The California State University (CSU) currently consists of 22 campuses. The CSU Channel Islands, located in Camarillo (Ventura County), is scheduled to open in 2002 as CSU's 23rd campus. The budget proposes General Fund spending of $2.4 billion, an increase of $191 million, or 8.7 percent, over the current year. Accounting for one-time adjustments in 1999-00 ($34.8 million), the proposed budget increases CSU's General Fund spending by $226 million, or 10.5 percent, over the current year. Figure 1 shows adjustments to the General Fund in the current-year budget and lists the major funding proposals for the 2000-01 budget.

The Governor characterizes his budget with CSU as a "partnership." This year's budget includes a General Fund base increase of 6 percent, funding for a 4.5 percent increase in enrollment, General Fund support in lieu of a 4.5 percent increase in student fees, and additional funding for two teacher recruitment initiatives. The partnership agreement is predicated on the understanding that CSU will achieve certain performance goals, such as increasing the number of community college transfers and improving its graduation rate. The budget, however, does not specify any financial repercussions if CSU fails to meet these goals.

General Fund Base Increase of 6 Percent. The budget provides $124.9 million to increase CSU's base budget by 6 percent. This amount includes $104.1 million, or a 5 percent base increase, that the Governor does not allocate for specific purposes. The total also includes $20.8 million, or a 1 percent base increase, that the Governor designates specifically for three long-term core needs: technology ($15 million), libraries ($3 million), and deferred maintenance ($2.8 million).

Enrollment Growth of 4.5 Percent. The budget proposes that CSU serve 4.5 percent, or 12,577, additional full-time-equivalent (FTE) students in 2000-01. At a marginal General Fund cost of $5,813 per additional student, the cost of serving these students is $73.1 million.

| Figure 1 | |

| Governor's General Fund Budget

Proposal for California State University |

|

| 2000-01

(Dollars in Millions) |

|

| 1999-00 Budget (Revised) | $2,194.1 |

| Baseline Funding Adjustments | |

| Carryover/reappropriations | -$28.3 |

| One-time appropriations | -6.3 |

| Other adjustments | -.3 |

| 1999-00 Adjusted for One-Time Spending | $2,159.2 |

| Elements of the Partnership | |

| 5 percent base increase | $104.1 |

| 1 percent base increase for "core" needs | 20.8 |

| 4.5 percent enrollment growth (12,577 FTE) | 73.1 |

| General Fund in lieu of fee increase (4.5 percent) | 15.0 |

| Subtotal | $213.0 |

| Other Budget Proposals | |

| CalTEACH media campaign for teacher recruitment | $9.0 |

| Teaching fellowships | 3.5 |

| Off-campus center development at Coachella Valley | .4 |

| Subtotal | $12.8 |

| 2000-01 Proposed Budget | $2,385.1 |

| Change From Revised 1999-00 Budget | |

| Amount | $191.0 |

| Percent | 8.7% |

| After Adjusting for One-Time Expenditures in Current Year | |

| Amount | $225.9 |

| Percent | 10.5% |

No Increase in Student Fees. The Governor proposes to maintain resident and nonresident fees at their current levels. The proposed fees--including both systemwide and average campus-based fees--are shown in Figure 2 (see next page).

| Figure 2 | ||

| Proposed Student Fees | ||

| 2000-01 | ||

| Undergraduates | Graduates | |

| Residents | ||

| Systemwide fee | $1,428 | $1,506 |

| Average campus fee | 402 | 402 |

| Totals | $1,830 | $1,908 |

| Nonresidents | ||

| Base fee | $1,830 | $1,908 |

| Nonresident tuition | 7,380 | 7,380 |

| Totals | $9,210 | $9,288 |

The Governor's budget provides $15 million to compensate CSU for revenue it would otherwise obtain if it raised fees by 4.5 percent, which is based on a projection of the increase in the California per capita personal income in 2000-01.

Governor's Teaching Initiatives. The budget includes $12.5 million to fund two initiatives related to teacher recruitment. Of this amount, the budget designates $9 million for the California Center for Teaching Careers (CalTeach) to expand its teacher-recruitment media campaign. Of the $9 million, CalTeach is to use $7 million to run an in-state television advertising campaign and $2 million to run an out-of-state advertising campaign. The second initiative provides $3.5 million to establish the Governor's Teaching Fellowships. Of this amount, the Governor requests $2.5 million to provide 250 fellowships to students in teacher preparation programs. The Governor provides the remaining $1 million to CSU for administrative costs. Representatives from the University of California (UC), CSU, and the independent colleges and universities will form an administrative group housed within CSU that will distribute the fellowships.

We address several issues relating to CSU in other sections of the Analysis. We discuss the proposed technology staff development at CSU in the K-12 section, and we discuss issues related to the proposed increase in CSU's base budget in "Crosscutting Issues." In "Intersegmental Issues," we examine CSU's budgeted enrollment growth and the marginal cost formula it uses to determine the appropriate funding level for additional students. In these analyses, we recommend reductions in General Fund support for CSU totaling $124.3 million. Figure 3 summarizes our recommendations on these issues and provides the associated page references.

| Figure 3 | ||

| Summary of Crosscutting and Intersegmental Issues Involving CSU | ||

| Issue | Recommendation | Page

Number |

| K-12 technology staff development | Shift $25 million in General Fund support from CSU (which would receive grant funds from the Office of the Secretary for Education) to K-12 schools to give them greater flexibility in meeting local needs. | E-80 |

| Requested 6 percent increase in base budget | Shift $65.8 million in General Fund support from CSU to K-12 and community colleges to equalize base increases at 2.84 percent. | E-19 |

| Proposed partnership | Do not endorse proposed annual automatic 5 percent increase in CSU's base budget. | E-137 |

| Enrollment growth-rate projection | Reduce General Fund support by $30.7 million to reflect demographically based enrollment growth of 2.9 percent rather than the 4.5 percent included in the budget. | E-140 |

| Marginal-cost funding | Reduce General Fund support by $2.8 million because CSU understates the amount of fee-related resources it will receive from additional students. | E-145 |

If the Legislature makes all these reductions, we recommend it not further reduce CSU's budget by making specific budgetary cuts. If the Legislature, however, does not make all the recommended reductions, then we recommend it consider the four specific budgetary cuts that we discuss below.

We recommend the Legislature approve the requested level of funding for the Governor's Teaching Fellowships but redesign the program to make it more cost-effective. We recommend the Legislature convert the fellowships into an augmented Assumption Program of Loans for Education, transfer implementation of the program from the Chancellor's Office to the Student Aid Commission (SAC), thereby saving the $1 million the budget provides to the California State University, and shift $79,000 and one position from the Commission on Teacher Credentialing to the SAC to administer the program.

The budget includes $3.5 million to establish the Governor's Teaching Fellowships. Of this amount, the budget allocates $1 million to the Chancellor's Office of CSU for first-year administrative costs. The remaining $2.5 million would fund 250 merit-based fellowships. The fellowships would each be worth $20,000. The first 250 recipients would receive two separate $10,000 installments--one in 2000-01 as they begin their teacher preparation programs and one in 2001-02. These funds represent phase-in funds, with the ultimate intent to provide 1,000 fellowships by 2002-03. As Figure 4 shows, the phase-in would take three budget years, with the total cost of the fellowships reaching $17.5 million in the second budget year and $20 million in the third budget year. The administration proposes to introduce legislation in the budget trailer bill(s) to create the program.

