Legislative Analyst's OfficeAnalysis of the 2001-02 Budget Bill |

General Fund expenditures for health and social services programs are proposed to increase by 6.3 percent in the budget year. This increase is due primarily to a variety of caseload and cost increases and the Governor's initiatives to expand the Healthy Families Program and other public health programs. The budget also proposes to replace some California Work Opportunity and Responsibility to Kids General Fund spending with federal Temporary Assistance for Needy Families (TANF) funds in the current year, which reduces the TANF reserve in 2001-02.

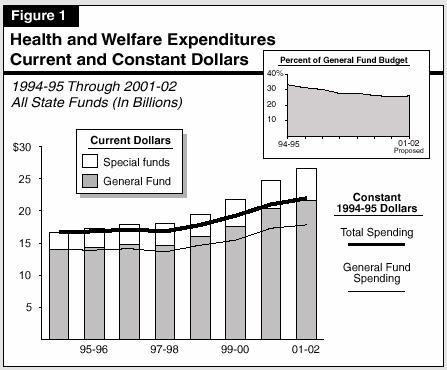

The budget proposes General Fund expenditures of $21.6 billion for health and social services programs in 2001-02, which is 26 percent of total proposed General Fund expenditures. As shown in Figure 1, the health and social services share of the budget generally has been declining since 1994-95, but would increase slightly compared to the prior year under the Governor's 2001-02 budget plan. The budget proposal represents an increase of $1.3 billion, or 6.3 percent, over estimated expenditures in the current year.

Figure 1 shows that General Fund expenditures (current dollars) for health and social services programs are projected to increase by $7.7 billion, or 55 percent, from 1994-95 through 2001-02. This represents an average annual increase of 6.5 percent.

The figure also shows that General Fund spending (in current dollars) has increased each year since 1994-95, except for a slight reduction in 1997-98 due primarily to a decline in California Work Opportunity and Responsibility to Kids (CalWORKs, formerly Aid to Families with Dependent Children [AFDC]) program caseloads.

Special funds expenditures are estimated to increase significantly in the budget year, primarily because of the creation of a special new trust fund for health services programs comprised of monies received by the state from the settlement of tobacco litigation. The budget estimates that spending from the new trust fund will amount to $445 million in 2001-02.

Combined General Fund and special funds spending is projected to increase by about $10 billion, or almost 60 percent, from 1994-95 through 2001-02. This represents an average annual increase of 6.9 percent.

Figure 1 also displays the spending for these programs adjusted for inflation (constant dollars). On this basis, General Fund expenditures are estimated to increase by 28 percent from 1994-95 through 2001-02, an average annual rate of 3.6 percent. Combined General Fund and special funds expenditures are estimated to increase by 31 percent during the same period. This is an average annual increase of 4 percent.

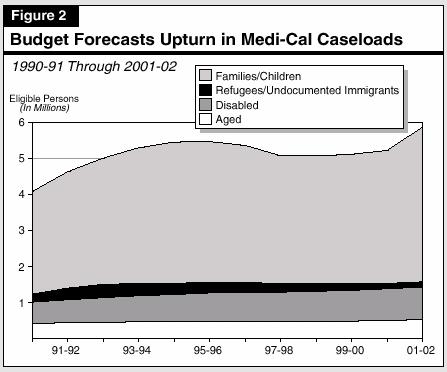

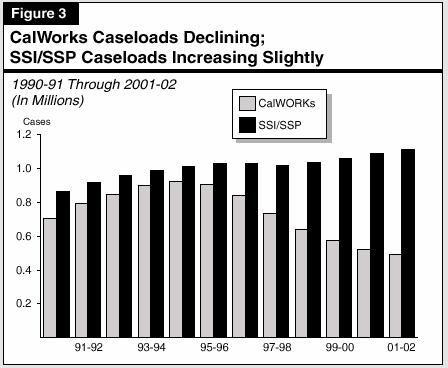

Figures 2 and 3 illustrate the caseload trends for the largest health and welfare programs. Figure 2 shows Medi-Cal caseload trends over the last decade, divided into three groups: families and children (primarily recipients of CalWORKs—formerly AFDC), refugees and undocumented persons, and disabled and aged persons (who are primarily recipients of Supplemental Security Income/State Supplementary Program [SSI/SSP]). Figure 3 shows the caseloads for CalWORKs and SSI/SSP.

