The budget package includes $46.5 billion in Proposition 98 spending in 2002-03 for K-14 education. This represents an increase of $3.3 billion, or 7.6 percent, from spending in 2001-02 as revised by the Third Extraordinary Session and budget trailer bills. Figure 1 summarizes the budget, by funding source, for K-12 schools, community colleges, and other agencies in 2001-02 and 2002-03.

|

Figure 1 Proposition 98 Budget

Summary |

|||

|

2001‑02 and 2002‑03 |

|||

|

|

2001‑02

Budget Package |

2002‑03 |

|

|

As

Enacted |

Revised |

||

|

K-12 Proposition 98 |

|||

|

General Fund |

$28.8 |

$26.4 |

$28.6 |

|

Local property taxes |

11.7 |

11.9 |

12.9 |

|

Subtotals,

K-12 |

($40.5) |

($38.3) |

($41.6) |

|

Average

Daily Attendance (ADA) |

5,780,737 |

5,800,896 |

5,880,576 |

|

Amount

per ADA |

$7,002 |

$6,610 |

$7,067 |

|

California

Community Colleges |

|||

|

General Fund |

$2.7 |

$2.6 |

$2.8 |

|

Local property taxes |

1.8 |

1.8 |

2.0 |

|

Subtotals,

Community Colleges |

($4.5) |

($4.4) |

($4.8) |

|

Other

|

|||

|

Other agencies |

$0.1 |

$0.1 |

$0.1 |

|

Loan repayment |

0.4 |

0.4 |

� |

|

Totals,

Proposition 98 |

$45.4 |

$43.2 |

$46.5 |

|

General Fund |

$31.9 |

$29.5 |

$31.6 |

|

Local property taxes |

13.5 |

13.8 |

14.9 |

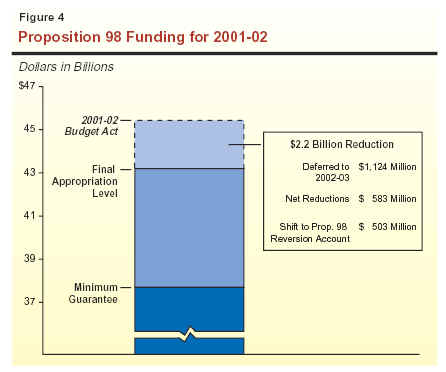

Proposition 98 spending for 2001-02 was reduced by a total of $2.2 billion as a result of actions taken in the Third Extraordinary Session, Chapter 99, Statutes of 2002 (AB 3008, Committee on Budget), and Chapter 101, Statures of 2002 (AB 3011, Committee on Budget). Even after the reductions, Proposition 98 spending for 2001-02 exceeded the minimum guarantee by $5.5 billion. For 2002-03 the Proposition 98 commitments are just above the minimum guarantee.

The revised 2001-02 budget yields a K-12 per-pupil funding level of $6,610. The 2002-03 budget results in per-pupil funding of $7,067, an increase of $457, or 6.9 percent, above the 2001-02 level. The level of growth in Proposition 98 spending per pupil, however, is distorted because expenses were deferred from one fiscal year to another (discussed in detail below). Figure 2 displays the impact that the deferrals have on the growth of per-pupil spending. Adjusting for the deferrals, per-pupil spending increased by $227, or 3.4 percent, over the 2001-02 level.

|

Figure 2 K-12 Proposition 98

Spending Per Pupil |

|||

|

2000‑01 Through 2002‑03 |

|||

|

|

2000‑01 |

2001‑02 |

2002‑03 |

|

Budgeted Funding |

|||

|

Dollar per ADA |

$6,685 |

$6,610 |

$7,067 |

|

Percent Growth |

� |

-1.1% |

6.9% |

|

Programmatic

Funding |

|||

|

Dollar per ADA |

$6,685 |

$6,784 |

$7,011 |

|

Percent Growth |

� |

1.5% |

3.4% |

|

|

|||

|

a

To adjust for the deferrals, we counted funds toward the

fiscal year in which school districts had programmatically committed the

resources. The deferrals meant, however, that districts technically did

not receive the funds until the beginning of the next fiscal year. |

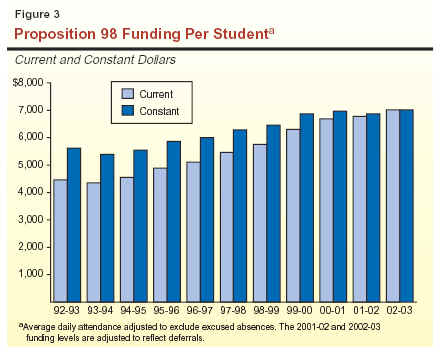

|||

Figure 3 displays K-12 per-pupil funding amounts from 1992-93 through 2002-03. After adjusting for deferrals, the effects of inflation, and changes in attendance accounting, per-pupil funding increased $1,390 or 25 percent over the period.

In the 2001-02 Budget Act, the Legislature appropriated over the minimum guarantee by about $4 billion. The level of the appropriation over the minimum guarantee increased an additional $3.7 billion during 2001-02 because actual General Fund revenues were less than predicted due to the worsening economy. Given the over-appropriation, the Legislature was able to achieve budgetary savings by reducing 2001-02 funding for K-12 schools and the community colleges in the Third Extraordinary Session and the trailer bills accompanying the 2002-03 Budget Act. Figure 4 (see page 30) details the major changes in Proposition 98 funding from the 2001-02 Budget Act to the revised 2001-02 appropriation level. In total, the Legislature reduced Proposition 98 funding for 2001-02 by $2.2 billion, as described below.

Proposition 98 Deferrals From 2001-02 to 2002-03. Through a series of actions, the Legislature deferred $1.1 billion of Proposition 98 spending from 2001-02 to 2002-03. Instead of receiving $1.1 billion in categorical funding in the late spring of 2002, schools received the funding in summer 2002. The deferral had no programmatic impact on school districts, although some districts may have experienced cash-flow and accounting difficulties as a result of the delay. The deferral, however, allowed the state to achieve one-time General Fund savings of $1.1 billion in 2001-02.

Third Extraordinary Session and Trailer Bill Reduce Proposition 98 Spending. In addition to the deferral, the Legislature made a net reduction of $583 million to Proposition 98 funding for 2001-02—with reductions made during the Third Extraordinary Session and cuts made in education trailer bills. Chapter 1xxx, Statutes of 2002 (SB 1xxx, Peace) reduced Proposition 98 funding for 2001-02 by $457 million. Major reductions included delaying the High Priority School Grant program ($162 million), delaying funding for the Teaching as a Priority Block Grant ($119 million), and suspending the Certificated Staff Performance Awards ($100 million). In addition, Chapter 1xxx eliminated funding for energy costs ($250 million) that were originally appropriated to meet a Proposition 98 "settle-up" obligation for 1995-96 and 1996-97. In Chapter 99, the Legislature made additional 2001-02 reductions totaling $169 million for various categorical programs. The cuts included CalSafe ($44 million), 9th Grade Class Size Reduction ($25 million), and Healthy Start ($25 million).

Proposition 98 Reversion Account Fund Shift. In Chapter 99, the Legislature also reduced Proposition 98 General Fund support for adult education in 2001-02 by $503 million. The Legislature then provided $503 million from the Proposition 98 reversion account to fund adult education. This generated $503 million in one-time General Fund savings.

Compared to revised 2001-02 Proposition 98 spending, the 2002-03 budget includes a combination of baseline increases and reductions for various education programs that result in a net increase of $3.3 billion. Figure 5 details the major changes in Proposition 98 funding from the final 2001-02 appropriation level to the 2002-03 appropriation level.

|

Figure 5 How Was 2002‑03

Growth in Proposition 98 Allocated? |

|

|

Purpose |

Amount |

|

K-12 growth and COLA |

$1,544 |

|

Program payment deferred from 2001‑02 |

1,124 |

|

CCC growth and COLA |

201 |

|

High Priority Schools Grant Program |

199 |

|

Proposition 98 reserve |

143 |

|

Other changes |

56 |

|

Total growth |

$3,267 |

Major Increases. The budget allocates over $1.5 billion to provide inflation and growth adjustments to K-12 education. Specifically, the budget includes $731 million to accommodate a 1.37 percent increase in the student population and $789 million for a 2 percent cost-of-living adjustment (COLA). This COLA applies to most programs and is higher than the 1.66 percent required under current law. The budget directs the remaining funds for other purposes, including $199 million to begin implementation of the High Priority Schools Grant Program.

