May 16, 2005

The May Revision proposes to use about $4 billion in new funds generated from an improved revenue outlook to reduce budgetary debt and restore the Proposition 42 transfer to transportation. We believe the administration’s general approach of using the resources for debt reduction and one-time purposes is sensible in light of the state’s structural budget shortfall. We strongly urge the Legislature to aim at ongoing solutions which are of the same magnitude as the administration’s proposal.

In the May Revision, the administration is proposing to use a roughly $4 billion increase in revenues to eliminate new borrowing proposed in January, make an early repayment of a loan from local governments, restore funding for transportation and senior citizens' tax relief, and make modest new commitments in a variety of other areas. It also retains the great majority of budget reductions proposed in January for Proposition 98, social services, and state employee compensation.

We believe that the general approach of the administration—in particular, using most of the new revenues for repayment of debt or for one-time purposes—makes sense, given the formidable structural budget shortfall facing the state. For this reason, we believe it is important that the Legislature, in making its own budgetary decisions, adopt ongoing solutions involving either expenditures or revenues that are similar in magnitude to those proposed by the administration.

In January, the Governor proposed a budget which addressed an estimated $8.6 billion shortfall through significant program savings in Proposition 98 education, social services, and state employee compensation. It also relied on significant amounts of new borrowing, including the sale of $1.7 billion of the remaining deficit-financing bonds authorized by Proposition 57, and the suspension of the Proposition 42 transfer (which the administration indicated would be treated as a loan that would be paid off in future years).

Relative to the January budget proposal, the May Revision projects about $4.2 billion in added revenues (including prior-year increases) from improved economic activity ($4 billion) and a modest increase ($180 million) in the net gain related directly and indirectly to the state's amnesty program (discussed in more detail below). As shown in Figure 1, the revised plan proposes to use these increased resources almost exclusively for one-time purposes. Specifically:

|

Figure 1 Major Sources and

Uses of |

|

Sources of New Funds ($4.2 Billion) |

|

Economics-Related Increase in State Revenues—$4 Billion |

|

Prior-year balance—$0.1 billion. |

|

2004‑05—$2.7 billion. |

|

2005‑06—$1.1 billion. |

|

Amnesty-Related Increase in State Revenues (Net)—$180 Million |

|

Uses of New Funds ($4.2 Billion) |

|

Reduce Debt—$2.5 Billion |

|

Eliminate planned 2005‑06 sale of deficit-financing bonds—$1.7 billion. |

|

Accelerate repayment of one-half of vehicle license fee “gap” loan—$0.6 billion. |

|

Reduce size of pension obligation bond—$0.2 billion. |

|

Restore/Augment Spending—$1.7 Billion |

|

Proposition 42 transfer to transportation—$1.3 billion. |

|

Proposition 98 settle-up payments—$0.3 billion. |

|

Senior citizens’ property tax and renters’ assistance programs—$0.1 billion. |

|

|

|

Detail may not total due to rounding. |

The May Revision also contains numerous individual program savings and cost changes, some of which are related to caseload and other "baseline" factors, and some of which are related to policy changes. We have not been able to fully identify and allocate all of these individual changes. However, we estimate that, in the aggregate, these are largely offsetting.

Finally, the May Revision retains most of the program savings proposed in January in education, social services, and state employee compensation.

Figure 2 shows the administration's estimate of the General Fund budget condition in 2004-05 and 2005-06 after taking account of the May Revision budget proposals.

|

Figure 2 Governor’s May Revision General Fund Condition |

||

|

(In Millions) |

||

|

|

2004-05 |

2005-06 |

|

Prior-year fund balance |

$7,200 |

$6,714 |

|

Revenues and transfers |

79,495 |

83,867 |

|

Deficit financing bond |

2,012 |

— |

|

Total resources available |

$88,707 |

$90,581 |

|

Expenditures |

$81,993 |

$88,525 |

|

Ending fund balance |

$6,714 |

$2,056 |

|

Encumbrances |

641 |

641 |

|

Reserve |

$6,073 |

$1,415 |

|

2006-07 amnesty-related revenue reductions |

|

($900) |

|

Remaining reserve |

|

($515) |

|

|

||

|

Detail may not total due to rounding. |

||

2004-05. As shown in Figure 2, the prior-year balance is estimated at $7.2 billion, which is more than double the $3.5 billion balance estimated in January. The improvement is almost entirely due to higher-than-expected cash payments directly and indirectly associated with the state's tax amnesty program that concluded in early April. As discussed in the box, under the state's current accounting system, these current-year cash collections are attributed back to the tax years prior to 2003 that were covered by the amnesty program. Also, of this May Revision increase all but $180 million will be offset by lower audit collections and higher refunds in 2004-05 through 2006-07.

