Table of Contents

Supplement A--General Descriptive Information About the Internet

Supplement B--Selected Internet Tax Policy Advisory Groups

Supplement C--Selected Provisions of the Federal Internet Tax Freedom Act

Supplement D--Additional Information Regarding the Sales and Use Tax

Supplement E--Additional Information on Taxation of Telecommunications

Supplement F--Additional Information on Corporate Income Taxation

The Internet had its beginnings in the late 1960s as part of a project by the Advanced Research Projects Administration (ARPA) of the U.S. Department of Defense (DOD). The project�s purpose was to provide an alternative communication system based on a standard protocol linking government agencies, university research facilities, and high technology defense contractors. In 1967, the DOD distributed a plan to link four sites--University of California Los Angeles, Stanford Research Institute, University of California Santa Barbara, and University of Nevada. The ARPAnet, as it was called, was designed to be a self-maintaining and decentralized communication network, capable of transmitting packets of data automatically, with the ability to reroute communication if one or more individual links became damaged or unavailable.

The ARPAnet was based around various equipment installations made by the military, as well as existing telecommunications infrastructure. In the 1980s, however, the National Science Foundation (NSF) created NSFnet. This was a high-speed, high-capacity network �backbone� created to provide connectivity between university-and government-based supercomputer centers, and to provide other general services. The NFSnet supplanted the military system by 1990 and gradually expanded outside of government and education to include the public at large. The NSFnet was phased out beginning in 1994, although it still plays a role in the development of regional networks and access points for Internet service providers (ISPs).

The current ownership of the Internet backbone is primarily comprised of large companies. Some of the most prominent of these are AT&T Networked Commerce Services, Apex Global Information Services, IBM Global Services, MCI WorldCom, GTE Internetworking, PSInet Inc., and Sprint IP Services. Some of their services are overlap-ping and provide �back-up� capacity to the system.

Individuals gain access to the Internet by contracting directly with an ISP, or through an institution which contracts with an ISP or has its own connection to the Internet. Connections to the ISP may be made through regular telephone lines, dedicated telephone lines (such as direct subscriber lines), cable connections, or wireless technology. The ISPs may offer Internet services through any or all of these methods.

Links to web sites, e-mail to individuals, and other uses of the Internet go through the ISP, which uses routing and switching equipment--essentially computers--to direct

the communication to the correct address or uniform resource locator (URL). Most of the network �hardware� (that is, tangible items) that comprises the Internet are communication lines, routers, and switches. In the regional and backbone networks, the lines are often leased telephone trunk lines, and are increasingly fiberoptic. The routers and switches are largely owned and maintained by ISPs or telecommunications companies.

Technical Characteristics

The Internet shares certain characteristics with traditional telephone technology but also has some fundamental distinctions. Most backbone and regional network electronic �traffic� moves over telephone lines using routers and switches, so at a basic level the technology of the two activities is the same. The fundamental differences relate to how the physical infrastructure is actually used. Telephone communication is based on �circuit switching� technology, which means that a direct dedicated connection is made between the two end points. A fixed share of the network is reserved for this call and no other telecommunications connection can use those resources until the call is completed and the connection broken.

The Internet, on the other hand, uses what is known as �packet-switching� technology. This means that no direct connection or circuit is made between the origination and destination points. Instead the data stream is broken up into so called �packets� which are then sent out on different routes through the Internet. They are each identified with a �header� which contains information regarding the destination of the packet. The header allows the packet to be combined with other packets or broken up into smaller packets. A packet may go through as many as 30 to 40 different routers before it reaches its destination. Once the packets reach their destination computer, the headers allow them to be reassembled.

Economic Advantages

The Internet offers significant economic advantages as a communications medium because its packet-switching technology allows for more efficient use of existing telecommunications resources. Packets from many different sources and with different destinations can use the same telecommunication lines at the same time, allowing for efficient use of existing capacity. No direct and dedicated connection needs to be maintained between communication points.

In addition, the Internet�s packet-switching technology exploits recent trends in the relative costs of using different elements of telecommunications infrastructure. This is because while the cost of both routers and telephone line capacity has dropped exponentially in recent years, the cost of routers (a type of computer) that the Internet

heavily relies on has declined more steeply. With this change in relative prices, packet-switching technology has become more economical.

Internet activity is increasingly pervasive and has grown dramatically in the past several years. As yet, however, no official U.S. data on Internet usage or e-commerce are available. As a result, the exact magnitude of Internet activity is not currently known. The U.S. Department of Commerce (DOC) plans to release data on e-commerce activity for the first time in 2000. However, while there is a lack of official Internet-related data, there have been a number of studies on the topic conducted by consulting firms and industry groups that essentially confirm the rapid growth of Internet activity and e-commerce.

