Personal Care

Services Program. Budget legislation requires the

Department of Health Services (DHS) to seek federal approval of a

Medicaid State Plan amendment to extend coverage of personal care

services to Medi-Cal "medically needy" individuals.

This action will increase the federal share of costs in the IHSS

program and will result in estimated General Fund savings of

$19.9 million.

The Department of Developmental Services

contracts with 21 nonprofit regional centers to coordinate

educational, vocational, and residential services for

approximately 140,000 developmentally disabled clients each year.

The department also operates five state developmental centers

(DCs) that house nearly 4,000 residents.

Provider Rate Increases.

The budget includes a $48.3 million General Fund

augmentation (including the state share of reimbursements) to

increase rates for services provided to people with developmental

disabilities. This includes services in community care facilities

(13 percent increase) and day and respite care programs

(7 percent). In-home respite workers will also receive an

average pay increase of about 14 percent. In addition,

Chapter 1043 (SB 1038, Thompson) appropriates $2.5 million

General Fund (including reimbursements) to provide increased

wages and benefits for supported living workers.

Regional Center Staff.

The budget includes $20.8 million from the General Fund for

additional staff at the regional centers: 757 new case managers,

105 supervisors, and 218 other positions such as information

systems specialists, training officers, and related clerical

staff.

Developmental Center Staffing

Increase. The budget includes $30.3 million

($1.8 million General Fund and $28.5 million in

reimbursements, which are 49 percent General Fund) for new

staff at the DCs. This includes 438 direct care workers, 107

support staff, and 32 peace officers.

The California Department of Aging

administers various programs providing services to the elderly

and functionally disabled adults.

Expansion of Programs for the

Elderly. The Governor's budget proposed

$9.1 million to expand Adult Day Health Care, the

Multipurpose Senior Services Program, Alzheimer's Day Care

Resource Centers, Linkages, the Foster Grandparent program, the

Senior Companion program, Respite Purchase of Services, Respite

Registry, and the Brown Bag program into areas of the state that

are currently unserved. The Legislature augmented the Governor's

proposal by $12.8 million, but the Governor vetoed

$10.3 million of the augmentation.

The Department of Alcohol and Drug Programs

(DADP) coordinates the state's efforts to prevent or minimize the

effects of alcohol-related problems, narcotic addiction, and drug

abuse. The department also serves as the coordinating agency for

the California Mentor Initiative.

Drug Court Partnership Grants.

Senate Bill 1587 (Alpert) appropriates $8 million from the

General Fund to create the Drug Court Partnership, a competitive

grant program aimed at expanding the use of drug treatment as an

alternative to incarceration for defendants who plead guilty to

drug-related offenses. The Governor subsequently reduced the

appropriation to $4 million. The DADP and the Judicial Council

will administer the grants, which are intended to continue

through 2001-02 at a total General Fund cost of $28 million,

subject to appropriation in future budget acts. As of May 1998,

75 jurisdictions in 31 counties had a drug court in operation,

primarily funded through federal grants.

The California Medical Assistance (Medi-Cal)

program provides health care services to welfare recipients and

to other qualified low-income persons (primarily families with

children and the aged, blind, or disabled). The DHS administers

the program. The budget appropriates $6.9 billion from the

General Fund to the department for Medi-Cal benefits in 1998-99,

an increase of 1.8 percent over estimated General Fund

spending in 1997-98. The DHS budget also includes

$10 billion of federal Medicaid funds in 1998-99. These

Medicaid funds match state General Fund spending for Medi-Cal

benefits in the DHS budget. They include additional federal

funding to (1) provide supplemental payments to

disproportionate share hospitals (DSHs) and (2) match state funds

budgeted in other departments for several related programs.

Provider Rate Increases.

The budget, as passed by the Legislature, included a total of

$57.9 million from the General Fund for various Medi-Cal

provider rate increases plus $74 million for a

6 percent increase in nursing home rates that was required

pursuant to an adjustment mechanism in existing law. The Governor

vetoed $9.3 million by eliminating increases for

optometrists and medical vans, and half the increase for

outpatient hospital services. Figure 14 lists the rate

increases that were included in the enacted budget.

