The state spending plan enacted for 2002-03 authorizes total state spending from all funds of $98.9 billion. As indicated in Figure 1, this total includes budgetary spending of $96.1 billion, reflecting $76.7 billion from the General Fund and $19.4 billion from special funds. In addition, spending from selected bond funds totals $2.8 billion. These bond-fund expenditures reflect the use of bond proceeds on capital outlay projects in a given year. The General Fund costs of these outlays, however, involve the ongoing principal and interest payment until the bonds are retired.

The amount of 2002-03 budget spending compared to 2001-02 represents a decline of $782 million (0.8 percent)—$141 million (0.2 percent) for the General Fund and $641 million (3.2 percent) for special funds.

|

Figure 1 The 2002-03 Budget Package |

|||||

|

(Dollars in Millions) |

|||||

|

Fund |

Actual |

Estimated |

Enacted |

Change

From 2001-02 |

|

|

Amount |

Percent |

||||

|

General Fund |

$78,053 |

$76,863 |

$76,722 |

-$141 |

-0.2% |

|

Special funds |

13,972 |

19,995 |

19,354 |

-641 |

-3.2 |

|

Budget totals |

$92,024 |

$96,858 |

$96,076 |

-$782 |

-0.8% |

|

Selected bond funds |

4,357 |

4,456 |

2,812 |

-1,644 |

-36.9 |

|

Totals |

$96,382 |

$101,314 |

$98,888 |

-$2,426 |

-2.4% |

|

|

|||||

|

Detail may not total due to rounding. |

|||||

Figure 2 summarizes the estimated General Fund condition for 2001-02 and 2002-03 that results from the adopted spending plan and related legislation.

|

Figure 2 The 2002-03 Budget Package |

|||

|

(Dollars in Millions) |

|||

|

|

2001-02 |

2002-03 |

Percent |

|

Prior-year fund balance |

$3,037 |

$72 |

|

|

Revenues

and transfers |

73,898 |

79,158 |

7.1% |

|

Total resources available |

$76,935 |

$79,230 |

|

|

Expenditures |

$76,863 |

$76,722 |

-0.2% |

|

Ending

fund balances |

$72 |

$2,508 |

|

|

Encumbrances |

$1,473 |

$1,473 |

|

|

Reserve |

-$1,401 |

$1,035 |

|

|

|

|||

|

Detail may not total due to rounding. |

|||

2001-02. In the prior year, estimated revenues and transfers totaled $73.9 billion (a growth of 3.5 percent from 2000-01) while expenditures were $76.9 billion (a 1.5 percent decline). This resulted in a negative operating balance (that is, expenditures in excess of revenues) of about $3 billion. This was offset by a carry-in balance of about $3 billion from 2000-01. However, because encumbrances totaled $1.5 billion, a year-end budget deficit of roughly $1.4 billion occurred. (These figures include the $6.2 billion electricity loan from the General Fund in 2000-01 and its assumed repayment in 2001-02.)

2002-03. Figure 2 shows that, under the adopted budget agreement, the current year is projected to end with a positive reserve balance of slightly over $1 billion. This reflects estimated revenues and transfers totaling $79.2 billion (7.1 percent growth) and estimated expenditures of $76.7 billion (a 0.2 percent decline). This, in turn, results in an operating surplus of $2.4 billion.

General Fund spending in 2002-03 is summarized in Figure 3, by major program area. As discussed in greater detail in "Chapter Four", budgetary growth varies considerably by program area. For example, K-12 education and social services programs collectively experience modest percentage gains, whereas health and corrections experience moderate reductions. Similarly, the University of California experiences a moderate reduction, California State University has a modest decline, and funding for the California Community Colleges sees moderate growth.

