May 17, 2004

The state's near-term fiscal picture has

improved significantly as a result of an improved

revenue outlook and the one-time receipt of funds.

Despite this improvement, the state's long-term fiscal outlook relative to the January budget

plan has worsened. The May Revision plan misses an opportunity to make further progress

toward eliminating the state's long-term structural

imbalance.

Introduction

The state's near-term fiscal picture brightened significantly in the May Revision,

although an imposing structural budget problem still

exists that will require further major actions in

the future. The updated budget plan assumes a roughly $3.6 billion increase in resources. It

uses these increases to cover various added costs

in the budget that have materialized, partly

associated with the Governor's withdrawal of

certain previously proposed spending cuts in health

and social services programs. It also reduces the amount of Proposition 57 bonds to be sold

to cover the 2004-05 budget shortfall, thereby preserving these bond proceeds for use

in future years. The updated spending plan also reflects significant new agreements

involving local governments and higher education.

LAO Bottom Line

On the positive side, the plan continues to have real savings in numerous areas of the budget. If adopted, it would result in a balanced budget in 2004-05, and leave the state with enough Proposition 57 bond proceeds to temporarily cover much of the structural budget gap for 2005-06.

Despite these positive features, however, we believe the May Revision plan misses an important opportunity to make more meaningful inroads toward eliminating the state's long-term structural imbalance—a persistent gap that the state will not be able to simply "grow its way" out of. This is because the May Revision proposal relies on less ongoing savings than did the January plan, and in other instances, the May Revision adds to the state's future spending commitments. These factors have resulted in a worsening in the state's long-term fiscal outlook relative to the January proposal, even though the underlying revenue picture has brightened.

For these reasons, we believe that it will be important for the Legislature as it reviews

the Governor's plan to look for opportunities for additional ongoing budget solutions, as well

as avoid actions which either add to the state's future spending commitments or reduce

its flexibility to deal with its projected future

budget shortfalls.

Key Changes Contained in the May Revision

In January, the Governor proposed a budget that dealt with a roughly $17 billion estimated shortfall. About $5 billion of the January solution was related to the use of bond proceeds authorized by Proposition 57, anticipated to be approved by voters at the March 2004 election. (These bonds were intended to replace a smaller statutory bond that had been previously approved in conjunction with the 2003-04 budget.) After voter approval of Propositions 57 and Proposition 58 in March 2004, the state was thus left with a $12 billion fiscal shortfall, which the January budget plan proposed to close through a variety of spending reductions, funding shifts, additional borrowing, and a diversion of local property taxes for the benefit of the state.

Although many of these elements remain in the May Revision proposal, the plan also has undergone some major changes.

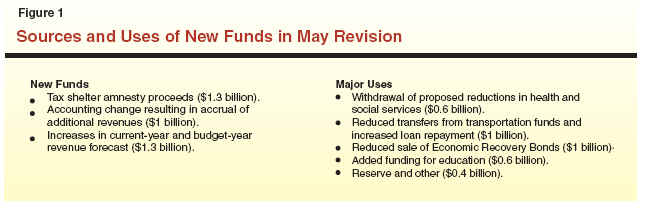

New Funds Have Become Available. As noted above, the May Revision relies on about $3.6 billion in new resources relative to the January budget proposal. As shown in Figure 1 and identified earlier, these are related to: (1) about $1.3 billion associated with greater-than-expected receipts from a previously enacted tax shelter amnesty program, (2) another roughly $1.3 billion related to an increase in the administration's forecast of tax collections in 2003-04 and 2004-05 combined, and (3) $1 billion from an accounting adjustment which results in the accrual of tax revenues attributable to prior-year liabilities. While this accounting change improves the state's budget condition, there is no actual effect on cash received by the state.

How the Added Funds Are Used. These new funds are used by the administration to scale back or eliminate savings that had been proposed in January related to Medi-Cal provider rates, In-Home Supportive Services (IHSS), and transfers from transportation funds. The administration is also proposing to reduce the amount of Proposition 57 bonds utilized by $1 billion (from a total of $12.3 billion to $11.3 billion), leaving the remainder of the $15 billion in authorized bonds available to offset budget shortfalls in future years. The remainder of the funds are used to cover cost increases related to caseloads, erosion of proposed current-year savings, adverse court decisions, and other factors.

Other Changes. In other areas, the

May Revision reflects recent multiyear agreements between the Governor and various

parties relating to future funding for higher

education and local governments. These are in addition

to the agreement included in the January budget plan related to Proposition 98 education.

Collectively, the agreements result in budget

savings consistent with what was proposed in January

in the near term, but added costs in the longer term.

Governor's General Fund Condition

Figure 2 shows the administration's projection of the General Fund's condition in 2003-04 and 2004-05, taking into account the May Revision budget proposals.

|

Figure 2 Governor�s May Revision

General Fund Condition |

||

|

(In Millions) |

||

|

|

2003-04 |

2004-05 |

|

Prior-year fund balance |

$3,837 |

$2,816 |

|

Revenues and transfers |

74,591 |

76,688 |

|

Economic Recovery Bond proceeds |

2,012 |

� |

|

Total

resources available |

$80,440 |

$79,504 |

|

Expenditures |

$75,612 |

$79,590 |

|

Deficit Recovery Fund transfer |

2,012 |

-2,012 |

|

Total

expenditures |

$77,624 |

$77,578 |

|

Ending fund balance |

$2,816 |

$1,927 |

|

Encumbrances |

929 |

929 |

|

Reserve |

$1,887 |

$998 |

|

|

||

|

Detail may not total due to rounding. |

||

2003-04. Reflecting the additional revenues from tax amnesty and accounting-related accruals (which are being reflected as an adjustment to the 2003-04 carry-in balance), the budget's condition in the current year is significantly stronger than estimated in January. The figure shows that the current year is now expected to conclude with a reserve of $1.9 billion, which is well above the $679 million estimated in January.

