January 12, 2007

The 2007-08 Governor�s Budget proposes a major redirection of transportation funds, reductions in social services, and a variety of other actions to eliminate a significant shortfall in 2007-08. The plan assumes that adoption of its proposals will result in a balanced budget with an over-$2 billion reserve. However, the budget contains a significant number of downside risks and is based on a number of optimistic assumptions. Its key proposals also raise serious policy and legal issues. Adverse outcomes in just a few of these areas could easily eliminate most or all of the proposed reserve.

After a year in which the state was able to use surging revenues to significantly increase education spending and prepay budgetary debt, the situation for 2007-08 is much tougher. Reflecting these more difficult circumstances, the Governor�s budget includes only a few program expansions, and instead proposes a number of budget-balancing actions, including a major redirection of transportation funds and significant reductions in social services, to eliminate a significant shortfall in the budget year.

If the administration�s assumptions were to hold, the Governor�s proposal would both (1) produce a balanced budget with a healthy reserve in 2007-08 and (2) significantly reduce the state�s ongoing structural shortfall. Even if all the budget�s proposals were adopted, however, it is likely that the actual amount of budget savings and new revenues would fall short of the levels estimated by the administration. The Governor�s key budget proposals raise a number of serious policy and legal issues, which may make their implementation problematic, and the budget�s assumptions on matters ranging from the fiscal benefits of its solutions to the outcome of court cases appear to be optimistic. Adverse outcomes in just a few of these areas could easily eliminate most or all of the budget�s proposed reserve.

Given the above factors, as well as the continuing existence of the structural budget shortfall facing the state, it will be important that the Legislature develop a more realistic budget which includes alternative budgetary solutions and avoids raising ongoing commitments (absent identified funding to pay for them).

In November, we estimated that, under current-law revenue and expenditure policies, the state would conclude 2007-08 with a deficit of $2.4�billion. This consisted of a carryover reserve of $3.1�billion from the current year to offset an operating shortfall of $5.5�billion in 2007-08.

In contrast, the 2007-08 Governor�s Budget includes a year-end reserve of $2.1�billion, an improvement of nearly $4.5�billion relative to our November baseline estimate. This difference reflects both policy actions assumed in the budget as well as its more optimistic assumptions relating to baseline revenues, expenditures, and the outcome of court cases. These factors, enumerated in Figure�1, can be separated into four major categories.

|

Figure 1 How the Governor�s Budget Closes the 2007-08 Shortfall |

|

||

|

(Dollars in Millions) |

|

||

|

|

|

Totals |

|

|

LAO November Forecast |

|

-$2,411 |

|

|

New Spending |

|

-$1,198 |

|

|

Supplemental deficit-financing bond payment |

-$595 |

|

|

|

Other |

-603 |

|

|

|

Budget Solutions |

|

$3,438 |

|

|

Substitute transportation special funds for General Fund expenditures |

$1,111 |

|

|

|

New tribal gambling compacts |

506 |

|

|

|

Substitute bond proceeds for General Fund expenditures |

200 |

|

|

|

CalWORKs reductions |

496 |

|

|

|

Shift some child care costs to Proposition 98 |

269 |

|

|

|

Tax policy changes |

200 |

|

|

|

Other |

656 |

|

|

|

Baseline Estimates |

|

$1,178 |

|

|

Higher revenue estimate |

$641 |

|

|

|

Lower expenditure estimate |

537 |

|

|

|

Court-Related Assumptions |

|

$1,078 |

|

|

CalWORKs (Guillen) |

$553 |

|

|

|

Pension obligation bonds |

525 |

|

|

|

Budget Estimate of 2007‑08 Reserve |

|

$2,085 |

|

Spending Beyond Our November Baseline ($1.2�Billion). Relative to our baseline, the budget includes $595�million in additional spending for a supplemental payment toward retirement of outstanding deficit-financing bonds. It also includes $132�million above our baseline to University of California and California State University, and $471�million in various other state programs. In Figure�1, these factors have a negative sign, meaning that they worsen the deficit.

Budget Solutions ($3.4�Billion Savings). The single largest component is over $1.1�billion related to the redirection of monies from a transportation special fund to support certain transportation-related General Fund expenditures in the areas of Proposition�98, general obligation bond debt service, and the Department of Developmental Services.

Other solutions include: new revenues from amended tribal gambling compacts, California Work Opportunity and Responsibility to Kids (CalWORKs) savings related to a suspension of the July 2007 cost-of-living adjustment (COLA) and time limits for children; substitution of bond fund proceeds for General Fund flood protection expenditures; elimination of General Fund support for deferred park maintenance; a shift of CalWORKs childcare to Proposition�98 (thereby reducing General Fund spending in the CalWORKs budget); and permanent elimination of the teachers� tax credit and permanent extension of recent changes involving application of the use tax to out-of-state sales of vessels, aircraft, and vehicles.