Spending Reductions. Figure 6 (see page 32) shows the major spending

reductions (including Governor's vetoes). The Legislature used additional

2000-01 and 2001-02 savings to restore several of its key education

priorities. The Governor vetoed most of these restorations and augmentations (a

total of $143 million). The largest reductions and vetoes are discussed below:

|

Figure 6 Major K-12 Proposition 98

Funding Reductions |

|

|

2002‑03 |

|

|

Program |

Amount |

|

Governor's Performance Awards |

$157a |

|

School Libraries |

135b |

|

Digital High School |

61c

|

|

Certificated Staff Performance Awards |

50 |

|

Equalization |

42 |

|

Public Employees� Retirement System Offset |

36 |

|

Teaching as a Priority |

30 |

|

K-4 Classroom Libraries |

25 |

|

9th Grade Class Size Reduction |

25 |

|

|

|

|

a

The Budget Act provides $77 million as part of the deferral

package for awards earned in the 2001‑02 school year. |

|

|

b

The budget contains $9.5 million from the Proposition 98

Reversion Account for this purpose. |

|

|

c

The Legislature adopted intent language to fund this program in

2003‑04. |

|

• Reward Programs Suspended ($207 Million). The budget includes the Governor's proposals to suspend funding for the Governor's Performance Awards ($157 million) and Certificated Staff Performance Awards ($50 million) for the 2002-03 school year. These programs provide financial awards to schools and certificated staff based on improvements in Academic Performance Index scores. The budget, however, does provide $77 million to fund performance awards that schools earned in 2001-02.

• School and Classroom Libraries Cut ($160 Million). The budget reduces $135 million from K-12 libraries and eliminates the K-4 Classroom Libraries program ($25 million). The budget, however, retains a total of $400 million for instructional materials.

• Digital High School Program Suspended ($61 Million). The budget eliminates funding on a one-time basis for the Digital High School program, but includes intent language stating that funding will be provided in 2003-04 fiscal.

• Revenue Limit Equalization ($42 Million—Vetoed). The Governor vetoed the $42 million the Legislature provided as a partial payment toward equalizing school districts' revenue limit funding. This funding would have continued the equalization effort the Legislature began in 2001-02 on a one-time basis. (See below with regard to future legislative commitments to equalization.)

• Public Employees' Retirement System (PERS) Offset ($36 Million—Vetoed). The Governor vetoed the $36 million in general purpose funds the Legislature provided to school districts and county offices of education to continue the 2001-02 reduction for the PERS offset. The PERS offset is a series of complex calculations that allowed the state to "capture" savings from falling PERS contribution costs in the 1980s.

• Other Program Restorations ($40 Million—Vetoed). The Governor vetoed a total of $40 million associated with two other legislative restorations. Specifically, the Governor vetoed $23 million (the entire restoration) for adult education for CalWORKs pupils, and $17 million for the Healthy Start program (leaving $2 million).

Governor Creates Proposition 98 Reserve. The Legislature passed a budget that appropriated Proposition 98 funding only slightly ($6 million) above the minimum guarantee. The Governor's vetoes, therefore, move the appropriation level below the minimum guarantee. The state has, in effect, set aside $143 million in Proposition 98 set-aside to be appropriated later in the fiscal year for any K-14 purpose.

State Mandates Eliminated, Suspended, or Deferred. The Legislature suspended three mandates in K-12 education—School Bus Safety, School Bus Safety II, and School Crime Reporting II. The Legislature also required the Commission on State Mandates to amend the parameters and guidelines for School Bus Safety II, which should reduce the cost of outstanding mandate claims from prior years. The one-year suspension in the School Crime Reporting II mandate will allow the State Department of Education to develop a new methodology for collecting school crime data consistent with new federal requirements. The Legislature eliminated three mandates related to absentee ballots for school elections, school site discipline notification, and inter-district transfer. In addition, the Legislature deferred an additional $27.8 million for several state mandate claims. The Legislature will be required to pay these costs in future years with interest.

The budget includes an increase in federal funds of over $740 million. Most of the additional funds are from the federal No Child Left Behind Act of 2001, which imposes significant new federal requirements on teacher quality, student assessments, and school accountability. The Legislature appropriated the new federal funding and adopted language governing the appropriation and expressing legislative intent. In many instances, the Governor vetoed the budget bill language, but not the appropriation. Major federal fund items include:

• Title I, Grants to Local Education Agencies ($1.5 Billion). Title I provides school districts with economically disadvantaged students resources to assist low-performing students. The 2002-03 funding level is a $291 million increase over 2001-02. The additional funds will be distributed to school districts based on a revised federal formula. The Governor vetoed budget bill language that would have helped protect the state against potential state mandates related to new data collection requirements imposed by Title I.

• Reading First ($132 Million). This new program will provide grants to school districts to improve the quality of reading education. AB 65 (Strom-Martin) provides implementing legislation controlling how the funding can be used.

• Improving Teacher Quality Grants ($332 Million). Through budget bill language, the Legislature directed the bulk of these new federal funds for (1) mitigating the costs of K-3 class size reduction (CSR), (2) expanding CSR in kindergarten and grades 1 to 12, and (3) funding teacher recruitment, retention, and standards-aligned professional development. The Governor vetoed this language, thereby allowing the State Board of Education to specify how the funds may be used.

• Language Acquisition State Grants ($109 Million). This new program provides funding to school districts based on the number of English language learners the district serves. The Legislature appropriated these funds pending enactment of legislation designating the specific uses of the funds and related accountability provisions.

• 21st Century Community Learning Centers ($41 Million). The Legislature appropriated these funds generally to complement the state's Before and After School Learning and Safe Neighborhood Partnerships program.

• Special Education ($871 Million). This is $135 million more than the 2001-02 level. The Legislature approved the Governor's proposal to use $112 million of the new federal funds to offset the General Fund cost of growth and COLA for special education.

The 2002-03 budget package also includes several important provisions affecting Proposition 98 spending in 2003-04:

• Proposition 98 Deferral from 2002-03 to

2003-04. The Legislature deferred payment of $681 million of expenditures from 2002-03 to

2003-04. As part of the deferral, the Legislature appropriated

$681 million in 2003-04 funds for four programs—Supplemental

Grants ($241.7 million), Targeted Instructional Improvement Grants

($184.4), Home to School Transportation ($139.6 million), and School

Improvement Program ($115.3 million). These appropriations are to cover

costs incurred by school districts administering these programs in the

2002-03 school year.

• Revenue Limit Equalization. The Legislature passed AB 2781 (Oropeza), which provides $406 million in 2003-04 funding for revenue limit equalization. AB 2781 allocates half the money based on revenue limits adjusted for excused absences and half on unadjusted limits.

• Commitment to Over-Appropriate Proposition 98. In AB 2781, the Legislature committed to appropriate $78.8 million over the Proposition 98 minimum funding guarantee in 2003-04. Of this amount, the Legislature committed to over-appropriate $57.8 million in recognition of the impact to school districts and community colleges of the $1.1 billion deferral from 2001-02 to 2002-03, and the $503 million funding shift for adult education. Similarly, the Legislature committed to over-appropriate $20.9 million in recognition of the impact of the $681 million deferral from 2002-03 to 2003-04.

• Outstanding State Mandate Claims Continue to Grow. The budget defers payments to school districts and county offices of education for state-mandated programs. This deferral includes reimbursements for 2002-03 mandate claims, prior-year deficiencies, and newly identified mandate claims. We estimate that the state's one-time costs to pay these deferred claims totals about $600 million. In addition, we estimate that the on-going annual costs of state mandates for K-12 education will exceed $300 million in 2003-04.

