March 2006

Year-to-year changes in the state�s higher education costs are greatly influenced by changes in student enrollment levels. Each year as part of the annual budget process, the Legislature must determine (1) how many additional students will enroll at the University of California and the California State University and (2) how much it will cost to serve those additional students. This report reviews factors that influence enrollment growth and the current methodology of calculating the �marginal cost� of serving additional students. We identify issues for the Legislature to consider in determining the amount of enrollment growth to fund for a given year. We also recommend revisions to the current marginal cost methodology in order to more accurately budget for these expenses.

One of the principal factors influencing the state�s higher education costs is the number of students enrolled at the public higher education segments. Typically, the Legislature and Governor provide funding in the annual budget act to support a specific level of enrollment growth at the state�s public higher education segments. The total amount of funding provided each year is based upon a per-student funding rate (typically referred to as the �marginal cost� of instruction) multiplied by the number of additional students. For example, the 2005-06 Budget Act included a total of about $89�million from the General Fund to support (1) 5,000 additional students at the University of California (UC) at a per-student funding rate of $7,528 and (2) 8,103 additional students at the California State University (CSU) at $6,270 per student.

In recent years, the Legislature has expressed a desire to review the current process of funding new enrollment at UC and CSU. For example, in adopting the 2005-06 budget, the Legislature requested a review of the current marginal cost funding process and an examination of possible modifications for legislative consideration. Given this directive, in this report we:

Present recent enrollment trends at UC and CSU, including the relationship between actual and budgeted enrollment.

Discuss the main factors that influence enrollment growth and identify issues for the Legislature to consider in determining the amount of additional enrollment to fund for a given year.

Review the current practice for determining the amount of funding to provide for each additional UC and CSU student and recommend an alternative approach.

Essentially, there are two methods of measuring higher education enrollment levels: headcount and full-time equivalent (FTE).

Headcount. Headcount refers to the number of individual students attending college, whether they attend on a part-time or full-time basis.

FTE. In contrast to headcount, the FTE measure converts part-time student attendance into the equivalent full-time basis. For example, two half-time students would be represented as one FTE student.

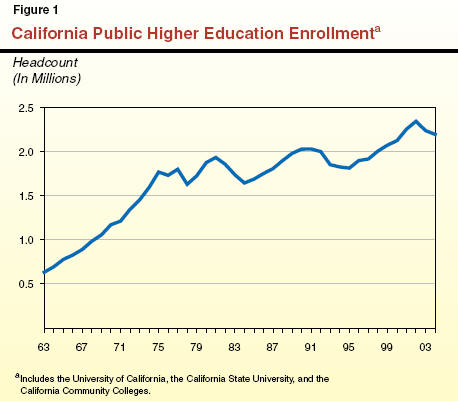

Headcount measures are useful for indicating how many individuals are participating in higher education at a given point in time. For example, in fall 2004, approximately 2.2�million students (headcount) were enrolled either full-time or part-time at UC, CSU, and California Community Colleges. Figure�1 summarizes actual headcount enrollment for the past 40 years. The figure shows that enrollment grew rapidly through 1975 and then fluctuated over the next two decades. Since 1995, enrollment grew steadily until a slight decline in 2003 and 2004. This decline was largely made up of part-time community college students who were taking relatively few courses. Despite this drop in headcount, there was a much smaller decline in community college FTE enrollment. The remainder of this report focuses exclusively on enrollment growth funding for UC and CSU.

In contrast to headcount, FTE measures better reflect the costs of serving students (that is, the number of course units taken) and is the preferred measure used for state budgeting purposes. For example, the Legislature provides funding in the annual budget act to support a specific number of FTE students at UC and CSU. Typically, this includes funding for enrollment growth. In any given year, UC and CSU typically serve slightly more or fewer FTE students than budgeted. Recently, however, actual enrollment has deviated more significantly from funded levels. In recognition of this disconnect between the number of students funded at each segment and the number of students actually enrolled, the Legislature adopted budget bill language as part of the annual budget acts for 2004-05 and 2005-06 to ensure that UC and CSU use enrollment funding only for enrollment. Specifically, the language requires that the segments report in the spring on whether they met their enrollment target for that year. If a segment does not meet its goal, the Director of the Department of Finance (DOF) is to revert to the General Fund the total amount of enrollment funding associated with the unmet enrollment. As we discuss below, $15.5�million in enrollment funding provided to CSU in 2004-05 reverted to the General Fund as a result of this provision.