2004-05. In the budget year, the administration projects revenues of $76.7 billion. This is roughly $900 million less than proposed expenditures of $77.6 billion, thus generating a modest operating shortfall. However, the spending totals in the budget year are reduced by $2.1 billion to reflect the use of Economic Recovery Bond proceeds to support General Fund programs. Absent these bond proceeds, a significantly larger operating shortfall of $2.9 billion would result, given that expenditures would be $79.6 billion.

In the remaining sections of this brief we discuss in more detail: (1) the

administration's economic and revenue projections,

(2) key programmatic features of the May Revision,

and (3) our assessment of the May Revision's

short-term and long-term fiscal implications.

Economic and Revenue Projections

Modest Downward Revisions to Economic Forecast

Economic developments in recent months have been generally consistent with both the administration's January forecast and our own February forecast, which called for accelerating income and job growth in California. Positive signs include healthy residential housing sales and new construction, a notable improvement in exports of California-made goods, healthy gains in personal income tax withholding, and upbeat profit and sales reports by California businesses. Job growth has continued to lag in California, although the just-released report for April finally provided encouraging evidence that California's labor markets also are improving.

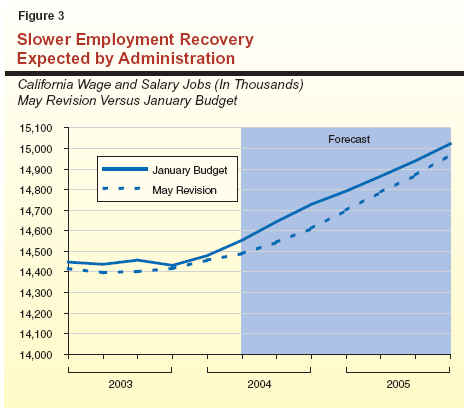

Reflecting these developments, the May Revision economic forecast is similar to the January projections, but assumes that the growth in California employment and personal income will be a bit more restrained than was anticipated in January (see Figure 3). The updated projection assumes that, after falling by 0.3 percent in 2003, wage and salary employment will grow by 0.8 percent in 2004 and 2.1 percent in 2005. California personal income growth is now forecast to accelerate from 3.7 percent in 2003 to 5.4 percent in 2004 and 5.6 percent in 2005. The administration also indicates that—given the recent positive economic developments—it believes that the downside risks associated with its economic forecast for the next two years have declined. We agree with that assessment.

Revenue Forecast Revised Upward

Despite its slightly more restrained economic forecast, the administration has revised upward its revenue projections. These revisions are driven by stronger-than-expected tax receipts from key sources such as personal income tax withholding. Overall, the administration has increased its forecast of General Fund tax revenues by $753 million in the current year and $505 million in 2004-05—for a two-year total of $1.3 billion.

LAO Assessment. The

administration's economic and revenue projections are similar

to our own forecasts for the current and budget years. Recent

employment and income trends are consistent with

our February projections, and we continue to believe that California's economic

expansion will accelerate to a moderate pace

through 2004 and 2005. On the revenue side, we do have differences from the administration

with respect to individual tax projections—namely,

we project that sales taxes will be stronger and

that corporation taxes will be weaker than assumed in the May Revision. However, our bottom

line total revenue estimate for all sources is up

just $300 million from the administration in

the current and budget years combined.

Key Features of the May Revision

How Plan Addresses the Shortfall

The May Revision proposes about $17 billion in solutions to cover the shortfall that remains after taking into account both the new resources (discussed above) and the offsetting cost increases related to higher caseloads, court decisions, and erosion of savings related to the proposed mid-year spending reductions. As shown in Figure 4:

|

Figure 4 Allocation of May Revision Proposed Solutions |

|||

|

(In Billions) |

|||

|

|

2003-04

and |

2004-05 |

Two-Year

Total |

|

Program

reductions and savings |

$1.4 |

$4.0 |

$5.4 |

|

Economic

Recovery Bonds: |

|

|

|

|

Proceed amounts |

0.7 |

2.0 |

2.7 |

|

Reduced debt service |

� |

1.3 |

1.3 |

|

Other loans

and borrowing |

1.6 |

2.2 |

3.8 |

|

Fund shifts,

transfers, and revenues |

0.3 |

2.4 |

2.7 |

|

Local

government-related |

� |

1.4 |

1.4 |

|

Totals |

$4.0 |

$13.2 |

$17.2 |

|

Detail may not total due to rounding. |

|||

One-Time Solutions in the May

Revision. Overall, about $5 billion of the May

Revision solutions are strictly one time in nature.

These include the use of $2 billion in

Proposition 57 bond proceeds; $1 billion in pension

obligation bond proceeds; $1.2 billion related to the

loan of Proposition 42 funds from

transportation special funds; and a variety of one-time

savings from delayed Medi-Cal checkwrites, special

fund loans, and other funding shifts. The expiration

of savings from these one-time solutions is a key factor behind the re-emergence of the

structural budget shortfall in 2005-06 and beyond.

