September 2006

Programmatic Features of the 2006-07 Budget

Budgetary Debt and the 2006-07 Budget

Out-Year Impacts of the 2006-07 Budget

Resources and Environmental Protection

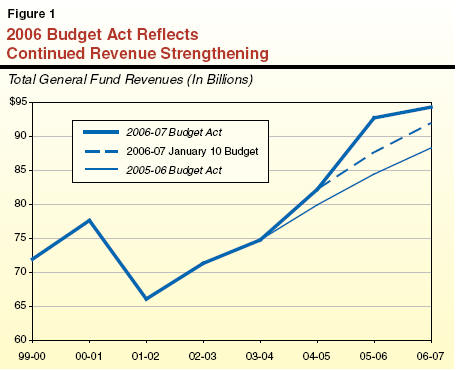

The 2006-07 budget sharply increases funding for education, provides targeted increases in several other program areas, and prepays nearly $3�billion in budgetary debt incurred during the 2002-03 through 2004-05 fiscal years. The expanded commitments included in this spending plan are in striking contrast to the four previous years, when policymakers were faced with closing major budget shortfalls. This turnaround has been made possible by much stronger-than-expected revenues. As one indication of this strength, between mid-2005 and mid-2006, the revenue estimates for the 2004-05 through 2006-07 fiscal years rose a combined total of $17�billion (see Figure�1), reflecting much better-than-expected performances from the personal income tax and corporation tax.

The revenue improvement that occurred in 2003-04 through 2005-06-when combined with past budget-related borrowing and various one-time and ongoing savings enacted in the 2003-04 through 2005-06 budgets-resulted in the accumulation of over $9�billion in carry-over balances that were available to support spending in 2006-07. The 2006-07 budget uses over $7�billion of these carryover balances, along with $94�billion in revenues projected in 2006-07, to finance over $101�billion in spending during the year, 9.5�percent more than in 2005-06.

Key programmatic features of this budget are as follows:

Allocates $7�billion in new funds for K-12 Proposition�98 education, resulting in an over 11�percent increase in per pupil funding relative to the level provided in the 2005-06 Budget Act.

Provides an over 10�percent General Fund increase for California Community Colleges, including funds for district equalization, block grants to districts, and for the backfill of foregone revenues resulting from a reduction in community college fees from $26 to $20 per unit beginning in spring 2007. With the 2006-07 increases, the state has met its goal of fully achieving equalization among the community college districts.

Provides General Fund increases of 8.5�percent for the University of California and 7.4�percent for California State University, including additional General Fund support in lieu of planned fee increases for 2006-07.

Provides the full $1.4�billion annual Proposition�42 transfer of sales taxes on gasoline to fund transportation programs, and it repays $1.4�billion of past Proposition�42 loans (that is, transfers which were deferred in 2003-04 and 2004-05).

Includes largely one-time funding for hospitals to increase patient capacity to meet public health emergencies, such as an avian flu pandemic.

Increases funding for county block grants for California Work Opportunity and Responsibility to Kids, child welfare services, and foster care.

Includes funding for the pass-through of the federal January 2007 Supplemental Security Income cost-of-living adjustment, which-under the terms of the previous 2005-06 budget package-had been delayed until April 2007.

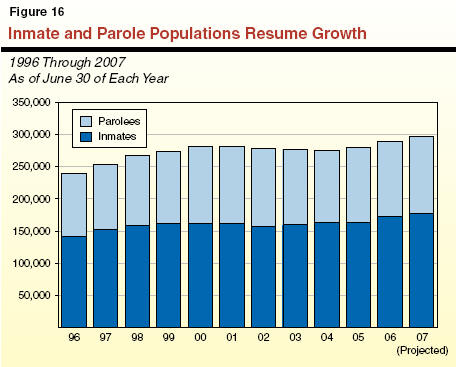

Includes large increases to the Department of Corrections and Rehabilitation to cover inmate population increases and health-related costs.

Includes added funding for local law enforcement and local flood control.

The budget does not include any major tax changes. However, it does include the administration�s proposals to extend two previously enacted measures for one year. These are (1) the suspension of the teachers� tax credit and (2) an increase-from 90 days to one year-in the time period that vessels, vehicles, and aircraft purchased outside of California must be kept out of state to avoid the use tax.

The 2006-07 spending plan includes $2.8�billion in prepayments of budgetary debt that had been incurred in prior years. About one-half of the total is related to repayment of transportation loans (cited above and discussed in more detail in the transportation section). The remainder is accelerated repayments of other special fund loans that had planned repayment dates in the future. These include payments toward deficit-financing bonds (Proposition�57), local government mandate claims, and settle up of prior-year Proposition�98 obligations. Taking into account these prepayments, along with the new debt created by the Proposition�98 settlement (discussed below), the General Fund will have roughly $22�billion in budgetary debt outstanding at the close of 2006-07.

While not part of the budget package for 2006-07, agreements reached between the Governor and Legislature in three areas will have implications for General Fund spending, particularly in future years.

Proposition�98 Settlement. Following enactment of the budget, the Legislature approved a $2.9 billion settlement proposed by the administration relating to funds that some education groups claimed were owed to K-14 education for 2004-05 and 2005-06. Under this settlement, K-14 Proposition�98 will receive annual payments of $300�million in 2007-08 and $450�million per year beginning in 2008-09 until the obligation has been met.

Infrastructure Package. The Governor and Legislature reached agreement in late April on a bond package totaling $37�billion, to be submitted to voters for authorization in November 2006. These include $19.9�billion for state and local transportation projects, $10.4�billion for K-12 and higher education projects, $4.1�billion for various flood management programs, and $2.9�billion for housing and development programs. If approved, debt service on these four bonds would be roughly $100�million in 2007-08, rising to over $2.7�billion in future years when all the bonds were sold.

Collective Bargaining Agreements. The Legislature approved new agreements with 19 of 21 employee bargaining units. (All but one agreement were approved in August 2006.) These agreements result in $632�million ($270�million General Fund) in additional compensation costs during 2006-07. Most employees receive a 3.5�percent general salary increase in 2006-07, and some receive a one-time $1,000 bonus.

The 2006-07 budget is balanced with a significant reserve. As noted above, however, revenues are over $7�billion less than expenditures in 2006-07, with the difference being covered by the drawdown of carryover reserves available from 2005-06. While nearly $3�billion of the difference is due to prepayments of budgetary debt, the remaining $4�billion-plus shortfall reflects ongoing difference between revenues and expenditures for General Fund programs. Based on our out-year estimates of revenues and expenditures, we estimate that this imbalance will continue in 2007-08 and 2008-09 absent corrective action, with annual operating shortfalls in the range of $4.5�billion and $5�billion projected for this period. We will be updating our projections for 2006-07 and future years to reflect economic, revenue, and expenditure developments in our annual publication entitled California�s Fiscal Outlook, scheduled to be released in November 2006.

The state spending plan for 2006-07 includes total budget expenditures of $128.4�billion. This includes $101.6�billion from the General Fund and $26.9�billion from special funds. As Figure�1 shows, the combined spending total from these funds is up $11�billion (9.5�percent) from 2005-06.�

The figure also shows that spending of bond proceeds for capital outlay jumped from $5.6�billion in 2004-05 to $11�billion in 2005-06, before falling back to $3.6�billion in 2006-07. Bond-fund expenditures reflect the use of bond proceeds on capital outlay projects in a given year (or, in the case of education bonds, the allocation of the bond authority to specific local projects by the State Allocation Board). The costs associated with debt service on the bonds are included in the General Fund and special funds spending totals. The one-time jump in bond spending in 2005-06 is primarily related to the allocation of K-12 education bonds (approved by voters in 2004) to specific projects.

|

Figure 1 The 2006-07 Budget

Package |

|||||

|

(Dollars in Millions) |

|||||

|

Fund Type |

Actual |

Estimated 2005-06 |

Enacted |

Change From 2005-06 |

|

|

Amount |

Percent |

||||

|

General Funda |

$79,804 |

$92,730 |

$101,572 |

$8,842 |

9.5% |

|

Special fundsa |

22,192 |

24,509 |

26,824 |

2,315 |

9.4 |

|

Budget Totals |

$101,996 |

$117,239 |

$128,396 |

$11,157 |

9.5% |

|

Selected bond funds |

5,595 |

11,018 |

3,550 |

-7,469 |

-67.8 |

|

Totals |

$107,590 |

$128,257 |

$131,945 |

$3,688 |

2.9% |

|

|

|||||

Figure�2 summarizes the estimated General Fund condition for 2005-06 and 2006-07 that results from the adopted spending plan.�

2005-06. The figure shows that 2005-06 began with a prior-year carryover balance of $9.5�billion. This large balance is related to the sale of over $11�billion in deficit-financing bonds and other forms of budgetary borrowing in previous years, as well as the carryover of unanticipated revenues (associated with both higher tax liabilities and amnesty payments) received in 2003-04 and 2004-05. The figure also shows that revenues and expenditures were an identical $92.7�billion during 2005-06, leaving the fund balance at the end of the year at $9.5�billion, unchanged from the prior year. After accounting for $521�million in year-end funds encumbered by state agencies, the unencumbered year-end reserve was $9�billion.