| Figure 4 | |||

| Phase-In Funding for Governor's Teaching Fellowships | |||

| Phase

1

2000-01 |

Phase 2

2001-02 |

Phase 3

2002-03 |

|

| Date fellowships awarded | Jan. 2001 | Sept. 2001 | Sept. 2002 |

| Number of fellowships | |||

| New | 250 | 750 | 1,000 |

| Renewals | -- | 250 | -- |

| Cost per fellowship | $10,000 a | $20,000 | $20,000 |

| Total cost of fellowships | $2.5 million | $17.5 million | $20.0 million |

| Administrative costsb | $1.0 million | -- | -- |

| Total cost of program | $3.5 million | $17.5 million c | $20.0 million c |

| a The 250 initial awards consist of two $10,000 installments in the 2000-01 budget and 2001-02 budget. | |||

| b Administrative costs in phases 2 and 3 are unknown at this time. | |||

| c Represents minimum projected cost. | |||

The primary objective of the program is to entice highly qualified prospective teachers to teach in low-performing schools after obtaining their credentials. The Chancellor's Office would set the criteria for selecting the most qualified individuals for the fellowships. The criteria would include individuals' previous academic and employment records, faculty and employer evaluations, interviews, and letters of recommendation. Students receiving fellowships could attend any accredited traditional or alternative teacher preparation program--public or private. They could use the fellowships to cover both tuition and living expenses. The fellowship program would require recipients to teach in low-performing schools in California for four consecutive years. The Chancellor's Office would require recipients to repay $5,000 for each year (of the four consecutive years) that they do not teach in a low-performing school. For purposes of the program, a low-performing school would be one that ranked in the lowest half of the Academic Performance Index (API). The API, established pursuant to Education Code Section 52056(a), ranks schools based primarily on how their students perform on standardized tests.

The Governor's budget provides $1 million--almost 30 percent of the total amount allocated for the fellowship program--to the Chancellor's Office to develop an application process, market and distribute the fellowships, and design and implement a system to extract repayment from recipients who do not complete their teaching commitments. Legislation would permit the Chancellor's Office to develop any rules and regulations necessary to recover funds from recipients who do not fulfill their agreements. A 12-member intersegmental committee--appointed by the Governor to four-year terms--would be responsible for reviewing all applications and recommending fellowship candidates to the Chancellor's Office. The committee would be comprised of six members recommended by CSU, three by UC, and three by the Association of Independent California Colleges and Universities. The Commission on Teacher Credentialing (CTC) would track fellowship recipients to identify recipients who fail to teach four consecutive years in a low-performing school. One position is included in CTC's budget for this purpose.

Although fellowships that encourage qualified individuals to teach in low-performing schools have merit, the proposed fellowship program has three serious problems.

The Legislature could improve upon the proposed fellowship program in several key ways. The changes described below would improve the proposed program by better targeting the lowest performing schools, reducing enforcement costs, and streamlining administrative operations.

Improving Aim at Low-Performing Schools. To better target low-performing schools, the program should require recipients to work in a smaller, more focused set of schools (such as the bottom quartile) rather than the bottom half of low-performing schools. The program might also consider alternative selection criteria. For example, the program could target highly talented individuals willing to teach in schools with more than 20 percent noncredentialed teachers. (For further discussion of programs designed to target low-performing schools, please see page E-24 of this Analysis.)

Reducing Enforcement Costs by Using an APLE-Like Loan. The costs of ensuring teachers actually teach the required four years could be lowered substantially by converting the fellowship program into an augmented APLE. The APLE is a loan forgiveness program administered by the SAC. Students in teacher-preparation programs who agree to teach four consecutive years in low-performing schools can receive APLE warrants for up to $11,000 in value. The APLE recipients can redeem their warrants to repay their student loans.

In lieu of giving fellowships to cover expenses during their teacher preparation program, the state could give participants augmented APLE warrants worth $20,000. The warrant would be similar to the proposed fellowship in that the student would receive $20,000 to cover tuition and living expenses. The warrant would be different from the scholarship only in that the participants would receive the $20,000 as a loan that the state would forgive in stages after they had fulfilled each year of their teaching commitment. Moreover, if participants did not fulfill their teaching commitment, they would be held immediately and personally responsible for payment of loan debt.

Transferring Administration to SAC Would Further Reduce Costs. The SAC currently administers both the Cal Grant T and APLE. Thus, its program staff are already experienced in designing the application, marketing, selection, and other administrative processes associated with operating successful financial aid programs. Because the fellowship program is merit-based, the SAC, in consultation with the administration and higher education segments, could develop appropriate selection criteria. The SAC already has the ability to select recipients for various award programs based on such criteria, making an additional review body unnecessary.

In sum, we recommend the Legislature approve the requested funding for the Government Teaching Fellowship program, but it implement the program by:

Accordingly, we recommend eliminating the $1 million for the CSU Chancellor's Office and shifting the $79,000 and one position requested for the CTC to the SAC for administration of the program.

We recommend the Legislature delete $2.3 million the Governor's budget provides to California State University (CSU) to cover fixed costs at its Monterey Bay campus because CSU cannot provide an expenditure plan.

The budget provides CSU with $2.3 million for fixed costs associated with its Monterey Bay campus. The CSU Monterey Bay--CSU's 21st campus--is located on Fort Ord, a renovated military base that the federal government closed in 1991 and transferred to CSU for the explicit purpose of developing a new campus.

Monterey Bay enrolled its first class in fall 1995. Figure 5 reviews the campus's total budget and General Fund support for the last five years. In 1999-00, CSU Monterey Bay's total budget was almost $40 million. This amount was $5.3 million, or 15 percent, more than in 1998-99. Of this amount, $34.6 million was General Fund revenue. Whereas General Fund revenue increased $5.6 million, or 19 percent, between 1998-99 and 1999-00, funding from other sources fell by approximately $310,000, or almost 6 percent. The CSU does not have a proposed 2000-01 budget for CSU Monterey Bay. It claims, however, that it needs an additional $2.3 million in General Fund support to cover fixed costs associated with the start-up of the campus.

| Figure 5 | |||||||

| Review of Recent Budgets at CSU Monterey Bay | |||||||

| (Dollars in Millions) | |||||||

| 1995-96 | 1996-97 | 1997-98 | 1998-99 | 1999-00 | Change From

1998-99 |

||

| Amount | Percent | ||||||

| General Fund | $12.9 | $17.5 | $23.0 | $29.0 | $34.6 | $5.6 | 19.4% |

| Other funds | 2.7 | 3.4 | 4.2 | 5.6 | 5.3 | -0.3 | -5.5 |

| Totals | $15.6 | $20.9 | $27.2 | $34.6 | $39.9 | $5.3 | 15% |

The state provides supplemental funds to cover fixed costs (such as administrative overhead) at new campuses because they lack the economies of scales that established campuses enjoy. Because new campuses tend to be considerably smaller than established campuses, they experience higher fixed costs per student. These costs should begin to decline, however, as enrollment levels increase and campuses are able to distribute fixed costs across a larger number of students. For example, a campus might need one librarian for every 5,000 students, at a cost of $100,000 for each librarian it employs. If a new campus enrolls only 1,000 students, the cost per student of employing the librarian is $100. By comparison, if the campus enrolls 5,000 students, the cost per student of employing the librarian falls to only $20.

Precisely because of initially high fixed costs per student, supplemental report language in the 1994-95 Budget Act stated, "It is the intent of the Legislature, in providing an augmentation for start-up costs ($9.3 million) at the Monterey Bay campus, that enrollment growth at this campus be faster than that [initially] projected." The language set a specific enrollment goal for the campus of 4,000 FTE students in 1999-00. Figure 6 traces both enrollment growth and changes in the General Fund cost per FTE at CSU Monterey Bay over the last three years. The CSU Monterey Bay has not met the Legislature's enrollment target, though its enrollment has kept pace with its own internally-generated projections. Despite this moderate enrollment growth, average General Fund costs have not declined. In 1997-98, the average General Fund cost at CSU Monterey Bay was $14,900 per FTE. In 1999-00, the average General Fund cost had increased to $16,133 per FTE, more than double the systemwide average ($8,010 per FTE).

| Figure 6 | |||||

| General Fund Cost Per FTEa High and Increasing at CSU Monterey Bay | |||||

| 1997-98 | 1998-99 | 1999-00 | Change From

1998-99 |

||

| Amount | Percent | ||||

| General Fund (GF)b | $23.0 | $29.0 | $34.6 | $5.6 | 19.4% |

| FTE | 1,544 | 1,830 | 2,145 | 315 | 17.2 |

| Average GF Per FTE: | |||||

| CSU Monterey Bay | $14,900 | $15,842 | $16,133 | $291 | 1.8 |

| Systemwide | 6,987 | 7,662 | 8,010 | 348 | 4.5 |

| a Full-time equivalent. | |||||

| b Dollars in millions. | |||||

These trends are disconcerting for two reasons.

