July 2006

On June 30, 2006, the Governor signed the 2006-07 Budget Act. In this report we highlight the major features of the budget package.

VI. Judiciary & Criminal Justice

VIII. Resources and Environmental Protection

Appendix 1: Budget-Related Legislation

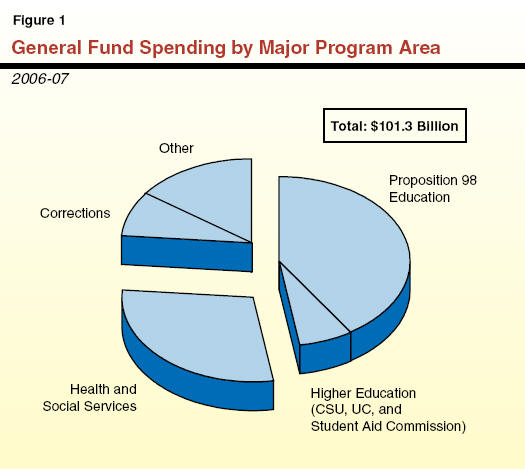

On June 27, 2006, the Legislature passed the 2006-07 Budget Bill along with implementing legislation (see Appendix 1 for a list of these �trailer bills�). The Governor signed the budget on June 30, after using his line item veto authority to reduce appropriations by $112�million ($62�million General Fund). The budget package authorizes total spending of $127.9�billion, of which $101.3�billion is from the General Fund and $26.6�billion is from special funds. Figure�1 shows the distribution of General Fund spending by major program area.

The 2006-07 budget reflects a sharply improving fiscal picture, brought about by continued stronger-than-expected growth in General Fund revenues. Spending under the plan increases by over 9�percent between 2005-06 and 2006-07, reflecting significant program augmentations, budgetary debt prepayments, and rising caseloads and costs in state programs.

Spending Highlights. The budget includes substantial increases in education spending. It allocates $8�billion in new funds for K-14 Proposition�98 education, resulting in an over 11�percent increase in K-12 per pupil funding relative to the level provided in the 2005-06 Budget Act. It also provides large funding increases for the University of California (UC) and California State University (CSU), including funding in lieu of planned fee increases for 2006-07. The budget package also rolls back community college fees from $26 to $20 per unit beginning in spring 2007. The budget provides $40�million in Proposition�98 General Fund support to backfill the foregone fee revenue.

In the transportation area, it provides the full $1.4�billion annual Proposition�42 transfer of sales taxes on gasoline to fund transportation programs, and it repays $1.4�billion of past Proposition�42 related loans.

In the health and social services area, the budget package includes: (1) one-time funding for hospitals to increase patient capacity to meet health care emergencies such as an avian flu pandemic; (2) increased funding for county block grants for California Work Opportunity and Responsibility to Kids, child welfare services, and foster care, and (3) funding for pass through of the federal January 2007 Supplementary Security Income cost-of-living adjustment, which-under the terms of the 2005-06 budget package-had previously been delayed until April 2007.

The budget includes significant funding increases for corrections to cover higher inmate population and health-related costs.

Debt Prepayment. The budget devotes $2.8�billion in General Fund revenues to the repayment of budgetary debt which had been incurred in previous years. About one-half of the total is for the prepayment of Proposition�42 loans from transportation (cited above), and the remainder is for local governments, schools, and special funds.

Figure�2 shows that 2005-06 began with a prior-year balance of $9.5�billion (reflecting the combination of better-than-expected revenues and past budgetary borrowing). Revenues and expenditures are an identical $92.7�billion in 2005-06, leaving the fund balance at the end of the year at the same $9.5�billion. After accounting for $521�million in encumbrances, the year-end reserve is $9�billion.

|

Figure 2 The 2006-07 Budget General Fund Condition |

||

|

(In Millions) |

||

|

|

2005‑06 |

2006‑07 |

|

Prior-year fund balance |

$9,511 |

$9,530 |

|

Revenues and transfers |

92,749 |

94,354 |

|

Total resources available |

$102,260 |

$103,884 |

|

Expenditures |

92,730 |

101,261 |

|

Ending fund balance |

$9,530 |

$2,623 |

|

Encumbrances |

521 |

521 |

|

Reserve |

$9,009 |

$2,102 |

|

Budget Stabilization Account |

� |

$472 |

|

Reserve for Economic Uncertainties |

$9,009 |

$1,630 |

In 2006-07, the budget assumes that revenues will total $94.4�billion (a 1.7�percent increase), and that expenditures will total $101.3�billion (a 9.2�percent increase). The $6.9�billion operating shortfall between revenues and expenditures leaves the General Fund with a reserve of $2.1�billion at the conclusion of the budget year. This reserve estimate does not include the fiscal impacts of future collective bargaining contracts approved by the Legislature. (For example, the tentative agreement recently reached between the administration and Service Employees International Union would, if approved, result in 2006-07 costs of more than $100�million.)

Out-Year Implications of the 2006-07 Budget. Based on our current projections of revenues and expenditures under the 2006-07 Budget Act policies, the state would continue to face operating shortfalls in the range of $4.5�billion to $5�billion in 2007-08 and 2008-09. The carryover reserve from 2006-07 would be available to offset a portion of the shortfall in 2007-08. We will be updating our fiscal projections in November 2006, when we release our California Fiscal Outlook.

Prepared by the Economic, Taxation, and Fiscal Forecasting Section�-(916) 319-8306

As Figure�1 shows, the budget package includes $55.1�billion in Proposition�98 spending in 2006-07 for K-14 education (K-12 schools and community colleges). This represents an increase of $5.2�billion, or 10.3�percent, from the enacted 2005-06 spending level. Figure�1 summarizes the budget package for K-12 schools, community colleges, and other agencies for both the current and past fiscal years. In 2006-07, funding for K-12 education grows 10�percent and community college funding grows 13�percent.

|

Figure 1 Proposition 98 Budget Summary |

||||

|

(Dollars in Billions) |

||||

|

|

2005-06 |

|

|

|

|

|

Enacted |

Revised |

2006-07 |

Percent Change From 2005-06 Enacted |

|

K-12 |

$44.6 |

$46.5 |

$49.1 |

10.0% |

|

California Community Colleges |

5.2 |

5.5 |

5.9 |

13.0 |

|

Other agencies |

0.1 |

0.1 |

0.1 |

6.6 |

|

Totals, Proposition 98 |

$50.0 |

$52.0 |

$55.1 |

10.3% |

|

K-12 |

|

|

|

|

|

Average daily attendance (ADA) |

6,031,404 |

5,972,985 |

5,957,368 |

-1.2% |

|

Amount per ADA (in dollars) |

$7,402 |

$7,777 |

$8,244 |

11.4 |

This funding level is almost $600�million above the Proposition�98 minimum guarantee for 2006-07 assuming the lawsuit settlement discussed in a box below. (Without the proposed settlement, the �overappropriation� level would be $1.9�billion.) This includes a $426�million required overappropriation for Proposition�49 after school programs, and around $165�million resulting from the fact that final budget negotiations recognized roughly an additional $300�million in current-year revenues, which lowered the required funding level for the budget year.

As discussed later, the budget package also includes an additional $2.8�billion in one-time funds for K-14 education ($2.5�billion for K-12 and around $300�million for community colleges).�Figure�1 shows that roughly $2�billion of these one-time funds result from the 2005-06 Proposition�98 minimum guarantee increasing from $50�billion to $52�billion after the 2005-06 Budget Act was passed (due to higher-than-expected state tax revenues).