2006-07. Figure�2 shows that revenues are projected to increase to $94.4�billion (1.7�percent), and that expenditures are projected to increase to $101.6�billion (9.5�percent). The $7.2�billion difference between expenditures and revenues is covered through the drawdown of the 2005-06 year-end reserve, leaving a remaining reserve of about $1.8�billion at the close of 2006-07. This total includes $472�million in the newly created Budget Stabilization Account (as required by Proposition�58, which was approved by the voters in 2004) and $1.3�billion in the Reserve for Economic Uncertainties.

|

Figure 2 The 2006-07 Budget |

||

|

(In Millions) |

||

|

|

2005-06 |

2006-07 |

|

Prior-year fund balance |

$9,511 |

$9,530 |

|

Revenues and transfers |

92,749 |

94,354 |

|

Total resources available |

$102,260 |

$103,884 |

|

Expendituresa |

92,730 |

101,572 |

|

Ending fund balance |

$9,530 |

$2,312 |

|

Encumbrances |

521 |

521 |

|

Reserve |

$9,009 |

$1,791 |

|

Budget Stabilization Account |

� |

$472 |

|

Reserve for Economic Uncertainties |

$9,009 |

1,319 |

|

|

||

|

a Includes 2006-07

budget package, as well as collective bargaining agreements and

certain other |

||

Figure�3 shows General Fund spending by major program area for 2004-05 through 2006-07. It shows that K-12 spending is the single largest area, accounting for nearly 40�percent of the General Fund total. Higher education, health, social services, and criminal justice spending account for most of the balance of total spending.

|

Figure 3 The 2006-07 Budget

Package |

|||||

|

(Dollars in Millions) |

|||||

|

|

Actual 2004-05 |

Estimated 2005-06 |

Enacted 2006-07 |

Change From 2005-06 |

|

|

Amount |

Percent |

||||

|

K-12 Education |

$32,595 |

$36,343 |

$39,174 |

$2,831 |

7.8% |

|

Higher Education |

9,216 |

10,313 |

11,285 |

972 |

9.4 |

|

Health |

15,898 |

17,730 |

19,527 |

1,797 |

10.1 |

|

Social Services |

8,954 |

9,235 |

9,778 |

542 |

5.9 |

|

Criminal Justice |

9,113 |

10,165 |

11,404 |

1,239 |

12.2 |

|

Transportation |

347 |

1,695 |

2,990 |

1,295 |

76.4 |

|

All other |

3,681 |

7,249 |

7,414 |

166 |

2.3 |

|

Totals |

$79,804 |

$92,730 |

$101,572 |

$8,842 |

9.5% |

|

|

|||||

|

a Includes 2006-07

budget package, as well as collective bargaining agreements and

certain other |

|||||

In terms of overall budget growth, the figure shows that General Fund expenditures are projected to rise by 9.5�percent between 2005-06 and 2006-07. Three sets of factors contribute to this increase: (1) one-time and ongoing program increases in education and selected other areas of the budget; (2) rising costs related to program utilization, health care costs, and caseloads; and (3) repayment of past budgetary debt. In terms of specific program areas:

General Fund spending on transportation jumped by 76�percent between 2005-06 and 2006-07. The 2005-06 total includes the annual transfer of sales taxes on gasoline from the General Fund to transportation special funds. The 2006-07 total includes both the annual transfer and an additional $1.4�billion loan repayment associated with Proposition�42 transfers that had been deferred from earlier years.

The second largest percentage increase is in criminal justice, where spending is being boosted by prison inmate population growth, rising health care costs, and targeted increases in spending for courts and local law enforcement.

The third most rapid increase is in the area of health, reflecting rising costs and utilization of services, as well as largely one-time spending increases to deal with public health emergencies, in particular the threat of an avian flu pandemic.

Higher education is projected to increase 9.4�percent. The 2006-07 totals include funds to cover both base increases (that is, growth to cover salaries and other cost increases) of over 5�percent plus enrollment growth for all three segments. The base increases for California State University (CSU) and University of California (UC) include General Fund monies to replace student fee increases previously planned for 2006-07. The budget also includes General Fund spending to offset a reduction in community college fees from $26 to $20 per unit beginning in spring 2007.

K-12 education increases by 7.8�percent. While this is slightly less than the overall average, it is important to note that the gain follows a rapid 11.5�percent increase in 2005-06.

All other spending increases by only 2.3�percent. The spending totals for both 2005-06 and 2006-07 include one-time expenditures for repayment of budgetary debt-that is, loans from schools, local governments, and the private sector in recent years.

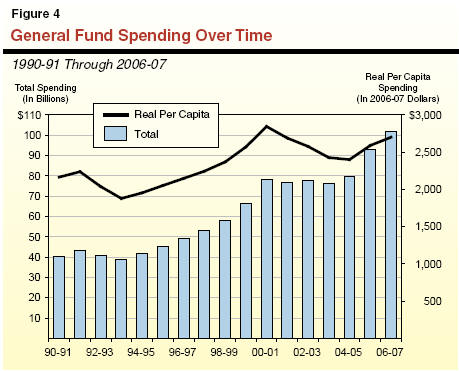

Figure�4 shows General Fund expenditures from 1990-91 through 2006-07 both in current dollars and as adjusted for population and inflation (that is, in real per capita terms). The figure indicates that after growing rapidly in the late 1990s, real per capita spending fell significantly during the 2001-02 through 2004-05 period, before rebounding in 2005-06 and 2006-07. General Fund spending is now 30�percent higher than the peak reached in 2000-01. Adjusted for inflation and population, however, real per capita spending is still slightly below the 2000-01 peak.

In this section, we highlight the major developments in the evolution of the 2006-07 budget, beginning with the original Governor�s January budget proposal and ending in June 2006, when the budget was signed into law.

Although the January budget was based on revenue projections that were less optimistic than the budget that was ultimately enacted in June, the budget proposal still was able to more or less fully fund a �current services� budget in most areas in 2006-07 and still have resources left over for other priorities. This improved outlook relative to previous years reflected both much stronger-than-expected revenues projected for 2005-06 and 2006-07 and the availability of large reserves carried over from 2004-05 (itself due to better-than-expected revenue performance, as well as budgetary borrowing and program savings in previous budgets).

Reflecting this improvement, the Governor�s budget proposed significant funding increases for K-12 and higher education and funding to cover caseload and cost increases in most other state programs. As shown in Figure�5, the budget for K-12 education fully funded enrollment and cost-of-living adjustments (COLAs) and provided an additional $1.2�billion in program spending. The increases were allocated to the equalization of school district funding, restoration of COLAs foregone in prior years, mandate payments, new teacher retention initiatives, and several other new categorical programs. The budget also included first-year funding of after school programs as required by Proposition�49.

|

Figure 5 Key Elements of Governor�s January Proposal |

|

|

|

Increased K-12 Proposition 98 Spending |

|

� Fully funded enrollment and cost-of-living adjustments (COLAs). |

|

� Provided an additional $1.2 billion for various purposes. |

|

Increased Higher Education Spending |

|

� Funded Governor�s compact with University of California and California State University. |

|

� Provided General Fund support in lieu of student fee increases planned for 2006-07. |

|

Transportation |

|

� Made full Proposition 42 transfer to transportation programs. |

|

� Proposed early repayment of $920 million in prior loans from transportation funds. |

|

Criminal Justice |

|

� Proposed phase-in of 150 new judgeships over three years. |

|

� Targeted funding for inmate and parolee programs. |

|

Social Services |

|

� Further delayed pass through of federal COLA for Supplemental Security Income/State Supplementary Program grants, from April 2007 to July 2008. |

|

� Reduced funding for county administration, child care, and welfare-to-work services. |

In higher education, the budget included funds for the Governor�s compact with the UC and CSU systems, and included General Fund monies in lieu of 8�percent student fee increases that had been planned for 2006-07.

