Legislative Analyst's OfficeAnalysis of the 2001-02 Budget Bill |

The budget includes an increase in K-12 Proposition 98 funding of almost $3.2 billion in the budget year. This is $479 per pupil, or 7.1 percent, more than the revised estimate of per-pupil expenditures in the current year.

Figure 1 shows the budget from all significant sources for K-12 education for the budget year and the two previous years. As the figure shows, Proposition 98 funding constitutes over three-fourths of overall K-12 funding. For 2001-02, the budget proposes to increase K-12 Proposition 98 funding by almost $3.2 billion above revised current-year estimated expenditures. This represents an increase of $479 per pupil, or 7.1 percent, on an average daily attendance (ADA) basis, bringing Proposition 98 per-pupil spending to $7,174.

|

Figure 1 |

|||||

|

K-12 Education Budget Summary |

|||||

|

1999-00 Through 2001-02 |

|||||

|

|

Change From |

||||

|

Actual |

Estimated 2000-01 |

Proposed 2001-02 |

Amount |

Percent |

|

|

K-12 Proposition 98 |

|||||

|

State (General Fund) |

$25,269.7 |

$27,192.2 |

$29,471.0 |

$2,278.7 |

8.4% |

|

Local property tax revenue a |

10,100.4 |

10,894.9 |

11,779.1 |

884.2 |

8.1 |

|

Subtotals, Proposition 98 |

($35,370.1) |

($38,087.1) |

($41,250.1) |

($3,163.0) |

(8.3%) |

|

Other Funds |

|||||

|

General Fund |

|||||

|

Teachers' retirement |

$864.4 |

$833.8 |

$807.2 |

-$26.6 |

-3.2% |

|

Bond payments |

877.9 |

1,075.7 |

1,141.6 |

65.9 |

6.1 |

|

Other programs |

165.0 |

745.8 |

661.1 |

-84.6 |

-11.3 |

|

State lottery funds |

769.4 |

826.4 |

826.4 |

— |

— |

|

Other state funds |

50.6 |

54.4 |

61.0 |

6.6 |

12.1 |

|

Federal funds |

4,131.7 |

4,681.8 |

4,542.9 |

-138.9 |

-3.0 |

|

Other local funds |

3,454.2 |

3,454.2 |

3,454.2 |

— |

— |

|

Subtotals, Other Funds |

($10,313.3) |

($11,672.2) |

($11,494.5) |

(-$177.7) |

(-1.5%) |

|

Totals |

$45,683.3 |

$49,759.3 |

$52,744.6 |

$2,985.2 |

6.0% |

|

K-12 Proposition 98 |

|||||

|

Average Daily |

5,606,894 |

5,688,675 |

5,750,105 |

61,430 |

1.1% |

|

Amount per ADA |

$6,308 |

$6,695 |

$7,174 |

$479 |

7.1% |

a Department of Finance estimate. The Legislative Analyst's Office estimates that the amount is $74 million less in 2000-01 and $108 million less in 2001-02, requiring General Fund backfills of equal amounts. |

|||||

Spending for K-12 education from all sources is projected to increase by nearly $3 billion, or 6 percent, above the current-year level. This reflects the budget's estimate that several non-Proposition 98 funding sources either will not grow or will decline. This estimate, however, probably understates the resources that will be available. For example, as we discuss elsewhere in this chapter, the state will be receiving a considerable amount of federal funds in the budget year that are not included in the budget.

The budget proposes a General Fund K-12 Proposition 98 funding increase of approximately $2.3 billion. The budget estimates an increase in local property taxes allocated to school districts and county offices of education of $884 million, which brings the total Proposition 98 increase for K-12 education to more than $3.2 billion. The administration, however, miscalculated its estimate of property tax revenues to be allocated to school districts during the current and budget years. This miscalculation results in an overstatement of property tax revenues to the schools of $74 million in 2000-01 and $108 million in 2001-02. This overstatement does not affect the total amounts of Proposition 98 funds available to schools in either fiscal year, but does affect the budget's estimate of the portion that must be contributed from the state General Fund. Thus, this error causes the budget to overstate the General Fund reserve by a total of $182 million.

Figure 2 highlights the significant changes proposed for K-12 Proposition 98 funds in the budget year. Major changes include:

|

Figure 2 |

|

|

Governor's K-12 Budget Proposals 2001-02 Proposition 98 |

|

|

(In Millions) |

|

|

2000-01 (revised) |

$38,087.1 |

|

Enrollment Growth |

|

|

Revenue Limits |

$323.2 |

|

Categoricals |

139.3 |

|

Subtotal |

($462.5) |

|

Cost-of-Living Increases |

|

|

Revenue Limits |

$1,036.6 |

|

Categoricals |

380.5 |

|

Subtotal |

($1,417.1) |

|

Funding Adjustments |

|

|

Child care and preschool annualizations |

$108.5 |

|

Governor's Performance Awards base |

96.2 |

|

II/USPa |

88.2 |

|

Mandates—ongoing funding |

68.0 |

|

Other |

27.4 |

|

Subtotal |

($388.3) |

|

Program Expansions |

|

|

Special Education settlement |

$125.0 |

|

Governor's Performance Awards |

123.0 |

|

High School Exit Exam, 10th graders |

45.0 |

|

Other |

31.2 |

|

Subtotal |

($324.2) |

|

New Programs |

|

|

Teacher training |

$335.0 |

|

Longer year for middle school grades |

100.0 |

|

Algebra incentives |

30.0 |

|

Testing workbooks |

27.5 |

|

High-tech high schools |

20.0 |

|

STAR data analysis |

20.0 |

|

Principal training |

15.0 |

|

Kindergarten Readiness Pilot (AB 25) |

13.4 |

|

Student tracking |

5.0 |

|

Math and Science Challenge Grants |

5.0 |

|

Subtotal |

($570.9) |

|

2001-02 (proposed) |

$41,250.1 |

a Immediate Intervention/Underperforming schools Program. |

|

Figure 3 shows Proposition 98 spending for major K-12 programs. "Revenue limit" funding (available for school districts and county offices to spend on general purposes) accounts for $27.2 billion in 2001-02, or nearly two-thirds of Proposition 98 expenditures. The state General Fund supports about 58 percent of revenue limit funding, and local property taxes provide the remaining 42 percent.

|

Figure 3 |

||||

|

Major K-12 Education ProgramsFunded by Proposition 98 |

||||

|

(Dollars in Millions) |

||||

|

|

Change |

|||

|

Estimated 2000-01 |

Proposed 2001-02 |

Amount |

Percent |

|

|

Revenue Limits |

||||

|

General Fund |

$15,140.3 |

$15,693.8 |

$553.5 |

3.7% |

|

Local revenuea |

10,621.0 |

11,483.2 |

862.2 |

8.1 |

|

Subtotals |

($25,761.3) |

($27,177.0) |

($1,415.7) |

(5.5%) |

|

Existing Programs |

||||

|

Special education |

$2,442.6 |

$2,727.3 |

$284.6 |

11.7% |

|

Class size reduction |

1,733.1 |

1,751.9 |

18.8 |

1.1 |

|

Child development |

1,140.2 |

1,310.3 |

170.1 |

14.9 |

|

Adult education |

573.6 |

610.9 |

37.3 |

6.5 |

|

Desegregation |

677.3 |

711.2 |

33.9 |

5.0 |

|

Instructional materials |

573.4 |

581.4 |

8.1 |

1.4 |

|

Home to school transportation |

481.3 |

505.5 |

24.1 |

5.0 |

|

Economic impact aid |

426.9 |

465.8 |

38.9 |

9.1 |

|

Public School Accountability Act |

156.7 |

464.0 |

307.4 |

196.1 |

|

Summer school/after school |

418.7 |

435.1 |

16.4 |

3.9 |

|

School improvement |

400.7 |

418.6 |

17.9 |

4.5 |

|

ROC/Psb |

337.4 |

360.2 |

22.8 |

6.8 |

|

Staff development day buy-out |

246.8 |

259.3 |

12.4 |

5.0 |

|

Supplemental grants |

222.0 |

233.1 |

11.1 |

5.0 |

|

Assessments |

112.4 |

221.3 |

108.9 |

96.9 |

|

Other |

2,382.6 |

2,493.7 |

111.1 |

4.7 |

|

Subtotals |

($12,325.8) |

($13,549.7) |

($1,223.8) |

(9.9%) |

|

New Programs |

||||

|

Teacher training |

— |

$335.0 |

$335.0 |

— |

|

Longer year for middle school |

— |

100.0 |

100.0 |

— |

|

Algebra incentives |

— |

30.0 |

30.0 |

— |

|

High-tech high schools |

— |

20.0 |

20.0 |

— |

|

Principal training |

— |

15.0 |

15.0 |

— |

|

Kindergarten Readiness Pilot |

— |

13.0 |

13.0 |

— |

|

Math and Science Challenge Grants |

— |

5.0 |

5.0 |

— |

|

Student tracking |

— |

5.0 |

5.0 |

— |

|

Subtotals |

— |

($523.4) |

($523.4) |

— |

|

Totals |

$38,087.1 |

$41,250.1 |

$3,163.0 |

8.3% |

a Department of Finance estimate. Legislative Analyst's Office estimates that the amount is $74 million less in 2000-01 and $108 million less in 2001-02, requiring General Fund backfills of equal amounts. |

||||

b Regional occupational centers/programs. |

||||

The largest "categorical" program (an expenditure earmarked for a specified purpose) is special education. The budget proposes to increase special education

funding by $285 million, or 12 percent, to a total of $2.7 billion from Proposition 98 sources. Class size reduction in K-3 and 9th grade is the second largest

categorical spending program in 2001-02 at almost

$1.8 billion. A modest increase of $19 million (1.1 percent) is due to the COLA, offset slightly by a downward revision in estimated K-3 enrollment.

The budget proposes over $700 million of one-time spending on Proposition 98 programs. These spending proposals are funded largely by unspent balances from prior appropriations, but also in part from the state's General Fund reserve. Figures 4, 5, and 6 detail the sources and uses of one-time funds according to the fiscal year that the budget attributes appropriations for Proposition 98 purposes.

Prior Year. Figure 4 shows proposed sources and uses of funds for one-time purposes that the budget attributes to the 1999-00 fiscal year. The major spending items are (1) a one-time $270 million payment that is part of the proposed settlement of the special education mandate claims and (2) a $72 million adjustment for revenue limit payments based on final attendance data. As the figure shows, the $347 million total of proposed expenditures exceeds available resources from prior-year Proposition 98 savings, thus, requiring $189 million from the General Fund.

|

Figure 4 |

|

|

K-12 Education Governor's Budget Proposals for Prior-Year Revenue |

|

|

1999-00 |

|

|

Sources |

|

|

Proposition 98 savings |

|

|

Increased property tax allocations to schools |

$95.5 |

|

School district PERS a adjustment |

22.0 |

|

County Office of Education lower ADA b |

24.7 |

|

Beginning teacher salary savings |

15.0 |

|

County Office of Education adjustments |

0.8 |

|

Subtotal |

($158.0) |

|

Transfer from General Fund |

$188.9 |

|

Total |

$346.9 |

|

Proposed Augmentations |

|

|

Special Education settlement (prior years) |

$270.0 |

|

School district higher ADA |

71.9 |

|

County Office of Education property tax backfill |

5.0 |

|

Total |

$346.9 |

a Public Employees' Retirement System. |

|

b Average daily attendance. |

|

Current Year. As Figure 5 indicates, the budget estimates that $226 million of savings from previous Proposition 98 appropriations is available for reallocation in the current year. The budget proposes one-time reallocations totaling $86 million, leaving $140 million uncommitted. As mentioned above, however, the administration miscalculated its estimate of General Fund savings resulting from property tax allocations to school districts. As a result, savings to the General Fund would be about $66 million.

|

Figure 5 |

|

|

K-12 Education Governor's Budget Proposals for Current-Year Revenue |

|

|

2000-01 |

|

|

Sources |

|

|

Proposition 98 savings |

|

|

Increased property tax allocation to schools |

$154.8a |

|

County Office of Education lower ADAb |

33.7 |

|

School district PERSc adjustment |

22.0 |

|

Beginning teacher salary savings |

15.0 |

|

Technical adjustments |

0.8 |

|

Total |

$226.4 |

|

Proposed Augmentations |

|

|

School district apportionment adjustments |

$79.9 |

|

County Office of Education property tax backfill |

4.5 |

|

Deferred maintenance |

1.0 |

|

State employee compensation adjustment |

0.6 |

|

Subtotal |

($86.0) |

|

General Fund savings |

$140.4a |

|

Total |

$226.4 |

a Department of Finance estimate. Legislative Analyst's Office estimates that the amount is $74 million less. |