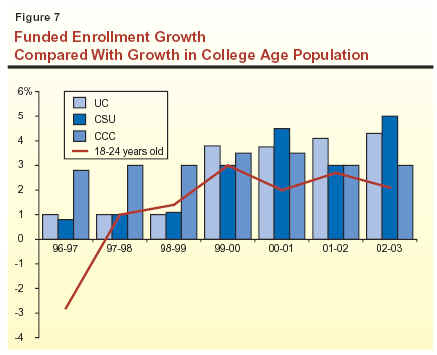

The enacted budget includes $11.6 billion in General Fund and local property tax support for higher education in 2002-03. This is $284 million, or 2.5 percent, higher than the amount expended in 2001-02. In general, the budget fully funds the Cal Grant entitlement programs, avoids any increases in resident student fees, and increases base funding for faculty and staff compensation and enrollment growth. As shown in Figure 7 (see page 36), the budget continues a trend in prior budgets to fund enrollment growth at levels above the college age population growth. In order to accommodate these funding commitments, the budget includes a number of one-time and ongoing reductions to noninstructional programs. It also defers some community college funding from 2001-02 to 2002-03 as a way to save money (one-time) and help meet the Proposition 98 minimum guarantee in 2002-03.

Governor's Vetoes. The Governor vetoed a total of $20.3 million from the higher education appropriations approved by the Legislature. This amount primarily includes the reduction of $10 million from California Community Colleges' (CCC) matriculation programs, and $9 million from CCC's California Work Opportunity and Responsibility to Kids (CalWORKs) services. (The budget's treatment of CalWORKs funding is discussed in the Social Services section of this report.)

The Governor vetoed budget bill language requiring the deferral of new spending by the California State University (CSU) on an information technology project until after a pending audit is completed. He also vetoed language that would have reappropriated up to $20 million in unspent 2001-02 CCC funding. Total appropriations for the higher education segments are shown in Figure 8.

|

Figure 8 Higher Education Budget

Summary |

|||

|

(Dollars in Millions) |

|||

|

Segment |

2002‑03 |

Change

From 2001‑02 |

|

|

Amount |

Percent |

||

|

University of California |

$3,223.9 |

-$107.8 |

-3.2% |

|

California State University |

2,680.3 |

-27.2 |

-1.0 |

|

California Community Colleges |

5,030.0 |

320.3 |

6.8 |

|

General

Fund |

(3,016.5) |

(162.1) |

5.7 |

|

Property

taxes |

(2,013.5) |

(158.2) |

8.5 |

|

Student Aid Commission |

661.6 |

100.1 |

17.8 |

|

Hastings College of the Law |

15.4 |

0.3 |

2.0 |

|

California Postsecondary |

2.2 |

-1.6 |

-42.9 |

|

Totals,

Higher Education |

$11,613.3 |

$284.1 |

2.5% |

The 2002-03 budget provides $3.2 billion in General Fund support for the University of California (UC). This is $108 million, or 3.2 percent, less than provided in 2001-02. However, most ($77.5 million) of this amount is due to one-time expenditures in 2001-02. Despite the net reduction in total General Fund support, the budget includes major augmentations for the following purposes:

• $69.2 million to serve approximately 7,700 additional full-time equivalent students (a 4.3 percent increase).

• $47.6 million for a 1.5 percent increase in base support.

• $16.8 million for increased costs of annuitant health and dental benefits.

• $13.9 million to recruit faculty and for other startup costs at UC's new campus in Merced.

In order to fund these augmentations, the budget reduces several noninstructional programs from 2001-02 funding levels. Major reductions include:

• $50.9 million to eliminate funding for grants to providers of training for K-12 teachers.

• $32.1 million in research funding.

• $29 million on a one-time basis for information technology, instructional equipment, library materials, and deferred maintenance.

• $17 million for institutional financial aid programs.

• $7.6 million for several outreach programs.

The 2002-03 budget provides $2.7 billion in General Fund support for

CSU. This is $27.2 million, or 1 percent, less than provided in 2001-02. About

two-thirds ($18.9 million) of this amount is due to one-time expenditures in

2001-02. Despite the net reduction in total General Fund support, the

budget includes major augmentations for the following purposes:

• $97.6 million to serve approximately 15,000 additional full-time equivalent students (a 5 percent increase).

• $37.7 million for a 1.5 percent increase in base support.

In order to fund these augmentations, the budget reduces several noninstructional programs from 2001-02 funding levels. Major reductions include:

• $43 million on a one-time basis for information technology, library acquisitions, instructional equipment, and facility maintenance.

• $21 million to suspend the Governor's Teaching Fellowship program, and issue loan forgiveness awards in place of the fellowship awards.

• $14.5 million for institutional financial aid programs.

• $12.5 million to defund the Education Technology Professional Development program.

The budget provides $3 billion in General Fund support for CCC. All but $157 million of this amount is Proposition 98 funding. After adding local property tax revenues, total funding for CCC in 2002-03 exceeds the 2001-02 amount by $320.3 million, or 6.8 percent. This increase is primarily due to a May Revision proposal, approved by the Legislature, to defer $115.6 million in Proposition 98 funding for apportionments from 2001-02 to 2002-03. Without this deferral, CCC's funding increase for 2002-03 would have been 1.8 percent.

Other major features of CCC's budget include:

• An increase of $120.2 million to accommodate a 3 percent increase in enrollment.

• An increase of $82.6 million to accommodate a 2 percent cost-of-living adjustment for apportionments and categorical programs.

• A reduction of $104.9 million to various categorical programs.

• $300 million to continue funding for the Partnership for Excellence program at the same level as 2001-02.

The 2002-03 budget provides $2.2 million in General Fund support for the California Postsecondary Education Commission (CPEC). Although the Governor proposed eliminating almost all General Fund funding for CPEC in the May Revision, the Legislature approved only a portion of that reduction. Specifically, the enacted budget reflects a reduction of $1.6 million, or 43 percent, from the prior year. The reduction is primarily due to the elimination of 20.7 positions and a corresponding decrease in expenditures for operating expenses and equipment.

The 2002-03 budget provides $662 million in General Fund support for the Student Aid Commission. This represents a net increase of $100 million, or 17.8 percent, above expenditures in the prior year. Major augmentations include:

• $107 million for the Cal Grant A and Cal Grant B programs.

• $10.6 million for the Assumption Program of Loans for Education.

Notable reductions include:

• $8.6 million for the California Student Opportunity and Access Program, which will be sustained at the same level as 2001-02, but now funded entirely with federal funds.

• $4 million for the Cal Grant T program.

General Fund support for health programs in 2002-03 totals $13 billion, a decrease of more than $650 million, or 4.8 percent, compared to 2001-02. This includes the impact of the Governor's vetoes of specific health program budget items that resulted in about $139 million in General Fund savings. Figure 9 (see page 40) summarizes the changes in expenditures for major health programs. Figure 10 (see page 41) provides a summary of some of the most significant actions adopted in the budget plan to address the state's fiscal difficulties.

|

Figure 9 Major Health Services

Programs |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Change |

|

|

|

2001‑02 |

2002‑03 |

Dollars |

Percentage |

|

Medi-Cal (local assistance only) |

$9,745 |

$9,841 |

$96 |

1.0% |

|

Department of |

1,778 |

1,815 |

38 |

2.1 |

|

Department of Mental Health |

982 |

821 |

-161 |

-16.4 |

|

Department of Alcohol and |

254 |

237 |

-17 |

-6.8 |

|

Healthy Families Program |

148 |

21 |

-127 |

-85.8 |

|

Emergency Medical Services |

36 |

28 |

-9 |

-23.6 |

|

Additional federal funds offsets |

� |

-425 |

-425 |

N/A |

|

All other health services |

732 |

684 |

-48 |

-23.6 |

|

Totals |

$13,675 |

$13,022 |

-$653 |

-4.8% |

|

Figure 10 Major General Fund

Reductions in State Health Programs |

|

|

(In Millions) |

|

|

|

General

Fund |

|

Medi-Cal |

|

|

Assumed federal relief to offset cost-sharing

ratio increase |

$400 |

|

Assumed additional savings from antifraud

activities |

245 |

|

Changes in the purchase of drugs and medical

supplies |

189 |

|

Shift additional program support to Tobacco

Settlement Fund |

89 |

|

Reduction in provider ratesa |

71 |

|

Assumed receipt of additional rebates on drugs |

66 |

|

Increase the state "takeout" from

hospital funding |

55 |

|

Reduction in county administration of eligibility |

29 |

|

Assumed additional caseload savings |

23 |

|

Postpone start of "express lane"