In the area of transportation, the budget made the full transfer of Proposition�42 revenues (that is, sales taxes on gasoline) to transportation funds, and included an additional $920�million of repayments for loans made from transportation funds in previous years.

Finally, the budget included funds for the phase-in of 150 new judgeships over three years and targeted increases in the correction�s budget for inmate and parolee programs.

The budget included targeted savings in social services and state operations. For example, it delayed the pass-through of the federal COLA to Supplemental Security Income/State Supplementary Program (SSI/SSP) grants from April 2007 to July 2008 (the pass-through had been previously delayed from January 2007 to April 2007 by legislation enacted with the 2005-06 budget). It also included reductions in funding for county administration of social services programs, child care, and welfare-to-work services. In state operations, the budget assumed unspecified savings of $158�million.

In conjunction with the January budget, the Governor proposed a ten-year infrastructure plan. Areas of capital improvement included transportation, education, flood control and water supply, public safety and courts, and other public service infrastructure. The plan included $68�billion in new general obligation bonds, of which $25�billion would be submitted to the voters for authorization in 2006, and the balance to be authorized over the subsequent four election cycles.

Legislative Package Submitted to Voters. After several months of negotiations, the Governor and Legislature reached agreement in late April on a bond package totaling $37�billion, to be submitted to voters for authorization in November 2006. These include $19.9�billion for state and local transportation projects (Proposition�1B), $10.4�billion for K-12 and higher education programs (Proposition�1D), $4.1�billion for various flood management programs (Proposition�1E), and $2.9�billion for housing and development programs (Proposition�1C). In addition, the Legislature passed Chapter�34, Statutes of 2006 (AB�142, Nu�ez), which appropriates $500�million for flood control.

Major Revenue Improvement. In the months following the release of the January budget, the state revenue picture improved dramatically. Total receipts during the January-through-April period exceeded the budget forecast by well over $4�billion, with more than $3�billion of that gain occurring in April alone. While some of the increase appeared to be related to one-time transactions, the May Revision projected that some of the increase was ongoing as well. Its revised forecast of General Fund revenues was up from the January estimate by $4.8�billion in 2005-06 and $2.7�billion in 2006-07, for a two-year increase of $7.5�billion.

How New Revenues Were Allocated. As shown in Figure�6, the May Revision proposed that the additional $7.5�billion in revenues be used in three major ways.

First, the administration proposed that about $4.3�billion of the total be used for spending on state programs. This included: additional Proposition�98 spending of $2.9�billion; largely one-time spending for hospitals of $400�million for public health emergencies such as an avian flu pandemic; and additional spending in the Department of Corrections and Rehabilitation of $500�million to cover inmate population increases and rising expenditures for health care.

Second, the May Revision included an additional $1.6�billion in prepayments toward outstanding budgetary debt that had been accumulated in previous years. This included $1�billion toward outstanding deficit-financing bonds, as well as $600�million related to Proposition�98 settle-up payments and loans from special funds and local governments. Combined with the $1.6�billion already proposed in January, the additional proposed payments brought the total amount of loan repayments in the May Revision to $3.2�billion.

Third, the May Revision included a 2006-07 year-end reserve of $2.2�billion, or $1.6�billion more than the $613�million reserve proposed in January.

|

Figure 6 May Revision�Key Differences From January |

|

|

|

New Spending ($4.3 Billion) |

|

� Proposition 98�additional $2 billion for 2005‑06 and $800 million for 2006‑07. |

|

� Hospitals�largely one-time funding for hospitals to deal with public health emergencies, such as an avian flu pandemic. |

|

� Department of Corrections and Rehabilitation�added funding for inmate population increase and health care. |

|

Additional Budgetary Debt Repayment ($1.6 Billion) |

|

� $1 billion for deficit-financing bonds. |

|

� $600 million to special funds, local governments, and schools. |

|

Higher Reserve ($1.6 Billion) |

|

� Year-end 2006‑07 reserve increased from $613 million to $2.2 billion. |

Other Provisions. In addition to the 2005-06 and 2006-07 increases for Proposition�98, the May Revision proposed to settle a lawsuit related to $2.9�billion in Proposition�98 funding. Under the proposal, annual payments averaging roughly $400�million would be made over seven years, beginning in 2007-08.

Following the May Revision, the Senate and Assembly took actions on the revised proposal, and the budget was sent to Conference Committee to reconcile the differences between the houses. Following conference actions and subsequent negotiations between the Governor and legislative leadership, an agreement regarding the budget was reached in late June. The resulting budget was passed by both houses of the Legislature on June 27, 2006. After using his line-item veto authority to delete about $320�million ($114�million General Fund) in spending, the Governor signed the budget on June 30, 2006.

Comparison to the May Revision. The final budget package (see Figure 7) reflects a number of elements of the Governor�s May Revision plan. It funds Proposition�98 at a level that is roughly consistent with the May Revision, although it allocates funding within the overall Proposition�98 budget somewhat differently. For example, it provides additional funds for school district equalization and economic impact aid than proposed in the May Revision. It also combines a portion of the funding proposed in the May Revision for various categorical programs into block grants. In higher education, it adopts the Governor�s proposal to provide additional General Fund monies in lieu of planned student fee increases in 2006-07. In addition, it reduces community college fees from $26 to $20 per unit in spring 2007. As proposed in the May Revision, the final budget includes significant funding increases in corrections for inmate population growth and health care.

|

Figure 7 Final Budget�Key Differences From May Revision |

|

|

|

K-12 Proposition 98 |

|

� Roughly the same overall spending level, but with more emphasis on school district equalization and economic impact aid. |

|

� Categorical spending combined into block grant, distributed to school sites. |

|

Community Colleges |

|

� Rolls back student fees from $26 to $20 per unit in spring 2007. |

|

Health and Social Services |

|

� Provides $190 million to expand hospital capacity for public health emergencies or about one-half the May Revision amount. |

|

� Passes through federal cost-of-living adjustment for SSI/SSP grants in January 2007�three months earlier than May Revision. |

|

� Funds shifted from child welfare services to CalWORKs. |

|

Debt Repayment |

|

� Total debt prepayments reduced from $3.2 billion to $2.8 billion. |

|

� Supplemental payment toward deficit-financing bond rejected, and partly replaced with additional loan repayments to transportation, local governments, special funds, and schools. |

In other areas, it includes $190�million in largely one-time funding for hospitals to increase patient capacity to meet public health emergencies, or about one-half the $400�million proposed in the May Revision. It passes through the federal COLA for SSI/SSP grants in January 2007. These grants had been delayed until April 2007 under the 2005-06 budget package, and this delay was assumed in the May Revision. Finally, the final budget contains additional public safety funding for local governments.

Background. Article XIII B of the State Constitution places limits on the appropriation of taxes for the state and each of its local entities. Certain appropriations, however, such as for capital outlay and subventions to local governments, are specifically exempted from the state�s limit. As modified by Proposition�111 in 1990, Article XIII B requires that any revenues in excess of the limit that are received over a two-year period be split evenly between taxpayer rebates and increased school spending.

State�s Position Relative to Its Limit. As a result of the previous sharp decline in revenues, the level of state spending is now well below the spending limit. Specifically, state appropriations were $16�billion below the limit in 2005-06 and, based on the revenue and expenditure estimates incorporated in the 2006-07 budget, are expected to remain $16�billion below the limit in 2006-07. There are two main reasons that the state remains well below the limit in 2006-07 despite the large expenditure increase:

First, about $7�billion of the 2006-07 expenditure increase is financed by a draw-down of reserves carried over from prior years. The limit is applied to the appropriations of tax proceeds (including appropriations into reserves but excluding appropriations out of reserves), thus, spending supported from previously accumulated reserves are not subject to the limit.

Second, much of the increased funding that was supported by taxes is in areas, such as K-12 education and transportation, which are exempt from the state�s limit.