|

b Average daily attendance. |

|

c Public Employees' Retirement System. |

|

Budget Year. Figure 6 shows estimated Proposition 98 savings of $273 million available for one-time reallocation in 2001-02. These one-time savings include $130 million arising from implementation delays on recently authorized summer school programs, and $40 million arising from implementation delays on current-year expansion of child care services. The budget proposes spending all but $939,000 of these estimated savings. The largest single expenditure is $224 million in Item 6110-485 to reimburse estimated prior-year and current-year costs of a mandate for school bus safety improvements required by a series of legislation between 1994 and 1997. The budget also includes $67 million from the General Fund (Proposition 98) for the budget-year costs of this mandate. The Commission on State Mandates estimates that the state will be responsible for similar annual costs in the future. The $67 million will be included in the annual mandates claims bill.

|

Figure 6 |

|

|

Proposition 98 Reversion Account Budget-Year, One-Time Expenditures |

|

|

2001-02 |

|

|

Sources |

|

|

Summer school savings |

$130.0 |

|

Reversion balance |

60.0 |

|

Child care expansion savings |

40.0 |

|

CCC a property tax savings (2000-01) |

26.4 |

|

CCC property tax savings (1999-00) |

16.2 |

|

Total |

$272.6 |

|

Proposed Augmentations |

|

|

School Bus Safety II mandate |

$223.7 |

|

Special education ADA b growth (current year) |

13.6 |

|

CSIS c |

12.0 |

|

ROC/Ps d equipment |

10.0 |

|

Parental notification mandate |

4.2 |

|

CCC part-time office hours |

3.2 |

|

Child nutrition deficiency |

2.1 |

|

FCMAT e |

1.2 |

|

Alvord Primary Education Center |

1.0 |

|

Student Friendly Services |

0.5 |

|

Curriculum frameworks |

0.1 |

|

Unspent residual |

0.9 |

|

Total |

$272.6 |

a California Community Colleges. |

|

b Average daily attendance. |

|

c California School Information Services. |

|

d Regional occupational centers/programs. |

|

e Fiscal Crisis Management and Assistance Team. |

|

Figure 7 lists some of the major K-12 school reforms enacted by the Legislature or by the voters in the last decade. The list is meant to be illustrative rather than exhaustive. Particularly in the last several years, numerous significant reforms have taken place in K-12 education. Indeed, one of the challenges facing local school districts has been to coordinate the implementation of interrelated, and sometimes conflicting, reforms—often over very short time frames.

|

Figure 7 |

|

|

Major K-12 School Reforms in Last Decade |

|

|

Timeline |

Action |

|

1992 |

Chapter 781 (SB 1448, Hart) authorizes up to 100 charter schools. |

|

1995 |

Chapter 975 (AB 265, Alpert) authorizes development of state academic content standards. |

|

1996 |

Chapter 163 (SB 1777, O'Connell) creates K-3 class-size reduction program. |

|

1997 |

Chapter 828 (SB 376, Alpert) authorizes Standardized Testing and Reporting (STAR) and use of "off-the-shelf" test (Stanford-9). |

|

1998 |

Proposition 227 sharply limits bilingual programs; requires rapid transition of English language learners to English fluency. |

|

|

Chapter 313 (SB 1193, Peace) lengthens minimum school year from 172 to 180 days. |

|

|

Chapter 742 (AB 1626, Wayne) restricts "social promotion." |

|

|

Chapter 34 (AB 544, Lempert) allows significant growth of charter schools. |

|

|

Chapter 548 (SB 2042, Alpert) expands Beginning Teacher Support and Assessment; makes changes to higher education training of teachers. |

|

|

Chapter 312 (AB 2041, Bustamante) provides $1 billion over a four-year period for standards-aligned instructional materials. |

|

1999 |

Chapter 1x (SB 2x, O'Connell) creates High School Exit Exam. |

|

|

Chapter 3x (SB 1x, Alpert) creates Public Schools Accountability Act and Academic Performance Index. |

|

|

Chapter 4x (AB 1x, Villaraigosa) creates Teacher Peer Assistance and Review program. |

|

2000 |

Chapter 70 (SB 1666, Alarcon) provides teacher recruit- ment/retention incentives for low-performing schools. |

|

|

Proposition 39 lowers vote requirement for K-14 facility bonds financed by local property taxes. |