eligibility for children |

21 |

|

Public Health Programs |

|

|

Reductions in County Medical Services Program |

$24 |

|

Reduced transfers to the Cancer Research Fund |

13 |

|

Managed Risk Medical Insurance Board |

|

|

Postpone expansion of Healthy Families coverage to

parents |

$105 |

|

Department of Developmental Services |

|

|

Shift clients to home and community-based services |

$97 |

|

Shift program support to Title XX federal funds |

71 |

|

Unallocated reduction in Regional Center budgets |

52 |

|

Department of Mental Health |

|

|

Defer payments to counties for state-mandated

programs |

$65 |

|

Reduce various community mental health grants |

58 |

|

Establish county share of cost for EPSDT servicesb |

35 |

|

Adjust caseload for recent trends in hospital

population growth |

15 |

|

Eliminate categorical program for special

education pupils |

12 |

|

Department of Alcohol and Drug Programs |

|

|

Reductions in various local grant programs |

$14 |

|

a

The

administration is proposing to restore about $22 million of this

reduction through funding adjustments to be offered in January 2003. |

|

|

b

Reduction

shown in DMH budget is to reimbursements. Equivalent General Fund

savings are reflected in the Department of Health Services Medi-Cal

budget. |

|

The budget provides about $9.8 billion from the General Fund and $224 million from the Tobacco Settlement Fund (almost $27 billion all funds) for local assistance support of the Medi-Cal Program. The Medi-Cal General Fund budget increased almost $100 million, or 1 percent, above the 2001-02 expenditure level. The spending plan accommodates changes in costs, utilization, and caseload and also includes other changes to reduce program expenditures. Below we discuss the major changes adopted by the Legislature, as well as proposals considered and rejected by the Legislature.

Assumed Federal Relief. The 2002-03 spending plan includes an adjustment which assumes that the state will be able to offset, on a one-time basis, $400 million in Medi-Cal Program expenditures with special federal relief. The additional federal funds would be for the purpose of offsetting a projected decrease in the federal cost-sharing ratio (known as the Federal Medicaid Assistance Percentage or FMAP) for the state's Medicaid payments. The FMAP is based on per-capita income and is adjusted by the federal government each year. It remains uncertain whether Congress will appropriate the necessary federal funds to provide the FMAP relief that is assumed in the state budget.

Drug and Medical Supply Purchases. The Legislature largely accepted the Governor's proposal to reduce the Medi-Cal budget by about $189 million (General Fund) through various changes in the way the state purchases drugs and certain medical supplies and services. The budget plan further assumes an additional $66 million in General Fund savings due to increased rebates from pharmaceutical companies from the state's purchases of drugs for Medi-Cal beneficiaries.

Provider Rates and Copayments. The Legislature accepted the Governor's proposal to reduce Medi-Cal provider rates by about $71 million from the General Fund—in effect, partially reversing rate increases granted to them two years ago. However, it rejected a May Revision proposal for an additional $73 million in General Fund reductions. Moreover, the Governor indicated in his veto message his intention to exempt California Children's Services, nonemergency medical transportation, home health services, shift nursing, and family planning from the rate reduction accepted by the Legislature. The Governor indicated that the funding adjustments needed to allow this would be presented in January 2003. It is estimated that such action could add as much as $22 million in state spending.

The Legislature did not accept a separate proposal to further reduce provider rates by an amount equivalent to proposed additional copayment charges for Medi-Cal beneficiaries that was intended to reduce General Fund costs by about $31 million.

Changes in Eligibility Rules and Procedures. The Governor had proposed to slow down the growth in the Medi-Cal caseload and reduce expenditures primarily by reinstating parental quarterly status reporting requirements that were dropped as a result of 2000 legislation, and rescinding the 1931(b) expansion of Medi-Cal benefits to poor families that was enacted in 1999. These two actions in combination were projected by the administration to reduce the average number of Medi-Cal eligibles by almost 400,000. The reversal of the 1931(b) expansion would have saved $92 million from the General Fund in 2002-03, while the reinstatement of quarterly status reports was estimated to result in about $155 million in General Fund savings. However, both proposals were rejected by the Legislature.

The administration put on hold the implementation of recent legislation providing "Express Lane" eligibility for children participating in school lunch or food stamp programs in order to save $12.1 million from the General Fund. The Legislature reinstated $6 million from the General Fund to move ahead with the school-lunch component of the program, but the funds provided for this purpose in the budget bill were vetoed by the Governor.

Reductions in Medi-Cal Services. The Governor's proposal to reduce certain optional Medi-Cal services, such as dental care, for adult beneficiaries was not approved by the Legislature. The administration had estimated that the savings from the proposal in 2002-03 would have been $263 million. However, the budget plan does limit dental cleanings and exams to one visit annually for adults in order to save an estimated $4 million in General Fund resources.

County Administration. The Legislature rejected a proposal by the Governor to impose a 20 percent reduction in payments to counties for Medi-Cal eligibility activities to achieve a state General Fund savings of $88 million. The Governor subsequently implemented about a 6 percent reduction in these payments by vetoing $29 million (General Fund) from the spending plan.

Disproportionate Share Hospitals (DSH). The state funds the DSH program by combining local funding from public entities such as counties, the University of California, and hospital districts with federal dollars. Hospitals that serve a disproportionate share of Medi-Cal patients and the uninsured are eligible to receive this funding. The budget plan includes a $55 million increase in the state's "takeout" of funding that is used to offset costs for the Medi-Cal Program that would otherwise be supported by the state General Fund. However, the Legislature rejected a May Revision proposal to save the state an additional $31 million by increasing the DSH takeout even further.

Other Budget Adjustments. The Governor's budget plan assumed that the state would achieve an additional $145 million in savings to the General Fund as a result of various efforts to crack down on Medi-Cal fraud. The Legislature revised the budget plan to assume an additional $100 million in savings from these activities, in effect assuming that the total General Fund savings from antifraud efforts will be $245 million above the level estimated for the prior fiscal year.

In addition, the Legislature assumed that Medi-Cal caseloads would run below the projected level, reducing General Fund costs by about $23 million in the budget year. Finally, a larger portion of the Medi-Cal Program would be supported from the Tobacco Settlement Fund in order to achieve about $89 million in General Fund savings.

Funding Level. The budget provides about $21 million from the General Fund and $235 million from the Tobacco Settlement Fund (about $677 million all funds) for local assistance provided under the Healthy Families Program. This spending total for 2002-03 amounts to about a $127 million, or 86 percent, decrease in General Fund support. However, this is due primarily to a shift in program support to the Tobacco Settlement Fund. Spending would actually increase more than 22 percent above the 2001-02 level of expenditures when all fund sources for the Healthy Families Program are taken into account. That spending total reflects ongoing increases in the children's program caseload, including an assumption that the total number of enrolled children will grow by about 65,000 over the course of 2002-03. These spending totals include a reduced level of funding—about $4.6 million all funds—for Rural Health Demonstration Projects, a component of the Healthy Families Program.

Parent Expansion Delayed. The 2001-02 state budget had included funding to expand the Healthy Families Program to parents commencing in October 2001, but the Legislature and Governor subsequently agreed to delay implementation to at least July 2002 because of the state's fiscal problems. Had the program actually begun operation on that date, the cost to the state during 2002-03 would have been as much as $105 million to add 166,000 parents to Healthy Families enrollment. As the state's fiscal problems worsened, the Legislature subsequently proposed a further delay in the program that would allow implementation at lower state cost during 2002-03. It augmented the 2002-03 spending plan by about $52 million from the General Fund (about $143 million all funds) to start the program in October 2002. However, the Governor vetoed all funds for the program expansion, in effect delaying the expansion to parents to at least July 2003. He also vetoed a $7.7 million appropriation from the General Fund within the Medi-Cal Program budget to establish transitional Medi-Cal coverage for parents that would have shifted over to Healthy Families.