More Optimistic Baseline Estimates ($1.2�Billion). After adjusting for the impacts of policy-related changes, the budget�s underlying forecast of General Fund revenues for 2005-06 through 2007-08 combined is about $641�million above our November projections. On the expenditure side, the administration�s baseline estimate for the three years combined is $537�million below our November forecast. While there are a number of offsetting factors on the expenditure side, a key difference is that the administration is projecting higher local property taxes available to offset state spending on Proposition�98.

More Optimistic Assumptions About Pending Court Decisions ($1.1�Billion). Finally, the 2007-08 budget assumes that the state will prevail on its appeal in two cases where it has lost at the superior court level. One is the Guillen case, which involves retroactive application of a 2003 COLA to CalWORKs grants. The other is related to a validation case involving the sale of pension obligation bonds to cover a portion of the state contribution to its retirement fund. Our November estimates assumed that the state would incur added costs of over $500�million related to the Guillen case, and that no pension obligation bonds would be sold in the budget year or beyond.

As we note in the final section of this report, many of the assumptions regarding pending legal decisions, baseline estimates, and new revenues and/or savings from its proposed budgetary solutions are subject to considerable risk.

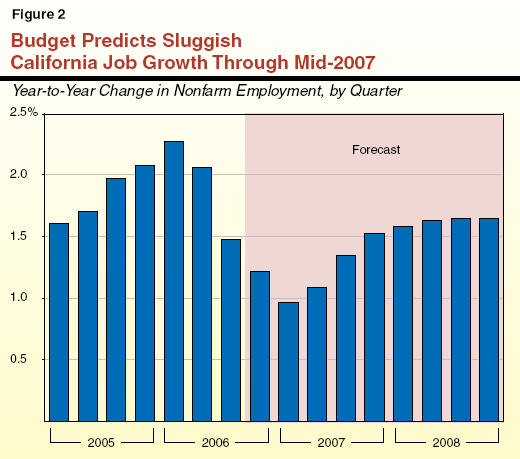

The U.S. and California economic expansions clearly slowed over the course of 2006, reflecting high fuel prices through midyear and declines in home construction and sales of light vehicles. The budget forecast assumes that the slowdown will persist through the first half of 2007 before stabilizing real estate markets provide support for a mild upturn beginning in the second half of the year. On an annual average basis, the budget forecasts that U.S. gross domestic product growth will slow from 3.3�percent in 2006 to 2.4�percent in 2007, before partially rebounding to 2.9�percent in 2008. In California, wage and salary employment is projected to slow from 1.8�percent in 2006 to 1.2�percent in 2007, before rebounding to 1.6�percent in 2008 (see Figure�2).

In contrast to last year, when tax-related cash receipts soared above expectations during the first half of the fiscal year, tax receipts during the first six months of this fiscal year fell slightly short of the budget act estimate, which itself assumed only modest growth in 2006-07.

The administration�s forecast assumes that current trends will improve modestly in the second half of this fiscal year, but that total revenues and transfers will still increase by only 1.7�percent from the prior year-reaching $95�billion for all of 2006-07. Major taxes are projected to increase by a slightly stronger rate of 2.7�percent. In 2007-08, the budget forecast projects that revenues and transfers will be $102.3�billion, a 7.7�percent increase from the current year. The increase is boosted by the proposed expansion of tribal gambling compacts as well as one-time receipts from the assumed sale of the pension obligation bonds. Adjusting for these and other special factors, revenues are expected to increase by slightly over 6.5�percent in the budget year.

LAO Assessment. After adjusting for policy-related changes, the administration�s forecast is down from our November projections by $70�million in the prior year, but up by $328�million in the current year, and $383�million in 2007-08-for a three-year total of $641�million. At this time, recent mixed developments relating to both the economy and cash receipts would not appear to support such an upward adjustment. However, cash receipts during the next two weeks will provide us with a clearer picture of current revenue trends. During this period, the state will be receiving payments related to the fourth quarter estimated taxes from individuals, which are due on January 15. Historically, the strength in these payments has been an early indicator of the strength or weakness in final payments that are remitted in April. Early signs are not particularly positive, but we will be reviewing the upcoming collections data, along with other new economic and revenue information for purposes of making a more complete assessment of the updated revenue outlook. Our updated projections will be included in The 2007-08 Budget: Perspectives and Issues released next month.