In other developments, revenues in the current year are estimated to total $79.5 billion, or about $2.5 billion less than the $82 billion in expenditures. Most of the difference is covered by the proceeds of last year's sale of $2 billion in deficit-financing bonds. After accounting for year-end encumbrances, the current year is projected to conclude with a reserve of $6.1 billion.

2005-06. In the budget year, the administration projects revenues of $83.9 billion, while expenditures are proposed to total $88.5 billion, thus generating an operating shortfall (revenues minus expenditures) of $4.6 billion during the year. This draws the current-year reserve of $6.1 billion down to $1.4 billion by the close of the budget year. The administration notes, however, that $900 million of this reserve will be needed to fund the revenue reductions anticipated in 2006-07 attributable to amnesty-related refunds and auditing changes (see box). This leaves an uncommitted reserve of $515 million, which is about the same as the level proposed in January.

California's Tax Amnesty ProgramThe Basic ProgramCalifornia created a limited-term tax amnesty program as part of its enacted 2004-05 budget. Its last amnesty program was in 1984-85. The new amnesty program applied to the three major General Fund taxes—the personal income tax, corporation tax, and sales and use tax. The amnesty filing timeframe ran from February 1, 2005 through March 31, 2005, and applied to tax years before 2003. The program allowed those taxpayers with past unreported or underreported tax liabilities (excluding those eligible to participate in either federal or state abusive tax shelter voluntary compliance programs) to avoid penalties and fees on overdue amounts if they came forward and paid such taxes in full or entered into installment repayment agreements. The program also prevents the state's tax agencies from taking subsequent criminal action against program participants. To encourage participation, the program provided for sharply increased penalties on past noncompliance once the amnesty period was over. Bottom-Line Revenue ImpactExplaining the revenue impacts from amnesty is complicated by both (1) the peculiarities of how the state's accounting system works and (2) the fact that these impacts have several different components, including direct impacts from amnesty participants and indirect impacts from nonparticipants. However, as discussed below and illustrated in the accompanying figure, the "bottom line" is that the May Revision estimates a net multiyear General Fund personal and corporate income tax revenue gain from the amnesty program of $380 million. This represents a $180 million increase from the $200 million gain assumed in January.

Revenue ComponentsCash Receipts in 2004-05. The state's tax agencies estimate that 2004-05 cash receipts due directly or indirectly to the amnesty program totaled roughly $4.4 billion. This includes both $800 million directly from amnesty participants, and another $3.6 billion largely from nonamnesty participants who have nevertheless filed so-called "protective claims" to avoid the possibility of being charged high post-amnesty penalties if their current tax challenges are not upheld or they receive future audit assessments. Of the $4.4 billion, it is expected that about $4 billion either represents an acceleration of future tax payments that have already been projected, or amounts that will have to be refunded in the future because they will exceed what taxpayers owe. These cash offsets are estimated to total roughly $0.6 billion in 2004-05, $1.5 billion in 2005-06, $1.1 billion in 2006-07, and $0.9 billion in 2007-08. Budgetary Impacts. In theory, for budgetary accounting purposes, all of the $4.4 billion of payments made should be allocated back to the individual tax years before 2003 to which they apply. However, under our current method of accounting, we do not "go back" into history and change the individual-year revenue data for such payments. Rather, the state shows such amounts as a positive adjustment to the prior-year's incoming balance. Likewise, the state's accrual accounting procedure incorporates the changes as revenue adjustments in the immediately preceding year. Given this, as shown in the figure, the impacts of the $4.4 billion in direct and indirect payments is to raise the 2004-05 carry-in balance from 2003-04 by $3.8 billion, and reduce revenues by $1.5 billion in 2004-05, $1.1 billion in 2005-06, and $0.9 billion in 2006-07, resulting in a net gain of $380 million. |