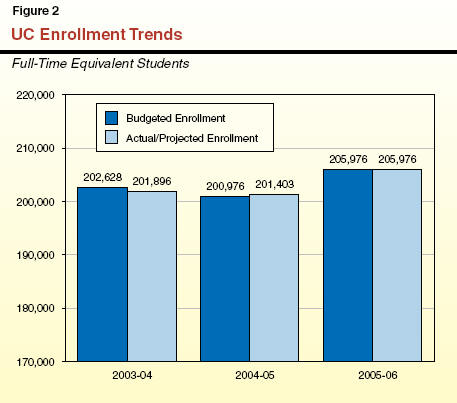

As indicated in Figure�2, UC enrolled roughly 400 more FTE students in 2004-05 than it was budgeted to serve for that year. For the current year, the 2005-06 Budget Act provides $37.9�million to UC to enroll 5,000 additional FTE students above the 2004-05 funded enrollment level, for a total of 205,976 FTE students. As of January 2006, the university estimated that it will meet this current-year enrollment target. The act requires UC to report to the Legislature by March�15, 2006 on whether in fact it met the target.

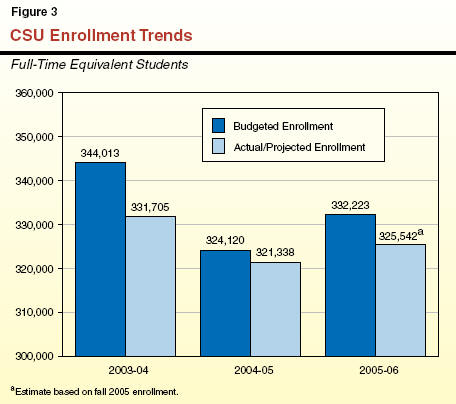

As shown in Figure�3, CSU has not met its budgeted-enrollment targets in the previous two years (2003-04 and 2004-05). In other words, the state provided funding for more students than the university enrolled. Based on recent trends and preliminary data, CSU may not meet its 2005-06 enrollment target as well.

Did Not Meet 2003-04 Enrollment Target; $81�Million Redirected to Other CSU Programs. As we discussed in our Analysis of the 2004-05 Budget Bill, CSU enrolled about 12,000 fewer FTE students than it was funded to serve in 2003-04. Instead, the university redirected about $81�million of enrollment growth funding to essentially �backfill� budget reductions approved by the Legislature in other program areas. In effect, CSU campuses reduced spring 2004 admissions in order to help �free up� enrollment funds.

Did Not Meet 2004-05 Enrollment Target; $15.5�Million Reverted to General Fund. In recognition that CSU shifted some of its enrollment funding to backfill base budget reductions in 2003-04, the 2004-05 budget essentially �rebenched� CSU�s enrollment level downward to 324,120 FTE students. This amount was roughly 20,000 FTE students fewer than the number of students funded the year before. (In fact, the enrollment target was less than the number of students actually served in 2003-04. Although the enrollment target was lowered, CSU retained the associated enrollment funding from the prior year in its base budget for 2004-05, thus permanently �backfilling� the earlier General Fund reductions.

Despite the downward �rebenching� of CSU�s enrollment target, the university again fell short of its 2004-05 enrollment target by about 2,800 FTE students (see Figure�3). The university states that the reasons for this shortfall include:

Increased Degree Conferrals. From 2002-03 to 2003-04, the number of students that received a CSU degree-bachelor�s, master�s, or joint doctoral-increased sharply by about 5,877 students, or 8�percent (from 76,755 to 82,592 students). The university states that this increase, most of which occurred in the spring, significantly reduced the number of students campuses assumed would continue in fall 2004.

Decreased Demand for Teacher Preparation. From fall 2003 to fall 2004, the number of postbaccalaureate students enrolled in CSU teacher preparation programs decreased by 1,717 FTE students (from 14,746 to 13,029 FTE students). The university asserts that this decrease occurred in part due to the (1) softening of the market for elementary school teachers in California because of K-12 budget constraints and (2) elimination of state-funded teacher recruitment programs.

As required under provisional language in the 2004-05 Budget Act, the funding associated with CSU�s unmet enrollment target ($15.5�million) reverted to the General Fund on a one-time basis. This funding was restored to CSU�s base budget for 2005-06, thus providing a second opportunity and expectation to enroll the associated 2,800 FTE students.

Unlikely to Meet 2005-06 Enrollment Target. For the current year, the 2005-06 Budget Act provided $50.8�million to CSU to enroll about 8,100 additional FTE students above the 2004-05 funded enrollment level, for a total of 332,223 FTE students. (This total is about 11,000 more FTE students than it actually enrolled in 2004-05, as shown in Figure�3.)

At the time this report was prepared, the Chancellor�s Office reported that estimated enrollment for fall 2005 is almost 325,540 FTE students. This is about 6,680 FTE students below the university�s current-year enrollment target. Although CSU�s final enrollment numbers for 2005-06 will not be known until May 1, 2006, the fall estimate does suggest that CSU may not meet its enrollment target. Moreover, the university could end up serving fewer students than it did two years ago (2003-04), despite continued, annual increases in enrollment funding. In our Analysis of the 2006-07 Budget Bill (please see page E-188), we propose permanently adjusting CSU�s base budget if it does not meet its current-year enrollment target.

The Legislature typically provides funding each year for a particular level of enrollment growth at the state�s public universities. In doing so, the Legislature must annually determine the following:

How much enrollment growth (or additional students) to fund at UC and CSU?