Reduced State "Takeout"

From DSH Payments. The budget includes a General

Fund augmentation of $40 million in the Medi-Cal program to

backfill for an equivalent reduction in the state takeout from

DSH transfers made by public hospitals operated by counties, the

University of California, and local hospital districts. The state

takeout is used to offset a portion of the General Fund cost of

the Medi-Cal program. The remainder of the transfers, along with

matching federal funds, are returned as DSH payments to

qualifying public and private hospitals. The budget action

reduces by $40 million the amount of the transfers to the

state needed to obtain the full allotment of DSH payments.

Regional Burn and Trauma Center.

The budget includes $25 million to partially fund

construction of a new regional burn and trauma center in Fresno

to replace facilities in the former county hospital, which is

scheduled to close by 2003.

Los Angeles County Comprehensive

Health Centers. The budget bill, as passed by the

Legislature, included a General Fund appropriation of

$40 million to partially fund construction of three

comprehensive health clinics in Los Angeles County. Budget

legislation SB 1573 (Solis) makes the funding contingent on

a commitment by the county to build a replacement hospital for

the Los Angeles County-University of Southern California Medical

Center with a capacity of at least 750 beds and also makes the

hospital replacement project eligible for future state funding.

The Governor vetoed both the budget appropriation and

SB 1573.

Continuation of Prenatal Care for

Undocumented Immigrant Women. The budget bill, as

passed by the Legislature, provided $36.8 million to

continue prenatal benefits for undocumented immigrants after

December 31, 1998, as authorized by SB 34

(Vasconcellos). The Governor vetoed SB 34 and eliminated the

funding in the budget. These state-only Medi-Cal benefits

continue to be provided, however, under a court order pending the

outcome of litigation challenging regulations of the DHS that

would terminate the program. The Governor indicated that the

vetoed funds are included in the General Fund reserve, pending

resolution of this litigation.

The Healthy Families Program, administered by

the Managed Risk Medical Insurance Board with the assistance of

the DHS, expands health care coverage for uninsured children in

families with incomes up to 200 percent of the federal

poverty level. The program began enrolling children in July 1998

and implements the federal Children's Health Insurance Program,

enacted in 1997. Funding for California generally is on a 2-to-1

federal/state matching basis. Families pay a relatively low

monthly premium and can choose from a selection of managed care

plans for their children. Coverage is similar to that offered to

state employees and includes some dental and vision benefits. The

program also includes some modest expansions of Medi-Cal

eligibility for children.

The budget provides a total of

$65.2 million from the General Fund for the program

(including related Medi-Cal, administrative, and outreach costs)

in 1998-99. (Initial General Fund start-up costs in 1997-98 were

$5.9 million.) The budget also includes a total

$132 million of federal funds for the program in 1998-99. By

the end of 1998-99, the budget estimates that the number of

children enrolled in the managed care plans under the program

will be 201,000 (plus an additional 58,000 children covered by

the Medi-Cal expansions).

Expand Eligibility.

As passed by the Legislature, the budget included $3 million

from the General Fund to expand eligibility for children's health

coverage under the new Healthy Families Program. The expansions,

authorized by AB 2778 (Villaraigosa), increased the family

income limit from 200 percent to 250 percent of the

federal poverty level (with Medi-Cal income disregards) and made

recently arrived legal immigrant children eligible for coverage.

The Governor eliminated the additional funding and vetoed

AB 2778.

The DHS administers a broad range of public

health programs. Among these are (1) programs that

complement and support the activities of local health agencies

controlling environmental hazards (including the protection of

public drinking water systems), preventing and controlling

disease, and providing health services to populations with

special needs; and (2) state-operated programs, such as

those which license health facilities and certain types of

technical personnel.

Drinking Water Systems.

The budget appropriates $15.2 million from the General Fund

to serve as the state match for $76 million in federal funds

for local drinking water systems. The budget provides that if a

water bond measure is placed on the ballot and approved by the

voters, the General Fund would be reimbursed from the bond

proceeds.

Newborn Hearing Screening

Program. Budget legislation established a newborn

hearing screening program, at a cost of $6.2 million ($3.5

million from the General Fund) in 1998-99. Under this new

program, all hospitals approved by the California Children's

Services program (which deliver about 70 percent of all newborns

in the state) are required to offer hearing screening tests to

newborn infants.

The 1998-99 budget for judicial and

criminal justice programs totals $6.3 billion, including

$5.7 billion from the General Fund and $634 million

from state special funds. This is an increase of

$636 million, or 11 percent, over 1997-98 expenditures.

