The budget proposes a $750 million increase in General Fund expenditures for higher education in 2000-01. This is an increase of 9.8 percent above estimated expenditures in the current year. This funds enrollment growth above demographic projections for all three segments. It also funds base increases at twice the rate of inflation for the University of California and the California State University and at the rate of inflation for the California Community Colleges. The budget also provides funding for several new and expanded program initiatives.

As Figure 1 (see next page) shows, the 2000-01 budget proposal provides a total of $25 billion from all sources for higher education. This amount is $1.2 billion, or 5.2 percent, more than estimated expenditures in the current year. The total consists of funding for all activities of the University of California (UC), California State University (CSU), California Community Colleges (CCC), Hastings College of the Law, the California Student Aid Commission, the California Postsecondary Education Commission, and various other costs. The total includes funding for activities at UC that are only marginally related to instruction, such as providing medical care at its hospitals ($1.8 billion) and managing three major U.S. Department of Energy laboratories ($3.2 billion).

The 2000-01 budget proposes General Fund expenditures of $8.4 billion for higher education. This amount is $750 million, or 9.8 percent, more than estimated expenditures in the current year. The budget also projects that local property taxes will contribute $1.7 billion for the community colleges in 2000-01, an increase of $114 million, or 7.2 percent, over the current year. In addition, student fee and tuition revenue at all the higher education segments account for $1.9 billion of proposed expenditures. This amount is $71 million, or 4 percent, greater than student fee revenue in the current year. The increase in student fee revenue results almost entirely from proposed enrollment growth (3.4 percent). The Governor does not raise fees for resident students. He does propose a 4.5 percent increase, however, in the nonresident tuition component of student fees at UC. Lastly, the budget includes $13 billion in other funds, which includes federal funds, restricted funds, and funds from private sources. The numbers in Figure 1 do not include the General Fund costs of paying off general obligation bonds. These costs are estimated to be $259 million in 2000-01, an increase of 2.1 percent.

| Figure 1 | ||||

| Higher Education Budget Summary | ||||

| (Dollars in Millions) | ||||

| Estimated 1999-00 |

Proposed 2000-01 |

Change | ||

| Amount | Percent | |||

| University of California | ||||

| General Fund | $2,717.9 | $3,045.7a | $327.7 | 12.1% |

| Student fee revenue | 1,044.2 | 1,092.1 | 47.9 | 4.6 |

| Federal and other funds | 9,454.6 | 9,693.3 | 238.7 | 2.5 |

| Totals | $13,216.7 | $13,831.1 | $614.3 | 4.6% |

| California State University | ||||

| General Fund | $2,194.1 | $2,385.1 | $191.0 | 8.7% |

| Student fee revenue | 585.1 | 603.4 | 18.3 | 3.1 |

| Federal and other funds | 1,669.7 | 1,676.4 | 6.7 | 0.4 |

| Totals | $4,448.9 | $4,664.9 | $216.1 | 4.9% |

| California Community Colleges | ||||

| General Fund | $2,373.0 | $2,532.9 | $159.9 | 6.7% |

| Local property tax revenue | 1,580.3 | 1,694.4 | 114.2 | 7.2 |

| Student fee revenue | 152.7 | 157.2 | 4.6 | 3.0 |

| Other funds | 1,188.5 | 1,256.5 | 68.0 | 5.7 |

| Totals | $5,294.4 | $5,641.1 | $346.7 | 6.5% |

| Student Aid Commission | ||||

| General Fund | $388.5 | $459.9 | $71.3 | 18.4% |

| Federal and other funds | 415.5 | 415.5 | -- | -- |

| Totals | $804.0 | $875.4 | $71.4 | 8.9% |

| Otherb | ||||

| General Fund | $18.0 | $18.1 | $0.1 | 0.6% |

| Student fee revenue | 12.4 | 12.9 | 0.5 | 3.8 |

| Federal and other funds | 14.8 | 13.4 | -1.4 | -9.6 |

| Totals | $45.2 | $44.4 | -$0.9 | -1.9% |

| Grand totals | $23,809.3 | $25,056.9 | $1,247.6 | 5.2% |

| General Fund | $7,691.6 | $8,441.6 | $750.1 | 9.8% |

| Property tax revenue | 1,580.3 | 1,694.4 | 114.2 | 7.2 |

| Student fee revenue | 1,794.4 | 1,865.7 | 71.3 | 4.0 |

| Federal and other funds | 12,743.1 | 13,055.2 | 312.1 | 2.4 |

| a Does not include $75 million for capital outlay. | ||||

| b Includes Hastings College of the Law and the California Postsecondary Education Commission. | ||||

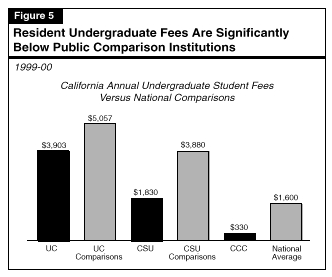

Figure 2 (see next page) describes the major General Fund budget changes proposed by the Governor for UC, CSU, and CCC. The largest change in the UC and CSU budgets is a 6 percent increase in their General Fund base5 percent of which is entirely discretionary and 1 percent which is targeted by the segments for "core" purposes. The budget provides $157 million to UC and $125 million to CSU for this base increase. For CCC, the budget contains $103 million for a statutory cost-of-living-adjustment (COLA) of 2.84 percent.

As Figure 3 (see page 133) shows, the budget proposes total higher education full-time equivalent (FTE) student enrollments of 1.5 million, or 3.4 percent, over the budgeted enrollments for the current year. The budget provides funding for a 3.65 percent, or 6,000 FTE, increase in enrollment at UC, and a 4.5 percent, or 12,577 FTE, increase in enrollment at CSU. The Governor provides $8,554 and $5,813, respectively, in General Fund support for each additional student at UC and CSU. Thus, the total cost of accommodating enrollment growth at UC is $51 million and the total cost at CSU is $73 million. The budget includes $106 million for CCC to accommodate a 3 percent, or 29,721 FTE, increase in enrollment.

| Figure 2 | |||||

| Higher Education

Proposed Major General Fund Changes |

|||||

| University of California | Requested: | $3.0 billion | |||

| Increase: | $328 million | (+12.1%) | |||

| + $156.7 million for 6 percent base increase. | |||||

| + $51.2 million for 6,000 full-time-equivalent (FTE) enrollment growth (3.65 percent). | |||||

| + $19.3 million in lieu of 4.5 percent fee increase. | |||||

| + $69.6 million for expansion of Governor's Teacher Professional Development Programs. | |||||

| + $5.7 million for other K-14 and outreach initiatives. | |||||

| + $25 million in one-time equipment funding for UC teaching hospitals. | |||||

| California State University | Requested: | $2.4 billion | |||

| Increase: | $191 million | (+8.7%) | |||

| + $124.9 million for 6 percent base increase. | |||||

| + $73.1 million for 12,577 FTE enrollment growth (4.5 percent). | |||||

| + $15 million in lieu of 4.5 percent fee increase. | |||||

| + $9 million for California Center for Teaching Careers' teacher recruitment campaign. | |||||

| + $3.5 million for Governor's Teaching Fellowships. | |||||

| California Community

Colleges |

Requested: | $2.5 billion | |||

| Increase: | $160 milliona | (+6.7%) | |||

| + $103.1 million for statutory cost-of-living adjustment (2.84 percent). | |||||

| + $105.7 million for 29,721 FTE enrollment growth (3 percent). | |||||

| + $25 million for Partnership for Excellence. | |||||

| + $10 million for scheduled maintenance and special repairs. | |||||

| a Budget changes add to more than $160 million General Fund increase because they are funded by both General Fund and local property tax revenue. | |||||

| Figure 3 | |||||

| Higher Education

Full-Time Equivalent (FTE) Students |

|||||

| 1998-99 Through 2000-01 | |||||

|

Actual 1998-99 |

Budgeted 1999-00 |

Proposed 2000-01 |

Change From 1999-00 | ||

| Amount | Percent | ||||

| University of California | |||||

| Undergraduate | 122,789 | 125,686 | 130,130 | 4,444 | 3.5% |

| Postbaccalaureate | 438 | 584 | 975 | 391 | 67.0 |

| Graduate | 25,629 | 26,130 | 27,195 | 1,065 | 4.1 |

| Health Sciences | 12,544 | 12,166 | 12,266 | 100 | 0.8 |

| UC totals | 161,400 | 164,566 | 170,566 | 6,000 | 3.6% |

| California State Universitya | |||||

| Undergraduate | 233,155 | 237,297 | 247,988 | 10,691 | 4.5% |

| Postbaccalaureate | 18,856 | 19,263 | 20,131 | 868 | 4.5 |

| Graduate | 21,917 | 22,613 | 23,631 | 1,018 | 4.5 |

| Calstate Teachb | -- | 230 | 230 | -- | -- |

| CSU totals | 273,928 | 279,403 | 291,980 | 12,577 | 4.5% |

| California Community Colleges | 957,201 | 990,703 | 1,020,424 | 29,721 | 3.0% |

| Hastings College

of the Law |

1,140 | 1,122 | 1,165 | 43 | 3.8% |

| Grand totals | 1,393,669 | 1,435,794 | 1,484,135 | 48,341 | 3.4% |

| a The FTE totals for CSU accurately reflect proposed enrollment growth, but the detail shown by enrollment type is subject to change. | |||||

| b The number of FTE students in teacher preparation distance education may change once campus enrollment targets are identified for 2000-01. | |||||

Figure 4 (see next page) shows student fee levels at California's public colleges and universities. The Governor holds resident student fees constant across the segments. The budget includes $19 million for UC and $15 million for CSU to compensate them for revenue they would have otherwise obtained if they raised fees by 4.5 percent. The budget assumes that if fees were to rise, they would rise with California per-capita personal income.

| Figure 4 | ||||

| Higher Education

Annual Student Fees |

||||

| 1998-99 Through 2000-01 | ||||

| 1998-99 | 1999-00 | Proposed 2000-01 | Change from 1999-00 | |

| University of California | ||||

| Systemwide Fee | ||||

| Undergraduate | $3,609 | $3,429 | $3,429 | -- |

| Graduate studies | 3,799 | 3,609 | 3,609 | -- |

| Professional studies | ||||

| Business | $9,609 | $9,609 | $9,609 | -- |

| Dentistry | 8,609 | 8,609 | 8,609 | -- |

| Law | 9,985 | 9,985 | 9,985 | -- |

| Medicine | 8,895 | 8,895 | 8,895 | -- |

| Nursing | 5,409 | 5,409 | 5,409 | -- |

| Optometry | 6,609 | 6,609 | 6,609 | -- |

| Pharmacy | 6,609 | 6,609 | 6,609 | -- |

| Theater, film, and TV | 5,609 | 5,609 | 5,609 | -- |

| Veterinary medicine | 7,609 | 7,609 | 7,609 | -- |

| Additional campus fees, average | ||||

| Undergraduate | $428 | $474 | $474 | -- |

| Graduate | 839 | 969 | 969 | -- |

| Additional fee, nonresidents | 9,384 | 9,804 | 10,244 |

4.5% |

| California State University | ||||

| Undergraduates | $1,506 | $1,428 | $1,428 | -- |

| Graduates | 1,584 | 1,506 | 1,506 | -- |

| Additional campus fees, average | 383 | 402 | 402 | -- |

| Additional fee, nonresidents | 7,380 | 7,380 | 7,380 | -- |

| California Community Colleges | $360 | $330 | $330 | -- |

| Hastings College of the Law | ||||

| Residents | $11,167 | $11,191 | $11,191 | -- |

| Additional fee, nonresidents | 8,770 | 8,770 | 9,121 | 4.0 |

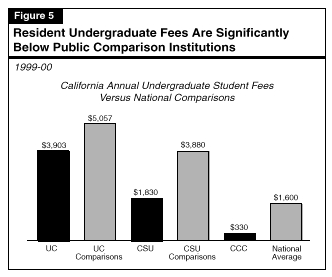

Figure 5 shows that student fees at California's public colleges and universities are among the lowest in the country. The proposed fee for UC resident undergraduates in 2000-01 is $3,903, or 23 percent, lower than the average current fee at UC's four public comparison institutions. The proposed fee for CSU resident undergraduates is $1,830, or 53 percent, lower than the average fee at CSU's 15 public comparison institutions. The 1999-00 budget year was the fifth consecutive year the state either reduced fees or held them constant. Unlike UC and CSU, the CCC do not have a comparison group, but their proposed fee level for 2000-01$330 per year for a full-time studentis the nation's lowest. Students attending CCC pay only one-fifth of the national average for public two-year institutions.

Figure 6 (see next page) identifies major K-12 initiatives involving UC and CSU. The budget provides $113 million to UC and CSU to fund these initiatives. Of this amount, the budget allocates $75 million to UC, $12.5 million to CSU, and $25 million to the Office of the Secretary for Education to contract with CSU for services. The following sections on UC and CSU describe the specific initiatives in more detail.

| Figure 6 | |

| K-12 Initiatives Involving UC and CSU | |

| (In Millions) | |

| University of California--Requested $75.3 Million | |

| Governor's Teacher Professional Development | |

| California subject matter projects | $20.0 |

| Governor's reading professional development institutes | 14.0 |

| California algebra institutes | 2.5 |

| California mathematics institutes | 7.5 |

| English language development professional institutes | 5.0 |

| High school math and English professional development institutes | 20.0 |

| New teacher center | 0.6 |

| Subtotal | ($69.6) |

| Advanced Placement On-Line Initiative | $3.0 |

| California State Summer School for Math and Science | $1.0 |

| Intensive Algebra Professional Development Institutes | $1.7 |

| California State University--Requested $37.5 Million | |

| California Center for Teaching Careers' Media Campaign | $9.0 |

| Governor's Teaching Fellowships | $3.5 |

| Staff Development on Use of Technology | $25.0a |

| a Included in budget of the Office of the Secretary for Education for contract with CSU. | |

We recommend the Legislature not endorse the proposed "partnership" with the California State University (CSU) and University of California (UC) because it would reduce legislative flexibility in balancing its budget priorities and it could reduce incentives for CSU and UC to increase productivity.

The Governor proposes a "higher education partnership" with the California State University (CSU) and University of California (UC). As Figure 1 (see next page) shows, the partnership would provide annual funding for base increases of 5 percent, enrollment growth, high-priority initiatives, and necessary capital outlay. According to the budget summary document (A pages): "These annual funding commitments will be contingent on progress by the segments to achieve certain accountability goals." The document says further "The administration, UC, and CSU will continue discussions focused on finalizing the accountability goals in the spring." Figure 1 shows the accountability goals being considered, but the partnership currently does not contain any measurable performance measures or rewards and sanctions to ensure that CSU and UC achieve them.

Partnership Sweetened in 2000-01. Under the partnership, CSU and UC would be guaranteed a 5 percent increase in base funding each year. For 2000-01, the Governor sweetens the pie by providing base General

| Figure 1 | ||

| Elements of Higher Education Partnership With CSU and UC | ||

| Annual Funding | ||

|

||

|

||

|

||

|

||

|

||

| Accountability Goals | ||

|

||

|

||

|

||

|

||

|

||

Fund increases for CSU and UC of 6 percent "to be allocated by [UC and CSU] based on [their] priorities." In our section on Education Crosscutting Issues (please see page E-19 of this analysis), we contrast this 6 percent increase with the 2.84 percent cost-of-living adjustment the budget proposes for K-12 and the community colleges.

The Governor does not provide a rationale for guaranteeing CSU and UC annual funding increases rather than budgeting them on a year-by-year basis, as is done for other agencies. In our August 1999 report, Higher Education "Compacts": An Assessment, we noted that guaranteed annual funding for CSU and UC is not necessary because:

In sum, the proposed higher education partnership would guarantee CSU and UC base increases of 5 percent when the inflation rate is roughly half that. This guaranteed base increase is higher than that given to any other state agency. Accordingly, we recommend that the Legislature not endorse the proposed higher education partnership.

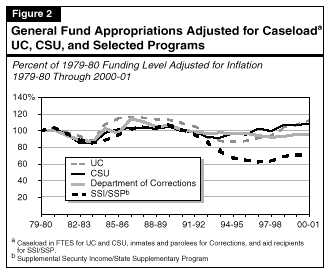

In 1998, approximately 2 million students ("headcounts") were enrolled either full-time or part-time in the California Community Colleges (CCC), CSU, or UC. This was 30,000, or 1.5 percent, fewer students than in 1990. (In 1998, there were 15 percent fewer 18 to 24 year olds in California than there were in 1990.) After declining for five years following a peak in 1990, enrollments grew by about 3.2 percent per year from 1995 to 1998. The Demographics Unit in the Department of Finance (DOF) projects that headcount enrollments will grow by 790,000 from 1998 to 2010, or an average annual increase of 2.4 percent over this 12-year period. This is equal to approximately 540,000 additional full-time-equivalent (FTE) students.

Figure 3 shows actual enrollments from 1963 to 1998 and DOF projections through 2010, for the state's public colleges and universities. The figure shows DOF's main enrollment growth-rate projection, which assumes that rates of college participation among high school graduates and adults will increase significantly. The figure also shows DOF's estimate of enrollments if current college-participation rates continue through 2010. Although projecting enrollments is subject to much uncertainty, enrollments are likely to fall somewhere between these two levels.

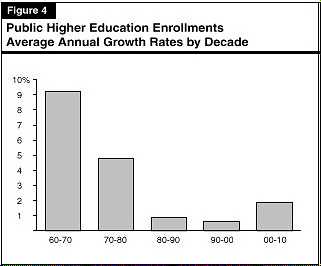

Figure 4 (see next page) puts projected higher education enrollment growth into historical perspective. As the figure shows, DOF projects that total enrollments in CCC, CSU, and UC will grow by an average of 2.2 percent from 2000 to 2010. Although this rate is somewhat higher than those of the previous two decades, it is a much lower rate than in the 1960s and 1970s. After 2010, enrollment growth rates should fall to around 1 percent per year as growth in the college age population slows.

We recommend the Legislature reduce $61 million from the $230 million requested in the budget for enrollment growth in the California Community Colleges, California State University, and University of California, because budgeted growth rates significantly exceed growth-rate projections of the Department of Finance and California Postsecondary Education Commission.

The budget requests a total of $230 million from the General Fund for increased enrollments in CCC ($105.7 million, Proposition 98), CSU ($73.1 million), and UC ($51.2 million). The budget assumes that enrollments will increase by 29,721 FTE students at CCC, 12,577 FTE students at CSU, and 6,000 FTE students at UC in 2000-01.

As Figure 5 shows, budgeted enrollment-growth rates are significantly higher than growth rates projected by DOF and the California Postsecondary Education Commission (CPEC). The DOF and CPEC developed their projections using demographically based projections of growth in the number of high school graduates and in the adult population. In developing their "main" projections, both DOF and CPEC assumed that college-participation rates would significantly increase for high school graduates and for many adult age groups. For added perspective, they also estimated what enrollment growth would be if existing college-participation rates remained at current rates over time. Figure 5 shows these estimates as well.

The budget does not provide any evidence that growth in the number of high school graduates and adults will significantly exceed demographic projections. It also does not provide any evidence that college-participation rates will grow significantly more than DOF and CPEC assumed in their recent projections. Consequently, there is no basis for the amount of enrollment growth included in the budget. Figure 6 compares budgeted FTE with those supported by demographically based growth projections.

| Figure 5 | |||||||

| Budgeted Versus Projected Enrollment Growth Rates | |||||||

| 1999-00 to 2000-01 | |||||||

| DOF a | CPEC b | Governor's Budget | |||||

| Constant Participation | Increasing Participation | Constant Participation | Increasing Participation | ||||

| CCC | 1.9% | 2.7% | 1.9% | 2.6% | 3.0% | ||

| CSU | 2.2 | 2.9 | 2.2 | 2.6 | 4.5 | ||

| UC | 2.0 | 2.7 | 1.2 | 2.4 | 3.65 | ||

| a Department of Finance. | |||||||

| b California Postsecondary Education Commission. | |||||||

| Figure 6 | ||||||||

| Excess Funding for Higher Education Enrollment Growth

Budget Versus Demographically Based Projections |

||||||||

| (Dollars in Millions) | ||||||||

| Budget | Demographically Based Projection a | Amount Above Demographically Based Projection | ||||||

| FTE b | GF c Support | FTE | GF Support | FTE | GF Support | |||

| CCC | 29,721 | $105.7 | 26,000 | $92.5 | 3,721 | $13.2 | ||

| CSU | 12,577 | 73.1 | 7,300 | 42.4 | 5,277 | 30.7 | ||

| UC | 6,000 | 51.2 | 4,000 | 34.1 | 2,000 | 17.1 | ||

| Totals | 48,298 | $230.0 | 37,300 | $169.0 | 10,998 | $61.0 | ||

| a Based on DOF's main projections. | ||||||||

| b Full-time-equivalent student. | ||||||||

| c General Fund. | ||||||||

In sum, we recommend the Legislature provide funding for enrollment growth at rates projected by DOF, which are slightly higher than those of CPEC. Accordingly we recommend a total reduction of $61 million from CCC ($13.2 million), CSU ($30.7 million), and UC ($17.1 million). By budgeting for projected enrollment growth, the Legislature would free up the $61 million to meet its other budget priorities, including those in K-12 and higher education. We recommend below, for example, that the Legislature appropriate $24 million to reduce student fees at CSU and UC for students who enroll in summer courses.

We recommend the Legislature adopt budget bill language that provides full marginal-cost funding for all enrollment growth at the University of California (UC) and California State University (CSU), regardless of the season in which it occurs. We recommend that the Legislature appropriate a total of $24 million from the General Fund to CSU ($12 million) and UC ($12 million) to reduce student fees in summer to the same level as for fall, winter, and spring terms. We also recommend that the administration, California Community Colleges, CSU, and UC report during budget hearings on their plans for implementing year-round instruction on college campuses.

Without utilizing existing facilities more intensively, most community college, CSU, and UC campuses will reach their planned capacities within the next decade. In our report, Year Round Operation in Higher Education (February 1999), we recommended that the three segments move to year-round operation. By providing the same level of educational services in the summer as they now provide in the fall, winter, and spring, the state could serve substantially more students in existing instructional facilities and save several billions of dollars that would otherwise have to be spent on additional instruction-related buildings and additional campuses.

State Should Provide Marginal-Cost Funding for Enrollment Growth in Summer. To provide positive incentives for campuses to fully utilize facilities in summer, the state should commit to funding enrollment increases that occur in summer. Currently, the state provides funding for summer enrollments only for the community colleges and four of the 22 CSU campuses--Hayward, San Luis Obispo, Los Angeles, and Pomona. Summer classes held on the other 18 CSU campus and all UC campus must be fully supported from student fees and whatever funding campuses can redirect from within their budgets. This not only reduces the incentive for campuses to serve students in summer, it causes summer fees to exceed nonsummer fees and reduces student demand for summer classes. By providing at least the same amount of funding per student for increased enrollments in summer that it provides UC and CSU in fall, winter, and spring, the state would allow campuses to accommodate enrollment growth in available space in summer without incurring a financial penalty. Accordingly, we recommend that the Legislature adopt the following budget bill language in each segment's budget specifying that state funding for enrollment growth shall be available for all academic terms.

Funds provided in this item for growth in the number of full-time-equivalent students is provided for such growth, regardless of the academic term in which the enrollment growth occurs.

Reducing Summer Fees Would Be Fair. By providing marginal-cost funding for enrollment growth in summer, campuses would be able to charge fees for additional summer enrollments that are the same as those they charge students in fall, winter, and spring. As a matter of fairness, campuses should also charge the same fee for existing summer enrollments. According to UC and CSU, reducing summer fees for existing enrollments would reduce revenue by approximately $12 million each. We, therefore, recommend an increase of $12 million in both the CSU and UC budgets to allow the reduction of summer fees for existing summer enrollments.

Segments Are Committed to Increasing Year-Round Instruction. The community colleges, CSU, and UC have indicated to the Legislature on several occasions that they intend to increase FTE enrollments during the summer. In its Supplemental Report of the 1999-00 Budget Act, the Legislature directed CSU and UC to evaluate the pros and cons of year-round instruction as one method of accommodating anticipated enrollment growth. The Legislature called upon the segments to report their findings by April 1, 2000. The Governor's summary document for the 2000-01 budget states, "The Administration intends to work with the systems during the spring to resolve the policy and funding issues associated with implementation of year-round operations." We recommend that the administration report during budget hearings on its plans for fostering year-round instruction on community college, CSU, and UC campuses. We further recommend that the segments report during budget hearings on steps they are taking to fully use existing instructional capacity.

We recommend General Fund reductions of $2.8 million and $6.6 million in the General Fund requests for new enrollments at the California State University and University of California, respectively, because the requests incorrectly account for fee-related resources.

The Governor requests a total of $124.3 million from the General Fund to pay for the costs of FTE student enrollment increases at CSU and UC. This amount consists of $73.1 million for 12,577 additional FTE students at CSU and $51.2 million for 6,000 additional FTE students at UC. We recommend the Legislature reduce the requested increases because they are based on faulty calculations as detailed below.

Budget Based on "Marginal-Cost" Formula. The CSU and UC estimate that they will spend $6,861 and $10,267, respectively, for each additional FTE student they enroll in 2000-01. These amounts are estimates by CSU and UC of the marginal cost per student for additional faculty, teaching assistants, equipment, and various support services. The universities subtract from these amounts revenues that they anticipate from the additional students. The CSU subtracts $1,048 per FTE student and UC subtracts $1,713 per FTE student from the marginal cost estimate to determine how much General Fund support they will need for each additional FTE student. Based on these calculations, the budget requests General Fund support of $5,813 for CSU and $8,554 for UC for each additional FTE student in 2000-01. Figure 7 summarizes these calculations.

| Figure 7 | ||

| Budgeted Marginal Costs Per Full-Time-Equivalent (FTE) Student--CSU and UC | ||

| 2000-01 | ||

| Cost Component | CSU | UC |

| Faculty salaries and benefits | $2,860 | $3,270 |

| Teaching assistants | 244 | 618 |

| Instructional equipment | 127 | 308 |

| Instructional support | 716 | 3,362 |

| Academic support | 1,113 | 818 |

| Student services | 818 | 917 |

| Institutional support | 983 | 974 |

| Total Marginal Cost | $6,861 | $10,267 |

| Less fee revenue | -$1,048 a | -$1,713 a |

| Budgeted Marginal Cost (General Fund) | $5,813 | $8,554 |

| a Assumes one-third of fee revenue returned to students as financial aid. | ||

The CSU and UC Underestimate Fee-Related Resources. The calculations shown in Figure 7 understate the amount of student fee revenue that the universities receive per student and do not take into account the General Fund support the universities receive to compensate for maintaining fees at 1999-00 levels.

Based on proposed fees, CSU will receive approximately $1,234 in fee revenue per additional student, net of financial aid provided from fees. In addition, the budget includes $34 per FTE student (also net of financial aid) in General Fund support for CSU in lieu of raising fees. The CSU, therefore, will receive $1,268 in fee-related support for each additional student, rather than the $1,048 per student it assumes. As a result, the General Fund request for marginal-cost funding for CSU is $2.8 million more than is necessary to meet the marginal cost of the additional students.

Based on proposed fees, UC will receive at least $2,732 in additional fee revenue, net of financial aid given back to students, for each additional student. The budget also provides $76 in General Fund support per student (also net of financial aid) in lieu of a fee increase. The university will, therefore, receive $2,808 in fee-related support for each additional student, rather than the $1,713 it assumes. As a result, the General Fund request for marginal cost funding for UC is $6.6 million more than is necessary to meet the marginal costs of the additional students.

Accordingly, we recommend that the General Fund request for CSU be reduced by $2.8 million and the General Fund request for UC be reduced by $6.6 million to account for the fee-related support that the universities will obtain above the amounts assumed in the marginal-cost funding calculations.

Chapter 284, Statutes of 1998 (SB 1729, M. Thompson), requires specified higher education campuses in California to enter into written agreements with local law enforcement agencies that: (1) designate which law enforcement agencies have operational responsibility for the investigation of specified violent crimes and (2) delineate the specific geographic boundaries of each agency's operational responsibilities. The written reports were required for all UC, CSU, CCC campuses, as well as Stanford University, the University of the Pacific, and the University of Southern California. The act requires that the campuses place the written agreements in public view by July 1, 1999. The act was named for Kristin Smart, a Cal Poly student who disappeared in May 1996.

The act required each campus to send a copy of their agreement to the Legislative Analyst's Office (LAO) by September 1, 1999 and requires the LAO to report to the Legislature, by either March 1, 2000 or as part of the Analysis of the 2000-01 Budget Bill, on the implementation of this act and make any pertinent recommendations for improving the process.

In October 1999 we began working with each system and with the Association of Independent California Colleges and Universities to ensure compliance with Chapter 284. As of January 31, 2000 we received reports from all UC, CSU, and private university campuses. However, only 40 of the 107 CCC campuses have provided responses. We are continuing our efforts to obtain reports from those who have not complied and will provide an update and other pertinent information on the implementation of Chapter 284 during budget hearings.

The University of California (UC) includes eight general campuses and one health science campus. The university is developing a tenth campus in Merced. The budget proposes General Fund spending of $3 billion. This is an increase of $328 million, or 12 percent, over the current year. The bulk of this increase consists of $157 million for a general 6 percent increase in the university's base budget, $51 million for increases in budgeted enrollments, $71 million to expand existing and create new professional development programs for teachers, and $25 million for equipment at UC's hospitals. Figure 1 summarizes the various changes in UC's budget.

Partnership With Higher Education. Of the requested 6 percent base increase, 5 percent ($131 million) is part of the Governor's "partnership" with UC and California State University (CSU). The partnership would provide UC and CSU with this 5 percent increase each year, plus funds for enrollment growth, capital needs, and high-priority initiatives. (Please see page E-137 of this analysis for a discussion of the Governor's proposed partnership with CSU and UC.)

Enrollment Growth of 3.6 Percent. The budget assumes that UC will serve 6,000, or 3.6 percent, more full-time equivalent (FTE) students in 2000-01 than was budgeted for 1999-00. The budget provides UC with $51 million to offset the "marginal cost" UC anticipates it will incur to serve the additional students.

No Increase in Resident Student Fees. The budget includes a total of $19.3 million in lieu of raising resident student fees by 4.5 percent. Fees for resident undergraduate, graduate, and professional school students would remain at current levels. The supplementary fee for nonresident students would increase by 4.5 percent from $9,804 to $10,244.

| Figure 1 | |

| University of California

General Fund Proposal |

|

| 2000-01

(Dollars in Millions) |

|

| 1999-00 Expenditures | $2,718.0 |

| New Spending | |

| 6 percent base increase | $156.7 |

| Expand teacher professional development | 71.3 |

| Enrollment growth (3.75 percent) | 51.2 |

| Equipment for UC teaching hospitals | 25.0 |

| General Fund in lieu of fee increase | 19.3 |

| Online advanced placement courses | 3.0 |

| Annuitant health and dental benefit increases | 1.8 |

| Substance abuse research | 1.0 |

| Community college outreach | 1.0 |

| Summer school for K-12 math and science | 1.0 |

| Other adjustments | -3.5 |

| 2000-01 Proposed | $3,045.7 |

| Change From 1999-00 | |

| Amounta | $327.7 |

| Percent | 12.1% |

| a Total does not add due to rounding. | |

Governor's K-12 Initiatives in UC Budget. The Governor requests a total of $101 million in UC's budget for specified program initiatives designed to improve K-12 education. This is $75.3 million more than in the current year for these programs.

We address several issues relating to UC in other sections of the Analysis.

In "Crosscutting Issues," we discuss the Governor's teacher professional development

institutes and the proposed increase in UC's base budget. In "Intersegmental

Issues," we discuss UC's budgeted enrollment growth and the marginal cost formula

UC uses to determine the funding level for additional students. In these analyses,

we recommend reductions in General Fund support for UC of $177.6 million. Figure 2

(see next page) summarizes our recommendations on these issues and provides

the associated page references.

| Figure 2 | ||

| Summary of Crosscutting and Intersegmental Issues Involving UC | ||

| Issue | Recommendation | Page

Number |

| Governor's K-12 initiatives | Shift $71.3 million in General Fund support requested for K-12 teacher professional development institutes to K-12 schools to give them greater flexibility in meeting their account-ability standards. | E-37 |

| Requested 6 percent increase in UC's base budget | Shift $82.6 million in General Fund support from UC to K-12 and community colleges to equalize base increases at 2.84 percent. | E-19 |

| Proposed partnership | Do not endorse proposed annual automatic 5 percent increase in

UC's base budget. |

E-137 |

| Enrollment growth-rate projection | Reduce General Fund support by $17.1 million to reflect demo-

graphically based enrollment growth of 2.9 percent rather than the 3.6 percent included in the budget. |

E-140 |

| Marginal-cost funding | Reduce General Fund support by $6.6 million because UC understates the amount of fee-related resources it will receive from additional students. | E-145 |

We recommend that the Legislature deny the budget request for a one-time augmentation of $25 million to the University of California teaching hospitals for the purchase of medical equipment because our analysis of the hospitals' recent financial statements indicates that the hospitals are generating sufficient funds to purchase this equipment.

The budget proposes a one-time augmentation of $25 million for the UC teaching hospitals to purchase medical equipment to be used for teaching, patient care, and research purposes. The UC Regents did not request these funds in their budget proposal for 2000-01.

Background. The UC has five campuses with academic medical centers (teaching hospitals). Four campuses--Davis, Irvine, Los Angeles, and San Diego--have teaching hospitals owned and operated by UC. The fifth center operates under an affiliation agreement with UC San Francisco (UCSF) Stanford Health Care, a nonprofit organization created when the UCSF Medical Center merged with the Stanford University Health Services on November 1, 1997. Recently, UCSF and Stanford approved the dissolution of the merger, and as a result the UCSF Medical Center is expected to return to UC by March 1, 2000. Consequently, we have not included UCSF in this analysis.

The four hospitals realized $2 billion in revenue in 1998-99. The hospitals realize most of their revenue from third-party contracts (40 percent) and third-party payers such as Medicare (26 percent) and Medi-Cal (23 percent). For the current year, the state General Fund provides $39 million, or 2 percent, of the hospitals' operating revenue, in the form of clinical teaching support (CTS). These CTS funds help hospitals cover costs related to training of UC undergraduate and resident medical students. The university has long managed its capital and operating budgets for the hospitals independently of state control. They are, in most respects, business enterprises of UC.

Strong Bottom Line Since 1996-97. Figure 3 (see next page) shows that since 1996-97, the bottom-line for each UC-owned and operated medical center has been very strong. The average net gain over this period was $105 million, or 5.8 percent of total net revenues.

In light of their current profitable position, we do not see any need for additional state support for what is principally a UC enterprise. Accordingly, we recommend that the Legislature deny this augmentation request for $25 million and instead budget these funds for other higher-priority purposes.

We recommend the Legislature direct the University of California (UC) to increase total fees paid by nonresident students by 4.5 percent. This would add $2 million to UC's fee revenue and result in a $2 million reduction in General Fund costs. We further recommend the Legislature require UC to report on its policies for fees and grant aid for nonresident students.

There are approximately 13,000 nonresident undergraduate (7,000) and graduate (6,000) students attending UC. Total fees in 1999-00 for UC are $14,077 for nonresident undergraduates and $14,572 for nonresident graduate students. Of each total, $9,804 represents the supplementary fee nonresident students pay on top of regular systemwide and campus-based fees paid by all students. The Governor proposes to increase the supplementary fee for nonresidents from $9,804 to $10,244, an increase of $440, or 4.5 percent. This has the effect of raising total fees for nonresident undergraduates to $14,517, an increase of 3.1 percent. It would raise total nonresident graduate fees to $15,012, a 3 percent increase.