How much General Fund support to provide the segments for each additional student?

Below, we examine each of these issues and make recommendations for legislative consideration.

Determining the amount of additional enrollment to fund each year can be difficult. Unlike enrollment in compulsory programs such as elementary and secondary schools, which corresponds almost exclusively with changes in the school-age population, enrollment in higher education responds to a variety of factors. Some of these factors, such as population growth, are beyond the control of the state. Others, such as higher education funding levels and fees, stem directly from state policy choices. As a result, enrollment projections must consider the interaction of demographic changes and state policies that influence enrollment demand.

There are two main factors influencing enrollment growth in higher education:

Population Growth. Other things being equal, an increase in the state�s college-age population causes a proportionate increase in those who are eligible to attend each segment. Population growth, therefore, is a major factor driving increases in college enrollment. Most enrollment projections begin with estimates of growth in the student �pool� (18- to 24-year old population) which for the rest of the decade is expected to range from 1.2�percent to 2.6�percent annually.

Participation Rates. For any subgroup of the general population, the percentage of individuals who are enrolled in college is that subgroup�s college participation rate. California�s participation rates are among the highest in the nation. Specifically, California ranks fourth in college enrollment among 18- to 24-year olds, and first among 25- to 49-year olds. However, predicting future participation rates is difficult because students� interest in attending college is influenced by a number of factors (including student fee levels, availability of financial aid, and the availability and attractiveness of other postsecondary options).

We project that demographically driven enrollment at UC and the CSU will grow annually between 1.4�percent and 1.8�percent from 2006-07 through 2010-11. Based on our projections, we recommend the Legislature provide funding to UC and CSU in 2006-07 for 2�percent budgeted enrollment growth, which would allow the segments to accommodate enrollment growth due to both increases in population and modest increases in college participation.

As a starting point for considering how much enrollment growth to fund, we use a demographics-based model to estimate future higher education enrollment levels. In our model, we calculate the ethnic, gender, and age makeup of each segment�s student population, and then project separate growth rates for each group based on statewide demographic data. For example, we estimate a distinct growth rate for Asian females between 18 and 24 years of age, and calculate the resulting additional higher education enrollment this group would contribute assuming constant participation rates. When all student groups� growth rates are aggregated together, we project that demographically driven enrollment at UC and CSU will grow annually between 1.4�percent and 1.8�percent from 2006-07 through 2010-11.

As mentioned above, college participation rates are difficult to predict because they can be affected by a variety of factors. We assume that California�s participation rates will remain constant for the foreseeable future. This is because the state�s rates have been relatively flat over recent years, and we are not aware of any evidence supporting alternative assumptions. We do acknowledge that participation rates could change to the extent that the Legislature makes various policy choices affecting higher education. As such, our projections provide a baseline reflecting underlying population trends.

Fund 2�Percent Enrollment Growth in 2006-07. For the budget year (2006-07), we estimate that enrollment at UC and CSU will grow by roughly 1.4�percent. Since this projection is driven solely by projected population growth, the Legislature can evaluate how various related budget and policy choices could change relative to this baseline. We note that DOF�s Demographics Unit also develops enrollment projections using demographically based projections of growth in the number of high school graduates and in the adult population. However, unlike our model, DOF also assumes changes in college participation rates. As a result, DOF projects that in 2006-07, enrollment at UC and CSU will grow by about 1.6�percent, which is significantly less than the 2.5�percent budgeted enrollment growth rate requested in the Governor�s budget proposal for 2006-07.

Over the years, the Legislature has taken deliberate policy actions (such as funding student outreach programs and expanding the availability of financial aid) in an effort to increase college participation rates. Consistent with these actions, the state has provided funding for enrollment growth in some of those years that significantly exceeded changes in the college-age population. In view of the Legislature�s interest in increasing college participation, we recommend funding 2�percent enrollment growth at UC and CSU for 2006-07. This is about 40�percent higher than our estimate of population-driven enrollment growth, and therefore should allow the segments to easily accommodate enrollment growth next year due to increases in population as well as modest increases in college participation. Accordingly, in our Analysis of the 2006-07 Budget Bill (page E-186), we recommend that the Legislature reduce the Governor�s proposed enrollment growth for UC and CSU from 2.5�percent to 2�percent.

We recommend the Legislature adopt budget bill language each year specifying enrollment targets for both the UC and the CSU, in order to protect its priority to increase higher education enrollment.

We believe the Legislature, the Governor, and the public should have a clear understanding of how many students are funded at UC and CSU in the annual budget act. Additionally, the segments should be expected to use enrollment funding provided by the state for that purpose and be held accountable for meeting their annual enrollment targets as adopted by the Legislature. As a result, we recommend the Legislature adopt budget bill language each year (similar to the language adopted in the annual budget acts for 2004-05 and 2005-06) that establish specific enrollment targets and accountability provisions for UC and CSU. (For 2006-07, we recommend in our Analysis of the 2006-07 Budget Bill specific budget bill language for UC and CSU.)