In addition to the 2006-07 Budget Act, the budget package includes a number of related measures enacted to implement and carry out the budget�s provisions. Figure�8 lists these bills at the time of the budget enactment. Our current estimate of the General Fund�s condition also include the impacts of collective bargaining agreements and certain other legislation approved by the Legislature subsequent to the budget�s enactment.

|

Figure 8 2006‑07 Budget and Budget-Related Legislation |

|||

|

Bill Number |

Chapter |

Author |

Subject |

|

Budget Package |

|

|

|

|

AB 1801 |

47 |

Laird |

Budget bill (conference report) |

|

AB 1811 |

48 |

Laird |

Budget revisions |

|

AB 1802 |

79 |

Budget Committee |

Education |

|

AB 1803 |

77 |

Budget Committee |

Resources |

|

AB 1805 |

78 |

Budget Committee |

Local government |

|

AB 1806 |

69 |

Budget Committee |

General government |

|

AB 1807 |

74 |

Budget Committee |

Health |

|

AB 1808 |

75 |

Budget Committee |

Human services |

|

AB 1809 |

49 |

Budget Committee |

Revenues |

|

SB 1132 |

56 |

Budget Committee |

Transportation |

|

SB 1137 |

63 |

Ducheny |

Proposition 36 reforms |

|

Post-Budget Legislation |

|

|

|

|

SB 1131 |

Enrolled |

Budget Committee |

Education trailer bill cleanup |

|

SB 1133 |

Enrolled |

Torlakson |

K-14 settlement |

|

SB 1134 |

Enrolled |

Budget Committee |

Corrections�mental health staffing |

|

AB 1812 |

Enrolled |

Budget Committee |

Grants to counties�sexual assault enforcement |

|

Variousa |

� |

|

Collective bargaining agreements |

|

|

|||

|

a Various measures which ratify agreements with 19 of 21 employee bargaining units. Full listing is provided in "Chapter 3," Figure 25. |

|||

The 2006-07 budget package includes $55.1�billion in ongoing Proposition�98 funding for K-14 education. This represents an increase of $5.2�billion, or 10.3�percent, from the funding level proposed in the 2005-06 Budget Act. Figure�1 shows Proposition�98 funding, by source, for K-12 schools, community colleges, and other affected agencies.

|

Figure 1 K-14 Proposition 98 Spending |

|||||

|

(Dollars in Billions) |

|||||

|

|

2005-06 |

|

Change From |

||

|

|

Budget Act |

Revised |

2006-07 |

Amount |

Percent |

|

K-12 Education |

|

|

|

|

|

|

General Fund |

$33.1 |

$34.6 |

$37.1 |

$4.1 |

12.3% |

|

Local property taxes |

11.6 |

11.8 |

12.0 |

0.4 |

3.5 |

|

Subtotals |

($44.6) |

($46.5) |

($49.1) |

($4.5) |

(10.0%) |

|

California Community Colleges |

|

|

|

|

|

|

General Fund |

$3.4 |

$3.7 |

$4.0 |

$0.6 |

18.4% |

|

Local property taxes |

1.8 |

1.8 |

1.9 |

� |

2.7 |

|

Subtotals |

($5.2) |

($5.5) |

($5.9) |

($0.7) |

(13.0%) |

|

Other Agencies |

$0.1 |

$0.1 |

$0.1 |

� |

6.6% |

|

Totals, Proposition 98 |

$50.0 |

$52.0 |

$55.1 |

$5.2 |

10.3% |

|

General Fund |

$36.6 |

$38.4 |

$41.3 |

$4.7 |

12.9% |

|

Local property taxes |

13.4 |

13.6 |

13.8 |

0.4 |

3.4 |

|

Percent General Fund |

73% |

74% |

75% |

|

|

|

Percent local property taxes |

27 |

26 |

25 |

|

|

Budget Package Also Includes $2.8�Billion in One-Time Funds. As discussed in more detail later in this section, the budget package also includes an additional $2.8�billion in one-time funds for K-14 education ($2.5�billion for K-12 and $305�million for community colleges).�Of these one-time monies, $2.3�billion is for meeting the higher 2005-06 Proposition�98 minimum guarantee (which increased after the 2005-06 budget was enacted due to higher-than-expected state tax revenues), $283�million is for settling up prior-year Proposition�98 obligations, and almost $250�million is from unspent prior-year Proposition�98 funds.

General Fund Share of Proposition�98 Driven by Property Tax Shifts. As shown in Figure�1, the budget assumes that $13.8�billion, or 25�percent of overall 2006-07 Proposition�98 spending, will be funded by local property taxes. The remaining 75�percent is supported by the General Fund. This is about the same proportional split as in the prior year. It is a significant increase, however, from 2003-04-when the General Fund share of Proposition�98 was roughly 65�percent. The increase in the General Fund share is due to various state-level decisions regarding the allocation of local property tax revenues between school districts and other local governments.

During the state�s recent difficult budget times, a number of actions were taken to defer spending or borrow funds. Specifically, as one of its midyear 2001-02 budget solutions, the Legislature decided to defer significant education program costs to the subsequent fiscal year. (Rather than a budget reduction, these deferrals resulted in districts receiving some program funds a few weeks later than normal.) In addition, the state delayed reimbursement of outstanding mandate cost claims dating back to 1995-96. Similarly, as of 2005-06, the state also had not fully restored ongoing revenue limit reductions made in 2003-04. We have referred to these outstanding debts as the education �credit card.�

Figure�2 shows that the budget makes significant progress in paying down the education credit card, reducing it by about 40�percent. Specifically, the 2006-07 Budget Act includes slightly more than $300�million to fully restore the revenue limit �deficit factor� and provides almost $1�billion to school districts and community colleges for the costs of prior-year mandates. Despite this progress, however, the budget includes only $34�million for 2006-07 K-14 mandate costs, which is approximately $120�million less than needed to cover all anticipated costs. In addition, the budget continues to defer to the subsequent fiscal year approximately $1.3�billion in K-14 costs.

|

Figure 2 Update on the K-14 Credit Card Balance |

||||

|

(In Millions) |

||||

|

|

2003-04 |

2004-05 |

2005-06 |

2006-07 |

|

One-Time Costs |

|

|

|

|

|

Deferrals: |

|

|

|

|

|

K-12 |

$1,097 |

$1,083 |

$1,103 |

$1,103 |

|

Community colleges |

200 |

200 |

200 |

200 |

|

Prior-year mandates: |

|

|

|

|

|

K-12 |

860 |

1,105 |

1,100 |

273 |

|

Community colleges |

100 |

100 |

100 |

76 |

|

Ongoing Costs |

|

|

|

|

|

K-12 revenue limit deficit |

$906 |

$663 |

$290 |

�a |

|

Totals |

$3,163 |

$3,151 |

$2,793 |

$1,652 |

|

|

||||

|

a Budget includes $309 million to pay off entire outstanding obligation. |

||||

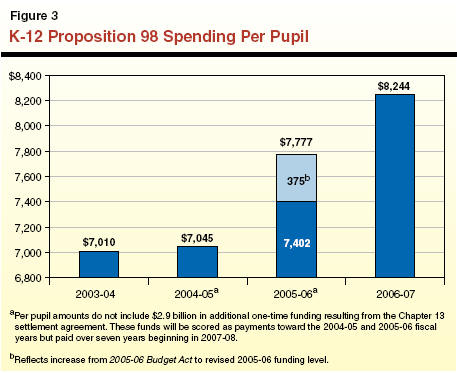

As shown in Figure�3, K-12 Proposition�98 spending in 2006-07 totals $49.1�billion, an increase of $4.5�billion, or 10�percent, from the 2005-06 Budget Act. Per-pupil funding in K-12 also increases substantially. As Figure�3 shows, K-12 per pupil funding increases to $8,244, or $842 above the level assumed in the 2005-06 Budget Act. As the figure also shows, the 2005-06 funding level increased by $375 from the 2005-06 Budget Act-to a total of $7,777 per pupil-as a result of both higher-than-expected state revenues and lower-than-expected student enrollments. This revised 2005-06 funding level is $732 per pupil higher than the 2004-05 level.

As Figure�4 shows, the $4.5�billion in new ongoing K-12 spending is sufficient to fully fund base programs, significantly increase funding for several existing programs, and provide funding for a few new programs. Major ongoing funding changes include:

Growth and Cost-of-Living Adjustment ($2.4�Billion). The budget provides $2.6�billion to fund a 5.92�percent cost-of-living adjustment (COLA) for revenue limits and most categorical programs. The budget also reflects a net of roughly $220�million in savings-mostly for revenue limits-due to estimates that statewide attendance will decline by 0.26�percent in 2006-07 compared to revised estimates for the preceding year. (Despite this decline in attendance, the budget continues to fund most categorical programs at 2005-06 levels plus COLA adjustments.)