The increase is the result of two primary factors: additional

costs associated with the state's increased financial

responsibility for support of the trial courts and increases in

spending to accommodate the projected growth in the state's

prison and parole populations. Figure 15 (see page 48) shows

the budget act appropriations for the major judiciary and

criminal justice programs for 1998-99.

The amount is about $104 million, or

about 1.6 percent, below the Governor's proposed budget.

Although the net amount is relatively close to the spending level

proposed by the Governor, the Legislature made a number of

changes to the Governor's budget, including deletions of some

requests, additions of new policy initiatives and augmentations,

and modifications to individual spending proposals.

Post-Budget Legislative

Actions. Subsequent to the enactment of the 1998-99

Budget Act, the Legislature passed and the Governor signed a

number of bills that appropriate an additional $320 million

from the General Fund in the current year for various judiciary

and criminal justice programs.

Under Chapter 850, Statutes of 1997

(AB 233, Escutia), the state is now primarily responsible for

support of the trial courts. The budget includes

$1.7 billion for support of the trial courts in 1998-99. The

amount includes $623 million from the General Fund,

$224 million from fine and penalty revenues,

$235 million in court fees, and $572 million

transferred from counties to the state. Chapter 850 made

substantial reductions in the amount of money counties are

required to transfer to the state beginning in 1998-99, thus

requiring the state to backfill the reductions with large

increases from the General Fund. Figure 16 compares the cost

to the General Fund and to counties for support of the trial

courts since 1994-95.

Legislative Budget Actions.

In enacting the 1998-99 budget, the Legislature made several

modifications to the Governor's Trial Court Funding budget

proposal, including:

Trailer Bill to Provide

Additional County Relief in Subsequent Years. The

Legislature adopted a trailer bill related to Trial Court Funding

that was designed to provide additional fiscal relief to counties

and results in substantial increases in costs to the state

General Fund in subsequent years. Specifically, AB 1590

(Thomson), which the Governor signed, further reduced the county

MOE levels for support of the trial courts beginning in 1999-00.

The bill does this in two ways by: (1) increasing from 20 to 37

the number of counties for which the state will pay

100 percent of costs (thus, all counties with populations

below 300,000 would make no contributions) and (2) reducing the

MOE for the remaining 21 counties by 10 percent. The effect

of these provisions will be to increase the state's costs by

$92 million beginning in 1999-00.

In addition, AB 1590 provided further MOE

relief to counties for contributions they made in 1997-98. This

relief will be provided over five years starting in 1999-00. The

provision will cost the state about $50 million, or about

$10 million annually, from 1999-00 through 2004-05.

Post-Budget Legislation.

In late August, the Legislature also adopted two other bills that

made further modifications to the county MOE levels and

appropriated additional General Fund money to backfill the loss.

Assembly Bill 2788 (Thomson) provided the

same MOE relief for the 1997-98 contributions (discussed above)

but over a three-year period beginning in the current

year. The measure appropriated $16.6 million from the

General Fund to cover these additional current-year costs. The

measure also added one county to the list of counties for which

the state will pay all costs. The Governor signed this measure.

Assembly Bill 2791 (Thomson) contained the

same provisions as AB 2788, but also moved up the 10 percent

MOE reductions and 100 percent county buy-outs from 1999-00

to the current year. This measure appropriated $114 million

from the General Fund to cover the additional costs. However, the

Governor vetoed this measure.

The budget provides a total of

$3.9 billion ($3.9 billion from the General Fund and

$45 million from other funds) for support of the California

Department of Corrections (CDC). This represents an increase of

about $216 million, or 5.9 percent, above the 1997-98

level and is primarily due to projected increases in inmate and

parole populations. The budget assumes that the prison population

will grow to about 166,000 inmates and the parole population will

grow to about 115,000 parolees by the end of 1998-99.

Figure 17 shows the prison and parole populations over the

past five years and the level projected by the budget for the

current year.

Legislative Changes to the

Budget. In the 1998-99 Budget Act, the

Legislature made net General Fund reductions of about

$38.8 million below the Governor's requested budget for CDC.

The most significant changes were reductions of

$52.5 million to reflect recent caseload trends and

$12.5 million budgeted for merit salary adjustments. In

addition, the budget included an increase of $18.6 million

for various programs designed to rehabilitate and reduce future

criminality of inmates and parolees. The Governor vetoed

$16.1 million of this amount, leaving only the Legislature's

augmentation of $2.5 million to expand inmate work and

education slots in state prison to reduce inmate idleness.