The budget proposes total state spending in 2007-08 of $131�billion (excluding expenditures of federal funds and bond funds). General Fund spending is projected to increase from $102.1�billion to $103.1�billion (an increase of 1�percent), while special funds spending rises from $24.5�billion to $27.7�billion.

Figure�3 shows the General Fund�s condition from 2005-06 through 2007-08 under the budget�s assumptions and proposals. It shows that:�

The 2005-06 fiscal year concluded with a reserve of slightly under $10.1�billion. The large reserve reflects major increases in revenues in 2004-05 and 2005-06, as well as strong amnesty payments received in 2004-05. It also reflects the proceeds of the deficit-financing bonds issued in 2003-04.

In 2006-07, expenditures (at $102.1�billion) are expected to exceed revenues (at $95�billion) by slightly over $7.1�billion, leaving $2.9�billion in the reserve.

In 2007-08, expenditures increase slightly to $103.1�billion, while revenues are projected to reach $102.3�billion. The $800�million operating shortfall reduces the year-end reserve to $2.1�billion by the close of the budget year.

|

Figure 3 Governor�s Budget General Fund Condition |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Proposed for 2007‑08 |

|

|

|

2005‑06 |

2006‑07 |

Amount |

Percent Change |

|

Prior-year fund balance |

$8,981 |

$10,816 |

$3,670 |

|

|

Revenues and transfers |

93,427 |

94,991 |

102,300 |

7.7% |

|

Total resources available |

$102,408 |

$105,807 |

$105,971 |

|

|

Expenditures |

$91,592 |

$102,137 |

$103,141 |

1.0% |

|

Ending fund balance |

$10,816 |

$3,670 |

$2,830 |

|

|

Encumbrances |

$745 |

$745 |

$745 |

|

|

Reserve |

$10,071 |

$2,925 |

$2,085 |

|

|

Budget Stabilization Account |

� |

472 |

1,495 |

|

|

Reserve for Economic Uncertainties |

10,071 |

2,453 |

590 |

|

The main programmatic and related features of the budget are shown in Figure�4. The budget provides funding to address a number of previously identified issues relating to inmate capacity and health care in the state�s prison system. However, in other areas, there are relatively few major new initiatives. (The Governor�s health care reform proposal is not reflected in the budget.) Funding is generally provided to cover caseload and implementation costs associated with initiatives adopted in the current year. The two areas of the budget experiencing the biggest reductions are social services and transportation.

|

Figure 4 Key Programmatic Features of the 2007‑08 Budget Proposal |

|

|

|

Proposition 98 |

|

� Implements current-year program expansions, but does not propose new expansions for budget year. Uses $1.9 billion funding increase to cover a 4 percent cost-of-living adjustment (COLA) in K-12 and provides additional support for CalWORKs-related child care. |

|

� Rebenches the minimum guarantee related to transportation proposal discussed below. |

|

� Increases community college funding to cover a 4 percent COLA, 2 percent enrollment growth, and the full-year costs associated with backfill of the student fee reduction that takes effect in the middle of 2006‑07. |

|

UC and CSU |

|

� Provides funding to cover 4 percent base increases and 2.5 percent enrollment growth in both segments. Proposes student fee increases of 7 percent for UC and 10 percent for CSU. The increased fees would be retained by the segments. |

|

� Eliminates state support for outreach programs. |

|

� Proposes $70 million in lease-revenue bonds and $20 million in General Fund support to UC for a research initiative on technological innovation. |

|

Transportation |

|

� Uses $1.1 billion from the Public Transportation Account to replace General Fund spending in three areas: Proposition 98 funding on home-to-school transportation; transportation services provided by regional centers; and debt service on general obligations bonds issued for transportation projects. |

|

Health and Social Services |

|

� Suspends the July 1, 2007, COLA for CalWORKs grants, and places new time limits and sanctions on children whose parents cannot or will not comply with CalWORKs participation requirements. |

|

� Makes relatively few significant changes in health programs. Does not reflect impacts of Governor�s proposed health care reforms. |

|

Criminal Justice |

|

� Provides significant funding increases in the Department of Corrections and Rehabilitation to cover price increases, inmate growth, compliance with various court orders, and a new probation grant program. Includes some offsetting savings from a proposed change in parole policies and shifts juvenile offenders to county facilities. |

|

� Proposes capital outlay spending of about $10 billion�mostly funded with lease-revenue bonds�that is generally consistent with the prison capacity package recently announced by the Governor. |

|

Revenues |

|

� Includes $506 million resulting from amended tribal gambling compacts. |

|

� Proposes permanent elimination of the teachers� tax credit and permanent extension of the recent use tax law changes. |

|

� Assumes $78 million in new revenues from audit-related proposals to address the �tax gap.� |

