General Fund expenditures for health and social services programs are proposed to increase by 6 percent in the budget year. This increase is due primarily to a variety of workload and cost increases, the Governor's initiative related to nursing homes and other adult care programs, and a technical change in the way child support collections are reflected in the budget. The budget also proposes to revise the formula for providing county fiscal incentives under the California Work Opportunity and Responsibility to Kids program, which would result in significant state savings.

The budget proposes General Fund expenditures of $18.9 billion for health and social services programs in 2000-01, which is 27 percent of total proposed General Fund expenditures. The health and social services share of the budget generally has been declining since 1993-94. The budget proposal represents an increase of $1.1 billion, or 6 percent, over estimated expenditures in the current year.

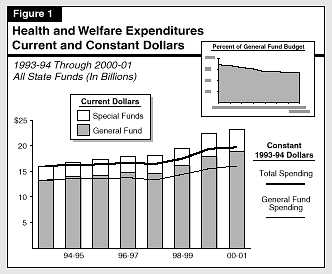

Figure 1 (see next page) shows that General Fund expenditures (current dollars) for health and social services programs are projected to increase by $5.6 billion, or 42 percent, from 1993-94 through 2000-01. This represents an average annual increase of 5.2 percent.

Figure 1 shows that General Fund spending ( in current dollars) has increased since 1993-94, except for a slight reduction in 1997-98 due primarily to a decline in California Work Opportunity and Responsibility to Kids (CalWORKs, formerly Aid to Families with Dependent Children [AFDC]) program caseloads. Spending is estimated to increase by 11 percent in 1999-00, primarily due to Medi-Cal eligibility expansion and cost increases, and caseload and cost increases in various health and social services programs. As noted above, the budget proposes a 6.6 percent increase in 2000-01.

In 1991-92, realignment legislation shifted $2 billion of health and social services program costs from the General Fund to the Local Revenue Fund, which is funded through state sales taxes and vehicle license fees. This shift in funding accounted for a significant increase in special funds starting in 1991-92. The budget estimates that realignment revenues will be $2.9 billion in 2000-01.

Special funds expenditures are estimated to increase significantly in the current year, primarily because of the effect of Proposition 10 of 1998, which imposes a tax increase on cigarettes and other tobacco products and requires that almost all of the revenues be spent by state and local commissions for early childhood development programs. The budget estimates that spending from the new California Children and Families Trust Fund will amount to $1.1 billion in 1999-00 (which includes revenues carried over from 1998-99) and $729 million in 2000-01. (For a discussion of Proposition 10, please see our report Proposition 10: How Does it Work and What Role Should the Legislature Play in its Implementation?, January 13, 1999.)

Combined General Fund and special funds spending is projected to increase by 52 percent from 1993-94 through 2000-01. This represents an average annual increase of 5.5 percent.

Figure 1 also displays the spending for these programs adjusted for inflation (constant dollars). On this basis, General Fund expenditures are estimated to increase by 21 percent from 1993-94 through 2000-01. Combined General Fund and special funds expenditures are estimated to increase by 23 percent during the same period. This is an average annual increase of 3 percent.

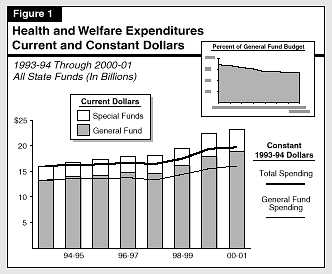

Figures 2 and 3 (see next page) illustrate the caseload trends for the largest health and welfare programs. Figure 2 shows Medi-Cal caseload trends over the last decade, divided into four groups: families and children (primarily recipients of CalWORKs--formerly AFDC), refugees and undocumented persons, and disabled and elderly persons (who are primarily recipients of Supplemental Security Income/State Supplementary ProgramSSI/SSP).