The administration's economic forecast has not changed significantly since January. It continues to assume that economic growth at both the national and state levels will slow some from the pace in 2004, reflecting the constraining impacts of high energy costs and rising interest rates on consumer spending and business investment. Despite the slowdown, however, the expansion is projected to continue at a moderate pace during the next two years. At the national level, real gross domestic product growth is projected to slow from 4.4 percent in 2004 to 3.6 percent in 2005, and 3.0 percent in 2006. In California, personal income growth is projected to slow from 6.1 percent in 2004, to 5.7 percent in 2005, before slightly rebounding to 5.8 percent in 2006.

As indicated previously, the May Revision anticipates a $4.2 billion increase in General Fund revenues. The majority of this increase is related to stronger-than-expected receipts from the personal income tax, which the administration is attributing mainly to higher-than-expected capital gains and other cyclical factors. The remaining $180 million of the difference is related to the net impact on revenues of the tax amnesty program.

Figure 3 displays in detail the incremental changes from the January budget's revenue forecast that are due to (1) economics-related, capital gains, and other more traditional revenue determinants versus (2) the tax payments and refunds directly or indirectly related to the state's tax amnesty program.

|

Figure 3 Change in General

Fund Resources |

||||

|

(In Millions) |

||||

|

|

Carry-In Balance |

|

Revenuesb |

|

|

|

2003-04a |

|

2004-05 |

2005-06 |

|

January Budget |

$3,489 |

|

$78,219 |

$83,772 |

|

Changes |

|

|

|

|

|

Economics-related and other factors |

$121 |

|

$2,736 |

$1,145 |

|

Amnesty-related income taxes |

3,590 |

|

-1,460 |

-1,050 |

|

May Revision |

$7,200 |

|

$79,495 |

$83,867 |

|

|

||||

|

a Displayed as adjustment to carry-in balance. |

||||

|

b Does not include $900 million reduction in revenues related to amnesty in 2006-07. |

||||

January Forecast. The January budget forecast assumed that the state would have a carry-in balance of $3.5 billion, and that revenues would total $78.2 billion in 2004-05 and $83.8 billion in 2005-06. Embedded in these estimates was the assumption that the state would collect $550 million in income taxes from participants in the tax amnesty program, of which $200 million would be "new money" (that is, funds that would not otherwise have been collected through the audit process).

May Revision Changes. The May Revision revenue forecast reflects two sets of adjustments relative to the January projections.

Amnesty-Related Estimates Reasonable. The May Revision's estimates of the direct and indirect impacts of amnesty-related payments and refunds are reasonable. It is our understanding that the protective claims payments (which account for $3.4 billion of the total payments) are concentrated among large companies that are routinely audited by the Franchise Tax Board. Payments associated with these audits were assumed to occur over the next several years. Thus, their acceleration implies that future audit-related collections will be less than previously forecast. In the case where companies are successful in appealing state audit claims, the protective claims payments will need to be refunded, which also reduces net revenues to the state, and the forecast incorporates this.

Current-Year Revenue Estimate Overstated. While we agree that recent favorable payment trends portend higher revenues in both the current year and budget year, the administration has seriously overstated the 2004-05 year-end accrual adjustments that will be made to the personal income tax. Using the administration's own estimates of personal income tax payments and refunds during the second half of calendar-year 2005 (and which are accrued back to the current year), we estimate that the overestimate is approximately $625 million. After accounting for some offsetting gains from other revenue sources, we therefore believe that revenues will be $600 million below the May Revision estimate in 2004-05. With respect to the budget year, however, our forecast of revenues is similar to the administration's revised estimate.

How Much of Revenue Gain Is Ongoing? The administration has asserted that virtually all of the roughly $4 billion revenue increase is one-time relative to its January estimate, and thus will not help the state's structural budget shortfall. The administration has not provided its updated longer-term fiscal estimates, and thus we cannot comment on this assertion directly. However, relative to our own February forecast (which was above the administration's January estimate by $1.4 billion in the current year and $0.8 billion in 2005-06), we estimate that the ongoing increase is about $0.5 billion per year, suggesting that a significant portion of the increase is ongoing relative to our estimates.