| Figure 3 | |||||

| University of California Teaching Hospital Net Gain | |||||

| 1996-97 Through 1998-99

(Dollars in Millions) |

|||||

| Davis | Irvine | Los Angeles | San Diego | Totals | |

| Net Gain | |||||

| 1996-97 | $35.5 | $16.0 | $36.4 | $23.9 | $111.8 |

| 1997-98 | 28.2 | 10.2 | 42.6 | 26.1 | 107.1 |

| 1998-99 | 22.0 | 14.4 | 28.1 | 31.4 | 95.9 |

| Average | $28.5 | $13.5 | $35.7 | $27.1 | $104.9 |

| Net Gain as a

Percent of Net Revenue |

|||||

| 1996-97 | 6.6% | 7.5% | 5.8% | 8.0% | 6.7% |

| 1997-98 | 4.7 | 4.7 | 6.1 | 8.6 | 5.9 |

| 1998-99 | 3.4 | 6.3 | 3.8 | 9.0 | 4.9 |

| Average | 4.8% | 6.1% | 5.2% | 8.6% | 5.8% |

Nonresident Fees Do Not Cover Average Cost of UC Education. The Master Plan for Higher Education calls for nonresident students to pay not less than the average cost of providing instruction and related services. Such a policy is justified, because nonresident students and their families have not paid the state taxes that help subsidize the education of UC students. Consequently, nonresident students should pay directly for the services they receive from the university.

The average General Fund cost per FTE student at UC is approximately $16,500 for 1999-00. For the current year, then, nonresident students pay between 85 percent (undergraduates) and 88 percent (graduates) of the average costs. The average cost per FTE student under the proposed budget would be $17,900. Even with the proposed increase in nonresident fees, nonresident students would cover less of the average costs in 2000-01 (81 percent for undergraduates and 84 percent for graduates) than they cover in the current year.

The UC Should Phase In Nonresident Fee Increases to Equal Average Cost. We recommend that the Legislature direct UC to raise nonresident student fees so that they are equal to the average cost of UC programs per student. This would require, however, that total nonresident undergraduate fees be raised by $3,800, or 27 percent, and nonresident graduate fees be raised by $3,300, or 23 percent. We, therefore, recommend UC develop a plan for phasing in such increases over several fiscal years. For 2000-01, we recommend that UC increase total fees paid by nonresident students by 4.5 percent. This would increase total fee revenue from nonresident students by approximately $8 million, or $2 million more than is included in UC's budget for the proposed 3 percent increase ($6 million). Accordingly, we recommend a General Fund reduction of $2 million from the UC budget, to reflect increased fee revenue from nonresident students. We further recommend the Legislature adopt supplemental report language directing UC to report by November 30, 2000 on its plans for increasing nonresident student fees to the average General Fund cost per FTE student.

The UC Provides Handsome Aid Packages to Nonresident Students. Not only do nonresident fees not cover the average cost of UC programs per student, UC provides nonresident students with substantial amounts of financial aid. According to UC, it provided $10.3 million in grant aid to nonresident undergraduates in 1998-99, which was 32 percent of the fee revenue it received from these students. Surprisingly, UC provided $47.4 million in grant aid to nonresident graduate students in 1998-99. This is 72 percent more than it collected in fees from nonresident graduate students that year. Combined, UC provides virtually the same amount of grant aid to nonresident undergraduate and graduate students that it receives from them in fee revenue.

Recommend UC Report on Financial Aid Policies for Nonresident Students. At a time when the Legislature is concerned with ensuring access to UC for all qualified California students, it is counterproductive that UC is providing virtually the same amount of grant aid to nonresident students that it receives from them in fees. We recommend that the Legislature also, in its supplemental report language, direct UC to report by November 30, 2000 on its financial aid policies for nonresident students.

We recommend that the Legislature deny the request for $1.1 million from the General Fund for the University of California (UC) to hire staff to begin planning for a UC Santa Cruz off-campus center in Santa Clara because UC has neither shown a need for the center nor gone through the established process for new center proposals.

The budget proposes a General Fund augmentation of $1.1 million for development, including start-up costs--of a UC Santa Cruz (UCSC) off-campus center in the Santa Clara Valley. The university says that the center will (1) provide undergraduate and graduate education, including programs for working professionals; (2) provide academic outreach services; and (3) facilitate collaborative research efforts with industry. According to UC documents, the General Fund augmentation of $1.1 million "would be used to hire up to five dedicated, full-time staff that could include an academic provost, an academic planner, a strategic planner, clerical support, equipment and supplies, and related expenses and to house these individuals in an interim site in Santa Clara Valley."

According to UC's plans, the center would open an "academy" with a targeted enrollment of up to 2,000 students (FTE) by 2010-11. The academy "would provide curriculum tailored to meet the needs of UC-eligible students in the Santa Clara Valley." The plan states that UC is currently considering three sites for the location of the academy. The UC began its plans for this center in 1999 and reports that the campus has made significant progress in achieving its planning objectives in 1999-00.

We have two major concerns with this proposal. First, it offers no rationale for why this center is needed and, second, the system has preempted the legislatively established process for new center proposals.

With regard to need, there are a number of questions that are not addressed in the current UC documentation. Among these are:

None of these questions are addressed in UC's documents. The requested $1.1 million would provide funds sufficient for only the initial request for core support. The UC documents indicate that there will be additional requests for core support and capital resources in future budgets. Approving this first request without adequate justification would establish an ill-advised precedent for future requests.

In addition, UC has placed the "cart before the horse" with regard to the process for new centers. The system should first present its case for a new off-campus center to the California Postsecondary Education Commission. If the commission recommends approval, it would then be appropriate for UC to make a request to the Legislature.

Given these concerns, we recommend that the Legislature deny the request for $1.1 million at this time.