Each year, the Legislature should require the segments to annually report each spring on whether they met their budgeted enrollment target. If UC or CSU does not meet its target, the amount of enrollment funding associated with the enrollment shortfall should revert to the state�s General Fund. The segments� enrollment reports (and the enrollment targets themselves) should exclude students in summer instruction programs who do not receive full state support. Since these programs do not receive enrollment growth funding from the state, past practice has been to exclude these students from state enrollment targets. (Please see nearby box for a more detailed discussion of summer enrollment.)

Update on Summer OperationsIn recent years, the Legislature has strongly encouraged the University of California (UC) and the California State University (CSU) to serve more students during the summer term by implementing year-round operations. Expanding summer operations has the benefit of significantly increasing UC�s and CSU�s enrollment capacity while reducing costs associated with constructing new classrooms and campuses. In moving toward the full implementation of year-round operations, the state: (1) agreed to provide marginal cost funding for all additional full-time equivalent (FTE) students enrolled at UC and CSU regardless of whether they enrolled in fall, winter, spring, or summer; (2) reduced summer fees to levels charged in other terms; and (3) provided supplemental funding in order to enhance summer operations at specific university campuses. Despite these efforts, summer enrollment at some campuses has not significantly increased. Moreover, the summer term at many UC and CSU campuses are operating far from full capacity.

In our Analysis of the 2006-07 Budget Bill, we (1) examine whether the Legislature should provide funding to �fully convert� (meaning provide supplemental funding) additional UC and CSU campuses to year-round operations and (2) outline steps that campuses could take to encourage more students to enroll during the summer term. |

In addition to deciding the number of additional FTE students to fund each year, the Legislature must also determine the amount of funding to provide for each additional FTE student at UC and CSU. Given past practice, this funding level would be based on the marginal cost of serving each additional student for additional faculty, teaching assistants (TAs), equipment, and various support services. The marginal cost is less than the average cost because it reflects what are called �economies of scale�-that is, it excludes certain fixed costs (such as central administration) which may change very little as new students are added to an existing campus. The marginal costs of a UC and CSU education are funded from the state General Fund and student fee revenue. (A similar, but distinct, approach is used for funding enrollment growth at community colleges.)

The current practice has been for the state to provide a separate funding rate for each higher education segment. In other words, the state uses a model of differential funding-providing separate funding rates for distinct categories of students-based on which higher education segment the student attends. (As we discuss below, the state in the past has provided separate funding rates based on education level and type of instruction.)

As part of the 2005-06 budget package, the Legislature adopted language directing our office and DOF to jointly convene a working group to review the current marginal cost methodology for funding new enrollments at UC and CSU and to provide recommendations that would be considered for the 2006-07 budget. The working group met throughout the summer and fall, but was unable to reach consensus on specific modifications to the current methodology for the budget year, as envisioned by the Legislature. In the following sections of this report, we present our review the current marginal cost methodology and recommendations for improving its effectiveness.

For many years, the state has funded enrollment growth at UC and CSU based on the marginal cost of instruction. However, the formula used to calculate the marginal cost has evolved over the years. (The nearby text box provides a timeline of key state actions pertaining to marginal cost funding.) In general, the state has sought to simplify the way it funds enrollment growth and more accurately reflect costs. As we discuss below, the state has moved from utilizing a large number of complex funding formulas for each segment to a more simplified approach for calculating enrollment funding that is more consistent across the two university segments.

Chronology of Marginal Cost FundingPre-1992: The University of California (UC) and the California State University (CSU) use different methodologies to calculate marginal cost of instruction. 1992: Legislature and Governor suspend marginal cost funding practices for UC and CSU and do not provide funding specifically for enrollment growth. 1994: Legislature expresses intent to return to use of marginal cost funding and requests review of 1991-92 marginal cost formulas. 1995: The Legislative Analyst�s Office (LAO), Department of Finance (DOF), UC, and CSU jointly develop new marginal cost methodology. 1996: New marginal cost methodology is first implemented in the 1996-97 Budget Act. 2005: Legislature directs LAO and DOF to jointly convene a working group to review current marginal cost methodology and recommend possible modifications for 2006-07. |

From 1960 through 1992, CSU�s enrollment growth funding was determined by using a separate marginal cost rate for each type of enrollment category (for example, lower-division lecture courses). In other words, the different marginal cost formulas took into account education levels-lower division, upper division, and graduate school-and �instructional modes� (including lecture, seminar, laboratories, and independent study). Each year, CSU determined the number of additional academic-related positions needed in the budget year (based on specific student-faculty ratios) to meet its enrollment target. These data were used to derive the separate marginal cost rates. Unlike the current methodology, the marginal cost formula before 1992 did not account for costs related to student services and institutional support. The state made funding adjustments to these budget rates independent of enrollment funding decisions.