Medi-Cal Caseloads. Medi-Cal caseloads increased by 51 percent over the 12 years shown in Figure 2. As the figure shows, the growth generally occurred during the period from 1989-90 through 1994-95. The growth in the number of families and children receiving Medi-Cal during this period reflects the rapid growth in AFDC caseloads as well as the expansion of Medi-Cal to cover additional women and children with incomes too high to qualify for cash aid in the welfare programs. Coverage of refugees and undocumented persons also increased caseloads significantly during this period. Since 1994-95, Medi-Cal caseloads have declined, due primarily to a decline in AFDC/CalWORKs caseloads. The figure also shows that the caseload leveled off in 1997-98 and 1998-99. While the budget states that the caseload is forecasted to decline by 1 percent in 2000-01, this excludes the effect of an expansion in eligibility enacted in the current year. With this adjustment, the Medi-Cal caseload is estimated to increase by 2.6 percent in the current year and 1.9 percent in the budget year.

We also note that while the number of CalWORKs families and children has been declining in recent years, the number of nonwelfare families (generally lower-income working families) has been increasing and now constitutes the majority of Medi-Cal families and children.

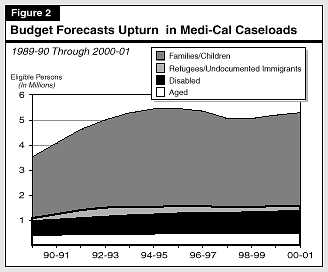

CalWORKs and SSI/SSP Caseloads. Figure 3 shows the caseload trend for the CalWORKs and SSI/SSP programs. While the number of cases in SSI/SSP is greater than in the CalWORKs program, there are more persons in the CalWORKs program--about 1.5 million compared to about 1 million for SSI/SSP. (The SSI/SSP cases are reported as individual persons, while CalWORKs cases are primarily families.)

To the extent that caseloads have been increasing in these two programs, it has been due, in part, to the growth of the eligible target populations. The increase in the rate of growth in the CalWORKs caseloads in 1990-91 and 1991-92 was also due to the effect of the recession. During the next two years, the caseload continued to increase, but at a slower rate of growth. This slowdown, according to the Department of Finance, was due partly to: (1) certain population changes, including lower migration from other states; and (2) a lower rate of increase in "child-only" cases (including citizen children of undocumented and newly legalized persons), which was the fastest growing segment of the caseload until 1993-94.

Figure 3 also shows that since 1994-95, CalWORKs caseloads have declined. As discussed in our annual California's Fiscal Outlook reports, this trend is due to various factors, including the improving economy, lower birth rates for young women, a decline in legal immigration to California, reductions in grant levels, behavioral changes in anticipation of federal and state welfare reform, and--for the current and budget years--the impact of the CalWORKs program interventions (including additional employment services). We have noted, however, that contrary to this overall downward trend, the number of child-only cases has been increasing slightly in recent years. This category of the caseload includes children whose parents are undocumented, children with nonneedy relative caretakers, and children whose parents are removed from the assistance unit because of sanctions for nonparticipation in the CalWORKs employment services program.

The SSI/SSP caseload can be divided into two major components: the aged and the disabled. The aged caseload generally increases in proportion to increases in the eligible population--age 65 or older. This component accounts for about one-third of the total caseload. The larger component--the disabled caseload--grew significantly faster than the rate of increase in the eligible population group (primarily ages 18 to 64) in the early 1990s. This was due to several factors, including (1) the increasing incidence of AIDS-related disabilities, (2) changes in federal policy that liberalized the criteria for establishing a disability, (3) a decline in the rate at which recipients leave the program (perhaps due to increases in life expectancy), and (4) expanded state and federal outreach efforts in the program. In recent years, however, the growth of the disabled caseload has slowed.

Total SSI/SSP caseload growth has also moderated in recent years. This is partly attributable to federal policy changes that (1) eliminated drug or alcohol addiction as a qualifying disability and (2) added restrictions on the eligibility of disabled children.