|

Figure 3 The 2002-03 Budget Package |

|||||

|

(Dollars in Millions) |

|||||

|

Program |

Actual |

Estimated |

Enacted |

Change

From |

|

|

Amount |

Percent |

||||

|

K-12 Educationa |

$29,746 |

$29,939 |

$30,769 |

$830 |

2.8% |

|

Higher Education |

|

|

|

|

|

|

CCCa |

2,808 |

2,854 |

3,016 |

162 |

5.7 |

|

UC |

3,201 |

3,458 |

3,224 |

-234 |

-6.8 |

|

CSU |

2,442 |

2,713 |

2,681 |

-32 |

-1.2 |

|

Other |

697 |

753 |

838 |

84 |

11.2 |

|

Health |

12,245 |

13,675 |

13,022 |

-653 |

-4.8 |

|

Social Services |

7,564 |

8,419 |

8,611 |

192 |

2.9 |

|

Corrections |

5,298 |

5,544 |

5,285 |

-259 |

-4.7 |

|

All other |

14,050 |

9,508 |

9,276 |

-232 |

-2.4 |

|

Totals |

$78,053 |

$76,863 |

$76,722 |

-$141 |

-0.2% |

|

|

|||||

|

Detail may not total due to rounding. |

|||||

|

a

Includes expenditures from prior-year Proposition 98

appropriations. |

|||||

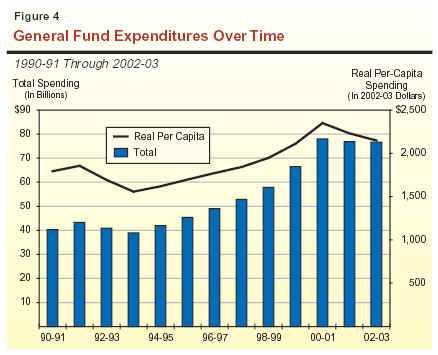

Figure 4 (see page 10) shows General Fund expenditures from 1990-91 through 2002-03, both in current dollars (shaded bars) and as adjusted for population growth and inflation (that is, in real per capita terms, displayed using the line).

The figure indicates that, based on the approved spending plan, General

Fund spending in 2002-03 will decline for the second year in a row after

having peaked in 2000-01. Likewise, real per capita spending will fall for the

second consecutive year in 2002-03, which will leave it roughly 9 percent below

its 2000-01 peak. This reduced percapita spending level will still be about

16 percent above its peak prior to the early 1990s' recession, and nearly

40 percent above its 1990s' recession low.

In this section, we highlight the key developments in the evolution of the 2002-03 budget, beginning with the November 2001 executive order freezing certain state expenditures and concluding with the Governor's signing of the budget on September 5, 2002.

In the months immediately following the adoption of the 2001-02 budget in July 2001, the economy and state revenues both fell sharply below forecasted levels. The downturn accelerated following the September 11, 2001 terrorist attacks. By the fall, it was clear that the 2001-02 budget was falling seriously out of balance, and that the 2002-03 budget faced a major shortfall. In our November 2001 release of California's Fiscal Outlook, we estimated that the state faced a cumulative shortfall of over $12 billion in 2002-03, absent corrective actions.

In response to the emerging budget problem, the Governor issued an executive order in November freezing certain state expenditures. He also requested that the Legislature convene an extraordinary session to consider various current-year adjustments to help address the situation. These savings were included as part of the 2002-03 Governor's Budget released in January. On January 29, 2002, the Legislature adopted SB 1xxx (Chapter 1xxx, Peace), which included many of the Governor's proposals. The measure included savings of $2.2 billion in 2001-02 and $589 million in 2002-03. As shown in Figure 5:

|

Figure 5 Mid-Year Savings for

2001-02 |

|

|

(In Millions) |

|

|

|

|

|

K-12 Education |

$857 |

|

General Government |

605 |

|

Resources |

187 |

|

Transportation |

138 |

|

Social Services |

116 |

|

Local Government |

109 |

|

Health Services |

89 |

|

Higher Education |

56 |

|

Criminal Justice |

6 |

|

Total |

$2,163 |

• About $857 million of the 2001-02 savings were in education, including $250 million from a rescission of funds for energy costs. Other education-related savings included funding deferrals for certain teacher incentives, as well as reductions in various categorical programs.

• About $600 million in savings were in General Government. These included across-the-board cuts in state operating expenses, a reduction in funds provided for various energy-related costs and initiatives, and a reversion of funds that had been earmarked for Smog Impact Fee refunds (reflecting a reduction in the estimate of the likely amount of refunds needed to be paid).

• The balance of savings came from a variety of other areas, including a delay in the planned expansion of the Healthy Families program and the reversion of funds that had been approved for various program expansions and resources capital projects.