The higher revenues projected in the May Revision have reduced the size of the projected budget shortfall facing the state in 2004-05. In this section we: (1) discuss the size of the remaining budget shortfall, taking into account the improved revenue outlook and other factors affecting the revised outlook, and (2) highlight the main solutions that are included in the May Revision.

The January budget proposal contained solutions totaling about $9.1 billion, which eliminated an estimated $8.6 billion shortfall and funded a $500 million reserve. After taking into account the higher revenues and other offsetting factors (including higher Proposition 98 funding requirements under current law), the revised shortfall is in the range of $6 billion.

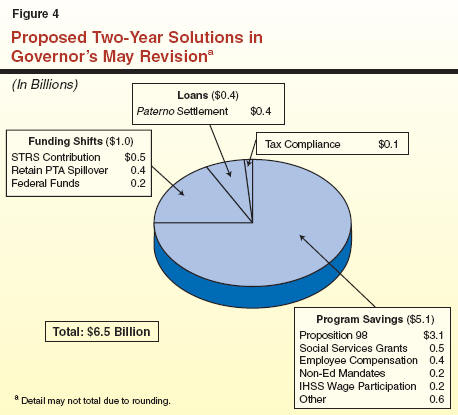

Figure 4 shows the distribution of the $6.5 billion in solutions proposed by the administration to (1) eliminate the $6 billion budget shortfall and (2) maintain a $500 million reserve. It shows that:

Figure 5 shows the programmatic distribution of proposed General Fund spending in 2005-06. It shows that overall spending would grow from $82 billion in 2004-05 to $88.5 billion in 2005-06, an increase of 8 percent. The increase is boosted by the proposed transfer of Proposition 42 funds to transportation, a one-time payment of past Proposition 98 settle-up obligations, and a $90 million increase in the Department of Mental Health's budget to cover payment of prior-year county mandate claims for mental health services to special education pupils. As noted in the K-14 education discussion below, part of the General Fund increase in 2005-06 is being used to offset reductions in local property taxes being received by schools in 2005-06. The figure also shows the impacts of the May Revision's proposed reductions on spending in California Work Opportunity and Responsibility to Kids (CalWORKs), IHSS, and Supplementary Security Income/State Supplementary Program (SSI/SSP).

|

Figure 5 Summary of

May Revision Spending Proposal |

||||

|

(Dollars in Millions) |

||||

|

|

|

2005-06 |

||

|

|

2004-05 |

Amount |

Change |

|

|

Education Programs |

|

|

|

|

|

K-12—Proposition 98a |

$30,877 |

$33,265 |

7.7% |

|

|

Community Colleges—Proposition 98a |

3,036 |

3,444 |

13.4 |

|

|

UC/CSU |

5,212 |

5,433 |

4.3 |

|

|

Other |

4,794 |

4,146 |

-13.5 |

|

|

Health and Social Services Programs |

|

|

|

|

|

Medi-Cal |

$11,702 |

$12,962 |

10.8% |

|

|

SSI/SSP |

3,417 |

3,478 |

1.8 |

|

|

Developmental Services |

2,133 |

2,286 |

7.2 |

|

|

CalWORKs |

2,054 |

1,955 |

-4.9 |

|

|

Mental Health |

984 |

1,276 |

29.7 |

|

|

In-Home Supportive Services |

1,178 |

1,028 |

-12.7 |

|

|

Other |

3,542 |

3,850 |

8.7 |

|

|

Youth and Adult Corrections |

$6,987 |

$7,259 |

3.9% |

|

|

Debt Serviceb |

$3,028 |

$3,301 |

9.0% |

|

|

Proposition 42 Transfer |

— |

$1,313 |

— |

|

|

All Other |

$3,050 |

$3,528 |

15.7% |

|

|

Totals |

$81,993 |

$88,525 |

8.0% |

|

|

|

||||

|

a Reflects only the General Fund share of Proposition 98. |

||||

|

b Includes debt-service payments for general obligation bonds. Debt service for lease-revenue bonds is distributed in individual departmental budgets. |

||||

The May Revision has eliminated some of the risky assumptions in the January plan, such as the savings assumed from contract procurement reform. At the same time, however, the revised plan continues to face significant risks in several areas. These include:

Figure 6 summarizes the May Revision's main programmatic features. The proposal's impact on Proposition 98 and transportation funding are discussed in greater detail below.

|

Figure 6 Key General Fund May Revision Spending Proposals |

|

Education |

|

Holds K-14 Proposition 98 funding near amount proposed in January. |

|

Uses $252 million in one-time settle-up funds and savings from lower average daily attendance to fund a modest expansion of class-size reduction and a variety of other initiatives. |

|

Retains January proposal to shift portion of state teachers’ retirement costs from General Fund to school districts. |

|

Transportation |

|

Drops January proposal to suspend in 2005‑06 Proposition 42 transfer from General Fund to transportation ($1.3 billion). |

|

Reduces by $222 million the amount of transportation loans to be repaid in 2005‑06 with tribal gaming bonds. The amount would instead be repaid from future compacts or from the General Fund no later than June 30, 2022. |

|

Health Services |

|

Retains, with some minor changes, the January Medi-Cal redesign proposal to expand managed care, establish premiums for some beneficiaries, cap adult dental coverage, and implement administrative changes to reduce long-term costs of the program. |

|

Social Services |

|

Drops CalWORKs proposals to reduce the earned income disregard and strengthen the sanction policy. Delays proposed 6.5 percent grant reduction. |

|

Achieves an additional $104 million in General Fund savings by shifting funds out of CalWORKs. |

|

Retains the proposals to eliminate or suspend, respectively, the CalWORKs and SSI/SSP cost-of-living adjustments. |

|

Retains proposal to reduce state support for IHSS provider wages. |

|

Judiciary and Criminal Justice |

|

Adds $94 million to support a higher inmate and parole population. |

|

Restores $85 million in program reductions proposed in the January budget, including those for existing inmate and parole programs and the Rural/Small County Sheriff Grant program. |

|

Local Government |

|

Proposes to accelerate, by one year, repayment of one-half (or $593 million) of the vehicle license fee “gap” loan from local governments. |

|

Proposes $108 million increased funding for mandate reimbursements. |

|

Statewide |

|

Retains January proposals relating to employee compensation savings. |

|

Rescinds January proposal to eliminate senior citizens’ property tax assistance program and reduce the senior citizens renters’ tax assistance program. |

|

Assumes loan from Merrill Lynch (instead of judgment bond) to fund Paterno lawsuit settlement. |

Figure 7 displays the May Revision changes in Proposition 98 funding from those proposed in the January budget. The Governor proposes the same funding level in the budget year, and $142 million less in the current year. The Governor provides technical augmentations to 2003-04 ($16 million), and settle-up funding for prior-year Proposition 98 obligations ($252 million). So across all years, the Governor provides an additional $126 million in Proposition 98 funding.

|

Figure 7 May Revision Changes in Proposition 98 Funding |

||

|

(In Millions) |

||

|

|

2004-05 |

2005-06 |

|

Total Proposition 98 Funding |

|

|

|

January budget |

$47,083 |

$49,968 |

|

May Revision |

46,941 |

46,968 |

|

Changes |

-$142 |

— |

|

Changes by Fund Source |

|

|

|

General Fund |

-$115 |

$283 |

|

Local property tax |

-27 |

-283 |

|

Totals |

-$142 |

— |

|

Changes by Program Area |

|

|

|

K-12 |

-$113 |

-$66 |

|

Community colleges |

-29 |

54 |

|

Other |

— |

12 |

|

Totals |

-$142— |

— |

|

|

|

|

Prior-Year Proposition 98 Obligations. The Governor proposes settling up $252 million in one-time funding for prior-year Proposition 98 obligations (1995-96 and 1996-97). This funding is used for a variety of new proposals (discussed below). While we do not believe the state has any obligations for those fiscal years (see our 2004-05 Analysis, page E-18), it could apply any one-time payments to settle-up obligations in 2002-03 or 2003-04.

Current-Year Attendance Falls. In the January budget, the 2004-05 Proposition 98 minimum guarantee was suspended, and the Governor provided $47.1 billion. The May Revision reflects property tax and attendance adjustments to the current-year funding level—reducing it by $142 million. Most of this reduction results from almost 26,000 in lower K-12 attendance. This spending level also establishes a lower base for calculating the 2005-06 Proposition 98 minimum guarantee.