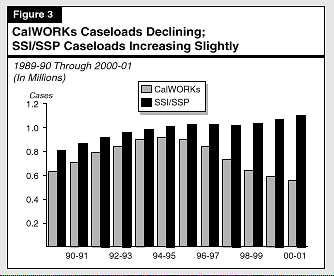

Figure 4 shows expenditures for the major health and social services programs in 1998-99 and 1999-00, and as proposed for 2000-01. As shown in the figure, the three major benefit payment programs--Medi-Cal, CalWORKs, and SSI/SSPaccount for a large share of total spending in the health and social services area.

Figures 5 and 6 (see pages 14 and 15) illustrate the major budget changes proposed for health and social services programs in 2000-01. (We include the federal funds for CalWORKs because, as a block grant, they are essentially interchangeable with state funds within the program.) Most of the major changes can be grouped into the following categories:

1. The Budget Funds Caseload Growth in SSI/SSP, Medi-Cal, and the Healthy Families Program, Reflects Savings From Caseload Reductions in CalWORKs, and Funds Other Workload Cost Increases. The budget includes a projected caseload reduction of 5.5 percent in the CalWORKs program and increases of 1.9 percent (as adjusted) in the Medi-Cal Program, 3.1 percent in SSI/SSP, and 32 percent in the Healthy Families Program.

2. The Budget Proposes to Fund Statutory Cost-of-Living Adjustments (COLAs) for CalWORKs and SSI/SSP. The budget includes a 3.6 percent COLA for CalWORKs and SSI/SSP in 2000-01. We also note that it proposes to fund the statutory COLA for foster family agencies (FFAs) but does not fund the COLA for non-FFA foster family homes or group homes. Current law provides for these COLAs, but makes them "subject to the availability of funds."