Program Spending

Figure 5 shows the programmatic distribution of proposed General Fund spending in 2004-05. It shows that overall spending would total about $77.6 billion in both the current and budget years. It should be noted, however, that the spending totals in both of these years are distorted by accounting changes, funding shifts, and other one-time factors. For example:

|

Figure 5 Summary of May Revision

Spending Proposal |

||||

|

(Dollars in Millions) |

||||

|

|

|

2004-05 |

||

|

|

2003-04 |

Amount |

Change |

|

|

Education Programs |

|

|

|

|

|

K-12�Proposition

98 |

$28,055 |

$30,874 |

10.0% |

|

|

Community

Colleges�Proposition 98 |

2,272 |

3,035 |

33.6 |

|

|

UC/CSU |

5,538 |

5,101 |

-7.9 |

|

|

Other |

2,708 |

4,176 |

54.2 |

|

|

Health and Social Services Programs |

|

|

|

|

|

Medi-Cal |

$9,947 |

$11,908 |

19.7% |

|

|

CalWORKs |

2,064 |

1,987 |

-3.7 |

|

|

SSI/SSP |

3,157 |

3,371 |

6.8 |

|

|

Other |

7,799 |

7,930 |

1.7 |

|

|

Youth and Adult Corrections |

$5,424 |

$6,215 |

14.6% |

|

|

Vehicle License Fee Offset |

$2,689 |

� |

-100.0% |

|

|

Deficit Recovery Fund Transfer |

$2,012 |

-$2,012 |

� |

|

|

All Other |

$5,959 |

$4,994 |

-16.2% |

|

|

Totals |

$77,624 |

$77,578 |

-0.1% |

|

Figure 6 summarizes the May Revision's main programmatic features. These proposals are discussed in greater detail below.

|

Figure 6 Key Expenditure-Related

May Revision Budget Proposals |

|

Education |

|

Retains January proposal to suspend Proposition 98 and

provide $2 billion less than guarantee. Modestly increases K-12

funding from January proposal for various purposes.

Modifies January proposal to reduce funding. Modifies student fee

increases. Includes new compact with UC and CSU beginning in

2005‑06 relating to future funding and fee increases. |

|

Judiciary and Criminal Justice |

|

Increases corrections savings proposed in January from $400 million

to $477 million, mostly through contract renegotiations, and adds

funding for inmate population adjustments and the

Increases unallocated reduction to the courts, and adds funding

for court security, and court employee and judges� salaries and

benefits. |

|

Health Services |

|

Reverses January proposals relating to provider rate reductions

and enrollment caps.

Includes new reductions related to delayed Medi-Cal checkwrites

and reduced pharmacy reimbursement rates. |

|

Social Services |

|

Drops January proposal to eliminate IHSS �residual� program

and instead pursues a federal waiver, which would result in federal

share-of-cost for the program.

Retains January proposals to eliminate cost-of-living adjustments

for CalWORKs and SSI/SSP grants, and to further reduce CalWORKs grants

by 5 percent.

Drops January proposal to cap enrollments and create county block

grants for programs for legal immigrants. |

|

Transportation |

|

Drops proposals to transfer transportation funds to the General

Fund in 2003‑04.

Modifies January proposal to suspend Proposition 42 transfer

to transportation in 2004‑05. Instead loans amount to General Fund

with repayment in 2007-08. |

|

Local Government |

|

Limits ongoing $1.3 billion property tax shift from local

governments (proposed in January) to two years.

Provides local governments with additional property taxes in

return for equal reduction in vehicle license fee backfill payments. |

|

Statewide |

|

Assumes ongoing revenues of $450 million from proposal to

allocate 75 percent of court-related punitive damages awards to the

General Fund.

Assumes $464 million in savings from employee contract

renegotiations.

Includes other savings related to contracting and unallocated

reductions. |

Proposition 98—K-14 Education

Figure 7 displays May Revision changes in Proposition 98 funding from those proposed in the January budget.

|

Figure 7 May Revision Changes in

Proposition 98 Funding |

|||

|

(In Millions) |

|||

|

|

2002-03 |

2003-04 |

2004-05 |

|

January budget |

$43,624 |

$45,945 |

$46,714 |

|

May Revision |

43,694 |

46,212 |

46,989 |

|

Differences |

$71 |

$267 |

$275 |

|

K-12 |

(62) |

(230) |

(147)a |

|

Community Colleges |

(9) |

(36) |

(128) |

|

|

|||

|

a

Includes $2 million increase to other agencies. |

|||

|

Detail may not add due to rounding. |

|||

Current Year. In the January budget, the Governor provided $448 million less than required to meet the Proposition 98 minimum guarantee for 2003-04, creating a settle-up obligation the Governor proposed to fund starting in 2006-07. The May Revision continues to defer that settle-up obligation. Because of higher current-year General Fund revenues and other adjustments, the 2003-04 minimum guarantee has now increased $267 million from the January estimate. The May Revision proposes to use these additional one-time funds to reduce K-12 education's credit card balance and fund one-time activities for community colleges—maintenance, special repairs, instructional equipment, and library materials.

Budget Year. The May Revision continues to assume a proposed $2 billion suspension of Proposition 98 for 2004-05. Even with the $2 billion suspension, the Governor's budget provides enough resources to fully fund attendance growth, COLAs, and some program expansion. The Governor's local government proposal transfers $4 billion in local property tax revenues from school districts and community colleges to local government. To hold school districts and community colleges harmless, the Governor backfills this transfer with $4 billion from the General Fund. In 2004-05, the Governor increases Proposition 98 funding by $275 million from the January budget, reflecting the increase in the minimum guarantee caused by a forecasted increase in General Fund revenues and other adjustments. The May Revision provides an additional $147 million for K-12 and $128 million for community colleges.

LAO Comments. We continue to

recommend suspending the Proposition 98

minimum guarantee for 2002-03 and 2003-04. This

recommendation would result in one-time General Fund savings of $267 million in the current

year and eliminate a $935 million settle-up

obligation the Governor proposes to fund starting in 2006-07. For 2004-05, we continue to recommend that the Legislature balance K-14

funding with other non-Proposition 98 programs

to determine the appropriate suspension level without regard to the exact suspension

level proposed by the Governor.