Not only does CSU Monterey Bay have lower-than-expected enrollment and higher-than-expected fixed costs per student, it also has no plan for how it would expend the requested $2.3 million. Figure 7 traces the General Fund support provided for fixed costs at CSU Monterey Bay. The state has provided CSU with six years of start-up funding totaling $22.7 million. Without an itemized expenditure plan, the Governor's proposal to provide CSU with a seventh year of supplemental funding for fixed costs at the Monterey Bay campus is unjustified. The CSU states that it cannot provide an itemized budget plan because individual campuses determine how they will use funds only "after funding commitments have been identified for the fiscal year."

| Figure 7 | ||

| History of Supplemental Funding at CSU Monterey Bay | ||

| (In Millions) | ||

| Budget Year | Supplemental Funding | Total Funding for Fixed Costs |

| 1994-95 | $9.3 | $9.3 |

| 1995-96 | 2.8 | 12.1 |

| 1996-97 | 2.2 | 14.3 |

| 1997-98 | 2.9 | 17.3 |

| 1998-99 | 2.6 | 19.9 |

| 1999-00 | 2.8 | 22.7 |

We recommend the Legislature delete the $2.3 million the Governor's budget designates for fixed costs at CSU Monterey Bay because CSU can neither establish how much its Monterey Bay campus actually needs to cover its fixed costs nor can it document how it will expend the proposed funds. In addition to lacking an expenditure plan, CSU has not met the 1999-00 enrollment target set by the Legislature even though systemwide enrollments have grown steadily. Furthermore, its average General Fund cost per FTE is relatively high.

We recommend the Legislature delete $10.4 million the California State University (CSU) proposes to use to fund compensation agreements it made in 1998-99 and 1999-00 because CSU should bear the costs of more costly compensation agreements than authorized in the budget act.

In 1999-00, the state provided CSU with funds to cover a general compensation increase of 3.8 percent for its represented employees. During collective bargaining sessions in 1999-00, however, CSU agreed to provide a 4 percent compensation increase at an additional cost of $3.6 million. Similarly, CSU's 1999-00 faculty agreement, which covered both the 1998-99 and 1999-00 fiscal years, cost $6.8 million more than the amount the 1999-00 Budget Act provided to CSU for faculty salary increases. Together, the differences between the state's appropriation and CSU's internal agreements total $10.4 million.

The CSU Should Bear Excess Costs of Compensation Agreements. Rather than the General Fund, CSU should bear the costs when it strikes more costly compensation agreements than authorized in the budget act. If CSU chooses to make more costly internal agreements, it should cover the excess costs of these agreements by achieving savings elsewhere or by redirecting existing funds. The system could, for instance, use carryover funds to cover these costs. The system used carryover funds in the current year to cover the costs associated with its 1999-00 general salary increase agreement. The CSU has a history of carrying over a substantial amount of funds. In the 1999-00 budget, CSU carried over almost $25 million, and in the 2000-01 budget, CSU is carrying over more than $28 million.

Consequently, we recommend the Legislature delete $10.4 million to cover the excess costs of agreements CSU made with its employee bargaining units in prior years.

We recommend that the Legislature delete $380,000 requested to shift operations at California State University's existing off-campus center in Palm Desert to a new permanent facility in the Coachella Valley because the shift is both premature and unjustifiably costly.

The Governor's budget requests $380,000 to support a new off-campus center in the Coachella Valley. The CSU plans to move

San Bernardino's off-campus center--currently housed in facilities it shares with a community college located in Palm Desert--into permanent facilities

located in the Coachella Valley. It plans to construct three buildings on the new site.

Figure 8 shows the projected support costs and sources of funding for the new off-campus center. The CSU expects support costs at the new facility to total $2.2 million, or $1.3 million (138 percent) more than current support costs. To cover the $2.2 million in support costs, CSU plans to use $380,000 in General Fund support specifically requested for development of the new center, redirect $1.2 million internally from its systemwide General Fund support, and collect $700,000 in student fees. The total proposed increase in General Fund support for its new off-campus center is $1.2 million, or 324 percent, more than General Fund support in the current year for its existing center. We have two significant concerns with the proposal.

| Figure 8 | ||||

| Substantial Increase in Support Costs at CSU's Proposed Off-Campus Center | ||||

| (Dollars in Thousands) | ||||

| Estimated 1999-00 | Proposed 2000-01 | Change From 1999-00 | ||

| Existing Center | Proposed Center | Amount | Percent | |

| General Fund Support | $363 | $1,539 | $1,176 | 324% |

| Budget request | (0) | (380) | (380) | 100 |

| Existing CSU funds | (363) | (1,159) | (796) | 219 |

| Fee Support | $576 | $700 | $124 | 22% |

| Total cost | $939 | $2,239 | $1,300 | 138% |

Request Is Premature. The CSU San Bernardino's Capital Outlay Master Plan does not currently include plans for a new off-campus center in the Coachella Valley and the Legislature has not approved its development. In addition, CSU has neither demonstrated to the Legislature that it needs a new center in the Coachella Valley nor has it established that its current services would be sufficiently enhanced at the new center to warrant a substantial increase in state support. Furthermore, even if the Legislature had already approved the new center, CSU states that its first building will not be completed until fall 2001. Thus, it will not need any additional operating funds in the budget year. Despite these points, the 2000-01 budget proposal provides support funds to hire additional faculty, librarians, and other staff as well as purchase additional equipment and cover basic operating costs at the new facility. (Please see page G-82 of this Analysis for further discussion of capital outlay issues related to the construction of CSU's proposed off-campus center in the Coachella Valley.)

Proposed Move Is Not Cost-Effective. Figure 9 compares the estimated average General Fund cost per FTE student at the existing facility with the projected average cost per FTE at the new facility. The average General Fund cost to serve the 300 students at the existing site is $1,210 per FTE. The projected average General Fund cost to serve 405 students at the new facility is $3,800 per FTE. This is $2,590, or 214 percent, more than the average cost per FTE at the existing site.

| Figure 9 | ||||||

| Moving CSU's Off-Campus Center Is Not Cost-Effective | ||||||

| Estimated 1999-00 | Proposed 2000-01 | Change From 1999-00 | ||||

| Existing Center | Proposed Center | Amount | Percent | |||

| Total General Fund support | $363,000 | $1,539,000 | $1,176,000 | 324% | ||

| Full-time equivalent (FTE) students | 300 | 405 | 105 | 35 | ||

| Average General Fund cost per FTE | $1,210 | $3,800 | $2,590 | 214% | ||

In sum, we recommend that the Legislature not approve the $380,000 requested for CSU to move San Bernardino's existing off-campus center into a new facility in the Coachella Valley. The CSU does not have capital plans or funds for the new facility. In addition, its operating costs per student at the new facility would be significantly higher than current operating costs.

The budget includes a $269 million increase in California Community College Proposition 98 funding in the budget year. This is $149 per student, or 3.8 percent, more than the revised estimate of per-student expenditures in the current year.

The California Community Colleges (CCC) provide instruction to about 1.6 million adults at 107 colleges operated by 72 locally governed districts throughout the state. The system offers academic and occupational programs at the lower-division (freshman and sophomore) level. Based on agreements with local school districts, some college districts offer a variety of adult education programs including basic skills education, citizenship instruction, vocational, avocational, and recreational programs. Finally, pursuant to state law, many colleges have established programs intended to further regional economic development.

Figure 1 shows the budget from all significant sources for community college education for the budget year and the two previous years. As the figure shows, CCC spending from all sources is projected to increase by $348 million, or 6.5 percent, above the current-year level.

Proposition 98 funding constitutes about 72 percent of overall community college funding. For 2000-01, the budget proposes to increase community college Proposition 98 funding by $268.6 million. Figure 2 (see page 172) shows the changes proposed for community college Proposition 98 funds in the budget year. The major changes include:

| Figure 1 | |||||

| Community College Budget Summary | |||||

| 1998-99 Through 2000-01

(Dollars in Millions) |

|||||

|

Actual 1998-99 |

Estimated 1999-00 |

Proposed 2000-01 |

Change From 1999-00 | ||

| Amount | Percent | ||||

| Community College Proposition 98 | |||||

| Proposition 98 total | $3,628.2 | $3,886.9 | $4,138.1 | $251.2 | 6.5% |

| Less projected savings | -10.8 | -17.4 |

-- |

17.4 | -100.0 |

| Less local property tax | -1,484.4 | -1,580.3 | -1,694.4 | -114.2 | 7.2 |

| Subtotals, General Fund | ($2,133.0) | ($2,289.2) | ($2,443.6) | ($154.4) | 6.7% |

| Other Funds | |||||

| General Fund | |||||

| Teachers' retirement | $47.8 | $72.1 | $77.5 | $5.4 | 7.5% |

| Bond payments | 67.8 | 78.8 | 80.4 | 1.7 | 2.1 |

| State operations | 10.6 | 11.2 | 11.8 | 0.5 | 4.8 |

| Other | 0.4 | 0.5 | -- | -0.5 | -100.0 |

| Other state funds | 7.3 | 8.6 | 7.0 | -1.6 | -18.9 |

| State lottery funds | 117.8 | 121.0 | 121.0 | -- | -- |

| Student fees | 160.2 | 152.7 | 157.2 | 4.6 | 3.0 |

| Federal funds | 160.8 | 171.0 | 182.3 | 11.3 | 6.6 |

| Local property taxes | 1,484.4 | 1,580.3 | 1,694.4 | 114.2 | 7.2 |

| Other local | 834.9 | 887.9 | 946.3 | 58.4 | 6.6 |

| Totals | $5,025.0 | $5,373.2 | $5,721.5 | $348.3 | 6.5% |

| Students | |||||

| Enrollment | 1,494,751 | 1,547,067 | 1,593,479 | 46,412 | 3.0% |

| Full-time equivalent (FTE) | 957,201 | 990,703 | 1,020,424 | 29,721 | 3.0 |

| Proposition 98 | |||||

| Amount per FTE student | $3,779 | $3,906 | $4,055 | $149 | 3.8% |

| Figure 2 | |

| Governor's Community College Budget

Proposals

Proposition 98 |

|

| (In Millions) | |

| 1999-00 (revised) | $3,869.5 |

| Enrollment Growth | |

| Apportionments | $99.1 |

| Selected categorical programs | 6.6 |

| Subtotal | ($105.7) |

| Cost-of-Living Increases | |

| Apportionments | $96.6 |

| Selected categorical programs | 6.5 |

| Subtotal | ($103.1) |

| Program Expansion | |

| Partnership for Excellence | $25.0 |

| Maintenance/repairs | 10.0 |

| Telecommunications and technology | 6.3 |

| Extended opportunity and services | 6.0 |

| Lease-purchase payments | 6.0 |

| Disabled students | 5.1 |

| Instructional equipment | 5.0 |

| Financial aid administration | 1.2 |

| Economic development | 1.1 |

| Puente project | 1.0 |

| Financial aid reimbursements | 0.5 |

| Subtotal | ($67.1) |

| Adjustments | |

| Other | -$7.3 |

| Subtotal | (-$7.3) |

| 2000-01 (proposed) | $4,138.1 |

| Change from 1999-00 (revised) | |

| Amount | $268.6 |

| Percent | 6.9% |

Figure 3 shows Proposition 98 spending for community college programs. "Apportionment" funding (available for the districts to spend on general purposes) accounts for $3.3 billion in 2000-01, or about 81 percent of total Proposition 98 expenditures. The state General Fund supports about 49 percent of apportionment funding, and local property taxes provide the remaining 51 percent.

"Categorical" programs (expenditures earmarked for a specified purpose) are

also shown in Figure 3. These programs support a wide range of activities from

services for disabled students to maintenance/special repairs.

| Figure 3 | |||

| Major Community College Programs Funded by Proposition 98 | |||

| 1999-00 and 2000-01

(In Millions) |

|||

| Estimated 1999-00 | Proposed 2000-01 | Change From 1999-00 | |

| Apportionments | |||

| State General Fund | $1,570.1 | $1,647.6 | $77.5 |

| Local property tax revenue | 1,580.3 | 1,694.4 | 114.2 |

| Subtotals | ($3,150.4) | ($3,342.0) | ($191.7) |

| Categorical Programs | |||

| Partnership for Excellence | $145.0 | $170.0 | $25.0 |

| Matriculation--credit/noncredit | 67.1 | 71.1 | 4.0 |

| Extended opportunity and services | 59.7 | 69.3 | 9.5 |

| Disabled students | 60.1 | 68.8 | 8.7 |

| Services for CalWORKs recipients | 65.0 | 65.0 | -- |

| Lease-purchase payments | 61.3 | 67.3 | 6.0 |

| Maintenance/special repairs | 39.0 | 49.0 | 10.0 |

| Instructional equipment/library | 44.0 | 49.0 | 5.0 |

| Economic development program | 34.1 | 35.2 | 1.1 |

| Telecommunications and technology | 28.0 | 34.3 | 6.3 |

| Basic skills | 23.3 | 24.7 | 1.4 |

| CARE program | 10.4 | 11.0 | 0.6 |

| Financial aid administration | 6.4 | 7.6 | 1.2 |

| Puente program | 0.9 | 1.9 | 1.0 |

| Other programs | 71.9 | 71.9 | -- |

| Other adjustments | 2.8 | -- | -2.8 |

| Subtotals | ($719.1) | ($796.0) | ($76.9) |

| Totals | $3,869.5 | $4,138.1 | $268.6 |

We recommend a General Fund appropriation of $27.8 million to the California Community Colleges (CCC) to increase the equality of funding among districts. We further recommend adoption of legislation requiring the CCC to use a simpler and more effective method to allocate funding for cost-of-living adjustments among districts, based on the average level of funding per full-time-equivalent student in districts of similar size.

The Supplemental Report of the 1999-00 Budget Act directed the Legislative Analyst's Office (LAO) to study and report on the distribution of general purpose funding among CCC districts. The language required the LAO to evaluate the existing process of equalizing general purpose funding among districts and, if necessary, to recommend a more effective alternative.

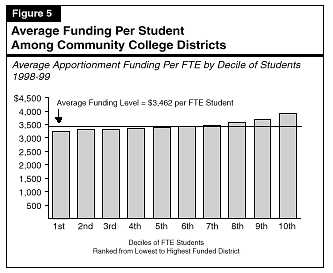

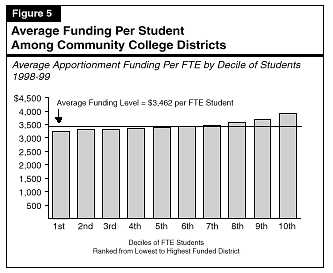

Funding Levels Are Already Fairly Equal. The CCC provided us with district-by-district apportionment data for 1998-99, which was the most recent year for which they had such detailed data. Figure 4 shows these district funding levels. Although funding levels appear to vary greatly--from a low of $3,191 per full-time-equivalent (FTE) student in the Santa Monica district (with 18,000 students) to a high of $7,530 in the West Kern district (with 900 students)--overall they are fairly close for the majority of districts. The funding level of most districts is relatively close to the systemwide average of $3,462 per FTE student. For example, the lowest-funded districts that account for 50 percent of students receive 48 percent of total general purpose funds. Figure 5 (see page 176) shows how funding was allocated among districts. It shows the average funding level per FTE student by decile.

Current CCC Method of Allocating Funds. Each year, the budget provides community colleges with additional apportionment funding for enrollment growth and COLAs. For example, the budget for 2000-01 includes $99 million for enrollment growth and $97 million for COLAs of 2.84 percent.

The CCC allocates funds for enrollment growth on an equal per FTE student basis, after adjusting for the size of districts and whether they have one or more campuses. The CCC allocates funding for COLAs quite differently. It allocates COLA funding based on a rather complex system of scoring districts according to a "program-based funding" formula. The formula assigns points to districts in each of five categories--instruction, instructional services, student services, maintenance and operations, and institutional support--based on hypothetical standards of how districts should spend their funds. Thus, rather than compare districts directly based on funding levels per FTE student, the CCC compares them very indirectly based on these hypothetical scores.

| Figure 4 | |||

| Community College District Apportionment Funding

Average Per Full-Time-Equivalent (FTE) Student |

|||

| 1998-99

(Actual Dollars) |

|||

| District | Funding | District | Funding |

| Small Districts | Medium Districts (continued) | ||

| Barstow | $ 4,523 | Mt. San Antonio | $3,244 |

| Compton | 3,570 | Mt. San Jacinto | 3,549 |

| Feather River | 5,078 | North Orange | 3,308 |

| Gavilan | 3,690 | Palomar | 3,460 |

| Imperial | 3,404 | Pasadena | 3,265 |

| Lake Tahoe | 4,872 | Peralta | 3,658 |

| Lassen | 4,892 | Rancho Santiago | 3,438 |

| Mendocino-Lake | 4,286 | Redwoods | 3,596 |

| Napa | 3,685 | Rio Hondo | 3,498 |

| Palo Verde | 5,460 | Riverside | 3,272 |

| Siskiyou | 4,305 | San Bernardino | 3,406 |

| West Hills | 4,553 | San Diego | 3,324 |

| West Kern | 7,530 | San Francisco | 3,648 |

| Average, Small Districts | $4,061 | San Joaquin | 3,605 |

| Medium Districts | San Jose | 3,614 | |

| Allan Hancock | $3,400 | San Luis Obispo | 3,392 |

| Antelope Valley | 3,356 | San Mateo | 3,475 |

| Butte | 3,440 | Santa Barbara | 3,359 |

| Cabrillo | 3,369 | Santa Clarita | 3,514 |

| Cerritos | 3,300 | Santa Monica | 3,191 |

| Chabot-Las Positas | 3,399 | Sequoias | 3,353 |

| Chaffey | 3,263 | Shasta-Tehama-Trinity | 3,506 |

| Citrus | 3,416 | Sierra | 3,329 |

| Coast | 3,706 | Solano | 3,437 |

| Contra Costa | 3,444 | Sonoma | 3,336 |

| Desert | 3,481 | South Orange | 3,409 |

| El Camino | 3,363 | Southwestern | 3,200 |

| Foothill-De Anza | 3,350 | State Center | 3,306 |

| Fremont-Newark | 3,417 | Ventura | 3,326 |

| Glendale | 3,301 | Victor Valley | 3,487 |

| Grossmont-Cuyamaca | 3,276 | West Valley | 3,359 |

| Hartnell | 3,594 | Yosemite | 3,483 |

| Kern | 3,654 | Yuba | 3,392 |

| Long Beach | 3,330 | Average, Medium Districts | $3,413 |

| Los Rios | 3,339 | ||

| Marin | 3,927 | Large District | |

| Merced | 3,427 | Los Angeles | $3,682 |

| Mira Costa | 3,852 | Average, All Districts | $3,462 |

| Monterey Peninsula | 3,553 | ||

Our analysis indicates that the program-based funding method will not increase equality of funding among districts as effectively and as quickly as possible. This is because this method is only indirectly based on actual funding levels. In a simulation of funding allocation methods, we found that allocating additional funding based directly on actual funding levels increases funding equality faster than when allocating additional funding based indirectly on the CCC's scoring system. The direct method would also be much less complex and therefore much easier for the public to understand.

Accordingly, we recommend the Legislature enact legislation directing the CCC to allocate funding for COLAs based on the average funding level per FTE student of districts within district-size groupings. This would provide the same dollar amount per FTE student for COLA funding for each district within size groupings. Districts with above-average funding per FTE student would therefore receive a smaller percentage of their funding in COLAs than districts below the average funding level per FTE student. Consequently, funding differences among districts would decline on a percentage basis gradually over time.

If the Legislature wanted to increase equality even more quickly using annual COLAs, it could provide lower-funded districts with more COLA funds per FTE student than higher funded districts. This would increase the rate at which funding per FTE student is equalized among districts within size groupings. This method is consistent with our recommendation for allocating COLA funds within the K-12 system. (Please see our discussion of discretionary funding in the K-12 education write up in this Analysis.)

Effect of Adding Funds Specifically for Equalization. In addition to increasing funding equality each year through enrollment growth and COLA funding, the Legislature can infuse the system with funds specifically for "equalization." The 1996-97 Budget Act appropriated $14 million to the CCC to increase equality of funding among districts, and the 1997-98 Budget Act appropriated $8.6 million for this purpose. The CCC allocated these equalization funds to districts that scored lowest in the CCC's program-based funding scoring system. This process increased funding equality less effectively than if the CCC had identified the lowest-funded districts directly. As Figure 6 shows, to bring 50 percent of districts to an equal funding level per FTE student within each district-size grouping would cost roughly $22 million. To bring 90 percent of systemwide enrollments up to the same level would cost roughly $200 million.

| Figure 6 | ||||

| Effects of Various CCC Equalization Options | ||||

| Current

Average |

Percent of FTEa Equalized | |||

| 50 | 70 | 90 | ||

| Funding Averages Per FTE Student | ||||

| Small districtsb | $4,061 | $4,122 | $4,549 | $4,910 |

| Medium districts | 3,413 | 3,440 | 3,481 | 3,644 |

| Large districts | 3,682 | 3,682 | 3,682 | 3,682 |

| General Fund cost of increases (millions) | -- | $22 | $71 | $200 |

| a Full-time equivalent. | ||||

| b Funding average for small districts excludes West Kern. | ||||

We do not have any analytical basis for advising the Legislature on the appropriate level of equality. We recommend that the Legislature specify a practical longer-term equalization goal--that is, specify a point at which disparities in revenue limits can be reduced to acceptable levels. A practical equalization goal, for example, might involve equalizing general purpose funding for 90 percent of FTE students. As noted above, we have recommended General Fund reductions to the CCC budget totaling $38.2 million. In the following section, we recommend augmenting the CCC budget by $10.4 million to provide additional assistance to students for textbooks. Thus, a total of $27.8 million from our recommended cuts would be available for other legislative priorities. We recommend that the Legislature use these funds to increase equality of funding in the CCC. This would bring districts that account for over 50 percent of students up to an equal level. To the extent that the Legislature wishes to increase funding for the CCC above the Governor's budget, we recommend it consider directing these funds to further increasing funding equality among districts.

To the extent that the Legislature chooses to appropriate equalization funds, we recommend that the Legislature require the CCC to base allocation of such funds directly on levels of funding per FTE student (taking into account the district-size grouping of the districts), rather than by the current indirect scoring method it uses in its funding program.

We recommend that the Legislature deny the $25 million augmentation request for the Partnership for Excellence Program until the California

Community Colleges provides the Legislature with

(1) meaningful goals, (2) plans to achieve the goals, and (3) indications that its performance is improving in the areas covered by the goals.