Proposition�49 After-School Program ($426�Million). As required by Proposition�49 (passed by voters in 2002), the budget package includes $426�million in new Proposition�98 spending for after-school programs. These funds are provided on top of the base 2006-07 Proposition�98 minimum guarantee. In addition, the budget includes approximately $2�million in non-Proposition�98 General Fund monies for the California Department of Education (CDE) to administer and evaluate the program.

Revenue Limit Equalization ($350�Million). The budget provides $350�million to reduce historical inequities in general purpose spending. Chapter�79, Statutes of 2006 (AB 1802, Budget Committee), stipulates that these funds will be allocated using the current equalization methodology, which sets targets at the 90th percentile of average daily attendance and distinguishes districts by size and type.

Economic Impact Aid ($350�Million). The budget augments Economic Impact Aid (EIA) by $350�million-bringing total program funding to approximately $975�million. The program provides funding for districts to serve economically disadvantaged and English learner students. Chapter�79, Statutes of 2006 (AB 1802, Budget Committee), changes the EIA distribution formula to address various data issues and historic funding inequities.

Deficit Factor Elimination ($309�Million). The budget package provides $309�million in general purpose funds to eliminate the revenue limit deficit factor for school districts and county offices of education. In 2003-04, the state reduced revenue limits and did not provide a COLA, creating a deficit factor of 3.02�percent that would eventually need to be restored. The revenue limit reduction was partially restored in 2004-05 and 2005-06. The 2006-07 budget package fully restores it.

Counselors ($200�Million). The budget provides $200�million for additional counselors in grades 7 through 12. As a condition of receiving these funds, districts must develop coursework plans for each low-performing 7th grade student and each�10th, 11th, and 12th grade student who has not passed the California High School Exit Examination (CAHSEE). In addition, districts must schedule individual counseling sessions with these students and their parents.

Arts and Music Block Grant ($105�Million). The budget includes $105�million for a new block grant designed to enhance and expand standards-aligned instruction in arts and music. The block grant provides districts with supplemental funding to hire and train staff as well as purchase books, supplies, and equipment.

Expansion of Child Care Eligibility ($67�Million). The budget �unfreezes� the child care income eligibility cutoff-raising it to a maximum of 75�percent of the 2005 state median income level. (The income eligibility cutoff had been frozen at 75�percent of the 2000 state median income level.) The budget provides $67�million to fund the associated increase in child care caseload.

Preschool Expansion ($50�Million). The budget provides $50�million for expanded preschool services. Chapter 211, Statutes of 2006 (AB 172, Chan), which implements the expansion, provides additional preschool services in the attendance areas of decile 1 through 3 schools. Of the $50�million, $45�million funds half-day preschool services for more than 10,000 children and $5�million funds required family literacy services for parents of participating children.

Additional Support for High School Exit Exam ($50�Million). The budget provides an increase of $50�million (over base funding of $20�million) for supplemental instruction for 11th and 12th grade students who have not passed the CAHSEE. School districts will receive $500 for each such 12th grade student. Funds remaining after covering 12th grade students will be prorated across 11th grade students who have not yet passed the exam.

|

Figure 4 Ongoing K-12 Proposition 98 Changes |

|

|

2006-07 (In Millions) |

|

|

|

Amount |

|

Cost-of-living adjustments, growth, and other adjustments |

$2,383 |

|

Proposition 49 after-school programs |

426 |

|

Revenue limit equalization |

350 |

|

Economic Impact Aid |

350 |

|

Deficit-factor reduction (including basic aid) |

309 |

|

Counselors |

200 |

|

Arts and music block grant |

105 |

|

Child care eligibility |

67 |

|

Preschool expansion |

50 |

|

Increased support for high school exit exam |

50 |

|

Other |

187 |

|

Total Changes |

$4,476 |

The budget provides an additional $2.5�billion in one-time K-12 education funds. This total is comprised of additional funds required to meet the higher Proposition�98 minimum guarantee in 2005-06 ($2�billion), settle-up payments to meet Proposition�98 obligations from prior years ($258�million), and the Proposition�98 Reversion Account, which are funds that have been appropriated for K-14 education in prior years but not used ($226�million). Figure�5 shows how the final budget package spends these funds. Major one-time spending includes:

|

Figure 5 K-12 Spending From One-Time Funds |

|

|

2006-07 |

|

|

|

Amount |

|

Payment of K-12 mandate claims from prior years |

$927 |

|

Discretionary block grant |

534 |

|

Arts, music, and P.E. equipment block grant |

500 |

|

School facilities emergency repairs (Williams settlement) |

137 |

|

Instructional materials |

100 |

|

Preschool facilities |

50 |

|

Teacher recruitment |

50 |

|

Career technical education equipment |

40 |

|

Mandates�2006-07 costs |

30 |

|

Other |

165 |

|

Total |

$2,533 |

K-12 Education Mandates ($927�Million). The budget provides $927�million in one-time funds to pay for mandate costs deferred from prior years. These funds are drawn from all of the three sources of one-time funds described above. These funds retire over three-fourths of the state�s past-year mandate liabilities.

Discretionary Block Grant ($534�Million). The budget provides $534�million to districts and schools for various one-time costs-including purchasing instructional materials, providing professional development, undertaking maintenance, and paying down outstanding fiscal obligations (such as retiree health liabilities). Of this amount, 25�percent ($133�million) will be allocated to school districts and 75�percent ($400�million) will be allocated directly to school sites.

Equipment Block Grant ($500�Million). The budget includes $500�million to be distributed to school districts on a per-pupil basis. Funds may be used for supplies, equipment, and professional development for art, music, and physical education.

School Facilities Emergency Repairs ($137�Million). As part of the settlement of Williams v. California, the state is required to commit one-half of the funds in the Proposition�98 Reversion Account for emergency facility repairs. The 2006-07 budget meets this obligation by providing $137�million for this purpose.

Instructional Materials Block Grant ($100�Million). The budget includes $100�million to be distributed to school districts on a per- pupil basis. Funds may be used for instructional materials, library materials, or one-time education technology costs.

Preschool Facilities ($50�Million). In addition to the ongoing funds provided to expand preschool, the budget includes $50�million in one-time funds for preschool facilities. This funding comes in the form of a loan and is available for renovation, repair, or improvement of existing facilities as well as for purchase of new portable child care facilities.

Teacher Recruitment and Retention ($50�Million). The budget includes $50�million to be distributed on a per-pupil basis for schools ranked in the bottom three deciles of the 2005 Academic Performance Index (API). Funds are intended to improve the educational culture and environment of participating schools and may be used for various activities, including differential compensation, planning time for teachers and principals, support services for teachers and students, and small group instruction.

The Governor vetoed $37.8�million provided to increase the per meal reimbursement rate for the child nutrition program. The Governor set the funds aside, with the intent to link funding to a requirement that school districts further improve the nutritional quality of school meals. Senate Bill 1674, (Murray), which appropriates the $37.8�million, increases the reimbursement rate for free- and reduced-price meals from 16 cents to 21 cents per meal, subject to specified nutrition criteria.

The Governor also vetoed $15.1�million for a new cohort of federal Reading First schools. In an accompanying action, he deleted language that would have (1) made the continuation of a school�s funding contingent on making significant academic progress, as defined in future legislation, and (2) required CDE to report on program outcomes and the treatment of waivered classrooms.

In addition to the budget package, the Legislature concurred with the Governors proposal to settle a lawsuit initiated by the California Teachers Association. The lawsuit was based on a disagreement over the suspension of Proposition�98 in 2004-05. Chapter�213, Statutes of 2004 (SB 1101, Budget Committee), established a target funding level for K-14 education that was $2�billion lower than the amount called for by the Proposition�98 constitutional guarantee. Because final General Fund revenues for 2004-05 were substantially higher than projected, the final 2004-05 funding level was $3.6�billion lower than the constitutional guarantee (or $1.6�billion lower than the Chapter�213 target). Because the Proposition�98 minimum guarantee is calculated based on the prior-year funding level, the 2005-06 funding level also was affected, being $1.3�billion less than what it would have been had the Chapter�213 target been met.

