In California, the federal Medicaid Program is administered by the state as the California Medical Assistance (Medi-Cal) Program. This program provides health care services to welfare recipients and other qualified low-income persons (primarily families with children and the aged, blind, or disabled). Expenditures for medical benefits are shared about equally by the General Fund and by federal funds. The Medi-Cal budget also includes additional federal funding for (1)�disproportionate share hospital (DSH) payments, which provide additional funds to hospitals that serve a disproportionate number of Medi-Cal or other low-income patients, and (2)�matching funds for state and local funds in other related programs.

At the state level, the Department of Health Services (DHS) administers the Medi-Cal Program. Other state agencies, including the California Medical Assistance Commission (CMAC), the Department of Social Services (DSS), the Department of Mental Health (DMH), the Department of Developmental Services (DDS), the Department of Aging, and the Department of Alcohol and Drug Programs receive Medi-Cal funding from DHS for eligible services that they provide to Medi-Cal beneficiaries. At the local level, county welfare departments determine the eligibility of applicants for Medi-Cal and are reimbursed by DHS for the cost of those activities. The federal Health Care Financing Administration oversees the program to ensure compliance with federal law.

Proposed Spending. The budget for DHS proposes Medi-Cal expenditures totaling $23.2�billion from all funds for state operations and local assistance in 2000-01. The General Fund portion of this spending ($8.8�billion) increases by $551�million, or 6.7�percent, compared with estimated General Fund spending in the current year. The remaining expenditures for the program are mostly federal funds ($12.8�billion).

The spending total for the Medi-Cal budget includes an estimated $3�billion (federal funds and local matching funds) for payments to DSH hospitals, and about $1.8�billion of federal funds to match $1.7�billion of state and local funds budgeted elsewhere for programs operated by other departments, counties, and the University of California. Including these other state and local funds, total proposed spending would be about $24.4�billion in 2000-01.

Federal law requires the Medi-Cal Program to provide a core of basic services, including hospital inpatient and outpatient care, skilled nursing care, doctor visits, laboratory tests and x-rays, family planning, and regular examinations for children under the age of 21. California also has chosen to offer 32 optional services, such as outpatient drugs and adult dental care, for which the federal government provides matching funds. Certain Medi-Cal services--such as hospitalization in many circumstances--require prior authorization from DHS as medically necessary in order to qualify for payment.

Currently, more than half (57�percent) of the Medi-Cal caseload consists of participants in the state's two major welfare programs, which include Medi-Cal coverage in their package of benefits. These programs are (1)�the California Work Opportunity and Responsibility to Kids (CalWORKs) program, which provides assistance to families with children and replaces the former Aid to Families with Dependent Children (AFDC) program, and (2)�the Supplemental Security Income/State Supplementary Program (SSI/SSP), which assists elderly, blind, or disabled persons. Counties administer the CalWORKs program and county welfare offices determine eligibility for CalWORKs benefits and Medi-Cal coverage concurrently. Counties also determine Medi-Cal eligibility for persons who are not eligible for (or do not wish) welfare benefits. The federal Social Security Administration determines eligibility for SSI/SSP, and the state automatically adds SSI/SSP beneficiaries to the Medi-Cal rolls.

Generally, persons who have been determined eligible for Medi-Cal benefits (Medi-Cal "eligibles") receive a Medi-Cal card, which they use to obtain services from providers who agree to accept Medi-Cal patients. Medi-Cal uses two basic types of arrangements for health care--fee-for-service and managed care.

Fee-for-Service. This is the traditional arrangement for health care in which providers are paid for each examination, procedure, or other service that they furnish. Beneficiaries generally may obtain services from any provider who has agreed to accept Medi-Cal payments. The Medi-Cal Program employs a variety of "utilization control" techniques (such as requiring prior authorization for some services) designed to avoid costs for medically unnecessary or duplicative services.

Managed Care. Prepaid health plans generally provide managed care. The plans receive monthly "capitation" payments from the Medi-Cal Program for each enrollee in return for providing all of the covered care needed by those enrollees. These plans are similar to health plans offered by many public and private employers. Currently, slightly more than half (2.6�million of the total of 5�million Medi-Cal eligibles) are enrolled in managed care organizations. Beneficiaries in managed care choose a plan and then must use providers in that plan for most services. Since payments to the plan do not vary with the amount of service provided, there is much less need for utilization control by the state. Instead, plans must be monitored to ensure that they provide adequate care to enrollees.

Almost all Medi-Cal eligibles fall into two broad groups of people. They either are aged, blind, or disabled or they are in families with children. Somewhat more than half of Medi-Cal eligibles are welfare recipients. Figure�1 shows for each of the major Medi-Cal eligibility categories, the maximum income limit in order to be eligible for health benefits and the estimated caseload and total benefit costs for 1999-00. The figure also indicates for each category, whether an asset limit applies and whether eligible persons with incomes over the limit can participate on a "spend down" basis. If spend down is allowed, then Medi-Cal will pay the portion of any qualifying medical expenses that exceed the person's "share of cost," which is the amount by which that person's income exceeds the applicable Medi-Cal income limit.

| Figure 1 | |||||

| Who is Eligible for Medi-Cal?

Major Eligibility Categories | |||||

| 1999-00 | |||||

| Maximum Monthly Income Or Granta | Asset Limit Imposed? | Spend Downb Allowed? | Enrollees (Thousands) | Annual Benefit Costs (Millions)c | |

| Aged, Blind, or Disabled Persons | |||||

|

$1,249 | X | -- | 1,162 | $7,267 |

|

954 | X | X | 111 | 742 |

|

Special limits | X | X | 70 | 2,430 |

| Families, Children, and Pregnant Women | |||||

| Families | |||||

|

$1,032d | X | -- | 1,773 | $2,264 |

|

1,482e | X | -- | 1,209 | 1,635 |

|

1,190 | X | X | --f | --f |

| Children and Pregnant Women | |||||

| Children | |||||

|

$2,873 | -- | -- | 52 | --g |

|

1,941 | -- | -- | 127 | $86 |

|

1,482 | -- | -- | 97 | 68 |

|

1,190 | X | X | 254 | 432 |

| Pregnant women | |||||

|

$2,873 | -- | -- | 115 | $445 |

|

1,190 | X | X | 10 | 95 |

| Emergency-Only | |||||

| Undocumented immigrants who qualify in any eligibility group are limited to emergency services (including labor and delivery and long-term care). | 207h | $494 | |||

| a Amounts are for aged or disabled couple (including the standard $20 disregard) or for a four-person family with children (including a $90 work expense disregard). | |||||

| b Indicates whether persons with higher incomes may receive benefits on a share-of-costs basis. | |||||

| c Combined state and federal costs. | |||||

| d Income limit to apply for CalWORKs (including a $90 work expense disregard). After becoming eligible, the income limit increases to $1,717 (family of four) with the maximum earned income disregard. | |||||

| e Applicant income limit of 100 percent of poverty, effective March 1, 2000. Increases to $2,124 after enrollment. | |||||

| f Enrollment and costs included in amounts for Section 1931(b) family coverage. | |||||

| g Costs included in amount for 200 percent of poverty pregnant women group. | |||||

| h About 70,000 additional undocumented immigrants are included in other enrollment categories. | |||||

Aged, Blind, or Disabled Persons. About 1.3�million low-income persons who are (1)�at least 65 years old or (2)�disabled or blind persons of any age receive Medi-Cal coverage. Overall, the disabled make up more than half (61�percent) of this portion of the Medi-Cal caseload. Most of the aged, blind, or disabled persons on Medi-Cal (86�percent) are recipients of SSI/SSP benefits and receive Medi-Cal coverage automatically. The other aged, blind, or disabled eligibles are in the "medically needy" category. They also have low incomes, but do not qualify for, or choose not to participate in the SSI/SSP program. For example, aged low-income noncitizens generally may not apply for SSI/SSP (although they may continue on SSI/SSP if they already were in the program as of August�22, 1996). As another example, about 17�percent of the medically needy persons in this category have incomes above the Medi-Cal limit and participate on a share-of-cost basis.

The number of Medi-Cal eligibles in long-term care is small--only 70,000 people, or 1.4�percent of the total caseload--but because long-term care is very expensive, benefit costs for this group total $2.4�billion, or 15�percent of total Medi-Cal benefit costs.Almost 60�percent of the aged or disabled Medi-Cal eligibles also have health coverage under the federal Medicare Program. Medi-Cal generally pays the Medicare premiums, deductibles, and any co-payments for these "dual beneficiaries," and Medi-Cal pays for services not covered by Medicare, such as drugs and long-term care. Medi-Cal also provides some limited assistance to a small number of Medicare eligibles who have incomes somewhat higher than the medically needy standard.

Families with Children. About 35�percent of all Medi-Cal eligibles are CalWORKs welfare recipients, who receive Medi-Cal coverage under the state's "Section 1931(b)" family coverage category. Section 1931(b) family coverage was created by the 1996 federal welfare reform legislation to replace the former AFDC-linked Medicaid eligibility category. Although CalWORKs recipients constitute the largest single group of Medi-Cal eligibles by far, they account for only 17�percent of total Medi-Cal benefit costs. This is because almost all CalWORKs recipients are children or able-bodied working-age adults, who generally are relatively healthy. Low-income families who are not in CalWORKs may enroll in Medi-Cal in the Section 1931(b) family coverage category or in the medically needy family category. Medi-Cal covers both the adults and the children in these families.

As in CalWORKs, applicants for Medi-Cal family coverage in either the Section 1931(b) or medically needy categories have been restricted to single-parent or unemployed families with very low incomes. Currently (until March 2000), the income limit for families applying for Medi-Cal is about 70�percent of the federal poverty level (FPL) for Section 1931(b) coverage and about 80�percent of the FPL for medically needy coverage. However, once enrolled in Section 1931(b) coverage, families may work and remain on Medi-Cal at higher income levels (up to about 155�percent of the FPL). Families whose incomes are above the Section 1931(b) or medically needy limits, but who meet all of the other medically needy qualifications, may receive Medi-Cal benefits on a share-of-cost basis.

Expansion of Section 1931(b) Family Coverage. Effective March 1, 2000, Chapter�146, Statutes of 1999 (AB 1170, Cedillo) expands Section 1931(b) eligibility to families with incomes up to 100�percent of the FPL, plus applicable income deductions. This expansion has the effect of broadening eligibility for parents since children in families with incomes up to 250�percent of the FPL (plus income deductions) currently are eligible for either Medi-Cal child-only coverage or for coverage under the Healthy Families Program administered by the Managed Risk Medical Insurance Board.

The expansion also will make working parents in two-parent families eligible for Medi-Cal if they meet the income and asset limits. At present, only families with single parents or unemployed parents (defined as working less than 100 hours per month) qualify for Section 1931(b) or medically needy family coverage (these limitations also apply to CalWORKs applicants and will continue for them).

Women and Children. Medi-Cal includes a number of additional eligibility categories for pregnant women and for children. Medi-Cal covers all health care services for poor pregnant women in the medically indigent category, which has the same income and asset limits and spend-down provisions as apply to medically needy families. However, pregnancy-related care is covered with no share of cost and no limit on assets for women with family incomes up to 200�percent of the FPL (an annual income of $34,480 for a family of four, including a $90 monthly work expense disregard).

The medically indigent category also covers children and young adults through age 20. Several special categories provide coverage without a share of cost or an asset limit to children in families with higher incomes--200�percent of poverty for infants, 133�percent of poverty for children ages 1 through 5, and 100�percent of poverty for children ages 6 through 18. Pregnant women and poverty-group children also may use a simplified mail-in application to apply for Medi-Cal or Healthy Families Program coverage (for children above the Medi-Cal income limits).

Emergency-Only Medi-Cal. Noncitizens who are undocumented immigrants, or are otherwise not qualified immigrants under federal law, may apply for Medi-Cal coverage in any of the regular categories. However, benefits are restricted to emergency care (including labor and delivery). Medi-Cal also provides prenatal care and long-term care to undocumented immigrants. These services, as well as nonemergency services for recent legal immigrants, do not qualify for federal funds and are supported entirely by the General Fund.

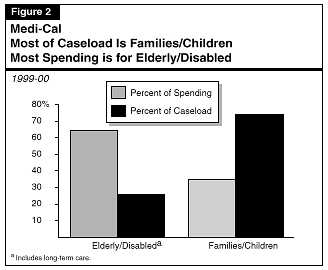

The average cost per eligible for the aged and disabled Medi-Cal caseload (including long-term care) is much higher than the average cost per eligible for families and children on Medi-Cal. As a result, almost two-thirds of Medi-Cal spending is for the elderly and disabled, although they account for only about one-fourth of the total Medi-Cal caseload, as shown in Figure�2.

Figure�3 presents a summary of Medi-Cal General Fund expenditures in the DHS budget for the past, current, and budget years.

The budget estimates that the General Fund share of Medi-Cal local assistance costs will increase by $738�million (9.9�percent) in 1999-00, compared with 1998-99. The bulk of this increase is for benefit costs, which will total an estimated $7.7�billion in 1999-00--an increase of $662�million (9.4�percent). County administration costs increase by an estimated $82.1�million (24�percent).

Our analysis of the Medi-Cal estimate indicates that increases in the cost and utilization of health care goods and services (including provider rate increases) account for the largest portion of the increase in benefit costs--about $425�million. Caseload growth adds about $180�million of General Fund cost, and other factors account for the remainder of the cost increase (about $57�million).

| Figure 3 | |||||

| Medi-Cal General Fund Budget Summarya

Department of Health Services | |||||

| 1998-99 Through 2000-01

(Dollars in Millions) | |||||

| Actual

1998-99 |

Estimated

1999-00 |

Proposed

2000-01 |

Change From

1999-00 |

||

| Amount | Percent | ||||

| Support (state operations) | $65.8 | $69.5 | $79.9 | $10.4 | 15.0% |

| Local Assistance | |||||

| Benefits | $7,002.2 | $7,664.7 | $8,169.8 | $505.1 | 6.6% |

| County administration (eligibility) | 339.7 | 421.7 | 451.0 | 29.2 | 6.9 |

| Fiscal intermediaries (claims processing) | 69.2 | 66.4 | 73.6 | 7.1 | 10.7 |

| Hospital construction debt service | 60.2 | 55.9 | 55.1 | -0.9 | -1.5 |

| Subtotals, local assistance | $7,471.2 | $8,208.8 | $8,749.4 | $540.6 | 6.6% |

| Totals | $7,536.1 | $8,278.2 | $8,829.3 | $551.0 | 6.7% |

| Caseload (thousands of beneficiaries) | 5,061 | 5,192 | 5,289 | 131 | 2.6% |

| a Excludes General Fund Medi-Cal spending budgeted in other departments. | |||||

1999-00 Rate Increases. Roughly $140�million of the General Fund spending increase in the current year is for provider rate increases. Rate increases for nursing homes and other long-term care facilities total $49.3�million, most of which is to increase staffing ratios and raise pay levels for direct-care staff by 5�percent. Various rate increases for physicians, in-home nursing, optometrists, pharmacists, and emergency medical transportation total $33�million. In addition, we estimate that rate increases approved by DHS or by CMAC for Medi-Cal managed care plans increase General Fund costs by roughly $55�million.

Pharmacy and Certain Other Costs Growing Rapidly. The budget estimates that the General Fund cost of payments to pharmacy providers (for drugs and various types of medical supplies) will increase by $205�million, or 26�percent, in the current year. In addition, General Fund costs for the "Other Services" category in the Medi-Cal estimate, which includes durable medical equipment suppliers and adult day health services, will increase by an estimated $46�million (22�percent), compared with 1998-99. Both of these categories include some groups of providers that DHS has targeted for fraud prevention efforts.

Caseload Increase Reflects Backlog of Eligibility Determinations. The budget estimates that caseload in the current year will increase by 132,000 eligibles, or 2.6�percent. (The Governor's Budget Summary states that caseload will grow by much less in the current year and then decline in 2000-01, but this reflects only the "base" caseload before adding the estimated caseload increase from recently-enacted and proposed eligibility expansions.)

The 2.6�percent caseload increase is primarily related to two factors. First, the caseload continues to be inflated by continued delays in determining the Medi-Cal eligibility of former CalWORKs welfare recipients. These are individuals who were automatically continued on Medi-Cal since 1998 pending the development of Section 1931(b) eligibility standards by DHS and the implementation of the resulting complex standards by county welfare departments. A backlog of more than 300,000 eligibility determinations built up, which the budget anticipates will not be eliminated until late 2000-01. By then, the budget estimates that half of the backlogged caseload will be dropped from the Medi-Cal rolls due to a lack of response by (or inability to locate) beneficiaries or due to a determination of ineligibility.

The second factor increasing the caseload is the expansion of Section 1931(b) eligibility enacted as part of the 1999-00 budget. This expansion will take effect in March 2000, increasing the average caseload for the current year by 83,000. Also, contributing to the growth in caseload costs is a moderate growth in the number of disabled SSI/SSP recipients. Although the size of this caseload increase is modest (about 19,000 eligibles or 2.6�percent), it results in a disproportionate cost increase due to the relatively greater health care needs of this group.

Reduction in State DSH Payment "Takeout." The 1999-00 budget reduced by $30�million the portion of county matching funds for DSH hospital payments that the state diverts to offset General Fund Medi-Cal costs. This state "takeout" now has been gradually reduced from $239.8�million in 1995-96 to a current level of $84.8�million.

County Administration. The General Fund share of county administration costs for eligibility determinations, outreach, and related activities increases by $82.1�million, or 24�percent. The large increase results from rapid growth in the nonwelfare caseload. The county administration costs budgeted in Medi-Cal exclude (with some minor exceptions) eligibility determination costs for welfare recipients because those costs are budgeted elsewhere or not paid by the state. Eligibility determination costs for CalWORKs recipients are included in the DSS' budget for the CalWORKs program, and the federal government performs SSI/SSP eligibility determinations. The rapid increase in the nonwelfare caseload reflects both ongoing caseload growth and a shift of Medi-Cal eligibles to nonaided categories as the CalWORKs welfare population declines.

The 1999-00 Budget Act anticipated some of the ongoing Medi-Cal cost increase and provided funding for legislatively approved rate increases, the expansion of Section 1931(b) family eligibility, and the reduction in the DSH takeout. The Governor's budget caseload estimate, however, is substantially above the budget act estimate, and savings assumed from certain federal actions either did not occur or resulted in less than the budgeted amount of savings.

Budget Estimates Caseload Will Increase Rather Than Decline. The 1999-00 Budget Act anticipated that total Medi-Cal caseload would decline by 193,000 eligibles (3.8�percent) in the current year compared with 1998-99. The Governor's budget now estimates that caseload will increase by 132,000 (2.6�percent)--a difference of 325,000 eligibles from the budget act estimate. This additional caseload increases Medi-Cal General Fund costs by roughly $250�million compared with the budget act estimate.

In addition to continued delays in eliminating the backlog of eligibility determinations for former CalWORKs recipients, two other factors also contribute to the additional caseload costs. First, the Governor's budget estimates that the number of pregnant women and children enrolled in the poverty-level eligibility groups will be 48,000 above the budget act forecast. Second, the number of aged, blind or disabled Medi-Cal eligibles (including those in long-term care) has increased by about 12,000, compared with the budget act estimate. Although this portion of the caseload increase is relatively small, it adds about $55�million of General Fund cost due to the greater health care expenses of these groups.

Savings from Federal Assumptions Fall Short. The 1999-00 Budget Act assumed that the federal government would make an upward adjustment to the Federal Medical Assistance Percentage (FMAP) for California--the federal matching rate for Medi-Cal expenditures--in order to correct for an underestimate of the state's population in the formula used to calculate the FMAP. The budget assumed a General Fund savings of $210�million in 1999-00 due to this adjustment. The federal government did not make the adjustment, however, so these savings will not occur.

The budget also assumed federal approval, effective July 1, 1999, of a Medicaid waiver to provide 90 percent federal funding for previously state-funded family planning services for low-income persons not otherwise eligible for Medi-Cal. The waiver was not approved until December�1, 1999, and was somewhat less comprehensive than anticipated. As a result, the budget estimates that General Fund spending will be $93.5�million more than the amount provided in the 1999-00 Budget Act.

Unbudgeted 1999-00 Managed Care Rate Increases. Most of the current-year deficiency results from unbudgeted caseload and unrealized federal assumptions, as noted above. However, rate increases granted by the department to Medi-Cal managed care plans in the 12 counties that operate under the "two-plan" model add an additional $39.7�million of General Fund costs to the deficiency amount.

The Governor's budget estimates that total General Fund spending for Medi-Cal local assistance (in the DHS budget) will be $8.7�billion in 2000-01, an increase of $541�million, or 6.6�percent, compared with estimated spending in the current year. The budget estimates that the Medi-Cal caseload will increase by 97,000 (1.9�percent) in the budget year to a total of almost 5.3�million average monthly eligibles--about 15�percent of the state's population. Most of the added spending is for Medi-Cal benefit costs, which are projected to increase by $505�million (6.6�percent) in 2000-01. Figure�4 shows the major components of the increase in benefit costs.

Increased Cost and Utilization of Services--$264.2�Million. Based on the budget's projections, General Fund costs for Medi-Cal benefits will increase by about 3.4�percent in 2000-01 due to provider rate increases, cost increases for goods and services, and increased use of services by beneficiaries. The department attributes about two-thirds of this increase to spending on drugs. This includes price and utilization increases for existing drugs and for new drugs added to the Medi-Cal formulary. Medi-Cal "buy-in" payments for Medicare premiums also are increasing. Medi-Cal pays Medicare premiums for Medi-Cal enrollees who also are eligible for Medicare (dual eligibles) in order to obtain 100�percent federal funding for those services covered by Medicare. The budget estimates that the General Fund cost of these buy-in payments will increase by $36.2�million in 2000-01. The budget also projects a 30�percent increase ($9.9�million General Fund) in the use of adult day health care services, which the budget attributes to the effect of state start-up grants and the entry of for-profit providers into this market.

| Figure 4 | |

| Medi-Cal Benefits

Major General Fund Spending Changes Governor's Budget | |

| 2000-01

(In Millions) | |

| Increased Price and Utilization of Services | $264.2 |

| Increased pharmacy costs | 180.0 |

| Increased cost for Medicare premiums | 36.2 |

| Additional 5 percent long-term care wage pass-through | 32.5 |

| Full-year cost of 1999-00 increase in long-term care staffing ratio | 17.1 |

| Expanded use of adult day health care | 9.9 |

| Expanded family planning services authorized in 1999-00 budget | 7.3 |

| Increase in pharmacist dispensing fee (Chapter 190, Statutes of 1999 [SB 651, Burton]) | 3.3 |

| Increased savings from antifraud activities | -9.9 |

| Other | -12.2 |

| Cost of Increased Caseload | $137.7 |

| Full-year impact of Section 1931(b) expansion | 81.9 |

| Increase in ongoing disabled caseload | 68.6 |

| Expanded eligibility for aged, blind, and disabled | 4.7 |

| Other | -17.3 |

| Pass-Through Funding for Other Departments | $95.6 |

| Short-Doyle Mental Health Early and Periodic Screening, Diagnosis and Treatment services | $43.1 |

| State mental hospitals and developmental centers | $24.8 |

| Regional center and community-based developmental services | 27.7 |

| Changes in Financing, Payments, and Recoveries | $7.6 |

| One-time recoupment in 1999-00 of past hospital overpayments | 54.2 |

| Reduction in federal matching rate | 51.6 |

| Reduce state disproportionate share hospital takeout/increase physician rates | 30.0 |

| Full-year federal funding in 2000-01 for family planning waiver | -66.3 |

| One-time cost in 1999-00 for federal disallowance of past charges for institutions for mental diseases | -43.9 |

| Other | -17.9 |

| Total | $505.1 |

The budget proposes to continue funding ancillary services to patients in institutions for mental diseases (IMDs) through 2000-01 at a General Fund cost of $12.5�million. The 1999-00 budget continued funding for these services on a state-only basis for 1999-00 after the federal government determined that they did not qualify for Medicaid funding. Absent this state program, county indigent health care systems would become responsible for these services. Several new budget proposals also contribute to the projected General Fund spending changes:

Caseload Increases--$137.7�million. The largest caseload-related cost increase ($81.9�million General Fund) is for the expansion of Section 1931(b) family coverage to applicants in working families with incomes up to the poverty level. The budget estimates that this eligibility expansion will add 247,000 average monthly eligibles to the Medi-Cal caseload in 2000-01. Because this expansion begins in March 2000, the cost in the current year is one-third of the full-year cost budgeted in 2000-01.

The budget also projects an increase of about 18,500 disabled Medi-Cal eligibles due to ongoing caseload trends. Although this caseload increase is modest, the relatively high healthcare costs of this group result in an added General Fund cost of about $69�million. In addition, the budget includes the following two eligibility expansions for the aged, blind, or disabled (one of which was previously enacted by the Legislature):

Pass-Through Funding Increases for Other Departments/Programs--$95.6�Million. The DHS Medi-Cal budget includes increases in General Fund costs for some services provided to Medi-Cal beneficiaries in programs operated or supervised by DMH or DDS. These services include state hospitals and developmental centers operated by DMH and DDS, respectively; and services to developmentally disabled Medi-Cal beneficiaries living in the community who are served by regional centers throughout the state. The budget also includes an increase of $43.1�million (45�percent) for mental health Early and Periodic Screening, Diagnosis, and Treatment services to children provided through county mental health programs. (We discussed the rapid rate of spending increase for this program last year in our Analysis of the 1999-00 Budget Bill [please see page C-85 of that Analysis].)

Changes to Financing, Payments, and Recoveries--$7.6�Million. The relatively small spending increase in this category results from a number of larger offsetting adjustments. Improving personal income in California results in a slight reduction in the FMAP pursuant to the formula for determining the federal matching rate. The FMAP reduction increases the General Fund share of Medi-Cal costs by $51.6�million in 2000-01. In addition, budget-year adjustments delete a one-time gain in 1999-00 from recoveries of past Medi-Cal "crossover" overpayments to hospitals for services to dual (Medi-Cal/Medicare) beneficiaries and a one-time 1999-00 cost to repay the federal government for disallowed past IMD charges. Finally, the budget estimates increased General Fund savings of $66.3�million in 2000-01 because the federal family planning waiver will provide enhanced federal funding for the full year.

In addition, the budget proposes a further reduction in the state's DSH "takeout" of up to $30�million, with the benefit to be shared among both public and private DSH hospitals. The budget also indicates that as an alternative to reducing the DSH takeout by the full $30�million the takeout reduction could be a lesser amount, with the difference used to increase Medi-Cal rates paid to emergency physicians and on-call specialists.

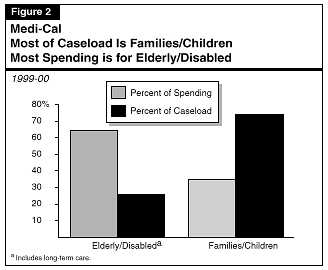

Figure�5 illustrates how Medi-Cal caseload and per-eligible costs have changed since 1990-91, along with projections of caseload and costs per eligible for 1999-00 and 2000-01 based on the budget estimates.

After earlier dips in the growth of costs and caseloads, the budget forecasts that both the cost of benefits per eligible and the number of eligibles will grow steadily through the current year and 2000-01.

Caseload. The number of persons enrolled in Medi-Cal grew rapidly in the early 1990's--caseload growth in 1991-92 was almost 14�percent over the prior year. Between 1990-91 and 1995-96, the Medi-Cal average monthly caseload grew from 4.1�million eligibles to 5.5�million. The rapid growth resulted from the ongoing effects of Medicaid eligibility expansions enacted in the late 1980s and from increased welfare caseloads associated with the severe recession that California experienced at that time.

In the mid-1990s, the Medi-Cal caseload leveled off, and then dropped by almost 300,000 eligibles (5.4�percent) in 1997-98. Again, the change in the Medi-Cal caseload roughly paralleled changes in the CalWORKs welfare caseload, which also began a sharp drop at that time in response to the turnaround in the state's economy and greater emphasis on moving families from welfare to work in the wake of enactment of state and federal welfare reform legislation. Another factor contributing to declining welfare and Medi-Cal caseloads probably was reluctance among immigrant Californians to make use of public benefits because of concerns about whether such use might adversely affect their ability to naturalize or to sponsor the immigration of family members in the future.

During 1997-98 and 1998-99, the Medi-Cal caseload has been relatively flat while the CalWORKs caseload has continued to decline. The Medi-Cal caseload has not declined primarily because of the backlog of eligibility determinations for former CalWORKs recipients that resulted from the delay in implementation of Section 1931(b) Medi-Cal eligibility by DHS and the counties. In the current year and 2000-01, the budget estimates that the Medi-Cal caseload will grow once more, primarily because of the expansion of Section 1931(b) family eligibility enacted as part of the 1999-00 budget.

Cost Per Eligible. While the caseload has gone up and down, the cost trend has been almost steadily upward. The average annual growth rate of the estimated cost of benefits per eligible (excluding pass-through funding to other departments and local governments) is 4�percent, which is twice the rate of general inflation during this period, as measured by the Gross Domestic Product deflator.

The temporary dip in the cost-per-eligible that occurred in 1994-95 and 1995-96 was partly the result of a change in the caseload mix, rather than an underlying drop in health care costs. This is because the rapid increase in the number of families on welfare (whose health care costs are relatively low) temporarily reduced the proportion of aged and disabled persons (relatively high-cost groups) in the Medi-Cal caseload, and this change in the mix tended to reduce the average cost per eligible. As the CalWORKs welfare caseload subsequently fell, the elderly and disabled share of the Medi-Cal caseload returned to its earlier level of about 26�percent, and the cost per eligible resumed its growth.

In 1998-99, the estimated cost per eligible for DHS Medi-Cal benefits increased by 7.6�percent. Based on the Governor's budget, these costs will increase by 5.5�percent in the current year and 4.7�percent in the budget year. The apparent slowing of the growth rate in 2000-01, however, results from the failure to include in the estimate funding for likely rate increases for nursing homes and managed care plans. Including an allowance for these would increase the 2000-01 growth rate to almost the current-year rate of 5.5�percent.

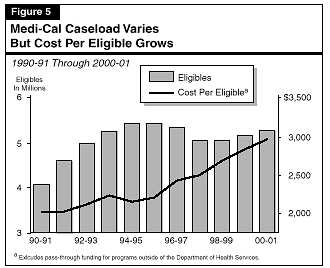

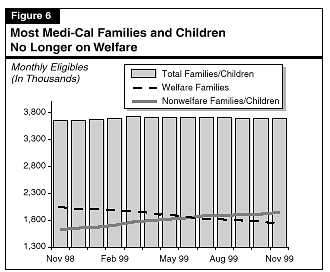

In July 1999, as shown in Figure�6, the Medi-Cal Program reached a milestone. For the first time in the program's history, welfare recipients accounted for less than half of the families (including pregnant women) and children enrolled in Medi-Cal. Medi-Cal began as a program to provide health care to welfare recipients. Most of the elderly and disabled persons in Medi-Cal continue to be welfare (SSI/SSP) recipients, but the combination of declining family welfare (CalWORKs) caseloads, expanded eligibility for families and children who are not on welfare, and stronger outreach efforts has reduced the CalWORKs share of families and children in Medi-Cal to less than half.

We find that the budget's estimate for the Medi-Cal caseload of families and children is likely to be too high, based on current trends. General Fund caseload savings could total as much as $150�million through 2000-01. However, a number of factors currently add considerable uncertainty to Medi-Cal caseload projections. Accordingly, we will monitor caseload trends and recommend appropriate adjustments at the time of the May revision to the Governor's budget.

Figure 7 (see next page) illustrates the budget's forecast for the Medi-Cal caseload in the current year and 2000-01. Estimated caseload growth for the aged and disabled is 2.2�percent in the current year and 2.4�percent in 2000-01, with most of the growth in the disabled portion of the caseload. The budget forecast for the aged and disabled appears reasonable. It includes the effects of the eligibility expansions for this group (discussed earlier) and is in line with recent caseload trends.

| Figure 7 | |||||||

| Medi-Cal Caseload

Governor's Budget Estimate | |||||||

| 1998-99 through 2000-01

(Eligibles in Thousands) | |||||||

| 1998-99 | 1999-00 | Change from 1998-99 | 2000-01 | Change From 1999-00 | |||

| Amount | Percent | Amount | Percent | ||||

| Families/Children | 3,741 | 3,844 | 103 | 2.8% | 3,909 | 65 | 1.7% |

| CalWORKsa | 2,025 | 1,773 | -252 | -12.4 | 1,686 | -87 | -4.9 |

| Nonwelfare familiesb | 1,127 | 1,419 | 292 | 25.9 | 1,546 | 127 | 8.9 |

| Pregnant women | 157 | 175 | 18 | 11.7 | 182 | 7 | 4.1 |

| Children | 433 | 478 | 45 | 10.3 | 495 | 17 | 3.6 |

| Aged/Disabled | 1,320 | 1,348 | 28 | 2.2% | 1,380 | 32 | 2.4% |

| Aged | 489 | 497 | 8 | 1.6 | 506 | 9 | 1.9 |

| Disabled | 831 | 851 | 21 | 2.5 | 874 | 22 | 2.6 |

| Totals | 5,061 | 5,192 | 132 | 2.6% | 5,289 | 97 | 1.9% |

| a California Work Opportunity and Responsibility to Kids program. | |||||||

| b Includes former CalWORKs recipients temporarily continued in the "Edwards" category. | |||||||

As Figure�7 shows, the majority of the forecasted Medi-Cal caseload growth consists of families and children. The budget estimates that increasing caseloads of nonwelfare families and children will more than offset declining CalWORKs caseload. This will result in a net increase of 103,000 eligibles in the current year compared with 1998-99, and an additional increase of 65,000 in 2000-01. As noted earlier, the forecast includes the effect of the Section 1931(b) eligibility expansion to be implemented on March�1, 2000, which the budget estimates will add 246,000 persons to the Medi-Cal rolls. The estimated average monthly caseload for the full year in 1999-00 increases by only 82,000 because the expansion will be in place for only one-third of the current year.

The budget estimates an average monthly ongoing caseload of 3,758,000 family and child eligibles in the current year (excluding the 1931[b] eligibility expansion). Based on our review, we believe that this estimate is likely to be overstated for two reasons. First, the actual caseload for November 1999 was 3,688,000 (70,000 below the estimate for the year). Second, Los Angeles County indicates that it is rapidly clearing its large backlog of former CalWORKs recipients. Based on preliminary results of this process, the ongoing caseload in Los Angeles County could decline by as much as 80,000 by March 2000.

Based on the declining statewide caseload trend for families and children and the potential additional reduction in Los Angeles County, the budget caseload estimate for the current year could be as much as 150,000 too high. If this caseload reduction carries through the budget year as well, then the combined two-year General Fund savings could be on the order of $150�million.

While we believe that some caseload savings are likely, we do not recommend a specific adjustment at this time because a number of factors currently add an unusual degree of uncertainty to caseload projections. These factors include (1)�the recent shift to a predominantly nonwelfare caseload of families and children, (2)�continued delays and difficulties in the implementation of Section 1931(b) eligibility determination by the counties, (3)�the actual magnitude and timing of the caseload reductions resulting from the backlog elimination in Los Angeles County and elsewhere, and (4)�the actual caseload effect of the scheduled Section 1931(b) eligibility expansion. Accordingly, we will continue to monitor Medi-Cal caseload trends and recommend appropriate adjustments at the time of the May revision to the Governor's budget.

We find that the Department of Finance (DOF) did not provide the Legislature with notification of the 1999-00 Medi-Cal deficiency as required by Section 27.00 of the 1999-00 Budget Act. In addition, the administration's proposed Medi-Cal deficiency includes some spending that does not appear to meet the requirements of Section�27.00. We recommend that the DOF report at budget hearings on how it intends to meet the requirements of Section 27.00 with respect to future deficiencies.

The Governor's budget indicates that DHS will incur a deficiency of $562.5�million in the current year, essentially all for the Medi-Cal Program. In other words, DHS expects to spend $562.5�million more in the current year than the Legislature has appropriated. This spring the DOF will ask the Legislature to provide the additional funding, presumably as part of the annual omnibus deficiency bill.

Section 27.00 Requirements. Section 27.00 of the 1999-00 Budget Act (as in each annual budget act) generally requires the Director of DOF to notify the chairperson of the Joint Legislative Budget Committee and the chairpersons of the fiscal committees in the Assembly and Senate of any deficiency spending request for more than $500,000 within 15 days of receiving that request from a department or other entity. Section 27.00 also requires the Director to notify the chairpersons if he or she intends to approve the request, and provides a 30-day waiting period to allow for legislative consideration or comment prior to approval of the deficiency request. The DOF, however, did not notify the Legislature of either the DHS request for the Medi-Cal deficiency or the administration's approval of the deficiency.

Medi-Cal deficiency spending that results from caseload changes is exempt from the Section 27.00 notification requirement. As discussed earlier in this analysis, we estimate that the caseload-related portion of the deficiency is about $250�million. The remainder of the deficiency, about $313�million, is not covered by the caseload exemption.

The DOF contends that including the Medi-Cal deficiency in the current-year spending estimate in the Governor's budget meets the requirements of Section 27.00. We disagree. The notification requirements in Section 27.00 are intended to (1)�highlight individual deficiencies for legislative review and (2)�address how they meet the statutory requirements for deficiency spending--namely that the added spending must be both "unanticipated" and confined to "cases of actual necessity." Simply including deficiencies in budget estimates accomplishes neither of these purposes.

Most of the proposed Medi-Cal deficiency would meet the tests of Section 27.00, according to our review, because it is needed to compensate for shortfalls in federal funds over which DHS had no control and which must be backfilled in order to maintain existing Medi-Cal services. Nevertheless, the administration's expectation that this spending would be consistent with Section 27.00 does not exempt it from the section's notification requirements.

Medi-Cal Deficiency Includes Some Discretionary Spending. However, the Medi-Cal deficiency also includes some spending that does not appear to meet the requirements of Section 27.00--specifically, the cost of managed care rate increases that were not funded in the budget, but were subsequently granted by DHS. These rate increases, which we discuss in more detail in the following issue, are discretionary. Since DHS reviews managed care rates on a regular schedule, these events are hardly unanticipated, and the department has not made a case that the specific rate increases granted this year were compelled by necessity. The department made policy choices in deciding on rate increases without legislative review. For example, DHS chose to freeze the rates of two plans that would otherwise have received rate reductions under the methodology employed by the department. The lack of timely notification, however, limits the Legislature's options because health plans have used the administration's approved rates in their budgeting for the current year and are now receiving these funds.

The authority to incur deficiencies represents a substantial legislative delegation of spending discretion to the executive branch. As such, the administration's use of this authority warrants careful monitoring and oversight by the Legislature. Consequently, we recommend that the DOF report at budget hearings on how it intends to comply with the requirements of Section 27.00 for future deficiencies. In the General Government section of this analysis, we also identify a number of broader, budget-wide issues concerning the application of Section 27.00, and we withhold recommendation on this provision for 2000-01, pending resolution of those issues.

We recommend that the Departments of Finance and Health Services report at budget hearings on (1)�their plans for considering Medi-Cal managed care rate increases in 2000-01 and (2)�the potential amount of additional funding needed in 2000-01 for managed care rate increases.

Managed Care Rate Increases in the Current Year. As discussed above, a portion of the 1999-00 Medi-Cal deficiency is for rate increases that DHS has granted to Medi-Cal managed care plans. In October 1999, DOF approved rate increases proposed by DHS for Medi-Cal managed care plans operating in the 12 counties under the "two-plan" model (primarily those counties with the largest Medi-Cal caseloads). These rate increases average 6.5�percent and were effective October 1, 1999. The General Fund cost for the 1999-00 rate increases in the two-plan counties is $42.3�million. A small portion of this amount represents an allocation of funding appropriated in the 1999-00 Budget Act for specific provider rate increases (for surgeons, for example). However, most of the cost of the rate increase--about $39.7�million--was not budgeted and contributes to the large Medi-Cal deficiency in the current year. In addition to the two-plan rate increases, other rate increases were granted to the five county-organized health systems and to health plans in the two counties operating under the geographic managed care model (Sacramento and San Diego). However, the amounts of these rate increases are negotiated by CMAC and therefore are confidential.

Potential Budget-Year Costs. The budget request for 2000-01 does not include any additional funding for Medi-Cal managed care rate increases, although increases typically have been granted every year. Excluding these costs results in an underbudgeting bias in the Medi-Cal Program. Furthermore, as discussed in the issue above, the deficiency process is not an appropriate funding mechanism for these rate increases. Thus, we recommend that DHS and DOF report at budget hearings on (1)�their plans for considering Medi-Cal managed care rate increases in the 2000-01 budget and (2)�the potential amount needed to provide for these rate increases.

We recommend General Fund reductions of $6.8�million in 1999-00 and $19.1�million in 2000-01 because recent payment data indicate that savings from the department's efforts to prevent Medi-Cal provider fraud are greater than the savings anticipated in the budget. (Reduce Item 4260-101-0001 by $19,088,000.)

Background. The department's antifraud efforts initially have focused on the following four types of providers of outpatient medical equipment, supplies, or services:

Recent rapid increases in the number of providers and claims among these groups, which had no apparent relationship to caseload or program changes, were potential indicators of an upswing in fraudulent activity. The department--along with the State Controller's Office, the Bureau of Medi-Cal Fraud in the Department of Justice, and the Federal Bureau of Investigation--began to focus intensified investigative and enforcement activities on these provider groups in 1998-99. The 1999-00 Budget Act and budget trailer bill legislation provided DHS with additional antifraud resources--specifically, funding for 41 positions and enhanced statutory authority to fight Medi-Cal provider fraud.

In August 1999, DHS implemented a provider review and reenrollment process for all of the providers in the targeted groups. Providers were mailed letters and asked whether they wished to continue to participate in the Medi-Cal Program. Those who responded positively were required to provide additional information and were visited by field staff of the DHS Medi-Cal Fraud Prevention Bureau to check for indicators of fraudulent activities. A significant number of providers did not respond or did not seek continued Medi-Cal participation and were removed from the Medi-Cal provider rolls, including 31�percent of DME providers and 18�percent of P&O providers.

Budget Understates Current-Year Savings. Medi-Cal payment data through November 1999 indicate that these efforts have begun to pay off. Claims by, and payments to, DME and P&O providers have declined significantly compared with 1998-99. Payments per processing day are down by 9.7�percent and 26�percent for DME and P&O providers, respectively. Based on this recent payment data, we estimate that the reduction in total payments to these two provider groups in 1999-00 will be $18.4�million ($8.9�million General Fund) compared with 1998-99. This estimate of General Fund savings for the current year is $6.8�million more than the Governor's budget estimate of current-year savings that will result from antifraud efforts for all types of Medi-Cal providers (excluding family planning providers).

Projected Budget-Year Savings Also Too Low. The budget estimates that savings in 2000-01 from the positions added in the current year will grow by 270�percent over the current year, as the additional staff are hired and trained and as antifraud activities affect more types of providers. Using this growth factor in conjunction with our estimate of current-year savings, we estimate that savings in 2000-01 due to the ongoing efforts of the positions added in the current year will exceed the budget savings estimate for 2000-01 by $19.1�million (General Fund). Accordingly, we recommend a General Fund reduction of $19.1�million in Medi-Cal expenditures for 2000-01.

Savings Could Be Much Larger. Savings potentially could be much larger than our estimate because our current-year estimate is conservative. We note, in this respect, that the current-year data so far do not reflect savings from antifraud efforts related to pharmacies, clinical laboratories, and medical transportation. Payments to these three types of providers total about $1.5�billion--more than five times greater than payments to DME and P&O providers combined. Thus, as the department's antifraud activities become more fully implemented and affect these additional types of providers, savings should increase significantly.

We withhold recommendation on a proposed General Fund augmentation of $30�million to reduce the state "takeout" from disproportionate share hospital funding and/or to increase Medi-Cal provider rates, pending receipt of a specific proposal for the use of the funds.

The budget proposes a General Fund augmentation of $30�million in 2000-01 to reduce the state "takeout" from intergovernmental transfers used to finance hospital DSH payments. Alternatively, the budget indicates that a portion of the funds could be used to increase Medi-Cal rates for emergency room physicians and on-call specialists.

Counties that operate hospitals, the University of California, and hospital districts make these intergovernmental transfers to the state under formulas in state law. These transfers, which total about $1�billion, provide the state match to draw down federal funds which are paid to both public and private hospitals in California serving a disproportionate share of low-income patients. The state takeout, currently $84.8�million, is the amount of these transfers that the state retains to offset General Fund Medi-Cal costs. In effect, the state takeout is an extra "fee" on top of the usual nonfederal match that the transferring enmities pay in order to receive their federal DSH funds. Reducing the DSH takeout lessens the amount of intergovernmental transfers that these entities must provide to the state in order to receive their federal DSH allotment.

At present, the administrations's proposal is unclear regarding how much of the proposed $30�million augmentation would be used to reduce the takeout versus increasing provider rates; nor does the budget specify how the takeout reduction would be allocated or how the potential rate increases would be structured. Accordingly, we withhold recommendation on the $30�million augmentation, pending receipt of a specific proposal that addresses these issues.

We recommend a General Fund reduction of $2.9�million in 1999-00 and $4.6�million in 2000-01 (and an equivalent increase in federal funds) because the state will receive Hepatitis A vaccine for children enrolled in Medi-Cal at no state cost through the federal Vaccines for Children Program. (Reduce Item 4260-101-0001 by $4,588,000.)

The budget requests $12.6�million ($7.7�million General Fund) in 2000-01 for Hepatitis A vaccinations for children. In October 1999, the Advisory Committee on Immunization Practices of the federal Centers for Disease Control recommended that children in California receive the Hepatitis A vaccine. The budget request assumes that the state will purchase the Hepatitis A vaccine through the Medi-Cal Program at the usual state/federal cost-sharing ratio. However, Hepatitis A vaccine now is covered by the federal Vaccines for Children Program, which pays for the entire cost of vaccines for children who are enrolled in Medi-Cal or who are uninsured. Only the fee paid to health providers for administering the vaccinations ($7.50 per vaccination) will require state matching funds. About one-fourth of the amount requested in the budget is for the cost of paying providers for vaccine administration.

Based on cost factors provided by DHS, we estimate that the General Fund savings, compared with the budget request, will be $4.6�million in 2000-01. Accordingly, we recommend a General Fund reduction of this amount. We also note that federal funding for Hepatitis A vaccines will result in a current-year savings of $2.9�million because this vaccine has been provided through Medi-Cal since January 1, 2000.

We recommend that the department report during budget hearings regarding when and how it intends to provide certain legislative committees with access to the DataScan component of the Medi-Cal Management Information System/Decision Support System, as required by existing law.

The department currently is implementing the final phase of its new Medi-Cal Management Information System/Decision Support System (MIS/DSS). The MIS/DSS is a comprehensive information system that (1)�contains comprehensive detailed data on the use of services, provider payments, and eligibility, and (2)�organizes the large amounts of data that it contains into a database with software that provides both standard reports and answers to individual inquiries. Potentially, the MIS/DSS can be an extremely powerful tool in understanding how Medi-Cal is used, determining the effectiveness of different treatment approaches, and detecting patterns of fraud or abuse. The total cost of system development exceeds $40�million.

The Medi-Cal MIS/DSS data can be accessed in two ways. One is through "Panorama View," which is a management information system that provides access to the data after they have been aggregated and compiled in certain ways. For example, Panorama View can show how many prescriptions Medi-Cal pays for each month for all beneficiaries statewide, or for certain subgroups, such as elderly Medi-Cal beneficiaries in Los Angeles County. Another way to access the data is through "DataScan." This system can answer much more specific questions, such as how much of a particular drug Medi-Cal purchases. DataScan also has the ability to track courses of care in order to answer questions such as whether the use of a specific drug for a particular condition reduces the need for hospitalization.

Existing law requires DHS to provide the fiscal and health policy committees of the Legislature with access to both the management information system (Panorama View) and the ad hoc reporting system (Data Scan) with safeguards to protect patient privacy by the conclusion of Phase 3 of the MIS/DSS. Although the department provided the designated legislative committees with access to Panorama View during fall 1999, it has not yet provided the required access to the more powerful DataScan system even though both Phase 3 and Phase 4 of the project have been completed. The department has not explained why the required access to the DataScan system has not been provided or when it will be provided.

Accordingly, we recommend that the department report to the budget committees regarding when and how it intends to provide the designated legislative committees with access to the DataScan component of the Medi-Cal MIS/DSS information system.