Budget-Year Funding Level Maintained. The May Revision continues to provide $50 billion for Proposition 98 for 2005-06. Because of the lower current-year base, and lower year-to-year growth in General Fund revenues, the minimum guarantee fell just over $500 million compared to the January budget. Thus, the Governor's proposed spending level is now $509 million above the Proposition 98 minimum guarantee for 2005-06.

The General Fund cost of meeting the $50 billion spending level has increased by $283 million because of a downward revision in local property tax revenues. The decline in local property tax revenues is the net effect of $314 million in additional VLF-related property tax transfers to cities and counties as part of last year's local government deal and an increase in the underlying revenues of $31 million. Funding for K-12 falls $66 million from January, while community college funding increases $54 million and other agency funding increases $12 million.

The VLF-related decrease of $314 million in school local property tax revenues is on top of a $675 million VLF-related decrease in January. Because these transfers are so large and unexpected, we are continuing to investigate the technical details of this transfer.

Ongoing Funds. Figure 8 shows the major K-14 budget proposals compared to the January budget. The Governor reduces K-12 revenue limits by $307 million because of 32,000 less pupils, lower Public Employees' Retirement System (PERS) costs, and lower unemployment insurance costs. These savings are redirected to fund an increased cost-of-living adjustment (COLA) for revenue limits ($80 million). The main ongoing policy change is $123 million for additional class size reduction in low performing schools ($52 million in one-time funds are also provided for this proposal). Even though total K-12 spending falls by $66 million in the May Revision, the attendance decline still results in an increase in Proposition 98 per pupil spending for 2005-06 of $28 per pupil—from $7,374 per pupil in January to $7,402 per pupil in May. For community colleges, the May Revision provides $40 million for equalization and $14 million for growth and COLA.

|

Figure 8

2005-06 K-14 Proposition 98 |

|

|

(In Millions) |

|

|

|

Change |

|

K-12 Revenue Limits |

|

|

Cost-of-living adjustment (COLA) |

$80 |

|

Growth |

-191 |

|

Unemployment insurance |

-51 |

|

Public Employees’ Retirement System |

-65 |

|

Subtotal |

(-$227) |

|

K-12 Categorical Programs |

|

|

Class size reduction |

$123 |

|

Special education adjustments |

9 |

|

Growth/COLA |

29 |

|

Subtotal |

($161) |

|

Community Colleges |

|

|

Equalization |

$40 |

|

COLA |

14 |

|

Subtotal |

($54) |

|

Other Agencies |

$12 |

One-Time Funds. Figure 9 shows the proposed uses of the $252 million in one-time settle-up funds. These funds are spent on new K-12 program initiatives such as high school supplemental instruction for students at risk of failing the high school exit exam ($58 million), teacher recruitment and retention ($50 million), additional beginning teacher professional development ($30 million), career technical education ($30 million), and a fruits and vegetables breakfast program ($18 million). The proposal also provides $10 million to expand community college nursing programs.

|

Figure 9 Proposition 98 Prior-Year Settle-Up Funds |

|

|

(In Millions) |

|

|

Program |

Amount |

|

High school supplemental instruction |

$58 |

|

Class size reduction |

52 |

|

Teacher retention |

50 |

|

Beginning teacher block grant |

30 |

|

Career technical education |

30 |

|

Breakfast program—fruits and vegetables |

18 |

|

Community colleges—nursing program |

10 |

|

Others |

4 |

|

Total |

$252 |

LAO Concerns. We are concerned that the revised proposal creates numerous new categorical programs prior to paying for existing obligations. At the start of 2005-06, the state will have $3.6 billion in education credit card obligations. These include prior-year and on-going state mandate costs, obligations for prior-year foregone COLAs and funding deferrals. (The administration proposes to pay off $329 million of the foregone COLA.) Dedicating funding to reducing the credit card obligations would also provide additional discretionary funding to K-12 schools which could be used to address cost pressures like declining enrollment, restoration of reserves for economic uncertainty and long-term maintenance, and absorbing higher costs for health care and retiree health benefit costs. In addition to the importance of funding the base program prior to creating new programs, most of the new proposals would use one-time funds to create programs addressing ongoing issues. This creates ongoing cost pressures and expectations that may be difficult to meet in subsequent years.