Internet Activity

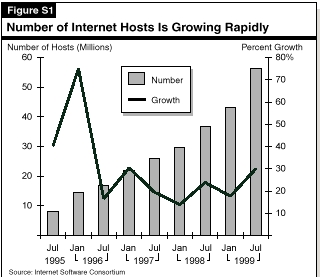

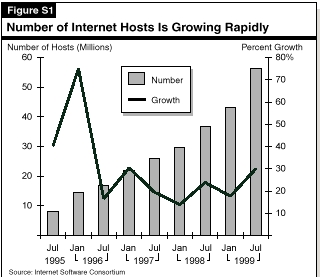

Two of the most common measures of Internet activity are (1) the number of domain

names (that is, names that represent a record within the domain name system), and

(2) the number of hosts, (that is, computers that are connected to the Internet). The number of domains is currently estimated to be approximately 6.7 million, up from an estimated 1.3 million in 1997. The number and growth of Internet hosts provides a rough

estimate of the minimum size of the Internet and the pace at which it is expanding.

Figure S1 presents estimates of this measure of Internet activity.

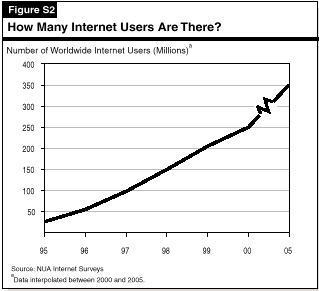

In terms of Internet use, one recent study concluded that between 1998 and 1999, the

number of users increased worldwide by 55 percent, the number of Internet hosts increased by 46 percent, the number of web servers increased by 128 percent, and the

number of new web address registrations increased by 136 percent. Likewise, the DOC

has estimated that the number of Internet users in the U.S. had increased from fewer

than 5 million in 1993 to over 62 million in 1997, and to approximately 80 million by

1999. Currently, the number of worldwide users of the Internet is estimated to be approximately 200 million, with the greatest amount of Internet penetration in the

U.S. (37 percent), Canada (36 percent), the Nordic countries (33 percent), and Australia

(31 percent). Figure S2 displays the estimated number of worldwide Internet users.

The Volume of E-Commerce

Along with the use of the Internet has come a rapid increase in e-commerce--that is, business conducted over the Internet. One indicator of such commercial activity is the rise in the number of commercial domain names, which according to one study, increased from 27,400 to 764,000 between January 1995 and July 1997. In 1998, the DOC noted that studies indicated that business-to-business e-commerce would rise to $300 billion by 2003. By late 1998, however, most forecasting firms considered this to be

too low, with one source suggesting that a more realistic estimate would be on the order of $1.3 trillion. More recent estimates have indicated even higher volume.

Retail transactions are also expected to grow rapidly. Estimates of retail e-commerce were in the $10 billion range in 1998, with firms forecasting online retail sales in excess of $100 billion by 2003. Recent estimates for 1999 retail sales are from $20 billion to $36 billion, suggesting a larger volume by 2003 than previously forecast. Even with this rapid growth, the Internet share of total retail sales currently is still relatively small. The National Retail Federation estimates retail sales during the 1999 Thanksgiving through December shopping period was $186 billion, of which only $3 billion to $5 billion was in Internet sales.

Regardless of the exact magnitude, Internet and e-commerce activity is showing considerable growth, with little if any end in sight as this new technology continues to evolve and spread.

In addition to the Advisory Commission on Electronic Commerce (discussed in Supplement C) that was established under the federal Internet Tax Freedom Act (ITFA), there exist several other organizations that are involved in addressing issues regarding Internet tax policy. A selection of the leading ones is presented below along with their web addresses.

Organisation for Economic Cooperation and Development

The Organisation for Economic Cooperation and Development (OECD), which is comprised of the United States and 28 other countries which generally subscribe to the principles of a market economy and pluralistic democracy, is actively working on taxation issues related to e-commerce from an international perspective. The OECD�s Committee on Fiscal Affairs has adopted principles in the areas of tax treaties, consumption taxes, tax administration, and taxpayer services, and is involved in investigating the means by which to apply these elements of the tax system to e-commerce. The OECD is also engaged in an ongoing effort to involve businesses as well as non-OECD nations in the Internet tax policy discussion (http://www.oecd.org).

National Tax Association

The National Tax Association (NTA) is a professional organization of government officials, tax practitioners, business representatives, and academicians which is focused on examining a wide spectrum of public policy aspects of taxation. The NTA�s Communications and Electronic Commerce Tax Project was organized to bring together representatives of these diverse groups in order to identify possible solutions to the state and local tax issues raised by e-commerce (http://www.ntanet.org).

The NTA�s final report was issued in September 1999 and consists of analysis and recommendations in several areas of tax policy. Regarding the sales and use tax (SUT), for example, the NTA�s Communications and Electronic Commerce Tax Project:

� Recommended that states adopt a single SUT rate in order to simplify the tax reporting process.

� Could not reach agreement on recommendations for a uniform SUT base.

� Recommended that sales transactions be sourced for tax purposes only to the state (versus substate) level of destination.

� Addressed various tax simplification issues, but made no specific recommendations regarding such simplification or how it might be accomplished.