K-12 Education

Figure 8 shows the 2004-05 changes in major K-12 budget proposals compared to the 2003-04 Budget Act. In April, the Governor modified his January proposal to reflect his revised agreement with the Education Coalition. The April Finance Letter reduced funding for instructional materials, deferred maintenance, and K-12 and community college equalization. These savings were redirected to discretionary COLAs for K-12 and community colleges, and provided partial restoration of the "deficit factor"—a general purpose reduction school districts experienced in 2003-04.

|

Figure 8 Major Adjustments to K-12

Proposition 98 Funding |

|||

|

Change From 2003-04 Budget Act |

|||

|

|

2004-05 |

||

|

Program |

January

Budget |

April

Letter |

May

Revision |

|

Revenue limits |

|

|

|

|

COLA |

$555 |

$555 |

$724 |

|

Growth |

280 |

280 |

162 |

|

K-12

equalization |

110 |

82 |

110 |

|

Deficit

factor reduction |

� |

270 |

270 |

|

Instructional materials |

$188 |

� |

$100 |

|

Deferred maintenance |

$173 |

� |

$107 |

|

Net reduction of deferral costsa |

-$1,036 |

-$1,036 |

-$1,029 |

|

Other changes |

$163 |

$216 |

$136 |

|

Total Changes |

$433 |

$367 |

$580 |

|

|

|||

|

a

In 2003-04, the state used over $1 billion to pay off categorical

and revenue limit deferrals. These costs were one-time in nature, and

the funds can be used for ongoing purposes beginning in 2004-05. The

budget takes advantage of these freed-up one-time funds to support other

K-14 priorities. |

|||

The May Revision restores $107 million for deferred maintenance, $100 million for

instructional materials, and $28 million for

revenue limit equalization of the reductions proposed

in April. Revenue limit funding increases by $169 million to reflect a higher COLA

(from 1.84 percent to 2.41 percent) and decreases

by $118 million to reflect slower enrollment growth. The budget reduces

Proposition 98 support for child care by $56 million,

reflecting Stage 2 and Stage 3 caseload

adjustments, funding shifts and reductions in savings

estimates associated with the Governor's child

care reform proposals (see additional discussion

in social services section below). Increased

federal funds and Proposition 98 funds are provided

for various special education purposes:

(1) Licensed Children's Institutes ($38 million),

(2) mental health services ($31 million), and

(3) COLA ($21 million).

Community Colleges

For the current year, the May Revision would provide an additional $28.4 million for scheduled maintenance, repairs, and instructional equipment and materials. For the budget year, the May Revision increases Proposition 98 General Fund support for California Community Colleges (CCC) by an additional $620.4 million from the January level. Most of this amount ($492.6 million) is related to the reduction in local property tax revenue due to the Governor's proposed deal with local governments (discussed later in this report). The remaining $127.8 million General Fund augmentation for CCC includes the following major proposals:

UC and CSU. The May Revision contains mainly technical changes for the University of California (UC) and California State University (CSU) budgets. Total 2004-05 General Fund support for the two systems would increase by $20.8 million compared to the January budget plan. The May Revision, however, reflects two significant changes to the administration's fee proposals—an undergraduate student fee increase of 14 percent (rather than 10 percent) and graduate student fee increases of between 20 percent and 25 percent (rather than 40 percent).

The May Revision states that the Governor has established a six-year "compact" with UC and CSU. Under this compact, the Governor commits to include annual funding increases for UC and CSU in his budget proposals beginning in 2005-06. (See box, below, for a summary of the compact's major features.) The compact is not binding upon the Legislature. We identify our concerns with the compact at the end of this section.

|

Major Features of the Governor's Compact With UC and CSU The compact would be in effect from 2005-06 through 2010-11. Under the agreement, the Governor commits to include the following augmentations in his annual budget proposals:

For their part, the segments commit to the following:

|

The May Revision retains the Governor's January proposal to eliminate all General Fund support for outreach programs at UC and CSU. However, it references a "negotiated assurance" that UC and CSU will in 2004-05 spend $12 million and $45 million, respectively, of their overall funding on outreach programs. The administration provides no details about which programs would be funded and from what funding source.

Student Aid Commission. For the budget year, the May Revision makes a net General Fund reduction of $73.3 million from the level proposed in January. This includes the following major changes:

LAO Comments. We have concerns with several of the Governor's proposals in the May Revision.

The May Revision dropped a number of January budget proposals for ongoing spending reductions, but did propose some new steps (mostly one-time in nature) that would partly offset these changes.

Provider Rate Reductions. Most of the additional spending results from a proposal to largely reverse the assumption of savings from a proposed 5 percent reduction in the rates paid to certain Medi-Cal providers, and to completely drop a proposal for a further 10 percent reduction in these provider rates. A successful legal action challenging the 5 percent reduction meant it was uncertain whether these reductions could be achieved. These proposals alone account for almost an additional $850 million increase in General Fund spending.

New Medi-Cal Savings. About $143 million in one-time savings in the Medi-Cal Program would be achieved by postponing a checkwrite for the reimbursement of providers for services from 2004-05 into 2005-06. The administration had proposed such a delay in January for one such checkwrite, but its May Revision plan now would also affect a second checkwrite to achieve additional savings. Additional and ongoing Medi-Cal savings of about $79 million are expected to result from a proposal to reduce pharmacy reimbursement rates. Also, the May Revision plan reflects assumptions that tightening of Medi-Cal eligibility administration and other policy changes will reduce the program caseload by about 2.1 percent relative to the Governor's January budget proposal for 2004-05.

Enrollment Caps and County Block Grants. The May Revision plan dropped proposals to impose enrollment limits (caps) on all or part of the population served by the Healthy Families Program, Medi-Cal, state mental hospitals, and various public health programs. A January proposal to shift part of the Healthy Families coverage of certain legal immigrants into a county block grant was withdrawn, but additional savings in the program would be achieved in 2005-06 through an increase in premiums for higher-income families whose children are eligible for coverage.