Proposed Settlement Agreement With Education CommunityIn May, the Governor proposed to settle a pending lawsuit by the education community stemming from a disagreement over the suspension of Proposition�98 in 2004-05. Chapter�213, Statutes of 2004 (SB 1101, Budget Committee), suspended the Proposition�98 minimum guarantee and established a target funding level for K-14 education that was $2�billion lower than the amount called for by the constitutional guarantee. Because final General Fund revenues for 2004-05 were substantially higher than projected when the 2004-05 Budget Act was adopted, the final suspension level was $3.6�billion, $1.6�billion higher than the Chapter�213 target. The settlement agreement proposed by the Governor would provide a total of $2.9�billion-$1.6�billion associated with the 2004-05 fiscal year and $1.3�billion for the subsequent impact on 2005-06. The total would be paid over seven years beginning in 2007-08, to be scored as Proposition�98 payments to 2004-05 and 2005-06. Legislation to implement this agreement was not part of the budget package, but will likely come before the Legislature for approval in August. While the funding of the settlement was not a part of the budget, the 2006-07 Proposition�98 spending level essentially reflects the level that would have been required had the state spent at the Chapter�213 target level in 2004-05. |

The K-12 portion of the Proposition�98 budget package includes:

2005-06. Revised Proposition�98 funding of $7,777 per pupil, an increase of $375 per pupil from the 2005-06 Budget Act level.

2006-07. Provides $8,244 per pupil, which represents an increase of $842 per pupil, or 11.4�percent, above enacted 2005-06 per pupil spending.

Figure�2 displays major K-12 funding changes from the enacted 2005-06 budget. The budget package provides about $4.5�billion in new ongoing K-12 expenditures (including funds vetoed, but set aside for subsequent legislation). The budget fully funds base programs and provides significant increases for a number of existing programs, as well as some funding for new programs. Major funding changes include:

|

Figure 2 Ongoing K-12 Proposition 98 Changes |

|

|

2006-07 (In Millions) |

|

|

|

Amount |

|

Cost-of-living adjustments, growth, and other adjustments |

$2,383 |

|

Proposition 49 after school programs |

426 |

|

Revenue limit equalization |

350 |

|

Economic Impact Aid |

350 |

|

Deficit-factor reduction (including basic aid) |

309 |

|

Counselors |

200 |

|

Arts and music block grant |

105 |

|

Child care eligibility |

67 |

|

Preschool expansion |

50 |

|

Increased support for high school exit exam |

50 |

|

Other |

187 |

|

Total Changes |

$4,476 |

Growth and Cost-of-Living Adjustments (COLA) ($2.4�Billion). The budget provides $2.6�billion to fund a 5.92�percent COLA for revenue limits and most categorical programs (including statutory and discretionary COLAs). The budget also reflects a net of roughly $220�million in savings-mostly for revenue limits-due to estimates that statewide attendance will decline by 0.26�percent in 2006-07 compared to revised estimates for the preceding year. (In general, the budget does not decrease funding for categorical programs based on these declines in statewide growth rates, but rather continues to fund them at 2005-06 levels plus COLA�s.)

Proposition�49 After School Program ($426�Million). The budget package includes $426�million in new Proposition�98 spending for after school programs, as required by Proposition�49 (passed by voters in 2002). These funds were provided after the state fully funded the 2006-07 Proposition�98 minimum guarantee. In addition, the budget includes around $2�million in non-Proposition�98 General Fund monies for the California Department of Education to administer and evaluate the program.

Revenue Limit Equalization ($350�Million). The budget provides $350�million to reduce historical inequities in general purpose spending. Trailer bill legislation stipulates that these funds will be allocated using the current equalization methodology, which sets targets at the 90th percentile of average daily attendance and distinguishes districts by size and type.

Economic Impact Aid Augmentation and Formula Change ($350�Million). The budget includes a $350�million funding increase for districts to educate economically disadvantaged and English learner students, bringing total program funding to roughly $975�million. Trailer bill legislation changes the distribution formula to address data issues and historic inequities in the distribution of funds.

Deficit Factor Elimination ($309�Million). The budget package provides $309�million in general purpose funds by eliminating the revenue limit deficit factor for school districts and county offices of education. In 2003-04, the state reduced revenue limits and did not provide a COLA, creating a �deficit factor� of 3.02�percent that would eventually need to be restored. The revenue limit reduction was partially restored in 2004-05 and 2005-06, and the 2006-07 budget package fully restores the deficit factor.

Counselors ($200�Million). The budget provides $200�million for additional counselors for students in grades 7-12. The trailer bill includes a requirement that, as a condition of receiving these funds, districts develop a course plan to assist low-performing 7th grade students and high school students who have not passed the California High School Exit Examination.

Arts and Music Block Grant ($105�Million). The budget includes $105�million to create a new block grant, which will provide districts with supplemental funding to hire staff and purchase supplies for standards-aligned instruction in arts and music.

Expansion of Child Care Eligibility ($67�Million). The budget �unfreezes� child care income eligibility levels to a maximum of 75�percent of current state median income. To accommodate the projected increases in caseload as a result of the eligibility change, the budget provides $67�million for additional subsidized child care slots.

Preschool Expansion ($50�Million). The budget provides $50�million for expanded preschool services. Details are to be specified in legislation later this summer. The budget also provides $50�million in one-time funds for facility loans to providers.

Additional Support for High School Exit Exam ($50�Million). The budget provides an increase of $50�million for supplemental instruction for 11th and 12th grade students who have not passed the California High School Exit Examination. Combined with the $20�million that continues from the prior year, the 2006-07 budget provides $500 per student for each�12th grade student. Funds available after funding 12th grade students will be distributed for services to 11th grade students.

The budget provides an additional $2.5�billion in one-time K-12 education funds. This total is comprised of three main sources-additional funds required to meet the Proposition�98 minimum guarantee in 2005-06 ($2�billion), settle-up payments to meet Proposition�98 obligations from prior years ($258�million), and the Proposition�98 Reversion Account, which are funds that have been appropriated for K-14 education in prior years but not used ($226�million). Figure�3 shows the uses of the one-time funds included in the final budget package. The major one-time spending includes:

|

Figure 3 K-12 Spending From One-Time Funds |

|

|

(In Millions) |

|

|

|

Amount |

|

Payment of K-12 mandate claims from prior years |

$927 |

|

Discretionary block grant |

534 |

|

Arts, music, and P.E. equipment block grant |

500 |

|

School facilities emergency repairs (Williams settlement) |

137 |

|

Instructional materials |

100 |

|

Preschool facilities |

50 |

|

Teacher recruitment |

50 |

|

Career technical education equipment |

40 |

|

Mandates�2006-07 costs |

30 |

|

Other |

165 |

|

Total |

$2,533 |

K-12 Education Mandates ($927�Million). The budget provides $927�million in one-time funds to pay for mandate costs deferred from prior years. These funds are drawn from all of the three sources of one-time funds described above-funds owed to meet the minimum guarantee in 2005-06 ($650�million), settle-up payments to meet Proposition�98 obligations from prior years ($258�million), and the Proposition�98 Reversion Account ($19�million).

Discretionary Block Grant ($584�Million). The budget provides $584�million to districts and schools to use for one-time purposes-including instructional materials, maintenance, professional development, and fiscal obligations. Of this amount, 25�percent ($146�million) will be allocated to school districts and 75�percent ($438�million) will be allocated directly to school sites.

Equipment Block Grant ($500�Million). The budget includes $500�million to be distributed to school districts on a per pupil basis, to be used for supplies and equipment for art, music, and physical education.

School Facilities Emergency Repairs ($137�Million). As part of the settlement of Williams v. California, the state is required to commit one-half of the funds in the Proposition�98 Reversion Account for emergency facility repairs. The 2006-07 budget meets this obligation by providing $137�million for this purpose.

Instructional Materials Block Grant ($100�Million). The budget includes $100�million to be distributed to school districts on a per pupil basis, to be used for instructional materials, library materials, or one-time educational technology costs.

The Governor vetoed $37.8�million provided to increase the per meal reimbursement rate for the child nutrition program. The Governor set the funds aside for subsequent legislation to tie the funding to increased nutritional quality. The Governor also vetoed $15.1�million for a new cohort of the federal Reading First schools, and accompanying language making the continuation of a school�s funding contingent on making significant academic progress, as defined in future legislation.