Settlement Agreement Provides Additional $2.9�Billion to K-14 Education. The settlement agreement essentially covers the difference between the actual 2004-05 and 2005-06 funding levels and the higher levels that would have been provided had the Chapter�213 target been met. The $2.9�billion obligation is to be scored as prior-year Proposition�98 payments ($1.6�billion scored to 2004-05 and $1.3�billion scored to 2005-06). The 2006-07 Proposition�98 base spending level was established based on these higher prior-year Proposition�98 levels.

Monies Paid Over Seven-Year Period. The $2.9�billion is to be paid in installments over a seven-year period (2007-08 through 2013-14). The state is to make a first payment of $300�million in 2007-08. In each of the subsequent years, until the full obligation has been met, the state is to make payments of $450�million. These payments would be on top of the Proposition�98 minimum guarantee for each of those years.

K-12 Funds Targeted to Lowest Performing Schools. Senate Bill 1133 (Torlakson), allocates $2.6�billion of the settlement for K-12 education. Of this amount, $268�million is to be provided in 2007-08 and $402�million in each of the six subsequent years. The funds are designated for a new reform program intended to improve student achievement in schools ranked in deciles 1 or 2 of the 2005 API. Available funds are sufficient to cover about 40�percent of the approximately 1,500 eligible schools. The State Board of Education is to select the specific schools to be funded. Participating schools will receive $500 per K-3 student, $900 per grade 4 though 8 student, and $1,000 per grade 9 through 12 student.

K-12 Funds Used for Major New Class Size Reduction (CSR) Initiative. As a condition of receiving funding, schools would have to meet the requirements of the state�s existing K-3 CSR program as well as reduce class sizes in grades 4 through 12. Specifically, schools would need to reduce average classroom size to 25 students or by at least five students from their 2006-07 levels, whichever is less. The average classroom size is calculated by grade level, but no individual class may have more than 27 students. In addition to meeting the new CSR requirements, high schools would need to have a pupil-to-counselor ratio of no more than 300-to-1. All participating schools would need to demonstrate that: (1) its teachers were highly qualified, as defined by federal law, and (2) the average years of experience of its classroom teachers were equal to or higher than the district�s average.

If K-12 Program Requirements Not Met, Funding Terminated. Schools may use 2007-08 funding for facility costs associated with implementing CSR. They may use all subsequent funding for hiring additional teachers and counselors and meeting the other requirements of the program. If progress is not made, however, toward meeting the program�s requirements, school site funding can be terminated as early as the end of 2009-10.

Community College Funds Designated Primarily for Career Technical Education. Senate Bill 1133 (Torlakson), allocates slightly more than $300�million of the settlement for community colleges. Of this amount, $32�million is to be provided in 2007-08 and $48�million in each of the subsequent six years. The funds are designated primarily for improving and expanding career technical education, including hiring additional faculty to increase the number of related programs and courses. In every year but the first, $10�million is set aside for a one-time block grant that may be used for various other activities, including maintenance and purchasing instructional materials, library materials, instructional equipment, and education technology.

The enacted budget provides a total of $11.3�billion in General Fund support for higher education in 2006-07 (see Figure�6). This reflects an increase of $972�million, or 9.4�percent, above the amount provided in 2005-06. The budget fully funds anticipated enrollment increases at the University of California (UC), the California State University (CSU), and the California Community Colleges (CCC). The budget includes no undergraduate fee increases. In fact, as described below, student fees at CCC will decline in the spring term.

|

Figure 6 Higher Education

Budget Summary |

||||

|

(Dollars in Millions) |

||||

|

Department |

2005-06 |

2006-07 |

Change |

|

|

Amount |

Percent |

|||

|

University of California |

$2,845 |

$3,086 |

$241 |

8.5% |

|

California State University |

2,597 |

2,789 |

191 |

7.4 |

|

California Community Colleges |

3,714 |

4,102 |

388 |

10.4 |

|

Student Aid Commission |

738 |

847 |

108 |

14.7 |

|

California Postsecondary |

2 |

2 |

� |

0.9 |

|

Hastings College of the Law |

8 |

11 |

2 |

27.6 |

|

Other |

408 |

449 |

41 |

10.0 |

|

Totals |

$10,313 |

$11,285 |

$972 |

9.4% |

|

|

||||

|

Detail may not add due to rounding. |

||||

The budget provides about $3.1�billion in General Fund support for UC in 2006-07. This is $241�million, or 8.5�percent, more than was provided in the prior year. For CSU, the budget provides $2.8�billion in General Fund support in 2006-07. This is an increase of $192�million, or 7.4�percent, from 2005-06.

Base Budget Increases. Both university systems received substantial General Fund base augmentations to address salary and other cost increases, which amount to $156�million (5.8�percent) for UC and $130�million (5.2�percent) for CSU. These base increases include funding associated with a �fee buyout� as proposed by the Governor. The Governor had proposed the additional buyout funding in lieu of fee increases that had been planned by UC and CSU.

Enrollment Growth. The budget includes a total of $112�million to fund 2.5�percent enrollment growth at UC ($51�million) and CSU ($61�million). This accommodates an additional 5,149 full-time equivalent (FTE) students at UC and 8,490 FTE students at CSU.

In the prior (2005-06) year, UC fell short of its funded enrollment target by 500 FTE students. As a result, the 2005-06 Budget Act required a one-time reversion $3.8�million, which is the enrollment funding associated with that shortfall. However, this funding returns to the base in 2006-07, thus allowing UC to increase enrollment above the actual 2005-06 level by more than 2.7�percent.

For CSU, the 2006-07 Budget Act redefines an FTE graduate student from 30 units of instruction to 24 units. This change, which is consistent with the definition used by most other university systems, has the effect of increasing the size of CSU�s year-to-year enrollment growth. By reducing the number of units that define a graduate FTE student by 20�percent, this change makes a corresponding increase in the number of graduate FTE students that CSU is funded to serve. Without this change in the definition of an FTE graduate student, CSU�s growth target and overall enrollment levels would be lower.

Marginal Cost. For many years, the state has used a �marginal cost� methodology for determining the amount of funding to provide UC and CSU for each additional FTE student. In response to legislative direction expressed in the 2005-06 Budget Act, our office and the Department of Finance worked with the segments and others to develop an improved methodology. The parties were unable to reach consensus on a new methodology, and the Governor�s 2006-07 budget proposal included enrollment funding based on an entirely new methodology developed by the administration.

The Legislature rejected the Governor�s marginal cost proposal and instead used its own alternative methodology for funding UC and CSU enrollment growth in the 2006-07 Budget Act. Unlike the preexisting methodology, the Legislature�s approach includes costs for operation and maintenance, bases faculty costs on the salaries of recently hired professors, and redefines a full-time graduate student at CSU from 30 units per year to 24 units. Accordingly, the enacted budget funds enrollment growth based on a marginal General Fund cost of $9,901 per additional UC student and $7,225 per additional CSU student. In signing the budget, the Governor vetoed provisional language specifying that future budgets be based on the alternative methodology adopted by the Legislature.

Student Fees. Figure�7 shows student fee levels at the three segments. In fall 2005, the UC Regents and the CSU Trustees both adopted undergraduate fees increases of 8�percent for the 2006-07 academic year. As noted above, the Governor�s budget proposed that those increases be rescinded, and provided $130�million in General Fund support to compensate the segments for the foregone fee revenue. The Legislature adopted the Governor�s proposal, and the segments rescinded the fee increases. As a result, resident undergraduate fees are unchanged from 2005-06 levels.

|

Figure 7 Annual Education Fees for Full-Time Resident Studentsa |

|||

|

|

2004‑05 |

2005‑06 |

2006‑07 |

|

University of California (UC)b |

|

|

|

|

Undergraduate |

$5,684 |

$6,141 |

$6,141 |

|

Graduate |

6,269 |

6,897 |

6,897 |

|

Hastings College of the Law |

$18,750 |

$19,725 |

$19,725 |

|

California State University |

|

|

|

|

Undergraduate |

$2,334 |

$2,520 |

$2,520 |

|

Teacher Education |

2,706 |

2,922 |

2,922 |

|

Graduate |

2,820 |

3,102 |

3,102 |

|

California Community Colleges |

$780 |

$780 |

$600c |

|

|

|||

|

a Fees shown do not include campus-based fees. |

|||

|

b The UC charges special fee rates for 12 professional programs, such as medicine and nursing. |

|||

|

c Effective in spring 2007. |

|||

Student Academic Preparation (Outreach). The Legislature rejected the Governor�s proposal to eliminate General Fund support for student academic preparation programs at UC and CSU. Instead, the budget provides General Fund support of $19.3�million to UC and $7�million to CSU for these programs. Of the UC amount, $2�million is for a new transfer initiative between UC and CCC.