The budget plan assumes the state will have about $546 million in resources from the settlement of tobacco-related litigation that will be deposited into a special fund, known as the Tobacco Settlement Fund, established last year. The budget plan appropriates all of the anticipated funds for recently enacted expansion of health care programs and does not provide for a reserve. The expenditure plan for these funds is summarized in Figure 11.

|

Figure 11 Tobacco Settlement Fund |

|

|

(In Millions) |

|

|

|

|

|

Revenues in 2002-03 |

$474.4 |

|

Prior-year carryover |

71.6 |

|

Total

Resources |

$546.0 |

|

Expenditures: |

|

|

Healthy

Families Program |

$229.9 |

|

Access

for Infants and Mothers (AIM) |

4.3 |

|

Medi-Cal

Programs: |

|

|

Section

1931(b) expansion to poor families |

213.5 |

|

Breast

and Cervical Cancer Treatment |

10.6 |

|

State-Only Breast and Cervical Cancer Treatment |

11.1 |

|

Child Health and Disability Prevention Program |

56.7 |

|

Prostate Cancer Treatment |

20.0 |

|

Total

Expenditures |

$546.0 |

|

Ending

Balance |

$0 |

Under the adopted budget plan, the state's future revenue stream from the tobacco settlement is to be sold to provide cash needed to support state operations during 2002-03. Thus, little if any of these funds would be available in 2003-04 and subsequent years for the support of health programs. The tobacco securitization action is discussed further in "Chapter 3" of this report.

Due to legislative opposition, the administration eventually withdrew an initial 2002-03 budget proposal to abolish the CHDP program for an estimated net savings of about $52 million (after related augmentations to community clinic programs were taken into account).

At the time of the May Revision, the administration proposed and the Legislature subsequently approved steps to make the CHDP immunization and screening program a more effective "gateway" to transition eligible children to more comprehensive health coverage under the Medi-Cal and Healthy Families Programs. The net fiscal impact on the budget of implementing the gateway plan, including the assumed shifts in caseloads, was about $3.8 million General Fund ($9.7 million all funds).

The Legislature further augmented the CHDP budget by $2 million from the General Fund ($4 million all funds) to update the schedule for children's visits to the doctor under the program, but these augmentations were vetoed by the Governor.

Antitobacco Programs. The administration's January 10 budget plan for

2002-03 proposed a $35 million augmentation for youth antitobacco

programs using resources from the Tobacco Settlement Fund. The May Revision

spending proposal, which was accepted by the Legislature, withdrew this

augmentation request. The budget plan also eliminates the proposed

expenditure of about $24 million in Proposition 99 cigarette tax revenues to

continue a media campaign to persuade the public to quit smoking.

Cancer Research. The administration had initially proposed to reduce transfers of General Fund resources to the Cancer Research Fund by $25 million. But the budget plan that was finally adopted reflects a revised proposal by the Governor to restore $12.5 million from the General Fund that is to be matched by an equal amount of private-sector contributions for continued cancer research efforts.

County Medical Services Program (CMSP). The Legislature accepted an administration proposal to suspend, on a one-year basis for the fourth year in a row, state General Fund support of the county-run CMSP, which provides care for indigent adults. This action comes at a time when the program continues to have a significant financial reserve. The Legislature also agreed to shift some of the state Department of Health Services' administrative support costs for the program to CMSP. Together these actions are expected to save about $24 million for the state General Fund.

Expanded Access to Primary Care (EAPC) Program. The Governor's January 10 budget plan had proposed an augmentation of almost $18 million to the EAPC Program, which gives grants to primary care clinics to provide care for uninsured persons. That proposed funding increase, which was tied to the proposal discussed above to abolish CHDP, was withdrawn.

Bioterrorism Preparedness. The budget plan includes about $51 million in additional federal grant funding for programs administered by the state Department of Health Services and local public health departments to improve their ability to respond to the threat of bioterrorist attacks. The funding was allocated to upgrade the abilities of these governmental agencies to detect and investigate potential outbreaks of infectious diseases, to prepare hospital systems and providers to deal with large numbers of potential casualties, and to expand public health laboratory and communication systems.

Childhood Lead Prevention Program (CLPP). The budget reflects legislative approval of an administration plan to expand the CLPP, the primary program responsible for ensuring that children at an increased risk for lead poisoning are tested for the presence of lead in their blood. The budget would increase local assistance for lead poisoning prevention activities, provide for increased testing of blood for lead contamination, expand computer systems needed to better track the cases of children exposed to lead, and step up local and state enforcement of lead abatement laws. The spending plan (including changes proposed in the May Revision) increases the resources provided to CLPP by about $4.4 million when all funding sources are taken into account. General Fund support for CLPP would decrease by about $2.1 million due to a shift in program support to fees assessed on past and present manufacturers of lead products.

The Emergency Medical Services Authority budget provides about $28 million from the General Fund ($43 million all funds). The spending plan provides for a decline in General Fund support of about $8.6 million and 24 percent below the 2001-02 level of spending. When all fund sources are taken into account, however, the overall spending level for the authority would actually increase slightly.

Some small General Fund-supported programs and administrative expenditures of the authority were reduced because of the state's fiscal difficulties. However, the budget plan provides the authority with an additional $9.1 million in federal funds (reflected in the budget as reimbursements from the Department of Health Services) to help prepare the state's hospital system for the threat of a bioterrorism attack. Also, the Legislature augmented the authority's budget by $25 million from the General Fund to continue a grant program to assist trauma care centers that was begun in 2001-02. The Governor vetoed $5 million of this sum because of the state's fiscal problems, leaving $20 million available in the current year to continue support for trauma care systems.

The budget provides $1.8 billion from the General Fund ($2.9 billion all funds) for services to individuals with developmental disabilities in developmental centers and Regional Centers.

Community Programs. The 2002-03 budget includes a total of $1.5 billion from the General Fund ($2.2 billion all funds) for community services for the developmentally disabled, an increase of $59 million over the prior fiscal year. This increase is the net result of caseload and cost increases as well as some offsetting General Fund program reductions and funding shifts.

An additional $110 million from the General Fund ($138 million all funds) is provided in the budget to accommodate Regional Center caseload growth of 9,725 persons, or 5.6 percent, as well as cost increases for community-based services. A $15.9 million increase from the General Fund ($20.4 million all funds) was provided to help move or divert individuals from developmental centers to the community. However, the Governor vetoed a legislative augmentation to provide an additional $5.6 million in one-time grants to provide additional resources for community programs.

General Fund expenditures for community programs were reduced by $97 million by shifting additional Regional Center consumers to the Medicaid home and community-based services waiver. An additional $71 million was saved by shifting federal Title XX funds to the Regional Centers to further offset General Fund costs. While these funding shifts were not expected to affect community programs, the budget also reflects an unallocated reduction of $52 million in General Fund resources for Regional Centers. Additional savings were to be achieved by suspending start-up of new community programs and temporarily extending the deadline for intake assessments at Regional Centers.

Developmental Centers. The budget provides a total of $343 million from the General Fund for operations of the developmental centers ($629 million all funds), about the same amount of funds as the prior fiscal year. While some operating costs increased, the budget also assumes a small decline in the developmental center population of 19 residents.

The budget provides about $821 million from the General Fund ($2.1 billion all funds) for mental health services provided in state hospitals and in various community programs.

Community Programs. The 2002-03 budget includes a total of about $320 million from the General Fund (about $1.5 billion all funds) for local assistance for the mentally ill, a decrease of almost $164 million, or 34 percent, in General Fund resources compared to the prior year. Reductions totaling $58 million were made in various categorical grant programs, including the adult and children's systems of care, integrated services for the homeless, supportive housing grants, and dual diagnosis programs for mentally ill persons who are also addicted to illegal drugs.

The budget eliminated a $12 million categorical program supporting mental health services for special education pupils, with the result that counties would henceforth seek reimbursement for these costs through the state claims process. However, the budget delays payments to counties for that and other state-mandated programs. The Legislature did adopt budget-related legislation providing potentially tens of millions of dollars in fiscal relief to county governments from cost-sharing requirements for providing such services to children.