Prepared by the K-12 Education Section�- (916) 319-8333

The enacted budget provides a total of $10.8�billion in General Fund support for higher education in 2006-07 (see Figure�1). This reflects an increase of $931�million, or 9.4�percent, above the amount provided in 2005-06. As shown in the figure, the budget provides the University of California (UC) with $3.1�billion in General Fund support, which is $241�million, or 8.5�percent, more than the revised 2005-06 level. For the California State University (CSU), the budget provides $2.8�billion in General Fund support, which is an increase of $191�million, or 7.4�percent.

|

Figure 1 Higher Education

Budget Summary |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Change |

|

|

|

2005-06 |

2006-07 |

Amount |

Percent |

|

University of California |

$2,844.7 |

$3,085.8 |

$241.1 |

8.5% |

|

California State University |

2,597.5 |

2,788.7 |

191.2 |

7.4 |

|

California Community Colleges |

3,714.5 |

4,102.4 |

388.0 |

10.4 |

|

Student Aid Commission |

738.4 |

846.7 |

108.3 |

14.7 |

|

Hastings College of the Law |

8.4 |

10.9 |

2.6 |

30.6 |

|

California Postsecondary |

2.0 |

2.1 |

� |

0.9 |

|

Totals |

$9,905.5 |

$10,836.5 |

$931.0 |

9.4% |

The budget provides the California Community Colleges (CCC) with $4.1�billion in General Fund support for 2006-07, which is $388�million, or 10.4�percent, above the revised 2005-06 level. In addition, the budget provides CCC with another $305�million in one-time funds that, for Proposition�98 purposes, will count toward prior fiscal years. Virtually all of CCC�s General Fund support counts toward the state�s Proposition�98 expenditures, as does CCC�s local property tax revenue. Total Proposition�98 support for CCC in 2006-07 is $5.9�billion, which is 10.7�percent of total Proposition�98 appropriations.

The budget also provides $847�million in General Fund support to the California Student Aid Commission. This funding, which supports the state�s Cal Grant programs and other financial aid programs, is $108�million, or 14.7�percent, above the 2005-06 level.

Base Increases. All three higher education segments received substantial General Fund base augmentations to address salary and other cost increases. These include $156�million (5.8�percent) for UC, $130�million (5.2�percent) for CSU, and $312�million (5.9�percent) for CCC. The CCC�s base increase follows the same statutory formula used to calculate the K-12 cost-of-living adjustment. The base increases for UC and CSU include funding associated with a �fee buyout� as proposed by the Governor. The Governor had proposed the buyout funding in lieu of fee increases that had been planned by UC and CSU.

Enrollment Growth. The three higher education segments received augmentations to fully fund all anticipated enrollment growth. The budget provides a total of $112�million for 2.5�percent growth at both UC and CSU. This funds an additional 5,149 full-time equivalent (FTE) students at UC and 8,490 FTE students at CSU. Funding for these students is determined using a new methodology for determining the marginal cost of serving each additional student. The Legislature rejected the Governor�s proposed methodology, and adopted an alternative which accounts for fee revenue and faculty salary costs differently.

The budget provides CCC with $97.5�million to fund enrollment growth of 2�percent, or 22,688 FTE students. However, because community college enrollment has been declining, CCC has a similar number of unfilled, funded �slots� that also will be available for enrolling additional students in 2006-07. Thus, as a practical matter, CCC will have funding to grow by slightly more than 4�percent in 2006-07.

Student Fees. The budget provides for no UC or CSU resident student fee increases in 2006-07. (As noted above, both segments received additional funds-$130 million-in lieu of fee increases.) The budget reduces student fees at CCC from $26 per unit to $20 per unit, effective in spring 2007. The budget provides $40�million to backfill this foregone fee revenue.

Student Academic Preparation (Outreach). The Legislature rejected the Governor�s proposal to eliminate General Fund support for student academic preparation programs at UC and CSU. Instead, the budget provides General Fund support of $19.3�million to UC and $7�million to CSU for these programs. Of the UC amount, $2�million is for a new transfer initiative between UC and CCC.

Nursing Initiatives. The budget includes $10.5�million for various higher education nursing initiatives. These include $1�million for expanded enrollment at UC, $4�million for expanded enrollment and various start-up costs at CSU, and $5.5�million for student services and faculty recruitment and retention at CCC. In addition, the budget authorizes 40 loan forgiveness warrants for nursing graduates who work in state facilities, such as prisons and developmental centers, contingent upon enactment of legislation.

The 2006-07 Budget Act includes several major features that are specific to the higher education segments.

University of California. Major General Fund augmentations include:

$14�million in one-time funds for start-up costs to support the UC Merced campus.

$10�million for research centers focusing on (1) labor issues and (2) substance abuse.

California State University. For 2006-07, revenue that CSU collects as student fees is no longer deposited in a central state account and appropriated to the university through the budget act. Instead, student fee revenue will be deposited in trust accounts maintained by CSU campuses. The budget reduces CSU�s General Fund support by $5�million to account for the fact that interest earned on these funds will accrue to CSU rather than the state General Fund.

California Community Colleges. Major features of the CCC budget include:

$159�million for equalization. This funding is intended to fully achieve the state�s equalization goal for CCC, contingent upon enactment of legislation specifying the allocation of this funding.

$100�million in one-time funding for general purpose block grants to districts.

$94.1�million in one-time funding for facilities maintenance and equipment.

$40�million in one-time funding for career technical education equipment and facility upgrades.

$30�million to increase the funding rate for selected noncredit enrollment, contingent upon enactment of legislation authorizing these rate enhancements.

Prepared by the Higher Education Section�- (916) 319-8331

The 2006-07 budget plan provides about $19.5�billion from the General Fund for health programs, which is an increase of about $1.8�billion or 10�percent compared to the revised prior-year level of spending. Several key aspects of the budget package are discussed below and summarized in Figure�1.

|

Figure 1 Major Changes�State Health Programs 2006‑07 General Fund Effect |

|

|

(In Millions) |

|

|

|

|

|

Enrollment Activities for Children's Health Programs |

|

|

Support new activities to expand enrollment |

$50 |

|

Medi-Cal |

|

|

Increase rates for nursing homes and other long-term care facilities |

$87 |

|

Reverse 5 percent reduction in physician rates |

75 |

|

Increase rates for certain managed care plans |

39 |

|

Make technical adjustments for funding shifts to other departments |

-356 |

|

Disaster Preparedness |

|

|

Implement steps to prepare for flu pandemic and other emergencies |

$190 |

|

Public Health |

|

|

Augment AIDS prevention and education efforts |

$6 |

|

Continue local assistance to combat West Nile Virus outbreak |

3 |

|

Department of Developmental Services |

|

|

Provide rate increase for some community service providers |

$47 |

|

Increase wages for direct care staff in day and work activity programs |

24 |

|

Department of Mental Health |

|

|

Address federal court orders on mental health care for prison inmates |

$27 |

|

Comply with federal consent decree for state hospitals |

21 |

|

Department of Alcohol and Drug Programs |

|

|

Improve Proposition 36 drug treatment performance and outcomes |

$25 |

|

Establish new statewide campaign to deter methamphetamine use |

10 |

|

|

|

The budget plan provides about $50�million in General Fund support for new activities to (1) enroll additional children who are eligible for, but not now enrolled, in Medi-Cal and the Healthy Families Program (HFP) and (2) retain in coverage more children who are enrolled. State grants are provided to counties to spur local outreach activities, HFP enrollment procedures are simplified, and new financial incentives are provided for certified application assistants. The spending plan also includes funds for the additional case-loads expected to result from these outreach and enrollment efforts.

The 2006-07 enacted budget provides about $13.8�billion from the General Fund ($35.1�billion all funds) for Medi-Cal local assistance expenditures. This amounts to about a $1�billion, or 7.4�percent, increase in General Fund support for Medi-Cal local assistance. This increase would have been significantly greater except for $356�million in technical adjustments reflected in the budget plan. General Fund support previously displayed in the Medi-Cal budget is now shown in the Department of Mental Health (DMH) budget item for mental health services for children and in the Department of Aging budget item for the Multipurpose Senior Services Program.