Medi-Cal Caseloads. As shown in Figure 2, the Governor's budget plan assumes that significant caseload growth will occur during the budget year in the Medi-Cal program. Specifically, the overall caseload is anticipated to increase by about 640,000, or 12 percent, during 2001-02 compared to the estimated current-year caseload.

This projection of strong growth follows a period of several years in which the overall size of the Medi-Cal caseload experienced relatively small changes from year to year. This projected trend reflects the estimated impact of a number of policy changes to the Medi-Cal program approved during the past two years. The changes resulting in the largest projected caseload increases are (1) the expansion of health coverage for two-parent families earning up to 100 percent of the federal poverty level (FPL) and (2) changes in program rules intended to make it more likely that families and children remain eligible for Medi-Cal coverage following their enrollment in the program.

These increases in caseload would be partly offset by a projected decline in the number of CalWORKs families who are eligible for Medi-Cal benefits. Following the enactment of welfare reform laws, the number of CalWORKs families and children has declined, along with the number of persons who are on Medi-Cal caseloads due to their receipt of CalWORKs public assistance. While this decrease in the CalWORKs-related caseload would continue to be significant, the Governor's budget proposal assumes it will not be sufficient to offset the other factors discussed above that are increasing the Medi-Cal caseload.

Healthy Families Caseload. The Governor's budget plan assumes that the caseload for the Healthy Families Program will continue the rapid growth experienced since it began enrolling children in July 1998. The budget provides for the enrollment of 106,000 additional children by the end of 2001-02 as a result of ongoing outreach efforts to increase program participation and several changes in eligibility rules. The Governor's budget plan also proposes to make parents in families earning up to 200 percent of the FPL eligible for Healthy Families coverage and enroll 174,000 of them in the program by the end of the budget year. Taken together, these proposals would increase Health Families participation by about 62 percent to 735,000 children and parents by the end of the budget year.

CalWORKs and SSI/SSP Caseloads. Figure 3 shows the caseload trend for CalWORKs and SSI/SSP. While the number of cases in SSI/SSP is greater than in the CalWORKs program, there are more persons in the CalWORKs program—about 1.4 million compared to about 1.1 million for SSI/SSP. (The SSI/SSP cases are reported as individual persons, while CalWORKs cases are primarily families.)

To the extent that caseloads increased in these two programs, it has been due, in part, to the growth of the eligible target populations. The increase in the rate of growth in the CalWORKs caseloads in 1990-91 and 1991-92 was due to the effect of the recession. During the next two years, the caseload continued to increase, but at a slower rate of growth. This slowdown, according to the Department of Finance, was due partly to: (1) certain population changes, including lower migration from other states; and (2) a lower rate of increase in "child-only" cases (including citizen children of undocumented and newly legalized persons), which was the fastest growing segment of the caseload until 1993-94.

Figure 3 also shows that since 1994-95, CalWORKs caseloads have declined. As discussed in our annual California's Fiscal Outlook reports, this trend is due to various factors, including the improving economy, lower birth rates for young women, a decline in legal immigration to California, changes in grant levels, behavioral changes in anticipation of federal and state welfare reform, and, since 1999-00, the impact of the CalWORKs program interventions (including additional employment services). We note, however, that contrary to this overall downward trend, the number of child-only cases has been increasing slightly in recent years. This category of the caseload includes children whose parents are undocumented, children with nonneedy relative caretakers, and children whose parents are removed from the assistance unit because of sanctions for nonparticipation in the CalWORKs employment services program.