Figure�5 shows General Fund spending by major program area. As has been the case in recent years, the year-to-year changes in many programs are being affected by special factors, such as transfers of programs, funding redirections, availability from other sources, and one-time actions. For example, while part of the 34�percent decline in CalWORKs is related to significant proposed reductions in the program, a portion is also due solely to a funding shift in CalWORKs-related child care expenditures to Proposition�98.

|

Figure 5 General Fund Spending by Major Program Area |

||||

|

(Dollars in Millions) |

||||

|

|

|

|

Proposed for 2007-08 |

|

|

|

Actual 2005-06 |

Estimated 2006-07 |

Amount |

Percent Change |

|

Education Programs |

|

|

|

|

|

K-12 Proposition 98 |

$34,582 |

$36,658 |

$36,851 |

0.5% |

|

CCC Proposition 98 |

3,670 |

4,040 |

4,224 |

4.6 |

|

UC/CSU |

5,444 |

5,895 |

6,246 |

6.0 |

|

Other |

3,939 |

4,792 |

5,193 |

8.4 |

|

Health and Social Services |

|

|

|

|

|

Medi-Cal |

$12,358 |

$13,649 |

$14,629 |

7.2% |

|

CalWORKs |

1,963 |

2,014 |

1,324 |

-34.3 |

|

SSI/SSP |

3,427 |

3,543 |

3,893 |

9.9 |

|

IHSS |

1,355 |

1,444 |

1,471 |

1.9 |

|

Other |

7,238 |

9,170 |

8,558 |

-6.7 |

|

Youth & Adult Corrections |

$7,783 |

$9,236 |

$10,043 |

8.7% |

|

Transportation |

$1,699 |

$2,993 |

$1,558 |

-47.9% |

|

All Other |

$8,133 |

$8,704 |

$9,150 |

5.1% |

|

Totals |

$91,592 |

$102,137 |

$103,141 |

1.0% |

Similarly, the low growth in General Fund expenditures on Proposition�98 in 2007-08 is due to two factors: (1) a transfer of $627�million in home-to-school transportation expenses to a transportation special fund; and (2) nearly 10�percent property tax growth (which offsets, dollar for dollar, General Fund obligations to Proposition�98). Finally, the large decline in transportation funding between 2006-07 and 2007-08 reflects large one-time loan repayments to transportation special funds made in the current year.

In this section, we provide additional discussion for Proposition�98 and certain other programs which are significantly affected by the Governor�s budget�s proposals.

Figure�6 summarizes the Governor�s Proposition�98 budget proposal for K-12 schools and community colleges. For 2007-08, it provides $56.8�billion in total K-14 Proposition�98 funding. This is an increase of $1.8�billion, or 3.3�percent, over the revised current-year estimate. (This funding level, however, reflects the �rebenching� of the Proposition�98 requirement downward by $627�million to account for the proposed shift of school transportation funding, as discussed below.) As shown in the figure, most of the increase in proposed K-14 Proposition�98 funding would be covered by growth in local property tax revenues ($1.4�billion).

|

Figure 6 Proposed Proposition 98 Funding |

||||

|

(Dollars in Millions) |

||||

|

|

2006-07 Revised |

2007-08 Proposed |

Change From 2006-07 Revised |

|

|

Amount |

Percent |

|||

|

K-12 |

$49,011 |

$50,446a |

$1,435 |

2.9% |

|

California Community Colleges (CCC) |

5,897 |

6,274 |

380 |

6.4 |

|

Totalsb |

$55,022 |

$56,835 |

$1,813 |

3.3% |

|

General Fund |

($40,812) |

($41,190) |

($378) |

(0.9%) |

|

Local property tax revenue |

(14,210) |

(15,645) |

(1,435) |

(10.1) |

|

Per Pupil Spending |

|

|

|

|

|

K-12 average daily attendance |

5,940,989 |

5,917,948 |

-23,041 |

-0.4% |

|

K-12 funding per pupil |

$8,250 |

$8,525c |

$275 |

3.3 |

|

CCC full-time equivalent students (FTES) |

1,153,025 |

1,176,086 |

23,061 |

2.0 |

|

CCC funding per FTES |

$5,114 |

$5,335 |

$220 |

4.3 |

|

|

||||

|

a Reflects Governor's proposal to fund the Home-to-School Transportation program ($627 million) from the Public Transportation Account and rebench the Proposition 98 guarantee down by a like amount. If the swap were not to occur, the year-to-year change for K-12 would be $2.1 billion, or 4.2 percent. |