Similar to CSU, annual enrollment growth funding provided to UC before 1992 was based on the particular mix of new students, with different groups of students funded at different rates. However, UC�s methodology for determining the marginal cost of each student was much less complex than CSU�s methodology and did not require different rates based on modes of instruction. The university calculated separate funding rates for undergraduate students, graduate students, and for each program in the health sciences based on an associated student-faculty ratio. For example, the marginal cost of hiring faculty for new undergraduate students was estimated by dividing the average faculty salary and benefits by 17.48 FTE students (the undergraduate student-faculty ratio). Each marginal cost formula also estimated the increased costs of library support due to enrolling additional students. As was the practice for CSU, however, UC�s marginal cost formulas did not account for costs related to student services and institutional support.

Beginning in 1992-93, the Legislature and Governor suspended the above marginal cost funding practices for UC and CSU. While the state did provide base budget increases to the universities, it did not provide funding specifically for enrollment growth during that time. In the Supplemental Report of the 1994 Budget Act, the Legislature stated its intent that, beginning in the 1996-97 budget, the state would return to the use of marginal cost as the basis for funding enrollment growth. Specifically, the language required representatives from our office, UC, CSU, and DOF to review the 1991-92 marginal cost formulas and propose improvements that could be used in developing the 1996-97 budget.

Overall, the 1995 working group identified two major issues related to the 1991-92 marginal cost calculations. First, the data used in the calculations were out of date and did not accurately reflect actual costs. In addition, there was inconsistency between segments in the methods used to fund enrollment growth (such as the allocation of student fees toward the marginal cost). At the same time, the 1995 working group observed that many parts of the 1991-92 marginal cost calculations remained valid. These included (1) determining the marginal cost for the budget year based on current-year costs and (2) setting the additional cost of hiring faculty to serve additional students at entry-level, rather than average, salaries.

Compromise Methodology Adopted in 1996-97. After a series of negotiations, the four agencies developed a new methodology for estimating the amount of funding needed to support each additional FTE student at each segment. This new methodology reflected a compromise that all parties agreed should be the basis for funding future enrollment growth. The methodology was first implemented in 1996-97 and has generally been used to calculate enrollment funding since that time. Some of the key features of this methodology include:

Single Marginal Cost Formula for Each Segment. Enrollment growth funding is no longer based on differential funding formulas by education level and academic program. Instead, each university segment uses one formula to calculate a single marginal cost that reflects the costs of all the system�s education levels and academic programs. For instance, a single student-faculty ratio helps determine the faculty costs associated with each additional student (regardless of education level). Thus, the state currently provides a different per-student funding rate depending only on which higher education segment that student attends.

Marginal Cost for Additional Program Areas. The 1995 working group concluded that the marginal cost formula should include additional cost components beyond salaries for faculty, TAs, and other academic support personnel. As a result, the current formula takes into account the marginal costs for eight program areas-faculty salary, faculty benefits, TAs, academic support, instructional support, student services, institutional support, and instructional equipment. These program costs are based on current-year funding and enrollment levels, and then discounted to adjust for fixed costs that typically are not affected by year-to-year changes in enrollment.

Student Fee Revenue Adjustments. In addition, the working group agreed that both the General Fund and student fee revenue should contribute toward the total marginal cost. This reflects a long-standing practice that students and the state share in the cost of education. It also acknowledges that fee revenue is used for general purposes-the same as General Fund revenue. Therefore, under the methodology, a portion of the student fee revenue that UC and CSU anticipate from the additional students is subtracted from the total marginal cost in order to determine how much General Fund support is needed from the state for each additional FTE student.

In adopting the 2005-06 budget, the Legislature called for a review of the marginal cost methodology that was developed in 1995. Specifically, the Supplemental Report of the 2005 Budget Act directed our office and DOF to jointly convene a working group, including representatives from UC and CSU, to (1) review the current process for determining the marginal cost of each additional FTE student and (2) examine possible modifications to that methodology for the 2006-07 budget. The intent was that the working group would recommend a new methodology that all parties agreed should be the basis for funding enrollment growth, as was done in 1995.

Working Group Met, but Could Not Reach Agreement. In response to the Legislature�s directive, our office and DOF worked together this past summer and fall to improve the formulas for calculating the marginal cost of instruction. For example, together we developed a series of principles to guide our work. Figure�4 outlines these principles. As the figure shows, many of these principles are features of the current methodology. In addition, we met with UC and CSU to solicit their input and relevant data.

|

Figure 4 Guiding Principles for Marginal Cost Funding |

|

|

|

� Exclude Fixed Costs. The current approach of determining the average cost of individual program areas, and then discounting certain areas to adjust for fixed costs, makes sense. |

|

� Comparability. To the extent possible, we should have comparable formulas for the University of California (UC) and the California State University (CSU). |

|

� Growth-Related Costs. Include only costs that change with enrollment growth. |

|

� Facts-Based. Calculations should be based on factual data. |

|

� Student Fees Should Contribute. A portion of student fee revenue that UC and CSU anticipate from the additional students should be subtracted from the total marginal cost in order to determine how much General Fund support is needed from the state for each additional student. |

|

� Data Accessibility. All parties (UC, CSU, Department of Finance, and the Legislative Analyst�s Office) should have access to the data necessary to independently calculate the marginal cost in a given year and reach the same conclusion. |