Major Cost Factors. The increase in expenditures primarily reflects: (1)�increases in costs and utilization of medical services in the base program; (2) rate increases for physicians and certain other providers; (3) a number of significant policy changes in Medi-Cal, including the continued shift of prescription drug coverage for certain aged and disabled beneficiaries to the federal Medicare Part D drug benefit; and (4) ongoing growth in caseloads. Specifically, Medi-Cal caseloads are assumed to grow by about 85,000, or 1.3�percent, in the budget year to a total of about 6.7�million average monthly eligibles.

Changes in Medi-Cal Provider Rates. The budget plan provides $87�million General Fund for rate increases for nursing homes and other facilities that provide long-term care services to Medi-Cal beneficiaries. The budget also includes $75�million General Fund to reflect the reversal of a 5�percent reduction in rates for physicians and certain other Medi-Cal providers that was enacted in 2003-04, but only partially implemented due to a now-resolved legal challenge. In addition, among other provider rate increases, $39�million in state funds would be provided for rate increases for certain Medi-Cal managed care plans. The Governor vetoed an additional $9.3�million General Fund augmentation for rate increases for these plans.

New Federal Documentation Requirements. The budget plan adopts changes in state law to comply with new federal requirements that states obtain documentation of the identity and citizenship of individuals who enroll and re-enroll in Medi-Cal.

The budget plan provides about $368�million from the General Fund ($1�billion all funds) for local assistance under HFP during 2006-07. This reflects an overall increase of about $128�million (all funds), or 14�percent, in annual spending for the program. General Fund spending for HFP local assistance is budgeted to increase by about $47�million. This is primarily the result of increases in caseload assumed to occur as a result of additional funding for application assistance and the implementation of efforts to streamline children�s enrollment, as discussed above. Underlying caseload trends and increases in provider rates are also projected to contribute to the increased spending level for HFP. Overall, program enrollment is assumed to grow by 78,000 children, or about 10�percent, to reach a total of about 859,000 children by the end of the budget year.

The budget plan adopts, with some significant modifications, various administration proposals to better prepare the state for public health emergencies and, in particular, the threat of an avian flu pandemic. In all, the spending plan provides more than $190�million in state funding (plus federal funds) to the Department of Health Services (DHS) and the Emergency Medical Services Authority (EMSA) to make additional hospital beds available in case of a flu emergency, strengthen the state and local public health laboratory systems, and conduct local planning to respond to a major public health disaster. Most of this additional funding is provided on a one-time basis.

The budget plan provides DHS with about $560�million from the General Fund ($2.5�billion all funds) for public health local assistance during 2006-07. General Fund spending for public health local assistance would increase by about $178�million, or almost 47 percent, primarily due to the augmentations for disaster preparedness discussed above. The budget supports various expansions of public health programs, including augmentations for AIDS prevention and education activities, breast cancer screening, Alzheimer�s disease diagnosis and treatment, and clinic programs for agricultural workers and rural areas. Genetic testing of newborns would be expanded to include screening for cystic fibrosis and biotinidase deficiency. The budget also continues state assistance to local special districts in controlling the West Nile Virus, although the Governor used his veto authority to reduce the amount provided for this purpose in 2006-07.

General Fund support for EMSA would increase under the budget by about 21�percent to about $29�million. About $53�million would be provided to EMSA from all fund sources. The increase is due partly to the expansion of EMSA�s disaster preparedness activities discussed earlier. The Governor vetoed a proposed $10�million General Fund augmentation for grants to improve the operation of trauma care centers.

The budget significantly expands staffing for the inspection of nursing homes, hospitals, and other health care facilities. It establishes a special fund within DHS to pay for these activities primarily from fees, but provides some General Fund support to moderate the initial impact of fee increases.

The budget provides almost $2.5�billion from the General Fund ($4�billion all funds) for services to individuals with developmental disabilities in developmental centers and regional centers. This amounts to an increase of about $246�million, about 11�percent, in General Fund support over the revised prior-year level of spending provided to the department.

Community Programs. The 2006-07 budget includes a total of almost $2.1�billion from the General Fund ($3.2�billion all funds) for community services for the developmentally disabled, an increase in General Fund resources of about $245�million, or 13�percent, over the revised prior fiscal year level of spending. This growth in community programs is due mainly to increases in caseload, costs, and utilization of regional center services. Also, about $47�million General Fund is allocated to provide a 3�percent rate increase for providers of specified regional center services. The budget also provides about an additional $24�million General Fund to increase wages for direct care staff in certain day programs and work activity programs, as well as to increase funding for supported employment programs. The budget continues several mostly temporary actions to hold down community program costs.

Developmental Centers. The budget provides $385�million from the General Fund for operations of the developmental centers (almost $703�million all funds), roughly the same level of support as the revised prior-year level of spending. The budget continues to support plans to close the Agnews Developmental Center and place many of its clients in community programs, but assumes a further postponement of the closure to June 2008.

The budget provides about $1.7�billion from the General Fund ($3.6�billion all funds) for mental health services provided in state hospitals and in various community programs. This is about a $445�million, or 35�percent, increase in General Fund support compared to the revised prior-year level of spending for DMH.

Community Programs. The 2006-07 budget includes about $781�million from the General Fund (almost $2.5�billion all funds) for local assistance for the mentally ill, about a 82�percent increase in General Fund support compared to the revised prior-year level of spending. The increase in General Fund spending is mainly due to the technical budget adjustment discussed above, in which General Fund support previously displayed in the DHS Medi-Cal budget for certain mental health services for children enrolled in Medi-Cal is now displayed in the DMH budget item.

�AB 3632� Mandates. The budget plan does not adopt an administration proposal to suspend what are known as the AB 3632 mandates for children in special education programs. Instead, the budget provides $69�million in federal special education funds and $52�million from the General Fund for a new DMH categorical program to reimburse a significant portion of the estimated costs for providing these services in the budget year. The spending plan also provides $66�million from the General Fund to pay outstanding mandate claims from 2004-05 and 2005-06.

State Hospitals. The budget provides about $879�million from the General Fund for state hospital operations (about $951�million all funds). The $96�million, or 12�percent, increase in General Fund resources is due to several factors, including projected increases in the state hospital population. The budget provides about $21�million General Fund and 453 staff positions to meet the requirements of a consent decree that resulted from a U.S. Department of Justice civil rights investigation of state mental hospitals. The spending plan also includes about $27�million General Fund and an additional 271 staff positions to address a federal court order in the Coleman case, which requires additional intermediate and acute care inpatient mental health services for state prison inmates.

The budget provides about $290�million from the General Fund ($670�million all funds) for community programs operated by the Department of Alcohol and Drug Programs (DADP). This is about a $47�million, or 19�percent, increase in General Fund support compared to the revised prior-year level of spending for alcohol and drug programs.

Proposition�36. The budget continues funding for the Substance Abuse and Crime Prevention Act (also known as Proposition�36) at the current level of $120�million, and provides an additional $25�million General Fund to improve the performance and outcomes of participants in these drug treatment programs. The budget package also modifies current law to change various provisions of Proposition�36, including establishing new requirements for drug testing, permitting the brief incarceration in jail of some offenders for violation of probation, and excluding some repeat offenders from eligibility for diversion from prison or jail to Proposition�36 treatment.

Methamphetamine Prevention Campaign. The budget provides $10�million General Fund to DADP to establish a new statewide media and outreach campaign to deter the use of methamphetamine.

Drug Medi-Cal Rate Increase. The Governor vetoed a proposed $2.3�million General Fund augmentation to increase certain reimbursement rates for Drug Medi-Cal providers.