||||

|

b Total Proposition 98 amounts include around $115 million in funding that goes to other state agencies for education purposes. |

||||

|

c If the transportation funding swap were not to occur, K-12 per pupil funding in 2007-08 would be $8,631, reflecting a 4.6 percent increase over the current year. |

||||

Year-to-year K-12 Proposition�98 comparisons are complicated by the proposed transportation funding shift. As shown in Figure�6, if the shift were to occur, total K-12 Proposition�98 funding would increase by $1.4�billion, or 2.9�percent, from 2006-07. If the $627�million shift were not to occur, total K-12 Proposition�98 funding would increase by $2.1�billion, or 4.2�percent, from 2006-07.

Similarly, comparisons of Proposition�98 per pupil funding rates also are complicated by the proposed shift. If the shift were to occur, the 2007-08 Proposition�98 per pupil funding rate would be $8,525, an increase of $275, or 3.3�percent, from the revised current-year estimate. If the $627�million shift were not to occur, the 2007-08 per pupil funding rate would be $8,631, an increase of $381, or 4.6�percent, over 2006-07.

Budget Maintains Existing Programs With Few Expansions. The 2007-08 budget proposal contains relatively few Proposition�98 program expansions. The primary funding increases go toward providing COLAs and increasing the Proposition�98 share of the state�s child care program. Partial funding for these expenditures comes from savings associated with declines in K-12 attendance.

Fully Funds COLAs ($1.9�Billion). The proposal fully funds both statutory and discretionary COLAs. Specifically, the budget provides $1.9�billion for a 4.04�percent COLA-$1.4�billion for revenue limits and $516�million for categorical programs.

Increases Proposition�98 Spending for Child Care ($269�Million). The Governor proposes to increase Proposition�98 funding for CalWORKs child care by $269�million. This proposal would free up a comparable amount of federal Temporary Assistance for Needy Families funds for other CalWORKs purposes, thereby offsetting General Fund costs and creating savings for the state. This funding shift proposal would not affect total monies available for child care or the level of child care services.

Recognizes Savings From Declining Attendance (About $90�Million). The budget assumes that student attendance will decline by 0.39�percent from 2006-07 to 2007-08. The Governor�s budget shows roughly $90�million in associated attendance- related savings.

Proposed School Transportation Funding Shift. The budget proposes to use the Public Transportation Account (PTA) in lieu of Proposition�98 to fund the $627�million Home-to-School Transportation program. In a related action, it would �rebench� the Proposition�98 minimum funding requirement downward by a like amount, thereby freeing up $627�million in General Fund monies. As with the proposed child care funding shift, this shift would not affect total funding for school transportation or the level of school transportation services. We think the proposed funding shift and rebenching of the Proposition�98 guarantee raises serious policy and legal issues and may not achieve the proposed General Fund savings.

Additional K-12 Education Expenditures. The budget also includes the following expenditures from one-time funds:

Quality Education Improvement Act ($268�Million). The budget includes the first installment of a $2.9�billion settlement agreement related to Proposition�98 K-14 funding requirements. The bulk of the funds are for reducing class size in grades 4-12 in about 500 low-performing schools.

School Facilities ($6.9�Billion). The budget proposes to spend $6.9�billion in bond monies in 2006-07 and 2007-08 for school facilities. Of the $6.9�billion, $3.1�billion comes from the 2006 School Facilities Bond (authorized by Proposition�1D) and the remainder comes from the 2004 and 2002 school bonds. The Governor�s Strategic Growth Plan proposes to seek an additional $6.5�billion in general obligation bonds for K-12 school facilities on the 2008 ballot and $5.1�billion on the 2010 ballot.

Various One-Time Expenditures ($252�Million). The Governor proposes to spend $186�million from the Proposition�98 Reversion Account. The bulk of these one-time monies are designated for emergency facility repairs at low performing schools ($100�million), facility lease costs for charter schools located in low-income areas ($44�million), and child care ($26�million). In addition, the budget proposes to spend $65�million in 2006-07 attendance-related savings for various one-time purposes. The bulk is for continuing teacher block grants to low performing schools for a third year ($50�million) and establishing a new program to recruit retiring professionals into teaching ($10�million).

The Governor�s budget proposes $380�million in increased Proposition�98 expenditures for community colleges in 2007-08. This reflects a 6.4�percent increase over the revised current-year estimate. Major new expenditures include:

COLAs and Growth ($354�Million). The proposal provides funding for COLAs at the same rate (4.04�percent) as K-12�s statutory rate. It also funds an assumed 2�percent growth in enrollment. This exceeds the statutory minimum guideline based on population growth, which is estimated to be 1.65�percent.

Annualized Costs Related to 2006-07 Student Fee Reduction ($33.2�Million). Student fees were reduced-effective January 2006-from $26 per unit to $20 per unit. The state provided the community colleges $40�million in the current year to make up for the reduced fees revenues. The budget proposes an additional $33.2�million for the full-year impact in 2007-08 of the lower fee level.

Proposition�42, approved by voters in 2002, requires that revenue from the sales tax on gasoline that previously went to the General Fund be transferred into the Transportation Investment Fund for transportation purposes. For 2007-08, the budget proposes to transfer $1.475�billion to transportation, as required by Proposition�42. Of the amount, $602�million would be for the Traffic Congestion Relief Program, $698�million for the State Transportation Improvement Program, and $175�million would go to PTA. Consistent with current law, none of the Proposition�42 funds in 2007-08 would be allocated to local governments for streets and road purposes.

Due to the state�s fiscal condition, the Proposition�42 transfer was suspended partially in 2003-04 and fully in 2004-05. By the end of 2006-07, there will be about $750�million in outstanding Proposition�42 loans that must be repaid from the General Fund. Proposition�1A, passed by voters in November 2006, requires that the amount be repaid, with interest, no later than June 30, 2016, with minimum annual repayment of one-tenth the amount owed. The budget proposes to repay from the General Fund $83�million, about one-ninth of the outstanding amount in 2007-08.

State law requires certain �spillover� gasoline sales tax revenue (the amount exceeding the amount generated from one-quarter percent sales tax on all other goods) to be deposited in the PTA. The account also receives diesel fuel sales tax revenues as well as a portion of the annual Proposition�42 funds for transportation (as noted above). Funds in the PTA are available only for transportation planning and mass transportation purposes. Current law also requires that one-half of PTA revenues be allocated to support transit operations (mainly bus and rail) under the State Transit Assistance (STA) program. The remaining revenues are used to support transportation planning, provide intercity rail services, and fund transit capital improvements.

The budget proposes several changes to the allocation of spillover funds (projected to be $617�million in 2007-08) and to the use of PTA funds. In total, these proposals would result in $1.1�billion being used in 2007-08 for expenditures that currently are funded from the General Fund.

Use a Portion of Spillover for Debt Service on Transportation Bonds. The budget proposes to retain the first $340�million in spillover in 2007-08 to pay debt service on outstanding transportation bonds. (These include general obligation bonds issued under Propositions 108 and 116 in 1990 and Proposition�192 in 1996.) Traditionally, debt service for these bonds has been paid from the General Fund. The budget proposes a one-time shift in the fund source for these payments in 2007-08. Debt service in 2008-09 would be paid again from the General Fund.

Use PTA to Offset General Fund Expenditures. The budget proposes about $771�million in PTA money to fund home-to-school transportation ($627�million) and regional center transportation ($144�million) in 2007-08. Currently, home-to-school transportation is paid from Proposition�98 school funding. The budget proposes the funding shift to PTA on a permanent basis and to rebench the Proposition�98 funding level. The proposal to fund regional center transportation from PTA instead of the General Fund, however, would be a one-time shift for the budget year only.

No Spillover for STA. The budget proposes to permanently discontinue the allocation of spillover revenue to STA. For 2007-08, the proposal would free up $309�million in PTA revenue for other uses.

Reduce 2007-08 STA by the Extra Amount Appropriated in 2006-07. The current-year budget appropriated $624�million to STA, in part based on overly high gasoline price projections. As a result, the program received about $102�million more than it otherwise would. The budget proposes to offset this amount by reducing the 2007-08 funding level by a corresponding amount.

Fund Only Staff Support for High Speed Rail Authority. The budget proposes to indefinitely postpone the bond measure for the development of a statewide high-speed rail system, which is scheduled for the November 2008 ballot. This would free up bonding capacity for other capital improvements proposed by the Governor. At the same time, the budget proposes $1.2�million from PTA for staff support of the authority, but no funding for any contracted services to develop the system.

The budget projects a PTA balance of $69�million at the end of the budget year. Because spillover revenue is very volatile and could fluctuate greatly depending on gasoline prices and the economy, lower than projected gasoline prices could result in significantly lower spillover revenue (as well as Proposition�42 funds) into PTA. For instance, if gasoline prices are just 5�percent lower than the budget projects (a price of $2.73 per gallon rather than $2.87 per gallon), everything else being the same, PTA would not have sufficient funds to pay for all the expenditures proposed in the budget. In that event, it is not clear what expenditures would be excluded as the administration has yet to identify its expenditure priorities for PTA funds.

Chapter�91, Statutes of 2004 (AB 687, Nu�ez), provided $1.2�billion in bond funds to repay certain transportation loans made to the General Fund. The bonds would be backed by tribal gambling revenues, which have been accruing at $25�million per quarter. The current-year budget assumes that bonds would be issued in 2006-07 to repay $827�million (plus interest) in loans to the General Fund. Due to pending lawsuits, the bonds will not be issued in the current year, and most likely not in 2007-08. Absent the bonds, the budget proposes to use $100�million of tribal gambling revenue in each of the current and budget years to repay a portion of the loan.

The budget proposes $9.4�billion from the General Fund for the state�s social services programs, a reduction of about $580�million (5.8�percent) compared to 2006-07. This overall decrease is attributable to substantial reductions in CalWORKs and federal penalty relief in child support, partially offset by increased costs in the Supplemental Security Income/State Supplementary Program (SSI/SSP).

COLAs. The budget provides the statutory January 2008 SSI/SSP COLA at an estimated cost of $217�million. The budget suspends the July 2007 CalWORKs COLA resulting in savings of $140�million. The budget does not provide the discretionary Foster Care COLA or inflationary adjustments for county administration.

Increasing CalWORKs Sanctions. Currently, when an able-bodied adult does not comply with CalWORKs participation requirements, the family�s grant is reduced by the adult portion, resulting in a �child-only� grant. The budget proposes a �full family sanction� whereby the reduced grant for the children is eliminated if an adult is out of compliance with participation requirements for three months. In response to this increased sanction, the budget estimates that many families will enter employment, resulting in child care and employment services costs of $28�million. In cases where families do not comply, the budget estimates grant and administrative savings of $17�million, so the net cost of this proposal is about $11�million.

Time Limits for Aided Children. Currently, after five years of assistance, a family�s grant is reduced by the adult portion, and the children continue to receive a child-only grant in the safety net program. The budget proposes to eliminate the safety net grant for children whose parents fail to comply with the federal work participation requirements (20 hours per week for families with a child under age 6 or 30 hours per week for families where all children are at least age 6). The budget also proposes to limit assistance to five years for most other child-only cases (such as those with parents who are undocumented or ineligible due to a previous felony drug conviction). These time limit policies are estimated to result in savings of about $335�million in 2007-08.

Guillen Law Suit. A superior court has ruled in the Guillen court case that the October 2003 COLA is required by current law. In December 2006, an appellate court heard the state�s appeal and a decision is anticipated in February 2007. Unless the appellate court overturns the prior decision, the state faces one-time CalWORKs grant costs of about $435�million, plus ongoing costs of about $115�million, neither of which are included in the Governor�s budget.

Employee Compensation. The Governor�s budget proposes an appropriation of $468�million from the General Fund to cover the budget-year costs of new employee compensation costs. Specifically, the budget provides funding to pay for the costs associated with existing collective bargaining agreements, which generally provide for an inflation-based pay increase. The budget assumes that increase will equal 3.3�percent. There are no funds set aside to pay for any potential costs related to a new agreement for the only bargaining unit-correctional officers-without a current agreement. The budget, however, accounts for General Fund costs of $240�million in the current and budget years to pay for a recent arbitration decision which found that the state had miscalculated past pay raises for correctional officers.

Pension Obligation Bonds. Existing law authorizes the sale of pension obligation bonds to cover a portion of the state�s retirement costs. The budget assumes the administration will sell these bonds in 2007-08 for a net General Fund benefit of $525�million. The sale of the bonds has been repeatedly delayed due to court decisions that concluded that the sale is unconstitutional without voter approval.

California State Teachers� Retirement System (CalSTRS). Current law requires funds to be annually appropriated from the General Fund to CalSTRS to ensure that retired teachers� benefits are not eroded by inflation. The program protects retirees to 80�percent of the purchasing power of their original pension, but the benefit is limited to the amount of money available. The budget proposes to reduce the statutorily required contribution to this program by $75�million on an ongoing basis. In exchange for the payment reduction, the administration will be proposing language to guarantee the inflation protection benefit for retirees. The remaining payment stream after the reduction is assumed to be sufficient to keep the program actuarially sound. In 2003-04, the state reduced funding for this program by $500�million on a one-time basis. In contrast to the current proposal, that reduction was not accompanied by a change in the benefit guarantee, and a superior court decision (currently on appeal) requires that the state repay the funds.

The budget assumes that General Fund revenues derived from tribal casinos grow from $33�million in 2006-07 to $539�million in 2007-08. The estimate is based on the assumption that amended gambling compacts proposed by the Governor in 2006 with tribes that operate some of Southern California�s largest casinos will be approved by the Legislature. The proposed compact amendments would allow these casinos to operate 22,500 new slot machines. The tribes would make annual General Fund payments equal to a fixed amount plus a percentage of revenues derived from new slot machines. To date, the administration has provided very limited information about the reasoning behind its revenue estimates for the proposed compact amendments. A key assumption is how quickly tribes would add new slot machines. Even if the Legislature quickly approved the new compacts, we believe the level of revenues assumed for the budget year is probably still overstated by $300�million.

As in the current year, the budget proposes to capture $100�million in savings through mid-year reductions in departmental appropriations. In recent years, these savings have been concentrated in a few departments and tended to relate to items that occur �on the natural�-revised caseload estimates or other unexpected events which reduce the cost of programs.

In 2005-06, the Department of Finance began work on developing a new budget system for the state. The project had a budget of $138�million. The administration proposes to dramatically expand the original project�s scope to include revamping most of the state�s fiscal IT systems. The project, now known as the Financial Information System for California, would cost $1.3�billion over the next decade. The budget proposes $36�million and 238 positions for the project in 2007-08.

In November 2006, the state�s voters approved $42.7�billion in general obligation bonds for infrastructure spending on transportation, education, flood control, resources, and housing. The administration proposes commitments of roughly $14�billion by the end of the budget year. The Governor proposes additional general obligation bonds totaling $29.4�billion to be put before the voters by 2010. As shown in Figure�7, the new bonds would primarily be for education ($23.1�billion). In addition, the Governor proposes the use of lease-revenue bonds totaling $11.9�billion-primarily for corrections and local jails. In the budget year, the budget proposes $478�million in direct General Fund appropriations for capital outlay purposes, with the majority of these funds for projects in the California Department of Corrections and Rehabilitation.

|

Figure 7 Approved and Proposed General Obligation Bonds |

|||

|

2006 Through 2010 (In Billions) |

|||

|

|

Approved 2006 |

Proposed 2008 and 2010 |

Totals |

|

Transportation |

$19.9 |

� |

$19.9 |

|

K-12 Education |

7.3 |

$11.6 |

18.9 |

|

Higher Education |

3.1 |

11.5 |

14.6 |

|

Flood control |

4.9 |

4.0 |

8.9 |

|

Resources |

4.6 |

� |

4.6 |

|

Housing |

2.9 |

� |

2.9 |

|

Courts and other |

� |

2.3 |

2.3 |

|

Totals |

$42.7 |

$29.4 |

$72.1 |

In our November Fiscal Outlook report, we indicated that, under current-law revenue and expenditure policies, the state faces annual operating shortfalls (that is, the difference between annual revenues and annual expenditures) averaging slightly under $5�billion over the next three years. If the Governor�s budget proposals were fully adopted and all of the assumed savings were fully realized, our projected operating shortfalls would be reduced by roughly one half over this period. However, as discussed below, we believe that the fiscal benefits of many of the budget�s key proposals are overstated, and that the actual decline in operating shortfalls would be significantly less.

The Legislature will face a number of key issues as it proceeds to review the proposal and craft its own budget plan over the next several months. Clearly, the budget raises a number of key policy issues with regard to its proposals to divert public transportation funds and increase CalWORKs sanctions for families that fail to comply with its work requirements as well as impose new time limits on CalWORKs children. In addition, the proposal to issue new pension obligation bonds is at cross purposes with the administration�s goal to reduce budgetary debt.

Aside from the policy considerations, however, we believe that the budget relies on optimistic assumptions in a number of areas. While any budget is subject to risks and uncertainties, we believe that the number and magnitude of these risks is unusually high in the current plan. These risks fall into three areas:

The downside risks in this budget could easily exceed the $2.1�billion reserve budgeted for 2007-08. It is also important to remember that the state continues to face a significant ongoing structural shortfall in its budget, as well as pressures related to unfunded retiree health care costs and potential additional costs to the state�s correctional health care system. In view of these factors, it will be important that the Legislature develop a more realistic budget which includes alternative budgetary solutions and avoids raising ongoing commitments (absent identified funding to pay for them).

|

Acknowledgments This report was prepared by Brad Williams with assistance from many others in the office. The Legislative Analyst's Office (LAO) is a nonpartisan office which provides fiscal and policy information and advice to the Legislature. |

LAO Publications To request publications call (916) 445-4656. This report and others, as well as an E-mail subscription service , are available on the LAO's Internet site at www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000, Sacramento, CA 95814. |