Mental Health and Public Health. The May Revision also dropped proposals from January to reduce rates paid for community mental health services and assumed a slower growth rate for specialty mental health services for children eligible for Medi-Cal. Additional funding would be added to the budget for AIDS treatment programs, federal funding for the Community Challenge Grant program for prevention of teenage pregnancies would be restored, and a proposal to implement copayments for participants in the Genetically Handicapped Persons Program would be scrapped.

Developmental Services. The spending

plan provides that community services for persons

with developmental disabilities would be subject

to statewide purchase of service standards, and copayments would be expanded to certain

clients in higher-income families. Also, the closure

of Agnews Developmental Center would take one year longer than previously proposed.

Closure would now be completed in June 2006.

Social Services

In-Home Supportive Services (IHSS). The May Revision restores General Fund support for the residual (state-only) program (a cost of $365 million) and seeks a waiver to obtain federal Medicaid funding for the residual program (a General Fund savings of $169 million). The May Revision defers implementation of the administration's proposal to reduce services for common area upkeep for recipients living with relatives until a separate federal waiver is approved. The May Revision continues the January proposal to limit state participation in provider wages to the minimum wage.

CalWORKs and SSI/SSP Grants. The May Revision retains (1) the assumption that the October 2003 California Work Opportunity and Responsibility to Kids (CalWORKs) COLA is not required by current law and (2) the proposal to suspend the July 2004 COLA. Implementation of the proposed 5 percent grant reduction is delayed until October 2004. For Supplemental Security Income/State Supplementary Program grants, the May Revision retains the proposals to suspend the January 2005 state COLA and not pass through the federal COLA.

CalWORKs Welfare Reform. With the exception of some modifications noted below, the May Revision retains the January welfare reform proposal to increase work participation by imposing greater sanctions and limiting allowable participation activities. However, the May Revision modifies the January proposal by making the required up-front job search a county option and provides an additional $15.4 million for welfare-to-work services, including community service slots.

Child Care Reforms. The May Revision modifies the January child care proposal in several respects. First, current recipients of Stage 3 child care (along with the associated funding) would shift into guaranteed slots in existing voucher programs without time limits. Second, nonaided recipients of Stage 1 and Stage 2 child care would have two years of Stage 3 eligibility when they reach that stage (instead of one year per the January proposal). Consistent with the January proposal, future CalWORKs child care recipients and current recipients of cash aid would remain limited to two years in Stage 2 and one year in Stage 3. Third, the May Revision scores less savings ($39 million) from the proposal to shift 11- and 12-year-olds receiving child care to after school programs because it recognizes that some families may not have access to appropriate after school programs. Finally, under the May Revision, families pursuing education may receive child care for more than two years if they are working at least 20 hours per week (the January proposal made no exception for those working part-time).

Programs for Children and Child Support. The January budget assumed that unspecified Foster Care reforms would result in $20 million in General Fund savings. The May Revision now proposes specific reforms resulting in $15.2 million in savings. These reforms include reducing the grant level for nonrelated legal guardians appointed by the probate court and limiting Foster Care eligibility redeterminations to once per year. With respect to child welfare, the May Revision establishes a 30 percent share of cost for county receipt of certain child welfare services funds. This shifts $17.1 million in state costs to the counties. Finally, it is our understanding that subsequent to the release of the May Revision, the administration has received written federal authorization to defer payment of the $220 million federal child support automation penalty until the fourth quarter of federal fiscal year 2005, the beginning of the state's 2005-06 fiscal year.

Enrollment Caps and County Block Grants. The May Revision rescinds the January budget proposal to establish enrollment caps on various social services (and health) programs. Dropped are the enrollment caps for CalWORKs for legal immigrants, California Food Assistance Program (for immigrants), and Cash Assistance Program for Immigrants. The May Revision also withdraws the proposal to establish block grants for these programs.

LAO Comments. As noted above, the administration assumes savings of

$169 million based on federal approval of a waiver to

allow current IHSS residual program recipients to

be eligible for funding from the federal Medicaid program. Proposed trailer bill language

provides the administration with broad authority

to negotiate this waiver, and, depending on the outcome of the final negotiations, the

administration could terminate benefits for any

recipient who would not be federally eligible under

the terms of the negotiated waiver. Finally, we would also note that in order to avoid

$228 million in costs associated with the October

2003 CalWORKs COLA (as assumed in the May Revision), the state would have to prevail

on appeal in the Guillen court case.

Judiciary and Criminal Justice

Corrections. In January, the Governor proposed a $400 million unallocated reduction in corrections. The May Revision includes specific proposals to achieve corrections savings of $477 million. The plan has four components: (1) renegotiation of the correctional officer contract ($300 million), (2) parole reforms aimed at reducing parolee recidivism ($85 million), (3) health care cost containment ($48 million), and (4) operational efficiency savings ($43 million).

The May Revision increases spending ($175 million) to fully fund the projected inmate and ward populations in 2004-05. The higher inmate population reflects delayed implementation of current-year parole reforms, as well as an increase in new admissions. In addition, the May Revision adds funding to correct historical budget shortfalls in medical guarding and transportation and administrative segregation ($35 million), and to implement the Valdivia remedial plan for parole revocation ($58 million).

Judicial and Trial Court Funding. The May Revision proposes a net increase of $94 million for the judicial branch, consisting of $89.5 million for Trial Court Funding, and $4.3 million for Judicial. This reflects augmentations of approximately $100 million for court security, court employee, and judges' salaries and benefits, which are partially offset by an additional $11 million unallocated reduction. This brings the total unallocated reduction for the trial courts to $70 million in 2004-05.

The administration also proposes a number of policy reforms to achieve about $10 million in court operations savings. These include adopting electronic reporting in certain case types, eliminating the government exemption from filing fees, and various changes relating to jury trials. In addition, a workgroup will be established to examine the existing court labor negotiation process, and make recommendations for achieving state-level approval of negotiated agreements.