The budget provides CCC with $4.1�billion in General Fund support for 2006-07, which is $388�million, or 10.4�percent, above the revised 2005-06 level. In addition, as discussed earlier the budget provides CCC with another $305�million in one-time funds that, for Proposition�98 purposes, will count toward prior fiscal years. Virtually all of CCC�s General Fund support counts toward the state�s Proposition�98 expenditures, as does CCC�s local property tax revenue. Total Proposition�98 support for CCC in 2006-07 is $5.9�billion, which is 10.7�percent of total Proposition�98 appropriations.

Base Budget Increase. The budget includes $312�million to fund a 5.92�percent base increase for CCC. This increase follows the same statutory formula used to calculate the K-12 COLA. The base budget increase applies to CCC�s general apportionments and selected categorical programs.

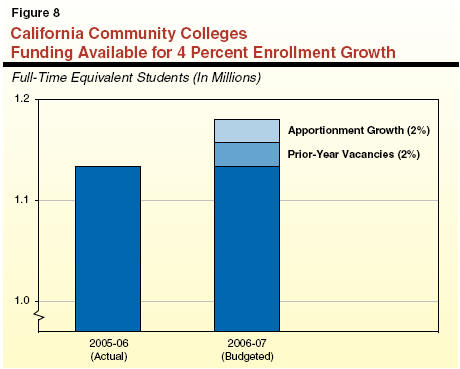

Enrollment Growth. The budget provides CCC with $97.5�million to fund enrollment growth of 2�percent, or 22,688 FTE students. However, as shown in Figure�8, community colleges actually have funded capacity to increase total enrollment by about twice this amount in 2006-07. This is because many colleges have been experiencing declining enrollment, yet will still have some funding in 2006-07 for existing slots that became vacant in 2005-06. This �stability� funding, as it is called, will permit community colleges to enroll about 24,000 additional students to fill funded vacancies from 2005-06.

Student Fees. The budget package reduces CCC student fees from $26 per unit to $20 per unit, effective spring 2007. The budget includes $40�million in General Fund support to replace the fee revenue that will be foregone as a result of the fee reduction.

Equalization. The budget includes $159�million to fully achieve the state�s equalization goal for community colleges. Trailer legislation also modifies the community college funding allocation model in order to ensure that district funding remains equalized in subsequent years.

Noncredit Instruction. The budget includes $30�million to increase the funding rate for noncredit courses that advance career development or college preparation. Such courses, which are to be defined by the Chancellor�s Office, would receive $3,092 per FTE student, while all other noncredit courses would receive $2,626 per FTE student.

Other Augmentations. The budget provides various other augmentations to CCC, including the following one-time funds:

$100�million for a general purpose block grant to all districts.

$94.1�million for facilities maintenance and equipment.

$40�million for career technical education equipment and facility upgrades. (As discussed earlier, the Proposition�98 settlement allocates a total of roughly $250�million to the community colleges over a seven-year period beginning in 2007-08 for the expansion of career technical education programs.)

The budget includes $846�million in General Fund support for the California Student Aid Commission (CSAC). This reflects an increase of $108�million, or 14.7�percent, from the 2005-06 level. Almost one-half of this increase ($51�million) is to replace one-time surplus funding from the Student Loan Operating Fund that had been used to support financial aid programs in 2005-06. Another $50.6�million funds increased costs associated with the Cal Grant programs, and the remaining $6.8�million funds increased costs of the Assumption Program of Loans for Education (APLE).

The budget package also authorizes student participation in several new APLE programs. Specifically, the budget directs CSAC to issue 40 new loan forgiveness awards for the Nurses in State Facilities APLE, 100 new awards for the National Guard APLE, and 100 new awards for the Student Nursing APLE (SNAPLE). The state will not incur costs for these awards until subsequent years after the students receiving them graduate from college. The authorization of SNAPLE awards is part of a larger package of nursing-related items in the budget package, as described below.

The budget package includes a number of augmentations for expanding enrollment of nursing students at all three segments, increasing financial aid opportunities to nursing students, and advancing the recruitment and retention of nurses as faculty members at the community colleges, and as employees at state facilities. The major elements of the nursing package are shown in Figure�9. These include an expansion of graduate nursing enrollment at UC and CSU, an increase in undergraduate nursing enrollment at CSU and CCC, the creation of new CCC programs to recruit and retain nursing faculty and students, and the authorization of loan forgiveness awards for SNAPLE and the Nurses in State Facilities APLE.

|

Figure 9 Major Nursing-Related

Appropriations |

|

|

(In Thousands) |

|

|

Description |

Appropriation |

|

University of California |

|

|

Increase entry-level master's students by 65 FTE students |

$860 |

|

Increase master's degree nursing students by 20 FTE students |

103 |

|

California State University |

|

|

Fund "startup costs" to prepare for 340 additional baccalaureate nursing students in 2007-08 |

$2,000 |

|

Increase entry-level master's students by 280 FTE students |

560 |

|

Increase baccalaureate nursing students by 35 FTE students |

371 |

|

California Community Colleges |

|

|

Fund new Nursing Enrollment Growth and Retention Program |

$12,886 |

|

Fund enrollment and equipment costs for nursing programs |

4,000 |

|

Fund new Nursing Faculty Recruitment and Retention Program |

2,500 |

|

California Student Aid Commission |

|

|

Authorize 100 new SNAPLE awards |

�a |

|

Authorize 40 new nurses in State Facilities APLE awards |

�a |

|

|

|

|

a State will not incur costs of forgiving loans under this program until subsequent years. |

|

|

APLE=Assumption Program of Loans for Education; SNAPLE= Student Nursing APLE. |

|

The 2006-07 budget plan provides about $19.5�billion from the General Fund for health programs, which is an increase of about $1.8�billion or 10�percent compared to the revised prior-year level of spending as shown in Figure�10. Several key aspects of the budget package are discussed below and summarized in Figure�11.

|

Figure 10 Health Services

Programs |

||||

|

(Dollars in Millions) |

||||

|

|

2005‑06 |

2006‑07 |

Change |

|

|

Amount |

Percent |

|||

|

Medi-Cal�local assistancea |

$12,831 |

$13,777 |

$946 |

7.4% |

|

Department of Developmental Services |

2,255 |

2,502 |

247 |

10.9 |

|

Department of Mental Health (DMH)a |

1,276 |

1,727 |

451 |

35.3 |

|

Department of Health Services� |

382 |

560 |

178 |

46.5 |

|

Healthy Families Program� |

322 |

368 |

46 |

14.4 |

|

Department of Health Services� |

384 |

247 |

-137 |

-35.7 |

|

Department of Alcohol and Drug |

242 |

290 |

47 |

19.5 |

|

Emergency Medical Services Authority |

24 |

29 |

5 |

21.1 |

|

All other health services |

14 |

27 |

5 |

21.1 |

|

Totals |

$17,730 |

$19,527 |

$1,784 |

10.1% |

|

|

||||

|

a The DMH budget increased in 2006‑07 by $340 million, with a related reduction made in Medi-Cal support, due to technical shift of General Fund from Medi-Cal to DMH. |

||||

|

b Drop in spending in 2006‑07 reflects (1) shift in support for licensing and certification activities from General Fund to fee support in 2006‑07 and (2) one-time spending in 2005‑06 for emergency drug coverage for Medi-Cal patients shifted to drug coverage under Medicare Part D. |