The scope of the 2002-03 budget problem grew substantially between when the Governor released his original proposal in January and when the budget was approved in early September. The budget shortfall, along with the distribution of budget savings by major category, are shown in Figure 6 (see page 12) for the January proposal, the May Revision, and the 2002-03 Budget Act.

|

Figure 6 Evolution of 2002-03

General Fund Budget Solutions |

|||

|

(In Billions) |

|||

|

Type of Solution |

January

2002 |

2002 |

September

2002 |

|

Program cost savings |

$5.2 |

$7.6 |

$7.5 |

|

Deferral of education |

— |

1.1 |

1.7 |

|

Tobacco settlement securitization |

2.4 |

4.5 |

4.5 |

|

Debt restructuring |

— |

1.1 |

1.1 |

|

Funding shifts, loans, |

3.6 |

4.3 |

4.9 |

|

Revenue increases and |

0.2 |

3.9 |

2.9 |

|

Federal funding increases |

1.1 |

1.1 |

1.1 |

|

Total

Solution |

$12.5 |

$23.6 |

$23.6 |

In January, the Governor proposed a 2002-03 General Fund budget, which incorporated his proposed 2001-02 mid-year savings discussed above, as well as numerous other actions to cover an estimated $12.5 billion budget shortfall. Specifically, the budget included:

• About $5.2 billion in major program cost savings, including $2.4 billion from his November proposal, and an additional $2.6 billion from suspension of cost-of-living adjustments, postponements of some health care expansions, reduced inflationary adjustments for higher education, and various other funding delays. Overall, these reductions were largely from cutbacks in planned spending increases—either to cover workload, inflation, or previously approved program expansions. Relatively few of the savings were from cuts to existing ongoing programs.

• About $2.4 billion from the securitization of future tobacco settlement receipts. Under this plan, the state would sell its future rights to about 45 percent of the present value of roughly 25 years of its annual tobacco settlement receipts for up-front cash. This would be achieved through the sale of a revenue bond whose repayment would be secured by a portion of future tobacco settlement payments beginning in 2003-04. Under legislation passed in conjunction with the 2001-02 budget, these tobacco settlement receipts had been earmarked for a variety of health care expansions.

• About $3.6 billion in funding shifts, special fund loans, and deferrals. This category included about $900 million in savings from the deferral of annual contributions to the state's public employees' and teachers' retirement funds (in return for additional benefits in the future). It also included a $672 million loan from transportation funds to the General Fund.

• About $1.1 billion in additional funds from the federal government. These funds were earmarked to offset state costs for Medi-Cal, undocumented felon incarceration, and security activities. The budget also assumed elimination of federal child support penalties.

During the months following the release of the January budget, the state's revenue picture continued to deteriorate sharply. In April alone, final payments were below the budget forecast by over $2.5 billion. In response to these developments, the May Revision included a major downward revision to its revenue forecast. Specifically, the administration reduced its revenue forecast by $3.8 billion for 2001-02 and $5.8 billion for 2002-03, or a two-year total of $9.5 billion.

In addition to the revenue reduction, the administration raised its estimate of expenditures by $1.6 billion for 2001-02 and 2002-03 combined, primarily due to a significant upward revision to the 2002-03 Proposition 98 minimum funding guarantee. The combination of the two-year revenue decline and the two-year expenditure increase caused the estimated overall budget shortfall to almost double between January and May—from $12.5 billion to $23.6 billion.

The Governor's May Revision budget proposed to deal with the worsening fiscal outlook through a wide range of new program cost savings, significant tax increases, sharply expanded borrowing, new funding shifts, and additional interfund loans.

New Program Cost Savings. As shown in Figure 6, the May Revision included program cost savings totaling $7.6 billion, about $2.4 billion more than in January. The additional cuts were mostly in the areas of health, social services, and local government. In contrast to January—which focused mainly on elimination of previously approved program expansions—many of the cuts proposed in May involved reductions or elimination of existing programs. Examples include the proposed elimination of certain optional benefits in Medi-Cal, significant cuts to county administration funding for health and social services programs, and reduced higher education funding for research, equipment, and K-12 outreach and staff development.

The May Revision also proposed reduced funding for local programs, including law enforcement grants, open space subventions, high technology law enforcement, and booking fee reimbursements. It also included the deferral of funding for various mandates. The May Revision eliminated 4,000 positions and required unallocated reductions in operating expenses for most state departmental budgets.

New Tax Increases. The May Revision included $3.9 billion in tax increases and revenue accelerations. These included a one-year increase in vehicle license fees (VLF), a two-year suspension of net operating loss carryforward deductions for businesses, an ongoing 50-cent increase in the excise tax on cigarettes, and a variety of tax compliance and auditing-related measures.

Expanded Savings in Other Areas. In the May Revision, the administration proposed to sell the full stream of the state's future tobacco settlement receipts over the next approximately 25 years for $4.5 billion in cash. This was up from the $2.4 billion in tobacco securitization bonds proposed in January. The May Revision also proposed increases in loans from transportation funds to over $1.2 billion in total, and contained a variety of other funding redirections to cover the additional shortfall. It also deferred $1.1 billion of K-12 education expenditures from June 2002 to July 2002, thereby achieving one-time savings in 2001-02 while at the same time meeting the increased Proposition 98 guarantee in 2002-03.

Finally, the revised plan replaced the proposed deferral of retirement contributions with the Treasurer's plan to restructure state debt. The restructuring plan reduces debt service payments by $223 million in 2001-02 and $860 million in 2003-04—primarily by delaying principal repayments on certain debt maturing during the two-year period and instead borrowing to pay them over time.

Assembly and Senate Versions. The budgets adopted by the Senate and Assembly in late May assumed most of the administration's May Revision budget proposals involving tax increases, the securitization of tobacco settlement receipts, special fund loans and transfers, and various other funding redirections. However, both houses rejected many of the May Revision's proposed spending reductions in the areas of health and social services. They also, to varying degrees, restored the May Revision's proposed reductions to local government programs. Both houses included unspecified savings ($900 million for the Senate and $1 billion in the Assembly) to offset the additional spending in each of the budgets.

Conference Committee Actions. The Assembly and Senate versions of the budget were sent to the Conference Committee for reconciliation in early June. In addition to the normal reconciliation of the Assembly and Senate budgets, the committee considered a wide variety of other actions, including various alternative spending reductions, tax increases, as well as additional loans and transfers from special funds.

The budget that emerged from the Conference Committee was similar to the earlier legislative versions, in that it restored many of the May Revision budget cuts in health, social services, and local governments. It compensated for the additional spending by: (1) deferring $481 million in K-12 education programs from 2002-03 into early 2003-04, (2) raising the amount of targeted savings in state operations through the elimination of up to 6,000 vacant positions, and (3) further increasing one-time loans and transfers from special funds. The conference committee also adopted additional revenue and spending actions proposed by the administration in mid-June.

Subsequent Legislative Actions. The Conference version, with some modifications, was passed by the Senate on June 29, 2002. However, the budget failed to garner a two-thirds majority in the Assembly. Despite negotiations involving both alternative spending cuts and the substitution of higher cigarette taxes for the proposed VLF increase, a budget impasse ensued which lasted through July and most of August.

On the final night of the 2001-02 legislative session, the Assembly reached a compromise on the budget. The main provisions of the compromise were the elimination of the VLF and cigarette tax increases that had been approved by the Senate. These tax provisions were replaced with withholding increases on stock options and capital gains, an additional $200 million in K-12 spending deferrals from 2002-03 into 2003-04, an up-to-5 percent unallocated cut to state operations, and assumed savings from a retirement incentive program. Other elements of the agreement included:

• The placement of ACA 11 on the 2004 ballot. This measure would dedicate annual amounts (starting at 1 percent in 2006-07 and potentially rising to 3 percent in future years) of General Fund revenues to infrastructure spending at the state and local levels.

• The dedication of approximately $400 million of 2003-04 Proposition 98 funding for school district equalization.

• A requirement that spending not exceed revenues in 2003-04.

• The elimination of an additional 1,000 positions in 2003-04, beyond the 6,000 eliminated in 2002-03.

Both houses passed the revised budget and sent it to the Governor for signature.

Before signing the budget, the Governor used his line item veto authority to "blue pencil" $236 million in appropriations from the budget, including $220 million from the General Fund. Of the total General Fund reduction, $177 million was in health and social services programs, where the Governor deleted legislative augmentations for the Healthy Families program, child welfare services, and mental health. Of the remaining General Fund vetoes, about $29 million was related to trial court funding. The Governor also vetoed a variety of legislative augmentations for K-12 Proposition 98 spending. However, these vetoes reduced the 2002-03 spending levels below the minimum funding guarantee. Thus, the Governor's spending totals include a Proposition 98 reserve of $143 million, which can be appropriated later in the year for any K-14 purpose.

K-12 Education. The budget includes $41.6 billion in funding (state and

local sources) for K-12 Proposition 98 funding, an 8.6 percent increase from

2001-02. Per-pupil funding will grow to $7,067 during the year,

representing an increase of 6.9 percent from 2001-02. After adjusting for the various

spending deferrals in both 2001-02 and 2002-03, the underlying spending

increases are more modest, with adjusted per-pupil funding growing by

3.4 percent. The budget includes $1.5 billion to cover enrollment growth and

inflation adjustments for most programs. Most of the remaining discretionary

funds are earmarked for the High Priority School Grants Program. The budget

includes funding reductions for certain previously enacted teacher

incentive programs, digital high school, libraries, as well as funds that had

previously been planned for school district equalization in 2002-03. It also defers

spending for the scholarshare program.

Higher Education. The budget includes a 6.8 percent increase in community college funding, and declines of 3.2 percent for the University of California and 1 percent for California State University. The year-to-year changes for all three segments are affected by spending deferrals and one-time expenditures in 2001-02. Ongoing funding for higher education covers the Cal Grant entitlement programs, avoids any increases in resident student fees, more than fully funds student population increases, and provides funds (to varying degrees) for price increases. In order to make room for some of these increases, the budgets contain some reductions in noninstructional funding for such purposes as research and K-12 teacher training.

Health. General Fund spending for health programs decreases by about 5 percent from the 2001-02 level. The reduction is partly related to an assumed $400 million increase in federal funds for Medi-Cal payments. The budget generally funds caseload and cost increases. However, it contains specified reductions for such items as prescription drugs and medical supplies, and it assumes $245 million in additional savings from antifraud activities. The budget also postpones the scheduled expansion of health care coverage to parents under the Healthy Families Program, imposes an unallocated reduction in the Regional Center budget, and reduces various community mental health grants. Finally, the budget increases the state's "takeout" of federal funding for hospitals that serve a disproportionate share of Medi-Cal and uninsured patients.

Social Services. General Fund spending for social services programs increases by about 2.5 percent in 2002-03, reflecting growth in the Supplemental Security Income/State Supplementary Program (SSI/SSP) and In-Home Supportive Services (IHSS) program, but declines in other areas.

The budget achieves savings by delaying cost-of-living increases for the CalWORKs and SSI/SSP programs until June 2003, eliminating discretionary cost-of-living-adjustments for Foster Care and related programs, and redirecting unspent county performance incentives to the core CalWORKs program. It also assumes suspension of state participation in the IHSS $1 wage increase, and reduces adult education and community college support for CalWORKs recipients. Finally, the budget assumes enactment of federal legislation that will relieve the state of penalties associated with the delay in implementation of its child support computer automation.

Judicial and Criminal Justice. The budget reduces funding for certain adult and youth parole services, as well as contract medical services. It provides funds to continue the Citizens' Option for Public Safety (COPS) and Juvenile Justice grants at their 2001-02 levels, and provides funding for the High Technology Grant Program at about one-half its 2001-02 level.

Local Government. The budget does not include any major reductions in local government subventions. As discussed above, the budget maintains funding for the COPS and juvenile justice programs. However, it defers payments to local governments for state-mandated local programs, thereby avoiding budget-year costs. It also contains a one-time shift of $75 million in property taxes from redevelopment agencies to school districts (and reduces General Fund support by a like amount). Finally, it reduces state funding for the administration of health and social services programs.

Background. Article XIII B of the State Constitution places limits on the appropriation of taxes for the state and each of its local entities. Certain appropriations, however, such as capital outlay and subventions to local governments, are specifically exempted from the state's limit. As modified by Proposition 111 in 1990, Article XIII B requires that any revenues in excess of the limit that are received over a two-year period be split evenly between taxpayer rebates and increased school spending.

State's Position Relative to Its Limit. After exceeding its limit by $975 million in 1999-00, state appropriations fell below the state appropriations limit (SAL) in both 2000-01 and 2001-02.

For 2000-01, appropriations were more than $1.8 billion below the SAL, due largely to a substantial volume of spending related to exempt appropriations. As a result, appropriations subject to the limit grew only marginally from the 1999-00 level, while the SAL itself rose by $3.4 billion. The large volume of exempt 2000-01 appropriations related largely to VLF reimbursements, school district apportionments, local subventions, and capital outlay.

Then, in 2001-02, the gap dramatically expanded further—to $16.5 billion. This occurred as appropriations subject to the limit dropped significantly, by $8.8 billion, while the limit itself rose by over $5.2 billion. This widening gap reflected the combination of declining General Fund appropriations necessitated by the budget imbalance, along with a rapid increase in the per capita personal income factor used to adjust the SAL during the year. (The rapid increase occurred between the fourth quarter of 1999 and the fourth quarter of 2000, prior to the economic and revenue downturn.)

For 2002-03, appropriations are expected to continue to remain well below the SAL, although the gap will drop to $10.6 billion. This is because the SAL is expected to grow only marginally, reflecting the impact of the downturn on the per capita income factor, while appropriations subject to the limit are expected to grow by several billion dollars.

In addition to the 2002-03 Budget Act, the budget package includes a number of related measures enacted to implement and carry out the budget's provisions. Figure 7 lists these bills and their status as of September 19, 2002.

|

Figure 7 2002-03 Budget-Related

Legislation |

|||

|

|

|||

|

Chaptered |

|||

|

Bill Number |

Author |

Chapter # |

Subject |

|

ACA 11 |

Richman |

185 |

Infrastructure financing |

|

AB 2065 |

Oropeza |

488 |

Tax-related suspensions, withholding, and

administration |

|

AB 2360 |

Dutra |

578 |

Transportation: freeway service patrols |

|

AB 2785 |

Oropeza |

444 |

Education (current-year clean up) |

|

AB 3008 |

Budget Committee |

99 |

Education (current-year deferral) |

|

AB 3011 |

Budget Committee |

101 |

Education (current-year deferral) |

|

SB 192 |

O’Connell |

582 |

Federal education technology |

|

SB 1831 |

Peace |

414 |

Tobacco securitization |

|

SB 1834 |

Budget and Fiscal Review |

445 |

Transportation loans |

|

Enrolled |

|||

|

Bill Number |

Author |

Subject |

|

|

AB 65 |

Strom-Martin |

Federal Reading First |

|

|

AB 312 |

Diaz |

School sanctions and interventions |

|

|

AB 442 |

Budget Committee |

Omnibus health bill |

|

|

AB 444 |

Budget Committee |

Omnibus social services bill |

|

|

AB 593 |

Oropeza |

Unallocated reductions, golden handshake |

|

|

AB 692 |

Aroner |

Social services |

|

|

AB 1100 |

Simitian |

Charter schools |

|

|

AB 1768 |

Oropeza |

General government |

|

|

AB 2781 |

Oropeza |

Education finance and equalization |

|

|

AB 2996 |

Budget Committee |

Transportation |

|

|

AB 2997 |

Budget Committee |

Resources |

|

|

AB 2998 |

Budget Committee |

Charter schools |

|

|

AB 3000 |

Budget Committee |

General government omnibus bill |

|

|

AB 3002 |

Budget Committee |

Local government omnibus bill |

|

|

AB 3004 |

Budget Committee |

City of Millbrae disaster loan repayment |

|

|

AB 3005 |

Budget Committee |

Education mandates |

|

|

AB 3006 |

Budget Committee |

Medi-Cal provider rates |

|

|

AB 3009 |

Budget Committee |

Energy surcharge and natural heritage tax deferral |

|

|

AB 3010 |

Budget Committee |

Unemployment insurance |

|

|

SB 1453 |

Alpert |

Federal student data collection |

|

|

SB 2083 |

Polanco |

Federal education English learners |

|

|

HR 96 |

Wesson |

Commission on budgeting |

|

|

|

|||