The SSI/SSP caseload can be divided into two major components—the aged and the disabled. The aged caseload generally increases in proportion to increases in the eligible population—age 65 or older. This component accounts for about one-third of the total caseload. The larger component—the disabled caseload—grew significantly faster than the rate of increase in the eligible population group (primarily ages 18 to 64) in the early 1990s. This was due to several factors, including (1) the increasing incidence of AIDS-related disabilities, (2) changes in federal policy that broadened the criteria for establishing a disability, (3) a decline in the rate at which recipients leave the program (perhaps due to increases in life expectancy), and (4) expanded state and federal outreach efforts in the program. In recent years, however, the growth of the disabled caseload has slowed.

In the mid-to-late 1990s, the total SSI/SSP caseload leveled off and actually declined in 1997-98, in part, because of federal changes that restricted eligibility. Since March 1998, however, the caseload has been growing moderately, about 2.3 percent each year.

Figure 4 shows expenditures for the major health and social services programs in 1999-00 and 2000-01, and as proposed for 2001-02. As shown in the figure, the three major benefit payment programs—Medi-Cal, CalWORKs, and SSI/SSP—account for a large share of total spending in the health and social services area.

|

Figure 4 |

|||||

|

Major Health and Social Services Program Budget Summary a |

|||||

|

1999-00 Through 2001-02 |

|||||

|

|

|

|

Change from 2000-01 |

||

| Actual 1999-00 |

Estimated 2000-01 |

Proposed 2001-02 |

Amount |

Percent |

|

|

Medi-Cal |

|||||

|

General Fund b |

$8,064.9 |

$9,457.6 |

$9,325.0 |

-$132.6 |

-1.4% |

|

All funds |

20,128.8 |

22,990.3 |

23,523.4 |

533.1 |

2.3 |

|

CalWORKs |

|||||

|

General Fund |

$1,991.3 |

$1,935.3 |

$2,128.0 |

$192.7 |

10.0% |

|

All funds |

5,437.7 |

5,582.2 |

5,456.4 |

-125.8 |

-2.3 |

|

AFDC-Foster Care |

|||||

|

General Fund |

$405.8 |

$387.7 |

$413.0 |

$25.3 |

6.5% |

|

All funds |

1,387.7 |

1,458.6 |

1,550.4 |

91.8 |

6.3 |

|

SSI/SSP |

|||||

|

General Fund |

$2,501.0 |

$2,626.0 |

$2,870.2 |

$244.2 |

9.3% |

|

All funds |

6,494.8 |

6,827.0 |

7,293.0 |

466.0 |

6.8 |

|

In-Home Supportive Services |

|||||

|

General Fund |

$596.5 |

$746.0 |

$843.3 |

$97.3 |

13.0% |

|

All funds |

1,610.3 |

1,971.7 |

2,260.5 |

288.8 |

14.6 |

|

Regional Centers/Community Services |

|||||

|

General Fund b |

$788.2 |

$972.6 |

$1,479.9 |

$507.3 |

52.2% |

|

All funds c |

1,623.0 |

1,878.2 |

2,037.7 |

159.5 |

8.5 |

|

Developmental Centers |

|||||

|

General Fund b |

$95.2 |

$177.4 |

$322.3 |

$144.9 |

81.7% |

|

All funds c |

555.4 |

641.7 |

601.0 |

-40.7 |

-6.3 |

|

Child Welfare Services |

|||||

|

General Fund |

$486.3 |

$533.0 |

$565.1 |

$32.1 |

6.0% |

|

All funds |

1,532.9 |

1,697.8 |

1,774.5 |

76.7 |

4.5 |

|

Healthy Families |

|||||

|

General Fund |

$76.2 |

$145.6 |

$125.2 |

-$20.4 |

-14.0% |

|

All funds |

211.8 |

400.1 |

733.1 |

333.0 |

83.2 |

|

Children and Families First Commissions d |

|||||

|

General Fund |

— |

— |

— |

— |

— |

|

All funds |

$784.3 |

$622.2 |

$656.7 |

$34.5 |

5.5% |

|

Child Support Services |

|||||

|

General Fund |

—e |

$370.7 |

$455.1 |

$84.4 |

22.8% |

|

All funds |

—e |

840.6 |

998.7 |

158.1 |

18.8 |

a Excludes departmental support. |

|||||

b Beginning in 2001-02, some General Fund spending for Medi-Cal services is displayed in the Department of Developmental Services budget instead of the Department of Health Services budget. |