Prepared by the Health Section- (916) 319-8350

General Fund support for social services programs in 2006-07 totals $9.8�billion, an increase of 6�percent over the prior year. Most of the increase is due to (1) caseload increases in the Supplemental Security Income/State Supplementary Program (SSI/SSP), In-Home Supportive Services program, and Adoptions Assistance program; (2) passing through the federal SSI cost-of-living adjustment (COLA) in January 2007; (3) new initiatives in child welfare services; and (4) the General Fund costs for backfilling the redirection of Temporary Assistance for Needy Families (TANF) federal block grant funds from child welfare and foster care into California Work Opportunities and Responsibility to Kids (CalWORKs) county block grants. The 2006-07 Budget Act and related legislation make various changes to current law, and the fiscal impacts of these changes are summarized in Figure�1.

|

Figure 1 Major Changes�Social Services Programs 2006‑07 General Fund and Federal TANF Block Grant Funds |

||

|

(Dollars in Millions) |

||

|

|

Change From Prior Law |

|

|

Programs |

General Fund |

TANF |

|

SSI/SSP |

|

|

|

Pass-through January 2007 federal COLA |

$42.0 |

� |

|

CalWORKs County Block Grants |

|

|

|

Increase to account for higher spending in 2005‑06 |

� |

$140.0 |

|

Reduction for unspent county incentive funds |

� |

-40.0 |

|

Reduce transfer to CalWORKs from Employment Training Fund |

� |

17.9 |

|

TANF Reauthorization Package |

|

|

|

Projects promoting work participation |

� |

$90.0 |

|

Grant savings assumed from work-related projects |

� |

-17.2 |

|

Homelessness prevention |

� |

5.0 |

|

Community colleges work study programs |

$9.0 |

|

|

Foster Care and Child Welfare Services (CWS) |

|

|

|

Replace TANF funds with General Fund |

$100.0 |

-$100.0 |

|

Flexible funding for CWS improvements |

50.0 |

� |

|

Increase kinship programs |

10.5 |

� |

|

Support for emancipating foster youth |

9.7 |

� |

|

Augmentation for adoptions |

11.1 |

� |

|

Augmentation for dependency drug courts |

3.0 |

� |

|

Community Care Licensing |

|

|

|

Increase random inspection visits/other improvements |

$5.7 |

� |

|

Child Support |

|

|

|

Hold certain noncustodial parents harmless for transitional payment |

$25.5 |

� |

|

Augmentation for local child support agency improvement |

4.0 |

� |

|

Department of Aging |

|

|

|

Transfer of local assistance funding for MSSP from Health Services |

$22.3 |

� |

|

Augmentation for MSSP providers |

3.0 |

� |

|

Employment Development Department |

|

|

|

Los Angeles County health care workforce development |

$5.7 |

� |

|

Department of Rehabilitation |

|

|

|

Increase for supported employment rates |

$5.6 |

� |

|

Totals |

$307.1 |

$95.7 |

|

|

||

|

TANF=Temporary Assistance for Needy Families and MSSP= Multipurpose Senior Services Program. |

||

January 2007 Federal COLA. Prior law delayed the effective �pass-through� of the federal January 2007 COLA until April 2007. Budget legislation restores the pass-through to January 2007, resulting in a onetime General Fund cost of $42�million.

Net Increase in Funding for County Block Grants. Counties receive a block grant, known as the single allocation, to fund eligibility determination, welfare-to-work services, and child care. Because county block grant spending was higher during the first three quarters of 2005-06 in comparison to prior years, the Legislature increased county block grant allocations by $140�million for 2006-07. However, the budget reduces funding by $40�million, on a one-time basis in counties that retain unspent CalWORKs performance incentives. The budget replaces $18�million in Employment Training Fund support for county block grants with TANF federal funds, freeing up an identical $18�million for use by the Employment Training Panel for its training programs.

TANF Reauthorization Package. In order to meet the higher work participation requirements of the federal Deficit Reduction Act of 2005, the budget provides $90�million for various projects to engage nonworking recipients in work-related activities, and $9�million for work study programs with the community colleges. These changes are assumed to result in grant savings of $17.2�million (higher earnings reduces grant payments). Finally, the budget provides $5�million for homelessness prevention among CalWORKs families facing potential eviction.

CWS Improvements. The budget provides $50�million in flexible funding to counties which may be used for reducing social worker caseloads or implementing early interventions to improve outcomes for families and children. The budget also adds an additional $3�million in 2006-07 to expand the use of Drug Dependency Courts as an intervention strategy in child welfare cases.

Kinship Support. The budget provides $8�million in additional funds to KinGap, a program which provides payments to relatives who become guardians to former foster children. The additional funds will increase payments for children with special needs and expand KinGap eligibility to youth in the probation system who are in the care of relatives. The budget also expands by $2.5�million county programs that provide support and services to kin caregivers of foster children.

Emancipating Foster Youth. The budget adds $9.7�million to increase support for emancipating foster youth. This includes $4�million to eliminate the county share of cost in the transitional housing placement program and $5.7�million to create a state-only program of education and training vouchers for emancipating foster youth, similar to the federal �Chafee� program.

Adoptions. The budget provides a total of $11.1�million to increase adoptions. This includes $7.1�million to support additional adoption workers. The Legislature also added $4�million to establish a project in five areas of the state to provide pre- and post-adoption services for foster children who have been in care for more than 18 months and are over 9 years of age.

Budget legislation provides an increase of $6.1�million ($5.7�million General Fund), and a total of 80 positions in order to increase the frequency of random facility inspection visits and to implement other licensing division reforms, including making certain licensing information available to the public on the Internet. Budget legislation clarifies the requirement that the department conduct unannounced visits in at least 20�percent of facilities each year. The amounts noted above reflect the Governor�s veto of four positions and $320,000 for placing CCL data on the internet.

Holding Certain Noncustodial Parents Harmless for Transitional Payment. In developing its federally required automated child support system, the state changed the date when a child support payment is recorded from the date of withholding to the date of receipt. This change places some noncustodial parents (NCPs), through no fault of their own, behind in their child support payments, creating an �arrearage.� Budget legislation allows the state to make child support payments on behalf of the affected NCPs, thus preventing the arrearage and holding these NCPs harmless. The NCPs will be required to repay the state for this prepayment upon termination of their child support obligation. These one-time prepayments result in General Fund costs of $25.5�million in 2006-07.

The Legislature also added $4�million General Fund (and about $8�million in federal matching funds) to the allocations for local child support agencies for the purpose of improving performance on child support enforcement.

The budget transfers the local assistance funding ($22.3�million) for the Multipurpose Senior Services Program (MSSP) from the Department of Health Services to the Department of Aging. The budget also provided $3�million General Fund to support increased reimbursement rates for MSSP service provider organizations.

Legislative Augmentations. The budget provides $5.7�million General Fund to Los Angeles County to continue training and workforce development programs for its public health system that were formerly supported with federal Workforce Investment Act funds. The budget includes $5.6�million in the Department of Rehabilitation to fund a rate increase in the Supported Employment Program.

Cash Assistance Program for Immigrants (CAPI). The budget rejects the Governor�s proposal to extend, from the current 10 years to 15 years, the period for which a sponsor�s income is �deemed� (counted for purposes of financial eligibility) to a legal noncitizen. Upon the end of the ten-year deeming period, state-only CAPI payments for certain legal immigrants will commence in September 2006. These payments result in General Fund costs of approximately $12�million in 2006-07, rising to over $40�million in 2007-08.

Prepared by the Social Services Section-(916) 319-8353

The 2007 Budget Act contains $12.9�billion for judicial and criminal justice programs, including $11.4�billion from the General Fund. The total amount is an increase of $1.2�billion, or 10�percent, from 2005-06 expenditures. The General Fund total represents an increase of $1.2�billion, or 12�percent, relative to 2005-06 expenditures.

Figure�1 shows the changes in General Fund expenditures in some of the major judicial and criminal justice budgets. Below, we highlight the major changes in these budgets.

|

Figure 1 Judicial and Criminal Justice Budget Summary General Fund |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Change |

|

|

Program/Department |

2005‑06 |

2006‑07 |

Amount |

Percent |

|

Judicial Branch |

$1,757 |

$1,973 |

$216 |

12.3% |

|

Department of Corrections and Rehabilitation |

7,709 |

8,654 |

945 |

12.3 |

|

Department of Justice |

338 |

386 |

48 |

14.2 |

|

Citizens' Option for Public Safety |

100 |

119 |

19 |

19.0 |

|

Juvenile Justice Crime Prevention Grants |

100 |

119 |

19 |

19.0 |

|

Other Corrections Programsa |

164 |

128 |

-36 |

-22.0 |

|

Totals |

$10,168 |

$11,379 |

$1,211 |

11.9% |

|

|

||||

|

a Includes debt service on general obligation bonds and the State Criminal Alien Assistance Program. Other programs include the Office of the Inspector General, the State Public Defender, and Payments to Counties for Homicide Trials. |

||||

The budget includes $3.4�billion for support of the judicial branch. This amount includes $1.9�billion from the General Fund, $475�million transferred from the counties to the state and $957�million in fine, penalty, and court fee revenues. The General Fund amount is $216�million, or 12�percent, greater than the revised 2005-06 amount.