Chapter 330, Statutes of 1998 (SB 1564, Schiff), established the Partnership for Excellence Program. The act required the CCC to develop specific goals and outcome measures to improve student success and assess district performance. The act states that the CCC must establish goals for the following areas: (1) student transfers, (2) degrees and certificates, (3) successful course completion, (4) work force development, and (5) basic skills improvement. Chapter 330 expresses the state's intent to provide supplemental funding "to invest in program enhancements that will increase performance toward the community colleges' system outcome measures." The 1998-99 Budget Act appropriated $100 million to the CCC for this purpose and the 1999-00 Budget Act provided an augmentation of $45 million, which brings current-year funding to $145 million.

The budget proposes an augmentation of $25 million in the budget year for the Partnership for Excellence Program, which would increase overall funding to $170 million. The administration proposes to make this augmentation contingent on the CCC developing more rigorous and ambitious goals for the program.

Three-Agency Review Cites Deficiencies in Partnership Goals. The 1999-00 Budget Act directed the CCC to report to the Department of Finance (DOF), the California Postsecondary Education Commission (CPEC), and the LAO by September 1, 1999 on the following with respect to the Partnership Program:

The CCC report was reviewed jointly by the three agencies. The agencies found the CCC's proposed goals inadequate. For example, they found that the CCC's proposals for increases in degrees and certificates and workforce development were not above increases that would reasonably be expected as a result of COLAs and "normal" enrollment growth. The three agencies found that the CCC's goals for 2005 for (1) transfer-prepared students, (2) successful course completions, and (3) basic-skills achievement were not cost-effective at the current $145 million funding level.

In a joint letter to the CCC dated December 21, 1999 (with copies provided to the Legislature), the three agencies described their findings. The agencies offered to share the details of their analysis with the CCC, to assist it in redefining more appropriate goals, and to help define mechanisms to advance performance-based-funding in the community colleges. The CCC has not formally responded to this letter. The Governor's budget does not reflect any subsequent changes to the Partnership for Excellence Program.

Based on the three-agency joint review, we recommend that the Legislature defer any augmentation for this program until the CCC provides the Legislature with (1) meaningful goals, (2) plans to achieve the goals, and (3) indications that its performance is improving in the areas covered by the goals. We therefore recommend that Item 6870-001-0001 be reduced by $25 million.

The administration also proposes related budget bill language which--in part--states that: ". . .no allocation of funds shall be made until the California Postsecondary Education Commission, the Legislative Analyst, and the Department of Finance have approved in writing the specific annual goals and measures relevant to the current level of funding for the Partnership."

This budget bill language relates to the entire program. We recommend striking this contingent language because it places the final review and decision-making with three agencies rather than with the Legislature, which is where this decision should be made.

In the event that the CCC is not able to respond adequately to the concerns expressed by the three agencies in time for appropriate legislative consideration in budget hearings, we recommend the administration pursue program enhancements through separate legislation. This would allow the Legislature the opportunity to fully review any proposal with advice from the three agencies.

We recommend that the Legislature provide $10.4 million to the California Community Colleges to augment its textbook assistance program because the program targets a critical resource to the most needy of students.

Low-income CCC students who are also "educationally disadvantaged" are eligible for special services through a program referred to as Extended Opportunity and Program Services (EOPS). Among the forms of assistance provided through EOPS are: counseling services, tutoring, basic skills instruction, peer counseling, and textbook purchase assistance. In the 1998-99 school year, 85,900 students were receiving some form of assistance through EOPS. The overall EOPS budget was $56.9 million in that year. Approximately $12.4 million, or nearly 22 percent, of the 1998-99 EOPS budget was allocated to help EOPS students purchase textbooks for classes. This amount allowed 55,250 EOPS students, or 64 percent of the total, to receive approximately $225 each in 1998-99 to purchase textbooks. Based on the annual Student Expense and Resources Survey (SEARS) conducted by the Student Aid Commission, the CCC estimates that its students spend an average of approximately $810 per year on textbooks and supplies.

Textbook Program to Reach Fewer Needy Students. Adjusting for enrollment growth and program expansion since 1998-99, we estimate that 101,600 students will be enrolled in EOPS in 2000-01. Without additional funding for the EOPS textbook assistance program, the program for 2000-01 will have to provide either the $225 grant to only 54 percent of the projected number of EOPS students, or lower the per student textbook allowance to reach more students.

Book Assistance Targets Important Resource to Most Needy Students. The Legislature has long viewed cost as a potential barrier for low-income educationally disadvantaged students who wish to attend a CCC. While the CCC waives its fees for 36 percent of students ($330 annually per eligible student), the annual cost of $810 for textbooks is about 2.5 times the average state fee. Purchasing textbooks for EOPS-eligible students is perhaps one of the most cost-effective financial aid programs, because it:

In light of the targeted nature of textbook assistance, we therefore recommend that the Legislature augment the amount by $10.4 million, which would bring the total General Fund support for the EOPS textbook assistance program to $22.8 million. This augmentation would allow all EOPS-eligible students in 2000-01 to receive an average of $225 annually to purchase textbooks.

We withhold recommendation on $35.2 million for Economic Development activities, pending receipt and review of the contracted evaluation of this program. This evaluation is due to the Legislature by March 1, 2000.

Chapter 805, Statutes of 1994 (AB 3512, Polanco), reauthorized an existing CCC program and changed its name to the Economic Development Program. The budget proposes $35.2 million from Proposition 98 funds for this program in 2000-01. This is an increase of $1.1 million, or 3.1 percent, over the current-year amount. The increase is proposed for 17 Mexican International Trade Centers established in the current-year in Chapter 959, Statutes of 1999 (SB 213, Polanco). Chapter 959 provided $1.1 million for these centers. Thus, total funding would increase to $2.2 million for the centers in 2000-01.

Chapter 299, Statutes of 1997 (AB 1578, Midgen), directed the Board of Governors to review the Economic Development Program by September 1, 1998 to determine whether the program should be extended beyond a sunset date of June 30, 1999. Chapter 299 further directed the Legislative Analyst, in conjunction with the Bureau of State Audits, to review the effectiveness of the program, with specific attention to the findings of the review by the CCC board.

In last year's Analysis we found that the evaluation completed under contract by the Board of Governors lacked even the most basic information on program outcomes and effectiveness. Furthermore, in collecting information for its report, the contractor used faulty survey methods. We recommended that the Legislature direct the CCC Chancellor's Office to end the contract and extend the program for one year until the CCC could complete a new evaluation.

The Legislature adopted that recommendation. Chapter 78, Statutes of 1999 (AB 1115, Strom-Martin) extends the sunset date for the program to January 1, 2001. The Chancellor's Office contracted for a new evaluation and requested that the contractor provide a preliminary report to the Legislature by March 1, 2000. The CCC says that the March report will provide sufficient information to determine the overall effectiveness of the program.

We will review this evaluation in the context of the state's other economic development efforts, especially those funded within the Trade and Commerce Agency, and with respect to the appropriateness and most effective use of Proposition 98 funds within the CCC. Pending receipt and review of this evaluation, we withhold recommendation on the $35.2 million budget request for the program.

The Student Aid Commission (SAC) provides financial aid to students through a variety of grant, loan, and work-study programs. The commission's proposed 2000-01 budget includes state and federal funds totaling $875 million. This is $71 million, or 8.9 percent, more than estimated expenditures in the current year.

The budget requests $460 million from the General Fund for the commission. This is $71 million, or 18 percent, more than estimated expenditures in the current year. Of the total General Fund amount, 98 percent is for direct student aid for higher education. The balance is for the cost of operating the commission and an outreach program for K-12 students.