Despite the above efforts, our office and DOF were not able to reach an agreement on a new marginal cost methodology, as envisioned by the Legislature. Moreover, DOF independently developed a new marginal cost formula, which is used in the Governor�s budget proposal for 2006-07. Thus, the Governor�s proposed methodology cannot be construed as a product of the working group. In our Analysis of the 2006-07 Budget Bill, we review the Governor�s methodology, which differs significantly from the agreed-upon methodology developed in 1995. We identify significant concerns with the proposed methodology, and recommend the Legislature reject it. (We summarize our analysis of the proposal in the text box below.) In the next section we recommend an alternative approach that builds upon the existing methodology.

Governor�s Proposed Marginal Cost Methodology: A Step in the Wrong DirectionThe Governor�s budget for 2006-07 proposes a new marginal cost methodology for funding enrollment growth at the University of California (UC) and the California State University (CSU). The major differences between the Governor�s proposed methodology and the current methodology are:

Although some of the changes in the Governor�s marginal cost methodology merit legislative consideration, many of them raise serious concerns. This is because the proposal represents a significant departure from the rationale underlying the 1995 agreed-upon methodology. We summarize our concerns below. Ignores Contribution of Student Fees. The proposed methodology does not account for new student fee revenue-resulting from fee increases-available to support a greater share of the marginal cost of instruction. In addition the methodology does not recognize that General Fund and fee revenue are �fungible� resources that support the total marginal cost. Overbudgets Certain Costs. The Governor�s proposal assumes faculty costs at UC and CSU will increase on the average (rather than on the margin) with each additional FTE student. The proposal overbudgets other program costs, because it does not appropriately adjust the costs for health science students at UC. Limits Legislative Budgetary Discretion. The methodology assumes that the Legislature will approve the annual base adjustments contained in the Governor�s compact each year. Moreover, it �shields� the marginal cost from future legislative policy decisions (such as possible changes to student-faculty ratios or the share of education costs paid by students) which might otherwise reduce the state�s share of cost. |

In reviewing the current marginal cost methodology (as requested by the Legislature), we found that the methodology could be improved to more effectively fund the increased costs associated with enrollment growth. We recommend below specific steps for improvement that essentially build upon the existing methodology. We further recommend that the Legislature fund enrollment growth at UC and CSU beginning in 2006-07 based on our revised methodology.

We recommend the Legislature revise the current marginal cost methodology, in order to more effectively fund the increased costs associated with enrollment growth. Specifically, we recommend (1) excluding unrelated costs, (2) reflecting actual costs for faculty and teaching assistants, (3) including operation and maintenance costs, (4) redefining a full-time equivalent graduate student at the California State University, and (5) adjusting the total marginal cost by the average fee revenue collected per student.

Based on our review of marginal cost funding, we continue to support the underlying basis of the current marginal cost methodology (as developed in 1995)-that is, determining a total marginal cost based on current-year expenditures and �backing out� a student fee component to determine the state�s share. We have, however, identified individual components of the current methodology that could be improved in order to more appropriately fund the increased costs associated with enrollment growth.

Our proposed revisions respond to legislative attempts over the years to (1) simplify the way the state funds enrollment growth, (2) more accurately account for costs, and (3) provide greater consistency across segments. In developing our recommendations, we also sought to advance the guiding principles outlined in Figure�4, such as ensuring that the marginal cost calculations are based on factual data. Our proposed changes also incorporate some of the suggestions made by the segments during the marginal cost working group discussions (such as including costs for operation and maintenance services). Specifically, we recommend the Legislature adopt a marginal cost methodology that:

Excludes activities whose costs are essentially unaffected by additional students.

Adjusts the faculty and TA components of the marginal cost formula to better reflect actual costs.

Includes the marginal cost of operation and maintenance services.

Defines a full-time CSU graduate student load at 12 units per term (rather than 15 units).

Accurately accounts for available student fee revenue by adjusting the marginal cost based on the average systemwide fee revenue collected for each additional FTE student.

Exclude Costs for Specific Activities. Under the current methodology, the marginal cost for each program area (such as institutional support) is calculated by first determining the average cost based on current-year funding and enrollment levels, and then discounting that amount by a particular percentage to adjust for fixed costs that typically are not affected by year-to-year changes in enrollment. For example, the current discount factor for institutional support at UC is 50�percent. The different discount percentages contained in the current methodology for each segment were essentially negotiated as part of the 1995 working group. Since there is obviously no one correct discount factor, the current percentages are somewhat arbitrary.