The Governor's May Revision proposes a number of changes in transportation funding relative to the January budget.

No Suspension of Proposition 42. Due to higher-than-anticipated state revenue, the May Revision proposes to allow the transfer of gasoline sales tax revenue from the General Fund to transportation purposes per Proposition 42. The total amount of the transfer is estimated at $1.313 billion. This amount would be allocated as follows:

Proposition 42 Funding Linked to GoCalifornia Proposal. While the May Revision proposes to allow the Proposition 42 transfer to occur as described above, the administration has stated its intent to make the expenditure of these funds contingent on passage of three bills that are part of the Governor's GoCalifornia proposal. These three bills—AB 850 (Canciamilla), AB 1266 (Niello), and SB 705 (Runner)—would allow the state to enter into agreements that permit private companies to build toll-funded transportation projects in addition to those already permitted by law, allow construction to begin on some transportation projects before design is complete, and allow Caltrans to award contracts to private companies to both design and build projects, respectively. The May Revision proposes to link the availability of Proposition 42 funds to the passage of these three bills. However, the Governor's ability to prevent the expenditure of Proposition 42 funds is limited. Under the State Constitution, the Governor would not be able to prevent the transfer of gasoline sales tax revenue to the Transportation Investment Fund (TIF) without a two-thirds vote of the Legislature. Once in the TIF, only some of the money is subject to annual budget act appropriation, which the Governor has the power to veto.

Estimated Size of Tribal Gaming Bond Lowered. Under current law, the General Fund is due to repay previous loans totaling $1.2 billion to the Traffic Congestion Relief Fund (TCRF) in 2005-06. Current law also states that this amount is to be repaid by a bond securitized by revenue resulting from renegotiation of tribal gaming compacts. The May Revision proposes to delete the requirement that this money be repaid by the end of the budget year. It also reduces the estimated amount of money to be received from the tribal gaming bond to $1 billion, as shown in Figure 10. The remaining $200 million, plus interest, would be repaid from revenues resulting from future tribal gaming compacts if more compacts are negotiated. If tribal gaming revenues are not sufficient to cover any part of the $1.2 billion owed, the remainder would be repaid from the General Fund by July 1, 2021.

|

Figure 10 Transportation Loans and Repaymentsa |

||||||

|

(In Millions) |

||||||

|

|

To General Fundb |

|

To TCRFc |

|||

|

Year |

From SHA |

From TCRF |

From TIF |

|

From SHA |

From PTA |

|

2000-01 |

— |

— |

— |

|

$2 |

— |

|

2001-02 |

$173 |

$238 |

— |

|

41 |

$180 |

|

2002-03 |

-173 |

1,145 |

— |

|

520 |

95 |

|

2003-04 |

— |

— |

$868 |

|

-100 |

— |

|

2004-05 |

— |

-183 |

1,243 |

|

-20 |

— |

|

2005-06 |

— |

-1,000d |

— |

|

-443 |

-123 |

|

2006-07 |

— |

— |

— |

|

— |

— |

|

2007-08 |

— |

— |

-141e |

|

— |

-153 |

|

|

||||||

|

SHA = State Highway Account; TCRF = Traffic Congestion Relief Fund; TIF = Transportation Investment Fund; PTA = Public Transportation Account. |

||||||

|

a Amounts do not include interest. |

||||||

|

b Positive numbers are amounts payable to the General Fund, negative numbers are payable from the General Fund. |

||||||

|

c Positive numbers are amounts payable to TCRF, negative numbers are payable from TCRF. |

||||||

|

d To be repaid from revenues resulting from renegotiation of tribal gaming compacts in 2005-06 or whenever revenues become available. Repayment of the remaining $200 million plus interest owed to TCRF will come from future tribal gaming revenue or the General Fund. |

||||||

|

e Represents the first of 15 annual loan repayments through 2021-22. |

||||||

Capital Outlay Support Increased to Match Increased Funding. The January Governor's budget did not include funding for Caltrans to work on projects that would be funded by Proposition 42 or tribal gaming bonds. Because the May Revision assumes that funding from both of these sources will be available in the budget year, the administration proposes to increase funding for Caltrans' project-related workload by a total of $174 million. This money would support a net increase of 316 state staff positions and the equivalent of 758 personnel-years of contracted work and state staff overtime.