Enrollment growth significantly shapes the Legislature's annual K-12 budget and policy decisions. When enrollment grows slowly, for example, fewer resources are needed to meet statutory funding obligations for revenue limits and K-12 education categorical programs. This leaves more General Fund resources available for other budget priorities both within K-12 education and, potentially, outside it. Conversely, when enrollment grows rapidly (as it did in the 1980s), schools face greater challenges in supplying enough teachers to meet demand. In light of the important implications of enrollment growth, we describe below two major trends in the K-12 student population.

The enrollment numbers used in this section are from the Department of Finance's Demographic Research Unit, and reflect aggregate, statewide enrollment. While the enrollment trends described here will likely differ from those in any one particular school district, they reflect the overall patterns the state is likely to see in the near future.

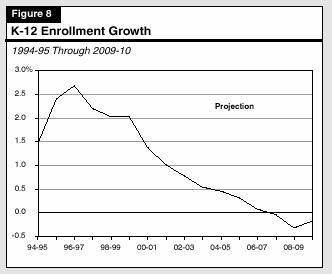

K-12 enrollment is projected to increase by 1 percent in 2001-02, bringing total enrollment to just over 6 million students. Figure 8 shows how enrollment growth has slowed since 1996-97 and is projected to continue slowing through 2008-09. This slowing trend is expected to result in an actual decrease in the number of pupils enrolled beginning in 2007-08. This contrasts with growth averaging 2.3 percent annually during the 1990s.

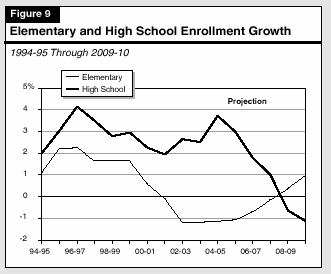

Figure 9 shows that the steady decline in K-12 enrollment growth masks two distinct trends in elementary (grades K-6 ) and high school (grades 9-12) enrollment. Elementary school enrollment growth has gradually slowed since 1996-97. Growth rates are expected to become negative in 2001-02 and remain negative through 2007-08. Over this period, elementary school enrollment is expected to decline by 180,000 pupils (5 percent).

In contrast, high school enrollment growth is expected to accelerate in the short term, reaching a 3.7 percent growth rate in 2004-05. Then, growth is expected to slow sharply, becoming negative in 2008-09. Expected growth over the next seven years is slightly over 300,000 pupils (18 percent).

These trends have significant budgetary and policy implications for issues such as class size reduction, teacher demand, and facilities investment. A few of the major implications include:

Background. In November 2000, the administration reached a settlement agreement with school districts and county offices of education (referred to as local educational agencies [LEAs]) that had filed claims for the cost of certain special education programs. The agreement ends a 20-year-old lawsuit in which LEAs alleged that the state mandated eight special education activities in excess of federal requirements without providing additional funds. This agreement also includes settlement of a separate mandate claim by Long Beach Unified School District regarding provision of services for students, ages 3 to 5 and 18 to 21.

Major Provisions of the Proposed Settlement Agreement. The major provisions of the agreement include:

Conditions for the Agreement to Take Effect. In order for the agreement to take effect, the following events must occur:

Other Considerations. These payments would not directly affect the state's long-term minimum funding requirement under Proposition 98. The budget eliminates any effect on the base from the $270 million payment for retrospective costs by attributing the payment to the 1999-00 fiscal year. The combined $125 million payable in 2001-02 has no direct effect because the total of Proposition 98 appropriations proposed by the budget for 2001-02 does not exceed the long-run commitment set by "test 2" of Proposition 98 (an estimated $46.4 billion of General Fund and local property tax revenue).

Under this agreement, the mandate claim is resolved only if the Legislature approves the terms of the settlement without substantive change. In other words, the agreement presented to the Legislature is a "take it or leave it" proposition. Adoption of the settlement would "close the books" on this issue.