Post-Budget Legislation.

In late August, however, the Legislature enacted and the Governor

later signed measures that provided funds for various inmate and

parolee rehabilitation programs, including funds for some of the

programs that the Governor had vetoed in the budget act.

Specifically, SB 2108 (Vasconcellos and Brulte) provided a total

of $23.5 million for expanded drug treatment and other

services for inmates and parolees. In addition, AB 2321 (Knox)

provided $3 million to expand and evaluate the Preventing

Parolee Crime Program.

New Prison Capacity.

The Governor had requested authority in the budget for CDC to

contract for 5,000 beds at publicly or privately built and

operated prisons (the beds would not have come on-line until

1999-00). However, the final version of the budget deleted the

authority to contract for these beds. Subsequent legislation (SB

491, [Brulte and Vasconcellos]) was enacted, however, to

authorize CDC to contract for 2,000 additional beds under

specified conditions. In addition, SB 491 authorized expansion at

ten existing prisons that would provide facilities to house a

total of $1,900 male inmates. Funding for construction of these

facilities ($74 million) was appropriated in SB 2108.

The budget as enacted for 1998-99 assumes

a total of $195 million in federal funds to offset the

state's costs of incarcerating and supervising undocumented

inmates and wards in state prison and the Department of the Youth

Authority. In the January budget, the Governor assumed that the

state would received $286 million in the budget year. In

late May, however, the state learned that its share of recent

federal appropriations would be significantly less than the

Governor had assumed. As a consequence, the estimates were

reduced for 1998-99, as well as for the two prior fiscal years

for which the state is still expecting funding. As a result,

General Fund costs increased by $238 million in order to

backfill for the anticipated loss in federal funds.

In addition, the Legislature chose to

shift an additional $15.8 million in federal prison

construction grant funds to offset incarceration costs of

undocumented felons, as permitted under federal law. Last year,

the Legislature shifted $54 million for this purpose.

The budget provides $312 million

($308 million from the General Fund and $4.1 million

from other funds) for support of the Youth Authority. General

Fund support for the Youth Authority declines by

$24 million, or 7.3 percent, from 1997-98 to 1998-99,

primarily as a result of the declining ward population. There

were no major policy changes in the budget.

Subsequent to the enactment of the budget,

the Legislature appropriated $25 million to the Youth

Authority in AB 2796 (Wright) for distribution to nonprofit

organizations for acquiring, renovating, or constructing

community youth centers. The Governor signed AB 2796.

The budget provides $176 million for

the Board of Corrections. This amount includes $42 million

from the General Fund, $16.9 million from special funds,

$114 million from federal funds, and $2.9 million from

bond funds. This amount was substantially higher than the amount

requested by the Governor ($86.6 million) for two principal

reasons. First, the Legislature provided net General Fund

augmentations of $31 million for new and expanded criminal

justice and juvenile delinquency grant programs for local

governments. The Governor reduced the net augmentations by

$23.2 million. Second, the Legislature augmented

$81.4 million in federal funds for distribution to local

governments to construct or expand local juvenile correctional

facilities. The federal government provided these funds to the

state for construction of state prisons, but federal law and

regulation permit the state to use the funds for local juvenile

detention facilities instead.

Post-Budget Legislation.

Two bills mentioned above also provided substantial

appropriations from the General Fund for programs in the Board of

Corrections. Specifically, SB 2108 provided an additional

$50 million to the board for grants to counties under the

Juvenile Crime Enforcement and Accountability Challenge Grant

Program. In addition, the bill included $27 million for a

new grant program for counties (established in SB 1485,

[Rosenthal]) for the purpose of expanding or establishing a

continuum of responses to reduce crime and criminal justice costs

related to mentally ill offenders. Assembly Bill 2796 included an

additional $100 million for the board to provide funding to

counties for renovation, construction, replacement, and deferred

maintenance of county juvenile correctional facilities.

The 1998 budget provides about

$2 billion for support of the Department of Transportation

(Caltrans)roughly 9 percent more than the 1997-98 amount.

Included in this increase is funding to augment Caltrans' capital

outlay support staff by almost 2,000 personnel-year equivalents

in order to meet the expanded workload resulting from the 1998

State Transportation Improvement Program.