Annual Savings of $50 Million. The May Revision proposes to revert $51.6 million in current-year savings in the Caltrans budget. The primary source of this reversion would be salary savings from unfilled Caltrans positions. The May Revision also proposes to reduce Caltrans' budget year appropriation by $50 million and states the intent that this reduction be ongoing, so that the state would have an additional $250 million to expend on transportation projects over a five-year period.

Background. In February, we indicated that the stronger revenues that we were projecting relative to the budget's forecast (about $2.2 billion over the current year and budget year combined) presented the Legislature with an opportunity to make significant progress toward addressing the state's ongoing structural budget shortfall. We noted that, by adopting ongoing legislative solutions similar in magnitude to those proposed by the Governor, the state could balance its budgets in both 2005-06 and 2006-07, and reduce its structural budget shortfall (from a peak under current law of about $10 billion to around $4 billion per year). At the same time, we warned that the anticipated revenue growth was not strong enough for the state to simply "grow its way out" of the structural imbalance. Absent ongoing solutions, we concluded that the state would face a major budget problem in 2006-07 and beyond (when temporary solutions adopted in past budgets expire and past borrowing starts coming due), with its borrowing capacity exhausted and relatively few easy options available.

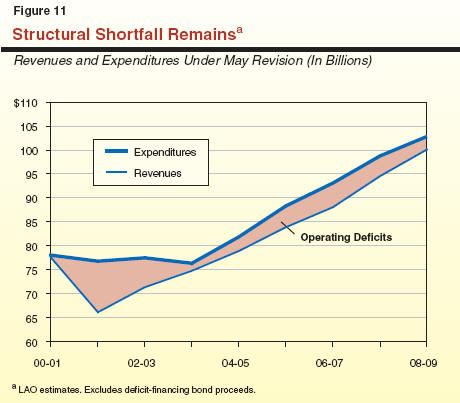

Outlook Under May Revision. Despite some policy-related changes and a modest improvement in the revenue outlook relative to our February projections, the basic fiscal picture facing the state has not changed dramatically since that time. (Part of the reason for this is that our earlier projections had already anticipated higher revenues than projected in the January budget.) Figure 11 and Figure 12 present our estimate of the longer-term implications of the policy proposals embedded in the May Revision. They show that, the annual operating imbalance would be about $5 billion in 2006-07 (or about $1 billion more than our February estimate), and then would fall back to around $4 billion in 2007-08 and $3 billion in 2008-09 (or slightly lower than the February estimates for the two years). One key reason for the larger structural imbalance in 2006-07 is the assumed $900 million—and final—revenue reduction from higher refunds and lower audit payments associated with the tax amnesty program. As noted earlier, the administration has appropriately earmarked part of the 2005-06 reserve to cover the impacts of that reduction. After adjusting for that change, the underlying year-end 2006-07 outlook is quite similar to our earlier projection.

Given the similarity of the current fiscal picture to that which we portrayed in February, the opportunities and challenges facing the Legislature are much the same as those we noted then. In view of the still-large structural imbalance facing the state, we believe the general approach the administration has taken with respect to the additional revenues in its May Revision—namely, using them for debt reduction and one-time purposes—makes sense. This is because a significant amount of additional resources will be needed in 2006-07 to deal with the large budget shortfall we project for that year.

As it considers the Governor's May Revision proposal, it will continue to be important for the Legislature to aim at adopting ongoing solutions that are reasonably close to the magnitude proposed in the budget. If it fails to do so, the underlying structural budget problem will only get worse. This, in turn, implies that any significant augmentations to ongoing spending in the May Revision plan should be offset by ongoing spending reductions elsewhere and/or through increased revenues.

| Acknowledgments

This report was prepared by Brad Williams and Jon David Vasche, with contributions from others in the office. The Legislative Analyst's Office (LAO) is a nonpartisan office which provides fiscal and policy information and advice to the Legislature. |

LAO Publications

To request publications call (916) 445-4656. This report and others, as well as an E-mail subscription service, are available on the LAO's Internet site at www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000, Sacramento, CA 95814. |