Court Operations. Funding for trial court operations is the single largest component of the judicial branch budget, accounting for over 90�percent of total judicial branch spending. The 2006-07 budget provides for growth in trial court operations funding based on the annual change in the state appropriations limit ($113�million), restoration of one-time reductions ($58�million), and increased court security ($19�million). It also includes partial-year funding for 50 new superior court judge positions ($5.5�million). The Governor vetoed $10�million added by the Legislature to provide court interpreter services in certain civil cases.

The budget contains $8.7�billion from the General Fund for support of the California Department of Corrections and Rehabilitation, an increase of $945�million, or 12�percent, above the revised 2005-06 level. Effective July 1, 2005, the various corrections departments were consolidated into a single department pursuant to Chapter�10, Statutes of 2005 (SB 737, Romero).

Adult Corrections. Major new spending includes funding to comply with court settlements relating to the delivery of medical, mental, and dental health care services to inmates ($400�million), address increased inmate and parole caseloads ($303�million), and implement a variety of new and expanded programs aimed at reducing recidivism among adult offenders ($53�million). Figure�2 shows the allocation of new funds for recidivism reduction programs. The budget also provides funding to expand the Basic Correctional Officer Academy ($55�million), reduce the backlog of lifer parole hearings ($7�million), and expand the use of Global Positioning System devices to track sex offenders and other high-risk parolees ($5�million).

|

Figure 2 Adult Corrections New Recidivism Reduction Funding |

|

|

(In Millions) |

|

|

Program Area |

Amount |

|

Inmate education |

$21.1 |

|

Parole programs |

7.8 |

|

Community partnerships |

7.7 |

|

Administrative supporta |

6.2 |

|

Rehabilitative programs |

6.0 |

|

Treatment |

3.9 |

|

Total |

$52.8 |

|

|

|

|

a Includes funding for research and evaluation, information technology, staff training, and support services. |

|

|

Detail may not total due to rounding. |

|

Juvenile Justice. The budget provides funding to further implement remedial plans resulting from the Farrell v. Hickman lawsuit ($60�million). This consists of funds to increase the staff-to-ward ratio in the youth correctional facilities and enhance the delivery of medical and mental health care services. The budget also establishes the Community Re-Entry Challenge Grant Program, which is aimed at reducing recidivism among juvenile parolees through enhanced community-based services ($10�million).

The budget includes $386�million (General Fund) for support of the Department of Justice, an increase of $48�million above the revised 2005-06 amount. Notable new spending includes $6.5�million to create four new Gang Suppression Enforcement Teams, $6�million to expand the California Methamphetamine Strategies Program, $10.6�million for new vehicles and equipment, and $1.3�million to increase the investigation and prosecution of complex financial and identity theft crimes. The budget also provides a total of $30�million for the Proposition�69 DNA Program, which represents an increase of $19�million relative to the 2005-06 funding level. This increase for the DNA program consists of $9�million General Fund and $10�million from the DNA Identification Fund to be generated primarily by a newly enacted increase in criminal penalties.

The budget provides $565�million for the major local public safety programs. This represents an increase of $146�million, or 35�percent, above the 2005-06 funding level. Figure�3 shows the changes in local public safety programs.

|

Figure 3 Major Local Public Safety Programs General Fund |

|||||

|

(Dollars in Millions) |

|||||

|

|

|

|

|

Change |

|

|

Program |

2005‑06 |

2006‑07 |

|

Amount |

Percent |

|

Citizens' Option for Public Safety |

$100.0 |

$119.0 |

|

$19.0 |

19.0% |

|

Juvenile Justice Crime Prevention Grantsa |

100.0 |

119.0 |

|

19.0 |

19.0 |

|

County Probation Grants |

201.0 |

201.0 |

|

� |

� |

|

Mentally Ill Offender Crime Reduction Grants |

� |

45.0 |

|

45.0 |

� |

|

Vertical Prosecution Block Grants |

8.0 |

16.0 |

|

8.0 |

100.0 |

|

War on Methamphetamine Grants |

9.5 |

29.5 |

|

20.0 |

210.5 |

|

Booking Fee Reimbursement |

� |

35.0 |

|

35.0 |

� |

|

Totals |

$418.5 |

$564.5 |

|

$146.0 |

34.9% |

|

|

|||||

|

a The 2005‑06 Budget Act provided $26 million for this program and anticipated a $74 million carry over from the prior year. |

|||||

Notable initiatives for local law enforcement include those targeting mentally ill offenders and local booking fees. Specifically, the budget provides $45�million to reestablish the Mentally Ill Offender Crime Reduction Grant Program. This program will provide grants to local governments for demonstration projects designed to reduce recidivism among mentally ill offenders. In addition, the budget provides $35�million to reimburse cities for jail booking fees paid to counties in 2005-06 and revamps county authority to collect fees starting in 2007-08.

Prepared by the Criminal Justice Section- (916) 319-8340

The 2006-07 budget plan provides total expenditures of $12.3�billion from state special funds and federal funds for the Department of Transportation (Caltrans). This level of expenditures is primarily due to the substantial repayment of past Proposition�42 loans, as detailed below. The 2006-07 expenditure level, however, is about the same as that expended in 2005-06 which includes the award of the Bay Bridge self-anchored suspension contract in March�2006.

The 2006-07 budget provides approximately $5.2�billion for transportation capital outlay, $1.5�billion for capital outlay support, $2.2�billion for local assistance, and about $1.1�billion for highway operations and maintenance. The budget also provides about $1.5�billion for support of Caltrans� mass transportation and rail program and $538�million for transportation planning and departmental administration.

Full Funding of Proposition�42. Consistent with the requirements of Proposition�42, the 2006-07 budget provides for the transfer of gasoline sales tax revenue from the General Fund to the Transportation Improvement Fund (TIF) for transportation purposes. The total amount of the 2006-07 transfer is estimated at $1.4�billion. This amount is to be allocated as follows:

$678�million for the Traffic Congestion Relief Program (TCRP) to fund 141 state and local transportation projects.

$594�million for the State Transportation Improvement Program (STIP) to fund state and local transportation projects.

$148�million to the Public Transportation Account (PTA) for mass transportation purposes.

Substantial �Spillover� Revenues, New Allocation. Due to high gasoline prices, the 2006-07 budget projects that spillover revenues will total $668�million. These revenues will be allocated as follows:

$200�million to partially repay a Proposition�42 suspension.

$125�million for seismic retrofit of Bay Area toll bridges.

$20�million for farm worker transportation grants.

$13�million for high-speed rail development.

Remaining revenues (about $310 million) will be distributed:

-80�percent to State Transit Assistance (STA).

-20�percent to other mass transportation activities.

The 2006-07 budget provides a greater share of spillover revenue to STA than is required by current law. This, together with other STA revenues sources such as diesel sales tax revenues, Proposition�42 funding, and early repayment of prior suspensions (as discussed below), will provide STA with an estimated $630�million in 2006-07. This is up from a funding level of roughly $237�million in 2005-06.

Early Partial Repayment of Proposition�42 Debt. The 2006-07 budget provides $1,415�million to repay about two-thirds of the amount of Proposition�42 funds suspended in 2003-04 and 2004-05. The repayment includes $920�million that would otherwise be repaid in 2007-08 and $495�million that is due in 2008-09. The repayment includes $1,215�million from the General Fund and $200�million in spillover revenues (as mentioned above). The amount will be allocated as follows:

$315�million for TCRP projects.

$424�million plus interest for STIP projects.

$424�million plus interest for local streets and roads.

$210�million (approximately) to the PTA.