General Fund support for special mental health services provided under the Early and Periodic Screening, Diagnosis and Treatment (EPSDT) program (including therapeutic behavioral services) would increase by about $44 million. However, the budget plan assumes that EPSDT expenditures will increase by $35 million less than was otherwise projected because of anticipated state-county efforts to help control the 30 percent annual growth in the cost of the program. As part of this effort, counties were required to assume a 10 percent share of the nonfederal costs of the growth in the EPSDT program.

State Hospitals. The budget provides a total of $451 million from the

General Fund for state hospital operations ($589 million all funds), about a

1.3 percent increase above the prior-year level of funding. The Governor's

January 10 budget request for the state hospital budget was reduced

by $14.8 million from the General Fund to adjust for actual trends in

patient population growth.

The budget provides about $237 million from the General Fund ($578 million all funds) for drug and alcohol programs, a decrease of about $17 million, or 6.8 percent, below the prior fiscal year. The decrease in General Fund resources is primarily the result of caseload adjustments in the Drug Medi-Cal Program and reductions in state-local assistance programs. The Legislature restored funding for some programs that had been proposed for reduction, including drug courts, perinatal services, and technical assistance grants. This was achieved by a combination of actions, including the redirection of additional federal grant funds that became available to the state as well as restructuring the drug court program to focus on felons in order to generate additional state General Fund savings on prison operations.

The HIPAA is a federal law that, among other provisions, establishes national standards and requirements for the transmission, storage, and handling of certain electronic health care data. The budget plan postponed to 2002-03 a large part of the HIPAA compliance expenditures initially scheduled for 2001-02 due to the state's fiscal problems. Also, about $4 million from the General Fund ($6.1 million all funds) proposed for HIPAA remediation activities was deleted until state agencies complete an assessment of the steps they need to take to comply with the federal law. Overall, the budget plan provides an additional $20.7 million General Fund ($59.2 million all funds) to 13 state agencies for HIPAA compliance efforts.

General Fund support for social services programs in 2002-03 totals $8.6 billion, an increase of 2.5 percent over the prior year. This increase results from substantial additional combined costs of $360 million in the Supplemental Security Income/State Supplementary Program (SSI/SSP) and In-Home Supportive Services (IHSS), partially offset by savings in almost all other social services programs ($150 million). Figure 12 shows the changes in expenditures for social services programs.

|

Figure 12 Social Services Programs |

||||

|

(Dollars in Millions) |

||||

|

|

2001-02 |

2002-03 |

Change |

|

|

Amount |

Percent |

|||

|

|

|

|

|

|

|

SSI/SSP |

$2,807 |

$3,058 |

$252 |

9.0% |

|

CalWORKs |

2,057 |

2,071 |

14 |

0.7 |

|

Foster Care/Children's Services/ |

1,246 |

1,276 |

30 |

2.4 |

|

IHSS |

887 |

996 |

108 |

12.2 |

|

Child Support Services |

426 |

376 |

-50 |

-11.7 |

|

County Administration of Food Stamps/ |

421 |

415 |

-6 |

-1.5 |

|

All other social services programs |

556 |

419 |

-137 |

-24.6 |

|

Totals |

$8,401 |

$8,611 |

$210 |

2.5% |

Although General Fund spending for social services programs increased by $210 million compared to 2001-02, spending would have increased by about $1 billion had the Legislature not made substantial program reductions in comparison to statutory requirements. Figure 13 lists $840 million in major reductions to social services programs.

|

Major

Changes�Social Services Programs |

|

|

(In Millions) |

|

|

Department/Program |

Change

From |

|

Department

of Social Services (DSS)�CalWORKs |

|

|

Redirect unspent county performance incentives to core program |

-$317.2a |

|

Delay COLA by eight months until June 2003 |

-99.1a |

|

Reduce adult education and community colleges support |

-56.0 |

|

Reduce administrative support |

-47.4a |

|

Defer Welfare-to-Work match payment |

-25.4 |

|

Reinstate senior parent deeming for teen parent cases |

-12.1a |

|

Require quarterly rather than monthly financial reporting |

16.8a |

|

DSS�Adult

and Special Programs |

|

|

Delay SSI/SSP state COLA by five months until June 2003 |

-$111.5 |

|

Suspend state participation in IHSS $1 per hour wage increase |

-25.9 |

|

Reduce adult protective services |

-6.0 |

|

Provide no funding for special circumstances program |

-5.0 |

|

DSS�Food

Stamps |

|

|

Reduction in administrative funding |

-$6.8 |

|

Require quarterly rather than monthly financial reporting |

-2.1 |

|

DSS�Children's

Programs |

|

|

Child welfare services reductions |

-$28.1 |

|

No discretionary COLA for Foster Care and related programs |

-23.0 |

|

Basic adoption funding replaced with federal adoption incentives |

-11.4 |

|

Adoptions program reduction |

-3.0 |

|

Department

of Rehabilitation |

|

|

Suspend Work Activity Program rate adjustment |

-$10.8 |

|

Department

of Child Support Services |

|

|

Assume enactment of federal penalty relief legislation |

-$57.0 |

|

Suspend certain incentive payments to counties |

-4.3 |

|

Other

Reductions |

|

|

Reduce naturalization assistance funding |

-$2.9 |

|

Eliminate job agent program |

-2.7 |

|

Totals |

-$840.9 |

|

|

|

|

a

Combined General Fund and Temporary Assistance for Needy Families

(TANF) funds. |

|

The budget includes $2.1 billion from the General Fund in the Department of Social Services (DSS) budget for the California Work Opportunity and Responsibility to Kids (CalWORKs) program in 2002-03, which is an increase of less than 1 percent compared to 2001-02.

CalWORKs Grants. Budget legislation delays the October 2002 statutory cost-of-living adjustment (COLA) until June 2003 resulting in an eight-month savings of $99 million. Effective June 1, 2003, the maximum monthly grant for a family of three in high-cost counties will increase by $25 (3.7 percent) to a total of $704, and grants in low-cost counties will similarly increase to a total of $671 (see Figure 14, page 52).

|

Figure 14 Cost-of-Living Adjustments

Delayed Until June 2003 |

||||

|

(Maximum Monthly Grants) |

||||

|

Program |

2001-02 |

June |

Change |

|

|

Amount |

Percent |

|||

|

CalWORKsa |

|

|

|

|

|

Low-cost

counties |

$647 |

$671 |

$24 |

3.7% |

|

High-cost

counties |

679 |

704 |

25 |

3.7 |

|

SSI/SSP |

|

|

|

|

|

Individuals |

$750 |

$778 |

$28 |

3.7% |

|

Couples |

1,332 |

1,382 |

50 |

3.8 |

|

|

||||

|

a

Family of three. |

||||

County Performance Incentives. Since 2000-01, payments for county incentives are subject to annual budget appropriation. No additional incentives are provided in 2002-03 and the budget redirects $317 million in unspent performance incentives (previously paid to the counties) to support core program activities (such as grants and child care).

Reductions in Adult Education and Community Colleges. The Governor's May Revision included reductions of $26 million for adult education and $30 million for community colleges services. (These education programs were designed to assist CalWORKs recipients.) The Legislature restored $23 million for adult education and $9 million for the community colleges. The Governor, however, vetoed these partial restorations.

Senior Parent Deeming. Budget legislation reinstates the senior parent "deeming" requirement, whereby the income of a grandparent is deemed to the grandchild for purposes of determining financial eligibility. This results in combined Temporary Assistant for Needy Families (TANF)/General Fund savings of $12.1 million.

Reduction in Administration. The Governor's May Revision proposed a net reduction of $71.9 million (TANF/General Fund) to the CalWORKs administration. The Governor sustained a partial legislative restoration of $24.5 million. Thus, the net reduction to CalWORKs county administration is $47.4 million (about 12 percent of estimated 2001-02 spending).

Quarterly Reporting. Budget legislation reduces the frequency of required income reporting from monthly to quarterly for CalWORKs and food stamps recipients. This change results in net CalWORKs costs of about $16.8 million and Food Stamps administrative savings of about $2 million. The primary benefit of this change is an expected reduction in the state's Food Stamps error rate, which should also result in lower federal Food Stamps penalties (currently exceeding $100 million).