Figure 1 (see next page) shows the major changes proposed for the commission's budget in 2000-01. As the figure shows, the budget requests a General Fund increase of $71 million. The major factor driving this change is the out-year costs of $40 million associated with increases in the number and amount of Cal Grant A awards provided in the previous three years. The Governor's budget also includes a total of $30.5 million to increase Cal Grant aid. This consists of $28.3 million to provide 7,000 additional first-time Cal Grant A (3,500) and Cal Grant B (3,500) awards and $2.2 million to increase the maximum Cal Grant award by 3 percent from $9,420 to $9,701. The annual cost of these augmentations would increase to over $100 million by 2002-03 because each year the additional first-time awards will be given to new students while awards to prior recipients are renewed. The Governor's budget proposes to eliminate the $10 million currently provided for the Cal Grant T program.

| Figure 1 | |

| Student Aid Commission

Major General Fund Changes |

|

| (In Millions) | |

| 1999-00 | $388.5 |

| Costs of prior-year grant increases | $40.0 |

| Add 3,500 new first-time Cal Grant A awards | 15.3 |

| Add 3,500 new first-time Cal Grant B awards | 13.0 |

| Eliminate Cal Grant T program | -10.0 |

| Expand Cal-SOAP student-outreach program | 5.0 |

| Funding for redemption of APLE loan- forgiveness warrants | 4.0 |

| Increase maximum Cal Grant award from $9,420 to $9,703 | 2.2 |

| Expand state work study program | 2.6 |

| Survey of student expenses and

resources (one-time) |

.3 |

| Five new positions for various programs | .3 |

| Technical and other adjustments | -1.3 |

| Proposed 2000-01 | $459.9 |

| Increasea | $71.3 |

| Percent increase | 18% |

| a Total does not add due to rounding. | |

The Cal Grant program consists of four parts. Figure 2 summarizes the purpose; eligibility requirements; and awards for the Cal Grant A, Cal Grant B, and Cal Grant C programs. The Cal Grant T program, which provides grants to financially needy teacher-education students, uses the same eligibility criteria as the Cal Grant A program.

| Figure 2 | ||

| Description of Cal Grant Programs | ||

| 2000-01 | ||

| Cal Grant A | Cal Grant B | Cal Grant C |

| Based on financial need and academic performance. | Based primarily on financial need, preference for initial attendance at community college. | Vocational--based on financial need. |

|

Eligibility |

||

| Income ceiling: $68,700 for dependent student with five family members. | Income ceiling: $37,172 for dependent student with five or more family members. | Income ceiling: Same as Cal Grant A. |

| Asset ceiling: $45,400 | Asset ceiling: $45,400 | Asset ceiling: $45,400 |

| GPA cut-off was 3.09 for all grade levels in 1999-00. | Applicants ranked based on family income, family size, GPA, family education background, and marital status of parents. | Applicants ranked based on work experience, educational performance, and recommendations |

| Plan to enroll at least two years at UC, CSU, or nonpublic institution. | Plan to enroll at least one year at a college. | Plan to enroll at least four months at community college, independent college, or vocational school. |

|

Average Family Income of New Recipients (1999-00) |

||

| $34,471 | $14,998 | $27,174 |

| Maximum Award (1999-00) | ||

| Tuition and fees:

Nonpublic: $9,420 UC: $3,429 CSU: $1,428 |

Tuition and fees:

No award in the first year, then same as Cal Grant A. |

Tuition and fees:

Nonpublic: $2,360 UC: $2,360 |

| Other costs: none | Other costs: Up to $1,410 | Other costs: Up to $530 |

|

Number of New Awards Annually (1999-00) |

||

| 25,640 | 25,640 | 3,774 |

| Proposed Budget 2000-01 (In Millions) | ||

| $283.5 | $145.7 | $6.0 |

| Number of Current Recipients | ||

| 66,339 | 61,767 | 5,442 |

Figure 3 shows--for selected past years--how Cal Grant activities compared to the program's statutory goals. It indicates, for example, that the budget would support about 62,000 first-time Cal Grant awards in 2000-01 which would meet 80 percent of the statutory goal of providing Cal Grants to one-fourth of California high school graduates. (In most years, the statutory goal represents roughly one-half of graduates that go immediately to college.)

| Figure 3 | |||

| Cal Grants--Statutory Goals Compared to Actual Awards | |||

| Selected Years | |||

| 1980-81 | 1990-91 | 2000-01 Proposed | |

| Goal: Awards for 25 Percent of High School Graduates | |||

| 25 percent of high school graduates | 65,848 | 64,077 | 77,603 |

| Actual number of new awards | 23,232 | 31,220 | 62,054 |

| Percent of goal | 35.3% | 48.7% | 80.0% |

| Goal: Cover UC and CSU Fees for Financially Needy Students | |||

| University of California | |||

| Weighted average tuition and fees | $776 | $1,820 | $3,879 |

| Maximum award | 774 | 1,820 | 3,429 |

| Percent of goal | 99.7% | 100.0% | 88.4% |

| California State University | |||

| Weighted average tuition and fees | $226 | $920 | $1,812 |

| Maximum award | 225 | 920 | 1,428 |

| Percent of goal | 99.6% | 100.0% | 78.8% |

We recommend the Legislature adopt budget bill language directing the Student Aid Commission to allocate new Cal Grant awards in a manner that maintains General Fund costs for the additional awards at a constant level over time. Funding commitments made in this (or any) budget generally should not obligate future Legislatures to significant General Fund cost increases.

The budget requests a total of $28.3 million from the General Fund to provide 3,500 additional first-time Cal Grant A awards ($15.3 million) and 3,500 first-time Cal Grant B awards ($13 million).

Costs of Proposals Increase Significantly in Out-Years. Freshmen that receive Cal Grant awards continue to receive annual awards as they matriculate through four years of college (unless they drop out or otherwise become ineligible for the aid). In addition, increases in the number of first-time awards apply to every successive freshman class. Consequently, within four years, the annual cost of Cal Grant augmentations increases about 3.5 times. Thus, the $28.3 million the budget requests in 2000-01 for additional grants would cost the state over $100 million annually by 2004-05.

Costs of Cal Grant Augmentations Should Be Leveled Over Time. When the Governor and Legislature approve augmentations to the Cal Grant program in any year, they are, under current practice, effectively committing future Legislatures to increases that are approximately 3.5 times as high as the initial augmentation. The state could avoid this increase over time, however, if SAC implemented Cal Grant augmentations differently.

For example, the SAC could distribute additional awards among freshmen, sophomores, juniors, and seniors in the first year, taking into account the normal attrition rate, which is approximately 10 percent per year. For example, if the budget provides for 100 new awards and the attrition rate is 10 percent, the SAC could distribute 29 new awards to freshmen, 26 to sophomores, 24 to juniors, and 21 to seniors. Each year thereafter, the 29 awards could be given to freshmen, and the total of 100 awards would be sustained. As long as the SAC continued to allocate future increases in additional Cal Grant awards in this way, Legislatures would be better able to assess the fiscal implications of their actions and would not commit future Legislatures to budget increases over which they did not have direct control. Accordingly, we recommend that the Legislature adopt budget bill language directing the SAC to allocate additional Cal Grant awards among freshmen, sophomores, juniors, and seniors in the first year so as to level the costs of the increase over time.

We recommend the Legislature narrow the eligibility criteria of the Assumption Program of Loans for Education (APLE). Currently, APLE recipients can teach in more than 70 percent of all public elementary and secondary schools and still receive benefits for teaching in a "disadvantaged school." By offering APLE warrants only to individuals who agree to teach in the neediest schools, the Legislature could more effectively target the benefits of the program.

The budget proposes to expand the Assumption Program of Loans for Education (APLE) by issuing 1,000 additional warrants, thereby increasing the maximum number of warrants issued each year from 5,500 to 6,500. An APLE warrant is an agreement between a student and SAC stipulating that SAC will pay off a specified amount of a student's loan debt if the student complies with all APLE requirements. Because APLE warrants are redeemed only after a recipient has completed school and at least one year of teaching, the proposed budget does not include funds for the additional 1,000 warrants. Issuing 1,000 additional warrants in the budget year, however, will increase state costs in subsequent years.

In addition to the increase in APLE warrants requested in the budget, proposed trailer bill language would remove some of the administrative complexity of the program and further broaden the program's eligibility criteria.

Background. The legislative intent for APLE is contained in Education Code Sections 69612 through 69616. The primary purpose of APLE is to provide financial incentives to students to become credentialed teachers and to teach in subject shortage areas, schools serving low-income pupils, rural schools, and schools with a high percentage of teachers holding emergency permits. The state agrees to pay a maximum of $11,000 of APLE recipients' loan debt if they agree to teach in one of these areas for four consecutive years.

Currently, statute requires teacher preparation institutions to allocate a specific percentage of APLE warrants to participants who agree to teach in each of these areas. For example, statute requires institutions to distribute 60 percent of their allotted warrants to individuals who agree to teach in subject shortage areas and 40 percent to individuals who agree to teach in schools serving many students from low-income families. Because many teacher preparation institutions have had difficulty filling the precisely specified warrant allotments, trailer bill language proposes to allow institutions to offer warrants to individuals willing to teach in any of the designated areas. Trailer bill language would also expand the current eligibility categories by adding "low-performing schools" to the list of schools where APLE participants may teach.

Broad Eligibility Criteria Fail to Target Neediest Schools. Under both the current and the proposed eligibility requirements, APLE recipients can teach in almost any school in the state and still receive benefits. Under the current eligibility requirements, APLE recipients could receive benefits in 1999-00 if they taught in any of the following subject shortage areas: reading, life or physical science, math, bilingual education, or special education. They could also receive benefits if they taught in any of the 5,823 schools (approximately 70 percent of all public elementary and secondary schools) that statute defines as low-income. Beginning in 2000-01, APLE recipients will also be able to receive benefits if they work in rural schools or in schools with a high percentage of teachers holding emergency permits. The trailer bill language would also allow APLE recipients to receive benefits if they teach in any low-performing school, which under the administration's definition of "low performance" equals half the state's schools.

Narrowing Eligibility Criteria Can Focus Program's Benefits. The Legislature could more effectively target the benefits of APLE by narrowing its eligibility criteria. Because the program's eligibility criteria are so broad, the program is likely to have little noticeable effect on the schools that have the greatest need for qualified teachers. If the Legislature narrowed the pool of state-approved schools, it could magnify the program's impact on these schools.

While continuing to endorse the administrative simplicity that is embedded in the proposed trailer bill language, the Legislature might focus the program by agreeing to provide APLE benefits only to those individuals who agree to teach in schools with 20 percent or more noncredentialed teachers. A recent report by SRI International found that schools with 20 percent or more noncredentialed teachers confront significantly more challenges than other schools. Narrowing the percent of state-approved schools would allow the Legislature to ensure that APLE actually benefits these neediest of schools. (Please see page E-24 for a more detailed discussion of low-performing schools.)

In sum, we recommend the Legislature reduce the set of schools in which APLE recipients may teach to those with 20 percent or more noncredentialed teachers. Under both the current and proposed eligibility criteria, APLE recipients could work in almost any school in the state and still receive benefits. The Legislature could greatly target the benefits of the program by offering APLE benefits only to those individuals who agree to teach in the neediest schools.

We recommend the Legislature restore funding for the Cal Grant T program because it provides incentives for financially needy students to pursue teaching careers with little, if any, additional cost to the state. (Increase Item 7980-101-0001 by $10 million.)

The Governor's budget proposes eliminating the Cal Grant T program. In the 1998-99 and the 1999-00 budgets, the state appropriated $10 million to provide 3,000 new Cal Grant T awards. Figure 4 (see next page) provides basic information regarding Cal Grant T awards and recipients. In 1998-99, 2,044 students received Cal Grant T awards, at a total cost of $9.4 million. In 1999-00, 2,098 students received new awards and 521 students received renewals, at a total cost of $14 million.

| Figure 4 | ||||

| Cal Grant T Awards | ||||

| Number of Recipients | Percent of All Recipients | Average Award | Total Award Amount

(In Millions) |

|

| 1998-99 | ||||

| UC | 227 | 11% | $3,609 | $0.8 |

| CSU | 1,046 | 51 | 1,584 | 1.7 |

| Independents | 771 | 38 | 8,951 | 6.9 |

| Totals | 2,044 | 100% | $4,588 | $9.4 |

| 1999-00 | ||||

| UC | 162 | 8% | $3,609 | $0.5 |

| CSU | 955 | 46 | 1,506 | 1.4 |

| Independents | 981 | 47 | 9,456 | 9.3 |

| Subtotals | (2,098) | (100%) | ($5,386) | ($11.3) |

| Renewals | 521 | -- | $5,204 | $2.7 |

| Totals | 2,619 | -- | $5,350 | $14.0 |

Chapter 336, Statutes of 1998 (SB 2064, O'Connell), created the Cal Grant T program, which is administered by SAC. The program provides a one-year grant to students who have already obtained a baccalaureate degree and are currently (or soon to be) enrolled in a state-approved teacher preparation program. The grant covers only educational fees. The eligibility requirements for Cal Grant T awards are the same as those for Cal Grant A awards. Both awards are based foremost on need. The SAC then ranks those who meet the need-based requirements according to their undergraduate grade point average (GPA).

Rationale for Eliminating the Cal Grant T Program. According to the Office of the Secretary for Education, the Governor proposes to eliminate the Cal Grant T program because he believes the APLE is more effective at recruiting and retaining teachers. The APLE was enacted almost 15 years ago and, like the Cal Grant T program, is administered by SAC. The APLE is designed to attract and retain teachers by paying off students' loans. The APLE recipients who teach four consecutive years in a low-income area or in a subject-shortage area can have a maximum of $11,000 of their loan debt forgiven. Unlike APLE recipients, Cal Grant T recipients neither have to make a commitment to teach in particular areas nor do they actually have to teach before receiving financial assistance.

The Governor's proposal to eliminate the Cal Grant T program has two major adverse consequences.

Restricts Options of Financially Needy Students. Without being able to obtain a Cal Grant T award, financially disadvantaged students would have to rely exclusively on APLE since it would be the only remaining state financial aid program for prospective teachers. Eliminating the Cal Grant T program and relying exclusively on APLE, however, restricts the options of financially needy students in two significant ways.

Threatens to Reduce Supply of Teachers in Midst of Growing Demand. Although programs should demonstrate their effectiveness before the Legislature endorses them, the Legislature needs to be wary of reducing the supply of teachers when the demand for them remains so great. Unfortunately, we do not know if either Cal Grant T or APLE is cost-effective. The SAC does not know if Cal Grant T recipients are more or less likely than APLE recipients to finish their teacher preparation program, to obtain a teaching credential, to enter the classroom, to remain teachers, or to be effective as teachers. In addition, while approximately half of Cal Grant T recipients also receive APLE warrants, the extent to which the programs serve distinct populations and purposes is unknown. Without these data, it is difficult for the Legislature to determine if Cal Grant T, APLE, or both programs should be eliminated or expanded.

The Cal Grant program has an established history as an effective program in offering assistance to financially needy students. More than 4,000 students have benefitted from the Cal Grant T program in the last two years. The Cal Grant T program might be equally or more cost-effective than APLE even if the retention rate among Cal Grant T recipients is lower than among APLE recipients. This is because Cal Grant T recipients receive, on average, less financial assistance. For example, if SAC distributed 1,000 APLE warrants and APLE recipients had a 75 percent retention rate, such that SAC forgave 750 loans at $11,000 per loan, the state would incur a total cost of $8.3 million. For the same cost, the SAC could distribute more than 1,500 Cal Grant T awards, at the average award amount ($5,386). Even if Cal Grant T recipients had only a 50 percent retention rate, the two programs would be equally cost-effective. Given these factors, coupled with all the remaining unknown factors, we recommend the Legislature exercise caution in eliminating programs that are likely to increase the supply of qualified teachers.

In sum, by eliminating the Cal Grant T program, the administration would restrict the choices of financially needy students, potentially increase the cost the state incurs to educate prospective teachers, and possibly diminish the future supply of qualified teachers. We, therefore, recommend the Legislature restore the $10 million General Fund support for the Cal Grant T program.