||||

|

Figure 11 Major Changes�State

Health Programs |

|

|

(In Millions) |

|

|

|

|

|

Enrollment Activities for Children's Health Programs |

|

|

Support new activities to expand enrollment |

$50 |

|

Medi-Cal |

|

|

Provide nursing home rate increase required by current law |

$393 |

|

Increase rates further for nursing homes and long-term care facilities |

87 |

|

Reverse 5 percent reduction in physician rates |

75 |

|

Increase rates for certain managed care plans |

39 |

|

Make technical adjustments for funding shifts to other departments |

-362 |

|

Disaster Preparedness |

|

|

Implement steps to prepare for flu pandemic and other emergencies |

$190 |

|

Public Health |

|

|

Augment AIDS prevention and education efforts |

$6 |

|

Continue local assistance to combat West Nile Virus outbreak |

3 |

|

Licensing and Certification Program Reform |

|

|

Shift support for licensing and certification

programs from General Fund |

-$50 |

|

Department of Developmental Services |

|

|

Provide rate increase for some community service providers |

$47 |

|

Increase wages for direct care staff in day and work activity programs |

24 |

|

Expand the Autistic Spectrum Disorders Initiative |

3 |

|

Department of Mental Health |

|

|

Pay outstanding mandate claims from prior years for �AB 3632� program |

$66 |

|

Create new categorical program for services to special education students |

52 |

|

Address federal court orders on mental health care for prison inmates |

27 |

|

Comply with federal consent decree for state hospitals |

21 |

|

Department of Alcohol and Drug Programs |

|

|

Improve Proposition 36 drug treatment performance and outcomes |

$25 |

|

Establish new statewide campaign to deter methamphetamine use |

10 |

|

Expand felony drug court program |

4 |

The budget plan provides about $50�million in General Fund support for new activities to (1) enroll additional children who are eligible for, but not now enrolled, in Medi-Cal and the Healthy Families Program (HFP) and (2) retain in coverage more children who are enrolled. Specifically, state grants are provided to counties to spur local outreach activities, HFP enrollment procedures are simplified, and new financial incentives are provided for certified application assistants. The spending plan also includes funds for the additional caseloads expected to result from these outreach and enrollment efforts.

The 2006-07-enacted budget provides about $13.8�billion from the General Fund ($35.1�billion all funds) for Medi-Cal local assistance expenditures. This amounts to about a $1�billion, or 7.4�percent, increase in General Fund support for Medi-Cal local assistance.

This increase in Medi-Cal local assistance expenditures would have been significantly greater except for $362�million in technical adjustments reflected in the budget plan. General Fund support previously displayed in the Medi-Cal budget is now shown in the Department of Mental Health (DMH) budget item for mental health services for children and in the Department of Aging budget item for the Multipurpose Senior Services Program. Had these expenditures been included within the Medi-Cal local assistance budget item, the increase in spending for the program in 2006-07 would have been greater than the 7.4�percent figure discussed above.

However, another factor makes the increase in the Medi-Cal local assistance budget in 2006-07 look somewhat larger than it would otherwise have been. In 2005-06, the state allocated $113�million from the General Fund for emergency state assistance to Medi-Cal beneficiaries who encountered problems in obtaining their prescription drugs when they were shifted from Medi-Cal drug coverage to coverage under the new federal Medicare Part D drug benefit. Although these expenditures are primarily for Medi-Cal patients, the administration counted them as part of the state operations budget of the Department of Health Services (DHS) in 2005-06 and did not count them as spending on Medi-Cal Program local assistance. Had these expenditures instead been counted as Medi-Cal local assistance, the increase in General Fund spending for Medi-Cal local assistance in 2006-07 would have been smaller than the 7.4�percent increase discussed above.

Major Cost Factors. The increase in expenditures primarily reflects: (1)�increases in costs and utilization of medical services in the base program; (2) rate increases for physicians and certain other providers; (3) a number of significant policy changes in Medi-Cal; and (4) ongoing growth in caseloads. Specifically, Medi-Cal caseloads are assumed to grow by about 85,000, or 1.3�percent, in the budget year to a total of about 6.7�million average monthly eligibles.

As noted above, expenditures for emergency drug coverage for Medi-Cal beneficiaries were not counted by the administration as Medi-Cal local assistance spending. However, various other fiscal effects of the new Medicare Part D drug coverage on the Medi-Cal Program are reflected in the Medi-Cal budget. The growth in the Medi-Cal budget reflects a number of fiscal effects-both positive and negative-relating to the continued shift of prescription drug coverage for certain aged and disabled beneficiaries to the federal Medicare Part D drug benefit. For example, so-called �clawback� payments by the state to the federal government required under the Medicare Part D law are included in the Medi-Cal local assistance budget.

Changes in Medi-Cal Provider Rates. The budget plan provides $393�million General Fund for rate increases for nursing homes as required by Chapter�875, Statutes of 2004 (AB 1629, Frommer), in addition to $93�million General Fund for rate increases for other facilities that provide long-term care services to Medi-Cal beneficiaries. The budget also includes $75�million General Fund to reflect the reversal of a 5�percent reduction in rates for physicians and certain other Medi-Cal providers that was enacted in 2003-04, but only partially implemented due to a now-resolved legal challenge. In addition, among other provider rate increases, $39�million in state funds is provided for rate increases for certain Medi-Cal managed care plans. The Governor vetoed an additional $9.3�million General Fund augmentation for rate increases for these plans.

New Federal Documentation Requirements. The budget plan adopts changes in state law to comply with new federal requirements that states obtain documentation of the identity and citizenship of individuals who enroll and reenroll in Medi-Cal. Because of uncertainty over its fiscal effect on the Medi-Cal Program, no fiscal changes were made in the state budget plan to reflect the impact of the new federal law.

The budget plan provides about $368�million from the General Fund ($1�billion all funds) for local assistance under HFP during 2006-07. This reflects an overall increase of about $128�million (all funds), or 14�percent, in annual spending for the program, which is administered by the Managed Risk Medical Insurance Board (MRMIB). General Fund spending for HFP local assistance is budgeted to increase by about $46�million. This is primarily the result of increases in caseload assumed to occur as a result of additional funding for application assistance and the implementation of efforts to streamline children�s enrollment, as discussed above. Underlying caseload trends and increases in provider rates are also projected to contribute to the increased spending level for HFP. Overall, program enrollment is assumed to grow by 78,000 children, or about 10�percent, to reach a total of about 859,000 children by the end of the budget year.

After the budget bill was enacted, the Legislature subsequently passed legislation (SB 1702, Speier) to amend the budget plan to augment another health coverage program administered by MRMIB known as the Managed Risk Medical Insurance Program (MRMIP). The MRMIP provides assistance to individuals who have difficulty obtaining private health coverage because of their medical conditions. If the Governor signs the measure, MRMIP would receive an additional $4�million in Proposition�99 tobacco revenues that would expand coverage to an estimated additional 1,400 enrollees now on the program�s waiting lists.

The budget plan adopts, with some significant modifications, various administration proposals to better prepare the state for public health emergencies and, in particular, the threat of an avian flu pandemic. In all, the spending plan provides more than $190�million in state funding (plus federal funds) to DHS and the Emergency Medical Services Authority (EMSA) to make additional hospital beds available in case of a flu emergency, strengthen the state and local public health laboratory systems, and conduct local planning to respond to a major public health disaster. For example, EMSA is allocated funding to establish mobile field hospitals and disaster response teams. Likewise, DHS received additional funding to stock up on antiviral medications and protective masks for health care workers and to purchase ventilators and other supplies and equipment to quickly expand emergency hospital capacity in the event of a disaster. Most of this additional funding is provided on a one-time basis.

The budget plan provides DHS with about $560�million from the General Fund ($2.5�billion all funds) for public health local assistance during 2006-07. General Fund spending for public health local assistance would increase by about $178�million, or almost 47�percent, primarily due to the augmentations for disaster preparedness discussed above. The budget supports various expansions of public health programs, including augmentations for AIDS prevention and education activities, breast cancer screening, Alzheimer�s disease diagnosis and treatment, and clinic programs for agricultural workers and rural areas. Genetic testing of newborns would be expanded to include screening for cystic fibrosis and biotinidase deficiency. The budget also continues state assistance to local special districts in controlling the West Nile Virus, although the Governor used his veto authority to reduce the amount provided for this purpose in 2006-07.

General Fund support for EMSA would increase under the budget by about 21�percent to about $29�million. About $53�million would be provided to EMSA from all fund sources. The increase is due partly to the expansion of EMSA�s disaster preparedness activities discussed earlier. The Governor vetoed a proposed $10�million General Fund augmentation for grants to improve the operation of trauma care centers.

The budget significantly expands staffing for the inspection of nursing homes, hospitals, and other health care facilities. It establishes a special fund within DHS to pay for these activities primarily from fees, but provides some General Fund support to moderate the initial impact of fee increases. After these changes have been taken into account, the budget plan replaces about $50�million in General Fund support for the DHS licensing and certification program with fee revenues, resulting in a General Fund savings to the state.