The budget also provides

$1.9 billion for transportation capital outlay

projects--essentially the same as the 1997-98 level. In addition,

the budget appropriates $1.4 billion for a variety of local

assistance programs. Approximately half of the funds are a

pass-through of federal funds for highway and transit purposes.

Of the remaining funds, $310 million is for transit capital

projects, $100 million is for transit operating assistance,

and $200 million is for the State and Local Partnership

program.

In adopting the 1998 budget, the

Legislature made a partial repayment of $46 million from the

General Fund to the Public Transportation Account for a loan made

in 1993-94. The Governor indicated in his veto message that he

will direct that the full amount of the loan principal and

interest owed, estimated to total $113 million, be repaid

from the General Fund in 1998-99.

Storm Damage Repair of

Local Streets and Roads. In post-budget action, the

Legislature enacted SB 1477 (Kopp) which appropriates $300

million from the State Highway Account to counties and cities for

local street and highway reconstruction and for repair of storm

damage to local streets and highways. The amount will be

allocated over two years, with $200 million to be available in

1998-99 and $100 million in 1999-00. Fifty percent of the funds

will be allocated to counties and 50 percent will be allocated to

cities in accordance with specified formulas. The Governor

subsequently vetoed SB 1477.

The 1998 budget, as adopted by the

Legislature, provides a total of $2.2 billion for resources

programs, of which $1.2 billion is from the General Fund,

$106 million from bond funds, and $106 million from

federal funds. The remaining $965 million are special funds.

Total resources expenditures are

16 percent higher than in 1997-98. Significant features include:

The Governor vetoed $132.4 million

from various resources programs including:

Post-Budget Actions.

The Legislature restored $24.7 million in various projects

which had been vetoed by the Governor. Of that amount,

$15.7 million was for local dredging projects. The Governor

subsequently vetoed $22.6 million of these projects, including

the $15.7 million for local dredging projects.

Additionally, the Legislature augmented

resources expenditures by a total of about $530 million,

including the following:

- $230 million for the acquisition

of the Headwaters Forest Preserve, the Elk Head Forest,

the Elk River Property, Owl Creek, and the Grizzly Creek

Marbled Murrelet Conservation Areaall within Humboldt

County; $15 million for economic assistance for

Humboldt County; and $500,000 for the Wildlife

Conservation Board's administrative expenses and costs

related to these acquisitions. The Governor subsequently

reduced the appropriation for economic assistance to

Humboldt County to $12 million.

-

- $235 million for management of

Colorado River water, including (1) $200 million to

line the All American Canal as part of the efforts to

conserve water so that it can be transferred from the

Imperial Irrigation District to the San Diego County

Water Authority and (2) $35 million to construct

storage and other facilities related to groundwater

supplies.

-

- $15 million for the state's

share of costs for a flood control project in San Joaquin

County and $15 million for private property

connections to sewer systems in coastal San Luis Obispo

County. The Governor subsequently reduced the

appropriation for the flood control project to $12.6

million and vetoed the $15 million for the sewer system

infrastructure.

-

- $9.2 million to compensate certain

claimants, including the City of Portola and Plumas

County, with respect to the Department of Fish and Game's

northern pike eradication project at Lake Davis.

-

- $5 million for preliminary

plans, working drawings, and construction to preserve and

restore the Leland Stanford Mansion State Historic Park.

-

- $5.6 million in various other

projects. The Governor subsequently vetoed about $5.5

million of these projects.

Additionally, state firefighters received

employee compensation increases totaling $16.1 million, of

which $15.2 million comes from the General Fund. This item

is discussed further in this report under the heading Employee

Compensation.

The 1998 budget, as adopted by the

Legislature, provides about $880 million for environmental

protection programs, including about $665 million for

various environmental protection agencies and $215 million

for local assistance. This amount is about $9 million (1

percent) more than 1997-98 expenditures. Significant features

include:

The Governor vetoed legislative

augmentations totaling $7.8 million, including

$5.8 million for nonpoint source pollution and water

recycling research. Additionally, the Governor deleted budget

bill language adopted by the Legislature which tied the

$25 million for the ARB grant program to AB 1368

(Villaraigosa) and SB 1857 (Brulte). These bills--subsequently

vetoed by the Governor--provided that the grant program would

become inoperative if the air quality tax credit initiative

(Proposition 7) is approved by the voters this November.

Post-Budget Action.

The Legislature enacted legislation to restore $1.7 million

of the $5.8 million that had been vetoed by the Governor for

nonpoint source pollution prevention and water recycling

research. The Governor subsequently vetoed this restoration.

The Legislature took a number of actions

with a direct fiscal impact on local governments, particularly

counties. These changes are summarized in Figure 18.

The capital outlay program for 1998-99

totals almost $1.7 billion as shown in Figure 19. About 60

percent ($1 billion) of this amount is from bonds, including $577

million from a $2.5 billion higher education general obligation

bond measure that has been placed on the November 1998 ballot and

$327 million in lease-payment bonds. Future appropriations of

$474 million will be needed to complete the capital outlay

projects funded in the budget. Other funding includes $533

million from the General Fund, $70 million from various special

funds, and $34 million from federal funds. The Governor vetoed

about $160 million in capital outlay appropriations contained in

the 1998-99 Budget Act mainly in the areas of higher

education ($100 million) and resources ($45 million).

Some of the major projects and programs

funded in 1998-99 include:

The Legislature enhanced retirement

benefits for members of the State Teachers' Retirement System

(STRS) who retire on or after January 1, 1999 and provided

General Fund support to pay for these new benefits through

enactment of the following legislation:

The Legislature appropriated sufficient

funds ($706 million, all funds) to provide state employees a

6 percent salary increase effective July 1, 1998 and another

3 percent effective January 1, 1999. The availability of

these funds was conditioned on the administration and employee

bargaining units reaching agreement for salary increases through

the collective bargaining process. The Governor reduced this

funding to $279 million ($141 million General Fund and

$138 million in other funds)the amount he proposed in

January. This would provide sufficient funds for a 3 percent

salary increase but is subject to collective bargaining.

Before the final recess of the

legislative session, the administration reached agreement on, and

the Legislature ratified, memoranda of understanding (MOUs) for

four bargaining units. These units cover about 32,000 of the more

than 150,000 represented state employees. The MOUsall of which

expire June 30, 1999address a wide range of issues such as

salaries, state contribution for health benefits, retirement

benefits, and civil service reform. A summary of the Department

of Personnel Administration's (DPA's) estimated fiscal effect of

these MOUs is shown in Figure 20.

As shown in the

figure, the 1998-99 General Fund cost for these MOUs

($154 million) is $12 million more than the amount the

Governor left in the budget for employee compensation. In

addition, the DPA recently approved a 3 percent salary

increase for excluded employees (managers and supervisors not

represented by bargaining units) effective July 1, 1998. This

action will result in additional General Fund cost in the

neighborhood of $30 million annually.

In January, the

Governor proposed augmentations totaling $19.6 million (all

funds) for state departments to fund efforts to modify computers

to accommodate the year 2000 (Y2K). The Legislature augmented the

amount by $20 million ($10 million from the General

Fund, $8 million from special funds, and $2 million

from nongovernmental cost funds) and placed the augmentation in a

special appropriation item to be distributed to departments to

cover unbudgeted Y2K costs. A principal reason for this

augmentation was an April 1998 report to the Legislature from the

Department of Information Technology that identified a large gap

between Y2K costs identified by state departments and amounts

budgeted for that purpose.

The Legislature

approved a major increase in state support for the California

Arts Council. Specifically, the Legislature provided a total of

$61.5 million, which included $60.1 million from the

General Fund, an amount that was almost four times greater than

both the 1997-98 expenditures and the Governor's proposed 1998-99

budget. The amount included a $20 million General Fund

augmentation for the Arts Council's existing competitive grant

programs. In addition, it included a General Fund augmentation of

$27.6 million for grants to 29 specified museums and

arts-related organizations. The Governor reduced the total

augmentation to $30.2 million, which includes a

$6 million augmentation for existing competitive grant

programs and $24.2 million for grants to 21 specified

museums and organizations. Legislation (AB 2217, Villaraigosa)

enacted subsequent to the enactment of the 1998-99 Budget Act

and signed by the Governor increased funding for one of the

organizations by $2.5 million.

The budget sent to

the Governor included a total of $45 million in

augmentations for housing programs not included in the Governor's

May Revision. Of this total, the Governor vetoed $39 million

in spending. The remaining $6 million will be used to fund

the housing needs assessment mandate, migrant farm worker housing

reconstruction, and an Indian housing assistance grant program.

Return to California State Spending Plan,

Chapter 1--Table of Contents

Return to LAO Home Page