The NTA�s committee was not able to reach agreement with respect to the subject of telecommunications taxes. In fact, no agreement was reached even regarding the definition of �telecommunications,� thereby making it impossible to make progress on the broader issue of state and local telecommunications tax policy and potential reform.

Electronic Commerce Advisory Council

The Electronic Commerce Advisory Council (ECAC) was created by California Governor Pete Wilson for the purpose of recommending how governments at the local, state, and federal levels should further promote the development of e-commerce by clarifying, modifying, and/or removing certain existing policies and practices, and/or implementing new policies and practices. The council considered a number of Internetrelated topics, including tax policy issues and released a report addressing these items in November 1998 (http://www.e-commerce.ca.gov).

The ECAC put forth a series of recommendations on various tax topics, including the following:

� Certain basic tax policies--including neutrality, low rates and broad base, transparency, certainty, and ease of administration--should be adhered to in any tax regime considered.

� Tax rules for income, property, and consumption taxes should be rationalized and harmonized to reduce compliance costs and avoid multiple levels of taxation by different jurisdictions.

� A multistate agreement should be crafted regarding collection of SUTs by out-of-state sellers.

� The �status quo� should be maintained regarding the application of the SUT only to tangible (versus intangible) personal property.

� The State Board of Equalization (BOE) should consider exempting from the SUT tangible forms of software, music, books, magazines, and other such goods.

� If and when a system for the taxation of interstate sales is in place, California should consider lowering its tax rate to make the overall net revenue effect of any base-broadening steps neutral.

Joint Venture: Silicon Valley Network

The Joint Venture: Silicon Valley Network (JVSVN) is a nonprofit organization of individuals from the business sector, government, education, and the local communities and is focused on economic and social issues in the Silicon Valley. The JVSVN formed the Council on Tax and Fiscal Policy in order to address issues which are tax related. The Internet Tax Task Force of the council was formed in September 1997 in order to focus on Internet-related tax policy issues. The task force has released a draft of a white paper laying out the council�s initial positions, and expects to release a final version of the study (http://www.jointventure.org).

In addition to the above-cited entities, there are many other organizations involved in the general area of Internet tax policy. For example, many states have their own task forces which are looking at the various tax issues involved, and numerous state and substate regional consortiums likewise exist of business and government representatives. Many tax economists and public finance analysts associated with governments, academia, and independent organizations have also �weighed in� on the subject and numerous manuscripts, papers, and reports have been published on the topic.

Taxes Prohibited by the Federal Internet Tax Freedom Act

The federal Internet Tax Freedom Act (ITFA) prohibits Internet access taxes and multiple or discriminatory taxes on Internet activity. Prohibited multiple taxes include those imposed by a state or other jurisdiction on the same e-commerce activity that is also subject to taxation by another jurisdiction. Prohibited discriminatory taxes are defined as those:

� Not generally imposed and legally collectable on transactions involving similar goods or services accomplished through other means or not imposed at the same rate.

� Imposing an obligation to collect or pay the tax on a different person or entity than in the case of transactions involving similar goods or services accomplished through other means.

� Establishing a classification of Internet access service providers or online service providers for purposes of establishing a higher tax rate than the tax rate generally applied to all other similar providers.

Prohibited taxes would include Internet access taxes (such as those levied on the monthly fee paid to ISPs) or the �bit� tax (a tax based on the amount of information conveyed over the Internet). Discriminatory taxes might also include--depending upon how they are applied--certain telecommunications taxes, utility user taxes, and franchise fees. Discriminatory taxes would generally not include the SUT, since this tax is collected by other businesses engaged in selling the same products through other means.

Reporting Requirements of the Advisory Commission on Electronic Commerce

The Advisory Commission on Electronic Commerce (ACEC) established by ITFA is to study Internet tax policy issues and report to Congress as to whether Internet activity and e-commerce should be taxed and, if so, what the appropriate taxation method would be. The ACEC is comprised of three federal officials, eight state and local government representatives, and eight representatives from the e-commerce industry, telecommunications carriers, local retail businesses, and consumer groups. By April 2000, the commission is to deliver its report to Congress, which is to examine and evaluate:

� Barriers imposed in foreign markets on e-commerce and their impacts on the U.S.

� Consumption taxes on e-commerce in the U.S. and in other countries.

� The impact of the Internet and Internet access on the revenue base for telecommunications taxes.

� Model state legislation that would treat e-commerce in a tax-neutral and technologically-neutral manner relative to other forms of remote sales.

� The effects of taxation and the absence of taxation on all interstate sales transactions, including the Internet transactions, local retail sales, and state and local governments.

� Ways to simplify federal, state, and local taxes imposed on telecommunications services.

The ACEC has held three meetings thus far in its consideration of Internet tax policy. The first was held on June 21 and 22, 1999 in Williamsburg, Virginia; the second occurred in New York, New York on September 14 and 15, 1999; and the third was held in San Francisco, California on December 14 and 15, 1999. The fourth and final meeting is scheduled for March 20 and 21, 2000 in Dallas, Texas.

Return to Report: California Tax Policy And the Internet