Defer Welfare-to-Work Match Payment. In order to receive federal Welfare-to-Work block grant funds, the state must provide a $1 match for every $2 in federal funds. California's matching funds are appropriated to county welfare departments as part of the CalWORKs program. In 2001-02, California provided $25.4 million in matching funds. For 2002-03, the budget provides no matching funds, and the remaining match obligation of approximately $60 million must be paid by July 2004.

The budget includes $3.1 billion for the program in 2002-03, which is an increase of 9 percent compared to the prior year.

Grant Payments. Budget trailer bill legislation delays the January 2003 COLA for SSI/SSP until June 2003. The five-month SSI/SSP COLA delay results in savings of $111.5 million. Effective June 2003, the maximum grant for aged and disabled individuals will increase by $28 to a total of $778 per month and the grant for couples will increase by $50 to a total of $1,382 per month (see Figure 14).

The budget includes $415 million from the General Fund for county administration of Food Stamps and Foster Care. This amount represents a decrease of 1.5 percent compared to 2001-02.

Rejection of Most Administrative Reductions. The Governor's May Revision proposed 20 percent reductions in county administration of Food Stamps and Foster Care as well as similar reductions to IHSS and Medi-Cal (please see the "Health" section of this chapter for a discussion of the Medi-Cal administration). The Legislature rejected these proposed reductions. Nevertheless, the Governor vetoed $6.8 million in General Fund support for Food Stamps administration.

The budget includes $65.9 million from the General Fund for various special programs which serve the aged, disabled, and certain refugees. This funding level represents a reduction of 14 percent compared to 2001-02.

Special Circumstances. The budget provides no funding for the special services program, resulting in a savings of $5 million compared to 2001-02.

Adult Protective Services (APS). The budget reduces General Fund support for APS by $6 million (about 11 percent compared to 2001-02).

The budget provides a combined total of $1.3 billion from the General Fund for Foster Care, Child Welfare Services, and Adoptions. This is an increase of $30 million (2.4 percent) compared to 2001-02.

Child Welfare Services. The Legislature rejected the Governor's May Revision proposal to (1) eliminate the cost-of-doing-business inflationary adjustment ($10.9 million General Fund) and (2) reduce the workload relief augmentation provided since 2000-01 by $17.2 million General Fund. The Governor, however, vetoed these legislative restorations.

Adoptions. The Legislature adopted the Governor's January proposal to replace basic adoptions funding with federal funds resulting in a General Fund savings of $11.4 million. Although the Legislature rejected an additional May Revision reduction of $9.1 million, the Governor vetoed $3 million in Adoptions funding.

Foster Care COLA. The budget provides no funding for discretionary COLAs for Foster Care and related programs. This results in General Fund savings of $23 million.

The budget provides $1 billion from the General Fund for IHSS, an increase of 12 percent compared to 2001-02.

Suspension of Wage Increase. The budget assumes General Fund savings

of $25.9 million from suspending the statutory requirement to increase by

$1 per hour state participation in wage increases for IHSS providers

working in "public authorities." Because legislation to suspend this requirement

was not passed by the Legislature, the $25.9 million in assumed savings

could result in a deficiency in the IHSS program. The actual amount of such a

deficiency would depend on the outcome of wage negotiations between

counties and IHSS workers.

The budget provides $165 million from the General Fund for the Department of Rehabilitation. This is an increase of $5 million (3.1 percent), compared to the prior year.

Rate Adjustment Suspension. The budget achieves savings of $10.8 million by suspending the Work Activity Program rate adjustment.

The budget includes $376 million in General Fund support for the DCSS, a decrease of $50 million (12 percent) compared to 2001-02

Assumed Automation Penalty Relief. Because California has not

completed its automated statewide child support collection system, it is subject to

penalties that are collected in the form of reduced federal administrative

support for child support enforcement. In 2001-02, the penalty was

approximately $157 million and is estimated to be $180 million in 2002-03. The budget

assumes enactment of federal legislation which would effectively reduce

the penalty by 50 percent, resulting in savings of $67 million compared to

2001-02. At the time this report was prepared, Congress had not passed

any penalty relief legislation.

Incentive Payment Suspension. Budget bill legislation suspends $4.3 million in incentive payments to counties that have been successful in collecting child support.

The budget eliminates the Job Agent program at the Employment Development Department, resulting in General Fund savings of $2.7 million. Finally, the budget reduces funding for naturalization assistance at the Department of Community Services and Development by $2.9 million.

The 2002 budget for judicial and criminal justice programs totals about $7.8 billion, including $7.2 billion from the General Fund and $519 million from federal and special funds. The total amount is a decrease of $331 million, or 4.1 percent, from 2001-02 expenditures. The General Fund total represents a decrease of $291 million, or 3.9 percent, relative to 2001-02 expenditures. This decrease in the General Fund amount is the result of (1) a projected decline in the inmate and ward populations, (2) a shift of funding for certain programs from the General Fund to special funds, and (3) one-time expenditures included in the 2001-02 budget that were not included in the 2002-03 budget. Figure 15 shows the changes in expenditures in some of the major judicial and criminal justice budgets.

|

Figure 15 Judicial and Criminal

Justice Budget Summary |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Change |

|

|

Program/Department |

2001-02 |

2002-03 |

Amount |

Percent |

|

Trial Court Funding |

$1,191 |

$1,106 |

-$85 |

-7.2% |

|

Department of Corrections |

4,883 |

4,800 |

-83 |

-1.7 |

|

Department of Youth Authority |

368 |

336 |

-32 |

-8.7 |

|

Citizens� Option for Public Safety |

116 |

116 |

� |

� |

|

Juvenile Justice Grants |

116 |

116 |

� |

� |

The budget includes $2.2 billion for support of the trial courts. This amount includes $1.1 billion from the General Fund, $475 million transferred from counties to the state, and $589 million in special funds (fine, penalty, and court fee revenues). The General Fund amount is $85 million, or 7.2 percent, less than the prior-year amount. This decrease primarily reflects a shift of funding for certain program costs from the General Fund to special funds.

The budget contains $4.8 billion from the General Fund for the

California Department of Corrections (CDC), a decrease of $83 million, or

1.7 percent, from the 2001-02 expenditure level. The decrease is the result of several

factors, including a projected decline in the inmate population, reductions

in inmate substance abuse treatment and parole programs, and overtime

expenditures included in the 2001-02 budget that were not included in the

2002-03 budget.

The budget provides full funding for the projected inmate and parole caseloads in 2002-03. Specifically, the budget assumes that the inmate population will be about 155,000 by the end of the current year. This represents a decrease of approximately 3,000 inmates from the prior year. According to CDC, this decline in the population is due primarily to the implementation of Proposition 36, which diverts certain drug offenders who would otherwise be sent to prison, into drug treatment programs. The budget also provides full funding for a parole population of approximately 122,500. This represents an increase of approximately 1,200 parolees above the 2001-02 level.

Federal Funds for Incarceration and Supervision of Undocumented Felons. The budget also assumes that the state will receive $204 million in federal funds to offset the state's costs of supervising undocumented felons in CDC and the Department of the Youth Authority. This is about $50 million more than received in 2001-02. The federal funds are counted as offsets to state expenditures and are not shown in the budgets of the CDC and the Youth Authority or in the budget act.

The budget provides $336 million from the General Fund for support of

the Youth Authority, a decrease of $32 million, or 8.7 percent, relative to the

2001-02 funding level. This decrease is largely due to the projected decline

in the number of wards, and reductions in substance abuse treatment and

parole services. The budget includes increased funding for mental health

services ($1 million) and litigation management ($1.7 million) to address a

recent class action lawsuit.

Citizens' Option for Public Safety (COPS) Program. The budget includes $116.3 million for support of the COPS program, which is the same level that was provided in 2001-02. The program provides discretionary funding on a per capita basis to local police departments and sheriffs for front-line law enforcement (with a minimum guarantee of $100,000), to sheriffs for jail services, and to district attorneys for prosecution.

High Technology Crime Programs. The budget provides $18.5 million for grants to local law enforcement agencies for technology equipment purchases, a reduction of $16.9 million from the 2001-02 funding level. In addition, the budget provides $10.8 million for the High Technology Theft, Apprehension, and Prosecution program; and $3.3 million for the High Technology Identity Theft program, the same levels as provided in the prior year.

War on Methamphetamine. The budget includes $15 million for local law enforcement in the Central Valley for antimethamphetamine activities.

Rural and Small County Law Enforcement Assistance Program. The budget continues funding of $18.5 million for small and rural county sheriff departments to enhance law enforcement efforts in those counties.

Juvenile Justice Grants. The budget maintains $116.3 million to fund county juvenile justice programs, which is the same level as last year. The grants go to local juvenile justice coordinating councils who have identified program needs related to juvenile delinquency and crime. Chapter 495, Statutes of 2001 (SB 736, Poochigian), permanently established the Juvenile Justice Grants and COPS programs.

The 2002-03 budget provides a total of $9 billion from special funds and federal funds for the Department of Transportation (Caltrans), a 15 percent increase over 2001-02. The increase is entirely the result of higher anticipated capital outlay expenditures funded from federal dollars. Of the total Caltrans budget, approximately $7.4 billion will be for the highway program, including $3.3 billion for capital outlay, $1.3 billion for highway design and engineering, $1.5 billion for local assistance, and $814 million for highway maintenance. The budget provides about $853 million for Caltrans' mass transportation program including the support of intercity rail service. The budget also provides $686 million for all other programs, including administration, planning, and aviation.

In addition to the funding increases for the transportation program, the budget provides for a number of transportation loans to the General Fund, as shown in Figure 16. These loans are a part of the state's strategy for addressing the General Fund condition, and are described in greater detail below.

|

Figure 16 Transportation Loans and

Repaymentsa |

|||||

|

(In Millions) |

|||||

|

|

To

General Fundb |

|

To

Traffic Congestion Relief Fundc |

||

|

Year |

From

State Highway Account |

From

Traffic Congestion Relief Fund (TCRF) |

|

From

State Highway Account |

From

Public Transportation Account |

|

2000-01 |

� |

� |

|

$9 |

� |

|

2001-02 |

$173 |

$238 |

|

40 |

$180 |

|

2002-03 |

� |

1,045 |

|

534 |

95 |

|

2003-04 |

� |

-500 |

|

-50 |

� |

|

2004-05 |

-173 |

-650 |

|

-149 |

� |

|

2005-06 |

� |

-380 |

|

-275 |

� |

|

2006-07 |

� |

147 |

|

-109 |

� |

|

2007-08 |

� |

100 |

|

� |

-275 |

|

|

|||||

|

a

Amounts do not include interest. |

|||||

|

b

Positive

numbers are amounts payable to the General Fund, negative numbers

are payable from the General Fund. |

|||||

|

c

Positive

numbers are amounts payable to TCRF, negative numbers are payable

from TCRF. |

|||||

The TCRF to Loan Money to General Fund, Backfilled by State Highway Account. The 2002-03 budget includes over $1 billion in loans from the Traffic Congestion Relief Fund (TCRF) to the General Fund. This amount is in addition to the $238 million loaned to the General Fund in 2001-02 as part of the refinancing of the Traffic Congestion Relief Program (TCRP). All of these loans must be repaid to TCRF by June 30, 2006.

In order that the TCRF loan would not negatively affect the delivery of transportation projects, the budget backfills part of this loan with a $474 million loan from the State Highway Account (SHA) to TCRF. This loan is in addition to a $60 million SHA loan to TCRF previously approved in the 2001-02 budget to be made in 2002-03, as part of the refinancing of TCRP. All these loans must be repaid to SHA by June 30, 2007.

Chapter 445, Statutes of 2002, (SB 1834 [Committee on Budget and Fiscal Review]), the trailer bill legislation to implement these loans, requires that the new $474 million loan from SHA be repaid with interest, and that the interest be paid from the General Fund instead of TCRF. This is because TCRF currently does not retain any interest accrued to its fund balance; instead, any interest it earns is transferred to the General Fund.

The SHA to Loan Money Directly to General Fund. In addition to the loans described above, the budget provides a three-year loan of $173 million from SHA to the General Fund in the 2001-02 fiscal year. This loan must be repaid in full by June 30, 2005. In addition, Chapter 445 requires that the General Fund repay this loan with interest.

Public Transportation Account Loan to TCRF Reduced. The Legislature reduced by $5.1 million the Public Transportation Account (PTA) loan to TCRF for 2002-03, thereby providing a loan of $94.5 million instead of the $100 million approved as part of the refinancing of TCRP. In turn, the Legislature used the $5.1 million to augment the State Transportation Assistance (STA) program for local transit operators, thus providing a total of $103.1 million for STA. The amount is $5.1 million more than the minimum amount called for by statutory formula.

The Governor vetoed the augmentation. The freed-up amount will remain in PTA, to be available for mass transit capital improvement projects.

The budget provides a total of $1.1 billion to support the California Highway Patrol (CHP), about $100 million, or 9.7 percent, above the 2001-02 level. Virtually all of this support comes from the Motor Vehicle Account (MVA).

Antiterrorism Programs Funded. The budget includes $93.4 million from MVA for CHP to carry out enhanced security antiterrorism activities in 2002-03. This amount would be repaid with any federal funds that the state receives for antiterrorism activities. Of the $93.4 million, $32.5 million will be available only for tactical alerts when security monitoring and patrol activities are increased. The remaining funding will support 322 new CHP positions, including 150 officers to inspect commercial vehicles and carriers of hazardous materials. Other new officers will serve on antiterrorism task forces and provide security for major bridges, the State Capitol and state office buildings, nuclear power plants, and state health laboratories. The budgeted amount also includes funding for five new helicopters and 24 pilots and flight officers to operate them.

The budget provides about $660 million for the support of the Department of Motor Vehicles (DMV), about $13 million less than the 2001-02 level. The amount includes $346 million from MVA, $265 million from vehicle license fees, and $40 million from SHA.

Increased Fees and Penalties Boost MVA Funding. To address a projected funding shortfall in the MVA, the Legislature adopted the Governor's proposal to increase various fees and penalties and to impose new fees charged by DMV. These actions are expected to increase MVA revenue by $76 million in 2002-03 and $98 million annually thereafter, as shown in Figure 17. Specifically, the following penalties and fees will be increased:

|

Motor

Vehicle Account Revenue Increases |

||

|

(In Millions) |

||

|

Program |

2002-03 |

Ongoing |

|

Higher

penalties for late registration |

$25 |

$50 |

|

Doubled

charges for sale of information |

40 |

40 |

|

Merge Motor

Carriers Permit fee with MVA |

9 |

2 |

|

New driving

test retake fee |

� |

2 |

|

DUI appeal

and license reissuance fees |

2 |

4 |

|

Totals |

$76 |

$98 |

• Higher penalties for late vehicle registration, including an increase from $10 to $17 for missing the registration deadline by less than ten days, and from $165 to $217 for missing the deadline by more than two years.

• Increased fees of $4 per record, instead of $2, for the purchase of driver information.

• A new $5 fee for retaking a driving test, a new $120 fee for second appeals of driving-under-the-influence (DUI) sanctions, and an increase from $100 to $125 in the fee for the reissuance of a license for former DUI offenders.

The budget provides a total of about $3.6 billion for resources programs, of which about $1.1 billion is from the General Fund, $1.3 billion is from special funds and federal funds, and about $1.2 billion is from bond funds. Of the bond funds, about $636 million is from Proposition 40 (the $2.6 billion resources bond approved by the voters in March 2002).

The total funding for resources programs is a decrease of about $1.4 billion below estimated 2001-02 expenditures. This decrease largely reflects an $800 million reduction in bond fund expenditures for park and water projects. The decrease also reflects significant one-time General Fund expenditures that occurred in 2001-02, including funding for energy conservation and efficiency programs and for local flood control projects. In addition, 2001-02 resources expenditures reflect a particularly high level of expenditures for emergency fire suppression.

The overall budget solution includes a number of loans and transfers to the General Fund from resources-related special funds. These loans and transfers are highlighted in the "Revenue" chapter of this report.

Significant features of the resources budgets are discussed below.