| Figure 4 | |||||

| Major Health and Welfare Programs Budget Summarya | |||||

| 1998-99 Through 2000-01

(Dollars in Millions) | |||||

| Actual

1998-99 |

Estimated

1999-00 |

Proposed

2000-01 |

Change From 1999-00 | ||

| Amount | Percent | ||||

| Medi-Cal | |||||

| General Fund | $7,471.3 | $8,208.8 | $8,749.4 | $540.6 | 6.6% |

| All Funds | 18,494.2 | 20,492.4 | 21,450.8 | 958.4 | 4.7 |

| CalWORKs (Grants and Services) | |||||

| General Fund | $2,022.4 | $1,994.1 | $2,071.7 | $77.6 | 3.9% |

| All Funds | 5,347.3 | 5,380.7 | 5,567.6 | 186.9 | 3.5 |

| AFDC-Foster Care | |||||

| General Fund | $377.5 | $425.7 | $389.5 | $-36.2 | -8.5% |

| All Funds | 1,394.4 | 1,496.4 | 1,478.1 | -18.3 | -1.2 |

| SSI/SSP | |||||

| General Fund | $2,242.2 | $2,482.6 | $2,619.8 | $137.2 | 5.5% |

| All Funds | 6,084.4 | 6,508.4 | 6,904.8 | 396.4 | 6.1 |

| In-Home Supportive Services | |||||

| General Fund | $370.4 | $527.4 | $538.8 | $11.4 | 2.2% |

| All Funds | 1,397.8 | 1,628.3 | 1,784.5 | 156.2 | 9.6 |

| Regional Centers/Community Services | |||||

| General Fund | $647.5 | $809.4 | $896.3 | $86.9 | 10.7% |

| All Fundsb | 1,400.2 | 1,617.3 | 1,763.7 | 146.4 | 9.1 |

| Developmental Centers | |||||

| General Fund | $34.0 | $82.4 | $71.4 | -$11.0 | -13.3% |

| All Fundsb | 482.7 | 561.1 | 612.7 | 51.6 | 9.2 |

| Child Welfare Services | |||||

| General Fund | $421.0 | $496.9 | $457.5 | -$39.4 | -7.9% |

| All Funds | 1,177.0 | 1,507.0 | 1,554.1 | 47.1 | 3.1 |

| State Hospitals | |||||

| General Fund | $311.6 | $362.9 | $424.4 | $61.5 | 16.9% |

| All Funds | 490.2 | 526.8 | 573.9 | 47.1 | 8.9 |

| Children and Families First Commissionsc | |||||

| General Fund |

-- |

-- |

-- |

-- |

-- |

| All Funds | $5.5 | $1,062.7 | $728.9 | -$333.8 | -31.4% |

| Child Support Services | |||||

| General Fund | --

d |

--d |

$332.3 | $332.3 |

-- |

| All Funds | --

d |

--d |

874.1 | 874.1 |

-- |

| a Excludes departmental support, except for state hospitals. | |||||

| b Includes General Fund share of Medicaid reimbursements (costs budgeted in Medi-Cal). | |||||

| c Includes state and county commissions. | |||||

| d Expenditures included in CalWORKs and other Department of Social Services programs. The CalWORKs grant savings from child support are shown as General Fund revenues in 2000-01. | |||||

| Figure 5 | |||||

| Health Services Programs

Proposed Major Changes for 2000-01 General Fund | |||||

| Medi-Cal | Requested: | $8.7 million | |||

| Increase: | $541 million | (+6.6%) | |||

| + $183 million due to higher drug costs and new drugs | |||||

| + $82 million for full-year costs of expanding eligibility of families to 100 percent of poverty level | |||||

| + $52 million due to a reduction in the federal matching rate | |||||

| + $43 million for the state match for county mental health services under the Early and Periodic Screening, Diagnosis, and Treatment Program | |||||

| + $33 million for a 5 percent wage increase for nursing home staff

(included in Aging with Dignity Initiative) |

|||||

| + $30 million to reduce the state "takeout" from payments to disproportionate share hospitals and, potentially, to increase specified physician rates | |||||

| -- $66 million for full-year savings from the waiver to provide federal funds for family planning | |||||

| Healthy Families | Requested: | $142 million | |||

| Increase: | $46 million | (+48%) | |||

| + $46 million for caseload growth and cost increases | |||||

| Public Health | Requested: | $349 million | |||

| Decrease: | $27 million | (-7.1%) | |||

| -- $20 million by eliminating General Fund support for the County Medical Services Program (which was suspended for one year in 1999-00) | |||||

| -- $20 million by using federal rather than state funds to continue the Community Challenge Grants program | |||||

| Figure 6 | |||||

| Social Services Programs

Proposed Major Changes for 2000-01 General Fund | |||||

| CalWORKs | Requested: | $2.1 billion | |||

| Increase: | $78 million | (+3.9%) | |||

| + $198 million due to a technical change related to the child support enforcement program | |||||

| + $112 million for a 3.6 percent cost-of-living adjustment (COLA) | |||||

| -- $496 million by revising the formula for county fiscal incentive payments | |||||

| -- $258 million due to caseload reduction | |||||

| SSI/SSP | Requested: | $2.6 billion | |||

| Increase: | $137 million | (+5.5%) | |||

| + $59 million due to a caseload increase | |||||

| + $55 million for a 3.6 percent COLA | |||||

| Regional Centers | Requested: | $896 million | |||

| Increase: | $87 million | (+11%) | |||

| + $129 million for caseload and cost increases | |||||

| Department of Aging | Requested: | $53 million | |||

| Increase: | $21 million | (+64%) | |||

| + $20 million for a new grants program for adult care alternatives to nursing homes (included in Aging with Dignity Initiative) | |||||

| Child Support Enforcement | Requested: | $332 million | |||

| Increase: | $23 million | (+7.4%) | |||

| + $23 million in local assistance to implement legislative reforms under the supervision of the new Department of Child Support Services | |||||

4. The Budget Proposes to Keep General Fund Spending for CalWORKs at the Federally-Required Maintenance-of-Effort (MOE) Level. The budget uses unexpended federal block grant funds carried over from the current year to help meet federal MOE requirements.

5. The Budget Includes Various Policy Changes, Including the Following: