U.S. Retail Sales Update: April 2023 May 16, 2023

U.S. retail sales have dropped 0.9 percent over the last 3 months and grown 1.6 percent over the last 12 months.

U.S. Retail Sales Update: March 2023 April 14, 2023

U.S. retail sales have grown 1.9 percent over the last 3 months and 2.9 percent over the last 12 months. Sales have grown faster than inflation over the last 3 months but slower than inflation over the last 12.

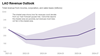

Updated 2022-23 "Big Three" Revenue Outlook March 15, 2023

Based on the most recent revenue and economic data, we currently estimate that collections from the state’s “big three” taxes—personal income, sales, and corporation taxes—are likely to fall below the Governor's Budget assumption of $200 billion in 2022-23.

U.S. Retail Sales Update: February 2023 March 15, 2023

U.S. retail sales have grown 2 percent over the last 3 months and 5.4 percent over the last 12 months.

An Update on California Competes March 10, 2023

We look at recent program statistics and research on California Competes.

Cannabis Tax Revenue Update February 22, 2023

Revenue from the cannabis retail excise tax has declined for six straight quarters.

U.S. Retail Sales Update: January 2023 February 15, 2023

U.S. retail sales have grown 6.4 percent over the last 12 months, but have been flat after accounting for inflation.

Updated Inflation Outlook January 22, 2023

Based on the most recent economic data, we now estimate that annual inflation will drop to about 4 percent by the second quarter of 2023.

U.S. Retail Sales Update: December 2022 January 18, 2023

U.S. retail sales (seasonally adjusted) declined 1.1 percent from November to December. The two-month decline was 2.1 percent. In the last 30 years, two-month drops of at least 2 percent have happened around recessions.

U.S. Retail Sales Update: November 2022 December 15, 2022

U.S. retail sales (seasonally adjusted) declined 0.6 percent from October to November.

November 2022 Cap-and-Trade Auction Update December 14, 2022

Based on the preliminary results, the state will receive an estimated $961 million in revenue from the most recent quarterly cap-and-trade auction held on November 16, 2022.

Unemployment Claims Tracker December 9, 2022

Despite worrying signs in some parts of the economy, the labor market remains steady. Seasonally adjusted weekly UI claims held steady over the last several months at between 40,000 and 50,000 claims per week. This level is in-line with UI claims seen during periods of sustained economic growth.

Cannabis Tax Revenue Update November 18, 2022

Cannabis tax revenues have declined for five straight quarters. One part of last quarter’s revenue decline is the lost revenue from the recently eliminated cultivation tax. Despite this policy change, revenues from the retail excise tax declined faster than ever before, indicating that other factors continue to drive down revenues.

October Tax Collections November 17, 2022

Although October colletions from the state's “big three” tax revenues—personal income, corporation, and sales taxes—came in far ahead of Budget Act assumptions, this is not indicative of better than expected revenue performance for 2022-23 overall. Instead, a closer look at the data shows that the recent trend of revenue weakness continued in October.