Under Chapter�49, Statutes of 2006 (SCA 7, Torlakson), to be considered on the November 2006 ballot, the remaining Proposition�42 debt (about $754�million) would be repaid by June 30, 2016, with minimum annual repayment of one-tenth the total amount owed. Figure�1 shows the past Proposition�42 suspensions and the repayments to the TIF in 2006-07 and future years.

Tribal Gaming Bond to Repay $827�Million in Transportation Debt. Under current law, $1.2�billion in previous loans to the General Fund from the Traffic Congestion Relief Fund (TCRF) are to be repaid by tribal gaming revenue bonds. The 2006 budget assumes that tribal gaming bonds will be issued in 2006-07 to repay $827�million plus interest to the TCRF, as shown in Figure�1. These bond funds would be allocated as follows:

|

Figure 1 Transportation Loans and Repaymentsa |

|||||

|

(In Millions) |

|||||

|

|

To General Fundb |

|

To TCRFc |

||

|

Year |

From TCRFd |

From TIF |

|

From SHA |

From PTA |

|

Balance through 2003‑04 |

$1,383 |

$868 |

|

$463 |

$275 |

|

2004‑05 |

-183 |

1,258 |

|

-20 |

� |

|

2005‑06 |

-151 |

� |

|

-151 |

� |

|

2006‑07 |

-827 |

-1,373 |

|

-292 |

-245 |

|

2007‑08 |

� |

-84 |

|

� |

� |

|

2008‑09 |

� |

-84 |

|

� |

� |

|

2009‑10 |

� |

-84 |

|

� |

� |

|

Beyond 2009‑10 |

-222e |

-502 |

|

� |

-30e |

|

|

|||||

|

SHA = State Highway Account; TCRF= Traffic Congestion Relief Fund; TIF= Transportation Investment Fund; PTA = Public Transportation Account. |

|||||

|

a Amounts do not include interest. |

|||||

|

b Positive numbers are amounts payable to the General Fund, negative numbers are amounts payable from the General Fund. |

|||||

|

c Positive numbers are amounts payable to TCRF, negative numbers are amounts payable from TCRF. |

|||||

|

d Funds shown from the General Fund as payment to the TCRF in 2005‑06 and beyond come from tribal gaming revenues. |

|||||

|

e To be repaid from future tribal gaming bonds. The date when these bonds will be issued is unknown. |

|||||

$292�million, plus interest, will be used to repay the State Highway Account for previous loans made to TCRF.

$290�million will remain in the TCRF to fund TCRP projects.

$245�million will be used to partially repay PTA for previous loans made to TCRF.

The budget includes trailer bill language to modify the allocation of tribal gaming bond revenues. Specifically, it provides additional future-year bond revenues to TCRP projects. After 2006-07, TCRF will still be owed $222�million, of which $30�million would go to PTA and $192�million would be used for TCRP projects. It is unknown when tribal gaming bond revenues will repay this debt. Figure�1 assumes these revenues to be available after 2009-10.

Programmatic Funding Impact of Major Budget Actions. The 2006-07 budget provides for the full Proposition�42 transfer, repays early $1,415�million in transportation debt, reallocates substantial spillover revenues, and anticipates that $827�million plus interest will be repaid by tribal gaming bond revenues. Together, these actions result in $4.2�billion in funding for transportation programs. This is about $2.7�billion more than revenues received from these sources (Proposition�42 and tribal gaming revenues) in 2005-06. Figure�2 shows how revenues from major budget actions are distributed between programs. (The budget provides over $8�billion in additional revenues to transportation beyond those listed here. These additional revenue sources include primarily excise tax on motor fuels, truck weight fees, and federal funds.)

|

Figure 2 Major 2006‑07 Budget Actionsa Funding by Program |

|

|

(In Millions) |

|

|

Program |

Fundingb |

|

Traffic Congestion Relief Program |

$1,283 |

|

State Transportation Improvement Program |

1,018 |

|

Public Transportation Account |

913 |

|

State Highway Accountc |

443 |

|

Local streets and roads |

424 |

|

Bay Area toll bridges |

125 |

|

Farm worker transportation grants |

20 |

|

High-speed rail development |

13 |

|

Total |

$4,239 |

|

|

|

|

a Includes full Proposition 42 transfer in 2006‑07, $1,415 million in early partial repayment for past suspension, distribution of spillover revenues, and anticipated receipt of tribal gaming bond revenues. |

|

|

b Amounts do not include interest. |

|

|

c Amount includes $151 million in tribal gaming revenues received at end of 2005‑06. |

|

The 2006-07 budget provides about $1.6�billion to fund the CHP, an increase of about $120�million (8.3�percent) compared to the 2005-06 level. The increase is primarily due to first-year funding ($56�million) for CHP to begin a multiyear project to upgrade its radio communications system and support costs ($41�million) related to hiring additional patrol officers and 911 call center staff. About $1.4�billion of the total funding will come from the Motor Vehicle Account.

With regard to DMV, the budget provides $848�million in departmental support, about $77�million (10�percent) more than the 2005-06 level. A major component of the increase in DMV�s support costs is funding provided in the budget that enables the department to begin work on projects to improve its computing infrastructure related to its drive licensing and vehicle registration programs.

Prepared by the Transportation Section�- (916) 319-8320

Overview. The 2006-07 budget provides about $4.4�billion for resources programs and $1.3�billion for environmental protection programs.

Of the $4.4�billion for resources programs, about $1.8�billion is from the General Fund and $1.7�billion is from special funds. The remaining $900�million are bond funds and federal funds. This total amount is a decrease of about $1�billion from estimated 2005-06 expenditures. This decrease largely results from the large one-time expenditures in 2005-06 from bond funds.

Of the $1.3�billion for environmental protection programs, $1�billion is from special funds and $171�million is from federal funds. The remaining $157�million are General Fund and bond funds. This total amount is a net decrease of $378�million from estimated 2005-06 expenditures, mainly due to large one-time bond-funded expenditures in 2005-06 in the State Water Resources Control Board (SWRCB).

Bond Funds. The budget provides about $800�million from bond funds (mostly Propositions 13, 40, and 50) for various resources and environmental protection programs. This amount includes about $148�million for state park improvements and acquisitions; $100�million for land acquisitions and restoration activities of the various state conservancies and the Wildlife Conservation Board; $57�million to SWRCB for local water quality projects; and $31�million for river parkway programs. Of the remaining funds, most ($367�million) is for various water-related state activities and local assistance administered by the Department of Water Resources (DWR). This includes funding for water conservation projects and the CALFED Bay-Delta Program.

State Parks. The budget provides $250�million in one-time funding from the General Fund for deferred maintenance at state parks. These funds are projected to be spent over a three-year period. In addition, the budget includes an ongoing augmentation of $15�million (General Fund) in the Department of Parks and Recreation�s budget for operations and maintenance at existing state parks.

CALFED. The budget includes $246�million from various state funds ($26�million General Fund) for the CALFED Bay-Delta Program, in addition to about $95�million of reappropriations. (These CALFED expenditures are under seven resources and environmental protection departments, plus the Department of Health Services.) Proposition�50 bond funds are the largest source of funding for the program, providing about $103�million of the program�s funding in 2006-07. The budget reflects a reorganization of the program, including a transfer of all funding and position authority of the California Bay-Delta Authority to various other CALFED state agencies. The Secretary for Resources is largely assuming the function of providing staff support to the board of the California Bay-Delta Authority.

Flood Management. The budget includes various increases totaling over $170�million for flood management-related state operations, local assistance, and capital outlay. These increases include the following: (1) $38.2�million ($7.6�million one-time) from the General Fund for DWR�s state operations and local assistance to improve flood management activities in the Central Valley and Delta regions; (2) $31.4�million (General Fund) for flood control capital outlay projects in the Central Valley; and (3) $100�million (one-time) from the General Fund to pay local governments for the state�s share of costs of federally authorized, locally sponsored flood control projects outside of the Central Valley. These increases bring the department�s flood management budget to a total of about $215�million (various funds) for state operations and state and local flood control projects. In addition, the budget includes 28 new positions to implement Chapter�34, Statutes of 2006 (AB 142, Nu�ez), which appropriated $500�million for flood control system repairs and improvements, including the repair of critical erosion sites. These new positions will be paid for from this appropriation.