|||||

c Includes General Fund share of Medicaid reimbursements (costs budgeted in Medi-Cal). |

|||||

d Includes state and county commissions. |

|||||

e Child Support Services were included in the Department of Social Services in 1999-00. |

|||||

As the figure shows, General Fund expenditures on Medi-Cal benefits would decline 1.4 percent under the Governor's budget plan compared with projected General Fund spending in the current year. However, this is not an accurate reflection of expenditure growth in this program. Some General Fund support for the program was replaced with support from the new tobacco settlement fund, and other General Fund support for Medi-Cal was shifted to the Department of Developmental Services (DDS) budget in a purely technical change. If these amounts were added back to the Medi-Cal budget, Medi-Cal General Fund growth would be 6.7 percent.

The technical shift of Medi-Cal General Fund support to the DDS budget results in nominal increases in the budget year of about 52 percent for regional centers and about 82 percent for developmental centers. But these nominal increases also do not accurately reflect actual program expenditure growth in these DDS programs. If the technical shift had not been made, the General Fund budget would reflect about a 17 percent increase in expenditures for regional centers and about a 62 percent decrease for developmental centers compared to current-year spending. Developmental center expenditures are proposed to decrease significantly because of (1) a reduction in caseload and (2) significant augmentations that were made to the current-year budget for special repairs and other purposes that were one-time appropriations.

The figure indicates that expenditures for the Healthy Families Program would decline about 14 percent in the budget year. However, this reflects a shift of some program support to the new tobacco settlement fund as well as significant increases in expenditures of federal funds. Thus, as the figure indicates, overall spending on the Healthy Families Program would increase 83 percent under the Governor's spending plan.

Figures 5 and 6 illustrate the major budget changes proposed for health and social services programs in 2001-02. (We include the federal funds for CalWORKs because, as a block grant, they are essentially interchangeable with state funds within the program.) Most of the major changes can be grouped into the following categories:

1. The Budget Funds Caseload Growth in SSI/SSP, Medi-Cal, and the Healthy Families Program, Reflects Savings From Caseload Reductions in CalWORKs and Funds Other Workload Cost Increases. The budget includes a projected caseload reduction of 5.2 percent in the CalWORKs program and increases of 12 percent in the Medi-Cal program, 2.2 percent in SSI/SSP, and 62 percent in the Healthy Families Program.

2. The Budget Proposes to Fund Statutory Cost-of-Living Adjustments (COLAs) for CalWORKs and SSI/SSP as Well as Discretionary COLAs for Foster Care. The budget includes a 4.85 percent COLA for CalWORKs and SSI/SSP in 2001-02. We note that the budget proposes to fund COLAs for all types of foster care placements—foster family agencies (FFAs), non-FFA foster family homes, and group homes. Current law provides for these COLAs, but makes them "subject to the availability of funds."

3. The Budget Proposes to Keep General Fund Spending for CalWORKs in 2001-02 at the Federally Required Maintenance-of-Effort (MOE) Level and Achieves General Fund Savings of $154 Million in 2000-01 Due to a Retroactive One-Time Reduction in the MOE. California successfully appealed a federal finding that the state failed to comply with federal work participation requirements in 1997. Based on this successful appeal, the budget assumes that California's MOE requirement is reduced by $154 million retroactively on a one-time basis. The budget reflects a General Fund savings of $154 million in the current year by replacing General Fund monies with federal TANF funds, thus reducing the TANF reserve by an identical amount.