Rather than continue to use or modify the current discount percentages, we propose eliminating entire activities under each program area whose costs increase very little with additional students. In other words, we recommend excluding activities that primarily reflect fixed costs. Such an approach was discussed by the recent working group. For example, we exclude from academic support funding for (1) museums and galleries, (2) ancillary support, and (3) academic personnel development. We believe that this change to the current methodology would more accurately reflect the marginal cost of each additional student.

Adjust Faculty and TA Components to Better Reflect Actual Costs. The expenditure and enrollment data used to calculate the marginal cost of hiring additional faculty and TAs should reflect actual costs. In developing the current marginal cost methodology, the 1995 working group observed that the additional cost of hiring faculty to serve additional students should be set at entry-level, rather than average, salaries. Thus, the current methodology calls for the faculty salary to be based on each university�s published salary of an assistant professor (step 3), which currently is $54,828 at UC and $45,696 at CSU. According to the segments, they typically have to pay new assistant professors more than the published salaries, in order to hire their first-choice candidate. As a result, both segments have proposed in their budget requests to increase the faculty salary component of the marginal cost. We believe that such a change is reasonable, but that the salary component should still reflect the level of the recently hired professors.

According to data provided to us by the segments, most of the new professors at UC and CSU continue in fact to be hired at the assistant professor level. For example, UC hired a total of 505 new faculty members in 2003-04. Of this amount, 67�percent were hired at the assistant professor level. The CSU reports that 85�percent of the 393 faculty members the university hired in fall 2004 were assistant professors. We therefore recommend that the marginal cost be based on the average annual salary paid to all new assistant professors (regardless of step) that were hired in 2004-05 and adjusted for the base budget increase approved in the 2005-06 Budget Act, which was 3�percent. (Since UC was unable to provide the average salary of new assistant professors in 2004-05, we used an adjusted 2003-04 average salary.) This approach results in a faculty salary cost of $69,576 for UC and $58,262 for CSU.

We further propose that the above faculty salaries for 2006-07 be the base amounts in the marginal cost calculation for future years. For each year after 2006-07, the faculty salary in the marginal cost formula would be the prior-year marginal cost salary adjusted for the segments� current-year base budget increase (as approved in the enacted budget for that year). For example, the faculty salary for the 2007-08 marginal cost would be the salary used in the 2006-07 marginal cost formula adjusted by the base budget increase approved for each segment in the 2006-07 Budget Act.

Another key component of the current marginal cost methodology is an underlying assumption that the annual salary of a TA at CSU is roughly 50�percent of an entering faculty member�s salary and benefits cost, which currently translates to an annual full-time TA salary of $30,226. According to the CSU Chancellor�s Office, however, the average salary for a full-time TA is only $10,133 (about 16�percent of an entering faculty member�s salary and benefits). This means that the state is currently overbudgeting the marginal cost of hiring additional TAs at CSU. We, therefore, recommend that the current marginal cost formula for CSU be revised to use the average annual TA salary at the university ($10,133). This would be consistent with how the state budgets for additional TAs at UC.

In addition to the salary of a full-time TA, the current methodology also assumes a fixed student-TA ratio of 44:1 at UC and 107:1 at CSU to determine the marginal cost of a TA per FTE student. We believe these ratios are significantly low and do not accurately reflect the current makeup of students and TAs. For example, the student-TA ratio currently used for CSU is essentially based on �headcount� rather than FTE students and TAs. In addition, UC�s student-TA ratio accounts only for undergraduate students, whereas the marginal cost funding rate is intended to fund all additional FTE students (regardless of education level). Based on recent data the segments provided us on FTE students and full-time TAs, we calculate a student-TA ratio of 62:1 at UC and 608:1 at CSU. (The high student-TA ratio at CSU reflects the fact that, unlike UC, many courses at CSU do not include TA support.) We recommend that these ratios be used in determining the marginal cost of instruction.

Include Costs for Operation and Maintenance. The current marginal cost methodology does not include costs for operation and maintenance. (Operation and maintenance primarily includes funding for the administration, supervision, maintenance, preservation, and protection of the university�s physical plant.) During our marginal cost working group discussions, both UC and CSU requested that the marginal cost account for such costs. Since the costs of operation and maintenance services eventually increase as more students are on university campuses, we recommend adding these services as a new marginal cost component (with the exception of maintenance costs that either increase very little with additional students or support UC�s research facilities).

Change Definition of CSU Graduate FTE Student. Currently, a graduate student FTE unit load at CSU is recognized in the marginal cost formula as 15 units per term. We recommend changing this definition to 12 units (as requested by the university and proposed in the Governor�s budget for 2006-07). This would be consistent with how such a load is defined at UC and most other higher education institutions. The proposed change would be revenue neutral, simultaneously increasing the defined number of graduate students and decreasing the defined cost of a graduate student.

Accurately Account for Available Student Fee Revenue. In order to determine how much state General Fund support is needed for each additional FTE student at UC and CSU, the marginal cost formula must back out the fee revenue that the segments anticipate collecting from each student. Under the current methodology, this is based on the percentage of the university�s entire operating budget that is supported by student fee revenue. For example, if fee revenue makes up 30�percent of UC�s budget for 2005-06, then new fee revenue would be deemed to support 30�percent of the total marginal cost for 2006-07. The remaining 70�percent would be funded by the state�s General Fund. Based on the current methodology, the fee backout for the budget year (2006-07) would be $3,336 for UC and $1,966 for CSU.

In our review of the current marginal cost methodology, we found that the above approach underestimates the student fee revenue available to support enrollment growth. This is because the percentage share of fees is calculated based on the university�s total operating budget, which includes program costs that are not supposed to be covered by fees (such as research and UC�s teaching hospitals). In other words, the �base� (or denominator) is larger than appropriate, which in turn depresses the percentage supported by fees. We recommend the total marginal cost be adjusted for the average systemwide fee revenue colleted from each additional FTE student (regardless of education level). In order to calculate the average fee per FTE student at UC and CSU, total current-year mandatory, systemwide fee revenue (registration and education fees for UC and state university fees for CSU) is divided by total current-year FTE students. This approach results in a fee backout for the budget year of $6,211 for UC and $2,949 for CSU. These amounts reflect the average fee amount that each additional student will pay towards their educational costs.

We recommend the Legislature fund enrollment growth based on our revised marginal cost methodology beginning in the 2006-07 budget. We further recommend the Legislature adopt (1) language in the annual budget specifying the marginal cost funding rate for each segment and (2) supplemental report language in 2006-07 specifying that enrollment growth funding provided in future budgets be based on our proposed methodology.

We recommend the Legislature fund enrollment growth at UC and CSU based on our proposed revisions to current proposed marginal cost methodology beginning in the 2006-07 budget. Thus, for 2006-07, we recommend providing $8,574 in General Fund support for each additional FTE student at UC and $6,407 for each additional FTE student at CSU. (See Figure�5 for a detailed description of our marginal cost calculations.) Our proposed methodology would provide UC and CSU with more General Fund support in 2006-07 than called for under the current marginal cost methodology ($8,087 per student at UC and $5,597 per student at CSU). As we discuss in our Analysis of the 2006-07 Budget Bill, our rates are lower than the Governor�s proposed funding rates and, therefore, results in General Fund savings relative to the Governor�s budget for 2006-07.

|

Figure 5 LAO Marginal Cost Recommendations |

|||

|

2006-07 |

|||

|

|

Marginal Cost Per FTEa Student |

||

|

|

UC |

CSU |

|

|

Faculty salary |

$3,721 |

$3,083 |

|

|

Faculty benefits |

714 |

1,133 |

|

|

Teaching assistants |

479 |

17 |

|

|

Instructional equipment replacement |

461 |

126 |

|

|

Instructional support |

4,310 |

783 |

|

|

Academic support |

1,507 |

1,293 |

|

|

Student services |

1,028 |

992 |

|

|

Institutional support |

837 |

988 |

|

|

Operation and maintenance |

1,729 |

942 |

|

|

Totals |

$14,785 |

$9,356 |

|

|

Less student fee revenue |

-$6,211 |

-$2,949 |

|

|

LAO�s Proposed State Funding Rate |

$8,574 |

$6,407 |

|

|

Current Methodology |

$8,087 |

$5,597 |

|

|

Governor�s Proposed Methodology |

$10,103 |

$6,792 |

|

|

|

|||

|

a Full-time equivalent. |

|||

As part of the 2006-07 budget, we also recommend the Legislature adopt supplemental report language specifying its intent that enrollment growth funding provided to UC and CSU in subsequent budgets be based on our proposed marginal cost methodology. Moreover, we recommend the Legislature adopt budget bill language each year, for both UC and CSU, specifying the (1) amount of funding provided for enrollment growth, (2) estimated marginal cost funding rate, and (3) number of additional FTE students funded. This is because the Legislature, the Governor, and the public should have a clear understanding of how much enrollment growth is funded at UC and CSU in the annual budget. Additionally, the segments should be expected to use enrollment growth funding provided by the state to serve additional students and not to supplement funding for existing students (such as those enrolled in nonstate supported summer instruction programs).

A major factor in determining the state budget for higher education is the number of enrolled students. In adopting the 2005-06 budget, the Legislature called for a review of the current process for funding additional students at UC and CSU. Given this directive, in this report we answer two basic questions:

How much enrollment growth to fund?

How much General Fund support to provide for each additional student?

Specifically, for 2006-07, we recommend (1) funding 2 percent enrollment growth at UC and CSU and (2) revising the current methodology for calculating the marginal cost of enrolling an additional student, in order to more accurately budget for these expenses.

|

Acknowledgments This report was prepared by Anthony Simbol and reviewed by Steve Boilard. The Legislative Analyst's Office (LAO) is a nonpartisan office which provides fiscal and policy information and advice to the Legislature. |

LAO Publications To request publications call (916) 445-4656. This report and others, as well as an E-mail subscription service, are available on the LAO's Internet site at www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000, Sacramento, CA 95814. |