Canal Lining. The budget provides $84.1�million (General Fund) for the lining of the All-American and Coachella canals. These projects when complete will save approximately 100,000 acre-feet of water and are related to the Colorado River �Quantification Settlement Agreement.�

Paterno Lawsuit Financing. The budget provides $62.9�million (General Fund) for the second year of payments related to the $464�million Paterno lawsuit settlement, stemming from a flood in 1986. (Of the settlement amount, $428�million is being financed over ten years, beginning in 2005-06.)

Habitat Protection and Restoration; Marine Resources. The budget includes various General Fund increases totaling about $53�million ($40�million of which is one-time spending) for habitat protection and restoration activities carried out by the Department of Fish and Game, Wildlife Conservation Board, and the State Coastal Conservancy. The increases include: (1) $19�million for marine life and ecosystem protection and management; (2) $14�million for salmon and steelhead restoration; (3) $10�million for nongame fish and wildlife management; (4) $5�million for wetlands and riparian habitat conservation; and (5) $5�million to create an endowment fund for the management of coastal wetlands.

Climate Change. The budget includes $36.9�million, mostly in one-time funding from special funds, for actions to reduce greenhouse gas emissions. This includes funding for various incentive programs for clean alternative fuels development, and zero emission and partially zero emission vehicle programs, including the Hydrogen Highway.

Fish and Game Preservation Fund. The budget provides $19.9�million in one-time funding and $5.9�million in ongoing funding from the General Fund to address structural deficits in the Fish and Game Preservation Fund.

Public Utilities Commission. The budget provides $12.2�million (special funds) for implementation of the Telecommunications Consumer Bill of Rights. These funds will support 29.5 new positions, a media campaign to inform consumers of their rights, and an upgraded system to resolve consumer complaints. The budget also includes $5.6�million for 58.5 new positions to increase regulatory staffing at the commission.

Governor�s Vetoes. The Governor vetoed (partially or fully) a number of budget changes made by the Legislature. Significant vetoes include:

Air Quality Emission Reduction Grants-Vetoed $25�million augmentation for grants to reduce emissions from locomotives, construction equipment, and dairy equipment. With this veto, the approved budget provides $140�million for emission reduction grants.

Local Air District Subventions-Vetoed $10�million augmentation for subventions to local air districts, leaving $10.1�million as originally proposed by the Governor for this purpose.

Public Utilities Commission-Reduced by $2.6�million (and 25.5 positions) the Legislature�s augmentation for staffing at the Public Utilities Commission. With this veto, an augmentation of $3�million (and 33 positions) was retained.

Prepared by the Resources and Environmental Protection Section- (916) 319-8323

Noneducation Mandates. The budget includes $232.5�million (General Fund) and $1.7�million (special funds) to pay 2005-06 and 2006-07 claims for 38 noneducation mandates, including the Peace Officer�s Procedural Bill of Rights mandate. Funding for the AB 3632 mental health mandate is provided separately in the budget (we discuss this mandate in the health chapter of this report). The budget suspends local agency obligations to carry out 29 mandates in the budget year and directs the Commission on State Mandates to reconsider two previous mandate determinations that found state reimbursable costs. The budget starts the process of paying local governments for the large backlog of pre-2004-05 mandate claims. Specifically, the budget provides $169.9�million (General Fund) to make the 2006-07 and 2007-08 payments towards the state�s 15-year plan to retire this mandate debt.

Employee Compensation. The budget provides $567�million ($361�million General Fund) to increase pay for state employees. Of this amount, $30�million ($15�million General Fund) is available for the administration to address recruitment and retention issues among employees, supervisors, and managers. The budget includes contractual pay raises for 6 of the state�s 21 employee bargaining units. The status of bargaining units is summarized in Figure 1. Since most contracts have expired, any increased General Fund costs from future contracts approved by the Legislature will be paid from the reserve. For instance, the tentative agreement for the nine units represented by the Service Employees International Union would reduce the General Fund reserve by more than $100�million.

|

Figure 1 Status of State Employee Labor Agreements |

|||

|

Bargaining Unit |

Percent of State Workforce |

Status |

Funding for 2006‑07 Pay Increases |

|

1�Administrative, Financial, and Staff Services |

20.4% |

Pending�AB 1369 (Nu�ez) |

Not in budget. |

|

2�Attorneys |

1.7 |

In effect until June 30, 2007 |

Budgeted. |

|

3�Educators and Librarians (Institutional) |

1.2 |

Pending�AB 1369 (Nu�ez) |

Not in budget.a |

|

4�Office and Allied |

13.7 |

Pending�AB 1369 (Nu�ez) |

Not in budget. |

|

5�Highway Patrol |

2.9 |

Expired July 2, 2006 |

Budgeted increases under prior agreement. |

|

6�Correctional Peace Officers |

14.0 |

Expired July 2, 2006 |

Budgeted increases under prior agreement. |

|

7�Protective Services and Public Safety |

3.1 |

In effect until June 30, 2007 |

Budgeted. |

|

8�Firefighters |

2.1 |

Pending�AB 1165 (Bogh) |

Budgeted increases under prior agreement. Increases under pending agreement not in budget. |

|

9�Professional Engineers |

4.8 |

In effect until July 2, 2008 |

Budgeted. |

|

10�Professional Scientific |

1.2 |

Expired July 1, 2006 |

Not in budget. |

|

11�Engineering and Scientific Technicians |

1.2 |

Pending�AB 1369 (Nu�ez) |

Not in budget. |

|

12�Craft and Maintenance |

5.0 |

Pending |

Not in budget. |

|

13�Stationary Engineer |

0.4 |

Expired July 2, 2003 |

Not in budget. |

|

14�Printing Trades |

0.2 |

Pending�AB 1369 (Nu�ez) |

Not in budget. |

|

15�Allied Services (Custodial, Food, Laundry) |

1.9 |

Pending�AB 1369 (Nu�ez) |

Not in budget. |

|

16�Physicians, Dentists, and Podiatrists |

0.7 |

Expired June 30, 2006 |

Not in budget.a |

|

17�Registered Nurses |

1.8 |

Pending�AB 1369 (Nu�ez) |

Not in budget.a |

|

18�Psychiatric Technicians |

3.2 |

Expired June 30, 2006 |

Not in budget. |

|

19�Health and Social Services/Professional |

1.9 |

Expired July 1, 2006 |

Not in budget. |

|

20�Medical and Social Services |

1.0 |

Pending�AB 1369 (Nu�ez) |

Not in budget. |

|

21�Education and Libraries (Noninstitutional) |

0.3 |

Pending�AB 1369 (Nu�ez) |

Not in budget. |

|

Excluded, Supervisors, and Managers |

17.4 |

Not applicable |

Budgeted for selected groups only. |

|

|

|||

|

a Some increases budgeted for corrections court orders. |

|||

Retirement. The budget includes an estimated $4.6�billion ($3.4�billion General Fund) for state employee and teacher retirement benefits, including health costs. Payments for teacher retirement benefits from the General Fund decline by $123�million due to a one-time credit for previous overpayments by the state.

Preparing for Retiree Health Accounting Rules. New public sector accounting rules require disclosure of unfunded liabilities for retired employee health benefits beginning in 2007-08. The budget includes $3.2�million for (1) the State Controller to contract for an actuarial assessment of liabilities and (2) the California Public Employees� Retirement System to begin offering services to public agencies that are obtaining actuarial valuations of liabilities and considering setting aside funds to address these liabilities. The budget also holds more than $30�million of expected federal Medicare payments related to state retiree drug benefits in a special account for future legislative consideration.

Unallocated Reductions. The budget assumes $200�million in General Fund savings from authority given to the administration to reduce departmental appropriations during the fiscal year. State operations appropriations could be reduced by no more than 20�percent, and local assistance appropriations could be reduced by no more than 5�percent.

Veterans Affairs. The budget augments the department�s current-year budget by more than $12�million from the General Fund (an 18�percent increase) to cover rising costs and increased services, such as a new Alzheimer�s wing at the Yountville home.