4. The Budget Includes Various Significant Changes, Including the Following:

The budget provides an additional $272 million during 2001-02 above projected current-year General Fund expenditure levels due to increases in the cost of prescription drugs for Medi-Cal beneficiaries. These additional costs would be partly offset by a projected $69 million increase in the rebates the state receives on drugs for Medi-Cal patients.

|

Figure 5 |

|||

|

Health Services Programs |

|||

|

Medi-Cal |

Requested: |

$9.3 billion |

|

|

|

Decrease: |

$133 million |

(-1.4%) |

|

+ $272 million due to higher costs for prescription drugs, partly offset by a $69 million increase in rebates the state receives on drug purchases |

|||

|

+ $259 million for the costs of major changes to Medi-Cal eligibility rules, including eliminating quarterly status reports for beneficiaries and providing 12-month continuous coverage for children |

|||

|

+ $117 million for growth in the Early Periodic Screening, Diagnosis, and Treatment Program which provides mental health services for children |

|||

|

+ $64 million for ongoing hospital rate increases for settlement of the Orthopaedic Hospital v. Belsh� lawsuit, following a related one-time payment of $175 million in the current year |

|||

|

+ $20 million to provide expanded services to residents of Institutions for Mental Diseases |

|||

|

+ $10 million to help Medi-Cal beneficiaries pay for new or increased insurance premiums to stay enrolled in Medicare HMOs |

|||

|

0 $601 million due to a technical change shifting the display of Medi-Cal General Fund expenditures to the budget of the Department of Developmental Services |

|||

|

0 $170 million due to shift from General Fund to new tobacco settlement trust fund |

|||

|

0 $21 million due to an increase in the federal matching rate |

|||

|

Healthy Families |

Requested: |

$125 million |

|

|

|

Decrease: |

$20 million |

(-14%) |

|

0 $20 million General Fund due to shift in some program costs from General Fund to new tobacco settlement trust fund. (Overall Healthy Families budget [all funds] would increase by $333 million due to additional federal funds and allocation of tobacco settlement funds) |

|||

|

Figure 6 |

|||

|

Social Services Programs |

|||

|

CalWORKs |

Requested: |

$2.1 billion |

|

|

|

Increase: |

$193 million |

(+10%) |

|

+ $154 million due to the maintenance-of-effort requirement returning to $2.7 billion following a one-time reduction in 2000-01 |

|||

|

+ $128 million for a 4.85 percent cost-of-living adjustment (COLA) |

|||

|

+ $40 million for an increase in state matching fund expenditures for federal Department of Labor Welfare-to-Work funds |

|||

|

0 $148 million due to caseload reduction |

|||

|

0 $97 million due to no funding for county performance incentives |

|||

|

SSI/SSP |

Requested: |

$2.9 billion |

|

|

|

Increase: |

$244 million |

(+9.3%) |

|

+ $156 million for a 4.85 percent COLA |

|||

|

+ $55 million due to a caseload increase |

|||

|

In-Home Supportive |

Requested: |

$843 million |

|

|

|

Increase: |

$97 million |

(+13%) |

|

+ $55 million due to increases in the minimum wage |

|||

|

+ $38 million due to a caseload increase |

|||

The budget plan provides Medi-Cal funding for a one-time payment of $175 million from the General Fund in the current year to settle the case of Orthopaedic Hospital v. Belshé related to hospital reimbursement rates. In fulfillment of the settlement agreement, an additional General Fund expenditure of $64 million is budgeted for 2001-02 for an ongoing hospital rate increase. (The Medi-Cal budget also includes an additional $60 million from the General Fund in the current year for negotiated increases in hospital rates unrelated to the court case.)

About $80 million from the General Fund, the new tobacco settlement fund, and other sources is provided for various augmentations to create or to expand various public health programs. Proposals include medical screening and treatment programs for prostate and breast cancer, as well as programs to prevent youth from using tobacco and to better track infectious diseases.

The budget makes two proposals to reduce CalWORKs county performance incentives. First, in the current year, the budget proposes urgency legislation to reduce the incentives by $153 million compared to the appropriation. In 2001-02, the budget exercises the option, created in last year's social services budget trailer bill, to spend less for performance incentives than the amount suggested by the statutory formula. Specifically, the budget proposes no funding in 2001-02 for county performance incentives, resulting in a savings of $244 million compared to the statutory formula.