Punitive Damages. The May Revision proposes to amend state law to require that 75 percent of punitive damage awards in civil lawsuits be deposited into a newly established Public Benefit Trust Fund administered by the State Controller's Office. The remaining 25 percent would go to plaintiffs, as well as cover attorney's fees. Under the proposal, only one award of punitive damages could be recovered in cases involving product liability. In addition, the proposal places a cap on damages that can be awarded against small businesses. The budget allocates $450 million from this fund in 2004-05.

LAO Comments. Overall, the budget proposal for the judiciary and criminal justice programs has merit. For the most part, the budget for corrections is based on reasonable population estimates. Many of the corrections budget proposals are consistent with legislative priorities. For example, it builds on parole reforms adopted as part of the 2003-04 Budget Act. The budget also attempts to address aspects of California Department of Corrections' (CDCs) budget that have caused annual deficiencies, and strengthen the ability of CDC headquarters to control spending at the prison level.

Although the May Revision has merit, it contains several significant risks. First, the administration's plan to control corrections spending hinges on renegotiation of the Bargaining Unit 6 contract, for which no details are available. Second, in light of current-year delays in implementing policy changes, the estimated savings from these new policy changes in the areas of parole and health care may be overstated. Similarly, we believe the savings estimates from court proposals also may be overstated.

Third, based on our review of the available data on punitive damages awards, we believe the $450 million estimate for 2004-05 is high. If the Legislature adopts this policy change, a more realistic estimate of the budget-year impact is $200 million.

Finally, due to the limited detail provided at this point, and

the broad policy implications of some of the proposed changes, the Legislature may wish

to handle some of these proposals through the policy process rather than the budget

process. Examples include the administration's proposal

to require community hospitals to provide inmate health care at Medi-Cal rates, as well as

proposed changes in the jury process.

Transportation

The Governor's May Revision proposes a number of changes in transportation funding relative to the January budget.

Proposition 42 Suspension to Be Repaid

by 2007-08. Due to higher gasoline prices, the

total transfer under Proposition 42 is now

estimated at $1.207 billion, $80 million more than

estimated in the January budget. While the May Revision still suspends the transfer as

proposed in January, the total suspended amount will

now be repaid to transportation by

2007-08, as shown in Figure 9.

|

Figure 9 Transportation Loans and

Repaymentsa |

||||||

|

(In Millions) |

||||||

|

|

To

General Fundb |

|

To TCRFc |

|||

|

Year |

From SHA |

From TCRF |

From TIF |

|

From SHA |

From PTA |

|

2000-01 |

� |

� |

� |

|

$2 |

� |

|

2001-02 |

$173 |

$238 |

� |

|

41 |

$180 |

|

2002-03 |

-173 |

1,145 |

� |

|

520 |

95 |

|

2003-04 |

� |

� |

$862 |

|

-100 |

� |

|

2004-05 |

� |

-383 |

1,207 |

|

-184 |

-36 |

|

2005-06 |

� |

-1,000d |

� |

|

� |

� |

|

2006-07 |

� |

� |

� |

|

-279 |

� |

|

2007-08 |

� |

� |

-1,207 |

|

� |

-239 |

|

2008-09 |

� |

� |

-862 |

|

� |

� |

|

|

||||||

|

SHA =

State Highway Account; TCRF = Traffic Congestion Relief Fund; TIF =

Transportation Investment Fund; PTA = Public Transportation Account. |

||||||

|

a

Amounts do not include interest. |

||||||

|

b

Positive numbers are amounts payable to the General Fund,

negative numbers are payable from the General Fund.

|

||||||

|

c

Positive numbers are amounts payable to TCRF, negative

numbers are payable from TCRF. |

||||||

|

d

Potentially to be repaid from revenues resulting from

renegotiation of tribal gaming compacts. |

||||||

Partial Repayment of Outstanding Transportation Loans. Figure 9 also shows that the May Revision proposes to provide a total of $383 million to the Traffic Congestion Relief Fund (TCRF) in the budget year as a partial loan repayment. Funding would include (1) $243 million from the General Fund and (2) $140 million in spillover revenue (from gasoline sales tax) that otherwise would accrue to the Public Transportation Account (PTA). The TCRF would then transfer $184 million to the State Highway Account (SHA) and $36 million to the PTA as partial repayment of outstanding loans.

Traffic Congestion Relief Program (TCRP) to Continue. After making the repayments to the SHA and PTA noted above, $163 million would remain in TCRF to pay the ongoing costs of TCRP projects that have been approved for funding by the California Transportation Commission. Thus, the May Revision would allow the TCRP to continue, rather than repealing the program as proposed in January. However, continuation of the program in future years is uncertain. This is because the May Revision includes a trailer bill provision that would make the continuation of the program dependent on a review and prioritization of TCRP projects by the Business, Transportation and Housing Agency.

One-Time Tribal Gaming Revenue to Potentially Repay 2005-06 Obligation. After repaying $383 million to the TCRF in the budget year as described above, the General Fund would still owe the TCRF $1 billion in 2005-06. The May Revision proposes a budget control section that would allocate any potential one-time revenue from the renegotiation of tribal gaming compacts to repay this loan. In the event that the tribal gaming funds do not materialize, existing law would require repayment of this amount from the General Fund by the end of 2005-06.

Accounting Shift Proposal Reduced, but Uncertainty Remains. The May Revision reduces the amount expected from a federal fund accounting shift from $800 million to $200 million. As a result, the May Revision reverses a mid-year proposal (submitted in November 2003) to transfer $606 million from the SHA to the General Fund. While $200 million appears more realistic than the original proposal, the exact amount that can be generated by this proposal remains uncertain. Furthermore, achieving this one-time benefit would create ongoing workload for Caltrans. The Legislature should consider whether the reduced benefits of this proposal still outweigh the costs.

LAO Comments. When combined, the Governor's Mid-Year budget and January budget proposed to use more than $2 billion in transportation money to aid the General Fund. The May Revision reverses most of the mid-year proposals and transfers some additional General Fund money to transportation, reducing transportation aid to the General Fund in the current and budget years by about $1 billion. The proposed suspension of Proposition 42 benefits the General Fund, but this suspension provides one-time money only. Furthermore, the May Revision's proposal to repay this money to transportation in 2007-08 increases the General Fund's obligations beyond the budget year.

Conversely, transportation would be better off than proposed in the January budget

by almost $600 million in the current and

budget years. Transportation would also receive

repayment of the Proposition 42 suspension, making

it better off in future years as well. However, as

we indicated in the Analysis of the 2004-05 Budget

Bill, instability remains the central problem of

transportation funding in California, and this

problem remains unaddressed in the May Revision.

Local Government

In its May Revision, the administration proposes the Legislature place before the statewide voters in November a constitutional amendment to enact far-reaching changes to state-local finance. Over time, the proposed constitutional provisions would significantly influence state decision making regarding cities, counties, special districts, and redevelopment agencies. (K-14 districts, in contrast, are largely unaffected by the proposed measure.)

In general, the measure greatly restricts state authority to reduce noneducation local government taxes, except for a $1.3 billion shift from these agencies in 2004-05 and 2005-06. The measure also includes a complex swap of VLF "backfill" revenues for K-14 property taxes and places into the constitution: (1) the current effective VLF rate, (2) certain existing statutory provisions relating to local finance, and (3) changes to reform the mandate reimbursement process. Figure 10 summarizes the major provisions in the local government proposal and Figure 11 (next page) provides detail regarding the proposed allocation of the $1.3 billion local government revenue shifts.

|

Figure 10 Major Provisions of the

Administration�s Local Government Initiative |

|

|

Policy Area |

Provisions |

|

Protection of major local government revenues |

State may not reduce the rate of the sales tax, or reallocate or

delay any local government�s share of revenues from the property tax,

sales tax, or vehicle license fee (VLF), except as provided below.

Authorizes a $1.3 billion

shift of local government revenues in 2004‑05 and 2005‑06.

Places the current effective VLF rate (.65 percent) in the

constitution as the maximum rate. |

|

VLF backfill for property tax swap |

Shifts $4.1 billion of K-14 district property taxes to cities and

counties as replacement for VLF �backfill� revenues. (As a result,

the state would have higher spending on schools�to compensate for the

property tax loss�and commensurate lower spending on VLF backfill

payments.) |

|

Mandates |

Unfunded mandates sunset automatically, unless they pertain to

educational programs or employee rights or benefits.

Mandates may not be suspended in the budget.

State pays backlog of noneducation mandates (currently $1.1 billion)

over five years, beginning in 2006‑07.

The process for determining noneducation mandates is expedited. |

|

Figure 11 Allocation of $1.3 Billion

Revenue Shift |

|

|

Agencies�Amount |

Allocation

|

|

Cities� |

Each city�s reduction reflects its proportionate share of

statewide city vehicle license fee (VLF) revenues, property taxes, and

sales taxes.

Each city�s reduction must be at least 2 percent�and not

more than 4 percent�of the city�s general-purpose revenues. |

|

Counties� |

Each county�s reduction reflects its proportionate share of

2003‑04 county nonrealignment VLF. (This formula is similar to

imposing reductions on a population basis.) |

|

Special districts� |

Nonenterprise special districts�with the exception of fire,

police, healthcare, and library districts�shift 25 percent of

their property taxes.

If a fire, police, or healthcare district receives more than $1 million

per year from property taxes, the district shifts 3 percent of its

property taxes. Library districts and fire, police, and healthcare

districts receiving less than $1 million in property taxes are

exempt.

If this methodology

fails to generate $350 million statewide, the percentage reductions

are increased proportionately for districts other than police, fire, and

healthcare. |

|

Redevelopment agencies� |

Half of the amount ($125 million) is allocated among

redevelopment agencies based on their relative share of gross tax

increment revenues. The other half is allocated based on tax increment

net of revenues �passed-through� to other agencies. This formula is

similar to the Educational Revenue Augmentation Fund (ERAF) methodology

in current law.

If an agency fails to make its payment to ERAF, the city or

county sponsoring agency makes the payment.

The life of all redevelopment agencies is extended by two years. |

LAO Comments. Many elements of the administration's proposal still are under development. Our review of the preliminary materials provided by the administration indicates that the proposed constitutional provisions would increase the stability of local finance and increase accountability in the mandate process. We also find, however, that the measure would:

The Governor's initial budget plan proposed $875 million ($464 million General Fund) for the costs of pay and benefit increases included in existing collective bargaining agreements. This amount included:

The May Revision proposes to delete this funding from the budget. The administration states its intention to renegotiate these agreements to reduce budget-year costs. In the absence of renegotiated agreements, the administration still proposes to delete funding for the agreements. In this second case, the administration suggests relying on provisions in current law that make collective bargaining provisions with costs contingent upon the appropriation of funding. In other words, state employees would not receive the scheduled pay increases without the appropriation. In such a case, current law allows the parties to reopen negotiations on the contract.

LAO Comments. The renegotiation

of existing contracts is worth pursuing. Recent renegotiations, however, resulted in

minimal short-term benefits compared to the costs

of ongoing, long-term concessions. As to the alternative of not funding the existing

agreements, the Legislature has never previously pursued this approach. Consequently, the

consequences of such an approach are

unknown.

Unallocated Reductions

The January budget assumed that $150 million in current-year unallocated reductions to departments' budgets would be continued into 2004-05. Most of the current-year identified savings, however, were one-time in nature related to caseload adjustments. The May Revision assumes that $150 million in additional reductions will be identified during the budget year. Unlike this year's authority, the proposed language would allow the administration to reduce a program by any amount, including local assistance items.

LAO Comments. In the current year,

almost all of the savings are either double-counted

or unlikely to be achieved. The budget, therefore, overstates current-year savings by

about $150 million. For the budget year, the

proposed authority would give the administration

broad powers to reduce state spending. The

proposed language would allow the administration

to make these reductions without legislative notification or review. This would expose

legislative priorities to reductions.

Contract and Procurement Savings

The current-year budget assumed $50 million in ongoing General Fund savings from improved contracting and procurement practices. The budget and related legislation gave the administration new powers to generate these savings. To date, the administration has identified no savings from these provisions. Yet, the administration has increased the estimate of achievable General Fund savings in 2004-05 from $50 million to $96 million.

LAO Comment. The administration has

been unable to identify specific opportunities for immediate savings, making budget-year

savings questionable.

Indian Gaming Revenues

The budget assumes $500 million in ongoing General Fund revenues from the renegotiation of existing Indian gaming revenue sharing agreements with tribes. In addition, the administration suggests that the renegotiations will generate significant one-time revenues, which would be dedicated to the repayment of transportation-related obligations. The budget, however, does not assume any specific dollar amount of these one-time revenues.

LAO Comments. The administration

has provided no details as to the nature of any renegotiated agreements. It is unclear,

therefore, what level of revenues is realistic or what level

of increased gaming would be allowed under the proposal. Any agreements would require

approval by both the Legislature and the federal government.

Near-Term and Out-Year Implications

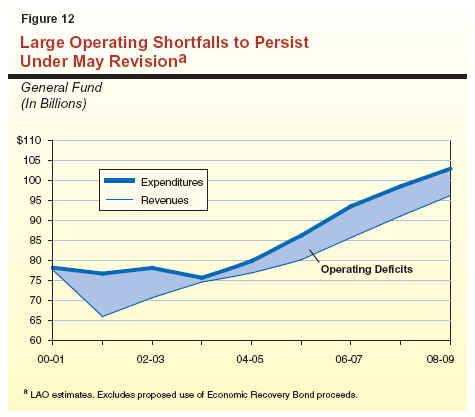

In this section, we examine the implications of the May Revision plan on the state's near-term and long-term outlook, using our own estimates of revenues and expenditures that would occur under the proposal. Our findings are illustrated in Figure 12 and Figure 13.

In discussing our findings, it is first helpful to recall our

principal finding about the January budget proposal

that we offered in our February Perspectives

and Issues. We noted there that, while the Governor's plan

nearly balanced in 2004-05, an over $7 billion

annual operating shortfall (the difference between annual expenditures

and revenues) would re-emerge in

2005-06, which absent corrective actions would persist through

our forecast period which ended in 2008-09.

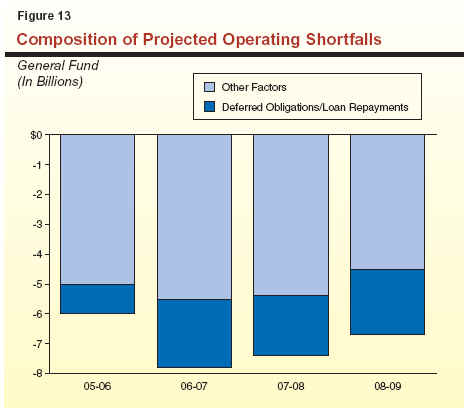

Our review of the May Revision indicates that, while the near-term budgetary situation has improved since January, the longer-term situation has worsened. Specifically, as shown in Figure 12 and Figure 13:

The out-year deterioration since January—despite the improvement in the revenue outlook—is primarily related to three factors: (1) the revision to the local property tax shift proposal, limiting it to two years instead of ongoing; (2) the withdrawal of budget-solution proposals in health and social services which would have produced ongoing savings; and (3) the change in the Proposition 42 transfer suspension into a deferral to 2007-08.

More generally, however, the persistence of ongoing budget shortfalls reflects the

still-large reliance on borrowing and other one-time

and limited-term savings in the 2004-05 budget

plan. In addition, the out-year shortfalls are

aggravated by repayments of loans and other

obligations created in the proposed as well as

previous budgets. These include repayment of:

(1) the VLF "gap" loan in 2006-07, (2) portions of

the Proposition 98 settle-up loan,

(3) Proposition 42 transportation deferrals in 2007-08 and

2008-09, and (4) deferred local mandate claims. As

shown in Figure 13, such repayments account

for between one-fourth and one-third of the annual operating shortfall

projected for each of the three years from 2006-07 through 2008-09.

Legislative Considerations

Given the near-term and longer-term implications discussed above of the May Revision budget plan, we believe there are three key considerations that the Legislature should focus on in reviewing the proposal:

We believe that making progress in dealing with the structural problem is of utmost importance, especially while the economy is in a growth mode. As we have indicated previously, the size and difficulty of addressing the problem means that all options should be kept on the table until the situation is resolved. Among the many options and alternatives to be considered are (1) the appropriate mix between spending and resources solutions, (2) whether it makes sense to suspend Proposition 98 in the current year (so as to avoid a large out-year obligation that will occur under the May Revision proposal), and (3) the extent to which added ongoing reductions should be adopted. The ultimate resolution of the structural budget problem will require further spending reductions and/or augmentations to resources.

This report was prepared by Brad Williams and

Jon David Vasche, with contributions from others in the office. The Legislative Analyst's Office (LAO) is a nonpartisan office

which provides fiscal and policy information and advice to the

Legislature. To request publications call (916) 445-4656. This report and others, as well as an E-mail

subscription service, are available on the LAO's Internet site at

www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000,

Sacramento, CA 95814.

Acknowledgments

LAO Publications

Return to LAO Home Page